Europe Sustainable Aviation Fuel Market, By Fuel Type (Bio Fuel, Hydrogen Fuel, and Power to Liquid Fuel), Manufacturing Technology (Hydroprocessed Fatty Acid Esters And Fatty Acids - Synthetic Paraffinic Kerosene (HEFA-SPK), Fischer Tropsch Synthetic Paraffinic Kerosene (FT-SPK), Synthetic ISO-Paraffin From Fermented Hydroprocessed Sugar (HFS-SIP), Fischer Tropsch (FT) Synthetic Paraffinic Kerosene With Aromatics (FT-SPK/A), Alcohol To Jet SPK (ATJ-SPK) and Catalytic Hydrothermolysis Jet (CHJ)), Blending Capacity (Below 30 %, 30 % to 50 % and Above 50%), Blending Platform (Commercial Aviation, Military Aviation, Business & General Aviation, and Unmanned Aerial Vehicle) Industry Trends and Forecast to 2029.

Europe Sustainable Aviation Fuel Market Analysis and Size

The aviation industry is keen on bringing down carbon footprints to achieve a sustainable environment and meet the stringent regulatory standards on emissions. Alternative solutions, such as improving aero-engine efficiency by design modifications, hybrid-electric and all-electric aircraft, renewable jet fuels, etc., are being adopted by various stakeholders of the aviation industry. However, out of these solutions, the adoption of sustainable aviation fuels such as E-fuels, synthetic fuels, green jet fuels, biojet fuels, hydrogen fuels is one of the most feasible alternative solutions with respect to socio and economic benefits when compared to others, which contributes significantly to mitigating current and expected future environmental impacts of aviation.

Sustainable aviation fuels are a key component in meeting the aviation industry’s commitments to decouple increases in carbon emissions from traffic growth. Factors such as a rise in a number of airline passengers, growing disposable income, increase in air transportation, and increase in consumption of synthetic lubricants supplement the growth of the Europe sustainable aviation fuel market. However, the lack of infrastructure act as a restraining factor for the market.

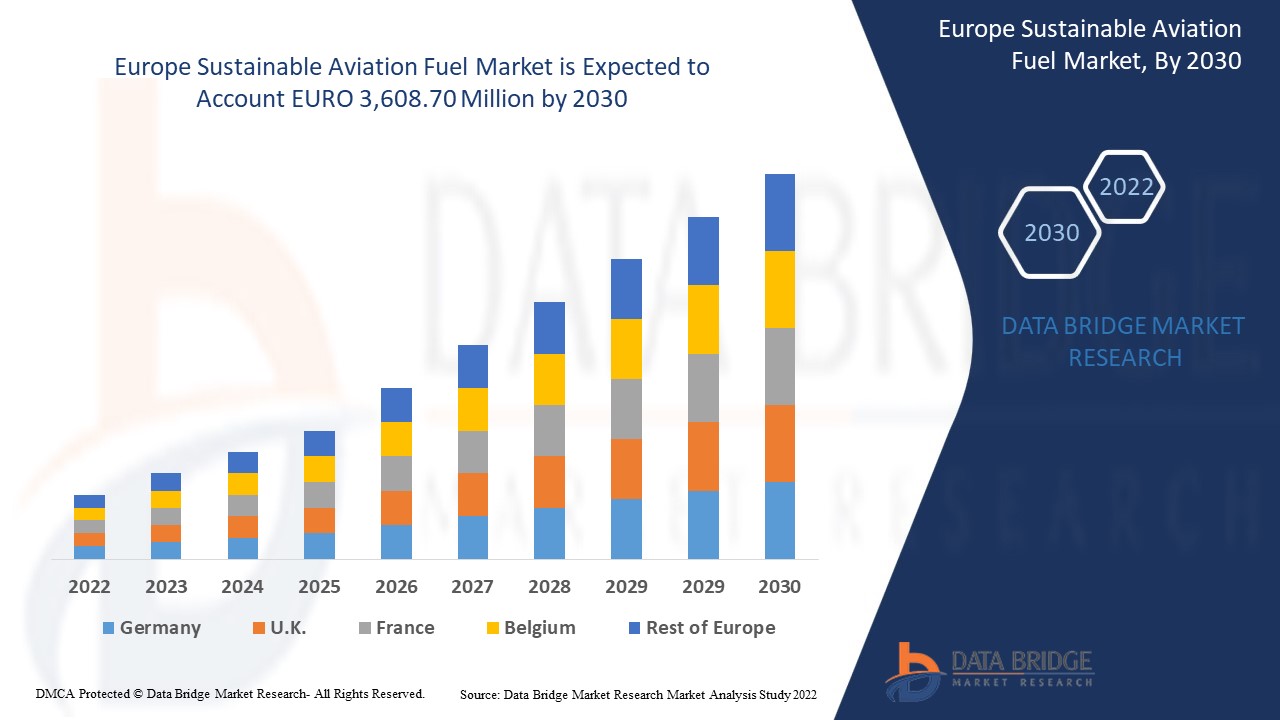

Data Bridge Market Research analyses that the sustainable aviation fuel market is expected to reach the value of EURO 3,608.70 million by 2029, at a CAGR of 47.7% during the forecast period. “Bio Fuel" accounts for the largest technology segment in the sustainable aviation fuel market due to Europe highlights the importance of boosting the development of alternative fuels. The sustainable aviation fuel market report also covers pricing analysis, patent analysis, and technological advancements in depth.

|

Report Metric |

Details |

|

Forecast Period |

2022 to 2029 |

|

Base Year |

2021 |

|

Historic Years |

2020 |

|

Quantitative Units |

Revenue in EURO Million, Volumes in Units, Pricing in EURO |

|

Segments Covered |

По типу топлива (биотопливо, водородное топливо и энергия в жидкое топливо), по технологии производства (гидроочищенные эфиры жирных кислот и жирные кислоты - синтетический парафиновый керосин (Hefa-Spk), синтетический парафиновый керосин Фишера-Тропша (FT-SPK), синтетический изопарафин из ферментированного гидроочищенного сахара (Hfs-Sip), синтетический парафиновый керосин Фишера-Тропша (Ft) с ароматикой (FT-SPK/A), спирт в реактивный двигатель (ATJ-SPK) и реактивный двигатель каталитического гидротермолиза (CHJ)), по смешивающей способности (ниже 30%, от 30% до 50% и выше 50%), по платформе смешивания (коммерческая авиация, военная авиация, деловая и общая авиация, а также беспилотные летательные аппараты) |

|

Страны, охваченные |

Германия, Великобритания, Франция, Испания, Италия, Россия, Нидерланды, Швейцария, Турция, Бельгия и остальные страны Европы в Европе |

|

Охваченные участники рынка |

Neste, VELOCYS, SkyNRG, Preem AB, Eni BP plc, Cepsa, TotalEnergies, ZeroAvia, Inc. и другие. |

Определение рынка

Устойчивое авиационное топливо — это уникальная форма топлива, разработанная для использования в самолетах, и в то же время повышающая производительность самолетов. Устойчивое авиационное топливо производится из устойчивого сырья и может быть весьма сопоставимо по химическому составу со стандартным ископаемым реактивным топливом. Увеличение полезности устойчивого авиационного топлива приводит к сокращению выбросов углерода по сравнению с традиционным реактивным топливом, поскольку оно заменяет жизненный цикл топлива.

Авиационное предприятие стремится к снижению выбросов углерода для получения устойчивой окружающей среды и соответствия строгим нормативным требованиям по выбросам. Более того, улучшение характеристик авиационных двигателей за счет изменений компоновки, гибридно-электрических и полностью электрических самолетов, возобновляемых видов реактивного топлива принимаются многочисленными заинтересованными сторонами авиационной отрасли, однако принятие устойчивого авиационного топлива принимается во внимание как максимально надежные и жизнеспособные решения возможностей в отношении социальных и экономических преимуществ по сравнению с другими, что вносит значительный вклад в смягчение современных и ожидаемых будущих воздействий авиации на окружающую среду.

Динамика рынка устойчивого авиационного топлива

В этом разделе рассматривается понимание движущих сил рынка, преимуществ, возможностей, ограничений и проблем. Все это подробно обсуждается ниже:

- Растущая потребность в сокращении выбросов парниковых газов в авиационной промышленности

Выбросы парниковых газов (ПГ), вызванные деятельностью человека, усиливают парниковый эффект, вызывая изменение климата. Углекислый газ выделяется в основном за счет сжигания ископаемого топлива, такого как уголь, нефть и природный газ. Некоторые из крупнейших загрязнителей в Европе — Китай и Россия. Эти загрязнения в основном вызваны угольными, нефтяными и газовыми корпорациями, принадлежащими ОПЕК (Организация стран-экспортеров нефти). Уровень углекислого газа в атмосфере вырос примерно на 50% по сравнению с доиндустриальными временами из-за выбросов, вызванных деятельностью человека.

Загрязнители, выбрасываемые авиационными двигателями, эквивалентны тем, которые выбрасываются при сжигании ископаемого топлива. На больших высотах выбросы самолетов имеют большую концентрацию загрязняющих веществ. Эти выбросы создают серьезные экологические проблемы, как с точки зрения их влияния на Европу, так и с точки зрения их влияния на качество местного воздуха

- Рост объемов авиаперевозок и рост потребления синтетических смазочных материалов

Воздушные перевозки являются важнейшим компонентом в достижении экономического роста и развития. В национальном, региональном и мировом масштабе воздушные перевозки способствуют интеграции в экономику Европы и предлагают важнейшие связи. Они способствуют росту торговли, туризма и возможностей трудоустройства. Авиационная система развивается и будет продолжать развиваться. Однако в долгосрочной перспективе системе воздушного транспорта будет сложно адаптироваться достаточно быстро для удовлетворения меняющихся потребностей с точки зрения пропускной способности, воздействия на окружающую среду, удовлетворенности потребителей, безопасности и защищенности, при этом сохраняя экономическую жизнеспособность поставщиков услуг.

Пандемия Covid-19, наряду с поддержкой правительства и технологическими открытиями, особенно в области топливных технологий, ускорила переход авиационной отрасли на устойчивое авиационное топливо (SAF). В то время как использование устойчивого авиационного топлива (SAF) растет, несинтетические смазочные материалы идут на спад. Ожидается, что синтетические и полусинтетические смазочные материалы выиграют от перехода, поскольку большинство самолетов используют усовершенствованные смазочные материалы. Прогнозируется, что мировой рынок устойчивого авиационного топлива (SAF) будет зависеть от этого фактора.

- Рост спроса на устойчивое авиационное топливо со стороны авиакомпаний

Авиационный сектор принимает «срочные меры» для достижения мировых климатических целей, которые включают сокращение роста авиаперевозок и быстрое масштабирование использования устойчивого авиационного топлива (SAF). Цель SAF — перерабатывать углерод из существующей устойчивой биомассы или газов в реактивное топливо в качестве замены ископаемого реактивного топлива, очищенного от сырой нефти. Цель SAF — перерабатывать углерод из существующей устойчивой биомассы или газов в реактивное топливо в качестве замены ископаемого реактивного топлива, очищенного от сырой нефти. Авиационный сектор в целом, а также авиакомпании-члены ИАТА, стремятся достичь агрессивных целей по сокращению выбросов. SAF (устойчивое авиационное топливо) было выделено как ключевой компонент в достижении этих целей. Для использования устойчивого авиационного топлива для достижения климатических целей отрасли потребуется государственная поддержка

Поскольку ключевые игроки отрасли осознают необходимость использования экологически чистых видов авиационного топлива (SAF), поставщики услуг начали внедрять различные альтернативы экологически чистому авиационному топливу (SAF) в различных авиакомпаниях, что, как ожидается, будет способствовать дальнейшему значительному росту использования экологически чистого авиационного топлива (SAF).

- Недостаточная доступность сырья и нефтеперерабатывающих заводов для удовлетворения устойчивого спроса на производство авиационного топлива

Устойчивое авиационное топливо (SAF), которое производится из биосырья, является важной частью плана по сокращению углеродного следа авиации. Технически, замена и смешивание SAF с реактивным топливом возможно; фактически, авиационная промышленность использует SAF уже более десятилетия. Однако из-за ограничений спроса и предложения уровни потребления остаются чрезвычайно низкими.

Масличные культуры, сахарные культуры, водоросли, отработанное масло и другие биологические и небиологические ресурсы являются сырьем, которое играет важную роль во всей цепочке производства альтернативных видов авиационного топлива, таких как синтетическое топливо, электронное топливо и биореактивное топливо. Потребность в устойчивом авиационном топливе может прекратиться из-за нехватки сырья, необходимого для производства. Из-за нехватки сырья, необходимого для его производства, спрос на устойчивое авиационное топливо может прекратиться. Кроме того, ограничения нефтеперерабатывающих заводов, которые играют решающую роль в оптимальной эксплуатации этого сырья, добавляются к общему процессу производства SAF. Низкие поставки топлива также создают нагрузку на способность смешивания топлива, что приводит к снижению эффективности.

Когда конкуренция со стороны сектора дорожного бензина за сырье, отвечающее стандартам устойчивости, растет, доступность сырья становится узким местом. Расходы на сырье составляют значительную часть стоимости SAF, а колебания цен могут вызвать проблемы с поставками для производителей топлива. Таким образом, более высокая топливная надбавка перевозчика еще больше сдерживает рост рынка в определенной степени.

- Колебания цен на сырую нефть и загрязнение смазочных материалов

Растущая конкуренция в Европе и ценовое давление заставляют предприятия и цепочки поставок открывать необнаруженные потенциалы экономии затрат. В частности, интерфейсы с рынком сырой нефти являются многообещающей областью для совершенствования. В сегодняшней деловой среде каждая организация сталкивается с определенным риском колебаний цен на сырую нефть и смазочные материалы. В производстве производители могут полагаться на значительное количество нефтяных товаров, и в результате на них может особенно влиять волатильность цен на нефтепродукты, которые они закупают напрямую и косвенно через компоненты и подузлы. Нестабильные и нестабильные рынки Европы имеют широкомасштабные последствия для производственных организаций. От роста цен на энергоносители до неожиданных колебаний затрат на производство сырой нефти, непредвиденные препятствия дестабилизируют цепочки поставок и мешают производителям оставаться в плюсе. Поскольку поставки многих видов сырья становятся все сложнее обеспечить, волатильность цен на сырьевые товары может быть не просто временным явлением, и производители должны либо покрыть дополнительные расходы, либо найти новые способы смягчения расходов, либо переложить рост цен на клиентов, которые и так неохотно тратят деньги. Поскольку на ценообразование влияет ужесточение рынков поставок, эта тенденция не показывает никаких признаков изменения в ближайшее время. Таким образом, колеблющаяся стоимость сырой нефти и других смазочных материалов выступает в качестве основного сдерживающего фактора для европейского рынка устойчивого авиационного топлива (SAF).

Фрагменты углерода обычно недостаточно тверды или достаточно велики, чтобы вызвать отказ насоса. Однако они могут быть достаточно большими, чтобы заблокировать крошечные фильтры или форсунки. Другой причиной эксплуатационного загрязнения является наличие песка, гравия и металлических частиц в системе смазки. Что является сдерживающим фактором для европейского рынка устойчивого авиационного топлива (SAF).

- Сокращение выбросов углекислого газа из-за низкой эффективности устойчивого авиационного топлива

Устойчивое авиационное топливо (SAF) снижает выбросы углерода в течение срока службы топлива по сравнению с традиционным реактивным топливом, которое оно заменяет. Растительное масло и другие непальмовые отходы масел животных или растений являются обычным сырьем, как и твердые отходы из домов и компаний, такие как упаковка, бумага, текстиль и пищевые отходы, которые в противном случае были бы утилизированы на свалках или сожжены. Лесной мусор, такой как древесные отходы, и энергетические культуры, такие как быстрорастущие растения и водоросли, также являются возможными источниками.

В зависимости от используемого устойчивого сырья, производственного процесса и цепочки поставок в аэропорт, SAF может сократить выбросы углерода до 80% в течение срока службы топлива по сравнению с традиционным авиатопливом, которое оно заменяет.

SAF можно смешивать до 50% со стандартным реактивным топливом, и он проходит те же испытания качества, что и традиционное реактивное топливо. После этого смесь повторно сертифицируется как Jet A или Jet A-1. С ним можно обращаться так же, как и со стандартным реактивным топливом, поэтому не требуется никаких изменений в заправочной инфраструктуре или самолетах, которые хотят использовать SAF, что создает возможность для роста европейского рынка устойчивого авиационного топлива.

- Разработка экологически чистых и безопасных авиационных смазочных материалов

В современном мире авиационная промышленность переживает бум, что приводит к росту конкуренции среди производителей авиационного топлива во всех областях. Альтернативные экологически чистые источники для долгосрочного производства авиационного топлива, как ожидается, окажут будущее влияние на сектор авиационного топлива. Рынок устойчивого авиационного топлива значительно вырос за эти годы из-за растущей тенденции использования передовых видов топлива в самолетах по всему миру.

Выращивание биомассы для производства устойчивого авиационного топлива также позволяет фермерам зарабатывать больше денег в межсезонье, внося вклад в эту новую отрасль в качестве сырья, одновременно обеспечивая сельскохозяйственные преимущества, такие как сокращение потерь питательных веществ и улучшение качества почвы. Тем самым создавая возможность для роста европейского рынка устойчивого авиационного топлива (SAF).

- Высокая стоимость экологически чистого авиационного топлива увеличивает эксплуатационные расходы авиакомпаний

Расходы на рабочую силу и топливо являются двумя наиболее значительными расходами, с которыми сталкиваются авиакомпании. В краткосрочной перспективе расходы на рабочую силу обычно стабильны, но цены на топливо значительно колеблются в зависимости от цены на нефть. Топливо составляет значительную часть расходов на содержание авиакомпании, составляя 20-30% от общих расходов. Скачки цен на нефть стали одними из самых сложных моментов для авиакомпаний. Авиакомпании могут подготовиться к постепенному росту цен, повысив цены на билеты или сократив количество рейсов, но неожиданный рост цен приводит к тому, что многие авиакомпании теряют деньги.

Цели по использованию устойчивого авиационного топлива (SAF) начнут увеличивать стоимость топлива в этом году, что еще больше усложнит жизнь авиакомпаний. По данным Международной ассоциации воздушного транспорта (IATA), производство SAF в Европе составляет всего около 100 миллионов литров в год, или 0,1 процента от всего используемого авиационного топлива. С другой стороны, различные авиакомпании пообещали увеличить этот процент до 10% к 2030 году, что является действительно высокой целью.

К сожалению, из-за ограниченного объема производства стоимость также высока. По оценкам IATA, стоимость SAF в два-четыре раза выше стоимости ископаемого топлива, в то время как недавнее раскрытие Air France-KLM предполагает, что разница в стоимости может быть ближе к четырем-восьмикратной стоимости керосина.

Международная ассоциация воздушного транспорта (IATA) и другие настоятельно призывают правительства поощрять развитие SAF, но в форме экономического стимулирования. Это открывает путь к росту цен на устойчивое авиационное топливо (SAF), тем самым выступая в качестве вызова для европейского рынка устойчивого авиационного топлива.

Влияние COVID-19 на устойчивый рынок авиационного топлива

COVID-19 оказал серьезное влияние на рынок устойчивого авиационного топлива, поскольку почти каждая страна решила закрыть все производственные мощности, за исключением тех, которые занимаются производством товаров первой необходимости. Правительство приняло ряд строгих мер, таких как закрытие производства и продажи неосновных товаров, блокировка международной торговли и многое другое, чтобы предотвратить распространение COVID-19. Единственный бизнес, который работает в этой пандемической ситуации, — это основные услуги, которым разрешено открываться и осуществлять процессы.

Рост рынка устойчивого авиационного топлива увеличивается из-за необходимости сокращения выбросов парниковых газов в авиационной отрасли. Однако такие факторы, как недостаточная доступность сырья и нефтеперерабатывающих заводов для удовлетворения спроса на устойчивое авиационное топливо, сдерживают рост рынка. Остановка производственных мощностей в условиях пандемии оказала существенное влияние на рынок.

Производители принимают различные стратегические решения, чтобы оправиться после COVID-19. Игроки проводят многочисленные исследования и разработки для улучшения технологий, используемых в устойчивом авиационном топливе. Благодаря этому компании выведут на рынок передовые и точные контроллеры. Кроме того, использование государственными органами устойчивого авиационного топлива в авиаперевозках привело к росту рынка.

Недавнее развитие

- В марте 2022 года Neste в сотрудничестве с DHL Express объявили об одной из крупнейших когда-либо заключенных сделок по устойчивому авиационному топливу. Это соглашение является крупнейшим для Neste по устойчивому авиационному топливу (SAF) на сегодняшний день и одним из крупнейших соглашений SAF в авиационной отрасли. Это сотрудничество улучшит текущую сеть Neste, предлагая бесперебойную связь по всему миру

- В марте 2022 года BP Ventures инвестировала 3 миллиона фунтов стерлингов в акционерный капитал Flylogix — новаторский бизнес беспилотных летательных аппаратов (БПЛА), который использует дроны для обнаружения метана. Эти BP Ventures фокусируются на подключении и развитии нового энергетического бизнеса и существующей сети, предлагая бесшовную связь по всему миру

Масштаб европейского рынка устойчивого авиационного топлива

Рынок устойчивого авиационного топлива сегментирован на основе типа топлива, технологии производства, емкости смешивания и платформы смешивания. Рост среди этих сегментов поможет вам проанализировать сегменты с незначительным ростом в отраслях и предоставить пользователям ценный обзор рынка и рыночные идеи, которые помогут им принимать стратегические решения для определения основных рыночных приложений.

Тип топлива

- Биотопливо

- Водородное топливо

- Энергия в жидкое топливо

По типу топлива рынок устойчивого авиационного топлива в Европе сегментирован на биотопливо, водородное топливо и электроэнергию в жидком топливе.

Технология производства

- Гидроочищенные эфиры жирных кислот и жирные кислоты - синтетический парафиновый керосин (HEFA-SPK)

- Синтетический парафиновый керосин Фишера-Тропша (FT-SPK)

- Синтетический изопарафин из ферментированного гидроочищенного сахара (HFS-SIP)

- Синтетический парафиновый керосин Фишера-Тропша (FT) с ароматическими соединениями (FT-SPK/A)

- Алкоголь в реактивный двигатель Spk (ATJ-SPK)

- Каталитический гидротермолизный струйный аппарат (CHJ)

На основе технологии производства рынок устойчивого авиационного топлива Европы сегментирован на гидроочищенные эфиры жирных кислот и жирные кислоты - синтетический парафиновый керосин (HEFA-SPK), синтетический парафиновый керосин Фишера-Тропша (FT-SPK), синтетический изопарафин из ферментированного гидроочищенного сахара (HFS-SIP), синтетический парафиновый керосин Фишера-Тропша (FT) с ароматикой (FT-SPK/A), спирт для реактивного SPK (ATJ-SPK) и реактивный каталитический гидротермолиз (CHJ).

Емкость смешивания

- Менее 30 %

- 30 % до 50 %

- Более 50%

На основе возможностей смешивания европейский рынок устойчивого авиационного топлива сегментирован на сегменты ниже 30%, от 30% до 50% и выше 50%.

Смешивающая платформа

- Коммерческая авиация

- Военная авиация

- Деловая и общая авиация

- Беспилотный летательный аппарат

На основе платформы смешивания европейский рынок устойчивого авиационного топлива был сегментирован на коммерческую авиацию , военную авиацию, деловую и общую авиацию, а также беспилотные летательные аппараты.

Региональный анализ/идеи рынка устойчивого авиационного топлива

Проанализирован рынок устойчивого авиационного топлива, а также предоставлены сведения о размерах рынка и тенденциях по странам, типу топлива, технологии производства, мощности смешивания и отрасли платформ смешивания, как указано выше.

В отчете о рынке устойчивого авиационного топлива рассматриваются следующие страны: Великобритания, Германия, Франция, Испания, Италия, Нидерланды, Швейцария, Россия, Бельгия, Турция и остальные страны Европы.

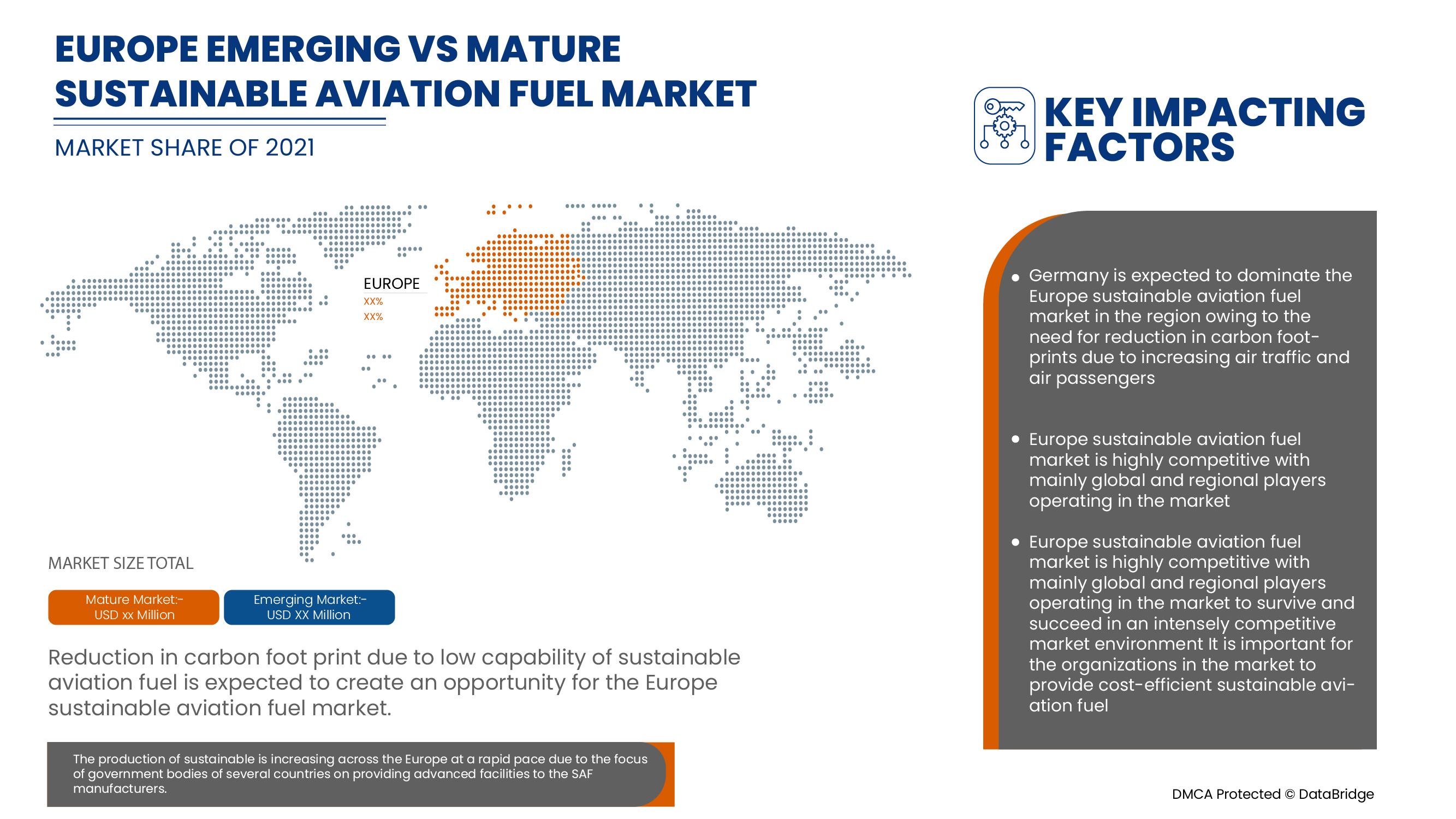

Великобритания доминирует на европейском рынке устойчивого авиационного топлива; это объясняется преимуществами, которые предлагает устойчивое авиационное топливо. Кроме того, возросший спрос на сокращение выбросов углерода продвигает европейский рынок устойчивого авиационного топлива вперед в Германии. Прогнозируется, что спрос в этом регионе будет обусловлен важностью стимулирования разработки альтернативных видов топлива.

Раздел отчета по странам также содержит отдельные факторы, влияющие на рынок, и изменения в регулировании рынка, которые влияют на текущие и будущие тенденции рынка. Такие данные, как анализ цепочки создания стоимости вверх и вниз по течению, технические тенденции и анализ пяти сил Портера, тематические исследования — вот некоторые из указателей, используемых для прогнозирования рыночного сценария для отдельных стран. Кроме того, при предоставлении прогнозного анализа данных по странам учитываются наличие и доступность европейских брендов и их проблемы из-за большой или малой конкуренции со стороны местных и отечественных брендов, влияние внутренних тарифов и торговых путей.

Анализ конкурентной среды и доли рынка устойчивого авиационного топлива

Конкурентная среда рынка устойчивого авиационного топлива содержит сведения по конкурентам. Включены сведения о компании, финансы компании, полученный доход, рыночный потенциал, инвестиции в исследования и разработки, новые рыночные инициативы, присутствие в Европе, производственные площадки и объекты, производственные мощности, сильные и слабые стороны компании, запуск продукта, широта и широта продукта, доминирование в применении. Приведенные выше данные относятся только к фокусу компаний, связанному с рынком устойчивого авиационного топлива.

Среди основных игроков, работающих на рынке устойчивого авиационного топлива, можно назвать Neste, VELOCYS, SkyNRG, Preem AB, Eni BP plc, Cepsa, TotalEnergies, ZeroAvia, Inc. и другие.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Интерактивная панель анализа данных

- Панель анализа компании для возможностей с высоким потенциалом роста

- Доступ аналитика-исследователя для настройки и запросов

- Анализ конкурентов с помощью интерактивной панели

- Последние новости, обновления и анализ тенденций

- Используйте возможности сравнительного анализа для комплексного отслеживания конкурентов

Содержание

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE EUROPE SUSTAINABLE AVIATION FUEL MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MULTIVARIATE MODELING

2.9 FUEL TYPE TIMELINE CURVE

2.1 SECONDARY SOURCES

2.11 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 ANALYSIS OF FUTURE APPLICATIONS

4.2 ADVANCING SUSTAINABILITY WITHIN AVIATION

4.3 ORGANIZATIONS INVOLVED IN SUSTAINABLE AVIATION FUEL PROGRAMS

4.4 RESEARCH & INNOVATION ROADMAP FOR AVIATION HYDROGEN TECHNOLOGY

4.5 RECENT SUPPLY CONTRACTS BY SHELL

4.6 STANDARDS

4.6.1 OVERVIEW

4.6.2 INTERNATIONAL CIVIL AVIATION ORGANIZATION (ICAO)

4.6.3 INTERNATIONAL AIR TRANSPORT ASSOCIATION (IATA)

4.6.4 BUREAU OF CIVIL AVIATION SECURITY

4.6.5 FEDERAL AVIATION ADMINISTRATION

4.6.6 EUROPEAN UNION AVIATION SAFETY AGENCY (EASA)

4.6.7 CIVIL AVIATION ADMINISTRATION OF CHINA (CAAC)

4.6.8 UAE GENERAL CIVIL AVIATION AUTHORITY (GCAA)

4.7 VALUE CHAIN ANALYSIS

4.7.1 OVERVIEW OF VALUE CHAIN ANALYSIS OF SUSTAINABLE AVIATION FUEL MARKET

4.8 TECHNOLOGY TRENDS

4.8.1 OVERVIEW

4.8.2 HYDROTHERMAL LIQUEFACTION (HTL)

4.8.3 PYROLYSIS PATHWAYS OR PYROLYSIS-TO-JET (PTJ)

4.8.4 TECHNOLOGICAL MATURITY - FUEL READINESS LEVEL AND FEEDSTOCK READINESS LEVEL

4.9 IMPACT OF MEGATREND

4.1 INNOVATION AND PATENT ANALYSIS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 INCREASING NEED FOR REDUCTION IN GHG EMISSIONS IN THE AVIATION INDUSTRY

5.1.2 INCREASE IN AIR TRANSPORTATION CONSUMPTION OF SYNTHETIC LUBRICANTS

5.1.3 INCREASE IN DEMAND FOR SUSTAINABLE AVIATION FUEL BY AIRLINES

5.1.4 INCREASE IN INVESTMENTS FOR THE GROWTH OF COMMERCIAL AIRCRAFTS

5.2 RESTRAINTS

5.2.1 INADEQUATE AVAILABILITY OF FEEDSTOCK AND REFINERIES TO MEET SUSTAINABLE AVIATION FUEL PRODUCTION DEMAND

5.2.2 FLUCTUATIONS IN CRUDE OIL PRICES AND CONTAMINATION OF LUBRICANTS

5.3 OPPORTUNITIES

5.3.1 REDUCTION IN CARBON FOOTPRINT DUE TO LOW CAPABILITY OF SUSTAINABLE AVIATION FUEL

5.3.2 DEVELOPMENT OF ECO-FRIENDLY AND SAFE AVIATION LUBRICANTS

5.3.3 RISE IN DEMAND FOR LOW-DENSITY LUBRICANTS FOR REDUCED WEIGHT

5.3.4 RISE IN SAFETY REGULATIONS FOR AIRCRAFTS

5.4 CHALLENGE

5.4.1 THE HIGH COST OF SUSTAINABLE AVIATION FUEL INCREASES THE OPERATING COST OF AIRLINES

6 EUROPE SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE

6.1 OVERVIEW

6.2 BIOFUEL

6.3 HYDROGEN FUEL

6.4 POWER TO LIQUID FUEL

7 EUROPE SUSTAINABLE AVIATION FUEL MARKET, BY MANUFACTURING TECHNOLOGY

7.1 OVERVIEW

7.2 HYDROPROCESSED FATTY ACID EASTERS AND FATTY ACIDS - SYNTHETIC PARAFFINIC KEROSENE (HEFA-SPK)

7.3 FISCHER TROPSCH SYNTHETIC PARAFFINIC KEROSENE (FT-SPK)

7.4 SYNTHETIC ISO-PARAFFIN FROM FERMENTED HYDROPROCESSED SUGAR (HFS-SIP)

7.5 FISCHER TROPSCH (FT) SYNTHETIC PARAFFINIC KEROSENE WITH AROMATICS (FT-SPK/A)

7.6 ALCOHOL TO JET SPK (ATJ-SPK)

7.7 CATALYTIC HYDROTHERMOLYSIS JET (CHJ)

8 EUROPE SUSTAINABLE AVIATION FUEL MARKET, BY BLENDING CAPACITY

8.1 OVERVIEW

8.2 BELOW 30%

8.3 30% TO 50%

8.4 ABOVE 50%

9 EUROPE SUSTAINABLE AVIATION FUEL MARKET, BY BLENDING PLATFORM

9.1 OVERVIEW

9.2 COMMERCIAL AVIATION

9.2.1 BY TYPE

9.2.1.1 NARROW BODY AIRCRAFT

9.2.1.2 WIDE-BODY AIRCRAFT (WBA)

9.2.1.3 VERY LARGE AIRCRAFT (VLA)

9.2.1.4 REGIONAL TRANSPORT AIRCRAFT (RTA)

9.2.2 BY FUEL TYPE

9.2.2.1 BIOFUEL

9.2.2.2 HYDROGEN

9.2.2.3 POWER TO LIQUID FUEL

9.3 BUSINESS & GENERAL AVIATION

9.3.1 BIOFUEL

9.3.2 HYDROGEN

9.3.3 POWER TO LIQUID FUEL

9.4 MILITARY AVIATION

9.4.1 BIOFUEL

9.4.2 HYDROGEN

9.4.3 POWER TO LIQUID FUEL

9.5 UNMANNED AERIAL VEHICLE

9.5.1 BIOFUEL

9.5.2 HYDROGEN

9.5.3 POWER TO LIQUID FUEL

10 EUROPE SUSTAINABLE AVIATION FUEL MARKET, BY REGION

10.1 EUROPE

10.1.1 U.K.

10.1.2 GERMANY

10.1.3 FRANCE

10.1.4 SPAIN

10.1.5 ITALY

10.1.6 RUSSIA

10.1.7 NETHERLANDS

10.1.8 SWITZERLAND

10.1.9 TURKEY

10.1.10 BELGIUM

10.1.11 REST OF EUROPE

11 EUROPE SUSTAINABLE AVIATION FUEL MARKET: COMPANY LANDSCAPE

11.1 COMPANY SHARE ANALYSIS: EUROPE

12 SWOT ANALYSIS

13 COMPANY PROFILES

13.1 NESTE

13.1.1 COMPANY SNAPSHOT

13.1.2 REVENUE ANALYSIS

13.1.3 COMPANY SHARE ANALYSIS

13.1.4 PRODUCT PORTFOLIO

13.1.5 RECENT DEVELOPMENTS

13.2 BP P.L.C.

13.2.1 COMPANY SNAPSHOT

13.2.2 REVENUE ANALYSIS

13.2.3 COMPANY SHARE ANALYSIS

13.2.4 SERVICE PORTFOLIO

13.2.5 RECENT DEVELOPMENTS

13.3 PREEM AB.

13.3.1 COMPANY SNAPSHOT

13.3.2 COMPANY SHARE ANALYSIS

13.3.3 PRODUCT PORTFOLIO

13.3.4 RECENT DEVELOPMENT

13.4 CEPSA

13.4.1 COMPANY SNAPSHOT

13.4.2 COMPANY SHARE ANALYSIS

13.4.3 PRODUCT PORTFOLIO

13.4.4 RECENT DEVELOPMENT

13.5 CHEVRON CORPORATION

13.5.1 COMPANY SNAPSHOT

13.5.2 REVENUE ANALYSIS

13.5.3 COMPANY SHARE ANALYSIS

13.5.4 PRODUCT PORTFOLIO

13.5.5 RECENT DEVELOPMENTS

13.6 AVFUEL CORPORATION

13.6.1 COMPANY SNAPSHOT

13.6.2 PRODUCT PORTFOLIO

13.6.3 RECENT DEVELOPMENT

13.7 ENI

13.7.1 COMPANY SNAPSHOT

13.7.2 REVENUE ANALYSIS

13.7.3 PRODUCT PORTFOLIO

13.7.4 RECENT DEVELOPMENTS

13.8 EXXON MOBIL CORPORATION

13.8.1 COMPANY SNAPSHOT

13.8.2 REVENUE ANALYSIS

13.8.3 PRODUCT PORTFOLIO

13.8.4 RECENT DEVELOPMENTS

13.9 FULCRUM BIOENERGY

13.9.1 COMPANY SNAPSHOT

13.9.2 PRODUCT PORTFOLIO

13.9.3 RECENT DEVELOPMENT

13.1 GEVO

13.10.1 COMPANY SNAPSHOT

13.10.2 REVENUE ANALYSIS

13.10.3 PRODUCT PORTFOLIO

13.10.4 RECENT DEVELOPMENTS

13.11 HONEYWELL INTERNATIONAL INC.

13.11.1 COMPANY SNAPSHOT

13.11.2 REVENUE ANALYSIS

13.11.3 PRODUCT PORTFOLIO

13.11.4 RECENT DEVELOPMENTS

13.12 HYPOINT INC.

13.12.1 COMPANY SNAPSHOT

13.12.2 PRODUCT PORTFOLIO

13.12.3 RECENT DEVELOPMENT

13.13 JOHNSON MATTHEY

13.13.1 COMPANY SNAPSHOT

13.13.2 REVENUE ANALYSIS

13.13.3 PRODUCT PORTFOLIO

13.13.4 RECENT DEVELOPMENT

13.14 LANZATECH

13.14.1 COMPANY SNAPSHOT

13.14.2 PRODUCT PORTFOLIO

13.14.3 RECENT DEVELOPMENT

13.15 PROMETHEUS FUELS

13.15.1 COMPANY SNAPSHOT

13.15.2 PRODUCT PORTFOLIO

13.15.3 RECENT DEVELOPMENT

13.16 SKYNRG

13.16.1 COMPANY SNAPSHOT

13.16.2 PRODUCT PORTFOLIO

13.16.3 RECENT DEVELOPMENTS

13.17 SASOL

13.17.1 COMPANY SNAPSHOT

13.17.2 REVENUE ANALYSIS

13.17.3 PRODUCT PORTFOLIO

13.17.4 RECENT DEVELOPMENTS

13.18 TOTALENERGIES

13.18.1 COMPANY SNAPSHOT

13.18.2 REVENUE ANALYSIS

13.18.3 PRODUCT PORTFOLIO

13.18.4 RECENT DEVELOPMENT

13.19 VELOCYS

13.19.1 COMPANY SNAPSHOT

13.19.2 REVENUE ANALYSIS

13.19.3 PRODUCT PORTFOLIO

13.19.4 RECENT DEVELOPMENTS

13.2 VIRENT, INC.

13.20.1 COMPANY SNAPSHOT

13.20.2 PRODUCT PORTFOLIO

13.20.3 RECENT DEVELOPMENT

13.21 WORLD ENERGY

13.21.1 COMPANY SNAPSHOT

13.21.2 PRODUCT PORTFOLIO

13.21.3 RECENT DEVELOPMENT

13.22 ZEROAVIA, INC.

13.22.1 COMPANY SNAPSHOT

13.22.2 PRODUCT PORTFOLIO

13.22.3 RECENT DEVELOPMENT

14 QUESTIONNAIRE

15 RELATED REPORTS

Список таблиц

TABLE 1 EUROPE SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 2 EUROPE BIOFUEL IN SUSTAINABLE AVIATION FUEL MARKET, BY REGION, 2020-2029 (EURO MILLION)

TABLE 3 EUROPE HYDROGEN IN SUSTAINABLE AVIATION FUEL MARKET, BY REGION, 2020-2029 (EURO MILLION)

TABLE 4 EUROPE POWER TO LIQUID FUEL IN SUSTAINABLE AVIATION FUEL MARKET, BY REGION, 2020-2029 (EURO MILLION)

TABLE 5 EUROPE SUSTAINABLE AVIATION FUEL MARKET, BY MANUFACTURING TECHNOLOGY, 2020-2029 (EURO MILLION)

TABLE 6 EUROPE HYDROPROCESSED FATTY ACID EASTERS AND FATTY ACIDS - SYNTHETIC PARAFFINIC KEROSENE (HEFA-SPK) IN SUSTAINABLE AVIATION FUEL MARKET, BY REGION, 2020-2029 (EURO MILLION)

TABLE 7 EUROPE FISCHER TROPSCH SYNTHETIC PARAFFINIC KEROSENE (FT-SPK) IN SUSTAINABLE AVIATION FUEL MARKET, BY REGION, 2020-2029 (EURO MILLION)

TABLE 8 EUROPE SYNTHETIC ISO-PARAFFIN FROM FERMENTED HYDROPROCESSED SUGAR (HFS-SIP) IN SUSTAINABLE AVIATION FUEL MARKET, BY REGION, 2020-2029 (EURO MILLION)

TABLE 9 EUROPE FISCHER TROPSCH (FT) SYNTHETIC PARAFFINIC KEROSENE WITH AROMATICS (FT-SPK/A) IN SUSTAINABLE AVIATION FUEL MARKET, BY REGION, 2020-2029 (EURO MILLION)

TABLE 10 EUROPE ALCOHOL TO JET SPK (ATJ-SPK) IN SUSTAINABLE AVIATION FUEL MARKET, BY REGION, 2020-2029 (EURO MILLION)

TABLE 11 EUROPE CATALYTIC HYDROTHERMOLYSIS JET (CHJ) IN SUSTAINABLE AVIATION FUEL MARKET, BY REGION, 2020-2029 (EURO MILLION)

TABLE 12 EUROPE SUSTAINABLE AVIATION FUEL MARKET, BY BLENDING CAPACITY, 2020-2029 (EURO MILLION)

TABLE 13 EUROPE BELOW 30% IN SUSTAINABLE AVIATION FUEL MARKET, BY REGION, 2020-2029 (EURO MILLION)

TABLE 14 EUROPE 30% TO 50% IN SUSTAINABLE AVIATION FUEL MARKET, BY REGION, 2020-2029 (EURO MILLION)

TABLE 15 EUROPE ABOVE 50% IN SUSTAINABLE AVIATION FUEL MARKET, BY REGION, 2020-2029 (EURO MILLION)

TABLE 16 EUROPE SUSTAINABLE AVIATION FUEL MARKET, BY BLENDING PLATFORM, 2020-2029 (EURO MILLION)

TABLE 17 EUROPE COMMERCIAL AVIATION IN SUSTAINABLE AVIATION FUEL MARKET, BY REGION, 2020-2029 (EURO MILLION)

TABLE 18 EUROPE COMMERCIAL AVIATION IN SUSTAINABLE AVIATION FUEL MARKET, BY TYPE, 2020-2029 (EURO MILLION)

TABLE 19 EUROPE COMMERCIAL AVIATION IN SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 20 EUROPE BUSINESS & GENERAL AVIATION IN SUSTAINABLE AVIATION FUEL MARKET, BY REGION, 2020-2029 (EURO MILLION)

TABLE 21 EUROPE BUSINESS & GENERAL AVIATION IN SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 22 EUROPE MILITARY AVIATION IN SUSTAINABLE AVIATION FUEL MARKET, BY REGION, 2020-2029 (EURO MILLION)

TABLE 23 EUROPE MILITARY AVIATION IN SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 24 EUROPE UNMANNED AERIAL VEHICLE IN SUSTAINABLE AVIATION FUEL MARKET, BY REGION, 2020-2029 (EURO MILLION)

TABLE 25 EUROPE UNMANNED AERIAL VEHICLE IN SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 26 EUROPE SUSTAINABLE AVIATION FUEL MARKET, BY COUNTRY, 2020-2029 (EURO MILLION)

TABLE 27 EUROPE SUSTAINABLE AVIATION FUEL MARKET, BY COUNTRY, 2020-2029 (METRIC TONNES)

TABLE 28 EUROPE SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 29 EUROPE SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (METRIC TONNES)

TABLE 30 EUROPE SUSTAINABLE AVIATION FUEL MARKET, BY MANUFACTURING TECHNOLOGY, 2020-2029 (EURO MILLION)

TABLE 31 EUROPE SUSTAINABLE AVIATION FUEL MARKET, BY BLENDING CAPACITY, 2020-2029 (EURO MILLION)

TABLE 32 EUROPE SUSTAINABLE AVIATION FUEL MARKET, BY BLENDING PLATFORM, 2020-2029 (EURO MILLION)

TABLE 33 EUROPE COMMERCIAL AVIATION IN SUSTAINABLE AVIATION FUEL MARKET, BY TYPE, 2020-2029 (EURO MILLION)

TABLE 34 EUROPE COMMERCIAL AVIATION IN SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 35 EUROPE BUSINESS & GENERAL AVIATION IN SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 36 EUROPE MILITARY AVIATION IN SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 37 EUROPE UNMANNED AERIAL VEHICLE IN SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 38 U.K. SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 39 U.K. SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (METRIC TONNES)

TABLE 40 U.K. SUSTAINABLE AVIATION FUEL MARKET, BY MANUFACTURING TECHNOLOGY, 2020-2029 (EURO MILLION)

TABLE 41 U.K. SUSTAINABLE AVIATION FUEL MARKET, BY BLENDING CAPACITY, 2020-2029 (EURO MILLION)

TABLE 42 U.K. SUSTAINABLE AVIATION FUEL MARKET, BY BLENDING PLATFORM, 2020-2029 (EURO MILLION)

TABLE 43 U.K. COMMERCIAL AVIATION IN SUSTAINABLE AVIATION FUEL MARKET, BY TYPE, 2020-2029 (EURO MILLION)

TABLE 44 U.K. COMMERCIAL AVIATION IN SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 45 U.K. BUSINESS & GENERAL AVIATION IN SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 46 U.K. MILITARY AVIATION IN SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 47 U.K. UNMANNED AERIAL VEHICLE IN SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 48 GERMANY SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 49 GERMANY SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (METRIC TONNES)

TABLE 50 GERMANY SUSTAINABLE AVIATION FUEL MARKET, BY MANUFACTURING TECHNOLOGY, 2020-2029 (EURO MILLION)

TABLE 51 GERMANY SUSTAINABLE AVIATION FUEL MARKET, BY BLENDING CAPACITY, 2020-2029 (EURO MILLION)

TABLE 52 GERMANY SUSTAINABLE AVIATION FUEL MARKET, BY BLENDING PLATFORM, 2020-2029 (EURO MILLION)

TABLE 53 GERMANY COMMERCIAL AVIATION IN SUSTAINABLE AVIATION FUEL MARKET, BY TYPE, 2020-2029 (EURO MILLION)

TABLE 54 GERMANY COMMERCIAL AVIATION IN SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 55 GERMANY BUSINESS & GENERAL AVIATION IN SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 56 GERMANY MILITARY AVIATION IN SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 57 GERMANY UNMANNED AERIAL VEHICLE IN SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 58 FRANCE SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 59 FRANCE SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (METRIC TONNES)

TABLE 60 FRANCE SUSTAINABLE AVIATION FUEL MARKET, BY MANUFACTURING TECHNOLOGY, 2020-2029 (EURO MILLION)

TABLE 61 FRANCE SUSTAINABLE AVIATION FUEL MARKET, BY BLENDING CAPACITY, 2020-2029 (EURO MILLION)

TABLE 62 FRANCE SUSTAINABLE AVIATION FUEL MARKET, BY BLENDING PLATFORM, 2020-2029 (EURO MILLION)

TABLE 63 FRANCE COMMERCIAL AVIATION IN SUSTAINABLE AVIATION FUEL MARKET, BY TYPE, 2020-2029 (EURO MILLION)

TABLE 64 FRANCE COMMERCIAL AVIATION IN SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 65 FRANCE BUSINESS & GENERAL AVIATION IN SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 66 FRANCE MILITARY AVIATION IN SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 67 FRANCE UNMANNED AERIAL VEHICLE IN SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 68 SPAIN SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 69 SPAIN SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (METRIC TONNES)

TABLE 70 SPAIN SUSTAINABLE AVIATION FUEL MARKET, BY MANUFACTURING TECHNOLOGY, 2020-2029 (EURO MILLION)

TABLE 71 SPAIN SUSTAINABLE AVIATION FUEL MARKET, BY BLENDING CAPACITY, 2020-2029 (EURO MILLION)

TABLE 72 SPAIN SUSTAINABLE AVIATION FUEL MARKET, BY BLENDING PLATFORM, 2020-2029 (EURO MILLION)

TABLE 73 SPAIN COMMERCIAL AVIATION IN SUSTAINABLE AVIATION FUEL MARKET, BY TYPE, 2020-2029 (EURO MILLION)

TABLE 74 SPAIN COMMERCIAL AVIATION IN SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 75 SPAIN BUSINESS & GENERAL AVIATION IN SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 76 SPAIN MILITARY AVIATION IN SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 77 SPAIN UNMANNED AERIAL VEHICLE IN SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 78 ITALY SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 79 ITALY SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (METRIC TONNES)

TABLE 80 ITALY SUSTAINABLE AVIATION FUEL MARKET, BY MANUFACTURING TECHNOLOGY, 2020-2029 (EURO MILLION)

TABLE 81 ITALY SUSTAINABLE AVIATION FUEL MARKET, BY BLENDING CAPACITY, 2020-2029 (EURO MILLION)

TABLE 82 ITALY SUSTAINABLE AVIATION FUEL MARKET, BY BLENDING PLATFORM, 2020-2029 (EURO MILLION)

TABLE 83 ITALY COMMERCIAL AVIATION IN SUSTAINABLE AVIATION FUEL MARKET, BY TYPE, 2020-2029 (EURO MILLION)

TABLE 84 ITALY COMMERCIAL AVIATION IN SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 85 ITALY BUSINESS & GENERAL AVIATION IN SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 86 ITALY MILITARY AVIATION IN SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 87 ITALY UNMANNED AERIAL VEHICLE IN SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 88 RUSSIA SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 89 RUSSIA SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (METRIC TONNES)

TABLE 90 RUSSIA SUSTAINABLE AVIATION FUEL MARKET, BY MANUFACTURING TECHNOLOGY, 2020-2029 (EURO MILLION)

TABLE 91 RUSSIA SUSTAINABLE AVIATION FUEL MARKET, BY BLENDING CAPACITY, 2020-2029 (EURO MILLION)

TABLE 92 RUSSIA SUSTAINABLE AVIATION FUEL MARKET, BY BLENDING PLATFORM, 2020-2029 (EURO MILLION)

TABLE 93 RUSSIA COMMERCIAL AVIATION IN SUSTAINABLE AVIATION FUEL MARKET, BY TYPE, 2020-2029 (EURO MILLION)

TABLE 94 RUSSIA COMMERCIAL AVIATION IN SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 95 RUSSIA BUSINESS & GENERAL AVIATION IN SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 96 RUSSIA MILITARY AVIATION IN SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 97 RUSSIA UNMANNED AERIAL VEHICLE IN SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 98 NETHERLANDS SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 99 NETHERLANDS SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (METRIC TONNES)

TABLE 100 NETHERLANDS SUSTAINABLE AVIATION FUEL MARKET, BY MANUFACTURING TECHNOLOGY, 2020-2029 (EURO MILLION)

TABLE 101 NETHERLANDS SUSTAINABLE AVIATION FUEL MARKET, BY BLENDING CAPACITY, 2020-2029 (EURO MILLION)

TABLE 102 NETHERLANDS SUSTAINABLE AVIATION FUEL MARKET, BY BLENDING PLATFORM, 2020-2029 (EURO MILLION)

TABLE 103 NETHERLANDS COMMERCIAL AVIATION IN SUSTAINABLE AVIATION FUEL MARKET, BY TYPE, 2020-2029 (EURO MILLION)

TABLE 104 NETHERLANDS COMMERCIAL AVIATION IN SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 105 NETHERLANDS BUSINESS & GENERAL AVIATION IN SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 106 NETHERLANDS MILITARY AVIATION IN SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 107 NETHERLANDS UNMANNED AERIAL VEHICLE IN SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 108 SWITZERLAND SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 109 SWITZERLAND SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (METRIC TONNES)

TABLE 110 SWITZERLAND SUSTAINABLE AVIATION FUEL MARKET, BY MANUFACTURING TECHNOLOGY, 2020-2029 (EURO MILLION)

TABLE 111 SWITZERLAND SUSTAINABLE AVIATION FUEL MARKET, BY BLENDING CAPACITY, 2020-2029 (EURO MILLION)

TABLE 112 SWITZERLAND SUSTAINABLE AVIATION FUEL MARKET, BY BLENDING PLATFORM, 2020-2029 (EURO MILLION)

TABLE 113 SWITZERLAND COMMERCIAL AVIATION IN SUSTAINABLE AVIATION FUEL MARKET, BY TYPE, 2020-2029 (EURO MILLION)

TABLE 114 SWITZERLAND COMMERCIAL AVIATION IN SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 115 SWITZERLAND BUSINESS & GENERAL AVIATION IN SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 116 SWITZERLAND MILITARY AVIATION IN SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 117 SWITZERLAND UNMANNED AERIAL VEHICLE IN SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 118 TURKEY SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 119 TURKEY SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (METRIC TONNES)

TABLE 120 TURKEY SUSTAINABLE AVIATION FUEL MARKET, BY MANUFACTURING TECHNOLOGY, 2020-2029 (EURO MILLION)

TABLE 121 TURKEY SUSTAINABLE AVIATION FUEL MARKET, BY BLENDING CAPACITY, 2020-2029 (EURO MILLION)

TABLE 122 TURKEY SUSTAINABLE AVIATION FUEL MARKET, BY BLENDING PLATFORM, 2020-2029 (EURO MILLION)

TABLE 123 TURKEY COMMERCIAL AVIATION IN SUSTAINABLE AVIATION FUEL MARKET, BY TYPE, 2020-2029 (EURO MILLION)

TABLE 124 TURKEY COMMERCIAL AVIATION IN SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 125 TURKEY BUSINESS & GENERAL AVIATION IN SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 126 TURKEY MILITARY AVIATION IN SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 127 TURKEY UNMANNED AERIAL VEHICLE IN SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 128 BELGIUM SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 129 BELGIUM SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (METRIC TONNES)

TABLE 130 BELGIUM SUSTAINABLE AVIATION FUEL MARKET, BY MANUFACTURING TECHNOLOGY, 2020-2029 (EURO MILLION)

TABLE 131 BELGIUM SUSTAINABLE AVIATION FUEL MARKET, BY BLENDING CAPACITY, 2020-2029 (EURO MILLION)

TABLE 132 BELGIUM SUSTAINABLE AVIATION FUEL MARKET, BY BLENDING PLATFORM, 2020-2029 (EURO MILLION)

TABLE 133 BELGIUM COMMERCIAL AVIATION IN SUSTAINABLE AVIATION FUEL MARKET, BY TYPE, 2020-2029 (EURO MILLION)

TABLE 134 BELGIUM COMMERCIAL AVIATION IN SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 135 BELGIUM BUSINESS & GENERAL AVIATION IN SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 136 BELGIUM MILITARY AVIATION IN SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 137 BELGIUM UNMANNED AERIAL VEHICLE IN SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 138 REST OF EUROPE SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 139 REST OF EUROPE SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (METRIC TONNES)

Список рисунков

FIGURE 1 EUROPE SUSTAINABLE AVIATION FUEL MARKET: SEGMENTATION

FIGURE 2 EUROPE SUSTAINABLE AVIATION FUEL MARKET: DATA TRIANGULATION

FIGURE 3 EUROPE SUSTAINABLE AVIATION FUEL MARKET: DROC ANALYSIS

FIGURE 4 EUROPE SUSTAINABLE AVIATION FUEL MARKET: EUROPE VS REGIONAL MARKET ANALYSIS

FIGURE 5 EUROPE SUSTAINABLE AVIATION FUEL MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 EUROPE SUSTAINABLE AVIATION FUEL MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 EUROPE SUSTAINABLE AVIATION FUEL MARKET: DBMR MARKET POSITION GRID

FIGURE 8 EUROPE SUSTAINABLE AVIATION FUEL MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 EUROPE SUSTAINABLE AVIATION FUEL MARKET: SEGMENTATION

FIGURE 10 THE INCREASING NEED FOR REDUCTION IN GHG EMISSIONS IN THE AVIATION INDUSTRY IS EXPECTED TO DRIVE THE EUROPE SUSTAINABLE AVIATION FUEL MARKET IN THE FORECAST PERIOD

FIGURE 11 BIO FUEL SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF EUROPE SUSTAINABLE AVIATION FUEL MARKET IN 2022 & 2029

FIGURE 12 NORTH AMERICA IS EXPECTED TO DOMINATE AND BE THE FASTEST-GROWING REGION IN THE EUROPE SUSTAINABLE AVIATION FUEL MARKET IN THE FORECAST PERIOD

FIGURE 13 VALUE CHAIN ANALYSIS FRAMEWORK

FIGURE 14 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGE OF EUROPE SUSTAINABLE AVIATION FUEL MARKET

FIGURE 15 EUROPE AIR TRANSPORT PASSENGER DEMAND

FIGURE 16 EUROPE SUSTAINABLE AVIATION FUEL MARKET: BY TECHNOLOGY, 2021

FIGURE 17 EUROPE SUSTAINABLE AVIATION FUEL MARKET: BY MANUFACTURING TECHNOLOGY, 2021

FIGURE 18 EUROPE SUSTAINABLE AVIATION FUEL MARKET: BY BLENDING CAPACITY, 2021

FIGURE 19 EUROPE SUSTAINABLE AVIATION FUEL MARKET: BY BLENDING PLATFORM, 2021

FIGURE 20 EUROPE SUSTAINABLE AVIATION FUEL MARKET: SNAPSHOT (2021)

FIGURE 21 EUROPE SUSTAINABLE AVIATION FUEL MARKET: BY COUNTRY (2021)

FIGURE 22 EUROPE SUSTAINABLE AVIATION FUEL MARKET: BY COUNTRY (2022 & 2029)

FIGURE 23 EUROPE SUSTAINABLE AVIATION FUEL MARKET: BY COUNTRY (2021 & 2029)

FIGURE 24 EUROPE SUSTAINABLE AVIATION FUEL MARKET: BY FUEL TYPE (2022-2029)

FIGURE 25 EUROPE SUSTAINABLE AVIATION FUEL MARKET: COMPANY SHARE 2021 (%)

Методология исследования

Сбор данных и анализ базового года выполняются с использованием модулей сбора данных с большими размерами выборки. Этап включает получение рыночной информации или связанных данных из различных источников и стратегий. Он включает изучение и планирование всех данных, полученных из прошлого заранее. Он также охватывает изучение несоответствий информации, наблюдаемых в различных источниках информации. Рыночные данные анализируются и оцениваются с использованием статистических и последовательных моделей рынка. Кроме того, анализ доли рынка и анализ ключевых тенденций являются основными факторами успеха в отчете о рынке. Чтобы узнать больше, пожалуйста, запросите звонок аналитика или оставьте свой запрос.

Ключевой методологией исследования, используемой исследовательской группой DBMR, является триангуляция данных, которая включает в себя интеллектуальный анализ данных, анализ влияния переменных данных на рынок и первичную (отраслевую экспертную) проверку. Модели данных включают сетку позиционирования поставщиков, анализ временной линии рынка, обзор рынка и руководство, сетку позиционирования компании, патентный анализ, анализ цен, анализ доли рынка компании, стандарты измерения, глобальный и региональный анализ и анализ доли поставщика. Чтобы узнать больше о методологии исследования, отправьте запрос, чтобы поговорить с нашими отраслевыми экспертами.

Доступна настройка

Data Bridge Market Research является лидером в области передовых формативных исследований. Мы гордимся тем, что предоставляем нашим существующим и новым клиентам данные и анализ, которые соответствуют и подходят их целям. Отчет можно настроить, включив в него анализ ценовых тенденций целевых брендов, понимание рынка для дополнительных стран (запросите список стран), данные о результатах клинических испытаний, обзор литературы, обновленный анализ рынка и продуктовой базы. Анализ рынка целевых конкурентов можно проанализировать от анализа на основе технологий до стратегий портфеля рынка. Мы можем добавить столько конкурентов, о которых вам нужны данные в нужном вам формате и стиле данных. Наша команда аналитиков также может предоставить вам данные в сырых файлах Excel, сводных таблицах (книга фактов) или помочь вам в создании презентаций из наборов данных, доступных в отчете.