Dexa Equipment Market

Размер рынка в млрд долларов США

CAGR :

%

USD

2.00 Billion

USD

2.84 Billion

2024

2032

USD

2.00 Billion

USD

2.84 Billion

2024

2032

| 2025 –2032 | |

| USD 2.00 Billion | |

| USD 2.84 Billion | |

|

|

|

|

Сегментация мирового рынка оборудования для двухканальной рентгеновской абсорбциометрии (DEXA) по типу продукта (центральная DEXA и периферическая DEXA), области применения (анализ состава тела, диагностика переломов, костная денситометрия и оценка риска переломов), конечным пользователям (больницы, клиники, мобильные медицинские центры и другие) — тенденции отрасли и прогноз до 2032 года

Размер рынка оборудования для двухэмиссионной рентгеновской абсорбциометрии (DEXA)

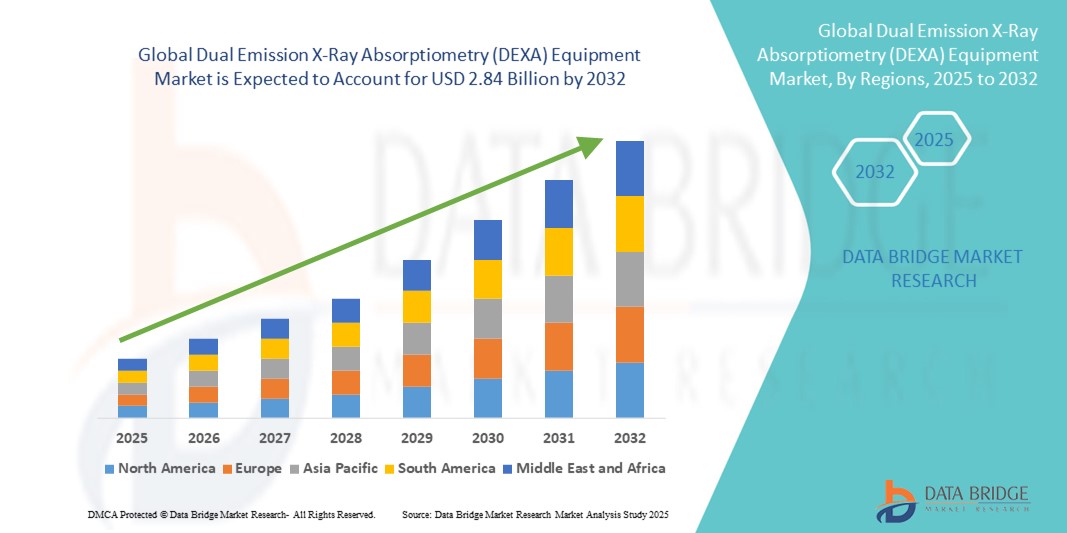

- Объем мирового рынка оборудования для двухэмиссионной рентгеновской абсорбциометрии (DEXA) в 2024 году оценивался в 2,00 млрд долларов США и, как ожидается , достигнет 2,84 млрд долларов США к 2032 году при среднегодовом темпе роста 4,5% в течение прогнозируемого периода.

- Рост рынка обусловлен в первую очередь растущей распространенностью остеопороза и других заболеваний костей, а также повышением осведомленности о ранней диагностике и лечении с помощью передовых технологий визуализации.

- Кроме того, технологические достижения в области денситометрии (DEXA), такие как повышение скорости и точности сканирования, а также растущее применение в больницах, диагностических центрах и научно-исследовательских институтах, стимулируют спрос. Эти факторы в совокупности стимулируют расширение рынка, позиционируя оборудование DEXA как важнейший инструмент для оценки состояния костей во всем мире.

Анализ рынка оборудования для двухэмиссионной рентгеновской абсорбциометрии (DEXA)

- Оборудование DEXA, обеспечивающее точное измерение минеральной плотности костной ткани и состава тела, становится все более необходимым для диагностики остеопороза и других метаболических заболеваний костей в больницах, диагностических центрах и научно-исследовательских учреждениях по всему миру.

- Рост заболеваемости остеопорозом, старение населения и растущая осведомлённость о необходимости ранней оценки состояния костей являются ключевыми факторами, определяющими спрос на оборудование для денситометрии (DEXA) во всем мире. Кроме того, росту рынка способствуют постоянные технологические разработки, повышающие точность сканирования и снижающие дозу облучения.

- Северная Америка доминировала на рынке оборудования для двухэмиссионной рентгеновской абсорбциометрии (DEXA) с наибольшей долей выручки в 39,2% в 2024 году, что объясняется развитой инфраструктурой здравоохранения в регионе, ранним внедрением передовых технологий визуализации и высокой распространенностью заболеваний костей, особенно в США, чему способствовали постоянные инновации от ведущих производителей медицинских устройств.

- Прогнозируется, что Азиатско-Тихоокеанский регион станет самым быстрорастущим регионом на рынке оборудования для двухэмиссионной рентгеновской абсорбциометрии (DEXA) в течение прогнозируемого периода, что обусловлено ростом расходов на здравоохранение, ростом численности пожилого населения и расширением диагностических возможностей в развивающихся экономиках, таких как Китай и Индия.

- Центральный сегмент сканеров DEXA доминировал на рынке оборудования для двухэмиссионной рентгеновской абсорбциометрии (DEXA) с долей 46,1% в 2024 году, благодаря своим комплексным возможностям визуализации и широкому применению в клинических и исследовательских учреждениях.

Область применения отчета и сегментация рынка оборудования для двухэмиссионной рентгеновской абсорбциометрии (DEXA)

|

Атрибуты |

Ключевые данные о рынке оборудования для двухэмиссионной рентгеновской абсорбциометрии (DEXA) |

|

Охваченные сегменты |

|

|

Охваченные страны |

Северная Америка

Европа

Азиатско-Тихоокеанский регион

Ближний Восток и Африка

Южная Америка

|

|

Ключевые игроки рынка |

|

|

Рыночные возможности |

|

|

Информационные наборы данных с добавленной стоимостью |

Помимо информации о рыночных сценариях, таких как рыночная стоимость, темпы роста, сегментация, географический охват и основные игроки, отчеты о рынке, подготовленные Data Bridge Market Research, также включают в себя углубленный экспертный анализ, анализ цен, анализ доли бренда, опрос потребителей, демографический анализ, анализ цепочки поставок, анализ цепочки создания стоимости, обзор сырья/расходных материалов, критерии выбора поставщиков, анализ PESTLE, анализ Портера и нормативную базу. |

Тенденции рынка оборудования для двухэмиссионной рентгеновской абсорбциометрии (DEXA)

Достижения в области технологий визуализации и диагностики на основе искусственного интеллекта

- Ключевой тенденцией на мировом рынке оборудования для денситометрии (DEXA) является интеграция искусственного интеллекта (ИИ) и передовых технологий визуализации для повышения точности диагностики и эффективности работы. Программное обеспечение на базе ИИ теперь помогает точно анализировать плотность костной ткани и прогнозировать риск переломов, улучшая принятие клинических решений.

- Например, система Horizon DXA использует алгоритмы искусственного интеллекта для автоматизации измерения минеральной плотности костной ткани (МПКТ), сокращая время сканирования и минимизируя человеческий фактор. Аналогичным образом, система Lunar iDXA от GE Healthcare использует усовершенствованное программное обеспечение для детального анализа состава тела и оценки состояния костей.

- Интеграция с искусственным интеллектом позволяет проводить персонализированную оценку состояния пациента, изучая предыдущие сканирования и историю болезни, что позволяет более целенаправленно лечить остеопороз. Кроме того, эти технологии поддерживают автоматизированный контроль качества, обеспечивая согласованные и воспроизводимые результаты.

- Разработка компактных, портативных устройств DEXA, совместимых с облачными платформами, упрощает удаленную диагностику и расширяет доступ в небольших клиниках и регионах с недостаточным уровнем обслуживания.

- Эта тенденция к более интеллектуальному, точному и подключенному диагностическому оборудованию трансформирует клинические рабочие процессы и мониторинг пациентов. Такие компании, как Hologic и Norland, разрабатывают инновационные системы DEXA с использованием искусственного интеллекта, которые оптимизируют лечение пациентов и поддерживают инициативы в области телемедицины.

- Спрос на решения DEXA на основе искусственного интеллекта стремительно растёт в больницах, амбулаторных центрах и научно-исследовательских институтах, поскольку поставщики медицинских услуг уделяют первостепенное внимание раннему выявлению и лечению заболеваний костей.

Динамика рынка оборудования для двухэмиссионной рентгеновской абсорбциометрии (DEXA)

Водитель

Рост распространенности остеопороза и старение населения

- Рост заболеваемости остеопорозом и другими метаболическими заболеваниями костей, особенно среди пожилых людей во всем мире, является основной причиной роста спроса на оборудование для денситометрии (DEXA). Ранняя диагностика и мониторинг с помощью DEXA имеют решающее значение для предотвращения переломов и улучшения результатов лечения.

- Например, в марте 2024 года компания Hologic объявила об обновлении своей системы Horizon DXA, повышающем скорость сканирования и четкость изображений, что направлено на повышение эффективности скрининга остеопороза в группах высокого риска.

- Поставщики медицинских услуг все чаще инвестируют в системы DEXA в рамках протоколов профилактической помощи, что обусловлено государственными инициативами и политикой возмещения расходов, способствующей ранней оценке здоровья костей.

- Кроме того, растущее применение рутинного тестирования плотности костной ткани в гериатрии и программах лечения остеопороза расширяет установленную базу оборудования DEXA во всем мире.

- Растущая осведомленность и образовательные кампании по здоровью костей, проводимые организациями здравоохранения и правительствами, побуждают больше пациентов проходить скрининг DEXA, что повышает спрос.

- Расширение использования технологии DEXA за пределами здоровья костей, включая анализ состава тела для контроля ожирения и мониторинга спортивных результатов, открывает новые клинические и исследовательские возможности, что дополнительно стимулирует рост рынка.

Сдержанность/Вызов

Высокая стоимость оборудования и барьеры, связанные с соблюдением нормативных требований

- Относительно высокая стоимость приобретения и обслуживания современных систем DEXA остаётся существенным сдерживающим фактором, особенно для небольших медицинских учреждений и клиник в развивающихся регионах. Это ограничивает проникновение технологии DEXA на рынки, чувствительные к цене.

- Например, стоимость модернизации систем с использованием искусственного интеллекта может оказаться непомерно высокой, несмотря на долгосрочные клинические преимущества, что приведет к задержке в принятии решений о закупках.

- Кроме того, строгие нормативные требования и длительные процессы утверждения новых устройств DEXA и обновлений программного обеспечения создают проблемы для производителей, влияя на сроки выпуска продукции и увеличивая расходы на соблюдение требований.

- Опасения относительно воздействия радиации на пациента, хотя и низкие при использовании современных устройств, также способствуют осторожному применению этих устройств некоторыми поставщиками медицинских услуг.

- Решение этих проблем посредством оптимизации затрат, гибких вариантов финансирования и оптимизированных схем регулирования, а также непрерывного обучения пациентов и врачей преимуществам и безопасности сканирования DEXA, будет иметь решающее значение для устойчивого роста рынка.

Рынок оборудования для двухэмиссионной рентгеновской абсорбциометрии (DEXA)

Рынок сегментирован по типу продукта, области применения и конечным пользователям.

- По типу продукта

В зависимости от типа продукта рынок оборудования для двухэмиссионной рентгеновской абсорбциометрии (DEXA) сегментируется на центральную DEXA и периферическую DEXA. Сегмент центральной DEXA доминировал на рынке с наибольшей долей выручки в 46,1% в 2024 году благодаря своим комплексным возможностям визуализации, более высокой точности и широкому применению в больницах и научно-исследовательских учреждениях для детальной денситометрии костей и анализа состава тела. Системы центральной DEXA предпочтительны для сканирования всего тела и более точной оценки риска переломов, помогая принимать важные клинические решения при лечении остеопороза.

Ожидается, что сегмент периферийных денситометров (DEXA) будет демонстрировать самые высокие темпы роста в период с 2025 по 2032 год, что обусловлено растущим спросом на портативные и экономичные устройства, подходящие для предварительного скрининга, а также для удаленных или мобильных медицинских центров. Компактный размер и простота использования делают их популярными в клиниках и небольших медицинских учреждениях, особенно на развивающихся рынках, где доступ к крупным централизованным системам ограничен.

- По применению

По области применения рынок оборудования для двухэмиссионной рентгеновской абсорбциометрии (DEXA) сегментируется на анализ состава тела, диагностику переломов, костную денситометрию и оценку риска переломов. Костная денситометрия доминировала на рынке с наибольшей долей выручки в 2024 году из-за высокой клинической значимости тестирования минеральной плотности костной ткани для диагностики остеопороза и контроля эффективности лечения.

Ожидается, что сегмент анализа состава тела будет демонстрировать быстрый рост в течение прогнозируемого периода в связи с растущим интересом к контролю ожирения, спортивной медицине и оздоровительным программам, которые используют возможности DEXA для точного измерения распределения жировой, мышечной и костной массы.

- Конечными пользователями

По типу конечных пользователей рынок оборудования для двухэмиссионной рентгеновской абсорбциометрии (DEXA) сегментируется на больницы, клиники, мобильные медицинские центры и другие. В 2024 году на больницы пришлась наибольшая доля рынка благодаря их развитой инфраструктуре и способности поддерживать комплексные диагностические процессы, требующие централизованных систем DEXA для широкого круга пациентов.

Ожидается, что в течение прогнозируемого периода клиники зарегистрируют самый быстрый рост, поскольку они все чаще используют оборудование DEXA для рутинных скрининговых обследований и анализа состава тела, что обусловлено тенденциями в амбулаторном лечении и растущей осведомленностью о здоровье костей.

Региональный анализ рынка оборудования для двухэмиссионной рентгеновской абсорбциометрии (DEXA)

- Северная Америка доминировала на рынке оборудования для двухэмиссионной рентгеновской абсорбциометрии (DEXA) с наибольшей долей выручки в 39,2% в 2024 году, что объясняется развитой инфраструктурой здравоохранения в регионе, ранним внедрением передовых технологий визуализации и высокой распространенностью заболеваний костей, особенно в США, чему способствовали постоянные инновации от ведущих производителей медицинских устройств.

- Поставщики медицинских услуг и пациенты в регионе все больше внимания уделяют точной и ранней оценке здоровья костей, поддерживаемой государственными инициативами и политикой возмещения расходов, направленными на скрининг и профилактическую помощь при остеопорозе.

- Широкое распространение этой технологии подкрепляется значительными инвестициями в научные исследования и разработки в сфере здравоохранения, наличием квалифицированных специалистов и присутствием ключевых игроков на рынке, разрабатывающих передовые системы DEXA, что делает регион лидером как в области клинических, так и исследовательских приложений.

Обзор рынка оборудования для двухэмиссионной рентгеновской абсорбциометрии (DEXA) в США

Рынок оборудования для двухэмиссионной рентгеновской абсорбциометрии (DEXA) в США занял наибольшую долю выручки в 82% в Северной Америке в 2024 году благодаря развитой системе здравоохранения страны и растущему вниманию к ранней диагностике и профилактике остеопороза и метаболических заболеваний костей. Рост населения пожилого возраста в сочетании с государственными инициативами по поддержке скрининга здоровья костей ускоряет рост спроса. Интеграция технологий визуализации на основе искусственного интеллекта и наличие политики возмещения расходов дополнительно стимулируют рост рынка.

Обзор европейского рынка оборудования DEXA

Ожидается, что рынок оборудования для двухэмиссионной рентгеновской абсорбциометрии (DEXA) в Европе будет расти значительными среднегодовыми темпами в течение всего прогнозируемого периода, чему будут способствовать рост распространенности остеопороза и старение населения в регионе. Ключевыми факторами являются строгие правила в сфере здравоохранения и растущие инвестиции в диагностическую инфраструктуру. Расширение информационных кампаний и более широкое использование DEXA для оценки риска переломов в клинических рекомендациях способствуют его внедрению как в существующих больницах, так и в амбулаторных центрах.

Обзор рынка оборудования DEXA в Великобритании

Ожидается, что рынок оборудования для двухэмиссионной рентгеновской абсорбциометрии (DEXA) в Великобритании будет стабильно расти, что обусловлено растущим спросом на мониторинг здоровья костей и профилактические меры. Расширению рынка способствуют усилия правительства, направленные на снижение частоты переломов, связанных с остеопорозом, и расширение доступа к диагностике в учреждениях здравоохранения общего профиля. Росту заболеваемости метаболическими заболеваниями костей и внедрение портативных систем DEXA в программы помощи нуждающимся также способствуют.

Обзор рынка оборудования DEXA в Германии

Ожидается, что рынок оборудования для двухэмиссионной рентгеновской абсорбциометрии (DEXA) в Германии будет расти значительными среднегодовыми темпами в течение прогнозируемого периода, чему будут способствовать развитая экосистема здравоохранения и активная исследовательская деятельность, направленная на изучение здоровья костей и метаболизма. Растущая осведомленность пациентов и внедрение технологий DEXA с использованием искусственного интеллекта в диагностических центрах ускоряют проникновение на рынок. Инициативы в области устойчивого развития и соблюдение нормативных требований дополнительно стимулируют использование передовых систем визуализации.

Обзор рынка оборудования DEXA в Азиатско-Тихоокеанском регионе

Рынок оборудования для двухэмиссионной рентгеновской абсорбциометрии (DEXA) в Азиатско-Тихоокеанском регионе, как ожидается, продемонстрирует самый быстрый среднегодовой рост на 22% в период с 2025 по 2032 год, что обусловлено ростом распространенности остеопороза, увеличением расходов на здравоохранение и расширением диагностической инфраструктуры в таких странах, как Китай, Индия и Япония. Государственные программы здравоохранения, ориентированные на раннее выявление заболеваний костей, и рост числа пожилых людей способствуют росту спроса. Кроме того, растущая доступность недорогих и портативных устройств DEXA способствует их более широкому внедрению в сельской местности и пригородах.

Обзор рынка оборудования DEXA в Японии

Рынок оборудования для двухэмиссионной рентгеновской абсорбциометрии (DEXA) в Японии стабильно растёт благодаря старению населения страны и высоким стандартам здравоохранения. Растущее внимание к профилактической медицине и интеграция технологии DEXA с другими методами диагностики стимулируют спрос. Акцент Японии на внедрение передовых медицинских технологий и повышение осведомлённости населения о скрининге остеопороза дополнительно способствуют росту рынка.

Обзор рынка оборудования DEXA в Индии

Рынок оборудования для двухэмиссионной рентгеновской абсорбциометрии (DEXA) в Индии в 2024 году обеспечил наибольшую долю выручки в Азиатско-Тихоокеанском регионе, что обусловлено быстрой урбанизацией, ростом численности населения среднего класса и повышением осведомленности о здоровье костей. Расширение инфраструктуры здравоохранения и государственные инициативы, направленные на лечение остеопороза и профилактическую диагностику, стимулируют рост рынка. Доступность экономически эффективных систем DEXA и рост инвестиций в частную медицину дополнительно стимулируют их внедрение в больницах и диагностических центрах.

Доля рынка оборудования для двухэмиссионной рентгеновской абсорбциометрии (DEXA)

Лидерами отрасли оборудования для двухэмиссионной рентгеновской абсорбциометрии (DEXA) являются, в первую очередь, хорошо зарекомендовавшие себя компании, в том числе:

- Hologic, Inc. (США)

- GE Healthcare (США)

- Hitachi, Ltd. (Япония)

- Norland Medical Systems, Inc. (США)

- Furuno Electric Co., Ltd. (Япония)

- OsteoSys Co., Ltd. (Южная Корея)

- DMS Imaging (Франция)

- Остеометр MediTech A/S (Дания)

- Mindways Software, Inc. (США)

- OsteoDiagnostic Technologies, Inc. (США)

- OsteoCare Solutions, Inc. (США)

- Stratec Medizintechnik GmbH (Германия)

- Siemens Healthineers AG (Германия)

- Корпорация Shimadzu (Япония)

- PerkinElmer (США)

- Quidel Corporation (США)

- MEDILINK, Inc. (Япония)

- Biospace Co., Ltd. (Южная Корея)

- Rayence Co., Ltd. (Южная Корея)

- Корпорация Toshiba Medical Systems (Япония)

Каковы последние разработки на мировом рынке оборудования для двухэмиссионной рентгеновской абсорбциометрии (DEXA)?

- В мае 2025 года правительство Великобритании объявило о внедрении 13 новых сканеров DEXA по всей Англии для улучшения качества услуг по охране здоровья костей. Эти инвестиции, являющиеся частью государственного «Плана перемен», направлены на проведение дополнительных 29 000 сканирований костей в год, что поможет в ранней диагностике таких заболеваний, как остеопороз. Новые сканеры, которые называют «современными», оснащены передовыми технологиями для точного определения состояния костей. Эта инициатива является прямым действием национального правительства, направленным на повышение доступности и использования оборудования для DEXA.

- В марте 2024 года компания Hologic представила обновленную систему Horizon DXA с улучшенной четкостью изображений и ускоренным сканированием, разработанную для повышения эффективности и точности диагностики остеопороза в клинических условиях. Новая версия обеспечивает более высокую пропускную способность при сохранении точности измерения минеральной плотности костной ткани, отвечая растущему спросу на профилактические услуги по здоровью костей во всем мире.

- В феврале 2024 года компания Fujifilm India объявила об установке своего усовершенствованного денситометра FDX Visionary-DR в Центре спортивной травмы в Дели. Этот новый аппарат использует технологию 3D-DXA, которая позволяет создавать 3D-модели бедренной кости на основе стандартных изображений минеральной плотности костной ткани. Аппарат также оснащен функцией 2D-веерного луча для получения изображений высокого разрешения и быстрой оценки состояния костей за 15 секунд. Этот шаг является частью стратегии Fujifilm по решению проблемы высокой распространенности заболеваний костей в Индии и повышению доступности передовых диагностических возможностей для практикующих врачей. Это конкретный, практический шаг крупной компании на рынке денситометров.

- В ноябре 2023 года компания GE Healthcare представила обновлённый программный пакет для своей системы Lunar iDXA, добавив передовые инструменты анализа состава тела, полезные в спортивной медицине, питании и клинической диагностике. Это обновление расширяет возможности DEXA-сканирования, позволяя не только измерять плотность костей, но и проводить комплексную оценку состояния здоровья, отражая меняющиеся потребности рынка.

- В феврале 2022 года компании Aurora Spine и Echolight Medical, производитель портативного денситометра EchoS без использования радиации, объявили о заключении совместного маркетингового соглашения. Партнерство, известное как «Платформа Aurora DEXA», включало продвижение продукции друг друга среди своих клиентов. Это сотрудничество позволило Aurora Spine интегрировать технологию оценки состояния костей Echolight со своими спинальными имплантатами на основе технологии DEXA.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Интерактивная панель анализа данных

- Панель анализа компании для возможностей с высоким потенциалом роста

- Доступ аналитика-исследователя для настройки и запросов

- Анализ конкурентов с помощью интерактивной панели

- Последние новости, обновления и анализ тенденций

- Используйте возможности сравнительного анализа для комплексного отслеживания конкурентов

Методология исследования

Сбор данных и анализ базового года выполняются с использованием модулей сбора данных с большими размерами выборки. Этап включает получение рыночной информации или связанных данных из различных источников и стратегий. Он включает изучение и планирование всех данных, полученных из прошлого заранее. Он также охватывает изучение несоответствий информации, наблюдаемых в различных источниках информации. Рыночные данные анализируются и оцениваются с использованием статистических и последовательных моделей рынка. Кроме того, анализ доли рынка и анализ ключевых тенденций являются основными факторами успеха в отчете о рынке. Чтобы узнать больше, пожалуйста, запросите звонок аналитика или оставьте свой запрос.

Ключевой методологией исследования, используемой исследовательской группой DBMR, является триангуляция данных, которая включает в себя интеллектуальный анализ данных, анализ влияния переменных данных на рынок и первичную (отраслевую экспертную) проверку. Модели данных включают сетку позиционирования поставщиков, анализ временной линии рынка, обзор рынка и руководство, сетку позиционирования компании, патентный анализ, анализ цен, анализ доли рынка компании, стандарты измерения, глобальный и региональный анализ и анализ доли поставщика. Чтобы узнать больше о методологии исследования, отправьте запрос, чтобы поговорить с нашими отраслевыми экспертами.

Доступна настройка

Data Bridge Market Research является лидером в области передовых формативных исследований. Мы гордимся тем, что предоставляем нашим существующим и новым клиентам данные и анализ, которые соответствуют и подходят их целям. Отчет можно настроить, включив в него анализ ценовых тенденций целевых брендов, понимание рынка для дополнительных стран (запросите список стран), данные о результатах клинических испытаний, обзор литературы, обновленный анализ рынка и продуктовой базы. Анализ рынка целевых конкурентов можно проанализировать от анализа на основе технологий до стратегий портфеля рынка. Мы можем добавить столько конкурентов, о которых вам нужны данные в нужном вам формате и стиле данных. Наша команда аналитиков также может предоставить вам данные в сырых файлах Excel, сводных таблицах (книга фактов) или помочь вам в создании презентаций из наборов данных, доступных в отчете.