Europe Drinking Chocolate Market

Размер рынка в млрд долларов США

CAGR :

%

USD

13.27 Billion

USD

18.30 Billion

2024

2032

USD

13.27 Billion

USD

18.30 Billion

2024

2032

| 2025 –2032 | |

| USD 13.27 Billion | |

| USD 18.30 Billion | |

|

|

|

Europe Drinking Chocolate Market Segmentation, By Type (Dark, Milk, White), Cocoa Content (60-90%, 40-60%, 30-40%, Others), Application (Chocolate Drinks, Protein Shakes, Energy Drinks, Coffee Mixes), Flavor (Vanilla, Caramel, Honey, Hazelnut), Form (Powder, Liquid), Target Consumers (Adult, Kids), End User (Food Service Providers, Household/Domestic, Corporates, Airlines) – Industry Trends and Forecast to 2032

Drinking Chocolate Market Analysis

The constant desire to create, unveil, and commercialize new delicacies underpins the drinking chocolate market's growth prospects. Taste and exquisiteness are two key factors driving product development in the drinking chocolate market.

Drinking Chocolate Market Size

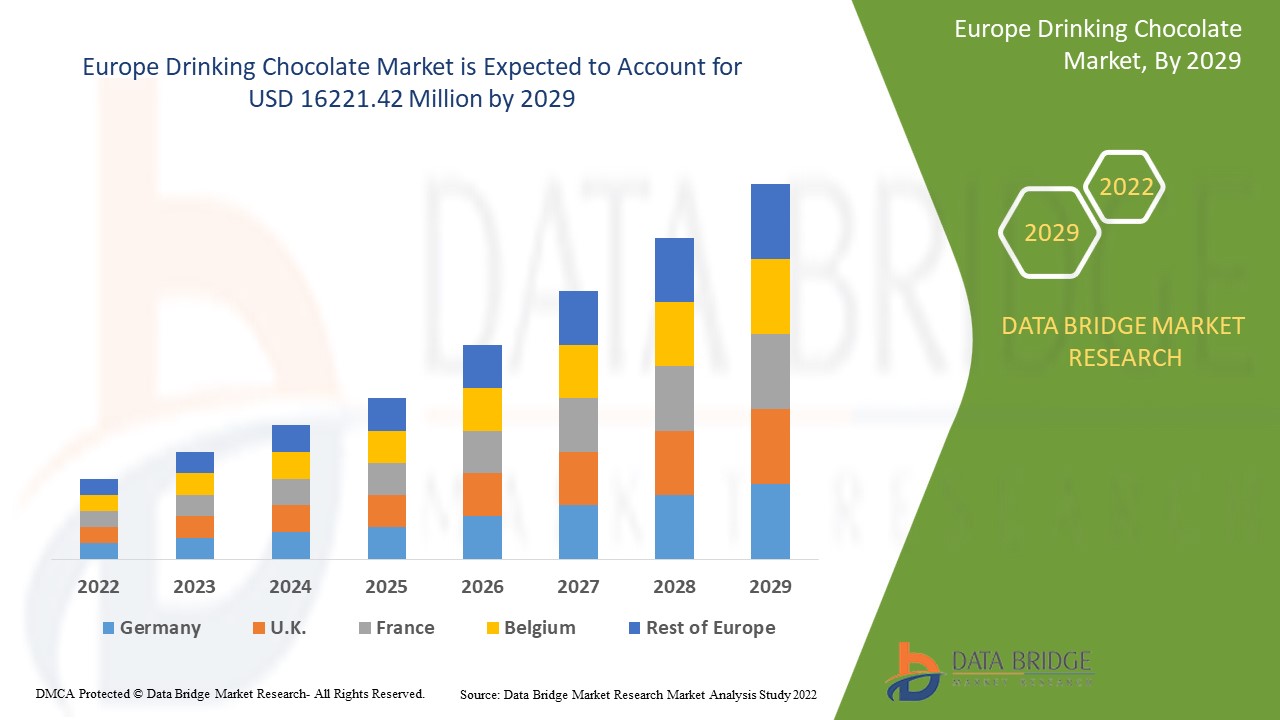

Europe drinking chocolate market size was valued at USD 13.27 billion in 2024 and is projected to reach USD 18.30 billion by 2032, with a CAGR of 4.1% during the forecast period of 2025 to 2032.

Report Scope and Market Segmentation

|

Attributes |

Drinking Chocolate Key Market Insights |

|

Segmentation |

|

|

Countries Covered |

Germany, U.K., France, Italy, Switzerland, The Netherlands, Spain, Belgium, Turkey, Russia, Sweden, Denmark, Poland, Luxemburg, Rest of Europe |

|

Key Market Players |

Barry Callebaut (Switzerland), The Hershey Company (U.S.), Nestle SA (Switzerland), Ingredion (U.S.), Mars, Incorporated (U.S.), DSM (Netherlands)Kerry Group plc (Ireland), Tate & Lyle (U.K.), Godiva (US), LUIGI LAVAZZA SPA, (Italy), Starbucks Coffee Company (US), PepsiCo (US), Mondelez International (US), The Simply Good Foods Company (US) |

|

Market Opportunities |

|

Drinking Chocolate Market Definition

Hot chocolate is another name for drinking chocolate. In some parts of the world, drinking chocolate is known as chocolate tea. As a beverage, drinking chocolate is made from small pieces of chocolate that are slowly melted and blended with milk and water. It's made with melted chocolate, heated chocolate, chocolate powder, or cocoa powder. To make drinking chocolate, the powdered forms are dissolved in water or milk. The cocoa content of drinking chocolates determines whether they are sweetened or unsweetened. A variety of drinking chocolates are made from milk chocolate or white chocolate.

Drinking Chocolate Market Dynamics

Drivers

- Rising online retails as well as expansion in supply chains

One of the key trends driving the evolution of the drinking chocolate market is advancements in online retail. Convenience stores, specialty stores, supermarkets, drug stores, and hypermarkets are all large product distribution channels. Continuous efforts by retailers and manufacturers to expand their supply and distribution chain have played an essential role in increasing access to products in the drinking chocolate market.

- Diversification of products according to the needs

The constant desire to try new ethnic flavors and tastes is a major driving force in the drinking chocolate market. Over the years, the chocolate industry has shifted its focus to producing healthier products. The growing health-conscious population is driving this trend, particularly in emerging economies. The evolution of the drinking chocolate market has been fueled by advances in organized retail in developing regions.

Opportunity

The ease of payment for products through online channels and the wide range of chocolate flavours and textures are essential factors driving the popularity of e-commerce in the drinking chocolate market. Furthermore, drinking chocolate is increasingly being used in the formulation of a wide variety of beverages and confectionery products, such as cakes, drinking shakes, croissants, and hot chocolate, contributing to the Europe drinking chocolate market's growth.

Restraints

However, the easy availability of product substitutes, stringent government regulations pertaining to quality standardization, and supply chain disruptions caused by the pandemic will limit the scope of growth for the chocolate drinking market. The high cost of R&D activities and the volatility of raw material prices will stymie the drinking chocolate market's growth rate. Other market growth restraints include rising obesity prevalence, high sugar levels in patients, and a rising incidence rate of diabetes.

This drinking chocolate market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the drinking chocolate market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

Drinking Chocolate Market Scope

The drinking chocolate market is segmented on the basis of type, cocoa content, application, flavor, form, target consumers, packaging type, packaging material, end-user and distribution channel. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Type

- Dark chocolate

- Milk chocolate

- White

Cocoa content

- 60-90%

- 40-60%

- 30-40%

- Others

Distribution channel

- Hypermarkets/supermarkets

- Specialty store

- Convenience stores

- Online store

- Other

Application

- Chocolate Drinks

- Protein Shakes

- Energy Drinks

- Coffee Mixes

- Others

Flavour

- Vanilla

- Caramel

- Honey

- Hazelnut

Form

- Powder

- Liquid

Target customers

- Adults

- Kids

End users

- Food Service Providers

- Household/Domestic

- Corporates

- Airlines

Drinking Chocolate Market Regional Analysis

The drinking chocolate market is analyzed and market size insights and trends are provided by country, type, cocoa content, application, flavor, form, target consumers, packaging type, packaging material, end user and distribution channel as referenced above.

The countries covered in the drinking chocolate market report are Germany, U.K., France, Italy, Switzerland, The Netherlands, Spain, Belgium, Turkey, Russia, Sweden, Denmark, Poland, Luxemburg, Rest of Europe.

The Asia-Pacific region dominates the drinking chocolate market and will continue to do so during the forecast period due to the region's tremendous popularity and substantial consumption of chocolate, rising consumption of waffles and pitas prepared with chocolate spreads, rising adoption of Western culture and foods that have replaced traditional foods with bread and toasts, growing population, rising lifestyle changes.

The country section of the report also provides individual market impacting factors and changes in market regulation that impact the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of Europe brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Drinking Chocolate Market Share

The drinking chocolate market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, Europe presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to drinking chocolate market.

Drinking Chocolate Market Leaders Operating in the Market Are:

- Barry Callebaut (Switzerland)

- The Hershey Company (U.S)

- Nestle SA (Switzerland)

- Ingredion (U.S)

- Mars, Incorporated (U.S)

- DSM (Netherlands)

- Kerry Group plc (Ireland)

- Tate & Lyle (U.K)

- Godiva (U.S)

- LUIGI LAVAZZA SPA, (Italy)

- Starbucks Coffee Company (U.S)

- PepsiCo (US)

- Mondelez International (U.S)

- The Simply Good Foods Company (U.S)

Latest Developments in Drinking Chocolate Market

- Nestlé will launch a plant-based Nesquik drink in Europe in September 2020, expanding its range of dairy alternatives. The new ready-to-drink beverage was first introduced in Spain, Portugal, and Hungary, and then expanded to other European countries. It is made with oats and peas and sustainably sourced cocoa, and it contains less sugar than regular milk-based Nesquik

- FrieslandCampina's flavoured milk brand Yazoo announced the release of a new flavour, Choco-Hazelicious, in March 2020. The beverage would be available in four different formats, allowing it to be consumed both on the go and at homeFerrero plans to pre-launch the new Ferrero Rocher Tablets in the travel-retail channel in September 2021 in collaboration with Lagardère. Ferrero enters the chocolate tablet market with the new product available in three flavors: drinking, dark 55 percent cocoa, and white

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Интерактивная панель анализа данных

- Панель анализа компании для возможностей с высоким потенциалом роста

- Доступ аналитика-исследователя для настройки и запросов

- Анализ конкурентов с помощью интерактивной панели

- Последние новости, обновления и анализ тенденций

- Используйте возможности сравнительного анализа для комплексного отслеживания конкурентов

Методология исследования

Сбор данных и анализ базового года выполняются с использованием модулей сбора данных с большими размерами выборки. Этап включает получение рыночной информации или связанных данных из различных источников и стратегий. Он включает изучение и планирование всех данных, полученных из прошлого заранее. Он также охватывает изучение несоответствий информации, наблюдаемых в различных источниках информации. Рыночные данные анализируются и оцениваются с использованием статистических и последовательных моделей рынка. Кроме того, анализ доли рынка и анализ ключевых тенденций являются основными факторами успеха в отчете о рынке. Чтобы узнать больше, пожалуйста, запросите звонок аналитика или оставьте свой запрос.

Ключевой методологией исследования, используемой исследовательской группой DBMR, является триангуляция данных, которая включает в себя интеллектуальный анализ данных, анализ влияния переменных данных на рынок и первичную (отраслевую экспертную) проверку. Модели данных включают сетку позиционирования поставщиков, анализ временной линии рынка, обзор рынка и руководство, сетку позиционирования компании, патентный анализ, анализ цен, анализ доли рынка компании, стандарты измерения, глобальный и региональный анализ и анализ доли поставщика. Чтобы узнать больше о методологии исследования, отправьте запрос, чтобы поговорить с нашими отраслевыми экспертами.

Доступна настройка

Data Bridge Market Research является лидером в области передовых формативных исследований. Мы гордимся тем, что предоставляем нашим существующим и новым клиентам данные и анализ, которые соответствуют и подходят их целям. Отчет можно настроить, включив в него анализ ценовых тенденций целевых брендов, понимание рынка для дополнительных стран (запросите список стран), данные о результатах клинических испытаний, обзор литературы, обновленный анализ рынка и продуктовой базы. Анализ рынка целевых конкурентов можно проанализировать от анализа на основе технологий до стратегий портфеля рынка. Мы можем добавить столько конкурентов, о которых вам нужны данные в нужном вам формате и стиле данных. Наша команда аналитиков также может предоставить вам данные в сырых файлах Excel, сводных таблицах (книга фактов) или помочь вам в создании презентаций из наборов данных, доступных в отчете.