Рынок технологий дистанционного зондирования в Азиатско-Тихоокеанском регионе по типу (пассивный и активный), типу системы (визуальная система дистанционного зондирования, инфракрасное дистанционное зондирование , оптическое дистанционное зондирование, микроволновое дистанционное зондирование, радиолокационное дистанционное зондирование, воздушное дистанционное зондирование, спутниковое дистанционное зондирование, акустическое и почти акустическое дистанционное зондирование), разрешению изображения (источники с низким пространственным разрешением ( 30 метров), спутниковое среднее разрешение (5-30 метров), промышленность с высоким разрешением (1-5 метров) и промышленность с очень высоким разрешением (лесное хозяйство , картографирование пойм и управление чрезвычайными ситуациями, здравоохранение, геология и разведка полезных ископаемых, океанография, сельское хозяйство и другие), стране (Япония, Китай, Индия, Южная Корея, Австралия, Сингапур, Малайзия, Таиланд, Индонезия, Филиппины и остальные страны Азиатско-Тихоокеанского региона). Тенденции отрасли и прогноз до 2029 года.

Анализ рынка и аналитика : Азиатско-Тихоокеанский рынок технологий дистанционного зондирования

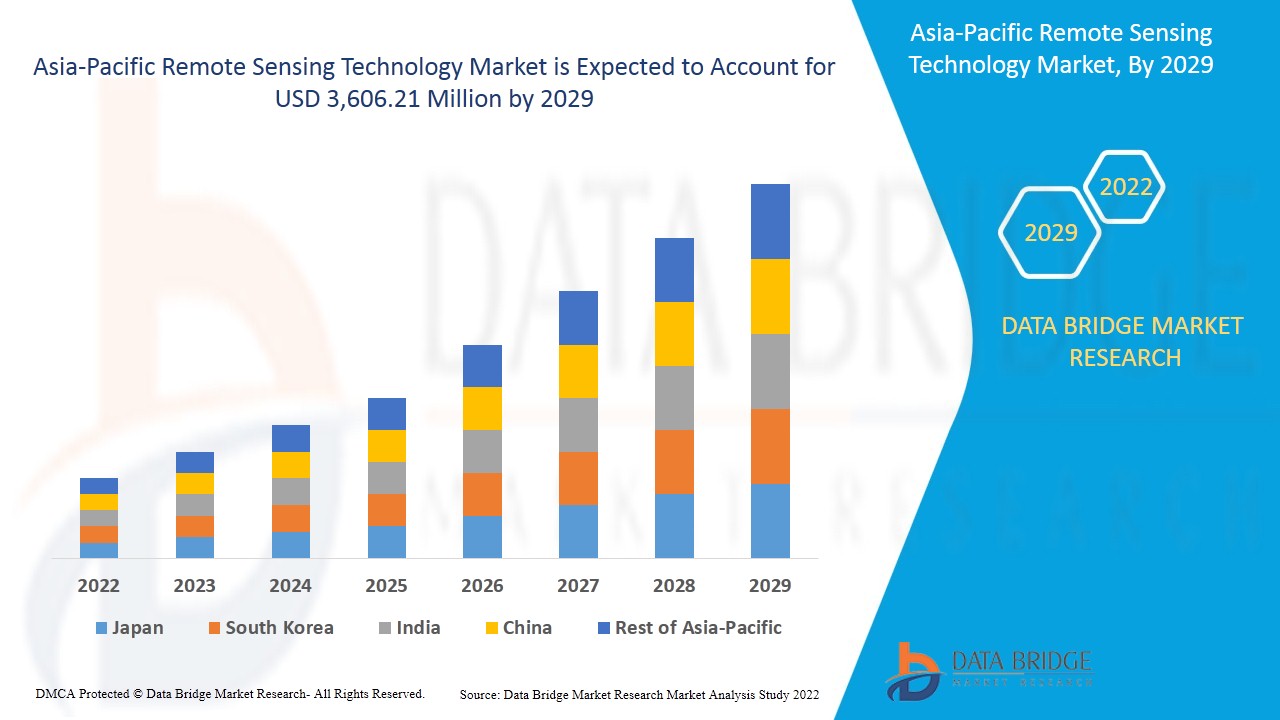

Ожидается, что рынок технологий дистанционного зондирования будет расти в прогнозируемый период с 2022 по 2029 год. По данным Data Bridge Market Research, среднегодовой темп роста рынка составит 8,3% в прогнозируемый период с 2022 по 2029 год, а к 2029 году его объем, как ожидается, достигнет 3 606,21 млн долларов США. Ожидается, что рост рынка будет обусловлен растущим внедрением инноваций Интернета вещей (IoT) в сельскохозяйственном секторе.

Дистанционное зондирование — это тип геопространственной технологии, которая излучает и отражает электромагнитное (ЭМ) излучение от наземных, атмосферных и водных экосистем Земли для обнаружения и мониторинга физических характеристик области без физического контакта. Этот метод сбора данных обычно включает в себя технологии датчиков на базе самолетов и спутников, которые классифицируются как пассивные датчики и активные датчики. Пассивные датчики реагируют на внешние раздражители, собирая излучение, которое отражается или испускается объектом или окружающим пространством. Наиболее распространенным источником излучения, измеряемым с помощью пассивного дистанционного зондирования, является отраженный солнечный свет. Активные датчики используют внутренние раздражители для сбора данных, излучая энергию, которая будет сканировать объекты и области, после чего датчик измеряет энергию, отраженную от цели.

IoT в сельском хозяйстве использует удаленные датчики, роботов, дроны и компьютерные изображения для отображения урожая на экране и предоставления фермерам информации для эффективного управления фермой. Датчики Интернета вещей (IoT) используются для сбора данных, которые передаются для анализа. Фермеры могут отображать качество урожая на систематической панели мониторинга.

Необходимость высоких первоначальных инвестиций в сборку многочисленных компонентов блокирует развитие рынка технологий дистанционного зондирования. Участники рынка хотят создавать элементы и кодировать контент данных, который соответствует рекомендациям административных организаций. Это ограничивает возможности развития организаций на рынке. Однако ожидается, что растущее внедрение в приложениях для исследований и разведки будет стимулировать рынок в ближайшие годы.

Ожидается, что растущий спрос на проекты по наблюдению за Землей среди развитых и развивающихся стран будет стимулировать рост рынка. Ожидается, что отсутствие бдительности и проблемы взаимодействия будет бросать вызов росту рынка, однако, как ожидается, растущее внедрение дистанционного зондирования в исследования и разведку в различных секторах создаст возможность для роста рынка. Высокая стоимость создания инфраструктуры может сдерживать рост рынка.

Отчет о рынке технологий дистанционного зондирования содержит подробную информацию о доле рынка, новых разработках и анализе продуктового портфеля, влиянии внутренних и локальных игроков рынка, анализирует возможности с точки зрения новых источников дохода, изменений в рыночных правилах, одобрений продуктов, стратегических решений, запусков продуктов, географических расширений и технологических инноваций на рынке. Чтобы понять анализ и сценарий рынка технологий дистанционного зондирования, свяжитесь с Data Bridge Market Research для получения аналитического обзора, наша команда поможет вам создать решение по влиянию на доход для достижения желаемой цели.

Масштаб рынка технологий дистанционного зондирования и размер рынка

Рынок технологий дистанционного зондирования сегментирован на четыре заметных сегмента, которые основаны на типе, типе системы, разрешении изображения и применении. Рост среди сегментов помогает вам анализировать нишевые карманы роста и стратегии для подхода к рынку и определять ваши основные области применения и разницу в ваших целевых рынках.

- Рынок технологий дистанционного зондирования по типу сегментируется на активный и пассивный. Ожидается, что в 2022 году пассивный сегмент будет доминировать на рынке, поскольку пассивная технология дистанционного зондирования обеспечивает высококачественные спутниковые изображения и широко используется для наблюдения за Землей.

- На основе типа системы рынок технологий дистанционного зондирования сегментирован на визуальную систему дистанционного зондирования, инфракрасное дистанционное зондирование, оптическое дистанционное зондирование, микроволновое дистанционное зондирование, радиолокационное дистанционное зондирование, воздушное дистанционное зондирование, спутниковое дистанционное зондирование, акустическое и почти акустическое дистанционное зондирование. Ожидается, что в 2022 году сегмент радиолокационного дистанционного зондирования будет доминировать на рынке, поскольку он способствует распространению и передаче четких и бесшумных радиосигналов.

- На основе разрешения изображения рынок технологий дистанционного зондирования сегментируется на источники с низким пространственным разрешением (> 30 метров), спутники со средним разрешением (5-30 метров), промышленность с высоким разрешением (1-5 метров) и промышленность с очень высоким разрешением (< 1 метра). Ожидается, что в 2022 году источники с низким пространственным разрешением (> 30 метров) будут доминировать на рынке, поскольку они обладают высокой огнестойкостью и могут использоваться в широком спектре промышленных приложений.

- На основе сферы применения рынок технологий дистанционного зондирования сегментируется на оценку ландшафта, безопасность, качество воздуха, гидрологию, лесное хозяйство, картографирование пойм и управление чрезвычайными ситуациями, здравоохранение, геологию и разведку полезных ископаемых, океанографию, сельское хозяйство и др. Ожидается, что в 2022 году сегмент оценки ландшафта будет доминировать на рынке, поскольку он обеспечивает устойчивое управление и развитие ландшафтов.

Анализ рынка технологий дистанционного зондирования на уровне страны

Проведен анализ рынка технологий дистанционного зондирования и предоставлена информация о его размере по стране, типу, типу системы, разрешению изображения и области применения, как указано выше.

В отчете о рынке технологий дистанционного зондирования рассматриваются следующие страны: Япония, Китай, Южная Корея, Индия, Австралия, Сингапур, Таиланд, Малайзия, Индонезия, Филиппины и остальные страны Азиатско-Тихоокеанского региона.

Ожидается, что Китай будет доминировать на рынке благодаря правительственным инициативам по развитию городской инфраструктуры.

Раздел отчета по странам также содержит индивидуальные факторы, влияющие на рынок, и изменения в регулировании на внутреннем рынке, которые влияют на текущие и будущие тенденции рынка. Такие данные, как новые продажи, заменяющие продажи, демографические данные страны, нормативные акты и импортно-экспортные тарифы, являются одними из основных указателей, используемых для прогнозирования рыночного сценария для отдельных стран. Кроме того, при предоставлении прогнозного анализа данных по стране учитываются наличие и доступность глобальных брендов и их проблемы, связанные с большой или малой конкуренцией со стороны местных и отечественных брендов, а также влияние каналов продаж.

Ожидается, что рост полезности в военном и оборонном секторе будет способствовать росту рынка

Рынок технологий дистанционного зондирования также предоставляет вам подробный анализ рынка для роста каждой страны на определенном рынке. Кроме того, он предоставляет подробную информацию о стратегии участников рынка и их географическом присутствии. Данные доступны за исторический период 2011-2020 гг.

Анализ конкурентной среды и доли рынка технологий дистанционного зондирования

Конкурентная среда рынка технологий дистанционного зондирования содержит сведения по конкурентам. Включены сведения о компании, финансах компании, полученном доходе, рыночном потенциале, инвестициях в исследования и разработки, новых рыночных инициативах, производственных площадках и объектах, сильных и слабых сторонах компании, запуске продукта, испытаниях продукта, одобрении продукта, патентах, широте и широте продукта, доминировании приложений, жизненно важной кривой технологии. Приведенные выше данные относятся только к фокусу компании на рынке технологий дистанционного зондирования.

Некоторые из основных игроков, работающих на рынке технологий дистанционного зондирования, включают Northrop Grumman, The Airborne Sensing Corporation, ITT INC., Leica Geosystems AG - часть Hexagon, Lockheed Martin Corporation., Honeywell International Inc., Thales Group, Orbital Insight, Ceres Imaging, Satellite Imaging Corporation, Descartes Labs, Inc, Astro Digital US, SlantRange, Inc., Droplet Measurement Technologies, Airbus, Farmers Edge Inc., SCANEX Group., SpaceKnow, Raytheon Technologies Corporation, Terra Remote Sensing, PrecisionHawk и другие.

Множество контрактов и соглашений также инициируются компаниями по всему миру, что также ускоряет развитие рынка технологий дистанционного зондирования.

Например,

- В декабре 2021 года Airbus завершила свой второй спутник мониторинга океана Sentinel-6B. Спутник был построен для измерения расстояния до поверхности моря с точностью до нескольких сантиметров. Основная цель спутника — измерение высоты морской поверхности, колебаний уровня моря, а также анализ и наблюдение за океанскими течениями.

- В январе 2022 года корпорация Northrop Grumman успешно завершила статические испытания ракетного двигателя для точного удара. Испытание ракетного двигателя было необходимым условием для проверки конструкции двигателя компании для производства. Инвестиции компании в цифровые технологии обеспечивают доступность современных и эффективных предприятий по производству тактических твердотопливных ракетных двигателей.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Интерактивная панель анализа данных

- Панель анализа компании для возможностей с высоким потенциалом роста

- Доступ аналитика-исследователя для настройки и запросов

- Анализ конкурентов с помощью интерактивной панели

- Последние новости, обновления и анализ тенденций

- Используйте возможности сравнительного анализа для комплексного отслеживания конкурентов

Содержание

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF ASIA PACIFIC REMOTE SENSING TECHNOLOGY MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MULTIVARIATE MODELING

2.9 TYPE TIMELINE CURVE

2.1 MARKET APPLICATION COVERAGE GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 IN-DEPTH ANALYSIS ON HYPERSPECTRAL REMOTE SENSING: PREMIUM INSIGHTS

4.1.1 INTRODUCTION

4.1.2 HISTORY

4.1.3 LIST OF HYPERSPECTRAL SENSORS:

4.1.4 APPLICATION OF HYPERSPECTRAL IMAGE ANALYSIS:

4.1.5 PRICING ANALYSIS:

5 REGIONAL SUMMARY

5.1 NORTH AMERICA

5.2 EUROPE

5.3 ASIA-PACIFIC

5.4 MIDDLE EAST AND AFRICA

5.5 SOUTH AMERICAN

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 RISING FOCUS TOWARDS EARTH OBSERVATION PROJECTS BETWEEN DEVELOPED AND DEVELOPING COUNTRIES

6.1.2 SURGING UTILITY IN MILITARY AND DEFENCE SECTOR

6.1.3 GROWING ADOPTION OF PRECISION FARMING TECHNOLOGY

6.2 RESTRAINT

6.2.1 HIGH INFRASTRUCTURE ESTABLISHMENT COST

6.3 OPPORTUNITIES

6.3.1 RISING ADOPTION OF REMOTE SENSING IN RESEARCH AND EXPLORATION AMONG DIFFERENT SECTORS

6.3.2 RISE IN ADOPTION OF INTERNET OF THING (IOT) IN REMOTE SENSING TECHNOLOGY

6.4 CHALLENGE

6.4.1 ABSENCE OF ALERTNESS AND INTEROPERABILITY ISSUE

7 IMPACT OF COVID-19 ON THE ASIA PACIFIC REMOTE SENSING TECHNOLOGY MARKET

7.1 ANALYSIS ON IMPACT OF COVID-19 ON THE MARKET

7.2 STRATEGIC DECISION BY MANUFACTURERS AFTER COVID-19

7.3 IMPACT ON PRICE

7.4 IMPACT ON DEMAND AND SUPPLY CHAIN

7.5 CONCLUSION

8 ASIA PACIFIC REMOTE SENSING TECHNOLOGY MARKET, BY TYPE

8.1 OVERVIEW

8.2 PASSIVE

8.2.1 NEAR INFRARED

8.2.2 THERMAL INFRARED ENERGY

8.2.3 VISIBLE

8.3 ACTIVE

8.3.1 RADAR

8.3.2 LASER

8.3.3 SONAR

9 ASIA PACIFIC REMOTE SENSING TECHNOLOGY MARKET, BY SYSTEM TYPE

9.1 OVERVIEW

9.2 RADAR REMOTE SENSING

9.3 AIRBORNE REMOTE SENSING

9.4 SATELLITE REMOTE SENSING

9.5 MICROWAVE REMOTE SENSING

9.6 INFRARED REMOTE SENSING

9.7 ACOUSTIC AND NEAR ACOUSTIC REMOTE SENSING

9.8 OPTICAL REMOTE SENSING

9.9 VISUAL REMOTE SENSING

10 ASIA PACIFIC REMOTE SENSING TECHNOLOGY MARKET, BY IMAGE RESOLUTION

10.1 OVERVIEW

10.2 LOW SPATIAL RESOLUTION RESOURCE (>30 METERS)

10.3 MEDIUM RESOLUTION SATELLITE (5-30 METERS)

10.4 HIGH RESOLUTION INDUSTRY (1-5 METERS)

10.5 VERY HIGH RESOLUTION INDUSTRY (< 1 METER)

11 ASIA PACIFIC REMOTE SENSING TECHNOLOGY MARKET, BY APPLICATION

11.1 OVERVIEW

11.2 LANDSCAPE ASSESSMENT

11.2.1 RURAL/URBAN CHANGE

11.2.2 BIOMASS MAPPING

11.3 SECURITY

11.4 GEOLOGY AND MINERAL EXPLORATION

11.5 HYDROLOGY

11.5.1 FLOOD DELINEATION AND MAPPING

11.5.2 SOIL MOISTURE

11.6 FORESTRY

11.6.1 COASTAL PROTECTION

11.6.2 BIOMASS ESTIMATION

11.6.3 AGROFORESTRY MAPPING

11.6.4 BURN DELINEATION

11.6.5 DEPLETION MONITORING

11.7 HEALTHCARE

11.8 AIR QUALITY

11.9 FLOOD PLAIN MAPPING AND EMERGENCY MANAGEMENT

11.1 AGRICULTURE

11.10.1 CROP MONITORING & DAMAGE ASSESSMENT

11.10.2 CROP TYPE MAPPING

11.11 OCEANOGRAPHY

11.12 OTHERS

12 ASIA PACIFIC REMOTE SENSING TECHNOLOGY MARKET, BY REGION

12.1 ASIA-PACIFIC

12.1.1 CHINA

12.1.2 JAPAN

12.1.3 INDIA

12.1.4 AUSTRALIA

12.1.5 SOUTH KOREA

12.1.6 INDONESIA

12.1.7 THAILAND

12.1.8 SINGAPORE

12.1.9 MALAYSIA

12.1.10 PHILIPPINES

12.1.11 REST OF ASIA-PACIFIC

13 ASIA PACIFIC REMOTE SENSING TECHNOLOGY MARKET: COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: ASIA PACIFIC

14 SWOT ANALYSIS.

15 COMPANY PROFILE

15.1 NORTHROP GRUMMAN

15.1.1 COMPANY SNAPSHOT

15.1.2 REVENUE ANALYSIS

15.1.3 COMPANY SHARE ANALYSIS

15.1.4 PRODUCT PORTFOLIO

15.1.5 RECENT DEVELOPMENTS

15.2 RAYTHEON TECHNOLOGIES CORPORATION

15.2.1 COMPANY SNAPSHOT

15.2.2 COMPANY SHARE ANALYSIS

15.2.3 PRODUCT PORTFOLIO

15.2.4 RECENT DEVELOPMENT

15.3 LOCKHEED MARTIN CORPORATION.

15.3.1 COMPANY SNAPSHOT

15.3.2 REVENUE ANALYSIS

15.3.3 COMPANY SHARE ANALYSIS

15.3.4 PRODUCT PORTFOLIO

15.3.5 RECENT DEVELOPMENTS

15.4 THALES GROUP

15.4.1 COMPANY SNAPSHOT

15.4.2 COMPANY SHARE ANALYSIS

15.4.3 PRODUCT PORTFOLIO

15.4.4 RECENT DEVELOPMENTS

15.5 AIRBUS

15.5.1 COMPANY SNAPSHOT

15.5.2 REVENUE ANALYSIS

15.5.3 COMPANY SHARE ANALYSIS

15.5.4 PRODUCT PORTFOLIO

15.5.5 RECENT DEVELOPMENT

15.6 ASTRO DIGITAL US

15.6.1 COMPANY SNAPSHOT

15.6.2 PRODUCT PORTFOLIO

15.6.3 RECENT DEVELOPMENT

15.7 CERES IMAGING

15.7.1 COMPANY SNAPSHOT

15.7.2 PRODUCT PORTFOLIO

15.7.3 RECENT DEVELOPMENT

15.8 DESCARTES LABS, INC

15.8.1 COMPANY SNAPSHOT

15.8.2 PRODUCT PORTFOLIO

15.8.3 RECENT DEVELOPMENT

15.9 DROPLET MEASUREMENT TECHNOLOGIES

15.9.1 COMPANY SNAPSHOT

15.9.2 PRODUCT PORTFOLIO

15.9.3 RECENT DEVELOPMENT

15.1 FARMERS EDGE INC.

15.10.1 COMPANY SNAPSHOT

15.10.2 REVENUE ANALYSIS

15.10.3 PRODUCT PORTFOLIO

15.10.4 RECENT DEVELOPMENT

15.11 HONEYWELL INTERNATIONAL INC.

15.11.1 COMPANY SNAPSHOT

15.11.2 REVENUE ANALYSIS

15.11.3 PRODUCT PORTFOLIO

15.11.4 RECENT DEVELOPMENTS

15.12 ITT INC.

15.12.1 COMPANY SNAPSHOT

15.12.2 REVENUE ANALYSIS

15.12.3 PRODUCT PORTFOLIO

15.12.4 RECENT DEVELOPMENT

15.13 LEICA GEOSYSTEMS AG - PART OF HEXAGON

15.13.1 COMPANY SNAPSHOT

15.13.2 PRODUCT PORTFOLIO

15.13.3 RECENT DEVELOPMENTS

15.14 MALLON TECHNOLOGY

15.14.1 COMPANY SNAPSHOT

15.14.2 PRODUCT PORTFOLIO

15.14.3 RECENT DEVELOPMENT

15.15 MAXAR TECHNOLOGIES

15.15.1 COMPANY SNAPSHOT

15.15.2 PRODUCT PORTFOLIO

15.15.3 RECENT DEVELOPMENT

15.16 ORBITAL INSIGHT

15.16.1 COMPANY SNAPSHOT

15.16.2 PRODUCT PORTFOLIO

15.16.3 RECENT DEVELOPMENT

15.17 PRECISIONHAWK

15.17.1 COMPANY SNAPSHOT

15.17.2 PRODUCT PORTFOLIO

15.17.3 RECENT DEVELOPMENT

15.18 SATELLITE IMAGING CORPORATION

15.18.1 COMPANY SNAPSHOT

15.18.2 PRODUCT PORTFOLIO

15.18.3 RECENT DEVELOPMENT

15.19 SLANTRANGE, INC.

15.19.1 COMPANY SNAPSHOT

15.19.2 PRODUCT PORTFOLIO

15.19.3 RECENT DEVELOPMENT

15.2 SCANEX GROUP.

15.20.1 COMPANY SNAPSHOT

15.20.2 PRODUCT PORTFOLIO

15.20.3 RECENT DEVELOPMENT

15.21 SPACEKNOW

15.21.1 COMPANY SNAPSHOT

15.21.2 PRODUCT PORTFOLIO

15.21.3 RECENT DEVELOPMENT

15.22 THE AIRBORNE SENSING CORPORATION

15.22.1 COMPANY SNAPSHOT

15.22.2 PRODUCT PORTFOLIO

15.22.3 RECENT DEVELOPMENT

15.23 TERRA REMOTE SENSING

15.23.1 COMPANY SNAPSHOT

15.23.2 PRODUCT PORTFOLIO

15.23.3 RECENT DEVELOPMENT

16 QUESTIONNAIRE

17 RELATED REPORT

Список таблиц

TABLE 1 WAVELENGTH RANGES APPLIED IN HYPERSPECTRAL REMOTE SENSING

TABLE 2 THE COSTS OF VARIOUS OPTICAL AND MICROWAVE SATELLITE DATA USED FOR CROP AREA ESTIMATION

TABLE 3 ASIA PACIFIC REMOTE SENSING TECHNOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 4 ASIA PACIFIC PASSIVE IN REMOTE SENSING TECHNOLOGY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 5 ASIA PACIFIC PASSIVE IN REMOTE SENSING TECHNOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 6 ASIA PACIFIC ACTIVE IN REMOTE SENSING TECHNOLOGY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 7 ASIA PACIFIC ACTIVE IN REMOTE SENSING TECHNOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 8 ASIA PACIFIC REMOTE SENSING TECHNOLOGY MARKET, BY SYSTEM TYPE, 2020-2029 (USD MILLION)

TABLE 9 ASIA PACIFIC RADAR REMOTE SENSING IN REMOTE SENSING TECHNOLOGY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 10 ASIA PACIFIC AIRBORNE REMOTE SENSING IN REMOTE SENSING TECHNOLOGY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 11 ASIA PACIFIC SATELLITE REMOTE SENSING IN REMOTE SENSING TECHNOLOGY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 12 ASIA PACIFIC MICROWAVE REMOTE SENSING IN REMOTE SENSING TECHNOLOGY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 13 ASIA PACIFIC INFRARED REMOTE SENSING IN REMOTE SENSING TECHNOLOGY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 14 ASIA PACIFIC ACOUSTIC AND NEAR ACOUSTIC REMOTE SENSING IN REMOTE SENSING TECHNOLOGY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 15 ASIA PACIFIC OPTICAL REMOTE SENSING IN REMOTE SENSING TECHNOLOGY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 16 ASIA PACIFIC VISUAL REMOTE SENSING IN REMOTE SENSING TECHNOLOGY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 17 ASIA PACIFIC REMOTE SENSING TECHNOLOGY MARKET, BY IMAGE RESOLUTION, 2020-2029 (USD MILLION)

TABLE 18 ASIA PACIFIC LOW SPATIAL RESOLUTION RESOURCES (> 30 METERS) IN REMOTE SENSING TECHNOLOGY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 19 ASIA PACIFIC MEDIUM RESOLUTION SATELLITE (5-30 METERS) IN REMOTE SENSING TECHNOLOGY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 20 ASIA PACIFIC HIGH RESOLUTION INDUSTRY (1-5 METERS) IN REMOTE SENSING TECHNOLOGY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 21 ASIA PACIFIC VERY HIGH RESOLUTION INDUSTRY (< 1 METER) IN REMOTE SENSING TECHNOLOGY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 22 ASIA PACIFIC REMOTE SENSING TECHNOLOGY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 23 ASIA PACIFIC LANDSCAPE ASSESSMENT IN REMOTE SENSING TECHNOLOGY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 24 ASIA PACIFIC LANDSCAPE ASSESSMENT IN REMOTE SENSING TECHNOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 25 ASIA PACIFIC SECURITY IN REMOTE SENSING TECHNOLOGY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 26 ASIA PACIFIC GEOLOGY AND MINERAL EXPLORATION IN REMOTE SENSING TECHNOLOGY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 27 ASIA PACIFIC HYDROLOGY IN REMOTE SENSING TECHNOLOGY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 28 ASIA PACIFIC HYDROLOGY IN REMOTE SENSING TECHNOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 29 ASIA PACIFIC FORESTRY IN REMOTE SENSING TECHNOLOGY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 30 ASIA PACIFIC FORESTRY IN REMOTE SENSING TECHNOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 31 ASIA PACIFIC HEALTHCARE IN REMOTE SENSING TECHNOLOGY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 32 ASIA PACIFIC AIR QUALITY IN REMOTE SENSING TECHNOLOGY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 33 ASIA PACIFIC FLOOD PLAIN MAPPING AND EMERGENCY MANAGEMENT IN REMOTE SENSING TECHNOLOGY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 34 ASIA PACIFIC AGRICULTURE IN REMOTE SENSING TECHNOLOGY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 35 ASIA PACIFIC AGRICULTURE IN REMOTE SENSING TECHNOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 36 ASIA PACIFIC OCEANOGRAPHY IN REMOTE SENSING TECHNOLOGY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 37 ASIA PACIFIC OTHERS IN REMOTE SENSING TECHNOLOGY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 38 ASIA-PACIFIC REMOTE SENSING TECHNOLOGY MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 39 ASIA-PACIFIC REMOTE SENSING TECHNOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 40 ASIA-PACIFIC PASSIVE IN REMOTE SENSING TECHNOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 41 ASIA-PACIFIC ACTIVE IN REMOTE SENSING TECHNOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 42 ASIA-PACIFIC REMOTE SENSING TECHNOLOGY MARKET, BY SYSTEM TYPE, 2020-2029 (USD MILLION)

TABLE 43 ASIA-PACIFIC REMOTE SENSING TECHNOLOGY MARKET, BY IMAGE RESOLUTION, 2020-2029 (USD MILLION)

TABLE 44 ASIA-PACIFIC REMOTE SENSING TECHNOLOGY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 45 ASIA-PACIFIC LANDSCAPE ASSESSMENT IN REMOTE SENSING TECHNOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 46 ASIA-PACIFIC HYDROLOGY IN REMOTE SENSING TECHNOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 47 ASIA-PACIFIC FORESTRY IN REMOTE SENSING TECHNOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 48 ASIA-PACIFIC AGRICULTURE IN REMOTE SENSING TECHNOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 49 CHINA REMOTE SENSING TECHNOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 50 CHINA PASSIVE IN REMOTE SENSING TECHNOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 51 CHINA ACTIVE IN REMOTE SENSING TECHNOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 52 CHINA REMOTE SENSING TECHNOLOGY MARKET, BY SYSTEM TYPE, 2020-2029 (USD MILLION)

TABLE 53 CHINA REMOTE SENSING TECHNOLOGY MARKET, BY IMAGE RESOLUTION, 2020-2029 (USD MILLION)

TABLE 54 CHINA REMOTE SENSING TECHNOLOGY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 55 CHINA LANDSCAPE ASSESSMENT IN REMOTE SENSING TECHNOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 56 CHINA HYDROLOGY IN REMOTE SENSING TECHNOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 57 CHINA FORESTRY IN REMOTE SENSING TECHNOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 58 CHINA AGRICULTURE IN REMOTE SENSING TECHNOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 59 JAPAN REMOTE SENSING TECHNOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 60 JAPAN PASSIVE IN REMOTE SENSING TECHNOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 61 JAPAN ACTIVE IN REMOTE SENSING TECHNOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 62 JAPAN REMOTE SENSING TECHNOLOGY MARKET, BY SYSTEM TYPE, 2020-2029 (USD MILLION)

TABLE 63 JAPAN REMOTE SENSING TECHNOLOGY MARKET, BY IMAGE RESOLUTION, 2020-2029 (USD MILLION)

TABLE 64 JAPAN REMOTE SENSING TECHNOLOGY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 65 JAPAN LANDSCAPE ASSESSMENT IN REMOTE SENSING TECHNOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 66 JAPAN HYDROLOGY IN REMOTE SENSING TECHNOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 67 JAPAN FORESTRY IN REMOTE SENSING TECHNOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 68 JAPAN AGRICULTURE IN REMOTE SENSING TECHNOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 69 INDIA REMOTE SENSING TECHNOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 70 INDIA PASSIVE IN REMOTE SENSING TECHNOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 71 INDIA ACTIVE IN REMOTE SENSING TECHNOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 72 INDIA REMOTE SENSING TECHNOLOGY MARKET, BY SYSTEM TYPE, 2020-2029 (USD MILLION)

TABLE 73 INDIA REMOTE SENSING TECHNOLOGY MARKET, BY IMAGE RESOLUTION, 2020-2029 (USD MILLION)

TABLE 74 INDIA REMOTE SENSING TECHNOLOGY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 75 INDIA LANDSCAPE ASSESSMENT IN REMOTE SENSING TECHNOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 76 INDIA HYDROLOGY IN REMOTE SENSING TECHNOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 77 INDIA FORESTRY IN REMOTE SENSING TECHNOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 78 INDIA AGRICULTURE IN REMOTE SENSING TECHNOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 79 AUSTRALIA REMOTE SENSING TECHNOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 80 AUSTRALIA PASSIVE IN REMOTE SENSING TECHNOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 81 AUSTRALIA ACTIVE IN REMOTE SENSING TECHNOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 82 AUSTRALIA REMOTE SENSING TECHNOLOGY MARKET, BY SYSTEM TYPE, 2020-2029 (USD MILLION)

TABLE 83 AUSTRALIA REMOTE SENSING TECHNOLOGY MARKET, BY IMAGE RESOLUTION, 2020-2029 (USD MILLION)

TABLE 84 AUSTRALIA REMOTE SENSING TECHNOLOGY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 85 AUSTRALIA LANDSCAPE ASSESSMENT IN REMOTE SENSING TECHNOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 86 AUSTRALIA HYDROLOGY IN REMOTE SENSING TECHNOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 87 AUSTRALIA FORESTRY IN REMOTE SENSING TECHNOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 88 AUSTRALIA AGRICULTURE IN REMOTE SENSING TECHNOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 89 SOUTH KOREA REMOTE SENSING TECHNOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 90 SOUTH KOREA PASSIVE IN REMOTE SENSING TECHNOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 91 SOUTH KOREA ACTIVE IN REMOTE SENSING TECHNOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 92 SOUTH KOREA REMOTE SENSING TECHNOLOGY MARKET, BY SYSTEM TYPE, 2020-2029 (USD MILLION)

TABLE 93 SOUTH KOREA REMOTE SENSING TECHNOLOGY MARKET, BY IMAGE RESOLUTION, 2020-2029 (USD MILLION)

TABLE 94 SOUTH KOREA REMOTE SENSING TECHNOLOGY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 95 SOUTH KOREA LANDSCAPE ASSESSMENT IN REMOTE SENSING TECHNOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 96 SOUTH KOREA HYDROLOGY IN REMOTE SENSING TECHNOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 97 SOUTH KOREA FORESTRY IN REMOTE SENSING TECHNOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 98 SOUTH KOREA AGRICULTURE IN REMOTE SENSING TECHNOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 99 INDONESIA REMOTE SENSING TECHNOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 100 INDONESIA PASSIVE IN REMOTE SENSING TECHNOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 101 INDONESIA ACTIVE IN REMOTE SENSING TECHNOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 102 INDONESIA REMOTE SENSING TECHNOLOGY MARKET, BY SYSTEM TYPE, 2020-2029 (USD MILLION)

TABLE 103 INDONESIA REMOTE SENSING TECHNOLOGY MARKET, BY IMAGE RESOLUTION, 2020-2029 (USD MILLION)

TABLE 104 INDONESIA REMOTE SENSING TECHNOLOGY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 105 INDONESIA LANDSCAPE ASSESSMENT IN REMOTE SENSING TECHNOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 106 INDONESIA HYDROLOGY IN REMOTE SENSING TECHNOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 107 INDONESIA FORESTRY IN REMOTE SENSING TECHNOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 108 INDONESIA AGRICULTURE IN REMOTE SENSING TECHNOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 109 THAILAND REMOTE SENSING TECHNOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 110 THAILAND PASSIVE IN REMOTE SENSING TECHNOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 111 THAILAND ACTIVE IN REMOTE SENSING TECHNOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 112 THAILAND REMOTE SENSING TECHNOLOGY MARKET, BY SYSTEM TYPE, 2020-2029 (USD MILLION)

TABLE 113 THAILAND REMOTE SENSING TECHNOLOGY MARKET, BY IMAGE RESOLUTION, 2020-2029 (USD MILLION)

TABLE 114 THAILAND REMOTE SENSING TECHNOLOGY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 115 THAILAND LANDSCAPE ASSESSMENT IN REMOTE SENSING TECHNOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 116 THAILAND HYDROLOGY IN REMOTE SENSING TECHNOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 117 THAILAND FORESTRY IN REMOTE SENSING TECHNOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 118 THAILAND AGRICULTURE IN REMOTE SENSING TECHNOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 119 SINGAPORE REMOTE SENSING TECHNOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 120 SINGAPORE PASSIVE IN REMOTE SENSING TECHNOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 121 SINGAPORE ACTIVE IN REMOTE SENSING TECHNOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 122 SINGAPORE REMOTE SENSING TECHNOLOGY MARKET, BY SYSTEM TYPE, 2020-2029 (USD MILLION)

TABLE 123 SINGAPORE REMOTE SENSING TECHNOLOGY MARKET, BY IMAGE RESOLUTION, 2020-2029 (USD MILLION)

TABLE 124 SINGAPORE REMOTE SENSING TECHNOLOGY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 125 SINGAPORE LANDSCAPE ASSESSMENT IN REMOTE SENSING TECHNOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 126 SINGAPORE HYDROLOGY IN REMOTE SENSING TECHNOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 127 SINGAPORE FORESTRY IN REMOTE SENSING TECHNOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 128 SINGAPORE AGRICULTURE IN REMOTE SENSING TECHNOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 129 MALAYSIA REMOTE SENSING TECHNOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 130 MALAYSIA PASSIVE IN REMOTE SENSING TECHNOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 131 MALAYSIA ACTIVE IN REMOTE SENSING TECHNOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 132 MALAYSIA REMOTE SENSING TECHNOLOGY MARKET, BY SYSTEM TYPE, 2020-2029 (USD MILLION)

TABLE 133 MALAYSIA REMOTE SENSING TECHNOLOGY MARKET, BY IMAGE RESOLUTION, 2020-2029 (USD MILLION)

TABLE 134 MALAYSIA REMOTE SENSING TECHNOLOGY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 135 MALAYSIA LANDSCAPE ASSESSMENT IN REMOTE SENSING TECHNOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 136 MALAYSIA HYDROLOGY IN REMOTE SENSING TECHNOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 137 MALAYSIA FORESTRY IN REMOTE SENSING TECHNOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 138 MALAYSIA AGRICULTURE IN REMOTE SENSING TECHNOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 139 PHILIPPINES REMOTE SENSING TECHNOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 140 PHILIPPINES PASSIVE IN REMOTE SENSING TECHNOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 141 PHILIPPINES ACTIVE IN REMOTE SENSING TECHNOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 142 PHILIPPINES REMOTE SENSING TECHNOLOGY MARKET, BY SYSTEM TYPE, 2020-2029 (USD MILLION)

TABLE 143 PHILIPPINES REMOTE SENSING TECHNOLOGY MARKET, BY IMAGE RESOLUTION, 2020-2029 (USD MILLION)

TABLE 144 PHILIPPINES REMOTE SENSING TECHNOLOGY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 145 PHILIPPINES LANDSCAPE ASSESSMENT IN REMOTE SENSING TECHNOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 146 PHILIPPINES HYDROLOGY IN REMOTE SENSING TECHNOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 147 PHILIPPINES FORESTRY IN REMOTE SENSING TECHNOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 148 PHILIPPINES AGRICULTURE IN REMOTE SENSING TECHNOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 149 REST OF ASIA-PACIFIC REMOTE SENSING TECHNOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

Список рисунков

FIGURE 1 ASIA PACIFIC REMOTE SENSING TECHNOLOGY MARKET: SEGMENTATION

FIGURE 2 ASIA PACIFIC REMOTE SENSING TECHNOLOGY MARKET: DATA TRIANGULATION

FIGURE 3 ASIA PACIFIC REMOTE SENSING TECHNOLOGY MARKET: DROC ANALYSIS

FIGURE 4 ASIA PACIFIC REMOTE SENSING TECHNOLOGY MARKET: ASIA PACIFIC VS REGIONAL MARKET ANALYSIS

FIGURE 5 ASIA PACIFIC REMOTE SENSING TECHNOLOGY MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 ASIA PACIFIC REMOTE SENSING TECHNOLOGY MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 ASIA PACIFIC REMOTE SENSING TECHNOLOGY MARKET: DBMR MARKET POSITION GRID

FIGURE 8 ASIA PACIFIC REMOTE SENSING TECHNOLOGY MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 ASIA PACIFIC REMOTE SENSING TECHNOLOGY MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 10 ASIA PACIFIC REMOTE SENSING TECHNOLOGY MARKET: SEGMENTATION

FIGURE 11 SURGING UTILITY IN MILITARY AND DEFENSE SECTOR IS EXPECTED TO DRIVE THE ASIA PACIFIC REMOTE SENSING TECHNOLOGY MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 12 PASSIVE SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF ASIA PACIFIC REMOTE SENSING TECHNOLOGY MARKET IN 2022 & 2029

FIGURE 13 NORTH AMERICA IS EXPECTED TO DOMINATE AND IS THE FASTEST-GROWING REGION IN THE ASIA PACIFIC REMOTE SENSING TECHNOLOGY MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 14 DRIVERS, RESTRAINT, OPPORTUNITIES, CHALLENGE OF ASIA PACIFIC REMOTE SENSING TECHNOLOGY MARKET

FIGURE 15 ASIA PACIFIC REMOTE SENSING TECHNOLOGY MARKET: BY TYPE, 2021

FIGURE 16 ASIA PACIFIC REMOTE SENSING TECHNOLOGY MARKET: BY SYSTEM TYPE, 2021

FIGURE 17 ASIA PACIFIC REMOTE SENSING TECHNOLOGY MARKET: BY IMAGE RESOLUTION, 2021

FIGURE 18 ASIA PACIFIC REMOTE SENSING TECHNOLOGY MARKET: BY APPLICATION, 2021

FIGURE 19 ASIA-PACIFIC REMOTE SENSING TECHNOLOGY MARKET: SNAPSHOT (2021)

FIGURE 20 ASIA-PACIFIC REMOTE SENSING TECHNOLOGY MARKET: BY COUNTRY (2021)

FIGURE 21 ASIA-PACIFIC REMOTE SENSING TECHNOLOGY MARKET: BY COUNTRY (2022 & 2029)

FIGURE 22 ASIA-PACIFIC REMOTE SENSING TECHNOLOGY MARKET: BY COUNTRY (2021 & 2029)

FIGURE 23 ASIA-PACIFIC REMOTE SENSING TECHNOLOGY MARKET: BY TYPE (2022-2029)

FIGURE 24 ASIA PACIFIC REMOTE SENSING TECHNOLOGY MARKET: COMPANY SHARE 2021 (%)

Методология исследования

Сбор данных и анализ базового года выполняются с использованием модулей сбора данных с большими размерами выборки. Этап включает получение рыночной информации или связанных данных из различных источников и стратегий. Он включает изучение и планирование всех данных, полученных из прошлого заранее. Он также охватывает изучение несоответствий информации, наблюдаемых в различных источниках информации. Рыночные данные анализируются и оцениваются с использованием статистических и последовательных моделей рынка. Кроме того, анализ доли рынка и анализ ключевых тенденций являются основными факторами успеха в отчете о рынке. Чтобы узнать больше, пожалуйста, запросите звонок аналитика или оставьте свой запрос.

Ключевой методологией исследования, используемой исследовательской группой DBMR, является триангуляция данных, которая включает в себя интеллектуальный анализ данных, анализ влияния переменных данных на рынок и первичную (отраслевую экспертную) проверку. Модели данных включают сетку позиционирования поставщиков, анализ временной линии рынка, обзор рынка и руководство, сетку позиционирования компании, патентный анализ, анализ цен, анализ доли рынка компании, стандарты измерения, глобальный и региональный анализ и анализ доли поставщика. Чтобы узнать больше о методологии исследования, отправьте запрос, чтобы поговорить с нашими отраслевыми экспертами.

Доступна настройка

Data Bridge Market Research является лидером в области передовых формативных исследований. Мы гордимся тем, что предоставляем нашим существующим и новым клиентам данные и анализ, которые соответствуют и подходят их целям. Отчет можно настроить, включив в него анализ ценовых тенденций целевых брендов, понимание рынка для дополнительных стран (запросите список стран), данные о результатах клинических испытаний, обзор литературы, обновленный анализ рынка и продуктовой базы. Анализ рынка целевых конкурентов можно проанализировать от анализа на основе технологий до стратегий портфеля рынка. Мы можем добавить столько конкурентов, о которых вам нужны данные в нужном вам формате и стиле данных. Наша команда аналитиков также может предоставить вам данные в сырых файлах Excel, сводных таблицах (книга фактов) или помочь вам в создании презентаций из наборов данных, доступных в отчете.