Europe Track And Trace Solutions Market

Размер рынка в млрд долларов США

CAGR :

%

USD

1.60 Billion

USD

6.34 Billion

2024

2032

USD

1.60 Billion

USD

6.34 Billion

2024

2032

| 2025 –2032 | |

| USD 1.60 Billion | |

| USD 6.34 Billion | |

|

|

|

Рынок решений для отслеживания и прослеживания в Европе, по продуктам (программные компоненты, аппаратные компоненты и автономная платформа), решение (сериализация на уровне линии и участка, облачная прослеживаемость на уровне предприятия, решение для дистрибуции и складирования, сеть обмена данными о цепочке поставок и другие), приложение (сериализация, печать, маркировка и проверка упаковки, агрегация, отслеживание, трассировка и отчетность), технология (2D-штрихкоды, радиочастотная идентификация (RFID) и линейные/1D-штрихкоды), конечный пользователь (фармацевтические и биофармацевтические компании, потребительские упакованные товары, предметы роскоши, продукты питания и напитки, компании по производству медицинских приборов, организации по контрактному производству, переупаковщики, косметические компании и другие), канал сбыта (прямые продажи и сторонние дистрибьюторы) — отраслевые тенденции и прогноз до 2032 г.

Анализ рынка решений для отслеживания и контроля в Европе

Отслеживание и прослеживание лекарств для повышения доступности продуктов в цепочке поставок рецептурных препаратов не является новым явлением. На самом деле концепция сериализации обсуждается уже более 15 лет. В 1999 году после исследования Медицинского колледжа США президент Билл Клинтон включил защиту пациентов (включая предотвращение ошибок при выдаче лекарств) в повестку дня федерального правительства и продолжил выступать за реформу после своего президентства. В 2003 году Управление по контролю за продуктами и лекарствами США (FDA) потребовало штрихкодирования на уровне единиц, и в том же году Всемирная организация здравоохранения (ВОЗ) опубликовала исследование, в котором подчеркивались масштабы проблемы поддельных лекарств, утверждая, что 10% лекарств во всем мире были поддельными. Значительный сдвиг в сериализации произошел около 2005 года, и ряд стран начали устанавливать цели для ее принятия. Однако после принятия ряда мер по защите цепочки поставок эта проблема стала менее актуальной после финансового кризиса 2008 года.

По мере изменения мировой экономики фокус постепенно смещался. Турция приняла стандарты сериализации в 2010 году, и правила действуют для других рынков, таких как Китай, Южная Корея и Индия. С вступлением в силу Директивы ЕС о фальсифицированных лекарственных средствах (FMD) в феврале 2019 года и принятием США законодательства в рамках Закона о безопасности цепочки поставок лекарств (DSCSA) в ноябре 2017 года более 75% европейских лекарств должны быть защищены той или иной формой правил мониторинга и отслеживания к 2019 году. Рынок решений для отслеживания и отслеживания имеет большое значение в различных отраслях, начиная от фармацевтической промышленности и заканчивая медицинскими приборами, продуктами питания и напитками и многими другими.

Рост спроса на решения по отслеживанию и прослеживанию в медицинских учреждениях обусловлен строгими законами, разработанными для сериализации и маркировки, что приводит к прибыльному росту решений по отслеживанию и прослеживанию на рынке. Обширный портфель продуктов с огромными возможностями почти для всех основных отраслей, таких как производство продуктов питания и напитков, косметики и медицинских приборов, среди прочего, еще больше стимулирует рост решений по отслеживанию и прослеживанию на европейском рынке решений по отслеживанию и прослеживанию.

Размер рынка решений для отслеживания и контроля в Европе

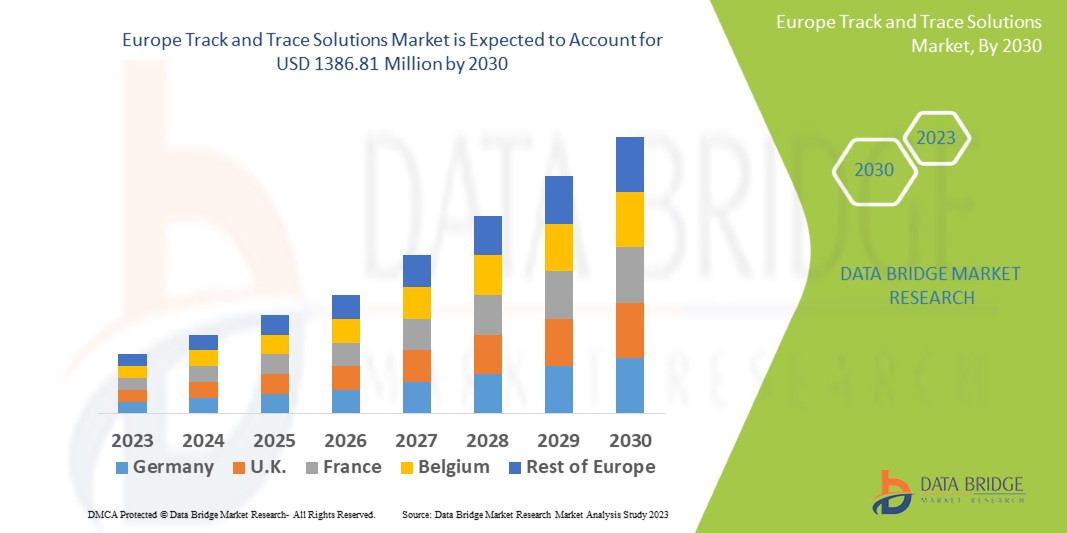

Объем европейского рынка решений для отслеживания и прослеживания оценивался в 1,60 млрд долларов США в 2024 году и, по прогнозам, достигнет 6,34 млрд долларов США к 2032 году со среднегодовым темпом роста 18,8% в прогнозируемый период с 2025 по 2032 год. Помимо информации о рыночных сценариях, таких как рыночная стоимость, темпы роста, сегментация, географический охват и основные игроки, рыночные отчеты, подготовленные Data Bridge Market Research, также включают анализ импорта и экспорта, обзор производственных мощностей, анализ потребления продукции, анализ ценовых тенденций, сценарий изменения климата, анализ цепочки поставок, анализ цепочки создания стоимости, обзор сырья/расходных материалов, критерии выбора поставщиков, анализ PESTLE, анализ Портера и нормативную базу.

Тенденции европейского рынка решений для отслеживания и контроля

«Возросший спрос на прозрачность цепочки поставок»

Спрос на решения по отслеживанию и прослеживанию особенно высок из-за необходимости обеспечения безопасности пациентов, целостности продукции и соответствия нормативным требованиям. Технологии отслеживания и прослеживания помогают контролировать перемещение фармацевтических продуктов, медицинских приборов и вакцин по всей цепочке поставок, сводя к минимуму риск поддельных лекарств и гарантируя, что продукты хранятся и транспортируются в надлежащих условиях. Кроме того, с ростом потребности в персонализированной медицине и большей подотчетности в здравоохранении эти решения позволяют поставщикам медицинских услуг отслеживать продукты от производства до конечного использования, гарантируя, что они безопасно и эффективно дойдут до нужных пациентов. Регулирующие органы, такие как FDA, требуют строгих мер прослеживаемости, что делает системы отслеживания и прослеживания неотъемлемой частью операций здравоохранения.

Область применения отчета и сегментация рынка решений для отслеживания и контроля в Европе

|

Атрибуты |

Европейский рынок решений для отслеживания и контроля. Анализ рынка. |

|

Охваченные сегменты |

|

|

Охваченный регион |

Германия, Великобритания, Франция, Италия, Испания, Швейцария, Россия, Турция, Бельгия, Нидерланды, Дания, Польша, Швеция, Норвегия, Финляндия и остальные страны Европы |

|

Ключевые игроки рынка |

SAP SE (Германия), Zebra Technologies Corp. (США), Videojet Technologies, Inc. (США), METTLER TOLEDO (США), Tracelink Inc. (США), Siemens (Германия), Domino Printing Sciences plc (Великобритания), Laetus GmbH (Германия), Xyntek Incorporated (США), IBM Corporation (США), WIPOTEC-OCS GmbH (Германия), 3Keys (Германия), ACG (Индия), NJM Packaging Inc. (США), OPTEL GROUP (Канада), Systech (Индия), Robert Bosch Manufacturing Solutions GmbH (Германия), ANTARES VISION SpA (Италия), Uhlmann (Индия), SEA VISION Srl (Италия), Jekson Vision (Индия), Kevision Systems (Индия), Arvato Systems (Германия), Grant-Soft Ltd. (Турция), PharmaSecure Inc. (США), Axyway (Франция), SL Controls Ltd. (США) и среди другие |

|

Возможности рынка |

Расширение в Европе Торговля |

|

Информационные наборы данных с добавленной стоимостью |

Помимо информации о рыночных сценариях, таких как рыночная стоимость, темпы роста, сегментация, географический охват и основные игроки, рыночные отчеты, подготовленные Data Bridge Market Research, также включают анализ импорта и экспорта, обзор производственных мощностей, анализ потребления продукции, анализ ценовых тенденций, сценарий изменения климата, анализ цепочки поставок, анализ цепочки создания стоимости, обзор сырья и расходных материалов, критерии выбора поставщиков, анализ PESTLE, анализ Портера и нормативную базу. |

Определение рынка решений для отслеживания и контроля в Европе

Метод определения настоящего и исторического положения (и другой информации) конкретного объекта или собственности включает хранение и транспортировку нескольких видов предметов, мониторинг и отслеживание или трассировку. Это определение может сопровождаться оценкой и регистрацией местоположения автомобилей и контейнеров, например, записанных в базу данных в реальном времени. Этот метод оставляет проблему составления связного описания соответствующих заметок о ходе работ. Отслеживание и трассировка означает привязку машин к ИТ и обмен данными на всех уровнях. Это включает в себя мощные модули аппаратных средств или автономные системы. Основная цель решений по отслеживанию и трассировке — сократить цепочку контрафактных лекарств и поддельных продуктов по всему миру и обеспечить бесперебойный поток и прослеживаемость товаров в каждой точке.

Динамика рынка решений для отслеживания и контроля в Европе

Драйверы

- Строгие правила и стандарты внедрения сериализации

Появление обязательной сериализации полностью преобразило фармацевтический рынок. С введением в действие Закона США о безопасности цепочки поставок лекарственных средств (DSCSA) и Директивы Азиатско-Тихоокеанского союза о фальсифицированных лекарственных средствах (FMD) цепочка поставок фармацевтических препаратов навсегда связана с сериализованными продуктами и данными. Если смотреть глубже, успешная программа сериализации подразумевает гораздо больше, чем просто размещение серийных номеров на упаковке. Правила различаются от рынка к рынку и могут часто меняться, а это значит, что специалисты по регулированию должны быть готовы корректировать процедуры, процессы и документы, чтобы идти в ногу со временем. Поскольку закон о маркировке и сериализации лекарственных средств появился сравнительно недавно, он подвержен большей сложности в Азиатско-Тихоокеанском регионе и меняется чаще, чем другие правила. Более того, поскольку цепочка поставок подлинных фармацевтических препаратов стала длиннее, это создает возможности для фальсификаторов на каждом этапе цепочки поставок. Следовательно, для защиты товаров вводятся строгие правила и стандартизация.

- В июле 2024 года, согласно статье, опубликованной Управлением по контролю за продуктами питания и лекарственными средствами, Закон о безопасности цепочки поставок лекарств (DSCSA) предписывает электронную идентификацию и отслеживание рецептурных препаратов на уровне упаковки, чтобы предотвратить попадание вредных препаратов в цепочку поставок США. Это строгое регулирование обуславливает необходимость в передовых решениях по отслеживанию и прослеживанию для обеспечения соответствия, защиты пациентов и быстрого реагирования на угрозы, тем самым выступая в качестве ключевого драйвера для рынка Азиатско-Тихоокеанского региона

- В феврале 2022 года, согласно статье, опубликованной Программой USAID по цепочке поставок в сфере здравоохранения в Азиатско-Тихоокеанском регионе, Государственное управление по контролю за продуктами питания и лекарственными средствами Китая ввело обязательную сериализацию для 502 фармацевтических препаратов из списка основных лекарственных средств, гарантируя прослеживаемость и подлинность. Это строгое регулирование повышает спрос на решения по отслеживанию и контролю для соответствия требованиям сериализации. В результате оно выступает в качестве ключевого драйвера для рынка Азиатско-Тихоокеанского региона, подталкивая к более широкому внедрению передовых технологий отслеживания

Проблема лекарств и фальсификации лекарств была проблемой Азиатско-Тихоокеанского региона на протяжении десятилетий. Подпитываемое незащищенными физическими и кибер-цепочками поставок Азиатско-Тихоокеанского региона, интернет-продажами и минимальными штрафами, правительство и различные фармацевтические компании по всему миру считают, что внедрение сериализации может уменьшить и остановить проблемы, связанные с подделкой. Это делает строгие правила и стандарты внедрения сериализации движущей силой для рынка решений по отслеживанию и прослеживанию Азиатско-Тихоокеанского региона.

- Растущие опасения по поводу подделок

Растущая обеспокоенность по поводу контрафактной продукции стала серьезной проблемой, особенно в фармацевтическом и медицинском секторах, где наличие поддельных лекарств может иметь серьезные последствия для здоровья и безопасности пациентов. Поддельные лекарства не только подрывают целостность системы здравоохранения, но и увеличивают риски побочных эффектов, лекарственной устойчивости и неудач лечения. В ответ на эту растущую угрозу регулирующие органы и заинтересованные стороны отрасли настаивают на более строгих мерах прослеживаемости и сериализации. Эти меры помогают гарантировать подлинность продукции, позволяя производителям, дистрибьюторам и розничным торговцам отслеживать перемещение товаров по всей цепочке поставок. Такие технологии, как RFID, штрихкодирование и блокчейн, все чаще используются для борьбы с подделками, позволяя контролировать и проверять продукцию на каждом этапе цепочки поставок, от производства до конечного потребителя. С расширением глобальной торговли и усложнением цепочек поставок риск выхода контрафактной продукции на рынки стал более выраженным, что еще больше обусловливает необходимость в усовершенствованных системах прослеживаемости. Повышенное понимание рисков контрафактной продукции является ключевым фактором развития мирового рынка решений по отслеживанию и контролю, поскольку предприятия и правительства ищут надежные системы для аутентификации продукции, обеспечения соблюдения нормативных требований и защиты потребителей от потенциально опасных контрафактных товаров.

Например,

- В мае 2024 года, согласно статье, опубликованной Управлением по контролю за продуктами и лекарствами, поддельные лекарства, которые могут содержать неправильные, недостаточные или вредные ингредиенты, представляют серьезную опасность для здоровья, будучи ложно продаваемыми как подлинные. Эта растущая обеспокоенность по поводу безопасности и эффективности фармацевтических препаратов стимулирует принятие решений по отслеживанию и прослеживанию для обеспечения подлинности продукции. В результате растущая обеспокоенность по поводу поддельных продуктов выступает в качестве существенного драйвера для мирового рынка решений по отслеживанию и прослеживанию

- В октябре 2024 года, согласно статье, опубликованной Science Direct, фальсифицированные и контрафактные лекарства, особенно в международных поездках, представляют серьезную угрозу общественному здоровью. С ростом числа зарегистрированных случаев во всем мире значительно возросли опасения по поводу распространения контрафактных лекарств. Это привело к большей потребности в системах прослеживаемости для обеспечения подлинности продукции. В результате растущая обеспокоенность по поводу контрафактных лекарств выступает в качестве ключевого фактора для мирового рынка решений по отслеживанию и прослеживанию

Опасения по поводу контрафактной продукции, особенно в фармацевтической и медицинской отраслях, стали серьезной проблемой из-за потенциального вреда, который поддельные лекарства могут нанести пациентам. Поддельные лекарства могут привести к неэффективному лечению и рискам для здоровья, что приводит к росту спроса на решения по отслеживанию. Используя такие технологии, как RFID, штрихкоды и блокчейн, компании могут отслеживать продукты по всей цепочке поставок, чтобы гарантировать их подлинность. По мере усложнения глобальных цепочек поставок возрастает риск попадания на рынок контрафактных товаров, что обусловливает необходимость в более надежных системах отслеживания. Этот спрос на безопасные и надежные решения по отслеживанию выступает в качестве основного драйвера для мирового рынка решений по отслеживанию и прослеживанию.

Возможности

- Рост в секторе электронной коммерции

Быстрый рост сектора электронной коммерции представляет существенную возможность для рынка решений для отслеживания и прослеживания в Азиатско-Тихоокеанском регионе из-за растущей сложности и масштаба операций онлайн-ритейла. Поскольку все больше потребителей переходят на онлайн-покупки, предприятиям необходимо обеспечить эффективность и прозрачность своих логистических и цепочных процессов поставок. Решения для отслеживания и прослеживания облегчают мониторинг в реальном времени уровней запасов, статуса отгрузки и процессов доставки, позволяя компаниям предоставлять клиентам точную информацию об их заказах. Этот повышенный уровень прозрачности повышает доверие клиентов и улучшает общий опыт покупок, делая компании электронной коммерции более конкурентоспособными на переполненном рынке.

Например,

- В июле 2024 года, согласно статье «Влияние электронной коммерции на логистику: адаптация к спросу», опубликованной в Marketplace Digest, внедрение передовых решений для отслеживания и видимости улучшает решения для отслеживания и видимости, которые имеют решающее значение для удовлетворения потребностей электронной коммерции. Технология отслеживания в реальном времени позволяет перевозчикам предоставлять точные оценки и обновления доставки, повышая прозрачность и доверие клиентов

- В апреле 2023 года, согласно статье «Определение преимуществ, проблем и путей развития в отраслях электронной коммерции, опубликованной в ScienceDirect: интегрированная двухэтапная модель принятия решений», за последнее десятилетие отрасль электронной коммерции значительно выросла, поскольку она фокусируется на удобстве и доступности, что привело к всплеску популярности онлайн-покупок, и все большее число потребителей отдают предпочтение именно им.

Более того, с ростом электронной коммерции растет риск таких проблем, как кража, мошенничество и поддельные товары, что требует надежных систем отслеживания и прослеживания, которые могут смягчить эти проблемы. Внедрение передовых технологий, таких как RFID, блокчейн и автоматизированные системы отслеживания, позволяет предприятиям электронной коммерции поддерживать целостность своих продуктов от склада до доставки. Эти решения также позволяют предприятиям соблюдать нормативные требования и отраслевые стандарты, связанные с подотчетностью и безопасностью продукции. По мере дальнейшего расширения электронной коммерции спрос на надежные решения для отслеживания и прослеживания будет расти, создавая значительные рыночные возможности для поставщиков таких технологий.

- Расширение мировой торговли

Расширение мировой торговли создает значительные возможности для мирового рынка решений для отслеживания и прослеживания, обусловленные растущей сложностью цепочек поставок, пересекающих международные границы. Поскольку компании все больше полагаются на глобальные сети для получения материалов и распространения своей продукции, потребность в эффективных системах отслеживания становится первостепенной. Решения для отслеживания и прослеживания позволяют компаниям отслеживать поставки в режиме реального времени, обеспечивая прозрачность и эффективность на протяжении всего логистического процесса. Эта возможность повышает операционную эффективность и помогает организациям соблюдать международные правила и стандарты, что приводит к большему доверию между партнерами и клиентами. Поскольку мировая торговля продолжает расширяться, спрос на сложные технологии отслеживания, которые могут обрабатывать различные нормативные требования и обеспечивать видимость в нескольких юрисдикциях, вероятно, резко возрастет.

Например,

- Согласно статье, опубликованной на Всемирном экономическом форуме, в мае 2024 года ожидается, что мировая торговля товарами и услугами вырастет на 2,3% в этом году и на 3,3% в 2025 году, что более чем вдвое превышает рост в 1%, наблюдавшийся в 2023 году.

Более того, рост электронной коммерции и онлайн-ритейла еще больше ускорил спрос на решения по отслеживанию и прослеживанию, поскольку потребители ожидают своевременных поставок и прозрачности в отношении своих заказов. Поскольку по всему миру перевозятся огромные объемы товаров, предприятиям нужны надежные системы для точного отслеживания своих запасов и поставок. Этот спрос стимулировал инновации на рынке отслеживания и прослеживания, поощряя развитие передовых технологий, таких как блокчейн, IoT и искусственный интеллект. Эти инновации расширяют возможности решений по отслеживанию и прослеживанию и предлагают возможность выделиться на переполненном рынке. Поскольку мировая торговля продолжает расти и развиваться, рынок решений по отслеживанию и прослеживанию готов извлечь выгоду из этой тенденции, предоставляя необходимые инструменты, которые помогают предприятиям ориентироваться в сложностях современного управления цепочками поставок, одновременно удовлетворяя требования потребителей к прозрачности и подотчетности.

Ограничения/Проблемы

- Риски, связанные с загрязнением образцов

Проблемы безопасности данных и конфиденциальности представляют собой значительную проблему для рынка решений для отслеживания и прослеживания в Азиатско-Тихоокеанском регионе, поскольку эти системы часто включают сбор, хранение и передачу конфиденциальной информации. Это может включать персональные данные, сведения о продуктах и информацию о цепочке поставок, которые, если их не защитить должным образом, представляют риски как для потребителей, так и для предприятий. Нарушения безопасности данных могут привести к финансовым потерям, репутационному ущербу и юридическим последствиям, особенно в свете все более строгих правил, таких как GDPR в Азиатско-Тихоокеанском регионе и различные законы о защите данных в Азиатско-Тихоокеанском регионе. Поскольку организации внедряют технологии отслеживания и прослеживания, они должны обеспечить надежные меры безопасности, что может увеличить затраты и усложнить процесс развертывания, потенциально удерживая компании от принятия этих решений.

Например,

- В августе 2024 года, согласно статье «Основные проблемы внедрения решений по отслеживанию и прослеживанию в управлении цепочками поставок», опубликованной Shriram Veritech Solutions Pvt. Ltd., при внедрении решений по отслеживанию и прослеживанию предприятия обрабатывают огромное количество конфиденциальных данных, включая конфиденциальную информацию, данные клиентов и отслеживание местоположения в реальном времени. Системы отслеживания и прослеживания уязвимы для кибератак.

Более того, растет осведомленность потребителей о конфиденциальности данных, что приводит к более пристальному вниманию к компаниям, которые обрабатывают персональные данные. Организации находятся под давлением, чтобы демонстрировать соответствие правилам защиты данных и укреплять доверие со своими клиентами. Если компании не могут с уверенностью заверить заинтересованные стороны в своей способности защищать данные, они рискуют потерять долю рынка и столкнуться с негативной реакцией потребителей. Такая атмосфера беспокойства может ограничить готовность компаний в полной мере инвестировать и внедрять передовые решения для отслеживания и прослеживания, которые могут потребовать обширной обработки данных. Следовательно, рынок может демонстрировать более медленный рост, поскольку организации будут преодолевать эти сложности, стремясь сбалансировать преимущества расширенных возможностей отслеживания с необходимостью сохранения конфиденциальности и безопасности данных.

- Повреждение меток отслеживания во время доставки

Повреждение меток отслеживания во время доставки существенно влияет на эффективность решений по отслеживанию и прослеживанию на мировом рынке. Когда метки отслеживания, такие как RFID-метки или штрихкоды, повреждаются во время транспортировки, это приводит к неточности данных, потере видимости продукта и задержкам в отслеживании. Это ставит под угрозу надежность операций цепочки поставок, особенно в отраслях, которые зависят от точного перемещения продукта и соответствия требованиям. Например, в фармацевтическом секторе поврежденные метки нарушают критически важные процессы прослеживаемости, увеличивая риск поддельной продукции и несоблюдения нормативных требований. Такие проблемы приводят к неэффективности, более высоким эксплуатационным расходам и снижению доверия клиентов, что является существенным ограничением на мировом рынке решений по отслеживанию и прослеживанию.

Например,

- В августе 2024 года, согласно статье, опубликованной encstorge.com, RFID-метки уязвимы к повреждениям во время доставки, вызванным такими факторами, как вода, чрезмерное тепло, химикаты или физический разрыв в чипе или антенных линиях. Понимание этих рисков имеет решающее значение для оптимизации производительности RFID в различных средах. Такие повреждения нарушают работу систем отслеживания и прослеживания, что приводит к неточностям и неэффективности, что является существенным сдерживающим фактором для роста мирового рынка

- В августе 2023 года, согласно статье, опубликованной Lexicon Tech Solutions, штрихкоды могут быть повреждены во время доставки из-за воздействия влаги, масел или шероховатых поверхностей, что приводит к таким проблемам, как смазывание или разрыв. Это повреждение делает штрихкод нечитаемым, нарушая процесс отслеживания. Такие проблемы с целостностью штрихкода могут привести к задержкам, неточностям и неэффективности в цепочках поставок, выступая в качестве существенного ограничения для мирового рынка решений для отслеживания и прослеживания

Повреждение меток отслеживания во время доставки снижает эффективность систем отслеживания и прослеживания на мировом рынке. Поврежденные метки RFID или штрихкоды приводят к ошибкам отслеживания, потере видимости и задержкам, что влияет на точность цепочки поставок. В таких секторах, как фармацевтика, это нарушает соответствие и прослеживаемость, что приводит к неэффективности, более высоким затратам и снижению доверия, что сдерживает рост рынка.

Сфера применения европейского рынка решений для отслеживания и контроля

Рынок сегментирован на основе продукта, решения, приложения, технологии, конечного пользователя и канала сбыта. Рост среди этих сегментов поможет вам проанализировать сегменты с незначительным ростом в отраслях и предоставить пользователям ценный обзор рынка и рыночные идеи, которые помогут им принимать стратегические решения для определения основных рыночных приложений.

Продукт

- Компоненты программного обеспечения

- Управляющий заводом

- Контроллер линии

- Менеджер предприятия и сети

- Отслеживание посылки

- Отслеживание дел

- Менеджер по складу и отгрузке

- Отслеживание поддонов

- Другие

- Аппаратные компоненты

- Печать и маркировка

- Сканер штрих-кода

- Мониторинг и проверка

- Этикетировщик

- Контрольные весы

- Считыватель RFID

- Другие

- Автономная платформа

Решение

- Сериализация на уровне строки и сайта

- Прослеживаемость на уровне предприятия в облаке

- Решение для дистрибуции и складирования

- Сеть обмена данными о цепочке поставок

- Другие

Приложение

- Сериализация

- Сериализация картонных коробок

- Сериализация бутылок

- Сериализация медицинских приборов

- Сериализация флаконов и ампул

- Сериализация блистера

- Печать

- Проверка маркировки и упаковки

- Агрегация

- Агрегация пакетов

- Агрегация случаев

- Агрегация поддонов

- Отслеживание

- Трассировка

- Отчетность

Технологии

- 2D штрих-коды

- Радиочастотная идентификация (Rfid)

- Линейные/1D штрихкоды

Конечный пользователь

- Фармацевтические и биофармацевтические компании

- Упакованные потребительские товары

- Предметы роскоши

- Еда и напитки

- Компании по производству медицинского оборудования

- Организации контрактного производства

- Переупаковщики

- Косметические компании

- Другие

Канал распространения

- Прямые продажи

- Сторонние дистрибьюторы

Региональный анализ европейского рынка решений для отслеживания и контроля

Проводится анализ рынка и предоставляются сведения о его размере и тенденциях по стране, продукту, решению, приложению, технологии, конечному пользователю и каналу сбыта, как указано выше.

Страны, на которые распространяется действие рынка: Германия, Великобритания, Франция, Италия, Испания, Швейцария, Россия, Турция, Бельгия, Нидерланды, Дания, Польша, Швеция, Норвегия, Финляндия и остальные страны Европы.

Германия лидирует по темпам роста благодаря сильным промышленным секторам, соблюдению нормативных требований и технологическим достижениям в области сериализации и прослеживаемости.

Великобритания доминирует за счет развитых отраслей фармацевтики, здравоохранения и логистики, раннего внедрения сериализации и строгого соблюдения нормативных требований.

Раздел отчета по странам также содержит отдельные факторы, влияющие на рынок, и изменения в регулировании на внутреннем рынке, которые влияют на текущие и будущие тенденции рынка. Такие данные, как анализ цепочки создания стоимости вверх и вниз по течению, технические тенденции и анализ пяти сил Портера, тематические исследования, являются некоторыми из указателей, используемых для прогнозирования рыночного сценария для отдельных стран. Кроме того, при предоставлении прогнозного анализа данных по странам учитываются наличие и доступность европейских брендов и их проблемы из-за большой или малой конкуренции со стороны местных и отечественных брендов, влияние внутренних тарифов и торговых путей.

Доля рынка решений для отслеживания и контроля в Европе

Конкурентная среда рынка содержит сведения о конкурентах. Включены сведения о компании, финансы компании, полученный доход, рыночный потенциал, инвестиции в исследования и разработки, новые рыночные инициативы, присутствие в Европе, производственные площадки и объекты, производственные мощности, сильные и слабые стороны компании, запуск продукта, широта и широта продукта, доминирование приложений. Приведенные выше данные относятся только к фокусу компаний на рынке.

Лидерами европейского рынка решений для отслеживания и контроля являются:

- SAP SE (Германия)

- Zebra Technologies Corp. (США)

- Videojet Technologies, Inc. (США)

- МЕТТЛЕР ТОЛЕДО (США)

- Tracelink Inc. (США)

- Сименс (Германия)

- Domino Printing Sciences plc (Великобритания)

- Laetus GmbH (Германия)

- Xyntek Incorporated (США)

- Корпорация IBM (США)

- WIPOTEC-OCS GmbH (Германия)

- 3Keys (Германия)

- ACG (Индия)

- NJM Packaging Inc. (США)

- OPTEL GROUP (Канада)

- Systech (Индия)

- Robert Bosch Manufacturing Solutions GmbH (Германия)

- ANTARES VISION SpA (Италия)

- Ульманн (Индия)

- SEA VISION Srl (Италия)

- Jekson Vision (Индия)

- Kevision Systems (Индия)

- Arvato Systems (Германия)

- Grant-Soft Ltd. (Турция)

- PharmaSecure Inc. (США)

- Axyway (Франция)

- SL Controls Ltd. (США)

Последние разработки на европейском рынке решений для отслеживания и контроля

- В мае 2024 года компания Videojet выпустила лазер CO2 3350 мощностью 30 Вт, предназначенный для высококачественной и постоянной маркировки различных материалов. Это передовое лазерное решение повышает эффективность работы и сокращает время простоя благодаря надежной и высокоскоростной работе. Оно особенно подходит для отраслей, требующих точной маркировки, таких как пищевая промышленность, производство напитков и фармацевтика.

- В мае 2019 года METTLER TOLEDO открыла свой новый испытательный центр по проверке продукции для европейских производителей продуктов питания и фармацевтики в Барселоне. Этот новый испытательный центр, открытый компанией, повысил ее авторитет на рынке, что привело к увеличению спроса и продаж ее продукции в будущем.

- В феврале 2020 года ACG представила инновационную платформу бренда на основе блокчейна. Эта новая платформа, представленная компанией, увеличит ее спрос на рынке

- В ноябре 2019 года ACG представила серию NXT — это машины, готовые к будущему, которые обеспечат нашим клиентам интеллектуальный опыт пользователя. В серию NXT входят машины Protab 300 NXT, Protab 700 NXT, BMax NXT, KartonX NXT, Verishield CS18 NXT на выставке PMEC 2019. Эти новые продукты, выпущенные ACG, увеличат спрос на их продукцию на рынке.

- В июле 2020 года Axyway получила как AWS Healthcare Competency, так и AWS Life Sciences Competency от Amazon Web Services (AWS) за свои решения, используемые в различных отраслях. Это признание, полученное компанией, повысит ее авторитет на рынке

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Интерактивная панель анализа данных

- Панель анализа компании для возможностей с высоким потенциалом роста

- Доступ аналитика-исследователя для настройки и запросов

- Анализ конкурентов с помощью интерактивной панели

- Последние новости, обновления и анализ тенденций

- Используйте возможности сравнительного анализа для комплексного отслеживания конкурентов

Содержание

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF EUROPE TRACK AND TRACE SOLUTIONS MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 MULTIVARIATE MODELLING

2.7 MARKET APPLICATION COVERAGE GRID

2.8 PRODUCTS LIFELINE CURVE

2.9 DBMR MARKET POSITION GRID

2.1 VENDOR SHARE ANALYSIS

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTAL ANALYSIS

4.2 PORTERS FIVE FORCES ANALYSIS

5 EUROPE TRACK & TRACE SOLUTIONS MARKET: REGULATIONS

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 STRINGENT REGULATIONS & STANDARDS FOR THE IMPLEMENTATION OF SERIALIZATION

6.1.2 RISING COUNTERFEIT CONCERNS

6.1.3 TECHNOLOGICAL ADVANCEMENTS IN TRACK AND TRACE SOLUTIONS

6.1.4 COMPLEXITY IN EUROPE SUPPLY CHAIN

6.2 RESTRAINTS

6.2.1 RESISTANCE FROM SMALL BUSINESSES

6.2.2 DAMAGE TO TRACKING TAGS DURING DELIVERY

6.3 OPPORTUNITIES

6.3.1 GROWTH IN THE E-COMMERCE SECTOR

6.3.2 INCREASING FOCUS ON DATA ANALYTICS

6.3.3 EXPANSION IN EUROPE TRADE

6.4 CHALLENGES

6.4.1 HIGH IMPLEMENTATION COSTS

6.4.2 DATA SECURITY AND PRIVACY CONCERNS

7 EUROPE TRACK AND TRACE SOLUTIONS MARKET, BY PRODUCTS

7.1 OVERVIEW

7.2 SOFTWARE COMPONENTS

7.2.1.1 PLANT MANAGER

7.2.1.2 ENTERPRISE & NETWORK MANAGER

7.2.1.3 BUNDLE TRACKING

7.2.1.4 PALLET TRACKING

7.2.1.5 CASE TRACKING

7.2.1.6 WAREHOUSE & SHIPMENT MANAGER

7.2.1.7 LINE CONTROLLER

7.2.1.8 OTHERS

7.3 HARDWARE COMPONENTS

7.3.1.1 PRINTING & MARKING

7.3.1.2 LABELER

7.3.1.3 BARCODE SCANNER

7.3.1.4 RFID READER

7.3.1.5 CHECKWEIGHER

7.3.1.6 MONITORING & VERIFICATION

7.3.1.7 OTHERS

7.4 STANDALONE PLATFORMS

8 EUROPE TRACK AND TRACE SOLUTIONS MARKET, BY SOLUTION

8.1 OVERVIEW

8.2 LINE & SITE LEVEL SERIALIZATION

8.3 CLOUD ENTERPRISE-LEVEL TRACEABILITY

8.4 DISTRIBUTION & WAREHOUSE SOLUTION

8.5 SUPPLY CHAIN DATA-SHARING NETWORK

8.6 OTHERS

9 EUROPE TRACK AND TRACE SOLUTIONS MARKET, BY TECHNOLOGY

9.1 OVERVIEW

9.2 2D BARCODES

9.3 RADIOFREQUENCY IDENTIFICATION (RFID)

9.4 LINEAR/1D BARCODESS

10 EUROPE TRACK AND TRACE SOLUTIONS MARKET, BY APPLICATION

10.1 OVERVIEW

10.2 SERIALIZATION

10.3 PRINTING

10.4 LABELING & PACKAGING INSPECTION

10.5 AGGREGATION

10.6 TRACKING

10.7 TRACING

10.8 REPORTING

11 EUROPE TRACK AND TRACE SOLUTIONS MARKET, BY END USER

11.1 OVERVIEW

11.2 PHARMACEUTICAL & BIOPHARMACEUTICAL COMPANIE

11.3 CONSUMER PACKAGED GOODS

11.4 LUXURY GOODS

11.5 FOOD & BEVERAGE

11.6 MEDICAL DEVICE COMPANIES

11.7 CONTRACT MANUFACTURING ORGANIZATIONS

11.8 REPACKAGERS

11.9 COSMETICS COMPANIES

11.1 OTHERS

12 EUROPE TRACK AND TRACE SOLUTIONS MARKET, BY DISTRIBUTION CHANNEL

12.1 OVERVIEW

12.2 DIRECT SALES

12.3 THIRD PARTY DISTRIBUTORS

13 EUROPE TRACK AND TRACE SOLUTIONS MARKET

13.1 EUROPE

13.1.1 GERMANY

13.1.2 U.K.

13.1.3 FRANCE

13.1.4 ITALY

13.1.5 SWITZERLAND

13.1.6 SPAIN

13.1.7 NETHERLANDS

13.1.8 BELGIUM

13.1.9 TURKEY

13.1.10 RUSSIA

13.1.11 REST OF EUROPE

14 EUROPE TRACK AND TRACE SOLUTIONS MARKET: COMPANY LANDSCAPE

14.1 COMPANY SHARE ANALYSIS: EUROPE

15 SWOT ANALYSIS

16 COMPANY PROFILE

16.1 SAP SE

16.1.1 COMPANY SNAPSHOT

16.1.2 REVENUE ANALYSIS

16.1.3 COMPANY SHARE ANALYSIS

16.1.4 PRODUCT PORTFOLIO

16.1.5 RECENT DEVELOPMENT

16.2 ZEBRA TECHNOLOGIES CORP.

16.2.1 COMPANY SNAPSHOT

16.2.2 REVENUE ANALYSIS

16.2.3 COMPANY SHARE ANALYSIS

16.2.4 PRODUCT PORTFOLIO

16.2.5 RECENT DEVELOPMENT

16.3 TRACELINK INC.

16.3.1 COMPANY SNAPSHOT

16.3.2 COMPANY SHARE ANALYSIS

16.3.3 PRODUCT PORTFOLIO

16.3.4 RECENT DEVELOPMENTS

16.4 VIDEOJET TECHNOLOGIES, INC.

16.4.1 COMPANY SNAPSHOT

16.4.2 COMPANY SHARE ANALYSIS

16.4.3 PRODUCT PORTFOLIO

16.4.4 RECENT DEVELOPMENT

16.5 METTLER TOLEDO

16.5.1 COMPANY SNAPSHOT

16.5.2 REVENUE ANALYSIS

16.5.3 COMPANY SHARE ANALYSIS

16.5.4 PRODUCT PORTFOLIO

16.5.5 RECENT DEVELOPMENT

16.6 ACG

16.6.1 COMPANY SNAPSHOT

16.6.2 PRODUCT PORTFOLIO

16.6.3 RECENT DEVELOPMENTS

16.7 AXYWAY

16.7.1 COMPANY SNAPSHOT

16.7.2 REVENUE ANALYSIS

16.7.3 PRODUCT PORTFOLIO

16.7.4 RECENT DEVELOPMENT

16.8 ANTARES VISION S.P.A.

16.8.1 COMPANY SNAPSHOT

16.8.2 REVENUE ANALYSIS

16.8.3 PRODUCT PORTFOLIO

16.8.4 RECENT DEVELOPMENTS

16.9 ARVATO SYSTEMS

16.9.1 COMPANY SNAPSHOT

16.9.2 PRODUCT PORTFOLIO

16.9.3 RECENT DEVELOPMENT

16.1 DOMINO PRINTING SCIENCES PLC

16.10.1 COMPANY SNAPSHOT

16.10.2 PRODUCT PORTFOLIO

16.10.3 RECENT DEVELOPMENTS

16.11 GRANT-SOFT LTD.

16.11.1 COMPANY SNAPSHOT

16.11.2 PRODUCT PORTFOLIO

16.11.3 RECENT DEVELOPMENT

16.12 IBM CORPORATION

16.12.1 COMPANY SNAPSHOT

16.12.2 REVENUE ANALYSIS

16.12.3 PRODUCT PORTFOLIO

16.12.4 RECENT DEVELOPMENT

16.13 JEKSON VISION

16.13.1 COMPANY SNAPSHOT

16.13.2 PRODUCT PORTFOLIO

16.13.3 RECENT DEVELOPMENTS

16.14 3KEYS

16.14.1 COMPANY SNAPSHOT

16.14.2 REVENUE ANALYSIS

16.14.3 PRODUCT PORTFOLIO

16.14.4 RECENT DEVELOPMENT

16.15 KEVISION SYSTEMS

16.15.1 COMPANY SNAPSHOT

16.15.2 PRODUCT PORTFOLIO

16.15.3 RECENT DEVELOPMENT

16.16 LAETUS GMBH

16.16.1 COMPANY SNAPSHOT

16.16.2 PRODUCT PORTFOLIO

16.16.3 RECENT DEVELOPMENT

16.17 NJM PACKAGING INC.

16.17.1 COMPANY SNAPSHOT

16.17.2 PRODUCT PORTFOLIO

16.17.3 RECENT DEVELOPMENTS

16.18 OPTEL GROUP

16.18.1 COMPANY SNAPSHOT

16.18.2 PRODUCT PORTFOLIO

16.18.3 RECENT DEVELOPMENTS

16.19 PHARMADECURE INC.

16.19.1 COMPANY SNAPSHOT

16.19.2 PRODUCT PORTFOLIO

16.19.3 RECENT DEVELOPMENT

16.2 ROBERT BOSCH MANUFACTURING SOLUTIONS GMBH

16.20.1 COMPANY SNAPSHOT

16.20.2 PRODUCT PORTFOLIO

16.20.3 RECENT DEVELOPMENT

16.21 SEA VISION S.R.L.

16.21.1 COMPANY SNAPSHOT

16.21.2 REVENUE ANALYSIS

16.21.3 PRODUCT PORTFOLIO

16.21.4 RECENT DEVELOPMENT

16.22 SIEMENS

16.22.1 COMPANY SNAPSHOT

16.22.2 REVENUE ANALYSIS

16.22.3 PRODUCT PORTFOLIO

16.22.4 RECENT DEVELOPMENT

16.23 SL CONTROLS LTD

16.23.1 COMPANY SNAPSHOT

16.23.2 PRODUCT PORTFOLIO

16.23.3 RECENT DEVELOPMENT

16.24 SYSTECH

16.24.1 COMPANY SNAPSHOT

16.24.2 PRODUCT PORTFOLIO

16.24.3 RECENT DEVELOPMENTS

16.25 UHLMANN

16.25.1 COMPANY SNAPSHOT

16.25.2 PRODUCT PORTFOLIO

16.25.3 RECENT DEVELOPMENTS

16.26 WIPOTEC-OCS GMBH

16.26.1 COMPANY SNAPSHOT

16.26.2 PRODUCT PORTFOLIO

16.26.3 RECENT DEVELOPMENT

16.27 XYNTEK INCORPORATED

16.27.1 COMPANY SNAPSHOT

16.27.2 PRODUCT PORTFOLIO

16.27.3 RECENT DEVELOPMENT

17 QUESTIONNAIRE

18 RELATED REPORTS

Список таблиц

TABLE 1 EUROPE TRACK AND TRACE SOLUTIONS MARKET, BY PRODUCTS, 2018-2032 (USD THOUSAND)

TABLE 2 EUROPE SOFTWARE COMPONENTS IN TRACK AND TRACE SOLUTIONS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 3 EUROPE SOFTWARE COMPONENTS IN TRACK AND TRACE SOLUTIONS MARKET, BY PRODUCTS, 2018-2032 (USD THOUSAND)

TABLE 4 EUROPE HARDWARE COMPONENTS IN TRACK AND TRACE SOLUTIONS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 5 EUROPE HARDWARE COMPONENTS IN TRACK AND TRACE SOLUTIONS MARKET, BY PRODUCTS, 2018-2032 (USD THOUSAND)

TABLE 6 EUROPE STANDALONE PLATFORMS IN TRACK AND TRACE SOLUTIONS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 7 EUROPE TRACK AND TRACE SOLUTIONS MARKET, BY SOLUTION, 2018-2032 (USD THOUSAND)

TABLE 8 EUROPE LINE & SITE LEVEL SERIALIZATION IN TRACK AND TRACE SOLUTIONS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 9 EUROPE CLOUD ENTERPRISE-LEVEL TRACEABILITY IN TRACK AND TRACE SOLUTIONS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 10 EUROPE DISTRIBUTION & WAREHOUSE SOLUTION IN TRACK AND TRACE SOLUTIONS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 11 EUROPE SUPPLY CHAIN DATA-SHARING NETWORK IN TRACK AND TRACE SOLUTIONS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 12 EUROPE OTHERS IN TRACK AND TRACE SOLUTIONS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 13 EUROPE TRACK AND TRACE SOLUTIONS MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 14 EUROPE 2D BARCODES IN TRACK AND TRACE SOLUTIONS MARKET, BY REGION, 2018-2032(USD THOUSAND)

TABLE 15 EUROPE RADIOFREQUENCY IDENTIFICATION (RFID) IN TRACK AND TRACE SOLUTIONS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 16 EUROPE LINEAR/1D BARCODES IN TRACK AND TRACE SOLUTIONS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 17 EUROPE TRACK AND TRACE SOLUTIONS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 18 EUROPE SERIALIZATION IN TRACK AND TRACE SOLUTIONS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 19 EUROPE SERIALIZATION IN TRACK AND TRACE SOLUTIONS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 20 EUROPE PRINTING IN TRACK AND TRACE SOLUTIONS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 21 EUROPE LABELING & PACKAGING INSPECTION IN TRACK AND TRACE SOLUTIONS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 22 EUROPE AGGREGATION IN TRACK AND TRACE SOLUTIONS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 23 EUROPE AGGREGATION IN TRACK AND TRACE SOLUTIONS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 24 EUROPE TRACKING IN TRACK AND TRACE SOLUTIONS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 25 EUROPE TRACING IN TRACK AND TRACE SOLUTIONS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 26 EUROPE REPORTING IN TRACK AND TRACE SOLUTIONS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 27 EUROPE TRACK AND TRACE SOLUTIONS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 28 EUROPE PHARMACEUTICAL & BIOPHARMACEUTICAL COMPANIE IN TRACK AND TRACE SOLUTIONS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 29 EUROPE CONSUMER PACKAGED GOODS IN TRACK AND TRACE SOLUTIONS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 30 EUROPE LUXURY GOODS IN TRACK AND TRACE SOLUTIONS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 31 EUROPE FOOD & BEVERAGE IN TRACK AND TRACE SOLUTIONS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 32 EUROPE MEDICAL DEVICE COMPANIES IN TRACK AND TRACE SOLUTIONS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 33 EUROPE CONTRACT MANUFACTURING ORGANIZATIONS IN TRACK AND TRACE SOLUTIONS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 34 EUROPE REPACKAGERS IN TRACK AND TRACE SOLUTIONS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 35 EUROPE COSMETICS COMPANIES IN TRACK AND TRACE SOLUTIONS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 36 EUROPE OTHERS IN TRACK AND TRACE SOLUTIONS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 37 EUROPE TRACK AND TRACE SOLUTIONS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 38 EUROPE DIRECT SALES IN TRACK AND TRACE SOLUTIONS MARKET, BY REGION, 2018-2032(USD THOUSAND)

TABLE 39 EUROPE THIRD-PARTY DISTRIBUTORS IN TRACK AND TRACE SOLUTIONS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 40 EUROPE TRACK AND TRACE SOLUTIONS MARKET, BY COUNTRY, 2018-2032 (USD THOUSAND)

TABLE 41 EUROPE TRACK AND TRACE SOLUTIONS MARKET, BY PRODUCTS, 2018-2032 (USD THOUSAND)

TABLE 42 EUROPE SOFTWARE COMPONENTS IN TRACK AND TRACE SOLUTIONS MARKET, BY PRODUCTS, 2018-2032 (USD THOUSAND)

TABLE 43 EUROPE HARDWARE COMPONENTS IN TRACK AND TRACE SOLUTIONS MARKET, BY PRODUCTS, 2018-2032 (USD THOUSAND)

TABLE 44 EUROPE TRACK AND TRACE SOLUTIONS MARKET, BY SOLUTION, 2018-2032 (USD THOUSAND)

TABLE 45 EUROPE TRACK AND TRACE SOLUTIONS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 46 EUROPE SERIALIZATION IN TRACK AND TRACE SOLUTIONS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 47 EUROPE AGGREGATION IN TRACK AND TRACE SOLUTIONS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 48 EUROPE TRACK AND TRACE SOLUTIONS MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 49 EUROPE TRACK AND TRACE SOLUTIONS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 50 EUROPE TRACK AND TRACE SOLUTIONS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 51 GERMANY TRACK AND TRACE SOLUTIONS MARKET, BY PRODUCTS, 2018-2032 (USD THOUSAND)

TABLE 52 GERMANY SOFTWARE COMPONENTS IN TRACK AND TRACE SOLUTIONS MARKET, BY PRODUCTS, 2018-2032 (USD THOUSAND)

TABLE 53 GERMANY HARDWARE COMPONENTS IN TRACK AND TRACE SOLUTIONS MARKET, BY PRODUCTS, 2018-2032 (USD THOUSAND)

TABLE 54 GERMANY TRACK AND TRACE SOLUTIONS MARKET, BY SOLUTION, 2018-2032 (USD THOUSAND)

TABLE 55 GERMANY TRACK AND TRACE SOLUTIONS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 56 GERMANY SERIALIZATION IN TRACK AND TRACE SOLUTIONS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 57 GERMANY AGGREGATION IN TRACK AND TRACE SOLUTIONS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 58 GERMANY TRACK AND TRACE SOLUTIONS MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 59 GERMANY TRACK AND TRACE SOLUTIONS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 60 GERMANY TRACK AND TRACE SOLUTIONS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 61 U.K. TRACK AND TRACE SOLUTIONS MARKET, BY PRODUCTS, 2018-2032 (USD THOUSAND)

TABLE 62 U.K. SOFTWARE COMPONENTS IN TRACK AND TRACE SOLUTIONS MARKET, BY PRODUCTS, 2018-2032 (USD THOUSAND)

TABLE 63 U.K. HARDWARE COMPONENTS IN TRACK AND TRACE SOLUTIONS MARKET, BY PRODUCTS, 2018-2032 (USD THOUSAND)

TABLE 64 U.K. TRACK AND TRACE SOLUTIONS MARKET, BY SOLUTION, 2018-2032 (USD THOUSAND)

TABLE 65 U.K. TRACK AND TRACE SOLUTIONS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 66 U.K. SERIALIZATION IN TRACK AND TRACE SOLUTIONS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 67 U.K. AGGREGATION IN TRACK AND TRACE SOLUTIONS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 68 U.K. TRACK AND TRACE SOLUTIONS MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 69 U.K. TRACK AND TRACE SOLUTIONS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 70 U.K. TRACK AND TRACE SOLUTIONS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 71 FRANCE TRACK AND TRACE SOLUTIONS MARKET, BY PRODUCTS, 2018-2032 (USD THOUSAND)

TABLE 72 FRANCE SOFTWARE COMPONENTS IN TRACK AND TRACE SOLUTIONS MARKET, BY PRODUCTS, 2018-2032 (USD THOUSAND)

TABLE 73 FRANCE HARDWARE COMPONENTS IN TRACK AND TRACE SOLUTIONS MARKET, BY PRODUCTS, 2018-2032 (USD THOUSAND)

TABLE 74 FRANCE TRACK AND TRACE SOLUTIONS MARKET, BY SOLUTION, 2018-2032 (USD THOUSAND)

TABLE 75 FRANCE TRACK AND TRACE SOLUTIONS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 76 FRANCE SERIALIZATION IN TRACK AND TRACE SOLUTIONS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 77 FRANCE AGGREGATION IN TRACK AND TRACE SOLUTIONS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 78 FRANCE TRACK AND TRACE SOLUTIONS MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 79 FRANCE TRACK AND TRACE SOLUTIONS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 80 FRANCE TRACK AND TRACE SOLUTIONS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 81 ITALY TRACK AND TRACE SOLUTIONS MARKET, BY PRODUCTS, 2018-2032 (USD THOUSAND)

TABLE 82 ITALY SOFTWARE COMPONENTS IN TRACK AND TRACE SOLUTIONS MARKET, BY PRODUCTS, 2018-2032 (USD THOUSAND)

TABLE 83 ITALY HARDWARE COMPONENTS IN TRACK AND TRACE SOLUTIONS MARKET, BY PRODUCTS, 2018-2032 (USD THOUSAND)

TABLE 84 ITALY TRACK AND TRACE SOLUTIONS MARKET, BY SOLUTION, 2018-2032 (USD THOUSAND)

TABLE 85 ITALY TRACK AND TRACE SOLUTIONS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 86 ITALY SERIALIZATION IN TRACK AND TRACE SOLUTIONS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 87 ITALY AGGREGATION IN TRACK AND TRACE SOLUTIONS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 88 ITALY TRACK AND TRACE SOLUTIONS MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 89 ITALY TRACK AND TRACE SOLUTIONS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 90 ITALY TRACK AND TRACE SOLUTIONS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 91 SWITZERLAND TRACK AND TRACE SOLUTIONS MARKET, BY PRODUCTS, 2018-2032 (USD THOUSAND)

TABLE 92 SWITZERLAND SOFTWARE COMPONENTS IN TRACK AND TRACE SOLUTIONS MARKET, BY PRODUCTS, 2018-2032 (USD THOUSAND)

TABLE 93 SWITZERLAND HARDWARE COMPONENTS IN TRACK AND TRACE SOLUTIONS MARKET, BY PRODUCTS, 2018-2032 (USD THOUSAND)

TABLE 94 SWITZERLAND TRACK AND TRACE SOLUTIONS MARKET, BY SOLUTION, 2018-2032 (USD THOUSAND)

TABLE 95 SWITZERLAND TRACK AND TRACE SOLUTIONS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 96 SWITZERLAND SERIALIZATION IN TRACK AND TRACE SOLUTIONS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 97 SWITZERLAND AGGREGATION IN TRACK AND TRACE SOLUTIONS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 98 SWITZERLAND TRACK AND TRACE SOLUTIONS MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 99 SWITZERLAND TRACK AND TRACE SOLUTIONS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 100 SWITZERLAND TRACK AND TRACE SOLUTIONS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 101 SPAIN TRACK AND TRACE SOLUTIONS MARKET, BY PRODUCTS, 2018-2032 (USD THOUSAND)

TABLE 102 SPAIN SOFTWARE COMPONENTS IN TRACK AND TRACE SOLUTIONS MARKET, BY PRODUCTS, 2018-2032 (USD THOUSAND)

TABLE 103 SPAIN HARDWARE COMPONENTS IN TRACK AND TRACE SOLUTIONS MARKET, BY PRODUCTS, 2018-2032 (USD THOUSAND)

TABLE 104 SPAIN TRACK AND TRACE SOLUTIONS MARKET, BY SOLUTION, 2018-2032 (USD THOUSAND)

TABLE 105 SPAIN TRACK AND TRACE SOLUTIONS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 106 SPAIN SERIALIZATION IN TRACK AND TRACE SOLUTIONS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 107 SPAIN AGGREGATION IN TRACK AND TRACE SOLUTIONS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 108 SPAIN TRACK AND TRACE SOLUTIONS MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 109 SPAIN TRACK AND TRACE SOLUTIONS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 110 SPAIN TRACK AND TRACE SOLUTIONS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 111 NETHERLANDS TRACK AND TRACE SOLUTIONS MARKET, BY PRODUCTS, 2018-2032 (USD THOUSAND)

TABLE 112 NETHERLANDS SOFTWARE COMPONENTS IN TRACK AND TRACE SOLUTIONS MARKET, BY PRODUCTS, 2018-2032 (USD THOUSAND)

TABLE 113 NETHERLANDS HARDWARE COMPONENTS IN TRACK AND TRACE SOLUTIONS MARKET, BY PRODUCTS, 2018-2032 (USD THOUSAND)

TABLE 114 NETHERLANDS TRACK AND TRACE SOLUTIONS MARKET, BY SOLUTION, 2018-2032 (USD THOUSAND)

TABLE 115 NETHERLANDS TRACK AND TRACE SOLUTIONS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 116 NETHERLANDS SERIALIZATION IN TRACK AND TRACE SOLUTIONS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 117 NETHERLANDS AGGREGATION IN TRACK AND TRACE SOLUTIONS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 118 NETHERLANDS TRACK AND TRACE SOLUTIONS MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 119 NETHERLANDS TRACK AND TRACE SOLUTIONS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 120 NETHERLANDS TRACK AND TRACE SOLUTIONS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 121 BELGIUM TRACK AND TRACE SOLUTIONS MARKET, BY PRODUCTS, 2018-2032 (USD THOUSAND)

TABLE 122 BELGIUM SOFTWARE COMPONENTS IN TRACK AND TRACE SOLUTIONS MARKET, BY PRODUCTS, 2018-2032 (USD THOUSAND)

TABLE 123 BELGIUM HARDWARE COMPONENTS IN TRACK AND TRACE SOLUTIONS MARKET, BY PRODUCTS, 2018-2032 (USD THOUSAND)

TABLE 124 BELGIUM TRACK AND TRACE SOLUTIONS MARKET, BY SOLUTION, 2018-2032 (USD THOUSAND)

TABLE 125 BELGIUM TRACK AND TRACE SOLUTIONS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 126 BELGIUM SERIALIZATION IN TRACK AND TRACE SOLUTIONS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 127 BELGIUM AGGREGATION IN TRACK AND TRACE SOLUTIONS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 128 BELGIUM TRACK AND TRACE SOLUTIONS MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 129 BELGIUM TRACK AND TRACE SOLUTIONS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 130 BELGIUM TRACK AND TRACE SOLUTIONS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 131 TURKEY TRACK AND TRACE SOLUTIONS MARKET, BY PRODUCTS, 2018-2032 (USD THOUSAND)

TABLE 132 TURKEY SOFTWARE COMPONENTS IN TRACK AND TRACE SOLUTIONS MARKET, BY PRODUCTS, 2018-2032 (USD THOUSAND)

TABLE 133 TURKEY HARDWARE COMPONENTS IN TRACK AND TRACE SOLUTIONS MARKET, BY PRODUCTS, 2018-2032 (USD THOUSAND)

TABLE 134 TURKEY TRACK AND TRACE SOLUTIONS MARKET, BY SOLUTION, 2018-2032 (USD THOUSAND)

TABLE 135 TURKEY TRACK AND TRACE SOLUTIONS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 136 TURKEY SERIALIZATION IN TRACK AND TRACE SOLUTIONS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 137 TURKEY AGGREGATION IN TRACK AND TRACE SOLUTIONS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 138 TURKEY TRACK AND TRACE SOLUTIONS MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 139 TURKEY TRACK AND TRACE SOLUTIONS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 140 TURKEY TRACK AND TRACE SOLUTIONS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 141 RUSSIA TRACK AND TRACE SOLUTIONS MARKET, BY PRODUCTS, 2018-2032 (USD THOUSAND)

TABLE 142 RUSSIA SOFTWARE COMPONENTS IN TRACK AND TRACE SOLUTIONS MARKET, BY PRODUCTS, 2018-2032 (USD THOUSAND)

TABLE 143 RUSSIA HARDWARE COMPONENTS IN TRACK AND TRACE SOLUTIONS MARKET, BY PRODUCTS, 2018-2032 (USD THOUSAND)

TABLE 144 RUSSIA TRACK AND TRACE SOLUTIONS MARKET, BY SOLUTION, 2018-2032 (USD THOUSAND)

TABLE 145 RUSSIA TRACK AND TRACE SOLUTIONS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 146 RUSSIA SERIALIZATION IN TRACK AND TRACE SOLUTIONS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 147 RUSSIA AGGREGATION IN TRACK AND TRACE SOLUTIONS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 148 RUSSIA TRACK AND TRACE SOLUTIONS MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 149 RUSSIA TRACK AND TRACE SOLUTIONS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 150 RUSSIA TRACK AND TRACE SOLUTIONS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 151 REST OF EUROPE TRACK AND TRACE SOLUTIONS MARKET, BY PRODUCTS, 2018-2032 (USD THOUSAND)

Список рисунков

FIGURE 1 EUROPE TRACK AND TRACE SOLUTIONS MARKET: SEGMENTATION

FIGURE 2 EUROPE TRACK AND TRACE SOLUTIONS MARKET: DATA TRIANGULATION

FIGURE 3 EUROPE TRACK AND TRACE SOLUTIONS MARKET: DROC ANALYSIS

FIGURE 4 EUROPE TRACK AND TRACE SOLUTIONS MARKET: EUROPE VS REGIONAL MARKET ANALYSIS

FIGURE 5 EUROPE TRACK AND TRACE SOLUTIONS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 EUROPE TRACK AND TRACE SOLUTIONS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 EUROPE TRACK AND TRACE SOLUTIONS MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 8 EUROPE TRACK AND TRACE SOLUTIONS MARKET: DBMR MARKET POSITION GRID

FIGURE 9 EUROPE TRACK AND TRACE SOLUTIONS MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 EUROPE TRACK AND TRACE SOLUTIONS MARKET: SEGMENTATION

FIGURE 11 STRINGENT REGULATIONS & STANDARDS FOR THE IMPLEMENTATION OF SERIALIZATION IS EXPECTED TO DRIVE THE EUROPE TRACK AND TRACE SOLUTIONS MARKET IN THE FORECAST PERIOD OF 2025 TO 2032

FIGURE 12 SOFTWARE COMPONENTS SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE EUROPE TRACK AND TRACE SOLUTIONS MARKET IN 2025 & 2032

FIGURE 13 DROC ANALYSIS

FIGURE 14 EUROPE TRACK AND TRACE SOLUTIONS MARKET: BY PRODUCTS, 2024

FIGURE 15 EUROPE TRACK AND TRACE SOLUTIONS MARKET: BY PRODUCTS, 2025-2032 (USD THOUSAND)

FIGURE 16 EUROPE TRACK AND TRACE SOLUTIONS MARKET: BY PRODUCTS, CAGR (2025-2032)

FIGURE 17 EUROPE TRACK AND TRACE SOLUTIONS MARKET: BY PRODUCTS, LIFELINE CURVE

FIGURE 18 EUROPE TRACK AND TRACE SOLUTIONS MARKET: BY SOLUTION, 2024

FIGURE 19 EUROPE TRACK AND TRACE SOLUTIONS MARKET: BY SOLUTION, 2025-2032 (USD THOUSAND)

FIGURE 20 EUROPE TRACK AND TRACE SOLUTIONS MARKET: BY SOLUTION, CAGR (2025-2032)

FIGURE 21 EUROPE TRACK AND TRACE SOLUTIONS MARKET: BY SOLUTION, LIFELINE CURVE

FIGURE 22 EUROPE TRACK AND TRACE SOLUTIONS MARKET: BY TECHNOLOGY, 2024

FIGURE 23 EUROPE TRACK AND TRACE SOLUTIONS MARKET: BY TECHNOLOGY, 2025-2032 (USD THOUSAND)

FIGURE 24 EUROPE TRACK AND TRACE SOLUTIONS MARKET: BY TECHNOLOGY, CAGR (2025-2032)

FIGURE 25 EUROPE TRACK AND TRACE SOLUTIONS MARKET: BY TECHNOLOGY, LIFELINE CURVE

FIGURE 26 EUROPE TRACK AND TRACE SOLUTIONS MARKET: BY APPLICATION, 2024

FIGURE 27 EUROPE TRACK AND TRACE SOLUTIONS MARKET: BY APPLICATION, 2025-2032 (USD THOUSAND)

FIGURE 28 EUROPE TRACK AND TRACE SOLUTIONS MARKET: BY APPLICATION, CAGR (2025-2032)

FIGURE 29 EUROPE TRACK AND TRACE SOLUTIONS MARKET: BY APPLICATION, LIFELINE CURVE

FIGURE 30 EUROPE TRACK AND TRACE SOLUTIONS MARKET: BY END USER, 2024

FIGURE 31 EUROPE TRACK AND TRACE SOLUTIONS MARKET: BY END USER, 2025-2032 (USD THOUSAND)

FIGURE 32 EUROPE TRACK AND TRACE SOLUTIONS MARKET: BY END USER, CAGR (2025-2032)

FIGURE 33 EUROPE TRACK AND TRACE SOLUTIONS MARKET: BY END USER, LIFELINE CURVE

FIGURE 34 EUROPE TRACK AND TRACE SOLUTIONS MARKET: BY DISTRIBUTION CHANNEL, 2024

FIGURE 35 EUROPE TRACK AND TRACE SOLUTIONS MARKET: BY DISTRIBUTION CHANNEL, 2025-2032 (USD THOUSAND)

FIGURE 36 EUROPE TRACK AND TRACE SOLUTIONS MARKET: BY DISTRIBUTION CHANNEL, CAGR (2025-2032)

FIGURE 37 EUROPE TRACK AND TRACE SOLUTIONS MARKET: BY DISTRIBUTION CHANNEL, LIFELINE CURVE

FIGURE 38 EUROPE TRACK AND TRACE SOLUTIONS MARKET SNAPSHOT

FIGURE 39 EUROPE TRACK AND TRACE SOLUTIONS MARKET: COMPANY SHARE 2024 (%)

Методология исследования

Сбор данных и анализ базового года выполняются с использованием модулей сбора данных с большими размерами выборки. Этап включает получение рыночной информации или связанных данных из различных источников и стратегий. Он включает изучение и планирование всех данных, полученных из прошлого заранее. Он также охватывает изучение несоответствий информации, наблюдаемых в различных источниках информации. Рыночные данные анализируются и оцениваются с использованием статистических и последовательных моделей рынка. Кроме того, анализ доли рынка и анализ ключевых тенденций являются основными факторами успеха в отчете о рынке. Чтобы узнать больше, пожалуйста, запросите звонок аналитика или оставьте свой запрос.

Ключевой методологией исследования, используемой исследовательской группой DBMR, является триангуляция данных, которая включает в себя интеллектуальный анализ данных, анализ влияния переменных данных на рынок и первичную (отраслевую экспертную) проверку. Модели данных включают сетку позиционирования поставщиков, анализ временной линии рынка, обзор рынка и руководство, сетку позиционирования компании, патентный анализ, анализ цен, анализ доли рынка компании, стандарты измерения, глобальный и региональный анализ и анализ доли поставщика. Чтобы узнать больше о методологии исследования, отправьте запрос, чтобы поговорить с нашими отраслевыми экспертами.

Доступна настройка

Data Bridge Market Research является лидером в области передовых формативных исследований. Мы гордимся тем, что предоставляем нашим существующим и новым клиентам данные и анализ, которые соответствуют и подходят их целям. Отчет можно настроить, включив в него анализ ценовых тенденций целевых брендов, понимание рынка для дополнительных стран (запросите список стран), данные о результатах клинических испытаний, обзор литературы, обновленный анализ рынка и продуктовой базы. Анализ рынка целевых конкурентов можно проанализировать от анализа на основе технологий до стратегий портфеля рынка. Мы можем добавить столько конкурентов, о которых вам нужны данные в нужном вам формате и стиле данных. Наша команда аналитиков также может предоставить вам данные в сырых файлах Excel, сводных таблицах (книга фактов) или помочь вам в создании презентаций из наборов данных, доступных в отчете.