Global Blockchain Market

Размер рынка в млрд долларов США

CAGR :

%

USD

29.62 Billion

USD

2,264.66 Billion

2024

2031

USD

29.62 Billion

USD

2,264.66 Billion

2024

2031

| 2025 –2031 | |

| USD 29.62 Billion | |

| USD 2,264.66 Billion | |

|

|

|

|

Сегментация глобального рынка блокчейнов по компонентам (платформы и сервисы), поставщику (поставщики приложений и решений, поставщики промежуточного программного обеспечения и поставщики инфраструктуры), типу (частная, публичная, гибридная и консорциум), размеру организации (малые и средние предприятия и крупные предприятия), разработке (подтверждение концепции, пилот и производство), применению (недвижимость и строительство, сельское хозяйство и продовольствие, производство, энергетика и коммунальные услуги, документация, ИТ и телекоммуникации, страхование, электронная коммерция, потребительские товары и другие), конечному пользователю (транспорт и логистика, розничная торговля и электронная коммерция, СМИ, реклама и развлечения, путешествия, здравоохранение и науки о жизни, банковское дело, финансовые услуги и страхование (BFSI) и правительство) — отраслевые тенденции и прогноз до 2032 года

Размер рынка блокчейна

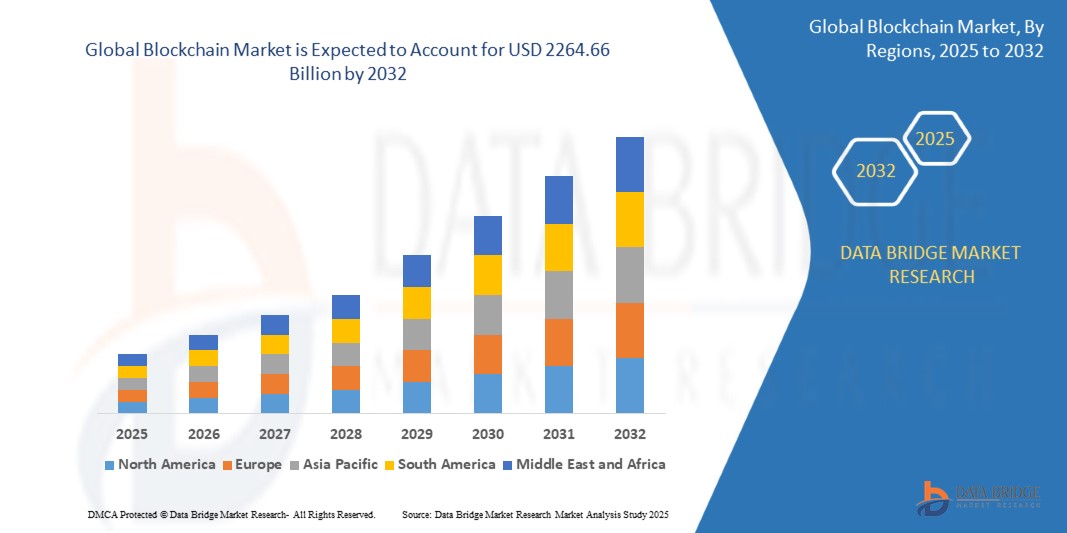

- Глобальный рынок блокчейнов был оценен в29,62 млрд долларов США в 2024 годуи, как ожидается, достигнет2264,66 млрд долларов США к 2032 году

- В прогнозируемый период с 2025 по 2032 год рынок, вероятно, будет расти темпамиСреднегодовой темп роста составил 71,96%,в первую очередь за счет роста криптовалюты и цифровых активов

- Этот рост обусловлен такими факторами, как институциональное принятие, массовое принятие и варианты использования, а также технологический прогресс.

Анализ рынка блокчейна

- Рынок блокчейна относится к экосистеме технологий распределенного реестра, которые обеспечивают безопасные, прозрачные и децентрализованные цифровые транзакции. Он обеспечивает одноранговый обмен данными, снижает зависимость от посредников и повышает безопасность с помощью криптографической проверки и механизмов консенсуса.

- Отрасль переживает быстрый рост из-за растущего спроса на безопасные и защищенные от несанкционированного доступа цифровые транзакции, растущего принятия децентрализованных финансов (DeFi) и растущей интеграции блокчейна в корпоративные приложения. Поскольку предприятия ищут инновационные решения для обеспечения целостности данных и автоматизации, компании развертывают масштабируемые, совместимые и энергоэффективные сети блокчейнов для стимулирования роста рынка

- Внедрение смарт-контрактов, токенизации и блокчейна как услуги (BaaS) трансформирует ландшафт блокчейна, обеспечивая автоматизацию процессов, оцифровку активов и бесперебойные трансграничные транзакции.

- Например, такие компании, как IBM, Ethereum и Hyperledger, внедрили блокчейн-фреймворки с улучшенной безопасностью, масштабируемостью и совместимостью для упрощения внедрения на предприятиях и повышения операционной эффективности.

- Растущий спрос на децентрализованные приложения (DApps), корпоративные блокчейн-решения и устойчивые блокчейн-модели продолжит формировать отрасль, при этом разработчики и предприятия будут уделять особое внимание масштабируемости, безопасности и массовому внедрению для сохранения конкурентного преимущества.

Область действия отчета иБлокчейнСегментация рынка

|

Атрибуты |

БлокчейнКлючАнализ рынка |

|

Охваченные сегменты |

|

|

Страны, охваченные |

Северная Америка

Европа

Азиатско-Тихоокеанский регион

Ближний Восток и Африка

Южная Америка

|

|

Ключевые игроки рынка |

|

|

Возможности рынка |

|

|

Информационные наборы данных с добавленной стоимостью |

Помимо таких рыночных данных, как рыночная стоимость, темпы роста, сегменты рынка, географический охват, участники рынка и рыночный сценарий, рыночный отчет, подготовленный командой Data Bridge Market Research, включает в себя углубленный экспертный анализ, анализ импорта/экспорта, анализ цен, анализ потребления продукции и анализ пестицидов. |

БлокчейнТенденции рынка

«Растущее внедрение блокчейна как услуги (BaaS) предприятиями»

- Одной из заметных тенденций на мировом рынке блокчейнов является растущее принятие блокчейна как услуги (BaaS) предприятиями.

- Эта тенденция обусловлена растущим спросом на оптимизированное развертывание блокчейна, что побуждает поставщиков технологий разрабатывать управляемые сервисы, которые повышают безопасность, совместимость и простоту интеграции в таких отраслях, как финансы, цепочка поставок и здравоохранение.

- Например, Microsoft Azure Blockchain Service, IBM Blockchain Platform и Oracle Blockchain Cloud Service предлагают решения BaaS корпоративного уровня, которые упрощают реализацию и обеспечивают повышенную безопасность и масштабируемость.

- Поскольку предприятия ищут более эффективные и экономичные решения на основе блокчейна, они внедряют функциональную совместимость, усовершенствования безопасности на основе искусственного интеллекта и энергоэффективные механизмы консенсуса для удовлетворения корпоративных потребностей.

- Ожидается, что этот сдвиг ускорит внедрение блокчейна, обеспечивая долгосрочный рост рынка, поскольку поставщики продолжают совершенствовать платформы BaaS с помощью расширенной безопасности, бесшовной интеграции и отраслевых приложений, чтобы оставаться конкурентоспособными в развивающейся цифровой экономике.

БлокчейнДинамика рынка

Водитель

«Возросший спрос на прозрачность»

- Растущая потребность в прозрачности и доверии к цифровым транзакциям является ключевым фактором роста рынка блокчейнов.

- Поскольку предприятия и потребители отдают приоритет безопасным, проверяемым и защищенным от несанкционированного доступа данным, спрос на блокчейн-решения, повышающие прозрачность в различных отраслях, продолжает расти.

- Поскольку организации стремятся к большей подотчетности и предотвращению мошенничества, технология блокчейн интегрируется в такие секторы, как финансы, цепочки поставок, здравоохранение и государственное управление.

- Такие функции, как децентрализованные реестры, неизменяемые записи и проверка в режиме реального времени, позволяют компаниям устанавливать доверие и оптимизировать операции.

- Растущий спрос на прозрачные и проверяемые системы привел к значительным инвестициям в разработку блокчейнов, побуждая предприятия внедрять решения, обеспечивающие сквозную прослеживаемость, автоматическое соответствие требованиям и повышенную защиту от манипуляций с данными.

Например,

- Блокчейн-платформа Food Trust от IBM позволяет поставщикам продуктов питания и розничным торговцам отслеживать продукцию от фермы до полки, гарантируя качество и безопасность.

- VeChain предлагает решения для цепочки поставок на основе блокчейна, которые позволяют компаниям проверять подлинность продукции и предотвращать подделку.

- Поскольку отрасли продолжают уделять первостепенное внимание прозрачности и соблюдению нормативных требований, поставщики блокчейнов используют эту тенденцию, разрабатывая безопасные, масштабируемые и совместимые решения, адаптированные к потребностям конкретной отрасли. С ростом нормативного контроля и потребностью в проверяемых цифровых транзакциях рынок блокчейнов будет продолжать расширяться, стимулируя технологические достижения, внедрение на предприятиях и инновационные приложения в различных отраслях.

Возможность

«Растущая потребность в конфиденциальности данных»

- Растущее внимание к конфиденциальности и безопасности данных представляет собой значительную возможность для рынка блокчейнов. Поскольку отдельные лица и организации все больше беспокоятся об утечках данных, несанкционированном доступе и цифровом наблюдении, спрос на решения по обеспечению конфиденциальности на основе блокчейнов растет

- В связи с ужесточением правил защиты данных, таких как GDPR, CCPA и HIPAA, растет потребность в блокчейн-решениях, которые обеспечивают безопасное управление идентификацией, зашифрованные транзакции и защищенное от несанкционированного доступа хранение данных.

- Спрос на блокчейн-решения, ориентированные на конфиденциальность, также стимулирует прогресс в криптографических технологиях, таких как доказательства с нулевым разглашением (ZKP), безопасные многосторонние вычисления и конфиденциальные смарт-контракты. Эти инновации позволяют выполнять проверку и обработку данных без раскрытия конфиденциальной информации

Например,

- Zcash интегрировал ZKP для обеспечения конфиденциальных финансовых транзакций, обеспечивая при этом целостность блокчейна

- Oasis Network предлагает смарт-контракты, сохраняющие конфиденциальность и позволяющие организациям безопасно обрабатывать конфиденциальные данные.

- Поскольку проблемы конфиденциальности данных продолжают формировать цифровые взаимодействия, разработчики блокчейна имеют возможность создавать инновационные решения, ориентированные на конфиденциальность, для таких отраслей, как финансы, здравоохранение и проверка личности. С ростом внимания к безопасности данных во всем мире принятие блокчейна будет продолжать расти, стимулируя дальнейшие инновации в технологиях сохранения конфиденциальности

Сдержанность/Вызов

«Общественное восприятие и осведомленность»

- Отсутствие широкого понимания и осведомленности о технологии блокчейн представляет собой значительную проблему для роста рынка. Несмотря на свой потенциал для повышения безопасности, прозрачности и эффективности в различных отраслях, блокчейн остается сложным и часто неправильно понимаемым бизнесом, регулирующими органами и широкой общественностью

- Заблуждения, связанные с блокчейном, в том числе его связь с волатильностью криптовалют, неопределенностью регулирования и проблемами энергопотребления, вызывают сомнения среди предприятий и потребителей.

- Недостаток осведомленности замедляет внедрение, поскольку организациям сложно в полной мере осознать его преимущества и практическое применение.

Например,

- Многие компании не решаются внедрять блокчейн из-за ложных представлений о его сложности и высоком энергопотреблении, часто связывая его исключительно с криптовалютой, а не с более широкими приложениями в управлении цепочками поставок, здравоохранении и защищенной цифровой идентификации.

- По мере того, как технология блокчейн продолжает развиваться, заблуждения и неосведомленность остаются существенными препятствиями для ее принятия. Неясные правила, скептицизм относительно ее реальных приложений и ассоциации с волатильностью криптовалют способствуют медленному росту рынка. Без более широкого понимания преимуществ блокчейна компании и потребители могут не решиться использовать его полный потенциал, что повлияет на его распространение в различных отраслях

Масштаб рынка блокчейна

Рынок сегментирован по компонентам, поставщикам, типам, типу организации, разработке, применению и конечным пользователям.

|

Сегментация |

Субсегментация |

|

По компоненту |

|

|

По провайдеру |

|

|

По типу |

|

|

По размеру организации |

|

|

По развитию |

|

|

По применению |

|

|

Конечным пользователем |

|

Региональный анализ рынка блокчейна

«Северная Америка является доминирующим регионом вБлокчейнРынок"

- Северная Америка доминирует в блокчейнерынок,обусловлено его прозрачной природой, более низкими транзакционными издержками и эффективными по времени процессами. Сильная технологическая инфраструктура региона, растущее внедрение блокчейна в отраслях и присутствие ключевых игроков на рынке усиливают его доминирование

- TheВШЬзанимает значительную долю благодаря активной интеграции блокчейна для защиты данных, кибербезопасности и финансовых транзакций в бизнесе. Сектор финансовых услуг, в частности, использует блокчейн для предотвращения мошенничества, безопасных транзакций и повышения операционной эффективности

- Кроме того, организации из разных отраслей, включая здравоохранение, цепочки поставок и государственное управление, внедряют блокчейн-решения для повышения прозрачности, безопасности и соответствия нормативным требованиям.

- Крупнейшие компании, такие какIBM, Microsoft и OracleПродолжать внедрять инновации и расширять применение блокчейна, еще больше укрепляя лидерство Северной Америки на рынке.

«Прогнозируется, что в Азиатско-Тихоокеанском регионе будут зарегистрированы самые высокие темпы роста»

- TheАзиатско-Тихоокеанский регионОжидается, что в регионе будут наблюдаться самые высокие темпы роста в сфере блокчейнарынок, обусловленный ранним внедрением технологий блокчейна и быстрым развитием финансовых услуг

- Такие страны, как Китай, Индия, Япония и Южная Корея, наблюдают всплеск внедрения блокчейна, особенно в банковском деле, платежах и торговом финансировании. Растущая цифровизация финансовых систем и правительственные инициативы, поддерживающие развитие блокчейна, являются ключевыми факторами, стимулирующими рост рынка

- Быстро развивающийся в регионе сектор финтеха и растущее число стартапов на основе блокчейна еще больше ускоряют процесс внедрения, поскольку компании ищут безопасные, прозрачные и эффективные решения дляцифровые платежи

- Поскольку развивающиеся экономики инвестируют в инновации на основе блокчейна во всех отраслях, в ближайшие годы Азиатско-Тихоокеанский регион станет крупным центром роста для приложений блокчейна.

Доля рынка блокчейна

Конкурентная среда рынка содержит сведения о конкурентах. Включены сведения о компании, ее финансах, полученном доходе, рыночном потенциале, инвестициях в исследования и разработки, новых рыночных инициативах, глобальном присутствии, производственных площадках и объектах, производственных мощностях, сильных и слабых сторонах компании, запуске продукта, широте и широте продукта, доминировании приложений. Приведенные выше данные касаются только фокуса компаний на рынке.

Основными лидерами рынка, работающими на рынке, являются:

- IBM (США)

- Майкрософт (США)

- SAP SE (Германия)

- Оракул (США)

- Цифровой актив (США)

- Stratis Group (США)

- Корпорация Intel (США)

- Guardtime (Эстония)

- AlphaPoint. (США)

- NTT DATA, Inc. (США)

- Пульсация (США)

- SoluLab (Индия)

- Ценойанализ (США)

- Cision US Inc. (США)

- Riot Platforms, Inc. (США)

- Bitfarms Ltd (Канада)

Последние события на мировом рынке блокчейна

- В апреле 2023 года правительство Германии ввело Закон о будущих финансах, который направлен на создание нормативной базы для стартапов, ориентированных на финансовые инновации. Это законодательство призвано усилить цифровизацию рынков капитала, в частности, путем содействия выпуску электронных ценных бумаг с использованием технологии блокчейн. Таким образом, правительство стремится повысить прозрачность и эффективность финансовых транзакций, в конечном итоге способствуя более динамичной финансовой экосистеме.

- В апреле 2023 года сеть BBK внедрила архитектуру на основе состояния на виртуальной машине Ethereum (EVM), значительно повысив операционную эффективность за счет устранения необходимости в открытых платежных каналах между сторонами. Это нововведение решает ключевые проблемы, которые исторически препятствовали принятию децентрализованных приложений (DApps) в экосистемах блокчейна. Оптимизируя взаимодействия, сеть BBK стремится создать более удобную среду для разработчиков и пользователей

- В январе 2023 года Amazon Web Services (AWS) объявила о стратегическом партнерстве с Ava Labs, направленном на масштабирование внедрения блокчейна посредством разработки блокчейна Avalanche layer-1. Это сотрудничество упростит процесс запуска приложений блокчейна для частных лиц и организаций, обеспечивая эффективное управление узлами в сети Avalanche. Партнерство символизирует приверженность AWS содействию инновациям в технологии блокчейна в различных секторах, включая предприятия и государственные учреждения.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Интерактивная панель анализа данных

- Панель анализа компании для возможностей с высоким потенциалом роста

- Доступ аналитика-исследователя для настройки и запросов

- Анализ конкурентов с помощью интерактивной панели

- Последние новости, обновления и анализ тенденций

- Используйте возможности сравнительного анализа для комплексного отслеживания конкурентов

Методология исследования

Сбор данных и анализ базового года выполняются с использованием модулей сбора данных с большими размерами выборки. Этап включает получение рыночной информации или связанных данных из различных источников и стратегий. Он включает изучение и планирование всех данных, полученных из прошлого заранее. Он также охватывает изучение несоответствий информации, наблюдаемых в различных источниках информации. Рыночные данные анализируются и оцениваются с использованием статистических и последовательных моделей рынка. Кроме того, анализ доли рынка и анализ ключевых тенденций являются основными факторами успеха в отчете о рынке. Чтобы узнать больше, пожалуйста, запросите звонок аналитика или оставьте свой запрос.

Ключевой методологией исследования, используемой исследовательской группой DBMR, является триангуляция данных, которая включает в себя интеллектуальный анализ данных, анализ влияния переменных данных на рынок и первичную (отраслевую экспертную) проверку. Модели данных включают сетку позиционирования поставщиков, анализ временной линии рынка, обзор рынка и руководство, сетку позиционирования компании, патентный анализ, анализ цен, анализ доли рынка компании, стандарты измерения, глобальный и региональный анализ и анализ доли поставщика. Чтобы узнать больше о методологии исследования, отправьте запрос, чтобы поговорить с нашими отраслевыми экспертами.

Доступна настройка

Data Bridge Market Research является лидером в области передовых формативных исследований. Мы гордимся тем, что предоставляем нашим существующим и новым клиентам данные и анализ, которые соответствуют и подходят их целям. Отчет можно настроить, включив в него анализ ценовых тенденций целевых брендов, понимание рынка для дополнительных стран (запросите список стран), данные о результатах клинических испытаний, обзор литературы, обновленный анализ рынка и продуктовой базы. Анализ рынка целевых конкурентов можно проанализировать от анализа на основе технологий до стратегий портфеля рынка. Мы можем добавить столько конкурентов, о которых вам нужны данные в нужном вам формате и стиле данных. Наша команда аналитиков также может предоставить вам данные в сырых файлах Excel, сводных таблицах (книга фактов) или помочь вам в создании презентаций из наборов данных, доступных в отчете.