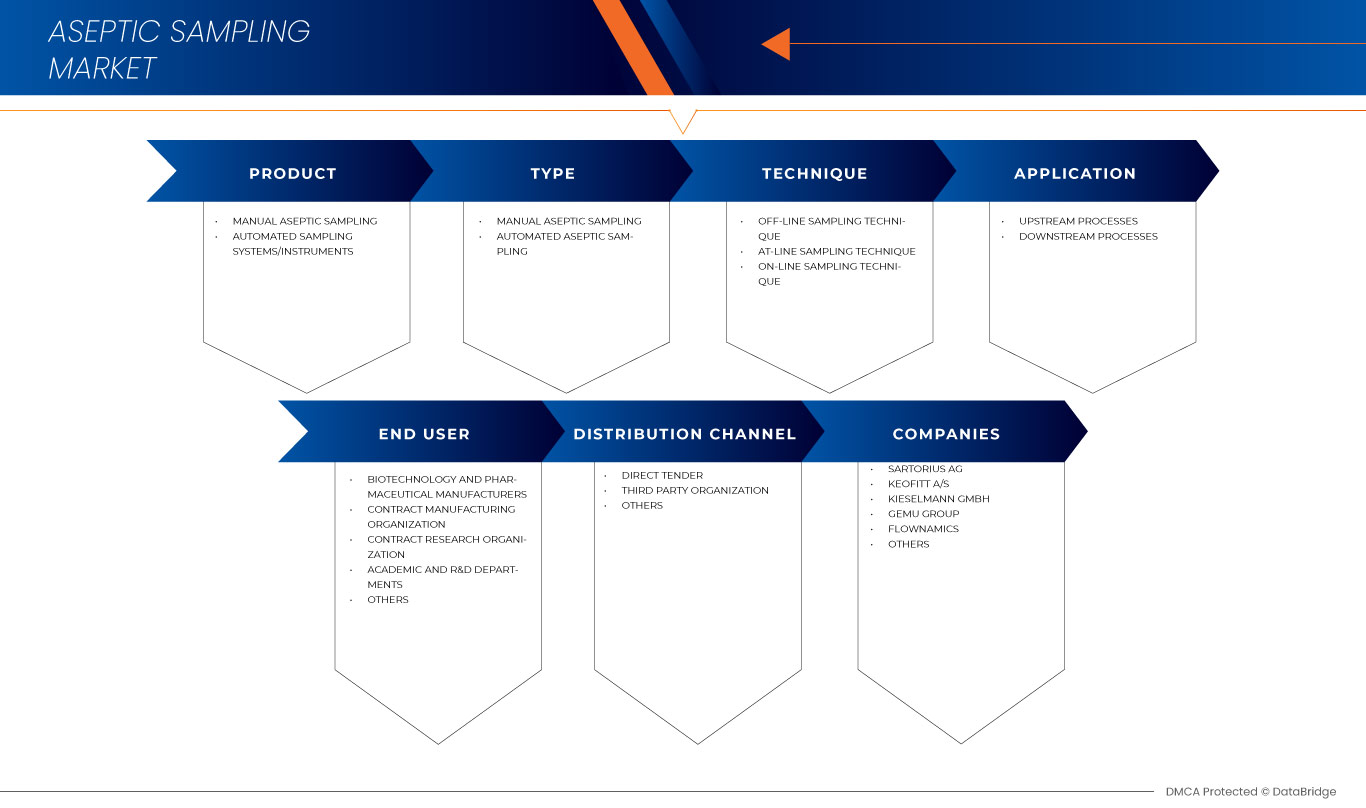

Global Aseptic Sampling Market, By Product (Manual Aseptic Sampling and Automated Sampling System/Instruments), Type (Manual Aseptic Sampling and Automated Aseptic Sampling), Technique (Off-Line Sampling Technique, At-Line Sampling Technique, and On-Line Aseptic Sampling), Application (Upstream Processes and Downstream Processes), End User (Biotechnology and Pharmaceutical Manufacturers, Contract Manufacturing Organization, Contract Research Organization, Academic and R&D Departments, and Others), Distribution Channel (Direct Tender, Third Party Distributer, and Others) Industry Trends and Forecast to 2030.

Aseptic Sampling Market Analysis and Insights

The aseptic specimen market provides products and services for collecting, transporting, and storing sterile specimens in various industries, including pharmaceuticals, biotechnology, and food and beverage. Aseptic sampling refers to the use of techniques and methods that prevent the entry of microorganisms and other contaminants during the sampling process and ensure the integrity and accuracy of the sample.

The aseptic sampling market is influenced by increasing demand for biologics, vaccines, and other complex medicines, investments in R&D activities, and regulatory compliance requirements. Biologics and other complex medicines require strict control of product sterility and purity, which increases the demand for aseptic sampling products and services. Investments in R&D to develop advanced treatments such as gene therapy, stem cell therapy, and personalized medicine are also contributing to market growth. Growing regulatory compliance requirements for quality control and safety also increase the demand for aseptic sampling products and services.

However, the market faces challenges such as the high cost of aseptic sampling products and services, lack of skilled personnel, and complex regulatory requirements.

The aseptic sampling market has seen significant technological advances in recent years aimed at improving the efficiency and accuracy of the sampling process. Manufacturers of the global aseptic sampling market have been focusing on collaborating with popular brands to attract a more consumer base and offer new and innovative sampling instruments.

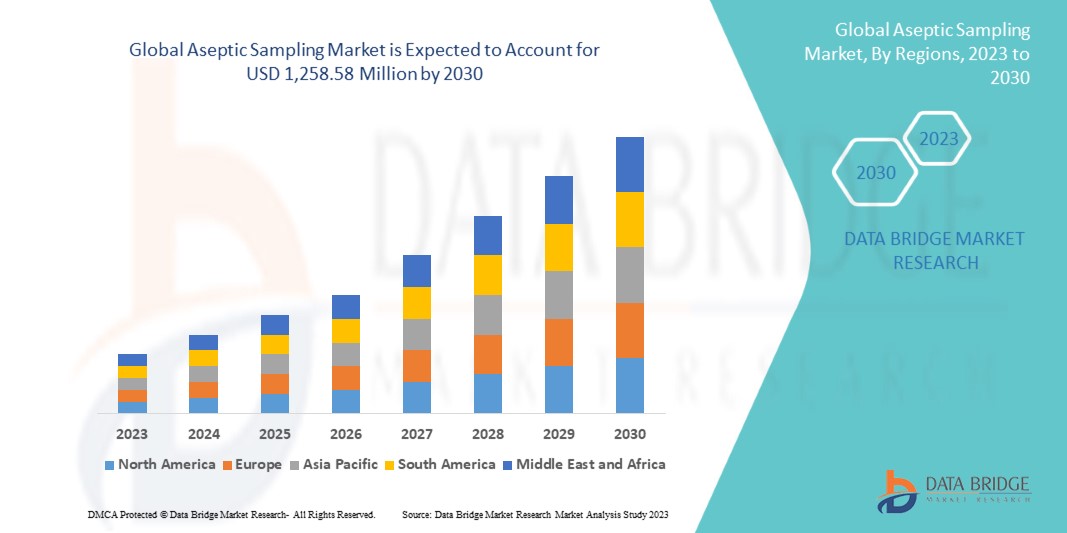

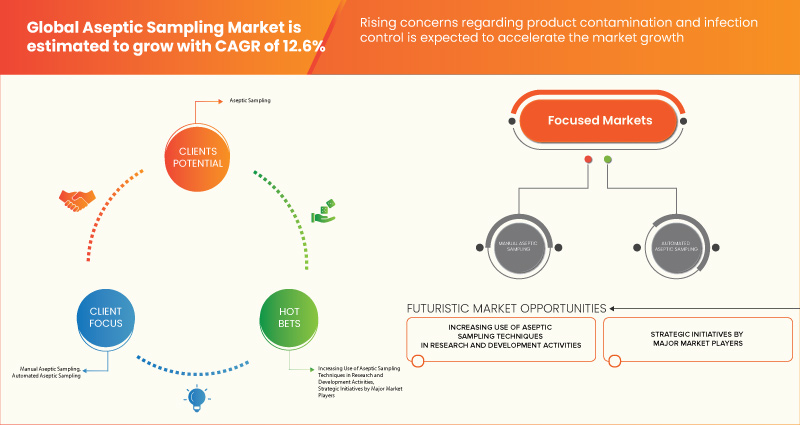

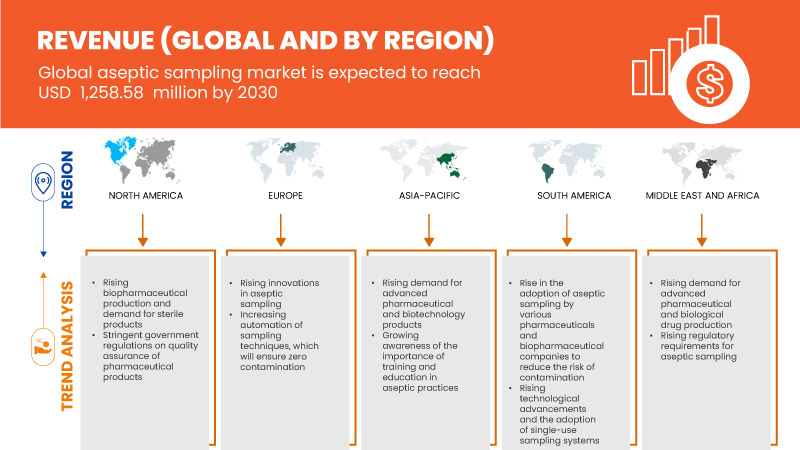

Data Bridge Market Research analyzes that the global aseptic sampling market is expected to reach USD 1,258.58 million by 2030, at a CAGR of 12.6% during the forecast period.

|

Report Metric |

Details |

|

Forecast Period |

2023 to 2030 |

|

Base Year |

2022 |

|

Historic Years |

2021 (Customizable to 2015 - 2020) |

|

Quantitative Units |

Revenue in USD Million |

|

Segments Covered |

Продукт (ручной асептический отбор проб и автоматизированная система/инструменты отбора проб), тип (ручной асептический отбор проб и автоматизированный асептический отбор проб), метод (автономный метод отбора проб, метод отбора проб на линии и асептический отбор проб в режиме онлайн), применение (восходящие и нисходящие процессы), конечный пользователь (производители биотехнологий и фармацевтических препаратов, организации контрактного производства, организации контрактных исследований, академические и научно-исследовательские отделы и другие), канал сбыта (прямой тендер, сторонний дистрибьютор и другие) |

|

Страны, охваченные |

США, Канада, Мексика, Германия, Великобритания, Франция, Италия, Россия, Испания, Нидерланды, Дания, Швейцария, Швеция, Польша, Норвегия, Финляндия, Бельгия, Турция, Остальная Европа, Китай, Япония, Индия, Новая Зеландия, Австралия, Южная Корея, Индонезия, Филиппины, Таиланд, Малайзия, Сингапур, Вьетнам, Тайвань, Остальная часть Азиатско-Тихоокеанского региона, Бразилия, Аргентина, Остальная часть Южной Америки, Саудовская Аравия, Южная Африка, Бахрейн, Кувейт, Оман, Катар, ОАЭ, Египет, Израиль и Остальная часть Ближнего Востока и Африки |

|

Охваченные участники рынка |

Sartorius AG, KEOFITT A/S, KIESELMANN GmbH, THERMO FISHER SCIENTIFIC INC., GEMU Group, Flownamics, Merck KGaA, Advanced Microdevices Pvt. Ltd. Mdi, SAINT-GOBAIN,GEA Group Aktiengesellschaft, Avantor, Inc., ALFA LAVAL, WL Gore & Associates, Inc., QualiTru Sampling Systems, Aerre Inox Srl, Shanghai LePure Biotech Co., Ltd., JONENG VALVES CO., LIMITED, Burkle GmbH и Dietrich Engineering Consultants среди прочих |

Определение мирового рынка асептического отбора проб

Рынок асептического отбора проб относится к рынку продуктов и услуг, используемых для сбора и обработки стерильных образцов для тестирования, анализа и контроля качества в различных отраслях промышленности, включая фармацевтическую, биотехнологическую, пищевую и индустрию напитков. Асептический отбор проб включает методы и процедуры, которые предотвращают попадание микроорганизмов и других загрязняющих веществ в процессе отбора проб и обеспечивают целостность и точность образцов.

Асептический отбор проб имеет решающее значение для поддержания качества и безопасности продукции, особенно в фармацевтической и биотехнологической промышленности, где стерильность и чистота продукта имеют решающее значение. В этом процессе используются различные продукты и оборудование для сбора образцов, такие как стерильные пакеты для сбора, бутылки, пробоотборники, совки и другие принадлежности.

Динамика мирового рынка асептического отбора проб

В этом разделе рассматривается понимание движущих сил рынка, преимуществ, возможностей, ограничений и проблем. Все это подробно обсуждается ниже:

Драйверы

- Строгие правила и рекомендации

Stringent laws and guidelines have been a major factor in the aseptic sample market's consistent expansion. Aseptic sampling entails gathering samples in a sterile setting to prevent contamination and protect the sample's integrity. Rules and guidelines are in place to ensure that these items adhere to strict quality and safety requirements. The pharmaceutical and biotechnology sectors have very severe standards that must be followed to guarantee their goods' safety and effectiveness. Aseptic sampling has consequently developed into a crucial procedure in various businesses to avoid contamination and guarantee the quality of their output.

Aseptic sampling is a crucial procedure in the pharmaceutical and biotechnology sectors for guaranteeing the safety and effectiveness of medicines and biologics. Regulatory agencies like the European Medicines Agency (EMA) and the U.S. Food and Drug Administration (FDA) have set strict rules for aseptic processing to prevent contamination throughout the manufacturing process. These guidelines call for the use of aseptic sampling techniques. These regulations demand the use of aseptic sampling techniques to ensure the samples are free of microbiological contamination, endotoxins, and other contaminants that could affect the quality of the final product.

The demand for aseptic sampling products and services has increased significantly in recent years. Companies in the aseptic sampling market invest in R&D to develop new products and services that meet strict regulatory requirements and guidelines.

Restraint

- Lack of Standardisation

Aseptic sampling in various industries, including pharmaceuticals, biotechnology, food, and drinks, entails gathering samples in a sterile setting to prevent contamination. Aseptic sampling methodologies used in various industries and applications are not universal, though, which might result in inconsistent results and restrict the comparability of data. Lack of regulatory organization's clear standards and norms results in a lack of standardization in aseptic sampling. Although regulatory bodies offer some general recommendations on aseptic sampling, there is no standardization for sampling procedures, sample sizes, tools, or validation techniques. As a result, it may be challenging to produce consistent outcomes across various applications and industries and cause business confusion.

Inaccurate or inconsistent data can lead to incorrect conclusions and poor decision-making in product development, quality control, and regulatory compliance. This can have serious consequences for public health and safety, as well as for the financial health of companies.

Thus, the lack of standardization is expected to restrain the growth of the global aseptic sampling market.

Opportunity

Growth in Technological Advancements

Developing new technologies within the realm of aseptic sampling is one of the most important factors contributing to expanding the aseptic sampling market globally. Companies can now improve their operations' accuracy, efficiency, and reliability due to the development of advanced sampling equipment and techniques. These developments are unleashing new growth opportunities for the market, and as a result, businesses are making significant investments in research and development to maintain their position as market leaders.

The development of automated systems is one of the most significant technological advancements that have been made in the field of aseptic sampling. These systems utilize robotics and artificial intelligence to improve the sampling procedures' accuracy while increasing their speed. They improve the consistency of results while simultaneously lowering the risk of contamination, which leads to an increase in the overall efficiency of the operations. Automated systems are particularly helpful in large-scale operations with a high sample throughput because of their speed and accuracy.

Advancements in sampling techniques are also driving the growth of the global aseptic sampling market. For example, developing closed-loop sampling techniques enables companies to take representative samples without exposing the product to the environment. This technique reduces the risk of contamination and improves the accuracy of results. Thus, the growth in technological advancements is an opportunity for the growth of the global aseptic sampling market.

Challenge

Lack of Skilled Workforce

Specialized equipment and trained personnel are essential to operate, maintain, and troubleshoot aseptic sampling systems. However, a shortage of trained and skilled personnel to operate these systems might hinder the market's expansion.

The market for aseptic sampling is very technically advanced, and employers look for candidates with experience in microbiology, engineering, and automation. On the other hand, there may not be enough qualified workers in these regions to support the implementation of aseptic sampling systems. This could result in longer lead times for the implementation of the system, higher costs associated with training, and decreased productivity due to personnel that lacks experience.

In addition, the high turnover rate of skilled personnel can make the challenge of a lack of skilled workforce even more difficult to deal with. When knowledgeable employees leave their posts, they take the information and experience necessary to operate aseptic sampling systems efficiently. Consequently, this may decrease efficiency, productivity, downtime, and maintenance costs.

In conclusion, the lack of a skilled workforce is a significant challenge in expanding the global market for aseptic sampling.

Recent Developments

- In June 2022, Merck kGaA announced a collaboration with Agilent Technologies to fill the industry gap in process analytical technologies for downstream processing. The collaboration will help in a further increase in revenue.

- In November 2021, Sartorius AG, a leading international partner of life science research and the biopharmaceutical industry, announced that it had been awarded the "Overall Best Bioprocessing Supplier" winner at the Europe Bioprocessing Excellence Awards 2021. This award has helped the company in making getting recognition for its work.

Global Aseptic Sampling Market Scope

Global aseptic sampling market is segmented into six notable segments: product, type, technique, application, end user, and distribution channel. The growth among segments helps you analyze niche pockets of growth and strategies to approach the market and determine your core application areas and the difference in your target markets.

Product

- Manual Aseptic Sampling

- Automated Sampling System/ Instruments

On the basis of product, the global aseptic sampling market is segmented into manual aseptic sampling and automated sampling systems/instruments.

Type

- Manual Aseptic Sampling

- Automated Aseptic Sampling

On the basis of type, the global aseptic sampling market is segmented into manual aseptic sampling and automated aseptic sampling.

Technique

- Off-Line Sampling Technique

- At-Line Sampling Technique

- On-Line Sampling Technique

On the basis of technique, the global aseptic sampling market is segmented into off-line sampling technique, at-line sampling technique, and on-line sampling technique.

Application

- Upstream Processes

- Downstream Processes

On the basis of application, the global aseptic sampling market is segmented into upstream processes and downstream processes.

End User

- Biotechnology And Pharmaceutical Manufacturers

- Contract Manufacturing Organization

- Contract Research Organization

- Academic And R&D Departments

- Others

On the basis of end user, the global aseptic sampling market is segmented into biotechnology and pharmaceutical manufacturers, contract manufacturing organization, contract research organization, academic and R&D departments, and others.

Distribution Channel

- Direct Tender

- Third Party Distributor

- Others

On the basis of distribution channel, the global aseptic sampling market is segmented into direct tender, third party distributor, and others.

Global Aseptic Sampling Market Regional Analysis/Insights

The global aseptic sampling market is categorized into six notable segments and geography.

Global aseptic sampling market is segmented into six notable segments: product, type, technique, application, end user, and distribution channel.

The countries covered in this market report are the U.S., Canada, Mexico, Germany, U.K., France, Italy, Russia, Spain, Netherlands, Denmark, Switzerland, Sweden, Poland, Norway, Finland, Belgium, Turkey, Rest of Europe, China, Japan, India, New Zealand, Australia, South Korea, Indonesia, Philippines, Thailand, Malaysia, Singapore, Vietnam, Taiwan, Rest of Asia-Pacific, Brazil, Argentina, Rest of South America, Saudi Arabia, South Africa, Bahrain, Kuwait, Oman, Qatar, U.A.E., Egypt, Israel, and Rest of Middle East and Africa.

North America is dominating the market due to the increasing investment in aseptic sampling is expected to boost the market growth. The U.S. dominates North America due to the strong presence of key players. Germany dominates Europe due to the increasing demand for aseptic sampling in emerging markets and expansion. China dominates the Asia-Pacific region due to increasing customer inclinations towards advanced technological processes.

The country section of the report also provides individual market-impacting factors and domestic regulation changes that impact the current and future trends of the market. Data points such as new sales, replacement sales, country demographics, regulatory acts, and import-export tariffs are some of the major pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges due to large or scarce competition from local and domestic brands and the impact of sales channels are considered while providing forecast analysis of the country data.

Competitive Landscape and Global Aseptic Sampling Market Share Analysis

Global aseptic sampling market competitive landscape provides details by a competitor. Details included are company overview, company financials, revenue generated, market potential, investment in R&D, new market initiatives, production sites and facilities, company strengths and weaknesses, product launch, product approvals, product width and breath, application dominance, product type lifeline curve. The above data points are only related to the company’s focus on the global aseptic sampling market.

Some of the major players operating in the aseptic sampling market are Sartorius AG, KEOFITT A/S, KIESELMANN GmbH, THERMO FISHER SCIENTIFIC INC., GEMU Group, Flownamics, Merck KGaA, Advanced Microdevices Pvt. Ltd. Mdi, SAINT-GOBAIN,GEA Group Aktiengesellschaft, Avantor, Inc., ALFA LAVAL, W. L. Gore & Associates, Inc., QualiTru Sampling Systems, Aerre Inox S.r.l., Shanghai LePure Biotech Co., Ltd., JONENG VALVES CO., LIMITED, Burkle GmbH, and Dietrich Engineering Consultants among others.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Интерактивная панель анализа данных

- Панель анализа компании для возможностей с высоким потенциалом роста

- Доступ аналитика-исследователя для настройки и запросов

- Анализ конкурентов с помощью интерактивной панели

- Последние новости, обновления и анализ тенденций

- Используйте возможности сравнительного анализа для комплексного отслеживания конкурентов

Содержание

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE GLOBAL ASEPTIC SAMPLING MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 PRODUCT TYPE LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET APPLICATION COVERAGE GRID

2.11 VENDOR SHARE ANALYSIS

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTEL ANALYSIS

4.2 PORTER'S FIVE FORCES MODEL

4.3 STRATEGIC INITIATIVES

5 INDUSTRY INSIGHTS

6 REGULATORY FRAMEWORK

7 MARKET OVERVIEW

7.1 DRIVERS

7.1.1 STRINGENT REGULATIONS AND GUIDELINES

7.1.2 RISING DEMAND FOR ADVANCED PHARMACEUTICAL AND BIOTECHNOLOGY PRODUCTS

7.1.3 INCREASING FOCUS ON QUALITY ASSURANCE AND GROWING AWARENESS OF ASEPTIC PRACTICES

7.1.4 GROWING R&D ACTIVITIES AND NEW APPROVALS AND LAUNCHES OF ASEPTIC SAMPLING PRODUCTS

7.2 RESTRAINTS

7.2.1 LACK OF STANDARDISATION

7.2.2 ALTERNATIVE SAMPLING TECHNIQUES

7.3 OPPORTUNITIES

7.3.1 GROWTH IN TECHNOLOGICAL ADVANCEMENTS

7.3.2 INCREASING ADOPTION OF SINGLE-USE ASEPTIC SAMPLING SYSTEMS

7.3.3 INCREASING DEMAND FOR STERILE PHARMACEUTICAL FORMULATIONS

7.4 CHALLENGES

7.4.1 HIGH INSTALLATION AND OPERATIONAL COSTS

7.4.2 LACK OF SKILLED WORKFORCE

8 GLOBAL ASEPTIC SAMPLING MARKET, BY PRODUCT

8.1 OVERVIEW

8.2 MANUAL ASEPTIC SAMPLING

8.3 AUTOMATED SAMPLING INSTRUMENTS/SYSTEMS

9 GLOBAL ASEPTIC SAMPLING MARKET, BY TYPE

9.1 OVERVIEW

9.2 MANUAL ASEPTIC SAMPLING

9.3 AUTOMATED ASEPTIC SAMPLING

10 GLOBAL ASEPTIC SAMPLING MARKET, BY TECHNIQUE

10.1 OVERVIEW

10.2 OFF-LINE SAMPLING TECHNIQUE

10.3 AT-LINE SAMPLING TECHNIQUE

10.4 ON-LINE SAMPLING TECHNIQUE

11 GLOBAL ASEPTIC SAMPLING MARKET, BY APPLICATION

11.1 OVERVIEW

11.2 UPSTREAM PROCESSES

11.3 DOWNSTREAM PROCESSES

12 GLOBAL ASEPTIC SAMPLING MARKET, BY END USER

12.1 OVERVIEW

12.2 BIOTECHNOLOGY AND PHARMACEUTICAL MANUFACTURERS

12.3 CONTRACT MANUFACTURING ORGANIZATION

12.4 CONTRACT RESEARCH ORGANIZATION

12.5 ACADEMIC AND R&D DEPARTMENTS

12.6 OTHERS

13 GLOBAL ASEPTIC SAMPLING MARKET, BY DISTRIBUTION CHANNEL

13.1 OVERVIEW

13.2 DIRECT TENDER

13.3 THIRD PARTY DISTRIBUTOR

13.4 OTHERS

14 GLOBAL ASEPTIC SAMPLING MARKET, BY REGION

14.1 OVERVIEW

14.2 NORTH AMERICA

14.2.1 U.S.

14.2.2 CANADA

14.2.3 MEXICO

14.3 EUROPE

14.3.1 GERMANY

14.3.2 FRANCE

14.3.3 U.K.

14.3.4 ITALY

14.3.5 SPAIN

14.3.6 RUSSIA

14.3.7 TURKEY

14.3.8 BELGIUM

14.3.9 DENMARK

14.3.10 NETHERLANDS

14.3.11 SWITZERLAND

14.3.12 SWEDEN

14.3.13 POLAND

14.3.14 NORWAY

14.3.15 FINLAND

14.3.16 REST OF EUROPE

14.4 ASIA-PACIFIC

14.4.1 CHINA

14.4.2 JAPAN

14.4.3 INDIA

14.4.4 SOUTH KOREA

14.4.5 AUSTRALIA

14.4.6 SINGAPORE

14.4.7 THAILAND

14.4.8 INDONESIA

14.4.9 PHILIPPINES

14.4.10 MALAYSIA

14.4.11 NEW ZEALAND

14.4.12 VIETNAM

14.4.13 TAIWAN

14.4.14 REST OF ASIA-PACIFIC

14.5 SOUTH AMERICA

14.5.1 BRAZIL

14.5.2 ARGENTINA

14.5.3 REST OF SOUTH AMERICA

14.6 MIDDLE EAST AND AFRICA

14.6.1 SOUTH AFRICA

14.6.2 SAUDI ARABIA

14.6.3 BAHRAIN

14.6.4 U.A.E.

14.6.5 KUWAIT

14.6.6 OMAN

14.6.7 QATAR

14.6.8 EGYPT

14.6.9 ISRAEL

14.6.10 REST OF MIDDLE EAST AND AFRICA

15 GLOBAL ASEPTIC SAMPLING MARKET_: COMPANY LANDSCAPE

15.1 COMPANY SHARE ANALYSIS: GLOBAL

15.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

15.3 COMPANY SHARE ANALYSIS: EUROPE

15.4 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

16 COMPANY PROFILE

16.1 SARTORIUS AG

16.1.1 COMPANY SNAPSHOT

16.1.2 REVENUE ANALYSIS

16.1.3 COMPANY SHARE ANALYSIS

16.1.4 PRODUCT PORTFOLIO

16.1.5 RECENT DEVELOPMENTS

16.2 KIESELMANN GMBH

16.2.1 COMPANY SNAPSHOT

16.2.2 COMPANY SHARE ANALYSIS

16.2.3 PRODUCT PORTFOLIO

16.2.4 RECENT DEVELOPMENTS

16.3 SAINT-GOBAIN

16.3.1 COMPANY SNAPSHOT

16.3.2 COMPANY SHARE ANALYSIS

16.3.3 PRODUCT PORTFOLIO

16.3.4 RECENT DEVELOPMENTS

16.4 MERCK KGAA

16.4.1 COMPANY SNAPSHOT

16.4.2 REVENUE ANALYSIS

16.4.3 COMPANY SHARE ANALYSIS

16.4.4 PRODUCT PORTFOLIO

16.4.5 RECENT DEVELOPMENT

16.5 ALFA LAVAL

16.5.1 COMPANY SNAPSHOT

16.5.2 REVENUE ANALYSIS

16.5.3 COMPANY SHARE ANALYSIS

16.5.4 PRODUCT PORTFOLIO

16.5.5 RECENT DEVELOPMENTS

16.6 ADVANCED MICRODEVICES PVT. LTD. MDI

16.6.1 COMPANY SNAPSHOT

16.6.2 PRODUCT PORTFOLIO

16.6.3 RECENT DEVELOPMENTS

16.7 AVANTOR, INC.

16.7.1 COMPANY SNAPSHOT

16.7.2 REVENUE ANALYSIS

16.7.3 COMPANY SHARE ANALYSIS

16.7.4 PRODUCT PORTFOLIO

16.7.5 RECENT DEVELOPMENT

16.8 AERRE INOX S.R.L.

16.8.1 COMPANY SNAPSHOT

16.8.2 PRODUCT PORTFOLIO

16.8.3 RECENT DEVELOPMENTS

16.9 BURKLE GMBH

16.9.1 COMPANY SNAPSHOT

16.9.2 PRODUCT PORTFOLIO

16.9.3 RECENT DEVELOPMENTS

16.1 DIETRICH ENGINEERING CONSULTANTS

16.10.1 COMPANY SNAPSHOT

16.10.2 PRODUCT PORTFOLIO

16.10.3 RECENT DEVELOPMENT

16.11 FLOWNAMICS

16.11.1 COMPANY SNAPSHOT

16.11.2 PRODUCT PORTFOLIO

16.11.3 RECENT DEVELOPMENTS

16.12 GEMU GROUP

16.12.1 COMPANY SNAPSHOT

16.12.2 PRODUCT PORTFOLIO

16.12.3 RECENT DEVELOPMENT

16.13 GEA GROUP AKTIENGESELLSCHAFT (2022)

16.13.1 COMPANY SNAPSHOT

16.13.2 REVENUE ANALYSIS

16.13.3 COMPANY SHARE ANALYSIS

16.13.4 PRODUCT PORTFOLIO

16.13.5 RECENT DEVELOPMENTS

16.14 JONENG VALVES CO., LIMITED

16.14.1 COMPANY SNAPSHOT

16.14.2 PRODUCT PORTFOLIO

16.14.3 RECENT DEVELOPMENTS

16.15 KEOFITT A/S

16.15.1 COMPANY SNAPSHOT

16.15.2 PRODUCT PORTFOLIO

16.15.3 RECENT DEVELOPMENTS

16.16 QUALITRU SAMPLING SYSTEMS

16.16.1 COMPANY SNAPSHOT

16.16.2 PRODUCT PORTFOLIO

16.16.3 RECENT DEVELOPMENTS

16.17 SHANGHAI LEPURE BIOTECH CO., LTD.

16.17.1 COMPANY SNAPSHOT

16.17.2 PRODUCT PORTFOLIO

16.17.3 RECENT DEVELOPMENT

16.18 THERMO FISHER SCIENTIFIC INC.

16.18.1 COMPANY SNAPSHOT

16.18.2 REVENUE ANALYSIS

16.18.3 COMPANY SHARE ANALYSIS

16.18.4 PRODUCT PORTFOLIO

16.18.5 RECENT DEVELOPMENT

16.19 W.L. GORE & ASSOCIATES, INC.

16.19.1 COMPANY SNAPSHOT

16.19.2 COMPANY SHARE ANALYSIS

16.19.3 PRODUCT PORTFOLIO

16.19.4 RECENT DEVELOPMENTS

17 QUESTIONNAIRE

18 RELATED REPORTS

Список рисунков

FIGURE 1 GLOBAL ASEPTIC SAMPLING MARKET: SEGMENTATION

FIGURE 2 GLOBAL ASEPTIC SAMPLING MARKET: DATA TRIANGULATION

FIGURE 3 GLOBAL ASEPTIC SAMPLING MARKET: DROC ANALYSIS

FIGURE 4 GLOBAL ASEPTIC SAMPLING MARKET : GLOBAL VS REGIONAL MARKET ANALYSIS

FIGURE 5 GLOBAL ASEPTIC SAMPLING MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 GLOBAL ASEPTIC SAMPLING MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 GLOBAL ASEPTIC SAMPLING MARKET: DBMR MARKET POSITION GRID

FIGURE 8 GLOBAL ASEPTIC SAMPLING MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 9 GLOBAL ASEPTIC SAMPLING MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 GLOBAL ASEPTIC SAMPLING MARKET: SEGMENTATION

FIGURE 11 STRINGENT REGULATIONS AND GUIDELINES IN VARIOUS INDUSTRIES FOR QUALITY PRODUCTS ARE EXPECTED TO DRIVE THE GLOBAL ASEPTIC SAMPLING MARKET IN THE FORECAST PERIOD OF 2023 TO 2030

FIGURE 12 MANUAL ASEPTIC SAMPLING SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE GLOBAL ASEPTIC SAMPLING MARKET IN THE FORECAST PERIOD OF 20213 & 2030

FIGURE 13 NORTH AMERICA IS EXPECTED TO DOMINATE THE GLOBAL ASEPTIC SAMPLING MARKET, AND EUROPE IS EXPECTED TO GROW WITH THE HIGHEST CAGR IN THE FORECAST PERIOD OF 2023 TO 2030

FIGURE 14 EUROPE IS THE FASTEST-GROWING MARKET FOR ASEPTIC SAMPLING MANUFACTURERS IN THE FORECAST PERIOD OF 2023 TO 2030

FIGURE 15 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE GLOBAL ASEPTIC SAMPLING MARKET

FIGURE 16 GLOBAL ASEPTIC SAMPLING MARKET: BY PRODUCT, 2022

FIGURE 17 GLOBAL ASEPTIC SAMPLING MARKET: BY PRODUCT, 2023-2030 (USD MILLION)

FIGURE 18 GLOBAL ASEPTIC SAMPLING MARKET: BY PRODUCT, CAGR (2023-2030)

FIGURE 19 GLOBAL ASEPTIC SAMPLING MARKET: BY PRODUCT, LIFELINE CURVE

FIGURE 20 GLOBAL ASEPTIC SAMPLING MARKET: BY TYPE, 2022

FIGURE 21 GLOBAL ASEPTIC SAMPLING MARKET: BY TYPE, 2023-2030 (USD MILLION)

FIGURE 22 GLOBAL ASEPTIC SAMPLING MARKET: BY TYPE, CAGR (2023-2030)

FIGURE 23 GLOBAL ASEPTIC SAMPLING MARKET: BY TYPE, LIFELINE CURVE

FIGURE 24 GLOBAL ASEPTIC SAMPLING MARKET: BY TECHNIQUE, 2022

FIGURE 25 GLOBAL ASEPTIC SAMPLING MARKET: BY TECHNIQUE, 2023-2030 (USD MILLION)

FIGURE 26 GLOBAL ASEPTIC SAMPLING MARKET: BY TECHNIQUE, CAGR (2023-2030)

FIGURE 27 GLOBAL ASEPTIC SAMPLING MARKET: BY TECHNIQUE, LIFELINE CURVE

FIGURE 28 GLOBAL ASEPTIC SAMPLING MARKET: BY APPLICATION, 2022

FIGURE 29 GLOBAL ASEPTIC SAMPLING MARKET: BY APPLICATION, 2023-2030 (USD MILLION)

FIGURE 30 GLOBAL ASEPTIC SAMPLING MARKET: BY APPLICATION, CAGR (2023-2030)

FIGURE 31 GLOBAL ASEPTIC SAMPLING MARKET: BY APPLICATION, LIFELINE CURVE

FIGURE 32 GLOBAL ASEPTIC SAMPLING MARKET: BY END USER, 2022

FIGURE 33 GLOBAL ASEPTIC SAMPLING MARKET: BY END USER, 2023-2030 (USD MILLION)

FIGURE 34 GLOBAL ASEPTIC SAMPLING MARKET: BY END USER, CAGR (2023-2030)

FIGURE 35 GLOBAL ASEPTIC SAMPLING MARKET: BY END USER, LIFELINE CURVE

FIGURE 36 GLOBAL ASEPTIC SAMPLING MARKET: BY DISTRIBUTION CHANNEL, 2022

FIGURE 37 GLOBAL ASEPTIC SAMPLING MARKET: BY DISTRIBUTION CHANNEL, 2023-2030 (USD MILLION)

FIGURE 38 GLOBAL ASEPTIC SAMPLING MARKET: BY DISTRIBUTION CHANNEL, CAGR (2023-2030)

FIGURE 39 GLOBAL ASEPTIC SAMPLING MARKET: BY DISTRIBUTION CHANNEL, LIFELINE CURVE

FIGURE 40 GLOBAL ASEPTIC SAMPLING MARKET: SNAPSHOT (2022)

FIGURE 41 LOBAL ASEPTIC SAMPLING MARKET : BY REGION (2022)

FIGURE 42 GLOBAL ASEPTIC SAMPLING MARKET : BY REGION (2023 & 2030)

FIGURE 43 GLOBAL ASEPTIC SAMPLING MARKET : BY REGION (2022 & 2030)

FIGURE 44 GLOBAL ASEPTIC SAMPLING MARKET : BY PRODUCT (2023-2030)

FIGURE 45 NORTH AMERICA ASEPTIC SAMPLING MARKET: SNAPSHOT (2022)

FIGURE 46 NORTH AMERICA ASEPTIC SAMPLING MARKET: BY COUNTRY (2022)

FIGURE 47 NORTH AMERICA ASEPTIC SAMPLING MARKET: BY COUNTRY (2023 & 2030)

FIGURE 48 NORTH AMERICA ASEPTIC SAMPLING MARKET: BY COUNTRY (2022 & 2030)

FIGURE 49 NORTH AMERICA ASEPTIC SAMPLING MARKET: BY PRODUCT (2023-2030)

FIGURE 50 EUROPE ASEPTIC SAMPLING MARKET: SNAPSHOT (2022)

FIGURE 51 EUROPE ASEPTIC SAMPLING MARKET: BY COUNTRY (2022)

FIGURE 52 EUROPE ASEPTIC SAMPLING MARKET: BY COUNTRY (2023 & 2030)

FIGURE 53 EUROPE ASEPTIC SAMPLING MARKET: BY COUNTRY (2022 & 2030)

FIGURE 54 EUROPE ASEPTIC SAMPLING MARKET: BY PRODUCT (2023-2030)

FIGURE 55 ASIA-PACIFIC ASEPTIC SAMPLING MARKET: SNAPSHOT (2022)

FIGURE 56 ASIA-PACIFIC ASEPTIC SAMPLING MARKET: BY COUNTRY (2022)

FIGURE 57 ASIA-PACIFIC ASEPTIC SAMPLING MARKET: BY COUNTRY (2023 & 2030)

FIGURE 58 ASIA-PACIFIC ASEPTIC SAMPLING MARKET: BY COUNTRY (2022 & 2030)

FIGURE 59 ASIA-PACIFIC ASEPTIC SAMPLING MARKET: BY PRODUCT (2023-2030)

FIGURE 60 SOUTH AMERICA ASEPTIC SAMPLING MARKET: SNAPSHOT (2022)

FIGURE 61 SOUTH AMERICA ASEPTIC SAMPLING MARKET: BY COUNTRY (2022)

FIGURE 62 SOUTH AMERICA ASEPTIC SAMPLING MARKET: BY COUNTRY (2023 & 2030)

FIGURE 63 SOUTH AMERICA ASEPTIC SAMPLING MARKET: BY COUNTRY (2022 & 2030)

FIGURE 64 SOUTH AMERICA ASEPTIC SAMPLING MARKET: BY PRODUCT (2023-2030)

FIGURE 65 MIDDLE EAST AND AFRICA ASEPTIC SAMPLING MARKET: SNAPSHOT (2022)

FIGURE 66 MIDDLE EAST AND AFRICA ASEPTIC SAMPLING MARKET: BY COUNTRY (2022)

FIGURE 67 MIDDLE EAST AND AFRICA ASEPTIC SAMPLING MARKET: BY COUNTRY (2023 & 2030)

FIGURE 68 MIDDLE EAST AND AFRICA ASEPTIC SAMPLING MARKET: BY COUNTRY (2022 & 2030)

FIGURE 69 MIDDLE EAST AND AFRICA ASEPTIC SAMPLING MARKET: BY PRODUCT (2023-2030)

FIGURE 70 GLOBAL ASEPTIC SAMPLING MARKET: COMPANY SHARE 2022 (%)

FIGURE 71 NORTH AMERICA ASEPTIC SAMPLING MARKET: COMPANY SHARE 2022 (%)

FIGURE 72 EUROPE ASEPTIC SAMPLING MARKET: COMPANY SHARE 2022 (%)

FIGURE 73 ASIA-PACIFIC ASEPTIC SAMPLING MARKET: COMPANY SHARE 2022 (%)

Методология исследования

Сбор данных и анализ базового года выполняются с использованием модулей сбора данных с большими размерами выборки. Этап включает получение рыночной информации или связанных данных из различных источников и стратегий. Он включает изучение и планирование всех данных, полученных из прошлого заранее. Он также охватывает изучение несоответствий информации, наблюдаемых в различных источниках информации. Рыночные данные анализируются и оцениваются с использованием статистических и последовательных моделей рынка. Кроме того, анализ доли рынка и анализ ключевых тенденций являются основными факторами успеха в отчете о рынке. Чтобы узнать больше, пожалуйста, запросите звонок аналитика или оставьте свой запрос.

Ключевой методологией исследования, используемой исследовательской группой DBMR, является триангуляция данных, которая включает в себя интеллектуальный анализ данных, анализ влияния переменных данных на рынок и первичную (отраслевую экспертную) проверку. Модели данных включают сетку позиционирования поставщиков, анализ временной линии рынка, обзор рынка и руководство, сетку позиционирования компании, патентный анализ, анализ цен, анализ доли рынка компании, стандарты измерения, глобальный и региональный анализ и анализ доли поставщика. Чтобы узнать больше о методологии исследования, отправьте запрос, чтобы поговорить с нашими отраслевыми экспертами.

Доступна настройка

Data Bridge Market Research является лидером в области передовых формативных исследований. Мы гордимся тем, что предоставляем нашим существующим и новым клиентам данные и анализ, которые соответствуют и подходят их целям. Отчет можно настроить, включив в него анализ ценовых тенденций целевых брендов, понимание рынка для дополнительных стран (запросите список стран), данные о результатах клинических испытаний, обзор литературы, обновленный анализ рынка и продуктовой базы. Анализ рынка целевых конкурентов можно проанализировать от анализа на основе технологий до стратегий портфеля рынка. Мы можем добавить столько конкурентов, о которых вам нужны данные в нужном вам формате и стиле данных. Наша команда аналитиков также может предоставить вам данные в сырых файлах Excel, сводных таблицах (книга фактов) или помочь вам в создании презентаций из наборов данных, доступных в отчете.