Europe Passive Fire Protection Coating Market, By Product Type (Intumescent Coating, Cementitious Material, Fireproofing Cladding And Others), Technology (Water-Based Protection Coating And Solvent-Based Protection Coating), Application (Automotive, Oil & Gas, Construction, Aerospace, Electrical And Electronics, Textile, Furniture, Warehousing And Others), End User (Building & Construction, Oil & Gas, Transportation And Others) – Industry Trends and Forecast to 2029

Europe Passive Fire Protection Coating Market Analysis and Size

Passive fire protection coating is a colorless, odorless, and viscous liquid soluble in water at all concentrations. It is a strong acid made by oxidizing sulfur dioxide solutions and used in large quantities as an industrial and laboratory reagent. Passive fire protection coating or passive fire protection coating, also known as oil of vitriol, is a mineral acid composed of sulfur, oxygen, and hydrogen, with molecular formula H2SO4 and melting point is 10 °C, the boiling point is 337 °C.

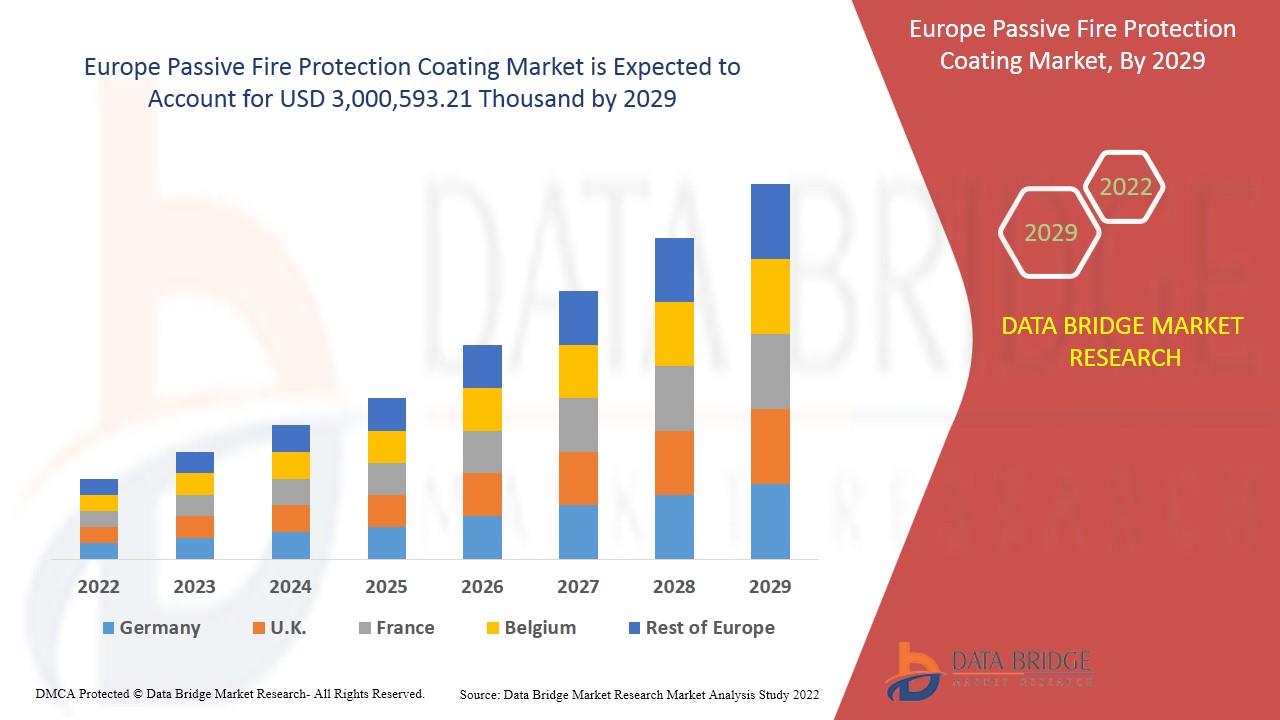

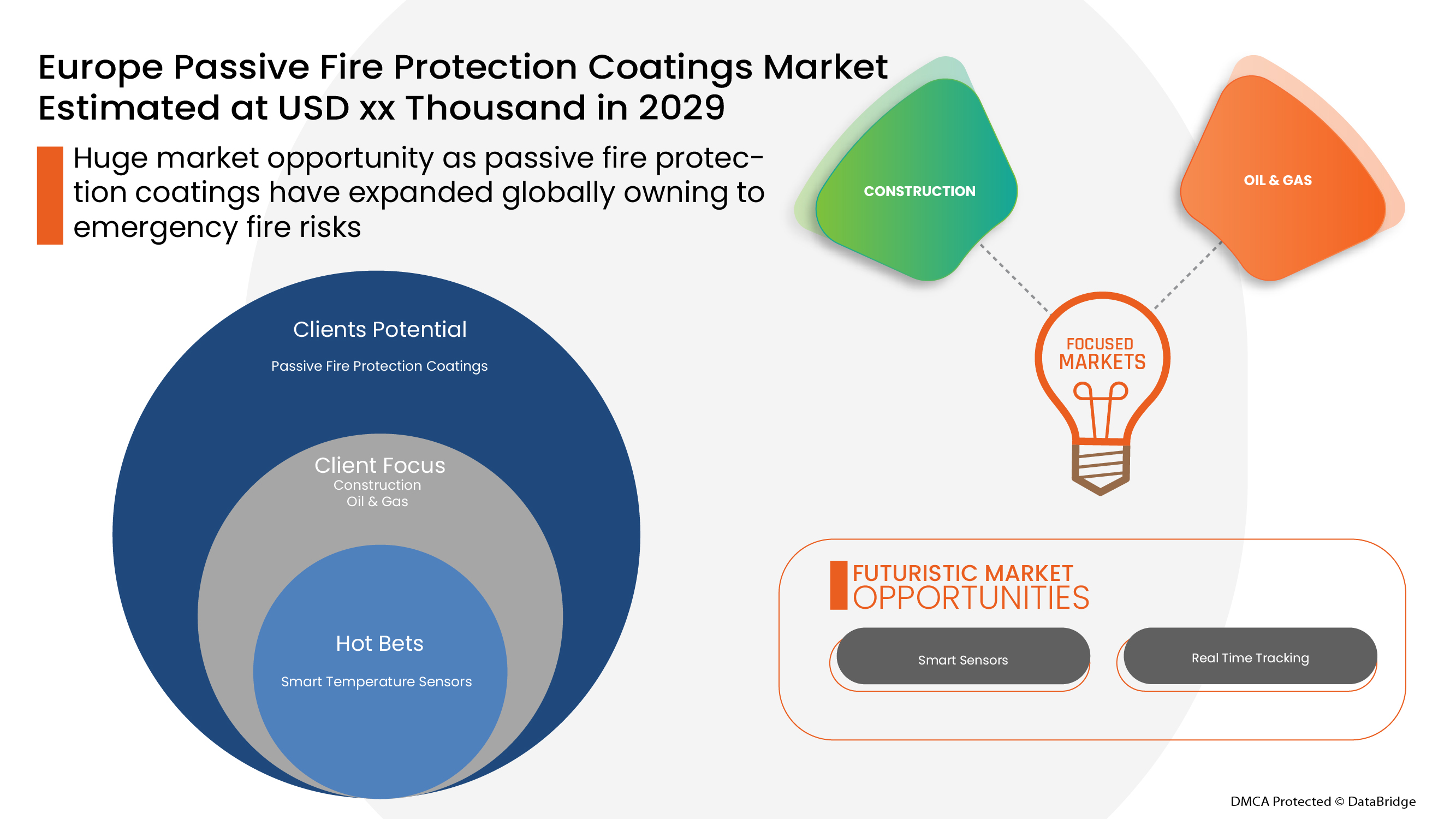

Increasing demand for fertilizers in the agriculture industry and the growing demand for passive fire protection coating across various industries are some of the drivers boosting passive fire protection coating demand in the market. Data Bridge Market Research analyses that the sulfuric market is expected to reach the value of USD 3,000,593.21 thousand by the year 2029, at a CAGR of 4.1% during the forecast period. " elemental sulfur " accounts for the most prominent raw material segment in the respective due to the abundant availability of sulfur across the globe. The market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and climate chain scenario.

|

Report Metric |

Details |

|

Forecast Period |

2022 to 2029 |

|

Base Year |

2021 |

|

Historic Years |

2020 (Customizable to 2019 - 2014) |

|

Quantitative Units |

Revenue in USD Thousand, Volumes in Thousand kg, Pricing in USD |

|

Segments Covered |

By Product Type (Cementitious Material, Intumescent Coating, Fireproofing Cladding, Others), Technology (Water-Based Protection Coating, Solvent-Based Protection Coating), Application (Oil & Gas, Construction, Aerospace, Electrical And Electronics, Automotive, Textile, Furniture, Warehousing, Others), End User (Building & Construction, Oil & Gas, Transportation, Others) |

|

Country Covered |

Germany, U.K., Italy, France, Spain, Russia, Switzerland, Turkey, Belgium, Netherlands, Luxemburg and Rest of Europe in Europe |

|

Market Players Covered |

LANXESS (Кельн, Германия), Brenntag GmbH (дочерняя компания Brenntag SE) (Эссен, Германия), Boliden Group (Стокгольм, Швеция), Adisseo (Энтони, Франция), Veolia (Париж, Франция), Univar Solutions Inc (Иллинойс, США), NORAM Engineering & Construction Ltd. (Ванкувер, Канада), Nouryon (Амстердам, Нидерланды), International Raw Materials LTD (Пенсильвания, США), Eti Bakir (Кастамону, Турция), ACIDEKA SA (Бискайя, Испания), Airedale Chemical Company Limited. (Северный Йоркшир, Великобритания), BASF SE (Людвигсхафен, Германия), Aguachem Ltd (Рексем, Великобритания), Feralco AB (Виднес, Великобритания), Fluorsid (Милан, Италия), Aurubis AG (Гамбург, Германия), Nyrstar (Бюдель, Нидерланды), Merck KGaA (Дармштадт, Германия) и Shrieve (Техас, США) |

Определение рынка

Пассивное противопожарное покрытие представляет собой сильную кислоту с гигроскопическими характеристиками и окислительными свойствами. Оно используется в производстве удобрений, химикатов, синтетического текстиля и пигментов. Другие области применения включают производство аккумуляторов, травление металла, а также другие промышленные производственные процессы. На рынке пассивное противопожарное покрытие доступно в различных концентрациях, таких как 98%, 96,5%, 76%, 70% и 38%. Большое количество пассивного противопожарного покрытия производит сульфаты калия и удобрения. Растущий спрос на удобрения в сельскохозяйственной отрасли и растущий спрос на пассивное противопожарное покрытие в различных отраслях промышленности являются одними из движущих факторов, повышающих спрос на пассивное противопожарное покрытие на рынке. С ростом потребления пассивного противопожарного покрытия во всем мире основные игроки расширяют свои производственные мощности в разных странах, чтобы усилить свое присутствие на рынке.

Нормативная база

- DHHS (1994) и EPA не классифицировали триоксид серы или пассивное противопожарное покрытие как канцерогенное. IARC считает профессиональное воздействие сильных неорганических туманов, содержащих пассивное противопожарное покрытие, канцерогенным для человека (Группа 1) (IARC 1992). ACGIH классифицировала пассивное противопожарное покрытие как предполагаемый канцероген для человека (Группа A2) (ACGIH 1998).

Пассивное противопожарное покрытие включено в список химических веществ «Токсичные химические вещества, подпадающие под действие раздела 3 13 Закона о планировании действий в чрезвычайных ситуациях и праве общественности на информацию» (EPA 1998f).

Допустимый предел воздействия на рабочем месте (PEL) для пассивного противопожарного покрытия составляет 1 мг/м3 (OSHA 1998). Рекомендуемый NIOSH предел воздействия (REL) также составляет 1 мг/м3 (NIOSH 1997). ACGIH рекомендует пороговое предельное значение, взвешенное по времени (TLV-TWA), в размере 1 мг/м3 и предел кратковременного воздействия (STEL) в размере 3 мг/м3 (ACGIH 1998).

COVID-19 оказал минимальное влияние на рынок пассивных противопожарных покрытий в Европе

COVID-19 повлиял на различные отрасли обрабатывающей промышленности в 2020-2021 годах, поскольку он привел к закрытию рабочих мест, нарушению цепочек поставок и ограничениям на транспорт. Однако было отмечено значительное влияние на пассивное противопожарное покрытие в операциях и цепочке поставок в Европе, при этом несколько производственных предприятий все еще работали. Поставщики услуг продолжили предлагать пассивное противопожарное покрытие после мер санитарии и безопасности в пост-COVID-сценарии.

Динамика рынка покрытий пассивной противопожарной защиты в Европе включает:

- Растущий спрос на удобрения в сельскохозяйственной отрасли

Растущий спрос на высококачественные удобрения для выращивания сельскохозяйственных культур стимулирует развитие европейского рынка пассивных огнезащитных покрытий.

- Значительный рост в химической промышленности

Увеличение химического производства в европейском регионе с химической стратегией для устойчивости является важной частью Green Deal по укреплению роста химической промышленности, что позволяет легче избегать использования опасных химикатов и поощрять инновации для разработки безопасных и устойчивых альтернатив. Таким образом, стратегия устойчивости в химической промышленности может помочь сохранить значительный рост в химической промышленности и продвинуть рынок пассивной противопожарной защиты Европы в ближайшие годы.

- Растущий спрос на пассивные противопожарные покрытия в различных отраслях промышленности

Ожидается, что спрос на пассивные огнезащитные покрытия в различных отраслях промышленности, таких как фармацевтическая, текстильная, бумажная и целлюлозно-бумажная, будет расти ускоренными темпами и, по прогнозам, будет стимулировать европейский рынок пассивных огнезащитных покрытий.

- Растущий спрос на аккумуляторы в автомобильной промышленности

Ожидается, что в связи с ростом спроса на утилизацию отходов печатных плат использование пассивного огнезащитного покрытия для извлечения различных металлов, таких как золото, серебро, железо и медь, станет движущей силой европейского рынка пассивных огнезащитных покрытий.

- Значительный рост в сфере здравоохранения

Растущие преимущества пассивного противопожарного покрытия аккумуляторных батарей в автомобилях и других машинах в электромобилях увеличивают спрос на пассивное противопожарное покрытие, создавая возможность для европейского рынка пассивного противопожарного покрытия выйти на него и продемонстрировать более высокие темпы роста в будущем.

- Обилие серы как сырья

Кроме того, сера в настоящее время также производится для промышленного использования в нефтяной и газовой промышленности по всему миру. Таким образом, обилие запасов серы по всему миру создает возможность для роста европейского рынка пассивных огнезащитных покрытий.

Ограничения/Проблемы, с которыми сталкивается рынок пассивных противопожарных покрытий в Европе

- Опасности для здоровья, связанные с пассивными противопожарными покрытиями

Растущая опасность для здоровья, связанная с использованием пассивных огнезащитных покрытий для кожи, глаз и других органов, вероятно, будет сдерживать спрос на европейском рынке пассивных огнезащитных покрытий.

- Снижение продаж в результате переизбытка поставок пассивных противопожарных покрытий

Недостаток пассивного противопожарного покрытия на европейском рынке пассивного противопожарного покрытия является самой большой проблемой, с которой сталкиваются ключевые производители, работающие на рынке, что напрямую влияет на их продажи и прибыль, поскольку переизбыток поставок со стороны других производителей привел к снижению цен. Это является самой большой проблемой в росте европейского рынка пассивного противопожарного покрытия.

В этом отчете о рынке пассивных огнезащитных покрытий содержатся сведения о последних разработках, правилах торговли, анализе импорта-экспорта, анализе производства, оптимизации цепочки создания стоимости, доле рынка, влиянии внутренних и локальных игроков рынка, анализируются возможности с точки зрения новых источников дохода, изменений в правилах рынка, анализ стратегического роста рынка, размер рынка, рост рынка категорий, ниши применения и доминирование, одобрения продуктов, запуски продуктов, географические расширения, технологические инновации на рынке. Чтобы получить больше информации о рынке пассивных огнезащитных покрытий, свяжитесь с Data Bridge Market Research для получения аналитического обзора. Наша команда поможет вам принять обоснованное рыночное решение для достижения роста рынка.

Недавнее развитие

- В ноябре 2020 года Airedale Chemical Company Limited приобрела Alutech, которая предлагает ряд решений по обработке металла, включая отбеливатели алюминия и очистители для предварительной обработки. Это развитие помогает компании увеличить спрос на пассивное противопожарное покрытие, что увеличило ее прибыль

- В мае 2017 года BASF SE представила новый катализатор для пассивной противопожарной защиты, который предпочтителен благодаря своей уникальной геометрической форме. Это обновление помогает компании увеличить производственные мощности, что в будущем принесет доход

Объем европейского рынка пассивных огнезащитных покрытий

Европейский рынок пассивных огнезащитных покрытий сегментирован на основе типа продукта, технологии, применения и конечного пользователя. Рост среди этих сегментов поможет вам проанализировать сегменты с незначительным ростом в отраслях и предоставить пользователям ценный обзор рынка и рыночные идеи, которые помогут им принимать стратегические решения для определения основных рыночных приложений.

Тип продукта

- Цементный материал

- Вспучивающееся покрытие

- Огнезащитная облицовка

- Другие

На основе типа продукта рынок пассивных огнезащитных покрытий в Европе сегментирован на цементные материалы, вспучивающиеся покрытия, огнестойкие облицовки и др. Ожидается, что сегмент вспучивающихся покрытий будет доминировать в европейском регионе, вспучивающиеся покрытия, как ожидается, будут доминировать на рынке из-за более широких потребительских предпочтений в строительной отрасли.

Технологии

- Защитное покрытие на водной основе

- Защитное покрытие на основе растворителя

По технологическому признаку европейский рынок пассивных огнезащитных покрытий сегментирован на защитные покрытия на водной основе и защитные покрытия на основе растворителей.

Приложение

- Нефть и газ

- Строительство

- Аэрокосмическая промышленность

- Электрика и электроника

- Автомобильный

- Текстиль

- Мебель

- Складирование

- Другие

По сфере применения рынок пассивных огнезащитных покрытий в Европе сегментирован на нефтегазовую, строительную, аэрокосмическую, электротехническую и электронную, автомобильную, текстильную, мебельную, складскую и др. В Азиатско-Тихоокеанском регионе, как ожидается, на рынке будет доминировать автомобильная промышленность, поскольку она снижает количество потенциально уязвимых людей, которые могут подвергаться риску на территории.

Конечный пользователь

- Строительство и возведение

- Нефть и газ

- Транспорт

- Другие

На основе конечного пользователя рынок пассивных огнезащитных покрытий в Европе сегментирован на строительство, нефть и газ, транспорт и др. В Азиатско-Тихоокеанском регионе ожидается, что сегмент строительства будет доминировать на рынке, поскольку крупнейшие строительные проекты были инициированы в этих регионах.

Европейский региональный анализ/анализ пассивных огнезащитных покрытий

Проведен анализ рынка пассивных огнезащитных покрытий, а также предоставлены сведения о размерах рынка и тенденциях по странам, типам продукции, технологиям, областям применения и конечным пользователям, как указано выше.

В отчете о рынке пассивных огнезащитных покрытий в Европе рассматриваются следующие страны: Германия, Великобритания, Италия, Франция, Испания, Россия, Швейцария, Турция, Бельгия, Нидерланды, Люксембург и остальные страны Европы.

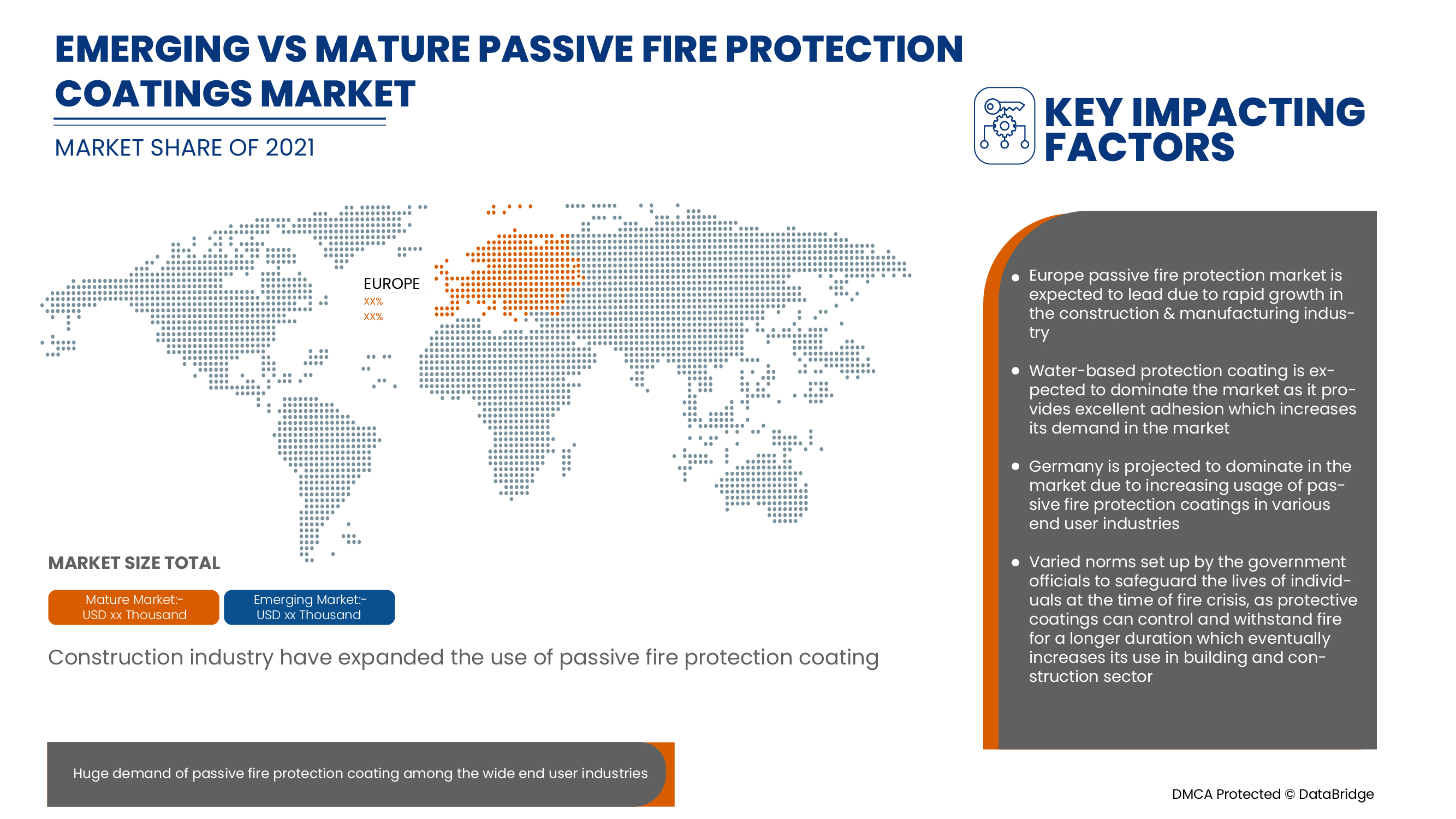

Ожидается, что Германия будет доминировать на европейском рынке пассивных огнезащитных покрытий из-за высокого спроса со стороны строительной отрасли. Ожидается, что Европа станет свидетелем значительного роста в прогнозируемый период с 2022 по 2029 год из-за растущего спроса на аккумуляторы в автомобильной промышленности региона

Раздел отчета по странам также содержит отдельные факторы, влияющие на рынок, и изменения в регулировании рынка, которые влияют на текущие и будущие тенденции рынка. Такие данные, как анализ цепочки создания стоимости сверху и снизу, технические тенденции и анализ пяти сил Портера, тематические исследования, являются некоторыми из указателей, используемых для прогнозирования рыночного сценария для отдельных стран. Кроме того, при предоставлении прогнозного анализа данных по странам учитываются наличие и доступность глобальных брендов и их проблемы из-за большой или малой конкуренции со стороны местных и отечественных брендов, влияние внутренних тарифов и торговых путей.

Конкурентная среда и анализ доли рынка пассивных огнезащитных покрытий в Европе

Конкурентная среда европейского рынка пассивных огнезащитных покрытий содержит сведения по конкурентам. Включены сведения о компании, финансы компании, полученный доход, рыночный потенциал, инвестиции в исследования и разработки, новые рыночные инициативы, глобальное присутствие, производственные площадки и объекты, производственные мощности, сильные и слабые стороны компании, запуск продукта, широта и широта продукта, доминирование в применении. Приведенные выше данные относятся только к фокусу компаний, связанному с рынком пассивных огнезащитных покрытий в Европе.

Некоторые из основных игроков, работающих на рынке покрытий пассивной огнезащиты, включают LANXESS, Brenntag GmbH (дочерняя компания Brenntag SE), Boliden Group, Adisseo, Veolia, Univar Solutions Inc, NORAM Engineering & Construction Ltd., Nouryon, International Raw Materials LTD, Eti Bakir, ACIDEKA SA, Airedale Chemical Company Limited., BASF SE, Aguachem Ltd, Feralco AB, Fluorsid, Aurubis AG, Nyrstar, Merck KGaA и Shrieve, среди прочих.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Интерактивная панель анализа данных

- Панель анализа компании для возможностей с высоким потенциалом роста

- Доступ аналитика-исследователя для настройки и запросов

- Анализ конкурентов с помощью интерактивной панели

- Последние новости, обновления и анализ тенденций

- Используйте возможности сравнительного анализа для комплексного отслеживания конкурентов

Содержание

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF EUROPE PASSIVE FIRE PROTECTION COATING MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 PRODUCT TYPE LIFE LINE CURVE

2.7 MULTIVARIATE MODELING

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET APPLICATION COVERAGE GRID

2.11 DBMR MARKET CHALLENGE MATRIX

2.12 DBMR VENDOR SHARE ANALYSIS

2.13 IMPORT-EXPORT DATA

2.14 SECONDARY SOURCES

2.15 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PRODUCTION PROCESS

4.1.1 INTRODUCTION

4.1.2 FUNCTION

4.1.3 KEYS ELEMENTS

4.1.4 PROCESS

4.2 POTENTIAL COLLABORATION OPPORTUNITIES

4.3 COMPARATIVE ANALYSIS WITH POTENTIAL SUBSTITUTES

4.4 REGIONAL SUMMARY

4.4.1 EUROPE

4.4.2 ASIA-PACIFIC

4.4.3 EUROPE

4.4.4 NORTH AMERICA

4.4.5 MIDDLE-EAST & AFRICA

4.4.6 SOUTH AMERICA

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 GROWING CONSTRUCTION INDUSTRY

5.1.2 ESCALATING APPLICATION SCOPE OF PASSIVE FIRE PROTECTION COATING IN VARIOUS INDUSTRIES

5.1.3 RISING DEMAND FOR WATER-BASED FIRE PROTECTION COATINGS

5.1.4 IMPOSITION OF FAVORABLE GOVERNMENT GUIDELINES AND FIRE SAFETY STANDARDS

5.2 RESTRAINTS

5.2.1 AVAILABILITY OF CHEAPER ALTERNATIVES

5.2.2 VOLATILITY IN THE RAW MATERIAL COSTS

5.3 OPPORTUNITIES

5.3.1 INCREASING INDIVIDUALS DISPOSABLE INCOME

5.3.2 RISING OIL AND GAS EXPLORATION ACTIVITIES

5.3.3 ADVANCEMENT IN THE CONSTRUCTION INDUSTRY TO BRING LUCRATIVE OPPORTUNITIES

5.3.4 RISING USAGES OF FIRE PROTECTION COATINGS IN RENOVATION PROJECTS

5.4 CHALLENGES

5.4.1 LACK OF AWARENESS AMONG POTENTIAL END-USERS

5.4.2 HIGH INSTALLATION AND MAINTENANCE COST

6 EUROPE PASSIVE FIRE PROTECTION COATING MARKET, PRODUCT TYPE

6.1 OVERVIEW

6.2 INTUMESCENT COATING

6.2.1 CELLULOSIC FIRE PROTECTION

6.2.2 HYDROCARBON FIRE PROTECTION

6.3 CEMENTITIOUS MATERIAL

6.3.1 HYDRAULIC CEMENT

6.3.2 SUPPLEMENTARY CEMENTITIOUS MATERIALS (SCMS)

6.4 FIREPROOFING CLADDING

6.5 OTHERS

7 EUROPE PASSIVE FIRE PROTECTION COATING MARKET, BY TECHNOLOGY

7.1 OVERVIEW

7.2 WATER-BASED PROTECTION COATING

7.3 SOLVENT-BASED PROTECTION COATING

8 EUROPE PASSIVE FIRE PROTECTION COATING MARKET, BY APPLICATION

8.1 OVERVIEW

8.2 AUTOMOTIVE

8.3 OIL & GAS

8.4 CONSTRUCTION

8.4.1 HOSPITALS

8.4.2 SKYSCRAPERS

8.4.3 COLLEGES

8.4.4 RESTAURANTS

8.4.5 RESIDENTIAL BUILDINGS

8.4.6 COMMERCIAL BUILDINGS

8.4.7 OFFICES

8.4.8 OTHERS

8.5 AEROSPACE

8.6 ELECTRICAL AND ELECTRONICS

8.7 TEXTILE

8.8 FURNITURE

8.9 WAREHOUSING

8.1 OTHERS

9 EUROPE PASSIVE FIRE PROTECTION COATING MARKET, END USER

9.1 OVERVIEW

9.2 BUILDING & CONSTRUCTION

9.2.1 INTUMESCENT COATING

9.2.2 CEMENTITIOUS MATERIAL

9.2.3 FIREPROOFING CLADDING

9.2.4 OTHERS

9.3 OIL & GAS

9.3.1 INTUMESCENT COATING

9.3.2 CEMENTITIOUS MATERIAL

9.3.3 FIREPROOFING CLADDING

9.3.4 OTHERS

9.4 TRANSPORTATION

9.4.1 INTUMESCENT COATING

9.4.2 CEMENTITIOUS MATERIAL

9.4.3 FIREPROOFING CLADDING

9.4.4 OTHERS

9.5 OTHERS

9.5.1 INTUMESCENT COATING

9.5.2 CEMENTITIOUS MATERIAL

9.5.3 FIREPROOFING CLADDING

9.5.4 OTHERS

10 EUROPE PASSIVE FIRE PROTECTION COATING MARKET, BY REGION

10.1 EUROPE

10.1.1 GERMANY

10.1.2 U.K

10.1.3 FRANCE

10.1.4 ITALY

10.1.5 SPAIN

10.1.6 RUSSIA

10.1.7 SWITZERLAND

10.1.8 TURKEY

10.1.9 BELGIUM

10.1.10 NETHERLANDS

10.1.11 LUXEMBURG

10.1.12 REST OF EUROPE

11 EUROPE PASSIVE FIRE PROTECTION COATING MARKET: COMPANY LANDSCAPE

11.1 COMPANY SHARE ANALYSIS: EUROPE

11.2 MERGER & ACQUISITION

11.3 RECENT UPDATE

11.4 PRODUCT LAUNCH

12 SWOT ANALYSIS

13 COMPANY PROFILE

13.1 3M

13.1.1 COMPANY SNAPSHOT

13.1.2 REVENUE ANALYSIS

13.1.3 COMPANY SHARE ANALYSIS

13.1.4 PRODUCT PORTFOLIO

13.1.5 RECENT UPDATE

13.2 GCP APPLIED TECHNOLOGIES INC.

13.2.1 COMPANY SNAPSHOT

13.2.2 REVENUE ANALYSIS

13.2.3 COMPANY SHARE ANALYSIS

13.2.4 PRODUCT PORTFOLIO

13.2.5 RECENT UPDATE

13.3 AKZO NOBEL N.V.

13.3.1 COMPANY SNAPSHOT

13.3.2 REVENUE ANALYSIS

13.3.3 COMPANY SHARE ANALYSIS

13.3.4 PRODUCT PORTFOLIO

13.3.5 RECENT UPDATE

13.4 THE SHERWIN-WILLIAMS COMPANY

13.4.1 COMPANY SNAPSHOT

13.4.2 REVENUE ANALYSIS

13.4.3 COMPANY SHARE ANALYSIS

13.4.4 PRODUCT PORTFOLIO

13.4.5 RECENT UPDATE

13.5 HILTI

13.5.1 COMPANY SNAPSHOT

13.5.2 COMPANY SHARE ANALYSIS

13.5.3 PRODUCT PORTFOLIO

13.5.4 RECENT UPDATE

13.6 ETEX GROUP

13.6.1 COMPANY SNAPSHOT

13.6.2 PRODUCT PORTFOLIO

13.6.3 RECENT UPDATE

13.7 KANSAI PAINT CO.,LTD.

13.7.1 COMPANY SNAPSHOT

13.7.2 REVENUE ANALYSIS

13.7.3 PRODUCT PORTFOLIO

13.7.4 RECENT UPDATE

13.8 JOTUN

13.8.1 COMPANY SNAPSHOT

13.8.2 REVENUE ANALYSIS

13.8.3 PRODUCT PORTFOLIO

13.8.4 RECENT UPDATE

13.9 CARBOLINE

13.9.1 COMPANY SNAPSHOT

13.9.2 PRODUCT PORTFOLIO

13.9.3 RECENT UPDATE

13.1 CONTEGO INTERNATIONAL INC.

13.10.1 COMPANY SNAPSHOT

13.10.2 PRODUCT PORTFOLIO

13.10.3 RECENT UPDATE

13.11 EASTMAN CHEMICAL COMPANY

13.11.1 COMPANY SNAPSHOT

13.11.2 REVENUE ANALYSIS

13.11.3 PRODUCT PORTFOLIO

13.11.4 RECENT UPDATE

13.12 ENVIROGRAF PASSIVE FIRE PRODUCTS

13.12.1 COMPANY SNAPSHOT

13.12.2 PRODUCT PORTFOLIO

13.12.3 RECENT UPDATE

13.13 HEMPEL A/S

13.13.1 COMPANY SNAPSHOT

13.13.2 REVENUE ANALYSIS

13.13.3 PRODUCT PORTFOLIO

13.13.4 RECENT UPDATE

13.14 ISOLATEK INTERNATIONAL

13.14.1 COMPANY SNAPSHOT

13.14.2 PRODUCT PORTFOLIO

13.14.3 RECENT UPDATE

13.15 NO BURN, INC

13.15.1 COMPANY SNAPSHOT

13.15.2 PRODUCT PORTFOLIO

13.15.3 RECENT UPDATE

13.16 PPG INDUSTRIES, INC.

13.16.1 COMPANY SNAPSHOT

13.16.2 REVENUE ANALYSIS

13.16.3 PRODUCT PORTFOLIO

13.16.4 RECENT UPDATE

13.17 RUDOLF HENSEL GMBH

13.17.1 COMPANY SNAPSHOT

13.17.2 PRODUCT PORTFOLIO

13.17.3 RECENT UPDATE

13.18 SHARPFIBRE LIMITED

13.18.1 COMPANY SNAPSHOT

13.18.2 PRODUCT PORTFOLIO

13.18.3 RECENT UPDATE

13.19 SVT GROUP OF COMPANIES

13.19.1 COMPANY SNAPSHOT

13.19.2 PRODUCT PORTFOLIO

13.19.3 RECENT UPDATE

13.2 TEKNOS GROUP

13.20.1 COMPANY SNAPSHOT

13.20.2 PRODUCT PORTFOLIO

13.20.3 RECENT UPDATE

13.21 VIJAY SYSTEMS ENGINEERS PVT LTD

13.21.1 COMPANY SNAPSHOT

13.21.2 PRODUCT PORTFOLIO

13.21.3 RECENT UPDATE

14 QUESTIONNAIRE

15 RELATED REPORT

Список таблиц

TABLE 1 IMPORT DATA OF PRODUCT: 842410 FIRE EXTINGUISHERS WHEATHER OR NOT CHANGE… (USD THOUSAND)

TABLE 2 EXPORT DATA OF PRODUCT: 842410 FIRE EXTINGUISHERS WHEATHER OR NOT CHANGE… (USD THOUSAND)

TABLE 3 POTENTIAL COLLABORATION OPPORTUNITIES

TABLE 4 POTENTIAL SUBSTITUTES

TABLE 5 EUROPE PASSIVE FIRE PROTECTION COATING MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 6 EUROPE PASSIVE FIRE PROTECTION COATING MARKET, BY PRODUCT TYPE, 2020-2029 (THOUSAND KG)

TABLE 7 EUROPE INTUMESCENT COATING IN PASSIVE FIRE PROTECTION COATING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 8 EUROPE INTUMESCENT COATING IN PASSIVE FIRE PROTECTION COATING MARKET, BY REGION, 2020-2029 (THOUSAND KG)

TABLE 9 EUROPE INTUMESCENT COATING IN PASSIVE FIRE PROTECTION COATING MARKET, PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 10 EUROPE CEMENTITIOUS MATERIAL IN PASSIVE FIRE PROTECTION COATING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 11 EUROPE CEMENTITIOUS MATERIAL IN PASSIVE FIRE PROTECTION COATING MARKET, BY REGION, 2020-2029 (THOUSAND KG)

TABLE 12 EUROPE CEMENTITIOUS MATERIAL IN PASSIVE FIRE PROTECTION COATING MARKET, PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 13 EUROPE FIREPROOFING CLADDING IN PASSIVE FIRE PROTECTION COATING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 14 EUROPE FIREPROOFING CLADDING IN PASSIVE FIRE PROTECTION COATING MARKET, BY REGION, 2020-2029 (THOUSAND KG)

TABLE 15 EUROPE OTHERS IN PASSIVE FIRE PROTECTION COATING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 16 EUROPE OTHERS IN PASSIVE FIRE PROTECTION COATING MARKET, BY REGION, 2020-2029 (THOUSAND KG)

TABLE 17 EUROPE PASSIVE FIRE PROTECTION COATING MARKET, BY TECHNOLOGY, 2020-2029 (USD THOUSAND)

TABLE 18 EUROPE WATER-BASED PROTECTION COATING IN PASSIVE FIRE PROTECTION COATING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 19 EUROPE SOLVENT-BASED PROTECTION COATING IN PASSIVE FIRE PROTECTION COATING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 20 EUROPE PASSIVE FIRE PROTECTION COATING MARKET, APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 21 EUROPE AUTOMOTIVE IN PASSIVE FIRE PROTECTION COATING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 22 EUROPE OIL & GAS IN PASSIVE FIRE PROTECTION COATING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 23 EUROPE CONSTRUCTION IN PASSIVE FIRE PROTECTION COATING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 24 EUROPE CONSTRUCTION IN PASSIVE FIRE PROTECTION COATING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 25 EUROPE AEROSPACE IN PASSIVE FIRE PROTECTION COATING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 26 EUROPE ELECTRICAL AND ELECTRONICS IN PASSIVE FIRE PROTECTION COATING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 27 EUROPE TEXTILE IN PASSIVE FIRE PROTECTION COATING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 28 EUROPE FURNITURE IN PASSIVE FIRE PROTECTION COATING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 29 EUROPE WAREHOUSING IN PASSIVE FIRE PROTECTION COATING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 30 EUROPE OTHERS IN PASSIVE FIRE PROTECTION COATING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 31 EUROPE PASSIVE FIRE PROTECTION COATING MARKET, BY END USER, 2020-2029 (USD THOUSAND)

TABLE 32 EUROPE BUILDING & CONSTRUCTION IN PASSIVE FIRE PROTECTION COATING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 33 EUROPE BUILDING & CONSTRUCTION IN PASSIVE FIRE PROTECTION COATING MARKET, PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 34 EUROPE OIL & GAS IN PASSIVE FIRE PROTECTION COATING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 35 EUROPE OIL & GAS IN PASSIVE FIRE PROTECTION COATING MARKET, PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 36 EUROPE TRANSPORTATION IN PASSIVE FIRE PROTECTION COATING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 37 EUROPE TRANSPORTATION IN PASSIVE FIRE PROTECTION COATING MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 38 EUROPE OTHERS IN PASSIVE FIRE PROTECTION COATING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 39 EUROPE OTHERS IN PASSIVE FIRE PROTECTION COATING MARKET, PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 40 EUROPE PASSIVE FIRE PROTECTION COATING MARKET, BY COUNTRY, 2020-2029 (USD THOUSAND)

TABLE 41 EUROPE PASSIVE FIRE PROTECTION COATING MARKET, BY COUNTRY, 2020-2029 (THOUSAND KG)

TABLE 42 EUROPE PASSIVE FIRE PROTECTION COATING MARKET, PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 43 EUROPE PASSIVE FIRE PROTECTION COATING MARKET, PRODUCT TYPE, 2020-2029 (THOUSAND KG)

TABLE 44 EUROPE INTUMESCENT COATING IN PASSIVE FIRE PROTECTION COATING MARKET, PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 45 EUROPE CEMENTITIOUS MATERIAL IN PASSIVE FIRE PROTECTION COATING MARKET, PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 46 EUROPE PASSIVE FIRE PROTECTION COATING MARKET, BY TECHNOLOGY, 2020-2029 (USD THOUSAND)

TABLE 47 EUROPE PASSIVE FIRE PROTECTION COATING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 48 EUROPE CONSTRUCTION IN PASSIVE FIRE PROTECTION COATING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 49 EUROPE PASSIVE FIRE PROTECTION COATING MARKET, BY END USER, 2020-2029 (USD THOUSAND)

TABLE 50 EUROPE BUILDING & CONSTRUCTION IN PASSIVE FIRE PROTECTION COATING MARKET, PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 51 EUROPE OIL & GAS IN PASSIVE FIRE PROTECTION COATING MARKET, PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 52 EUROPE TRANSPORTATION IN PASSIVE FIRE PROTECTION COATING MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 53 EUROPE OTHERS IN PASSIVE FIRE PROTECTION COATING MARKET, PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 54 GERMANY PASSIVE FIRE PROTECTION COATING MARKET, PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 55 GERMANY PASSIVE FIRE PROTECTION COATING MARKET, PRODUCT TYPE, 2020-2029 (THOUSAND KG)

TABLE 56 GERMANY INTUMESCENT COATING IN PASSIVE FIRE PROTECTION COATING MARKET, PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 57 GERMANY CEMENTITIOUS MATERIAL IN PASSIVE FIRE PROTECTION COATING MARKET, PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 58 GERMANY PASSIVE FIRE PROTECTION COATING MARKET, BY TECHNOLOGY, 2020-2029 (USD THOUSAND)

TABLE 59 GERMANY PASSIVE FIRE PROTECTION COATING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 60 GERMANY CONSTRUCTION IN PASSIVE FIRE PROTECTION COATING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 61 GERMANY PASSIVE FIRE PROTECTION COATING MARKET, BY END USER, 2020-2029 (USD THOUSAND)

TABLE 62 GERMANY BUILDING & CONSTRUCTION IN PASSIVE FIRE PROTECTION COATING MARKET, PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 63 GERMANY OIL & GAS IN PASSIVE FIRE PROTECTION COATING MARKET, PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 64 GERMANY TRANSPORTATION IN PASSIVE FIRE PROTECTION COATING MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 65 GERMANY OTHERS IN PASSIVE FIRE PROTECTION COATING MARKET, PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 66 U.K PASSIVE FIRE PROTECTION COATING MARKET, PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 67 U.K PASSIVE FIRE PROTECTION COATING MARKET, PRODUCT TYPE, 2020-2029 (THOUSAND KG)

TABLE 68 U.K INTUMESCENT COATING IN PASSIVE FIRE PROTECTION COATING MARKET, PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 69 U.K CEMENTITIOUS MATERIAL IN PASSIVE FIRE PROTECTION COATING MARKET, PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 70 U.K PASSIVE FIRE PROTECTION COATING MARKET, BY TECHNOLOGY, 2020-2029 (USD THOUSAND)

TABLE 71 U.K PASSIVE FIRE PROTECTION COATING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 72 U.K CONSTRUCTION IN PASSIVE FIRE PROTECTION COATING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 73 U.K PASSIVE FIRE PROTECTION COATING MARKET, BY END USER, 2020-2029 (USD THOUSAND)

TABLE 74 U.K BUILDING & CONSTRUCTION IN PASSIVE FIRE PROTECTION COATING MARKET, PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 75 U.K OIL & GAS IN PASSIVE FIRE PROTECTION COATING MARKET, PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 76 U.K TRANSPORTATION IN PASSIVE FIRE PROTECTION COATING MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 77 U.K OTHERS IN PASSIVE FIRE PROTECTION COATING MARKET, PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 78 FRANCE PASSIVE FIRE PROTECTION COATING MARKET, PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 79 FRANCE PASSIVE FIRE PROTECTION COATING MARKET, PRODUCT TYPE, 2020-2029 (THOUSAND KG)

TABLE 80 FRANCE INTUMESCENT COATING IN PASSIVE FIRE PROTECTION COATING MARKET, PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 81 FRANCE CEMENTITIOUS MATERIAL IN PASSIVE FIRE PROTECTION COATING MARKET, PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 82 FRANCE PASSIVE FIRE PROTECTION COATING MARKET, BY TECHNOLOGY, 2020-2029 (USD THOUSAND)

TABLE 83 FRANCE PASSIVE FIRE PROTECTION COATING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 84 FRANCE CONSTRUCTION IN PASSIVE FIRE PROTECTION COATING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 85 FRANCE PASSIVE FIRE PROTECTION COATING MARKET, BY END USER, 2020-2029 (USD THOUSAND)

TABLE 86 FRANCE BUILDING & CONSTRUCTION IN PASSIVE FIRE PROTECTION COATING MARKET, PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 87 FRANCE OIL & GAS IN PASSIVE FIRE PROTECTION COATING MARKET, PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 88 FRANCE TRANSPORTATION IN PASSIVE FIRE PROTECTION COATING MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 89 FRANCE OTHERS IN PASSIVE FIRE PROTECTION COATING MARKET, PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 90 ITALY PASSIVE FIRE PROTECTION COATING MARKET, PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 91 ITALY PASSIVE FIRE PROTECTION COATING MARKET, PRODUCT TYPE, 2020-2029 (THOUSAND KG)

TABLE 92 ITALY INTUMESCENT COATING IN PASSIVE FIRE PROTECTION COATING MARKET, PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 93 ITALY CEMENTITIOUS MATERIAL IN PASSIVE FIRE PROTECTION COATING MARKET, PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 94 ITALY PASSIVE FIRE PROTECTION COATING MARKET, BY TECHNOLOGY, 2020-2029 (USD THOUSAND)

TABLE 95 ITALY PASSIVE FIRE PROTECTION COATING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 96 ITALY CONSTRUCTION IN PASSIVE FIRE PROTECTION COATING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 97 ITALY PASSIVE FIRE PROTECTION COATING MARKET, BY END USER, 2020-2029 (USD THOUSAND)

TABLE 98 ITALY BUILDING & CONSTRUCTION IN PASSIVE FIRE PROTECTION COATING MARKET, PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 99 ITALY OIL & GAS IN PASSIVE FIRE PROTECTION COATING MARKET, PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 100 ITALY TRANSPORTATION IN PASSIVE FIRE PROTECTION COATING MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 101 ITALY OTHERS IN PASSIVE FIRE PROTECTION COATING MARKET, PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 102 SPAIN PASSIVE FIRE PROTECTION COATING MARKET, PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 103 SPAIN PASSIVE FIRE PROTECTION COATING MARKET, PRODUCT TYPE, 2020-2029 (THOUSAND KG)

TABLE 104 SPAIN INTUMESCENT COATING IN PASSIVE FIRE PROTECTION COATING MARKET, PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 105 SPAIN CEMENTITIOUS MATERIAL IN PASSIVE FIRE PROTECTION COATING MARKET, PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 106 SPAIN PASSIVE FIRE PROTECTION COATING MARKET, BY TECHNOLOGY, 2020-2029 (USD THOUSAND)

TABLE 107 SPAIN PASSIVE FIRE PROTECTION COATING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 108 SPAIN CONSTRUCTION IN PASSIVE FIRE PROTECTION COATING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 109 SPAIN PASSIVE FIRE PROTECTION COATING MARKET, BY END USER, 2020-2029 (USD THOUSAND)

TABLE 110 SPAIN BUILDING & CONSTRUCTION IN PASSIVE FIRE PROTECTION COATING MARKET, PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 111 SPAIN OIL & GAS IN PASSIVE FIRE PROTECTION COATING MARKET, PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 112 SPAIN TRANSPORTATION IN PASSIVE FIRE PROTECTION COATING MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 113 SPAIN OTHERS IN PASSIVE FIRE PROTECTION COATING MARKET, PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 114 RUSSIA PASSIVE FIRE PROTECTION COATING MARKET, PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 115 RUSSIA PASSIVE FIRE PROTECTION COATING MARKET, PRODUCT TYPE, 2020-2029 (THOUSAND KG)

TABLE 116 RUSSIA INTUMESCENT COATING IN PASSIVE FIRE PROTECTION COATING MARKET, PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 117 RUSSIA CEMENTITIOUS MATERIAL IN PASSIVE FIRE PROTECTION COATING MARKET, PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 118 RUSSIA PASSIVE FIRE PROTECTION COATING MARKET, BY TECHNOLOGY, 2020-2029 (USD THOUSAND)

TABLE 119 RUSSIA PASSIVE FIRE PROTECTION COATING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 120 RUSSIA CONSTRUCTION IN PASSIVE FIRE PROTECTION COATING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 121 RUSSIA PASSIVE FIRE PROTECTION COATING MARKET, BY END USER, 2020-2029 (USD THOUSAND)

TABLE 122 RUSSIA BUILDING & CONSTRUCTION IN PASSIVE FIRE PROTECTION COATING MARKET, PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 123 RUSSIA OIL & GAS IN PASSIVE FIRE PROTECTION COATING MARKET, PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 124 RUSSIA TRANSPORTATION IN PASSIVE FIRE PROTECTION COATING MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 125 RUSSIA OTHERS IN PASSIVE FIRE PROTECTION COATING MARKET, PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 126 SWITZERLAND PASSIVE FIRE PROTECTION COATING MARKET, PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 127 SWITZERLAND PASSIVE FIRE PROTECTION COATING MARKET, PRODUCT TYPE, 2020-2029 (THOUSAND KG)

TABLE 128 SWITZERLAND INTUMESCENT COATING IN PASSIVE FIRE PROTECTION COATING MARKET, PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 129 SWITZERLAND CEMENTITIOUS MATERIAL IN PASSIVE FIRE PROTECTION COATING MARKET, PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 130 SWITZERLAND PASSIVE FIRE PROTECTION COATING MARKET, BY TECHNOLOGY, 2020-2029 (USD THOUSAND)

TABLE 131 SWITZERLAND PASSIVE FIRE PROTECTION COATING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 132 SWITZERLAND CONSTRUCTION IN PASSIVE FIRE PROTECTION COATING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 133 SWITZERLAND PASSIVE FIRE PROTECTION COATING MARKET, BY END USER, 2020-2029 (USD THOUSAND)

TABLE 134 SWITZERLAND BUILDING & CONSTRUCTION IN PASSIVE FIRE PROTECTION COATING MARKET, PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 135 SWITZERLAND OIL & GAS IN PASSIVE FIRE PROTECTION COATING MARKET, PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 136 SWITZERLAND TRANSPORTATION IN PASSIVE FIRE PROTECTION COATING MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 137 SWITZERLAND OTHERS IN PASSIVE FIRE PROTECTION COATING MARKET, PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 138 TURKEY PASSIVE FIRE PROTECTION COATING MARKET, PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 139 TURKEY PASSIVE FIRE PROTECTION COATING MARKET, PRODUCT TYPE, 2020-2029 (THOUSAND KG)

TABLE 140 TURKEY INTUMESCENT COATING IN PASSIVE FIRE PROTECTION COATING MARKET, PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 141 TURKEY CEMENTITIOUS MATERIAL IN PASSIVE FIRE PROTECTION COATING MARKET, PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 142 TURKEY PASSIVE FIRE PROTECTION COATING MARKET, BY TECHNOLOGY, 2020-2029 (USD THOUSAND)

TABLE 143 TURKEY PASSIVE FIRE PROTECTION COATING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 144 TURKEY CONSTRUCTION IN PASSIVE FIRE PROTECTION COATING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 145 TURKEY PASSIVE FIRE PROTECTION COATING MARKET, BY END USER, 2020-2029 (USD THOUSAND)

TABLE 146 TURKEY BUILDING & CONSTRUCTION IN PASSIVE FIRE PROTECTION COATING MARKET, PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 147 TURKEY OIL & GAS IN PASSIVE FIRE PROTECTION COATING MARKET, PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 148 TURKEY TRANSPORTATION IN PASSIVE FIRE PROTECTION COATING MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 149 TURKEY OTHERS IN PASSIVE FIRE PROTECTION COATING MARKET, PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 150 BELGIUM PASSIVE FIRE PROTECTION COATING MARKET, PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 151 BELGIUM PASSIVE FIRE PROTECTION COATING MARKET, PRODUCT TYPE, 2020-2029 (THOUSAND KG)

TABLE 152 BELGIUM INTUMESCENT COATING IN PASSIVE FIRE PROTECTION COATING MARKET, PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 153 BELGIUM CEMENTITIOUS MATERIAL IN PASSIVE FIRE PROTECTION COATING MARKET, PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 154 BELGIUM PASSIVE FIRE PROTECTION COATING MARKET, BY TECHNOLOGY, 2020-2029 (USD THOUSAND)

TABLE 155 BELGIUM PASSIVE FIRE PROTECTION COATING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 156 BELGIUM CONSTRUCTION IN PASSIVE FIRE PROTECTION COATING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 157 BELGIUM PASSIVE FIRE PROTECTION COATING MARKET, BY END USER, 2020-2029 (USD THOUSAND)

TABLE 158 BELGIUM BUILDING & CONSTRUCTION IN PASSIVE FIRE PROTECTION COATING MARKET, PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 159 BELGIUM OIL & GAS IN PASSIVE FIRE PROTECTION COATING MARKET, PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 160 BELGIUM TRANSPORTATION IN PASSIVE FIRE PROTECTION COATING MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 161 BELGIUM OTHERS IN PASSIVE FIRE PROTECTION COATING MARKET, PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 162 NETHERLANDS PASSIVE FIRE PROTECTION COATING MARKET, PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 163 NETHERLANDS PASSIVE FIRE PROTECTION COATING MARKET, PRODUCT TYPE, 2020-2029 (THOUSAND KG)

TABLE 164 NETHERLANDS INTUMESCENT COATING IN PASSIVE FIRE PROTECTION COATING MARKET, PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 165 NETHERLANDS CEMENTITIOUS MATERIAL IN PASSIVE FIRE PROTECTION COATING MARKET, PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 166 NETHERLANDS PASSIVE FIRE PROTECTION COATING MARKET, BY TECHNOLOGY, 2020-2029 (USD THOUSAND)

TABLE 167 NETHERLANDS PASSIVE FIRE PROTECTION COATING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 168 NETHERLANDS CONSTRUCTION IN PASSIVE FIRE PROTECTION COATING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 169 NETHERLANDS PASSIVE FIRE PROTECTION COATING MARKET, BY END USER, 2020-2029 (USD THOUSAND)

TABLE 170 NETHERLANDS BUILDING & CONSTRUCTION IN PASSIVE FIRE PROTECTION COATING MARKET, PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 171 NETHERLANDS OIL & GAS IN PASSIVE FIRE PROTECTION COATING MARKET, PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 172 NETHERLANDS TRANSPORTATION IN PASSIVE FIRE PROTECTION COATING MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 173 NETHERLANDS OTHERS IN PASSIVE FIRE PROTECTION COATING MARKET, PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 174 LUXEMBURG PASSIVE FIRE PROTECTION COATING MARKET, PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 175 LUXEMBURG PASSIVE FIRE PROTECTION COATING MARKET, PRODUCT TYPE, 2020-2029 (THOUSAND KG)

TABLE 176 LUXEMBURG INTUMESCENT COATING IN PASSIVE FIRE PROTECTION COATING MARKET, PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 177 LUXEMBURG CEMENTITIOUS MATERIAL IN PASSIVE FIRE PROTECTION COATING MARKET, PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 178 LUXEMBURG PASSIVE FIRE PROTECTION COATING MARKET, BY TECHNOLOGY, 2020-2029 (USD THOUSAND)

TABLE 179 LUXEMBURG PASSIVE FIRE PROTECTION COATING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 180 LUXEMBURG CONSTRUCTION IN PASSIVE FIRE PROTECTION COATING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 181 LUXEMBURG PASSIVE FIRE PROTECTION COATING MARKET, BY END USER, 2020-2029 (USD THOUSAND)

TABLE 182 LUXEMBURG BUILDING & CONSTRUCTION IN PASSIVE FIRE PROTECTION COATING MARKET, PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 183 LUXEMBURG OIL & GAS IN PASSIVE FIRE PROTECTION COATING MARKET, PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 184 LUXEMBURG TRANSPORTATION IN PASSIVE FIRE PROTECTION COATING MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 185 LUXEMBURG OTHERS IN PASSIVE FIRE PROTECTION COATING MARKET, PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 186 REST OF EUROPE PASSIVE FIRE PROTECTION COATING MARKET, PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 187 REST OF EUROPE PASSIVE FIRE PROTECTION COATING MARKET, PRODUCT TYPE, 2020-2029 (THOUSAND KG)

Список рисунков

FIGURE 1 EUROPE PASSIVE FIRE PROTECTION COATING MARKET: SEGMENTATION

FIGURE 2 EUROPE PASSIVE FIRE PROTECTION COATING MARKET: DATA TRIANGULATION

FIGURE 3 EUROPE PASSIVE FIRE PROTECTION COATING MARKET: DROC ANALYSIS

FIGURE 4 EUROPE PASSIVE FIRE PROTECTION COATING MARKET: EUROPE VS REGIONAL MARKET ANALYSIS

FIGURE 5 EUROPE PASSIVE FIRE PROTECTION COATING MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 EUROPE PASSIVE FIRE PROTECTION COATING MARKET: PRODUCT LIFE LINE CURVE

FIGURE 7 EUROPE PASSIVE FIRE PROTECTION COATING MARKET: MULTIVARIATE MODELLING

FIGURE 8 EUROPE PASSIVE FIRE PROTECTION COATING MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 9 EUROPE PASSIVE FIRE PROTECTION COATING MARKET: DBMR MARKET POSITION GRID

FIGURE 10 EUROPE PASSIVE FIRE PROTECTION COATING MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 11 EUROPE PASSIVE FIRE PROTECTION COATING MARKET: THE MARKET CHALLENGE MATRIX

FIGURE 12 EUROPE PASSIVE FIRE PROTECTION COATING MARKET: VENDOR SHARE ANALYSIS

FIGURE 13 EUROPE PASSIVE FIRE PROTECTION COATING MARKET: SEGMENTATION

FIGURE 14 ASIA-PACIFIC IS EXPECTED TO DOMINATE THE EUROPE PASSIVE FIRE PROTECTION COATING MARKET AND IS EXPECTED TO GROW WITH THE HIGHEST CAGR IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 15 GROWING CONSTRUCTION INDUSTRY IS DRIVING THE EUROPE PASSIVE FIRE PROTECTION COATING MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 16 INTUMESCENT COATING SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE EUROPE PASSIVE FIRE PROTECTION COATING MARKET IN 2022 & 2029

FIGURE 17 DRIVERS, RESTRAINT, OPPORTUNITY, AND CHALLENGES OF EUROPE PASSIVE FIRE PROTECTION COATING MARKET

FIGURE 18 EUROPE PASSIVE FIRE PROTECTION COATING MARKET, BY PRODUCT TYPE, 2021

FIGURE 19 EUROPE PASSIVE FIRE PROTECTION COATING MARKET, BY TECHNOLOGY, 2021

FIGURE 20 EUROPE PASSIVE FIRE PROTECTION COATING MARKET, APPLICATION, 2021

FIGURE 21 EUROPE PASSIVE FIRE PROTECTION COATING MARKET, END USER, 2021

FIGURE 22 EUROPE PASSIVE FIRE PROTECTION COATING MARKET : SNAPSHOT (2021)

FIGURE 23 EUROPE PASSIVE FIRE PROTECTION COATING MARKET: BY COUNTRY (2021)

FIGURE 24 EUROPE PASSIVE FIRE PROTECTION COATING MARKET: BY COUNTRY (2022 & 2029)

FIGURE 25 EUROPE PASSIVE FIRE PROTECTION COATING MARKET: BY COUNTRY (2021 & 2029)

FIGURE 26 EUROPE PASSIVE FIRE PROTECTION COATING MARKET: BY PRODUCT TYPE (2022-2029)

FIGURE 27 EUROPE PASSIVE FIRE PROTECTION COATING MARKET: COMPANY SHARE 2021 (%)

Методология исследования

Сбор данных и анализ базового года выполняются с использованием модулей сбора данных с большими размерами выборки. Этап включает получение рыночной информации или связанных данных из различных источников и стратегий. Он включает изучение и планирование всех данных, полученных из прошлого заранее. Он также охватывает изучение несоответствий информации, наблюдаемых в различных источниках информации. Рыночные данные анализируются и оцениваются с использованием статистических и последовательных моделей рынка. Кроме того, анализ доли рынка и анализ ключевых тенденций являются основными факторами успеха в отчете о рынке. Чтобы узнать больше, пожалуйста, запросите звонок аналитика или оставьте свой запрос.

Ключевой методологией исследования, используемой исследовательской группой DBMR, является триангуляция данных, которая включает в себя интеллектуальный анализ данных, анализ влияния переменных данных на рынок и первичную (отраслевую экспертную) проверку. Модели данных включают сетку позиционирования поставщиков, анализ временной линии рынка, обзор рынка и руководство, сетку позиционирования компании, патентный анализ, анализ цен, анализ доли рынка компании, стандарты измерения, глобальный и региональный анализ и анализ доли поставщика. Чтобы узнать больше о методологии исследования, отправьте запрос, чтобы поговорить с нашими отраслевыми экспертами.

Доступна настройка

Data Bridge Market Research является лидером в области передовых формативных исследований. Мы гордимся тем, что предоставляем нашим существующим и новым клиентам данные и анализ, которые соответствуют и подходят их целям. Отчет можно настроить, включив в него анализ ценовых тенденций целевых брендов, понимание рынка для дополнительных стран (запросите список стран), данные о результатах клинических испытаний, обзор литературы, обновленный анализ рынка и продуктовой базы. Анализ рынка целевых конкурентов можно проанализировать от анализа на основе технологий до стратегий портфеля рынка. Мы можем добавить столько конкурентов, о которых вам нужны данные в нужном вам формате и стиле данных. Наша команда аналитиков также может предоставить вам данные в сырых файлах Excel, сводных таблицах (книга фактов) или помочь вам в создании презентаций из наборов данных, доступных в отчете.