Europe Medical Device Testing Market

Размер рынка в млрд долларов США

CAGR :

%

USD

1,226.46 Million

USD

2,499.53 Million

2021

2029

USD

1,226.46 Million

USD

2,499.53 Million

2021

2029

| 2022 –2029 | |

| USD 1,226.46 Million | |

| USD 2,499.53 Million | |

|

|

|

Европейский рынок тестирования медицинских устройств по типу услуг (услуги тестирования, инспекционные услуги и услуги сертификации), типу тестирования (физические испытания, химические/биологические испытания, испытания кибербезопасности, микробиологические испытания и испытания на стерильность и другие), фазе (доклинические и клинические), типу источника (внутренние и внешние), классу устройства (класс I, класс II и класс III), продукту (активное имплантируемое медицинское устройство, активное медицинское устройство, неактивное медицинское устройство, медицинское устройство для диагностики in vitro, офтальмологическое медицинское устройство, ортопедическое и стоматологическое медицинское устройство, сосудистое медицинское устройство и другие). Тенденции отрасли и прогноз до 2029 г.

Анализ и аналитика европейского рынка тестирования медицинских устройств

Тестирование медицинских устройств — это процесс демонстрации того, что устройство надежно и безопасно работает в использовании. При разработке новых продуктов применяются обширные испытания на проверку конструкции. Они включают в себя тестирование производительности, токсичности, химический анализ, а иногда и человеческий фактор или клинические испытания. Текущее тестирование обеспечения качества, как правило, более ограничено. Обычно оно включает в себя проверки размеров, некоторые функциональные испытания и проверку упаковки. На рынке доступны различные типы услуг по медицинскому тестированию, такие как инспекционные услуги, сертификационные услуги и другие.

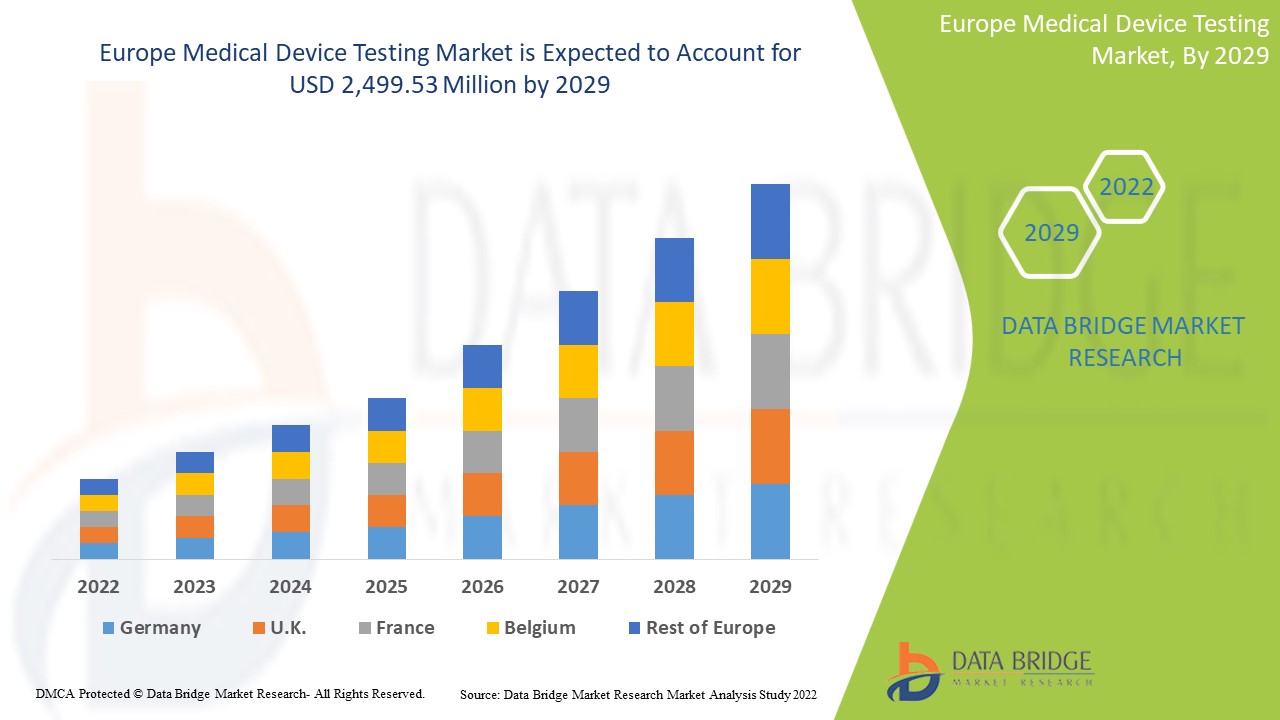

Ожидается, что рынок тестирования медицинских устройств в Европе вырастет в прогнозируемый период с 2022 по 2029 год. По данным Data Bridge Market Research, среднегодовой темп роста рынка составит 9,8% в прогнозируемый период с 2022 по 2029 год, и ожидается, что к 2029 году объем рынка достигнет 2 499,53 млн долларов США по сравнению с 1 226,46 млн долларов США в 2021 году.

|

Отчет Метрика |

Подробности |

|

Прогнозируемый период |

2022-2029 |

|

Базовый год |

2021 |

|

Исторические годы |

2020 (Можно настроить на 2019-2014) |

|

Количественные единицы |

Доход в млн. долл. США, цены в долл. США |

|

Охваченные сегменты |

По типу услуг (услуги тестирования, инспекционные услуги и услуги сертификации), типу тестирования (физические испытания, химические/биологические испытания, испытания кибербезопасности, микробиологические испытания и испытания на стерильность и другие), фазе (доклинические и клинические), типу источника (внутренние и внешние), классу устройства (класс I, класс II и класс III), продукту (активное имплантируемое медицинское устройство, активное медицинское устройство, неактивное медицинское устройство, медицинское устройство для диагностики in vitro, офтальмологическое медицинское устройство, ортопедическое и стоматологическое медицинское устройство, сосудистое медицинское устройство и другие) |

|

Страны, охваченные |

Германия, Франция, Великобритания, Италия, Испания, Нидерланды, Россия, Швейцария, Турция, Бельгия и остальная Европа |

|

Охваченные участники рынка |

Intertek Group plc, SGS SA, Bureau Veritas, TUV SUD, TUV Rheinland, UL LLC, North American Science Associates, LLC, Medistri SA, WuXi AppTec, NSF, Labcorp, Eurofins Scientific, Nelson Laboratories, LLC- A Sotera Health company, ITC ZLIN, Element Materials Technology, EndoLab Mechanical Engineering GmbH, Hohenstein, Medical Engineering Technologies Ltd., Cigniti, IMR Test Labs и другие |

Определение рынка

Тестирование медицинских устройств — это процесс демонстрации того, что устройство надежно и безопасно работает в использовании. При разработке новых продуктов применяются обширные испытания на проверку конструкции. Они включают в себя тестирование производительности, анализ токсичности и химического состава, а иногда и человеческий фактор или даже клинические испытания. Текущее тестирование обеспечения качества, как правило, более ограничено. Обычно оно включает в себя проверки размеров, некоторые функциональные испытания и проверку упаковки. На рынке доступны различные типы услуг по медицинскому тестированию, такие как инспекционные услуги, услуги по сертификации и т. д.

Динамика рынка тестирования медицинских приборов

Драйверы

- Эскалация инноваций и технологий

Ускорение развития технологий в секторе здравоохранения значительно возросло за последние несколько лет. Прогресс в технологиях медицинских устройств поддерживает безболезненное и несложное лечение во время управления заболеваниями. Более того, инновации и модернизация медицинских устройств способствуют точному и быстрому результату диагностики заболеваний. Наряду с инновациями в медицинских устройствах также обеспечивается экономическая эффективность терапевтических инструментов на основе технологий во время лечения заболеваний. Более того, многие государственные органы и организации здравоохранения поддерживают медицинские исследовательские центры. Основной целью этой поддержки является повышение инноваций в здравоохранении в Европе.

- Рост спроса на тесты in vitro

Диагностика in vitro (IVD) — это тесты на образцах, таких как кровь или ткани, взятые из человеческого тела. Диагностика in vitro может обнаруживать заболевания или другие состояния и может использоваться для мониторинга общего состояния здоровья человека, чтобы помочь вылечить, лечить или предотвратить заболевания. Тесты in vitro используются для обнаружения различных заболеваний, таких как ВИЧ-инфекции, малярия, гепатит и другие. Распространенность таких заболеваний быстро растет в европейских странах, что приводит к увеличению спроса на тесты in vitro и различные медицинские устройства.

Возможность

-

Рост расходов на здравоохранение

Расходы на здравоохранение увеличились во всем мире, поскольку располагаемый доход людей в разных странах увеличивается. Более того, чтобы удовлетворить потребности населения, государственные органы и организации здравоохранения берут на себя инициативу по ускорению расходов на здравоохранение. Рост расходов на здравоохранение одновременно помогает учреждениям здравоохранения улучшить свои услуги по тестированию медицинских устройств за последние годы

Кроме того, стратегические инициативы ключевых игроков рынка обеспечат структурную целостность и будущие возможности для рынка тестирования медицинских устройств в прогнозируемый период 2022–2029 годов.

Сдержанность/Вызов

- Высокая конкуренция в отраслях медицинских технологий

Однако барьеры для локальной разработки медицинских приборов и высокая стоимость медицинских приборов в некоторых регионах могут препятствовать меньшему производству медицинских приборов, что препятствует росту рынка. Кроме того, высокая конкуренция в отраслях медицинских технологий и длительное время выполнения зарубежной квалификации могут быть факторами, затрудняющими развитие рынка

В этом отчете о рынке тестирования медицинских устройств содержатся сведения о новых последних разработках, правилах торговли, анализе импорта-экспорта, анализе производства, оптимизации цепочки создания стоимости, доле рынка, влиянии внутренних и локальных игроков рынка, анализируются возможности с точки зрения новых источников дохода, изменений в правилах рынка, анализ стратегического роста рынка, размер рынка, рост рынка категорий, ниши приложений и доминирование, одобрения продуктов, запуски продуктов, географические расширения, технологические инновации на рынке. Чтобы получить дополнительную информацию, свяжитесь с Data Bridge Market Research для получения аналитического обзора, наша команда поможет вам принять обоснованное рыночное решение для достижения роста рынка.

Влияние COVID-19 на рынок тестирования медицинских устройств

COVID-19 положительно повлиял на рынок. Использование медицинских приборов возросло в те годы, таких как МРТ-сканеры, аппараты искусственной вентиляции легких и другие. Следовательно, использование различных приборов значительно возросло во всем мире. Следовательно, пандемия положительно повлияла на этот рынок тестирования.

Недавнее развитие

- В апреле 2021 года TUV SUD объявила, что она представила себя на Medtec LIVE, чтобы продемонстрировать свою способность быть универсальным центром для тестирования медицинских устройств. Услуги компании охватывали тестирование в области электрической и функциональной безопасности, кибербезопасности и программного обеспечения, ЭМС и биосовместимости. Эксперты TUV SUD приняли участие в онлайн-выставке и программе конгресса с различными докладами, живым хаком и презентацией в лифте.

Объем европейского рынка тестирования медицинских приборов

Европейский рынок тестирования медицинских устройств сегментирован по типу обслуживания, типу тестирования, фазе, типу источника, классу устройства и продукту. Рост среди этих сегментов поможет вам проанализировать сегменты с незначительным ростом в отраслях и предоставить пользователям ценный обзор рынка и рыночные идеи для принятия стратегических решений по определению основных рыночных приложений.

Тип услуги

- Услуги тестирования

- Инспекционные услуги

- Услуги по сертификации

По типу услуг европейский рынок испытаний медицинских изделий сегментируется на услуги по испытаниям, услуги по инспекции и услуги по сертификации.

Тип тестирования

- Физические испытания

- Химические/биологические испытания

- Тестирование кибербезопасности

- Микробиология и испытания на стерильность

- Другие

По типу испытаний европейский рынок испытаний медицинских приборов сегментируется на физические испытания, химико-биологические испытания, испытания кибербезопасности, микробиологические испытания, испытания на стерильность и другие.

Фаза

- Доклинические

- Клинический

По фазовому признаку европейский рынок испытаний медицинских изделий сегментируется на доклинический и клинический.

. Тип источника

- Аутсорсинг

- В доме

По типу источника поставок европейский рынок испытаний медицинских приборов сегментируется на внутренний и аутсорсинговый.

Класс устройства

- Класс I

- Класс II

- Класс III

По классу устройств европейский рынок испытаний медицинских приборов сегментирован на класс I, класс II и класс III.

Продукт

- Активный имплантат медицинского устройства

- Активное медицинское устройство

- Неактивное медицинское устройство

- Медицинское устройство для диагностики in vitro

- Офтальмологическое медицинское устройство

- Ортопедические и стоматологические медицинские изделия

- Сосудистое медицинское устройство

- Другие

По видам продукции европейский рынок испытаний медицинских устройств сегментирован на активные имплантируемые медицинские устройства, активные медицинские устройства, неактивные медицинские устройства, медицинские устройства для диагностики in vitro, офтальмологические медицинские устройства, ортопедические и стоматологические медицинские устройства, сосудистые медицинские устройства и другие.

Региональный анализ/информация о рынке тестирования медицинских устройств

Проанализирован рынок тестирования медицинских устройств, а также предоставлены сведения о размерах рынка и тенденциях по странам, типу услуг, типу тестирования, фазе, типу источника, классу устройства и продукту, как указано выше.

Страны, охваченные регионом Европа: Великобритания, Германия, Италия, Франция, Испания, Россия, Нидерланды, Швейцария, Турция, Бельгия и остальные страны Европы.

Германия доминирует на рынке тестирования медицинских устройств с точки зрения доли рынка и доходов рынка и продолжит процветать в течение прогнозируемого периода. Это связано с растущим спросом на тесты in vitro в Европе.

Раздел отчета по странам также содержит отдельные факторы, влияющие на рынок, и изменения в регулировании рынка, которые влияют на текущие и будущие тенденции рынка. Такие данные, как новые и заменяющие продажи, демографические данные страны, эпидемиология заболеваний и импортно-экспортные тарифы, являются одними из основных указателей, используемых для прогнозирования рыночного сценария для отдельных стран. Кроме того, при предоставлении прогнозного анализа данных по странам учитываются наличие и доступность глобальных брендов и их проблемы из-за высокой конкуренции со стороны местных и отечественных брендов, а также влияние каналов продаж.

Анализ конкурентной среды и доли рынка тестирования медицинских устройств

Конкурентная среда рынка тестирования медицинских устройств содержит подробную информацию о конкурентах. Подробности включают обзор компании, финансовые показатели компании, полученный доход, рыночный потенциал, инвестиции в исследования и разработки, новые рыночные инициативы, глобальное присутствие, производственные площадки и объекты, производственные мощности, сильные и слабые стороны компании, запуск продукта, широту и широту продукта и доминирование приложений. Приведенные выше данные относятся только к фокусу компаний на рынке тестирования медицинских устройств.

Некоторые из основных игроков, работающих на рынке испытаний медицинских устройств, включают Intertek Group plc, SGS SA, Bureau Veritas, TUV SUD, TUV Rheinland, UL LLC, North American Science Associates, LLC, Medistri SA, WuXi AppTec, NSF, Labcorp, Eurofins Scientific, Nelson Laboratories, LLC- A Sotera Health company, ITC ZLIN, Element Materials Technology, EndoLab Mechanical Engineering GmbH, Hohenstein, Medical Engineering Technologies Ltd., Cigniti, IMR Test Labs и другие.

Методология исследования

Сбор данных и анализ базового года выполняются с использованием модулей сбора данных с большими размерами выборки. Рыночные данные анализируются и оцениваются с использованием рыночных статистических и когерентных моделей. Кроме того, анализ доли рынка и анализ ключевых тенденций являются основными факторами успеха в рыночном отчете. Ключевой методологией исследования, используемой исследовательской группой DBMR, является триангуляция данных, которая включает в себя интеллектуальный анализ данных, анализ влияния переменных данных на рынок и первичную (отраслевую экспертную) проверку. Помимо этого, модели данных включают сетку позиционирования поставщиков, анализ временной линии рынка, обзор рынка и руководство, сетку позиционирования компании, анализ доли рынка компании, стандарты измерения, анализ Европы против региона и доли поставщика. Пожалуйста, запросите звонок аналитика в случае дальнейшего запроса.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Интерактивная панель анализа данных

- Панель анализа компании для возможностей с высоким потенциалом роста

- Доступ аналитика-исследователя для настройки и запросов

- Анализ конкурентов с помощью интерактивной панели

- Последние новости, обновления и анализ тенденций

- Используйте возможности сравнительного анализа для комплексного отслеживания конкурентов

Содержание

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF EUROPE MEDICAL DEVICE TESTING MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 SERVICE TYPE LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET TESTING TYPE COVERAGE GRID

2.11 VENDOR SHARE ANALYSIS

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTEL ANALYSIS

4.2 PORTER'S FIVE FORCES

5 EUROPE MEDICAL DEVICE TESTING MARKET: REGULATIONS

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 RISING NEED FOR VERIFICATION VALIDATION OF MEDICAL DEVICES

6.1.2 INCREASING DEMAND FOR IN-VITRO TESTS

6.1.3 ESCALATION IN INNOVATION AND TECHNOLOGIES

6.2 RESTRAINTS

6.2.1 BARRIERS TO THE LOCAL DEVELOPMENT OF MEDICAL DEVICES

6.2.2 HIGH COST OF MEDICAL DEVICES

6.3 OPPORTUNITIES

6.3.1 RISE IN HEALTHCARE EXPENDITURE

6.3.2 DEVELOPMENT IN AI AND IOT IN VARIOUS MEDICAL DEVICES

6.3.3 STRATEGIC INITIATIVES OF KEY PLAYERS

6.4 CHALLENGES

6.4.1 HIGH COMPETITION IN MEDICAL TECHNOLOGY INDUSTRY

6.4.2 LONG LEAD TIME FOR OVERSEAS QUALIFICATION

7 EUROPE MEDICAL DEVICE TESTING MARKET, BY SERVICE TYPE

7.1 OVERVIEW

7.2 TESTING SERVICES

7.3 INSPECTION SERVICES

7.4 CERTIFICATION SERVICES

8 EUROPE MEDICAL DEVICE TESTING MARKET, BY TESTING TYPE

8.1 OVERVIEW

8.2 CHEMICAL/BIOLOGICAL TESTING

8.3 MICROBIOLOGY AND STERILITY TESTING

8.3.1 STERILITY TEST & VALIDATION

8.3.2 BIO BURDEN DETERMINATION

8.3.3 ANTIMICROBIAL ACTIVITY TESTING

8.3.4 PYROGEN & ENDOTOXIN TESTING

8.3.5 OTHERS

8.4 PHYSICAL TESTING

8.4.1 ELECTRICAL SAFETY TESTING

8.4.2 FUNCTIONAL SAFETY TESTING

8.4.3 EMC TESTING

8.4.4 ENVIRONMENTAL TESTING

8.4.5 OTHERS

8.5 CYBERSECURITY TESTING

8.6 OTHERS

9 EUROPE MEDICAL DEVICE TESTING MARKET, BY PHASE

9.1 OVERVIEW

9.2 PRECLINICAL

9.3 CLINICAL

10 EUROPE MEDICAL DEVICE TESTING MARKET, BY SOURCING TYPE

10.1 OVERVIEW

10.2 OUTSOURCED

10.3 IN-HOUSE

11 EUROPE MEDICAL DEVICE TESTING MARKET, BY DEVICE CLASS

11.1 OVERVIEW

11.2 CLASS I

11.3 CLASS III

11.4 CLASS II

12 EUROPE MEDICAL DEVICE TESTING MARKET, BY PRODUCT

12.1 OVERVIEW

12.2 NON-ACTIVE MEDICAL DEVICE

12.3 ORTHOPEDIC AND DENTAL MEDICAL DEVICE

12.4 ACTIVE IMPLANT MEDICAL DEVICE

12.5 VASCULAR MEDICAL DEVICE

12.6 ACTIVE MEDICAL DEVICE

12.7 IN-VITRO DIAGNOSTICS MEDICAL DEVICE

12.8 OPTHALMIC MEDICAL DEVICE

12.9 OTHERS

13 EUROPE MEDICAL DEVICE TESTING MARKET, BY GEOGRAPHY

13.1 EUROPE

13.1.1 GERMANY

13.1.2 U.K.

13.1.3 FRANCE

13.1.4 ITALY

13.1.5 SPAIN

13.1.6 RUSSIA

13.1.7 NETHERLANDS

13.1.8 SWITZERLAND

13.1.9 TURKEY

13.1.10 BELGIUM

13.1.11 REST OF EUROPE

14 EUROPE MEDICAL DEVICE TESTING MARKET: COMPANY LANDSCAPE

14.1 COMPANY SHARE ANALYSIS: EUROPE

15 SWOT ANALYSIS

16 COMPANY PROFILE

16.1 LABCORP

16.1.1 COMPANY SNAPSHOT

16.1.2 REVENUE ANALYSIS

16.1.3 COMPANY SHARE ANALYSIS

16.1.4 PRODUCT PORTFOLIO

16.1.5 RECENT DEVELOPMENTS

16.2 CHARLES RIVER LABORATORIES.

16.2.1 COMPANY SNAPSHOT

16.2.2 REVENUE ANALYSIS

16.2.3 COMPANY SHARE ANALYSIS

16.2.4 PRODUCT PORTFOLIO

16.2.5 RECENT DEVELOPMENTS

16.3 TUV SUD

16.3.1 COMPANY SNAPSHOT

16.3.2 REVENUE ANALYSIS

16.3.3 COMPANY SHARE ANALYSIS

16.3.4 PRODUCT PORTFOLIO

16.3.5 RECENT DEVELOPMENTS

16.4 WUXI APPTEC

16.4.1 COMPANY SNAPSHOT

16.4.2 REVENUE ANALYSIS

16.4.3 COMPANY SHARE ANALYSIS

16.4.4 PRODUCT PORTFOLIO

16.4.5 RECENT DEVELOPMENTS

16.5 SGS SA

16.5.1 COMPANY SNAPSHOT

16.5.2 REVENUE ANALYSIS

16.5.3 COMPANY SHARE ANALYSIS

16.5.4 PRODUCT PORTFOLIO

16.5.5 RECENT DEVELOPMENTS

16.6 NORTH AMERICAN SCIENCE ASSOCIATES, LLC

16.6.1 COMPANY SNAPSHOT

16.6.2 PRODUCT PORTFOLIO

16.6.3 RECENT DEVELOPMENTS

16.7 HOHENSTEIN

16.7.1 COMPANY SNAPSHOT

16.7.2 PRODUCT PORTFOLIO

16.7.3 RECENT DEVELOPMENTS

16.8 ARBRO PHARMACEUTICALS PRIVATE LIMITED & AURIGA RESEARCH PRIVATE LIMITED

16.8.1 COMPANY SNAPSHOT

16.8.2 PRODUCT PORTFOLIO

16.8.3 RECENT DEVELOPMENTS

16.9 BIOMEDICAL DEVICE LABS

16.9.1 COMPANY SNAPSHOT

16.9.2 PRODUCT PORTFOLIO

16.9.3 RECENT DEVELOPMENTS

16.1 BIONEEDS

16.10.1 COMPANY SNAPSHOT

16.10.2 PRODUCT PORTFOLIO

16.10.3 RECENT DEVELOPMENTS

16.11 BUREAU VERITAS

16.11.1 COMPANY SNAPSHOT

16.11.2 REVENUE ANALYSIS

16.11.3 PRODUCT PORTFOLIO

16.11.4 RECENT DEVELOPMENTS

16.12 CIGNITI

16.12.1 COMPANY SNAPSHOT

16.12.2 REVENUE ANALYSIS

16.12.3 PRODUCT PORTFOLIO

16.12.4 RECENT DEVELOPMENTS

16.13 ELEMENT MATERIALS TECHNOLOGY

16.13.1 COMPANY SNAPSHOT

16.13.2 PRODUCT PORTFOLIO

16.13.3 RECENT DEVELOPMENTS

16.14 ENDOLAB MECHANICAL ENGINEERING GMBH

16.14.1 COMPANY SNAPSHOT

16.14.2 PRODUCT PORTFOLIO

16.14.3 RECENT DEVELOPMENTS

16.15 EUROFINS SCIENTIFIC

16.15.1 COMPANY SNAPSHOT

16.15.2 REVENUE ANALYSIS

16.15.3 PRODUCT PORTFOLIO

16.15.4 RECENT DEVELOPMENTS

16.16 GATEWAY ANALYTICAL.

16.16.1 COMPANY SNAPSHOT

16.16.2 PRODUCT PORTFOLIO

16.16.3 RECENT DEVELOPMENTS

16.17 IMR TEST LABS

16.17.1 COMPANY SNAPSHOT

16.17.2 PRODUCT PORTFOLIO

16.17.3 RECENT DEVELOPMENTS

16.18 INTERTEK GROUP PLC

16.18.1 COMPANY SNAPSHOT

16.18.2 REVENUE ANALYSIS

16.18.3 PRODUCT PORTFOLIO

16.18.4 RECENT DEVELOPMENTS

16.19 ITC ZLIN

16.19.1 COMPANY SNAPSHOT

16.19.2 PRODUCT PORTFOLIO

16.19.3 RECENT DEVELOPMENTS

16.2 MEDICAL ENGINEERING TECHNOLOGIES LTD.

16.20.1 COMPANY SNAPSHOT

16.20.2 PRODUCT PORTFOLIO

16.20.3 RECENT DEVELOPMENTS

16.21 MEDISTRI SA

16.21.1 COMPANY SNAPSHOT

16.21.2 PRODUCT PORTFOLIO

16.21.3 RECENT DEVELOPMENTS

16.22 NELSON LABORATORIES, LLC- A SOTERA HEALTH COMPANY

16.22.1 COMPANY SNAPSHOT

16.22.2 REVENUE ANALYSIS

16.22.3 PRODUCT PORTFOLIO

16.22.4 RECENT DEVELOPMENTS

16.23 NSF.

16.23.1 COMPANY SNAPSHOT

16.23.2 PRODUCT PORTFOLIO

16.23.3 RECENT DEVELOPMENTS

16.24 PACE

16.24.1 COMPANY SNAPSHOT

16.24.2 PRODUCT PORTFOLIO

16.24.3 RECENT DEVELOPMENTS

16.25 Q LABORATORIES

16.25.1 COMPANY SNAPSHOT

16.25.2 PRODUCT PORTFOLIO

16.25.3 RECENT DEVELOPMENTS

16.26 TUV RHEINLAND

16.26.1 COMPANY SNAPSHOT

16.26.2 REVENUE ANALYSIS

16.26.3 PRODUCT PORTFOLIO

16.26.4 RECENT DEVELOPMENTS

16.27 UL LLC

16.27.1 COMPANY SNAPSHOT

16.27.2 PRODUCT PORTFOLIO

16.27.3 RECENT DEVELOPMENTS

17 QUESTIONNAIRE

18 RELATED REPORTS

Список таблиц

TABLE 1 FDA REGULATIONS BASED ON DEVICES TYPE

TABLE 2 PRICES OF ESSENTIAL MEDICAL DEVICES

TABLE 3 EUROPE MEDICAL DEVICE TESTING MARKET, BY SERVICE TYPE, 2020-2029 (USD MILLION)

TABLE 4 EUROPE TESTING SERVICES IN MEDICAL DEVICE TESTING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 5 EUROPE INSPECTION SERVICES IN MEDICAL DEVICE TESTING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 6 EUROPE CERTIFICATION SERVICES IN MEDICAL DEVICE TESTING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 7 EUROPE MEDICAL DEVICE TESTING MARKET, BY TESTING TYPE, 2020-2029 (USD MILLION)

TABLE 8 EUROPE CHEMICAL/BIOLOGICAL TESTING IN MEDICAL DEVICE TESTING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 9 EUROPE MICROBIOLOGY AND STERILITY TESTING IN MEDICAL DEVICE TESTING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 10 EUROPE MICROBIOLOGY AND STERILITY TESTING IN MEDICAL DEVICE TESTING MARKET, BY TESTING TYPE, 2020-2029 (USD MILLION)

TABLE 11 EUROPE PHYSICAL TESTING IN MEDICAL DEVICE TESTING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 12 EUROPE PHYSICAL TESTING IN MEDICAL DEVICE TESTING MARKET, BY TESTING TYPE, 2020-2029 (USD MILLION)

TABLE 13 EUROPE CYBERSECURITY TESTING IN MEDICAL DEVICE TESTING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 14 EUROPE OTHERS IN MEDICAL DEVICE TESTING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 15 EUROPE MEDICAL DEVICE TESTING MARKET, BY PHASE, 2020-2029 (USD MILLION)

TABLE 16 EUROPE PRECLINICAL IN MEDICAL DEVICE TESTING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 17 EUROPE CLINICAL IN MEDICAL DEVICE TESTING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 18 EUROPE MEDICAL DEVICE TESTING MARKET, BY SOURCING TYPE, 2020-2029 (USD MILLION)

TABLE 19 EUROPE OUTSOURCED IN MEDICAL DEVICE TESTING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 20 EUROPE IN-HOUSE IN MEDICAL DEVICE TESTING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 21 EUROPE MEDICAL DEVICE TESTING MARKET, BY DEVICE CLASS, 2020-2029 (USD MILLION)

TABLE 22 EUROPE CLASS I IN MEDICAL DEVICE TESTING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 23 EUROPE CLASS III IN MEDICAL DEVICE TESTING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 24 EUROPE CLASS II IN MEDICAL DEVICE TESTING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 25 EUROPE MEDICAL DEVICE TESTING MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 26 EUROPE NON-ACTIVE MEDICAL DEVICE IN MEDICAL DEVICE TESTING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 27 EUROPE ORTHOPEDIC AND DENTAL MEDICAL DEVICE IN MEDICAL DEVICE TESTING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 28 EUROPE ACTIVE IMPLANT MEDICAL DEVICE IN MEDICAL DEVICE TESTING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 29 EUROPE VASCULAR MEDICAL DEVICE IN MEDICAL DEVICE TESTING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 30 EUROPE ACTIVE MEDICAL DEVICE IN MEDICAL DEVICE TESTING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 31 EUROPE IN-VITRO MEDICAL DEVICE IN MEDICAL DEVICE TESTING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 32 EUROPE OPTHALMIC MEDICAL DEVICE IN MEDICAL DEVICE TESTING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 33 EUROPE OTHERS IN MEDICAL DEVICE TESTING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 34 EUROPE MEDICAL DEVICE TESTING MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 35 EUROPE MEDICAL DEVICE TESTING MARKET, BY SERVICE TYPE, 2020-2029 (USD MILLION)

TABLE 36 EUROPE MEDICAL DEVICE TESTING MARKET, BY TESTING TYPE, 2020-2029 (USD MILLION)

TABLE 37 EUROPE MICROBIOLOGY AND STERILITY TESTING IN MEDICAL DEVICE TESTING MARKET, BY TESTING TYPE, 2020-2029 (USD MILLION)

TABLE 38 EUROPE PHYSICAL TESTING IN MEDICAL DEVICE TESTING MARKET, BY TESTING TYPE, 2020-2029 (USD MILLION)

TABLE 39 EUROPE MEDICAL DEVICE TESTING MARKET, BY PHASE, 2020-2029 (USD MILLION)

TABLE 40 EUROPE MEDICAL DEVICE TESTING MARKET, BY SOURCING TYPE, 2020-2029 (USD MILLION)

TABLE 41 EUROPE MEDICAL DEVICE TESTING MARKET, BY DEVICE CLASS, 2020-2029 (USD MILLION)

TABLE 42 EUROPE MEDICAL DEVICE TESTING MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 43 GERMANY MEDICAL DEVICE TESTING MARKET, BY SERVICE TYPE, 2020-2029 (USD MILLION)

TABLE 44 GERMANY MEDICAL DEVICE TESTING MARKET, BY TESTING TYPE, 2020-2029 (USD MILLION)

TABLE 45 GERMANY MICROBIOLOGY AND STERILITY TESTING IN MEDICAL DEVICE TESTING MARKET, BY TESTING TYPE, 2020-2029 (USD MILLION)

TABLE 46 GERMANY PHYSICAL TESTING IN MEDICAL DEVICE TESTING MARKET, BY TESTING TYPE, 2020-2029 (USD MILLION)

TABLE 47 GERMANY MEDICAL DEVICE TESTING MARKET, BY PHASE, 2020-2029 (USD MILLION)

TABLE 48 GERMANY MEDICAL DEVICE TESTING MARKET, BY SOURCING TYPE, 2020-2029 (USD MILLION)

TABLE 49 GERMANY MEDICAL DEVICE TESTING MARKET, BY DEVICE CLASS, 2020-2029 (USD MILLION)

TABLE 50 GERMANY MEDICAL DEVICE TESTING MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 51 U.K. MEDICAL DEVICE TESTING MARKET, BY SERVICE TYPE, 2020-2029 (USD MILLION)

TABLE 52 U.K. MEDICAL DEVICE TESTING MARKET, BY TESTING TYPE, 2020-2029 (USD MILLION)

TABLE 53 U.K. MICROBIOLOGY AND STERILITY TESTING IN MEDICAL DEVICE TESTING MARKET, BY TESTING TYPE, 2020-2029 (USD MILLION)

TABLE 54 U.K. PHYSICAL TESTING IN MEDICAL DEVICE TESTING MARKET, BY TESTING TYPE, 2020-2029 (USD MILLION)

TABLE 55 U.K. MEDICAL DEVICE TESTING MARKET, BY PHASE, 2020-2029 (USD MILLION)

TABLE 56 U.K. MEDICAL DEVICE TESTING MARKET, BY SOURCING TYPE, 2020-2029 (USD MILLION)

TABLE 57 U.K. MEDICAL DEVICE TESTING MARKET, BY DEVICE CLASS, 2020-2029 (USD MILLION)

TABLE 58 U.K. MEDICAL DEVICE TESTING MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 59 FRANCE MEDICAL DEVICE TESTING MARKET, BY SERVICE TYPE, 2020-2029 (USD MILLION)

TABLE 60 FRANCE MEDICAL DEVICE TESTING MARKET, BY TESTING TYPE, 2020-2029 (USD MILLION)

TABLE 61 FRANCE MICROBIOLOGY AND STERILITY TESTING IN MEDICAL DEVICE TESTING MARKET, BY TESTING TYPE, 2020-2029 (USD MILLION)

TABLE 62 FRANCE PHYSICAL TESTING IN MEDICAL DEVICE TESTING MARKET, BY TESTING TYPE, 2020-2029 (USD MILLION)

TABLE 63 FRANCE MEDICAL DEVICE TESTING MARKET, BY PHASE, 2020-2029 (USD MILLION)

TABLE 64 FRANCE MEDICAL DEVICE TESTING MARKET, BY SOURCING TYPE, 2020-2029 (USD MILLION)

TABLE 65 FRANCE MEDICAL DEVICE TESTING MARKET, BY DEVICE CLASS, 2020-2029 (USD MILLION)

TABLE 66 FRANCE MEDICAL DEVICE TESTING MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 67 ITALY MEDICAL DEVICE TESTING MARKET, BY SERVICE TYPE, 2020-2029 (USD MILLION)

TABLE 68 ITALY MEDICAL DEVICE TESTING MARKET, BY TESTING TYPE, 2020-2029 (USD MILLION)

TABLE 69 ITALY MICROBIOLOGY AND STERILITY TESTING IN MEDICAL DEVICE TESTING MARKET, BY TESTING TYPE, 2020-2029 (USD MILLION)

TABLE 70 ITALY PHYSICAL TESTING IN MEDICAL DEVICE TESTING MARKET, BY TESTING TYPE, 2020-2029 (USD MILLION)

TABLE 71 ITALY MEDICAL DEVICE TESTING MARKET, BY PHASE, 2020-2029 (USD MILLION)

TABLE 72 ITALY MEDICAL DEVICE TESTING MARKET, BY SOURCING TYPE, 2020-2029 (USD MILLION)

TABLE 73 ITALY MEDICAL DEVICE TESTING MARKET, BY DEVICE CLASS, 2020-2029 (USD MILLION)

TABLE 74 ITALY MEDICAL DEVICE TESTING MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 75 SPAIN MEDICAL DEVICE TESTING MARKET, BY SERVICE TYPE, 2020-2029 (USD MILLION)

TABLE 76 SPAIN MEDICAL DEVICE TESTING MARKET, BY TESTING TYPE, 2020-2029 (USD MILLION)

TABLE 77 SPAIN MICROBIOLOGY AND STERILITY TESTING IN MEDICAL DEVICE TESTING MARKET, BY TESTING TYPE, 2020-2029 (USD MILLION)

TABLE 78 SPAIN PHYSICAL TESTING IN MEDICAL DEVICE TESTING MARKET, BY TESTING TYPE, 2020-2029 (USD MILLION)

TABLE 79 SPAIN MEDICAL DEVICE TESTING MARKET, BY PHASE, 2020-2029 (USD MILLION)

TABLE 80 SPAIN MEDICAL DEVICE TESTING MARKET, BY SOURCING TYPE, 2020-2029 (USD MILLION)

TABLE 81 SPAIN MEDICAL DEVICE TESTING MARKET, BY DEVICE CLASS, 2020-2029 (USD MILLION)

TABLE 82 SPAIN MEDICAL DEVICE TESTING MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 83 RUSSIA MEDICAL DEVICE TESTING MARKET, BY SERVICE TYPE, 2020-2029 (USD MILLION)

TABLE 84 RUSSIA MEDICAL DEVICE TESTING MARKET, BY TESTING TYPE, 2020-2029 (USD MILLION)

TABLE 85 RUSSIA MICROBIOLOGY AND STERILITY TESTING IN MEDICAL DEVICE TESTING MARKET, BY TESTING TYPE, 2020-2029 (USD MILLION)

TABLE 86 RUSSIA PHYSICAL TESTING IN MEDICAL DEVICE TESTING MARKET, BY TESTING TYPE, 2020-2029 (USD MILLION)

TABLE 87 RUSSIA MEDICAL DEVICE TESTING MARKET, BY PHASE, 2020-2029 (USD MILLION)

TABLE 88 RUSSIA MEDICAL DEVICE TESTING MARKET, BY SOURCING TYPE, 2020-2029 (USD MILLION)

TABLE 89 RUSSIA MEDICAL DEVICE TESTING MARKET, BY DEVICE CLASS, 2020-2029 (USD MILLION)

TABLE 90 RUSSIA MEDICAL DEVICE TESTING MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 91 NETHERLANDS MEDICAL DEVICE TESTING MARKET, BY SERVICE TYPE, 2020-2029 (USD MILLION)

TABLE 92 NETHERLANDS MEDICAL DEVICE TESTING MARKET, BY TESTING TYPE, 2020-2029 (USD MILLION)

TABLE 93 NETHERLANDS MICROBIOLOGY AND STERILITY TESTING IN MEDICAL DEVICE TESTING MARKET, BY TESTING TYPE, 2020-2029 (USD MILLION)

TABLE 94 NETHERLANDS PHYSICAL TESTING IN MEDICAL DEVICE TESTING MARKET, BY TESTING TYPE, 2020-2029 (USD MILLION)

TABLE 95 NETHERLANDS MEDICAL DEVICE TESTING MARKET, BY PHASE, 2020-2029 (USD MILLION)

TABLE 96 NETHERLANDS MEDICAL DEVICE TESTING MARKET, BY SOURCING TYPE, 2020-2029 (USD MILLION)

TABLE 97 NETHERLANDS MEDICAL DEVICE TESTING MARKET, BY DEVICE CLASS, 2020-2029 (USD MILLION)

TABLE 98 NETHERLANDS MEDICAL DEVICE TESTING MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 99 SWITZERLAND MEDICAL DEVICE TESTING MARKET, BY SERVICE TYPE, 2020-2029 (USD MILLION)

TABLE 100 SWITZERLAND MEDICAL DEVICE TESTING MARKET, BY TESTING TYPE, 2020-2029 (USD MILLION)

TABLE 101 SWITZERLAND MICROBIOLOGY AND STERILITY TESTING IN MEDICAL DEVICE TESTING MARKET, BY TESTING TYPE, 2020-2029 (USD MILLION)

TABLE 102 SWITZERLAND PHYSICAL TESTING IN MEDICAL DEVICE TESTING MARKET, BY TESTING TYPE, 2020-2029 (USD MILLION)

TABLE 103 SWITZERLAND MEDICAL DEVICE TESTING MARKET, BY PHASE, 2020-2029 (USD MILLION)

TABLE 104 SWITZERLAND MEDICAL DEVICE TESTING MARKET, BY SOURCING TYPE, 2020-2029 (USD MILLION)

TABLE 105 SWITZERLAND MEDICAL DEVICE TESTING MARKET, BY DEVICE CLASS, 2020-2029 (USD MILLION)

TABLE 106 SWITZERLAND MEDICAL DEVICE TESTING MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 107 TURKEY MEDICAL DEVICE TESTING MARKET, BY SERVICE TYPE, 2020-2029 (USD MILLION)

TABLE 108 TURKEY MEDICAL DEVICE TESTING MARKET, BY TESTING TYPE, 2020-2029 (USD MILLION)

TABLE 109 TURKEY MICROBIOLOGY AND STERILITY TESTING IN MEDICAL DEVICE TESTING MARKET, BY TESTING TYPE, 2020-2029 (USD MILLION)

TABLE 110 TURKEY PHYSICAL TESTING IN MEDICAL DEVICE TESTING MARKET, BY TESTING TYPE, 2020-2029 (USD MILLION)

TABLE 111 TURKEY MEDICAL DEVICE TESTING MARKET, BY PHASE, 2020-2029 (USD MILLION)

TABLE 112 TURKEY MEDICAL DEVICE TESTING MARKET, BY SOURCING TYPE, 2020-2029 (USD MILLION)

TABLE 113 TURKEY MEDICAL DEVICE TESTING MARKET, BY DEVICE CLASS, 2020-2029 (USD MILLION)

TABLE 114 TURKEY MEDICAL DEVICE TESTING MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 115 BELGIUM MEDICAL DEVICE TESTING MARKET, BY SERVICE TYPE, 2020-2029 (USD MILLION)

TABLE 116 BELGIUM MEDICAL DEVICE TESTING MARKET, BY TESTING TYPE, 2020-2029 (USD MILLION)

TABLE 117 BELGIUM MICROBIOLOGY AND STERILITY TESTING IN MEDICAL DEVICE TESTING MARKET, BY TESTING TYPE, 2020-2029 (USD MILLION)

TABLE 118 BELGIUM PHYSICAL TESTING IN MEDICAL DEVICE TESTING MARKET, BY TESTING TYPE, 2020-2029 (USD MILLION)

TABLE 119 BELGIUM MEDICAL DEVICE TESTING MARKET, BY PHASE, 2020-2029 (USD MILLION)

TABLE 120 BELGIUM MEDICAL DEVICE TESTING MARKET, BY SOURCING TYPE, 2020-2029 (USD MILLION)

TABLE 121 BELGIUM MEDICAL DEVICE TESTING MARKET, BY DEVICE CLASS, 2020-2029 (USD MILLION)

TABLE 122 BELGIUM MEDICAL DEVICE TESTING MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 123 REST OF EUROPE MEDICAL DEVICE TESTING MARKET, BY SERVICE TYPE, 2020-2029 (USD MILLION)

Список рисунков

FIGURE 1 EUROPE MEDICAL DEVICE TESTING MARKET: SEGMENTATION

FIGURE 2 EUROPE MEDICAL DEVICE TESTING MARKET: DATA TRIANGULATION

FIGURE 3 EUROPE MEDICAL DEVICE TESTING MARKET: DROC ANALYSIS

FIGURE 4 EUROPE MEDICAL DEVICE TESTING MARKET: EUROPE VS REGIONAL MARKET ANALYSIS

FIGURE 5 EUROPE MEDICAL DEVICE TESTING MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 EUROPE MEDICAL DEVICE TESTING MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 EUROPE MEDICAL DEVICE TESTING MARKET: DBMR MARKET POSITION GRID

FIGURE 8 EUROPE MEDICAL DEVICE TESTING MARKET: MARKET TESTING TYPE COVERAGE GRID

FIGURE 9 EUROPE MEDICAL DEVICE TESTING MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 EUROPE MEDICAL DEVICE TESTING MARKET: SEGMENTATION

FIGURE 11 INCREASING DEMAND FOR IN-VITRO TESTS AND DEVELOPMENT IN AI AND IOT IN VARIOUS MEDICAL DEVICES ARE EXPECTED TO DRIVE THE EUROPE MEDICAL DEVICE TESTING MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 12 TESTING SERVICES SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE EUROPE MEDICAL DEVICE TESTING MARKET IN 2022 & 2029

FIGURE 13 NORTH AMERICA IS EXPECTED TO DOMINATE THE EUROPE MEDICAL DEVICE TESTINGMARKET, AND ASIA-PACIFIC IS EXPECTED TO GROW WITH THE HIGHEST CAGR IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 14 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF EUROPE MEDICAL DEVICE TESTING MARKET

FIGURE 15 EUROPE MEDICAL DEVICE TESTING MARKET: BY SERVICE TYPE, 2021

FIGURE 16 EUROPE MEDICAL DEVICE TESTING MARKET: BY SERVICE TYPE, 2022-2029 (USD MILLION)

FIGURE 17 EUROPE MEDICAL DEVICE TESTING MARKET: BY SERVICE TYPE, CAGR (2022-2029)

FIGURE 18 EUROPE MEDICAL DEVICE TESTING MARKET: BY SERVICE TYPE, LIFELINE CURVE

FIGURE 19 EUROPE MEDICAL DEVICE TESTING MARKET: BY TESTING TYPE, 2021

FIGURE 20 EUROPE MEDICAL DEVICE TESTING MARKET: BY TESTING TYPE, 2022-2029 (USD MILLION)

FIGURE 21 EUROPE MEDICAL DEVICE TESTING MARKET: BY TESTING TYPE, CAGR (2022-2029)

FIGURE 22 EUROPE MEDICAL DEVICE TESTING MARKET: BY TESTING TYPE, LIFELINE CURVE

FIGURE 23 EUROPE MEDICAL DEVICE TESTING MARKET: BY PHASE, 2021

FIGURE 24 EUROPE MEDICAL DEVICE TESTING MARKET: BY PHASE, 2022-2029 (USD MILLION)

FIGURE 25 EUROPE MEDICAL DEVICE TESTING MARKET: BY PHASE, CAGR (2022-2029)

FIGURE 26 EUROPE MEDICAL DEVICE TESTING MARKET: BY PHASE, LIFELINE CURVE

FIGURE 27 EUROPE MEDICAL DEVICE TESTING MARKET: BY SOURCING TYPE, 2021

FIGURE 28 EUROPE MEDICAL DEVICE TESTING MARKET: BY SOURCING TYPE, 2022-2029 (USD MILLION)

FIGURE 29 EUROPE MEDICAL DEVICE TESTING MARKET: BY SOURCING TYPE, CAGR (2022-2029)

FIGURE 30 EUROPE MEDICAL DEVICE TESTING MARKET: BY SOURCING TYPE, LIFELINE CURVE

FIGURE 31 EUROPE MEDICAL DEVICE TESTING MARKET: BY DEVICE CLASS, 2021

FIGURE 32 EUROPE MEDICAL DEVICE TESTING MARKET: BY DEVICE CLASS, 2022-2029 (USD MILLION)

FIGURE 33 EUROPE MEDICAL DEVICE TESTING MARKET: BY DEVICE CLASS, CAGR (2022-2029)

FIGURE 34 EUROPE MEDICAL DEVICE TESTING MARKET: BY DEVICE CLASS, LIFELINE CURVE

FIGURE 35 EUROPE MEDICAL DEVICE TESTING MARKET: BY PRODUCT, 2021

FIGURE 36 EUROPE MEDICAL DEVICE TESTING MARKET: BY PRODUCT, 2022-2029 (USD MILLION)

FIGURE 37 EUROPE MEDICAL DEVICE TESTING MARKET: BY PRODUCT, CAGR (2022-2029)

FIGURE 38 EUROPE MEDICAL DEVICE TESTING MARKET: BY PRODUCT, LIFELINE CURVE

FIGURE 39 EUROPE MEDICAL DEVICE TESTING MARKET: SNAPSHOT (2021)

FIGURE 40 EUROPE MEDICAL DEVICE TESTING MARKET: BY COUNTRY (2021)

FIGURE 41 EUROPE MEDICAL DEVICE TESTING MARKET: BY COUNTRY (2022 & 2029)

FIGURE 42 EUROPE MEDICAL DEVICE TESTING MARKET: BY COUNTRY (2021 & 2029)

FIGURE 43 EUROPE MEDICAL DEVICE TESTING MARKET: BY SERVICE TYPE (2022-2029)

FIGURE 44 EUROPE MEDICAL DEVICE TESTING MARKET: COMPANY SHARE 2021 (%)

Методология исследования

Сбор данных и анализ базового года выполняются с использованием модулей сбора данных с большими размерами выборки. Этап включает получение рыночной информации или связанных данных из различных источников и стратегий. Он включает изучение и планирование всех данных, полученных из прошлого заранее. Он также охватывает изучение несоответствий информации, наблюдаемых в различных источниках информации. Рыночные данные анализируются и оцениваются с использованием статистических и последовательных моделей рынка. Кроме того, анализ доли рынка и анализ ключевых тенденций являются основными факторами успеха в отчете о рынке. Чтобы узнать больше, пожалуйста, запросите звонок аналитика или оставьте свой запрос.

Ключевой методологией исследования, используемой исследовательской группой DBMR, является триангуляция данных, которая включает в себя интеллектуальный анализ данных, анализ влияния переменных данных на рынок и первичную (отраслевую экспертную) проверку. Модели данных включают сетку позиционирования поставщиков, анализ временной линии рынка, обзор рынка и руководство, сетку позиционирования компании, патентный анализ, анализ цен, анализ доли рынка компании, стандарты измерения, глобальный и региональный анализ и анализ доли поставщика. Чтобы узнать больше о методологии исследования, отправьте запрос, чтобы поговорить с нашими отраслевыми экспертами.

Доступна настройка

Data Bridge Market Research является лидером в области передовых формативных исследований. Мы гордимся тем, что предоставляем нашим существующим и новым клиентам данные и анализ, которые соответствуют и подходят их целям. Отчет можно настроить, включив в него анализ ценовых тенденций целевых брендов, понимание рынка для дополнительных стран (запросите список стран), данные о результатах клинических испытаний, обзор литературы, обновленный анализ рынка и продуктовой базы. Анализ рынка целевых конкурентов можно проанализировать от анализа на основе технологий до стратегий портфеля рынка. Мы можем добавить столько конкурентов, о которых вам нужны данные в нужном вам формате и стиле данных. Наша команда аналитиков также может предоставить вам данные в сырых файлах Excel, сводных таблицах (книга фактов) или помочь вам в создании презентаций из наборов данных, доступных в отчете.