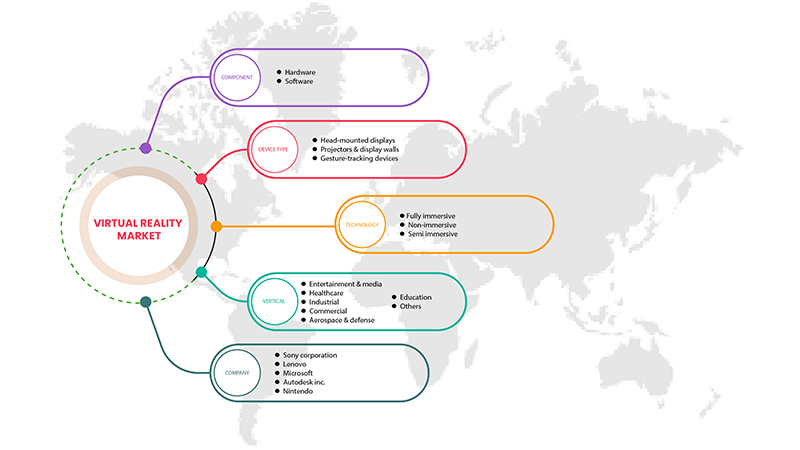

Европейский рынок виртуальной реальности по компонентам (аппаратное и программное обеспечение), типу устройства ( головные дисплеи , проекторы и видеостены, а также устройства с отслеживанием жестов), технологии (полное погружение, отсутствие погружения и частичное погружение), вертикали (развлечения и медиа, здравоохранение, промышленность, коммерция, аэрокосмическая и оборонная промышленность, автомобилестроение, образование и другие) — отраслевые тенденции и прогноз до 2029 года.

Анализ и размер европейского рынка виртуальной реальности

Виртуальная реальность принесла новые изменения в цифровизацию. Стало проще воспринимать реальный мир, задавая различные условия окружающей среды. Дополненная реальность и смешанная реальность имеют широкий спектр применения. Рост рынка увеличился по мере использования дополненной реальности, и смешанная реальность стала популярной в симуляторах вождения. Дополненная реальность и смешанная реальность предоставляют водителю реальное ощущение дороги, условий вождения, руководств по эксплуатации автомобиля и дорожного движения, что помогает избегать аварий на начальном этапе обучения и готовит водителей к различным ситуациям. Эти атрибуты также привели к более широкому использованию виртуальной реальности в обороне и аэрокосмической отрасли. Военнослужащие использовали ее для обучения в различных условиях, таких как прыжки с парашютом, подводные лодки, боевые ситуации и вождение в различных условиях окружающей среды.

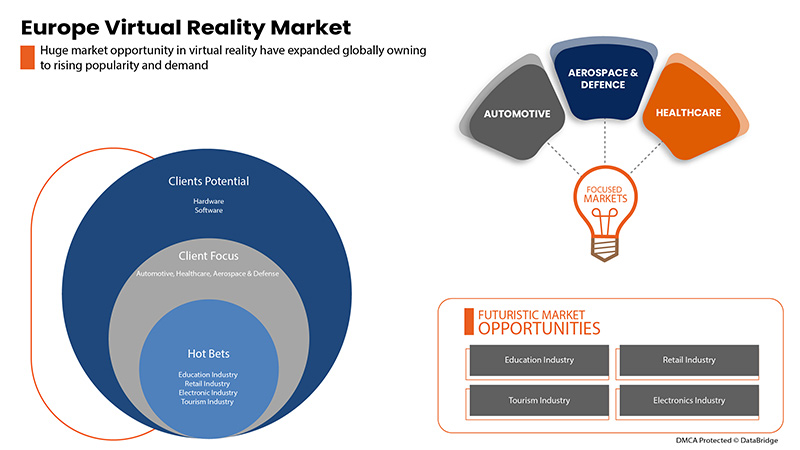

Ожидается, что растущий спрос на HMD в игровой и развлекательной индустрии станет основным драйвером для европейского рынка виртуальной реальности. Отсутствие эффективного дизайна пользовательского опыта может сдерживать рынок. Кроме того, более широкое внедрение технологий VR в аэрокосмической и оборонной промышленности, а также в архитектурно-планировочном секторе может стать важной возможностью, способствующей росту рынка. Однако возникающие риски и угрозы целостности данных могут бросить вызов европейскому рынку виртуальной реальности.

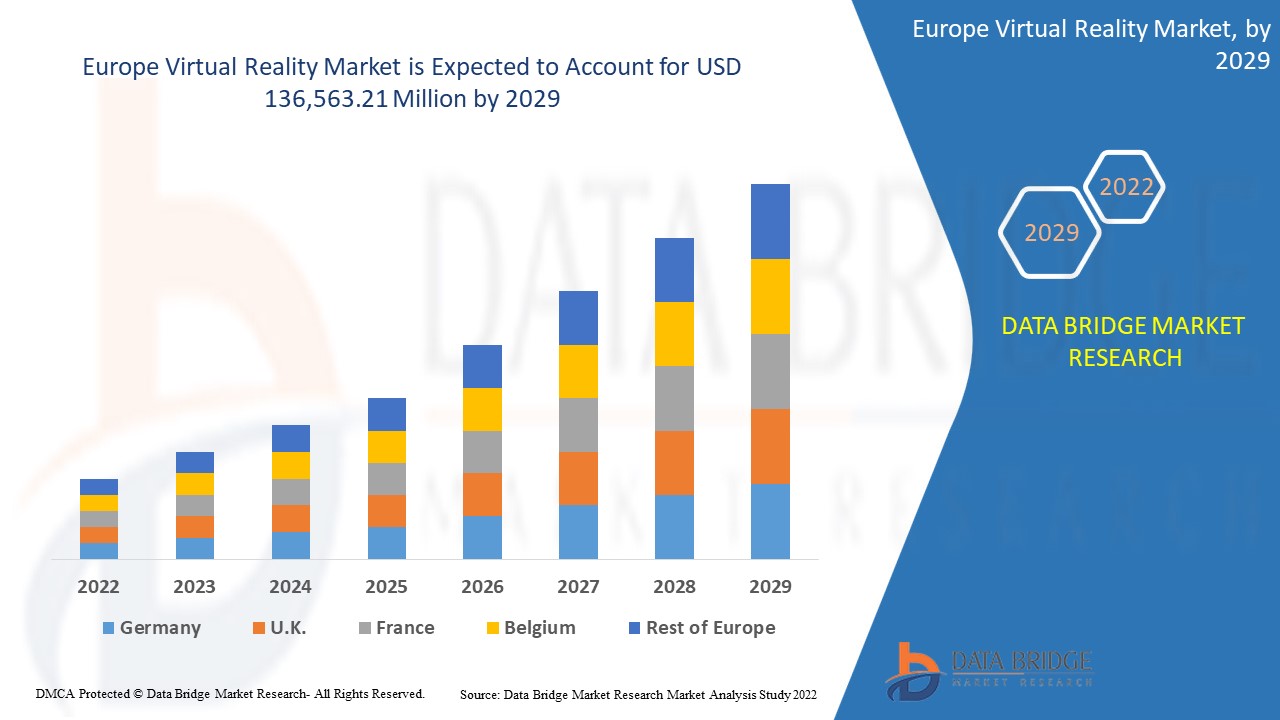

Data Bridge Market Research анализирует, что рынок виртуальной реальности в Европе, как ожидается, достигнет значения 136 563,21 млн долларов США к 2029 году, при среднегодовом темпе роста 47,5% в прогнозируемый период. Сегмент оборудования составляет крупнейший сегмент предложения на рынке виртуальной реальности в Европе. Отчет о рынке виртуальной реальности в Европе также всесторонне охватывает ценообразование, патенты и технологические достижения.

|

Отчет Метрика |

Подробности |

|

Прогнозируемый период |

2022-2029 |

|

Базовый год |

2021 |

|

Исторические годы |

2020 (Можно настроить на 2019-2014) |

|

Количественные единицы |

Доход в млн. долл. США, цены в долл. США |

|

Охваченные сегменты |

По компоненту (аппаратное и программное обеспечение), типу устройства (головные дисплеи, проекторы и видеостены, а также устройства с отслеживанием жестов), технологии (полное погружение, неполная иммерсия и полуиммерсия), вертикали (развлечения и медиа, здравоохранение, промышленность, коммерция, аэрокосмическая и оборонная промышленность, автомобилестроение, образование и другие) |

|

Страны, охваченные |

Германия, Великобритания, Франция, Швейцария, Италия, Испания, Нидерланды, Россия, Бельгия, Турция, Остальная Европа |

|

Охваченные участники рынка |

Sony Corporation, Lenovo, Autodesk Inc., Nintendo, LG Electronics, HTC Corporation, Ultraleap, Google (дочерняя компания Alphabet Inc.), Qualcomm Technologies, Inc., Barco, PSICO SMART APPS, SL, HP Development Company, LP, Microsoft, SAMSUNG ELECTRONICS CO., LTD. и другие |

Определение рынка

Виртуальную реальность можно определить как технологию, которая создает имитируемую среду с помощью компьютерных технологий. Виртуальная реальность обеспечивает погружение в трехмерную среду для пользователя, имитируя различные чувства, такие как зрение, осязание, слух и даже обоняние. Виртуальная реальность использует такие устройства, как головные дисплеи , проекторы и видеостены, для создания реалистичных изображений и звуков, чтобы обеспечить реальный опыт в виртуальной среде. Человек, использующий виртуальную реальность, может просматривать искусственный мир на 360 градусов и даже ощущать виртуальную среду с помощью высокотехнологичных механизмов. Эта технология широко используется в различных промышленных приложениях, особенно в учебных и исследовательских целях. Оборонная и аэрокосмическая промышленность используют ее для обучения личного состава армии, предоставляя различные условия окружающей среды, что помогает снизить общую стоимость обучения. Игровой сектор предоставляет виртуальную реальность непосредственно пользователям, улучшая их игровой опыт; люди все больше привыкают к виртуальной реальности через свой опыт в игровой и развлекательной индустрии. Виртуальная реальность также помогает в создании симуляторов вождения, предоставляя реальный опыт вождения в искусственной среде, помогая пользователям адаптироваться к условиям вождения и узнавать, как реагировать в различных ситуациях, без фактического прохождения уроков вождения непосредственно на дороге.

Динамика рынка виртуальной реальности в Европе

В этом разделе рассматривается понимание движущих сил рынка, преимуществ, возможностей, ограничений и проблем. Все это подробно обсуждается ниже:

Драйверы

- Растущий спрос на HMD в игровой и развлекательной индустрии

Головные дисплеи (HMD) занимают лидирующие позиции в секторе игр и развлечений. Игровая индустрия претерпела технологическую эволюцию с появлением технологий виртуальной реальности и 3D. Использование HMD помогло достичь полного погружения пользователей и вывело игровой опыт на новый уровень. Безупречный переход, проведенный с VR HMD, помог обеспечить уникальный и улучшенный пользовательский опыт. HMD имеют высокий уровень проникновения в сектор видеоигр, и пользователи видеоигр предпочитают их за обогащение опыта и развлечений. HMD проецируют цифровые изображения, обеспечивая 3D-вид, что улучшает пользовательский опыт. Таким образом, растущий игровой сектор будет стимулировать рынок HMD и, в свою очередь, виртуальной реальности.

- Растущий спрос на технологии виртуальной реальности из-за пандемии COVID-19

Мир переживает различные фазы физической изоляции, и социальные встречи по-прежнему запрещены в большинстве стран. Таким образом, технологии AR и VR во время COVID-19 становятся супергероями, позволяя людям чувствовать связь друг с другом. Дополненная реальность добавляет цифровые элементы в физический мир, а виртуальная реальность дает зрителям захватывающий опыт. Устройства VR, такие как Google Cardboard, HTC Vive или Oculus Rift, переносят пользователей в несколько реальных и воображаемых сред с помощью устройств.

Возможность

- Более широкое применение технологий виртуальной реальности в аэрокосмической и оборонной промышленности, а также в архитектуре и планировании

3D-дизайн обеспечил значительные преимущества в процессах производства аэрокосмического и оборонного оборудования. Это также положительно повлияло как на характеристики самолета, так и на производственные процессы. Достижения в новых 3D-технологиях открывают новые рыночные возможности для оптимизации времени и стоимости производства в аэрокосмической и оборонной промышленности. 3D-технологии были постоянной тенденцией, особенно в аэрокосмической промышленности. Недавние разработки в области технологий виртуальной реальности обещали новые приложения в аэрокосмической и оборонной сфере, влияя на рост виртуальной реальности на аэрокосмическом и оборонном рынке. Возможности 3D-визуализации, объединенные с цифровыми макетами физических объектов, виртуальными сборочными линиями, более тесной интеграцией и бесшовным процессом проектирования, вскоре станут движущей силой рынка.

Сдержанность/Вызов

- Новые риски и угрозы целостности данных

Виртуальная реальность широко используется для обучения и образования в оборонной и аэрокосмической промышленности, а также в телемедицине в здравоохранении. Виртуальная реальность использует вычислительные технологии, использование облака и интернет-сервисы для работы, что делает ее крайне уязвимой для кибератак, угрожает целостности данных и увеличивает риск утечки данных. Надлежащей безопасности и конфиденциальности не уделяется большого внимания, что создает существенную проблему для европейского рынка виртуальной реальности.

Влияние COVID-19 на рынок виртуальной реальности в Европе

COVID-19 существенно повлиял на различные отрасли, поскольку почти каждая страна решила закрыть все объекты, за исключением тех, которые находятся в сегменте товаров первой необходимости. Правительство приняло строгие меры, такие как закрытие объектов и продажа неосновных товаров, блокировка международной торговли и многое другое, чтобы предотвратить распространение COVID-19. Единственный бизнес, работающий в этой пандемической ситуации, — это основные услуги, которым разрешено открыться и вести процессы.

Возросшее использование устройств на основе виртуальной реальности предоставило значительные возможности в условиях пандемии COVID-19. Хотя покупательная способность потребителей значительно снизилась из-за экономического спада, вызванного коронавирусом, что привело к снижению прибыли в организациях. Хотя многие ключевые маркетологи и руководители увидели признаки улучшения по сравнению с прошлыми годами, по-прежнему сложно определить фактическую ситуацию на рынке, поскольку сдерживаемый спрос может покрывать более низкий внутренний уровень спроса на устройства на основе VR. Рост числа приложений VR для смартфонов, рост спроса на удаленное сотрудничество и технологические достижения в медицинских приложениях являются некоторыми факторами, способствующими росту рынка виртуальной реальности в Европе.

Производители принимают различные стратегические решения для удовлетворения растущего спроса в период COVID-19. Игроки были вовлечены в стратегические мероприятия, такие как партнерства, сотрудничество, приобретения и другие, чтобы улучшить технологии, задействованные на рынке виртуальной реальности. Компании будут предлагать рынку передовые и точные решения. Кроме того, правительственные инициативы по стимулированию цифровизации в различных отраслях привели к росту рынка.

Последние события

- В апреле 2021 года Microsoft объявила о контракте Пентагона с американскими военными на головные уборы дополненной реальности для солдат стоимостью 21,88 млрд долларов США. Этот HoloLens обеспечит солдатам более эффективную видимость, ночное видение следующего поколения и ситуационную осведомленность для любой войны. Это также помогло компании выйти за традиционные границы пространства и времени в области AR, тем самым расширив свои продукты на рынке

- В октябре 2019 года Ultraleap Limited присоединилась к Khronos Group, отраслевому консорциуму, включающему 150 компаний-поставщиков аппаратного и программного обеспечения. Новое партнерство интегрировало технологию отслеживания рук Ultraleap с OpenXR для улучшения характеристик. Новое партнерство увеличит клиентскую базу компании

Объем рынка виртуальной реальности в Европе

Европейский рынок виртуальной реальности сегментирован по компонентам, типу устройства, технологии и вертикали. Рост среди этих сегментов поможет вам проанализировать сегменты с незначительным ростом в отраслях и предоставить пользователям ценный обзор рынка и рыночные идеи, которые помогут им принимать стратегические решения для определения основных рыночных приложений.

Компонент

- Аппаратное обеспечение

- Программное обеспечение

По компонентному признаку рынок виртуальной реальности в Европе сегментируется на аппаратное и программное обеспечение.

Тип устройства

- Дисплеи, устанавливаемые на голову,

- Проекторы и видеостены

- Устройства отслеживания жестов

По типу устройства европейский рынок виртуальной реальности сегментируется на шлемы виртуальной реальности, проекторы и видеостены, а также устройства отслеживания жестов.

Технологии

- Полное погружение,

- Полупогружение

- Неиммерсивный

По технологическому признаку рынок виртуальной реальности в Европе сегментируется на полностью иммерсивный, полуиммерсивный и неиммерсивный.

Вертикальный

- Автомобильный

- Аэрокосмическая промышленность и оборона

- Развлечения и СМИ

- Здравоохранение

- Образование

- Промышленный

- Коммерческий

- Другие

По вертикали рынок виртуальной реальности в Европе сегментирован на автомобилестроение, аэрокосмическую и оборонную отрасли, развлечения и медиа, здравоохранение, образование, промышленность, коммерцию и другие.

Региональный анализ/инсайты европейского рынка виртуальной реальности

Проведен анализ европейского рынка виртуальной реальности, а также предоставлены сведения о размерах и тенденциях рынка по странам, компонентам, типам устройств, технологиям и отраслевым направлениям, как указано выше.

В отчете о европейском рынке виртуальной реальности рассматриваются следующие страны: Германия, Великобритания, Франция, Швейцария, Италия, Испания, Нидерланды, Россия, Бельгия, Турция и остальные страны Европы.

Ожидается, что Германия будет доминировать на европейском рынке виртуальной реальности благодаря постоянно растущему цифровому рабочему месту и мобильной рабочей силе. Более того, Великобритания чрезвычайно чутко реагирует на внедрение новейших технологических достижений, включая мобильные устройства, облачные вычисления и IoT, на предприятиях, стимулируя рост рынка.

Раздел отчета по странам также содержит отдельные факторы, влияющие на рынок, и изменения в регулировании рынка, которые влияют на текущие и будущие тенденции рынка. Такие данные, как анализ цепочки создания стоимости вверх и вниз по течению, технические тенденции, анализ пяти сил Портера и тематические исследования, являются некоторыми из указателей, используемых для прогнозирования рыночного сценария для отдельных стран. Кроме того, при предоставлении прогнозного анализа данных по странам учитываются наличие и доступность европейских брендов и их проблемы, связанные с большой или малой конкуренцией со стороны местных и отечественных брендов, влияние внутренних тарифов и торговые пути.

Анализ конкурентной среды и доли рынка виртуальной реальности в Европе

Конкурентная среда европейского рынка виртуальной реальности содержит сведения о конкуренте. Включены сведения о компании, финансы компании, полученный доход, рыночный потенциал, инвестиции в исследования и разработки, новые рыночные инициативы, присутствие в Европе, производственные площадки и объекты, производственные мощности, сильные и слабые стороны компании, запуск продукта, широта и широта продукта, доминирование приложений. Приведенные выше данные относятся только к фокусу компаний, связанному с европейским рынком виртуальной реальности.

Среди основных игроков, работающих на европейском рынке виртуальной реальности, можно назвать Sony Corporation, Lenovo, Autodesk Inc., Nintendo, LG Electronics, HTC Corporation, Ultraleap, Google (дочерняя компания Alphabet Inc.), Qualcomm Technologies, Inc., Barco, PSICO SMART APPS, SL, HP Development Company, LP, Microsoft, SAMSUNG ELECTRONICS CO., LTD. и другие.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Интерактивная панель анализа данных

- Панель анализа компании для возможностей с высоким потенциалом роста

- Доступ аналитика-исследователя для настройки и запросов

- Анализ конкурентов с помощью интерактивной панели

- Последние новости, обновления и анализ тенденций

- Используйте возможности сравнительного анализа для комплексного отслеживания конкурентов

Содержание

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE EUROPE VIRTUAL REALITY MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MULTIVARIATE MODELING

2.9 COMPONENT TIMELINE CURVE

2.1 MARKET VERTICAL COVERAGE GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

5 MARKET TRENDS

6 LIST OF TOP COMPETITORS ACROSS THE GLOBE

7 REGULATION AND POLICY

8 REGIONAL SUMMARY

9 MARKET OVERVIEW

9.1 DRIVERS

9.1.1 GROWING DEMAND FOR HMD IN THE GAMING AND ENTERTAINMENT INDUSTRY

9.1.2 HIGH INVESTMENT IN VR MARKET

9.1.3 INCREASING DEMAND FOR VR TECHNOLOGY DUE TO COVID-19 PANDEMIC

9.1.4 AVAILABILITY OF AFFORDABLE VR DEVICES

9.1.5 INCREASING INTEREST OF LARGE TECHNOLOGY CORPORATIONS

9.1.6 INCREASE IN PENETRATION OF SMARTPHONES AND INTERNET SERVICES

9.2 RESTRAINTS

9.2.1 LACK OF EFFECTIVE IN-USER EXPERIENCE DESIGN

9.2.2 HEALTH CONCERNS AMONG THE USERS

9.2.3 EUROPE ECONOMIC SLOWDOWN

9.3 OPPORTUNITIES

9.3.1 INCREASED DEPLOYMENT OF VR TECHNOLOGY IN AEROSPACE & DEFENSE AND ARCHITECTURE & PLANNING SECTOR

9.3.2 INCREASED PENETRATION OF VR IN THE HEALTHCARE INDUSTRY

9.3.3 INCREASE IN VARIOUS STRATEGIC DECISIONS SUCH AS PARTNERSHIP AND ACQUISITION

9.3.4 DEVELOPMENT OF HARDWARE WITH FASTER PROCESSING SPEEDS

9.4 CHALLENGES

9.4.1 EMERGING RISKS AND THREATS TO DATA INTEGRITY

9.4.2 DEVELOPING USER-FRIENDLY VR SYSTEM

10 EUROPE VIRTUAL REALITY MARKET, BY COMPONENT

10.1 OVERVIEW

10.2 HARDWARE

10.2.1 DISPLAYS AND PROJECTORS

10.2.2 CONTROLLER AND PROCESSOR

10.2.3 POSITION TRACKERS

10.2.4 CAMERAS

10.2.5 OTHERS

10.3 SOFTWARE

10.3.1 VR CONTENT CREATION

10.3.2 SOFTWARE DEVELOPMENT KITS

10.3.3 CLOUD BASED SERVICES

11 EUROPE VIRTUAL REALITY MARKET, BY DEVICE TYPE

11.1 OVERVIEW

11.2 HEAD-MOUNTED DISPLAYS

11.3 PROJECTORS & DISPLAY WALLS

11.4 GESTURE-TRACKING DEVICES

12 EUROPE VIRTUAL REALITY MARKET, BY TECHNOLOGY

12.1 OVERVIEW

12.2 FULLY IMMERSIVE

12.3 NON-IMMERSIVE

12.4 SEMI IMMERSIVE

13 EUROPE VIRTUAL REALITY MARKET, BY VERTICAL

13.1 OVERVIEW

13.2 ENTERTAINMENT & MEDIA

13.2.1 ENTERTAINMENT & MEDIA, BY TECHNOLOGY

13.2.1.1 FULLY IMMERSIVE

13.2.1.2 NON-IMMERSIVE

13.2.1.3 SEMI IMMERSIVE

13.2.2 ENTERTAINMENT & MEDIA, BY APPLICATION

13.2.2.1 GAME

13.2.2.2 BROADCAST

13.2.2.3 ANIMATION

13.2.2.4 CHARACTER

13.2.2.5 CARTOON

13.2.2.6 MUSIC

13.2.2.7 FASHION

13.3 HEALTHCARE

13.3.1 HEALTHCARE, BY TYPE

13.3.1.1 SURGERY

13.3.1.2 PATIENT CARE MANAGEMENT

13.3.1.3 FITNESS MANAGEMENT

13.3.1.4 PHARMACY MANAGEMENT

13.3.2 HEALTHCARE, BY TECHNOLOGY

13.3.2.1 FULLY IMMERSIVE

13.3.2.2 NON-IMMERSIVE

13.3.2.3 SEMI IMMERSIVE

13.4 INDUSTRIAL

13.4.1 FULLY IMMERSIVE

13.4.2 NON-IMMERSIVE

13.4.3 SEMI IMMERSIVE

13.5 COMMERCIAL

13.5.1 COMMERCIAL, BY TYPE

13.5.1.1 RETAIL AND E-COMMERCE

13.5.1.2 TRAVEL AND TOURISM

13.5.1.3 ADVERTISING

13.5.2 COMMERCIAL, BY TECHNOLOGY

13.5.2.1 FULLY IMMERSIVE

13.5.2.2 NON-IMMERSIVE

13.5.2.3 SEMI IMMERSIVE

13.6 AEROSPACE & DEFENSE

13.6.1 SEMI IMMERSIVE

13.6.2 FULLY IMMERSIVE

13.6.3 NON-IMMERSIVE

13.7 AUTOMOTIVE

13.7.1 SEMI IMMERSIVE

13.7.2 FULLY IMMERSIVE

13.7.3 NON-IMMERSIVE

13.8 EDUCATION

13.8.1 FULLY IMMERSIVE

13.8.2 NON-IMMERSIVE

13.8.3 SEMI IMMERSIVE

13.9 OTHERS

14 EUROPE VIRTUAL REALITY MARKET, BY REGION

14.1 EUROPE

14.1.1 GERMANY

14.1.2 FRANCE

14.1.3 U.K.

14.1.4 ITALY

14.1.5 RUSSIA

14.1.6 SPAIN

14.1.7 NETHERLANDS

14.1.8 BELGIUM

14.1.9 SWITZERLAND

14.1.10 TURKEY

14.1.11 REST OF EUROPE

15 EUROPE VIRTUAL REALITY MARKET, COMPANY LANDSCAPE

15.1 COMPANY SHARE ANALYSIS: EUROPE

16 SWOT ANALYSIS

17 COMPANY PROFILE

17.1 SONY CORPORATION

17.1.1 COMPANY PROFILE

17.1.2 REVENUE ANALYSIS

17.1.3 COMPANY SHARE ANALYSIS

17.1.4 PRODUCT PORTFOLIO

17.1.5 RECENT DEVELOPMENTS

17.2 SAMSUNG ELECTRONICS CO., LTD.

17.2.1 COMPANY PROFILE

17.2.2 REVENUE ANALYSIS

17.2.3 COMPANY SHARE ANALYSIS

17.2.4 PRODUCT PORTFOLIO

17.2.5 RECENT DEVELOPMENTS

17.3 NINTENDO

17.3.1 COMPANY PROFILE

17.3.2 REVENUE ANALYSIS

17.3.3 COMPANY SHARE ANALYSIS

17.3.4 PRODUCT PORTFOLIO

17.3.5 RECENT DEVELOPMENTS

17.4 QUALCOMM TECHNOLOGIES, INC.

17.4.1 COMPANY PROFILE

17.4.2 REVENUE ANALYSIS

17.4.3 COMPANY SHARE ANALYSIS

17.4.4 PRODUCT PORTFOLIO

17.4.5 RECENT DEVELOPMENT

17.5 MICROSOFT

17.5.1 COMPANY PROFILE

17.5.2 REVENUE ANALYSIS

17.5.3 COMPANY SHARE ANALYSIS

17.5.4 PRODUCT PORTFOLIO

17.5.5 RECENT DEVELOPMENTS

17.6 AUTODESK INC.

17.6.1 COMPANY PROFILE

17.6.2 REVENUE ANALYSIS

17.6.3 PRODUCT PORTFOLIO

17.6.4 RECENT DEVELOPMENTS

17.7 BARCO

17.7.1 COMPANY PROFILE

17.7.2 REVENUE ANALYSIS

17.7.3 PRODUCT PORTFOLIO

17.7.4 RECENT DEVELOPMENTS

17.8 BHAPTICS INC.

17.8.1 COMPANY PROFILE

17.8.2 PRODUCT PORTFOLIO

17.8.3 RECENT DEVELOPMENT

17.9 FIRSTHAND TECHNOLOGY INC.

17.9.1 COMPANY PROFILE

17.9.2 PRODUCT PORTFOLIO

17.9.3 RECENT DEVELOPMENTS

17.1 FOVE, INC.

17.10.1 COMPANY PROFILE

17.10.2 PRODUCT PORTFOLIO

17.10.3 RECENT DEVELOPMENTS

17.11 FXGEAR INC.

17.11.1 COMPANY PROFILE

17.11.2 PRODUCT PORTFOLIO

17.11.3 RECENT DEVELOPMENT

17.12 GOOGLE (A SUBSIDIARY OF ALPHABET INC.)

17.12.1 COMPANY PROFILE

17.12.2 REVENUE ANALYSIS

17.12.3 PRODUCT PORTFOLIO

17.12.4 RECENT DEVELOPMENT

17.13 HP DEVELOPMENT COMPANY, L.P.

17.13.1 COMPANY PROFILE

17.13.2 REVENUE ANALYSIS

17.13.3 PRODUCT PORTFOLIO

17.13.4 RECENT DEVELOPMENTS

17.14 HTC CORPORATION

17.14.1 COMPANY PROFILE

17.14.2 REVENUE ANALYSIS

17.14.3 PRODUCT PORTFOLIO

17.14.4 RECENT DEVELOPMENTS

17.15 INNOSIMULATION

17.15.1 COMPANY PROFILE

17.15.2 PRODUCT PORTFOLIO

17.15.3 RECENT DEVELOPMENT

17.16 LENOVO

17.16.1 COMPANY PROFILE

17.16.2 REVENUE ANALYSIS

17.16.3 PRODUCT PORTFOLIO

17.16.4 RECENT DEVELOPMENT

17.17 LG ELECTRONICS

17.17.1 COMPANY PROFILE

17.17.2 REVENUE ANALYSIS

17.17.3 PRODUCT PORTFOLIO

17.17.4 RECENT DEVELOPMENTS

17.18 NOVINT

17.18.1 COMPANY PROFILE

17.18.2 PRODUCT PORTFOLIO

17.18.3 RECENT DEVELOPMENT

17.19 PSICO SMART APPS, S.L.

17.19.1 COMPANY PROFILE

17.19.2 PRODUCT PORTFOLIO

17.19.3 RECENT DEVELOPMENTS

17.2 SIXENSE ENTERPRISES INC.

17.20.1 COMPANY PROFILE

17.20.2 PRODUCT PORTFOLIO

17.20.3 RECENT DEVELOPMENTS

17.21 SKONEC ENTERTAINMENT CO., LTD.

17.21.1 COMPANY PROFILE

17.21.2 PRODUCT PORTFOLIO

17.21.3 RECENT DEVELOPMENTS

17.22 STARVR CORP

17.22.1 COMPANY PROFILE

17.22.2 PRODUCT PORTFOLIO

17.22.3 RECENT DEVELOPMENTS

17.23 ULTRALEAP LIMITED

17.23.1 COMPANY PROFILE

17.23.2 PRODUCT PORTFOLIO

17.23.3 RECENT DEVELOPMENTS

17.24 VIRTUIX

17.24.1 COMPANY PROFILE

17.24.2 PRODUCT PORTFOLIO

17.24.3 RECENT DEVELOPMENT

17.25 WORLDVIZ, INC.

17.25.1 COMPANY PROFILE

17.25.2 PRODUCT PORTFOLIO

17.25.3 RECENT DEVELOPMENTS

18 QUESTIONNAIRE

19 RELATED REPORTS

Список таблиц

TABLE 1 EUROPE VIRTUAL REALITY MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 2 EUROPE HARDWARE IN VIRTUAL REALITY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 3 EUROPE HARDWARE IN VIRTUAL REALITY MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 4 EUROPE SOFTWARE IN VIRTUAL REALITY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 5 EUROPE SOFTWARE IN VIRTUAL REALITY MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 6 EUROPE VIRTUAL REALITY MARKET, BY DEVICE TYPE, 2020-2029 (USD MILLION)

TABLE 7 EUROPE HEAD-MOUNTED DISPLAYS IN VIRTUAL REALITY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 8 EUROPE PROJECTORS & DISPLAY WALLS IN VIRTUAL REALITY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 9 EUROPE GESTURE-TRACKING DEVICES IN VIRTUAL REALITY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 10 EUROPE VIRTUAL REALITY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 11 EUROPE FULLY IMMERSIVE IN VIRTUAL REALITY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 12 EUROPE NON-IMMERSIVE IN VIRTUAL REALITY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 13 EUROPE SEMI IMMERSIVE IN VIRTUAL REALITY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 14 EUROPE VIRTUAL REALITY MARKET, BY VERTICAL, 2020-2029 (USD MILLION)

TABLE 15 EUROPE ENTERTAINMENT & MEDIA IN VIRTUAL REALITY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 16 EUROPE ENTERTAINMENT & MEDIA IN VIRTUAL REALITY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 17 EUROPE ENTERTAINMENT & MEDIA IN VIRTUAL REALITY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 18 EUROPE HEALTHCARE IN VIRTUAL REALITY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 19 EUROPE HEALTHCARE IN VIRTUAL REALITY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 20 EUROPE HEALTHCARE IN VIRTUAL REALITY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 21 EUROPE INDUSTRIAL IN VIRTUAL REALITY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 22 EUROPE INDUSTRIAL IN VIRTUAL REALITY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 23 EUROPE COMMERCIAL IN VIRTUAL REALITY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 24 EUROPE COMMERCIAL IN VIRTUAL REALITY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 25 EUROPE COMMERCIAL IN VIRTUAL REALITY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 26 EUROPE AEROSPACE & DEFENSE IN VIRTUAL REALITY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 27 EUROPE AEROSPACE AND DEFENSE IN VIRTUAL REALITY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 28 EUROPE AUTOMOTIVE IN VIRTUAL REALITY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 29 EUROPE AUTOMOTIVE IN VIRTUAL REALITY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 30 EUROPE EDUCATION IN VIRTUAL REALITY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 31 EUROPE EDUCATION IN VIRTUAL REALITY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 32 EUROPE OTHERS IN VIRTUAL REALITY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 33 EUROPE VIRTUAL REALITY MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 34 EUROPE VIRTUAL REALITY MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 35 EUROPE HARDWARE IN VIRTUAL REALITY MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 36 EUROPE SOFTWARE IN VIRTUAL REALITY MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 37 EUROPE VIRTUAL REALITY MARKET, BY DEVICE TYPE, 2020-2029 (USD MILLION)

TABLE 38 EUROPE VIRTUAL REALITY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 39 EUROPE VIRTUAL REALITY MARKET, BY VERTICAL, 2020-2029 (USD MILLION)

TABLE 40 EUROPE ENTERTAINMENT & MEDIA IN VIRTUAL REALITY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 41 EUROPE ENTERTAINMENT & MEDIA IN VIRTUAL REALITY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 42 EUROPE HEALTHCARE IN VIRTUAL REALITY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 43 EUROPE HEALTHCARE IN VIRTUAL REALITY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 44 EUROPE INDUSTRIAL IN VIRTUAL REALITY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 45 EUROPE COMMERCIAL IN VIRTUAL REALITY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 46 EUROPE COMMERCIAL IN VIRTUAL REALITY MARKET, BY TECHNOLOGY, 2022-2029 (USD MILLION)

TABLE 47 EUROPE AEROSPACE & DEFENSE IN VIRTUAL REALITY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 48 EUROPE AUTOMOTIVE IN VIRTUAL REALITY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 49 EUROPE EDUCATION IN VIRTUAL REALITY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 50 GERMANY VIRTUAL REALITY MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 51 GERMANY HARDWARE IN VIRTUAL REALITY MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 52 GERMANY SOFTWARE IN VIRTUAL REALITY MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 53 GERMANY VIRTUAL REALITY MARKET, BY DEVICE TYPE, 2020-2029 (USD MILLION)

TABLE 54 GERMANY VIRTUAL REALITY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 55 GERMANY VIRTUAL REALITY MARKET, BY VERTICAL, 2020-2029 (USD MILLION)

TABLE 56 GERMANY ENTERTAINMENT & MEDIA IN VIRTUAL REALITY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 57 GERMANY ENTERTAINMENT & MEDIA IN VIRTUAL REALITY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 58 GERMANY HEALTHCARE IN VIRTUAL REALITY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 59 GERMANY HEALTHCARE IN VIRTUAL REALITY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 60 GERMANY INDUSTRIAL IN VIRTUAL REALITY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 61 GERMANY COMMERCIAL IN VIRTUAL REALITY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 62 GERMANY COMMERCIAL IN VIRTUAL REALITY MARKET, BY TECHNOLOGY, 2022-2029 (USD MILLION)

TABLE 63 GERMANY AEROSPACE & DEFENSE IN VIRTUAL REALITY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 64 GERMANY AUTOMOTIVE IN VIRTUAL REALITY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 65 GERMANY EDUCATION IN VIRTUAL REALITY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 66 FRANCE VIRTUAL REALITY MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 67 FRANCE HARDWARE IN VIRTUAL REALITY MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 68 FRANCE SOFTWARE IN VIRTUAL REALITY MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 69 FRANCE VIRTUAL REALITY MARKET, BY DEVICE TYPE, 2020-2029 (USD MILLION)

TABLE 70 FRANCE VIRTUAL REALITY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 71 FRANCE VIRTUAL REALITY MARKET, BY VERTICAL, 2020-2029 (USD MILLION)

TABLE 72 FRANCE ENTERTAINMENT & MEDIA IN VIRTUAL REALITY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 73 FRANCE ENTERTAINMENT & MEDIA IN VIRTUAL REALITY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 74 FRANCE HEALTHCARE IN VIRTUAL REALITY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 75 FRANCE HEALTHCARE IN VIRTUAL REALITY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 76 FRANCE INDUSTRIAL IN VIRTUAL REALITY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 77 FRANCE COMMERCIAL IN VIRTUAL REALITY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 78 FRANCE COMMERCIAL IN VIRTUAL REALITY MARKET, BY TECHNOLOGY, 2022-2029 (USD MILLION)

TABLE 79 FRANCE AEROSPACE & DEFENSE IN VIRTUAL REALITY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 80 FRANCE AUTOMOTIVE IN VIRTUAL REALITY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 81 FRANCE EDUCATION IN VIRTUAL REALITY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 82 U.K. VIRTUAL REALITY MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 83 U.K. HARDWARE IN VIRTUAL REALITY MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 84 U.K. SOFTWARE IN VIRTUAL REALITY MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 85 U.K. VIRTUAL REALITY MARKET, BY DEVICE TYPE, 2020-2029 (USD MILLION)

TABLE 86 U.K. VIRTUAL REALITY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 87 U.K. VIRTUAL REALITY MARKET, BY VERTICAL, 2020-2029 (USD MILLION)

TABLE 88 U.K. ENTERTAINMENT & MEDIA IN VIRTUAL REALITY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 89 U.K. ENTERTAINMENT & MEDIA IN VIRTUAL REALITY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 90 U.K. HEALTHCARE IN VIRTUAL REALITY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 91 U.K. HEALTHCARE IN VIRTUAL REALITY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 92 U.K. INDUSTRIAL IN VIRTUAL REALITY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 93 U.K. COMMERCIAL IN VIRTUAL REALITY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 94 U.K. COMMERCIAL IN VIRTUAL REALITY MARKET, BY TECHNOLOGY, 2022-2029 (USD MILLION)

TABLE 95 U.K. AEROSPACE & DEFENSE IN VIRTUAL REALITY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 96 U.K. AUTOMOTIVE IN VIRTUAL REALITY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 97 U.K. EDUCATION IN VIRTUAL REALITY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 98 ITALY VIRTUAL REALITY MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 99 ITALY HARDWARE IN VIRTUAL REALITY MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 100 ITALY SOFTWARE IN VIRTUAL REALITY MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 101 ITALY VIRTUAL REALITY MARKET, BY DEVICE TYPE, 2020-2029 (USD MILLION)

TABLE 102 ITALY VIRTUAL REALITY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 103 ITALY VIRTUAL REALITY MARKET, BY VERTICAL, 2020-2029 (USD MILLION)

TABLE 104 ITALY ENTERTAINMENT & MEDIA IN VIRTUAL REALITY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 105 ITALY ENTERTAINMENT & MEDIA IN VIRTUAL REALITY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 106 ITALY HEALTHCARE IN VIRTUAL REALITY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 107 ITALY HEALTHCARE IN VIRTUAL REALITY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 108 ITALY INDUSTRIAL IN VIRTUAL REALITY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 109 ITALY COMMERCIAL IN VIRTUAL REALITY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 110 ITALY COMMERCIAL IN VIRTUAL REALITY MARKET, BY TECHNOLOGY, 2022-2029 (USD MILLION)

TABLE 111 ITALY AEROSPACE & DEFENSE IN VIRTUAL REALITY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 112 ITALY AUTOMOTIVE IN VIRTUAL REALITY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 113 ITALY EDUCATION IN VIRTUAL REALITY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 114 RUSSIA VIRTUAL REALITY MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 115 RUSSIA HARDWARE IN VIRTUAL REALITY MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 116 RUSSIA SOFTWARE IN VIRTUAL REALITY MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 117 RUSSIA VIRTUAL REALITY MARKET, BY DEVICE TYPE, 2020-2029 (USD MILLION)

TABLE 118 RUSSIA VIRTUAL REALITY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 119 RUSSIA VIRTUAL REALITY MARKET, BY VERTICAL, 2020-2029 (USD MILLION)

TABLE 120 RUSSIA ENTERTAINMENT & MEDIA IN VIRTUAL REALITY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 121 RUSSIA ENTERTAINMENT & MEDIA IN VIRTUAL REALITY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 122 RUSSIA HEALTHCARE IN VIRTUAL REALITY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 123 RUSSIA HEALTHCARE IN VIRTUAL REALITY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 124 RUSSIA INDUSTRIAL IN VIRTUAL REALITY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 125 RUSSIA COMMERCIAL IN VIRTUAL REALITY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 126 RUSSIA COMMERCIAL IN VIRTUAL REALITY MARKET, BY TECHNOLOGY, 2022-2029 (USD MILLION)

TABLE 127 RUSSIA AEROSPACE & DEFENSE IN VIRTUAL REALITY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 128 RUSSIA AUTOMOTIVE IN VIRTUAL REALITY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 129 RUSSIA EDUCATION IN VIRTUAL REALITY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 130 SPAIN VIRTUAL REALITY MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 131 SPAIN HARDWARE IN VIRTUAL REALITY MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 132 SPAIN SOFTWARE IN VIRTUAL REALITY MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 133 SPAIN VIRTUAL REALITY MARKET, BY DEVICE TYPE, 2020-2029 (USD MILLION)

TABLE 134 SPAIN VIRTUAL REALITY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 135 SPAIN VIRTUAL REALITY MARKET, BY VERTICAL, 2020-2029 (USD MILLION)

TABLE 136 SPAIN ENTERTAINMENT & MEDIA IN VIRTUAL REALITY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 137 SPAIN ENTERTAINMENT & MEDIA IN VIRTUAL REALITY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 138 SPAIN HEALTHCARE IN VIRTUAL REALITY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 139 SPAIN HEALTHCARE IN VIRTUAL REALITY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 140 SPAIN INDUSTRIAL IN VIRTUAL REALITY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 141 SPAIN COMMERCIAL IN VIRTUAL REALITY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 142 SPAIN COMMERCIAL IN VIRTUAL REALITY MARKET, BY TECHNOLOGY, 2022-2029 (USD MILLION)

TABLE 143 SPAIN AEROSPACE & DEFENSE IN VIRTUAL REALITY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 144 SPAIN AUTOMOTIVE IN VIRTUAL REALITY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 145 SPAIN EDUCATION IN VIRTUAL REALITY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 146 NETHERLANDS VIRTUAL REALITY MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 147 NETHERLANDS HARDWARE IN VIRTUAL REALITY MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 148 NETHERLANDS SOFTWARE IN VIRTUAL REALITY MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 149 NETHERLANDS VIRTUAL REALITY MARKET, BY DEVICE TYPE, 2020-2029 (USD MILLION)

TABLE 150 NETHERLANDS VIRTUAL REALITY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 151 NETHERLANDS VIRTUAL REALITY MARKET, BY VERTICAL, 2020-2029 (USD MILLION)

TABLE 152 NETHERLANDS ENTERTAINMENT & MEDIA IN VIRTUAL REALITY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 153 NETHERLANDS ENTERTAINMENT & MEDIA IN VIRTUAL REALITY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 154 NETHERLANDS HEALTHCARE IN VIRTUAL REALITY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 155 NETHERLANDS HEALTHCARE IN VIRTUAL REALITY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 156 NETHERLANDS INDUSTRIAL IN VIRTUAL REALITY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 157 NETHERLANDS COMMERCIAL IN VIRTUAL REALITY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 158 NETHERLANDS COMMERCIAL IN VIRTUAL REALITY MARKET, BY TECHNOLOGY, 2022-2029 (USD MILLION)

TABLE 159 NETHERLANDS AEROSPACE & DEFENSE IN VIRTUAL REALITY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 160 NETHERLANDS AUTOMOTIVE IN VIRTUAL REALITY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 161 NETHERLANDS EDUCATION IN VIRTUAL REALITY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 162 BELGIUM VIRTUAL REALITY MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 163 BELGIUM HARDWARE IN VIRTUAL REALITY MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 164 BELGIUM SOFTWARE IN VIRTUAL REALITY MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 165 BELGIUM VIRTUAL REALITY MARKET, BY DEVICE TYPE, 2020-2029 (USD MILLION)

TABLE 166 BELGIUM VIRTUAL REALITY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 167 BELGIUM VIRTUAL REALITY MARKET, BY VERTICAL, 2020-2029 (USD MILLION)

TABLE 168 BELGIUM ENTERTAINMENT & MEDIA IN VIRTUAL REALITY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 169 BELGIUM ENTERTAINMENT & MEDIA IN VIRTUAL REALITY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 170 BELGIUM HEALTHCARE IN VIRTUAL REALITY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 171 BELGIUM HEALTHCARE IN VIRTUAL REALITY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 172 BELGIUM INDUSTRIAL IN VIRTUAL REALITY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 173 BELGIUM COMMERCIAL IN VIRTUAL REALITY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 174 BELGIUM COMMERCIAL IN VIRTUAL REALITY MARKET, BY TECHNOLOGY, 2022-2029 (USD MILLION)

TABLE 175 BELGIUM AEROSPACE & DEFENSE IN VIRTUAL REALITY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 176 BELGIUM AUTOMOTIVE IN VIRTUAL REALITY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 177 BELGIUM EDUCATION IN VIRTUAL REALITY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 178 SWITZERLAND VIRTUAL REALITY MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 179 SWITZERLAND HARDWARE IN VIRTUAL REALITY MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 180 SWITZERLAND SOFTWARE IN VIRTUAL REALITY MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 181 SWITZERLAND VIRTUAL REALITY MARKET, BY DEVICE TYPE, 2020-2029 (USD MILLION)

TABLE 182 SWITZERLAND VIRTUAL REALITY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 183 SWITZERLAND VIRTUAL REALITY MARKET, BY VERTICAL, 2020-2029 (USD MILLION)

TABLE 184 SWITZERLAND ENTERTAINMENT & MEDIA IN VIRTUAL REALITY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 185 SWITZERLAND ENTERTAINMENT & MEDIA IN VIRTUAL REALITY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 186 SWITZERLAND HEALTHCARE IN VIRTUAL REALITY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 187 SWITZERLAND HEALTHCARE IN VIRTUAL REALITY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 188 SWITZERLAND INDUSTRIAL IN VIRTUAL REALITY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 189 SWITZERLAND COMMERCIAL IN VIRTUAL REALITY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 190 SWITZERLAND COMMERCIAL IN VIRTUAL REALITY MARKET, BY TECHNOLOGY, 2022-2029 (USD MILLION)

TABLE 191 SWITZERLAND AEROSPACE & DEFENSE IN VIRTUAL REALITY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 192 SWITZERLAND AUTOMOTIVE IN VIRTUAL REALITY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 193 SWITZERLAND EDUCATION IN VIRTUAL REALITY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 194 TURKEY VIRTUAL REALITY MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 195 TURKEY HARDWARE IN VIRTUAL REALITY MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 196 TURKEY SOFTWARE IN VIRTUAL REALITY MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 197 TURKEY VIRTUAL REALITY MARKET, BY DEVICE TYPE, 2020-2029 (USD MILLION)

TABLE 198 TURKEY VIRTUAL REALITY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 199 TURKEY VIRTUAL REALITY MARKET, BY VERTICAL, 2020-2029 (USD MILLION)

TABLE 200 TURKEY ENTERTAINMENT & MEDIA IN VIRTUAL REALITY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 201 TURKEY ENTERTAINMENT & MEDIA IN VIRTUAL REALITY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 202 TURKEY HEALTHCARE IN VIRTUAL REALITY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 203 TURKEY HEALTHCARE IN VIRTUAL REALITY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 204 TURKEY INDUSTRIAL IN VIRTUAL REALITY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 205 TURKEY COMMERCIAL IN VIRTUAL REALITY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 206 TURKEY COMMERCIAL IN VIRTUAL REALITY MARKET, BY TECHNOLOGY, 2022-2029 (USD MILLION)

TABLE 207 TURKEY AEROSPACE & DEFENSE IN VIRTUAL REALITY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 208 TURKEY AUTOMOTIVE IN VIRTUAL REALITY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 209 TURKEY EDUCATION IN VIRTUAL REALITY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 210 REST OF EUROPE VIRTUAL REALITY MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

Список рисунков

FIGURE 1 EUROPE VIRTUAL REALITY MARKET: SEGMENTATION

FIGURE 2 EUROPE VIRTUAL REALITY MARKET: DATA TRIANGULATION

FIGURE 3 EUROPE VIRTUAL REALITY MARKET: DROC ANALYSIS

FIGURE 4 EUROPE VIRTUAL REALITY MARKET: EUROPE VS REGIONAL MARKET ANALYSIS

FIGURE 5 EUROPE VIRTUAL REALITY MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 EUROPE VIRTUAL REALITY MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 EUROPE VIRTUAL REALITY MARKET: DBMR MARKET POSITION GRID

FIGURE 8 EUROPE VIRTUAL REALITY MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 EUROPE VIRTUAL REALITY MARKET: MARKET VERTICAL COVERAGE GRID

FIGURE 10 EUROPE VIRTUAL REALITY MARKET: SEGMENTATION

FIGURE 11 GROWING DEMAND FOR HMD IN THE GAMING AND ENTERTAINMENT INDUSTRY IS EXPECTED TO DRIVE THE EUROPE VIRTUAL REALITY MARKET GROWTH IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 12 HARDWARE SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF EUROPE VIRTUAL REALITY MARKET IN 2022 & 2029

FIGURE 13 ASIA-PACIFIC IS EXPECTED TO DOMINATE THE VIRTUAL REALITY MARKET AND GROW WITH THE FASTEST GROWTH RATE IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 14 THE ABOVE FIGURE SHOWS THE POTENTIAL OF VIRTUAL REALITY APPLICATIONS BY CATEGORY.

FIGURE 15 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE EUROPE VIRTUAL REALITY MARKET

FIGURE 16 EUROPE VIRTUAL REALITY MARKET ESTIMATION (2016-2021)

FIGURE 17 EUROPE VIRTUAL REALITY MARKET: BY COMPONENT, 2021

FIGURE 18 EUROPE VIRTUAL REALITY MARKET: BY DEVICE TYPE, 2021

FIGURE 19 EUROPE VIRTUAL REALITY MARKET: BY TECHNOLOGY, 2021

FIGURE 20 EUROPE VIRTUAL REALITY MARKET: BY VERTICAL, 2021

FIGURE 21 EUROPE VIRTUAL REALITY MARKET: SNAPSHOT (2021)

FIGURE 22 EUROPE VIRTUAL REALITY MARKET: BY COUNTRY (2021)

FIGURE 23 EUROPE VIRTUAL REALITY MARKET: BY COUNTRY (2022 & 2029)

FIGURE 24 EUROPE VIRTUAL REALITY MARKET: BY COUNTRY (2021 & 2029)

FIGURE 25 EUROPE VIRTUAL REALITY MARKET: BY COMPONENT (2022-2029)

FIGURE 26 EUROPE VIRTUAL REALITY MARKET: COMPANY SHARE 2021 (%)

Методология исследования

Сбор данных и анализ базового года выполняются с использованием модулей сбора данных с большими размерами выборки. Этап включает получение рыночной информации или связанных данных из различных источников и стратегий. Он включает изучение и планирование всех данных, полученных из прошлого заранее. Он также охватывает изучение несоответствий информации, наблюдаемых в различных источниках информации. Рыночные данные анализируются и оцениваются с использованием статистических и последовательных моделей рынка. Кроме того, анализ доли рынка и анализ ключевых тенденций являются основными факторами успеха в отчете о рынке. Чтобы узнать больше, пожалуйста, запросите звонок аналитика или оставьте свой запрос.

Ключевой методологией исследования, используемой исследовательской группой DBMR, является триангуляция данных, которая включает в себя интеллектуальный анализ данных, анализ влияния переменных данных на рынок и первичную (отраслевую экспертную) проверку. Модели данных включают сетку позиционирования поставщиков, анализ временной линии рынка, обзор рынка и руководство, сетку позиционирования компании, патентный анализ, анализ цен, анализ доли рынка компании, стандарты измерения, глобальный и региональный анализ и анализ доли поставщика. Чтобы узнать больше о методологии исследования, отправьте запрос, чтобы поговорить с нашими отраслевыми экспертами.

Доступна настройка

Data Bridge Market Research является лидером в области передовых формативных исследований. Мы гордимся тем, что предоставляем нашим существующим и новым клиентам данные и анализ, которые соответствуют и подходят их целям. Отчет можно настроить, включив в него анализ ценовых тенденций целевых брендов, понимание рынка для дополнительных стран (запросите список стран), данные о результатах клинических испытаний, обзор литературы, обновленный анализ рынка и продуктовой базы. Анализ рынка целевых конкурентов можно проанализировать от анализа на основе технологий до стратегий портфеля рынка. Мы можем добавить столько конкурентов, о которых вам нужны данные в нужном вам формате и стиле данных. Наша команда аналитиков также может предоставить вам данные в сырых файлах Excel, сводных таблицах (книга фактов) или помочь вам в создании презентаций из наборов данных, доступных в отчете.