Asia-Pacific Machine Control System Market, By Technology (Global Navigation Satellite System (GNSS), Laser Scanners, GIS Collectors, Total Stations, Airborne Systems, and Others), Vehicle Equipment (Excavators, Loaders, Dozers, Scrapers, Graders, Rollers, Drillers and Pillars, Pavers and Cold Planers, and Others), Controller Type (Computer Numerical Control (CNC), Programmable Logic Controller (PLC), Programmable Automation Controller (PAC), Personal Computer (PC), Motion Controllers, and Others), Application (Motion and Control, Guidance and Automation, Mass Excavation, Spot-Bulldozing, and Others), Industry (Building and Construction, Agriculture, Mining, Transportation, Aerospace and Defense, Automotive, Marine, Waste Management, Utilities, and Others) Industry Trends and Forecast to 2029.

Asia-Pacific Machine Control System Market Analysis and Size

Manufacturers were continuously trying to increase the precision of work, enhance services, safety, and work with growing technology. The requirement for these reasons is being fulfilled by implementing the machine control system as they are used to provide enhanced, uninterrupted, free, and timely services at the industrial operations. The machine control system in various industries is being used widely due to the rising adoption of digital technologies in the industrial sector. It enables industries to enhance their operations and productivity. Machine control systems help end-users make better decisions around supply chain, machinery, assets performance, drilling, and others. The Asia-Pacific machine control system market is growing rapidly due to increasing digitization in various industries, which drives the demand for the machine control system. The companies are even launching new products to gain a larger market share.

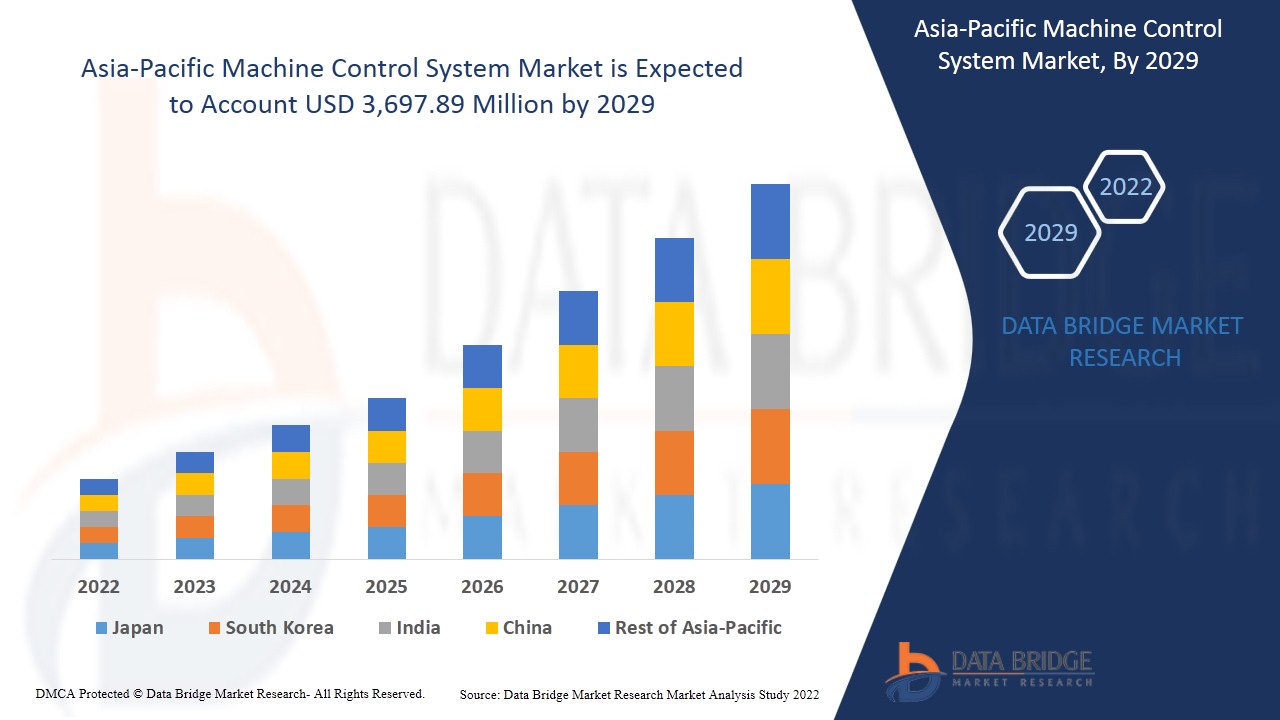

Data Bridge Market Research analyses that the Asia-Pacific machine control system market is expected to reach the value of USD 3,697.89 million by 2029, at a CAGR of 7.9% during the forecast period. "Global Navigation Satellite System (GNSS)" accounts for the largest technology segment in the machine control system market. The global navigation satellite system (GNSS) provides accurate timing information, which is utilized to develop a high-precision IoT network. The Asia-Pacific machine control system market report also covers pricing analysis, patent analysis, and technological advancements in depth.

Asia-Pacific Machine Control System Market Definition

Система управления машинами относится к выполнению промышленных и коммерческих видов деятельности с помощью цифрового прикосновения. Она включает в себя различные решения и услуги, разработанные для оптимизации и управления промышленными, инфраструктурными операциями и производственной деятельностью. Она помогает автоматизировать различные виды деятельности на основе приложений, такие как управление записями, хранение данных, мониторинг, оптимизация производственной деятельности, управление цепочками поставок, управление активами, управление рисками и другие. Она также включает в себя такие технологии, как системы управления заводом, технологии GPS, мобильная широкополосная связь, автоматизированная перевозка, ИИ, блокчейн, цифровой двойник и другие.

|

Отчет Метрика |

Подробности |

|

Прогнозируемый период |

2022-2029 |

|

Базовый год |

2021 |

|

Исторические годы |

2020 |

|

Количественные единицы |

Доход в млн. долл. США, объемы в единицах, цены в долл. США |

|

Охваченные сегменты |

По технологии (глобальная навигационная спутниковая система (GNSS), лазерные сканеры, ГИС-коллекторы, тахеометры, бортовые системы и другие), транспортное оборудование (экскаваторы, погрузчики, бульдозеры, скреперы, грейдеры, катки, буровые установки и столбы, асфальтоукладчики и дорожные фрезы и другие), тип контроллера (числовое программное управление (ЧПУ), программируемый логический контроллер (ПЛК), программируемый контроллер автоматизации (ПАК), персональный компьютер (ПК), контроллеры движения и другие), применение (движение и управление, наведение и автоматизация, массовая выемка грунта, точечная бульдозерная обработка и другие), отрасль (строительство, сельское хозяйство, горнодобывающая промышленность, транспорт, аэрокосмическая и оборонная промышленность, автомобилестроение, судостроение, управление отходами, коммунальные услуги и другие) |

|

Страны, охваченные |

Китай, Япония, Южная Корея, Австралия и Новая Зеландия, Малайзия, Сингапур, Индия, Таиланд, Индонезия, Филиппины и остальные страны Азиатско-Тихоокеанского региона |

|

Охваченные участники рынка |

ABB, Topcon, Kobelco Construction Machinery Co, Ltd., SATEL, Trimble Inc., Hemisphere GNSS, Inc., MOBA MOBILE AUTOMATION AG, Belden Inc., RaptorTech.com, Hexagon, RIB Group, James Fisher and Sons plc, Carlson Software, LIEBHERR, Schneider Electric, MITSUI & CO., LTD., Rockwell Automation, Inc., Komatsu Ltd., Microverse Automation Pvt. Ltd., Coperion GmbH, Otto Bihler Maschinenfabrik GmbH & Co. KG, OMRON Corporation, ANDRITZ, Siemens, Honeywell International Inc. и другие |

Динамика рынка систем управления машинами в Азиатско-Тихоокеанском регионе

В этом разделе рассматривается понимание рыночных драйверов, преимуществ, возможностей, ограничений и проблем. Все это подробно обсуждается ниже:

- Растущая потребность в точности и достоверности в системах управления

Решения по управлению машинами повышают качество работы на рабочем месте за счет упрощения, автоматизации и интеграции решений, что приводит к уменьшению количества ошибок и увеличению времени на работе. Решения по управлению машинами позволяют операторам получать цифровые знания, одновременно снижая риск ошибок. Интуитивно понятные графические интерфейсы 3D с индивидуальным дизайном помогают операторам чувствовать себя более уверенно в своей способности выполнять работу, что повышает производительность.

- Рост числа систем управления беспроводными машинами

Хорошо известно, что население Азиатско-Тихоокеанского региона растет беспрецедентными темпами. Компании вкладывают значительные средства в беспроводные технологии, чтобы предложить оптимальные решения для конечных пользователей и профессионалов; по мере развития отрасли все больше внимания будет уделяться беспроводному оборудованию для лучшей производительности и гибкости в работе. Ожидается, что разработка этих беспроводных батарей, оснащенных системами управления машинами, будет способствовать росту рынка систем управления машинами в Азиатско-Тихоокеанском регионе.

- Растущий спрос на технологии машинного управления в развивающихся странах

Автоматизация и искусственный интеллект (ИИ) меняют отрасли и будут повышать производительность, что приведет к ускорению экономического развития. Во всем мире цифровизация способствует повышению безопасности, производительности, доступности и устойчивости энергетических систем. Строительный сектор имеет решающее значение для экономического развития развивающихся стран. В результате во многих странах было создано несколько специализированных агентств для мониторинга строительных работ и профессионализации функционирования строительных площадок, таких как Совет по развитию строительной отрасли (Малайзия), Институт обучения и развития строительства (Шри-Ланка), Национальный совет по строительству (Танзания) и Управление по строительству и строительству (Сингапур). В строительном секторе необходимо использовать экономически эффективные и экономичные подходы для обеспечения безопасной, высококачественной, устойчивой и дружественной строительной среды. В результате системы управления машинами играют решающую роль в обеспечении безопасности и качества на строительных площадках в развивающихся странах.

Технологии, управляемые машинами, регулярно фокусируются на эксплуатации и обслуживании машины или ее части. В настоящее время операции по эксплуатации и обслуживанию, выполняемые на машине, полностью контролируются с помощью различных технологий, таких как искусственный интеллект (ИИ), машинное обучение (МО) и т. д. Внедрение этих технологий сократило вмешательство человека и увеличило потребность в технологиях, управляемых машинами, на рынке, тем самым выступая в качестве возможности для рынка систем управления машинами в Азиатско-Тихоокеанском регионе.

- Требование высоких первоначальных инвестиций

Система управления машинами предлагает отраслям меры предосторожности и различные методы, такие как GNSS, GIS, лазерное сканирование и роботы, среди прочих. Компаниям, работающим с отраслями, нужны системы управления машинами для перемещения сырья из одного места в другое. Для эффективного внедрения оборудования систем управления требуются высокие затраты, что в конечном итоге увеличивает общую стоимость установки, поскольку это необходимо для обеспечения безопасности завода. Эти инструменты предполагают обработку более высоких рисков и критических рабочих сред. Но первоначальная стоимость системы значительно высока, а косвенные затраты, такие как лицензии, сертификация, установка, затраты на электроэнергию для обслуживания и затраты, связанные с техническим трудом.

- Разработка эргономичных и легких систем управления машинами

Системы управления машинами должны быть компактными по размеру и легкими, чтобы их можно было легко транспортировать и эффективно использовать. Компактный размер позволяет рабочим выполнять широкий диапазон движений, а точность систем управления машинами увеличивается. Легкий инструмент облегчает перемещение по площадке. Основная проблема заключается в том, что системы управления машинами имеют тяжелую конструкцию; даже беспроводные электроинструменты имеют слоты для батарей, что делает их громоздкими и трудными для переноски.

Системы управления машинами могут вызывать различные проблемы со здоровьем у пользователя. Системы управления сносом вызывают сильные вибрации во время работы, а малейшее неверное движение пользователя может сломать позвоночник пользователя и нанести серьезный ущерб. Шлифовальные машины и резаки могут производить пыль и мелкие детали, которые могут нанести вред пользователю. Эргономике систем управления машинами следует уделять особое внимание, чтобы защитить пользователя от любого такого несчастного случая.

Системы управления машинами могут стать причиной серьезных несчастных случаев и проблем со здоровьем, а тяжелый корпус систем управления машинами, как правило, затрудняет работу с полной эффективностью. Эти факторы могут стать серьезной проблемой для рынка систем управления машинами в Азиатско-Тихоокеанском регионе.

Влияние COVID-19 на рынок систем управления машинами в Азиатско-Тихоокеанском регионе

COVID-19 оказал серьезное влияние на рынок систем управления машинами в Азиатско-Тихоокеанском регионе, поскольку почти каждая страна решила закрыть все производственные мощности, за исключением тех, которые занимаются производством товаров первой необходимости. Правительство приняло ряд строгих мер, таких как закрытие производства и продажи неосновных товаров, блокировка международной торговли и многое другое, чтобы предотвратить распространение COVID-19. Единственным бизнесом, работающим в этой пандемической ситуации, являются основные службы, которым разрешено открыться и запустить процессы.

Рост рынка систем управления машинами в Азиатско-Тихоокеанском регионе объясняется ростом коммерческих и жилых строительных и инфраструктурных проектов, внедрением электроинструментов в домохозяйствах для жилых/сделай сам целей, ростом производственных установок и увеличением операций по ремонту и техническому обслуживанию по всему миру. Однако такие факторы, как рост рисков безопасности и опасений из-за неправильного использования систем управления машинами, сдерживают рост рынка. Остановка производственных предприятий во время пандемии оказала существенное влияние на рынок.

Производители принимают различные стратегические решения, чтобы оправиться после COVID-19. Игроки проводят многочисленные исследования и разработки для улучшения технологий, задействованных в системе управления машинами. Благодаря этому компании выведут на рынок передовые и точные контроллеры. Кроме того, использование систем управления машинами государственными органами в управлении водными ресурсами, сельском хозяйстве, океанографии, гидрологии, обороне и безопасности привело к росту рынка

Последние события

- В ноябре 2021 года Rockwell Automation представила новое решение для удаленного доступа. Это новое решение, разработанное для OEM-производителей, является лишь последним предложением Rockwell Automation по удаленному доступу, которое предлагает широкий спектр услуг удаленного доступа для производителей, включая круглосуточный удаленный мониторинг приложений и поддержку, чтобы помочь клиентам проактивно решать проблемы обслуживания. Благодаря этому запуску компания улучшила свои продукты и услуги на рынке

- В декабре 2021 года Honeywell International Inc. планировала приобрести US Digital Designs, Inc., расширив возможности связи для общественной безопасности. Это приобретение привело к расширению линейки решений для компании. Это приобретение помогло компании расширить портфель продуктов, а также увеличить доход компании

Масштаб рынка систем управления машинами в Азиатско-Тихоокеанском регионе

Рынок систем управления машинами в Азиатско-Тихоокеанском регионе сегментирован по технологиям, оборудованию транспортных средств, типу контроллера , применению и отрасли. Рост среди этих сегментов поможет вам проанализировать сегменты с незначительным ростом в отраслях и предоставить пользователям ценный обзор рынка и рыночные идеи, которые помогут им принимать стратегические решения для определения основных рыночных приложений.

Технологии

- Глобальная навигационная спутниковая система (ГНСС)

- Лазерные сканеры

- ГИС-коллекторы

- Всего станций

- Воздушные системы

- Другие

По технологическому признаку рынок систем управления машинами в Азиатско-Тихоокеанском регионе сегментируется на глобальные навигационные спутниковые системы (ГНСС), лазерные сканеры, ГИС-сборщики, тахеометры, бортовые системы и другие.

Оборудование транспортного средства

- Экскаваторы

- Грузчики

- Бульдозеры

- Скребки

- Грейдеры

- Ролики

- Бурильщики и столбы

- Асфальтоукладчики и холодные фрезы

- Другие

По типу транспортного оборудования рынок систем управления машинами в Азиатско-Тихоокеанском регионе сегментирован на экскаваторы, погрузчики, бульдозеры, скреперы, грейдеры, катки, бурильные машины и столбы, асфальтоукладчики и дорожные фрезы и другие.

Тип контроллера

- Числовое программное управление (ЧПУ)

- Программируемый логический контроллер (ПЛК)

- Программируемый контроллер автоматизации (ПАК)

- Персональный компьютер (ПК)

- Контроллеры движения

- Другие

По типу контроллера рынок систем управления станками в Азиатско-Тихоокеанском регионе сегментирован на системы числового программного управления (ЧПУ), программируемые логические контроллеры (ПЛК), программируемые контроллеры автоматизации (ПКА), персональные компьютеры (ПК), контроллеры движения и другие.

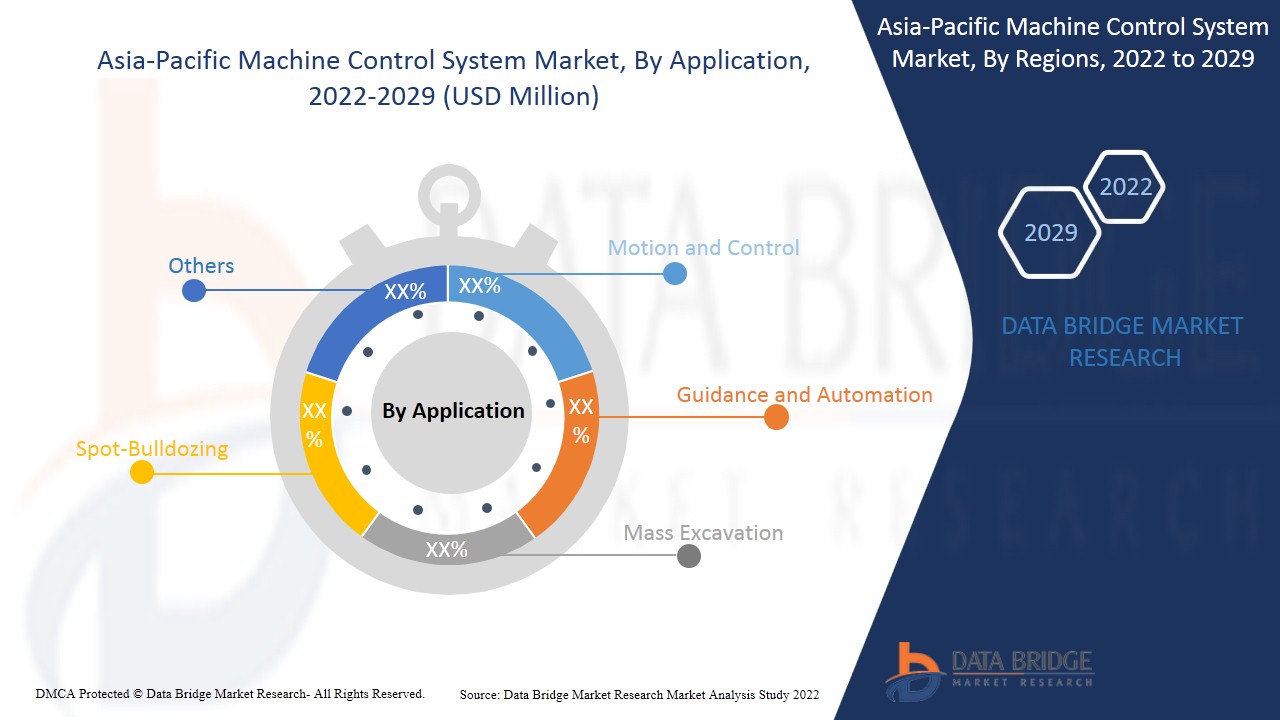

Приложение

- Движение и управление

- Руководство и автоматизация

- Массовые раскопки

- Точечная уборка бульдозером

- Другие

По сфере применения рынок систем управления машинами в Азиатско-Тихоокеанском регионе сегментирован на системы управления движением и контролем, наведения и автоматизации, массовых земляных работ, точечных бульдозерных работ и другие.

Промышленность

- Строительство и возведение

- Сельское хозяйство

- Добыча полезных ископаемых

- Транспорт

- Аэрокосмическая промышленность и оборона

- Автомобильный

- Морской

- Управление отходами

- Коммунальные услуги

- Другие

On the basis of industry, the Asia-Pacific machine control system market has been segmented into building and construction, agriculture, mining, transportation, aerospace and defense, automotive, marine, waste management, utilities, and others.

Asia-Pacific Machine Control System Market Regional Analysis/Insights

Asia-Pacific machine control system market is analyzed, and market size insights and trends are provided by country, technology, vehicle equipment, controller type, application, and industry, as referenced above.

Some of the countries covered in the Asia-Pacific machine control system market report are China, Japan, South Korea, Australia and New Zealand, Malaysia, Singapore, India, Thailand, Indonesia, Philippines and Rest of Asia-Pacific.

China dominates the Asia-Pacific machine control system market. China is likely to be the fastest-growing Asia-Pacific machine control system market. The rising infrastructure, commercial, and industrial developments in emerging countries such as Japan, India, and South Korea are credited with the market's dominance. China is expected to dominate the Asia-Pacific region as countries' old infrastructure, such as bridges, highways, sewage systems, and tunnels, is continually being repaired and improved using various machine control equipment, such as excavators, paving systems, and dozers.

The country section of the report also provides individual market impacting factors and changes in market regulation that impact the current and future trends of the market. Data points like downstream and upstream value chain analysis, technical trends, porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of Asia-Pacific brands and their challenges faced due to large or scarce competition from local and domestic brands, the impact of domestic tariffs, and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Asia-Pacific Machine Control System Market Share Analysis

The Asia-Pacific machine control system market competitive landscape provides details by the competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, Asia-Pacific presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width, and breadth, application dominance. The above data points are only related to the companies' focus on the Asia-Pacific machine control system market.

Some of the Major Players Operating in the Asia-Pacific Machine Control System Market are:

- ABB

- Topcon

- Maximatecc

- Kobelco Construction Machinery Co., Ltd.

- SATEL

- Trimble Inc.

- Hemisphere GNSS, Inc.

- MOBA MOBILE AUTOMATION AG

- Belden Inc.

- RaptorTech.com

- Hexagon

- RIB Group

- James Fisher and Sons plc

- Carlson Software

- LIEBHERR

- Schneider Electric

- МИЦУИ & КО., ЛТД.

- Rockwell Automation, Inc.

- Комацу Лтд.

- Microverse Automation Pvt. Ltd.

- Коперион ГмбХ

- Отто Билер Машиненфабрик ГмбХ & Ко. КГ

- Корпорация OMRON

- АНДРИТЦ

- Сименс

- Honeywell International Inc.

Методология исследования: рынок систем управления машинами в Азиатско-Тихоокеанском регионе

Сбор данных и анализ базового года выполняются с использованием модулей сбора данных с большими размерами выборки. Этап включает получение рыночной информации или связанных данных из различных источников и стратегий. Он включает изучение и планирование всех данных, полученных из прошлого заранее. Он также охватывает изучение несоответствий информации, наблюдаемых в различных источниках информации. Рыночные данные анализируются и оцениваются с использованием статистических и последовательных моделей рынка. Кроме того, анализ доли рынка и анализ ключевых тенденций являются основными факторами успеха в рыночном отчете. Чтобы узнать больше, запросите звонок аналитика или оставьте свой запрос.

Ключевой методологией исследования, используемой исследовательской группой DBMR, является триангуляция данных, которая включает в себя интеллектуальный анализ данных, анализ влияния переменных данных на рынок и первичную (отраслевую экспертную) проверку. Помимо этого, модели данных включают сетку позиционирования поставщиков, анализ временной линии рынка, обзор рынка и руководство, сетку позиционирования компании, патентный анализ, анализ цен, анализ доли рынка компании, стандарты измерения, Азиатско-Тихоокеанский регион в сравнении с региональным и анализ доли поставщиков. Чтобы узнать больше о методологии исследования, отправьте запрос, чтобы поговорить с нашими отраслевыми экспертами.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Интерактивная панель анализа данных

- Панель анализа компании для возможностей с высоким потенциалом роста

- Доступ аналитика-исследователя для настройки и запросов

- Анализ конкурентов с помощью интерактивной панели

- Последние новости, обновления и анализ тенденций

- Используйте возможности сравнительного анализа для комплексного отслеживания конкурентов

Содержание

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF ASIA PACIFIC MACHINE CONTROL SYSTEM MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MULTIVARIATE MODELING

2.9 TECHNOLOGY TIMELINE CURVE

2.1 MARKET APPLICATION COVERAGE GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 VALUE CHAIN ANALYSIS

4.1.1 OVERVIEW OF VALUE CHAIN ANALYSIS

4.1.2 VALUE CHAIN ANALYSIS FRAMEWORK

4.2 PESTLE ANALYSIS

4.3 PORTER’S FIVE FORCES MODEL

4.4 EVOLUTION OF MACHINE CONTROL SYSTEM WITH ARTIFICIAL INTELLIGENCE

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 RISING NEED FOR ACCURACY AND PRECISION IN CONTROL SYSTEMS

5.1.2 INCREASE IN GROWTH OF CORDLESS MACHINE CONTROL SYSTEMS

5.1.3 INCREASE IN GROWTH OF INFRASTRUCTURE PROJECTS ASIA PACIFICLY

5.1.4 EXPANSION OF MOTOR VEHICLE MAINTENANCE MARKET AS VEHICLE OWNERSHIP RATE INCREASES

5.2 RESTRAINTS

5.2.1 REQUIREMENT OF HIGH INITIAL INVESTMENT

5.2.2 FLUCTUATION IN PRICES OF RAW MATERIALS

5.2.3 LACK OF TECHNICAL EXPERTISE

5.3 OPPORTUNITIES

5.3.1 INCREASING DEMAND FOR MACHINE-GUIDED TECHNOLOGIES IN EMERGING NATIONS

5.3.2 SMART CONNECTIVITY IN MACHINE CONTROL SYSTEMS

5.3.3 TECHNOLOGICAL INNOVATIONS IN INDUSTRY 4.0

5.3.4 MACHINE CONTROL SYSTEMS MADE AVAILABLE ON E-COMMERCE PLATFORMS

5.4 CHALLENGES

5.4.1 DESIGNING ERGONOMIC AND LIGHTWEIGHT MACHINE CONTROL SYSTEMS

5.4.2 REGULATORY COMPLIANCE AND MACHINE CONTROL SYSTEM SAFETY

6 IMPACT OF COVID-19 ON THE ASIA PACIFIC MACHINE CONTROL SYSTEM MARKET

6.1 ANALYSIS ON IMPACT OF COVID-19 ON THE MARKET

6.2 STRATEGIC DECISION BY MANUFACTURERS AFTER COVID-19

6.3 IMPACT ON PRICE

6.4 IMPACT ON DEMAND AND SUPPLY CHAIN

6.5 CONCLUSION

7 ASIA PACIFIC MACHINE CONTROL SYSTEM MARKET, BY TECHNOLOGY

7.1 OVERVIEW

7.2 ASIA PACIFIC NAVIGATION SATELLITE SYSTEM (GNSS)

7.3 LASER SCANNERS

7.4 GIS COLLECTORS

7.5 TOTAL STATIONS

7.6 AIRBORNE SYSTEM

7.7 OTHERS

8 ASIA PACIFIC MACHINE CONTROL SYSTEM MARKET, BY VEHICLE EQUIPMENT

8.1 OVERVIEW

8.2 EXCAVATORS

8.3 LOADERS

8.4 DOZERS

8.5 SCRAPERS

8.6 GRADERS

8.7 ROLLERS

8.8 DRILLERS AND PILERS

8.9 PAVERS AND COLD PLANERS

8.1 OTHERS

9 ASIA PACIFIC MACHINE CONTROL SYSTEM MARKET, BY CONTROLLER TYPE

9.1 OVERVIEW

9.2 PROGRAMMABLE LOGIC CONTROLLER (PLC)

9.3 PROGRAMMABLE AUTOMATION CONTROLLER (PAC)

9.4 MOTION CONTROLLERS

9.5 COMPUTER NUMERICAL CONTROL (CNC)

9.6 PERSONAL COMPUTER (PC)

9.7 OTHERS

10 ASIA PACIFIC MACHINE CONTROL SYSTEM MARKET, BY APPLICATION

10.1 OVERVIEW

10.2 MONITORING AND CONTROL

10.3 GUIDANCE AND AUTOMATION

10.4 MASS EXCAVATION

10.5 SPOT-BULLDOZING

10.6 OTHERS

11 ASIA PACIFIC MACHINE CONTROL SYSTEM MARKET, BY INDUSTRY

11.1 OVERVIEW

11.2 BUILDING AND CONSTRUCTION

11.2.1 MONITORING AND CONTROL

11.2.2 GUIDANCE AND AUTOMATION

11.2.3 MASS EXCAVATION

11.2.4 SPOT-BULLDOZING

11.2.5 OTHERS

11.3 AGRICULTURE

11.3.1 MONITORING AND CONTROL

11.3.2 GUIDANCE AND AUTOMATION

11.3.3 MASS EXCAVATION

11.3.4 SPOT-BULLDOZING

11.3.5 OTHERS

11.4 MINING

11.4.1 MONITORING AND CONTROL

11.4.2 GUIDANCE AND AUTOMATION

11.4.3 MASS EXCAVATION

11.4.4 SPOT-BULLDOZING

11.4.5 OTHERS

11.5 TRANSPORTATION

11.6 AEROSPACE AND DEFENSE

11.7 AUTOMOTIVE

11.8 MARINE

11.8.1 MONITORING AND CONTROL

11.8.2 GUIDANCE AND AUTOMATION

11.8.3 MASS EXCAVATION

11.8.4 SPOT-BULLDOZING

11.8.5 OTHERS

11.9 WASTE MANAGEMENT

11.9.1 MONITORING AND CONTROL

11.9.2 GUIDANCE AND AUTOMATION

11.9.3 MASS EXCAVATION

11.9.4 SPOT-BULLDOZING

11.9.5 OTHERS

11.1 UTILITIES

11.10.1 MONITORING AND CONTROL

11.10.2 GUIDANCE AND AUTOMATION

11.10.3 MASS EXCAVATION

11.10.4 SPOT-BULLDOZING

11.10.5 OTHERS

11.11 OTHERS

12 ASIA PACIFIC MACHINE CONTROL SYSTEM MARKET, BY REGION

12.1 ASIA-PACIFIC

12.1.1 CHINA

12.1.2 INDIA

12.1.3 JAPAN

12.1.4 SOUTH KOREA

12.1.5 AUSTRALIA AND NEW ZEALAND

12.1.6 THAILAND

12.1.7 INDONESIA

12.1.8 SINGAPORE

12.1.9 MALAYSIA

12.1.10 PHILIPPINES

12.1.11 REST OF ASIA-PACIFIC

13 ASIA PACIFIC MACHINE CONTROL SYSTEM MARKET, COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: ASIA PACIFIC

14 SWOT ANALYSIS

15 COMPANY PROFILE

15.1 MITSUI & CO., LTD.

15.1.1 COMPANY SNAPSHOT

15.1.2 REVENUE ANALYSIS

15.1.3 COMPANY SHARE ANALYSIS

15.1.4 PRODUCT PORTFOLIO

15.1.5 RECENT DEVELOPMENT

15.2 TRIMBLE INC.

15.2.1 COMPANY SNAPSHOT

15.2.2 REVENUE ANALYSIS

15.2.3 COMPANY SHARE ANALYSIS

15.2.4 PRODUCT PORTFOLIO

15.2.5 RECENT DEVELOPMENTS

15.3 ROCKWELL AUTOMATION, INC.

15.3.1 COMPANY SNAPSHOT

15.3.2 REVENUE ANALYSIS

15.3.3 COMPANY SHARE ANALYSIS

15.3.4 PRODUCT PORTFOLIO

15.3.5 RECENT DEVELOPMENTS

15.4 TOPCON

15.4.1 COMPANY SNAPSHOT

15.4.2 REVENUE ANALYSIS

15.4.3 COMPANY SHARE ANALYSIS

15.4.4 PRODUCT PORTFOLIO

15.4.5 RECENT DEVELOPMENTS

15.5 BELDEN INC.

15.5.1 COMPANY SNAPSHOT

15.5.2 REVENUE ANALYSIS

15.5.3 COMPANY SHARE ANALYSIS

15.5.4 PRODUCT PORTFOLIO

15.5.5 RECENT DEVELOPMENT

15.6 ABB

15.6.1 COMPANY SNAPSHOT

15.6.2 REVENUE ANALYSIS

15.6.3 PRODUCT PORTFOLIO

15.6.4 RECENT DEVELOPMENTS

15.7 ANDRITZ

15.7.1 COMPANY SNAPSHOT

15.7.2 REVENUE ANALYSIS

15.7.3 PRODUCT PORTFOLIO

15.7.4 RECENT DEVELOPMENT

15.8 CARLSON SOFTWARE

15.8.1 COMPANY SNAPSHOT

15.8.2 PRODUCT PORTFOLIO

15.8.3 RECENT DEVELOPMENTS

15.9 CHALLENGER GEOMATICS LTD.

15.9.1 COMPANY SNAPSHOT

15.9.2 PRODUCT PORTFOLIO

15.9.3 RECENT DEVELOPMENT

15.1 COPERION GMBH

15.10.1 COMPANY SNAPSHOT

15.10.2 PRODUCT PORTFOLIO

15.10.3 RECENT DEVELOPMENT

15.11 EOS POSITIONING SYSTEMS, INC. (EOS)

15.11.1 COMPANY SNAPSHOT

15.11.2 PRODUCT PORTFOLIO

15.11.3 RECENT DEVELOPMENTS

15.12 HEMISPHERE GNSS, INC.

15.12.1 COMPANY SNAPSHOT

15.12.2 PRODUCT PORTFOLIO

15.12.3 RECENT DEVELOPMENTS

15.13 HEXAGON

15.13.1 COMPANY SNAPSHOT

15.13.2 REVENUE ANALYSIS

15.13.3 PRODUCT PORTFOLIO

15.13.4 RECENT DEVELOPMENT

15.14 HONEYWELL INTERNATIONAL INC.

15.14.1 COMPANY SNAPSHOT

15.14.2 REVENUE ANALYSIS

15.14.3 PRODUCT PORTFOLIO

15.14.4 RECENT DEVELOPMENTS

15.15 JAMES FISHER AND SONS PLC

15.15.1 COMPANY SNAPSHOT

15.15.2 REVENUE ANALYSIS

15.15.3 PRODUCT PORTFOLIO

15.15.4 RECENT DEVELOPMENT

15.16 KOBELCO CONSTRUCTION MACHINERY CO., LTD.

15.16.1 COMPANY SNAPSHOT

15.16.2 PRODUCT PORTFOLIO

15.16.3 RECENT DEVELOPMENTS

15.17 KOMATSU LTD.

15.17.1 COMPANY SNAPSHOT

15.17.2 REVENUE ANALYSIS

15.17.3 PRODUCT PORTFOLIO

15.17.4 RECENT DEVELOPMENTS

15.18 LIEBHERR

15.18.1 COMPANY SNAPSHOT

15.18.2 REVENUE ANALYSIS

15.18.3 PRODUCT PORTFOLIO

15.18.4 RECENT DEVELOPMENT

15.19 L5 NAVIGATION SYSTEMS AB

15.19.1 COMPANY SNAPSHOT

15.19.2 PRODUCT PORTFOLIO

15.19.3 RECENT DEVELOPMENT

15.2 MAXIMATECC

15.20.1 COMPANY SNAPSHOT

15.20.2 PRODUCT PORTFOLIO

15.20.3 RECENT DEVELOPMENTS

15.21 MACHINE CONTROL SYSTEMS

15.21.1 COMPANY SNAPSHOT

15.21.2 PRODUCT PORTFOLIO

15.21.3 RECENT DEVELOPMENT

15.22 MICROVERSE AUTOMATION PVT. LTD.

15.22.1 COMPANY SNAPSHOT

15.22.2 PRODUCT PORTFOLIO

15.22.3 RECENT DEVELOPMENT

15.23 MOBA MOBILE AUTOMATION AG

15.23.1 COMPANY SNAPSHOT

15.23.2 PRODUCT PORTFOLIO

15.23.3 RECENT DEVELOPMENT

15.24 OMRON CORPORATION

15.24.1 COMPANY SNAPSHOT

15.24.2 REVENUE ANALYSIS

15.24.3 PRODUCT PORTFOLIO

15.24.4 RECENT DEVELOPMENT

15.25 OTTO BIHLER MASCHINENFABRIK GMBH & CO. KG

15.25.1 COMPANY SNAPSHOT

15.25.2 PRODUCT PORTFOLIO

15.25.3 RECENT DEVELOPMENT

15.26 RAPTORTECH.COM

15.26.1 COMPANY SNAPSHOT

15.26.2 PRODUCT PORTFOLIO

15.26.3 RECENT DEVELOPMENT

15.27 RIB GROUP

15.27.1 COMPANY SNAPSHOT

15.27.2 REVENUE ANALYSIS

15.27.3 PRODUCT PORTFOLIO

15.27.4 RECENT DEVELOPMENT

15.28 SATEL

15.28.1 COMPANY SNAPSHOT

15.28.2 PRODUCT PORTFOLIO

15.28.3 RECENT DEVELOPMENT

15.29 SCHNEIDER ELECTRIC

15.29.1 COMPANY SNAPSHOT

15.29.2 REVENUE ANALYSIS

15.29.3 PRODUCT PORTFOLIO

15.29.4 RECENT DEVELOPMENT

15.3 SIEMENS

15.30.1 COMPANY SNAPSHOT

15.30.2 REVENUE ANALYSIS

15.30.3 PRODUCT PORTFOLIO

15.30.4 RECENT DEVELOPMENTS

16 QUESTIONNAIRE

17 RELATED REPORTS

Список таблиц

TABLE 1 ASIA PACIFIC MACHINE CONTROL SYSTEM MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 2 ASIA PACIFIC NAVIGATION SATELLITE SYSTEM (GNSS) IN MACHINE CONTROL SYSTEM MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 3 ASIA PACIFIC LASER SCANNERS IN MACHINE CONTROL SYSTEM MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 4 ASIA PACIFIC GIS COLLECTORS IN MACHINE CONTROL SYSTEM MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 5 ASIA PACIFIC TOTAL STATIONS IN MACHINE CONTROL SYSTEM MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 6 ASIA PACIFIC AIRBORNE SYSTEM IN MACHINE CONTROL SYSTEM MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 7 ASIA PACIFIC OTHERS IN MACHINE CONTROL SYSTEM MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 8 ASIA PACIFIC MACHINE CONTROL SYSTEM MARKET, BY VEHICLE EQUIPMENT, 2020-2029 (USD MILLION)

TABLE 9 ASIA PACIFIC EXCAVATORS IN MACHINE CONTROL SYSTEM MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 10 ASIA PACIFIC LOADERS IN MACHINE CONTROL SYSTEM MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 11 ASIA PACIFIC DOZERS IN MACHINE CONTROL SYSTEM MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 12 ASIA PACIFIC SCRAPERS IN MACHINE CONTROL SYSTEM MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 13 ASIA PACIFIC GRADERS SYSTEM IN MACHINE CONTROL SYSTEM MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 14 ASIA PACIFIC ROLLERS IN MACHINE CONTROL SYSTEM MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 15 ASIA PACIFIC DRILLERS AND PILERS IN MACHINE CONTROL SYSTEM MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 16 ASIA PACIFIC PAVERS AND COLD PLANERS IN MACHINE CONTROL SYSTEM MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 17 ASIA PACIFIC OTHERS IN MACHINE CONTROL SYSTEM MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 18 ASIA PACIFIC MACHINE CONTROL SYSTEM MARKET, BY CONTROLLER TYPE, 2020-2029 (USD MILLION)

TABLE 19 ASIA PACIFIC PROGRAMMABLE LOGIC CONTROLLER (PLC) IN MACHINE CONTROL SYSTEM MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 20 ASIA PACIFIC PROGRAMMABLE AUTOMATION CONTROLLER (PAC) IN MACHINE CONTROL SYSTEM MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 21 ASIA PACIFIC MOTION CONTROLLERS IN MACHINE CONTROL SYSTEM MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 22 ASIA PACIFIC COMPUTER NUMERICAL CONTROL (CNC) IN MACHINE CONTROL SYSTEM MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 23 ASIA PACIFIC PERSONAL COMPUTER (PC) IN MACHINE CONTROL SYSTEM MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 24 ASIA PACIFIC OTHERS IN MACHINE CONTROL SYSTEM MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 25 ASIA PACIFIC MACHINE CONTROL SYSTEM MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 26 ASIA PACIFIC MONITORING AND CONTROL IN MACHINE CONTROL SYSTEM MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 27 ASIA PACIFIC GUIDANCE AND AUTOMATION IN MACHINE CONTROL SYSTEM MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 28 ASIA PACIFIC MASS EXCAVATION IN MACHINE CONTROL SYSTEM MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 29 ASIA PACIFIC SPOT-BULLDOZING IN MACHINE CONTROL SYSTEM MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 30 ASIA PACIFIC OTHERS IN MACHINE CONTROL SYSTEM MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 31 ASIA PACIFIC MACHINE CONTROL SYSTEM MARKET, BY INDUSTRY, 2020-2029 (USD MILLION)

TABLE 32 ASIA PACIFIC BUILDING AND CONSTRUCTION IN MACHINE CONTROL SYSTEM MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 33 ASIA PACIFIC BUILDING AND CONSTRUCTION IN MACHINE CONTROL SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 34 ASIA PACIFIC AGRICULTURE IN MACHINE CONTROL SYSTEM MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 35 ASIA PACIFIC AGRICULTURE IN MACHINE CONTROL SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 36 ASIA PACIFIC MINING IN MACHINE CONTROL SYSTEM MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 37 ASIA PACIFIC MINING IN MACHINE CONTROL SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 38 ASIA PACIFIC TRANSPORTATION IN MACHINE CONTROL SYSTEM MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 39 ASIA PACIFIC AEROSPACE AND DEFENSE IN MACHINE CONTROL SYSTEM MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 40 ASIA PACIFIC AUTOMOTIVE IN MACHINE CONTROL SYSTEM MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 41 ASIA PACIFIC MARINE IN MACHINE CONTROL SYSTEM MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 42 ASIA PACIFIC MARINE IN MACHINE CONTROL SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 43 ASIA PACIFIC WASTE MANAGEMENT IN MACHINE CONTROL SYSTEM MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 44 ASIA PACIFIC WASTE MANAGEMENT IN MACHINE CONTROL SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 45 ASIA PACIFIC UTILITIES IN MACHINE CONTROL SYSTEM MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 46 ASIA PACIFIC UTILITIES IN MACHINE CONTROL SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 47 ASIA PACIFIC OTHERS IN MACHINE CONTROL SYSTEM MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 48 ASIA-PACIFIC MACHINE CONTROL SYSTEM MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 49 ASIA-PACIFIC MACHINE CONTROL SYSTEM MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 50 ASIA-PACIFIC MACHINE CONTROL SYSTEM MARKET, BY VEHICLE EQUIPMENT, 2020-2029 (USD MILLION)

TABLE 51 ASIA-PACIFIC MACHINE CONTROL SYSTEM MARKET, BY CONTROLLER TYPE, 2020-2029 (USD MILLION)

TABLE 52 ASIA-PACIFIC MACHINE CONTROL SYSTEM MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 53 ASIA-PACIFIC MACHINE CONTROL SYSTEM MARKET, BY INDUSTRY, 2020-2029 (USD MILLION)

TABLE 54 ASIA-PACIFIC BUILDING AND CONSTRUCTION IN MACHINE CONTROL SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 55 ASIA-PACIFIC AGRICULTURE IN MACHINE CONTROL SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 56 ASIA-PACIFIC MINING IN MACHINE CONTROL SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 57 ASIA-PACIFIC MARINE IN MACHINE CONTROL SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 58 ASIA-PACIFIC WASTE MANAGEMENT IN MACHINE CONTROL SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 59 ASIA-PACIFIC UTILITIES IN MACHINE CONTROL SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 60 CHINA MACHINE CONTROL SYSTEM MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 61 CHINA MACHINE CONTROL SYSTEM MARKET, BY VEHICLE EQUIPMENT, 2020-2029 (USD MILLION)

TABLE 62 CHINA MACHINE CONTROL SYSTEM MARKET, BY CONTROLLER TYPE, 2020-2029 (USD MILLION)

TABLE 63 CHINA MACHINE CONTROL SYSTEM MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 64 CHINA MACHINE CONTROL SYSTEM MARKET, BY INDUSTRY, 2020-2029 (USD MILLION)

TABLE 65 CHINA BUILDING AND CONSTRUCTION IN MACHINE CONTROL SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 66 CHINA AGRICULTURE IN MACHINE CONTROL SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 67 CHINA MINING IN MACHINE CONTROL SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 68 CHINA MARINE IN MACHINE CONTROL SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 69 CHINA WASTE MANAGEMENT IN MACHINE CONTROL SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 70 CHINA UTILITIES IN MACHINE CONTROL SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 71 INDIA MACHINE CONTROL SYSTEM MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 72 INDIA MACHINE CONTROL SYSTEM MARKET, BY VEHICLE EQUIPMENT, 2020-2029 (USD MILLION)

TABLE 73 INDIA MACHINE CONTROL SYSTEM MARKET, BY CONTROLLER TYPE, 2020-2029 (USD MILLION)

TABLE 74 INDIA MACHINE CONTROL SYSTEM MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 75 INDIA MACHINE CONTROL SYSTEM MARKET, BY INDUSTRY, 2020-2029 (USD MILLION)

TABLE 76 INDIA BUILDING AND CONSTRUCTION IN MACHINE CONTROL SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 77 INDIA AGRICULTURE IN MACHINE CONTROL SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 78 INDIA MINING IN MACHINE CONTROL SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 79 INDIA MARINE IN MACHINE CONTROL SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 80 INDIA WASTE MANAGEMENT IN MACHINE CONTROL SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 81 INDIA UTILITIES IN MACHINE CONTROL SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 82 JAPAN MACHINE CONTROL SYSTEM MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 83 JAPAN MACHINE CONTROL SYSTEM MARKET, BY VEHICLE EQUIPMENT, 2020-2029 (USD MILLION)

TABLE 84 JAPAN MACHINE CONTROL SYSTEM MARKET, BY CONTROLLER TYPE, 2020-2029 (USD MILLION)

TABLE 85 JAPAN MACHINE CONTROL SYSTEM MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 86 JAPAN MACHINE CONTROL SYSTEM MARKET, BY INDUSTRY, 2020-2029 (USD MILLION)

TABLE 87 JAPAN BUILDING AND CONSTRUCTION IN MACHINE CONTROL SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 88 JAPAN AGRICULTURE IN MACHINE CONTROL SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 89 JAPAN MINING IN MACHINE CONTROL SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 90 JAPAN MARINE IN MACHINE CONTROL SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 91 JAPAN WASTE MANAGEMENT IN MACHINE CONTROL SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 92 JAPAN UTILITIES IN MACHINE CONTROL SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 93 SOUTH KOREA MACHINE CONTROL SYSTEM MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 94 SOUTH KOREA MACHINE CONTROL SYSTEM MARKET, BY VEHICLE EQUIPMENT, 2020-2029 (USD MILLION)

TABLE 95 SOUTH KOREA MACHINE CONTROL SYSTEM MARKET, BY CONTROLLER TYPE, 2020-2029 (USD MILLION)

TABLE 96 SOUTH KOREA MACHINE CONTROL SYSTEM MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 97 SOUTH KOREA MACHINE CONTROL SYSTEM MARKET, BY INDUSTRY, 2020-2029 (USD MILLION)

TABLE 98 SOUTH KOREA BUILDING AND CONSTRUCTION IN MACHINE CONTROL SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 99 SOUTH KOREA AGRICULTURE IN MACHINE CONTROL SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 100 SOUTH KOREA MINING IN MACHINE CONTROL SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 101 SOUTH KOREA MARINE IN MACHINE CONTROL SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 102 SOUTH KOREA WASTE MANAGEMENT IN MACHINE CONTROL SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 103 SOUTH KOREA UTILITIES IN MACHINE CONTROL SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 104 AUSTRALIA AND NEW ZEALAND MACHINE CONTROL SYSTEM MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 105 AUSTRALIA AND NEW ZEALAND MACHINE CONTROL SYSTEM MARKET, BY VEHICLE EQUIPMENT, 2020-2029 (USD MILLION)

TABLE 106 AUSTRALIA AND NEW ZEALAND MACHINE CONTROL SYSTEM MARKET, BY CONTROLLER TYPE, 2020-2029 (USD MILLION)

TABLE 107 AUSTRALIA AND NEW ZEALAND MACHINE CONTROL SYSTEM MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 108 AUSTRALIA AND NEW ZEALAND MACHINE CONTROL SYSTEM MARKET, BY INDUSTRY, 2020-2029 (USD MILLION)

TABLE 109 AUSTRALIA AND NEW ZEALAND BUILDING AND CONSTRUCTION IN MACHINE CONTROL SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 110 AUSTRALIA AND NEW ZEALAND AGRICULTURE IN MACHINE CONTROL SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 111 AUSTRALIA AND NEW ZEALAND MINING IN MACHINE CONTROL SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 112 AUSTRALIA AND NEW ZEALAND MARINE IN MACHINE CONTROL SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 113 AUSTRALIA AND NEW ZEALAND WASTE MANAGEMENT IN MACHINE CONTROL SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 114 AUSTRALIA AND NEW ZEALAND UTILITIES IN MACHINE CONTROL SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 115 THAILAND MACHINE CONTROL SYSTEM MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 116 THAILAND MACHINE CONTROL SYSTEM MARKET, BY VEHICLE EQUIPMENT, 2020-2029 (USD MILLION)

TABLE 117 THAILAND MACHINE CONTROL SYSTEM MARKET, BY CONTROLLER TYPE, 2020-2029 (USD MILLION)

TABLE 118 THAILAND MACHINE CONTROL SYSTEM MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 119 THAILAND MACHINE CONTROL SYSTEM MARKET, BY INDUSTRY, 2020-2029 (USD MILLION)

TABLE 120 THAILAND BUILDING AND CONSTRUCTION IN MACHINE CONTROL SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 121 THAILAND AGRICULTURE IN MACHINE CONTROL SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 122 THAILAND MINING IN MACHINE CONTROL SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 123 THAILAND MARINE IN MACHINE CONTROL SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 124 THAILAND WASTE MANAGEMENT IN MACHINE CONTROL SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 125 THAILAND UTILITIES IN MACHINE CONTROL SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 126 INDONESIA MACHINE CONTROL SYSTEM MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 127 INDONESIA MACHINE CONTROL SYSTEM MARKET, BY VEHICLE EQUIPMENT, 2020-2029 (USD MILLION)

TABLE 128 INDONESIA MACHINE CONTROL SYSTEM MARKET, BY CONTROLLER TYPE, 2020-2029 (USD MILLION)

TABLE 129 INDONESIA MACHINE CONTROL SYSTEM MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 130 INDONESIA MACHINE CONTROL SYSTEM MARKET, BY INDUSTRY, 2020-2029 (USD MILLION)

TABLE 131 INDONESIA BUILDING AND CONSTRUCTION IN MACHINE CONTROL SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 132 INDONESIA AGRICULTURE IN MACHINE CONTROL SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 133 INDONESIA MINING IN MACHINE CONTROL SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 134 INDONESIA MARINE IN MACHINE CONTROL SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 135 INDONESIA WASTE MANAGEMENT IN MACHINE CONTROL SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 136 INDONESIA UTILITIES IN MACHINE CONTROL SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 137 SINGAPORE MACHINE CONTROL SYSTEM MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 138 SINGAPORE MACHINE CONTROL SYSTEM MARKET, BY VEHICLE EQUIPMENT, 2020-2029 (USD MILLION)

TABLE 139 SINGAPORE MACHINE CONTROL SYSTEM MARKET, BY CONTROLLER TYPE, 2020-2029 (USD MILLION)

TABLE 140 SINGAPORE MACHINE CONTROL SYSTEM MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 141 SINGAPORE MACHINE CONTROL SYSTEM MARKET, BY INDUSTRY, 2020-2029 (USD MILLION)

TABLE 142 SINGAPORE BUILDING AND CONSTRUCTION IN MACHINE CONTROL SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 143 SINGAPORE AGRICULTURE IN MACHINE CONTROL SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 144 SINGAPORE MINING IN MACHINE CONTROL SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 145 SINGAPORE MARINE IN MACHINE CONTROL SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 146 SINGAPORE WASTE MANAGEMENT IN MACHINE CONTROL SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 147 SINGAPORE UTILITIES IN MACHINE CONTROL SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 148 MALAYSIA MACHINE CONTROL SYSTEM MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 149 MALAYSIA MACHINE CONTROL SYSTEM MARKET, BY VEHICLE EQUIPMENT, 2020-2029 (USD MILLION)

TABLE 150 MALAYSIA MACHINE CONTROL SYSTEM MARKET, BY CONTROLLER TYPE, 2020-2029 (USD MILLION)

TABLE 151 MALAYSIA MACHINE CONTROL SYSTEM MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 152 MALAYSIA MACHINE CONTROL SYSTEM MARKET, BY INDUSTRY, 2020-2029 (USD MILLION)

TABLE 153 MALAYSIA BUILDING AND CONSTRUCTION IN MACHINE CONTROL SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 154 MALAYSIA AGRICULTURE IN MACHINE CONTROL SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 155 MALAYSIA MINING IN MACHINE CONTROL SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 156 MALAYSIA MARINE IN MACHINE CONTROL SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 157 MALAYSIA WASTE MANAGEMENT IN MACHINE CONTROL SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 158 MALAYSIA UTILITIES IN MACHINE CONTROL SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 159 PHILIPPINES MACHINE CONTROL SYSTEM MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 160 PHILIPPINES MACHINE CONTROL SYSTEM MARKET, BY VEHICLE EQUIPMENT, 2020-2029 (USD MILLION)

TABLE 161 PHILIPPINES MACHINE CONTROL SYSTEM MARKET, BY CONTROLLER TYPE, 2020-2029 (USD MILLION)

TABLE 162 PHILIPPINES MACHINE CONTROL SYSTEM MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 163 PHILIPPINES MACHINE CONTROL SYSTEM MARKET, BY INDUSTRY, 2020-2029 (USD MILLION)

TABLE 164 PHILIPPINES BUILDING AND CONSTRUCTION IN MACHINE CONTROL SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 165 PHILIPPINES AGRICULTURE IN MACHINE CONTROL SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 166 PHILIPPINES MINING IN MACHINE CONTROL SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 167 PHILIPPINES MARINE IN MACHINE CONTROL SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 168 PHILIPPINES WASTE MANAGEMENT IN MACHINE CONTROL SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 169 PHILIPPINES UTILITIES IN MACHINE CONTROL SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 170 REST OF ASIA-PACIFIC MACHINE CONTROL SYSTEM MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

Список рисунков

FIGURE 1 ASIA PACIFIC MACHINE CONTROL SYSTEM MARKET: SEGMENTATION

FIGURE 2 ASIA PACIFIC MACHINE CONTROL SYSTEM MARKET: DATA TRIANGULATION

FIGURE 3 ASIA PACIFIC MACHINE CONTROL SYSTEM MARKET: DROC ANALYSIS

FIGURE 4 ASIA PACIFIC MACHINE CONTROL SYSTEM MARKET: ASIA PACIFIC VS REGIONAL MARKET ANALYSIS

FIGURE 5 ASIA PACIFIC MACHINE CONTROL SYSTEM MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 ASIA PACIFIC MACHINE CONTROL SYSTEM MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 ASIA PACIFIC MACHINE CONTROL SYSTEM MARKET: DBMR MARKET POSITION GRID

FIGURE 8 ASIA PACIFIC MACHINE CONTROL SYSTEM MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 ASIA PACIFIC MACHINE CONTROL SYSTEM MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 10 ASIA PACIFIC MACHINE CONTROL SYSTEM MARKET: SEGMENTATION

FIGURE 11 RISING NEED FOR ACCURACY AND PRECISION IN CONTROL SYSTEMS IS EXPECTED TO DRIVE ASIA PACIFIC MACHINE CONTROL SYSTEM MARKET IN THE FORECAST PERIOD

FIGURE 12 TECHNOLOGY SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF ASIA PACIFIC MACHINE CONTROL SYSTEM MARKET IN 2022 & 2029

FIGURE 13 ASIA-PACIFIC IS EXPECTED TO DOMINATE AND BE THE FASTEST-GROWING REGION IN THE ASIA PACIFIC MACHINE CONTROL SYSTEM MARKET IN THE FORECAST PERIOD

FIGURE 14 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF ASIA PACIFIC MACHINE CONTROL SYSTEM MARKET

FIGURE 15 REGIONAL SHARE OF ASIA PACIFIC INFRASTRUCTURE INVESTMENT

FIGURE 16 ASIA PACIFIC MACHINE CONTROL SYSTEM MARKET: BY TECHNOLOGY, 2021

FIGURE 17 ASIA PACIFIC MACHINE CONTROL SYSTEM MARKET: BY VEHICLE EQUIPMENT, 2021

FIGURE 18 ASIA PACIFIC MACHINE CONTROL SYSTEM MARKET: BY CONTROLLER TYPE, 2021

FIGURE 19 ASIA PACIFIC MACHINE CONTROL SYSTEM MARKET: BY APPLICATION, 2021

FIGURE 20 ASIA PACIFIC MACHINE CONTROL SYSTEM MARKET: BY INDUSTRY, 2021

FIGURE 21 ASIA-PACIFIC MACHINE CONTROL SYSTEM MARKET: SNAPSHOT (2021)

FIGURE 22 ASIA-PACIFIC MACHINE CONTROL SYSTEM MARKET: BY COUNTRY (2021)

FIGURE 23 ASIA-PACIFIC MACHINE CONTROL SYSTEM MARKET: BY COUNTRY (2022 & 2029)

FIGURE 24 ASIA-PACIFIC MACHINE CONTROL SYSTEM MARKET: BY COUNTRY (2021 & 2029)

FIGURE 25 ASIA-PACIFIC MACHINE CONTROL SYSTEM MARKET: BY TECHNOLOGY (2022-2029)

FIGURE 26 ASIA PACIFIC MACHINE CONTROL SYSTEM MARKET: COMPANY SHARE 2021 (%)

Методология исследования

Сбор данных и анализ базового года выполняются с использованием модулей сбора данных с большими размерами выборки. Этап включает получение рыночной информации или связанных данных из различных источников и стратегий. Он включает изучение и планирование всех данных, полученных из прошлого заранее. Он также охватывает изучение несоответствий информации, наблюдаемых в различных источниках информации. Рыночные данные анализируются и оцениваются с использованием статистических и последовательных моделей рынка. Кроме того, анализ доли рынка и анализ ключевых тенденций являются основными факторами успеха в отчете о рынке. Чтобы узнать больше, пожалуйста, запросите звонок аналитика или оставьте свой запрос.

Ключевой методологией исследования, используемой исследовательской группой DBMR, является триангуляция данных, которая включает в себя интеллектуальный анализ данных, анализ влияния переменных данных на рынок и первичную (отраслевую экспертную) проверку. Модели данных включают сетку позиционирования поставщиков, анализ временной линии рынка, обзор рынка и руководство, сетку позиционирования компании, патентный анализ, анализ цен, анализ доли рынка компании, стандарты измерения, глобальный и региональный анализ и анализ доли поставщика. Чтобы узнать больше о методологии исследования, отправьте запрос, чтобы поговорить с нашими отраслевыми экспертами.

Доступна настройка

Data Bridge Market Research является лидером в области передовых формативных исследований. Мы гордимся тем, что предоставляем нашим существующим и новым клиентам данные и анализ, которые соответствуют и подходят их целям. Отчет можно настроить, включив в него анализ ценовых тенденций целевых брендов, понимание рынка для дополнительных стран (запросите список стран), данные о результатах клинических испытаний, обзор литературы, обновленный анализ рынка и продуктовой базы. Анализ рынка целевых конкурентов можно проанализировать от анализа на основе технологий до стратегий портфеля рынка. Мы можем добавить столько конкурентов, о которых вам нужны данные в нужном вам формате и стиле данных. Наша команда аналитиков также может предоставить вам данные в сырых файлах Excel, сводных таблицах (книга фактов) или помочь вам в создании презентаций из наборов данных, доступных в отчете.