Global High Purity Anhydrous Hydrogen Chloride Hcl Gas Market

Размер рынка в млрд долларов США

CAGR :

%

USD

1.19 Billion

USD

1.91 Billion

2025

2033

USD

1.19 Billion

USD

1.91 Billion

2025

2033

| 2026 –2033 | |

| USD 1.19 Billion | |

| USD 1.91 Billion | |

|

|

|

|

Сегментация мирового рынка высокочистого безводного хлористого водорода (HCL) по видам продукции (электроника и химия), сферам применения (электроника и электротехника, фармацевтика, химия и другие) — тенденции развития отрасли и прогноз до 2033 года

Размер рынка высокочистого безводного хлористого водорода (HCL)

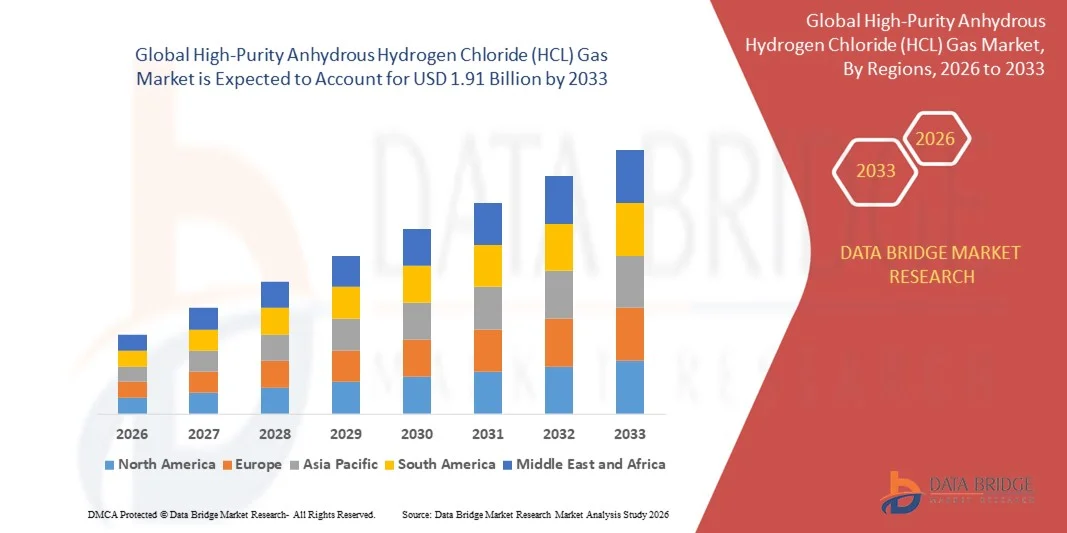

- Объем мирового рынка высокочистого безводного хлористого водорода (HCL) в 2025 году оценивался в 1,19 млрд долларов США , а к 2033 году , как ожидается, он достигнет 1,91 млрд долларов США при среднегодовом темпе роста 6,06% в течение прогнозируемого периода.

- Рост рынка во многом обусловлен растущим спросом на сверхчистые газы в производстве полупроводников, фармацевтической промышленности и производстве специальных химических веществ, где строгие требования к чистоте имеют решающее значение для эффективности процесса и качества продукции.

- Более того, рост промышленной автоматизации и внедрение передовых технологий химической переработки обуславливают потребность в надежном, высокочистом газе HCl, обеспечивающем стабильную производительность в чувствительных производственных процессах. Эти факторы ускоряют внедрение высокочистого газа HCl, тем самым значительно стимулируя расширение рынка.

Анализ рынка высокочистого безводного хлористого водорода (HCL)

- Высокочистый газ HCl, обеспечивающий крайне низкий уровень загрязнения влагой и ионами металлов, становится все более важным для применения в электронике, фармацевтике и производстве тонкой химии из-за его роли в травлении, химическом синтезе и специальных составах.

- Растущий спрос на высокочистый газ HCl обусловлен, прежде всего, быстрым ростом производства полупроводников и электроники, увеличением фармацевтического производства и растущей потребностью в точных химических процессах, требующих постоянного и сверхчистого химического сырья.

- Азиатско-Тихоокеанский регион доминировал на рынке высокочистого безводного хлористого водорода (HCL) с долей 67,5% в 2025 году благодаря быстрому росту производства электроники, увеличению производства фармацевтической продукции и наличию крупных центров химического производства.

- Ожидается, что Северная Америка станет регионом с самыми быстрыми темпами роста на рынке высокочистого безводного хлористого водорода (HCL) в течение прогнозируемого периода из-за высокого спроса на газ HCl в электронике, фармацевтике и производстве специальных химических веществ.

- Сегмент электроники и электротехники доминировал на рынке с долей рынка 54,6% в 2025 году благодаря широкому использованию газа HCl в производстве полупроводников, печатных плат и других высокоточных электронных процессах. Компании в секторе электроники отдают приоритет высокочистому газу HCl для поддержания строгих стандартов качества и надежности потребительских и промышленных устройств. Растущее внедрение современных электронных компонентов в смартфонах, компьютерах и автомобильной электронике способствует устойчивому росту рынка. Интеграция газа HCl в новые технологии электронного производства, такие как светодиодные чипы и солнечные панели, также стимулирует рыночный спрос. Производители получают выгоду от долгосрочных контрактов на поставки, которые обеспечивают постоянную доступность высокочистого газа HCl, что еще больше укрепляет его доминирующее положение в этой области применения.

Область применения отчета и сегментация рынка высокочистого безводного хлористого водорода (HCL)

|

Атрибуты |

Ключевые данные о рынке высокочистого безводного хлористого водорода (HCL) |

|

Охваченные сегменты |

|

|

Охваченные страны |

Северная Америка

Европа

Азиатско-Тихоокеанский регион

Ближний Восток и Африка

Южная Америка

|

|

Ключевые игроки рынка |

|

|

Рыночные возможности |

|

|

Информационные наборы данных с добавленной стоимостью |

Помимо информации о рыночных сценариях, таких как рыночная стоимость, темпы роста, сегментация, географический охват и основные игроки, рыночные отчеты, подготовленные Data Bridge Market Research, также включают анализ импорта и экспорта, обзор производственных мощностей, анализ потребления продукции, анализ ценовых тенденций, сценарий изменения климата, анализ цепочки поставок, анализ цепочки создания стоимости, обзор сырья/расходных материалов, критерии выбора поставщиков, анализ PESTLE, анализ Портера и нормативную базу. |

Тенденции рынка высокочистого безводного хлористого водорода (HCL)

Растущее применение высокочистого газа HCl в производстве полупроводников и электроники

- Растущее использование высокочистого газа HCl в производстве полупроводников, электроники и специальных химических процессах меняет цепочки поставок промышленных химикатов, поскольку производители требуют стабильных и не содержащих загрязняющих веществ ресурсов для прецизионных операций.

- Например, компания Air Products and Chemicals, Inc. внедрила сверхчистый газ HCl для травления пластин и очистки полупроводников, что позволяет производителям поддерживать надежность процесса и достигать более высоких показателей выхода продукции при производстве чувствительной электроники.

- Высокочистый газ HCl способствует фармацевтическому производству, обеспечивая чистое сырье для химического синтеза и производства специальных составов, гарантируя соблюдение нормативных требований и качество продукции. Кроме того, он способствует развитию тонкого химического производства, минимизируя количество примесей и стабилизируя реакционные процессы.

- Интеграция современных систем очистки и подачи в промышленные процессы позволяет производителям поддерживать сверхчистую среду и сокращать время простоя, повышая общую эффективность работы. Высокочистый газ HCl обеспечивает совместимость с автоматизированными производственными линиями, оптимизируя обработку и переработку химических веществ.

- Тенденция к использованию сверхчистых химических веществ стимулирует инвестиции в исследования и разработки передовых технологий очистки газов и эффективных систем доставки, позволяя компаниям соответствовать меняющимся отраслевым стандартам и ожиданиям клиентов.

- Растущее внимание к оптимизации технологических процессов, высокому качеству продукции и соблюдению нормативных требований в секторах электроники, фармацевтики и специальной химии усиливает спрос на высокочистый газ HCl, превращая его в незаменимый ресурс для дорогостоящих промышленных применений.

Динамика рынка высокочистого безводного хлористого водорода (HCL)

Водитель

Растущий спрос со стороны фармацевтической и специальной химической промышленности

- Рост производства полупроводников, электроники, фармацевтических препаратов и специальных химикатов создает острую потребность в высокочистом газе HCl, который необходим для точного травления, химического синтеза и производства специальных соединений.

- Например, в марте 2024 года компания Merck KGaA выпустила серию сверхчистых газов HCl для полупроводниковой и фармацевтической промышленности, что позволяет производителям поддерживать строгие стандарты качества и повышать эффективность работы.

- Высокочистый газ HCl обеспечивает стабильную подачу химикатов без примесей для чувствительных промышленных процессов, снижая риск дефектов и обеспечивая высокое качество продукции. Кроме того, растущая промышленная автоматизация в химическом и электронном производстве увеличивает потребность в стабильно чистых поставках газа.

- Внедрение высокочистого HCl в фармацевтическое промежуточное производство и производство продуктов тонкого органического синтеза способствует соблюдению нормативных требований, повышает надежность процессов и позволяет эффективно масштабировать производство. Эти тенденции стимулируют инвестиции в надежные источники поставок и инфраструктуру очистки.

- Сочетание развития электронной, фармацевтической и специализированной химической промышленности, а также потребность в точности химических процессов существенно стимулируют рост рынка высокочистого газа HCl, усиливая его важнейшую роль в высокоэффективных промышленных приложениях.

Сдержанность/Вызов

Высокие производственные затраты и строгие требования к чистоте

- Производство сверхчистого газа HCl требует использования передовых технологий очистки, специализированного оборудования и строгих протоколов обработки, что в совокупности приводит к высоким производственным затратам и ограничивает доступность для некоторых производителей.

- Например, небольшие производители химической продукции могут столкнуться с трудностями при инвестировании в очистные установки на месте и системы точной доставки, что может ограничить их возможности по использованию высокочистого HCl в крупномасштабных процессах.

- Поддержание сверхпостоянных уровней чистоты критически важно для применения в полупроводниках, электронике и фармацевтике, поскольку отклонения могут снизить качество продукции и эффективность процесса. Кроме того, строгие требования к безопасности и хранению усложняют эксплуатацию.

- Ограниченное количество поставщиков, способных производить сертифицированный сверхчистый газ HCl, может привести к ограничениям поставок, повлиять на графики производства и вынудить производителей рассмотреть возможность производства на месте или заключения долгосрочных контрактов на поставку.

- Решение проблемы высоких производственных затрат, строгих стандартов чистоты и ограничений поставок имеет решающее значение для более широкого внедрения высокочистого газа HCl и устойчивого роста рынка в секторах электроники, фармацевтики и специальной химии.

Рынок высокочистого безводного хлористого водорода (HCL)

Рынок сегментирован по продукту и области применения.

- По продукту

На основе продукта рынок высокочистого безводного хлористого водорода (HCl) сегментируется на два класса: электронный и химический. Сегмент электронного класса доминировал на рынке с наибольшей долей выручки в 51,4% в 2025 году, что обусловлено его критически важным использованием в производстве полупроводников и других высокоточных электронных приложениях. Газ HCl электронного класса предпочитают производители из-за его чрезвычайно низкого уровня примесей, что обеспечивает надежную работу в чувствительных процессах, таких как травление и очистка пластин. Сегмент также выигрывает от строгих стандартов качества в производстве электроники, которые отдают приоритет использованию высокочистых химических веществ для предотвращения дефектов. Более широкое внедрение передовой электроники и потребительских устройств во всем мире еще больше усиливает спрос на этот класс. Рынок получает дополнительную поддержку от интеграции HCl электронного класса в развивающиеся технологии, включая производство светодиодов и производство микросхем.

Ожидается, что сегмент химической продукции продемонстрирует самые высокие темпы роста – 19,8% – в период с 2026 по 2033 год, что обусловлено растущим спросом в сфере общей химической переработки, промышленного производства и лабораторного применения. Газообразный HCl химической чистоты широко используется для контроля pH, химического синтеза и производства специальных химикатов. Его экономичность и пригодность для крупномасштабных промышленных операций делают его весьма привлекательным для производителей химической продукции. Расширение мощностей химического производства в странах Азиатско-Тихоокеанского региона способствует ускоренному внедрению, а ужесточение нормативных требований к промышленным процессам обеспечивает устойчивый спрос на надежный HCl химической чистоты.

- По применению

На основе области применения рынок безводного газа HCl высокой чистоты сегментируется на электронику и электротехнику, фармацевтику, химию и другие. Сегмент электроники и электротехники доминировал на рынке с наибольшей долей выручки на рынке в 54,6% в 2025 году, что обусловлено широким использованием газа HCl в производстве полупроводников, производстве печатных плат и других высокоточных электронных процессах. Компании в секторе электроники отдают приоритет газу HCl высокой чистоты для поддержания строгих стандартов качества и надежности для потребительских и промышленных устройств. Растущее внедрение передовых электронных компонентов в смартфонах, компьютерах и автомобильной электронике поддерживает устойчивый рост рынка. Интеграция газа HCl в новые технологии электронного производства, такие как светодиодные чипы и солнечные панели, также подпитывает рыночный спрос. Производители выигрывают от долгосрочных контрактов на поставку, которые гарантируют постоянную доступность газа HCl высокой чистоты, что еще больше укрепляет его доминирование в этой области применения.

Ожидается, что химический сегмент будет демонстрировать самые высокие среднегодовые темпы роста в период с 2026 по 2033 год, что обусловлено растущим использованием газообразного HCl в производстве специальных химических веществ, очистке воды и процессах промышленного синтеза. Например, такие химические компании, как BASF и Dow, используют газообразный HCl для производства хлоридов, промежуточных продуктов ПВХ и других химических соединений. Его роль в регулировании pH и химических реакциях в различных отраслях промышленности делает его универсальным и всё более предпочтительным вариантом. Расширение индустриализации в развивающихся странах дополнительно способствует ускорению внедрения. Сегмент выигрывает от постоянной оптимизации технологических процессов, что обеспечивает повышение эффективности и сокращение отходов при использовании газообразного HCl в крупномасштабных химических производствах.

Региональный анализ рынка высокочистого безводного хлористого водорода (HCL)

- Азиатско-Тихоокеанский регион доминировал на рынке высокочистого безводного хлористого водорода (HCL) с наибольшей долей выручки в 67,5% в 2025 году, что было обусловлено быстрым ростом производства электроники, увеличением производства фармацевтической продукции и наличием крупных центров химического производства.

- Эффективная производственная база региона, растущие инвестиции в производство специализированной химии и расширение экспорта высокочистых промышленных газов ускоряют расширение рынка.

- Наличие квалифицированной рабочей силы, благоприятная государственная политика и быстрая индустриализация в развивающихся странах способствуют росту потребления газа HCl как в электронной, так и в химической промышленности.

Обзор рынка высокочистого безводного газа HCl в Китае

В 2025 году Китай занимал наибольшую долю на рынке газообразного HCl Азиатско-Тихоокеанского региона благодаря своему статусу мирового лидера в производстве полупроводников и химической продукции. Мощная промышленная база страны, благоприятные государственные стимулы для развития химической отрасли и обширные возможности экспорта промышленных газов являются основными факторами роста. Спрос также поддерживается продолжающимися инвестициями в химикаты электронного класса для внутреннего и международного применения.

Обзор рынка высокочистого безводного газа HCl в Индии

Индия демонстрирует самый быстрый рост в Азиатско-Тихоокеанском регионе, чему способствуют расширение фармацевтического производства, увеличение производства дженериков и увеличение инвестиций в инфраструктуру специализированной химической промышленности. Инициативы, стимулирующие местное химическое производство и самообеспечение фармацевтическими промежуточными продуктами, усиливают спрос на газообразный HCl. Кроме того, рост экспорта химической продукции и расширение возможностей НИОКР в области тонкой химии способствуют устойчивому расширению рынка.

Обзор европейского рынка высокочистого безводного газа HCl

Европейский рынок газообразного HCl стабильно растёт, чему способствуют строгие нормативные стандарты, высокий спрос на высокочистые промышленные газы и инвестиции в устойчивое химическое производство. В регионе особое внимание уделяется качеству, соблюдению экологических норм и передовым производственным процессам, особенно в фармацевтической и электронной промышленности. Расширение использования газообразного HCl в синтезе специальной химии и промышленных приложениях дополнительно стимулирует рост рынка.

Обзор рынка высокочистого безводного газа HCl в Германии

Рынок газообразного HCl в Германии обусловлен богатым опытом химического производства, высокоточным фармацевтическим производством и экспортно-ориентированной промышленной базой. Страна обладает преимуществами хорошо налаженных сетей НИОКР и сотрудничества между академическими учреждениями и производителями химической продукции, что способствует инновациям в области высокочистых газов. Спрос особенно высок для использования в производстве электроники, продуктов тонкой химии и фармацевтических промежуточных продуктов.

Обзор рынка высокочистого безводного газа HCl в Великобритании

Рынок Великобритании поддерживается развитой фармацевтической и специализированной химической промышленностью, усилиями по локализации цепочек поставок химической продукции и растущим спросом на высокочистые промышленные газы. Рост рынка обусловлен растущим вниманием к НИОКР, сотрудничеством между академическими кругами и промышленностью, а также инвестициями в лабораторный синтез и производство специализированных газов. Великобритания продолжает занимать ключевые позиции в сфере производства высококачественных химических и фармацевтических продуктов.

Обзор рынка высокочистого безводного газа HCl в Северной Америке

Прогнозируется, что в Северной Америке с 2026 по 2033 год будет наблюдаться самый быстрый среднегодовой темп роста, обусловленный высоким спросом на газ HCl в электронике, фармацевтике и производстве специализированной химии. Акцент на передовые производственные технологии, инновации в материаловедении и опора на высокочистые промышленные газы стимулируют спрос. Кроме того, реншоринг химического производства и расширение сотрудничества между химическими и электронными компаниями способствуют расширению рынка.

Обзор рынка высокочистого безводного газа HCl в США

В 2025 году США занимали наибольшую долю на североамериканском рынке благодаря своей обширной фармацевтической и электронной промышленности, мощной научно-исследовательской инфраструктуре и значительным инвестициям в производство специализированной химической продукции. Акцент страны на инновациях, соблюдении нормативных требований и требованиях к высокочистым процессам стимулирует использование газообразного HCl в синтезе лекарств, производстве полупроводников и промышленных химикатов. Присутствие ключевых игроков и развитая дистрибьюторская сеть дополнительно укрепляют лидирующие позиции США в регионе.

Доля рынка высокочистого безводного хлористого водорода (HCL)

В отрасли производства высокочистого безводного хлористого водорода (HCL) лидируют в основном хорошо зарекомендовавшие себя компании, в том числе:

- Air Liquide SA (Франция)

- Linde plc (Великобритания)

- Matheson Tri‑Gas, Inc. (США)

- Merck KGaA (Германия)

- Shandong Weitai Fine Chemical Co., Ltd. (Китай)

- Air Products and Chemicals, Inc. (США)

- Messer Group (Германия)

- Taiyo Nippon Sanso Corporation (Япония)

- BASF SE (Германия)

- Versum Materials / Merck (Германия)

- Сёва Денко К.К. (Япония)

- Химическая компания Dow (США)

- Корпорация Niacet (США)

- Газовые инновации (США)

- Evonik Industries AG (Германия)

Последние разработки на мировом рынке высокочистого безводного хлористого водорода (HCL)

- В июле 2025 года компания Air Products and Chemicals, Inc. расширила внедрение передовых технологий очистки сверхчистого газа HCl, чтобы удовлетворить растущий спрос со стороны производителей полупроводниковых фабрик и специализированной химической продукции. Компания внедрила системы, значительно снижающие уровень влажности и загрязнения ионами металлов, гарантируя соответствие HCl самым строгим стандартам, предъявляемым к травлению пластин и прецизионному химическому синтезу. Эта разработка укрепляет позиции Air Products в сфере поставок для высокотехнологичных отраслей, которым необходим стабильный и исключительно чистый HCl. Повышая надежность продукции и расширяя производственные мощности, компания способствует более широкому применению HCl в критически важной электронике и специализированной химической промышленности. Это нововведение также позволяет заказчикам оптимизировать эффективность процесса и минимизировать содержание примесей, укрепляя доверие к долгосрочным поставкам.

- В январе 2024 года компания Linde plc объявила о запуске нескольких проектов по поставкам газа на места эксплуатации в Северной Америке и Европе, обеспечивая поставки сверхчистого газа HCl непосредственно на объекты заказчиков. Эти воздухоразделительные установки и очистные сооружения позволяют производителям полупроводников, фармацевтической продукции и продуктов тонкой химии поддерживать бесперебойные поставки с минимальными логистическими рисками. Развертывание Linde обеспечивает точный контроль качества газа, соответствует строгим отраслевым стандартам и позволяет удовлетворять спрос в режиме реального времени. Проекты также поддерживают местные производственные экосистемы, снижая зависимость от поставок и транспортировки сторонними организациями. Предлагая индивидуальные решения по поставкам, Linde укрепляет свое присутствие в быстрорастущих промышленных секторах. Этот шаг укрепляет лидерство компании в области решений для высокочистых промышленных газов и деятельности, ориентированной на устойчивое развитие.

- В декабре 2023 года Messer Group объявила о прогнозах значительного расширения рынка сверхчистого газообразного HCl, обусловленного растущим спросом со стороны электроники, фармацевтики и специализированных химикатов. Компания отметила, что растущие требования к сверхчистому сырью стимулируют инвестиции в производственные мощности и НИОКР для разработки передовых технологий очистки. Messer фокусируется на удовлетворении растущего регионального спроса, особенно в Азиатско-Тихоокеанском регионе и Северной Америке, где электронная и фармацевтическая отрасли стремительно развиваются. Прогнозируемый рост рынка стимулирует стратегическое сотрудничество и модернизацию технологий для поддержания стабильного качества продукции. Ориентируясь на новые потребности промышленности, Messer укрепляет свою долю рынка и повышает устойчивость цепочки поставок для потребителей высокочистого HCl. Это развитие также подчеркивает важнейшую роль HCl в обеспечении высокоэффективных производственных процессов по всему миру.

- В июле 2023 года корпорация Nippon Sanso Holdings объявила, что её дочерняя компания в США, Matheson Tri-Gas, Inc., заключила соглашение о поставке газа с компанией 1PointFive для их первого завода прямого захвата воздуха (DAC) в Техасе. Matheson будет поставлять кислород через блок разделения воздуха для обеспечения процесса DAC, который улавливает и очищает CO2 для безопасного хранения. Хотя этот проект не является прямым производством HCl, он подчёркивает стратегические возможности Matheson в поставках высокочистых промышленных газов для новых технологий, косвенно поддерживая использование HCl в смежных химических процессах. Это сотрудничество демонстрирует растущую интеграцию специальных газов в проекты, ориентированные на устойчивое развитие, и открывает рыночные возможности для компаний, производящих высокочистый HCl и другие промышленные химикаты. Оно также укрепляет роль Matheson в развитии инновационных экологических приложений и расширении её присутствия на рынке США.

- В мае 2022 года компания SUMITOMO SEIKA CHEMICALS CO., LTD. получила главный приз 54-й ежегодной премии JCIA Technology Awards от Ассоциации химической промышленности Японии за свою технологию с низким воздействием на окружающую среду, которая преобразует хлористый водород в хлор путем окисления. Эта инновация повышает устойчивость химического производства за счет сокращения выбросов в окружающую среду и повышения эффективности процесса. Эта технология позиционирует Sumitomo Seika как лидера в области высокочистой конверсии HCl и охраны окружающей среды, привлекая внимание промышленных потребителей, стремящихся к более экологичным химическим процессам. Это признание подчеркивает стратегическую важность технологий на основе HCl в производстве тонкой химии, фармацевтики и промышленных газов. Предлагая решение, сочетающее эксплуатационную эффективность с соблюдением экологических норм, компания укрепляет свое конкурентное преимущество на рынке высокочистого HCl. Эта разработка также стимулирует дальнейшие инвестиции в НИОКР в области экологически безопасных химических процессов.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Интерактивная панель анализа данных

- Панель анализа компании для возможностей с высоким потенциалом роста

- Доступ аналитика-исследователя для настройки и запросов

- Анализ конкурентов с помощью интерактивной панели

- Последние новости, обновления и анализ тенденций

- Используйте возможности сравнительного анализа для комплексного отслеживания конкурентов

Методология исследования

Сбор данных и анализ базового года выполняются с использованием модулей сбора данных с большими размерами выборки. Этап включает получение рыночной информации или связанных данных из различных источников и стратегий. Он включает изучение и планирование всех данных, полученных из прошлого заранее. Он также охватывает изучение несоответствий информации, наблюдаемых в различных источниках информации. Рыночные данные анализируются и оцениваются с использованием статистических и последовательных моделей рынка. Кроме того, анализ доли рынка и анализ ключевых тенденций являются основными факторами успеха в отчете о рынке. Чтобы узнать больше, пожалуйста, запросите звонок аналитика или оставьте свой запрос.

Ключевой методологией исследования, используемой исследовательской группой DBMR, является триангуляция данных, которая включает в себя интеллектуальный анализ данных, анализ влияния переменных данных на рынок и первичную (отраслевую экспертную) проверку. Модели данных включают сетку позиционирования поставщиков, анализ временной линии рынка, обзор рынка и руководство, сетку позиционирования компании, патентный анализ, анализ цен, анализ доли рынка компании, стандарты измерения, глобальный и региональный анализ и анализ доли поставщика. Чтобы узнать больше о методологии исследования, отправьте запрос, чтобы поговорить с нашими отраслевыми экспертами.

Доступна настройка

Data Bridge Market Research является лидером в области передовых формативных исследований. Мы гордимся тем, что предоставляем нашим существующим и новым клиентам данные и анализ, которые соответствуют и подходят их целям. Отчет можно настроить, включив в него анализ ценовых тенденций целевых брендов, понимание рынка для дополнительных стран (запросите список стран), данные о результатах клинических испытаний, обзор литературы, обновленный анализ рынка и продуктовой базы. Анализ рынка целевых конкурентов можно проанализировать от анализа на основе технологий до стратегий портфеля рынка. Мы можем добавить столько конкурентов, о которых вам нужны данные в нужном вам формате и стиле данных. Наша команда аналитиков также может предоставить вам данные в сырых файлах Excel, сводных таблицах (книга фактов) или помочь вам в создании презентаций из наборов данных, доступных в отчете.