Europe Poct Market

Размер рынка в млрд долларов США

CAGR :

%

USD

16.43 Billion

USD

33.65 Billion

2025

2033

USD

16.43 Billion

USD

33.65 Billion

2025

2033

| 2026 –2033 | |

| USD 16.43 Billion | |

| USD 33.65 Billion | |

|

|

|

|

Рынок экспресс-диагностики (POCT) в Европе, по типу продукции (продукты для мониторинга уровня глюкозы, продукты для тестирования инфекционных заболеваний, продукты для кардиометаболического мониторинга, продукты для тестирования беременности и фертильности, продукты для гематологических исследований, продукты для мониторинга свертываемости крови, продукты для тестирования на наркотические вещества, продукты для анализа мочи, продукты для тестирования холестерина, продукты для тестирования опухолевых/раковых маркеров, продукты для тестирования на скрытую кровь в кале и другие), по платформе (тесты с латеральным потоком/иммунохроматографические тесты, иммуноанализы, тест-полоски, молекулярная диагностика, клинические биохимические анализы, микрофлюидика, гематология, другие), по применению (уровень глюкозы в крови, инфекционные заболевания, мониторинг жизненно важных показателей, кардиомониторинг, коагуляция, гематология, неинвазивный мониторинг SpO2, переливание крови, неинвазивные Мониторинг PCO2, анализ цельной крови и другие), по способу назначения (тестирование по рецепту и тестирование без рецепта), по конечному пользователю (больницы, домашний уход, клиники, лаборатории, диагностические центры, патологоанатомические лаборатории, амбулаторные хирургические центры, центры по уходу за пожилыми людьми и другие), по каналу сбыта (прямые продажи, розничная торговля, онлайн-продажи и другие), по стране (Италия, Германия, Франция, Испания, Великобритания, Россия, Турция, Бельгия, Нидерланды, Швейцария, Швеция, Дания, Норвегия, Финляндия, остальная Европа) - Тенденции и прогноз развития отрасли до 2033 года

Размер рынка экспресс-диагностики (POCT) в Европе

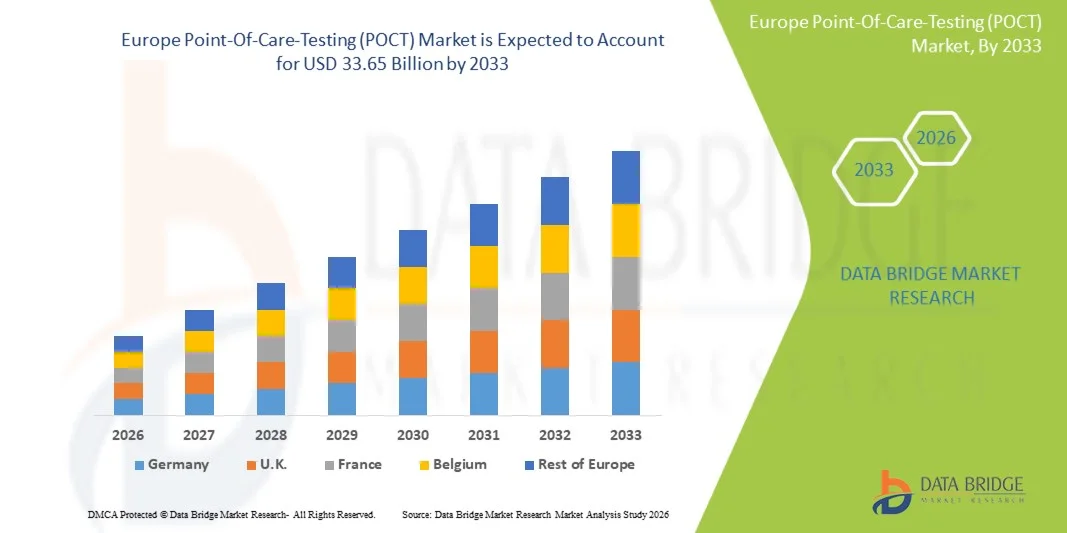

- Объем европейского рынка экспресс-диагностики (POCT) в 2025 году оценивался в 16,43 млрд долларов США и, как ожидается, достигнет 33,65 млрд долларов США к 2033 году , демонстрируя среднегодовой темп роста в 9,4% в течение прогнозируемого периода.

- Рост европейского рынка экспресс-диагностики (POCT) в первую очередь обусловлен растущим спросом на быстрые диагностические решения, позволяющие принимать немедленные клинические решения и снижать зависимость от централизованных лабораторных исследований. Устройства POCT обеспечивают более быстрое получение результатов, раннее выявление заболеваний и улучшение результатов лечения пациентов, что имеет решающее значение в неотложной помощи, дистанционном здравоохранении и домашнем мониторинге.

- Растущая распространенность хронических заболеваний, таких как диабет, сердечно-сосудистые заболевания, инфекционные заболевания и респираторные болезни, значительно увеличивает использование портативных устройств для мониторинга и лечения в режиме реального времени. Кроме того, достижения в области диагностических технологий, микрофлюидики, биосенсоров и подключенных медицинских платформ повышают точность, портативность и возможности интеграции данных, что способствует росту рынка.

Анализ рынка экспресс-диагностики (POCT) в Европе

- Европейский рынок экспресс-диагностики (POCT) — это быстрорастущий сегмент диагностической отрасли, предлагающий немедленные результаты анализов непосредственно в местах нахождения пациента, таких как клиники, больницы, машины скорой помощи и домашние условия. Устройства POCT обеспечивают быструю диагностику и мониторинг таких состояний, как диабет, инфекционные заболевания, беременность, кардиомаркеры, электролитный дисбаланс и параметры свертываемости крови, что позволяет повысить эффективность клинической работы и снизить нагрузку на систему здравоохранения.

- Растущий спрос на портативные и удобные в использовании диагностические технологии в значительной степени обусловлен увеличением распространенности хронических заболеваний, потребностью в неотложной медицинской помощи и расширением домашнего мониторинга состояния пациентов. Кроме того, интеграция цифровых медицинских платформ, диагностики на основе смартфонов, обнаружения с помощью искусственного интеллекта и беспроводной связи способствует улучшению отслеживания данных и удаленному управлению состоянием пациентов, что еще больше стимулирует рост рынка.

- Ожидается, что Германия будет доминировать на европейском рынке экспресс-диагностики (POCT) с наибольшей долей выручки, составляющей около 28,50% в 2026 году, благодаря сильному присутствию ключевых игроков рынка, высоким расходам на здравоохранение, развитой медицинской инфраструктуре и растущему внедрению инновационных диагностических технологий в больницах и в условиях домашнего ухода.

- Ожидается, что сегмент устройств для мониторинга уровня глюкозы будет доминировать на европейском рынке экспресс-диагностики (POCT) с долей более 39,44% в 2026 году, чему способствуют рост числа больных диабетом, предпочтение устройств для мониторинга в режиме реального времени и растущее использование портативных глюкометров и инструментов непрерывного мониторинга уровня глюкозы среди пациентов, получающих уход на дому.

Обзор отчета и сегментация рынка экспресс-диагностики (POCT) в Европе.

|

Атрибуты |

Ключевые тенденции рынка экспресс-диагностики (POCT) в Европе. |

|

Охваченные сегменты |

|

|

Охваченные страны |

Европа

|

|

Ключевые игроки рынка |

|

|

Рыночные возможности |

|

|

Информационные наборы данных, представляющие добавленную стоимость |

Помимо анализа рыночных сценариев, таких как рыночная стоимость, темпы роста, сегментация, географический охват и основные игроки, отчеты о рынке, подготовленные Data Bridge Market Research, также включают в себя отслеживание инноваций и стратегический анализ, технологические достижения, сценарий изменения климата, анализ цепочки поставок, анализ цепочки создания стоимости, критерии выбора поставщиков, PESTLE-анализ, анализ Портера, патентный анализ, анализ отраслевой экосистемы, обзор сырьевых материалов, тарифы и их влияние на рынок, обзор регулирования, поведение потребителей при покупке, перспективы бренда, анализ затрат и нормативно-правовую базу. |

Тенденции рынка экспресс-диагностики (POCT) в Европе

«Технологический прогресс и расширение функциональности за счет исследований и разработок и цифровой интеграции »

- Одной из основных и быстро развивающихся тенденций на европейском рынке экспресс-диагностики (POCT) является растущее внимание к инновациям, исследованиям и разработкам, а также передовым диагностическим технологиям, направленным на повышение точности, скорости, портативности и принятия решений в режиме реального времени. В условиях растущего спроса на децентрализованное и ориентированное на пациента тестирование, медицинские учреждения, диагностические компании и производители медицинского оборудования активно инвестируют в платформы POCT следующего поколения, которые поддерживают точную диагностику и расширенные возможности связи между различными учреждениями здравоохранения.

- Ведущие компании, такие как Abbott, Roche, Siemens Healthineers, Danaher и Thermo Fisher Scientific, ускоряют исследования по разработке миниатюрных устройств, технологий «лаборатория на чипе» и систем тестирования с поддержкой искусственного интеллекта, способных предоставлять результаты лабораторного качества непосредственно в месте необходимости. Эти технологические достижения также включают автоматизированную обработку образцов, улучшенную чувствительность биосенсоров и возможности мультиплексного тестирования, позволяющие одновременно обнаруживать несколько биомаркеров.

- В диагностике инфекционных заболеваний масштабные научно-исследовательские инициативы сосредоточены на создании быстрых молекулярных методов тестирования с высокой точностью, сокращенным временем выполнения и пригодностью для чрезвычайных ситуаций и вспышек заболеваний. Устройства для экспресс-диагностики, предназначенные для выявления гриппа, COVID-19, респираторных инфекций, ВИЧ и сепсиса, совершенствуются с помощью микрофлюидных технологий и изотермической амплификации, что позволяет проводить надежное тестирование вне централизованных лабораторий.

- В управлении хроническими заболеваниями инновации в мониторинге уровня глюкозы, тестировании кардиомаркеров, коагуляционных тестах и анализе функции почек поддерживают непрерывный мониторинг и предоставляют данные в режиме реального времени для клинического вмешательства. Компании интегрируют мобильные приложения, облачные системы отчетности и носимые диагностические устройства, чтобы обеспечить бесперебойный домашний мониторинг и удаленную телемедицинскую связь.

- На рынке также наблюдается расширение в области персонализированной диагностики, при этом разрабатываются решения для экспресс-диагностики (POCT) в поддержку скрининга онкологических заболеваний, заболеваний репродуктивной системы, желудочно-кишечных расстройств и метаболических заболеваний. Эти инновации направлены на обеспечение более раннего выявления, ускорение принятия терапевтических решений и улучшение клинических результатов, особенно в амбулаторных условиях и при оказании помощи на дому.

- Кроме того, интеграция подключенных устройств, цифровой аналитики данных и интерпретации на основе искусственного интеллекта позволяет создавать более интеллектуальные экосистемы экспресс-диагностики, которые повышают автоматизацию рабочих процессов и снижают количество человеческих ошибок. Эти достижения превращают экспресс-диагностику в многофункциональный и интеллектуальный диагностический инструмент, способный поддерживать профилактическую медицину, прецизионную медицину и управление здоровьем населения.

- Эта быстро развивающаяся, инновационная среда меняет рынок экспресс-диагностики, смещая акцент отрасли в сторону портативных, интегрированных и ориентированных на пациента диагностических систем. Поскольку европейские системы здравоохранения отдают приоритет эффективности, доступности и устойчивости, ожидается, что цифровая трансформация, основанная на исследованиях и разработках, откроет новые возможности применения и расширит проникновение на рынок как в развитых, так и в развивающихся регионах.

Динамика рынка экспресс-диагностики (POCT) в Европе

Водитель

«Растущий спрос на быстрые, децентрализованные и ориентированные на пациента диагностические решения»

- Одним из существенных факторов, ускоряющих рост европейского рынка экспресс-диагностики (POCT), является растущая потребность в быстрых, доступных и децентрализованных диагностических инструментах, улучшающих принятие клинических решений и результаты лечения пациентов. По мере перехода систем здравоохранения к моделям, ориентированным на ценность и пациента, экспресс-диагностика обеспечивает немедленные результаты анализов непосредственно в месте оказания медицинской помощи или рядом с ним, снижая зависимость от централизованных лабораторий и обеспечивая раннюю диагностику и своевременное лечение.

- Ведущие игроки отрасли, такие как Abbott, Roche, Siemens Healthineers и Danaher, активно расширяют инвестиции в НИОКР для разработки портативных, высокоточных и цифровых устройств для экспресс-диагностики, способных поддерживать диагностику в режиме реального времени в больницах, клиниках, отделениях неотложной помощи и на дому. Эти инновации соответствуют растущему спросу на интегрированные цифровые решения в области здравоохранения, расширению телемедицины и интерпретации результатов с помощью искусственного интеллекта.

- В сфере лечения хронических заболеваний устройства для экспресс-диагностики (POCT) для мониторинга уровня глюкозы, определения кардиомаркеров, коагуляционных тестов и оценки функции почек переживают стремительный рост в связи с увеличением распространенности диабета, сердечно-сосудистых заболеваний и нарушений образа жизни в Европе. Аналогичным образом, системы экспресс-диагностики инфекционных заболеваний, таких как COVID-19, грипп, сепсис, малярия и ВИЧ, становятся важнейшими инструментами для борьбы с эпидемиями, особенно в регионах с ограниченными ресурсами.

- Растущее внимание к мониторингу состояния пациентов на дому и дистанционно также способствует внедрению этих методов, чему способствуют разработка диагностических средств на базе смартфонов, носимых устройств для тестирования, облачных платформ и возможностей удаленной отчетности, что повышает клиническую взаимосвязь и непрерывность оказания медицинской помощи.

- В условиях модернизации инфраструктуры здравоохранения, растущего акцента на быстрой диагностике и значительных государственных и частных инвестиций, экспресс-диагностика (POCT) становится важнейшим компонентом системы здравоохранения будущего. Поскольку эффективность и доступность становятся центральными элементами реформы здравоохранения в Европе, ожидается значительное увеличение спроса на инновационные, точные и ориентированные на пациента системы экспресс-диагностики.

Сдержанность/Вызов

« Высокие затраты, сложности регулирования, а также проблемы с точностью и стандартизацией »

- Несмотря на уверенный рост рынка, европейский рынок экспресс-диагностики (POCT) сталкивается со значительными проблемами, связанными с высокими затратами на оборудование и тестирование, строгими процедурами получения разрешений от регулирующих органов и изменчивостью диагностической точности на разных платформах устройств. Обеспечение стабильной аналитической эффективности, сопоставимой со стандартами централизованных лабораторий, остается ключевым препятствием, особенно по мере расширения применения POCT в сегментах интенсивной терапии и высокосложных исследований.

- Получение разрешений от регулирующих органов, таких как FDA, EMA и других национальных ведомств, требует обширной клинической валидации, соответствия стандартам качества и постмаркетингового надзора. Эти процессы могут значительно замедлить сроки запуска продукта и увеличить затраты на разработку для производителей, особенно в случае новых диагностических технологий, таких как молекулярная экспресс-диагностика и мультиплексное тестирование.

- Ограничения по стоимости также сдерживают внедрение в развивающихся регионах, где ограниченные бюджеты здравоохранения и неадекватные системы возмещения расходов препятствуют широкому распространению. Кроме того, операционные проблемы, такие как требования к техническому обслуживанию, необходимость обучения пользователей и интеграция рабочих процессов, могут препятствовать крупномасштабному внедрению в больницах и диагностических центрах.

- Обеспокоенность по поводу точности, надежности и стандартизации результатов, особенно в случае высокочувствительных тестов на инфекционные заболевания и кардиомаркеры, может вызывать сомнения у врачей и увеличивать зависимость от централизованного подтверждающего тестирования. Проблемы, связанные с интеграцией данных и кибербезопасностью в цифровых платформах экспресс-диагностики, также требуют усовершенствованных технологических решений и инвестиций.

- По мере развития технологии экспресс-диагностики (POCT) преодоление этих финансовых, нормативных и технических проблем потребует значительного финансирования НИОКР, улучшения европейской гармонизации диагностических стандартов и стратегического сотрудничества между производителями устройств, поставщиками медицинских услуг и государственными органами здравоохранения. До тех пор эти барьеры могут продолжать ограничивать темпы внедрения в определенных сегментах рынка и регионах.

Обзор рынка экспресс-диагностики (POCT) в Европе

Рынок сегментирован по типу продукта, платформе, применению, способу назначения, конечному пользователю и каналу сбыта.

- По типу продукции

В зависимости от типа продукции, европейский рынок экспресс-диагностики (POCT) сегментирован на следующие категории: устройства для мониторинга уровня глюкозы, устройства для тестирования на инфекционные заболевания, устройства для кардиометаболического мониторинга, устройства для тестирования беременности и фертильности, устройства для гематологического тестирования, устройства для мониторинга свертываемости крови, устройства для тестирования на наркотические вещества (DOA), устройства для анализа мочи, устройства для тестирования уровня холестерина, устройства для тестирования опухолевых/раковых маркеров, устройства для тестирования на скрытую кровь в кале и другие. Ожидается, что сегмент устройств для мониторинга уровня глюкозы займет наибольшую долю рынка в 39,44% в 2026 году, чему способствуют растущая распространенность диабета в Европе, растущий спрос на самоконтроль на дому и непрерывные технологические достижения в области глюкометров и подключенных цифровых медицинских платформ.

- По платформе

В зависимости от платформы, европейский рынок экспресс-тестирования (POCT) сегментирован на следующие категории: экспресс-тесты/иммунохроматографические тесты, иммуноанализы, тест-полоски, молекулярная диагностика, клинические биохимические анализы, микрофлюидика, гематология и другие. Ожидается, что в 2026 году экспресс-тесты/иммунохроматографические тесты будут доминировать благодаря их широкому применению в скрининге инфекционных заболеваний, простоте использования, быстрой обработке результатов, низкой стоимости и широкому использованию во время вспышек таких заболеваний, как COVID-19, грипп, малярия и денге. Их пригодность для децентрализованных и удаленных медицинских учреждений дополнительно способствует росту сегмента.

- По заявлению

В зависимости от области применения, европейский рынок экспресс-диагностики (POCT) сегментирован на следующие категории: уровень глюкозы в крови, инфекционные заболевания, мониторинг жизненно важных показателей, кардиомониторинг, коагуляция, гематология, неинвазивный мониторинг SpO2, переливание крови, неинвазивный мониторинг PCO2, анализ цельной крови и другие. Ожидается, что в 2026 году рынок глюкометров будет доминировать, занимая наибольшую долю выручки, чему способствуют рост распространенности диабета, растущая предпочтение пациентов к портативным устройствам мониторинга, а также доступность высокоточных, удобных в использовании глюкометров и технологий непрерывного мониторинга глюкозы (CGM), поддерживающих управление диабетом в режиме реального времени.

- В режиме рецепта

В зависимости от режима выписки рецепта, европейский рынок экспресс-тестирования (POCT) сегментируется на тестирование без рецепта (OTC) и тестирование по рецепту. Сегмент тестирования без рецепта занимал наибольшую долю рынка в 2026 году благодаря растущей популярности решений для самотестирования среди потребителей, увеличению доступности экспресс-тестов и повышению внимания к профилактической медицине. Устройства OTC POCT позволяют людям отслеживать такие параметры здоровья, как уровень глюкозы, беременность, фертильность, инфекционные заболевания и сердечно-сосудистые показатели, без медицинского наблюдения.

- Конечным пользователем

В зависимости от конечного пользователя, европейский рынок экспресс-диагностики (POCT) сегментирован на больницы, домашний уход, клиники, лаборатории, диагностические центры, патологические лаборатории, амбулаторные хирургические центры, центры по уходу за пожилыми людьми и другие. Сегмент больниц занимал наибольшую долю рынка по выручке в 2026 году, что обусловлено высоким спросом на экспресс-диагностику для поддержки неотложной помощи, интенсивной терапии и рутинных клинических обследований. Устройства POCT, такие как глюкометры, анализаторы кардиомаркеров, экспресс-тесты на инфекционные заболевания, мониторы свертываемости крови и анализаторы газов крови, все чаще используются в больницах для ускорения принятия клинических решений, сокращения времени ожидания пациентов и повышения эффективности рабочих процессов.

- По каналам сбыта

В зависимости от канала сбыта, европейский рынок экспресс-диагностики (POCT) сегментирован на прямые тендеры, розничные продажи, онлайн-продажи и другие каналы. В 2026 году наибольшую долю выручки рынка занимал сегмент прямых тендеров , чему способствовали крупные закупки устройств POCT больницами, диагностическими лабораториями и органами здравоохранения. Крупномасштабные тендеры обеспечивают бесперебойные поставки необходимых диагностических инструментов, таких как глюкометры, экспресс-тесты на инфекционные заболевания, анализаторы кардиомаркеров и устройства для коагуляционного анализа, необходимых для рутинного тестирования и оказания неотложной помощи.

Анализ рынка экспресс-диагностики (POCT) в Европе

Прогнозируется, что европейский рынок экспресс-диагностики (POCT) будет стабильно расти в течение прогнозируемого периода, чему способствует растущий спрос на быструю диагностику в отделениях неотложной помощи, на дому и в амбулаторных клиниках. Акцент на качественном оказании медицинской помощи, ранней диагностике и снижении нагрузки на больницы ускоряет внедрение POCT для диагностики инфекционных заболеваний, определения кардиомаркеров, нарушений обмена веществ и мониторинга свертываемости крови. Нормативно-правовая база, способствующая созданию безопасных и надежных диагностических устройств, в сочетании с достижениями в области микрофлюидных методов тестирования, поддерживает рост рынка. Кроме того, растущее внимание Европы к цифровому здравоохранению, дистанционному мониторингу и интегрированной диагностике продолжает стимулировать внедрение POCT в ключевых странах.

Анализ рынка экспресс-диагностики (POCT) в Великобритании и Европе

Ожидается, что рынок экспресс-диагностики (POCT) в Великобритании будет расти значительными темпами, чему способствуют расширение цифровизации здравоохранения в стране, рост бремени хронических заболеваний и высокий спрос на решения для экспресс-тестирования в домашних условиях и учреждениях первичной медико-санитарной помощи. Повышение осведомленности о профилактической медицине и ранней диагностике привело к широкому использованию экспресс-диагностики для мониторинга уровня глюкозы, скрининга инфекционных заболеваний, тестирования на беременность/фертильность и определения сердечно-сосудистых маркеров. Растущие инвестиции в телемедицину, интеграцию электронных медицинских систем и децентрализованные диагностические услуги в Великобритании еще больше ускоряют внедрение этих технологий.

Анализ рынка экспресс-диагностики (POCT) в Германии и Европе

Рынок экспресс-диагностики (POCT) в Германии готов к значительному расширению, чему способствуют мощные производственные мощности страны в области медицинских изделий, высокоразвитая диагностическая инфраструктура и акцент на эффективном ведении пациентов. Растущее внедрение экспресс-тестирования в больницах, амбулаторных центрах и на дому в Германии обусловлено увеличением числа случаев диабета, сердечно-сосудистых заболеваний и инфекционных болезней. Достижения страны в области сенсорных технологий, соблюдение нормативных требований и акцент на высококачественных медицинских изделиях продолжают способствовать развитию и коммерциализации платформ POCT следующего поколения. Кроме того, акцент Германии на цифровой диагностике и дистанционном мониторинге укрепляет долгосрочный рост рынка.

Доля рынка экспресс-диагностики (POCT) в Европе

В отрасли экспресс-диагностики (POCT) лидируют преимущественно хорошо зарекомендовавшие себя компании, в том числе:

- Abbott Point of Care Inc. (США)

- Sinocare Inc. (Китай)

- F. Hoffmann-La Roche Ltd (Швейцария)

- Корпорация Данахер (США)

- Hologic, Inc. (США)

- bioMérieux SA (Франция)

- Siemens Healthineers AG (Германия)

- Thermo Fisher Scientific Inc. (США)

- BD Veritor (Becton, Dickinson and Company) (США)

- Корпорация QuidelOrtho (США)

- Bio-Rad Laboratories, Inc. (США)

- Верфен (Испания)

- Sekisui Diagnostics (Япония)

- Trividia Health, Inc. (США)

- Nova Biomedical Corporation (США)

- Meridian Bioscience, Inc. (США)

- Компания Pfizer Inc. (США)

- Шэньчжэньская новая промышленная биомедицинская инженерная компания (Китай)

- Корпорация Sysmex (Япония)

- Wondfo (Guangzhou Wondfo Biotech Co., Ltd.) (Китай)

- QIAGEN NV (Германия)

- Abaxis, Inc. (США)

- Компания Autobio Diagnostics Co., Ltd. (Китай)

- Getein Biotech, Inc. (Китай)

- Chembio Diagnostics, Inc. (США)

- EKF Diagnostics Holdings plc (Великобритания)

- Trinity Biotech plc (Ирландия)

- PTS Diagnostics (США)

- QuantuMDx Group Ltd. (Великобритания)

- Binx Health (США)

- Xiamen Boson Biotech Co., Ltd. (Китай)

- Компания Accubiotech Co., Ltd. (Китай)

- Sienco, Inc. (США)

- Корпорация LamdaGen (США)

Последние тенденции на европейском рынке экспресс-диагностики (POCT)

- В мае 2020 года тест ID NOW COVID-19 от компании Abbott обеспечил быстрые и надежные результаты в течение нескольких минут, способствуя своевременной диагностике и снижению риска заражения. Исследования показали высокую эффективность в условиях неотложной медицинской помощи, с чувствительностью ≥94,7% и специфичностью ≥98,6%. Несмотря на проблемы, выявленные в исследовании Нью-Йоркского университета, данные, полученные в реальных условиях, подтверждают его эффективность. Тест, одобренный FDA в рамках разрешения на экстренное использование, играет решающую роль в выявлении COVID-19.

- В сентябре 2025 года дочерняя компания Sinocare, Dongguan E-Test Technology, получила разрешение FDA 510(k) на свои интеллектуальные тонометры Multi-Series, подчеркивающие их точность, безопасность и беспроводные возможности. Устройства обеспечивают мониторинг медицинского уровня, подключение по Bluetooth и интеллектуальные оповещения, укрепляя стратегию расширения Sinocare в Европе и расширяя экосистему управления хроническими заболеваниями на международных рынках, включая США и Европу.

- В январе 2025 года корпорация Danaher заключила инвестиционное партнерство с компанией Innovaccer Inc., занимающейся разработкой искусственного интеллекта для здравоохранения. Цель этого сотрудничества — ускорить внедрение точной диагностики и оказания медицинской помощи, ориентированной на результат, путем предоставления медицинским учреждениям унифицированных данных о пациентах и расширенной аналитики, что позволит улучшить результаты лечения пациентов за счет персонализированных и своевременных вмешательств.

- В ноябре 2023 года компания Binx Health заключила партнерское соглашение с Fisher Healthcare для расширения распространения одобренной FDA платформы binx io, предназначенной для экспресс-диагностики хламидиоза и гонореи. Эта система обеспечивает результаты лабораторного качества примерно за 30 минут, что повышает оперативность диагностики и позволяет врачам проводить обследование и лечение пациентов за один визит, улучшая доступность медицинской помощи.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Интерактивная панель анализа данных

- Панель анализа компании для возможностей с высоким потенциалом роста

- Доступ аналитика-исследователя для настройки и запросов

- Анализ конкурентов с помощью интерактивной панели

- Последние новости, обновления и анализ тенденций

- Используйте возможности сравнительного анализа для комплексного отслеживания конкурентов

Содержание

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE EUROPE POINT-OF-CARE-TESTING (POCT) MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 MULTIVARIATE MODELLING

2.6 TYPE LIFELINE CURVE

2.7 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.8 DBMR MARKET POSITION GRID

2.9 MARKET END USER COVERAGE GRID

2.1 VENDOR SHARE ANALYSIS

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTER’S FIVE FORCES

4.2 PESTEL ANALYSIS

4.3 HEALTHCARE ECONOMY

4.3.1 HEALTHCARE EXPENDITURE

4.3.2 CAPITAL EXPENDITURE

4.3.3 CAPEX TRENDS

4.3.4 CAPEX ALLOCATION

4.3.5 FUNDING SOURCES

4.3.6 INDUSTRY BENCHMARKS

4.3.7 GDP RATIO IN OVERALL GDP

4.3.8 HEALTHCARE SYSTEM STRUCTURE

4.3.9 GOVERNMENT POLICIES

4.3.10 ECONOMIC DEVELOPMENT

4.4 REIMBURSEMENT FRAMEWORK

4.5 OPPORTUNITY MAP ANALYSIS

4.6 VALUE CHAIN ANALYSIS

4.7 MICRO AND MACRO ECONOMIC FACTORS

4.7.1 CURRENT MARKET PENETRATION

4.7.2 GROWTH PROSPECTS

4.7.3 KEY PRICING STRATEGIES

4.8 TECHNOLOGY ROADMAP: EUROPE POINT OF CARE TESTING

5 EUROPE POINT-OF-CARE TESTING (POCT) MARKET: REGULATIONS

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 RISING USE OF POC TESTING IN HEALTHCARE FACILITIES

6.1.2 RISING INCIDENCE OF SUBSTANCE ABUSE

6.1.3 INCREASED ADOPTION OF TELEMEDICINE

6.1.4 ADVANCEMENTS TECHNOLOGIES ENHANCING POC TESTING WITH BIOSENSORS AND MOBILE INTEGRATION

6.2 RESTRAINTS

6.2.1 DATA SECURITY AND PRIVACY CONCERNS

6.2.2 LACK OF ACCURACY AND TECHNICAL CHALLENGES

6.3 OPPORTUNITIES

6.3.1 RISING AWARENESS AND ADVOCACY FOR POINT-OF-CARE TESTING

6.3.2 STRATEGIC INITIATION AND DECISION TAKEN BY THE MARKET PLAYERS

6.3.3 EXPANDING PRODUCT RANGE FOR POINT-OF-CARE TESTING

6.4 CHALLENGES

6.4.1 LIMITED AWARENESS AND ACCEPTANCE

6.4.2 IMPACT OF HIGH MAINTENANCE COSTS THREATENING POINT-OF-CARE TESTING (POCT) SUSTAINABILITY IN LOW-RESOURCE SETTINGS

7 EUROPE POINT-OF-CARE TESTING (POCT) MARKET, BY PRODUCT TYPE

7.1 OVERVIEW

7.2 GLUCOSE MONITORING PRODUCTS

7.2.1 SELF-MONITORING OF BLOOD GLUCOSE (SMBG) DEVICES

7.2.1.1 Strips

7.2.1.2 Meters

7.2.1.3 Lancets and Lancing Devices

7.2.2 CONTINUOUS GLUCOSE MONITORING (CGM) SYSTEMS

7.3 INFECTIOUS DISEASE TESTING PRODUCTS

7.3.1 COVID-19

7.3.2 HIV TESTING PRODUCTS

7.3.2.1 Testing Reagents

7.3.2.2 Testing Equipment

7.3.3 RESPIRATORY INFECTION TESTING PRODUCTS

7.3.4 SEXUALLY TRANSMITTED DISEASES (STD) TESTING

7.3.4.1 NAAT-Based Systems

7.3.4.2 NON–NAAT-Based Systems

7.3.5 HEPATITIS C TESTING PRODUCTS

7.3.5.1 HCV Antibody Tests

7.3.5.2 HCV Viral Load Tests

7.3.6 INFLUENZA TESTING PRODUCTS

7.3.6.1 Traditional Diagnostic Test

7.3.6.2 Molecular Diagnostic Assay

7.3.6.2.1 Rapid Influenza Diagnostic Test (RIDT)

7.3.6.2.2 Direct Fluorescent Antibody Test (DFAT)

7.3.6.2.3 Viral Culture

7.3.6.2.4 Serological Assay

7.3.6.3 RT-PCR

7.3.6.4 Loop-Mediated Isothermal Amplification-Based Assay (LAMP)

7.3.6.5 Nucleic Acid Sequence-Based Amplification Test (NASBAT)

7.3.6.6 Simple Amplification-Based Assay (SAMBA)

7.3.6.7 Healthcare Associated Infection (HAI) Testing

7.3.6.8 Tropical Disease Testing Products

7.3.6.9 Other Infectious Disease Testing Products

7.4 CARDIOMETABOLIC MONITORING PRODUCTS

7.4.1 CARDIAC MARKER TESTING PRODUCTS

7.4.1.1 HSTNL

7.4.1.2 BNP

7.4.1.3 D-DIMER

7.4.1.4 CK-MB

7.4.1.5 Myoglobin

7.4.2 BLOOD GAS/ELECTROLYTE TESTING PRODUCTS

7.4.2.1 Blood Gas/Electrolyte Testing Consumables

7.4.2.2 Blood Gas/Electrolyte Testing Instruments

7.4.3 CARTRIDGES

7.4.4 REAGENTS

7.4.4.1 Portable

7.4.4.2 Benchtop

7.4.4.3 Combined Analyzers

7.4.4.4 Blood Gas Analyzers

7.4.4.5 Electrolyte Analyzers

7.4.4.6 Combined Analyzers

7.4.4.7 Blood Gas Analyzers

7.4.4.8 Electrolyte Analyzers

7.4.5 HBA1C TESTING PRODUCTS

7.4.5.1 HBA1C Testing Instruments

7.4.5.2 HBA1C Testing Consumables

7.4.5.3 POC Analyzer

7.4.5.4 ECG Device

7.4.5.5 Resting ECG Devices

7.4.5.6 Stress ECG Devices

7.4.5.7 Holter Monitors

7.5 PREGNANCY AND FERTILITY TESTING PRODUCTS

7.5.1 PREGNANCY TESTING PRODUCTS

7.5.1.1 Strips/ Dip Sticks and Cards

7.5.1.2 Mid Stream Devices

7.5.1.3 Cassettes

7.5.1.4 Digital Devices

7.5.1.5 Line-Indicator Devices

7.5.2 FERTILITY TESTING PRODUCTS

7.5.2.1 Luteinizing Hormone (LH) Urine Test

7.5.2.2 FSH Test

7.5.2.3 others

7.6 HAEMATOLOGY TESTING PRODUCTS

7.7 COAGULATION MONITORING PRODUCTS

7.7.1 ANTICOAGULATION MONITORING DEVICES

7.7.1.1 Prothrombin Time/International Normalized Ratio (PT-INR) Testing Devices

7.7.1.2 Activated Clotting Time (ACT)

7.7.1.3 Activated Partial Thromboplastin Time (APPT)

7.7.1.4 Platelet Function Monitoring Devices

7.7.1.5 Viscoelastic Coagulation Monitoring Devices

7.7.1.6 Rotational Thromboelastometry (ROTEM)

7.7.1.7 Thromboelastography (TEG)

7.7.1.8 Drug-Of-Abuse (DOA) Testing Products

7.7.2 DOA ANALYSERS

7.7.2.1 Immunoassays

7.7.2.2 Chromatographic Devices

7.7.2.3 Breath Analysers

7.7.3 RAPID TESTING DEVICES

7.7.3.1 Urine Testing Devices

7.7.3.2 Oral Fluid Testing Devices

7.7.3.4 Others

7.8 URINALYSIS TESTING PRODUCTS

7.8.1.1 POC Urine Strip Self-Testing

7.8.1.2 POC Urine Test Strip Professional Testing

7.9 CHOLESTEROL TESTING PRODUCTS

7.9.1.1 Testing Kits

7.9.1.2 Instruments

7.9.1.3 Table-Top Analyzers

7.9.1.4 Hand-Held Analyzers

7.1 TUMOR/CANCER MARKER TESTING PRODUCTS

7.11 FECAL OCCULT TESTING PRODUCTS

7.11.1.1 Guaiac FOB Stool Test

7.11.1.2 Lateral Flow Immuno-FOB Test

7.11.1.3 Immuno-FOB Agglutination Test

7.11.1.4 Immuno-FOB ELISA Test

7.12 OTHERS

8 EUROPE POINT-OF-CARE TESTING (POCT) MARKET, BY PLATFORM

8.1 OVERVIEW

8.2 LATERAL FLOW ASSAYS/IMMUNOCHROMATOGRAPHY TESTS

8.3 IMMUNOASSAYS

8.4 DIPSTICKS

8.5 MOLECULAR DIAGNOSTICS

8.6 CLINICAL CHEMISTRY ASSAYS

8.7 MICROFLUIDICS

8.8 HEMATOLOGY

8.9 OTHERS

9 EUROPE POINT-OF-CARE-TESTING (POCT) MARKET, BY APPLICATION

9.1 OVERVIEW

9.2 BLOOD GLUCOSE

9.3 INFECTIOUS DISEASES

9.3.1 COVID-19 TESTING

9.3.2 HIV TESTING

9.3.3 HEPATITIS C TESTING

9.3.4 INFLUENZA TESTING

9.3.5 TUBERCULOSIS TESTING

9.3.6 OTHERS

9.4 VITAL SIGN MONITORING

9.5 CARDIAC MONITORING

9.6 COAGULATION

9.7 HAEMATOLOGY

9.8 NON- INVASIVE SPO2 MONITORING

9.9 BLOOD TRANSFUSION

9.1 NON- INVASIVE PCO2 MONITORING

9.11 WHOLE BLOOD ANALYSIS

9.12 OTHERS

10 EUROPE POINT-OF-CARE TESTING (POCT) MARKET, BY PRESCRIPTION MODE

10.1 OVERVIEW

10.2 OTC TESTING

10.3 PRESCRIPTION-BASED TESTING

11 EUROPE POINT-OF-CARE-TESTING (POCT) MARKET, BY DISTRIBUTION CHANNEL

11.1 OVERVIEW

11.2 DIRECT TENDER

11.3 RETAIL SALES

11.4 ONLINE SALES

11.5 OTHERS

12 EUROPE POINT-OF-CARE TESTING (POCT) MARKET, BY END USER

12.1 OVERVIEW

12.2 HOSPITALS

12.2.1 PRIVATE

12.2.1.1 Tier 1

12.2.1.2 Tier 2

12.2.1.3 Tier 3

12.2.2 PUBLIC

12.2.2.1 Tier 1

12.2.2.2 Tier 2

12.2.2.3 Tier 3

12.3 HOME CARE

12.4 CLINICS

12.5 LABORATORIES

12.6 DIAGNOSTIC CENTERS

12.7 PATHOLOGY LABS

12.8 AMBULATORY SURGERY CENTERS

12.9 ELDERLY CARE CENTERS

12.1 OTHERS

13 EUROPE POINT-OF-CARE-TESTING (POCT) MARKET, BY REGION

13.1 EUROPE

13.1.1 GERMANY

13.1.2 FRANCE

13.1.3 U.K.

13.1.4 ITALY

13.1.5 SPAIN

13.1.6 RUSSIA

13.1.7 TURKEY

13.1.8 NETHERLANDS

13.1.9 SWITZERLAND

13.1.10 NORWAY

13.1.11 POLAND

13.1.12 REST OF EUROPE

14 EUROPE POINT-OF-CARE TESTING (POCT) MARKET: COMPANY LANDSCAPE

14.1 COMPANY SHARE ANALYSIS: GLOBAL

15 SWOT ANALYSIS

16 COMPANY PROFILES

16.1 ABBOTT POINT OF CARE INC(ABBOTT)

16.1.1 COMPANY SNAPSHOT

16.1.2 REVENUE ANALYSIS

16.1.3 COMPANY SHARE ANALYSIS

16.1.4 PRODUCT PORTFOLIO

16.1.5 RECENT DEVELOPMENT

16.2 SINOCARE.

16.2.1 COMPANY SNAPSHOT

16.2.2 COMPANY SHARE ANALYSIS

16.2.3 PRODUCT PORTFOLIO

16.2.4 RECENT DEVELOPMENT

16.3 F. HOFFMANN-LA ROCHE LTD

16.3.1 COMPANY SNAPSHOT

16.3.2 REVENUE ANALYSIS

16.3.3 COMPANY SHARE ANALYSIS

16.3.4 PRODUCT PORTFOLIO

16.3.5 RECENT DEVELOPMENT

16.4 DANAHER

16.4.1 COMPANY SNAPSHOT

16.4.2 REVENUE ANALYSIS

16.4.3 COMPANY SHARE ANALYSIS

16.4.4 PRODUCT PORTFOLIO

16.4.5 RECENT DEVELOPMENT

16.5 HOLOGIC, INC

16.5.1 COMPANY SNAPSHOT

16.5.2 REVENUE ANALYSIS

16.5.3 COMPANY SHARE ANALYSIS

16.5.4 PRODUCT PORTFOLIO

16.5.5 RECENT DEVELOPMENT

16.6 ACCUBIOTECH CO., LTD.

16.6.1 COMPANY SNAPSHOT

16.6.2 PRODUCT PORTFOLIO

16.6.3 RECENT DEVELOPMENT

16.7 ABAXIS (ABAXIS IS A PART OF ZOETIS)

16.7.1 COMPANY SNAPSHOT

16.7.2 PRODUCT PORTFOLIO

16.7.3 RECENT DEVELOPMENT

16.8 AUTOBIO

16.8.1 COMPANY SNAPSHOT

16.8.2 REVENUE ANALYSIS

16.8.3 PRODUCT PORTFOLIO

16.8.4 RECENT DEVELOPMENT

16.9 BD VERITOR(BD)

16.9.1 COMPANY SNAPSHOT

16.9.2 REVENUE ANALYSIS

16.9.3 PRODUCT PORTFOLIO

16.9.4 RECENT DEVELOPMENT

16.1 BINX HEALTH

16.10.1 COMPANY SNAPSHOT

16.10.2 SOLUTION PORTFOLIO

16.10.3 RECENT DEVELOPMENT

16.11 BIOMERIEUX

16.11.1 COMPANY SNAPSHOT

16.11.2 REVENUE ANALYSIS

16.11.3 PRODUCT PORTFOLIO

16.11.4 RECENT DEVELOPMENT

16.12 BIO- RAD LABORATORIES, INC.

16.12.1 COMPANY SNAPSHOT

16.12.2 REVENUE ANALYSIS

16.12.3 PRODUCT PORTFOLIO

16.12.4 RECENT DEVELOPMENT

16.13 CHEMBIO DIAGNOSTICS, INC.

16.13.1 COMPANY SNAPSHOT

16.13.2 PRODUCT PORTFOLIO

16.13.3 RECENT DEVELOPMENT

16.14 EKF DIAGNOSTICS HOLDINGS PLC

16.14.1 COMPANY SNAPSHOT

16.14.2 REVENUE ANALYSIS

16.14.3 PRODUCT PORTFOLIO

16.14.4 RECENT DEVELOPMENT

16.15 GETEIN BIOTECH, INC.

16.15.1 COMPANY SNAPSHOT

16.15.2 REVENUE ANALYSIS

16.15.3 PRODUCT PORTFOLIO

16.15.4 RECENT DEVELOPMENT

16.16 LAMDAGEN CORPORATION

16.16.1 COMPANY SNAPSHOT

16.16.2 PRODUCT PORTFOLIO

16.16.3 RECENT DEVELOPMENT

16.17 MERIDIAN BIOSCIENCE

16.17.1 COMPANY SNAPSHOT

16.17.2 PRODUCT PORTFOLIO

16.17.3 RECENT DEVELOPMENT

16.18 NOVA BIOMEDICAL

16.18.1 COMPANY SNAPSHOT

16.18.2 PRODUCT PORTFOLIO

16.18.3 RECENT DEVELOPMENT

16.19 PFIZER INC.

16.19.1 COMPANY SNAPSHOT

16.19.2 PRODUCT PORTFOLIO

16.19.3 RECENT DEVELOPMENT

16.2 PTS DIAGNOSTICS

16.20.1 COMPANY SNAPSHOT

16.20.2 PRODUCT PORTFOLIO

16.20.3 RECENT DEVELOPMENT

16.21 QIAGEN

16.21.1 COMPANY SNAPSHOT

16.21.2 REVENUE ANALYSIS

16.21.3 PRODUCT PORTFOLIO

16.21.4 RECENT DEVELOPMENT

16.22 QUIDELORTHO CORPORATION

16.22.1 COMPANY SNAPSHOT

16.22.2 REVENUE ANALYSIS

16.22.3 PRODUCT PORTFOLIO

16.22.4 RECENT DEVELOPMENT

16.23 QUANTUMDX GROUP LTD.

16.23.1 COMPANY SNAPSHOT

16.23.2 PRODUCT PORTFOLIO

16.23.3 RECENT DEVELOPMENT

16.24 SEKISUI DIAGNOSTICS

16.24.1 COMPANY SNAPSHOT

16.24.2 PRODUCT PORTFOLIO

16.24.3 RECENT. DEVELOPMENT

16.25 SHENZHEN NEW INDUSTRY BIOMEDICAL ENGINEERING CO., LTD.

16.25.1 COMPANY SNAPSHOT

16.25.2 REVENUE ANALYSIS

16.25.3 PRODUCT PORTFOLIO

16.25.4 RECENT DEVELOPMENT

16.26 SIEMENS HEALTHINEERS AG

16.26.1 COMPANY SNAPSHOT

16.26.2 REVENUE ANALYSIS

16.26.3 PRODUCT PORTFOLIO

16.26.4 RECENT DEVELOPMENT

16.27 SIENCO, INC.

16.27.1 COMPANY SNAPSHOT

16.27.2 PRODUCT PORTFOLIO

16.27.3 RECENT UPDATES

16.28 SYSMEX CORPORATION

16.28.1 COMPANY SNAPSHOT

16.28.2 REVENUE ANALYSIS

16.28.3 PRODUCT PORTFOLIO

16.28.4 RECENT DEVELOPMENT

16.29 TRINITY BIOTECH

16.29.1 COMPANY SNAPSHOT

16.29.2 REVENUE ANALYSIS

16.29.3 PR.ODUCT PORTFOLIO

16.29.4 RECENT DEVELOPMENT

16.3 TRIVIDIA HEALTH, INC.

16.30.1 COMPANY SNAPSHOT

16.30.2 PRODUCT PORTFOLIO

16.30.3 RECENT UPDATES

16.31 THERMO FISHER SCIENTIFIC INC.

16.31.1 COMPANY SNAPSHOT

16.31.2 REVENUE ANALYSIS

16.31.3 PRODUCT PORTFOLIO

16.31.4 RECENT DEVELOPMENT

16.32 WERFEN

16.32.1 COMPANY SNAPSHOT

16.32.2 PRODUCT PORTFOLIO

16.32.3 RECENT DEVELOPMENT

16.33 WONDFO

16.33.1 COMPANY SNAPSHOT

16.33.2 REVENUE ANALYSIS

16.33.3 PRODUCT PORTFOLIO

16.33.4 RECENT DEVELOPMENT

16.34 XIAMEN BOSON BIOTECH CO., LTD.

16.34.1 COMPANY SNAPSHOT

16.34.2 PRODUCT PORTFOLIO

16.34.3 RECENT DEVELOPMENT

17 QUESTIONNAIRE

18 RELATED REPORTS

Список таблиц

TABLE 1 EUROPE POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 2 EUROPE POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (VOLUME IN THOUSAND UNITS)

TABLE 3 EUROPE POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (ASP IN USD/UNITS)

TABLE 4 EUROPE GLUCOSE MONITORING PRODUCTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 5 EUROPE GLUCOSE MONITORING PRODUCTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 6 EUROPE GLUCOSE MONITORING PRODUCTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (VOLUME IN THOUSAND UNITS)

TABLE 7 EUROPE GLUCOSE MONITORING PRODUCTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (ASP IN USD/UNITS)

TABLE 8 EUROPE SELF-MONITORING OF BLOOD GLUCOSE (SMBG) DEVICES IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 9 EUROPE SELF-MONITORING OF BLOOD GLUCOSE (SMBG) DEVICES IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (VOLUME IN THOUSAND UNITS)

TABLE 10 EUROPE SELF-MONITORING OF BLOOD GLUCOSE (SMBG) DEVICES IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (ASP IN USD/UNITS)

TABLE 11 EUROPE INFECTIOUS DISEASE TESTING PRODUCTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 12 EUROPE INFECTIOUS DISEASE TESTING PRODUCTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSANDS)

TABLE 13 EUROPE INFECTIOUS DISEASE TESTING PRODUCTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (VOLUME IN THOUSANDS UNITS)

TABLE 14 EUROPE INFECTIOUS DISEASE TESTING PRODUCTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (ASP IN USD/UNITS)

TABLE 15 EUROPE HIV TESTING PRODUCTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 16 EUROPE HIV TESTING PRODUCTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (VOLUME IN THOUSAND UNITS)

TABLE 17 EUROPE HIV TESTING PRODUCTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (ASP IN USD/UNITS)

TABLE 18 EUROPE SEXUALLY TRANSMITTED DISEASES (STD) TESTING IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 19 EUROPE SEXUALLY TRANSMITTED DISEASES (STD) TESTING IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (VOLUME IN THOUSAND UNITS)

TABLE 20 EUROPE SEXUALLY TRANSMITTED DISEASES (STD) TESTING IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (ASP IN USD/UNITS)

TABLE 21 EUROPE HEPATITIS C TESTING PRODUCTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSANDS)

TABLE 22 EUROPE HEPATITIS C TESTING PRODUCTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (VOLUME IN THOUSAND UNITS)

TABLE 23 EUROPE HEPATITIS C TESTING PRODUCTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (ASP IN USD/UNITS)

TABLE 24 EUROPE INFLUENZA TESTING PRODUCTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 25 EUROPE TRADITIONAL DIAGNOSTIC TEST IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 26 EUROPE TRADITIONAL DIAGNOSTIC TEST IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (VOLUME IN THOUSAND UNITS)

TABLE 27 EUROPE TRADITIONAL DIAGNOSTIC TEST IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (ASP IN USD/UNITS)

TABLE 28 EUROPE MOLECULAR DIAGNOSTIC ASSAY IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 29 EUROPE MOLECULAR DIAGNOSTIC ASSAY IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (VOLUME IN THOUSAND UNITS)

TABLE 30 EUROPE MOLECULAR DIAGNOSTIC ASSAY IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (ASP IN USD/UNITS)

TABLE 31 EUROPE CARDIOMETABOLIC MONITORING PRODUCTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 32 EUROPE CARDIOMETABOLIC MONITORING PRODUCTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 33 EUROPE POC ANALYZER IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (VOLUME IN THOUSAND UNITS)

TABLE 34 EUROPE POC ANALYZER IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (ASP IN USD/UNITS)

TABLE 35 EUROPE CARDIAC MARKER TESTING PRODUCTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 36 EUROPE CARDIAC MARKER TESTING PRODUCTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (VOLUME IN THOUSAND UNITS)

TABLE 37 EUROPE CARDIAC MARKER TESTING PRODUCTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (ASP IN USD/UNITS)

TABLE 38 EUROPE BLOOD GAS/ELECTROLYTE TESTING PRODUCTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 39 EUROPE BLOOD GAS/ELECTROLYTE TESTING CONSUMABLES IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 40 EUROPE BLOOD GAS/ELECTROLYTE TESTING CONSUMABLES IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (VOLUME IN THOUSAND UNITS)

TABLE 41 EUROPE BLOOD GAS/ELECTROLYTE TESTING CONSUMABLES IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (ASP IN USD/UNITS)

TABLE 42 EUROPE BLOOD GAS/ELECTROLYTE TESTING INSTRUMENTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 43 EUROPE PORTABLE IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 44 EUROPE PORTABLE IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (VOLUME IN THOUSAND UNITS)

TABLE 45 EUROPE PORTABLE IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (ASP IN USD/UNITS)

TABLE 46 EUROPE BENCHTOP IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSANDS)

TABLE 47 EUROPE BENCHTOP IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (VOLUME IN THOUSAND UNITS)

TABLE 48 EUROPE BENCHTOP IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (ASP IN USD/UNITS)

TABLE 49 EUROPE HBA1C TESTING PRODUCTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 50 EUROPE HBA1C TESTING PRODUCTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (VOLUME IN THOUSAND UNITS)

TABLE 51 EUROPE HBA1C TESTING PRODUCTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (ASP IN USD/UNITS)

TABLE 52 EUROPE ECG DEVICE IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 53 EUROPE ECG DEVICE IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (VOLUME IN THOUSAND UNITS)

TABLE 54 EUROPE ECG DEVICE IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (ASP IN USD/UNITS)

TABLE 55 EUROPE PREGNANCY AND FERTILITY TESTING PRODUCTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 56 EUROPE PREGNANCY AND FERTILITY TESTING PRODUCTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 57 EUROPE PREGNANCY TESTING PRODUCTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 58 EUROPE PREGNANCY TESTING PRODUCTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (VOLUME IN THOUSANDS UNITS)

TABLE 59 EUROPE PREGNANCY TESTING PRODUCTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (ASP IN USD/UNITS)

TABLE 60 EUROPE FERTILITY TESTING PRODUCTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 61 EUROPE FERTILITY TESTING PRODUCTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (VOLUME IN THOUSAND UNITS)

TABLE 62 EUROPE FERTILITY TESTING PRODUCTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (ASP IN USD/UNITS)

TABLE 63 EUROPE HAEMATOLOGY TESTING PRODUCTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 64 EUROPE COAGULATION MONITORING PRODUCTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY REGION, 2018-2033 (USD THOUSANDS)

TABLE 65 EUROPE COAGULATION MONITORING PRODUCTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSANDS)

TABLE 66 EUROPE ANTICOAGULATION MONITORING DEVICES IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 67 EUROPE ANTICOAGULATION MONITORING DEVICES IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (VOLUME IN THOUSAND UNITS)

TABLE 68 EUROPE ANTICOAGULATION MONITORING DEVICES IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (ASP IN USD/UNITS)

TABLE 69 EUROPE VISCOELASTIC COAGULATION MONITORING DEVICES IN POINT-OF-CARE-TESTING (POCT) MARKET, BY METHOD, 2018-2033 (USD THOUSANDS)

TABLE 70 EUROPE DRUGS-OF-ABUSE (DOA) TESTING PRODUCTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 71 EUROPE DRUG-OF-ABUSE (DOA) TESTING PRODUCTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 72 EUROPE DOA ANALYZERS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSANDS)

TABLE 73 EUROPE DOA ANALYZERS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (VOLUME IN THOUSAND UNITS)

TABLE 74 EUROPE DOA ANALYZERS MONITORING DEVICES IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (ASP IN USD/UNITS)

TABLE 75 EUROPE RAPID TESTING DEVICES IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 76 EUROPE RAPID TESTING DEVICES IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (VOLUME IN THOUSAND UNITS)

TABLE 77 EUROPE RAPID TESTING DEVICES IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (ASP IN USD/UNITS)

TABLE 78 EUROPE URINALYSIS TESTING PRODUCTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 79 EUROPE URINALYSIS TESTING PRODUCTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 80 EUROPE URINALYSIS TESTING PRODUCTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (VOLUME IN THOUSAND UNITS)

TABLE 81 EUROPE URINALYSIS TESTING PRODUCTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (ASP IN USD/UNITS)

TABLE 82 EUROPE CHOLESTEROL TESTING PRODUCTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 83 EUROPE CHOLESTEROL TESTING PRODUCTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 84 EUROPE CHOLESTEROL TESTING PRODUCTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (VOLUME IN THOUSANDS UNITS)

TABLE 85 EUROPE CHOLESTEROL TESTING PRODUCTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (ASP IN USD/UNITS)

TABLE 86 EUROPE INSTRUMENTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSANDS)

TABLE 87 EUROPE INSTRUMENTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (VOLUME IN THOUSAND UNITS)

TABLE 88 EUROPE INSTRUMENTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (ASP IN USD/UNITS)

TABLE 89 EUROPE TUMOR/CANCER MARKER TESTING PRODUCTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 90 EUROPE FECAL OCCULT TESTING PRODUCTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 91 EUROPE FECAL OCCULT TESTING PRODUCTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 92 EUROPE FECAL OCCULT TESTING PRODUCTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (VOLUME IN THOUSANDS UNITS)

TABLE 93 EUROPE FECAL OCCULT TESTING PRODUCTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (ASP IN USD/UNITS)

TABLE 94 EUROPE OTHERS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 95 EUROPE POINT-OF-CARE-TESTING (POCT) MARKET, BY PLATFORM, 2018-2033 (USD THOUSAND)

TABLE 96 EUROPE LATERAL FLOW ASSAYS/IMMUNOCHROMATOGRAPHY TESTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY REGION, 2018-2033 (USD THOUSANDS)

TABLE 97 EUROPE IMMUNOASSAYS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY REGION, 2018-2033 (USD THOUSANDS)

TABLE 98 EUROPE DIPSTICKS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY REGION, 2018-2033 (USD THOUSANDS)

TABLE 99 EUROPE MOLECULAR DIAGNOSTICS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY REGION, 2018-2033 (USD THOUSANDS)

TABLE 100 EUROPE CLINICAL CHEMISTRY ASSAYS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 101 EUROPE MICROFLUIDICS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY REGION, 2018-2033 (USD THOUSANDS)

TABLE 102 EUROPE HEMATOLOGY IN POINT-OF-CARE-TESTING (POCT) MARKET, BY REGION, 2018-2033 (USD THOUSANDS)

TABLE 103 EUROPE OTHERS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY REGION, 2018-2033 (USD THOUSANDS)

TABLE 104 EUROPE POINT-OF-CARE-TESTING (POCT) MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 105 EUROPE BLOOD GLUCOSE IN POINT-OF-CARE-TESTING (POCT) MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 106 EUROPE INFECTIOUS DISEASES IN POINT-OF-CARE-TESTING (POCT) MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 107 EUROPE INFECTIOUS DISEASES IN POINT-OF-CARE-TESTING (POCT) MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 108 EUROPE VITAL SIGN MONITORING IN POINT-OF-CARE-TESTING (POCT) MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 109 EUROPE CARDIAC MONITORING IN POINT-OF-CARE-TESTING (POCT) MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 110 EUROPE COAGULATION IN POINT-OF-CARE-TESTING (POCT) MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 111 EUROPE HAEMATOLOGY IN POINT-OF-CARE-TESTING (POCT) MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 112 EUROPE NON- INVASIVE SPO2 MONITORING IN POINT-OF-CARE-TESTING (POCT) MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 113 EUROPE BLOOD TRANSFUSION IN POINT-OF-CARE-TESTING (POCT) MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 114 EUROPE NON- INVASIVE PCO2 MONITORING IN POINT-OF-CARE-TESTING (POCT) MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 115 EUROPE WHOLE BLOOD ANALYSIS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 116 EUROPE OTHERS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 117 EUROPE POINT-OF-CARE-TESTING (POCT) MARKET, BY PRESCRIPTION MODE, 2018-2033 (USD THOUSANDS)

TABLE 118 EUROPE OTC TESTING IN POINT-OF-CARE-TESTING (POCT) MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 119 EUROPE PRESCRIPTION-BASED TESTING IN POINT-OF-CARE-TESTING (POCT) MARKET, BY REGION, 2018-2033 (USD THOUSANDS)

TABLE 120 EUROPE POINT-OF-CARE-TESTING (POCT) MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD MILLION)

TABLE 121 EUROPE DIRECT TENDER IN POINT-OF-CARE-TESTING (POCT) MARKET, BY REGION, 2018-2033 (USD MILLIONS)

TABLE 122 EUROPE RETAIL SALES IN POINT-OF-CARE-TESTING (POCT) MARKET, BY REGION, 2018-2033 (USD MILLIONS)

TABLE 123 EUROPE ONLINE SALES IN POINT-OF-CARE-TESTING (POCT) MARKET, BY REGION, 2018-2033 (USD MILLIONS)

TABLE 124 EUROPE OTHERS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY REGION, 2018-2033 (USD MILLIONS)

TABLE 125 EUROPE POINT-OF-CARE-TESTING (POCT) MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 126 EUROPE HOSPITALS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY REGION, 2018-2032 (USD THOUSANDS)

TABLE 127 EUROPE HOSPITALS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY TYPE, 2018-2032 (USD THOUSANDS)

TABLE 128 EUROPE PRIVATE IN POINT-OF-CARE-TESTING (POCT) MARKET, BY LEVEL, 2018-2032 (USD THOUSANDS)

TABLE 129 EUROPE PUBLIC IN POINT-OF-CARE-TESTING (POCT) MARKET, BY LEVEL, 2018-2032 (USD THOUSANDS)

TABLE 130 EUROPE HOME CARE IN POINT-OF-CARE-TESTING (POCT) MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 131 EUROPE CLINICS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 132 EUROPE LABORATORIES IN POINT-OF-CARE-TESTING (POCT) MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 133 EUROPE DIAGNOSTIC CENTERS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 134 EUROPE PATHOLOGY LABS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 135 EUROPE AMBULATORY SURGERY CENTERS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 136 EUROPE ELDERLY CARE CENTERS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 137 EUROPE OTHERS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 138 EUROPE POINT-OF-CARE-TESTING (POCT) MARKET, BY COUNTRY, 2018-2033 (USD THOUSAND)

TABLE 139 EUROPE POINT-OF-CARE-TESTING (POCT) MARKET, BY COUNTRY, 2018-2033 (USD THOUSAND)

TABLE 140 EUROPE

TABLE 141 EUROPE POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 142 EUROPE POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (VOLUME IN THOUSAND UNITS)

TABLE 143 EUROPE POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (ASP IN USD/UNITS)

TABLE 144 EUROPE GLUCOSE MONITORING PRODUCTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 145 EUROPE GLUCOSE MONITORING PRODUCTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (VOLUME IN THOUSAND UNITS)

TABLE 146 EUROPE GLUCOSE MONITORING PRODUCTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (ASP IN USD/UNITS)

TABLE 147 EUROPE SELF-MONITORING OF BLOOD GLUCOSE (SMBG) DEVICES IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 148 EUROPE SELF-MONITORING OF BLOOD GLUCOSE (SMBG) DEVICES IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (VOLUME IN THOUSAND UNITS)

TABLE 149 EUROPE SELF-MONITORING OF BLOOD GLUCOSE (SMBG) DEVICES IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (ASP IN USD/UNITS)

TABLE 150 EUROPE INFECTIOUS DISEASE TESTING PRODUCTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 151 EUROPE INFECTIOUS DISEASE TESTING PRODUCTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (VOLUME IN THOUSAND UNITS)

TABLE 152 EUROPE INFECTIOUS DISEASE TESTING PRODUCTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (ASP IN USD/UNITS)

TABLE 153 EUROPE HIV TESTING PRODUCTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 154 EUROPE HIV TESTING PRODUCTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (VOLUME IN THOUSAND UNITS)

TABLE 155 EUROPE HIV TESTING PRODUCTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (ASP IN USD/UNITS)

TABLE 156 EUROPE SEXUALLY TRANSMITTED DISEASES (STD) TESTING IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 157 EUROPE SEXUALLY TRANSMITTED DISEASES (STD) TESTING IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (VOLUME IN THOUSAND UNITS)

TABLE 158 EUROPE SEXUALLY TRANSMITTED DISEASES (STD) TESTING IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (ASP IN USD/UNITS)

TABLE 159 EUROPE HEPATITIS C TESTING PRODUCTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 160 EUROPE HEPATITIS C TESTING PRODUCTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (VOLUME IN THOUSAND UNITS)

TABLE 161 EUROPE HEPATITIS C TESTING PRODUCTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (ASP IN USD/UNITS)

TABLE 162 EUROPE INFLUENZA TESTING PRODUCTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 163 EUROPE TRADITIONAL DIAGNOSTIC TEST IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 164 EUROPE TRADITIONAL DIAGNOSTIC TEST IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (VOLUME IN THOUSAND UNITS)

TABLE 165 EUROPE TRADITIONAL DIAGNOSTIC TEST IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (ASP IN USD/UNITS)

TABLE 166 EUROPE MOLECULAR DIAGNOSTIC ASSAY IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 167 EUROPE MOLECULAR DIAGNOSTIC ASSAY IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (VOLUME IN THOUSAND UNITS)

TABLE 168 EUROPE MOLECULAR DIAGNOSTIC ASSAY IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (ASP IN USD/UNITS)

TABLE 169 EUROPE CARDIOMETABOLIC MONITORING PRODUCTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 170 EUROPE POC ANALYZER IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (VOLUME IN THOUSAND UNITS)

TABLE 171 EUROPE POC ANALYZER IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (ASP IN USD/UNITS)

TABLE 172 EUROPE CARDIAC MARKER TESTING PRODUCTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 173 EUROPE CARDIAC MARKER TESTING PRODUCTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (VOLUME IN THOUSAND UNITS)

TABLE 174 EUROPE CARDIAC MARKER TESTING PRODUCTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (ASP IN USD/UNITS)

TABLE 175 EUROPE BLOOD GAS/ELECTROLYTE TESTING PRODUCTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 176 EUROPE BLOOD GAS/ELECTROLYTE TESTING CONSUMABLES IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 177 EUROPE BLOOD GAS/ELECTROLYTE TESTING CONSUMABLES IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (VOLUME IN THOUSAND UNITS)

TABLE 178 EUROPE BLOOD GAS/ELECTROLYTE TESTING CONSUMABLES IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (ASP IN USD/UNITS)

TABLE 179 EUROPE BLOOD GAS/ELECTROLYTE TESTING INSTRUMENTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 180 EUROPE PORTABLE IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 181 EUROPE PORTABLE IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (VOLUME IN THOUSAND UNITS)

TABLE 182 EUROPE PORTABLE IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (ASP IN USD/UNITS)

TABLE 183 EUROPE BENCHTOP IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 184 EUROPE BENCHTOP IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (VOLUME IN THOUSAND UNITS)

TABLE 185 EUROPE BENCHTOP IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (ASP IN USD/UNITS)

TABLE 186 EUROPE HBA1C TESTING PRODUCTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 187 EUROPE HBA1C TESTING PRODUCTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (VOLUME IN THOUSAND UNITS)

TABLE 188 EUROPE HBA1C TESTING PRODUCTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (ASP IN USD/UNITS)

TABLE 189 EUROPE ECG DEVICE IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 190 EUROPE ECG DEVICE IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (VOLUME IN THOUSAND UNITS)

TABLE 191 EUROPE ECG DEVICE IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (ASP IN USD/UNITS)

TABLE 192 EUROPE PREGNANCY AND FERTILITY TESTING PRODUCTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 193 EUROPE PREGNANCY TESTING PRODUCTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 194 EUROPE PREGNANCY TESTING PRODUCTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (VOLUME IN THOUSAND UNITS)

TABLE 195 EUROPE PREGNANCY TESTING PRODUCTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (ASP IN USD/UNITS)

TABLE 196 EUROPE FERTILITY TESTING PRODUCTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 197 EUROPE FERTILITY TESTING PRODUCTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (VOLUME IN THOUSAND UNITS)

TABLE 198 EUROPE FERTILITY TESTING PRODUCTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (ASP IN USD/UNITS)

TABLE 199 EUROPE COAGULATION MONITORING PRODUCTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 200 EUROPE ANTICOAGULATION MONITORING DEVICES IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 201 EUROPE ANTICOAGULATION MONITORING DEVICES IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (VOLUME IN THOUSAND UNITS)

TABLE 202 EUROPE ANTICOAGULATION MONITORING DEVICES IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (ASP IN USD/UNITS)

TABLE 203 EUROPE VISCOELASTIC COAGULATION MONITORING DEVICES IN POINT-OF-CARE-TESTING (POCT) MARKET, BY METHOD, 2018-2033 (USD THOUSAND)

TABLE 204 EUROPE DRUG-OF-ABUSE (DOA) TESTING PRODUCTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 205 EUROPE DOA ANALYZERS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 206 EUROPE DOA ANALYZERS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (VOLUME IN THOUSAND UNITS)

TABLE 207 EUROPE DOA ANALYZERS MONITORING DEVICES IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (ASP IN USD/UNITS)

TABLE 208 EUROPE RAPID TESTING DEVICES IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 209 EUROPE RAPID TESTING DEVICES IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (VOLUME IN THOUSAND UNITS)

TABLE 210 EUROPE RAPID TESTING DEVICES IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (ASP IN USD/UNITS)

TABLE 211 EUROPE URINALYSIS TESTING PRODUCTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 212 EUROPE URINALYSIS TESTING PRODUCTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (VOLUME IN THOUSAND UNITS)

TABLE 213 EUROPE URINALYSIS TESTING PRODUCTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (ASP IN USD/UNITS)

TABLE 214 EUROPE CHOLESTEROL TESTING PRODUCTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 215 EUROPE CHOLESTEROL TESTING PRODUCTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (VOLUME IN THOUSAND UNITS)

TABLE 216 EUROPE CHOLESTEROL TESTING PRODUCTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (ASP IN USD/UNITS)

TABLE 217 EUROPE INSTRUMENTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 218 EUROPE INSTRUMENTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (VOLUME IN THOUSAND UNITS)

TABLE 219 EUROPE INSTRUMENTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (ASP IN USD/UNITS)

TABLE 220 EUROPE FECAL OCCULT TESTING PRODUCTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 221 EUROPE FECAL OCCULT TESTING PRODUCTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (VOLUME IN THOUSAND UNITS)

TABLE 222 EUROPE FECAL OCCULT TESTING PRODUCTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (ASP IN USD/UNITS)

TABLE 223 EUROPE POINT-OF-CARE-TESTING (POCT) MARKET, BY PLATFORM, 2018-2033 (USD THOUSAND)

TABLE 224 EUROPE POINT-OF-CARE-TESTING (POCT) MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 225 EUROPE INFECTIOUS DISEASES IN POINT-OF-CARE-TESTING (POCT) MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 226 EUROPE POINT-OF-CARE-TESTING (POCT) MARKET, BY PRESCRIPTION MODE, 2018-2033 (USD THOUSAND)

TABLE 227 EUROPE POINT-OF-CARE-TESTING (POCT) MARKET, BY END USER, 2018-2033 (USD THOUSAND)

TABLE 228 EUROPE HOSPITALS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 229 EUROPE PRIVATE IN POINT-OF-CARE-TESTING (POCT) MARKET, BY LEVEL, 2018-2033 (USD THOUSAND)

TABLE 230 EUROPE PUBLIC IN POINT-OF-CARE-TESTING (POCT) MARKET, BY LEVEL, 2018-2033 (USD THOUSAND)

TABLE 231 EUROPE POINT-OF-CARE-TESTING (POCT) MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 232 GERMANY POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 233 GERMANY POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (VOLUME IN THOUSAND UNITS)

TABLE 234 GERMANY POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (ASP IN USD/UNITS)

TABLE 235 GERMANY GLUCOSE MONITORING PRODUCTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 236 GERMANY GLUCOSE MONITORING PRODUCTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (VOLUME IN THOUSAND UNITS)

TABLE 237 GERMANY GLUCOSE MONITORING PRODUCTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (ASP IN USD/UNITS)

TABLE 238 GERMANY SELF-MONITORING OF BLOOD GLUCOSE (SMBG) DEVICES IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 239 GERMANY SELF-MONITORING OF BLOOD GLUCOSE (SMBG) DEVICES IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (VOLUME IN THOUSAND UNITS)

TABLE 240 GERMANY SELF-MONITORING OF BLOOD GLUCOSE (SMBG) DEVICES IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (ASP IN USD/UNITS)

TABLE 241 GERMANY INFECTIOUS DISEASE TESTING PRODUCTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 242 GERMANY INFECTIOUS DISEASE TESTING PRODUCTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (VOLUME IN THOUSAND UNITS)

TABLE 243 GERMANY INFECTIOUS DISEASE TESTING PRODUCTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (ASP IN USD/UNITS)

TABLE 244 GERMANY HIV TESTING PRODUCTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 245 GERMANY HIV TESTING PRODUCTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (VOLUME IN THOUSAND UNITS)

TABLE 246 GERMANY HIV TESTING PRODUCTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (ASP IN USD/UNITS)

TABLE 247 GERMANY SEXUALLY TRANSMITTED DISEASES (STD) TESTING IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 248 GERMANY SEXUALLY TRANSMITTED DISEASES (STD) TESTING IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (VOLUME IN THOUSAND UNITS)

TABLE 249 GERMANY SEXUALLY TRANSMITTED DISEASES (STD) TESTING IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (ASP IN USD/UNITS)

TABLE 250 GERMANY HEPATITIS C TESTING PRODUCTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 251 GERMANY HEPATITIS C TESTING PRODUCTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (VOLUME IN THOUSAND UNITS)

TABLE 252 GERMANY HEPATITIS C TESTING PRODUCTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (ASP IN USD/UNITS)

TABLE 253 GERMANY INFLUENZA TESTING PRODUCTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 254 GERMANY TRADITIONAL DIAGNOSTIC TEST IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 255 GERMANY TRADITIONAL DIAGNOSTIC TEST IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (VOLUME IN THOUSAND UNITS)

TABLE 256 GERMANY TRADITIONAL DIAGNOSTIC TEST IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (ASP IN USD/UNITS)

TABLE 257 GERMANY MOLECULAR DIAGNOSTIC ASSAY IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 258 GERMANY MOLECULAR DIAGNOSTIC ASSAY IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (VOLUME IN THOUSAND UNITS)

TABLE 259 GERMANY MOLECULAR DIAGNOSTIC ASSAY IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (ASP IN USD/UNITS)

TABLE 260 GERMANY CARDIOMETABOLIC MONITORING PRODUCTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 261 GERMANY POC ANALYZER IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (VOLUME IN THOUSAND UNITS)

TABLE 262 GERMANY POC ANALYZER IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (ASP IN USD/UNITS)

TABLE 263 GERMANY CARDIAC MARKER TESTING PRODUCTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 264 GERMANY CARDIAC MARKER TESTING PRODUCTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (VOLUME IN THOUSAND UNITS)

TABLE 265 GERMANY CARDIAC MARKER TESTING PRODUCTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (ASP IN USD/UNITS)

TABLE 266 GERMANY BLOOD GAS/ELECTROLYTE TESTING PRODUCTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 267 GERMANY BLOOD GAS/ELECTROLYTE TESTING CONSUMABLES IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 268 GERMANY BLOOD GAS/ELECTROLYTE TESTING CONSUMABLES IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (VOLUME IN THOUSAND UNITS)

TABLE 269 GERMANY BLOOD GAS/ELECTROLYTE TESTING CONSUMABLES IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (ASP IN USD/UNITS)

TABLE 270 GERMANY BLOOD GAS/ELECTROLYTE TESTING INSTRUMENTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 271 GERMANY PORTABLE IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 272 GERMANY PORTABLE IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (VOLUME IN THOUSAND UNITS)

TABLE 273 GERMANY PORTABLE IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (ASP IN USD/UNITS)

TABLE 274 GERMANY BENCHTOP IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 275 GERMANY BENCHTOP IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (VOLUME IN THOUSAND UNITS)

TABLE 276 GERMANY BENCHTOP IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (ASP IN USD/UNITS)

TABLE 277 GERMANY HBA1C TESTING PRODUCTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 278 GERMANY HBA1C TESTING PRODUCTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (VOLUME IN THOUSAND UNITS)

TABLE 279 GERMANY HBA1C TESTING PRODUCTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (ASP IN USD/UNITS)

TABLE 280 GERMANY ECG DEVICE IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 281 GERMANY ECG DEVICE IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (VOLUME IN THOUSAND UNITS)

TABLE 282 GERMANY ECG DEVICE IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (ASP IN USD/UNITS)

TABLE 283 GERMANY PREGNANCY AND FERTILITY TESTING PRODUCTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 284 GERMANY PREGNANCY TESTING PRODUCTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 285 GERMANY PREGNANCY TESTING PRODUCTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (VOLUME IN THOUSAND UNITS)

TABLE 286 GERMANY PREGNANCY TESTING PRODUCTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (ASP IN USD/UNITS)

TABLE 287 GERMANY FERTILITY TESTING PRODUCTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 288 GERMANY FERTILITY TESTING PRODUCTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (VOLUME IN THOUSAND UNITS)

TABLE 289 GERMANY FERTILITY TESTING PRODUCTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (ASP IN USD/UNITS)

TABLE 290 GERMANY COAGULATION MONITORING PRODUCTS IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 291 GERMANY ANTICOAGULATION MONITORING DEVICES IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 292 GERMANY ANTICOAGULATION MONITORING DEVICES IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (VOLUME IN THOUSAND UNITS)

TABLE 293 GERMANY ANTICOAGULATION MONITORING DEVICES IN POINT-OF-CARE-TESTING (POCT) MARKET, BY PRODUCT TYPE, 2018-2033 (ASP IN USD/UNITS)

TABLE 294 GERMANY VISCOELASTIC COAGULATION MONITORING DEVICES IN POINT-OF-CARE-TESTING (POCT) MARKET, BY METHOD, 2018-2033 (USD THOUSAND)