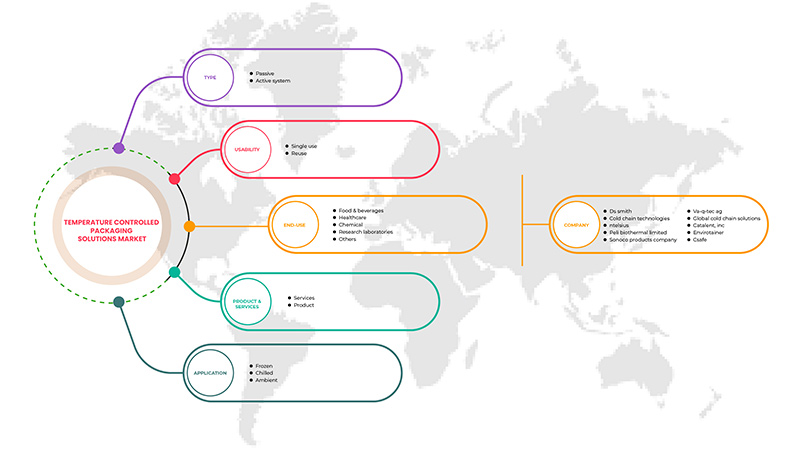

Рынок упаковочных решений с контролируемой температурой в Азиатско-Тихоокеанском регионе по типу (пассивная и активная система), продукту и услугам (услуги, продукт), удобству использования (однократное использование, повторное использование), применению (замороженные, охлажденные и для хранения при комнатной температуре), конечному использованию (продукты питания и напитки, здравоохранение, химическая промышленность, исследовательские лаборатории и другие). Отраслевые тенденции и прогноз до 2029 года.

Анализ и аналитика рынка упаковочных решений с контролируемой температурой в Азиатско-Тихоокеанском регионе

Рынок упаковочных решений с контролируемой температурой в Азиатско-Тихоокеанском регионе набирает значительный рост за счет различных типов, таких как сухой лед, жидкий азот и пенопластовый кирпич и т. д. Они обычно используются для транспортировки лекарств, скоропортящихся продуктов, образцов крови и многочисленных клинических испытаний. Упаковочные решения с контролируемой температурой изготавливаются из растянутого полистирола, полиуретана и панелей с вакуумной изоляцией. Ожидается, что растущий спрос в секторе здравоохранения и растущая потребность в контроле температуры в фармацевтическом секторе значительно стимулируют рост рынка. Спрос на упаковочные решения с контролируемой температурой в холодильных цепях, скоропортящихся пищевых продуктах и полуфабрикатах способствует росту рынка.

Таким образом, производители должны следовать растущим стандартам и правилам государственных органов, чтобы продавать свою продукцию и гарантировать, что потребительский спрос будет стимулировать рост рынка. Отсутствие технических знаний у малых предприятий, вероятно, ограничит рост рынка в регионе.

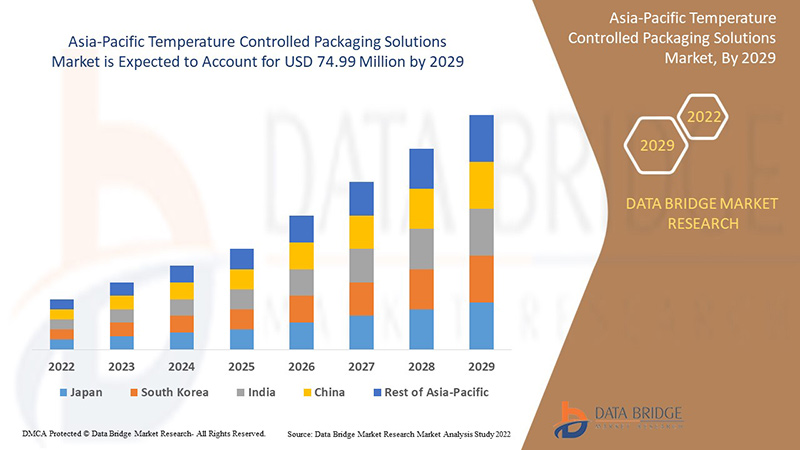

По данным исследования рынка Data Bridge, среднегодовой темп роста рынка терморегулируемой упаковки в Азиатско-Тихоокеанском регионе составит 6,4% в прогнозируемый период с 2022 по 2029 год.

|

Отчет Метрика |

Подробности |

|

Прогнозируемый период |

2022-2029 |

|

Базовый год |

2021 |

|

Исторические годы |

2020 (Можно настроить на 2019 - 2015) |

|

Количественные единицы |

Доход в млн. долл. США, цены в долл. США |

|

Охваченные сегменты |

По типу (пассивная и активная система), продукту и услугам (услуги, продукт), удобству использования (одноразовое использование, повторное использование), применению (замороженные, охлажденные и для хранения при комнатной температуре), конечному использованию (продукты питания и напитки, здравоохранение, химическая промышленность , исследовательские лаборатории и другие). |

|

Охваченные регионы |

Китай, Япония, Австралия и Новая Зеландия, Индия, Филиппины, Индонезия, Сингапур, Южная Корея, Малайзия, Таиланд и остальные страны Азиатско-Тихоокеанского региона. |

|

Охваченные участники рынка |

DS Smith, Cold Chain Technologies, Intelsius, Peli BioThermal Limited, Sonoco Products Company, va-Q-tec AG, Global Cold Chain Solutions, Catalent, Inc, Envirotainer и CSafe и другие. |

Определение рынка

Упаковка с контролируемой температурой в основном используется для транспортировки продуктов, веществ или образцов, которым требуется определенная температура в процессе транспортировки. Грузоотправители полагаются на упаковку с контролируемой температурой, которая позволяет им поддерживать температуру отправляемого продукта в соответствии с требованиями грузоотправителя. Упаковка с контролируемой температурой используется во многих отраслях, включая медицину, продукты питания и напитки, клинические испытания , исследования и разработки, а также транспортировку крови.

Решения по упаковке с контролируемой температурой бывают двух видов: активная система и пассивная система. Решения по активной упаковке имеют системы охлаждения сухим льдом или электрические системы нагрева и охлаждения. С другой стороны, пассивные решения состоят из изолированных коробок или контейнеров без активного контроля температуры. В результате пассивная упаковка не меняется в ответ на температуру окружающей среды. Решения по активной упаковке широко используются, поскольку они позволяют транспортировать пакеты любого размера на большие расстояния, не повреждая продукты; благодаря своей возможности повторного использования и высокому уровню технологий решения по упаковке с контролируемой температурой оставили свой след на рынке Азиатско-Тихоокеанского региона в области хранения.

Динамика рынка решений для терморегулируемой упаковки в Азиатско-Тихоокеанском регионе

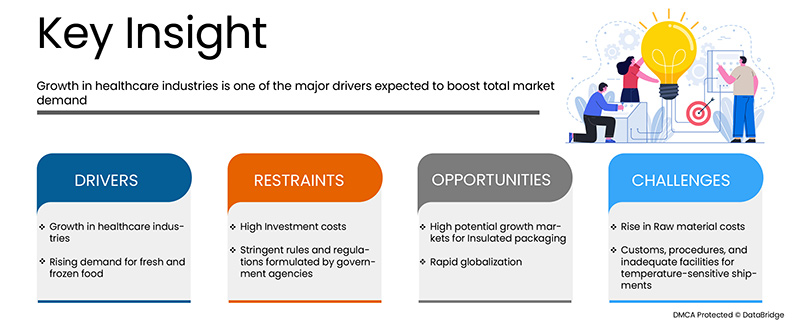

В этом разделе рассматривается понимание движущих сил рынка, возможностей, ограничений и проблем. Все это подробно обсуждается ниже:

Драйверы

Рост в отраслях здравоохранения

Индустрия здравоохранения является одной из самых быстрорастущих отраслей в мире. Индустрия помогает открывать разработки лекарственных средств или фармацевтических препаратов, используемых в качестве лекарств. Недавний рост в отраслях здравоохранения и фармацевтики позволяет безопасно перевозить спрос на медицинские продукты. Фармацевтическая упаковка является экономически эффективным способом обеспечения защиты, идентификационной информации, сдерживания, удобства и соответствия продукта во время хранения, перевозки и демонстрации до момента потребления продукта. Упаковка должна защищать от различных климатических условий, включая биологические, физические и химические, и быть экономичной для производителей. Кроме того, упаковка должна поддерживать стабильность продуктов в течение всего срока годности. Два типа упаковочных систем в отрасли здравоохранения — пассивные и активные. Качество медицинских продуктов напрямую влияет на безопасность пациентов и эффективность продукта в терапии пациентов. Температурные колебания имеют огромное значение при транспортировке готовых продуктов, транспортировке материалов клинических испытаний или доставке образцов лекарств. Одним из основных решений, связанных с этой проблемой, являются упаковочные решения с контролируемой температурой, которые помогут рынку расшириться в ближайшие годы.

Например,

- В июле 2020 года компания Softbox объявила о запуске Tempcell ECO. Tempcell ECO изготовлен из 100-процентного гофрированного картона и использует. Это ECO-упаковочное решение предназначено для транспортировки фармацевтических продуктов с широкой стабильностью, чувствительных к температуре.

Таким образом, ожидается, что возросшая потребность в упаковочных решениях с контролируемой температурой для транспортировки лекарственных средств по всему миру будет стимулировать рынок упаковочных решений с контролируемой температурой в Азиатско-Тихоокеанском регионе в прогнозируемый период.

Растущий спрос на свежие и замороженные продукты питания

Замороженные продукты подвергаются коммерческой обработке, чтобы сделать их удобными для хранения и требующими меньшего приготовления. Свежие продукты обычно являются скоропортящимися по своей природе. Скоропортящиеся продукты делятся на две категории: скоропортящиеся и полускоропортящиеся. К скоропортящимся продуктам относятся мясо, птица, рыба, молоко, яйца и многие сырые фрукты и овощи, и их необходимо хранить в холодильнике. Полускоропортящиеся продукты, хранящиеся при оптимальной температуре, остаются неиспорченными в течение шести месяцев до одного года. Холодильная цепь является важным способом сохранения и транспортировки скоропортящихся продуктов в надлежащем температурном диапазоне. Эти методы сохранения замедляют процессы биологического распада и повышают безопасность и качество продуктов питания для потребителей. Азиатские страны, такие как Китай и Индия, проявляют все больший интерес к потреблению импортных, замороженных и свежих продуктов. Продукты решений для терморегулируемой упаковки предоставляют ряд коробок и различных других продуктов для обслуживания тех же отраслей. Растущая тенденция потребления потребителями свежих и замороженных продуктов позволяет решениям для терморегулируемой упаковки в Азиатско-Тихоокеанском регионе расширяться по всему миру.

Например,

- В июне 2020 года Smurfit Kappa выпустила новую альтернативу на основе бумаги, которая может дольше сохранять мясные и немясные продукты питания стерильными и холодными. Упаковка также более гибкая, чем EPS, поскольку ее можно хранить в плоском виде, что снижает складские расходы.

Из-за изменения потребительского профиля пищевая промышленность существенно изменилась. Этот рост рынка увеличивает потребность в упаковочном материале с контролируемой температурой для сохранения качества продуктов питания в течение длительного времени и, как ожидается, будет стимулировать рынок упаковочных решений с контролируемой температурой в Азиатско-Тихоокеанском регионе в прогнозируемый период.

Возможности

- Высокий потенциал роста рынков для изолированной упаковки

Упаковка с контролируемой температурой специально разработана для поддержания соответствующей температуры чувствительных продуктов. Эта упаковка действует как щит и защищает продукты от повреждения или порчи. Упаковка с контролируемой температурой применяется в различных областях, таких как фармацевтика, продукты питания и напитки и многие другие. Рост использования упаковки с контролируемой температурой в фармацевтике обусловлен увеличением числа органов по контролю за лекарственными средствами в разных регионах, сосредоточенных на разработке строгих законов для обработки и распространения фармацевтических продуктов и повышении спроса на биологические препараты. Различные ключевые игроки, такие как Intelsius - A DGP Company (Великобритания), предоставляют решения по упаковке для холодовой цепи для фармацевтического сектора. FedEx (США), ведущая курьерская компания, поставляет изолированную упаковку для различных фармацевтических препаратов, продуктов питания и напитков, а также клинических испытаний по всему миру. Изолированная упаковка является дорогостоящей, поскольку она сохраняет продукты в их первоначальном виде и помогает поддерживать срок годности продукта.

Рынок продуктов питания и напитков является одним из растущих рынков изолированных упаковочных материалов. Упаковочные материалы сохраняют физические свойства продуктов и увеличивают срок годности продуктов. Компания, а именно Coca-Cola (США), производит бутилированную воду, соки и холодный чай. Unilever (Великобритания), один из крупнейших производителей готовых блюд, соусов и чая , использует изолированные упаковочные материалы. Поскольку крупные компании получают значительную прибыль, ожидается, что рынок продуктов питания и напитков будет расти и значительно откроет возможности для рынка упаковочных решений с контролируемой температурой в Азиатско-Тихоокеанском регионе.

Ограничения/Проблемы

- Рост стоимости сырья

Для производства терморегулируемых упаковочных решений используются различные типы сырья, такие как вспененный полистирол, полиуретан и жидкий азот. Cold Chain Technologies (США), Intelsius - A DGP Company (Великобритания) компания предлагает решения для холодильной упаковки, чтобы поддерживать термическую целостность продукции во время транспортировки до места назначения. Такие материалы, как полиуретан и жидкий азот, используются для производства вкладышей в коробки, мешков, почтовых конвертов и поддонов.

Цены на сырье растут, и производители сталкиваются с каскадными проблемами в цепочках поставок, поскольку цены продолжают расти, замедляя поставки поставщиков и сокращая доступность рабочей силы.

- В июле 2022 года, согласно статье, опубликованной Agro & Food Processing, рынок становится все более неопределенным из-за растущего спроса, мощностей и проблем с поставками, ограниченного выбора транспортных средств и стоимости сырья, которая растет экспоненциально ежедневно. Цены на полиуретановые смолы, растворители и другие нефтехимические сырьевые ингредиенты и производные в последнее время значительно выросли.

Таким образом, ожидается, что растущие цены на сырье, используемое при производстве терморегулируемых упаковочных решений, такое как полистирол и полиуретан, станут проблемой для рынка терморегулируемых упаковочных решений в Азиатско-Тихоокеанском регионе.

Влияние COVID-19 на рынок решений для терморегулируемой упаковки в Азиатско-Тихоокеанском регионе

После пандемии спрос на терморегулируемую упаковку увеличился, поскольку больше не будет ограничений на передвижение, поэтому поставка продукции будет легкой. Кроме того, компании разработали свою систему упаковки для транспортировки вакцин и лекарств по всему миру, а спрос на терморегулируемую упаковку для скоропортящихся товаров также увеличился, что может способствовать росту рынка.

Возросший спрос на терморегулируемые упаковочные решения позволяет производителям выпускать инновационные и многофункциональные терморегулируемые упаковочные продукты, что в конечном итоге увеличивает спрос на терморегулируемые упаковочные решения и способствует росту рынка.

Более того, высокий спрос на терморегулируемую упаковочную продукцию будет стимулировать рост рынка. Кроме того, спрос на упаковочные решения для термочувствительных лекарств после пандемии COVID-19 увеличился, поскольку высокий спрос со стороны сектора здравоохранения и фармацевтики привел к росту рынка. Кроме того, ожидается, что интерес потребителей к новым технологиям и многоцелевым продуктам будет способствовать росту рынка терморегулируемых упаковочных решений в Азиатско-Тихоокеанском регионе.

Последние события

- В сентябре 2022 года va-Q-tec запустила транспортный контейнер va-Q-one 300P размером с европоддон, температурный вариант транспортировки. Ящик особенно хорошо подходит для межстрановых перевозок в районах, где нет возможности обратной транспортировки. Этот запуск поможет компании расшириться на глобальном уровне.

- В июле 2022 года DS Smith сотрудничала с Valencian Company и разработала инновационную упаковку для своей новой линейки соковыжималок Soul Series 2. Упаковка на 100% пригодна для вторичной переработки. Этот запуск поможет компании расширить свое присутствие на рынке.

Объем рынка решений для терморегулируемой упаковки в Азиатско-Тихоокеанском регионе

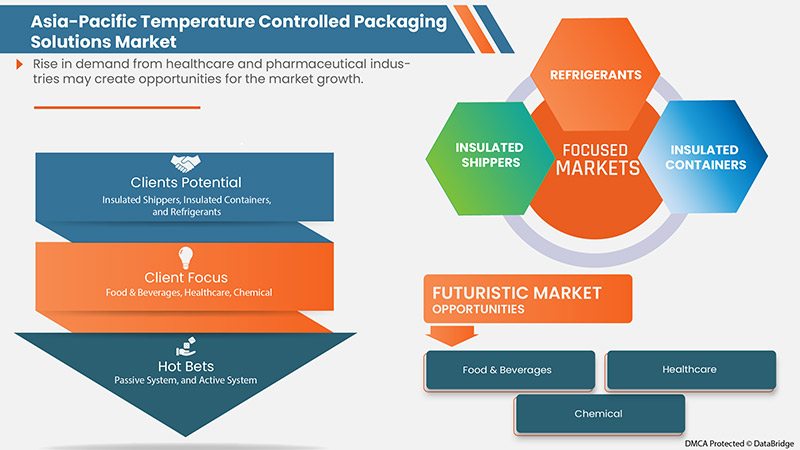

Рынок решений для терморегулируемой упаковки в Азиатско-Тихоокеанском регионе сегментирован по типу, продукту и услугам, удобству использования, применению и конечному использованию. Рост среди этих сегментов поможет вам проанализировать основные сегменты роста в отраслях и предоставить пользователям ценный обзор рынка и рыночные идеи для принятия стратегических решений по определению основных рыночных приложений.

Тип

- Пассивный

- Активная система

По типу рынок решений для терморегулируемой упаковки в Азиатско-Тихоокеанском регионе сегментируется на пассивные и активные системы.

Продукция и услуги

- Услуги

- Продукт

На основе продуктов и услуг рынок решений для терморегулируемой упаковки в Азиатско-Тихоокеанском регионе сегментирован на продукты и услуги.

Удобство использования

- Одноразовое использование

- Повторное использование

По принципу удобства использования рынок упаковочных решений с контролируемой температурой в Азиатско-Тихоокеанском регионе сегментируется на одноразовые и многоразовые.

Приложение

- Замороженный

- Охлажденный

- Окружающий

По сфере применения рынок упаковочных решений с контролируемой температурой в Азиатско-Тихоокеанском регионе сегментируется на замороженные, охлажденные и термостойкие.

Конечное использование

- Еда и напитки

- Здравоохранение

- Химический

- Научно-исследовательские лаборатории

- Другие

По сфере применения рынок решений для терморегулируемой упаковки в Азиатско-Тихоокеанском регионе сегментируется на следующие отрасли: продукты питания и напитки, здравоохранение, химическая промышленность, научно-исследовательские лаборатории и другие.

Анализ/информация о рынке терморегулируемых упаковочных решений в Азиатско-Тихоокеанском регионе

Проведен анализ рынка упаковочных решений с контролируемой температурой в Азиатско-Тихоокеанском регионе, а также предоставлены сведения о размерах рынка и тенденциях на основе страны, типа, продукта и услуг, удобства использования, области применения и конечного использования, как указано выше.

На рынке решений для терморегулируемой упаковки в Азиатско-Тихоокеанском регионе представлены следующие страны: Китай, Австралия и Новая Зеландия, Япония, Южная Корея, Сингапур, Малайзия, Индонезия, Таиланд, Филиппины, Индия и остальные страны Азиатско-Тихоокеанского региона.

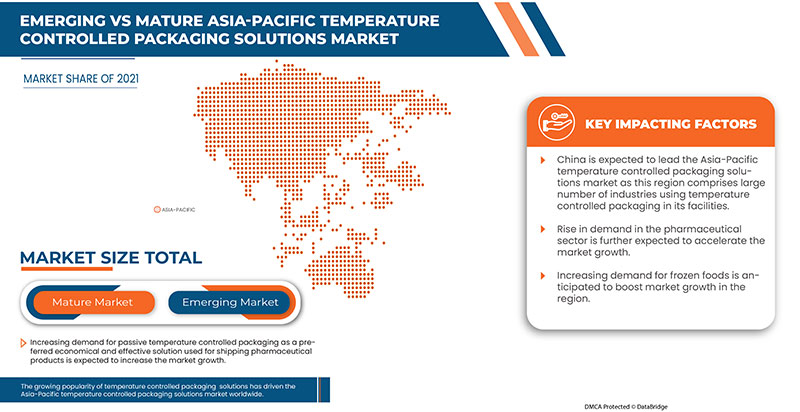

Ожидается, что Китай будет доминировать на рынке решений для термоконтроля упаковки в Азиатско-Тихоокеанском регионе с точки зрения доли рынка и доходов. Ожидается, что он сохранит свое доминирование в течение прогнозируемого периода из-за сильных игроков на рынке и высокого спроса на фармацевтическую продукцию в Азиатско-Тихоокеанском регионе.

В разделе отчета, посвященном региону, также приводятся отдельные факторы, влияющие на рынок, и изменения в правилах, которые влияют на текущие и будущие тенденции рынка. Такие данные, как новые и заменяющие продажи, демография страны, эпидемиология заболеваний и импортно-экспортные тарифы, являются одними из основных указателей, используемых для прогнозирования рыночного сценария для отдельных стран. Кроме того, при предоставлении прогнозного анализа данных по стране учитываются наличие и доступность брендов Азиатско-Тихоокеанского региона и их проблемы, связанные с высокой конкуренцией со стороны местных и отечественных брендов, а также влияние каналов продаж.

Анализ конкурентной среды и доли рынка решений для терморегулируемой упаковки в Азиатско-Тихоокеанском регионе

Конкурентный рынок терморегулируемых упаковочных решений Азиатско-Тихоокеанского региона предоставляет подробную информацию о конкурентах. Подробности включают обзор компании, финансовые показатели компании, полученный доход, рыночный потенциал, инвестиции в исследования и разработки, новые рыночные инициативы, присутствие в Азиатско-Тихоокеанском регионе, производственные площадки и объекты, производственные мощности, сильные и слабые стороны компании, запуск продукта, широту и широту продукта и доминирование в применении. Вышеуказанные пункты данных связаны только с фокусом компании на рынке терморегулируемых упаковочных решений Азиатско-Тихоокеанского региона.

Среди основных игроков, работающих на рынке решений для терморегулируемой упаковки в Азиатско-Тихоокеанском регионе, можно назвать DS Smith, Cold Chain Technologies, Intelsius, Peli BioThermal Limited, Sonoco Products Company, va-Q-tec AG, Global Cold Chain Solutions, Catalent, Inc, Envirotainer, CSafe и другие.

Методология исследования

Сбор данных и анализ базового года выполняются с использованием модулей сбора данных с большими размерами выборки. Рыночные данные анализируются и оцениваются с использованием рыночных статистических и когерентных моделей. Кроме того, анализ доли рынка и анализ ключевых тенденций являются основными факторами успеха в рыночном отчете. Ключевой методологией исследования, используемой исследовательской группой DBMR, является триангуляция данных, которая включает в себя интеллектуальный анализ данных, анализ влияния переменных данных на рынок и первичную (отраслевую экспертную) проверку. Помимо этого, модели данных включают сетки позиционирования поставщиков, анализ временной линии рынка, обзор рынка и руководство, сетку позиционирования компании, анализ доли рынка компании, стандарты измерения, Азиатско-Тихоокеанский регион против регионального и анализ доли поставщика. Пожалуйста, запросите звонок аналитика в случае дальнейшего запроса.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Интерактивная панель анализа данных

- Панель анализа компании для возможностей с высоким потенциалом роста

- Доступ аналитика-исследователя для настройки и запросов

- Анализ конкурентов с помощью интерактивной панели

- Последние новости, обновления и анализ тенденций

- Используйте возможности сравнительного анализа для комплексного отслеживания конкурентов

Содержание

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF ASIA-PACIFIC TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 TYPE LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 VENDOR SHARE ANALYSIS

2.11 MARKET APPLICATION COVERAGE GRID

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTEL ANALYSIS

4.2 PORTER'S FIVE FORCES:

4.2.1 THE THREAT OF NEW ENTRANTS:

4.2.2 THE THREAT OF SUBSTITUTES:

4.2.3 CUSTOMER BARGAINING POWER:

4.2.4 SUPPLIER BARGAINING POWER:

4.2.5 INTERNAL COMPETITION (RIVALRY):

4.3 TECHNOLOGICAL ADVANCEMENTS BY MANUFACTURERS

4.4 VENDOR SELECTION CRITERIA

4.5 RAW MATERIAL PRODUCTION COVERAGE

4.6 REGULATION COVERAGE

5 CLIMATE CHANGE SCENARIO

5.1 ENVIRONMENTAL CONCERNS

5.2 GOVERNMENT'S ROLE

5.3 PRE COVID AND POST COVID ANALYSIS

6 SUPPLY CHAIN ANALYSIS

6.1 OVERVIEW

6.2 LOGISTIC COST SCENARIO

6.3 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

7 MARKET OVERVIEW

7.1 DRIVERS

7.1.1 GROWTH IN HEALTHCARE INDUSTRIES

7.1.2 RISING DEMAND FOR FRESH AND FROZEN FOOD

7.2 RESTRAINTS

7.2.1 HIGH INVESTMENT COSTS

7.2.2 STRINGENT RULES AND REGULATIONS FORMULATED BY GOVERNMENT AGENCIES

7.3 OPPORTUNITIES

7.3.1 RAPID GLOBALIZATION

7.3.2 HIGH POTENTIAL GROWTH MARKETS FOR INSULATED PACKAGING

7.4 CHALLENGES

7.4.1 RISE IN RAW MATERIAL COSTS

7.4.2 CUSTOMS, PROCEDURES, AND INADEQUATE FACILITIES FOR TEMPERATURE-SENSITIVE SHIPMENTS

8 ASIA-PACIFIC TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY TYPE

8.1 OVERVIEW

8.2 PASSIVE

8.3 ACTIVE SYSTEM

9 ASIA-PACIFIC TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY PRODUCT & SERVICES

9.1 OVERVIEW

9.2 SERVICES

9.2.1 AIRWAYS

9.2.2 ROADWAYS

9.2.3 WATERWAYS

9.3 PRODUCT

9.3.1 INSULATED CONTAINERS

9.3.1.1 EXPANDED POLYSTYRENE

9.3.1.2 POLYURETHANE

9.3.1.3 VACUUM INSULATED PANELS

9.3.2 INSULATED SHIPPERS

9.3.3 REFRIGERANTS

9.3.3.1 DRY ICE

9.3.3.2 GEL PACKS

9.3.3.3 ADVANCED PHASE CHANGE MATERIALS

9.3.3.4 LIQUID NITROGEN

9.3.3.5 FOAM BRICKS

9.3.3.6 OTHERS

10 ASIA-PACIFIC TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY APPLICATION

10.1 OVERVIEW

10.2 FROZEN

10.3 CHILLED

10.4 AMBIENT

11 ASIA-PACIFIC TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY USABILITY

11.1 OVERVIEW

11.2 REUSE

11.3 SINGLE USE

12 ASIA-PACIFIC TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY END-USE

12.1 OVERVIEW

12.2 FOOD & BEVERAGES

12.2.1 PASSIVE SYSTEM

12.2.2 ACTIVE SYSTEM

12.3 HEALTHCARE

12.3.1 HEALTHCARE, BY END USE

12.3.1.1 PHARMACEUTICAL AND BIOTECHNOLOGY

12.3.1.2 BLOOD TRANSPORTATION

12.3.1.3 R&D AND CLINICAL TRIALS

12.3.1.4 MEDICAL DEVICES

12.3.1.5 OTHERS

12.3.2 HEALTHCARE, BY TYPE

12.3.2.1 PASSIVE

12.3.2.2 ACTIVE SYSTEM

12.4 CHEMICAL

12.4.1 PASSIVE

12.4.2 ACTIVE SYSTEM

12.5 RESEARCH LABORATORIES

12.5.1.1 PASSIVE

12.5.1.2 ACTIVE SYSTEM

12.6 OTHERS

12.6.1 PASSIVE

12.6.2 ACTIVE SYSTEM

13 ASIA-PACIFIC TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY COUNTRY

13.1 ASIA PACIFIC

13.1.1 CHINA

13.1.2 INDIA

13.1.3 JAPAN

13.1.4 SOUTH KOREA

13.1.5 THAILAND

13.1.6 SINGAPORE

13.1.7 INDONESIA

13.1.8 AUSTRALIA & NEW ZEALAND

13.1.9 PHILIPPINES

13.1.10 MALAYSIA

13.1.11 REST OF ASIA-PACIFIC

14 ASIA-PACIFIC TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, COMPANY LANDSCAPE

14.1 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

14.2 EXPANSION

14.3 PRODUCT LAUNCHES

14.4 ACQUISITION

15 SWOT ANALYSIS

16 COMPANY PROFILE

16.1 DS SMITH

16.1.1 COMPANY SNAPSHOT

16.1.2 REVENUE ANALYSIS

16.1.3 PRODUCT PORTFOLIO

16.1.4 RECENT DEVELOPMENTS

16.2 VA-Q-TEC AG

16.2.1 COMPANY SNAPSHOT

16.2.2 REVENUE ANALYSIS

16.2.3 PRODUCT PORTFOLIO

16.2.4 RECENT DEVELOPMENTS

16.3 SONOCO PRODUCTS COMPANY

16.3.1 COMPANY SNAPSHOT

16.3.2 REVENUE ANALYSIS

16.3.3 PRODUCT PORTFOLIO

16.3.4 RECENT DEVELOPMENTS

16.4 CATALENT, INC

16.4.1 COMPANY SNAPSHOT

16.4.2 REVENUE ANALYSIS

16.4.3 PRODUCT PORTFOLIO

16.4.4 RECENT DEVELOPMENTS

16.5 ENVIROTAINER

16.5.1 COMPANY SNAPSHOT

16.5.2 PRODUCT PORTFOLIO

16.5.3 RECENT DEVELOPMENT

16.6 COLD CHAIN TECHNOLOGIES

16.6.1 COMPANY SNAPSHOT

16.6.2 PRODUCT PORTFOLIO

16.6.3 RECENT DEVELOPMENTS

16.7 CSAFE

16.7.1 COMPANY SNAPSHOT

16.7.2 PRODUCT PORTFOLIO

16.7.3 RECENT DEVELOPMENT

16.8 GLOBAL COLD CHAIN SOLUTIONS

16.8.1 COMPANY SNAPSHOT

16.8.2 PRODUCT PORTFOLIO

16.8.3 RECENT DEVELOPMENT

16.9 INTELSIUS

16.9.1 COMPANY SNAPSHOT

16.9.2 PRODUCT PORTFOLIO

16.9.3 RECENT DEVELOPMENT

16.1 PELI BIOTHERMAL LIMITED

16.10.1 COMPANY SNAPSHOT

16.10.2 PRODUCT PORTFOLIO

16.10.3 RECENT DEVELOPMENT

17 QUESTIONNAIRE

18 RELATED REPORTS

Список таблиц

TABLE 1 REGULATORY FRAMEWORK

TABLE 2 ASIA-PACIFIC TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 3 ASIA-PACIFIC TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY TYPE, 2020-2029 ( KILO TONS)

TABLE 4 ASIA-PACIFIC TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 5 ASIA-PACIFIC TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY SERVICES, 2020-2029 (USD MILLION)

TABLE 6 ASIA-PACIFIC TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 7 ASIA-PACIFIC INSULATED CONTAINERS IN TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 8 ASIA-PACIFIC REFRIGERANTS IN TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 9 ASIA-PACIFIC TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 10 ASIA-PACIFIC TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, USABILITY, 2020-2029 (USD MILLION)

TABLE 11 ASIA-PACIFIC TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 12 ASIA-PACIFIC FOOD & BEVERAGES IN TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 13 ASIA-PACIFIC HEALTHCARE IN TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 14 ASIA-PACIFIC HEALTHCARE IN TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 15 ASIA-PACIFIC CHEMICAL IN TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 16 ASIA-PACIFIC RESEARCH LABORATORIES IN TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 17 ASIA-PACIFIC OTHERS IN TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 18 ASIA-PACIFIC TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 19 ASIA-PACIFIC TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY COUNTRY, 2020-2029 (KILO TONS)

TABLE 20 CHINA TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 21 CHINA TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 22 CHINA TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY TYPE, 2020-2029 (PRICE)

TABLE 23 CHINA TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 24 CHINA TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY SERVICES, 2020-2029 (USD MILLION)

TABLE 25 CHINA TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 26 CHINA INSULATED CONTAINERS IN TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 27 CHINA REFRIGERANTS IN TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 28 CHINA TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY USABILITY, 2020-2029 (USD MILLION)

TABLE 29 CHINA TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 30 CHINA IN TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 31 CHINA FOOD & BEVERAGES IN TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 32 CHINA HEALTHCARE IN TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 33 CHINA HEALTHCARE IN TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 34 CHINA CHEMICAL IN TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 35 CHINA RESEARCH LABORATORIES IN TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 36 CHINA OTHERS IN TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 37 INDIA TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 38 INDIA TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 39 INDIA TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY TYPE, 2020-2029 (PRICE)

TABLE 40 INDIA TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 41 INDIA TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY SERVICES, 2020-2029 (USD MILLION)

TABLE 42 INDIA TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 43 INDIA INSULATED CONTAINERS IN TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 44 INDIA REFRIGERANTS IN TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 45 INDIA TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY USABILITY, 2020-2029 (USD MILLION)

TABLE 46 INDIA TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 47 INDIA IN TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 48 INDIA FOOD & BEVERAGES IN TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 49 INDIA HEALTHCARE IN TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 50 INDIA HEALTHCARE IN TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 51 INDIA CHEMICAL IN TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 52 INDIA RESEARCH LABORATORIES IN TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 53 INDIA OTHERS IN TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 54 JAPAN TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 55 JAPAN TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 56 JAPAN TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY TYPE, 2020-2029 (PRICE)

TABLE 57 JAPAN TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 58 JAPAN TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY SERVICES, 2020-2029 (USD MILLION)

TABLE 59 JAPAN TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 60 JAPAN INSULATED CONTAINERS IN TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 61 JAPAN REFRIGERANTS IN TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 62 JAPAN TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY USABILITY, 2020-2029 (USD MILLION)

TABLE 63 JAPAN TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 64 JAPAN IN TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 65 JAPAN FOOD & BEVERAGES IN TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 66 JAPAN HEALTHCARE IN TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 67 JAPAN HEALTHCARE IN TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 68 JAPAN CHEMICAL IN TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 69 JAPAN RESEARCH LABORATORIES IN TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 70 JAPAN OTHERS IN TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 71 SOUTH KOREA TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 72 SOUTH KOREA TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 73 SOUTH KOREA TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY TYPE, 2020-2029 (PRICE)

TABLE 74 SOUTH KOREA TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 75 SOUTH KOREA TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY SERVICES, 2020-2029 (USD MILLION)

TABLE 76 SOUTH KOREA TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 77 SOUTH KOREA INSULATED CONTAINERS IN TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 78 SOUTH KOREA REFRIGERANTS IN TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 79 SOUTH KOREA TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY USABILITY, 2020-2029 (USD MILLION)

TABLE 80 SOUTH KOREA TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 81 SOUTH KOREA IN TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 82 SOUTH KOREA FOOD & BEVERAGES IN TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 83 SOUTH KOREA HEALTHCARE IN TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 84 SOUTH KOREA HEALTHCARE IN TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 85 SOUTH KOREA CHEMICAL IN TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 86 SOUTH KOREA RESEARCH LABORATORIES IN TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 87 SOUTH KOREA OTHERS IN TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 88 THAILAND TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 89 THAILAND TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 90 THAILAND TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY TYPE, 2020-2029 (PRICE)

TABLE 91 THAILAND TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 92 THAILAND TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY SERVICES, 2020-2029 (USD MILLION)

TABLE 93 THAILAND TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 94 THAILAND INSULATED CONTAINERS IN TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 95 THAILAND REFRIGERANTS IN TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 96 THAILAND TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY USABILITY, 2020-2029 (USD MILLION)

TABLE 97 THAILAND TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 98 THAILAND IN TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 99 THAILAND FOOD & BEVERAGES IN TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 100 THAILAND HEALTHCARE IN TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 101 THAILAND HEALTHCARE IN TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 102 THAILAND CHEMICAL IN TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 103 THAILAND RESEARCH LABORATORIES IN TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 104 THAILAND OTHERS IN TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 105 SINGAPORE TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 106 SINGAPORE TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 107 SINGAPORE TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY TYPE, 2020-2029 (PRICE)

TABLE 108 SINGAPORE TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 109 SINGAPORE TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY SERVICES, 2020-2029 (USD MILLION)

TABLE 110 SINGAPORE TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 111 SINGAPORE INSULATED CONTAINERS IN TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 112 SINGAPORE REFRIGERANTS IN TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 113 SINGAPORE TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY USABILITY, 2020-2029 (USD MILLION)

TABLE 114 SINGAPORE TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 115 SINGAPORE IN TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 116 SINGAPORE FOOD & BEVERAGES IN TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 117 SINGAPORE HEALTHCARE IN TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 118 SINGAPORE HEALTHCARE IN TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 119 SINGAPORE CHEMICAL IN TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 120 SINGAPORE RESEARCH LABORATORIES IN TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 121 SINGAPORE OTHERS IN TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 122 INDONESIA TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 123 INDONESIA TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 124 INDONESIA TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY TYPE, 2020-2029 (PRICE)

TABLE 125 INDONESIA TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 126 INDONESIA TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY SERVICES, 2020-2029 (USD MILLION)

TABLE 127 INDONESIA TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 128 INDONESIA INSULATED CONTAINERS IN TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 129 INDONESIA REFRIGERANTS IN TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 130 INDONESIA TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY USABILITY, 2020-2029 (USD MILLION)

TABLE 131 INDONESIA TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 132 INDONESIA IN TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 133 INDONESIA FOOD & BEVERAGES IN TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 134 INDONESIA HEALTHCARE IN TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 135 INDONESIA HEALTHCARE IN TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 136 INDONESIA CHEMICAL IN TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 137 INDONESIA RESEARCH LABORATORIES IN TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 138 INDONESIA OTHERS IN TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 139 AUSTRALIA & NEW ZEALAND TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 140 AUSTRALIA & NEW ZEALAND TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 141 AUSTRALIA & NEW ZEALAND TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY TYPE, 2020-2029 (PRICE)

TABLE 142 AUSTRALIA & NEW ZEALAND TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 143 AUSTRALIA & NEW ZEALAND TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY SERVICES, 2020-2029 (USD MILLION)

TABLE 144 AUSTRALIA & NEW ZEALAND TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 145 AUSTRALIA & NEW ZEALAND INSULATED CONTAINERS IN TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 146 AUSTRALIA & NEW ZEALAND REFRIGERANTS IN TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 147 AUSTRALIA & NEW ZEALAND TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY USABILITY, 2020-2029 (USD MILLION)

TABLE 148 AUSTRALIA & NEW ZEALAND TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 149 AUSTRALIA & NEW ZEALAND IN TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 150 AUSTRALIA & NEW ZEALAND FOOD & BEVERAGES IN TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 151 AUSTRALIA & NEW ZEALAND HEALTHCARE IN TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 152 AUSTRALIA & NEW ZEALAND HEALTHCARE IN TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 153 AUSTRALIA & NEW ZEALAND CHEMICAL IN TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 154 AUSTRALIA & NEW ZEALAND RESEARCH LABORATORIES IN TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 155 AUSTRALIA & NEW ZEALAND OTHERS IN TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 156 PHILIPPINES TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 157 PHILIPPINES TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 158 PHILIPPINES TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY TYPE, 2020-2029 (PRICE)

TABLE 159 PHILIPPINES TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 160 PHILIPPINES TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY SERVICES, 2020-2029 (USD MILLION)

TABLE 161 PHILIPPINES TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 162 PHILIPPINES INSULATED CONTAINERS IN TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 163 PHILIPPINES REFRIGERANTS IN TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 164 PHILIPPINES TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY USABILITY, 2020-2029 (USD MILLION)

TABLE 165 PHILIPPINES TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 166 PHILIPPINES IN TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 167 PHILIPPINES FOOD & BEVERAGES IN TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 168 PHILIPPINES HEALTHCARE IN TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 169 PHILIPPINES HEALTHCARE IN TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 170 PHILIPPINES CHEMICAL IN TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 171 PHILIPPINES RESEARCH LABORATORIES IN TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 172 PHILIPPINES OTHERS IN TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 173 MALAYSIA TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 174 MALAYSIA TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 175 MALAYSIA TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY TYPE, 2020-2029 (PRICE)

TABLE 176 MALAYSIA TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 177 MALAYSIA TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY SERVICES, 2020-2029 (USD MILLION)

TABLE 178 MALAYSIA TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 179 MALAYSIA INSULATED CONTAINERS IN TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 180 MALAYSIA REFRIGERANTS IN TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 181 MALAYSIA TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY USABILITY, 2020-2029 (USD MILLION)

TABLE 182 MALAYSIA TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 183 MALAYSIA IN TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 184 MALAYSIA FOOD & BEVERAGES IN TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 185 MALAYSIA HEALTHCARE IN TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 186 MALAYSIA HEALTHCARE IN TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 187 MALAYSIA CHEMICAL IN TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 188 MALAYSIA RESEARCH LABORATORIES IN TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 189 MALAYSIA OTHERS IN TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 190 REST OF ASIA-PACIFIC TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 191 REST OF ASIA-PACIFIC TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET, BY TYPE, 2020-2029 (KILO TONS)

Список рисунков

FIGURE 1 ASIA-PACIFIC TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET: SEGMENTATION

FIGURE 2 ASIA-PACIFIC TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET: DATA TRIANGULATION

FIGURE 3 ASIA-PACIFIC TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET: DROC ANALYSIS

FIGURE 4 ASIA-PACIFIC TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET: REGIONAL MARKET ANALYSIS

FIGURE 5 ASIA-PACIFIC TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 ASIA-PACIFIC TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 ASIA-PACIFIC TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET: DBMR MARKET POSITION GRID

FIGURE 8 ASIA-PACIFIC TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 ASIA-PACIFIC TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 10 ASIA-PACIFIC TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET: SEGMENTATION

FIGURE 11 RISING TREND OF FRESH AND FROZEN FOOD AND GROWING HEALTHCARE INDUSTRIES ARE EXPECTED TO DRIVE THE ASIA-PACIFIC TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET IN THE FORECAST PERIOD

FIGURE 12 PASSIVE SYSTEM SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE ASIA-PACIFIC TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET IN 2022 & 2029

FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE ASIA-PACIFIC TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET

FIGURE 14 ASIA-PACIFIC TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET: BY TYPE, 2021

FIGURE 15 ASIA-PACIFIC TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET: BY PRODUCT & SERVICES, 2021

FIGURE 16 ASIA-PACIFIC TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET: BY APPLICATION, 2021

FIGURE 17 ASIA-PACIFIC TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET: BY USABILITY, 2021

FIGURE 18 ASIA-PACIFIC TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET: BY END-USE, 2021

FIGURE 19 ASIA-PACIFIC TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET: SNAPSHOT (2020)

FIGURE 20 ASIA-PACIFIC TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET: BY COUNTRY (2020)

FIGURE 21 ASIA-PACIFIC TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET: BY TYPE (2022 & 2029)

FIGURE 22 ASIA-PACIFIC TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET: BY TYPE (2021 & 2029)

FIGURE 23 ASIA-PACIFIC TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET: BY TYPE (2022-2029)

FIGURE 24 ASIA-PACIFIC TEMPERATURE CONTROLLED PACKAGING SOLUTIONS MARKET: COMPANY SHARE 2021 (%)

Методология исследования

Сбор данных и анализ базового года выполняются с использованием модулей сбора данных с большими размерами выборки. Этап включает получение рыночной информации или связанных данных из различных источников и стратегий. Он включает изучение и планирование всех данных, полученных из прошлого заранее. Он также охватывает изучение несоответствий информации, наблюдаемых в различных источниках информации. Рыночные данные анализируются и оцениваются с использованием статистических и последовательных моделей рынка. Кроме того, анализ доли рынка и анализ ключевых тенденций являются основными факторами успеха в отчете о рынке. Чтобы узнать больше, пожалуйста, запросите звонок аналитика или оставьте свой запрос.

Ключевой методологией исследования, используемой исследовательской группой DBMR, является триангуляция данных, которая включает в себя интеллектуальный анализ данных, анализ влияния переменных данных на рынок и первичную (отраслевую экспертную) проверку. Модели данных включают сетку позиционирования поставщиков, анализ временной линии рынка, обзор рынка и руководство, сетку позиционирования компании, патентный анализ, анализ цен, анализ доли рынка компании, стандарты измерения, глобальный и региональный анализ и анализ доли поставщика. Чтобы узнать больше о методологии исследования, отправьте запрос, чтобы поговорить с нашими отраслевыми экспертами.

Доступна настройка

Data Bridge Market Research является лидером в области передовых формативных исследований. Мы гордимся тем, что предоставляем нашим существующим и новым клиентам данные и анализ, которые соответствуют и подходят их целям. Отчет можно настроить, включив в него анализ ценовых тенденций целевых брендов, понимание рынка для дополнительных стран (запросите список стран), данные о результатах клинических испытаний, обзор литературы, обновленный анализ рынка и продуктовой базы. Анализ рынка целевых конкурентов можно проанализировать от анализа на основе технологий до стратегий портфеля рынка. Мы можем добавить столько конкурентов, о которых вам нужны данные в нужном вам формате и стиле данных. Наша команда аналитиков также может предоставить вам данные в сырых файлах Excel, сводных таблицах (книга фактов) или помочь вам в создании презентаций из наборов данных, доступных в отчете.