Европейский рынок топливных карт для коммерческого автопарка по типу карты (универсальные топливные карты, фирменные топливные карты, торговые топливные карты), функциям (отчетность по транспортным средствам, соответствие стандарту EMV, токенизация, обновления в реальном времени, мобильные платежи и бескарточные транзакции, другие), типу подписки (зарегистрированная карта, карта на предъявителя), коммунальным услугам (плата за парковку транспортного средства, оплата сбора за топливо, техническое обслуживание автопарка, оплата дорожных сборов, другие), конечным пользователям (автопарки доставки, таксопарки, автопарки по аренде автомобилей, автопарки коммунальных служб, другие), стране (Великобритания, Германия, Франция, Италия, Испания, Россия, Нидерланды, Бельгия, Швейцария, Турция и остальная Европа) Тенденции отрасли и прогноз до 2029 года

Анализ рынка и аналитика: рынок топливных карт для коммерческого автопарка в Европе

Анализ рынка и аналитика: рынок топливных карт для коммерческого автопарка в Европе

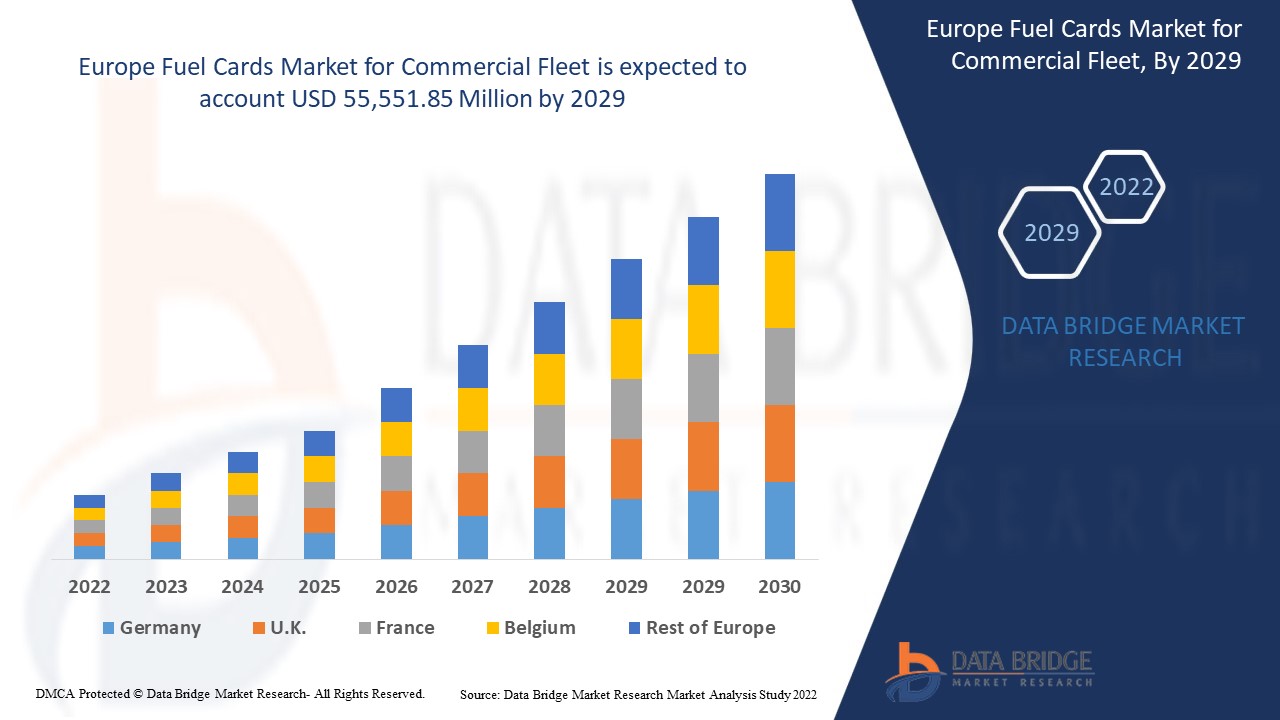

Ожидается, что рынок топливных карт для коммерческого автопарка в Европе будет расти в прогнозируемый период с 2022 по 2029 год. По данным Data Bridge Market Research, среднегодовой темп роста рынка составит 6,3% в прогнозируемый период с 2022 по 2029 год, и ожидается, что к 2029 году его объем достигнет 55 551,85 млн долларов США. Рост спроса на гаджеты, связанные с автоматизацией умного дома, стимулирует рынок.

Топливная карта — удобный способ оплаты бензина, дизельного топлива и других видов топлива на заправочных станциях. Вместо того чтобы платить наличными, кредитной картой или чеком, водитель передает топливную карту. Они предоставляют различные преимущества поставщикам автопарков, собирая низкоуровневые данные о пробеге транспортных средств, галлонах заправленного топлива и необходимости обслуживания транспортного средства. Кроме того, их поставщики услуг начали встраивать телематический интерфейс и надежные средства отчетности в качестве стандартных продуктовых предложений для повышения производительности управления автопарком. Более того, рост предпочтения в отношении оцифровки платежей и влияние Интернета вещей (IoT) значительно дополняют рост рынка топливных карт.

Растущий спрос на мониторинг покупки транспортного средства и экономии топлива является основным движущим фактором на рынке. Растущее использование скиммеров для сокрытия покупок с целью кражи топлива может оказаться проблемой, однако наличие выгодных скидок по топливным картам оказывается возможностью. Более высокая процентная ставка по карте на покупку топлива может стать сдерживающим фактором для принятия внешних жалюзи.

Отчет о рынке топливных карт для коммерческого автопарка содержит подробную информацию о доле рынка, новых разработках и анализе продуктового портфеля, влиянии внутренних и локальных игроков рынка, анализирует возможности с точки зрения новых источников дохода, изменений в рыночных правилах, одобрений продуктов, стратегических решений, запусков продуктов, географических расширений и технологических инноваций на рынке. Чтобы понять анализ и сценарий рынка топливных карт для коммерческого автопарка, свяжитесь с Data Bridge Market Research для получения аналитического обзора, наша команда поможет вам создать решение по влиянию на доход для достижения желаемой цели.

Европейский рынок топливных карт для коммерческого автопарка: масштаб и размер рынка

Европейский рынок топливных карт для коммерческого автопарка: масштаб и размер рынка

Европейский рынок топливных карт для коммерческого автопарка сегментирован на пять основных сегментов: тип карты, функции, тип подписки, полезность и конечный пользователь.

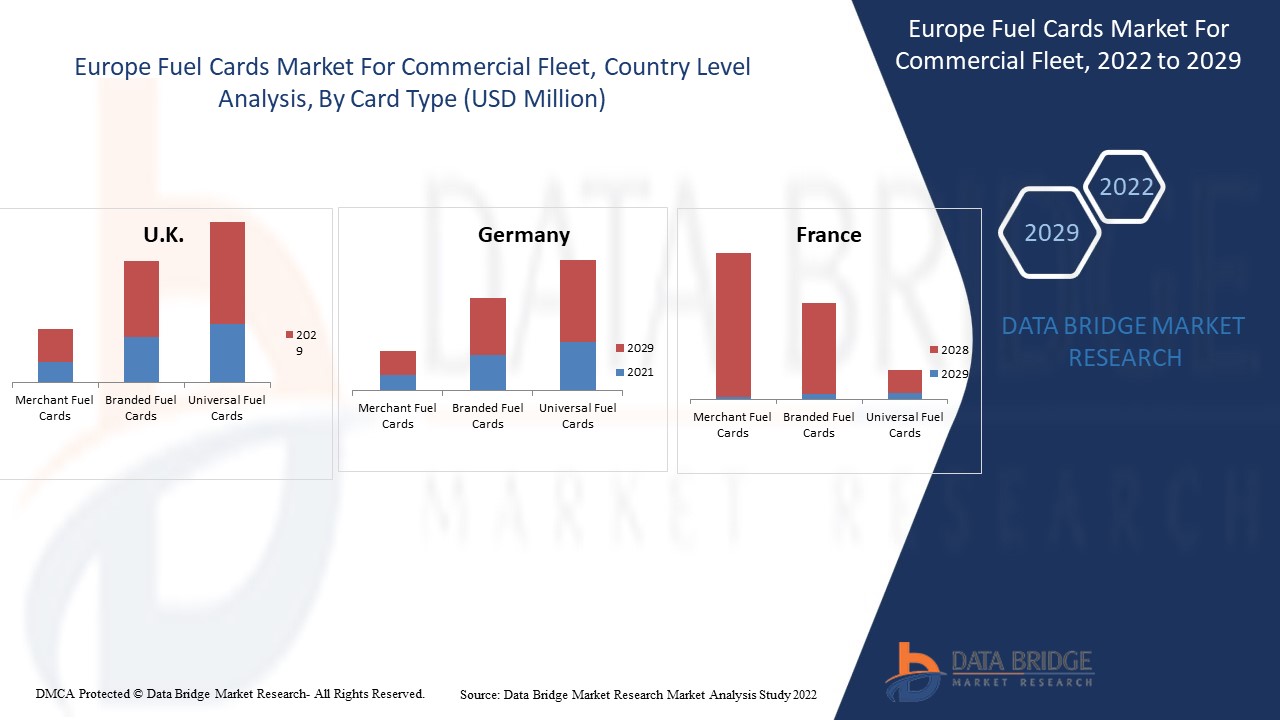

- На основе типа карты рынок топливных карт Европы для коммерческого автопарка сегментируется на универсальные топливные карты, фирменные карты и торговые карты. В 2022 году универсальные топливные карты занимают самый высокий сегмент, поскольку они предлагают гибкость, контроль и удобство для всех потребностей бизнеса в закупках, тем самым обеспечивая более жесткий контроль расходов бизнеса.

- На основе характеристик рынок топливных карт для коммерческого автопарка в Европе сегментируется на отчетность по транспортным средствам, соответствие EMV, токенизацию, обновления в реальном времени, мобильные платежи и транзакции без карт и т. д. В 2022 году мобильные платежи и транзакции без карт будут занимать самый высокий сегмент, поскольку они предлагают дополнительный уровень безопасности для всех типов бизнеса.

- На основе типа подписки рынок топливных карт для коммерческого автопарка в Европе сегментируется на именные карты и карты на предъявителя. В 2022 году именная карта занимает самый высокий сегмент, поскольку она помогает владельцам бизнеса отслеживать все расходы и предлагает большую гибкость в мониторинге транспортных средств.

- На основе полезности рынок топливных карт для коммерческого автопарка в Европе сегментируется на плату за парковку транспортных средств, оплату сбора за масло, обслуживание автопарка, оплату дорожных сборов и т. д. В 2022 году оплата сбора за масло занимает самый высокий сегмент, поскольку применение топливных карт больше на АЗС и автозаправочных станциях, а пользователи получают ряд преимуществ, таких как кэшбэки, бонусные баллы и т. д.

- На основе конечного пользователя рынок топливных карт для коммерческого автопарка в Европе сегментирован на автопарки доставки, автопарки аренды автомобилей, автопарки коммунальных служб, таксопарки и т. д. В 2022 году автопарки доставки займут самый высокий сегмент, поскольку они помогают улучшить обслуживание клиентов с помощью телематического интерфейса для надлежащего управления автопарком.

Анализ рынка топливных карт в Европе для коммерческого автопарка на уровне страны

Анализ рынка топливных карт в Европе для коммерческого автопарка на уровне страны

Проведен анализ рынка топливных карт для коммерческого автопарка, а также предоставлена информация о размере рынка по стране, типу карты, функциям, типу подписки, коммунальному обслуживанию и конечному пользователю, как указано выше.

В отчете о рынке топливных карт для коммерческого автопарка в Европе рассматриваются следующие страны: Германия, Франция, Италия, Великобритания, Испания, Россия, Нидерланды, Швейцария, Бельгия, Турция и остальные страны Европы.

Великобритания доминирует на рынке благодаря прогрессу в исследованиях и разработках, связанных с качеством и дизайном внешних жалюзи. Германия находится на втором месте из-за растущего спроса на энергоэффективные дома в стране. Франция находится на третьем месте из-за растущей осведомленности о защите от вредных ультрафиолетовых лучей в жилых и коммерческих помещениях.

Раздел отчета по странам также содержит отдельные факторы, влияющие на рынок, и изменения в регулировании на внутреннем рынке, которые влияют на текущие и будущие тенденции рынка. Такие данные, как новые продажи, заменяющие продажи, демографические данные страны, нормативные акты и импортно-экспортные тарифы, являются одними из основных указателей, используемых для прогнозирования рыночного сценария для отдельных стран. Кроме того, при предоставлении прогнозного анализа данных по странам учитываются наличие и доступность европейских брендов и их проблемы из-за большой или малой конкуренции со стороны местных и отечественных брендов, влияние каналов продаж.

Растущая тенденция к цифровому банкингу стимулирует рост европейского рынка топливных карт для коммерческого автопарка.

Рынок топливных карт Европы для коммерческого флота также предоставляет вам подробный анализ рынка для роста каждой страны на определенном рынке. Кроме того, он предоставляет подробную информацию о стратегии участников рынка и их географическом присутствии. Данные доступны за исторический период с 2012 по 2020 год.

Конкурентная среда и анализ доли европейского рынка топливных карт для коммерческого автопарка

Рынок топливных карт для коммерческого автопарка конкурентный ландшафт предоставляет детали по конкурентам. Подробности включают обзор компании, финансовые показатели компании, полученный доход, рыночный потенциал, инвестиции в исследования и разработки, новые рыночные инициативы, производственные площадки и объекты, сильные и слабые стороны компании, запуск продукта, испытания продуктов конвейеров, одобрения продуктов, патенты, ширина продукта и широта, доминирование приложений, кривая жизненной линии технологий. Приведенные выше точки данных связаны только с фокусом компании, связанным с рынком топливных карт для коммерческого автопарка.

Среди основных игроков, работающих на европейском рынке топливных карт для коммерческого автопарка, можно назвать Exxon Mobil Corporation, Shell, UK Fuels Limited, WAG payment solutions, as, bp plc, DKV EURO SERVICE Gmbh + Co. KG, Wex Europe Services, UTA (компания Edenred), OMV Aktiengesellschaft и TotalEnergies и другие.

Многие разработки, контракты, соглашения и расширения также инициируются компаниями по всему миру, что также ускоряет развитие рынка топливных карт для коммерческого автопарка.

Например,

- В июле 2021 года компания UK Fuels Limited расширила свой бизнес, увеличив свою сеть до более чем 3500 заправочных станций. Это расширение помогло компании увеличить клиентскую базу, заняв 97% европейского рынка, что привело к росту выручки и прибыли компании.

- В сентябре 2021 года WAG payment solutions, as расширила свой бизнес в Германии. Это расширение поможет клиентам компании использовать свои карты Eurowag на заправочных станциях TANKPOOL24 по всей Германии. Это поможет компании включить новых коммерческих клиентов в свой клиентский портфель, а также поможет диверсифицировать продуктовый портфель компании

Сотрудничество, запуск продукции, расширение бизнеса, награды и признание, совместные предприятия и другие стратегии участников рынка расширяют присутствие компании на рынке топливных карт для коммерческого автопарка, что также обеспечивает выгоду для роста прибыли организации.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Интерактивная панель анализа данных

- Панель анализа компании для возможностей с высоким потенциалом роста

- Доступ аналитика-исследователя для настройки и запросов

- Анализ конкурентов с помощью интерактивной панели

- Последние новости, обновления и анализ тенденций

- Используйте возможности сравнительного анализа для комплексного отслеживания конкурентов

Содержание

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF EUROPE FUEL CARDS FOR COMMERCIAL FLEET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MULTIVARIATE MODELING

2.9 CARD TYPE TIMELINE CURVE

2.1 MARKET UTILITY COVERAGE GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 CASE STUDIES

4.1.1 INTEGRAL

4.1.1.1 IDENTIFYING THE PROBLEM

4.1.1.2 SOLUTION

4.1.2 TOTAL PRODUCE

4.1.2.1 IDENTIFYING THE PROBLEM

4.1.2.2 SOLUTION

4.2 REGULATORY FRAMEWORK

4.2.1 PSD (PAYMENT SERVICE DIRECTIVE)

4.2.2 DIRECTIVE (EU) 2015/2366

4.3 TECHNOLOGICAL TRENDS

4.3.1 MOBILE & CONNECTED PAYMENTS

4.3.2 TELEMATICS INTERFACE

4.3.3 HOST CARD EMULATION

4.4 PRICING ANALYSIS

4.5 SUPPLY CHAIN ANALYSIS

4.6 TOP FLEET LEASING COMPANIES IN EUROPE

4.6.1 TOTAL COST OF OWNERSHIP (TCO) FOR A HEAVY DUTY FLEET

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 INCREASE IN DEMAND OF MONITORING VEHICLE PURCHASE & FUEL ECONOMY

5.1.2 THE GROWTH IN INCLINATION TOWARDS THE DIGITAL BANKING

5.1.3 INCREASE IN DEMAND FOR SECURE CASHLESS FUEL TRANSACTIONS ACROSS THE REGION

5.2 RESTRAINTS

5.2.1 HIGHER FUEL SURCHARGE (FSC) FEE BY A CARRIER

5.2.2 FUEL CARD ACCOUNTS CAN ONLY BE SET UP FOR BUSINESSES PURPOSES

5.3 OPPORTUNITIES

5.3.1 RISING IN THE STRATEGIC ACQUISITIONS AND PARTNERSHIPS AMONG VARIOUS ORGANIZATIONS

5.3.2 AVAILABILITY OF LUCRATIVE DISCOUNTS OVER THE FUEL CARDS

5.3.3 EFFICIENT FLEET ADMINISTRATION WITH THE HELP OF ENHANCED DATA CAPTURE

5.4 CHALLENGES

5.4.1 RISE IN NUMBER OF SKIMMERS TO DISGUISE PURCHASES TO STEAL FUEL

5.4.2 INCREASE IN CONCERN OF THE SECURITY ISSUES WITH THE FUEL CARD PAYMENT

6 ANALYSIS ON IMPACT OF COVID 19 ON THE EUROPE FUEL CARDS MARKET FOR COMMERCIAL FLEET

6.1 AFTERMATH OF THE EUROPE FUEL CARD MARKET FOR COMMERCIAL FLEET

6.2 STRATEGIC DECISIONS FOR MANUFACTURERS AFTER COVID-19 TO GAIN COMPETITIVE MARKET SHARE

6.3 IMPACT ON PRICE

6.4 IMPACT ON DEMAND

6.5 IMPACT ON SUPPLY CHAIN

6.6 CONCLUSION

7 EUROPE FUEL CARD MARKET FOR COMMERCIAL FLEET, BY CARD TYPE

7.1 OVERVIEW

7.2 UNIVERSAL FUEL CARDS

7.2.1 FUEL CREDIT CARDS

7.2.2 OVER THE ROAD FUEL CARD

7.2.3 NETWORK CARDS

7.3 BRANDED FUEL CARDS

7.4 MERCHANT FUEL CARDS

8 EUROPE FUEL CARD MARKET FOR COMMERCIAL FLEET, BY FEATURES

8.1 OVERVIEW

8.2 MOBILE PAYMENT & CARDLESS TRANSACTIONS

8.3 VEHICLE REPORTING

8.4 REAL TIME UPDATES

8.5 EMV COMPLIANT

8.6 TOKENIZATION

8.7 OTHERS

9 EUROPE FUEL CARD MARKET FOR COMMERCIAL FLEET, BY SUBSCRIPTION TYPE

9.1 OVERVIEW

9.2 REGISTERED CARD

9.3 BEARER CARD

10 EUROPE FUEL CARD MARKET FOR COMMERCIAL FLEET, BY UTILITY

10.1 OVERVIEW

10.2 OIL FEE PAYMENT

10.3 FLEET MAINTENANCE

10.4 VEHICLE PARKING FEES

10.5 TOLL FEE PAYMENT

10.6 OTHERS

11 EUROPE FUEL CARD MARKET FOR COMMERCIAL FLEET, BY END-USER

11.1 OVERVIEW

11.2 DELIVERY FLEETS

11.2.1 MEDIUM/HEAVY DUTY FLEET

11.2.2 LIGHT DUTY FLEET

11.2.3 UNIVERSAL FUEL CARDS

11.2.4 BRANDED FUEL CARDS

11.2.5 MERCHANT FUEL CARDS

11.3 TAXI CAB FLEETS

11.3.1 UNIVERSAL FUEL CARDS

11.3.2 BRANDED FUEL CARDS

11.3.3 MERCHANT FUEL CARDS

11.4 CAR RENTAL FLEETS

11.4.1 UNIVERSAL FUEL CARDS

11.4.2 BRANDED FUEL CARDS

11.4.3 MERCHANT FUEL CARDS

11.5 PUBLIC UTILITY FLEETS

11.5.1 UNIVERSAL FUEL CARDS

11.5.2 BRANDED FUEL CARDS

11.5.3 MERCHANT FUEL CARDS

11.6 OTHERS

11.6.1 UNIVERSAL FUEL CARDS

11.6.2 BRANDED FUEL CARDS

11.6.3 MERCHANT FUEL CARDS

12 EUROPE FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY COUNTRY

12.1 EUROPE

12.1.1 U.K.

12.1.2 GERMANY

12.1.3 FRANCE

12.1.4 ITALY

12.1.5 SPAIN

12.1.6 RUSSIA

12.1.7 NETHERLANDS

12.1.8 BELGIUM

12.1.9 SWITZERLAND

12.1.10 TURKEY

12.1.11 REST OF EUROPE

13 EUROPE FUEL CARDS MARKET FOR COMMERCIAL FLEET, COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: EUROPE

14 COMPANY PROFILE

14.1 BP P.L.C.

14.1.1 COMPANY SNAPSHOT

14.1.2 REVENUE ANALYSIS

14.1.3 SWOT ANALYSIS

14.1.4 PRODUCT PORTFOLIO

14.1.5 RECENT DEVELOPMENTS

14.1.6 DBMR ANALYSIS

14.2 OMV AKTIENGESELLSCHAFT

14.2.1 COMPANY SNAPSHOT

14.2.2 REVENUE ANALYSIS

14.2.3 SWOT ANALYSIS

14.2.4 PRODUCT PORTFOLIO

14.2.5 RECENT DEVELOPMENTS

14.2.6 DBMR ANALYSIS

14.3 EXXON MOBIL CORPORATION

14.3.1 COMPANY SNAPSHOT

14.3.2 REVENUE ANALYSIS

14.3.3 SWOT ANALYSIS

14.3.4 PRODUCT PORTFOLIO

14.3.5 RECENT DEVELOPMENTS

14.3.6 DBMR ANALYSIS

14.4 VALERO MARKETING AND SUPPLY COMPANY

14.4.1 COMPANY SNAPSHOT

14.4.2 REVENUE ANALYSIS

14.4.3 SWOT ANALYSIS

14.4.4 PRODUCT PORTFOLIO

14.4.5 RECENT DEVELOPMENTS

14.4.6 DBMR ANALYSIS

14.5 UK FUELS LIMITED

14.5.1 COMPANY SNAPSHOT

14.5.2 SWOT ANALYSIS

14.5.3 PRODUCT PORTFOLIO

14.5.4 RECENT DEVELOPMENTS

14.5.5 DBMR ANALYSIS

14.6 DKV EURO SERVICE GMBH + CO. KG

14.6.1 COMPANY SNAPSHOT

14.6.2 PRODUCT PORTFOLIO

14.6.3 RECENT DEVELOPMENTS

14.7 MORGAN FUELS

14.7.1 COMPANY SNAPSHOT

14.7.2 PRODUCT PORTFOLIO

14.7.3 RECENT DEVELOPMENTS

14.8 TOTALENERGIES

14.8.1 COMPANY SNAPSHOT

14.8.2 REVENUE ANALYSIS

14.8.3 PRODUCT PORTFOLIO

14.8.4 RECENT DEVELOPMENTS

14.9 SHELL

14.9.1 COMPANY SNAPSHOT

14.9.2 REVENUE ANALYSIS

14.9.3 PRODUCT PORTFOLIO

14.9.4 RECENT DEVELOPMENTS

14.1 UTA (AN EDENRED COMPANY)

14.10.1 COMPANY SNAPSHOT

14.10.2 REVENUE ANALYSIS

14.10.3 PRODUCT PORTFOLIO

14.10.4 RECENT DEVELOPMENTS

14.11 W.A.G. PAYMENT SOLUTIONS, A.S.

14.11.1 COMPANY SNAPSHOT

14.11.2 REVENUE ANALYSIS

14.11.3 PRODUCT PORTFOLIO

14.11.4 RECENT DEVELOPMENTS

14.12 WEX EUROPE SERVICES

14.12.1 COMPANY SNAPSHOT

14.12.2 PRODUCT PORTFOLIO

14.12.3 RECENT DEVELOPMENTS

15 QUESTIONNAIRE

16 RELATED REPORTS

Список таблиц

TABLE 1 LIST OF TOP LEASING COMPANIES AND THE FUEL CARDS USED BY THEM

TABLE 2 EUROPE FUEL CARD MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (USD MILLION)

TABLE 3 EUROPE UNIVERSAL FUEL CARDS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (USD MILLION)

TABLE 4 EUROPE FUEL CARD MARKET FOR COMMERCIAL FLEET, BY FEATURES, 2020-2029 (USD MILLION)

TABLE 5 EUROPE FUEL CARD MARKET FOR COMMERCIAL FLEET, BY SUBSCRIPTION TYPE, 2020-2029 (USD MILLION)

TABLE 6 EUROPE FUEL CARD MARKET FOR COMMERCIAL FLEET, BY UTILITY, 2020-2029 (USD MILLION)

TABLE 7 EUROPE FUEL CARD MARKET FOR COMMERCIAL FLEET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 8 EUROPE DELIVERY FLEETS IN FUEL CARD MARKET FOR COMMERCIAL FLEET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 9 EUROPE DELIVERY FLEETS IN FUEL CARD MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (USD MILLION)

TABLE 10 EUROPE TAXI CAB FLEETS IN FUEL CARD MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (USD MILLION)

TABLE 11 EUROPE CAR RENTAL FLEETS IN FUEL CARD MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (USD MILLION)

TABLE 12 EUROPE PUBLIC UTILITY FLEETS IN FUEL CARD MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (USD MILLION)

TABLE 13 EUROPE OTHERS IN FUEL CARD MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (USD MILLION)

TABLE 14 EUROPE FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 15 EUROPE FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY COUNTRY, 2020-2029 (THOUSAND UNITS)

TABLE 16 EUROPE FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (USD MILLION)

TABLE 17 EUROPE FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 18 EUROPE UNIVERSAL FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (USD MILLION)

TABLE 19 EUROPE UNIVERSAL FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 20 EUROPE FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY FEATURES, 2020-2029 (USD MILLION)

TABLE 21 EUROPE FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY SUBSCRIPTION TYPE, 2020-2029 (USD MILLION)

TABLE 22 EUROPE FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY SUBSCRIPTION TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 23 EUROPE FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY UTILITY, 2020-2029 (USD MILLION)

TABLE 24 EUROPE FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 25 EUROPE FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY END-USER, 2020-2029 (THOUSAND UNITS)

TABLE 26 EUROPE DELIVERY FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 27 EUROPE DELIVERY FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY VEHICLE TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 28 EUROPE DELIVERY FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (USD MILLION)

TABLE 29 EUROPE DELIVERY FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 30 EUROPE TAXI CAB FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (USD MILLION)

TABLE 31 EUROPE TAXI CAB FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 32 EUROPE CAR RENTAL IN FLEETS FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (USD MILLION)

TABLE 33 EUROPE CAR RENTAL IN FLEETS FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 34 EUROPE PUBLIC UTILITY FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (USD MILLION)

TABLE 35 EUROPE PUBLIC UTILITY FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 36 EUROPE OTHERS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (USD MILLION)

TABLE 37 EUROPE OTHERS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 38 U.K. FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (USD MILLION)

TABLE 39 U.K. FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 40 U.K. UNIVERSAL FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (USD MILLION)

TABLE 41 U.K. UNIVERSAL FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 42 U.K. FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY FEATURES, 2020-2029 (USD MILLION)

TABLE 43 U.K. FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY SUBSCRIPTION TYPE, 2020-2029 (USD MILLION)

TABLE 44 U.K. FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY SUBSCRIPTION TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 45 U.K. FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY UTILITY, 2020-2029 (USD MILLION)

TABLE 46 U.K. FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 47 U.K. FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY END-USER, 2020-2029 (THOUSAND UNITS)

TABLE 48 U.K. DELIVERY FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 49 U.K. DELIVERY FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY VEHICLE TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 50 U.K. DELIVERY FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 51 U.K. DELIVERY FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 52 U.K. TAXI CAB FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (USD MILLION)

TABLE 53 U.K. TAXI CAB FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 54 U.K. CAR RENTAL IN FLEETS FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (USD MILLION)

TABLE 55 U.K. CAR RENTAL IN FLEETS FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 56 U.K. PUBLIC UTILITY FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (USD MILLION)

TABLE 57 U.K. PUBLIC UTILITY FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 58 U.K. OTHERS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (USD MILLION)

TABLE 59 U.K. OTHERS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 60 GERMANY FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (USD MILLION)

TABLE 61 GERMANY FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 62 GERMANY UNIVERSAL FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (USD MILLION)

TABLE 63 GERMANY UNIVERSAL FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 64 GERMANY FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY FEATURES, 2020-2029 (USD MILLION)

TABLE 65 GERMANY FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY SUBSCRIPTION TYPE, 2020-2029 (USD MILLION)

TABLE 66 GERMANY FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY SUBSCRIPTION TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 67 GERMANY FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY UTILITY, 2020-2029 (USD MILLION)

TABLE 68 GERMANY FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 69 GERMANY FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY END-USER, 2020-2029 (THOUSAND UNITS)

TABLE 70 GERMANY DELIVERY FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 71 GERMANY DELIVERY FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY VEHICLE TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 72 GERMANY DELIVERY FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 73 GERMANY DELIVERY FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 74 GERMANY TAXI CAB FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (USD MILLION)

TABLE 75 GERMANY TAXI CAB FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 76 GERMANY CAR RENTAL IN FLEETS FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (USD MILLION)

TABLE 77 GERMANY CAR RENTAL IN FLEETS FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 78 GERMANY PUBLIC UTILITY FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (USD MILLION)

TABLE 79 GERMANY PUBLIC UTILITY FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 80 GERMANY OTHERS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (USD MILLION)

TABLE 81 GERMANY OTHERS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 82 FRANCE FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (USD MILLION)

TABLE 83 FRANCE FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 84 FRANCE UNIVERSAL FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (USD MILLION)

TABLE 85 FRANCE UNIVERSAL FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 86 FRANCE FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY FEATURES, 2020-2029 (USD MILLION)

TABLE 87 FRANCE FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY SUBSCRIPTION TYPE, 2020-2029 (USD MILLION)

TABLE 88 FRANCE FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY SUBSCRIPTION TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 89 FRANCE FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY UTILITY, 2020-2029 (USD MILLION)

TABLE 90 FRANCE FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 91 FRANCE FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY END-USER, 2020-2029 (THOUSAND UNITS)

TABLE 92 FRANCE DELIVERY FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 93 FRANCE DELIVERY FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY VEHICLE TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 94 FRANCE DELIVERY FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 95 FRANCE DELIVERY FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 96 FRANCE TAXI CAB FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (USD MILLION)

TABLE 97 FRANCE TAXI CAB FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 98 FRANCE CAR RENTAL IN FLEETS FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (USD MILLION)

TABLE 99 FRANCE CAR RENTAL IN FLEETS FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 100 FRANCE PUBLIC UTILITY FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (USD MILLION)

TABLE 101 FRANCE PUBLIC UTILITY FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 102 FRANCE OTHERS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (USD MILLION)

TABLE 103 FRANCE OTHERS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 104 ITALY FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (USD MILLION)

TABLE 105 ITALY FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 106 ITALY UNIVERSAL FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (USD MILLION)

TABLE 107 ITALY UNIVERSAL FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 108 ITALY FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY FEATURES, 2020-2029 (USD MILLION)

TABLE 109 ITALY FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY SUBSCRIPTION TYPE, 2020-2029 (USD MILLION)

TABLE 110 ITALY FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY SUBSCRIPTION TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 111 ITALY FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY UTILITY, 2020-2029 (USD MILLION)

TABLE 112 TALY FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 113 ITALY FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY END-USER, 2020-2029 (THOUSAND UNITS)

TABLE 114 ITALY DELIVERY FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 115 ITALY DELIVERY FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY VEHICLE TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 116 ITALY DELIVERY FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 117 ITALY DELIVERY FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 118 ITALY TAXI CAB FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (USD MILLION)

TABLE 119 ITALY TAXI CAB FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 120 ITALY CAR RENTAL IN FLEETS FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (USD MILLION)

TABLE 121 ITALY CAR RENTAL IN FLEETS FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 122 ITALY PUBLIC UTILITY FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (USD MILLION)

TABLE 123 ITALY PUBLIC UTILITY FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 124 ITALY OTHERS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (USD MILLION)

TABLE 125 ITALY OTHERS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 126 SPAIN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (USD MILLION)

TABLE 127 SPAIN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 128 SPAIN UNIVERSAL FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (USD MILLION)

TABLE 129 SPAIN UNIVERSAL FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 130 SPAIN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY FEATURES, 2020-2029 (USD MILLION)

TABLE 131 SPAIN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY SUBSCRIPTION TYPE, 2020-2029 (USD MILLION)

TABLE 132 SPAIN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY SUBSCRIPTION TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 133 SPAIN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY UTILITY, 2020-2029 (USD MILLION)

TABLE 134 SPAIN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 135 SPAIN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY END-USER, 2020-2029 (THOUSAND UNITS)

TABLE 136 SPAIN DELIVERY FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 137 SPAIN DELIVERY FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY VEHICLE TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 138 SPAIN DELIVERY FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 139 SPAIN DELIVERY FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 140 SPAIN TAXI CAB FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (USD MILLION)

TABLE 141 SPAIN TAXI CAB FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 142 SPAIN CAR RENTAL IN FLEETS FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (USD MILLION)

TABLE 143 SPAIN CAR RENTAL IN FLEETS FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 144 SPAIN PUBLIC UTILITY FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (USD MILLION)

TABLE 145 SPAIN PUBLIC UTILITY FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 146 SPAIN OTHERS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (USD MILLION)

TABLE 147 SPAIN OTHERS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 148 RUSSIA FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (USD MILLION)

TABLE 149 RUSSIA FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 150 RUSSIA UNIVERSAL FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (USD MILLION)

TABLE 151 RUSSIA UNIVERSAL FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 152 RUSSIA FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY FEATURES, 2020-2029 (USD MILLION)

TABLE 153 RUSSIA FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY SUBSCRIPTION TYPE, 2020-2029 (USD MILLION)

TABLE 154 RUSSIA FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY SUBSCRIPTION TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 155 RUSSIA FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY UTILITY, 2020-2029 (USD MILLION)

TABLE 156 RUSSIA FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 157 RUSSIA FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY END-USER, 2020-2029 (THOUSAND UNITS)

TABLE 158 RUSSIA DELIVERY FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 159 RUSSIA DELIVERY FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY VEHICLE TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 160 RUSSIA DELIVERY FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 161 RUSSIA DELIVERY FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 162 RUSSIA TAXI CAB FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (USD MILLION)

TABLE 163 RUSSIA TAXI CAB FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 164 RUSSIA CAR RENTAL IN FLEETS FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (USD MILLION)

TABLE 165 RUSSIA CAR RENTAL IN FLEETS FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 166 RUSSIA PUBLIC UTILITY FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (USD MILLION)

TABLE 167 RUSSIA PUBLIC UTILITY FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 168 RUSSIA OTHERS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (USD MILLION)

TABLE 169 RUSSIA OTHERS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 170 NETHERLANDS FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (USD MILLION)

TABLE 171 NETHERLANDS FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 172 NETHERLANDS UNIVERSAL FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (USD MILLION)

TABLE 173 NETHERLANDS UNIVERSAL FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 174 NETHERLANDS FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY FEATURES, 2020-2029 (USD MILLION)

TABLE 175 NETHERLANDS FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY SUBSCRIPTION TYPE, 2020-2029 (USD MILLION)

TABLE 176 NETHERLANDS FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY SUBSCRIPTION TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 177 NETHERLANDS FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY UTILITY, 2020-2029 (USD MILLION)

TABLE 178 NETHERLANDS FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 179 NETHERLANDS FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY END-USER, 2020-2029 (THOUSAND UNITS)

TABLE 180 NETHERLANDS DELIVERY FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 181 NETHERLANDS DELIVERY FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY VEHICLE TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 182 NETHERLANDS DELIVERY FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 183 NETHERLANDS DELIVERY FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 184 NETHERLANDS TAXI CAB FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (USD MILLION)

TABLE 185 NETHERLANDS TAXI CAB FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 186 NETHERLANDS CAR RENTAL IN FLEETS FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (USD MILLION)

TABLE 187 NETHERLANDS CAR RENTAL IN FLEETS FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 188 NETHERLANDS PUBLIC UTILITY FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (USD MILLION)

TABLE 189 NETHERLANDS PUBLIC UTILITY FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 190 NETHERLANDS OTHERS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (USD MILLION)

TABLE 191 NETHERLANDS OTHERS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 192 BELGIUM FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (USD MILLION)

TABLE 193 BELGIUM FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 194 BELGIUM UNIVERSAL FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (USD MILLION)

TABLE 195 BELGIUM UNIVERSAL FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 196 BELGIUM FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY FEATURES, 2020-2029 (USD MILLION)

TABLE 197 BELGIUM FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY SUBSCRIPTION TYPE, 2020-2029 (USD MILLION)

TABLE 198 BELGIUM FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY SUBSCRIPTION TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 199 BELGIUM FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY UTILITY, 2020-2029 (USD MILLION)

TABLE 200 BELGIUM FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 201 BELGIUM FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY END-USER, 2020-2029 (THOUSAND UNITS)

TABLE 202 BELGIUM DELIVERY FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 203 BELGIUM DELIVERY FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY VEHICLE TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 204 BELGIUM DELIVERY FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 205 BELGIUM DELIVERY FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 206 BELGIUM TAXI CAB FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (USD MILLION)

TABLE 207 BELGIUM TAXI CAB FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 208 BELGIUM CAR RENTAL IN FLEETS FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (USD MILLION)

TABLE 209 BELGIUM CAR RENTAL IN FLEETS FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 210 BELGIUM PUBLIC UTILITY FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (USD MILLION)

TABLE 211 BELGIUM PUBLIC UTILITY FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 212 BELGIUM OTHERS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (USD MILLION)

TABLE 213 BELGIUM OTHERS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 214 SWITZERLAND FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (USD MILLION)

TABLE 215 SWITZERLAND FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 216 SWITZERLAND UNIVERSAL FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (USD MILLION)

TABLE 217 SWITZERLAND UNIVERSAL FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 218 SWITZERLAND FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY FEATURES, 2020-2029 (USD MILLION)

TABLE 219 SWITZERLAND FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY SUBSCRIPTION TYPE, 2020-2029 (USD MILLION)

TABLE 220 SWITZERLAND FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY SUBSCRIPTION TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 221 SWITZERLAND FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY UTILITY, 2020-2029 (USD MILLION)

TABLE 222 SWITZERLAND FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 223 SWITZERLAND FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY END-USER, 2020-2029 (THOUSAND UNITS)

TABLE 224 SWITZERLAND DELIVERY FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 225 SWITZERLAND DELIVERY FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY VEHICLE TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 226 SWITZERLAND DELIVERY FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 227 SWITZERLAND DELIVERY FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 228 SWITZERLAND TAXI CAB FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (USD MILLION)

TABLE 229 SWITZERLAND TAXI CAB FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 230 SWITZERLAND CAR RENTAL IN FLEETS FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (USD MILLION)

TABLE 231 SWITZERLAND CAR RENTAL IN FLEETS FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 232 SWITZERLAND PUBLIC UTILITY FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (USD MILLION)

TABLE 233 SWITZERLAND PUBLIC UTILITY FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 234 SWITZERLAND OTHERS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (USD MILLION)

TABLE 235 SWITZERLAND OTHERS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 236 TURKEY FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (USD MILLION)

TABLE 237 TURKEY FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 238 TURKEY UNIVERSAL FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (USD MILLION)

TABLE 239 TURKEY UNIVERSAL FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 240 TURKEY FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY FEATURES, 2020-2029 (USD MILLION)

TABLE 241 TURKEY FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY SUBSCRIPTION TYPE, 2020-2029 (USD MILLION)

TABLE 242 TURKEY FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY SUBSCRIPTION TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 243 TURKEY FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY UTILITY, 2020-2029 (USD MILLION)

TABLE 244 TURKEY FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 245 TURKEY FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY END-USER, 2020-2029 (THOUSAND UNITS)

TABLE 246 TURKEY DELIVERY FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 247 TURKEY DELIVERY FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY VEHICLE TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 248 TURKEY DELIVERY FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 249 TURKEY DELIVERY FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 250 TURKEY TAXI CAB FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (USD MILLION)

TABLE 251 TURKEY TAXI CAB FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 252 TURKEY CAR RENTAL IN FLEETS FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (USD MILLION)

TABLE 253 TURKEY CAR RENTAL IN FLEETS FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 254 TURKEY PUBLIC UTILITY FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (USD MILLION)

TABLE 255 TURKEY PUBLIC UTILITY FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 256 TURKEY OTHERS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (USD MILLION)

TABLE 257 TURKEY OTHERS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 258 REST OF EUROPE FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (USD MILLION)

Список рисунков

FIGURE 1 EUROPE FUEL CARDS FOR COMMERCIAL FLEET MARKET: SEGMENTATION

FIGURE 2 EUROPE FUEL CARDS MARKET FOR COMMERCIAL FLEET: DATA TRIANGULATION

FIGURE 3 EUROPE FUEL CARDS FOR COMMERCIAL FLEET MARKET: DROC ANALYSIS

FIGURE 4 EUROPE FUEL CARDS MARKET FOR COMMERCIAL FLEET: REGIONAL VS COUNTRY ANALYSIS

FIGURE 5 EUROPE FUEL CARDS MARKET FOR COMMERCIAL FLEET: COMPANY RESEARCH ANALYSIS

FIGURE 6 EUROPE FUEL CARDS MARKET FOR COMMERCIAL FLEET: INTERVIEW DEMOGRAPHICS

FIGURE 7 EUROPE FUEL CARDS MARKET FOR COMMERCIAL FLEET: DBMR MARKET POSITION GRID

FIGURE 8 EUROPE FUEL CARDS MARKET FOR COMMERCIAL FLEET: VENDOR SHARE ANALYSIS

FIGURE 9 EUROPE FUEL CARDS MARKET FOR COMMERCIAL FLEET: SEGMENTATION

FIGURE 10 INCREASING IN DEMAND FOR MONITORING VEHICLE PURCHASE & FUEL ECONOMY IS EXPECTED TO DRIVE EUROPE FUEL CARDS MARKET FOR COMMERCIAL FLEET IN THE FORECAST PERIOD OF 2022 -2029

FIGURE 11 CARD TYPE SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF EUROPE FUEL CARDS MARKET FOR COMMERCIAL FLEET IN 2022 & 2029

FIGURE 12 ANNUAL CHARGES ON FUEL CARDS OFFERED BY VARIOUS COMPANIES

FIGURE 13 AVERAGE COST OF OWNERSHIP FOR HEAVY DUTY FLEET (IN %)

FIGURE 14 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES FOR EUROPE FUEL CARDS MARKET FOR COMMERCIAL FLEET

FIGURE 15 EUROPE FUEL CARD MARKET FOR COMMERCIAL FLEET: BY CARD TYPE, 2021

FIGURE 16 EUROPE FUEL CARD MARKET FOR COMMERCIAL FLEET: BY FEATURES, 2021

FIGURE 17 EUROPE FUEL CARD MARKET FOR COMMERCIAL FLEET: BY SUBSCRIPTION TYPE, 2021

FIGURE 18 EUROPE FUEL CARD MARKET FOR COMMERCIAL FLEET: BY UTILITY, 2021

FIGURE 19 EUROPE FUEL CARD MARKET FOR COMMERCIAL FLEET: BY END-USER, 2021

FIGURE 20 EUROPE FUEL CARDS MARKET FOR COMMERCIAL FLEET: SNAPSHOT (2021)

FIGURE 21 EUROPE FUEL CARDS MARKET FOR COMMERCIAL FLEET: BY COUNTRY (2021)

FIGURE 22 EUROPE FUEL CARDS MARKET FOR COMMERCIAL FLEET: BY COUNTRY (2022 & 2029)

FIGURE 23 EUROPE FUEL CARDS MARKET FOR COMMERCIAL FLEET: BY COUNTRY (2021 & 2029)

FIGURE 24 EUROPE FUEL CARDS MARKET FOR COMMERCIAL FLEET: BY CARD TYPE (2022-2029)

FIGURE 25 EUROPE FUEL CARDS MARKET FOR COMMERCIAL FLEET: COMPANY SHARE 2021 (%)

Методология исследования

Сбор данных и анализ базового года выполняются с использованием модулей сбора данных с большими размерами выборки. Этап включает получение рыночной информации или связанных данных из различных источников и стратегий. Он включает изучение и планирование всех данных, полученных из прошлого заранее. Он также охватывает изучение несоответствий информации, наблюдаемых в различных источниках информации. Рыночные данные анализируются и оцениваются с использованием статистических и последовательных моделей рынка. Кроме того, анализ доли рынка и анализ ключевых тенденций являются основными факторами успеха в отчете о рынке. Чтобы узнать больше, пожалуйста, запросите звонок аналитика или оставьте свой запрос.

Ключевой методологией исследования, используемой исследовательской группой DBMR, является триангуляция данных, которая включает в себя интеллектуальный анализ данных, анализ влияния переменных данных на рынок и первичную (отраслевую экспертную) проверку. Модели данных включают сетку позиционирования поставщиков, анализ временной линии рынка, обзор рынка и руководство, сетку позиционирования компании, патентный анализ, анализ цен, анализ доли рынка компании, стандарты измерения, глобальный и региональный анализ и анализ доли поставщика. Чтобы узнать больше о методологии исследования, отправьте запрос, чтобы поговорить с нашими отраслевыми экспертами.

Доступна настройка

Data Bridge Market Research является лидером в области передовых формативных исследований. Мы гордимся тем, что предоставляем нашим существующим и новым клиентам данные и анализ, которые соответствуют и подходят их целям. Отчет можно настроить, включив в него анализ ценовых тенденций целевых брендов, понимание рынка для дополнительных стран (запросите список стран), данные о результатах клинических испытаний, обзор литературы, обновленный анализ рынка и продуктовой базы. Анализ рынка целевых конкурентов можно проанализировать от анализа на основе технологий до стратегий портфеля рынка. Мы можем добавить столько конкурентов, о которых вам нужны данные в нужном вам формате и стиле данных. Наша команда аналитиков также может предоставить вам данные в сырых файлах Excel, сводных таблицах (книга фактов) или помочь вам в создании презентаций из наборов данных, доступных в отчете.