Europe Medical Device Sterilization Market

Размер рынка в млрд долларов США

CAGR :

%

USD

1.47 Billion

USD

2.74 Billion

2024

2032

USD

1.47 Billion

USD

2.74 Billion

2024

2032

| 2025 –2032 | |

| USD 1.47 Billion | |

| USD 2.74 Billion | |

|

|

|

|

Сегментация европейского рынка стерилизации медицинских устройств по видам продукции (инструменты, реагенты и услуги), технологиям (термическая стерилизация, стерилизация ионизирующим излучением, фильтрационная стерилизация, газовая и химическая стерилизация), конечным пользователям (фармацевтические компании, больницы, клиники, лаборатории, учебные и научно-исследовательские институты, производители медицинских устройств и другие), каналам сбыта (прямые тендеры, розничные продажи и сторонние дистрибьюторы) — тенденции отрасли и прогноз до 2032 года

Размер европейского рынка стерилизации медицинских изделий

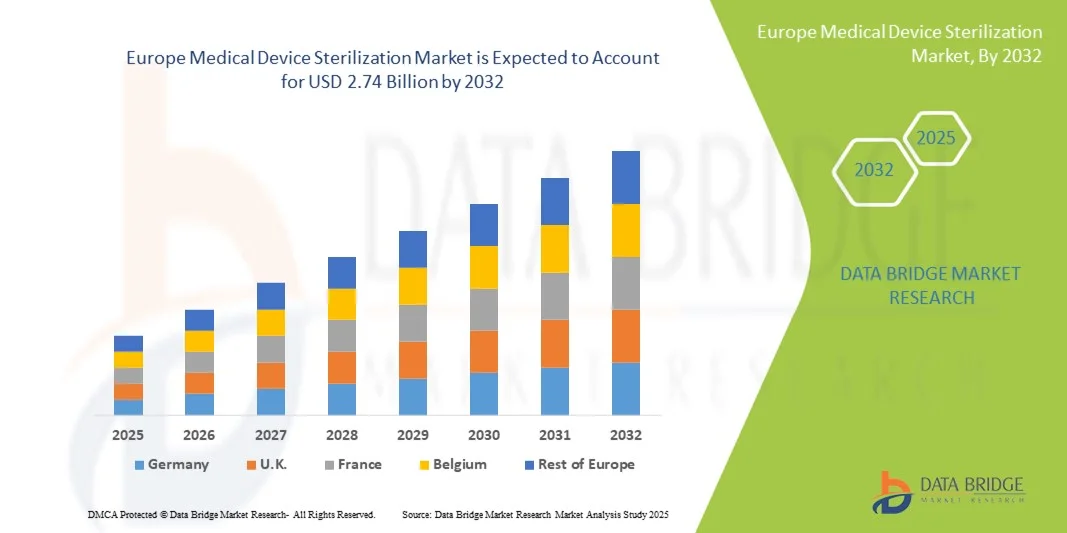

- Объем европейского рынка стерилизации медицинских изделий в 2024 году оценивался в 1,47 млрд долларов США , а к 2032 году, как ожидается , он достигнет 2,74 млрд долларов США при среднегодовом темпе роста 8,10% в течение прогнозируемого периода.

- Рост рынка во многом обусловлен растущим внедрением передовых технологий стерилизации, таких как оксид этилена, перекись водорода и гамма-облучение, в больницах и хирургических центрах, что обеспечивает повышенную безопасность пациентов и соответствие строгим нормативным стандартам.

- Кроме того, рост расходов на здравоохранение, растущая распространенность хронических и инфекционных заболеваний , а также растущий спрос на стерильные медицинские изделия как в больницах, так и в амбулаторных условиях ускоряют внедрение европейских решений по стерилизации медицинских изделий, тем самым значительно стимулируя рост отрасли.

Анализ европейского рынка стерилизации медицинских изделий

- Стерилизация медицинских изделий, включая инструменты, реагенты и услуги, становится все более важной в Европе для обеспечения безопасности пациентов, соблюдения нормативных требований и контроля инфекций в больницах, клиниках, лабораториях и фармацевтических компаниях.

- Растущий спрос на рынке обусловлен, прежде всего, ростом числа хирургических операций, ростом распространенности хронических и инфекционных заболеваний, а также строгими правилами стерилизации в европейских странах, которые требуют соблюдения высоких стандартов гигиены и безопасности.

- Германия доминировала на европейском рынке стерилизации медицинских изделий с наибольшей долей выручки в 35,6% в 2024 году, чему способствовала развитая инфраструктура здравоохранения, широкое внедрение автоматизированных технологий стерилизации и сильное присутствие ключевых игроков рынка, специализирующихся на решениях для термической и газовой стерилизации.

- Ожидается, что Франция станет страной с самыми быстрыми темпами роста на рынке в течение прогнозируемого периода благодаря расширению учреждений здравоохранения, росту производства фармацевтической продукции и медицинских приборов, а также увеличению инвестиций в современное стерилизационное оборудование.

- Газовая и химическая стерилизация доминировала на рынке в 2024 году с долей 42,5%, что обусловлено ее эффективностью для сложных приборов и нормативным признанием критических и полукритических устройств.

Область применения отчета и сегментация европейского рынка стерилизации медицинских изделий

|

Атрибуты |

Ключевые аспекты европейского рынка стерилизации медицинских изделий |

|

Охваченные сегменты |

|

|

Охваченные страны |

Европа

|

|

Ключевые игроки рынка |

|

|

Рыночные возможности |

|

|

Информационные наборы данных с добавленной стоимостью |

Помимо информации о рыночных сценариях, таких как рыночная стоимость, темпы роста, сегментация, географический охват и основные игроки, отчеты о рынке, подготовленные Data Bridge Market Research, также включают в себя углубленный экспертный анализ, анализ цен, анализ доли бренда, опрос потребителей, демографический анализ, анализ цепочки поставок, анализ цепочки создания стоимости, обзор сырья/расходных материалов, критерии выбора поставщиков, анализ PESTLE, анализ Портера и нормативную базу. |

Тенденции европейского рынка стерилизации медицинских изделий

Достижения в области технологий автоматизированной и низкотемпературной стерилизации

- Значительной и быстрорастущей тенденцией на европейском рынке стерилизации медицинских изделий является внедрение автоматизированных систем стерилизации и низкотемпературных методов, таких как плазма перекиси водорода и оксид этилена, что повышает безопасность и эффективность в больницах и лабораториях.

- Например, системы Steris V-PRO® объединяют низкотемпературную стерилизацию с расширенным мониторингом, позволяя медицинским учреждениям быстро и безопасно стерилизовать термочувствительные инструменты.

- Автоматизация стерилизационно-технического оборудования обеспечивает такие функции, как мониторинг цикла, создание отчетов и обнаружение ошибок, обеспечивая более строгое соответствие нормативным требованиям. Например, системы Getinge и Belimed обеспечивают автоматизированное ведение журналов и оповещения об отклонениях в обслуживании и использовании.

- Интеграция передовых технологий стерилизации с больничными информационными системами обеспечивает централизованное отслеживание статуса стерилизации инструментов, что снижает человеческий фактор и повышает эффективность работы.

- Эта тенденция к более точным, контролируемым и автоматизированным системам стерилизации фундаментально меняет рабочие процессы в больницах и требования к соблюдению требований. В связи с этим такие компании, как Tuttnauer, разрабатывают решения с автоматическим отслеживанием, возможностями низкотемпературной стерилизации и возможностью подключения для цифрового хранения данных.

- Спрос на современные автоматизированные решения по стерилизации стремительно растет как в больничном, так и в фармацевтическом секторе, поскольку медицинские учреждения все больше внимания уделяют безопасности пациентов, соблюдению нормативных требований и эффективности работы.

Динамика европейского рынка стерилизации медицинских изделий

Водитель

Растущий спрос на медицинские услуги и нормативные требования

- Растущая распространенность хронических и инфекционных заболеваний в сочетании с более строгими правилами стерилизации по всей Европе является важным фактором более широкого внедрения решений по стерилизации медицинских изделий.

- Например, в марте 2024 года компания Belimed объявила о запуске новых автоматизированных стерилизаторов, соответствующих нормам ЕС по лекарственным препаратам с множественной лекарственной устойчивостью (MDR), с целью повышения безопасности пациентов и эффективности работы.

- Поскольку больницы и клиники расширяют свои хирургические и диагностические процедуры, решения для стерилизации играют важную роль в контроле инфекций и обеспечении качества.

- Кроме того, рост производства медицинских изделий и фармацевтических препаратов в Европе увеличивает спрос на современные услуги стерилизации, гарантирующие безопасность и соответствие продукции установленным нормам.

- Внедрение также обусловлено интеграцией стерилизационного оборудования с системами управления больницами, что обеспечивает мониторинг в режиме реального времени, отчетность и оптимизацию циклов стерилизации.

- Повышение осведомленности и программы обучения по профилактике инфекций среди медицинских работников способствуют внедрению передовых решений в области стерилизации. Например, семинары в Германии и Франции демонстрируют преимущества автоматизированных систем в снижении риска заражения.

- Технологическое сотрудничество между производителями стерилизационного оборудования и больницами стимулирует инновации, позволяя повысить эффективность и скорость циклов стерилизации. Например, Getinge сотрудничает с крупными немецкими больницами для оптимизации протоколов стерилизации.

Сдержанность/Вызов

Высокая стоимость оборудования и сложность соблюдения требований

- Относительно высокая стоимость современного стерилизационного оборудования и расходных материалов представляет собой значительную проблему для более широкого проникновения на рынок, особенно для небольших больниц и клиник.

- Например, дорогостоящие системы Getinge и Steris могут быть менее доступны для учреждений здравоохранения с ограниченным бюджетом, что ограничивает их внедрение, несмотря на их эксплуатационные преимущества.

- Сложность соблюдения нормативных требований в европейских странах, включая стандарты ЕС по лекарственно-устойчивым лекарственным препаратам и местные стандарты стерилизации, увеличивает эксплуатационную и административную нагрузку на конечных пользователей.

- Кроме того, некоторые методы низкотемпературной стерилизации требуют специального обучения и обслуживания, что может быть ресурсоемким, что создает дополнительные препятствия для их внедрения.

- Преодоление этих проблем посредством оптимизации затрат, стандартизированных программ обучения и поддержки соблюдения нормативных требований будет иметь решающее значение для устойчивого роста рынка по всей Европе.

- Различия в инфраструктуре технического обслуживания и ремонта в разных странах могут влиять на надежность стерилизационного оборудования и препятствовать инвестициям в современные системы. Например, небольшие клиники в Восточной Европе могут не иметь технической поддержки для сложных систем.

- Недостаточная осведомлённость некоторых конечных пользователей о долгосрочной экономии средств и эффективности автоматизированных стерилизационых решений может препятствовать их внедрению. Например, некоторые больницы во Франции по-прежнему в значительной степени полагаются на ручную стерилизацию, несмотря на эксплуатационные преимущества автоматизации.

Объем европейского рынка стерилизации медицинских изделий

Рынок сегментирован по признаку продукта, технологии, конечного пользователя и канала сбыта.

- По продукту

Европейский рынок стерилизации медицинских изделий сегментирован по видам продукции на инструменты, реагенты и услуги. Сегмент инструментов доминировал на рынке с наибольшей долей выручки в 2024 году, что обусловлено широким использованием стерилизуемых хирургических инструментов, диагностических инструментов и критически важных медицинских изделий в больницах и клиниках. Инструменты требуют строгих протоколов стерилизации для обеспечения безопасности пациентов, соответствия нормам ЕС по множественной лекарственной устойчивости и предотвращения внутрибольничных инфекций. Больницы и хирургические центры отдают приоритет стерилизации инструментов из-за прямого влияния на результаты хирургических операций и стандарты инфекционного контроля. Передовые методы стерилизации, такие как низкотемпературная плазма перекиси водорода, все чаще применяются к инструментам для сохранения функциональности и обеспечения стерильности. Высокая стоимость и длительный срок службы инструментов дополнительно обуславливают необходимость регулярной стерилизации, что повышает спрос на эти решения. Например, Getinge и Tuttnauer предлагают специализированные циклы стерилизации инструментов со встроенным мониторингом для учреждений здравоохранения.

Ожидается, что сегмент услуг будет демонстрировать наиболее быстрый рост в период с 2025 по 2032 год, обусловленный аутсорсингом процессов стерилизации небольшими больницами, клиниками и производителями медицинских изделий. Услуги обеспечивают экономическую эффективность, гарантию соответствия требованиям и доступ к передовым технологиям стерилизации без необходимости внутренних капиталовложений. Фармацевтические компании все чаще полагаются на сторонние услуги стерилизации реагентов и критически важных устройств. Поставщики услуг часто предлагают индивидуальные решения, включая мониторинг цикла, отчетность и валидацию, что привлекает учреждения, стремящиеся к снижению операционной нагрузки. Росту также способствует расширение специализированных стерилизационных центров по всей Европе, предлагающих быструю обработку заказов и стерилизацию в соответствии с нормативными требованиями.

- По технологии

На основе технологий европейский рынок стерилизации медицинских изделий сегментирован на термическую стерилизацию, стерилизацию ионизирующим излучением, стерилизацию фильтрацией и стерилизацию газом и химикатами. Сегмент газовой и химической стерилизации доминировал на рынке с наибольшей долей выручки в 42,5% в 2024 году, что объясняется его доказанной эффективностью при стерилизации медицинских изделий, чувствительных к нагреванию и влаге. Методы газовой стерилизации, такие как плазма оксида этилена и перекиси водорода, широко используются в больницах, лабораториях и на фармацевтическом производстве. Этот сегмент является предпочтительным из-за его нормативного соответствия для критических и полукритических инструментов и способности сохранять целостность инструментов. Больницы с большими объемами сложных хирургических инструментов в значительной степени полагаются на газовую стерилизацию для соответствия стандартам инфекционного контроля. Кроме того, такие крупные производители, как Steris и Belimed, предлагают полностью автоматизированные системы газовой стерилизации с функциями мониторинга и отчетности. Например, стерилизаторы V-PRO® позволяют проводить низкотемпературную химическую стерилизацию, подходящую для деликатных медицинских инструментов.

Ожидается, что сегмент стерилизации ионизирующим излучением будет демонстрировать самые высокие темпы роста в период с 2025 по 2032 год, что обусловлено его растущим внедрением в фармацевтическое производство и производство одноразовых медицинских изделий. Радиационная стерилизация, включая гамма- и электронно-лучевые методы, обеспечивает высокую производительность и точность стерилизации без остаточных химических веществ. Рост производства одноразовых шприцев, катетеров и диагностических наборов повышает спрос на услуги радиационной стерилизации. Эффективность, масштабируемость и способность этого метода поддерживать качество продукции делают его привлекательным для производителей. Такие компании, как Nordion и Synergy Health, расширяют мощности для удовлетворения растущего спроса по всей Европе.

- Конечным пользователем

По принципу конечного пользователя рынок сегментирован на фармацевтические компании, больницы, клиники, лаборатории, академические и научно-исследовательские институты, производителей медицинского оборудования и другие. Сегмент больниц доминировал на европейском рынке стерилизации медицинских устройств в 2024 году, что обусловлено большим объемом хирургических процедур, диагностики и лечения, чувствительных к инфекциям, требующих стерилизации инструментов и расходных материалов. Больницы отдают приоритет автоматизированным и валидированным циклам стерилизации для снижения риска инфицирования и соответствия требованиям ЕС по множественной лекарственной устойчивости и национальным нормам здравоохранения. Как государственные, так и частные больницы инвестируют в современные стерилизаторы для повышения операционной эффективности и безопасности пациентов. Спрос особенно высок в больницах третичного и четвертичного уровней медицинской помощи со специализированными хирургическими отделениями. Например, в немецких и французских больницах широко внедряются интегрированные системы стерилизации, которые отслеживают использование инструментов и соблюдение требований.

Ожидается, что сегмент фармацевтических компаний продемонстрирует наиболее быстрый рост в период с 2025 по 2032 год благодаря увеличению производства стерильных лекарственных средств, биологических препаратов и инъекционных составов. Производителям фармацевтической продукции требуется точная стерилизация инструментов, флаконов и реагентов для соответствия строгим нормативным требованиям и обеспечения безопасности продукции. Росту также способствует рост контрактного производства и аутсорсинга процессов стерилизации. Услуги, включающие валидированную стерилизацию, мониторинг в режиме реального времени и предоставление отчетности, пользуются высоким спросом для обеспечения соответствия требованиям и эффективности. Такие компании, как Sartorius и Steris, расширяют предложения, адаптированные к требованиям фармацевтической стерилизации по всей Европе.

- По каналу распространения

По каналам сбыта рынок сегментируется на прямые тендеры, розничные продажи и сторонних дистрибьюторов. В 2024 году сегмент прямых тендеров доминировал на рынке, что обусловлено практикой закупок в больницах, клиниках и фармацевтических компаниях, которые отдают предпочтение прямым закупкам у производителей. Прямые тендеры обеспечивают соответствие нормам ЕС, предоставляют доступ к послепродажному обслуживанию и позволяют адаптировать решения для стерилизации к конкретным потребностям конечного пользователя. Больницы и крупные клиники предпочитают этот канал для поставок дорогостоящего оборудования, такого как автоматические стерилизаторы, установки химической стерилизации и решения для отдельных инструментов. Например, Getinge и Belimed поставляют стерилизационные системы напрямую в ведущие больницы Германии и Франции.

Ожидается, что сегмент сторонних дистрибьюторов продемонстрирует наиболее быстрый рост в период с 2025 по 2032 год, чему будет способствовать увеличение объёма аутсорсинга расходных материалов для стерилизации, реагентов и мелкосерийного оборудования. Дистрибьюторы обеспечивают гибкость, локальную поддержку и более быструю доставку для небольших больниц, клиник и научно-исследовательских институтов. Росту в канале сторонних дистрибьюторов также способствует расширение присутствия специализированных дистрибьюторов по всей Европе, которые обслуживают множество конечных пользователей, предлагая комплексные услуги и поддержку в сфере регулирования. Например, Tuttnauer и Steris сотрудничают с дистрибьюторами для эффективного взаимодействия с небольшими медицинскими учреждениями в Восточной Европе.

Региональный анализ европейского рынка стерилизации медицинских изделий

- Германия доминировала на европейском рынке стерилизации медицинских изделий с наибольшей долей выручки в 35,6% в 2024 году, чему способствовала развитая инфраструктура здравоохранения, широкое внедрение автоматизированных технологий стерилизации и сильное присутствие ключевых игроков рынка, специализирующихся на решениях для термической и газовой стерилизации.

- Поставщики медицинских услуг в регионе высоко ценят надежность, передовые технологии стерилизации и соответствие международным стандартам безопасности, предлагаемые немецкими стерилизационными решениями.

- Широкое распространение этой технологии подкрепляется постоянными технологическими инновациями, ростом расходов на здравоохранение и акцентом на инфекционный контроль, что делает стерилизацию медицинских устройств критически важным решением как для больниц, так и для производителей медицинских устройств по всей Европе.

Обзор рынка стерилизации медицинских изделий в Великобритании

Ожидается, что рынок стерилизации медицинских изделий в Великобритании будет расти значительными среднегодовыми темпами в течение прогнозируемого периода, что обусловлено увеличением объёма хирургических операций и строгими нормативными требованиями. Опасения по поводу инфекционного контроля побуждают больницы и клиники внедрять современные решения для стерилизации. Развитая инфраструктура здравоохранения Великобритании, внедрение передовых технологий стерилизации и особое внимание к безопасности пациентов, как ожидается, продолжат стимулировать рост рынка.

Обзор рынка стерилизации медицинских изделий в Германии

Ожидается, что рынок стерилизации медицинских изделий в Германии будет расти значительными среднегодовыми темпами в течение прогнозируемого периода, чему будет способствовать растущий спрос со стороны больниц, клиник и производителей медицинских изделий. Развитая инфраструктура здравоохранения Германии, мощная индустрия медицинских изделий, акцент на инновациях и строгая нормативно-правовая база способствуют внедрению передовых технологий стерилизации. Интеграция систем стерилизации в рабочие процессы больниц, наряду с предпочтением надежных, экологичных и высокоэффективных решений, становится все более распространенной.

Обзор рынка стерилизации медицинских изделий во Франции

Рынок стерилизации медицинских изделий во Франции демонстрирует устойчивый рост, обусловленный увеличением числа хирургических операций, модернизацией инфраструктуры больниц и ужесточением санитарно-гигиенических норм. Медицинские учреждения внедряют передовые технологии стерилизации, чтобы обеспечить соответствие национальным и европейским стандартам. Растущее внимание к профилактике инфекций и безопасности пациентов в сочетании с технологическим прогрессом в области стерилизационно-технического оборудования способствует расширению рынка как в больницах, так и на предприятиях по производству медицинских изделий.

Обзор рынка стерилизации медицинских изделий в Польше

Ожидается, что рынок стерилизации медицинских изделий в Польше будет расти значительными среднегодовыми темпами в течение прогнозируемого периода, чему будет способствовать рост инвестиций в инфраструктуру здравоохранения и модернизация больниц. Внедрение передовых решений для стерилизации растёт в связи с ужесточением нормативных требований и ростом числа медицинских процедур. Сектор здравоохранения Польши уделяет всё больше внимания инфекционному контролю и безопасности пациентов, что обуславливает спрос на надёжные и эффективные технологии стерилизации как в клинических, так и в производственных условиях.

Доля европейского рынка стерилизации медицинских изделий

Лидерами европейской отрасли стерилизации медицинских изделий являются, в первую очередь, хорошо зарекомендовавшие себя компании, в том числе:

- Steritech (США)

- BGS Beta-Gamma-Service GmbH & Co. KG (Германия)

- DE LAMA SPA (Италия)

- Andersen Products Ltd (Великобритания)

- Steriflow (Франция)

- Стеримед (Франция)

- SysTec Systemtechnik und Industrieautomation GmbH (Германия)

- Noxilizer, Inc. (США)

- SHP Steriltechnik AG (Германия)

- Группа Матахана (Испания)

- Sterigenics International LLC (США)

- Альвимедика (Турция)

- Getinge AB (Швеция)

- Medisafe International Ltd (Великобритания)

- СТЕРИС (Ирландия)

- Lohmann & Rauscher GmbH & Co. KG (Германия)

- Belimed AG (Швейцария)

- Metall Zug AG (Швейцария)

Каковы последние тенденции на европейском рынке стерилизации медицинских изделий?

- В июне 2025 года Европейская комиссия объявила о принятии регламента, позволяющего медицинским работникам получать инструкции к медицинским изделиям в электронном формате, а не только на бумаге. Этот шаг направлен на дальнейшую цифровизацию систем здравоохранения и сокращение бумажных отходов.

- В июне 2025 года Европейский союз принял решение отстранить китайские компании от большинства государственных тендеров на поставку медицинских изделий стоимостью более пяти миллионов евро. Эта мера является частью Международного инструмента ЕС по закупкам, направленного на обеспечение взаимного доступа к рынку и устранение несбалансированной практики закупок.

- В апреле 2025 года Европейская комиссия ввела обновлённые стандарты стерилизации медицинских изделий, направленные на повышение безопасности и эффективности. Эти изменения направлены на гармонизацию процессов стерилизации в государствах-членах, обеспечивая соответствие медицинских изделий строгим требованиям к стерилизации перед выходом на рынок.

- В марте 2025 года Управление по санитарному надзору за качеством пищевых продуктов и медикаментов США (FDA) одобрило пересмотренный стандарт ANSI/AAMI ST58, включающий информацию о новых технологиях и методах химической стерилизации, включая оксид этилена. Это обновление отражает достижения в методах стерилизации и нормативной практике.

- В январе 2025 года компания SGS, ведущая компания в области инспекций, проверок, испытаний и сертификации, объявила о расширении своих услуг по стерилизации в соответствии с Регламентом ЕС о медицинских изделиях (MDR) 2017/745. Федеральное агентство по лекарственным средствам и изделиям медицинского назначения (FAMHP) одобрило расширение сферы деятельности SGS после проверки уровня обучения, квалификации и компетентности персонала.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Интерактивная панель анализа данных

- Панель анализа компании для возможностей с высоким потенциалом роста

- Доступ аналитика-исследователя для настройки и запросов

- Анализ конкурентов с помощью интерактивной панели

- Последние новости, обновления и анализ тенденций

- Используйте возможности сравнительного анализа для комплексного отслеживания конкурентов

Методология исследования

Сбор данных и анализ базового года выполняются с использованием модулей сбора данных с большими размерами выборки. Этап включает получение рыночной информации или связанных данных из различных источников и стратегий. Он включает изучение и планирование всех данных, полученных из прошлого заранее. Он также охватывает изучение несоответствий информации, наблюдаемых в различных источниках информации. Рыночные данные анализируются и оцениваются с использованием статистических и последовательных моделей рынка. Кроме того, анализ доли рынка и анализ ключевых тенденций являются основными факторами успеха в отчете о рынке. Чтобы узнать больше, пожалуйста, запросите звонок аналитика или оставьте свой запрос.

Ключевой методологией исследования, используемой исследовательской группой DBMR, является триангуляция данных, которая включает в себя интеллектуальный анализ данных, анализ влияния переменных данных на рынок и первичную (отраслевую экспертную) проверку. Модели данных включают сетку позиционирования поставщиков, анализ временной линии рынка, обзор рынка и руководство, сетку позиционирования компании, патентный анализ, анализ цен, анализ доли рынка компании, стандарты измерения, глобальный и региональный анализ и анализ доли поставщика. Чтобы узнать больше о методологии исследования, отправьте запрос, чтобы поговорить с нашими отраслевыми экспертами.

Доступна настройка

Data Bridge Market Research является лидером в области передовых формативных исследований. Мы гордимся тем, что предоставляем нашим существующим и новым клиентам данные и анализ, которые соответствуют и подходят их целям. Отчет можно настроить, включив в него анализ ценовых тенденций целевых брендов, понимание рынка для дополнительных стран (запросите список стран), данные о результатах клинических испытаний, обзор литературы, обновленный анализ рынка и продуктовой базы. Анализ рынка целевых конкурентов можно проанализировать от анализа на основе технологий до стратегий портфеля рынка. Мы можем добавить столько конкурентов, о которых вам нужны данные в нужном вам формате и стиле данных. Наша команда аналитиков также может предоставить вам данные в сырых файлах Excel, сводных таблицах (книга фактов) или помочь вам в создании презентаций из наборов данных, доступных в отчете.