Canada Fleet Management Market, By Offering (Solutions and Services), Lease Type (On-Lease and Without Lease), Mode of Transport (Automotive, Marine, Rolling Stock, and Aircraft), Vehicle Type (Internal Combustion Engine and Electric vehicle), Hardware (GPS Tracking Devices, Dash Cameras, Bluetooth Tracking Tags, Data Loggers, and Others), Fleet Size (Small Fleets (1-5 Vehicles), Medium Fleets (5-20 Vehicles) and Large & Enterprise Fleets (20-50+ Vehicles), Communication Range (Short Range Communication and Long Range Communication), Deployment Model (On-Premise, Cloud, and Hybrid), Technology (GNSS, Cellular Systems, Electronic Data Interchange (EDI), Remote Sensing, Computational Method & Decision Making, RFID, and Others), Functions (Monitoring Driver Behavior, Fuel Consumption, Asset Management, ELD Complaint, Route Management, Vehicle Maintenance Updates, Delivery Schedule, Accident Prevention, Real Time Vehicle Location, Mobile Apps, and Others), Operations (Private and Commercial), Business Type (Small Business and Large Business), End User (Automotive, Transportation & Logistics, Retail, Manufacturing, Food & Beverages, Energy & Utilities, Mining, Government, Healthcare, Agriculture, Construction, and Others) – Industry Trends and Forecast to 2030.

Canada Fleet Management Market Analysis and Size

Major factors expected to boost the growth of the fleet management market in the forecast period are the rise in several industrial applications, including aerospace, steel, power, chemical, and others. Furthermore, the increased resistance to load variations is the benefit of fleet management, which is further anticipated to propel the growth of the fleet management market.

Data Bridge Market Research analyses that the Canada fleet management market is expected to reach the value of USD 2,204,927.30 thousand by 2030, at a CAGR of 8.1% during the forecast period. The fleet management market report also covers pricing analysis, patent analysis, and technological advancements in depth.

|

Report Metric |

Details |

|

Forecast Period |

2023 - 2030 |

|

Base Year |

2022 |

|

Historic Years |

2021 (Customizable to 2015 – 2020) |

|

Quantitative Units |

Revenue in USD Thousand |

|

Segments Covered |

Предложение (решения и услуги), Тип аренды (лизинг и без лизинга), Вид транспорта (автомобильный, морской, подвижной состав и самолет), Тип транспортного средства (двигатель внутреннего сгорания и электромобиль), Оборудование ( устройства слежения GPS , видеорегистраторы, метки слежения Bluetooth, регистраторы данных и другие), Размер парка (малые парки (1-5 транспортных средств), средние парки (5-20 транспортных средств) и большие и корпоративные парки (20-50+ транспортных средств), Дальность связи (связь на короткие и большие расстояния), Модель развертывания (локальная, облачная и гибридная), Технология (GNSS, сотовые системы, электронный обмен данными (EDI), дистанционное зондирование, вычислительный метод и принятие решений, RFID и другие), Функции (мониторинг поведения водителя, расход топлива, управление активами, жалобы ELD, управление маршрутами, обновления технического обслуживания транспортных средств, график доставки, предотвращение аварий, местоположение транспортного средства в реальном времени, мобильные приложения и Другие), Операции (частные и коммерческие), Тип бизнеса (малый и крупный бизнес), Конечный пользователь (автомобилестроение, транспорт и логистика, розничная торговля, производство, продукты питания и напитки, энергетика и коммунальные услуги, горнодобывающая промышленность, государственное управление, здравоохранение, сельское хозяйство, строительство и другие) |

|

Страна покрытия |

Канада |

|

Охваченные участники рынка |

Element Fleet Management Corp. (США), Verizon. (США), Geotab Inc. (Канада), Motive Technologies, Inc. (США), Jim Pattison Lease (Канада), Holman, Inc. (США), Cisco Systems, Inc. (США), Donlen (США), Omnitracs (часть Solera) (США), Wheels Inc. (США), DENSO CORPORATION (Япония), AT&T (США), Continental AG (Германия), ORBCOMM (США), Summit Fleet Leasing and Management (Канада), Siemens (Германия), ADDISON LEASING OF CANADA LTD (Канада), Robert Bosch GmbH (Германия), RAM Tracking (Великобритания), TRANSFLO (США), Foss National Leasing Ltd. (Канада), Samsara Inc. (США), Sierra Wireless. (США), Mendix Technology BV (Нидерланды), ALD Automotive (Франция), IBM (США), ADDISON LEASING OF CANADA LTD (Канада), Robert Bosch GmbH (Германия), RAM Tracking (Великобритания), TRANSFLO (США) и другие |

Определение рынка

Управление автопарком — это процессы и методы, используемые для управления автопарком компании. Управление автопарком включает автомобили, грузовики, фургоны и другие транспортные средства, используемые в деловых целях. Оно также включает множество методов, таких как приобретение транспортных средств, техническое обслуживание, управление топливом, управление водителями, а также безопасность и соответствие требованиям. Цель управления автопарком — оптимизировать использование транспортных средств компании для повышения эффективности, снижения затрат и повышения безопасности. Эффективное управление автопарком может помочь компаниям повысить производительность, сократить время простоя и продлить срок службы своих транспортных средств. Оно также может помочь улучшить поведение водителей, сократить количество аварий и обеспечить соответствие правилам и политикам. Управление автопарком используется в различных отраслях, включая транспорт, логистику, службы доставки и строительство. Передовые технологии, такие как GPS-отслеживание и телематика, сделали управление автопарком более эффективным и действенным в последние годы.

Динамика рынка управления автопарком в Канаде

В этом разделе рассматривается понимание движущих сил рынка, возможностей, ограничений и проблем. Все это подробно обсуждается ниже:

Драйверы

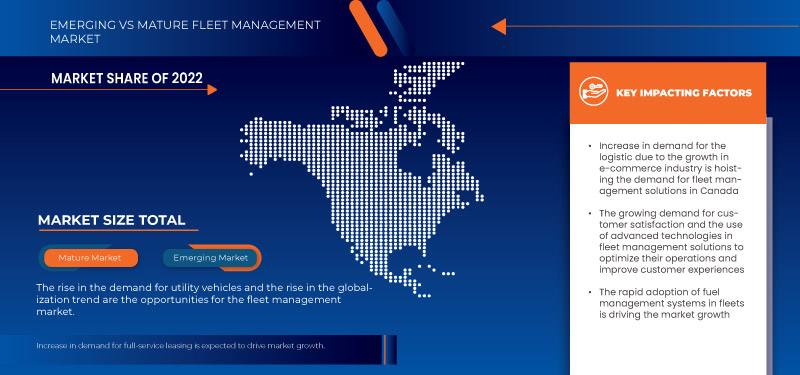

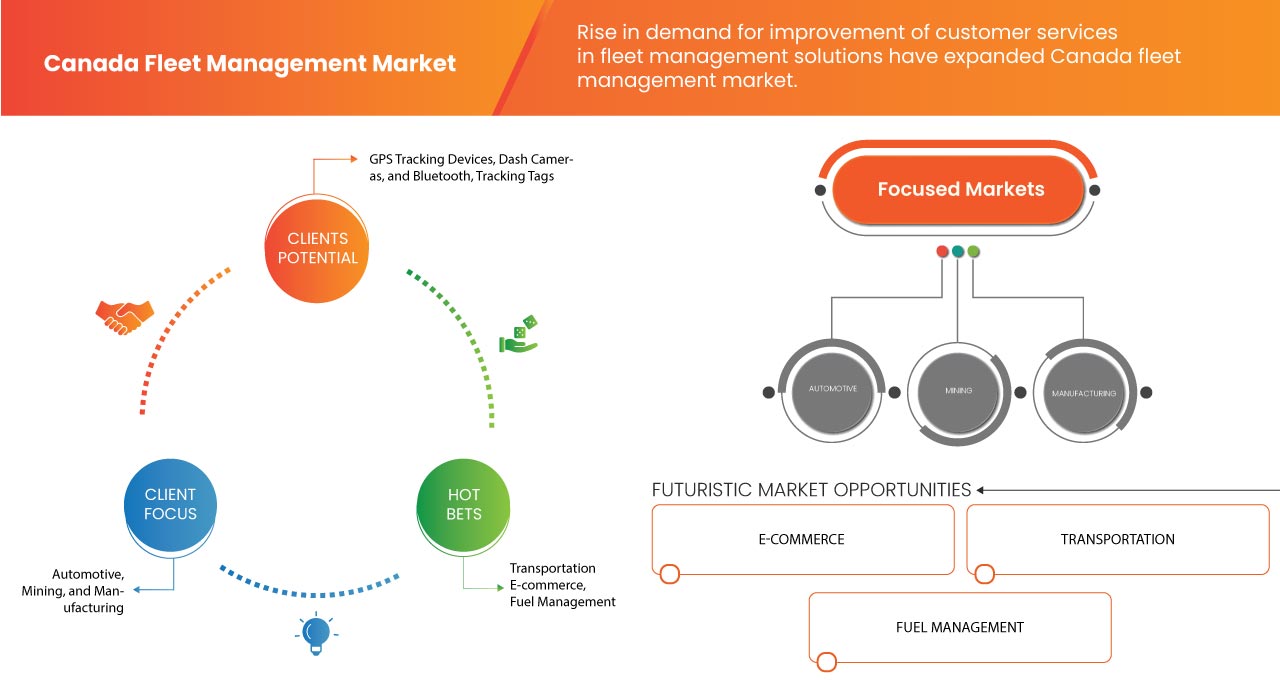

- Рост спроса на логистику из-за индустрии электронной коммерции

Управление автопарком — это практика, которая позволяет организациям управлять и координировать транспортные средства доставки для достижения оптимальной эффективности и снижения затрат. Практика управления автопарком используется для мониторинга и регистрации курьеров и персонала по доставке. Она требует системы технологий, которые облегчают менеджеру автопарка координацию действий от управления топливом до планирования маршрутов, и ею можно легко управлять с помощью программного обеспечения для управления автопарком. Расширение индустрии электронной коммерции значительно повлияло на логистическую отрасль. Логистика считается основой индустрии электронной коммерции, поскольку она непосредственно влияет на плановые операции, склады и организации производственной сети. Они будут постепенно зависеть от переоценки, чтобы справиться с растущими запросами, связанными с развитием интернет-бизнеса. Принятие этого курса либо для доставки последней мили, либо для удовлетворения запросов позволит им гарантировать предсказуемую, надежную, продуктивную и безошибочную доставку. Таким образом, это может стать важным фактором в управлении и расширении давления, вызванного ожидаемым ростом индустрии электронной коммерции.

- Рост спроса на улучшение обслуживания клиентов

Сегодня клиенты умнее и имеют более высокие ожидания, чем когда-либо прежде. Удовлетворенность и счастье клиентов являются одними из самых важных соображений для любой компании. Независимо от сферы бизнеса, недовольные клиенты не будут клиентами долго, поэтому важно, чтобы они были довольны и чувствовали себя ценимыми. Это также верно для логистики и управления автопарком, где удержание клиентов является ключом к долгосрочному успеху. Улучшение обслуживания клиентов и удовлетворенности за счет улучшения эффективности управления автопарком является ключевым фактором, который, как ожидается, усилит рынок управления автопарком в Канаде. На сегодняшнем конкурентном рынке компании осознают важность удовлетворенности клиентов и используют передовые технологии в решениях по управлению автопарком для оптимизации своих операций и улучшения обслуживания клиентов.

Возможность

- Рост спроса на коммунальные автомобили

Транспортные средства общего назначения — это транспортные средства, предназначенные и используемые для перевозки грузов или пассажиров. К таким транспортным средствам относятся грузовики, фургоны, автобусы и аналогичные транспортные средства, используемые в коммерческих целях. Рынок транспортных средств общего назначения является важнейшим компонентом автомобильной промышленности Канады и за последние десятилетия значительно вырос. Рост спроса на транспортные средства общего назначения можно объяснить несколькими факторами, включая рост индустрии электронной коммерции, растущую урбанизацию и потребность в эффективных транспортных системах. Также ожидается рост спроса на услуги и программное обеспечение для управления автопарком, поскольку все больше предприятий полагаются на транспортные средства общего назначения для своих транспортных нужд. Одной из причин роста спроса на транспортные средства общего назначения является рост индустрии электронной коммерции. Спрос на транспортные услуги увеличился с ростом числа платформ для онлайн-покупок. Использование транспортных средств общего назначения стало более распространенным, а управление автопарком стало более важным.

Ограничения/Проблемы

- Более низкая эффективность подключения

Логистика и транспортная отрасль значительно изменились за последние годы. Были введены такие концепции, как оцифровка, появление больших данных и подключение, и многие автопарки теперь используют ранние версии этих новых технологий. Во многих случаях они меняют то, как менеджеры автопарка работают ежедневно. Подключение является одной из самых важных и эффективных концепций. Это когда менеджер автопарка может иметь обзор всего автопарка и оставаться на связи с водителями, грузовиками и прицепами с помощью автоматизированных процессов, которые предоставляют действенные данные с бортовых устройств. С помощью телематических устройств и подключенных программных решений проблемы автопарка могут быть оповещены о незначительных проблемах с транспортным средством по мере их возникновения, что позволяет им решать проблемы раньше и устранять неполадки до возникновения поломок. Это дает гибкость для выполнения текущего ремонта или планового обслуживания заранее, что позволяет грузовикам чаще оставаться в пути, тратя больше времени на доставку грузов.

- Неправильное руководство по включению маршрута

Система отслеживания транспортных средств может быть определена как часть системы управления автопарком, которая позволяет оператору автопарка определять местоположение транспортного средства на протяжении всего пути транспортного средства с учетом времени. Помимо использования данных, полученных системой отслеживания транспортных средств для обеспечения соблюдения расписания движения автобусов, эти данные также предоставляют важные входные данные для принятия решений. Система облегчает расчет точного расстояния, пройденного за определенный период, расчет скорости автобуса в заданном месте, анализ времени, необходимого транспортному средству для преодоления определенного расстояния, и т. д. Она становится очень мощным инструментом в случае эксплуатационных агентств.

Последние события

- В июне 2023 года партнерство Siemens Xcelerator с Helixx станет решающим шагом в их стремлении к революции в производстве электромобилей. Интегрируя отраслевое программное обеспечение и услуги Siemens, Helixx стремится быстро развернуть свою инновационную систему производства электромобилей по всему миру, способствуя устойчивому экономическому росту с помощью доступных решений для городской мобильности с нулевым уровнем выбросов. Это сотрудничество подчеркивает новаторскую концепцию Helixx — Helixx Mobility Hubs, которая позволит лицензированным заводам по всему миру производить широкий спектр электромобилей, значительно расширяя их влияние за пределы первоначальных производственных прогнозов.

- В июне 2023 года Foss National Leasing Ltd. представила годовой отчет о программе Foss EV Pilot Program, в рамках которой интеграция электромобилей (ЭМ) в автопарк компании дала ценные операционные данные, помогающие клиентам в их пути внедрения ЭМ. Эта программа эффективно способствует более плавному переходу к решениям по устойчивому управлению автопарком, устраняя неопределенности. В заключение следует отметить, что постоянные усилия компании свидетельствуют о ключевой роли программы в содействии принятию обоснованных решений для более экологичного и эффективного будущего.

Масштаб рынка управления автопарком в Канаде

Канадский рынок управления автопарком сегментирован на основе предложения, типа аренды, вида транспорта, типа транспортного средства, оборудования, размера автопарка, диапазона связи, модели развертывания, технологии, функций, операций, типа бизнеса и конечного пользователя. Рост среди этих сегментов поможет вам проанализировать сегменты с незначительным ростом в отраслях и предоставить пользователям ценный обзор рынка и рыночные идеи, которые помогут им принимать стратегические решения для определения основных рыночных приложений.

Предложение

- Решения

- Услуги

По принципу предложения рынок сегментируется на решения и услуги.

Тип аренды

- В аренду

- Без аренды

По типу аренды рынок сегментируется на арендуемый и неарендуемый.

Вид транспорта

- Автомобильный

- Морской

- Подвижной состав

- Самолеты

По виду транспорта рынок сегментируется на автомобильный, морской, подвижной и авиационный.

Тип транспортного средства

- Двигатель внутреннего сгорания

- Электромобиль

По типу транспортного средства рынок сегментируется на автомобили с двигателем внутреннего сгорания и электромобили.

Аппаратное обеспечение

- Устройства GPS-слежения

- Видеорегистраторы

- Bluetooth-метки отслеживания

- Регистраторы данных

- Другие

По аппаратному обеспечению рынок сегментируется на устройства GPS-слежения, видеорегистраторы, Bluetooth-метки слежения, регистраторы данных и другие.

Размер флота

- Малые автопарки (1-5 автомобилей)

- Средний автопарк (5-20 автомобилей)

- Крупные и корпоративные автопарки (20–50+ транспортных средств)

По размеру автопарка рынок сегментируется на небольшие автопарки (1–5 транспортных средств), средние автопарки (5–20 транспортных средств) и крупные и корпоративные автопарки (20–50 и более транспортных средств).

Дальность связи

- Связь на короткие расстояния

- Связь на большие расстояния

По дальности связи рынок сегментируется на связь ближнего и дальнего действия.

Модель развертывания

- Локально

- Облако

- Гибридный

На основе модели развертывания рынок сегментируется на локальный, облачный и гибридный.

Технологии

- ГНСС

- Сотовые Системы

- Электронный обмен данными (ЭОД)

- Дистанционное зондирование

- Вычислительные методы и принятие решений

- RFID

- Другие

По технологическому признаку рынок сегментируется на ГНСС, сотовые системы, электронный обмен данными (EDI), дистанционное зондирование, вычислительные методы и принятие решений, RFID и другие.

Функции

- Управление активами

- Управление маршрутом

- Расход топлива

- Местоположение автомобиля в реальном времени

- График доставки

- Предотвращение несчастных случаев

- Мобильные приложения

- Мониторинг поведения водителя

- Обновления по техническому обслуживанию транспортных средств

- Соответствие ELD

- Другие

На основе функций рынок сегментируется на управление активами, управление маршрутами, расход топлива, местоположение транспортного средства в реальном времени, график доставки, предотвращение аварий, мобильные приложения, мониторинг поведения водителя, обновления технического обслуживания транспортного средства, соответствие требованиям ELD и другие.

Операции

- Частный

- Коммерческий

По характеру деятельности рынок сегментируется на частный и коммерческий.

Тип бизнеса

- Малый бизнес

- Крупный бизнес

По типу бизнеса рынок сегментируется на малый бизнес и крупный бизнес.

Конечный пользователь

- Автомобильный

- Транспорт и логистика

- Розничная торговля

- Производство

- Еда и напитки

- Энергетика и коммунальные услуги

- Добыча полезных ископаемых

- Правительство

- Здравоохранение

- Сельское хозяйство

- Строительство

- Другие

По признаку конечного пользователя рынок сегментируется на автомобилестроение, транспорт и логистику, розничную торговлю, производство, продукты питания и напитки, энергетику и коммунальные услуги, горнодобывающую промышленность, государственный сектор, здравоохранение, сельское хозяйство, строительство и другие.

Анализ конкурентной среды и доли рынка управления автопарком в Канаде

Конкурентная среда рынка управления автопарком Канады содержит сведения по конкурентам. Включены сведения о компании, финансы компании, полученный доход, рыночный потенциал, инвестиции в исследования и разработки, новые рыночные инициативы, присутствие в стране, производственные площадки и объекты, производственные мощности, сильные и слабые стороны компании, запуск продукта, широта и широта продукта и доминирование приложений. Приведенные выше данные относятся только к фокусу компаний, связанному с рынком управления автопарком.

Некоторые из основных игроков, работающих на рынке: Element Fleet Management Corp. (США), Verizon. (США), Geotab Inc. (Канада), Motive Technologies, Inc. (США), Jim Pattison Lease (Канада), Holman, Inc. (США), Cisco Systems, Inc. (США), Donlen (США), Omnitracs (часть Solera) (США), Wheels Inc. (США), DENSO CORPORATION (Япония), AT&T (США), Continental AG (Германия), ORBCOMM (США), Summit Fleet Leasing and Management (Канада), Siemens (Германия), ADDISON LEASING OF CANADA LTD (Канада), Robert Bosch GmbH (Германия), RAM Tracking (Великобритания), TRANSFLO (США), Foss National Leasing Ltd. (Канада), Samsara Inc. (США), Sierra Wireless. (США), Mendix Technology BV (Нидерланды), ALD Automotive (Франция), IBM (США), ADDISON LEASING OF CANADA LTD (Канада), Robert Bosch GmbH (Германия), RAM Tracking (Великобритания) и TRANSFLO (США) и другие.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Интерактивная панель анализа данных

- Панель анализа компании для возможностей с высоким потенциалом роста

- Доступ аналитика-исследователя для настройки и запросов

- Анализ конкурентов с помощью интерактивной панели

- Последние новости, обновления и анализ тенденций

- Используйте возможности сравнительного анализа для комплексного отслеживания конкурентов

Содержание

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE CANADA FLEET MANAGEMENT MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 MULTIVARIATE MODELING

2.8 OFFERING TIMELINE CURVE

2.9 MARKET END-USE COVERAGE GRID

2.1 SECONDARY SOURCES

2.11 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 INCREASE IN DEMAND FOR LOGISTICS DUE TO THE E-COMMERCE INDUSTRY

5.1.2 RISE IN DEMAND FOR IMPROVEMENT OF CUSTOMER SERVICES

5.1.3 RAPID ADOPTION OF FUEL MANAGEMENT SYSTEMS IN FLEETS

5.1.4 INCREASE IN DEMAND FOR FULL-SERVICE LEASING

5.2 RESTRAINTS

5.2.1 LOWER EFFICIENCY IN CONNECTIVITY

5.2.2 IMPROPER GUIDANCE FOR ENABLING THE ROUTE

5.3 OPPORTUNITIES

5.3.1 RISE IN THE DEMAND FOR UTILITY VEHICLES

5.3.2 RISE IN THE TREND OF GLOBALIZATION

5.3.3 INCREASING PARTNERSHIP, ACQUISITION, AND COLLABORATION AMONG MARKET PLAYERS

5.3.4 INCREASE IN DATA-DRIVEN MODELS IN MOBILITY

5.4 CHALLENGES

5.4.1 ACCUMULATION OF HUGE DATA VOLUME

5.4.2 RISE IN CYBER THREATS

6 CANADA FLEET MANAGEMENT MARKET, BY FUNCTIONS

6.1 OVERVIEW

6.2 ASSET MANAGEMENT

6.3 ROUTE MANAGEMENT

6.4 FUEL CONSUMPTION

6.5 REAL TIME VEHICLE LOCATION

6.6 DELIVERY SCHEDULE

6.7 ACCIDENT PREVENTION

6.8 MOBILE APPS

6.9 MONITORING DRIVER BEHAVIOR

6.1 VEHICLE MAINTENANCE UPDATES

6.11 ELD COMPLIANCE

6.12 OTHERS

7 CANADA FLEET MANAGEMENT MARKET, BY OPERATIONS

7.1 OVERVIEW

7.2 COMMERCIAL

7.3 PRIVATE

8 CANADA FLEET MANAGEMENT MARKET, BY BUSINESS TYPE

8.1 OVERVIEW

8.2 LARGE BUSINESS

8.2.1 FLORIST & GIFT DELIVERY BUSINESS

8.2.2 CATERING & FOOD DELIVERING COMPANY

8.2.3 CLEANING SERVICE COMPANY

8.2.4 ELECTRICIAN/PLUMBING/HVAC COMPANY

8.2.5 LANDSCAPING BUSINESS

8.3 SMALL BUSINESS

8.3.1 RENTAL CAR/TRUCK COMPANY

8.3.2 MOVING COMPANY

8.3.3 TAXI COMPANY

8.3.4 DELIVERY COMPANY

8.3.5 LONG HAUL SEMI-TRUCK COMPANY

9 CANADA FLEET MANAGEMENT MARKET, BY LEASE TYPE

9.1 OVERVIEW

9.2 ON-LEASE

9.3 WITHOUT LEASE

9.3.1 OPEN ENDED

9.3.2 CLOSE ENDED

10 CANADA FLEET MANAGEMENT MARKET, BY MODE OF TRANSPORT

10.1 OVERVIEW

10.1.1 AUTOMOTIVE

10.1.2 LIGHT COMMERCIAL VEHICLE

10.1.2.1 PICK UP TRUCKS

10.1.2.2 VANS

10.1.2.2.1 PASSENGER VAN

10.1.2.2.2 CARGO VAN

10.1.2.3 MINI BUS

10.1.2.4 OTHERS

10.1.3 PASSENGER CARS

10.1.3.1 SUV

10.1.3.2 HATCHBACK

10.1.3.3 SEDAN

10.1.3.4 COUPE

10.1.3.5 CROSSOVER

10.1.3.6 CONVERTIBLE

10.1.3.7 OTHERS

10.1.4 HEAVY COMMERCIAL VEHICLE

10.1.4.1 TRUCKS

10.1.4.2 TRAILERS

10.1.4.3 FORKLIFTS

10.1.4.4 SPECIALIST VEHICLES (SUCH AS MOBILE CONSTRUCTION MACHINERY)

10.1.5 MARINE

10.1.6 ROLLING STOCK

10.1.7 AIRCRAFT

11 CANADA FLEET MANAGEMENT MARKET, BY VEHICLE TYPE

11.1 OVERVIEW

11.2 INTERNAL COMBUSTION ENGINE

11.2.1 PETROL

11.2.2 DIESEL

11.2.3 CNG

11.2.4 OTHERS

11.3 ELECTRIC VEHICLE

11.3.1 BATTERY ELECTRIC VEHICLE (BEV)

11.3.2 PLUG-IN ELECTRIC VEHICLE (PEV)

11.3.3 HYBRID ELECTRIC VEHICLES (HEVS)

12 CANADA FLEET MANAGEMENT MARKET, BY HARDWARE

12.1 OVERVIEW

12.2 GPS TRACKING DEVICES

12.3 DASH CAMERAS

12.4 BLUETOOTH TRACKING TAGS

12.5 DATA LOGGERS

12.6 OTHERS

13 CANADA FLEET MANAGEMENT MARKET, BY FLEET SIZE

13.1 OVERVIEW

13.2 SMALL FLEETS (1-5 VEHICLES)

13.3 MEDIUM FLEETS (5-20 VEHICLES)

13.4 LARGE & ENTERPRISE FLEETS (20-50+ VEHICLES)

14 CANADA FLEET MANAGEMENT MARKET, BY COMMUNICATION RANGE

14.1 OVERVIEW

14.2 SHORT RANGE COMMUNICATION

14.3 LONG RANGE COMMUNICATION

15 CANADA FLEET MANAGEMENT MARKET, BY DEPLOYMENT MODEL

15.1 OVERVIEW

15.2 ON-PREMISE

15.3 CLOUD

15.4 HYBRID

16 CANADA FLEET MANAGEMENT MARKET, BY OFFERING

16.1 OVERVIEW

16.2 SOLUTIONS

16.2.1 ETA PREDICTIONS

16.2.1.1 STREAMLINED ROUTES

16.2.1.2 DETAILED LOCATION DATA

16.2.1.3 BREAKDOWN NOTIFICATION

16.2.2 OPERATIONS MANAGEMENT

16.2.2.1 FLEET TRACKING & GEO-FENCING

16.2.2.2 ROUTING & SCHEDULING

16.2.2.3 REAL & IDLE TIME MONITORING

16.2.3 PERFORMANCE MANAGEMENT

16.2.3.1 DRIVER MANAGEMENT

16.2.3.1.1 TRACKING

16.2.3.1.2 ROADSIDE/EMERGENCY ASSISTANCE FOR DRIVERS

16.2.3.1.3 MONITORING OF MISUSE (HARD BRAKING)

16.2.3.2 FLEET MANAGEMENT & TRACKING

16.2.3.2.1 REAL TIME ROUTING

16.2.3.2.2 SPEED/IDLING REAL TIME FEEDBACK

16.2.3.2.3 ENGINE DATA VIA ON-BOARD SENSORS

16.2.4 VEHICLE MAINTENANCE & DIAGNOSTICS

16.2.5 SAFETY & COMPLIANCE MANAGEMENT

16.2.6 FLEET ANALYTICS AND REPORTING

16.2.7 CONTRACT MANAGEMENT

16.2.7.1 BY STRUCTURE

16.2.7.1.1 LEASING

16.2.7.1.2 FUEL MANAGEMENT AND EV CHARGING

16.2.7.1.3 MAINTENANCE SPEND PLANNING

16.2.7.1.4 ACCIDENT MANAGEMENT

16.2.7.1.5 VEHICLE REGISTRATION

16.2.7.1.6 ADMINISTRATIVE COST

16.2.7.1.7 OTHERS

16.2.7.2 BY MODEL

16.2.7.2.1 LONG TERM CONTRACT

16.2.7.2.2 SHORT TERM CONTRACT

16.2.8 RISK MANAGEMENT

16.2.9 ELECTRIFICATION

16.2.10 REMARKETING

16.2.11 OTHERS

16.3 SERVICES

16.3.1 PROFESSIONAL SERVICES

16.3.1.1 SUPPORT & MAINTENANCE

16.3.1.2 IMPLEMENTATION

16.3.1.3 CONSULTING

16.3.2 MANAGED SERVICES

17 CANADA FLEET MANAGEMENT MARKET, BY TECHNOLOGY

17.1 OVERVIEW

17.2 GNSS

17.3 CELLULAR SYSTEMS

17.4 ELECTRONIC DATA INTERCHANGE (EDI)

17.5 REMOTE SENSING

17.6 COMPUTATIONAL METHOD & DECISION MAKING

17.7 RFID

17.8 OTHERS

18 CANADA FLEET MANAGEMENT MARKET, BY END USER

18.1 OVERVIEW

18.2 AUTOMOTIVE

18.2.1 SOLUTIONS

18.2.1.1 ETA PREDICTIONS

18.2.1.2 OPERATIONS MANAGEMENT

18.2.1.3 PERFORMANCE MANAGEMENT

18.2.1.4 VEHICLE MAINTENANCE & DIAGNOSTICS

18.2.1.5 SAFETY & COMPLIANCE MANAGEMENT

18.2.1.6 FLEET ANALYTICS AND REPORTING SEGMENT

18.2.1.7 CONTRACT MANAGEMENT

18.2.1.8 RISK MANAGEMENT

18.2.1.9 ELECTRIFICATION

18.2.1.10 REMARKETING

18.2.2 SERVICES

18.2.2.1 PROFESSIONAL SERVICES

18.2.2.2 MANAGED SERVICES

18.3 TRANSPORTATION & LOGISTICS

18.3.1 SOLUTIONS

18.3.1.1 ETA PREDICTIONS

18.3.1.2 OPERATIONS MANAGEMENT

18.3.1.3 PERFORMANCE MANAGEMENT

18.3.1.4 VEHICLE MAINTENANCE & DIAGNOSTICS

18.3.1.5 SAFETY & COMPLIANCE MANAGEMENT

18.3.1.6 FLEET ANALYTICS AND REPORTING SEGMENT

18.3.1.7 CONTRACT MANAGEMENT

18.3.1.8 RISK MANAGEMENT

18.3.1.9 ELECTRIFICATION

18.3.1.10 REMARKETING

18.3.2 SERVICES

18.3.2.1 PROFESSIONAL SERVICES

18.3.2.2 MANAGED SERVICES

18.4 RETAIL

18.4.1 SOLUTIONS

18.4.1.1 ETA PREDICTIONS

18.4.1.2 OPERATIONS MANAGEMENT

18.4.1.3 PERFORMANCE MANAGEMENT

18.4.1.4 VEHICLE MAINTENANCE & DIAGNOSTICS

18.4.1.5 SAFETY & COMPLIANCE MANAGEMENT

18.4.1.6 FLEET ANALYTICS AND REPORTING SEGMENT

18.4.1.7 CONTRACT MANAGEMENT

18.4.1.8 RISK MANAGEMENT

18.4.1.9 ELECTRIFICATION

18.4.1.10 REMARKETING

18.4.2 SERVICES

18.4.2.1 PROFESSIONAL SERVICES

18.4.2.2 MANAGED SERVICES

18.5 MANUFACTURING

18.5.1 SOLUTIONS

18.5.1.1 ETA PREDICTIONS

18.5.1.2 OPERATIONS MANAGEMENT

18.5.1.3 PERFORMANCE MANAGEMENT

18.5.1.4 VEHICLE MAINTENANCE & DIAGNOSTICS

18.5.1.5 SAFETY & COMPLIANCE MANAGEMENT

18.5.1.6 FLEET ANALYTICS AND REPORTING SEGMENT

18.5.1.7 CONTRACT MANAGEMENT

18.5.1.8 RISK MANAGEMENT

18.5.1.9 ELECTRIFICATION

18.5.1.10 REMARKETING

18.5.2 SERVICES

18.5.2.1 PROFESSIONAL SERVICES

18.5.2.2 MANAGED SERVICES

18.6 FOOD & BEVERAGES

18.6.1 SOLUTIONS

18.6.1.1 ETA PREDICTIONS

18.6.1.2 OPERATIONS MANAGEMENT

18.6.1.3 PERFORMANCE MANAGEMENT

18.6.1.4 VEHICLE MAINTENANCE & DIAGNOSTICS

18.6.1.5 SAFETY & COMPLIANCE MANAGEMENT

18.6.1.6 FLEET ANALYTICS AND REPORTING SEGMENT

18.6.1.7 CONTRACT MANAGEMENT

18.6.1.8 RISK MANAGEMENT

18.6.1.9 ELECTRIFICATION

18.6.1.10 REMARKETING

18.6.2 SERVICES

18.6.2.1 PROFESSIONAL SERVICES

18.6.2.2 MANAGED SERVICES

18.7 ENERGY & UTILITIES

18.7.1 SOLUTIONS

18.7.1.1 ETA PREDICTIONS

18.7.1.2 OPERATIONS MANAGEMENT

18.7.1.3 PERFORMANCE MANAGEMENT

18.7.1.4 VEHICLE MAINTENANCE & DIAGNOSTICS

18.7.1.5 SAFETY & COMPLIANCE MANAGEMENT

18.7.1.6 FLEET ANALYTICS AND REPORTING SEGMENT

18.7.1.7 CONTRACT MANAGEMENT

18.7.1.8 RISK MANAGEMENT

18.7.1.9 ELECTRIFICATION

18.7.1.10 REMARKETING

18.7.2 SERVICES

18.7.2.1 PROFESSIONAL SERVICES

18.7.2.2 MANAGED SERVICES

18.8 MINING

18.8.1 SOLUTIONS

18.8.1.1 ETA PREDICTIONS

18.8.1.2 OPERATIONS MANAGEMENT

18.8.1.3 PERFORMANCE MANAGEMENT

18.8.1.4 VEHICLE MAINTENANCE & DIAGNOSTICS

18.8.1.5 SAFETY & COMPLIANCE MANAGEMENT

18.8.1.6 FLEET ANALYTICS AND REPORTING

18.8.1.7 CONTRACT MANAGEMENT

18.8.1.8 RISK MANAGEMENT

18.8.1.9 ELECTRIFICATION

18.8.1.10 REMARKETING

18.8.2 SERVICES

18.8.2.1 PROFESSIONAL SERVICES

18.8.2.2 MANAGED SERVICES

18.9 GOVERNMENT

18.9.1 SOLUTIONS

18.9.1.1 ETA PREDICTIONS

18.9.1.2 OPERATIONS MANAGEMENT

18.9.1.3 PERFORMANCE MANAGEMENT

18.9.1.4 VEHICLE MAINTENANCE & DIAGNOSTICS

18.9.1.5 SAFETY & COMPLIANCE MANAGEMENT

18.9.1.6 FLEET ANALYTICS AND REPORTING

18.9.1.7 CONTRACT MANAGEMENT

18.9.1.8 RISK MANAGEMENT

18.9.1.9 ELECTRIFICATION

18.9.1.10 REMARKETING

18.9.2 SERVICES

18.9.2.1 PROFESSIONAL SERVICES

18.9.2.2 MANAGED SERVICES

18.1 HEALTHCARE

18.10.1 SOLUTIONS

18.10.1.1 ETA PREDICTIONS

18.10.1.2 OPERATIONS MANAGEMENT

18.10.1.3 PERFORMANCE MANAGEMENT

18.10.1.4 VEHICLE MAINTENANCE & DIAGNOSTICS

18.10.1.5 SAFETY & COMPLIANCE MANAGEMENT

18.10.1.6 FLEET ANALYTICS AND REPORTING

18.10.1.7 CONTRACT MANAGEMENT

18.10.1.8 RISK MANAGEMENT

18.10.1.9 ELECTRIFICATION

18.10.1.10 REMARKETING

18.10.2 SERVICES

18.10.2.1 PROFESSIONAL SERVICES

18.10.2.2 MANAGED SERVICES

18.11 AGRICULTURE

18.11.1 SOLUTIONS

18.11.1.1 ETA PREDICTIONS

18.11.1.2 OPERATIONS MANAGEMENT

18.11.1.3 PERFORMANCE MANAGEMENT

18.11.1.4 VEHICLE MAINTENANCE & DIAGNOSTICS

18.11.1.5 SAFETY & COMPLIANCE MANAGEMENT

18.11.1.6 FLEET ANALYTICS AND REPORTING

18.11.1.7 CONTRACT MANAGEMENT

18.11.1.8 RISK MANAGEMENT

18.11.1.9 ELECTRIFICATION

18.11.1.10 REMARKETING

18.11.2 SERVICES

18.11.2.1 PROFESSIONAL SERVICES

18.11.2.2 MANAGED SERVICES

18.12 CONSTRUCTION

18.12.1 SOLUTIONS

18.12.1.1 ETA PREDICTIONS

18.12.1.2 OPERATIONS MANAGEMENT

18.12.1.3 PERFORMANCE MANAGEMENT

18.12.1.4 VEHICLE MAINTENANCE & DIAGNOSTICS

18.12.1.5 SAFETY & COMPLIANCE MANAGEMENT

18.12.1.6 FLEET ANALYTICS AND REPORTING

18.12.1.7 CONTRACT MANAGEMENT

18.12.1.8 RISK MANAGEMENT

18.12.1.9 ELECTRIFICATION

18.12.1.10 REMARKETING

18.12.2 SERVICES

18.12.2.1 PROFESSIONAL SERVICES

18.12.2.2 MANAGED SERVICES

18.13 OTHERS

19 CANADA FLEET MANAGEMENT MARKET, COMPANY LANDSCAPE

19.1 COMPANY SHARE ANALYSIS: CANADA

20 SWOT ANALYSIS

21 COMPANY PROFILE

21.1 ELEMENT FLEET MANAGEMENT CORP.

21.1.1 COMPANY SNAPSHOT

21.1.2 REVENUE ANALYSIS

21.1.3 SOLUTION PORTFOLIO

21.1.4 RECENT DEVELOPMENT

21.2 VERIZON

21.2.1 COMPANY SNAPSHOT

21.2.3 SOLUTION PORTFOLIO

21.2.4 RECENT DEVELOPMENTS

21.3 GEOTAB INC.

21.3.1 COMPANY SNAPSHOT

21.3.2 SOLUTION PORTFOLIO

21.3.3 RECENT DEVELOPMENTS

21.4 MOTIVE TECHNOLOGIES, INC.

21.4.1 COMPANY SNAPSHOT

21.4.2 PRODUCT PORTFOLIO

21.4.3 RECENT DEVELOPMENTS

21.5 JIM PATTISON LEASE (A SUBSIDIARY OF THE JIM PATTISON GROUP)

21.5.1 COMPANY SNAPSHOT

21.5.2 SOLUTION PORTFOLIO

21.5.3 RECENT DEVELOPMENT

21.6 ADDISON LEASING OF CANADA LTD

21.6.1 COMPANY SNAPSHOT

21.6.2 SOLUTION PORTFOLIO

21.6.3 RECENT DEVELOPMENT

21.7 ALD AUTOMOTIVE

21.7.1 COMPANY SNAPSHOT

21.7.2 REVENUE ANALYSIS

21.7.3 SOLUTION PORTFOLIO

21.7.4 RECENT DEVELOPMENTS

21.8 AT&T INTELLECTUAL PROPERTY

21.8.1 COMPANY SNAPSHOT

21.8.2 REVENUE ANALYSIS

21.8.3 SOLUTION PORTFOLIO

21.8.4 RECENT DEVELOPMENTS

21.9 CISCO SYSTEMS, INC.

21.9.1 COMPANY SNAPSHOT

21.9.2 REVENUE ANALYSIS

21.9.3 SOLUTION PORTFOLIO

21.9.4 RECENT DEVELOPMENTS

21.1 CONTINENTAL AG

21.10.1 COMPANY SNAPSHOT

21.10.2 REVENUE ANALYSIS

21.10.3 SOLUTION PORTFOLIO

21.10.4 RECENT DEVELOPMENTS

21.11 DENSO CORPORATION

21.11.1 COMPANY SNAPSHOT

21.11.2 REVENUE ANALYSIS

21.11.3 SOLUTION PORTFOLIO

21.11.4 RECENT DEVELOPMENTS

21.12 DONLEN

21.12.1 COMPANY SNAPSHOT

21.12.2 REVENUE ANALYSIS

21.12.3 SOLUTION PORTFOLIO

21.12.4 RECENT DEVELOPMENTS

21.13 FOSS NATIONAL LEASING LTD.

21.13.1 COMPANY SNAPSHOT

21.13.2 SOLUTION PORTFOLIO

21.13.3 RECENT DEVELOPMENTS

21.14 HOLMAN, INC.

21.14.1 COMPANY SNAPSHOT

21.14.2 SOLUTION PORTFOLIO

21.14.3 RECENT DEVELOPMENTS

21.15 IBM CORPORATION

21.15.1 COMPANY SNAPSHOT

21.15.2 REVENUE ANALYSIS

21.15.3 SOLUTION PORTFOLIO

21.15.4 RECENT DEVELOPMENT

21.16 MENDIX TECHNOLOGY BV

21.16.1 COMPANY SNAPSHOT

21.16.2 SOLUTION PORTFOLIO

21.16.3 RECENT DEVELOPMENTS

21.17 OMNITRACS

21.17.1 COMPANY SNAPSHOT

21.17.2 SOLUTION PORTFOLIO

21.17.3 RECENT DEVELOPMENTS

21.18 ORBCOMM

21.18.1 COMPANY SNAPSHOT

21.18.2 SOLUTION PORTFOLIO

21.18.3 RECENT DEVELOPMENT

21.19 RAM TRACKING

21.19.1 COMPANY SNAPSHOT

21.19.2 SOLUTION PORTFOLIO

21.19.3 RECENT DEVELOPMENTS

21.2 ROBERT BOSCH GMBH

21.20.1 COMPANY SNAPSHOT

21.20.2 REVENUE ANALYSIS

21.20.3 SOLUTION PORTFOLIO

21.20.4 RECENT DEVELOPMENTS

21.21 SAMSARA INC.

21.21.1 COMPANY SNAPSHOT

21.21.2 SOLUTION PORTFOLIO

21.21.3 RECENT DEVELOPMENTS

21.22 SIEMENS

21.22.1 COMPANY SNAPSHOT

21.22.2 REVENUE ANALYSIS

21.22.3 SOLUTION PORTFOLIO

21.22.4 RECENT DEVELOPMENTS

21.23 SIERRA WIRELESS

21.23.1 COMPANY SNAPSHOT

21.23.2 REVENUE ANALYSIS

21.23.3 SOLUTION PORTFOLIO

21.23.4 RECENT DEVELOPMENT

21.24 SUMMIT FLEET LEASING AND MANAGEMENT LEASING AND MANAGEMENT

21.24.1 COMPANY SNAPSHOT

21.24.2 SOLUTION PORTFOLIO

21.24.3 RECENT DEVELOPMENTS

21.25 TRANSFLO

21.25.1 COMPANY SNAPSHOT

21.25.2 SOLUTION PORTFOLIO

21.25.3 RECENT DEVELOPMENTS

21.26 WHEELS INC.

21.26.1 COMPANY SNAPSHOT

21.26.2 SOLUTION PORTFOLIO

21.26.3 RECENT DEVELOPMENTS

22 QUESTIONNAIRE

23 RELATED REPORTS

Список таблиц

TABLE 1 CANADA FLEET MANAGEMENT MARKET, BY FUNCTIONS, 2021-2030 (USD THOUSAND)

TABLE 2 CANADA FLEET MANAGEMENT MARKET, BY OPERATIONS, 2021-2030 (USD THOUSAND)

TABLE 3 CANADA FLEET MANAGEMENT MARKET, BY BUSINESS TYPE, 2021-2030 (USD THOUSAND)

TABLE 4 CANADA LARGE BUSINESS IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 5 CANADA SMALL BUSINESS IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 6 CANADA FLEET MANAGEMENT MARKET, BY LEASE TYPE, 2021-2030 (USD THOUSAND)

TABLE 7 CANADA WITHOUT LEASE IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 8 CANADA FLEET MANAGEMENT MARKET, BY MODE OF TRANSPORT, 2021-2030 (USD THOUSAND)

TABLE 9 CANADA AUTOMOTIVE IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 10 CANADA LIGHT COMMERCIAL VEHICLE IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 11 CANADA VANS IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 12 CANADA PASSENGER CARS IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 13 CANADA HEAVY COMMERCIAL VEHICLE IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 14 CANADA FLEET MANAGEMENT MARKET, BY VEHICLE TYPE, 2021-2030 (USD THOUSAND)

TABLE 15 CANADA INTERNAL COMBUSTION ENGINE IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 16 CANADA ELECTRIC VEHICLE IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 17 CANADA FLEET MANAGEMENT MARKET, BY HARDWARE, 2021-2030 (USD THOUSAND)

TABLE 18 CANADA FLEET MANAGEMENT MARKET, BY FLEET SIZE, 2021-2030 (USD THOUSAND)

TABLE 19 CANADA FLEET MANAGEMENT MARKET, BY COMMUNICATION RANGE, 2021-2030 (USD THOUSAND)

TABLE 20 CANADA FLEET MANAGEMENT MARKET, BY DEPLOYMENT MODEL, 2021-2030 (USD THOUSAND)

TABLE 21 CANADA FLEET MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 22 CANADA SOLUTIONS IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 23 CANADA ETA PREDICTIONS IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 24 CANADA OPERATIONS MANAGEMENT IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 25 CANADA PERFORMANCE MANAGEMENT IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 26 CANADA DRIVER MANAGEMENT IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 27 CANADA FLEET MANAGEMENT & TRACKING IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 28 CANADA CONTRACT MANAGEMENT IN FLEET MANAGEMENT MARKET, BY STRUCTURE, 2021-2030 (USD THOUSAND)

TABLE 29 CANADA CONTRACT MANAGEMENT IN FLEET MANAGEMENT MARKET, BY MODEL, 2021-2030 (USD THOUSAND)

TABLE 30 CANADA SERVICES IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 31 CANADA PROFESSIONAL SERVICES IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 32 CANADA FLEET MANAGEMENT MARKET, BY TECHNOLOGY, 2021-2030 (USD THOUSAND)

TABLE 33 CANADA FLEET MANAGEMENT MARKET, BY END USER, 2021-2030 (USD THOUSAND)

TABLE 34 CANADA AUTOMOTIVE IN FLEET MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 35 CANADA SOLUTIONS IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (THOUSAND )

TABLE 36 CANADA SERVICES IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 37 CANADA TRANSPORTATION & LOGISTICS IN FLEET MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 38 CANADA SOLUTIONS IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (THOUSAND)

TABLE 39 CANADA SERVICES IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 40 CANADA RETAIL IN FLEET MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 41 CANADA SOLUTIONS IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 42 CANADA SERVICES IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 43 CANADA MANUFACTURING IN FLEET MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 44 CANADA SOLUTIONS IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 45 CANADA SERVICES IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 46 CANADA FOOD & BEVERAGES IN FLEET MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 47 CANADA SOLUTIONS IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 48 CANADA SERVICES IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 49 CANADA ENERGY & UTILITIES IN FLEET MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 50 CANADA SOLUTIONS IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 51 CANADA SERVICES IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 52 CANADA MINING IN FLEET MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 53 CANADA SOLUTIONS IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (THOUSAND )

TABLE 54 CANADA SERVICES IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 55 CANADA GOVERNMENT IN FLEET MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 56 CANADA SOLUTIONS IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (THOUSAND )

TABLE 57 CANADA SERVICES IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 58 CANADA HEALTHCARE IN FLEET MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 59 CANADA SOLUTIONS IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (THOUSAND )

TABLE 60 CANADA SERVICES IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 61 CANADA AGRICULTURE IN FLEET MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 62 CANADA SOLUTIONS IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (THOUSAND )

TABLE 63 CANADA SERVICES IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 64 CANADA CONSTRUCTION IN FLEET MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 65 CANADA SOLUTIONS IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (THOUSAND )

TABLE 66 CANADA SERVICES IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

Список рисунков

FIGURE 1 CANADA FLEET MANAGEMENT MARKET: SEGMENTATION

FIGURE 2 CANADA FLEET MANAGEMENT MARKET: DATA TRIANGULATION

FIGURE 3 CANADA FLEET MANAGEMENT MARKET: DROC ANALYSIS

FIGURE 4 CANADA FLEET MANAGEMENT MARKET: REGIONAL VS COUNTRY MARKET ANALYSIS

FIGURE 5 CANADA FLEET MANAGEMENT MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 CANADA FLEET MANAGEMENT MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 CANADA FLEET MANAGEMENT MARKET: DBMR MARKET POSITION GRID

FIGURE 8 CANADA FLEET MANAGEMENT MARKET: MULTIVARIATE MODELING

FIGURE 9 CANADA FLEET MANAGEMENT MARKET: OFFERING TIMELINE CURVE

FIGURE 10 CANADA FLEET MANAGEMENT MARKET: MARKET END-USE COVERAGE GRID

FIGURE 11 CANADA FLEET MANAGEMENT MARKET: SEGMENTATION

FIGURE 12 INCREASE IN DEMAND OF FULL SERVICE LEASING IS EXPECTED TO DRIVE THE CANADA FLEET MANAGEMENT MARKET IN THE FORECAST PERIOD OF 2023 TO 2030

FIGURE 13 SOLUTION SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE CANADA FLEET MANAGEMENT MARKET IN 2023 & 2030

FIGURE 14 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF CANADA FLEET MANAGEMENT MARKET

FIGURE 15 CANADA FLEET MANAGEMENT MARKET: BY FUNCTIONS, 2022

FIGURE 16 CANADA FLEET MANAGEMENT MARKET: BY OPERATIONS, 2022

FIGURE 17 CANADA FLEET MANAGEMENT MARKET: BY BUSINESS TYPE, 2022

FIGURE 18 CANADA FLEET MANAGEMENT MARKET: BY LEASE TYPE, 2022

FIGURE 19 CANADA FLEET MANAGEMENT MARKET: BY MODE OF TRANSPORT, 2022

FIGURE 20 CANADA FLEET MANAGEMENT MARKET: BY VEHICLE TYPE, 2022

FIGURE 21 CANADA FLEET MANAGEMENT MARKET: BY HARDWARE, 2022

FIGURE 22 CANADA FLEET MANAGEMENT MARKET: BY FLEET SIZE, 2022

FIGURE 23 CANADA FLEET MANAGEMENT MARKET: BY COMMUNIATION RANGE, 2022

FIGURE 24 CANADA FLEET MANAGEMENT MARKET: BY DEPLOYMENT MODEL, 2022

FIGURE 25 CANADA FLEET MANAGEMENT MARKET: BY OFFERING, 2022

FIGURE 26 CANADA FLEET MANAGEMENT MARKET: BY TECHNOLOGY, 2022

FIGURE 27 CANADA FLEET MANAGEMENT MARKET: END USER, 2022

FIGURE 28 CANADA FLEET MANAGEMENT MARKET: COMPANY SHARE 2022 (%)

Методология исследования

Сбор данных и анализ базового года выполняются с использованием модулей сбора данных с большими размерами выборки. Этап включает получение рыночной информации или связанных данных из различных источников и стратегий. Он включает изучение и планирование всех данных, полученных из прошлого заранее. Он также охватывает изучение несоответствий информации, наблюдаемых в различных источниках информации. Рыночные данные анализируются и оцениваются с использованием статистических и последовательных моделей рынка. Кроме того, анализ доли рынка и анализ ключевых тенденций являются основными факторами успеха в отчете о рынке. Чтобы узнать больше, пожалуйста, запросите звонок аналитика или оставьте свой запрос.

Ключевой методологией исследования, используемой исследовательской группой DBMR, является триангуляция данных, которая включает в себя интеллектуальный анализ данных, анализ влияния переменных данных на рынок и первичную (отраслевую экспертную) проверку. Модели данных включают сетку позиционирования поставщиков, анализ временной линии рынка, обзор рынка и руководство, сетку позиционирования компании, патентный анализ, анализ цен, анализ доли рынка компании, стандарты измерения, глобальный и региональный анализ и анализ доли поставщика. Чтобы узнать больше о методологии исследования, отправьте запрос, чтобы поговорить с нашими отраслевыми экспертами.

Доступна настройка

Data Bridge Market Research является лидером в области передовых формативных исследований. Мы гордимся тем, что предоставляем нашим существующим и новым клиентам данные и анализ, которые соответствуют и подходят их целям. Отчет можно настроить, включив в него анализ ценовых тенденций целевых брендов, понимание рынка для дополнительных стран (запросите список стран), данные о результатах клинических испытаний, обзор литературы, обновленный анализ рынка и продуктовой базы. Анализ рынка целевых конкурентов можно проанализировать от анализа на основе технологий до стратегий портфеля рынка. Мы можем добавить столько конкурентов, о которых вам нужны данные в нужном вам формате и стиле данных. Наша команда аналитиков также может предоставить вам данные в сырых файлах Excel, сводных таблицах (книга фактов) или помочь вам в создании презентаций из наборов данных, доступных в отчете.