Global Goat Milk Market

Размер рынка в млрд долларов США

CAGR :

%

USD

10.74 Billion

USD

16.11 Billion

2024

2032

USD

10.74 Billion

USD

16.11 Billion

2024

2032

| 2025 –2032 | |

| USD 10.74 Billion | |

| USD 16.11 Billion | |

|

|

|

|

Мировой рынок козьего молока, по продукту (цельное молоко, ультрапастеризованное полуобезжиренное и обезжиренное молоко, полуобезжиренное молоко и ультрапастеризованное цельное молоко), вкус (оригинальное/классическое и ароматизированное), содержание жира (обычное, с низким содержанием жира и обезжиренное), тип упаковки (бутылка, тетрапак, саше/пакет, банка и другие), канал сбыта (розничные торговцы в магазинах и розничные торговцы вне магазинов), конечный потребитель (домохозяйства/розничная торговля и сфера общественного питания) — тенденции отрасли и прогноз до 2032 года.

Размер рынка козьего молока

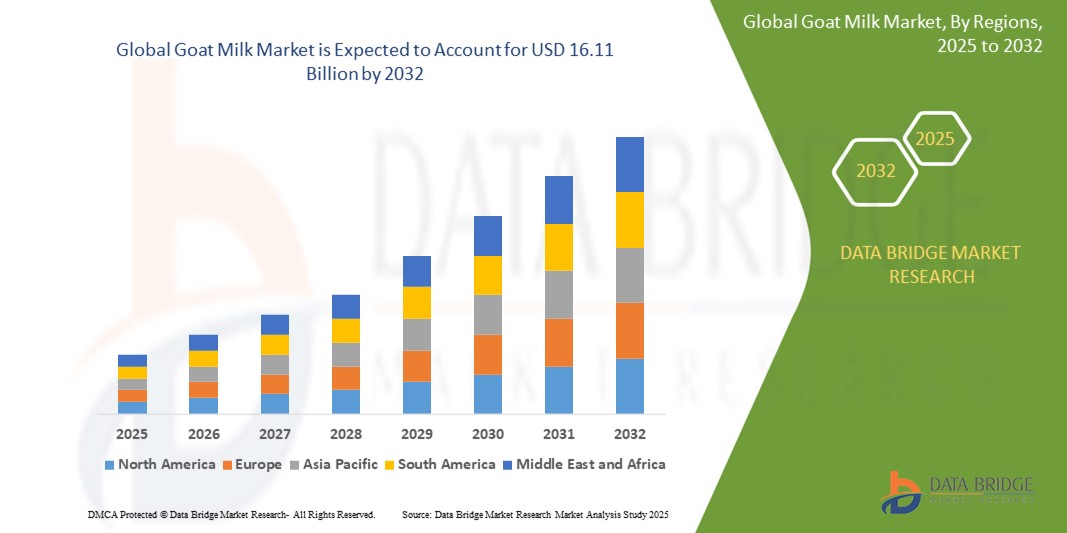

- Объем мирового рынка козьего молока оценивается в 10,74 млрд долларов США в 2024 году и, как ожидается, достигнет 16,11 млрд долларов США к 2032 году при среднегодовом темпе роста 5,2% в прогнозируемый период .

- Рост рынка обусловлен в первую очередь повышением осведомленности потребителей о преимуществах козьего молока для здоровья, таких как более высокая усвояемость и питательная ценность по сравнению с коровьим молоком, а также ростом спроса на натуральные и органические молочные продукты.

- Растущий спрос на безлактозные и гипоаллергенные молочные продукты в сочетании с расширением сферы их применения в сфере общественного питания еще больше способствуют внедрению продуктов из козьего молока, значительно ускоряя расширение рынка.

Анализ рынка козьего молока

- Козье молоко и его производные, такие как сыр, йогурт и сухое молоко, набирают популярность как питательные и легкоусвояемые альтернативы традиционным молочным продуктам, особенно для потребителей с непереносимостью лактозы и тех, кто ищет экологически чистые варианты питания.

- Растущий спрос на козье молоко обусловлен растущим осознанием важности своего здоровья, растущей распространенностью непереносимости лактозы и переходом на премиальные и специальные молочные продукты как в домашнем хозяйстве, так и в сфере общественного питания.

- Азиатско-Тихоокеанский регион доминировал на рынке козьего молока с наибольшей долей выручки в 42,5% в 2024 году, что обусловлено сильным культурным признанием продуктов из козьего молока, крупными молочными фермами и растущим потребительским спросом на полезные молочные альтернативы, особенно в таких странах, как Китай и Индия.

- Ожидается, что Северная Америка станет самым быстрорастущим регионом в прогнозируемый период, что объясняется ростом осведомленности о здоровье, более широким внедрением органических и натуральных продуктов, а также растущим спросом на детские смеси на основе козьего молока и специальные продукты питания.

- Сегмент цельного молока занял самую большую долю рынка в 43,42% в 2024 году, что обусловлено его высокой пищевой ценностью и широким распространением среди потребителей предпочтений в отношении необработанных, жирных молочных продуктов, особенно в домашнем потреблении.

Объем отчета и сегментация рынка козьего молока

|

Атрибуты |

Ключевые данные о рынке козьего молока |

|

Охваченные сегменты |

|

|

Страны, охваченные |

Северная Америка

Европа

Азиатско-Тихоокеанский регион

Ближний Восток и Африка

Южная Америка

|

|

Ключевые игроки рынка |

|

|

Возможности рынка |

|

|

Информационные наборы данных с добавленной стоимостью |

Помимо аналитических данных о рыночных сценариях, таких как рыночная стоимость, темпы роста, сегментация, географический охват и основные игроки, рыночные отчеты, подготовленные Data Bridge Market Research, также включают в себя углубленный экспертный анализ, анализ цен, анализ доли бренда, опрос потребителей, демографический анализ, анализ цепочки поставок, анализ цепочки создания стоимости, обзор сырья/расходных материалов, критерии выбора поставщиков, анализ PESTLE, анализ Портера и нормативную базу. |

Тенденции рынка козьего молока

«Растущая интеграция инноваций, ориентированных на здравоохранение, и аналитики потребителей»

- На мировом рынке козьего молока наблюдается заметная тенденция к интеграции инноваций, ориентированных на здоровье, и аналитики потребителей для удовлетворения меняющихся пищевых предпочтений.

- Эти достижения позволяют производителям глубже понять модели потребительских покупок, потребности в питании и предпочтения в продуктах, что облегчает разработку индивидуальных продуктов из козьего молока.

- Инновации, ориентированные на здоровье, такие как обогащенное козье молоко с добавлением пробиотиков, витаминов или минералов, удовлетворяют растущий спрос на функциональные продукты питания, которые поддерживают пищеварение и иммунитет.

- Например, компании используют аналитику данных о потребителях для создания ароматизированных вариантов козьего молока, таких как шоколадные или фруктовые смеси, ориентируясь на более молодую аудиторию и расширяя охват рынка.

- Эта тенденция повышает привлекательность продуктов из козьего молока, делая их более привлекательными для потребителей, заботящихся о своем здоровье, домохозяйств и предприятий общественного питания.

- Аналитика позволяет оценивать поведение потребителей, например, предпочтения в отношении нежирных или органических продуктов, что позволяет производителям оптимизировать предложения продуктов и маркетинговые стратегии.

Динамика рынка козьего молока

Водитель

«Растущий спрос на альтернативные молочные продукты, не содержащие лактозу и богатые питательными веществами»

- Растущий потребительский спрос на альтернативные молочные продукты, не содержащие лактозу и богатые питательными веществами, обусловленный ростом непереносимости лактозы и осведомленностью о здоровье, является ключевым фактором развития мирового рынка козьего молока.

- Продукты из козьего молока, известные своим более низким содержанием лактозы и более легкой усвояемостью по сравнению с коровьим молоком, обладают такими свойствами, как улучшенный пищевой профиль, включая высокий уровень кальция, белка и витаминов.

- Правительственные инициативы в таких регионах, как Азиатско-Тихоокеанский регион, направленные на поощрение диверсификации молочных продуктов и здорового питания, способствуют широкому распространению козьего молока.

- Развитие электронной коммерции и достижения в области упаковочных технологий, таких как тетрапаки и бутылки, способствуют дальнейшему росту рынка за счет улучшения доступности продукции и увеличения срока ее годности.

- Производители все чаще предлагают продукты из козьего молока, такие как цельное молоко, ультрапастеризованное полуобезжиренное молоко и ароматизированные варианты, в качестве стандартных или премиальных вариантов, чтобы соответствовать ожиданиям потребителей и повышать ценность продукта.

Сдержанность/Вызов

«Высокие издержки производства и ограничения в цепочке поставок»

- Высокая стоимость производства козьего молока, включая рабочую силу, корма и переработку, создает существенный барьер для его внедрения на рынок, особенно на развивающихся рынках, где чувствительность к затратам высока.

- Создание эффективных цепочек поставок козьего молока, особенно ультрапастеризованного полуобезжиренного и обезжиренного молока, может быть сложным и дорогостоящим из-за ограниченных масштабов производства по сравнению с коровьим молоком.

- Кроме того, опасения по поводу сбоев в цепочке поставок и доступности продукции представляют собой серьезные проблемы. Ограниченное количество крупных козьих молочных ферм, особенно в регионах за пределами Азиатско-Тихоокеанского региона, ограничивает постоянные поставки для удовлетворения растущего спроса

- Различия в нормативных требованиях разных стран в отношении органической сертификации, стандартов качества и требований к маркировке еще больше усложняют деятельность мировых производителей и дистрибьюторов.

- Эти факторы могут отпугивать потенциальных покупателей и ограничивать расширение рынка, особенно в таких регионах, как Северная Америка, где быстрый рост сдерживается проблемами с поставками и затратами.

Рынок козьего молока Сфера применения

Рынок сегментирован по продукту, вкусу, содержанию жира, типу упаковки, каналу сбыта и конечному потребителю.

- По продукту

На основе продукта глобальный рынок козьего молока сегментируется на цельное молоко, ультрапастеризованное полуобезжиренное и обезжиренное молоко, полуобезжиренное молоко и ультрапастеризованное цельное молоко. Сегмент цельного молока доминировал в наибольшей доле выручки рынка в 43,42% в 2024 году, что обусловлено его высокой пищевой ценностью и широким распространением потребительского предпочтения необработанных, жирных молочных продуктов, особенно в домашнем потреблении.

Ожидается, что сегмент полуобезжиренного и обезжиренного молока UHT будет демонстрировать самые высокие темпы роста с 2025 по 2032 год, что обусловлено его длительным сроком хранения, удобством и соответствием тенденциям, ориентированным на здоровый образ жизни. Потребители, ищущие менее жирные альтернативы молочным продуктам, и пригодность обработки UHT для международной торговли еще больше стимулируют принятие.

- По вкусу

На основе вкуса мировой рынок козьего молока сегментируется на оригинальное/классическое и ароматизированное. Оригинальный/классический сегмент доминировал на рынке с долей выручки 86,03% в 2024 году благодаря своему аутентичному вкусу, широкому принятию потребителями и универсальности в кулинарном применении в разных регионах.

Ожидается, что сегмент ароматизированных напитков будет испытывать самые быстрые темпы роста с 2025 по 2032 год, что обусловлено ростом спроса со стороны молодых потребителей и тех, кто ищет разнообразие. Такие вкусы, как шоколад, ваниль и фруктовые смеси, нравятся детям и нетрадиционным потребителям козьего молока, поддерживаемые инновационным маркетингом и готовыми к употреблению форматами.

- По содержанию жира

На основе содержания жира мировой рынок козьего молока сегментируется на обычное, с низким содержанием жира и обезжиренное. На обычный сегмент пришлась наибольшая доля выручки рынка в 50,63% в 2024 году, что объясняется его насыщенным вкусом и питательным профилем, который привлекает потребителей, отдающих предпочтение натуральным и минимально обработанным продуктам.

Ожидается, что сегмент с низким содержанием жира будет демонстрировать значительный рост с 2025 по 2032 год, что обусловлено растущим осознанием своего здоровья и спросом на молочные продукты, способствующие контролю веса. Обезжиренное козье молоко соответствует диетическим предпочтениям в плане снижения потребления калорий при сохранении питательных преимуществ.

- По типу упаковки

По типу упаковки мировой рынок козьего молока сегментируется на бутылки, тетра-пак, саше/пакеты, жестяные банки и другие. Сегмент бутылок занимал самую большую долю рынка в выручке около 40% в 2024 году благодаря своему удобству, возможности вторичной переработки и широкому использованию как в розничной торговле, так и в сфере общественного питания. Инновации в области устойчивой упаковки еще больше усиливают ее доминирование.

Прогнозируется, что сегмент тетра-паков будет демонстрировать самые высокие темпы роста с 2025 по 2032 год, что обусловлено его легкой конструкцией, увеличенным сроком хранения и пригодностью для продуктов UHT. Растущий спрос на портативную и экологичную упаковку в урбанизированных регионах поддерживает его рост.

- По каналу распространения

На основе канала сбыта глобальный рынок козьего молока сегментируется на розничных продавцов в магазинах и розничных продавцов вне магазинов. Сегмент розничных продавцов в магазинах доминировал на рынке с долей выручки около 70% в 2024 году, что обусловлено предпочтением потребителей совершать покупки в супермаркетах, гипермаркетах и специализированных магазинах, которые предлагают широкий ассортимент продуктов из козьего молока.

Ожидается, что сегмент немагазинной розничной торговли будет переживать быстрый рост с 2025 по 2032 год, подпитываемый растущей популярностью платформ электронной коммерции и онлайн-покупок продуктов питания. Удобство доставки на дом и возможность охватить потребителей в отдаленных районах стимулируют принятие, особенно после COVID-19.

- Конечным пользователем

На основе конечного потребителя глобальный рынок козьего молока сегментируется на домохозяйства/розничную торговлю и сферу общественного питания. Сегмент домохозяйств/розничной торговли занимал самую большую долю рынка в 77,07% в 2024 году, что обусловлено высоким потребительским спросом на козье молоко как питательную альтернативу коровьему молоку, особенно среди людей с непереносимостью лактозы и заботящихся о своем здоровье.

Ожидается, что сегмент индустрии общественного питания будет испытывать устойчивый рост с 2025 по 2032 год, чему будет способствовать растущее внедрение продуктов из козьего молока в кафе, ресторанах и пекарнях. Спрос на премиальные и специальные молочные продукты в кулинарии усиливает их внедрение в этом секторе.

Региональный анализ рынка козьего молока

- Азиатско-Тихоокеанский регион доминировал на рынке козьего молока с наибольшей долей выручки в 42,5% в 2024 году, что обусловлено сильным культурным признанием продуктов из козьего молока, крупными молочными фермами и растущим потребительским спросом на полезные молочные альтернативы, особенно в таких странах, как Китай и Индия.

- Потребители отдают предпочтение козьему молоку из-за его полезных для здоровья свойств, включая более легкое усвоение, меньшую аллергенность по сравнению с коровьим молоком и пригодность для людей с непереносимостью лактозы, особенно в регионах с различными диетическими предпочтениями.

- Росту способствуют достижения в технологиях переработки, таких как обработка при сверхвысокой температуре (UHT), а также растущее внедрение в бытовых, розничных и общепитовских отраслях с акцентом на ароматизированные и обезжиренные варианты.

Обзор рынка козьего молока в США

Ожидается, что рынок козьего молока в США будет переживать значительный рост, подпитываемый растущей осведомленностью потребителей о пользе козьего молока для здоровья и растущим спросом на натуральные органические молочные альтернативы. Тенденция к премиальным и специальным молочным продуктам в сочетании с растущей доступностью в основных розничных каналах стимулирует расширение рынка. Принятие индустрией общественного питания козьего молока в кафе и ресторанах дополняет розничные продажи, создавая надежную рыночную экосистему.

Обзор европейского рынка козьего молока

Ожидается, что рынок козьего молока в Европе будет переживать значительный рост, поддерживаемый растущим спросом на альтернативные молочные продукты и сильным акцентом на устойчивое сельское хозяйство. Потребители ищут козье молоко из-за его питательного профиля и использования в таких специальных продуктах, как сыры и йогурты. Рост заметен как в розничной торговле, так и в сфере общественного питания, причем такие страны, как Франция и Испания, демонстрируют значительное потребление из-за кулинарных традиций и тенденций, ориентированных на здоровый образ жизни.

Обзор рынка козьего молока в Великобритании

Ожидается, что рынок козьего молока в Великобритании будет стремительно расти, что обусловлено растущим интересом потребителей к альтернативным молочным продуктам, ориентированным на здоровье, и выбору устойчивых продуктов питания. Повышение осведомленности о преимуществах козьего молока для людей с непереносимостью лактозы и здоровья кожи стимулирует его принятие. Развитие диетических тенденций и расширение продуктов из козьего молока в супермаркетах и на онлайн-платформах дополнительно поддерживают рост рынка.

Обзор рынка козьего молока в Германии

Ожидается, что Германия станет свидетелем сильного роста рынка козьего молока, что объясняется ее развитой молочной промышленностью и высокой ориентацией потребителей на здоровье и благополучие. Немецкие потребители предпочитают продукты из козьего молока с низким содержанием жира и органическими сертификатами, что соответствует целям устойчивого развития. Интеграция козьего молока в премиальные молочные продукты и растущая доступность в розничных каналах поддерживают устойчивый рост рынка.

Обзор рынка козьего молока в Азиатско-Тихоокеанском регионе

Азиатско-Тихоокеанский регион доминирует на мировом рынке козьего молока, что обусловлено масштабным потреблением и производством в таких странах, как Китай, Индия и Пакистан. Рост располагаемых доходов и растущая осведомленность о пользе козьего молока для здоровья, включая его роль в питании младенцев и здоровье пищеварительной системы, стимулируют спрос. Правительственные инициативы, способствующие диверсификации молочных продуктов и пищевой безопасности, еще больше поощряют использование продуктов из козьего молока.

Обзор рынка козьего молока в Японии

Ожидается, что рынок козьего молока в Японии будет переживать значительный рост из-за сильного потребительского предпочтения высококачественных, ориентированных на здоровье молочных продуктов. Присутствие крупных производителей продуктов питания и напитков и интеграция козьего молока в функциональные продукты питания и напитки ускоряют проникновение на рынок. Растущий интерес к премиальным и органическим продуктам из козьего молока также способствует росту.

Обзор рынка козьего молока в Китае

Китай занимает самую большую долю на рынке козьего молока в Азиатско-Тихоокеанском регионе, чему способствуют быстрая урбанизация, растущая забота о здоровье и растущий спрос на питательные молочные альтернативы. Растущий средний класс страны и внимание к детскому питанию и функциональным продуктам поддерживают принятие козьего молока. Сильные внутренние производственные возможности и конкурентоспособные цены повышают доступность рынка.

Доля рынка козьего молока

В отрасли производства козьего молока лидируют в основном хорошо зарекомендовавшие себя компании, в том числе:

- Ansnutria Dairy Corporation Ltd. (Китай)

- Группа Emmi (Швейцария)

- Кооператив молочных коз (Новая Зеландия)

- Holle детское питание AG (Швейцария)

- Granarolo SpA (Италия)

- Bubs Australia Limited (Австралия)

- КаприЛак (Австралия)

- Castle Dairy sa (Бельгия)

- DEFEEM SDN. BHD. (Малайзия)

- Delamere Dairy (Великобритания)

- Farm Fresh Milk Sdn. Бхд (Малайзия)

- Hay Dairies Pte Ltd. (Сингапур)

- ЛАКТАЛИС (Франция)

- Orient EuroPharma CO. Ltd. (Тайвань)

- UK Farm SDN BHD (Малайзия)

Каковы последние события на мировом рынке козьего молока?

- В октябре 2023 года ICAR – Центральный институт исследований коз (CIRG) и Heifer India официально оформили стратегическое партнерство с целью преобразования ландшафта козоводства в Индии. Подписанный 6 октября в кампусе CIRG в Махдуме в Матхуре, Меморандум о взаимопонимании фокусируется на новаторских исследованиях, повышении квалификации и устойчивых методах для поддержки мелких фермеров и укрепления цепочки создания стоимости козьего молока. Сотрудничество направлено на повышение производительности, улучшение методов разведения и здравоохранения, а также обеспечение долгосрочной устойчивости за счет расширения прав и возможностей сообществ и связей с частным сектором. Эта инициатива поддерживает растущий спрос на производные козьего молока как в Индии, так и во всем мире.

- В июле 2023 года компания Ausnutria Dairy Corporation Ltd. объявила, что ее детская смесь на основе козьего молока Kabrita успешно прошла проверку FDA США на предмет соответствия требованиям по питанию и безопасности, что сделало ее первой европейской детской смесью на основе козьего молока, получившей такое разрешение. Этот рубеж позволяет Kabrita расширить свое присутствие на рынке США, предлагая безопасную для лактозы и легкоусвояемую альтернативу смесям на основе коровьего молока. Разработанная для детей в возрасте от 0 до 12 месяцев, эта смесь содержит бета-казеин А2 и соотношение сыворотки и казеина, аналогичное грудному молоку, что способствует здоровому росту и комфортному пищеварению.

- В июне 2023 года Vilvah представила свою маску для волос Goat Milk Hair Mask, средство глубокого кондиционирования 3 в 1, предназначенное для питания, укрепления и укладки волос с использованием козьего молока и растительных керамидов. Эта инновационная формула помогает восстановить барьер волоса, уменьшить ломкость и удерживать влагу, что делает ее идеальной для сухих, поврежденных или вьющихся волос. Обогащенная морскими бурыми водорослями и ксилитилглюкозидом, маска усиливает блеск, контролирует вьющиеся волосы и поддерживает здоровье кожи головы. Ее можно использовать как смываемый кондиционер, несмываемую маску или термозащитный крем для укладки, что соответствует растущему спросу на натуральный, устойчивый уход за волосами

- В ноябре 2022 года Redwood Hill Farm & Creamery Inc. и Jackson-Mitchell Inc. объединились, образовав Darey Brands Inc., объединив двух пионеров в области специализированных молочных продуктов под одним знаменем. Новое предприятие объединяет йогурты и кефиры из козьего молока Redwood Hill с козьим молоком и маслом Meyenberg® Jackson-Mitchell, создавая надежный портфель козьих, коровьих и растительных молочных продуктов. При поддержке материнской компании Emmi Group Darey Brands позиционируется для ускоренного роста в нескольких категориях, уделяя особое внимание устойчивым, полезным для вас молочным продуктам, которые отвечают меняющимся предпочтениям потребителей.

- В июне 2022 года Canada Royal Milk (CRM) заключила стратегическое партнерство с Ontario Goat Dairy Cooperative (ODGC) и Producteurs de lait de chèvre du Québec (PLCQ), обеспечив доступ к козьему молоку с более чем 120 ферм по всему Онтарио и Квебеку. Это сотрудничество позволяет CRM постоянно поставлять высококачественное козье молоко для своего предприятия в Кингстоне, Онтарио, поддерживая производство сухих продуктов из козьего молока, включая детскую смесь. Этот шаг знаменует собой значительный шаг в расширении CRM на североамериканском рынке козьего молока, предлагая производителям большую стабильность и открывая новые возможности для инноваций и экспорта.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Интерактивная панель анализа данных

- Панель анализа компании для возможностей с высоким потенциалом роста

- Доступ аналитика-исследователя для настройки и запросов

- Анализ конкурентов с помощью интерактивной панели

- Последние новости, обновления и анализ тенденций

- Используйте возможности сравнительного анализа для комплексного отслеживания конкурентов

Содержание

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE GLOBAL GOAT MILK MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 MULTIVARIATE MODELLING

2.7 MARKET END USER COVERAGE GRID

2.8 DBMR MARKET POSITION GRID

2.9 VENDOR SHARE ANALYSIS

2.1 SECONDARY SOURCES

2.11 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PROMOTIONAL ACTIVITIES

4.2 FACTORS INFLUENCING PURCHASING DECISION OF CUSTOMER

5 REGULATION COVERAGE

5.1 REGULATORY MONITORING AND ADAPTATION

5.2 THIRD-PARTY TESTING AND CERTIFICATION

5.3 SUSTAINABILITY INITIATIVES

5.4 DOCUMENTATION AND TRANSPARENCY

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 RISING PREVALENCE OF LACTOSE INTOLERANCE

6.1.2 ADVANCEMENT IN GOAT MILK-BASED INFANT FORMULA

6.1.3 SURGE IN DEMAND FOR GOAT MILK

6.1.4 ADVANTAGES OF GOAT MILK OVER COW MILK

6.2 RESTRAINTS

6.2.1 HIGH PRODUCTION COSTS OF GOAT MILK

6.2.2 STRICT REGULATORY REQUIREMENTS FOR PRODUCTION, PROCESSING, AND MARKETING

6.3 OPPORTUNITIES

6.3.1 HIGH PREVALENCE OF LIFESTYLE DISORDERS

6.3.2 INCREASING AVAILABILITY OF DIVERSIFIED GOAT MILK PRODUCTS

6.3.3 RISKS ASSOCIATED WITH THE CONSUMPTION OF COW MILK

6.4 CHALLENGES

6.4.1 LIMITED SUPPLY IN THE MARKET

6.4.2 INCREASING COMPETITION FROM PLANT BASED ALTERNATIVES

7 GLOBAL GOAT MILK MARKET, BY PRODUCT

7.1 OVERVIEW

7.2 WHOLE MILK

7.3 UHT SEMI SKIMMED & SKIMMED MILK

7.4 SEMI SKIMMED MILK

7.5 UHT WHOLE MILK

8 GLOBAL GOAT MILK MARKET, BY PACKAGING TYPE

8.1 OVERVIEW

8.2 BOTTLE

8.2.1 PLASTIC

8.2.2 GLASS

8.3 TETRA PAK

8.4 SACHET/POUCH

8.5 TIN

8.6 OTHERS

9 GLOBAL GOAT MILK MARKET, BY FLAVOUR

9.1 OVERVIEW

9.2 ORIGINAL/CLASSIC

9.3 FLAVOURED

9.3.1 CHOCOLATE

9.3.2 OTHERS

10 GLOBAL GOAT MILK MARKET, BY FAT CONTENT

10.1 OVERVIEW

10.2 REGULAR

10.3 LOW FAT

10.4 FAT FREE

11 GLOBAL GOAT MILK MARKET, BY END USER

11.1 OVERVIEW

11.2 HOUSEHOLD/RETAIL

11.3 FOOD SERVICE INDUSTRY

12 GLOBAL GOAT MILK MARKET, BY DISTRIBUTION CHANNEL

12.1 OVERVIEW

12.2 STORE BASED RETAILERS

12.2.1 SUPERMARKETS/HYPERMARKETS

12.2.2 CONVENIENCE STORES

12.2.3 GROCERY RETAILERS

12.2.4 OTHERS

12.3 NON-STORE RETAILERS

12.3.1 ONLINE RETAILERS

12.3.2 COMPANY WEBSITES

13 GLOBAL GOAT MILK MARKET, BY REGION

13.1 NORTH AMERICA

13.1.1 MEXICO

13.1.2 U.S.

13.1.3 CANADA

13.2 EUROPE

13.2.1 FRANCE

13.2.2 SPAIN

13.2.3 NETHERLANDS

13.2.4 ITALY

13.2.5 GERMANY

13.2.6 BELGIUM

13.2.7 SWITZERLAND

13.2.8 U.K.

13.2.9 RUSSIA

13.2.10 TURKEY

13.2.11 REST OF EUROPE

13.3 ASIA-PACIFIC

13.3.1 INDIA

13.3.2 CHINA

13.3.3 INDONESIA

13.3.4 AUSTRALIA

13.3.5 MALAYSIA

13.3.6 THAILAND

13.3.7 PHILIPPINES

13.3.8 SINGAPORE

13.3.9 SOUTH KOREA

13.3.10 JAPAN

13.3.11 REST OF ASIA-PACIFIC

13.4 MIDDLE EAST AND AFRICA

13.4.1 SOUTH AFRICA

13.4.2 SAUDI ARABIA

13.4.3 U.A.E

13.4.4 KUWAIT

13.4.5 REST OF MIDDLE EAST AFRICA

13.5 SOUTH AMERICA

13.5.1 BRAZIL

13.5.2 ARGENTINA

13.5.3 REST OF SOUTH AMERICA

14 GLOBAL GOAT MILK MARKET: COMPANY LANDSCAPE

14.1 COMPANY SHARE ANALYSIS: GLOBAL

14.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

14.3 COMPANY SHARE ANALYSIS: EUROPE

14.4 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

15 SWOT ANALYSIS

16 COMPANY PROFILES

16.1 AUSNUTRIA DAIRY CORPORATION LTD.

16.1.1 COMPANY SNAPSHOT

16.1.2 REVENUE ANALYSIS

16.1.3 COMPANY SHARE ANALYSIS

16.1.4 PRODUCT PORTFOLIO

16.1.5 RECENT DEVELOPMENT

16.2 EMMI GROUP

16.2.1 COMPANY SNAPSHOT

16.2.2 REVENUE ANALYSIS

16.2.3 COMPANY SHARE ANALYSIS

16.2.4 PRODUCT PORTFOLIO

16.2.5 RECENT DEVELOPMENT

16.3 DAIRY GOAT CO-OPERATIVE (N.Z.) LTD

16.3.1 COMPANY SNAPSHOT

16.3.2 COMPANY SHARE ANALYSIS

16.3.3 PRODUCT PORTFOLIO

16.3.4 RECENT DEVELOPMENT

16.4 HOLLE BABY FOOD AG

16.4.1 COMPANY SNAPSHOT

16.4.2 COMPANY SHARE ANALYSIS

16.4.3 PRODUCT PORTFOLIO

16.4.4 RECENT DEVELOPMENT

16.5 GRANAROLO S.P.A

16.5.1 COMPANY SNAPSHOT

16.5.2 COMPANY SHARE ANALYSIS

16.5.3 PRODUCT PORTFOLIO

16.5.4 RECENT DEVELOPMENTS

16.6 BUBS AUSTRALIA LIMITED.

16.6.1 COMPANY SNAPSHOT

16.6.2 PRODUCT PORTFOLIO

16.6.3 RECENT DEVELOPMENT

16.7 CAPRILAC

16.7.1 COMPANY SNAPSHOT

16.7.2 PRODUCT PORTFOLIO

16.7.3 RECENT DEVELOPMENTS

16.8 CASTLE DAIRY S.A.

16.8.1 COMPANY SNAPSHOT

16.8.2 PRODUCT PORTFOLIO

16.8.3 RECENT DEVELOPMENTS

16.9 DEFEEM SDN. BHD.

16.9.1 COMPANY SNAPSHOT

16.9.2 PRODUCT PORTFOLIO

16.9.3 RECENT DEVELOPMENTS

16.1 DELAMERE DAIRY

16.10.1 COMPANY SNAPSHOT

16.10.2 PRODUCT PORTFOLIO

16.10.3 RECENT DEVELOPMENTS

16.11 FARM FRESH MILK SDN. BHD.

16.11.1 COMPANY SNAPSHOT

16.11.2 REVENUE ANALYSIS

16.11.3 PRODUCT PORTFOLIO

16.11.4 RECENT DEVELOPMENTS

16.12 GOOD GOAT MILK CO.

16.12.1 COMPANY SNAPSHOT

16.12.2 PRODUCT PORTFOLIO

16.12.3 RECENT DEVELOPMENT

16.13 HAY DAIRIES PTE LTD.

16.13.1 COMPANY SNAPSHOT

16.13.2 PRODUCT PORTFOLIO

16.13.3 RECENT DEVELOPMENT

16.14 LACTALIS

16.14.1 COMPANY SNAPSHOT

16.14.2 PRODUCT PORTFOLIO

16.14.3 RECENT DEVELOPMENT

16.15 ORIENT EUROPHARMA CO., LTD.

16.15.1 COMPANY SNAPSHOT

16.15.2 PRODUCT PORTFOLIO

16.15.3 RECENT DEVELOPMENT

16.16 UK FARM SDN BHD

16.16.1 COMPANY SNAPSHOT

16.16.2 PRODUCT PORTFOLIO

16.16.3 RECENT DEVELOPMENT

17 QUESTIONNAIRE

18 RELATED REPORTS

Список таблиц

TABLE 1 REGULATIONS ACROSS VARIOUS REGIONS AND COUNTRIES

TABLE 2 GLOBAL GOAT MILK MARKET, BY PRODUCT, 2022-2031 (USD MILLION)

TABLE 3 GLOBAL WHOLE MILK IN GOAT MILK MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 4 GLOBAL UHT SEMI SKIMMED & SKIMMED MILK IN GOAT MILK MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 5 GLOBAL SEMI SKIMMED MILK IN GOAT MILK MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 6 GLOBAL UHT WHOLE MILK IN GOAT MILK MARKET, BY REGION, 2022-2031 (USD MILLION

TABLE 7 GLOBAL GOAT MILK MARKET, BY PACKAGING TYPE, 2022-2031 (USD MILLION)

TABLE 8 GLOBAL BOTTLE IN GOAT MILK MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 9 GLOBAL BOTTLE IN GOAT MILK MARKET, BY PACKAGING TYPE, 2022-2031 (USD MILLION)

TABLE 10 GLOBAL TETRA PAK IN GOAT MILK MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 11 GLOBAL SACHET/POUCH IN GOAT MILK MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 12 GLOBAL TIN IN GOAT MILK MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 13 GLOBAL OTHERS IN GOAT MILK MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 14 GLOBAL GOAT MILK MARKET, BY FLAVOUR, 2022-2031 (USD MILLION)

TABLE 15 GLOBAL ORIGINAL/CLASSIC IN GOAT MILK MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 16 GLOBAL FLAVOURED IN GOAT MILK MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 17 GLOBAL FLAVOURED IN GOAT MILK MARKET, BY FLAVOUR, 2022-2031 (USD MILLION)

TABLE 18 GLOBAL GOAT MILK MARKET, BY FAT CONTENT, 2022-2031 (USD MILLION)

TABLE 19 GLOBAL REGULAR IN GOAT MILK MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 20 GLOBAL LOW FAT IN GOAT MILK MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 21 GLOBAL FAT FREE IN GOAT MILK MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 22 GLOBAL GOAT MILK MARKET, BY END USER, 2022-2031 (USD MILLION)

TABLE 23 GLOBAL HOUSEHOLD/RETAIL IN GOAT MILK MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 24 GLOBAL FOOD SERVICE INDUSTRY IN GOAT MILK MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 25 GLOBAL GOAT MILK MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 26 GLOBAL STORE BASED RETAILERS IN GOAT MILK MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 27 GLOBAL STORE BASED RETAILERS IN GOAT MILK MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 28 GLOBAL NON-STORE RETAILERS IN GOAT MILK MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 29 GLOBAL NON-STORE RETAILERS IN GOAT MILK MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 30 GLOBAL GOAT MILK MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 31 NORTH AMERICA GOAT MILK MARKET, BY COUNTRY, 2022-2031 (USD MILLION)

TABLE 32 NORTH AMERICA GOAT MILK MARKET, BY PRODUCT, 2022-2031 (USD MILLION)

TABLE 33 NORTH AMERICA GOAT MILK MARKET, BY FLAVOUR, 2022-2031 (USD MILLION)

TABLE 34 NORTH AMERICA FLAVOURED IN GOAT MILK MARKET, BY FLAVOUR, 2022-2031 (USD MILLION)

TABLE 35 NORTH AMERICA GOAT MILK MARKET, BY FAT CONTENT, 2022-2031 (USD MILLION)

TABLE 36 NORTH AMERICA GOAT MILK MARKET, BY PACKAGING TYPE, 2022-2031 (USD MILLION)

TABLE 37 NORTH AMERICA BOTTLE IN GOAT MILK MARKET, BY PACKAGING TYPE, 2022-2031 (USD MILLION)

TABLE 38 NORTH AMERICA GOAT MILK MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 39 NORTH AMERICA STORE BASED RETAILERS IN GOAT MILK MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 40 NORTH AMERICA NON-STORE RETAILERS IN GOAT MILK MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 41 NORTH AMERICA GOAT MILK MARKET, BY END USER, 2022-2031 (USD MILLION)

TABLE 42 MEXICO GOAT MILK MARKET, BY PRODUCT, 2022-2031 (USD MILLION)

TABLE 43 MEXICO GOAT MILK MARKET, BY FLAVOUR, 2022-2031 (USD MILLION)

TABLE 44 MEXICO FLAVOURED IN GOAT MILK MARKET, BY FLAVOUR, 2022-2031 (USD MILLION)

TABLE 45 MEXICO GOAT MILK MARKET, BY FAT CONTENT, 2022-2031 (USD MILLION)

TABLE 46 MEXICO GOAT MILK MARKET, BY PACKAGING TYPE, 2022-2031 (USD MILLION)

TABLE 47 MEXICO BOTTLE IN GOAT MILK MARKET, BY PACKAGING TYPE, 2022-2031 (USD MILLION)

TABLE 48 MEXICO GOAT MILK MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 49 MEXICO STORE BASED RETAILERS IN GOAT MILK MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 50 MEXICO NON-STORE RETAILERS IN GOAT MILK MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 51 MEXICO GOAT MILK MARKET, BY END USER, 2022-2031 (USD MILLION)

TABLE 52 U.S. GOAT MILK MARKET, BY PRODUCT, 2022-2031 (USD MILLION)

TABLE 53 U.S. GOAT MILK MARKET, BY FLAVOUR, 2022-2031 (USD MILLION)

TABLE 54 U.S. FLAVOURED IN GOAT MILK MARKET, BY FLAVOUR, 2022-2031 (USD MILLION)

TABLE 55 U.S. GOAT MILK MARKET, BY FAT CONTENT, 2022-2031 (USD MILLION)

TABLE 56 U.S. GOAT MILK MARKET, BY PACKAGING TYPE, 2022-2031 (USD MILLION)

TABLE 57 U.S. BOTTLE IN GOAT MILK MARKET, BY PACKAGING TYPE, 2022-2031 (USD MILLION)

TABLE 58 U.S. GOAT MILK MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 59 U.S. STORE BASED RETAILERS IN GOAT MILK MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 60 U.S. NON-STORE RETAILERS IN GOAT MILK MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 61 U.S. GOAT MILK MARKET, BY END USER, 2022-2031 (USD MILLION)

TABLE 62 CANADA GOAT MILK MARKET, BY PRODUCT, 2022-2031 (USD MILLION)

TABLE 63 CANADA GOAT MILK MARKET, BY FLAVOUR, 2022-2031 (USD MILLION)

TABLE 64 CANADA FLAVOURED IN GOAT MILK MARKET, BY FLAVOUR, 2022-2031 (USD MILLION)

TABLE 65 CANADA GOAT MILK MARKET, BY FAT CONTENT, 2022-2031 (USD MILLION)

TABLE 66 CANADA GOAT MILK MARKET, BY PACKAGING TYPE, 2022-2031 (USD MILLION)

TABLE 67 CANADA BOTTLE IN GOAT MILK MARKET, BY PACKAGING TYPE, 2022-2031 (USD MILLION)

TABLE 68 CANADA GOAT MILK MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 69 CANADA STORE BASED RETAILERS IN GOAT MILK MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 70 CANADA NON-STORE RETAILERS IN GOAT MILK MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 71 CANADA GOAT MILK MARKET, BY END USER, 2022-2031 (USD MILLION)

TABLE 72 EUROPE GOAT MILK MARKET, BY COUNTRY, 2022-2031 (USD MILLION)

TABLE 73 EUROPE GOAT MILK MARKET, BY PRODUCT, 2022-2031 (USD MILLION)

TABLE 74 EUROPE GOAT MILK MARKET, BY FLAVOUR, 2022-2031 (USD MILLION)

TABLE 75 EUROPE FLAVOURED IN GOAT MILK MARKET, BY FLAVOUR, 2022-2031 (USD MILLION)

TABLE 76 EUROPE GOAT MILK MARKET, BY FAT CONTENT, 2022-2031 (USD MILLION)

TABLE 77 EUROPE GOAT MILK MARKET, BY PACKAGING TYPE, 2022-2031 (USD MILLION)

TABLE 78 EUROPE BOTTLE IN GOAT MILK MARKET, BY PACKAGING TYPE, 2022-2031 (USD MILLION)

TABLE 79 EUROPE GOAT MILK MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 80 EUROPE STORE BASED RETAILERS IN GOAT MILK MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 81 EUROPE NON-STORE RETAILERS IN GOAT MILK MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 82 EUROPE GOAT MILK MARKET, BY END USER, 2022-2031 (USD MILLION)

TABLE 83 FRANCE GOAT MILK MARKET, BY PRODUCT, 2022-2031 (USD MILLION)

TABLE 84 FRANCE GOAT MILK MARKET, BY FLAVOUR, 2022-2031 (USD MILLION)

TABLE 85 FRANCE FLAVOURED IN GOAT MILK MARKET, BY FLAVOUR, 2022-2031 (USD MILLION)

TABLE 86 FRANCE GOAT MILK MARKET, BY FAT CONTENT, 2022-2031 (USD MILLION)

TABLE 87 FRANCE GOAT MILK MARKET, BY PACKAGING TYPE, 2022-2031 (USD MILLION)

TABLE 88 FRANCE BOTTLE IN GOAT MILK MARKET, BY PACKAGING TYPE, 2022-2031 (USD MILLION)

TABLE 89 FRANCE GOAT MILK MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 90 FRANCE STORE BASED RETAILERS IN GOAT MILK MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 91 FRANCE NON-STORE RETAILERS IN GOAT MILK MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 92 FRANCE GOAT MILK MARKET, BY END USER, 2022-2031 (USD MILLION)

TABLE 93 SPAIN GOAT MILK MARKET, BY PRODUCT, 2022-2031 (USD MILLION)

TABLE 94 SPAIN GOAT MILK MARKET, BY FLAVOUR, 2022-2031 (USD MILLION)

TABLE 95 SPAIN FLAVOURED IN GOAT MILK MARKET, BY FLAVOUR, 2022-2031 (USD MILLION)

TABLE 96 SPAIN GOAT MILK MARKET, BY FAT CONTENT, 2022-2031 (USD MILLION)

TABLE 97 SPAIN GOAT MILK MARKET, BY PACKAGING TYPE, 2022-2031 (USD MILLION)

TABLE 98 SPAIN BOTTLE IN GOAT MILK MARKET, BY PACKAGING TYPE, 2022-2031 (USD MILLION)

TABLE 99 SPAIN GOAT MILK MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 100 SPAIN STORE BASED RETAILERS IN GOAT MILK MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 101 SPAIN NON-STORE RETAILERS IN GOAT MILK MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 102 SPAIN GOAT MILK MARKET, BY END USER, 2022-2031 (USD MILLION)

TABLE 103 NETHERLANDS GOAT MILK MARKET, BY PRODUCT, 2022-2031 (USD MILLION)

TABLE 104 NETHERLANDS GOAT MILK MARKET, BY FLAVOUR, 2022-2031 (USD MILLION)

TABLE 105 NETHERLANDS FLAVOURED IN GOAT MILK MARKET, BY FLAVOUR, 2022-2031 (USD MILLION)

TABLE 106 NETHERLANDS GOAT MILK MARKET, BY FAT CONTENT, 2022-2031 (USD MILLION)

TABLE 107 NETHERLANDS GOAT MILK MARKET, BY PACKAGING TYPE, 2022-2031 (USD MILLION)

TABLE 108 NETHERLANDS BOTTLE IN GOAT MILK MARKET, BY PACKAGING TYPE, 2022-2031 (USD MILLION)

TABLE 109 NETHERLANDS GOAT MILK MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 110 NETHERLANDS STORE BASED RETAILERS IN GOAT MILK MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 111 NETHERLANDS NON-STORE RETAILERS IN GOAT MILK MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 112 NETHERLANDS GOAT MILK MARKET, BY END USER, 2022-2031 (USD MILLION)

TABLE 113 ITALY GOAT MILK MARKET, BY PRODUCT, 2022-2031 (USD MILLION)

TABLE 114 ITALY GOAT MILK MARKET, BY FLAVOUR, 2022-2031 (USD MILLION)

TABLE 115 ITALY FLAVOURED IN GOAT MILK MARKET, BY FLAVOUR, 2022-2031 (USD MILLION)

TABLE 116 ITALY GOAT MILK MARKET, BY FAT CONTENT, 2022-2031 (USD MILLION)

TABLE 117 ITALY GOAT MILK MARKET, BY PACKAGING TYPE, 2022-2031 (USD MILLION)

TABLE 118 ITALY BOTTLE IN GOAT MILK MARKET, BY PACKAGING TYPE, 2022-2031 (USD MILLION)

TABLE 119 ITALY GOAT MILK MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 120 ITALY STORE BASED RETAILERS IN GOAT MILK MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 121 ITALY NON-STORE RETAILERS IN GOAT MILK MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 122 ITALY GOAT MILK MARKET, BY END USER, 2022-2031 (USD MILLION)

TABLE 123 GERMANY GOAT MILK MARKET, BY PRODUCT, 2022-2031 (USD MILLION)

TABLE 124 GERMANY GOAT MILK MARKET, BY FLAVOUR, 2022-2031 (USD MILLION)

TABLE 125 GERMANY FLAVOURED IN GOAT MILK MARKET, BY FLAVOUR, 2022-2031 (USD MILLION)

TABLE 126 GERMANY GOAT MILK MARKET, BY FAT CONTENT, 2022-2031 (USD MILLION)

TABLE 127 GERMANY GOAT MILK MARKET, BY PACKAGING TYPE, 2022-2031 (USD MILLION)

TABLE 128 GERMANY BOTTLE IN GOAT MILK MARKET, BY PACKAGING TYPE, 2022-2031 (USD MILLION)

TABLE 129 GERMANY GOAT MILK MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 130 GERMANY STORE BASED RETAILERS IN GOAT MILK MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 131 GERMANY NON-STORE RETAILERS IN GOAT MILK MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 132 GERMANY GOAT MILK MARKET, BY END USER, 2022-2031 (USD MILLION)

TABLE 133 BELGIUM GOAT MILK MARKET, BY PRODUCT, 2022-2031 (USD MILLION)

TABLE 134 BELGIUM GOAT MILK MARKET, BY FLAVOUR, 2022-2031 (USD MILLION)

TABLE 135 BELGIUM FLAVOURED IN GOAT MILK MARKET, BY FLAVOUR, 2022-2031 (USD MILLION)

TABLE 136 BELGIUM GOAT MILK MARKET, BY FAT CONTENT, 2022-2031 (USD MILLION)

TABLE 137 BELGIUM GOAT MILK MARKET, BY PACKAGING TYPE, 2022-2031 (USD MILLION)

TABLE 138 BELGIUM BOTTLE IN GOAT MILK MARKET, BY PACKAGING TYPE, 2022-2031 (USD MILLION)

TABLE 139 BELGIUM GOAT MILK MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 140 BELGIUM STORE BASED RETAILERS IN GOAT MILK MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 141 BELGIUM NON-STORE RETAILERS IN GOAT MILK MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 142 BELGIUM GOAT MILK MARKET, BY END USER, 2022-2031 (USD MILLION)

TABLE 143 SWITZERLAND GOAT MILK MARKET, BY PRODUCT, 2022-2031 (USD MILLION)

TABLE 144 SWITZERLAND GOAT MILK MARKET, BY FLAVOUR, 2022-2031 (USD MILLION)

TABLE 145 SWITZERLAND FLAVOURED IN GOAT MILK MARKET, BY FLAVOUR, 2022-2031 (USD MILLION)

TABLE 146 SWITZERLAND GOAT MILK MARKET, BY FAT CONTENT, 2022-2031 (USD MILLION)

TABLE 147 SWITZERLAND GOAT MILK MARKET, BY PACKAGING TYPE, 2022-2031 (USD MILLION)

TABLE 148 SWITZERLAND BOTTLE IN GOAT MILK MARKET, BY PACKAGING TYPE, 2022-2031 (USD MILLION)

TABLE 149 SWITZERLAND GOAT MILK MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 150 SWITZERLAND STORE BASED RETAILERS IN GOAT MILK MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 151 SWITZERLAND NON-STORE RETAILERS IN GOAT MILK MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 152 SWITZERLAND GOAT MILK MARKET, BY END USER, 2022-2031 (USD MILLION)

TABLE 153 U.K. GOAT MILK MARKET, BY PRODUCT, 2022-2031 (USD MILLION)

TABLE 154 U.K. GOAT MILK MARKET, BY FLAVOUR, 2022-2031 (USD MILLION)

TABLE 155 U.K. FLAVOURED IN GOAT MILK MARKET, BY FLAVOUR, 2022-2031 (USD MILLION)

TABLE 156 U.K. GOAT MILK MARKET, BY FAT CONTENT, 2022-2031 (USD MILLION)

TABLE 157 U.K. GOAT MILK MARKET, BY PACKAGING TYPE, 2022-2031 (USD MILLION)

TABLE 158 U.K. BOTTLE IN GOAT MILK MARKET, BY PACKAGING TYPE, 2022-2031 (USD MILLION)

TABLE 159 U.K. GOAT MILK MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 160 U.K. STORE BASED RETAILERS IN GOAT MILK MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 161 U.K. NON-STORE RETAILERS IN GOAT MILK MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 162 U.K. GOAT MILK MARKET, BY END USER, 2022-2031 (USD MILLION)

TABLE 163 RUSSIA GOAT MILK MARKET, BY PRODUCT, 2022-2031 (USD MILLION)

TABLE 164 RUSSIA GOAT MILK MARKET, BY FLAVOUR, 2022-2031 (USD MILLION)

TABLE 165 RUSSIA FLAVOURED IN GOAT MILK MARKET, BY FLAVOUR, 2022-2031 (USD MILLION)

TABLE 166 RUSSIA GOAT MILK MARKET, BY FAT CONTENT, 2022-2031 (USD MILLION)

TABLE 167 RUSSIA GOAT MILK MARKET, BY PACKAGING TYPE, 2022-2031 (USD MILLION)

TABLE 168 RUSSIA BOTTLE IN GOAT MILK MARKET, BY PACKAGING TYPE, 2022-2031 (USD MILLION)

TABLE 169 RUSSIA GOAT MILK MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 170 RUSSIA STORE BASED RETAILERS IN GOAT MILK MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 171 RUSSIA NON-STORE RETAILERS IN GOAT MILK MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 172 RUSSIA GOAT MILK MARKET, BY END USER, 2022-2031 (USD MILLION)

TABLE 173 TURKEY GOAT MILK MARKET, BY PRODUCT, 2022-2031 (USD MILLION)

TABLE 174 TURKEY GOAT MILK MARKET, BY FLAVOUR, 2022-2031 (USD MILLION)

TABLE 175 TURKEY FLAVOURED IN GOAT MILK MARKET, BY FLAVOUR, 2022-2031 (USD MILLION)

TABLE 176 TURKEY GOAT MILK MARKET, BY FAT CONTENT, 2022-2031 (USD MILLION)

TABLE 177 TURKEY GOAT MILK MARKET, BY PACKAGING TYPE, 2022-2031 (USD MILLION)

TABLE 178 TURKEY BOTTLE IN GOAT MILK MARKET, BY PACKAGING TYPE, 2022-2031 (USD MILLION)

TABLE 179 TURKEY GOAT MILK MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 180 TURKEY STORE BASED RETAILERS IN GOAT MILK MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 181 TURKEY NON-STORE RETAILERS IN GOAT MILK MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 182 TURKEY GOAT MILK MARKET, BY END USER, 2022-2031 (USD MILLION)

TABLE 183 REST OF EUROPE GOAT MILK MARKET, BY PRODUCT, 2022-2031 (USD MILLION)

TABLE 184 ASIA-PACIFIC GOAT MILK MARKET, BY COUNTRY, 2022-2031 (USD MILLION)

TABLE 185 ASIA-PACIFIC GOAT MILK MARKET, BY PRODUCT, 2022-2031 (USD MILLION)

TABLE 186 ASIA-PACIFIC GOAT MILK MARKET, BY FLAVOUR, 2022-2031 (USD MILLION)

TABLE 187 ASIA-PACIFIC FLAVOURED IN GOAT MILK MARKET, BY FLAVOUR, 2022-2031 (USD MILLION)

TABLE 188 ASIA-PACIFIC GOAT MILK MARKET, BY FAT CONTENT, 2022-2031 (USD MILLION)

TABLE 189 ASIA-PACIFIC GOAT MILK MARKET, BY PACKAGING TYPE, 2022-2031 (USD MILLION)

TABLE 190 ASIA-PACIFIC BOTTLE IN GOAT MILK MARKET, BY PACKAGING TYPE, 2022-2031 (USD MILLION)

TABLE 191 ASIA-PACIFIC GOAT MILK MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 192 ASIA-PACIFIC STORE BASED RETAILERS IN GOAT MILK MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 193 ASIA-PACIFIC NON-STORE RETAILERS IN GOAT MILK MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 194 ASIA-PACIFIC GOAT MILK MARKET, BY END USER, 2022-2031 (USD MILLION)

TABLE 195 INDIA GOAT MILK MARKET, BY PRODUCT, 2022-2031 (USD MILLION)

TABLE 196 INDIA GOAT MILK MARKET, BY FLAVOUR, 2022-2031 (USD MILLION)

TABLE 197 INDIA FLAVOURED IN GOAT MILK MARKET, BY FLAVOUR, 2022-2031 (USD MILLION)

TABLE 198 INDIA GOAT MILK MARKET, BY FAT CONTENT, 2022-2031 (USD MILLION)

TABLE 199 INDIA GOAT MILK MARKET, BY PACKAGING TYPE, 2022-2031 (USD MILLION)

TABLE 200 INDIA BOTTLE IN GOAT MILK MARKET, BY PACKAGING TYPE, 2022-2031 (USD MILLION)

TABLE 201 INDIA GOAT MILK MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 202 INDIA STORE BASED RETAILERS IN GOAT MILK MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 203 INDIA NON-STORE RETAILERS IN GOAT MILK MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 204 INDIA GOAT MILK MARKET, BY END USER, 2022-2031 (USD MILLION)

TABLE 205 CHINA GOAT MILK MARKET, BY PRODUCT, 2022-2031 (USD MILLION)

TABLE 206 CHINA GOAT MILK MARKET, BY FLAVOUR, 2022-2031 (USD MILLION)

TABLE 207 CHINA FLAVOURED IN GOAT MILK MARKET, BY FLAVOUR, 2022-2031 (USD MILLION)

TABLE 208 CHINA GOAT MILK MARKET, BY FAT CONTENT, 2022-2031 (USD MILLION)

TABLE 209 CHINA GOAT MILK MARKET, BY PACKAGING TYPE, 2022-2031 (USD MILLION)

TABLE 210 CHINA BOTTLE IN GOAT MILK MARKET, BY PACKAGING TYPE, 2022-2031 (USD MILLION)

TABLE 211 CHINA GOAT MILK MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 212 CHINA STORE BASED RETAILERS IN GOAT MILK MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 213 CHINA NON-STORE RETAILERS IN GOAT MILK MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 214 CHINA GOAT MILK MARKET, BY END USER, 2022-2031 (USD MILLION)

TABLE 215 INDONESIA GOAT MILK MARKET, BY PRODUCT, 2022-2031 (USD MILLION)

TABLE 216 INDONESIA GOAT MILK MARKET, BY FLAVOUR, 2022-2031 (USD MILLION)

TABLE 217 INDONESIA FLAVOURED IN GOAT MILK MARKET, BY FLAVOUR, 2022-2031 (USD MILLION)

TABLE 218 INDONESIA GOAT MILK MARKET, BY FAT CONTENT, 2022-2031 (USD MILLION)

TABLE 219 INDONESIA GOAT MILK MARKET, BY PACKAGING TYPE, 2022-2031 (USD MILLION)

TABLE 220 INDONESIA BOTTLE IN GOAT MILK MARKET, BY PACKAGING TYPE, 2022-2031 (USD MILLION)

TABLE 221 INDONESIA GOAT MILK MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 222 INDONESIA STORE BASED RETAILERS IN GOAT MILK MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 223 INDONESIA NON-STORE RETAILERS IN GOAT MILK MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 224 INDONESIA GOAT MILK MARKET, BY END USER, 2022-2031 (USD MILLION)

TABLE 225 AUSTRALIA GOAT MILK MARKET, BY PRODUCT, 2022-2031 (USD MILLION)

TABLE 226 AUSTRALIA GOAT MILK MARKET, BY FLAVOUR, 2022-2031 (USD MILLION)

TABLE 227 AUSTRALIA FLAVOURED IN GOAT MILK MARKET, BY FLAVOUR, 2022-2031 (USD MILLION)

TABLE 228 AUSTRALIA GOAT MILK MARKET, BY FAT CONTENT, 2022-2031 (USD MILLION)

TABLE 229 AUSTRALIA GOAT MILK MARKET, BY PACKAGING TYPE, 2022-2031 (USD MILLION)

TABLE 230 AUSTRALIA BOTTLE IN GOAT MILK MARKET, BY PACKAGING TYPE, 2022-2031 (USD MILLION)

TABLE 231 AUSTRALIA GOAT MILK MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 232 AUSTRALIA STORE BASED RETAILERS IN GOAT MILK MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 233 AUSTRALIA NON-STORE RETAILERS IN GOAT MILK MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 234 AUSTRALIA GOAT MILK MARKET, BY END USER, 2022-2031 (USD MILLION)

TABLE 235 MALAYSIA GOAT MILK MARKET, BY PRODUCT, 2022-2031 (USD MILLION)

TABLE 236 MALAYSIA GOAT MILK MARKET, BY FLAVOUR, 2022-2031 (USD MILLION)

TABLE 237 MALAYSIA FLAVOURED IN GOAT MILK MARKET, BY FLAVOUR, 2022-2031 (USD MILLION)

TABLE 238 MALAYSIA GOAT MILK MARKET, BY FAT CONTENT, 2022-2031 (USD MILLION)

TABLE 239 MALAYSIA GOAT MILK MARKET, BY PACKAGING TYPE, 2022-2031 (USD MILLION)

TABLE 240 MALAYSIA BOTTLE IN GOAT MILK MARKET, BY PACKAGING TYPE, 2022-2031 (USD MILLION)

TABLE 241 MALAYSIA GOAT MILK MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 242 MALAYSIA STORE BASED RETAILERS IN GOAT MILK MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 243 MALAYSIA NON-STORE RETAILERS IN GOAT MILK MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 244 MALAYSIA GOAT MILK MARKET, BY END USER, 2022-2031 (USD MILLION)

TABLE 245 THAILAND GOAT MILK MARKET, BY PRODUCT, 2022-2031 (USD MILLION)

TABLE 246 THAILAND GOAT MILK MARKET, BY FLAVOUR, 2022-2031 (USD MILLION)

TABLE 247 THAILAND FLAVOURED IN GOAT MILK MARKET, BY FLAVOUR, 2022-2031 (USD MILLION)

TABLE 248 THAILAND GOAT MILK MARKET, BY FAT CONTENT, 2022-2031 (USD MILLION)

TABLE 249 THAILAND GOAT MILK MARKET, BY PACKAGING TYPE, 2022-2031 (USD MILLION)

TABLE 250 THAILAND BOTTLE IN GOAT MILK MARKET, BY PACKAGING TYPE, 2022-2031 (USD MILLION)

TABLE 251 THAILAND GOAT MILK MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 252 THAILAND STORE BASED RETAILERS IN GOAT MILK MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 253 THAILAND NON-STORE RETAILERS IN GOAT MILK MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 254 THAILAND GOAT MILK MARKET, BY END USER, 2022-2031 (USD MILLION)

TABLE 255 PHILIPPINES GOAT MILK MARKET, BY PRODUCT, 2022-2031 (USD MILLION)

TABLE 256 PHILIPPINES GOAT MILK MARKET, BY FLAVOUR, 2022-2031 (USD MILLION)

TABLE 257 PHILIPPINES FLAVOURED IN GOAT MILK MARKET, BY FLAVOUR, 2022-2031 (USD MILLION)

TABLE 258 PHILIPPINES GOAT MILK MARKET, BY FAT CONTENT, 2022-2031 (USD MILLION)

TABLE 259 PHILIPPINES GOAT MILK MARKET, BY PACKAGING TYPE, 2022-2031 (USD MILLION)

TABLE 260 PHILIPPINES BOTTLE IN GOAT MILK MARKET, BY PACKAGING TYPE, 2022-2031 (USD MILLION)

TABLE 261 PHILIPPINES GOAT MILK MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 262 PHILIPPINES STORE BASED RETAILERS IN GOAT MILK MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 263 PHILIPPINES NON-STORE RETAILERS IN GOAT MILK MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 264 PHILIPPINES GOAT MILK MARKET, BY END USER, 2022-2031 (USD MILLION)

TABLE 265 SINGAPORE GOAT MILK MARKET, BY PRODUCT, 2022-2031 (USD MILLION)

TABLE 266 SINGAPORE GOAT MILK MARKET, BY FLAVOUR, 2022-2031 (USD MILLION)

TABLE 267 SINGAPORE FLAVOURED IN GOAT MILK MARKET, BY FLAVOUR, 2022-2031 (USD MILLION)

TABLE 268 SINGAPORE GOAT MILK MARKET, BY FAT CONTENT, 2022-2031 (USD MILLION)

TABLE 269 SINGAPORE GOAT MILK MARKET, BY PACKAGING TYPE, 2022-2031 (USD MILLION)

TABLE 270 SINGAPORE BOTTLE IN GOAT MILK MARKET, BY PACKAGING TYPE, 2022-2031 (USD MILLION)

TABLE 271 SINGAPORE GOAT MILK MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 272 SINGAPORE STORE BASED RETAILERS IN GOAT MILK MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 273 SINGAPORE NON-STORE RETAILERS IN GOAT MILK MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 274 SINGAPORE GOAT MILK MARKET, BY END USER, 2022-2031 (USD MILLION)

TABLE 275 SOUTH KOREA GOAT MILK MARKET, BY PRODUCT, 2022-2031 (USD MILLION)

TABLE 276 SOUTH KOREA GOAT MILK MARKET, BY FLAVOUR, 2022-2031 (USD MILLION)

TABLE 277 SOUTH KOREA FLAVOURED IN GOAT MILK MARKET, BY FLAVOUR, 2022-2031 (USD MILLION)

TABLE 278 SOUTH KOREA GOAT MILK MARKET, BY FAT CONTENT, 2022-2031 (USD MILLION)

TABLE 279 SOUTH KOREA GOAT MILK MARKET, BY PACKAGING TYPE, 2022-2031 (USD MILLION)

TABLE 280 SOUTH KOREA BOTTLE IN GOAT MILK MARKET, BY PACKAGING TYPE, 2022-2031 (USD MILLION)

TABLE 281 SOUTH KOREA GOAT MILK MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 282 SOUTH KOREA STORE BASED RETAILERS IN GOAT MILK MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 283 SOUTH KOREA NON-STORE RETAILERS IN GOAT MILK MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 284 SOUTH KOREA GOAT MILK MARKET, BY END USER, 2022-2031 (USD MILLION)

TABLE 285 JAPAN GOAT MILK MARKET, BY PRODUCT, 2022-2031 (USD MILLION)

TABLE 286 JAPAN GOAT MILK MARKET, BY FLAVOUR, 2022-2031 (USD MILLION)

TABLE 287 JAPAN FLAVOURED IN GOAT MILK MARKET, BY FLAVOUR, 2022-2031 (USD MILLION)

TABLE 288 JAPAN GOAT MILK MARKET, BY FAT CONTENT, 2022-2031 (USD MILLION)

TABLE 289 JAPAN GOAT MILK MARKET, BY PACKAGING TYPE, 2022-2031 (USD MILLION)

TABLE 290 JAPAN BOTTLE IN GOAT MILK MARKET, BY PACKAGING TYPE, 2022-2031 (USD MILLION)

TABLE 291 JAPAN GOAT MILK MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 292 JAPAN STORE BASED RETAILERS IN GOAT MILK MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 293 JAPAN NON-STORE RETAILERS IN GOAT MILK MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 294 JAPAN GOAT MILK MARKET, BY END USER, 2022-2031 (USD MILLION)

TABLE 295 REST OF ASIA-PACIFIC GOAT MILK MARKET, BY PRODUCT, 2022-2031 (USD MILLION)

TABLE 296 MIDDLE EAST AND AFRICA GOAT MILK MARKET, BY COUNTRY, 2022-2031 (USD MILLION)

TABLE 297 MIDDLE EAST AND AFRICA GOAT MILK MARKET, BY PRODUCT, 2022-2031 (USD MILLION)

TABLE 298 MIDDLE EAST AND AFRICA GOAT MILK MARKET, BY FLAVOUR, 2022-2031 (USD MILLION)

TABLE 299 MIDDLE EAST AND AFRICA FLAVOURED IN GOAT MILK MARKET, BY FLAVOUR, 2022-2031 (USD MILLION)

TABLE 300 MIDDLE EAST AND AFRICA GOAT MILK MARKET, BY FAT CONTENT, 2022-2031 (USD MILLION)

TABLE 301 MIDDLE EAST AND AFRICA GOAT MILK MARKET, BY PACKAGING TYPE, 2022-2031 (USD MILLION)

TABLE 302 MIDDLE EAST AND AFRICA BOTTLE IN GOAT MILK MARKET, BY PACKAGING TYPE, 2022-2031 (USD MILLION)

TABLE 303 MIDDLE EAST AND AFRICA GOAT MILK MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 304 MIDDLE EAST AND AFRICA STORE BASED RETAILERS IN GOAT MILK MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 305 MIDDLE EAST AND AFRICA NON-STORE RETAILERS IN GOAT MILK MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 306 MIDDLE EAST AND AFRICA GOAT MILK MARKET, BY END USER, 2022-2031 (USD MILLION)

TABLE 307 SOUTH AFRICA GOAT MILK MARKET, BY PRODUCT, 2022-2031 (USD MILLION)

TABLE 308 SOUTH AFRICA GOAT MILK MARKET, BY FLAVOUR, 2022-2031 (USD MILLION)

TABLE 309 SOUTH AFRICA FLAVOURED IN GOAT MILK MARKET, BY FLAVOUR, 2022-2031 (USD MILLION)

TABLE 310 SOUTH AFRICA GOAT MILK MARKET, BY FAT CONTENT, 2022-2031 (USD MILLION)

TABLE 311 SOUTH AFRICA GOAT MILK MARKET, BY PACKAGING TYPE, 2022-2031 (USD MILLION)

TABLE 312 SOUTH AFRICA BOTTLE IN GOAT MILK MARKET, BY PACKAGING TYPE, 2022-2031 (USD MILLION)

TABLE 313 SOUTH AFRICA GOAT MILK MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 314 SOUTH AFRICA STORE BASED RETAILERS IN GOAT MILK MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 315 SOUTH AFRICA NON-STORE RETAILERS IN GOAT MILK MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 316 SOUTH AFRICA GOAT MILK MARKET, BY END USER, 2022-2031 (USD MILLION)

TABLE 317 SAUDI ARABIA GOAT MILK MARKET, BY PRODUCT, 2022-2031 (USD MILLION)

TABLE 318 SAUDI ARABIA GOAT MILK MARKET, BY FLAVOUR, 2022-2031 (USD MILLION)

TABLE 319 SAUDI ARABIA FLAVOURED IN GOAT MILK MARKET, BY FLAVOUR, 2022-2031 (USD MILLION)

TABLE 320 SAUDI ARABIA GOAT MILK MARKET, BY FAT CONTENT, 2022-2031 (USD MILLION)

TABLE 321 SAUDI ARABIA GOAT MILK MARKET, BY PACKAGING TYPE, 2022-2031 (USD MILLION)

TABLE 322 SAUDI ARABIA BOTTLE IN GOAT MILK MARKET, BY PACKAGING TYPE, 2022-2031 (USD MILLION)

TABLE 323 SAUDI ARABIA GOAT MILK MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 324 SAUDI ARABIA STORE BASED RETAILERS IN GOAT MILK MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 325 SAUDI ARABIA NON-STORE RETAILERS IN GOAT MILK MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 326 SAUDI ARABIA GOAT MILK MARKET, BY END USER, 2022-2031 (USD MILLION)

TABLE 327 U.A.E GOAT MILK MARKET, BY PRODUCT, 2022-2031 (USD MILLION)

TABLE 328 U.A.E GOAT MILK MARKET, BY FLAVOUR, 2022-2031 (USD MILLION)

TABLE 329 U.A.E FLAVOURED IN GOAT MILK MARKET, BY FLAVOUR, 2022-2031 (USD MILLION)

TABLE 330 U.A.E GOAT MILK MARKET, BY FAT CONTENT, 2022-2031 (USD MILLION)

TABLE 331 U.A.E GOAT MILK MARKET, BY PACKAGING TYPE, 2022-2031 (USD MILLION)

TABLE 332 U.A.E BOTTLE IN GOAT MILK MARKET, BY PACKAGING TYPE, 2022-2031 (USD MILLION)

TABLE 333 U.A.E GOAT MILK MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 334 U.A.E STORE BASED RETAILERS IN GOAT MILK MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 335 U.A.E NON-STORE RETAILERS IN GOAT MILK MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 336 U.A.E GOAT MILK MARKET, BY END USER, 2022-2031 (USD MILLION)

TABLE 337 KUWAIT GOAT MILK MARKET, BY PRODUCT, 2022-2031 (USD MILLION)

TABLE 338 KUWAIT GOAT MILK MARKET, BY FLAVOUR, 2022-2031 (USD MILLION)

TABLE 339 KUWAIT FLAVOURED IN GOAT MILK MARKET, BY FLAVOUR, 2022-2031 (USD MILLION)

TABLE 340 KUWAIT GOAT MILK MARKET, BY FAT CONTENT, 2022-2031 (USD MILLION)

TABLE 341 KUWAIT GOAT MILK MARKET, BY PACKAGING TYPE, 2022-2031 (USD MILLION)

TABLE 342 KUWAIT BOTTLE IN GOAT MILK MARKET, BY PACKAGING TYPE, 2022-2031 (USD MILLION)

TABLE 343 KUWAIT GOAT MILK MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 344 KUWAIT STORE BASED RETAILERS IN GOAT MILK MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 345 KUWAIT NON-STORE RETAILERS IN GOAT MILK MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 346 KUWAIT GOAT MILK MARKET, BY END USER, 2022-2031 (USD MILLION)

TABLE 347 REST OF MIDDLE EAST AFRICA GOAT MILK MARKET, BY PRODUCT, 2022-2031 (USD MILLION)

TABLE 348 SOUTH AMERICA GOAT MILK MARKET, BY COUNTRY, 2022-2031 (USD MILLION)

TABLE 349 SOUTH AMERICA GOAT MILK MARKET, BY PRODUCT, 2022-2031 (USD MILLION)

TABLE 350 SOUTH AMERICA GOAT MILK MARKET, BY FLAVOUR, 2022-2031 (USD MILLION)

TABLE 351 SOUTH AMERICA FLAVOURED IN GOAT MILK MARKET, BY FLAVOUR, 2022-2031 (USD MILLION)

TABLE 352 SOUTH AMERICA GOAT MILK MARKET, BY FAT CONTENT, 2022-2031 (USD MILLION)

TABLE 353 SOUTH AMERICA GOAT MILK MARKET, BY PACKAGING TYPE, 2022-2031 (USD MILLION)

TABLE 354 SOUTH AMERICA BOTTLE IN GOAT MILK MARKET, BY PACKAGING TYPE, 2022-2031 (USD MILLION)

TABLE 355 SOUTH AMERICA GOAT MILK MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 356 SOUTH AMERICA STORE BASED RETAILERS IN GOAT MILK MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 357 SOUTH AMERICA NON-STORE RETAILERS IN GOAT MILK MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 358 SOUTH AMERICA GOAT MILK MARKET, BY END USER, 2022-2031 (USD MILLION)

TABLE 359 BRAZIL GOAT MILK MARKET, BY PRODUCT, 2022-2031 (USD MILLION)

TABLE 360 BRAZIL GOAT MILK MARKET, BY FLAVOUR, 2022-2031 (USD MILLION)

TABLE 361 BRAZIL FLAVOURED IN GOAT MILK MARKET, BY FLAVOUR, 2022-2031 (USD MILLION)

TABLE 362 BRAZIL GOAT MILK MARKET, BY FAT CONTENT, 2022-2031 (USD MILLION)

TABLE 363 BRAZIL GOAT MILK MARKET, BY PACKAGING TYPE, 2022-2031 (USD MILLION)

TABLE 364 BRAZIL BOTTLE IN GOAT MILK MARKET, BY PACKAGING TYPE, 2022-2031 (USD MILLION)

TABLE 365 BRAZIL GOAT MILK MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 366 BRAZIL STORE BASED RETAILERS IN GOAT MILK MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 367 BRAZIL NON-STORE RETAILERS IN GOAT MILK MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 368 BRAZIL GOAT MILK MARKET, BY END USER, 2022-2031 (USD MILLION)

TABLE 369 ARGENTINA GOAT MILK MARKET, BY PRODUCT, 2022-2031 (USD MILLION)

TABLE 370 ARGENTINA GOAT MILK MARKET, BY FLAVOUR, 2022-2031 (USD MILLION)

TABLE 371 ARGENTINA FLAVOURED IN GOAT MILK MARKET, BY FLAVOUR, 2022-2031 (USD MILLION)

TABLE 372 ARGENTINA GOAT MILK MARKET, BY FAT CONTENT, 2022-2031 (USD MILLION)

TABLE 373 ARGENTINA GOAT MILK MARKET, BY PACKAGING TYPE, 2022-2031 (USD MILLION)

TABLE 374 ARGENTINA BOTTLE IN GOAT MILK MARKET, BY PACKAGING TYPE, 2022-2031 (USD MILLION)

TABLE 375 ARGENTINA GOAT MILK MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 376 ARGENTINA STORE BASED RETAILERS IN GOAT MILK MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 377 ARGENTINA NON-STORE RETAILERS IN GOAT MILK MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 378 ARGENTINA GOAT MILK MARKET, BY END USER, 2022-2031 (USD MILLION)

TABLE 379 REST OF SOUTH AMERICA GOAT MILK MARKET, BY PRODUCT, 2022-2031 (USD MILLION)

Список рисунков

FIGURE 1 GLOBAL GOAT MILK MARKET: SEGMENTATION

FIGURE 2 GLOBAL GOAT MILK MARKET: DATA TRIANGULATION

FIGURE 3 GLOBAL GOAT MILK MARKET: DROC ANALYSIS

FIGURE 4 GLOBAL GOAT MILK MARKET: GLOBAL VS REGIONAL MARKET ANALYSIS

FIGURE 5 GLOBAL GOAT MILK MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 GLOBAL GOAT MILK MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 GLOBAL GOAT MILK MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 8 GLOBAL GOAT MILK MARKET: DBMR MARKET POSITION GRID

FIGURE 9 GLOBAL GOAT MILK MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 GLOBAL GOAT MILK MARKET: SEGMENTATION

FIGURE 11 TWO SEGMENTS COMPRISE GLOBAL GOAT MILK MARKET

FIGURE 12 GLOBAL GOAT MILK MARKET EXECUTIVE SUMMARY

FIGURE 13 GLOBAL GOAT MILK MARKET STRATEGIC DECISIONS

FIGURE 14 INCREASING PREVALENCE OF LACTOSE INTOLERANCE IS DRIVING THE GROWTH OF THE GLOBAL GOAT MILK MARKET FROM 2024 TO 2031

FIGURE 15 THE PRODUCT SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE GLOBAL GOAT MILK MARKET IN 2024 AND 2031

FIGURE 16 ASIA-PACIFIC IS EXPECTED TO DOMINATE THE GLOBAL GOAT MILK MARKET AND EUROPE IS EXPECTED TO GROW WITH THE HIGHEST CAGR IN THE FORECAST PERIOD OF 2024 TO 2031

FIGURE 17 EUROPE IS THE FASTEST-GROWING REGION FOR GOAT MILK MARKET MANUFACTURERS IN THE FORECAST PERIOD OF 2024 TO 2031

FIGURE 18 DROC ANALYSIS

FIGURE 19 GLOBAL GOAT MILK MARKET: BY PRODUCT, 2023

FIGURE 20 GLOBAL GOAT MILK MARKET: BY PACKAGING TYPE, 2023

FIGURE 21 GLOBAL GOAT MILK MARKET: BY FLAVOUR, 2023

FIGURE 22 GLOBAL GOAT MILK MARKET: BY FAT CONTENT, 2023

FIGURE 23 GLOBAL GOAT MILK MARKET: BY END USER, 2023

FIGURE 24 GLOBAL GOAT MILK MARKET: BY DISTRIBUTION CHANNEL, 2023

FIGURE 25 GLOBAL GOAT MILK MARKET: SNAPSHOT (2023)

FIGURE 26 GLOBAL GOAT MILK MARKET: COMPANY SHARE 2023 (%)

FIGURE 27 NORTH AMERICA GOAT MILK MARKET: COMPANY SHARE 2023 (%)

FIGURE 28 EUROPE GOAT MILK MARKET: COMPANY SHARE 2023 (%)

FIGURE 29 ASIA-PACIFIC GOAT MILK MARKET: COMPANY SHARE 2023 (%)

Методология исследования

Сбор данных и анализ базового года выполняются с использованием модулей сбора данных с большими размерами выборки. Этап включает получение рыночной информации или связанных данных из различных источников и стратегий. Он включает изучение и планирование всех данных, полученных из прошлого заранее. Он также охватывает изучение несоответствий информации, наблюдаемых в различных источниках информации. Рыночные данные анализируются и оцениваются с использованием статистических и последовательных моделей рынка. Кроме того, анализ доли рынка и анализ ключевых тенденций являются основными факторами успеха в отчете о рынке. Чтобы узнать больше, пожалуйста, запросите звонок аналитика или оставьте свой запрос.

Ключевой методологией исследования, используемой исследовательской группой DBMR, является триангуляция данных, которая включает в себя интеллектуальный анализ данных, анализ влияния переменных данных на рынок и первичную (отраслевую экспертную) проверку. Модели данных включают сетку позиционирования поставщиков, анализ временной линии рынка, обзор рынка и руководство, сетку позиционирования компании, патентный анализ, анализ цен, анализ доли рынка компании, стандарты измерения, глобальный и региональный анализ и анализ доли поставщика. Чтобы узнать больше о методологии исследования, отправьте запрос, чтобы поговорить с нашими отраслевыми экспертами.

Доступна настройка

Data Bridge Market Research является лидером в области передовых формативных исследований. Мы гордимся тем, что предоставляем нашим существующим и новым клиентам данные и анализ, которые соответствуют и подходят их целям. Отчет можно настроить, включив в него анализ ценовых тенденций целевых брендов, понимание рынка для дополнительных стран (запросите список стран), данные о результатах клинических испытаний, обзор литературы, обновленный анализ рынка и продуктовой базы. Анализ рынка целевых конкурентов можно проанализировать от анализа на основе технологий до стратегий портфеля рынка. Мы можем добавить столько конкурентов, о которых вам нужны данные в нужном вам формате и стиле данных. Наша команда аналитиков также может предоставить вам данные в сырых файлах Excel, сводных таблицах (книга фактов) или помочь вам в создании презентаций из наборов данных, доступных в отчете.