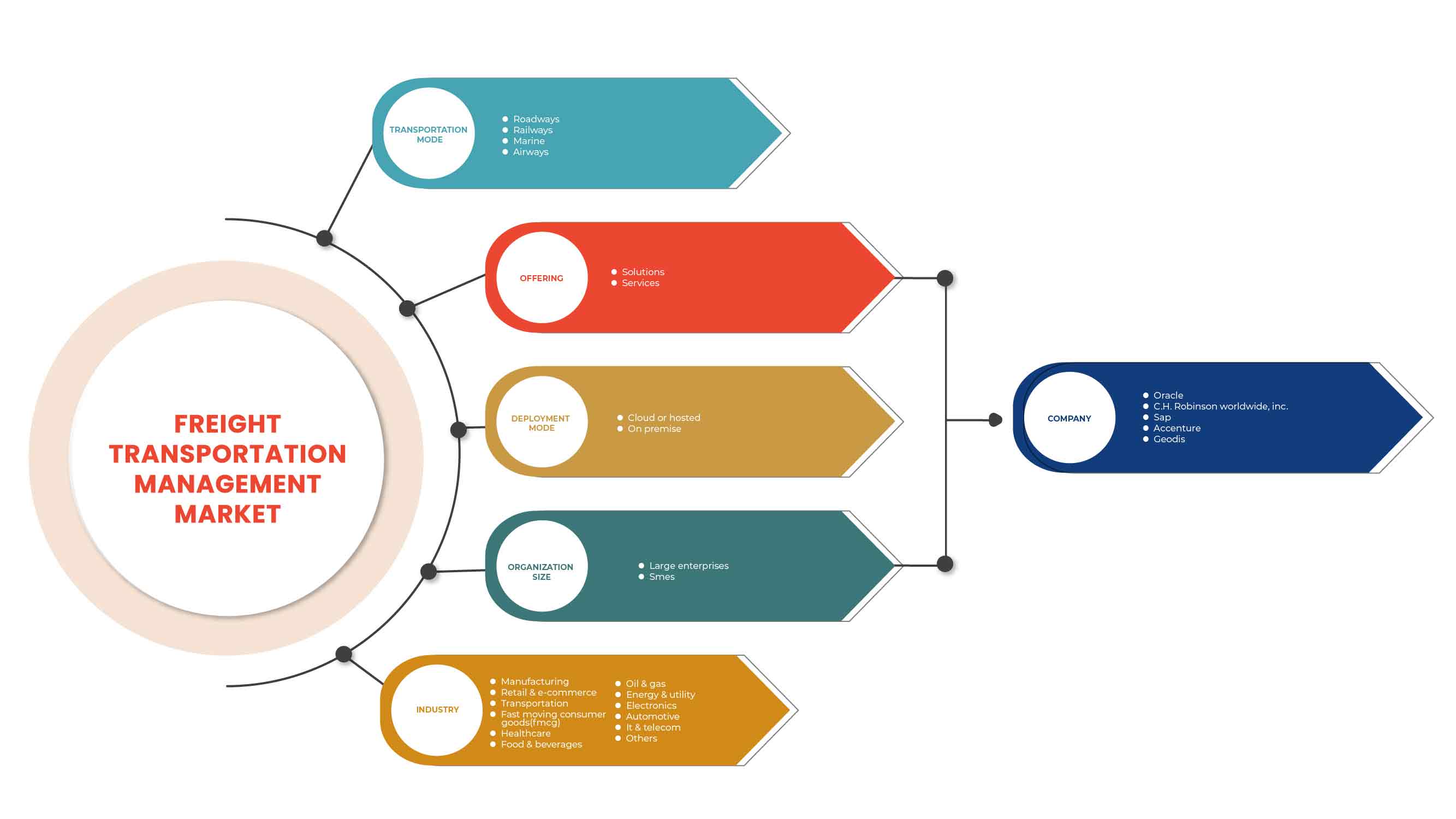

Европейский рынок управления грузовыми перевозками по видам транспорта (автомобильные, железнодорожные, морские и воздушные), предложениям (решения и услуги), способу развертывания (облачные или размещенные и локальные), размеру организации (крупные предприятия и малые и средние предприятия), отраслям (производство, розничная торговля и электронная коммерция, транспорт, товары народного потребления (FMCG), здравоохранение, продукты питания и напитки, нефть и газ, энергетика и коммунальное хозяйство, электроника, автомобилестроение, ИТ и телекоммуникации и другие) — отраслевые тенденции и прогноз до 2029 года.

Анализ и размер рынка управления грузовыми перевозками в Европе

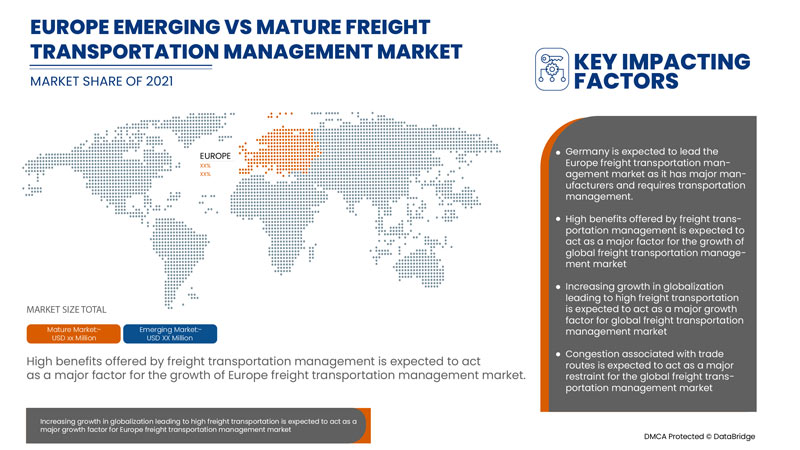

Управление грузовыми перевозками включает в себя формирование различных стратегий для повышения эффективности грузовых перевозок и коммерческой эффективности перевозок. Управление грузовыми перевозками фокусируется на снижении расходов грузоотправителя с учетом социальных издержек, таких как заторы или воздействие загрязнения. Высокие преимущества, предлагаемые управлением грузовыми перевозками, обуславливают рост спроса на решения по управлению грузовыми перевозками на рынке. Глобальный рынок управления грузовыми перевозками быстро растет из-за растущей глобализации, ведущей к высоким грузовым перевозкам. Компании даже запускают новые продукты, чтобы получить большую долю рынка.

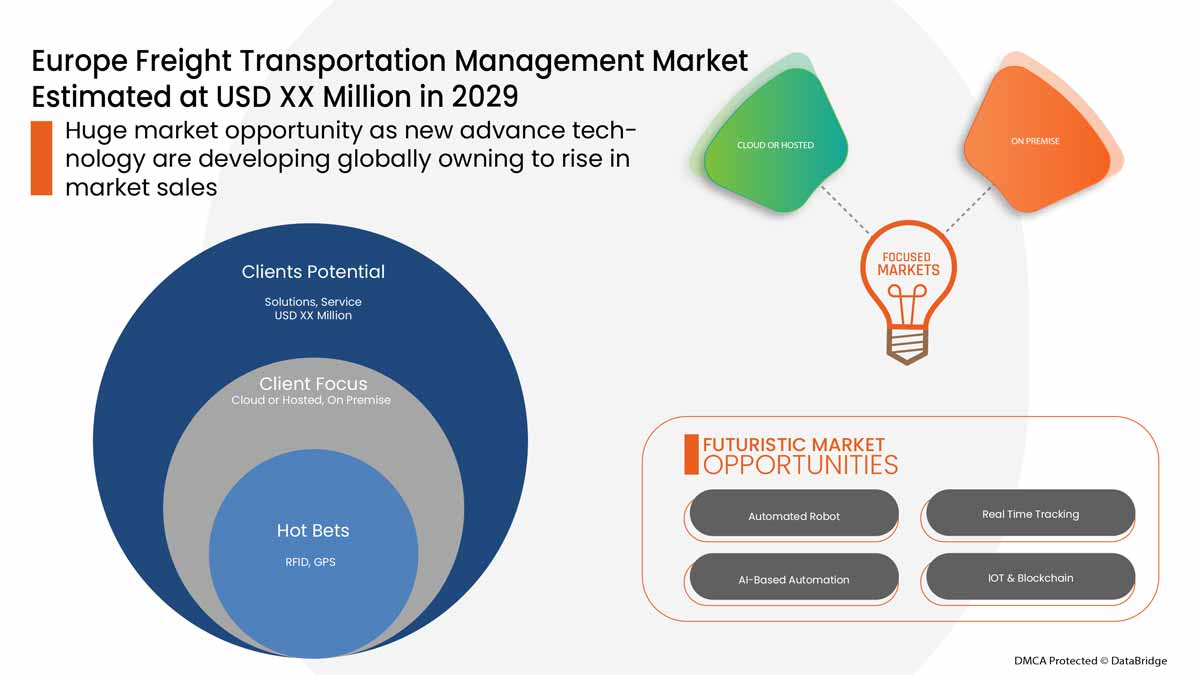

Data Bridge Market Research анализирует, что рынок управления грузовыми перевозками, как ожидается, достигнет значения 14 164,76 млн долларов США к 2029 году при среднегодовом темпе роста 8,6% в прогнозируемый период. «Дороги» составляют наиболее значимый сегмент вида транспорта, поскольку они требуют меньших капиталовложений и могут обеспечить фрагментированное управление «от двери до двери». Отчет о рынке управления грузовыми перевозками также подробно охватывает анализ цен, патентный анализ и технологические достижения.

|

Отчет Метрика |

Подробности |

|

Прогнозируемый период |

2022-2029 |

|

Базовый год |

2021 |

|

Исторические годы |

2020 |

|

Количественные единицы |

Миллион долларов США |

|

Охваченные сегменты |

По способу транспортировки (автомобильные, железнодорожные, морские и воздушные пути), по предложению (решения и услуги), по способу развертывания (облачные или размещенные и локальные), по размеру организации (крупные предприятия и малые и средние предприятия), по отраслям (производство, розничная торговля и электронная коммерция, транспорт, товары народного потребления (FMCG), здравоохранение, продукты питания и напитки, нефть и газ, энергетика и коммунальное хозяйство, электроника, автомобилестроение, ИТ и телекоммуникации и другие) |

|

Страны, охваченные |

Германия, Франция, Италия, Великобритания, Испания, Нидерланды, Швейцария, Бельгия, Россия, Турция, Остальная Европа |

|

Охваченные участники рынка |

CTSI-GLOBAL, GEODIS, THE DECARTES SYSTEMS GROUP INC, Manhattan Associates, Transplace, Softeon, GlobalTranz, Oracle, SAP SE, Accenture, Blue Yonder Group, Inc., E2open, LLC., Trimble Inc., DSV, Werner Enterprises, Supply Chain Solutions, CH Robinson Worldwide, Inc., TRANSPOREON GmbH, MercuryGate и другие |

Определение рынка

Управление грузовыми перевозками включает в себя формирование различных стратегий для повышения эффективности грузовых и коммерческих перевозок. Управление грузовыми перевозками фокусируется на снижении расходов грузоотправителя с учетом социальных издержек, таких как заторы или воздействие загрязнения. Оно помогает грузоотправителям использовать правильный вид транспорта. Например, железнодорожный и водный транспорт являются высокоэффективными для больших расстояний по сравнению с использованием грузовиков для тех же целей. Оно помогает улучшить маршрутизацию и планирование с целью увеличения коэффициентов загрузки и сокращения пробега грузовых транспортных средств. Оно помогает внедрять программы управления автопарком, которые помогают использовать транспортные средства оптимального размера для каждой поездки, сокращать пробег транспортных средств и обеспечивать эксплуатацию и обслуживание автопарка способами, которые сокращают внешние издержки.

Управление грузовыми перевозками используется для различных видов транспорта, таких как автомобильные дороги, железные дороги, морские и воздушные пути. Грузовые перевозки, осуществляемые по пути автомобильных дорог, называются сегментом. Это наиболее распространенный тип вида транспорта, поскольку он требует единой процедуры таможенного оформления. Железнодорожный вид транспорта отличается высокой топливной эффективностью и может быть назван «зеленым» видом транспорта. Морские перевозки используются для перевозки массовых грузов, таких как уголь, сельскохозяйственная продукция, железная руда и влажные насыпные продукты, такие как сырая нефть и газ. Воздушные пути являются самым быстрым видом транспорта и широко используются для пополнения запасов «точно в срок» (JIT).

Динамика рынка управления грузовыми перевозками

В этом разделе рассматривается понимание движущих сил рынка, преимуществ, возможностей, ограничений и проблем. Все это подробно обсуждается ниже:

- Высокие преимущества, предлагаемые управлением грузовыми перевозками

С годами стало крайне необходимо иметь высокоэффективную цепочку поставок. Это требование выполняется управлением грузовыми перевозками. Система управления грузовыми перевозками помогает предприятиям перемещать продукцию из одного пункта назначения в другой экономически эффективным, надежным и действенным способом. Система обеспечивает большую прозрачность и лучший анализ данных, тем самым увеличивая рост мирового рынка управления грузовыми перевозками.

- Растущий спрос на железнодорожные грузовые перевозки

Железнодорожный грузовой транспорт использует железные дороги для перевозки грузов по суше. Он используется для перевозки различных грузов, таких как химикаты, сырьевые строительные материалы, сельскохозяйственная, автомобильная, энергетическая (уголь, нефть и ветряные турбины) и лесная продукция. Железные дороги могут быстро перевозить тяжелые грузы по железным дорогам. Железные дороги являются одним из наиболее часто используемых видов транспорта и имеют огромную застроенную инфраструктуру по всему миру. Растущее использование железных дорог для транспортировки увеличивает рост управления грузовыми перевозками для управления железнодорожными грузовыми перевозками.

- Высокая степень использования управления грузовыми перевозками на дорогах

Рост цифровизации привел к трансформации в различных отраслях и породил электронную коммерцию. Рост электронной коммерции заставил компании сделать свою цепочку поставок высокоэффективной, сократить время транзита и доставлять продукцию клиентам без каких-либо задержек. Это увеличило поток внутренних перевозок по дорогам, и для этого используется большое количество грузовиков. Растущий рост технологий дорог усиливает рост мирового рынка управления грузовыми перевозками.

- Перегруженность торговых путей

По мере роста объемов перевозок и заторов на дорогах и водных путях операторам грузовых перевозок и транспортных услуг становится все сложнее соблюдать надежные графики. Это влияет на цепочки поставок и бизнес, зависящий от грузовиков, каждый из которых имеет растущее значение как для государственного покрытия, так и для частных региональных операторов. Более того, несколько аварий на дорогах или разливов нефти в море могут стать неожиданной проблемой для транспортных систем, что затрудняет управление системой. Недавний COVID-19 также остановил несколько логистических операций, нанеся серьезный ущерб всем операциям цепочки поставок. Эти параметры выступают в качестве основного сдерживающего фактора для роста мирового рынка управления грузовыми перевозками.

- Правительственные ограничения и правила торговли

Международная торговля столкнулась с рядом ограничений и изменений правил из-за торговой войны между США и Китаем и пандемии COVID-19. Трансграничные перевозки становятся ограниченными, а расходы увеличиваются, что не может предвидеть система управления транспортировкой, что приводит к неэффективности цепочки поставок и запасов, тем самым выступая в качестве основного ограничения для мирового рынка управления грузовыми перевозками.

Влияние COVID-19 на рынок управления грузовыми перевозками

COVID-19 оказал серьезное влияние на рынок управления грузовыми перевозками, поскольку почти каждая страна решила закрыть все производственные мощности, за исключением тех, которые занимаются производством товаров первой необходимости. Правительство приняло ряд строгих мер, таких как закрытие производства и продажи неосновных товаров, блокировка международной торговли и многое другое, чтобы предотвратить распространение COVID-19. Единственный бизнес, который работает в этой пандемической ситуации, — это основные услуги, которым разрешено открываться и осуществлять процессы.

Рост рынка управления грузовыми перевозками растет из-за политики правительства по стимулированию международной торговли после COVID. Кроме того, преимущества, предлагаемые управлением грузовыми перевозками для оптимизации затрат и маршрутов, увеличивают спрос на управление грузовыми перевозками на рынке. Однако такие факторы, как перегруженность торговых путей и торговые ограничения между некоторыми странами, сдерживают рост рынка. Остановка производственных предприятий во время пандемической ситуации оказала существенное влияние на рынок.

Производители принимают различные стратегические решения, чтобы оправиться после COVID-19. Игроки проводят многочисленные исследования и разработки для улучшения технологий, задействованных в управлении грузовыми перевозками. Благодаря этому компании выведут на рынок передовые и точные решения. Кроме того, правительственные инициативы по стимулированию международной торговли привели к росту рынка.

Недавнее развитие

- В марте 2021 года SAP SE объявила о партнерстве с Sedna Systems. В рамках этого партнерства компании будут интегрировать SAP TMS с решением Sedna Systems для совместной работы и управления электронной почтой, что может помочь клиентам получить полный контроль над данными, связанными с управлением транспортом. Таким образом, компания сможет укрепить свои позиции на рынке.

- В феврале 2022 года Oracle объявила о внедрении новых возможностей управления логистикой в Oracle Fusion Cloud Supply Chain & Manufacturing (SCM). Компания обновила Oracle Fusion Cloud Transportation Management, что может помочь организациям сократить расходы и риски, улучшить качество обслуживания клиентов и стать более адаптивными к сбоям в работе бизнеса. Таким образом, благодаря этому компания сможет привлечь больше клиентов на рынке.

Объем рынка управления грузовыми перевозками в Европе

Рынок управления грузовыми перевозками сегментирован на основе режима транспортировки, предложения, режима развертывания, размера организации и отрасли. Рост среди этих сегментов поможет вам проанализировать сегменты с незначительным ростом в отраслях и предоставить пользователям ценный обзор рынка и рыночные идеи, которые помогут им принимать стратегические решения для определения основных рыночных приложений.

По способу транспортировки

- Дороги

- Железные дороги

- Морской

- Воздушные пути

По виду транспорта мировой рынок управления грузовыми перевозками сегментируется на автомобильные, железнодорожные, морские и воздушные перевозки.

Предлагая

- Решения

- Услуги

На основе предложения мировой рынок управления грузоперевозками сегментирован на решения и услуги.

По режиму развертывания

- Облако или хостинг

- На территории

По способу развертывания глобальный рынок управления грузоперевозками сегментируется на облачный (хостинговый) и локальный.

По размеру организации

- Крупные предприятия

- МСП

По размеру организации мировой рынок управления грузовыми перевозками сегментирован на крупные предприятия и малые и средние предприятия.

По отраслям

- Производство

- Розничная торговля и электронная коммерция

- Транспорт

- Товары народного потребления (FMCG)

- Здравоохранение

- Еда и напитки

- Нефть и газ

- Энергия и коммунальные услуги

- Электроника

- Автомобильный

- ИТ и Телеком

- Другие

По отраслевому признаку глобальный рынок управления грузоперевозками сегментирован на производство, розничную торговлю и электронную коммерцию, транспорт, товары повседневного спроса (FMCG), здравоохранение, продукты питания и напитки, нефть и газ, энергетику и коммунальное хозяйство, электронику, автомобилестроение, ИТ и телекоммуникации и другие.

Региональный анализ/анализ рынка управления грузовыми перевозками

Проведен анализ рынка управления грузовыми перевозками, а также предоставлены сведения о размерах рынка и тенденциях по странам, видам транспорта, предложениям, способам развертывания, размерам организации и отраслям, как указано выше.

В отчете о рынке управления грузовыми перевозками рассматриваются следующие страны: Германия, Франция, Италия, Великобритания, Испания, Нидерланды, Швейцария, Бельгия, Россия, Турция и остальные страны Европы.

Германия доминирует на европейском рынке управления грузовыми перевозками . Германия, вероятно, будет самым быстрорастущим рынком управления грузовыми перевозками в Европе. В регионе находятся крупные производители из автомобильной отрасли и смежных отраслей, ведущие к экспорту из региона.

Раздел отчета по странам также содержит отдельные факторы, влияющие на рынок, и изменения в регулировании рынка, которые влияют на текущие и будущие тенденции рынка. Такие данные, как анализ цепочки создания стоимости вверх и вниз по течению, технические тенденции и анализ пяти сил Портера, тематические исследования — вот некоторые из указателей, используемых для прогнозирования рыночного сценария для отдельных стран. Кроме того, при предоставлении прогнозного анализа данных по странам учитываются наличие и доступность европейских брендов и их проблемы из-за большой или малой конкуренции со стороны местных и отечественных брендов, влияние внутренних тарифов и торговых путей.

Анализ конкурентной среды и доли рынка управления грузовыми перевозками

Конкурентная среда рынка управления грузовыми перевозками содержит сведения по конкурентам. Включены сведения о компании, финансы компании, полученный доход, рыночный потенциал, инвестиции в исследования и разработки, новые рыночные инициативы, присутствие в Европе, производственные площадки и объекты, производственные мощности, сильные и слабые стороны компании, запуск продукта, широта и широта продукта, доминирование приложений. Приведенные выше данные относятся только к фокусу компаний, связанному с рынком управления грузовыми перевозками.

Некоторые из основных игроков, работающих на рынке управления грузоперевозками: CTSI-GLOBAL, GEODIS, THE DESCARTES SYSTEMS GROUP INC, Manhattan Associates, Transplace, Softeon, Global Tranz, Oracle, SAP SE, Accenture, Blue Yonder Group, Inc., E2open, LLC., Trimble Inc., DSV, Werner Enterprises, Supply Chain Solutions, CH Robinson Worldwide, Inc, TRANSPOREON GmbH, MercuryGate.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Интерактивная панель анализа данных

- Панель анализа компании для возможностей с высоким потенциалом роста

- Доступ аналитика-исследователя для настройки и запросов

- Анализ конкурентов с помощью интерактивной панели

- Последние новости, обновления и анализ тенденций

- Используйте возможности сравнительного анализа для комплексного отслеживания конкурентов

Содержание

- introduction

- OBJECTIVES OF THE STUDY

- MARKET DEFINITION

- OVERVIEW of Europe freight transportation management market

- Currency and Pricing

- LIMITATIONS

- MARKETS COVERED

- MARKET SEGMENTATION

- MARKETS COVERED

- geographicAL scope

- years considered for the study

- DBMR TRIPOD DATA VALIDATION MODEL

- primary interviews with key opinion leaders

- DBMR MARKET POSITION GRID

- vendor share analysis

- Multivariate Modeling

- Transportation Modetimeline curve

- MARKET Industry COVERAGE GRID

- secondary sourcEs

- assumptions

- EXECUTIVE SUMMARY

- premium insights

- market overview

- drivers

- Increasing growth in globalization leading to high freight transportation

- high benefits offered by freight transportation management

- Surging demand for rail freight transports

- Increasing growth of logistics through airways and water ways

- High use of freight transportation management in roadways

- RESTRAINTS

- Congestion Associated with Trade Routes

- several government regulations and restrictions

- OPPoRTUNITies

- growing inclination towards digitalization

- Increasing growth in e-commerce

- Increasing use of Green Freight

- Emergence of new advanced technologies

- CHALLENGES

- Lack of Training and Education

- risk associated with cyber-attacks

- LACK OF DIGITAL LITERACY IN VARIOUS REGIONS

- COVID-19 IMPACT ON EUROPE FREIGHT TRANSPORTATION MANAGEMENT MARKET IN INFORMATION & COMMUNICATION TECHNOLOGY

- ANALYSIS ON IMPACT OF COVID-19 ON THE MARKET

- AFTERMATH OF COVID-19 AND GOVERNMENT INITIATIVE TO BOOST THE MARKET

- STRATEGIC DECISIONS FOR MANUFACTURERS AFTER COVID-19 TO GAIN COMPETITIVE MARKET SHARE

- IMPACT ON DEMAND

- IMPACT ON SUPPLY CHAIN

- CONCLUSION

- Europe freight transportation management market, BY Transportation Mode

- overview

- Roadways

- Railways

- Marine

- Airways

- Europe freight transportation management market, BY Offering

- overview

- Solutions

- Freight 3PL Solutions

- CROSS DOCK OPERATION

- LOAD OPTIMIZATION PLATFORM

- FREIGHT ORDER MANAGEMENT

- BROKERAGE OPERATIONAL MANAGEMENT

- BUSINESS INTELLIGENCE SOLUTION

- OTHERS

- Freight Transportation Cost Management System

- Freight Mobility Solution

- GPS

- RFID

- Freight Security Solutions

- CARGO TRACKING

- INTRUSION DETECTION

- VIDEO SURVEILLANCE

- Freight information Management System

- Fleet Tracking Solution

- Fleet Maintenance Solution

- Freight Operation Management Solution

- AUDIT AND PAYMENT SOLUTION

- SUPPLIER AND VENDOR MANAGEMENT

- CRM

- OTHERS

- Warehouse Management System

- Services

- Integration Services

- Managed Services

- Business Services

- Europe freight transportation management market, BY Deployment Mode

- overview

- Cloud or Hosted

- Subscription Based

- Transaction Based

- On Premise

- Europe freight transportation management market, BY Organization Size

- overview

- Large Enterprises

- SME's

- Europe freight transportation management market, BY Industry

- overview

- Manufacturing

- Retail & E-commerce

- Transportation

- Fast Moving Consumer Goods (FMCG)

- Healthcare

- Food & Beverages

- Oil & Gas

- Energy & Utility

- Electronics

- Automotive

- IT & Telecom

- Others

- Europe freight transportation management market, by country

- EUROPE

- GERMANY

- FRANCE

- Italy

- U.K.

- Spain

- Netherlands

- Switzerland

- Belgium

- Russia

- Turkey

- Rest of Europe

- Europe freight transportation management market, COMPANY landscape

- company share analysis: EUROPE

- swot analysis

- company profile

- SAP SE

- COMPANY snapshot

- REVENUE ANALYSIS

- PRODUCT PORTFOLIO

- recent DEVELOPMENTS

- Oracle

- COMPANY snapshot

- REVENUE ANALYSIS

- Application PORTFOLIO

- recent DEVELOPMENTS

- C.H. Robinson Worldwide, Inc.

- COMPANY snapshot

- REVENUE ANALYSIS

- PRODUCT PORTFOLIO

- recent DEVELOPMENTS

- Accenture

- COMPANY snapshot

- REVENUE ANALYSIS

- PRODUCT PORTFOLIO

- recent DEVELOPMENTS

- GEODIS

- COMPANY snapshot

- PRODUCT PORTFOLIO

- recent DEVELOPMENTS

- Blue Yonder Group, Inc.

- COMPANY snapshot

- PRODUCT PORTFOLIO

- recent DEVELOPMENTS

- BluJay Solutions Ltd.

- COMPANY snapshot

- PRODUCT PORTFOLIO

- recent DEVELOPMENTS

- TRANSPOREON GmbH

- COMPANY snapshot

- Platform PORTFOLIO

- recent DEVELOPMENTS

- Manhattan Associates

- COMPANY snapshot

- REVENUE ANALYSIS

- solution PORTFOLIO

- recent DEVELOPMENT

- CTSI-GLOBAL

- COMPANY snapshot

- PRODUCT PORTFOLIO

- recent DEVELOPMENT

- 3Gtms

- COMPANY snapshot

- Platform PORTFOLIO

- recent DEVELOPMENTS

- Cloud Logistics

- COMPANY snapshot

- PRODUCT PORTFOLIO

- recent DEVELOPMENT

- MercuryGate

- COMPANY snapshot

- Solutions PORTFOLIO

- recent DEVELOPMENT

- THE DESCARTES SYSTEMS GROUP INC

- COMPANY snapshot

- REVENUE ANALYSIS

- PRODUCT PORTFOLIO

- recent DEVELOPMENTS

- Transplace

- COMPANY snapshot

- solution PORTFOLIO

- recent DEVELOPMENTS

- questionnaire

- related reports

Список таблиц

TABLE 1 Europe freight transportation management market, By TRANSPORTATION MODE, Market Forecast 2021-2028 (USD Million)

TABLE 2 Europe freight transportation management market, By Offering, Market Forecast 2021-2028 (USD Million)

TABLE 3 Europe Solution in Freight Transportation Management Market, By Type, 2019-2028 (USD Million)

TABLE 4 Europe 3PL in Freight Transportation Management Market, By Type, 2019-2028 (USD Million)

TABLE 5 Europe Freight Mobility Solution in Freight Transportation Management Market, By Type, 2019-2028 (USD Million)

TABLE 6 Europe Freight Security Solutions in Freight Transportation Management Market, By Type, 2019-2028 (USD Million)

TABLE 7 Europe Freight Operation Management Solution in Freight Transportation Management Market, By Type, 2019-2028 (USD Million)

TABLE 8 Europe Services in Freight Transportation Management Market, By Type, 2019-2028 (USD Million)

TABLE 9 Europe freight transportation management market, By deployment mode, Market Forecast 2021-2028 (USD Million)

TABLE 10 Europe Cloud or Hosted in Freight Transportation Management Market, By Pricing, 2019-2028 (USD Million)

TABLE 11 Europe freight transportation management market, By organization size, Market Forecast 2021-2028 (USD Million)

TABLE 12 Europe freight transportation management market, By industry, Market Forecast 2021-2028 (USD Million)

TABLE 13 Europe Freight Transportation Management Market, By Country, 2019-2028 (USD Million)

TABLE 14 Europe Freight Transportation Management Market, By Transportation MODE, 2019-2028 (USD Million)

TABLE 15 Europe Freight Transportation Management Market, By Offering, 2019-2028 (USD Million)

TABLE 16 Europe Solution in Freight Transportation Management Market, By Type, 2019-2028 (USD Million)

TABLE 17 Europe 3PL in Freight Transportation Management Market, By Type, 2019-2028 (USD Million)

TABLE 18 Europe Freight Mobility Solution in Freight Transportation Management Market, By Type, 2019-2028 (USD Million)

TABLE 19 Europe Freight Security Solutions in Freight Transportation Management Market, By Type, 2019-2028 (USD Million)

TABLE 20 Europe Freight Operation Management Solution in Freight Transportation Management Market, By Type, 2019-2028 (USD Million)

TABLE 21 Europe Services in Freight Transportation Management Market, By Type, 2019-2028 (USD Million)

TABLE 22 Europe Freight Transportation Management Market, By Deployment Mode, 20189-2028 (USD Million)

TABLE 23 Europe Cloud or Hosted in Freight Transportation Management Market, By Pricing, 2019-2028 (USD Million)

TABLE 24 Europe Freight Transportation Management Market, By Organization Size, 2019-2028 (USD Million)

TABLE 25 Europe Freight Transportation Management Market, By Industry, 2019-2028 (USD Million)

TABLE 26 GERMANY Freight Transportation Management Market, By Transportation MODE, 2019-2028 (USD Million)

TABLE 27 GERMANY Freight Transportation Management Market, By Offering, 2019-2028 (USD Million)

TABLE 28 GERMANY Solution in Freight Transportation Management Market, By Type, 2019-2028 (USD Million)

TABLE 29 GERMANY 3PL in Freight Transportation Management Market, By Type, 2019-2028 (USD Million)

TABLE 30 GERMANY Freight Mobility Solution in Freight Transportation Management Market, By Type, 2019-2028 (USD Million)

TABLE 31 GERMANY Freight Security Solutions in Freight Transportation Management Market, By Type, 2019-2028 (USD Million)

TABLE 32 GERMANY Freight Operation Management Solution in Freight Transportation Management Market, By Type, 2019-2028 (USD Million)

TABLE 33 GERMANY Services in Freight Transportation Management Market, By Type, 2019-2028 (USD Million)

TABLE 34 GERMANY Freight Transportation Management Market, By Deployment Mode, 20189-2028 (USD Million)

TABLE 35 GERMANY Cloud or Hosted in Freight Transportation Management Market, By Pricing, 2019-2028 (USD Million)

TABLE 36 GERMANY Freight Transportation Management Market, By Organization Size, 2019-2028 (USD Million)

TABLE 37 GERMANY Freight Transportation Management Market, By Industry, 2019-2028 (USD Million)

TABLE 38 FRANCE Freight Transportation Management Market, By Transportation MODE, 2019-2028 (USD Million)

TABLE 39 FRANCE Freight Transportation Management Market, By Offering, 2019-2028 (USD Million)

TABLE 40 FRANCE Solution in Freight Transportation Management Market, By Type, 2019-2028 (USD Million)

TABLE 41 FRANCE 3PL in Freight Transportation Management Market, By Type, 2019-2028 (USD Million)

TABLE 42 FRANCE Freight Mobility Solution in Freight Transportation Management Market, By Type, 2019-2028 (USD Million)

TABLE 43 FRANCE Freight Security Solutions in Freight Transportation Management Market, By Type, 2019-2028 (USD Million)

TABLE 44 fRANCE Freight Operation Management Solution in Freight Transportation Management Market, By Type, 2019-2028 (USD Million)

TABLE 45 FRANCE Services in Freight Transportation Management Market, By Type, 2019-2028 (USD Million)

TABLE 46 FRANCE Freight Transportation Management Market, By Deployment Mode, 20189-2028 (USD Million)

TABLE 47 FRANCE Cloud or Hosted in Freight Transportation Management Market, By Pricing, 2019-2028 (USD Million)

TABLE 48 FRANCE Freight Transportation Management Market, By Organization Size, 2019-2028 (USD Million)

TABLE 49 FRANCE Freight Transportation Management Market, By Industry, 2019-2028 (USD Million)

TABLE 50 Italy Freight Transportation Management Market, By Transportation MODE, 2019-2028 (USD Million)

TABLE 51 ITALY Freight Transportation Management Market, By Offering, 2019-2028 (USD Million)

TABLE 52 iTALY Solution in Freight Transportation Management Market, By Type, 2019-2028 (USD Million)

TABLE 53 ITALY 3PL in Freight Transportation Management Market, By Type, 2019-2028 (USD Million)

TABLE 54 ITALY Freight Mobility Solution in Freight Transportation Management Market, By Type, 2019-2028 (USD Million)

TABLE 55 ITALY Freight Security Solutions in Freight Transportation Management Market, By Type, 2019-2028 (USD Million)

TABLE 56 ITALY Freight Operation Management Solution in Freight Transportation Management Market, By Type, 2019-2028 (USD Million)

TABLE 57 ITALY Services in Freight Transportation Management Market, By Type, 2019-2028 (USD Million)

TABLE 58 ITALY Freight Transportation Management Market, By Deployment Mode, 20189-2028 (USD Million)

TABLE 59 ITALY Cloud or Hosted in Freight Transportation Management Market, By Pricing, 2019-2028 (USD Million)

TABLE 60 ITALY Freight Transportation Management Market, By Organization Size, 2019-2028 (USD Million)

TABLE 61 ITALY Freight Transportation Management Market, By Industry, 2019-2028 (USD Million)

TABLE 62 U.K. Freight Transportation Management Market, By Transportation MODE, 2019-2028 (USD Million)

TABLE 63 U.K. Freight Transportation Management Market, By Offering, 2019-2028 (USD Million)

TABLE 64 U.K. Solution in Freight Transportation Management Market, By Type, 2019-2028 (USD Million)

TABLE 65 U.K. 3PL in Freight Transportation Management Market, By Type, 2019-2028 (USD Million)

TABLE 66 U.K. Freight Mobility Solution in Freight Transportation Management Market, By Type, 2019-2028 (USD Million)

TABLE 67 U.K. Freight Security Solutions in Freight Transportation Management Market, By Type, 2019-2028 (USD Million)

TABLE 68 U.K. Freight Operation Management Solution in Freight Transportation Management Market, By Type, 2019-2028 (USD Million)

TABLE 69 U.K. Services in Freight Transportation Management Market, By Type, 2019-2028 (USD Million)

TABLE 70 U.K. Freight Transportation Management Market, By Deployment Mode, 20189-2028 (USD Million)

TABLE 71 U.K. Cloud or Hosted in Freight Transportation Management Market, By Pricing, 2019-2028 (USD Million)

TABLE 72 U.K. Freight Transportation Management Market, By Organization Size, 2019-2028 (USD Million)

TABLE 73 U.K. Freight Transportation Management Market, By Industry, 2019-2028 (USD Million)

TABLE 74 Spain Freight Transportation Management Market, By Transportation MODE, 2019-2028 (USD Million)

TABLE 75 SPAIN Freight Transportation Management Market, By Offering, 2019-2028 (USD Million)

TABLE 76 SPAIN Solution in Freight Transportation Management Market, By Type, 2019-2028 (USD Million)

TABLE 77 SPAIN 3PL in Freight Transportation Management Market, By Type, 2019-2028 (USD Million)

TABLE 78 SPAIN Freight Mobility Solution in Freight Transportation Management Market, By Type, 2019-2028 (USD Million)

TABLE 79 SPAIN Freight Security Solutions in Freight Transportation Management Market, By Type, 2019-2028 (USD Million)

TABLE 80 SPAIN Freight Operation Management Solution in Freight Transportation Management Market, By Type, 2019-2028 (USD Million)

TABLE 81 SPAIN Services in Freight Transportation Management Market, By Type, 2019-2028 (USD Million)

TABLE 82 SPAIN Freight Transportation Management Market, By Deployment Mode, 20189-2028 (USD Million)

TABLE 83 SPAIN Cloud or Hosted in Freight Transportation Management Market, By Pricing, 2019-2028 (USD Million)

TABLE 84 SPAIN Freight Transportation Management Market, By Organization Size, 2019-2028 (USD Million)

TABLE 85 SPAIN Freight Transportation Management Market, By Industry, 2019-2028 (USD Million)

TABLE 86 Netherlands Freight Transportation Management Market, By Transportation MODE, 2019-2028 (USD Million)

TABLE 87 NETHERLANDS Freight Transportation Management Market, By Offering, 2019-2028 (USD Million)

TABLE 88 NETHERLANDS Solution in Freight Transportation Management Market, By Type, 2019-2028 (USD Million)

TABLE 89 NETHERLANDS 3PL in Freight Transportation Management Market, By Type, 2019-2028 (USD Million)

TABLE 90 NETHERLANDS Freight Mobility Solution in Freight Transportation Management Market, By Type, 2019-2028 (USD Million)

TABLE 91 NETHERLANDS Freight Security Solutions in Freight Transportation Management Market, By Type, 2019-2028 (USD Million)

TABLE 92 NETHERLANDS Freight Operation Management Solution in Freight Transportation Management Market, By Type, 2019-2028 (USD Million)

TABLE 93 NETHERLANDS Services in Freight Transportation Management Market, By Type, 2019-2028 (USD Million)

TABLE 94 NETHERLANDS Freight Transportation Management Market, By Deployment Mode, 20189-2028 (USD Million)

TABLE 95 NETHERLANDS Cloud or Hosted in Freight Transportation Management Market, By Pricing, 2019-2028 (USD Million)

TABLE 96 NETHERLANDS Freight Transportation Management Market, By Organization Size, 2019-2028 (USD Million)

TABLE 97 NETHERLANDS Freight Transportation Management Market, By Industry, 2019-2028 (USD Million)

TABLE 98 Switzerland Freight Transportation Management Market, By Transportation MODE, 2019-2028 (USD Million)

TABLE 99 SWITZERLAND Freight Transportation Management Market, By Offering, 2019-2028 (USD Million)

TABLE 100 SWITZERLAND Solution in Freight Transportation Management Market, By Type, 2019-2028 (USD Million)

TABLE 101 SWITZERLAND 3PL in Freight Transportation Management Market, By Type, 2019-2028 (USD Million)

TABLE 102 SWITZERLAND Freight Mobility Solution in Freight Transportation Management Market, By Type, 2019-2028 (USD Million)

TABLE 103 sWITZERLAND Freight Security Solutions in Freight Transportation Management Market, By Type, 2019-2028 (USD Million)

TABLE 104 SWITZERLAND Freight Operation Management Solution in Freight Transportation Management Market, By Type, 2019-2028 (USD Million)

TABLE 105 SWITZERLAND Services in Freight Transportation Management Market, By Type, 2019-2028 (USD Million)

TABLE 106 SWITZERLAND Freight Transportation Management Market, By Deployment Mode, 20189-2028 (USD Million)

TABLE 107 SWITZERLAND Cloud or Hosted in Freight Transportation Management Market, By Pricing, 2019-2028 (USD Million)

TABLE 108 SWITZERLAND Freight Transportation Management Market, By Organization Size, 2019-2028 (USD Million)

TABLE 109 SWITZERLAND Freight Transportation Management Market, By Industry, 2019-2028 (USD Million)

TABLE 110 Belgium Freight Transportation Management Market, By Transportation MODE, 2019-2028 (USD Million)

TABLE 111 BELGIUM Freight Transportation Management Market, By Offering, 2019-2028 (USD Million)

TABLE 112 BELGIUM Solution in Freight Transportation Management Market, By Type, 2019-2028 (USD Million)

TABLE 113 BELGIUM 3PL in Freight Transportation Management Market, By Type, 2019-2028 (USD Million)

TABLE 114 BELGIUM Freight Mobility Solution in Freight Transportation Management Market, By Type, 2019-2028 (USD Million)

TABLE 115 BELGIUM Freight Security Solutions in Freight Transportation Management Market, By Type, 2019-2028 (USD Million)

TABLE 116 BELGIUM Freight Operation Management Solution in Freight Transportation Management Market, By Type, 2019-2028 (USD Million)

TABLE 117 BELGIUM Services in Freight Transportation Management Market, By Type, 2019-2028 (USD Million)

TABLE 118 BELGIUM Freight Transportation Management Market, By Deployment Mode, 20189-2028 (USD Million)

TABLE 119 BELGIUM Cloud or Hosted in Freight Transportation Management Market, By Pricing, 2019-2028 (USD Million)

TABLE 120 BELGIUM Freight Transportation Management Market, By Organization Size, 2019-2028 (USD Million)

TABLE 121 BELGIUM Freight Transportation Management Market, By Industry, 2019-2028 (USD Million)

TABLE 122 Russia Freight Transportation Management Market, By Transportation MODE, 2019-2028 (USD Million)

TABLE 123 RUSSIA Freight Transportation Management Market, By Offering, 2019-2028 (USD Million)

TABLE 124 RUSSIA Solution in Freight Transportation Management Market, By Type, 2019-2028 (USD Million)

TABLE 125 RUSSIA 3PL in Freight Transportation Management Market, By Type, 2019-2028 (USD Million)

TABLE 126 RUSSIA Freight Mobility Solution in Freight Transportation Management Market, By Type, 2019-2028 (USD Million)

TABLE 127 RUSSIA Freight Security Solutions in Freight Transportation Management Market, By Type, 2019-2028 (USD Million)

TABLE 128 RUSSIA Freight Operation Management Solution in Freight Transportation Management Market, By Type, 2019-2028 (USD Million)

TABLE 129 RUSSIA Services in Freight Transportation Management Market, By Type, 2019-2028 (USD Million)

TABLE 130 RUSSIA Freight Transportation Management Market, By Deployment Mode, 20189-2028 (USD Million)

TABLE 131 RUSSIA Cloud or Hosted in Freight Transportation Management Market, By Pricing, 2019-2028 (USD Million)

TABLE 132 RUSSIA Freight Transportation Management Market, By Organization Size, 2019-2028 (USD Million)

TABLE 133 RUSSIA Freight Transportation Management Market, By Industry, 2019-2028 (USD Million)

TABLE 134 Turkey Freight Transportation Management Market, By Transportation MODE, 2019-2028 (USD Million)

TABLE 135 TURKEY Freight Transportation Management Market, By Offering, 2019-2028 (USD Million)

TABLE 136 TURKEY Solution in Freight Transportation Management Market, By Type, 2019-2028 (USD Million)

TABLE 137 TURKEY 3PL in Freight Transportation Management Market, By Type, 2019-2028 (USD Million)

TABLE 138 TURKEY Freight Mobility Solution in Freight Transportation Management Market, By Type, 2019-2028 (USD Million)

TABLE 139 TURKEY Freight Security Solutions in Freight Transportation Management Market, By Type, 2019-2028 (USD Million)

TABLE 140 TURKEY Freight Operation Management Solution in Freight Transportation Management Market, By Type, 2019-2028 (USD Million)

TABLE 141 TURKEY Services in Freight Transportation Management Market, By Type, 2019-2028 (USD Million)

TABLE 142 TURKEY Freight Transportation Management Market, By Deployment Mode, 20189-2028 (USD Million)

TABLE 143 TURKEY Cloud or Hosted in Freight Transportation Management Market, By Pricing, 2019-2028 (USD Million)

TABLE 144 TURKEY Freight Transportation Management Market, By Organization Size, 2019-2028 (USD Million)

TABLE 145 TURKEY Freight Transportation Management Market, By Industry, 2019-2028 (USD Million)

TABLE 146 Rest of Europe Freight Transportation Management Market, By Transportation MODE, 2019-2028 (USD Million)

Список рисунков

FIGURE 1 Europe freight transportation management market: segmentation

FIGURE 2 Europe freight transportation management market: data triangulation

FIGURE 3 Europe freight transportation management market: DROC ANALYSIS

FIGURE 4 Europe freight transportation management market: REGIONAL VS. GLOBAL MARKET ANALYSIS

FIGURE 5 Europe freight transportation management market: COMPANY RESEARCH ANALYSIS

FIGURE 6 Europe freight transportation management market: INTERVIEW DEMOGRAPHICS

FIGURE 7 Europe freight transportation management market: DBMR MARKET POSITION GRID

FIGURE 8 Europe freight transportation management market: vendor share analysis

FIGURE 9 Europe freight transportation management MARKET: MARKET IndustryCOVERAGE GRID

FIGURE 10 Europe freight transportation management market: SEGMENTATION

FIGURE 11 Increasing growth in globalization leading to high freight transportation is EXPECTED TO DRIVE Europe freight transportation management market IN THE FORECAST PERIOD OF 2021 to 2028

FIGURE 12 Roadways is expected to account for the largest share of Europe freight transportation management market in 2021 & 2028

FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES OF Europe freight transportation management market

FIGURE 14 Europe freight transportation management market: BY Transportation Mode, 2020

FIGURE 15 Europe freight transportation management market: BY Offering, 2020

FIGURE 16 Europe freight transportation management market: BY deployment mode, 2020

FIGURE 17 Europe freight transportation management market: BY organization size, 2020

FIGURE 18 Europe freight transportation management market: BY industry, 2020

FIGURE 19 Europe Freight transportation management MARKET: SNAPSHOT (2020)

FIGURE 20 Europe Freight transportation management MARKET: by Country (2020)

FIGURE 21 Europe Freight transportation management MARKET: by Country (2021 & 2028)

FIGURE 22 Europe Freight transportation management MARKET: by Country (2021 & 2028)

FIGURE 23 Europe Freight transportation management MARKET: by type (2021-2028)

FIGURE 24 Europe Freight Transportation Management Market: company share 2020 (%)

Методология исследования

Сбор данных и анализ базового года выполняются с использованием модулей сбора данных с большими размерами выборки. Этап включает получение рыночной информации или связанных данных из различных источников и стратегий. Он включает изучение и планирование всех данных, полученных из прошлого заранее. Он также охватывает изучение несоответствий информации, наблюдаемых в различных источниках информации. Рыночные данные анализируются и оцениваются с использованием статистических и последовательных моделей рынка. Кроме того, анализ доли рынка и анализ ключевых тенденций являются основными факторами успеха в отчете о рынке. Чтобы узнать больше, пожалуйста, запросите звонок аналитика или оставьте свой запрос.

Ключевой методологией исследования, используемой исследовательской группой DBMR, является триангуляция данных, которая включает в себя интеллектуальный анализ данных, анализ влияния переменных данных на рынок и первичную (отраслевую экспертную) проверку. Модели данных включают сетку позиционирования поставщиков, анализ временной линии рынка, обзор рынка и руководство, сетку позиционирования компании, патентный анализ, анализ цен, анализ доли рынка компании, стандарты измерения, глобальный и региональный анализ и анализ доли поставщика. Чтобы узнать больше о методологии исследования, отправьте запрос, чтобы поговорить с нашими отраслевыми экспертами.

Доступна настройка

Data Bridge Market Research является лидером в области передовых формативных исследований. Мы гордимся тем, что предоставляем нашим существующим и новым клиентам данные и анализ, которые соответствуют и подходят их целям. Отчет можно настроить, включив в него анализ ценовых тенденций целевых брендов, понимание рынка для дополнительных стран (запросите список стран), данные о результатах клинических испытаний, обзор литературы, обновленный анализ рынка и продуктовой базы. Анализ рынка целевых конкурентов можно проанализировать от анализа на основе технологий до стратегий портфеля рынка. Мы можем добавить столько конкурентов, о которых вам нужны данные в нужном вам формате и стиле данных. Наша команда аналитиков также может предоставить вам данные в сырых файлах Excel, сводных таблицах (книга фактов) или помочь вам в создании презентаций из наборов данных, доступных в отчете.