Global Hemostats Market

Размер рынка в млрд долларов США

CAGR :

%

USD

3.34 Billion

USD

5.67 Billion

2024

2032

USD

3.34 Billion

USD

5.67 Billion

2024

2032

| 2025 –2032 | |

| USD 3.34 Billion | |

| USD 5.67 Billion | |

|

|

|

|

Сегментация мирового рынка гемостатических средств по типу продукта (на основе тромбина, комбинированные, на основе окисленной регенерированной целлюлозы, на основе желатина и на основе коллагена), составу (матричные и гелевые гемостатические средства, листовые и подушечные гемостатические средства, губчатые гемостатические средства и порошковые гемостатические средства), применению (ортопедия, общая хирургия, нейрохирургия, сердечно-сосудистая хирургия, реконструктивная хирургия и гинекологическая хирургия), показаниям (закрытие ран и хирургия), конечному пользователю (больницы, клиники, амбулаторные центры, учреждения общественного здравоохранения и другие) — тенденции отрасли и прогноз до 2032 года

Размер рынка гемостатических препаратов

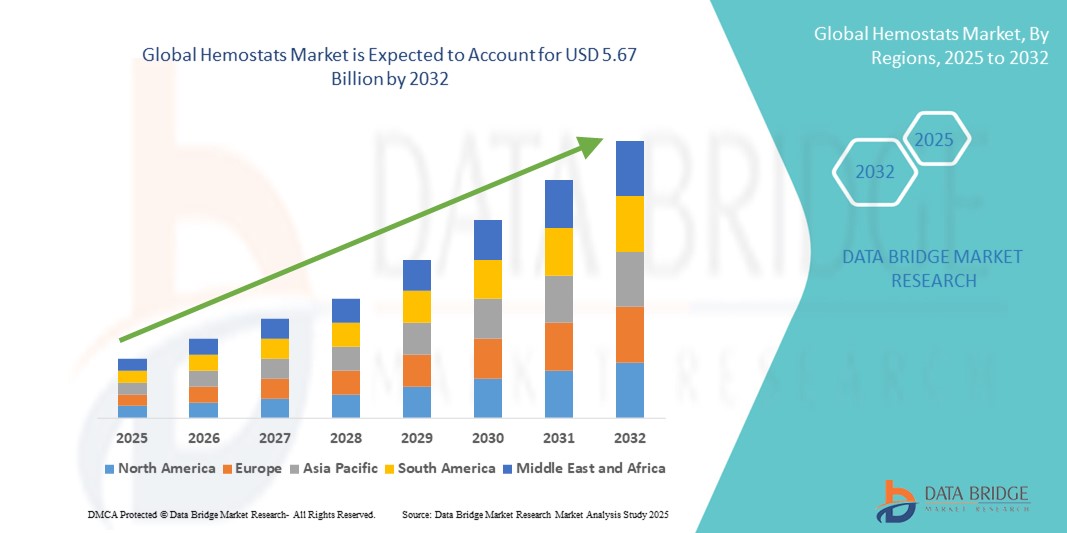

- Объем мирового рынка гемостатических средств в 2024 году оценивался в 3,34 млрд долларов США , а к 2032 году , как ожидается, он достигнет 5,67 млрд долларов США при среднегодовом темпе роста 6,85% в течение прогнозируемого периода.

- Рост рынка во многом обусловлен ростом числа хирургических операций во всем мире и растущей потребностью в эффективном контроле кровопотери, особенно в отделениях травматологии и неотложной помощи. Кровоостанавливающие средства играют важную роль в повышении эффективности хирургических операций, обеспечивая быструю и локализованную остановку кровотечения, тем самым снижая интраоперационные осложнения и улучшая результаты лечения пациентов.

- Более того, достижения в области гемостатических технологий, включая биорассасывающиеся материалы, препараты на основе тромбина и комбинированные препараты, ускоряют внедрение гемостатических средств в общую хирургию, сердечно-сосудистые процедуры и ортопедические вмешательства. Эти инновации не только повышают эффективность, но и позволяют более широко применять их в малоинвазивных и лапароскопических операциях, тем самым значительно стимулируя рост рынка.

Анализ рынка гемостатических препаратов

- Гемостатические препараты, жизненно важные хирургические средства, предназначенные для остановки кровотечения и облегчения свертывания крови во время хирургических операций, становятся все более незаменимыми при травматологической помощи, ортопедических процедурах, сердечно-сосудистых операциях и малоинвазивных вмешательствах благодаря своей способности обеспечивать быстрый гемостаз и улучшать результаты хирургических вмешательств.

- Растущий спрос на кровоостанавливающие средства обусловлен, прежде всего, растущим объемом хирургических операций во всем мире, увеличением числа травм и несчастных случаев, а также увеличением числа пожилых людей, подверженных хроническим заболеваниям, требующим оперативного лечения.

- Северная Америка доминировала на рынке гемостатических средств, достигнув наибольшей доли выручки в 39,8% в 2024 году благодаря развитой инфраструктуре здравоохранения, высоким расходам на здравоохранение на душу населения и сильному присутствию ведущих игроков рынка. В частности, в США наблюдается широкое внедрение как пассивных, так и активных гемостатических средств в больницах и амбулаторных хирургических центрах.

- Прогнозируется, что Азиатско-Тихоокеанский регион станет регионом с самыми быстрыми темпами роста рынка гемостатических средств в прогнозируемый период с 2025 по 2032 год, что обусловлено быстрой урбанизацией, ростом инвестиций в здравоохранение, улучшением доступа к хирургической помощи в таких странах, как Китай и Индия, а также повышением осведомленности об эффективном контроле кровопотери во время процедур.

- Хирургический сегмент доминировал на рынке гемостатических средств с долей рынка 65,4% в 2024 году, что связано с ростом числа сложных хирургических вмешательств, требующих немедленного и эффективного контроля кровотечения для минимизации осложнений.

Область применения отчета и сегментация рынка гемостатических средств

|

Атрибуты |

Ключевые данные о рынке гемостатических препаратов |

|

Охваченные сегменты |

|

|

Охваченные страны |

Северная Америка

Европа

Азиатско-Тихоокеанский регион

Ближний Восток и Африка

Южная Америка

|

|

Ключевые игроки рынка |

|

|

Рыночные возможности |

|

|

Информационные наборы данных с добавленной стоимостью |

Помимо информации о рыночных сценариях, таких как рыночная стоимость, темпы роста, сегментация, географический охват и основные игроки, отчеты о рынке, подготовленные Data Bridge Market Research, также включают в себя углубленный экспертный анализ, анализ цен, анализ доли бренда, опрос потребителей, демографический анализ, анализ цепочки поставок, анализ цепочки создания стоимости, обзор сырья/расходных материалов, критерии выбора поставщиков, анализ PESTLE, анализ Портера и нормативную базу. |

Тенденции рынка гемостатических средств

Растущий спрос на современные гемостатические средства в современной хирургии

- Важной и набирающей обороты тенденцией на мировом рынке гемостатических средств является растущее внедрение современных гемостатических средств в различных областях хирургии, включая ортопедию, сердечно-сосудистую хирургию, травматологию и нейрохирургию. Развитие хирургических технологий привело к повышению спроса на надежные и быстродействующие решения для эффективной остановки интраоперационного кровотечения.

- Современные гемостатические средства, включая такие активные вещества, как тромбин и фибриновые клеи, приобретают популярность благодаря своей превосходной эффективности, особенно при сложных или малоинвазивных процедурах, когда традиционные механические методы (например, наложение швов или лигатур) неэффективны.

- Больницы и амбулаторные хирургические центры всё чаще отдают предпочтение комбинированным гемостатическим средствам, которые обеспечивают двойной механизм остановки кровотечения — физический и биохимический. Этот сдвиг отражает более широкое предпочтение универсальным средствам, которые можно использовать в различных хирургических ситуациях и при различных типах ран.

- Кроме того, рост численности пожилых людей во всем мире, которые более подвержены хроническим заболеваниям, требующим хирургического вмешательства, напрямую повлиял на увеличение потребления гемостатических средств при хирургическом лечении и послеоперационном восстановлении.

- Ведущие производители сосредоточены на разработке гемостатических зажимов нового поколения с улучшенной биосовместимостью, минимальным иммуногенным ответом и более быстрым временем применения, что соответствует растущей тенденции к сокращению продолжительности хирургических операций и улучшению результатов лечения пациентов.

- Благодаря увеличению инвестиций в инфраструктуру здравоохранения и хирургические инновации, особенно в странах с развивающейся экономикой, мировой рынок гемостатических зажимов готов к устойчивому росту, обусловленному клинической эффективностью, безопасностью пациентов и расширяющимся спектром хирургических процедур, требующих точного контроля кровопотери.

Динамика рынка гемостатических препаратов

Водитель

Растущий спрос на услуги по остановке кровопотери среди хирургических специальностей

- Растущий объем хирургических операций во всем мире, особенно в области сердечно-сосудистой, ортопедической, травматологической и нейрохирургической хирургии, существенно повышает спрос на эффективные гемостатические средства.

- Больницы и хирургические центры отдают приоритет использованию современных гемостатических зажимов для более эффективного контроля интраоперационных и послеоперационных кровотечений, тем самым снижая частоту осложнений и улучшая результаты лечения пациентов.

- Например, растущее применение малоинвазивных хирургических методов, где видимость и точность имеют первостепенное значение, усилило потребность в быстродействующих местных кровоостанавливающих средствах.

- Это стимулирует производителей разрабатывать инновационные решения, обеспечивающие быстрое свертывание крови без вмешательства в операционное поле.

- Хронические заболевания, такие как диабет, заболевания печени и коагулопатии, которые повышают риск кровотечения во время операции, еще больше повышают спрос на надежные гемостатические решения как при плановых, так и при экстренных операциях.

- Использование дополнительных гемостатических зажимов становится стандартной практикой во многих высокорисковых хирургических операциях.

Сдержанность/Вызов

Высокие затраты и нормативные ограничения

- Несмотря на клиническую эффективность, высокая стоимость современных биологических и активных гемостатических препаратов, таких как препараты на основе тромбина или фибрина, остаётся ключевым препятствием в условиях ограниченных ресурсов здравоохранения. Многие государственные больницы и небольшие хирургические центры, особенно в развивающихся странах, по-прежнему полагаются на базовые механические методы из-за ограничений по стоимости.

- Более того, строгая нормативная база, регулирующая регистрацию биологических гемостатических препаратов, усложняет и удорожает выход на рынок. Производители должны вкладывать значительные средства в клиническую валидацию и соблюдать строгие требования, что может замедлить внедрение инноваций и доступность.

- Ещё одна проблема заключается в совместимости препаратов и простоте их применения. Некоторые гемостатические средства требуют специального хранения или подготовки, что делает их менее удобными в условиях экстренной помощи или сельской местности. В результате растёт спрос на готовые к использованию, долго хранящиеся препараты с широким спектром применения для различных видов процедур.

- Недостаточная осведомлённость о преимуществах современных гемостатических зажимов на некоторых развивающихся рынках ограничивает их внедрение. Хирурги и отделы закупок могут по-прежнему полагаться на традиционные методы из-за недостаточной подготовки или знакомства с новыми технологиями.

- Проблемы с возмещением расходов в ряде регионов также сдерживают рост рынка. Многие системы здравоохранения не предлагают полного возмещения расходов на дорогостоящие гемостатические средства, что создаёт финансовое бремя как для поставщиков, так и для пациентов.

- Сбои в цепочке поставок, особенно во время глобальных событий, таких как пандемия COVID-19, могут помешать постоянному наличию необходимых гемостатических препаратов в больницах и хирургических центрах, что повлияет на протоколы лечения и решения по запасам.

- Отзыв продукции и опасения, связанные с безопасностью или загрязнением, могут существенно повлиять на доверие к бренду и его принятие. Например, биологические продукты могут нести риск иммуногенной реакции или передачи вируса при неправильном обращении или обработке.

- Растет также обеспокоенность по поводу воздействия на окружающую среду и образования отходов от одноразовых гемостатических продуктов, что заставляет регулирующие органы и больницы искать более устойчивые альтернативы, которые в настоящее время могут предложить не все компании.

Рынок гемостатических препаратов

Рынок сегментирован по типу продукта, рецептуре, применению, показаниям и конечному потребителю.

- По типу продукта

По типу продукта рынок гемостатических средств сегментируется на гемостатические средства на основе тромбина, комбинированные гемостатические средства, гемостатические средства на основе окисленной регенерированной целлюлозы, желатиновые гемостатические средства и гемостатические средства на основе коллагена. Сегмент гемостатических средств на основе тромбина доминировал на рынке с долей выручки 31,8% в 2024 году благодаря его быстрой свертываемости и совместимости с различными хирургическими процедурами. Эти средства высокоэффективны в остановке как небольших, так и больших кровотечений, что делает их широко используемыми хирургами во всем мире.

Между тем, ожидается, что сегмент комбинированных гемостатических зажимов будет расти самыми быстрыми среднегодовыми темпами на уровне 6,9% в период с 2025 по 2032 год благодаря механизмам двойного действия и повышенной эффективности в сложных хирургических условиях, таких как кардиологические и ортопедические процедуры.

- По формулировке

По составу рынок гемостатических зажимов сегментируется на матричные и гелевые гемостатические зажимы, листовые и подушечные гемостатические зажимы, губчатые гемостатические зажимы и порошковые гемостатические зажимы. На сегмент матричных и гелевых гемостатических зажимов в 2024 году пришлась наибольшая доля выручки – 34,2% – благодаря их превосходной адаптации к неровным раневым поверхностям и быстрому действию при малоинвазивных операциях. Простота применения и минимальное повреждение тканей сделали их предпочтительным выбором хирургов при высокоточных операциях.

Ожидается, что сегмент порошковых кровоостанавливающих средств продемонстрирует самые быстрые темпы среднегодового роста на уровне 7,3% в период с 2025 по 2032 год, что обусловлено их универсальностью, удобством хранения и более широким применением при неотложных травмах и лапароскопических процедурах.

- По применению

По области применения рынок гемостатических средств подразделяется на ортопедическую, общую хирургию, нейрохирургию, сердечно-сосудистую хирургию, реконструктивную хирургию и гинекологическую хирургию. Общая хирургия лидировала в этом сегменте с долей выручки 28,6% в 2024 году, что объясняется широким применением гемостатических средств при операциях на органах брюшной полости, травматологических операциях и грыжах, где критически важен эффективный контроль кровопотери.

Ожидается, что сегмент неврологической хирургии будет расти самыми быстрыми темпами среднегодового темпа роста на уровне 7,5% в период с 2025 по 2032 год, поскольку эти процедуры требуют высокоточных гемостатических инструментов для остановки деликатных кровотечений вблизи тканей головного и спинного мозга.

- По показаниям

По показаниям рынок гемостатических средств сегментируется на сегменты для закрытия ран и хирургии. В 2024 году сегмент хирургии занял основную долю рынка – 65,4%, что обусловлено ростом числа сложных хирургических вмешательств, требующих немедленной и эффективной остановки кровотечения для минимизации осложнений.

Ожидается, что сегмент закрытия ран будет расти самыми быстрыми темпами среднегодового темпа роста в период с 2025 по 2032 год в связи с расширением использования местных гемостатических средств при оказании неотложной помощи и в послеоперационный период для сокращения времени заживления и риска инфицирования.

- Конечным пользователем

По типу конечного потребителя рынок гемостатических зажимов сегментирован на больницы, клиники, амбулаторные центры, учреждения здравоохранения общего профиля и другие. Больницы занимали наибольшую долю рынка – 58,1% – в 2024 году, что обусловлено высоким объемом хирургических операций, наличием специализированных хирургических бригад и инфраструктуры. Больницы являются основными местами проведения сложных процедур, требующих расширенной остановки кровотечения.

Прогнозируется, что амбулаторные центры будут демонстрировать самые высокие среднегодовые темпы роста на уровне 8,1% в период с 2025 по 2032 год в связи с ростом числа амбулаторных операций и более широким внедрением экономически эффективных процедур, выполняемых в тот же день, которые требуют надежных быстродействующих кровоостанавливающих зажимов.

Региональный анализ рынка гемостатических препаратов

- Северная Америка доминировала на рынке гемостатических средств с наибольшей долей выручки в 39,8% в 2024 году, что было обусловлено ростом числа хирургических операций, широким внедрением современных гемостатических средств и развитой инфраструктурой здравоохранения.

- Присутствие крупных игроков на рынке в сочетании с благоприятной политикой возмещения расходов и растущим вниманием к минимизации хирургических осложнений еще больше способствовало доминированию региона.

- Спрос на гемостатические средства в Северной Америке также обусловлен ростом численности пожилых людей в регионе, высокой распространенностью хронических заболеваний и увеличением числа травматологических и сердечно-сосудистых операций. Больницы и хирургические центры все активнее инвестируют в современные и эффективные гемостатические решения для уменьшения интраоперационного кровотечения и улучшения результатов лечения пациентов.

Обзор рынка гемостатических препаратов в США

Рынок гемостатических средств США в 2024 году занял самую большую долю выручки в Северной Америке – 64%. Этому способствовали растущая популярность малоинвазивных хирургических вмешательств, повышение осведомлённости о методах лечения кровопотери и технологический прогресс в области гемостатических средств. Страна также обладает хорошо развитой нормативно-правовой базой, широкое клиническое применение комбинированных гемостатических средств и стратегическое сотрудничество между больницами и производителями медицинских изделий. Более того, государственное финансирование и присутствие ведущих научных учреждений, проводящих исследования в области хирургического гемостаза, дополнительно способствуют росту рынка.

Обзор европейского рынка гемостатических препаратов

Ожидается, что рынок гемостатических препаратов в Европе будет расти со значительным среднегодовым темпом роста в течение прогнозируемого периода, главным образом благодаря увеличению объёма плановых и экстренных хирургических операций, повышению внимания к послеоперационным результатам и благоприятному финансированию государственного здравоохранения. В таких странах, как Германия, Франция и Великобритания, наблюдается рост использования современных биологических и активных гемостатических препаратов в ортопедических, сердечно-сосудистых и травматологических операциях. Кроме того, растущая активность, направленная на повышение квалификации хирургов, внедрение инноваций в области медицинских устройств и обеспечение хирургической безопасности, способствует их внедрению как в государственных, так и в частных медицинских учреждениях.

Обзор рынка гемостатических препаратов в Великобритании

Ожидается, что рынок гемостатических средств в Великобритании будет расти значительными среднегодовыми темпами в течение прогнозируемого периода, что обусловлено ростом распространенности хронических заболеваний, требующих хирургического вмешательства, и особым акцентом на улучшение результатов хирургических вмешательств с помощью современных интраоперационных инструментов. Инвестиции Национальной службы здравоохранения (NHS) в современное хирургическое оборудование и расширение роли амбулаторных хирургических центров (ASC) способствуют росту спроса. Более того, рост числа амбулаторных операций и лапароскопических процедур повышает потребность в быстродействующих рассасывающихся гемостатических средствах.

Обзор рынка гемостатических препаратов в Германии

Ожидается, что рынок гемостатических зажимов в Германии будет расти значительными среднегодовыми темпами в течение прогнозируемого периода, чему будут способствовать технологически передовая система здравоохранения, акцент на качестве медицинской помощи и растущее число пожилых пациентов, перенесших хирургическое лечение. Больницы по всей Германии внедряют комбинированные гемостатические зажимы и зажимы на основе фибринового клея благодаря их эффективности при сложных хирургических операциях. Расширению рынка в Германии также способствуют регулирующие меры и местные инновации в области хирургических материалов.

Обзор рынка гемостатических средств в Азиатско-Тихоокеанском регионе

Рынок гемостатических средств в Азиатско-Тихоокеанском регионе, как ожидается, будет расти самыми быстрыми темпами в течение прогнозируемого периода с 2025 по 2032 год, что обусловлено ростом инвестиций в здравоохранение, более широким внедрением современных хирургических методов и резким ростом объёмов хирургических операций в развивающихся странах. В таких странах, как Китай, Япония и Индия, наблюдается быстрое расширение больничной инфраструктуры в сочетании с государственной поддержкой мер по улучшению результатов хирургических вмешательств. Ожидается, что растущий спрос на экономически эффективные и эффективные гемостатические решения как в государственных, так и в частных больницах будет существенно способствовать росту в регионе.

Обзор рынка гемостатических препаратов в Японии

Рынок гемостатических средств в Японии набирает обороты благодаря большому объему хирургических операций, росту численности пожилых людей и усилению внимания к профилактике инфекций и улучшению послеоперационного заживления. Японские медицинские учреждения отдают приоритет высококачественным гемостатическим средствам с доказанной клинической безопасностью и эффективностью. Передовые больницы внедряют комбинированные и синтетические гемостатические средства для сокращения времени хирургических операций и потребности в переливании крови. Кроме того, внутренние инновации и строгие нормативные требования ускоряют внедрение новых продуктов.

Обзор рынка гемостатических препаратов в Китае

В 2024 году китайский рынок гемостатических средств обеспечил наибольшую долю выручки в Азиатско-Тихоокеанском регионе благодаря быстрой модернизации инфраструктуры здравоохранения, расширению сети специализированных больниц и увеличению числа ежегодно проводимых хирургических операций. Сильные местные производственные мощности и государственная поддержка отечественных производителей медицинских изделий дополнительно повышают доступность и финансовую доступность гемостатических средств в стране. Рост численности населения среднего класса в сочетании с ростом проникновения медицинского страхования расширяет доступ к хирургической помощи и стимулирует спрос на эффективные гемостатические средства.

Доля рынка гемостатиков

Лидерами отрасли по производству гемостатических средств являются в основном хорошо зарекомендовавшие себя компании, среди которых:

- CR Bard, Inc. (США)

- Б. Браун СЕ (Германия)

- Baxter International, Inc. (США)

- Integra LifeSciences (США)

- Marine Polymer Technologies, Inc. (США)

- Телефлекс (США)

- Ethicon, Inc. (США)

- Pfizer, Inc. (США)

- Z-Medica LLC (США)

- Gelita Medical GmbH (Германия)

- Anika Therapeutics, Inc. (США)

- Страйкер (США)

- Integra LifeSciences Corporation (США)

Последние разработки на мировом рынке гемостатических средств

- В апреле 2023 года компания Olympus представила три новых гемостатических продукта: EndoClot Adhesive (ECA), EndoClot Polysaccharide Hemostatic Spray (PHS) и EndoClot Submucosal Injection, предназначенные для быстрой остановки кровотечения во время эндоскопических процедур. Эти инновации отражают непрерывный рост рынка малоинвазивных хирургических вспомогательных средств.

- В марте 2023 года компания Axio Biosolutions получила разрешение FDA США 510(k) на свой хирургический кровоостанавливающий препарат Ax‑Surgi, разработанный на основе хитозана для остановки сильного хирургического кровотечения. Это разрешение подчеркивает динамику развития регуляторных органов в области разработки кровоостанавливающих средств.

- В январе 2024 года компания Baxter International Inc. приобрела PerClot, порошкообразный гемостатический препарат на основе растительного крахмала, расширив свое предложение в сегменте вспомогательных средств для гемостаза и подчеркнув стратегическую консолидацию в отрасли.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Интерактивная панель анализа данных

- Панель анализа компании для возможностей с высоким потенциалом роста

- Доступ аналитика-исследователя для настройки и запросов

- Анализ конкурентов с помощью интерактивной панели

- Последние новости, обновления и анализ тенденций

- Используйте возможности сравнительного анализа для комплексного отслеживания конкурентов

Методология исследования

Сбор данных и анализ базового года выполняются с использованием модулей сбора данных с большими размерами выборки. Этап включает получение рыночной информации или связанных данных из различных источников и стратегий. Он включает изучение и планирование всех данных, полученных из прошлого заранее. Он также охватывает изучение несоответствий информации, наблюдаемых в различных источниках информации. Рыночные данные анализируются и оцениваются с использованием статистических и последовательных моделей рынка. Кроме того, анализ доли рынка и анализ ключевых тенденций являются основными факторами успеха в отчете о рынке. Чтобы узнать больше, пожалуйста, запросите звонок аналитика или оставьте свой запрос.

Ключевой методологией исследования, используемой исследовательской группой DBMR, является триангуляция данных, которая включает в себя интеллектуальный анализ данных, анализ влияния переменных данных на рынок и первичную (отраслевую экспертную) проверку. Модели данных включают сетку позиционирования поставщиков, анализ временной линии рынка, обзор рынка и руководство, сетку позиционирования компании, патентный анализ, анализ цен, анализ доли рынка компании, стандарты измерения, глобальный и региональный анализ и анализ доли поставщика. Чтобы узнать больше о методологии исследования, отправьте запрос, чтобы поговорить с нашими отраслевыми экспертами.

Доступна настройка

Data Bridge Market Research является лидером в области передовых формативных исследований. Мы гордимся тем, что предоставляем нашим существующим и новым клиентам данные и анализ, которые соответствуют и подходят их целям. Отчет можно настроить, включив в него анализ ценовых тенденций целевых брендов, понимание рынка для дополнительных стран (запросите список стран), данные о результатах клинических испытаний, обзор литературы, обновленный анализ рынка и продуктовой базы. Анализ рынка целевых конкурентов можно проанализировать от анализа на основе технологий до стратегий портфеля рынка. Мы можем добавить столько конкурентов, о которых вам нужны данные в нужном вам формате и стиле данных. Наша команда аналитиков также может предоставить вам данные в сырых файлах Excel, сводных таблицах (книга фактов) или помочь вам в создании презентаций из наборов данных, доступных в отчете.