Europe Trauma Fixation Market

Размер рынка в млрд долларов США

CAGR :

%

USD

4.24 Billion

USD

9.10 Billion

2024

2032

USD

4.24 Billion

USD

9.10 Billion

2024

2032

| 2025 –2032 | |

| USD 4.24 Billion | |

| USD 9.10 Billion | |

|

|

|

|

Сегментация европейского рынка травматической фиксации по типу продукта (внутренние и внешние фиксаторы), материалу (металлические имплантаты (сталь, титан и другие), углеродное волокно (термопластика), гибридные имплантаты, биорассасывающиеся, трансплантаты и ортобиологические), применению (плечо и локоть, кисть и запястье, таз, бедро и бедренная кость, большеберцовая кость, краниомаксиллофациальный сустав, колено, стопа и голеностопный сустав, позвоночник и другие), конечному пользователю (больницы, амбулаторные хирургические центры, травматологические центры и другие), каналу сбыта (прямые тендеры, розничные продажи и онлайн-продажи) — тенденции отрасли и прогноз до 2032 года

Размер европейского рынка травмофиксации

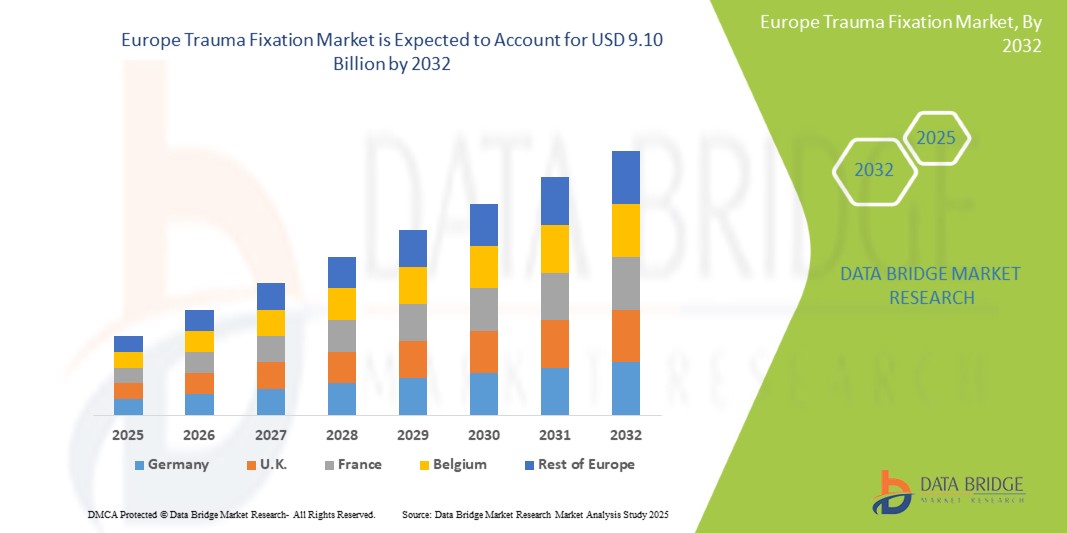

- Объем европейского рынка травматической фиксации в 2024 году оценивался в 4,24 млрд долларов США и, как ожидается, достигнет 9,10 млрд долларов США к 2032 году при среднегодовом темпе роста 10,0% в течение прогнозируемого периода .

- Рост рынка во многом обусловлен увеличением числа дорожно-транспортных происшествий и несчастных случаев, связанных со спортом, увеличением численности пожилых людей и продолжающимся технологическим прогрессом в области устройств для фиксации травм.

- Кроме того, растущий спрос потребителей и учреждений на надежные, точные и комплексные решения для фиксации, поддерживаемый ростом располагаемых доходов, государственной поддержкой и возмещением расходов, а также улучшением доступа к современным медицинским учреждениям, позиционирует устройства для фиксации травм как современный стандарт лечения переломов по всей Европе.

Анализ европейского рынка травмофиксации

- Устройства для фиксации травм, включая системы внутренней и внешней фиксации, играют важную роль в ортопедической хирургии, обеспечивая стабилизацию и выравнивание переломов костей, эффективное заживление и более быстрое восстановление пациентов как при острых травмах, так и в послеоперационный период.

- Растущий спрос на решения для фиксации травм обусловлен, прежде всего, ростом дорожно-транспортных происшествий и травм, связанных со спортом, старением населения с более высоким риском переломов, а также более широким внедрением малоинвазивных хирургических методов и современных материалов для имплантации.

- Германия доминировала на европейском рынке травматологической фиксации с наибольшей долей выручки в 22,5% в 2024 году, что характеризовалось ее развитой инфраструктурой здравоохранения, большими объемами хирургических операций, сильной средой возмещения расходов и наличием крупных производителей медицинских устройств и специализированных травматологических центров.

- Ожидается, что Польша станет страной с самыми быстрыми темпами роста на европейском рынке травматологической фиксации в течение прогнозируемого периода благодаря улучшению инфраструктуры больниц, увеличению государственных расходов на здравоохранение, более широкому доступу к передовым ортопедическим методам лечения и растущему внедрению современных технологий фиксации.

- Сегмент устройств для внутренней фиксации доминировал на европейском рынке травматологической фиксации с долей рынка 65,5% в 2024 году, что обусловлено предпочтением хирургов интрамедуллярным стержням, пластинам и винтам при сложных переломах, более короткими периодами восстановления и лучшими функциональными результатами по сравнению со многими вариантами внешней фиксации.

Область применения отчета и сегментация европейского рынка травмофиксации

|

Атрибуты |

Ключевые данные о рынке фиксации травм в Европе |

|

Охваченные сегменты |

|

|

Охваченные страны |

Европа

|

|

Ключевые игроки рынка |

|

|

Рыночные возможности |

|

|

Информационные наборы данных с добавленной стоимостью |

Помимо информации о рыночных сценариях, таких как рыночная стоимость, темпы роста, сегментация, географический охват и основные игроки, отчеты о рынке, подготовленные Data Bridge Market Research, также включают в себя углубленный экспертный анализ, анализ цен, анализ доли бренда, опрос потребителей, демографический анализ, анализ цепочки поставок, анализ цепочки создания стоимости, обзор сырья/расходных материалов, критерии выбора поставщиков, анализ PESTLE, анализ Портера и нормативную базу. |

Тенденции европейского рынка травмофиксации

Переход к минимально инвазивным и специфичным для пациента решениям по фиксации

- Значимой и набирающей обороты тенденцией на европейском рынке травматологической фиксации является внедрение малоинвазивных хирургических методов в сочетании с индивидуальными имплантационными решениями. Этот подход направлен на сокращение времени восстановления, минимизацию хирургической травмы и улучшение результатов лечения.

- Например, такие компании, как DePuy Synthes и Stryker, предлагают современные системы пластин и гвоздей, которые можно устанавливать через небольшие разрезы, что снижает кровопотерю и риск инфицирования. Компания Zimmer Biomet представила модульные системы фиксации, адаптируемые к индивидуальным анатомическим особенностям.

- Имплантаты, изготовленные индивидуально для каждого пациента, часто изготавливаемые с помощью 3D-печати, обеспечивают индивидуальную посадку и оптимальное распределение нагрузки, улучшая заживление костей и обеспечивая комфорт. Эта тенденция набирает популярность в случаях сложных переломов, когда стандартные имплантаты могут не обеспечить идеальных результатов.

- Интеграция современных методов визуализации и компьютерного хирургического планирования позволяет хирургам точно планировать процедуры фиксации и выбирать или проектировать наиболее подходящие устройства с учетом анатомических особенностей каждого пациента.

- Больницы в Германии, Франции и Великобритании все больше инвестируют в роботизированные ортопедические системы, которые в сочетании с этими инновационными методами фиксации повышают точность и воспроизводимость хирургических операций.

- Растущая популярность менее инвазивных, технологически усовершенствованных методов фиксации меняет стандарты ортопедии в Европе, побуждая производителей расширять НИОКР в области современных биоматериалов, высокоточных инструментов и производства имплантатов по индивидуальному заказу.

Динамика европейского рынка травмофиксации

Водитель

Рост числа случаев травм в результате дорожно-транспортных происшествий и старение населения

- Рост числа дорожно-транспортных происшествий, спортивных травм и падений среди стареющего населения Европы является основным фактором роста спроса на фиксацию травм.

- Например, данные Евростата показывают рост доли граждан старше 65 лет, многие из которых подвержены низкотравматичным переломам, требующим внутренней фиксации. Кроме того, плотность городского транспорта способствует повышению уровня аварийности, что обуславливает потребность в передовых решениях для лечения переломов.

- Современные фиксирующие устройства, такие как блокируемые пластины, канюлированные винты и интрамедуллярные штифты, обеспечивают более быструю мобилизацию и лучшее функциональное восстановление, что делает их предпочтительным выбором в современной ортопедической практике.

- Поддерживающая государственная политика в области здравоохранения, системы возмещения расходов и инвестиции в травматологические центры ускоряют внедрение, особенно в Западной Европе.

- Присутствие крупных мировых производителей ортопедической продукции с развитыми дистрибьюторскими сетями в Европе дополнительно способствует быстрому распространению технологий и обучению медицинских работников.

Сдержанность/Вызов

Высокие затраты на имплантацию и строгие нормативные требования

- Относительно высокая стоимость современных имплантатов для фиксации травм, особенно изготовленных из титановых сплавов или включающих биорассасывающиеся материалы, может ограничить их внедрение в чувствительных к затратам системах здравоохранения в некоторых частях Южной и Восточной Европы.

- Например, больницы, работающие в условиях ограниченного бюджета, могут выбирать стандартные имплантаты из нержавеющей стали вместо премиальных вариантов, что может повлиять на общее проникновение на рынок высококачественных устройств.

- Строгие нормативные требования в рамках Регламента ЕС о медицинских изделиях (MDR) представляют собой дополнительную проблему, поскольку получение сертификации для новых продуктов требует обширных клинических данных, длительных сроков и значительных затрат на соблюдение требований.

- В частности, мелкие производители сталкиваются с трудностями в управлении процессами MDR, что может задержать внедрение инноваций и выход на рынок.

- Решение этих проблем посредством оптимизированного по затратам производства устройств, рационализированных стратегий регулирования и партнерства с поставщиками медицинских услуг будет иметь решающее значение для поддержания роста рынка во всем регионе.

Объем европейского рынка травмофиксации

Рынок сегментирован по типу продукта, материалу, применению, конечному пользователю и каналу сбыта.

- По типу продукта

Европейский рынок травматологической фиксации сегментирован по типу продукции на два сегмента: устройства внутренней и внешней фиксации. Сегмент устройств внутренней фиксации доминировал на рынке с наибольшей долей выручки в 65,5% в 2024 году благодаря своей превосходной стабильности, способности способствовать более быстрой мобилизации пациентов и широкому применению хирургами сложных или многооскольчатых переломов.

Такие изделия, как блокируемые пластины, канюлированные винты и интрамедуллярные стержни, широко используются в ортопедической хирургии благодаря их доказанным долгосрочным клиническим результатам, минимальному уровню осложнений и уменьшенному риску инфицирования по сравнению с внешними системами.

Ожидается, что сегмент устройств внешней фиксации продемонстрирует заметный рост в течение прогнозируемого периода, что подтверждается их эффективностью при временной стабилизации, лечении открытых переломов и ситуациях, требующих постепенного восстановления костной ткани у пациентов с высокоэнергетическими травмами или политравмой.

- По материалу

Европейский рынок травматологической фиксации сегментирован по материалу: металлические имплантаты (сталь, титан и другие), углеродное волокно (термопластичные), гибридные имплантаты, биорассасывающиеся имплантаты, а также трансплантаты и ортобиологи. Сегмент металлических имплантатов занимал наибольшую долю рынка в 2024 году, поскольку сталь и титан остаются золотым стандартом для применения в условиях нагрузки, обладая превосходной прочностью, коррозионной стойкостью и биосовместимостью.

Ожидается, что сегмент биорассасывающихся имплантатов продемонстрирует самые быстрые темпы роста в прогнозируемый период, что обусловлено растущим спросом на имплантаты, которые естественным образом разрушаются в организме с течением времени, устраняя необходимость в повторных хирургических вмешательствах по их удалению и снижая расходы на здравоохранение. Имплантаты из углеродного волокна и гибридные имплантаты становятся узкоспециализированными, но перспективными категориями благодаря своей лёгкой структуре, рентгенопрозрачности для более чётких изображений и пригодности для применения в спортивной медицине и педиатрии.

- По применению

Европейский рынок фиксаторов для травматологии сегментирован по области применения: плечо и локоть, кисть и запястье, таз, тазобедренный сустав, большеберцовая кость, кранио-челюстно-лицевой сустав, колено, стопа и голеностопный сустав, позвоночник и другие. Сегмент тазобедренного сустава и бедренной кости доминировал в 2024 году из-за высокой частоты переломов шейки и диафиза бедренной кости, особенно среди пожилых людей, подверженных остеопорозу и травмам, связанным с падениями.

Ожидается, что краниомаксиллофациальный сегмент будет быстро расти в течение прогнозируемого периода из-за увеличения числа реконструктивных операций после травм лица, а также достижений в области систем рассасывающихся пластин и компьютерного хирургического планирования.

- Конечным пользователем

Европейский рынок травматологической фиксации сегментирован по типу конечного пользователя на больницы, амбулаторные хирургические центры, травматологические центры и другие. Больничный сегмент занимал наибольшую долю в 2024 году, что обусловлено высокой пропускной способностью, наличием современных операционных, многопрофильными хирургическими бригадами и комплексными услугами по оказанию травматологической помощи.

Ожидается, что сегмент амбулаторных хирургических центров продемонстрирует значительный рост в течение прогнозируемого периода в связи с растущим внедрением процедур дневного пребывания при травмах, экономической эффективностью систем здравоохранения и растущим желанием пациентов быстрее выписываться и восстанавливаться в амбулаторных условиях.

- По каналу распространения

Европейский рынок травматологической фиксации сегментирован по каналам сбыта на прямые торги, розничные продажи и онлайн-продажи. В 2024 году сегмент прямых торгов лидировал на рынке благодаря соглашениям о оптовых закупках между крупными больницами, государственными системами здравоохранения и производителями устройств, что обеспечивало бесперебойность поставок и выгодные цены.

Прогнозируется, что сегмент онлайн-продаж будет расти быстрее всего в течение прогнозируемого периода, что обусловлено увеличением цифровых закупок медицинскими учреждениями, улучшением логистических сетей и растущей ролью платформ электронной коммерции в поставках специализированных медицинских устройств.

Региональный анализ европейского рынка травмофиксации

- Германия доминировала на европейском рынке травматологической фиксации с наибольшей долей выручки в 22,5% в 2024 году, что характеризовалось ее развитой инфраструктурой здравоохранения, большими объемами хирургических операций, сильной средой возмещения расходов и наличием крупных производителей медицинских устройств и специализированных травматологических центров.

- Доминирование страны поддерживается высокими расходами на здравоохранение на душу населения, надежными системами возмещения расходов и широким внедрением технологически продвинутых фиксирующих устройств как в государственных, так и в частных больницах.

- Старение населения Германии, рост числа переломов и растущее внимание к малоинвазивным хирургическим методам дополнительно стимулируют спрос, позиционируя страну как ключевого драйвера инноваций и роста доходов в европейском секторе фиксации травм.

Обзор рынка травмофиксации в Германии

Германия заняла наибольшую долю европейского рынка травматологической фиксации в 2024 году благодаря высокому уровню хирургических операций, развитой сети больниц и значительным инвестициям в ортопедические исследования и инновации. Акцент страны на внедрение технологически передовых имплантатов, а также благоприятные системы возмещения расходов укрепили её позиции ключевого лидера рынка. Растущий спрос на малоинвазивные методы в сочетании с быстрым старением населения стимулируют внедрение современных фиксирующих устройств как в государственных, так и в частных медицинских учреждениях.

Обзор рынка травмофиксации в Великобритании

Ожидается, что рынок услуг по фиксации травматологических переломов в Великобритании будет расти среднегодовыми темпами в течение прогнозируемого периода, чему будет способствовать увеличение числа ортопедических операций, увеличение числа переломов при падениях и дорожно-транспортных происшествиях, а также расширение доступа к специализированной травматологической помощи. Особое внимание к модернизации Национальной службы здравоохранения (NHS) в сочетании с технологическими инновациями и внедрением лёгких и прочных фиксирующих устройств ускоряет рост рынка. Рост осведомлённости о необходимости раннего вмешательства при переломах и расширение услуг частной медицины дополнительно способствуют расширению рынка.

Обзор рынка травмофиксации во Франции

На французском рынке травматологической фиксации наблюдается значительное внедрение современных имплантатов, чему способствуют развитая система здравоохранения и мощная производственная база ортопедических изделий. Рост числа переломов, связанных с остеопорозом, особенно среди пожилых людей, стимулирует спрос на системы как внутренней, так и внешней фиксации. Государственные инициативы по улучшению доступа к высококачественной хирургической помощи и внедрение инструментов цифрового планирования в ортопедическую хирургию дополнительно способствуют росту рынка.

Обзор рынка травмофиксации в Италии

Рынок услуг по фиксации травм в Италии стабильно растёт благодаря росту числа спортсменов, увеличению численности пожилого населения и увеличению числа случаев сложных переломов. Инвестиции в модернизацию инфраструктуры здравоохранения, а также внедрение инновационных материалов для фиксации, таких как углеродное волокно и биодеградируемые имплантаты, способствуют росту рынка. Ортопедическое сообщество страны также всё чаще использует малоинвазивные методы фиксации, ускоряя и улучшая результаты лечения.

Обзор рынка травмофиксации в Польше

Рынок травматологической фиксации в Польше становится самым быстрорастущим в Европе благодаря стремительному развитию инфраструктуры здравоохранения, увеличению государственных инвестиций в современное хирургическое оборудование и расширению доступа к специализированной ортопедической помощи. Рост числа дорожно-транспортных происшествий в сочетании с ростом числа спортивных травм повышает спрос на современные фиксаторы. Ортопедическое сообщество страны всё чаще внедряет малоинвазивные методы и инновационные имплантационные материалы, что делает Польшу одним из наиболее быстрорастущих рынков в регионе.

Доля европейского рынка травмофиксации

В Европе отрасль фиксации травм представлена в основном хорошо зарекомендовавшими себя компаниями, среди которых:

- Johnson & Johnson и ее филиалы (США)

- Страйкер (США)

- Zimmer Biomet (США)

- Smith + Nephew (Великобритания)

- Medtronic (Ирландия)

- Б. Браун СЕ (Германия)

- Orthofix Medical Inc. (США)

- Wright Medical Group NV (Нидерланды)

- Корпорация ConMed (США)

- Acumed LLC (США)

- Arthrex, Inc. (США)

- DePuy Synthes Companies (США)

- ОстеоМед (США)

- Globus Medical, Inc. (США)

- Integra LifeSciences Holdings Corporation (США)

- BioPro, Inc. (США)

- Medartis AG (Швейцария)

- Double Medical Technology Inc. (Китай)

- Citieffe Srl (Италия)

- ChM sp. z oo (Poland)

Каковы последние тенденции на европейском рынке травмофиксации?

- В августе 2025 года Научно-исследовательский институт АО в Давосе совместно с Университетом Квинсленда (Австралия) проведёт европейские клинические испытания двухфазной пластины – нового фиксирующего устройства, сочетающего механическую стабильность с контролируемой микроподвижностью, способствующей формированию костной мозоли. Сотый пациент получил имплант в конце 2024 года. Завершение годичного периода наблюдения запланировано на 2026 год, после чего возможно начало производства и более широкое внедрение.

- В июне 2025 года компания Johnson & Johnson MedTech объявила о проведении первых в Европе операций по частичному эндопротезированию коленного сустава (однополюсной артропластики коленного сустава) с использованием роботизированной платформы VELYS, сертифицированной по стандартам CE, в сочетании с имплантатом SIGMA HP. Эта технология, внедренная в девяти странах, включая Германию, Великобританию, Францию и Италию, обещает персонализированное выравнивание и хирургическую диагностику с сохранением мягких тканей без использования КТ.

- В апреле 2025 года компания Zimmer Biomet получила сертификат CE на свою систему RibFix Advantage, предназначенную для малоинвазивной торакоскопической фиксации, стабилизации и сращения переломов рёбер. Конструкция предварительно собранной мостообразной пластины повторяет анатомию рёбер и обеспечивает меньшее повреждение тканей, что является значительным достижением в лечении переломов рёбер в Европе.

- В феврале 2025 года компания Bioretec Ltd., пионер в области рассасывающихся ортопедических имплантатов, получила маркировку CE для своей линейки травматических винтов RemeOs. Одобрение распространяется на более чем 200 вариантов продукции в четырёх линейках, предназначенных для верхних и нижних конечностей как у взрослых, так и у детей. Эти винты, изготовленные из запатентованного магниевого сплава, рассасываются, обладают остеопромотирующим эффектом и исключают необходимость удаления имплантата, что повышает экономическую эффективность и комфорт для пациента.

- В октябре 2024 года COBRA-OS, устройство для окклюзии аорты, предназначенное для предотвращения фатальных кровотечений у пациентов с травмами, было одобрено для использования в Европе в 2024 году. Устройство меньше по размеру и более экономично, чем аналогичные альтернативы, и уже используется в США.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Интерактивная панель анализа данных

- Панель анализа компании для возможностей с высоким потенциалом роста

- Доступ аналитика-исследователя для настройки и запросов

- Анализ конкурентов с помощью интерактивной панели

- Последние новости, обновления и анализ тенденций

- Используйте возможности сравнительного анализа для комплексного отслеживания конкурентов

Методология исследования

Сбор данных и анализ базового года выполняются с использованием модулей сбора данных с большими размерами выборки. Этап включает получение рыночной информации или связанных данных из различных источников и стратегий. Он включает изучение и планирование всех данных, полученных из прошлого заранее. Он также охватывает изучение несоответствий информации, наблюдаемых в различных источниках информации. Рыночные данные анализируются и оцениваются с использованием статистических и последовательных моделей рынка. Кроме того, анализ доли рынка и анализ ключевых тенденций являются основными факторами успеха в отчете о рынке. Чтобы узнать больше, пожалуйста, запросите звонок аналитика или оставьте свой запрос.

Ключевой методологией исследования, используемой исследовательской группой DBMR, является триангуляция данных, которая включает в себя интеллектуальный анализ данных, анализ влияния переменных данных на рынок и первичную (отраслевую экспертную) проверку. Модели данных включают сетку позиционирования поставщиков, анализ временной линии рынка, обзор рынка и руководство, сетку позиционирования компании, патентный анализ, анализ цен, анализ доли рынка компании, стандарты измерения, глобальный и региональный анализ и анализ доли поставщика. Чтобы узнать больше о методологии исследования, отправьте запрос, чтобы поговорить с нашими отраслевыми экспертами.

Доступна настройка

Data Bridge Market Research является лидером в области передовых формативных исследований. Мы гордимся тем, что предоставляем нашим существующим и новым клиентам данные и анализ, которые соответствуют и подходят их целям. Отчет можно настроить, включив в него анализ ценовых тенденций целевых брендов, понимание рынка для дополнительных стран (запросите список стран), данные о результатах клинических испытаний, обзор литературы, обновленный анализ рынка и продуктовой базы. Анализ рынка целевых конкурентов можно проанализировать от анализа на основе технологий до стратегий портфеля рынка. Мы можем добавить столько конкурентов, о которых вам нужны данные в нужном вам формате и стиле данных. Наша команда аналитиков также может предоставить вам данные в сырых файлах Excel, сводных таблицах (книга фактов) или помочь вам в создании презентаций из наборов данных, доступных в отчете.