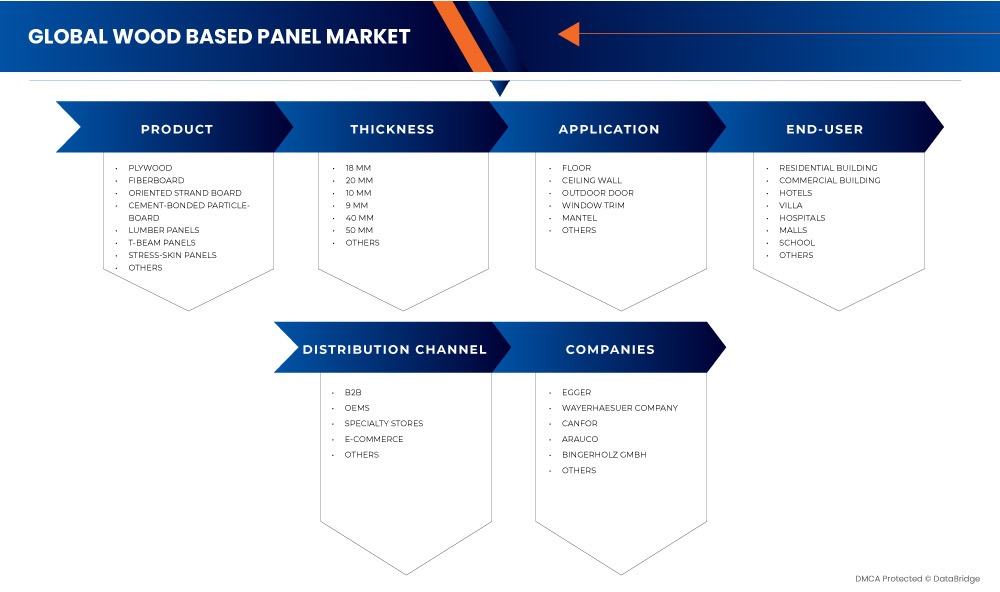

Европейский рынок древесных плит по видам продукции (фанера, древесноволокнистые плиты, ориентированно-стружечные плиты, цементно-стружечные плиты, пиломатериалы, панели с тавровыми балками, панели с напряженной обшивкой и другие), толщина (9 мм, 10 мм, 18 мм, 20 мм, 40 мм, 50 мм и другие), канал сбыта (B2B, OEM-производители, специализированные магазины, электронная коммерция и другие), применение (внешние двери, оконная отделка, потолочные панели, каминные полы, полы и другие), конечный пользователь (жилые здания, коммерческие здания, отели, виллы, больницы, школы, торговые центры и другие) — отраслевые тенденции и прогноз до 2029 г.

Анализ и размер европейского рынка древесных плит

Древесные панели широко используются для потолков, облицовки, кровли , напольных покрытий и мебели благодаря своей прочности и долговечности. Растущий спрос на древесные продукты со стороны отраслей конечного использования ускоряет рост рынка по всему миру. Адаптация этих технологий к отрасли древесных панелей была стимулирована необходимостью улучшения качества продукции и одновременного снижения производственных затрат или, скорее, обеспечения конкурентоспособности производителей древесных панелей. Следовательно, растущий спрос на древесные панели, вероятно, будет стимулировать рост рынка в прогнозируемый период.

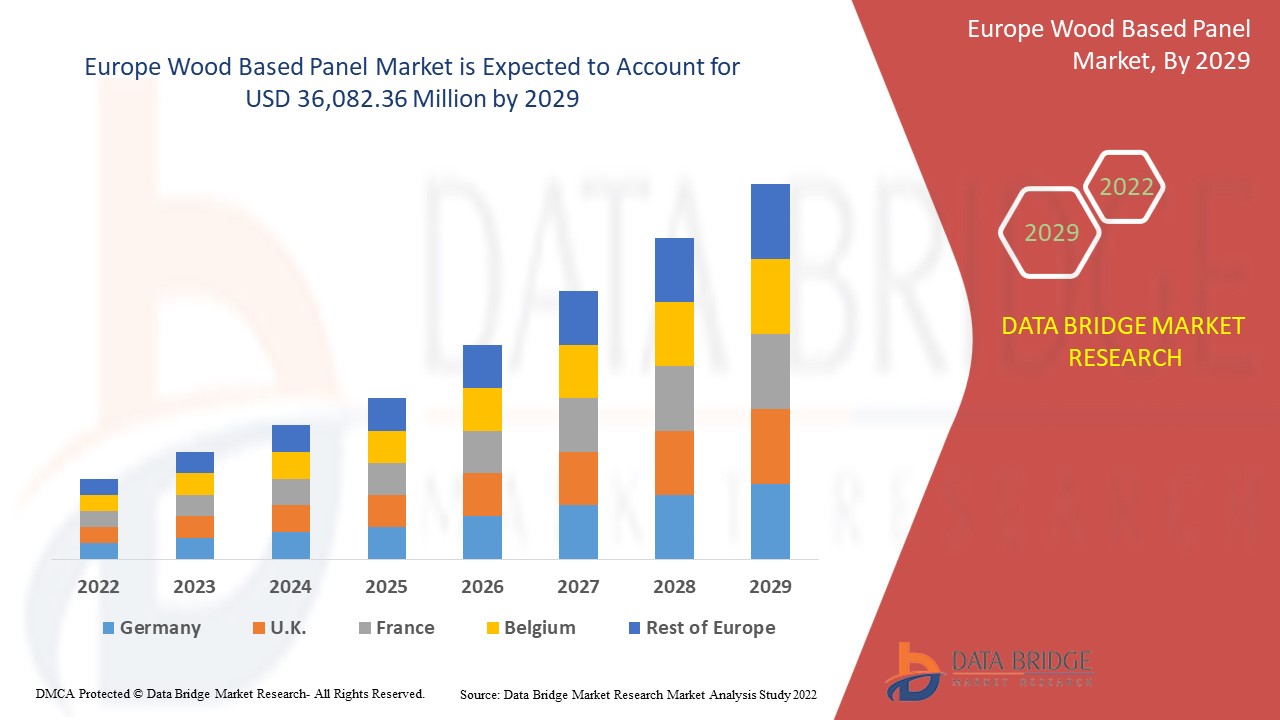

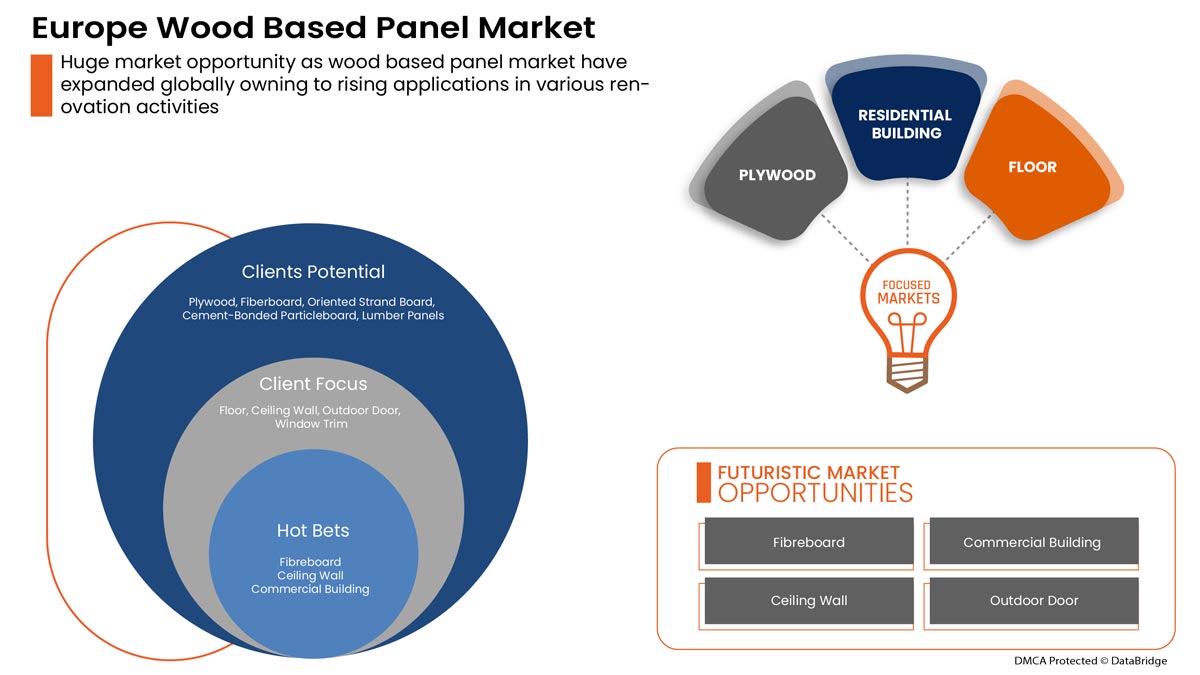

Data Bridge Market Research анализирует, что рынок древесных панелей, как ожидается, достигнет значения 36 082,36 млн долларов США к 2029 году при среднегодовом темпе роста 3,2% в течение прогнозируемого периода. «Пол» составляет наиболее заметный сегмент применения на соответствующем рынке из-за роста древесных панелей. Отчет о рынке, подготовленный командой Data Bridge Market Research, включает в себя углубленный экспертный анализ, анализ импорта/экспорта, анализ цен, анализ потребления производства и сценарий климатической цепочки.

|

Отчет Метрика |

Подробности |

|

Прогнозируемый период |

2022-2029 |

|

Базовый год |

2021 |

|

Исторические годы |

2020 (Можно настроить на 2019 - 2014) |

|

Количественные единицы |

Доход в млн. долл. США |

|

Охваченные сегменты |

По продукту (фанера, древесноволокнистая плита, ориентированно-стружечная плита, цементно-стружечная плита, пиломатериалы, панели с тавровыми балками, панели с напряженной обшивкой и другие), толщине (9 мм, 10 мм, 18 мм, 20 мм, 40 мм, 50 мм и другие), каналу сбыта (B2B, OEM-производители, специализированные магазины, электронная коммерция и другие), применению (внешние двери, оконные отделки, потолки, каминные полы, полы и другие), конечному пользователю (жилые здания, коммерческие здания, гостиницы, виллы, больницы, школы, торговые центры и другие). |

|

Страны, охваченные |

Германия, Великобритания, Италия, Франция, Испания, Россия, Турция, Швейцария, Бельгия, Нидерланды и остальные страны Европы. |

|

Охваченные участники рынка |

EGGER Group, West Fraser, Starbank Panel Products Ltd, Dongwha Group, Kronoplus Limited, BinderHolz GmbH, DARE panel group co., ltd., Canfor, Sonae Industria, EVERGREEN FIBREBOARD BERHAD, Mieco Chipboard Berhad, Kastamonu Entegre и PFEIFER GROUP, а также другие. |

Определение рынка

Древесные панели — это общее название для множества различных плитных изделий, которые обладают хорошим набором инженерных свойств. В то время как некоторые типы панелей относительно новы на рынке, другие были разработаны и успешно внедрены более ста лет назад. Однако типы панелей имеют долгую историю непрерывной оптимизации, которая все еще далека от полной разработки, и у них всегда может быть шанс на улучшение. С одной стороны, технологические разработки, а также новые рыночные и нормативные требования, наряду с постоянно меняющейся ситуацией с сырьем, стимулируют постоянное улучшение древесных панелей и процессов их производства.

Динамика рынка древесных плит на европейском рынке

В этом разделе рассматривается понимание движущих сил рынка, возможностей, ограничений и проблем. Все это подробно обсуждается ниже:

Драйверы/возможности, с которыми сталкивается рынок древесных плит в Европе

- Рост потребительских расходов на древесные плиты при ремонте домов и мебели

Отрасль деревянных панелей включает в себя фанерные листы, инженерные деревянные панели, МДФ (древесноволокнистые плиты средней плотности), мебельные плиты, ДСП и декоративные поверхностные продукты, такие как ламинаты. Рост потребительских расходов на древесные панели при ремонте домов и мебели, как ожидается, увеличит спрос на древесные панели в коммерческих и жилых зданиях. Улучшение и увеличение деятельности по ремонту зданий с принятием древесных панелей для повышения эстетики является еще одним фактором, стимулирующим рост рынка. Более того, увеличение строительства общественных зданий, гранд-отелей и курортов с декоративными деревянными панелями привело к росту рынка.

- Сбалансированные процедуры импорта и экспорта древесных плит между странами

Глобальная торговля древесными изделиями сильно регионализована, с Европой, Северной Америкой и Азией. В последние годы глобальная торговля древесными изделиями сильно изменилась с ростом спроса на древесные панели и ростом развивающихся рынков древесных панелей. В последние годы возросло производство и торговля древесными плитами, такими как фанера, ДСП, ДВП, ориентированно-стружечные плиты и пиломатериалы, из-за роста спроса со стороны рынка жилья и глобального роста населения.

- Низкая себестоимость продукции в сочетании с превосходными свойствами деревянных панелей, включая прочность и долговечность

Древесные панели — это специальные продукты, которые обеспечивают улучшенные эксплуатационные характеристики, долгосрочную производительность и повышенную долговечность, будучи менее дорогими в производстве и использовании. Древесные панели предоставляют удивительный набор возможностей с точки зрения как структурных, так и эстетических применений. Благодаря своей доступности, превосходным эксплуатационным характеристикам и гибкости в проектировании, строительстве и реконструкции, рост использования древесных панелей в жилищном строительстве увеличивается. Строительство деревянных каркасов значительно улучшилось благодаря более быстрому строительству, лучшему использованию волокна, меньшему количеству отходов и лучшему контролю качества. Новые технологические достижения в области EWP и соединений позволяют отрасли деревообработки успешно конкурировать в строительстве гораздо более крупных и сложных конструкций.

- Рост инвестиций и инициатив в сфере строительства как коммерческих, так и жилых объектов

Строительная отрасль стала надежным и эффективным производственным сектором во всем мире. Во всех странах рост спроса на строительные и риэлторские проекты обусловлен макроэкономическими и разрушительными мегатенденциями, такими как рост урбанизации, расширение торговли, демографическими тенденциями, такими как рост уровня доходов, а также технологиями и устойчивой средой. В связи с этим были инициированы различные проекты по созданию социально инклюзивных, устойчивых сообществ, поскольку экономический рост любой страны в первую очередь зависит от развития ее инфраструктуры.

Ограничения/проблемы, с которыми сталкивается рынок древесных плит в Европе

- Растет обеспокоенность по поводу пыли при использовании деревянных панелей

Древесные панели охватывают производство разнообразной продукции, и хотя производственный поток отличается от продукта к продукту, есть некоторые общие черты с точки зрения ключевых экологических проблем. Выбросы пыли, органических соединений и формальдегида являются основными растущими проблемами при производстве древесных панелей. Выбросы мелких твердых частиц способствуют выбросам пыли при производстве древесных панелей, где частицы размером менее 3 мкм могут составлять до 50 % от общего количества пыли, измеренного из-за выбросов пыли при производстве древесных панелей, вызывая проблемы со здоровьем и окружающей средой, что является одним из главных пунктов повестки дня экологической политики.

- Колебание цен на древесную массу

Колебание цен на сырье повлияет на себестоимость продукции из древесных плит. Изменение себестоимости изменит доход производителей. Древесная масса берется из деревьев, но из-за большего спроса в разных регионах импорт и экспорт древесной массы осуществляются в пределах указанного количества. Сырье доступно в разном качестве и по разным ценам, из-за чего производство древесной продукции очень затруднено для производителей. Сильно колеблющиеся затраты на сырье и неэффективное управление ценами могут подвергнуть производителя большой опасности на рынке. Из-за колебания цен на сырье производители теперь могут фиксировать себестоимость продукции, что приводит к убыткам для производителей.

- Колебания цен на сырье и непоследовательность в цепочке поставок

Экосистема цепочки поставок становится все более нестабильной из-за нехватки различных факторов, таких как высокая себестоимость продукции, транспортные расходы и другие. Производители изделий из древесины сталкиваются со многими проблемами из-за высокой изменчивости сырья. Каждый этап обработки в производстве влияет на использование материалов и эффективность затрат, что является причиной более высокой стоимости материалов. Наиболее распространенной проблемой для производителя изделий из древесины является получение прибыли и выполнение производственного процесса с низкими затратами, но с использованием дорогостоящего переменного сырья.

Влияние COVID-19 на рынок древесных плит в Европе

COVID-19 повлиял на различные отрасли обрабатывающей промышленности в 2020-2021 годах, поскольку он привел к закрытию рабочих мест, нарушению цепочек поставок и ограничениям на транспорт. Из-за карантина рынок испытал падение продаж из-за закрытия розничных точек и ограничений на доступ клиентов в течение последних нескольких лет.

Однако рост рынка после пандемии объясняется тем, что больше людей работают из дома, а также ростом располагаемого дохода. Это привело к увеличению спроса на мебель. Ключевые игроки рынка принимают различные стратегические решения, чтобы восстановиться после COVID-19. Игроки проводят многочисленные НИОКР-мероприятия для улучшения своих предложений. Они увеличивают свою долю рынка, исследуя различные каналы розничной торговли и выходя в новые регионы.

В этом отчете о рынке панелей из древесины в Европе содержатся сведения о последних новых разработках, правилах торговли, анализе импорта-экспорта, анализе производства, оптимизации цепочки создания стоимости, доле рынка, влиянии внутренних и локальных игроков рынка, анализируются возможности с точки зрения новых источников дохода, изменений в правилах рынка, анализ стратегического роста рынка, размер рынка, рост рынка категорий, ниши приложений и доминирование, одобрения продуктов, запуски продуктов, географические расширения, технологические инновации на рынке. Чтобы получить больше информации о рынке панелей из древесины, свяжитесь с Data Bridge Market Research для получения аналитического обзора. Наша команда поможет вам принять обоснованное рыночное решение для достижения роста рынка.

Последние события

- В ноябре 2020 года West Fraser приобрела Norbord, создав Diversified Europe Wood Products Leader. Это приобретение повысило авторитет компании на рынке и, таким образом, поможет ей диверсифицировать свой бизнес.

- В марте 2021 года Binderholz GmbH совместно с Hilti работали над герметизацией щелей в зданиях с конструкционной противопожарной защитой. Это создает ограничения для экспертов по безопасности и владельцев зданий. Партнерство обеспечивает одобрение большего количества структурных противопожарных единиц и критериев документации для планирования и разработки противопожарных зданий.

Объем европейского рынка древесных плит

Европейский рынок древесных панелей сегментирован на основе продукта, канала сбыта, толщины, применения и конечных пользователей. Рост среди этих сегментов поможет вам проанализировать сегменты с незначительным ростом в отраслях и предоставить пользователям ценный обзор рынка и рыночные идеи, которые помогут им принимать стратегические решения для определения основных рыночных приложений.

Продукт

- Фанера

- ДВП

- Цементно-стружечная плита

- Ориентированно-стружечная плита

- Панели из древесины

- Панели Т-образных балок

- Панели Stress-Skin

- Другие

По видам продукции европейский рынок древесных плит подразделяется на фанеру, древесноволокнистые плиты, ориентированно-стружечные плиты, цементно-стружечные плиты, пиломатериалы, панели с тавровыми балками, панели с обшивкой под напряжение и другие.

Канал распространения

- Электронная коммерция

- OEM-производители

- В2В

- Специализированные магазины

- Другие

По каналам сбыта европейский рынок древесных плит подразделяется на B2B, OEM-производителей, специализированные магазины, электронную коммерцию и другие.

Толщина

- 9 ММ

- 10 ММ

- 18 ММ

- 20 ММ

- 40 ММ

- 50 ММ

- Другие

По толщине европейский рынок древесных плит сегментируется на 9 ММ, 10 ММ, 18 ММ, 20 ММ, 40 ММ, 50 ММ и другие.

Приложение

- Наружная дверь

- Отделка окон

- Потолок Стена

- Камин

- Пол

- Другие

По сферам применения европейский рынок древесных панелей подразделяется на наружные двери, отделку окон, потолочные стены, каминные полы, напольные покрытия и другие.

Конечный пользователь

- Жилое здание

- Коммерческое здание

- Отели

- Вилла

- Больницы

- Школа

- Торговые центры

- Другие

По конечным потребителям европейский рынок древесных панелей сегментируется на жилые здания, коммерческие здания, гостиницы, виллы, больницы, школы, торговые центры и другие.

Региональный анализ/анализ рынка древесных плит в Европе

Проведен анализ европейского рынка древесных плит, а также предоставлены сведения о размерах рынка и тенденциях по продуктам, каналам сбыта, толщине, области применения и конечным пользователям, как указано выше.

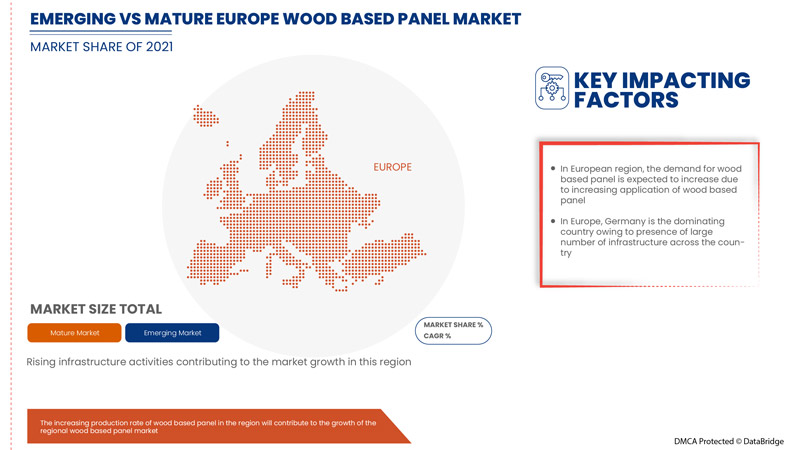

В отчете о европейском рынке древесных плит рассматриваются следующие страны: Германия, Великобритания, Италия, Франция, Испания, Россия, Турция, Швейцария, Бельгия, Нидерланды и остальные страны Европы.

Германия доминирует на рынке из-за роста потребительских расходов на древесные панели при ремонте домов и мебели в регионе. Рост инвестиций и инициатив в отношении строительства как коммерческих, так и жилых помещений стимулирует спрос региона на древесные панели.

Раздел отчета по странам также содержит отдельные факторы, влияющие на рынок, и изменения в регулировании рынка, которые влияют на текущие и будущие тенденции рынка. Такие данные, как анализ цепочки создания стоимости вверх и вниз по течению, технические тенденции, анализ пяти сил Портера и тематические исследования, являются некоторыми из указателей, используемых для прогнозирования рыночного сценария для отдельных стран. Кроме того, при предоставлении прогнозного анализа данных по странам учитываются наличие и доступность глобальных брендов и их проблемы, связанные с большой или малой конкуренцией со стороны местных и отечественных брендов, влияние внутренних тарифов и торговые пути.

Конкурентная среда и анализ доли рынка древесных плит в Европе

Конкурентная среда европейского рынка древесных панелей содержит подробную информацию по конкурентам. Подробности включают обзор компании, финансовые показатели компании, полученный доход, рыночный потенциал, инвестиции в исследования и разработки, новые рыночные инициативы, глобальное присутствие, производственные площадки и объекты, производственные мощности, сильные и слабые стороны компании, запуск продукта, широту и широту продукта и доминирование в применении. Вышеуказанные пункты данных связаны только с фокусом компаний на европейском рынке древесных панелей.

Среди основных игроков на рынке древесных плит можно назвать Egger Group, West Fraser, Starbank Panel Products Ltd, Dongwha Group, Kronoplus Limited, BinderHolz GmbH, Dare panel group co., ltd., Canfor, Sonae Industria, Evergreen Fibreboard Berhad, Mieco Chipboard Berhad, Kastamonu Entegre, Pfeifer Group и другие.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Интерактивная панель анализа данных

- Панель анализа компании для возможностей с высоким потенциалом роста

- Доступ аналитика-исследователя для настройки и запросов

- Анализ конкурентов с помощью интерактивной панели

- Последние новости, обновления и анализ тенденций

- Используйте возможности сравнительного анализа для комплексного отслеживания конкурентов

Содержание

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF EUROPE WOOD BASED PANELS MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 DISTRIBUTION CHANNEL LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET APPLICATION COVERAGE GRID

2.11 DBMR MARKET CHALLENGE MATRIX

2.12 VENDOR SHARE ANALYSIS

2.13 IMPORT-EXPORT DATA

2.14 SECONDARY SOURCES

2.15 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTLE ANALYSIS

4.1.1 POLITICAL FACTORS

4.1.2 ECONOMIC FACTORS

4.1.3 SOCIAL FACTORS

4.1.4 TECHNOLOGICAL FACTORS

4.1.5 LEGAL FACTORS

4.1.6 ENVIRONMENTAL FACTORS

4.2 IMPORT EXPORT SCENARIO

4.3 PORTER’S FIVE FORCES:

4.3.1 THREAT OF NEW ENTRANTS:

4.3.2 THREAT OF SUBSTITUTES:

4.3.3 CUSTOMER BARGAINING POWER:

4.3.4 SUPPLIER BARGAINING POWER:

4.3.5 INTERNAL COMPETITION (RIVALRY):

4.4 PRICING TREND SCENARIO

4.5 PRODUCTION & CONSUMPTION ANALYSIS

4.6 RAW MATERIAL PRODUCTION COVERAGE

4.7 TECHNOLOGICAL ADVANCEMENT BY MANUFACTURERS

4.8 VENDOR SELECTION CRITERIA

4.9 REGULATORY FRAMWORK

5 CLIMATE CHANGE SCENARIO

5.1 ENVIRONMENTAL CONCERNS

5.2 INDUSTRY RESPONSE

5.3 GOVERNMENT’S ROLE

5.4 ANALYST RECOMMENDATION

6 SUPPLY CHAIN ANALYSIS

6.1 OVERVIEW

6.2 LOGISTIC COST SCENARIO

6.3 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

7 MARKET OVERVIEW

7.1 DRIVERS

7.1.1 RISE IN CONSUMER SPENDING ON WOOD BASED PANELS IN THE RENOVATION OF HOMES AND FURNITURE

7.1.2 BALANCED IMPORT AND EXPORT PROCEDURES OF WOOD PANELS AMONG THE COUNTRIES

7.1.3 LOW PRODUCT COST COUPLED WITH SUPERIOR PROPERTIES OF WOOD PANELS, INCLUDING STRENGTH AND DURABILITY

7.2 RESTRAINTS

7.2.1 STRINGENT RULES AND NORMS BY THE GOVERNMENT REGARDING DEFORESTATION

7.2.2 RISE IN CONCERNS OF DUST BY WOOD PANEL USAGE

7.2.3 FLUCTUATION IN THE PRICES OF WOOD PULP

7.3 OPPORTUNITIES

7.3.1 RISE IN INVESTMENTS AND INITIATIVES TOWARDS CONSTRUCTION ACTIVITIES FOR BOTH COMMERCIAL AND RESIDENTIAL

7.3.2 INCREASE IN PARTNERSHIPS FOR THE GROWTH OF CONSTRUCTION SECTOR IN EMERGING COUNTRIES

7.3.3 INCORPORATION OF APA STANDARDS FOR MANUFACTURERS AIDS THE PRODUCT ENTRY INTO THE MARKET

7.4 CHALLENGES

7.4.1 SHORTAGE OF TIMBER AND CLIMATE CHANGE

7.4.2 FLUCTUATION OF RAW MATERIAL PRICES AND SUPPLY CHAIN INCONSISTENCY

7.4.3 SHORTAGE IN LABOR AND FINANCIAL LOSSES

8 IMPACT OF COVID-19 ON THE EUROPE WOOD BASED PANEL MARKET

8.1 ANALYSIS ON IMPACT OF COVID-19 ON EUROPE WOOD BASED PANEL MARKET

8.2 AFTERMATH OF COVID-19 AND GOVERNMENT INITIATIVE TO BOOST THE MARKET

8.3 STRATEGIC DECISION FOR MANUFACTURES AFTER COVID-19 TO GAIN COMPETITIVE MARKET SHARE

8.4 IMPACT ON PRICE

8.5 IMPACT ON DEMAND

8.6 IMPACT ON SUPPLY CHAIN

8.7 CONCLUSION

9 EUROPE WOOD BASED PANEL MARKET, BY PRODUCT

9.1 OVERVIEW

9.2 PLYWOOD

9.2.1 SOFTWOOD PLYWOOD

9.2.2 HARDWOOD PLYWOOD

9.2.3 OTHERS

9.3 FIBERBOARD

9.3.1 MDF

9.3.2 HDF

9.3.3 PARTICLEBOARD

9.3.4 HARDBOARD

9.3.5 OTHERS

9.4 ORIENTED STRAND BOARD

9.5 CEMENT-BONDED PARTICLEBOARD

9.6 LUMBER PANELS

9.7 T-BEAM PANELS

9.8 STRESS-SKIN PANELS

9.9 OTHERS

10 EUROPE WOOD BASED PANEL MARKET, BY DISTRIBUTION CHANNEL

10.1 OVERVIEW

10.2 B2B

10.3 OEMS

10.4 SPECIALTY STORES

10.5 E-COMMERCE

10.6 OTHERS

11 EUROPE WOOD BASED PANEL MARKET, BY THICKNESS

11.1 OVERVIEW

11.2 18 MM

11.3 20 MM

11.4 10 MM

11.5 9 MM

11.6 40 MM

11.7 50 MM

11.8 OTHERS

12 EUROPE WOOD BASED PANEL MARKET, BY APPLICATION

12.1 OVERVIEW

12.2 FLOOR

12.3 CEILING WALL

12.4 OUTDOOR DOOR

12.5 WINDOW TRIM

12.6 MANTEL

12.7 OTHERS

13 EUROPE WOOD BASED PANEL MARKET, BY END-USER

13.1 OVERVIEW

13.2 RESIDENTIAL BUILDING

13.2.1 PLYWOOD

13.2.2 FIBERBOARD

13.2.3 ORIENTED STRAND BOARD

13.2.4 CEMENT-BONDED PARTICLEBOARD

13.2.5 LUMBER PANELS

13.2.6 T-BEAM PANELS

13.2.7 STRESS-SKIN PANELS

13.2.8 OTHERS

13.3 COMMERCIAL BUILDING

13.3.1 PLYWOOD

13.3.2 FIBERBOARD

13.3.3 ORIENTED STRAND BOARD

13.3.4 CEMENT-BONDED PARTICLEBOARD

13.3.5 LUMBER PANELS

13.3.6 T-BEAM PANELS

13.3.7 STRESS-SKIN PANELS

13.3.8 OTHERS

13.4 HOTELS

13.4.1 PLYWOOD

13.4.2 FIBERBOARD

13.4.3 ORIENTED STRAND BOARD

13.4.4 CEMENT-BONDED PARTICLEBOARD

13.4.5 LUMBER PANELS

13.4.6 T-BEAM PANELS

13.4.7 STRESS-SKIN PANELS

13.4.8 OTHERS

13.5 VILLA

13.5.1 PLYWOOD

13.5.2 FIBERBOARD

13.5.3 ORIENTED STRAND BOARD

13.5.4 CEMENT-BONDED PARTICLEBOARD

13.5.5 LUMBER PANELS

13.5.6 T-BEAM PANELS

13.5.7 STRESS-SKIN PANELS

13.5.8 OTHERS

13.6 HOSPITALS

13.6.1 PLYWOOD

13.6.2 FIBERBOARD

13.6.3 ORIENTED STRAND BOARD

13.6.4 CEMENT-BONDED PARTICLEBOARD

13.6.5 LUMBER PANELS

13.6.6 T-BEAM PANELS

13.6.7 STRESS-SKIN PANELS

13.6.8 OTHERS

13.7 MALLS

13.7.1 PLYWOOD

13.7.2 FIBERBOARD

13.7.3 ORIENTED STRAND BOARD

13.7.4 CEMENT-BONDED PARTICLEBOARD

13.7.5 LUMBER PANELS

13.7.6 T-BEAM PANELS

13.7.7 STRESS-SKIN PANELS

13.7.8 OTHERS

13.8 SCHOOL

13.8.1 PLYWOOD

13.8.2 FIBERBOARD

13.8.3 ORIENTED STRAND BOARD

13.8.4 CEMENT-BONDED PARTICLEBOARD

13.8.5 LUMBER PANELS

13.8.6 T-BEAM PANELS

13.8.7 STRESS-SKIN PANELS

13.8.8 OTHERS

13.9 OTHERS

13.9.1 PLYWOOD

13.9.2 FIBERBOARD

13.9.3 ORIENTED STRAND BOARD

13.9.4 CEMENT-BONDED PARTICLEBOARD

13.9.5 LUMBER PANELS

13.9.6 T-BEAM PANELS

13.9.7 STRESS-SKIN PANELS

13.9.8 OTHERS

14 EUROPE WOOD BASED PANEL MARKET, BY REGION

14.1 EUROPE

14.1.1 GERMANY

14.1.2 U.K.

14.1.3 ITALY

14.1.4 TURKEY

14.1.5 RUSSIA

14.1.6 FRANCE

14.1.7 SPAIN

14.1.8 NETHERLANDS

14.1.9 BELGIUM

14.1.10 SWITZERLAND

14.1.11 REST OF EUROPE

15 EUROPE WOOD BASED PANEL MARKET, COMPANY LANDSCAPE

15.1 COMPANY SHARE ANALYSIS: EUROPE

15.2 MERGER & ACQUISITION

15.3 PRODUCT LAUNCH

15.4 PARTNERSHIP

15.5 EXPANSIONS

16 SWOT ANALYSIS

17 COMPANY PROFILE

17.1 WEST FRASER

17.1.1 COMPANY SNAPSHOT

17.1.2 REVENUE ANALYSIS

17.1.3 COMPANY SHARE ANALYSIS

17.1.4 PRODUCT PORTFOLIO

17.1.5 RECENT DEVELOPMENT

17.2 WEYERHAEUSER COMPANY

17.2.1 COMPANY SNAPSHOT

17.2.2 REVENUE ANALYSIS

17.2.3 COMPANY SHARE ANALYSIS

17.2.4 PRODUCT PORTFOLIO

17.2.5 RECENT DEVELOPMENTS

17.3 CANFOR

17.3.1 COMPANY SNAPSHOT

17.3.2 REVENUE ANALYSIS

17.3.3 COMPANY SHARE ANALYSIS

17.3.4 PRODUCT PORTFOLIO

17.3.5 RECENT DEVELOPMENTS

17.4 EGGER GROUP

17.4.1 COMPANY SNAPSHOT

17.4.2 COMPANY SHARE ANALYSIS

17.4.3 PRODUCT PORTFOLIO

17.4.4 RECENT DEVELOPMENT

17.5 ARAUCO

17.5.1 COMPANY SNAPSHOT

17.5.2 REVENUE ANALYSIS

17.5.3 PRODUCT PORTFOLIO

17.5.4 RECENT DEVELOPMENTS

17.6 BINDERHOLZ GMBH

17.6.1 COMPANY SNAPSHOT

17.6.2 PRODUCT PORTFOLIO

17.6.3 RECENT DEVELOPMENTS

17.7 BOISE CASCADE

17.7.1 COMPANY SNAPSHOT

17.7.2 REVENUE ANALYSIS

17.7.3 PRODUCT PORTFOLIO

17.7.4 RECENT DEVELOPMENT

17.8 DARE PANEL GROUP CO., LTD.

17.8.1 COMPANY SNAPSHOT

17.8.2 PRODUCT PORTFOLIO

17.8.3 RECENT DEVELOPMENTS

17.9 DONGWHA GROUP

17.9.1 COMPANY SNAPSHOT

17.9.2 REVENUE ANALYSIS

17.9.3 PRODUCT PORTFOLIO

17.9.4 RECENT DEVELOPMENTS

17.1 EVERGREEN FIBREBOARD BERHAD

17.10.1 COMPANY SNAPSHOT

17.10.2 REVENUE ANALYSIS

17.10.3 PRODUCT PORTFOLIO

17.10.4 RECENT DEVELOPMENTS

17.11 GEORGIA-PACIFIC

17.11.1 COMPANY SNAPSHOT

17.11.2 PRODUCT PORTFOLIO

17.11.3 RECENT DEVELOPMENT

17.12 GREEN RIVER HOLDING CO., LTD.

17.12.1 COMPANY SNAPSHOT

17.12.2 REVENUE ANALYSIS

17.12.3 PRODUCT PORTFOLIO

17.12.4 RECENT DEVELOPMENTS

17.13 KASTAMONU ENTEGRE

17.13.1 COMPANY SNAPSHOT

17.13.2 PRODUCT PORTFOLIO

17.13.3 RECENT DEVELOPMENTS

17.14 KRONOPLUS LIMITED

17.14.1 COMPANY SNAPSHOT

17.14.2 PRODUCT PORTFOLIO

17.14.3 RECENT DEVELOPMENTS

17.15 MIECO CHIPBOARD BERHAD

17.15.1 COMPANY SNAPSHOT

17.15.2 REVENUE ANALYSIS

17.15.3 PRODUCT PORTFOLIO

17.15.4 RECENT DEVELOPMENTS

17.16 PFEIFER GROUP

17.16.1 COMPANY SNAPSHOT

17.16.2 PRODUCT PORTFOLIO

17.16.3 RECENT DEVELOPMENT

17.17 SONAE INDUSTRIA

17.17.1 COMPANY SNAPSHOT

17.17.2 REVENUE ANALYSIS

17.17.3 PRODUCT PORTFOLIO

17.17.4 RECENT DEVELOPMENT

17.18 STARBANK PANEL PRODUCTS LTD

17.18.1 COMPANY SNAPSHOT

17.18.2 PRODUCT PORTFOLIO

17.18.3 RECENT DEVELOPMENT

17.19 TIMBER PRODUCTS COMPANY

17.19.1 COMPANY SNAPSHOT

17.19.2 PRODUCT PORTFOLIO

17.19.3 RECENT DEVELOPMENTS

18 QUESTIONNAIRE

19 RELATED REPORTS

Список таблиц

TABLE 1 IMPORT DATA OF FLOORING PANELS, ASSEMBLED, OF WOOD (EXCLUDING MULTILAYER PANELS AND FLOORING PANELS FOR MOSAIC FLOORS; HS CODE - 441879 (USD THOUSAND)

TABLE 2 EXPORT DATA OF FLOORING PANELS, ASSEMBLED, OF WOOD (EXCLUDING MULTILAYER PANELS AND FLOORING PANELS FOR MOSAIC FLOORS; HS CODE - 441879 (USD THOUSAND)

TABLE 3 EXPORT OF WOOD BASED PANEL (1,000 M3)

TABLE 4 IMPORT OF WOOD BASED PANEL (1,000 M3)

TABLE 5 EUROPE WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 6 EUROPE WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (MILLION CUBIC METERS)

TABLE 7 EUROPE PLYWOOD IN WOOD BASED PANEL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 8 EUROPE PLYWOOD IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 9 EUROPE FIBERBOARD IN WOOD BASED PANEL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 10 EUROPE FIBERBOARD IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 11 EUROPE ORIENTED STRAND BOARD IN WOOD BASED PANEL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 12 EUROPE CEMENT-BONDED PARTICLEBOARD IN WOOD BASED PANEL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 13 EUROPE LUMBER PANELS IN WOOD BASED PANEL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 14 EUROPE T-BEAM PANELS IN WOOD BASED PANEL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 15 EUROPE STRESS-SKIN PANELS IN WOOD BASED PANEL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 16 EUROPE OTHERS IN WOOD BASED PANEL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 17 EUROPE WOOD BASED PANEL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 18 EUROPE B2B IN WOOD BASED PANEL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 19 EUROPE OEMS IN WOOD BASED PANEL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 20 EUROPE SPECIALTY STORES IN WOOD BASED PANEL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 21 EUROPE E-COMMERCE IN WOOD BASED PANEL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 22 EUROPE OTHERS IN WOOD BASED PANEL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 23 EUROPE WOOD BASED PANEL MARKET, BY THICKNESS, 2020-2029 (USD MILLION)

TABLE 24 EUROPE 18 MM IN WOOD BASED PANEL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 25 EUROPE 20 MM IN WOOD BASED PANEL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 26 EUROPE 10 MM IN WOOD BASED PANEL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 27 EUROPE 9 MM IN WOOD BASED PANEL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 28 EUROPE 40 MM IN WOOD BASED PANEL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 29 EUROPE 50 MM IN WOOD BASED PANEL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 30 EUROPE OTHERS IN WOOD BASED PANEL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 31 EUROPE WOOD BASED PANEL MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 32 EUROPE FLOOR IN WOOD BASED PANEL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 33 EUROPE CEILING WALL IN WOOD BASED PANEL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 34 EUROPE OUTDOOR DOOR IN WOOD BASED PANEL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 35 EUROPE WINDOW TRIM IN WOOD BASED PANEL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 36 EUROPE MANTEL IN WOOD BASED PANEL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 37 EUROPE OTHERS IN WOOD BASED PANEL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 38 EUROPE WOOD BASED PANEL MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 39 EUROPE RESIDENTIAL BUILDING IN WOOD BASED PANEL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 40 EUROPE RESIDENTIAL BUILDING IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 41 EUROPE COMMERCIAL BUILDING IN WOOD BASED PANEL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 42 EUROPE COMMERCIAL BUILDING IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 43 EUROPE HOTELS IN WOOD BASED PANEL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 44 EUROPE HOTELS IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 45 EUROPE VILLA IN WOOD BASED PANEL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 46 EUROPE VILLA IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 47 EUROPE HOSPITALS IN WOOD BASED PANEL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 48 EUROPE HOSPITALS IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 49 EUROPE MALLS IN WOOD BASED PANEL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 50 EUROPE MALLS IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 51 EUROPE SCHOOL IN WOOD BASED PANEL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 52 EUROPE SCHOOL IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 53 EUROPE OTHERS IN WOOD BASED PANEL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 54 EUROPE OTHERS IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 55 EUROPE WOOD BASED PANEL MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 56 EUROPE WOOD BASED PANEL MARKET, BY COUNTRY, 2020-2029 (MILLION CUBIC METERS)

TABLE 57 EUROPE WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 58 EUROPE WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (MILLION CUBIC METERS)

TABLE 59 EUROPE PLYWOOD IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 60 EUROPE FIBERBOARD IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 61 EUROPE WOOD BASED PANEL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 62 EUROPE WOOD BASED PANEL MARKET, BY THICKNESS, 2020-2029 (USD MILLION)

TABLE 63 EUROPE WOOD BASED PANEL MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 64 EUROPE WOOD BASED PANEL MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 65 EUROPE RESIDENTIAL BUILDING IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 66 EUROPE COMMERCIAL BUILDING IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 67 EUROPE HOTELS IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 68 EUROPE VILLA IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 69 EUROPE HOSPITALS IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 70 EUROPE MALLS IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 71 EUROPE SCHOOL IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 72 EUROPE OTHERS IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 73 GERMANY WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 74 GERMANY WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (MILLION CUBIC METERS)

TABLE 75 GERMANY PLYWOOD IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 76 GERMANY FIBERBOARD IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 77 GERMANY WOOD BASED PANEL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 78 GERMANY WOOD BASED PANEL MARKET, BY THICKNESS, 2020-2029 (USD MILLION)

TABLE 79 GERMANY WOOD BASED PANEL MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 80 GERMANY WOOD BASED PANEL MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 81 GERMANY RESIDENTIAL BUILDING IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 82 GERMANY COMMERCIAL BUILDING IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 83 GERMANY HOTELS IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 84 GERMANY VILLA IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 85 GERMANY HOSPITALS IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 86 GERMANY MALLS IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 87 GERMANY SCHOOL IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 88 GERMANY OTHERS IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 89 U.K. WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 90 U.K. WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (MILLION CUBIC METERS)

TABLE 91 U.K. PLYWOOD IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 92 U.K. FIBERBOARD IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 93 U.K. WOOD BASED PANEL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 94 U.K. WOOD BASED PANEL MARKET, BY THICKNESS, 2020-2029 (USD MILLION)

TABLE 95 U.K. WOOD BASED PANEL MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 96 U.K. WOOD BASED PANEL MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 97 U.K. RESIDENTIAL BUILDING IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 98 U.K. COMMERCIAL BUILDING IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 99 U.K. HOTELS IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 100 U.K. VILLA IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 101 U.K. HOSPITALS IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 102 U.K. MALLS IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 103 U.K. SCHOOL IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 104 U.K. OTHERS IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 105 ITALY WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 106 ITALY WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (MILLION CUBIC METERS)

TABLE 107 ITALY PLYWOOD IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 108 ITALY FIBERBOARD IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 109 ITALY WOOD BASED PANEL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 110 ITALY WOOD BASED PANEL MARKET, BY THICKNESS, 2020-2029 (USD MILLION)

TABLE 111 ITALY WOOD BASED PANEL MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 112 ITALY WOOD BASED PANEL MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 113 ITALY RESIDENTIAL BUILDING IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 114 ITALY COMMERCIAL BUILDING IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 115 ITALY HOTELS IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 116 ITALY VILLA IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 117 ITALY HOSPITALS IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 118 ITALY MALLS IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 119 ITALY SCHOOL IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 120 ITALY OTHERS IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 121 TURKEY WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 122 TURKEY WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (MILLION CUBIC METERS)

TABLE 123 TURKEY PLYWOOD IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 124 TURKEY FIBERBOARD IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 125 TURKEY WOOD BASED PANEL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 126 TURKEY WOOD BASED PANEL MARKET, BY THICKNESS, 2020-2029 (USD MILLION)

TABLE 127 TURKEY WOOD BASED PANEL MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 128 TURKEY WOOD BASED PANEL MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 129 TURKEY RESIDENTIAL BUILDING IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 130 TURKEY COMMERCIAL BUILDING IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 131 TURKEY HOTELS IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 132 TURKEY VILLA IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 133 TURKEY HOSPITALS IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 134 TURKEY MALLS IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 135 TURKEY SCHOOL IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 136 TURKEY OTHERS IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 137 RUSSIA WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 138 RUSSIA WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (MILLION CUBIC METERS)

TABLE 139 RUSSIA PLYWOOD IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 140 RUSSIA FIBERBOARD IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 141 RUSSIA WOOD BASED PANEL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 142 RUSSIA WOOD BASED PANEL MARKET, BY THICKNESS, 2020-2029 (USD MILLION)

TABLE 143 RUSSIA WOOD BASED PANEL MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 144 RUSSIA WOOD BASED PANEL MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 145 RUSSIA RESIDENTIAL BUILDING IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 146 RUSSIA COMMERCIAL BUILDING IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 147 RUSSIA HOTELS IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 148 RUSSIA VILLA IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 149 RUSSIA HOSPITALS IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 150 RUSSIA MALLS IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 151 RUSSIA SCHOOL IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 152 RUSSIA OTHERS IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 153 FRANCE WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 154 FRANCE WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (MILLION CUBIC METERS)

TABLE 155 FRANCE PLYWOOD IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 156 FRANCE FIBERBOARD IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 157 FRANCE WOOD BASED PANEL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 158 FRANCE WOOD BASED PANEL MARKET, BY THICKNESS, 2020-2029 (USD MILLION)

TABLE 159 FRANCE WOOD BASED PANEL MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 160 FRANCE WOOD BASED PANEL MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 161 FRANCE RESIDENTIAL BUILDING IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 162 FRANCE COMMERCIAL BUILDING IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 163 FRANCE HOTELS IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 164 FRANCE VILLA IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 165 FRANCE HOSPITALS IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 166 FRANCE MALLS IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 167 FRANCE SCHOOL IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 168 FRANCE OTHERS IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 169 SPAIN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 170 SPAIN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (MILLION CUBIC METERS)

TABLE 171 SPAIN PLYWOOD IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 172 SPAIN FIBERBOARD IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 173 SPAIN WOOD BASED PANEL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 174 SPAIN WOOD BASED PANEL MARKET, BY THICKNESS, 2020-2029 (USD MILLION)

TABLE 175 SPAIN WOOD BASED PANEL MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 176 SPAIN WOOD BASED PANEL MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 177 SPAIN RESIDENTIAL BUILDING IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 178 SPAIN COMMERCIAL BUILDING IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 179 SPAIN HOTELS IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 180 SPAIN VILLA IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 181 SPAIN HOSPITALS IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 182 SPAIN MALLS IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 183 SPAIN SCHOOL IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 184 SPAIN OTHERS IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 185 NETHERLANDS WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 186 NETHERLANDS WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (MILLION CUBIC METERS)

TABLE 187 NETHERLANDS PLYWOOD IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 188 NETHERLANDS FIBERBOARD IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 189 NETHERLANDS WOOD BASED PANEL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 190 NETHERLANDS WOOD BASED PANEL MARKET, BY THICKNESS, 2020-2029 (USD MILLION)

TABLE 191 NETHERLANDS WOOD BASED PANEL MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 192 NETHERLANDS WOOD BASED PANEL MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 193 NETHERLANDS RESIDENTIAL BUILDING IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 194 NETHERLANDS COMMERCIAL BUILDING IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 195 NETHERLANDS HOTELS IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 196 NETHERLANDS VILLA IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 197 NETHERLANDS HOSPITALS IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 198 NETHERLANDS MALLS IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 199 NETHERLANDS SCHOOL IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 200 NETHERLANDS OTHERS IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 201 BELGIUM WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 202 BELGIUM WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (MILLION CUBIC METERS)

TABLE 203 BELGIUM PLYWOOD IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 204 BELGIUM FIBERBOARD IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 205 BELGIUM WOOD BASED PANEL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 206 BELGIUM WOOD BASED PANEL MARKET, BY THICKNESS, 2020-2029 (USD MILLION)

TABLE 207 BELGIUM WOOD BASED PANEL MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 208 BELGIUM WOOD BASED PANEL MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 209 BELGIUM RESIDENTIAL BUILDING IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 210 BELGIUM COMMERCIAL BUILDING IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 211 BELGIUM HOTELS IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 212 BELGIUM VILLA IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 213 BELGIUM HOSPITALS IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 214 BELGIUM MALLS IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 215 BELGIUM SCHOOL IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 216 BELGIUM OTHERS IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 217 SWITZERLAND WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 218 SWITZERLAND WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (MILLION CUBIC METERS)

TABLE 219 SWITZERLAND PLYWOOD IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 220 SWITZERLAND FIBERBOARD IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 221 SWITZERLAND WOOD BASED PANEL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 222 SWITZERLAND WOOD BASED PANEL MARKET, BY THICKNESS, 2020-2029 (USD MILLION)

TABLE 223 SWITZERLAND WOOD BASED PANEL MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 224 SWITZERLAND WOOD BASED PANEL MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 225 SWITZERLAND RESIDENTIAL BUILDING IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 226 SWITZERLAND COMMERCIAL BUILDING IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 227 SWITZERLAND HOTELS IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 228 SWITZERLAND VILLA IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 229 SWITZERLAND HOSPITALS IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 230 SWITZERLAND MALLS IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 231 SWITZERLAND SCHOOL IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 232 SWITZERLAND OTHERS IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 233 REST OF EUROPE WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 234 REST OF EUROPE WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (MILLION CUBIC METERS)

Список рисунков

FIGURE 1 EUROPE WOOD BASED PANELS MARKET: SEGMENTATION

FIGURE 2 EUROPE WOOD BASED PANEL MARKET: DATA TRIANGULATION

FIGURE 3 EUROPE WOOD BASED PANELS MARKET: DROC ANALYSIS

FIGURE 4 EUROPE WOOD BASED PANELS MARKET: EUROPE VS REGIONAL MARKET ANALYSIS

FIGURE 5 EUROPE WOOD BASED PANELS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 EUROPE WOOD BASED PANELS MARKET: THE DISTRIBUTION CHANNEL LIFE LINE CURVE

FIGURE 7 EUROPE WOOD BASED PANELS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 8 EUROPE WOOD BASED PANELS MARKET: DBMR MARKET POSITION GRID

FIGURE 9 EUROPE WOOD BASED PANELS MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 10 EUROPE WOOD BASED PANELS MARKET: THE MARKET CHALLENGE MATRIX

FIGURE 11 EUROPE WOOD BASED PANELS MARKET: VENDOR SHARE ANALYSIS

FIGURE 12 EUROPE WOOD BASED PANELS MARKET: SEGMENTATION

FIGURE 13 RISING CONSUMER SPENDING ON WOOD BASED PANELS IN THE RENOVATION OF HOMES AND FURNITURE EXPECTED TO DRIVE THE EUROPE WOOD BASED PANELS MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 14 PLYWOOD SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE EUROPE WOOD BASED PANELS MARKET IN 2022 & 2029

FIGURE 15 IMPORT EXPORT SCENARIO (USD THOUSAND)

FIGURE 16 PRICE ANALYSIS FOR EUROPE WOOD BASED PANEL MARKET, 2018-2022

FIGURE 17 EUROPE, EECCA, NORTH AMERICA WOOD BASED PANELS PRODUCTION, AND NET APPARENT CONSUMPTION, 2018-2020 FROM 2018-2020 (1,000 M3)

FIGURE 18 VENDOR SELECTION CRITERIA

FIGURE 19 SUPPLY CHAIN ANALYSIS- EUROPE WOOD BASED PANEL MARKET

FIGURE 20 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF EUROPE WOOD BASED PANEL MARKET

FIGURE 21 EUROPE WOOD BASED PANEL PRODUCTION, IN 2018

FIGURE 22 EXPENDITURE ON FURNISHINGS, EQUIPMENT AND ROUTINE MAINTENANCE

FIGURE 23 WOOD PULP PRICE IN 2020 (USD DOLLAR)

FIGURE 24 EUROPE WOOD BASED PANEL MARKET, BY PRODUCT, 2021

FIGURE 25 EUROPE WOOD BASED PANEL MARKET, BY DISTRIBUTION CHANNEL, 2021

FIGURE 26 EUROPE WOOD BASED PANEL MARKET, BY THICKNESS, 2021

FIGURE 27 EUROPE WOOD BASED PANEL MARKET, BY APPLICATION, 2021

FIGURE 28 EUROPE WOOD BASED PANEL MARKET, BY END-USER, 2021

FIGURE 29 EUROPE WOOD BASED PANEL MARKET: SNAPSHOT (2021)

FIGURE 30 EUROPE WOOD BASED PANEL MARKET: BY COUNTRY (2021)

FIGURE 31 EUROPE WOOD BASED PANEL MARKET: BY COUNTRY (2022 & 2029)

FIGURE 32 EUROPE WOOD BASED PANEL MARKET: BY COUNTRY (2021 & 2029)

FIGURE 33 EUROPE WOOD BASED PANEL MARKET: BY PRODUCT (2022-2029)

FIGURE 34 EUROPE WOOD BASED PANEL MARKET: COMPANY SHARE 2021 (%)

Методология исследования

Сбор данных и анализ базового года выполняются с использованием модулей сбора данных с большими размерами выборки. Этап включает получение рыночной информации или связанных данных из различных источников и стратегий. Он включает изучение и планирование всех данных, полученных из прошлого заранее. Он также охватывает изучение несоответствий информации, наблюдаемых в различных источниках информации. Рыночные данные анализируются и оцениваются с использованием статистических и последовательных моделей рынка. Кроме того, анализ доли рынка и анализ ключевых тенденций являются основными факторами успеха в отчете о рынке. Чтобы узнать больше, пожалуйста, запросите звонок аналитика или оставьте свой запрос.

Ключевой методологией исследования, используемой исследовательской группой DBMR, является триангуляция данных, которая включает в себя интеллектуальный анализ данных, анализ влияния переменных данных на рынок и первичную (отраслевую экспертную) проверку. Модели данных включают сетку позиционирования поставщиков, анализ временной линии рынка, обзор рынка и руководство, сетку позиционирования компании, патентный анализ, анализ цен, анализ доли рынка компании, стандарты измерения, глобальный и региональный анализ и анализ доли поставщика. Чтобы узнать больше о методологии исследования, отправьте запрос, чтобы поговорить с нашими отраслевыми экспертами.

Доступна настройка

Data Bridge Market Research является лидером в области передовых формативных исследований. Мы гордимся тем, что предоставляем нашим существующим и новым клиентам данные и анализ, которые соответствуют и подходят их целям. Отчет можно настроить, включив в него анализ ценовых тенденций целевых брендов, понимание рынка для дополнительных стран (запросите список стран), данные о результатах клинических испытаний, обзор литературы, обновленный анализ рынка и продуктовой базы. Анализ рынка целевых конкурентов можно проанализировать от анализа на основе технологий до стратегий портфеля рынка. Мы можем добавить столько конкурентов, о которых вам нужны данные в нужном вам формате и стиле данных. Наша команда аналитиков также может предоставить вам данные в сырых файлах Excel, сводных таблицах (книга фактов) или помочь вам в создании презентаций из наборов данных, доступных в отчете.