Европейский рынок упаковки из бумаги и картона, по продукту (бумажные стаканчики, крафт-картон, коробочный картон, складные коробки и футляры, бумажные пакеты и другие), тип (наклейки, шопперская бумага, покрытие, упаковка, приглашения / конверты / бумага для записей, этикетки, обложки, каталоги и цифровая печать), свойство (цветная, натуральная, с покрытием, перламутровая, текстурная, переработанная, хлопок и другие), вес (70 г/м2 - 100 г/м2, 101 г/м2 - 150 г/м2, 151 г/м2 - 200 г/м2, 201 г/м2 - 250 г/м2 и более 250 г/м2), конечный пользователь (средства личной гигиены и косметика , продукты питания и напитки, здравоохранение, потребительские товары, образование, канцелярские принадлежности и другие), страна (Германия, Франция, Италия, Великобритания, Бельгия, Испания, Россия, Турция, Нидерланды, Швейцария и Остальная Европа) Тенденции отрасли и прогноз до 2029 г.

Анализ рынка и аналитика: Европейский рынок упаковки из бумаги и картона

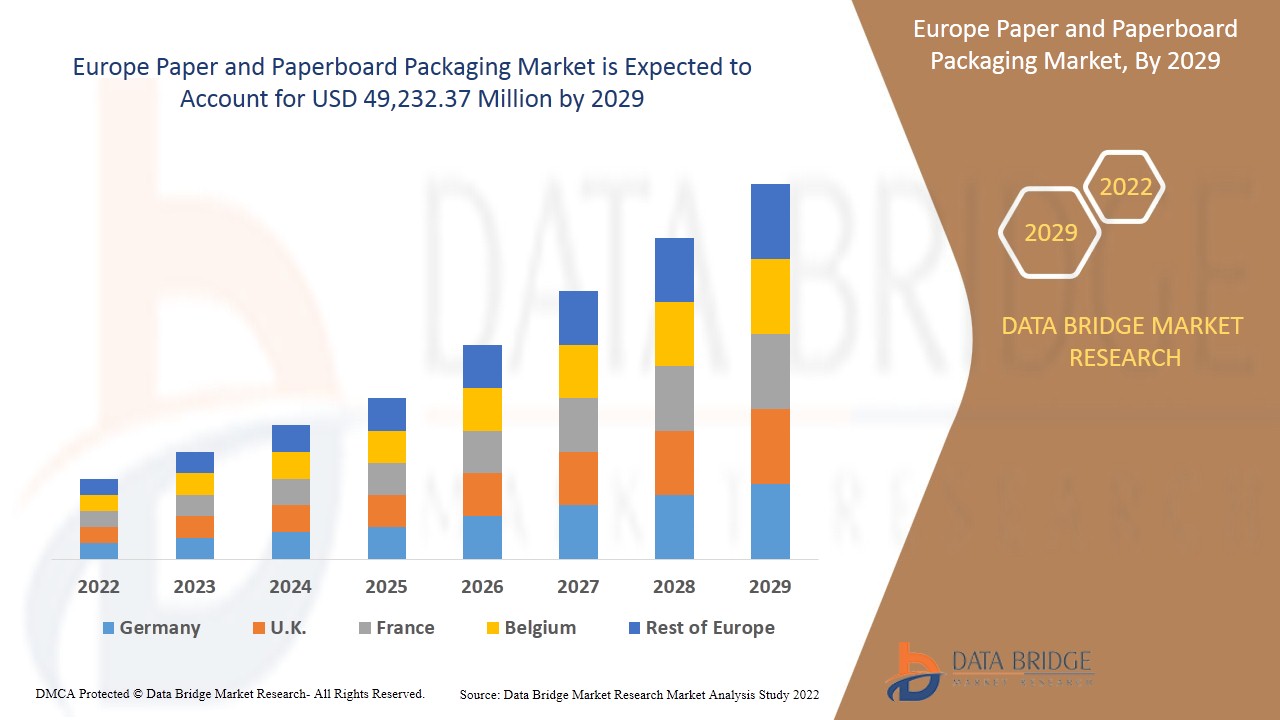

Ожидается, что рынок упаковки из бумаги и картона в Европе будет расти в прогнозируемый период с 2022 по 2029 год. По данным Data Bridge Market Research, среднегодовой темп роста рынка составит 4,6% в прогнозируемый период с 2022 по 2029 год, а к 2029 году его объем, как ожидается, достигнет 49 232,37 млн долларов США.

Бумага производится из целлюлозных волокон, которые получают из деревьев, восстановленной бумаги и однолетних растительных волокон, таких как солома зерновых. Сегодня около 97 процентов бумаги и картона в мире производится из древесной массы, и около 85 процентов используемой древесной массы изготавливается из елей, пихт и сосен. Кроме того, бумага и картон могут использоваться в контакте с пищевыми продуктами различными способами, как напрямую, так и косвенно, и либо отдельно, либо ламинированные другими материалами, такими как пластик или металлическая фольга.

Растущий спрос на картонные упаковочные коробки со стороны медицинской отрасли оказывает существенное влияние на расширение рынка бумажной и картонной упаковки. В соответствии с этим, растущая осведомленность относительно принятия экологически чистых упаковочных материалов и растущий спрос со стороны электронной коммерции на бумажные и картонные контейнеры являются ключевыми детерминантами, благоприятствующими росту рынка бумажной и картонной упаковки в течение прогнозируемого периода.

Однако введенные правительствами правила, касающиеся использования упаковочных материалов, могут стать серьезным сдерживающим фактором для темпов роста рынка бумажной и картонной упаковки, в то время как поддержание качества упаковочной продукции на бумажной основе является довольно сложной задачей и может потенциально поставить под сомнение рост рынка бумажной и картонной упаковки в течение прогнозируемого периода.

В этом отчете о рынке упаковки из бумаги и картона содержатся сведения о доле рынка, новых разработках и анализе продуктового портфеля, влиянии игроков внутреннего и локального рынка, анализируются возможности с точки зрения новых источников дохода, изменений в рыночных правилах, одобрений продуктов, стратегических решений, запусков продуктов, географических расширений и технологических инноваций на рынке. Чтобы понять анализ и рыночный сценарий, свяжитесь с нами для получения аналитического обзора, наша команда поможет вам создать решение по влиянию на доход для достижения желаемой цели.

Объем и размер европейского рынка бумажной и картонной упаковки

Европейский рынок упаковки из бумаги и картона сегментирован на пять заметных сегментов, которые основаны на типе, продукте, свойстве, весе и конечном пользователе. Рост среди сегментов помогает вам анализировать нишевые карманы роста и стратегии для выхода на рынок и определять ваши основные области применения и разницу в ваших целевых рынках.

- На основе типа мировой рынок бумажной и картонной упаковки сегментируется на наклейки, шопперы, покрытия, упаковку, приглашения/конверты/бумагу для записей, этикетки, обложки, каталоги и цифровую печать. Ожидается, что в 2022 году сегмент упаковки будет доминировать на рынке из-за растущего спроса на бумажные коробки со стороны индустрии электронной коммерции.

- На основе продукта мировой рынок упаковки из бумаги и картона сегментируется на бумажные стаканчики , крафт-картон, коробочный картон, складные коробки и ящики, бумажные пакеты и др. Ожидается, что в 2022 году сегмент крафт-картона будет доминировать на рынке, поскольку крафт-картон обладает высокой прочностью, что увеличивает спрос на него в Европе.

- На основе собственности мировой рынок бумажной и картонной упаковки сегментируется на цветную, натуральную, покрытую, перламутровую, текстурированную, переработанную, хлопчатобумажную и др. Ожидается, что в 2022 году сегмент переработки будет доминировать на рынке, поскольку перерабатываемая собственность способствует снижению загрязнения, что увеличивает ее спрос в Европе.

- На основе веса мировой рынок бумажной и картонной упаковки сегментируется на 70 Г/м2 - 100 Г/м2, 101 Г/м2 - 150 Г/м2, 151 Г/м2 - 200 Г/м2, 201 Г/м2 - 250 Г/м2 и более 250 Г/м2. Ожидается, что в 2022 году сегмент 151 Г/м2 - 200 Г/м2 будет доминировать на рынке, поскольку этот вес легче переносить, что увеличивает его спрос в Европе.

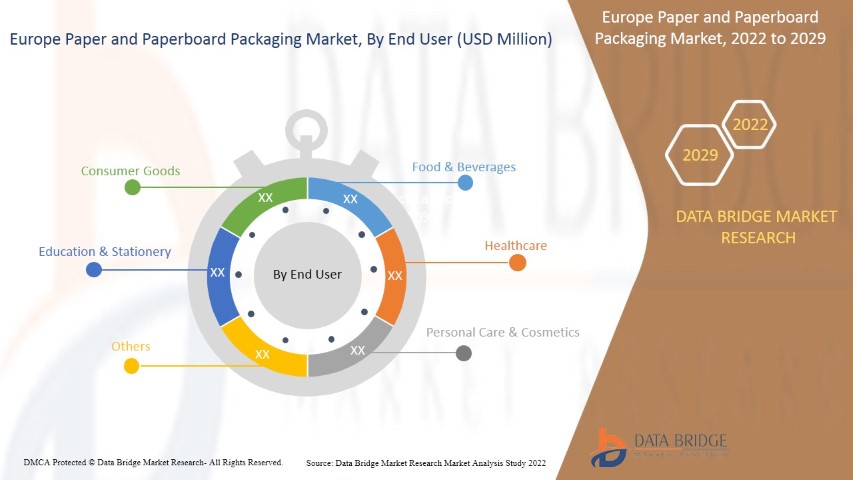

- На основе конечного потребителя мировой рынок упаковки из бумаги и картона сегментируется на средства личной гигиены и косметику, продукты питания и напитки, здравоохранение, потребительские товары, образование и канцелярские принадлежности и др. Ожидается, что в 2022 году сегмент продуктов питания и напитков будет доминировать на рынке, поскольку упаковка из бумаги и картона обладает хорошей гибкостью для хранения различных типов пищевых продуктов, что увеличивает спрос на нее в Европе.

Анализ европейского рынка бумажной и картонной упаковки на уровне стран

Европейский рынок упаковки из бумаги и картона разделен на четыре основных сегмента, которые основаны на типе, продукте, свойствах, весе и конечном пользователе.

Страны, охваченные отчетом о рынке бумажной и картонной упаковки в Европе: Германия, Франция, Италия, Великобритания, Бельгия, Испания, Россия, Турция, Нидерланды, Швейцария и остальные страны Европы. Германия доминирует на европейском рынке из-за растущего внедрения бумажной упаковки в пищевой промышленности, что увеличивает спрос на бумажную и картонную упаковку в регионе.

Раздел отчета по странам также содержит отдельные факторы, влияющие на рынок, и изменения в регулировании на внутреннем рынке, которые влияют на текущие и будущие тенденции рынка. Такие данные, как новые продажи, заменяющие продажи, демографические данные страны, нормативные акты и импортно-экспортные тарифы, являются одними из основных указателей, используемых для прогнозирования рыночного сценария для отдельных стран. Кроме того, при предоставлении прогнозного анализа данных по странам учитываются наличие и доступность европейских брендов и их проблемы из-за большой или малой конкуренции со стороны местных и отечественных брендов, влияние каналов продаж.

Растущий спрос на картонные упаковочные коробки со стороны медицинской отрасли

Бумажные и картонные упаковочные материалы играют важную роль в упаковке и демонстрации продукции в секторе медицины и фармацевтики. Заключение продукта в оболочку является самой основной функцией упаковки лекарств. Конструкция высококачественных упаковок должна учитывать потребности продукта и системы производства и дистрибуции. Это требует, чтобы упаковка не протекала, не позволяла продукту распространяться или проникать внутрь и была достаточно прочной, чтобы удерживать содержимое при обычном обращении.

Сектор здравоохранения способствует повышению спроса на упаковку. Картонные коробки требуются для транспортировки медицинских товаров и лекарств в различные места дистрибуции. Упаковка должна защищать продукт от всех внешних неблагоприятных воздействий, которые могут поставить под угрозу качество или эффективность, таких как свет, влага, кислород, биологическое загрязнение, механические повреждения, подделка или контрафакт.

Поэтому производители фармацевтической продукции должны тщательно продумать упаковку, поскольку безопасность лекарств важна для предотвращения разрушительных ошибок, неэффективного хранения и риска фальсификации лекарств и фальсификации продукции. Это, в свою очередь, повышает спрос на картонные коробки и, следовательно, способствует росту мирового рынка бумажной и картонной упаковки.

Анализ конкурентной среды и доли рынка бумажной и картонной упаковки

Конкурентная среда европейского рынка упаковки из бумаги и картона содержит сведения по конкурентам. Включены сведения о компании, финансы компании, полученный доход, рыночный потенциал, инвестиции в исследования и разработки, новые рыночные инициативы, присутствие в Европе, производственные площадки и объекты, сильные и слабые стороны компании, запуск продукта, клинические испытания, анализ бренда, одобрение продукта, патенты, ширина и дыхание продукта, доминирование приложений, кривая жизненной линии технологии. Приведенные выше точки данных относятся только к фокусу компании, связанному с европейским рынком упаковки из бумаги и картона.

Основными игроками на европейском рынке бумажной и картонной упаковки являются Amcor plc, Cascades inc., Packaging Corporation of America, DS Smith, Fedrigoni SPA Atlantic Packaging, International Paper, Smurfit Kappa, Svenska Cellulosa Aktiebolaget SCA, Mondi, Nippon Paper Industries Co., Ltd., Stora Enso, METSÄ GROUP, Georgia-Pacific, Oji Holdings Corporation, Mayr-Melnhof Karton AG, UPM, Rengo Co., Ltd., WestRock Company и другие.

Например,

- В ноябре 2021 года компания Nippon Paper Industries Co., Ltd. объявила всем своим агентствам о пересмотре цен на бумагу для печати, связи и промышленности на внутреннем рынке. Это, в свою очередь, помогло компании увеличить доход в долгосрочной перспективе.

- В ноябре 2021 года корпорация Oji Holdings объявила о создании нового завода по производству гофротары во Вьетнаме. Это еще больше помогло компании увеличить объемы производства гофроящиков в Азиатско-Тихоокеанском регионе.

- В декабре 2021 года компания Stora Enso получила награду Best Circular Solution, представленную Tetra Pak, за значительные достижения в области инноваций в переработке картонной упаковки для напитков. Это помогло компании укрепить свои позиции на мировом рынке.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Интерактивная панель анализа данных

- Панель анализа компании для возможностей с высоким потенциалом роста

- Доступ аналитика-исследователя для настройки и запросов

- Анализ конкурентов с помощью интерактивной панели

- Последние новости, обновления и анализ тенденций

- Используйте возможности сравнительного анализа для комплексного отслеживания конкурентов

Содержание

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF EUROPE PAPER AND PAPERBOARD PACKAGING MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 THE TYPE LINE CURVE

2.7 MULTIVARIATE MODELING

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET END-USER COVERAGE GRID

2.11 DBMR MARKET CHALLENGE MATRIX

2.12 VENDOR SHARE ANALYSIS

2.13 IMPORT-EXPORT DATA

2.14 SECONDARY SOURCES

2.15 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 TECHNOLOGY OVERVIEW

4.1.1 CORRUGATED SHEET

4.1.2 BUTTER PAPER

4.1.3 CARDBOARD

4.1.4 VIRGIN PAPER

4.1.5 KRAFT LINER

4.1.6 TESTLINER

4.1.7 SBS (SOLID BLEACHED SULFATE) BOARD

4.1.8 CCNB (CLAY COATED NEWS BACKBOARD)

4.2 MANUFACTURING INSIGHTS

5 REGIONAL SUMMARY

5.1 EUROPE

5.2 EUROPE

5.3 THE MIDDLE EAST AND AFRICA

5.4 ASIA-PACIFIC

5.5 NORTH AMERICA

5.6 SOUTH AMERICA

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 GROWING DEMAND FOR PAPERBOARD PACKAGING BOXES FROM THE HEALTHCARE INDUSTRY

6.1.2 INCREASING AWARENESS ABOUT SUSTAINABLE PACKAGING MATERIAL AND ADOPTION OF ECO-FRIENDLY PACKAGING

6.1.3 INCREASING ADOPTION OF PAPER-BASED PACKAGING IN THE FOOD INDUSTRY

6.1.4 MOUNTING REQUIREMENT FOR LIGHTWEIGHT PACKAGING BOARDS

6.1.5 INCREASING USE OF PAPERBOARD PACKAGING BY E-COMMERCE INDUSTRIES

6.2 RESTRAINTS

6.2.1 REGULATIONS IMPOSED BY GOVERNMENTS REGARDING THE USE OF PACKAGING MATERIALS

6.2.2 INCREASING COMPETITION FROM FLEXIBLE PLASTIC PACKAGING

6.3 OPPORTUNITIES

6.3.1 ENVIRONMENTAL BENEFITS ASSOCIATED WITH PAPER AND PAPERBOARD PACKAGING

6.3.2 STRONG EMPHASIS ON PAPER RECYCLING INITIATIVES IN SEVERAL COUNTRIES

6.3.3 SURGE IN INNOVATIVE PACKAGING SOLUTIONS WITH DIGITAL PRINTING

6.3.4 INCREASING USAGE OF COMPOSITE CARDBOARD PACKAGING IN THE PERSONAL CARE INDUSTRY

6.4 CHALLENGES

6.4.1 DIFFICULTY IN MAINTAINING QUALITY OF PAPER-BASED PACKAGING PRODUCTS

6.4.2 TEMPERATURE FLUCTUATIONS MAY AFFECT STRENGTH OF THE PAPERBOARD BOXES

7 IMPACT OF COVID-19 ON EUROPE PAPER AND PAPERBOARD PACKAGING MARKET

7.1 ANALYSIS ON IMPACT OF COVID-19 ON EUROPE PAPER AND PAPERBOARD PACKAGING MARKET

7.2 AFTERMATH OF COVID-19 AND GOVERNMENT INITIATIVE TO BOOST EUROPE PAPER AND PAPERBOARD MARKET

7.3 STRATEGIC DECISIONS FOR MANUFACTURERS AFTER COVID-19 TO GAIN COMPETITIVE MARKET SHARE

7.4 IMPACT ON PRICE

7.5 IMPACT ON DEMAND

7.6 IMPACT ON SUPPLY CHAIN

7.7 CONCLUSION

8 EUROPE PAPER AND PAPERBOARD PACKAGING MARKET, BY PRODUCT

8.1 OVERVIEW

8.2 KRAFT PAPER BOARDS

8.3 FOLDING BOXES AND CASES

8.4 PAPER CUPS

8.4.1 COLD PAPER CUPS

8.4.1.1 Serving Cups

8.4.1.2 Portion Cups

8.4.1.3 OTHERS

8.4.2 HOT PAPER CUPS

8.4.2.1 Serving Cups

8.4.2.2 Portion Cups

8.4.2.3 OTHERS

8.5 PAPER BAGS

8.6 BOXBOARD

8.7 OTHERS

9 EUROPE PAPER AND PAPERBOARD PACKAGING MARKET, BY TYPE

9.1 OVERVIEW

9.2 PACKAGING

9.3 SHOPPER

9.4 LABELS

9.5 COATING

9.6 CATALOGS

9.7 COVERS

9.8 DIGITAL PRINT

9.9 STICKERS

9.1 INVITATIONS/ENVELOPES/NOTEPAPER

10 EUROPE PAPER AND PAPERBOARD PACKAGING MARKET, BY PROPERTY

10.1 OVERVIEW

10.2 RECYCLE

10.3 COLORED

10.4 NATURAL

10.5 COATED

10.6 PEARLESCENT

10.7 TEXTURE

10.8 COTTON

10.9 OTHERS

11 EUROPE PAPER AND PAPERBOARD PACKAGING MARKET, BY WEIGHT

11.1 OVERVIEW

11.2 G/M2 TO 200 G/M2

11.3 G/M2 TO 150 G/M2

11.4 G/M2 TO 100 G/M2

11.5 G/M2 TO 250 G/M2

11.6 MORE THAN 250 G/M2

12 EUROPE PAPER AND PAPERBOARD PACKAGING MARKET, BY END-USER

12.1 OVERVIEW

12.2 FOOD & BEVERAGES

12.2.1 FOOD & BEVERAGES, BY END-USER

12.2.1.1 FRUITS & VEGETABLES

12.2.1.2 BAKERY & CONFECTIONERY

12.2.1.3 PROCESSED FOOD

12.2.1.4 FROZEN FOOD

12.2.1.5 MEAT & POULTRY PRODUCTS

12.2.1.6 DAIRY PRODUCTS

12.2.1.7 MILK & MILK DERIVED PRODUCTS

12.2.1.8 JUICES

12.2.1.9 OTHERS

12.2.2 FOOD & BEVERAGES, BY TYPE

12.2.2.1 PACKAGING

12.2.2.2 SHOPPER

12.2.2.3 LABELS

12.2.2.4 COATING

12.2.2.5 CATALOGS

12.2.2.6 COVERS

12.2.2.7 DIGITAL PRINT

12.2.2.8 STICKERS

12.2.2.9 INVITATIONS / ENVELOPES / NOTEPAPER

12.3 HEALTHCARE

12.3.1 HEALTHCARE, BY TYPE

12.3.1.1 PACKAGING

12.3.1.2 SHOPPER

12.3.1.3 LABELS

12.3.1.4 COATING

12.3.1.5 CATALOGS

12.3.1.6 COVERS

12.3.1.7 DIGITAL PRINT

12.3.1.8 STICKERS

12.3.1.9 INVITATIONS / ENVELOPES / NOTEPAPER

12.4 PERSONAL CARE & COSMETICS

12.4.1 PERSONAL CARE & COSMETICS, BY END-USER

12.4.1.1 SKIN CARE

12.4.1.2 HAIR CARE

12.4.1.3 NAIL CARE

12.4.1.4 OTHERS

12.4.2 PERSONAL CARE & COSMETICS, BY TYPE

12.4.2.1 PACKAGING

12.4.2.2 SHOPPER

12.4.2.3 LABELS

12.4.2.4 COATING

12.4.2.5 CATALOGS

12.4.2.6 COVERS

12.4.2.7 DIGITAL PRINT

12.4.2.8 STICKERS

12.4.2.9 INVITATIONS / ENVELOPES / NOTEPAPER

12.5 CONSUMER GOODS

12.5.1 CONSUMER GOODS, BY TYPE

12.5.1.1 PACKAGING

12.5.1.2 SHOPPER

12.5.1.3 LABELS

12.5.1.4 COATING

12.5.1.5 CATALOGS

12.5.1.6 COVERS

12.5.1.7 DIGITAL PRINT

12.5.1.8 STICKERS

12.5.1.9 INVITATIONS / ENVELOPES / NOTEPAPER

12.6 EDUCATION & STATIONERY

12.6.1 EDUCATION & STATIONERY, BY TYPE

12.6.1.1 PACKAGING

12.6.1.2 SHOPPER

12.6.1.3 LABELS

12.6.1.4 COATING

12.6.1.5 CATALOGS

12.6.1.6 COVERS

12.6.1.7 DIGITAL PRINT

12.6.1.8 STICKERS

12.6.1.9 INVITATIONS / ENVELOPES / NOTEPAPER

12.7 OTHERS

12.7.1 OTHERS, BY TYPE

12.7.1.1 PACKAGING

12.7.1.2 SHOPPER

12.7.1.3 LABELS

12.7.1.4 COATING

12.7.1.5 CATALOGS

12.7.1.6 COVERS

12.7.1.7 DIGITAL PRINT

12.7.1.8 STICKERS

12.7.1.9 INVITATIONS / ENVELOPES / NOTEPAPER

13 EUROPE PAPER AND PAPERBOARD PACKAGING MARKET, BY REGION

13.1 EUROPE

13.1.1 GERMANY

13.1.2 U.K.

13.1.3 ITALY

13.1.4 FRANCE

13.1.5 RUSSIA

13.1.6 SPAIN

13.1.7 NETHERLANDS

13.1.8 BELGIUM

13.1.9 TURKEY

13.1.10 SWITZERLAND

13.1.11 REST OF EUROPE

14 EUROPE PAPER AND PAPERBOARD PACKAGING MARKET: COMPANY LANDSCAPE

14.1 COMPANY SHARE ANALYSIS: EUROPE

15 SWOT ANALYSIS

16 COMPANY PROFILE

16.1 INTERNATIONAL PAPER

16.1.1 COMPANY SNAPSHOT

16.1.2 REVENUE ANALYSIS

16.1.3 COMPANY SHARE ANALYSIS

16.1.4 PRODUCT PORTFOLIO

16.1.5 RECENT DEVELOPMENTS

16.2 WESTROCK COMPANY

16.2.1 COMPANY SNAPSHOT

16.2.2 REVENUE ANALYSIS

16.2.3 COMPANY SHARE ANALYSIS

16.2.4 PRODUCT PORTFOLIO

16.2.5 RECENT UPDATES

16.3 OJI HOLDINGS CORPORATION

16.3.1 COMPANY SNAPSHOT

16.3.2 REVENUE ANALYSIS

16.3.3 COMPANY SHARE ANALYSIS

16.3.4 PRODUCT PORTFOLIO

16.3.5 RECENT UPDATES

16.4 AMCOR PLC

16.4.1 COMPANY SNAPSHOT

16.4.2 REVENUE ANALYSIS

16.4.3 COMPANY SHARE ANALYSIS

16.4.4 PRODUCT PORTFOLIO

16.4.5 RECENT DEVELOPMENTS

16.5 PACKAGING CORPORATION OF AMERICA

16.5.1 COMPANY SNAPSHOT

16.5.2 REVENUE ANALYSIS

16.5.3 COMPANY SHARE ANALYSIS

16.5.4 PRODUCT PORTFOLIO

16.5.5 RECENT DEVELOPMENTS

16.6 ATLANTIC PACKAGING

16.6.1 COMPANY SNAPSHOT

16.6.2 PRODUCT PORTFOLIO

16.6.3 RECENT DEVELOPMENTS

16.7 CASCADES INC.

16.7.1 COMPANY SNAPSHOT

16.7.2 REVENUE ANALYSIS

16.7.3 PRODUCT PORTFOLIO

16.7.4 RECENT DEVELOPMENTS

16.8 DS SMITH

16.8.1 COMPANY SNAPSHOT

16.8.2 REVENUE ANALYSIS

16.8.3 PRODUCT PORTFOLIO

16.8.4 RECENT DEVELOPMENTS

16.9 FEDRIGONI S.P.A.

16.9.1 COMPANY SNAPSHOT

16.9.2 PRODUCT PORTFOLIO

16.9.3 RECENT DEVELOPMENTS

16.1 GEORGIA-PACIFIC

16.10.1 COMPANY SNAPSHOT

16.10.2 PRODUCT PORTFOLIO

16.10.3 RECENT UPDATES

16.11 MAYR-MELNHOF KARTON AG

16.11.1 COMPANY SNAPSHOT

16.11.2 REVENUE ANALYSIS

16.11.3 PRODUCT PORTFOLIO

16.11.4 RECENT UPDATES

16.12 METSÄ GROUP

16.12.1 COMPANY SNAPSHOT

16.12.2 PRODUCT PORTFOLIO

16.12.3 RECENT UPDATE

16.13 MONDI

16.13.1 COMPANY SNAPSHOT

16.13.2 REVENUE ANALYSIS

16.13.3 PRODUCT PORTFOLIO

16.13.4 RECENT UPDATES

16.14 NIPPON PAPER INDUSTRIES CO., LTD.

16.14.1 COMPANY SNAPSHOT

16.14.2 REVENUE ANALYSIS

16.14.3 PRODUCT PORTFOLIO

16.14.4 RECENT UPDATES

16.15 RENGO CO., LTD.

16.15.1 COMPANY SNAPSHOT

16.15.2 REVENUE ANALYSIS

16.15.3 PRODUCT PORTFOLIO

16.15.4 RECENT UPDATES

16.16 SMURFIT KAPPA

16.16.1 COMPANY SNAPSHOT

16.16.2 REVENUE ANALYSIS

16.16.3 PRODUCT PORTFOLIO

16.16.4 RECENT DEVELOPMENTS

16.17 SONOCO PRODUCTS COMPANY

16.17.1 COMPANY SNAPSHOT

16.17.2 REVENUE ANALYSIS

16.17.3 PRODUCT PORTFOLIO

16.17.4 RECENT UPDATES

16.18 STORA ENSO

16.18.1 COMPANY SNAPSHOT

16.18.2 REVENUE ANALYSIS

16.18.3 PRODUCT PORTFOLIO

16.18.4 RECENT UPDATES

16.19 SVENSKA CELLULOSA AKTIEBOLAGET SCA

16.19.1 COMPANY SNAPSHOT

16.19.2 REVENUE ANALYSIS

16.19.3 PRODUCT PORTFOLIO

16.19.4 RECENT DEVELOPMENTS

16.2 UPM

16.20.1 COMPANY SNAPSHOT

16.20.2 REVENUE ANALYSIS

16.20.3 PRODUCT PORTFOLIO

16.20.4 RECENT UPDATES

17 QUESTIONNAIRES

18 RELATED REPORTS

Список таблиц

TABLE 1 EXPORT DATA OF CARTONS, BOXES, CASES, BAGS AND OTHER PACKING CONTAINERS, OF PAPER, PAPERBOARD, CELLULOSE WADDING OR WEBS OF CELLULOSE FIBRES, N.E.S.; BOX FILES, LETTER TRAYS, AND SIMILAR ARTICLES, OF PAPERBOARD OF A KIND USED IN OFFICES, SHOPS , HS CODE: 4819 (USD THOUSAND)

TABLE 2 IMPORT DATA OF CARTONS, BOXES, CASES, BAGS AND OTHER PACKING CONTAINERS, OF PAPER, PAPERBOARD, CELLULOSE WADDING OR WEBS OF CELLULOSE FIBRES, N.E.S.; BOX FILES, LETTER TRAYS, AND SIMILAR ARTICLES, OF PAPERBOARD OF A KIND USED IN OFFICES, SHOPS , HS CODE: 4819 (USD THOUSAND)

TABLE 3 TYPES OF RAW MATERIALS USED IN PHARMACEUTICAL PACKAGING

TABLE 4 EUROPE PAPER AND PAPERBOARD PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 5 EUROPE PAPER AND PAPERBOARD PACKAGING MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 6 EUROPE KRAFT PAPER BOARDS IN PAPER AND PAPERBOARD PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 7 EUROPE KRAFT PAPER BOARDS IN PAPER AND PAPERBOARD PACKAGING MARKET, BY REGION, 2020-2029 (TONS)

TABLE 8 EUROPE FOLDING BOXES AND CASES IN PAPER AND PAPERBOARD PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 9 EUROPE FOLDING BOXES AND CASES IN PAPER AND PAPERBOARD PACKAGING MARKET, BY REGION, 2020-2029 (TONS)

TABLE 10 EUROPE PAPER CUPS IN PAPER AND PAPERBOARD PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 11 EUROPE PAPER CUPS IN PAPER AND PAPERBOARD PACKAGING MARKET, BY REGION, 2020-2029 (TONS)

TABLE 12 EUROPE PAPER CUPS IN PAPER AND PAPERBOARD PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 13 EUROPE COLD PAPER CUPS IN PAPER CUPS IN PAPER AND PAPERBOARD PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 14 EUROPE HOT PAPER CUPS IN PAPER CUPS IN PAPER AND PAPERBOARD PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 15 EUROPE PAPER BAGS IN PAPER AND PAPERBOARD PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 16 EUROPE PAPER BAGS IN PAPER AND PAPERBOARD PACKAGING MARKET, BY REGION, 2020-2029 (TONS)

TABLE 17 EUROPE BOXBOARD IN PAPER AND PAPERBOARD PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 18 EUROPE BOXBOARD IN PAPER AND PAPERBOARD PACKAGING MARKET, BY REGION, 2020-2029 (TONS)

TABLE 19 EUROPE OTHERS IN PAPER AND PAPERBOARD PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 20 EUROPE OTHERS IN PAPER AND PAPERBOARD PACKAGING MARKET, BY REGION, 2020-2029 (TONS)

TABLE 21 EUROPE PAPER AND PAPERBOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 22 EUROPE PACKAGING IN PAPER AND PAPERBOARD PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 23 EUROPE SHOPPER IN PAPER AND PAPERBOARD PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 24 EUROPE LABELS IN PAPER AND PAPERBOARD PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 25 EUROPE COATING IN PAPER AND PAPERBOARD PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 26 EUROPE CATALOGS IN PAPER AND PAPERBOARD PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 27 EUROPE COVERS IN PAPER AND PAPERBOARD PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 28 EUROPE DIGITAL PRINT IN PAPER AND PAPERBOARD PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 29 EUROPE STICKERS IN PAPER AND PAPERBOARD PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 30 EUROPE INVITATIONS/ENVELOPES/NOTEPAPER IN PAPER AND PAPERBOARD PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 31 EUROPE PAPER AND PAPERBOARD PACKAGING MARKET, BY PROPERTY, 2020-2029 (USD MILLION)

TABLE 32 EUROPE RECYCLE IN PAPER AND PAPERBOARD PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 33 EUROPE COLORED IN PAPER AND PAPERBOARD PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 34 EUROPE NATURAL IN PAPER AND PAPERBOARD PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 35 EUROPE COATED IN PAPER AND PAPERBOARD PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 36 EUROPE PEARLESCENT IN PAPER AND PAPERBOARD PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 37 EUROPE TEXTURE IN PAPER AND PAPERBOARD PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 38 EUROPE COTTON IN PAPER AND PAPERBOARD PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 39 EUROPE OTHERS IN PAPER AND PAPERBOARD PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 40 EUROPE PAPER AND PAPERBOARD PACKAGING MARKET, BY WEIGHT, 2020-2029 (USD MILLION)

TABLE 41 EUROPE 151 G/M2 TO 200 G/M2 IN PAPER AND PAPERBOARD PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 42 EUROPE 101 G/M2 TO 150 G/M2 IN PAPER AND PAPERBOARD PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 43 EUROPE 70 G/M2 TO 100 G/M2 IN PAPER AND PAPERBOARD PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 44 EUROPE 201 G/M2 TO 250 G/M2 IN PAPER AND PAPERBOARD PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 45 EUROPE MORE THAN 250 G/M2 IN PAPER AND PAPERBOARD PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 46 EUROPE PAPER AND PAPERBOARD PACKAGING MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 47 EUROPE FOOD & BEVERAGES IN PAPER AND PAPERBOARD PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 48 EUROPE FOOD & BEVERAGES IN PAPER AND PAPERBOARD PACKAGING MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 49 EUROPE FOOD & BEVERAGES IN PAPER AND PAPERBOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 50 EUROPE HEALTHCARE IN PAPER AND PAPERBOARD PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 51 EUROPE HEALTHCARE IN PAPER AND PAPERBOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 52 EUROPE PERSONAL CARE & COSMETICS IN PAPER AND PAPERBOARD PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 53 EUROPE PERSONAL CARE & COSMETICS IN PAPER AND PAPERBOARD PACKAGING MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 54 EUROPE PERSONAL CARE & COSMETICS IN PAPER AND PAPERBOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 55 EUROPE CONSUMER GOODS IN PAPER AND PAPERBOARD PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 56 EUROPE CONSUMER GOODS IN PAPER AND PAPERBOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 57 EUROPE EDUCATION & STATIONERY IN PAPER AND PAPERBOARD PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 58 EUROPE EDUCATION & STATIONERY IN PAPER AND PAPERBOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 59 EUROPE OTHERS IN PAPER AND PAPERBOARD PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 60 EUROPE OTHERS IN PAPER AND PAPERBOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 61 EUROPE PAPER AND PAPERBOARD PACKAGING MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 62 EUROPE PAPER AND PAPERBOARD PACKAGING MARKET, BY COUNTRY, 2020-2029 (TONS)

TABLE 63 EUROPE PAPER AND PAPERBOARD PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 64 EUROPE PAPER AND PAPERBOARD PACKAGING MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 65 EUROPE PAPER CUPS IN PAPER AND PAPERBOARD PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 66 EUROPE COLD PAPER CUPS IN PAPER AND PAPERBOARD PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 67 EUROPE HOT PAPER CUPS IN PAPER AND PAPERBOARD PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 68 EUROPE PAPER AND PAPERBOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 69 EUROPE PAPER AND PAPERBOARD PACKAGING MARKET, BY PROPERTY, 2020-2029 (USD MILLION)

TABLE 70 EUROPE PAPER AND PAPERBOARD PACKAGING MARKET, BY WEIGHT, 2020-2029 (USD MILLION)

TABLE 71 EUROPE PAPER AND PAPERBOARD PACKAGING MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 72 EUROPE FOOD & BEVERAGES IN PAPER AND PAPERBOARD PACKAGING MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 73 EUROPE FOOD & BEVERAGES IN PAPER AND PAPERBOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 74 EUROPE HEALTHCARE PAPER AND PAPERBOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 75 EUROPE PERSONAL CARE & COSMETICS IN PAPER AND PAPERBOARD PACKAGING MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 76 EUROPE PERSONAL CARE & COSMETICS IN PAPER AND PAPERBOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 77 EUROPE CONSUMER GOODS IN PAPER AND PAPERBOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 78 EUROPE EDUCATION & STATIONERY IN PAPER AND PAPERBOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 79 EUROPE OTHERS IN PAPER AND PAPERBOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 80 GERMANY PAPER AND PAPERBOARD PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 81 GERMANY PAPER AND PAPERBOARD PACKAGING MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 82 GERMANY PAPER CUPS IN PAPER AND PAPERBOARD PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 83 GERMANY COLD PAPER CUPS IN PAPER AND PAPERBOARD PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 84 GERMANY HOT PAPER CUPS IN PAPER AND PAPERBOARD PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 85 GERMANY PAPER AND PAPERBOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 86 GERMANY PAPER AND PAPERBOARD PACKAGING MARKET, BY PROPERTY, 2020-2029 (USD MILLION)

TABLE 87 GERMANY PAPER AND PAPERBOARD PACKAGING MARKET, BY WEIGHT, 2020-2029 (USD MILLION)

TABLE 88 GERMANY PAPER AND PAPERBOARD PACKAGING MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 89 GERMANY FOOD & BEVERAGES IN PAPER AND PAPERBOARD PACKAGING MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 90 GERMANY FOOD & BEVERAGES IN PAPER AND PAPERBOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 91 GERMANY HEALTHCARE PAPER AND PAPERBOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 92 GERMANY PERSONAL CARE & COSMETICS IN PAPER AND PAPERBOARD PACKAGING MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 93 GERMANY PERSONAL CARE & COSMETICS IN PAPER AND PAPERBOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 94 GERMANY CONSUMER GOODS IN PAPER AND PAPERBOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 95 GERMANY EDUCATION & STATIONERY IN PAPER AND PAPERBOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 96 GERMANY OTHERS IN PAPER AND PAPERBOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 97 U.K. PAPER AND PAPERBOARD PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 98 U.K. PAPER AND PAPERBOARD PACKAGING MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 99 U.K. PAPER CUPS IN PAPER AND PAPERBOARD PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 100 U.K. COLD PAPER CUPS IN PAPER AND PAPERBOARD PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 101 U.K. HOT PAPER CUPS IN PAPER AND PAPERBOARD PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 102 U.K. PAPER AND PAPERBOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 103 U.K. PAPER AND PAPERBOARD PACKAGING MARKET, BY PROPERTY, 2020-2029 (USD MILLION)

TABLE 104 U.K. PAPER AND PAPERBOARD PACKAGING MARKET, BY WEIGHT, 2020-2029 (USD MILLION)

TABLE 105 U.K. PAPER AND PAPERBOARD PACKAGING MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 106 U.K. FOOD & BEVERAGES IN PAPER AND PAPERBOARD PACKAGING MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 107 U.K. FOOD & BEVERAGES IN PAPER AND PAPERBOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 108 U.K. HEALTHCARE PAPER AND PAPERBOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 109 U.K. PERSONAL CARE & COSMETICS IN PAPER AND PAPERBOARD PACKAGING MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 110 U.K. PERSONAL CARE & COSMETICS IN PAPER AND PAPERBOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 111 U.K. CONSUMER GOODS IN PAPER AND PAPERBOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 112 U.K. EDUCATION & STATIONERY IN PAPER AND PAPERBOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 113 U.K. OTHERS IN PAPER AND PAPERBOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 114 ITALY PAPER AND PAPERBOARD PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 115 ITALY PAPER AND PAPERBOARD PACKAGING MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 116 ITALY PAPER CUPS IN PAPER AND PAPERBOARD PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 117 ITALY COLD PAPER CUPS IN PAPER AND PAPERBOARD PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 118 ITALY HOT PAPER CUPS IN PAPER AND PAPERBOARD PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 119 ITALY PAPER AND PAPERBOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 120 ITALY PAPER AND PAPERBOARD PACKAGING MARKET, BY PROPERTY, 2020-2029 (USD MILLION)

TABLE 121 ITALY PAPER AND PAPERBOARD PACKAGING MARKET, BY WEIGHT, 2020-2029 (USD MILLION)

TABLE 122 ITALY PAPER AND PAPERBOARD PACKAGING MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 123 ITALY FOOD & BEVERAGES IN PAPER AND PAPERBOARD PACKAGING MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 124 ITALY FOOD & BEVERAGES IN PAPER AND PAPERBOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 125 ITALY HEALTHCARE PAPER AND PAPERBOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 126 ITALY PERSONAL CARE & COSMETICS IN PAPER AND PAPERBOARD PACKAGING MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 127 ITALY PERSONAL CARE & COSMETICS IN PAPER AND PAPERBOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 128 ITALY CONSUMER GOODS IN PAPER AND PAPERBOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 129 ITALY EDUCATION & STATIONERY IN PAPER AND PAPERBOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 130 ITALY OTHERS IN PAPER AND PAPERBOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 131 FRANCE PAPER AND PAPERBOARD PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 132 FRANCE PAPER AND PAPERBOARD PACKAGING MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 133 FRANCE PAPER CUPS IN PAPER AND PAPERBOARD PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 134 FRANCE COLD PAPER CUPS IN PAPER AND PAPERBOARD PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 135 FRANCE HOT PAPER CUPS IN PAPER AND PAPERBOARD PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 136 FRANCE PAPER AND PAPERBOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 137 FRANCE PAPER AND PAPERBOARD PACKAGING MARKET, BY PROPERTY, 2020-2029 (USD MILLION)

TABLE 138 FRANCE PAPER AND PAPERBOARD PACKAGING MARKET, BY WEIGHT, 2020-2029 (USD MILLION)

TABLE 139 FRANCE PAPER AND PAPERBOARD PACKAGING MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 140 FRANCE FOOD & BEVERAGES IN PAPER AND PAPERBOARD PACKAGING MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 141 FRANCE FOOD & BEVERAGES IN PAPER AND PAPERBOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 142 FRANCE HEALTHCARE PAPER AND PAPERBOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 143 FRANCE PERSONAL CARE & COSMETICS IN PAPER AND PAPERBOARD PACKAGING MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 144 FRANCE PERSONAL CARE & COSMETICS IN PAPER AND PAPERBOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 145 FRANCE CONSUMER GOODS IN PAPER AND PAPERBOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 146 FRANCE EDUCATION & STATIONERY IN PAPER AND PAPERBOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 147 FRANCE OTHERS IN PAPER AND PAPERBOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 148 RUSSIA PAPER AND PAPERBOARD PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 149 RUSSIA PAPER AND PAPERBOARD PACKAGING MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 150 RUSSIA PAPER CUPS IN PAPER AND PAPERBOARD PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 151 RUSSIA COLD PAPER CUPS IN PAPER AND PAPERBOARD PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 152 RUSSIA HOT PAPER CUPS IN PAPER AND PAPERBOARD PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 153 RUSSIA PAPER AND PAPERBOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 154 RUSSIA PAPER AND PAPERBOARD PACKAGING MARKET, BY PROPERTY, 2020-2029 (USD MILLION)

TABLE 155 RUSSIA PAPER AND PAPERBOARD PACKAGING MARKET, BY WEIGHT, 2020-2029 (USD MILLION)

TABLE 156 RUSSIA PAPER AND PAPERBOARD PACKAGING MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 157 RUSSIA FOOD & BEVERAGES IN PAPER AND PAPERBOARD PACKAGING MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 158 RUSSIA FOOD & BEVERAGES IN PAPER AND PAPERBOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 159 RUSSIA HEALTHCARE PAPER AND PAPERBOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 160 RUSSIA PERSONAL CARE & COSMETICS IN PAPER AND PAPERBOARD PACKAGING MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 161 RUSSIA PERSONAL CARE & COSMETICS IN PAPER AND PAPERBOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 162 RUSSIA CONSUMER GOODS IN PAPER AND PAPERBOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 163 RUSSIA EDUCATION & STATIONERY IN PAPER AND PAPERBOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 164 RUSSIA OTHERS IN PAPER AND PAPERBOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 165 SPAIN PAPER AND PAPERBOARD PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 166 SPAIN PAPER AND PAPERBOARD PACKAGING MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 167 SPAIN PAPER CUPS IN PAPER AND PAPERBOARD PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 168 SPAIN COLD PAPER CUPS IN PAPER AND PAPERBOARD PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 169 SPAIN HOT PAPER CUPS IN PAPER AND PAPERBOARD PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 170 SPAIN PAPER AND PAPERBOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 171 SPAIN PAPER AND PAPERBOARD PACKAGING MARKET, BY PROPERTY, 2020-2029 (USD MILLION)

TABLE 172 SPAIN PAPER AND PAPERBOARD PACKAGING MARKET, BY WEIGHT, 2020-2029 (USD MILLION)

TABLE 173 SPAIN PAPER AND PAPERBOARD PACKAGING MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 174 SPAIN FOOD & BEVERAGES IN PAPER AND PAPERBOARD PACKAGING MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 175 SPAIN FOOD & BEVERAGES IN PAPER AND PAPERBOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 176 SPAIN HEALTHCARE PAPER AND PAPERBOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 177 SPAIN PERSONAL CARE & COSMETICS IN PAPER AND PAPERBOARD PACKAGING MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 178 SPAIN PERSONAL CARE & COSMETICS IN PAPER AND PAPERBOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 179 SPAIN CONSUMER GOODS IN PAPER AND PAPERBOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 180 SPAIN EDUCATION & STATIONERY IN PAPER AND PAPERBOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 181 SPAIN OTHERS IN PAPER AND PAPERBOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 182 NETHERLANDS PAPER AND PAPERBOARD PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 183 NETHERLANDS PAPER AND PAPERBOARD PACKAGING MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 184 NETHERLANDS PAPER CUPS IN PAPER AND PAPERBOARD PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 185 NETHERLANDS COLD PAPER CUPS IN PAPER AND PAPERBOARD PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 186 NETHERLANDS HOT PAPER CUPS IN PAPER AND PAPERBOARD PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 187 NETHERLANDS PAPER AND PAPERBOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 188 NETHERLANDS PAPER AND PAPERBOARD PACKAGING MARKET, BY PROPERTY, 2020-2029 (USD MILLION)

TABLE 189 NETHERLANDS PAPER AND PAPERBOARD PACKAGING MARKET, BY WEIGHT, 2020-2029 (USD MILLION)

TABLE 190 NETHERLANDS PAPER AND PAPERBOARD PACKAGING MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 191 NETHERLANDS FOOD & BEVERAGES IN PAPER AND PAPERBOARD PACKAGING MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 192 NETHERLANDS FOOD & BEVERAGES IN PAPER AND PAPERBOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 193 NETHERLANDS HEALTHCARE PAPER AND PAPERBOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 194 NETHERLANDS PERSONAL CARE & COSMETICS IN PAPER AND PAPERBOARD PACKAGING MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 195 NETHERLANDS PERSONAL CARE & COSMETICS IN PAPER AND PAPERBOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 196 NETHERLANDS CONSUMER GOODS IN PAPER AND PAPERBOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 197 NETHERLANDS EDUCATION & STATIONERY IN PAPER AND PAPERBOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 198 NETHERLANDS OTHERS IN PAPER AND PAPERBOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 199 BELGIUM PAPER AND PAPERBOARD PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 200 BELGIUM PAPER AND PAPERBOARD PACKAGING MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 201 BELGIUM PAPER CUPS IN PAPER AND PAPERBOARD PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 202 BELGIUM COLD PAPER CUPS IN PAPER AND PAPERBOARD PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 203 BELGIUM HOT PAPER CUPS IN PAPER AND PAPERBOARD PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 204 BELGIUM PAPER AND PAPERBOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 205 BELGIUM PAPER AND PAPERBOARD PACKAGING MARKET, BY PROPERTY, 2020-2029 (USD MILLION)

TABLE 206 BELGIUM PAPER AND PAPERBOARD PACKAGING MARKET, BY WEIGHT, 2020-2029 (USD MILLION)

TABLE 207 BELGIUM PAPER AND PAPERBOARD PACKAGING MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 208 BELGIUM FOOD & BEVERAGES IN PAPER AND PAPERBOARD PACKAGING MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 209 BELGIUM FOOD & BEVERAGES IN PAPER AND PAPERBOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 210 BELGIUM HEALTHCARE PAPER AND PAPERBOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 211 BELGIUM PERSONAL CARE & COSMETICS IN PAPER AND PAPERBOARD PACKAGING MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 212 BELGIUM PERSONAL CARE & COSMETICS IN PAPER AND PAPERBOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 213 BELGIUM CONSUMER GOODS IN PAPER AND PAPERBOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 214 BELGIUM EDUCATION & STATIONERY IN PAPER AND PAPERBOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 215 BELGIUM OTHERS IN PAPER AND PAPERBOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 216 TURKEY PAPER AND PAPERBOARD PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 217 TURKEY PAPER AND PAPERBOARD PACKAGING MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 218 TURKEY PAPER CUPS IN PAPER AND PAPERBOARD PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 219 TURKEY COLD PAPER CUPS IN PAPER AND PAPERBOARD PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 220 TURKEY HOT PAPER CUPS IN PAPER AND PAPERBOARD PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 221 TURKEY PAPER AND PAPERBOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 222 TURKEY PAPER AND PAPERBOARD PACKAGING MARKET, BY PROPERTY, 2020-2029 (USD MILLION)

TABLE 223 TURKEY PAPER AND PAPERBOARD PACKAGING MARKET, BY WEIGHT, 2020-2029 (USD MILLION)

TABLE 224 TURKEY PAPER AND PAPERBOARD PACKAGING MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 225 TURKEY FOOD & BEVERAGES IN PAPER AND PAPERBOARD PACKAGING MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 226 TURKEY FOOD & BEVERAGES IN PAPER AND PAPERBOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 227 TURKEY HEALTHCARE PAPER AND PAPERBOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 228 TURKEY PERSONAL CARE & COSMETICS IN PAPER AND PAPERBOARD PACKAGING MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 229 TURKEY PERSONAL CARE & COSMETICS IN PAPER AND PAPERBOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 230 TURKEY CONSUMER GOODS IN PAPER AND PAPERBOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 231 TURKEY EDUCATION & STATIONERY IN PAPER AND PAPERBOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 232 TURKEY OTHERS IN PAPER AND PAPERBOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 233 SWITZERLAND PAPER AND PAPERBOARD PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 234 SWITZERLAND PAPER AND PAPERBOARD PACKAGING MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 235 SWITZERLAND PAPER CUPS IN PAPER AND PAPERBOARD PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 236 SWITZERLAND COLD PAPER CUPS IN PAPER AND PAPERBOARD PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 237 SWITZERLAND HOT PAPER CUPS IN PAPER AND PAPERBOARD PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 238 SWITZERLAND PAPER AND PAPERBOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 239 SWITZERLAND PAPER AND PAPERBOARD PACKAGING MARKET, BY PROPERTY, 2020-2029 (USD MILLION)

TABLE 240 SWITZERLAND PAPER AND PAPERBOARD PACKAGING MARKET, BY WEIGHT, 2020-2029 (USD MILLION)

TABLE 241 SWITZERLAND PAPER AND PAPERBOARD PACKAGING MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 242 SWITZERLAND FOOD & BEVERAGES IN PAPER AND PAPERBOARD PACKAGING MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 243 SWITZERLAND FOOD & BEVERAGES IN PAPER AND PAPERBOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 244 SWITZERLAND HEALTHCARE PAPER AND PAPERBOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 245 SWITZERLAND PERSONAL CARE & COSMETICS IN PAPER AND PAPERBOARD PACKAGING MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 246 SWITZERLAND PERSONAL CARE & COSMETICS IN PAPER AND PAPERBOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 247 SWITZERLAND CONSUMER GOODS IN PAPER AND PAPERBOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 248 SWITZERLAND EDUCATION & STATIONERY IN PAPER AND PAPERBOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 249 SWITZERLAND OTHERS IN PAPER AND PAPERBOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 250 REST OF EUROPE PAPER AND PAPERBOARD PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 251 REST OF EUROPE PAPER AND PAPERBOARD PACKAGING MARKET, BY PRODUCT, 2020-2029 (TONS)

Список рисунков

FIGURE 1 EUROPE PAPER AND PAPERBOARD PACKAGING MARKET: SEGMENTATION

FIGURE 2 EUROPE PAPER AND PAPERBOARD PACKAGING MARKET: DATA TRIANGULATION

FIGURE 3 EUROPE PAPER AND PAPERBOARD PACKAGING MARKET: DROC ANALYSIS

FIGURE 4 EUROPE PAPER AND PAPERBOARD PACKAGING MARKET: EUROPE VS REGIONAL MARKET ANALYSIS

FIGURE 5 EUROPE PAPER AND PAPERBOARD PACKAGING MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 EUROPE PAPER AND PAPERBOARD PACKAGING MARKET: THE TYPE LINE CURVE

FIGURE 7 EUROPE PAPER AND PAPERBOARD PACKAGING MARKET: MULTIVARIATE MODELLING

FIGURE 8 EUROPE PAPER AND PAPERBOARD PACKAGING MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 9 EUROPE PAPER AND PAPERBOARD PACKAGING MARKET: DBMR MARKET POSITION GRID

FIGURE 10 EUROPE PAPER AND PAPERBOARD PACKAGING MARKET: MARKET END-USER COVERAGE GRID

FIGURE 11 EUROPE PAPER AND PAPERBOARD PACKAGING MARKET: THE MARKET CHALLENGE MATRIX

FIGURE 12 EUROPE PAPER AND PAPERBOARD PACKAGING MARKET: VENDOR SHARE ANALYSIS

FIGURE 13 EUROPE PAPER AND PAPERBOARD PACKAGING MARKET: SEGMENTATION

FIGURE 14 RISING DEMAND FROM THE E-COMMERCE INDUSTRY FOR PAPER AND PAPERBOARD CONTAINERS IS EXPECTED TO DRIVE THE EUROPE PAPER AND PAPERBOARD PACKAGING MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 15 KRAFT PAPER BOARDS SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE EUROPE PAPER AND PAPERBOARD PACKAGING MARKET IN 2022 & 2029

FIGURE 16 ASIA-PACIFIC IS THE FASTEST GROWING MARKET FOR PAPER AND PAPERBOARD PACKAGING MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 17 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF EUROPE PAPER AND PAPERBOARD PACKAGING MARKET

FIGURE 18 EUROPE PAPER AND PAPERBOARD PACKAGING MARKET, BY PRODUCT, 2021

FIGURE 19 EUROPE PAPER AND PAPERBOARD PACKAGING MARKET, BY TYPE, 2021

FIGURE 20 EUROPE PAPER AND PAPERBOARD PACKAGING MARKET, BY PROPERTY, 2021

FIGURE 21 EUROPE PAPER AND PAPERBOARD PACKAGING MARKET, BY WEIGHT, 2021

FIGURE 22 EUROPE PAPER AND PAPERBOARD PACKAGING MARKET, BY END-USER, 2021

FIGURE 23 EUROPE PAPER AND PAPERBOARD PACKAGING MARKET: SNAPSHOT (2021)

FIGURE 24 EUROPE PAPER AND PAPERBOARD PACKAGING MARKET: BY COUNTRY (2021)

FIGURE 25 EUROPE PAPER AND PAPERBOARD PACKAGING MARKET: BY COUNTRY (2022 & 2029)

FIGURE 26 EUROPE PAPER AND PAPERBOARD PACKAGING MARKET: BY COUNTRY (2021 & 2029)

FIGURE 27 EUROPE PAPER AND PAPERBOARD PACKAGING MARKET: BY PRODUCT (2022-2029)

FIGURE 28 EUROPE PAPER AND PAPERBOARD PACKAGING MARKET: COMPANY SHARE 2021 (%)

Методология исследования

Сбор данных и анализ базового года выполняются с использованием модулей сбора данных с большими размерами выборки. Этап включает получение рыночной информации или связанных данных из различных источников и стратегий. Он включает изучение и планирование всех данных, полученных из прошлого заранее. Он также охватывает изучение несоответствий информации, наблюдаемых в различных источниках информации. Рыночные данные анализируются и оцениваются с использованием статистических и последовательных моделей рынка. Кроме того, анализ доли рынка и анализ ключевых тенденций являются основными факторами успеха в отчете о рынке. Чтобы узнать больше, пожалуйста, запросите звонок аналитика или оставьте свой запрос.

Ключевой методологией исследования, используемой исследовательской группой DBMR, является триангуляция данных, которая включает в себя интеллектуальный анализ данных, анализ влияния переменных данных на рынок и первичную (отраслевую экспертную) проверку. Модели данных включают сетку позиционирования поставщиков, анализ временной линии рынка, обзор рынка и руководство, сетку позиционирования компании, патентный анализ, анализ цен, анализ доли рынка компании, стандарты измерения, глобальный и региональный анализ и анализ доли поставщика. Чтобы узнать больше о методологии исследования, отправьте запрос, чтобы поговорить с нашими отраслевыми экспертами.

Доступна настройка

Data Bridge Market Research является лидером в области передовых формативных исследований. Мы гордимся тем, что предоставляем нашим существующим и новым клиентам данные и анализ, которые соответствуют и подходят их целям. Отчет можно настроить, включив в него анализ ценовых тенденций целевых брендов, понимание рынка для дополнительных стран (запросите список стран), данные о результатах клинических испытаний, обзор литературы, обновленный анализ рынка и продуктовой базы. Анализ рынка целевых конкурентов можно проанализировать от анализа на основе технологий до стратегий портфеля рынка. Мы можем добавить столько конкурентов, о которых вам нужны данные в нужном вам формате и стиле данных. Наша команда аналитиков также может предоставить вам данные в сырых файлах Excel, сводных таблицах (книга фактов) или помочь вам в создании презентаций из наборов данных, доступных в отчете.