Global Bio Acetic Acid Market

Размер рынка в млрд долларов США

CAGR :

%

USD

3.89 Million

USD

5.97 Million

2025

2033

USD

3.89 Million

USD

5.97 Million

2025

2033

| 2026 –2033 | |

| USD 3.89 Million | |

| USD 5.97 Million | |

|

|

|

|

Сегментация мирового рынка биоуксусной кислоты по сырью (биомасса, кукуруза, маис и сахар), областям применения (ацетатные эфиры, уксусный ангидрид, очищенная терефталевая кислота и винилацетатный мономер), конечному потребителю (химическая промышленность, продукты питания и напитки, средства личной гигиены и фармацевтика) — тенденции отрасли и прогноз до 2033 года

Размер рынка биоуксусной кислоты

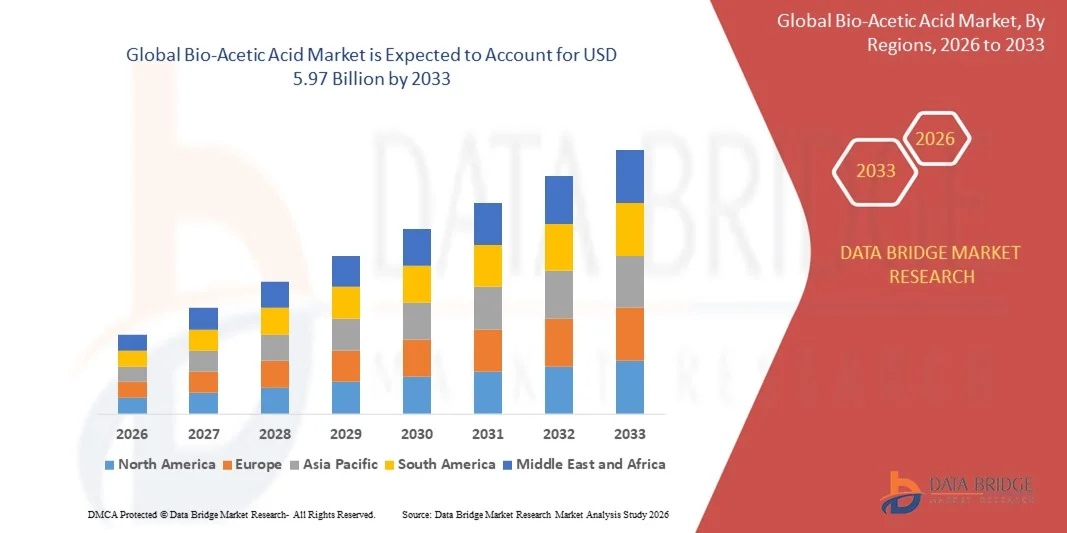

- Объем мирового рынка биоуксусной кислоты в 2025 году оценивался в 3,89 млрд долларов США , а к 2033 году , как ожидается, достигнет 5,97 млрд долларов США при среднегодовом темпе роста 5,5% в прогнозируемый период.

- Рост рынка во многом обусловлен растущим внедрением устойчивых и биохимических веществ в промышленном, пищевом и фармацевтическом секторах, что обусловлено ужесточением экологических норм и предпочтением потребителей экологически чистых продуктов.

- Кроме того, растущие инвестиции в биоперерабатывающие заводы, развитие технологий ферментации и биопереработки, а также расширение доступности сырья, такого как биомасса, кукуруза и сахар, позволяют масштабировать производство биоуксусной кислоты. Эти факторы ускоряют её внедрение в таких областях, как производство ацетатных эфиров, уксусного ангидрида, очищенной терефталевой кислоты и винилацетата, что значительно ускоряет рост рынка.

Анализ рынка биоуксусной кислоты

- Биоуксусная кислота, получаемая из возобновляемого сырья путем ферментации или других биотехнологических процессов, становится все более важной для химической, пищевой, фармацевтической промышленности и производства средств личной гигиены благодаря своему устойчивому происхождению, высокой чистоте и универсальности в различных областях применения.

- Растущий спрос на биоуксусную кислоту обусловлен, прежде всего, регулирующими мерами, направленными на сокращение выбросов углекислого газа, растущим предпочтением потребителей натуральным и экологически чистым ингредиентам, а также переходом от нефтяных к возобновляемым химическим веществам в промышленном производстве, что усиливает ее важную роль в устойчивом производстве и внедрении экологически чистых химических веществ.

- Азиатско-Тихоокеанский регион доминировал на рынке биоуксусной кислоты с долей 47,1% в 2025 году благодаря росту индустриализации, расширению химической и пищевой промышленности, а также росту инвестиций в производство биохимической продукции.

- Ожидается, что Северная Америка станет регионом с самыми быстрыми темпами роста рынка биоуксусной кислоты в течение прогнозируемого периода из-за высокого спроса на биохимические продукты в фармацевтике, пищевой промышленности, а также в промышленности.

- Сегмент винилацетатного мономера (ВАМ) доминировал на рынке с долей 42,9% в 2025 году благодаря растущему спросу в полимерной и упаковочной промышленности. Например, расширение производственных мощностей по производству винилацетатного мономера (ВАМ) корпорацией Celanese отражает рост потребления ВАМ в клеях, красках и покрытиях. Для производства винилацетатного мономера основным сырьем является биоуксусная кислота, что делает этот сегмент крайне зависимым от доступности экологически чистой уксусной кислоты. Расширение применения в производстве экологичных и высокопроизводительных упаковочных материалов дополнительно стимулирует рост производства ВАМ на биологической основе, делая этот сегмент высокопотенциальным.

Область применения отчета и сегментация рынка биоуксусной кислоты

|

Атрибуты |

Ключевые данные о рынке биоуксусной кислоты |

|

Охваченные сегменты |

|

|

Охваченные страны |

Северная Америка

Европа

Азиатско-Тихоокеанский регион

Ближний Восток и Африка

Южная Америка

|

|

Ключевые игроки рынка |

|

|

Рыночные возможности |

|

|

Информационные наборы данных с добавленной стоимостью |

Помимо информации о рыночных сценариях, таких как рыночная стоимость, темпы роста, сегментация, географический охват и основные игроки, рыночные отчеты, подготовленные Data Bridge Market Research, также включают анализ импорта и экспорта, обзор производственных мощностей, анализ потребления продукции, анализ ценовых тенденций, сценарий изменения климата, анализ цепочки поставок, анализ цепочки создания стоимости, обзор сырья/расходных материалов, критерии выбора поставщиков, анализ PESTLE, анализ Портера и нормативную базу. |

Тенденции рынка биоуксусной кислоты

Растущее внедрение био- и устойчивых химических веществ

- Растущее внимание к устойчивому развитию и экологической ответственности является одним из основных факторов, способствующих внедрению биоуксусной кислоты в химической, пищевой, фармацевтической и косметической промышленности. Компании всё чаще отказываются от использования нефтяной уксусной кислоты, чтобы сократить углеродный след и соответствовать строгим экологическим нормам.

- Например, компания Afyren SAS расширила свой завод NEOXY для производства высокочистой биоуксусной кислоты из сельскохозяйственных отходов, предлагая возобновляемое и экологически безопасное решение для промышленного и специального химического применения. Это расширение способствует увеличению производственных мощностей и удовлетворяет растущий спрос на европейском и мировом рынках.

- Технологические достижения в области ферментации, биопереработки и очистки значительно повышают выход, качество и масштабируемость производства биоуксусной кислоты. Эти достижения позволяют производителям поставлять стабильные, высокочистые продукты, подходящие для чувствительных областей применения, таких как производство фармацевтических препаратов и пищевых добавок.

- Растущая интеграция биоуксусной кислоты в специализированные продукты, такие как ацетатные эфиры, уксусный ангидрид, очищенная терефталевая кислота и винилацетатный мономер, способствует её использованию в различных секторах конечного потребления. Эта интеграция укрепляет роль биоуксусной кислоты как универсального и экологически устойчивого промежуточного химического продукта.

- Растущее предпочтение потребителями экологически чистых продуктов питания, косметики и фармацевтики с «чистой этикеткой» дополнительно стимулирует внедрение биоуксусной кислоты. Производители реагируют на этот спрос, инвестируя в производство биопродуктов и продвигая экологичные линейки продукции.

- В целом, сочетание технологических инноваций, требований устойчивого развития и растущего промышленного и потребительского спроса ускоряет внедрение биоуксусной кислоты, побуждая компании масштабировать производство, диверсифицировать сферы применения и укреплять свои позиции на рынке.

Динамика рынка биоуксусной кислоты

Водитель

Растущий промышленный и фармацевтический спрос на экологически чистую уксусную кислоту

- Рост промышленного использования, особенно в химической промышленности, фармацевтике и средствах личной гигиены, стимулирует спрос на биоуксусную кислоту, поскольку компании отдают приоритет устойчивым и возобновляемым альтернативам. Растущее внимание со стороны регулирующих органов к сокращению выбросов углерода и воздействия на окружающую среду способствует дальнейшему расширению рынка.

- Например, компания GODAVARI BIOREFINERIES LTD расширила свои мощности по производству биоуксусной кислоты для производства промежуточных фармацевтических продуктов и продуктов питания. Такое стратегическое расширение мощностей позволяет удовлетворить растущий внутренний и экспортный спрос, а также укрепляет присутствие компании на развивающихся и развитых рынках.

- Переход от химикатов на основе нефти к биосырью, такому как биомасса, кукуруза, маис и сахар, открывает для производителей новые возможности поставок экологически чистой уксусной кислоты для различных промышленных применений. Кроме того, это возобновляемое сырье помогает компаниям достигать целей устойчивого развития и улучшать соблюдение экологических норм.

- Рост инвестиций в биоперерабатывающие заводы и технологическую инфраструктуру позволяет производителям эффективно удовлетворять растущий спрос. Компании уделяют особое внимание оптимизации процессов, масштабируемости производства и устойчивости цепочек поставок, чтобы обеспечить бесперебойные поставки высококачественной биоуксусной кислоты.

- Растущая осведомлённость потребителей и промышленных покупателей в вопросах экологической устойчивости в сочетании с государственными мерами поддержки производства возобновляемой химической продукции способствуют дальнейшему развитию рынка. В совокупности эти факторы обеспечивают устойчивый рост использования биоуксусной кислоты в промышленности, пищевой и фармацевтической промышленности.

Сдержанность/Вызов

Высокие издержки производства и зависимость от сырья

- Высокая себестоимость производства биоуксусной кислоты, включая процессы ферментации, очистки и капиталоёмкое оборудование, представляет собой серьёзное препятствие для роста рынка. Эти затраты делают биоуксусную кислоту менее конкурентоспособной по сравнению с нефтяной уксусной кислотой на рынках, чувствительных к цене.

- Например, мелкие производители часто сталкиваются с трудностями в конкурентной борьбе из-за высоких операционных расходов и ограниченного доступа к экономически эффективным технологиям. Такие ограничения могут ограничивать проникновение на рынок, особенно в регионах с нестабильным снабжением сырьем.

- Зависимость от такого сырья, как биомасса, кукуруза, маис и сахар, подвергает производителей риску колебаний доступности и волатильности цен. Кроме того, сезонные колебания, колебания урожайности и проблемы с логистикой могут нарушить производственные графики и повлиять на рентабельность.

- Техническая сложность масштабирования производства биоуксусной кислоты для поддержания высокой чистоты и выхода продукта требует развитой инфраструктуры и квалифицированного персонала. Для решения этих производственных задач компаниям необходимо инвестировать в НИОКР, оптимизацию процессов и меры контроля качества.

- Несмотря на то, что постоянное совершенствование технологий постепенно снижает производственные затраты, достижение паритета цен с традиционной уксусной кислотой остаётся серьёзным препятствием. Преодоление этих трудностей посредством стратегического партнёрства, инноваций в процессах и инвестиций в возобновляемые источники сырья имеет решающее значение для устойчивого роста рынка.

Объем рынка биоуксусной кислоты

Рынок сегментирован по признакам сырья, области применения и конечного пользователя.

- По сырью

По типу сырья рынок биоуксусной кислоты сегментируется на следующие сегменты: биомасса, кукуруза, маис и сахар. Сегмент биомассы доминировал на рынке, обеспечив наибольшую долю выручки в 2025 году благодаря устойчивому и экологичному процессу производства, который соответствует ужесточающимся экологическим нормам и предпочтениям потребителей в отношении экологичных химикатов. Уксусная кислота на основе биомассы обеспечивает более высокий выход и часто используется в крупномасштабном промышленном производстве благодаря своему стабильному качеству и доступности. На рынке также наблюдается активное внедрение уксусной кислоты, полученной из биомассы, в областях, где критически важны возобновляемые источники энергии и сокращение углеродного следа, что повышает её рыночную привлекательность среди производителей.

Ожидается, что сегмент кукурузы будет демонстрировать самые высокие темпы роста в период с 2026 по 2033 год, чему будет способствовать его широкая доступность и относительно более низкая себестоимость по сравнению с другими видами сырья. Например, такие компании, как Cargill, инвестируют в производство уксусной кислоты на основе кукурузы, чтобы удовлетворить растущий спрос в секторе продуктов питания и напитков. Уксусная кислота, получаемая из кукурузы, также обеспечивает масштабируемость и совместимость с технологиями, основанными на ферментации, что делает её привлекательным выбором для развивающихся рынков. Растущая интеграция кукурузы в качестве сырья на биоперерабатывающих заводах дополнительно способствует её быстрому внедрению и расширению рынка.

- По заявкам

По сферам применения рынок биоуксусной кислоты сегментируется на ацетатные эфиры, уксусный ангидрид, очищенную терефталевую кислоту (ОТК) и винилацетат мономера (ВАМ). Сегмент ВАМ доминировал на рынке с наибольшей долей в 42,9% в 2025 году благодаря растущему спросу в полимерной и упаковочной промышленности. Например, расширение производственных мощностей по производству ВАМ корпорацией Celanese отражает рост потребления ВАМ в клеях, красках и покрытиях. Для производства винилацетат мономера биоуксусная кислота является ключевым сырьем, что делает этот сегмент сильно зависимым от доступности устойчивой уксусной кислоты. Расширение применения в экологичных и высокопроизводительных упаковочных материалах дополнительно стимулирует рост производства ВАМ на основе биотехнологий, делая этот сегмент высокопотенциальным.

Ожидается, что сегмент ацетатных эфиров будет демонстрировать самые высокие среднегодовые темпы роста в период с 2026 по 2033 год, что обусловлено их широким применением в растворителях, покрытиях, клеях и ароматизаторах в различных отраслях. Ацетатные эфиры обладают универсальными химическими свойствами, которые способствуют их широкому применению как в промышленных, так и в потребительских целях, обеспечивая стабильный спрос. Этот сегмент также выигрывает от растущего спроса в фармацевтической отрасли и средствах личной гигиены, где для стабильности и эффективности рецептур требуются высокочистые производные уксусной кислоты.

- Конечным пользователем

По типу конечного потребителя рынок биоуксусной кислоты сегментирован на химическую, пищевую, производство средств личной гигиены и фармацевтическую промышленность. В 2025 году химическая промышленность доминировала на рынке, обеспечивая наибольшую долю выручки благодаря широкому использованию уксусной кислоты в производстве различных производных, таких как ацетатные эфиры, ангидриды и растворители. Химический сектор в значительной степени зависит от высокочистой и стабильно качественной биоуксусной кислоты для промышленных реакций, что обуславливает устойчивый спрос и широкомасштабное внедрение. Кроме того, строгие экологические нормы стимулировали производителей химической продукции переход с нефтяной уксусной кислоты на биологическую, что еще больше укрепляет ее доминирующее положение на рынке.

Ожидается, что сегмент продуктов питания и напитков будет демонстрировать самые высокие темпы роста в период с 2026 по 2033 год, чему будет способствовать растущее предпочтение потребителями натуральных ингредиентов с «чистой этикеткой». Например, компания Tate & Lyle активно продвигает биоуксусную кислоту в уксусе и ароматизаторах, чтобы удовлетворить растущий спрос потребителей, заботящихся о своем здоровье. Биоуксусная кислота предлагает безопасную и экологичную альтернативу синтетическим добавкам в производстве продуктов питания, что способствует её быстрому внедрению. Рост потребления в развивающихся регионах и расширение тенденций в области функциональных продуктов питания вносят значительный вклад в ускоренный рост рынка в этом сегменте.

Региональный анализ рынка биоуксусной кислоты

- Азиатско-Тихоокеанский регион доминировал на рынке биоуксусной кислоты с наибольшей долей выручки в 47,1% в 2025 году, что было обусловлено ростом индустриализации, расширением химической и пищевой промышленности, а также ростом инвестиций в производство биохимической продукции.

- Эффективность производства в регионе, растущее использование экологически чистых сырьевых ресурсов и расширение экспорта биоуксусной кислоты ускоряют расширение рынка.

- Наличие квалифицированной рабочей силы, благоприятная государственная политика и быстрый рост экономик развивающихся стран способствуют увеличению потребления биоуксусной кислоты в химической, пищевой и фармацевтической промышленности.

Обзор рынка биоуксусной кислоты в Китае

В 2025 году Китай занимал наибольшую долю на рынке биоуксусной кислоты Азиатско-Тихоокеанского региона благодаря своему положению мирового лидера в области химического производства и развитой инфраструктуре биоперерабатывающих заводов. Мощная промышленная база страны, благоприятная государственная политика, поддерживающая производство возобновляемой химической продукции, и масштабный экспорт биохимической продукции являются основными драйверами роста, а продолжающиеся инвестиции в производство высокочистой уксусной кислоты для промышленного, фармацевтического и пищевого применения дополнительно усиливают спрос.

Обзор рынка биоуксусной кислоты в Индии

Индия демонстрирует самый быстрый рост в Азиатско-Тихоокеанском регионе, чему способствуют стремительное развитие химической и фармацевтической промышленности, увеличение производства биохимической продукции и увеличение инвестиций в устойчивое производство. Государственные инициативы, направленные на продвижение возобновляемых химических веществ, рост внутреннего спроса, экспортного потенциала, расширение возможностей НИОКР и внедрение экологичных методов производства, в совокупности способствуют устойчивому расширению рынка.

Обзор европейского рынка биоуксусной кислоты

Европейский рынок биоуксусной кислоты стабильно растёт, чему способствуют строгие экологические нормы, растущий спрос на биохимические продукты и увеличивающиеся инвестиции в устойчивое производство и производство специализированной химии. В регионе особое внимание уделяется качеству продукции, соблюдению экологических норм и использованию возобновляемого сырья, особенно в химической и фармацевтической промышленности. Рост использования биоуксусной кислоты в ацетатных эфирах, очищенной терефталевой кислоте и специализированных химикатах также способствует росту рынка.

Обзор рынка биоуксусной кислоты в Германии

Рынок Германии движим лидерством в области высокоточного химического производства, развитой промышленной инфраструктурой и экспортно-ориентированным производством. Развитые сети НИОКР, сотрудничество между академическими учреждениями и производителями химической продукции, а также высокий спрос на фармацевтические препараты, промышленные растворители и специализированные химические продукты способствуют постоянным инновациям и росту рынка.

Обзор рынка биоуксусной кислоты в Великобритании

Британский рынок поддерживается развитым химическим и фармацевтическим секторами, растущим вниманием к устойчивому развитию и растущим использованием биосырья. Рост инвестиций в НИОКР, партнерские отношения и производство высокочистой биоуксусной кислоты позволяет Великобритании сохранять значительную роль на рынках специализированной химии.

Обзор рынка биоуксусной кислоты в Северной Америке

Прогнозируется, что в Северной Америке с 2026 по 2033 год будут наблюдаться самые высокие среднегодовые темпы роста, обусловленные высоким спросом на биохимические продукты для фармацевтической, пищевой и промышленной промышленности. Акцент на устойчивое развитие, развитие производственных технологий, возвращение химических производств в другие страны и усиление сотрудничества между производителями химической продукции и конечными потребителями способствуют расширению рынка.

Обзор рынка биоуксусной кислоты в США

В 2025 году США занимали наибольшую долю на североамериканском рынке, чему способствовала развитая химическая и фармацевтическая промышленность, мощная научно-исследовательская инфраструктура и значительные инвестиции в производство биохимической продукции. Акцент страны на инновациях, устойчивом развитии, высоких стандартах чистоты продукции и развитой дистрибьюторской сети стимулирует внедрение технологий в промышленных и потребительских отраслях, укрепляя лидирующие позиции страны в регионе.

Доля рынка биоуксусной кислоты

В отрасли производства биоуксусной кислоты лидируют в основном хорошо зарекомендовавшие себя компании, среди которых:

- Airedale Chemicals (Великобритания)

- Bio‑Corn Products EPZ Ltd. (Индия)

- GODAVARI BIOREFINERIES LTD (Индия)

- Sucroal SA (Испания)

- Novozymes A/S (Дания)

- Cargill, Inc. (США)

- LanzaTech (США)

- Афирен САС (Франция)

- BTG Bioliquids (Нидерланды)

- Celanese Corporation (США)

- Wacker Chemie AG (Германия)

- Eastman Chemical Company (США)

- SEKAB Biofuels & Chemicals AB (Швеция)

- Zea2 LLC (США)

- Lenzing AG (Австрия)

- Группа INEOS (Великобритания)

- ADM (Арчер Дэниелс Мидленд) (США)

Последние события на мировом рынке биоуксусной кислоты

- В июле 2025 года компания Godavari Biorefineries сообщила о значительном росте производства этанола и подтвердила свою приверженность развитию биохимического производства, включая производство уксусной кислоты. Улучшение доступности сырья напрямую способствует росту производства биоуксусной кислоты, позволяя компании удовлетворять растущий спрос в химической, фармацевтической и пищевой отраслях. Это событие также свидетельствует о растущем доверии к биотехнологиям на развивающихся рынках, что дополнительно стимулирует инвестиции в устойчивое химическое производство.

- В июне 2025 года компания AFYREN объявила, что её завод NEOXY вышел на непрерывное промышленное производство биокислот, включая биоуксусную кислоту, что ознаменовало собой значительное расширение коммерческих операций. Это достижение позволяет ускорить поставки продукции в промышленность, пищевую промышленность и сектор средств личной гигиены, а также укрепляет позиции AFYREN как лидера в области устойчивой химии. Возможность заключать многолетние контракты на поставку повышает доверие клиентов и позволяет компании занять большую долю на растущем рынке биоуксусной кислоты.

- В январе 2025 года компания AFYREN получила кредит в размере 10 млн евро, связанный с устойчивым развитием, для своей дочерней компании NEOXY. Условия кредитования привязаны к показателям экологической и социальной ответственности. Эта стратегическая финансовая поддержка способствует масштабированию производства и подчёркивает доверие инвесторов к биотехнологиям в химической промышленности. Она также подчёркивает растущую важность показателей устойчивого развития для принятия продукта рынком, давая промышленным и коммерческим покупателям понять, что биоуксусная кислота — надёжная и экологичная альтернатива продуктам нефтехимического производства.

- В январе 2025 года компания LanzaTech объявила о создании дочерней компании LanzaX в рамках совместного предприятия, нацеленного на ускорение разработки специализированных биохимических препаратов, включая производные уксусной кислоты. Отделив свою деятельность, основанную на ферментации, от инновационных проектов, LanzaTech сможет сосредоточиться на коммерческом производстве биоуксусной кислоты, в то время как LanzaX будет способствовать развитию технологических разработок. Ожидается, что этот стратегический шаг расширит производственные мощности, будет способствовать инновациям в области высокочистых биокислот и расширит их применение в фармацевтической, пищевой и промышленной сферах.

- В сентябре 2024 года компания AFYREN успешно произвела первые коммерческие партии биокислот на заводе NEOXY. Это достижение обеспечивает бесперебойные поставки клиентам в пищевой, косметической и фармацевтической отраслях, укрепляя рыночный авторитет биоуксусной кислоты как экологически безопасной альтернативы. Ранний запуск коммерческого производства также позволяет проводить испытания с участием клиентов, внедрять её в специализированные приложения и позиционировать биоуксусную кислоту как масштабируемое и экологически безопасное решение, создавая условия для ускоренного роста рынка.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Интерактивная панель анализа данных

- Панель анализа компании для возможностей с высоким потенциалом роста

- Доступ аналитика-исследователя для настройки и запросов

- Анализ конкурентов с помощью интерактивной панели

- Последние новости, обновления и анализ тенденций

- Используйте возможности сравнительного анализа для комплексного отслеживания конкурентов

Методология исследования

Сбор данных и анализ базового года выполняются с использованием модулей сбора данных с большими размерами выборки. Этап включает получение рыночной информации или связанных данных из различных источников и стратегий. Он включает изучение и планирование всех данных, полученных из прошлого заранее. Он также охватывает изучение несоответствий информации, наблюдаемых в различных источниках информации. Рыночные данные анализируются и оцениваются с использованием статистических и последовательных моделей рынка. Кроме того, анализ доли рынка и анализ ключевых тенденций являются основными факторами успеха в отчете о рынке. Чтобы узнать больше, пожалуйста, запросите звонок аналитика или оставьте свой запрос.

Ключевой методологией исследования, используемой исследовательской группой DBMR, является триангуляция данных, которая включает в себя интеллектуальный анализ данных, анализ влияния переменных данных на рынок и первичную (отраслевую экспертную) проверку. Модели данных включают сетку позиционирования поставщиков, анализ временной линии рынка, обзор рынка и руководство, сетку позиционирования компании, патентный анализ, анализ цен, анализ доли рынка компании, стандарты измерения, глобальный и региональный анализ и анализ доли поставщика. Чтобы узнать больше о методологии исследования, отправьте запрос, чтобы поговорить с нашими отраслевыми экспертами.

Доступна настройка

Data Bridge Market Research является лидером в области передовых формативных исследований. Мы гордимся тем, что предоставляем нашим существующим и новым клиентам данные и анализ, которые соответствуют и подходят их целям. Отчет можно настроить, включив в него анализ ценовых тенденций целевых брендов, понимание рынка для дополнительных стран (запросите список стран), данные о результатах клинических испытаний, обзор литературы, обновленный анализ рынка и продуктовой базы. Анализ рынка целевых конкурентов можно проанализировать от анализа на основе технологий до стратегий портфеля рынка. Мы можем добавить столько конкурентов, о которых вам нужны данные в нужном вам формате и стиле данных. Наша команда аналитиков также может предоставить вам данные в сырых файлах Excel, сводных таблицах (книга фактов) или помочь вам в создании презентаций из наборов данных, доступных в отчете.