Asia Pacific Fraud Detection Transaction Monitoring Market

Размер рынка в млрд долларов США

CAGR :

%

USD

4.16 Billion

USD

19.26 Billion

2024

2032

USD

4.16 Billion

USD

19.26 Billion

2024

2032

| 2025 –2032 | |

| USD 4.16 Billion | |

| USD 19.26 Billion | |

|

|

|

|

Сегментация рынка мониторинга транзакций и обнаружения мошенничества в Азиатско-Тихоокеанском регионе по предложению (решения и услуги), функции (KYC/регистрация клиентов, управление делами, проверка списков наблюдения, панель управления и отчетность и другие), развертыванию (локально и в облаке), размеру организации (крупные организации, малые и средние организации), применению (обнаружение мошенничества с платежами, обнаружение отмывания денег, защита от кражи учетных записей, предотвращение кражи личных данных и другие), вертикали (банковское дело, финансовые услуги и страхование (BFSI), розничная торговля, ИТ и телекоммуникации, государственный сектор и оборона, здравоохранение, производство, энергетика и коммунальные услуги и другие) — отраслевые тенденции и прогноз до 2032 года

Размер рынка мониторинга транзакций и обнаружения мошенничества в Азиатско-Тихоокеанском регионе

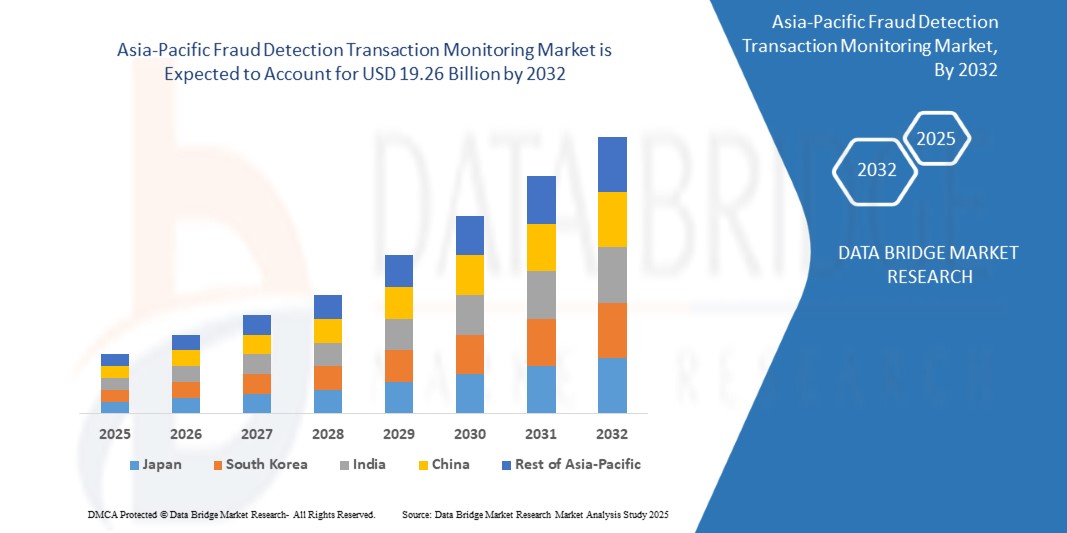

- Объем рынка мониторинга транзакций для обнаружения мошенничества в Азиатско-Тихоокеанском регионе оценивался в 4,16 млрд долларов США в 2024 году и, как ожидается , достигнет 19,26 млрд долларов США к 2032 году при среднегодовом темпе роста 21,1% в течение прогнозируемого периода.

- Рост рынка во многом обусловлен растущей цифровизацией финансовых транзакций, растущим внедрением онлайн-банкинга и цифровых платежных платформ, а также интеграцией технологий искусственного интеллекта и машинного обучения для обнаружения мошенничества в режиме реального времени в секторах банковских и финансовых услуг, розничной торговли и электронной коммерции.

- Более того, растущие требования к соблюдению нормативных требований, включая KYC, AML и требования по борьбе с мошенничеством, а также растущая потребность в безопасных, эффективных и автоматизированных системах мониторинга транзакций побуждают организации внедрять передовые решения для обнаружения мошенничества. Эти факторы ускоряют внедрение комплексных платформ мониторинга, тем самым значительно стимулируя рост отрасли.

Анализ рынка мониторинга транзакций и обнаружения мошенничества в Азиатско-Тихоокеанском регионе

- Решения для обнаружения мошенничества и мониторинга транзакций помогают организациям выявлять, предотвращать и минимизировать мошеннические действия, анализируя транзакции в режиме реального времени с помощью искусственного интеллекта, машинного обучения и предиктивной аналитики. Эти системы предоставляют оповещения, автоматизированную оценку рисков и отчетность о соответствии требованиям для защиты финансовых и операционных активов.

- Растущий спрос на эти решения обусловлен, прежде всего, резким ростом числа онлайн-транзакций, усложнением схем кибермошенничества и острой необходимостью для организаций обеспечивать соблюдение нормативных требований, одновременно защищая данные клиентов и поддерживая доверие.

- В 2024 году Китай занял лидирующие позиции на рынке мониторинга транзакций для выявления мошенничества благодаря быстрой цифровизации финансовых услуг, широкому распространению онлайн-банкинга и электронной коммерции, а также сильной нормативно-правовой базе, обеспечивающей соблюдение требований KYC и AML.

- Ожидается, что Индия станет страной с самыми быстрыми темпами роста на рынке мониторинга транзакций для обнаружения мошенничества в течение прогнозируемого периода благодаря быстрой цифровизации банковского сектора и сектора электронной коммерции, растущему внедрению мобильных и онлайн-платежей, а также усилению внимания регулирующих органов к соблюдению правил KYC и AML.

- Сегмент решений доминировал на рынке с долей рынка 62,9% в 2024 году благодаря растущей потребности в передовом программном обеспечении для обнаружения мошенничества, интегрирующем искусственный интеллект, машинное обучение и аналитику в режиме реального времени. Организации в секторах BFSI, розничной торговли и телекоммуникаций все чаще внедряют платформы обнаружения мошенничества для защиты транзакций, сокращения финансовых потерь и обеспечения соответствия нормативным требованиям. Масштабируемость решений, их способность предоставлять прогнозную аналитику и бесшовная интеграция с корпоративными системами делают их предпочтительным выбором для предприятий, для которых безопасность и операционная эффективность являются приоритетом.

Область отчета и сегментация рынка мониторинга транзакций и обнаружения мошенничества в Азиатско-Тихоокеанском регионе

|

Атрибуты |

Ключевые аспекты рынка мониторинга транзакций и обнаружения мошенничества в Азиатско-Тихоокеанском регионе |

|

Охваченные сегменты |

|

|

Охваченные страны |

Азиатско-Тихоокеанский регион

|

|

Ключевые игроки рынка |

|

|

Рыночные возможности |

|

|

Информационные наборы данных с добавленной стоимостью |

Помимо таких рыночных данных, как рыночная стоимость, темпы роста, сегменты рынка, географический охват, участники рынка и рыночный сценарий, отчет о рынке, подготовленный командой Data Bridge Market Research, включает в себя углубленный экспертный анализ, анализ импорта/экспорта, анализ цен, анализ потребления продукции и анализ пестицидов. |

Тенденции рынка мониторинга транзакций и обнаружения мошенничества в Азиатско-Тихоокеанском регионе

Внедрение ИИ для обнаружения мошенничества в режиме реального времени

- Растущее применение искусственного интеллекта для обнаружения мошенничества в режиме реального времени меняет рынок мониторинга транзакций. Финансовые учреждения и предприятия используют системы на базе искусственного интеллекта для мгновенного выявления подозрительной деятельности, сокращения ложных срабатываний и повышения общей точности обнаружения в всё более сложных сетях транзакций.

- Например, Mastercard использует инструменты обнаружения мошенничества на базе искусственного интеллекта, которые анализируют закономерности транзакций в режиме реального времени, чтобы пресекать мошеннические действия до их завершения. Аналогичным образом, Featurespace использует адаптивную поведенческую аналитику на основе машинного обучения, чтобы банки и платёжные компании могли с большей точностью выявлять аномалии в крупных финансовых транзакциях.

- Использование ИИ значительно расширяет возможности обнаружения мошенничества, анализируя огромные объёмы структурированных и неструктурированных данных за считанные секунды, чего не могут добиться традиционные системы, основанные на правилах. Это позволяет организациям эффективно противодействовать сложным методам мошенничества, таким как использование синтетических идентификаторов, кража учётных записей и трансграничное мошенничество с транзакциями.

- Технологии искусственного интеллекта также помогают снизить количество ложных отказов, которые могут негативно повлиять на качество обслуживания клиентов в финансовом секторе. Повышая точность обнаружения, системы искусственного интеллекта в режиме реального времени защищают учреждения от финансовых потерь, а также поддерживают доверие и лояльность потребителей.

- Расширение экосистем цифровых платежей, включая мобильные кошельки, платформы электронной коммерции и одноранговые переводы, обострило необходимость мгновенной защиты от мошенничества. Системы мониторинга транзакций на основе искусственного интеллекта предоставляют адаптивные возможности в режиме реального времени, обеспечивая бесшовную интеграцию с высокоскоростными финансовыми сетями.

- В заключение отметим, что внедрение ИИ для выявления мошенничества в режиме реального времени стимулирует быструю трансформацию отрасли. Эта тенденция подчёркивает растущую потребность в гибких, интеллектуальных и предиктивных системах мониторинга, способных адаптироваться к меняющимся тактикам мошенничества и обеспечивать безопасные и бесперебойные финансовые транзакции по всему миру.

Динамика рынка мониторинга транзакций и обнаружения мошенничества в Азиатско-Тихоокеанском регионе

Водитель

Повышенное внимание к проверке личности и аутентификации

- Растущее внимание к проверке личности и аутентификации является ключевым фактором, ускоряющим внедрение систем мониторинга транзакций. В связи с ростом числа цифровых транзакций финансовые учреждения отдают приоритет передовым методам аутентификации личности для защиты пользователей от кражи личных данных, мошеннического захвата счетов и несанкционированного доступа.

- Например, компания Experian интегрировала передовые инструменты проверки личности в свои решения по выявлению мошенничества, используя биометрическую аутентификацию и многофакторную верификацию для повышения безопасности транзакций. Аналогичным образом, такие компании, как LexisNexis Risk Solutions, используют искусственный интеллект и большие данные, чтобы финансовые организации могли проверять личность клиентов в режиме реального времени, одновременно снижая уровень неудобств для пользователей.

- Интеграция биометрических факторов, таких как распознавание лиц, сканирование отпечатков пальцев и поведенческая аналитика, дополнительно повышает уровень снижения рисков в банковской сфере, электронной коммерции и телекоммуникационных услугах. Эти меры обеспечивают надежные возможности верификации, дополняющие мониторинг транзакций и снижающие уязвимость учетных записей пользователей.

- Нормативно-правовая база, особенно такие требования, как «Знай своего клиента» (KYC) и «Борьба с отмыванием денег» (AML), также усиливает потребность в надежных инструментах проверки личности и аутентификации. Финансовым организациям необходимо внедрять передовые решения для мониторинга, чтобы соответствовать требованиям и минимизировать штрафы.

- В целом, повышенное внимание к проверке личности и аутентификации укрепляет доверие к цифровым каналам во всем мире. Это способствует дальнейшему развитию систем мониторинга транзакций и обнаружения мошенничества, которые становятся незаменимыми инструментами для обеспечения безопасности финансовых услуг и защиты отношений с клиентами.

Сдержанность/Вызов

Высокие первоначальные инвестиции и текущие расходы на обслуживание

- Серьёзной проблемой на рынке мониторинга транзакций для обнаружения мошенничества являются высокие финансовые вложения, необходимые для внедрения и постоянного обслуживания. Развертывание передовых систем мониторинга на базе искусственного интеллекта требует значительных капиталовложений в программные платформы, интеграционные технологии и квалифицированный персонал, что создаёт препятствия для небольших финансовых учреждений и предприятий.

- Например, крупные банки, такие как JPMorgan Chase, могут позволить себе внедрить платформы мониторинга мошенничества в режиме реального времени на базе искусственного интеллекта с функциями прогнозирования. Однако средние и региональные банки часто сталкиваются с высокими затратами на внедрение и испытывают трудности с обоснованием расходов, особенно на рынках с низкой рентабельностью.

- Сложность управления и обслуживания этих систем дополнительно увеличивает долгосрочные расходы. Для поддержания актуальности моделей угроз требуются постоянные обновления, а эксплуатационные расходы, такие как настройка системы, ёмкость облачного хранилища и инструменты расширенной аналитики, увеличивают финансовую нагрузку на организации.

- Кроме того, при резком росте объёмов транзакций возникают проблемы масштабируемости, требующие от организаций дополнительных инвестиций в инфраструктуру и системы поддержки. Это сказывается на организациях с ограниченным бюджетом, которым и так приходится балансировать между расходами на соблюдение требований и давлением со стороны прибыли.

- В результате высокие первоначальные затраты в сочетании с текущими расходами на обслуживание ограничивают широкое внедрение решений для обнаружения мошенничества и мониторинга транзакций. Для решения этой проблемы потребуется разработка экономичных платформ, облачных моделей подписки и общих сервисов для расширения доступности решений для организаций любого размера.

Рынок мониторинга транзакций и обнаружения мошенничества в Азиатско-Тихоокеанском регионе

Рынок сегментирован на основе предложения, функций, развертывания, размера организации, области применения и вертикали.

- Предлагая

По принципу предложения рынок сегментирован на решения и услуги. Сегмент решений обеспечил наибольшую долю рынка в 62,9% выручки в 2024 году, что обусловлено растущей потребностью в передовом программном обеспечении для обнаружения мошенничества, интегрирующем искусственный интеллект, машинное обучение и аналитику в режиме реального времени. Организации в секторах BFSI, розничной торговли и телекоммуникаций все чаще внедряют платформы обнаружения мошенничества для защиты транзакций, сокращения финансовых потерь и обеспечения соответствия нормативным требованиям. Масштабируемость решений, их способность предоставлять прогнозную информацию и бесшовная интеграция с корпоративными системами делают их предпочтительным выбором для предприятий, для которых безопасность и операционная эффективность являются приоритетом.

Ожидается, что сегмент услуг будет демонстрировать самые высокие темпы роста в период с 2025 по 2032 год, что обусловлено растущим спросом на управляемые услуги, консалтинг и техническую поддержку. Компании всё чаще передают мониторинг мошенничества на аутсорсинг поставщикам услуг из-за нехватки собственных специалистов и сложности борьбы с меняющимися киберугрозами. Резкий рост числа предложений по подписке на выявление мошенничества, обучение и круглосуточную поддержку мониторинга ещё больше ускоряет внедрение. Поставщики услуг, предлагающие индивидуальные консалтинговые и ориентированные на соблюдение требований решения, набирают популярность, особенно среди малых и средних предприятий, которым нужны экономически эффективные и масштабируемые решения для предотвращения мошенничества.

- По функции

По функциональному признаку рынок сегментируется на следующие сегменты: KYC/привлечение клиентов, управление делами, скрининг списков наблюдения, панель управления и отчётность и другие. Сегмент KYC/привлечение клиентов занимал наибольшую долю рынка в 2024 году благодаря растущим требованиям регулирующих органов и соблюдению требований в финансовом секторе. Финансовые учреждения, финтех-компании и цифровые банки используют надёжные решения KYC для аутентификации личности, предотвращения мошеннических операций при открытии счетов и укрепления доверия клиентов. Внедрение биометрической верификации, e-KYC и платформ цифрового присоединения клиентов обеспечило его доминирование, обеспечивая как операционную эффективность, так и снижение подверженности финансовым рискам.

Прогнозируется, что сегмент скрининга по спискам наблюдения будет демонстрировать самые высокие темпы роста в период с 2025 по 2032 год, что обусловлено растущим глобальным давлением в отношении соблюдения правил противодействия отмыванию денег (AML) и финансированию терроризма (CTF). Учреждения внедряют передовые инструменты скрининга для отслеживания транзакций на предмет соответствия международным санкциям, базам данных политически значимых лиц (PEP) и негативной информации в СМИ. Рост трансграничных платежей и международной торговли подталкивает компании к приоритетному использованию автоматизированных решений для скрининга в режиме реального времени, которые минимизируют риски несоблюдения требований и штрафы со стороны регулирующих органов.

- По развертыванию

По принципу развертывания рынок сегментируется на локальные и облачные решения. В 2024 году локальный сегмент обеспечил наибольшую долю выручки, поскольку крупные предприятия и государственные организации продолжают уделять первостепенное внимание максимальному контролю данных, настройке систем и усилению безопасности. Локальное развертывание остается популярным в таких строго регулируемых секторах, как банковское дело и оборона, где действуют строгие требования к суверенности данных и конфиденциальности. Возможность тесной интеграции локальных инструментов мониторинга мошенничества с устаревшими ИТ-системами также способствует его широкому распространению.

Ожидается, что сегмент облачных технологий будет демонстрировать самые высокие среднегодовые темпы роста в период с 2025 по 2032 год благодаря масштабируемости, экономической эффективности и способности поддерживать мониторинг в режиме реального времени в распределенных сетях. Облачные решения для обнаружения мошенничества предоставляют организациям мгновенные обновления программного обеспечения, аналитику на основе искусственного интеллекта и гибкость для адаптации к меняющимся схемам мошенничества. Стремительное распространение цифровых платежей, удаленной работы и онлайн-банкинга ускорило внедрение облачных технологий, особенно среди предприятий малого и среднего бизнеса, которым требуются безопасные платформы для мониторинга мошенничества на основе подписки с минимальными первоначальными затратами на инфраструктуру.

- По размеру организации

В зависимости от размера организации рынок сегментируется на крупные предприятия и малые и средние предприятия (МСП). В 2024 году на сегмент крупных предприятий пришлась наибольшая доля рынка, поскольку глобальные корпорации сталкиваются со значительными рисками, связанными с попытками крупномасштабного мошенничества, схемами отмывания денег и кибератаками. Эти организации активно инвестируют в платформы мониторинга мошенничества на базе искусственного интеллекта, передовую аналитику и общекорпоративные системы управления рисками. Наличие более крупных бюджетов, приоритетов, ориентированных на соблюдение требований, и интеграция с многоканальными операциями гарантируют, что крупные предприятия остаются лидерами в использовании решений для обнаружения мошенничества.

Прогнозируется, что сегмент малого и среднего бизнеса будет расти самыми быстрыми темпами в период с 2025 по 2032 год, что обусловлено растущей уязвимостью к кибермошенничеству, фишингу и кражам аккаунтов. Малые и средние предприятия используют экономичные облачные инструменты обнаружения мошенничества, которые обеспечивают автоматизированную защиту без необходимости создания обширной ИТ-инфраструктуры. Растущее внедрение решений для цифровых платежей в сочетании с растущим пониманием необходимости соблюдения требований законодательства побуждает малые и средние предприятия внедрять платформы для мониторинга мошенничества. Модели ценообразования на основе подписки и управляемые сервисы обнаружения мошенничества делают эти решения весьма привлекательными для малого бизнеса.

- По применению

По области применения рынок сегментируется на выявление мошенничества с платежами, выявление отмывания денег, защиту от кражи учетных записей, предотвращение кражи личных данных и другие. Сегмент выявления мошенничества с платежами доминировал на рынке в 2024 году благодаря быстрому росту цифровых платежей, электронной коммерции и мобильного банкинга. Рост числа несанкционированных транзакций, мошенничества с картами и фишинговых атак подтолкнул банки и розничные торговцы к внедрению систем обнаружения мошенничества на базе искусственного интеллекта. Анализ транзакций в режиме реального времени, предиктивная оценка мошенничества и интеграция с платежными шлюзами сделали этот сегмент наиболее распространенным приложением в различных отраслях.

Ожидается, что сегмент защиты от кражи аккаунтов будет демонстрировать самые высокие темпы роста в период с 2025 по 2032 год, что обусловлено всё более изощрёнными методами кражи учётных данных, фишинговыми атаками и атаками с использованием социальной инженерии. Мошенники атакуют аккаунты пользователей в банковской сфере, розничной торговле и телекоммуникациях, что делает кражу аккаунтов серьёзной проблемой. Компании внедряют многофакторную аутентификацию, поведенческую биометрию и мониторинг на основе искусственного интеллекта для выявления аномалий в схемах доступа пользователей. Резкий рост числа онлайн-аккаунтов, цифровых кошельков и облачных сервисов дополнительно стимулирует внедрение решений по защите от кражи аккаунтов.

- По вертикали

По вертикали рынок сегментирован на следующие сферы: банковское дело, финансовые услуги и страхование (BFSI), розничная торговля, ИТ и телекоммуникации, государственный сектор и оборона, здравоохранение, производство, энергетика и коммунальные услуги и другие. Сегмент BFSI обеспечил наибольшую долю выручки рынка в 2024 году, поскольку банки и финансовые учреждения остаются основными целями мошенников. Сектор активно инвестирует в платформы обнаружения мошенничества для обеспечения безопасности цифровых транзакций, борьбы с отмыванием денег и соблюдения строгих нормативных требований, таких как AML и KYC. Стремительное развитие онлайн-банкинга и финтех-инноваций продолжает стимулировать внедрение передовых решений по мониторингу мошенничества в BFSI.

Прогнозируется, что сектор здравоохранения будет демонстрировать самые высокие среднегодовые темпы роста в период с 2025 по 2032 год, что обусловлено ростом числа случаев кражи медицинских персональных данных, мошенничества со страховыми выплатами и утечек данных. В связи с растущей цифровизацией медицинских карт и систем выставления счетов пациентам, поставщики медицинских услуг внедряют платформы обнаружения мошенничества для защиты конфиденциальных данных. Аналитические и мониторинговые системы на основе искусственного интеллекта внедряются для выявления мошеннических заявлений и предотвращения несанкционированного доступа к медицинской информации. Растущее стремление регулирующих органов к защите данных пациентов также ускоряет внедрение мониторинга мошенничества в этом секторе.

Анализ рынка мониторинга транзакций и обнаружения мошенничества в Азиатско-Тихоокеанском регионе

- Китай занял лидирующие позиции на рынке мониторинга транзакций для обнаружения мошенничества, получив наибольшую долю выручки в 2024 году благодаря быстрой цифровизации финансовых услуг, широкому распространению онлайн-банкинга и электронной коммерции, а также сильной нормативно-правовой базе, обеспечивающей соблюдение правил KYC и AML.

- Рост инвестиций в системы мониторинга на основе искусственного интеллекта, предиктивную аналитику и проверку транзакций в режиме реального времени ускорил внедрение передовых решений по выявлению мошенничества. Присутствие крупных финтех-компаний, развитая технологическая инфраструктура и эффективные инициативы в области кибербезопасности ещё больше укрепляют лидерство Китая на региональном рынке.

- Рост числа случаев мошенничества с онлайн-платежами, растущая осведомленность потребителей о безопасных цифровых транзакциях и интеграция автоматизированного мониторинга мошенничества как в банковском, так и в розничном секторе гарантируют сохранение доминирования в прогнозируемый период.

Анализ рынка мониторинга транзакций и обнаружения мошенничества в Японии

Ожидается, что рынок Японии будет устойчиво расти с 2025 по 2032 год благодаря широкому внедрению технологически передовых решений по выявлению мошенничества и строгим стандартам соответствия нормативным требованиям. Японские финансовые учреждения и предприятия отдают приоритет автоматизации, мониторингу на основе искусственного интеллекта и интеграции многоканальных платформ по выявлению мошенничества. Развитая экосистема цифровых платежей, акцент на кибербезопасности и предпочтение безопасным и эффективным системам мониторинга транзакций стимулируют спрос. Постоянные инновации отечественных поставщиков технологий и инвестиции в машинное обучение и предиктивную аналитику делают Японию стабильным и инновационным рынком решений по выявлению мошенничества.

Анализ рынка мониторинга транзакций и обнаружения мошенничества в Индии

Прогнозируется, что в 2025–2032 годах Индия будет демонстрировать самые высокие среднегодовые темпы роста на рынке мониторинга транзакций и обнаружения мошенничества в Азиатско-Тихоокеанском регионе. Рост обусловлен быстрой цифровизацией банковского сектора и электронной коммерции, растущим внедрением мобильных и онлайн-платежей, а также растущим вниманием со стороны регулирующих органов к соблюдению принципов KYC и AML. Государственные инициативы, направленные на повышение доступности цифровых финансовых услуг, расширение финтех-услуг и рост осведомленности о безопасности транзакций, стимулируют спрос. Отечественные поставщики технологий в сочетании с масштабируемыми облачными решениями для мониторинга мошенничества укрепляют позиции Индии как самого быстрорастущего рынка. Рост числа онлайн-транзакций и потребность в предотвращении мошенничества в режиме реального времени дополнительно ускоряют рост.

Доля рынка мониторинга транзакций и обнаружения мошенничества в Азиатско-Тихоокеанском регионе

Лидерами отрасли мониторинга транзакций по выявлению мошенничества являются в первую очередь хорошо зарекомендовавшие себя компании, в том числе:

- Amazon Web Services, Inc. (США)

- LexisNexis (США)

- Mastercard (США)

- TATA Consultancy Services Limited (Индия)

- Fiserv, Inc. (США)

- SAS Institute Inc. (США)

- ACI Worldwide (США)

- Oracle (США)

- NICE (Израиль)

- FICO (США)

- SymphonyAI (США)

- ПОВСЕДНЕВНОСТЬ (США)

- Verafin Solutions ULC (Канада)

- GB Group plc («GBG») (Великобритания)

- INFORM SOFTWARE (Германия)

- Quantexa (Великобритания)

- Sum and Substance Ltd (Великобритания)

- DataVisor, Inc. (США)

- Ястреб (Германия)

- Featurespace Limited (Англия)

- INETCO Systems Ltd. (Канада)

- Abra Innovations, Inc. (США)

- Seon Technologies Ltd. (Венгрия)

- Feedzai (Португалия)

- Сканер санкций (Великобритания)

Последние разработки на рынке мониторинга транзакций и обнаружения мошенничества в Азиатско-Тихоокеанском регионе

- В июне 2024 года American Express ускорила обнаружение мошенничества, используя модели долговременной краткосрочной памяти (LSTM) на базе искусственного интеллекта. Используя параллельные вычисления на графических процессорах, компания быстро обрабатывала и анализировала огромные объёмы транзакционных данных, обеспечивая обнаружение мошенничества в режиме реального времени. Этот подход помог American Express справиться со сложностями, возникающими из-за большого объёма транзакций. Интеграция ускоренных вычислений и искусственного интеллекта расширила возможности компании по быстрому выявлению аномалий, повысив операционную эффективность и сократив потенциальные потери от мошенничества.

- В июне 2024 года компания DataVisor, Inc. расширила свои возможности многопользовательской среды, предоставив масштабируемые, безопасные и гибкие решения по предотвращению мошенничества и противодействию отмыванию денег (AML). Это обновление позволило организациям настраивать стратегии противодействия мошенничеству и AML и внедрять их среди субарендаторов с помощью таких функций, как модели машинного обучения и бизнес-правила. Эти усовершенствования помогли банкам-спонсорам обеспечить соответствие требованиям и позволили крупным финансовым учреждениям централизовать данные, предлагая при этом возможность принятия решений на основе субарендации. Это развитие помогло DataVisor укрепить свои позиции на рынке и увеличить число внедрений своих решений среди банков и финансовых учреждений, что повысило удовлетворенность и удержание клиентов.

- В июне 2024 года ACI Worldwide и RS2 запустили в Бразилии комплексное платёжное решение, объединяющее их технологии эквайринга и эмиссии. Эта облачная платформа позволила финансовым учреждениям и поставщикам платёжных услуг эффективно внедрять новые продукты и услуги, повышая безопасность и сокращая расходы. Интеграция передовых систем противодействия мошенничеству и аналитики в режиме реального времени позволила компаниям расширить своё присутствие на рынке и увеличить возможности получения дохода.

- В октябре 2023 года компания ACI Worldwide заключила партнерское соглашение с Nymcard для расширения своих возможностей по борьбе с мошенничеством и отмыванием денег. Это партнерство позволило Nymcard быстро и эффективно выявлять и предотвращать финансовое мошенничество, используя передовые технологии машинного обучения и аналитики. Развертывание системы через публичное облако ACI повысило масштабируемость, безопасность и операционную эффективность, значительно укрепив позиции Nymcard на рынке Ближнего Востока и Северной Африки.

- Согласно блогу BluEnt, в июле 2023 года компании столкнулись с возросшими трудностями в выявлении мошенничества из-за большого объёма транзакций. Для анализа больших массивов данных и выявления высокорисковых тенденций и отклонений были внедрены передовые технологии и автоматизированные системы. Несмотря на трудности с управлением неструктурированными данными, где чаще всего происходит мошенничество, аналитика данных о финансовых преступлениях позволила эффективно анализировать как структурированные, так и неструктурированные данные. Этот подход помог предотвратить мошеннические действия и интегрировать различные источники данных для более эффективного выявления.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Интерактивная панель анализа данных

- Панель анализа компании для возможностей с высоким потенциалом роста

- Доступ аналитика-исследователя для настройки и запросов

- Анализ конкурентов с помощью интерактивной панели

- Последние новости, обновления и анализ тенденций

- Используйте возможности сравнительного анализа для комплексного отслеживания конкурентов

Методология исследования

Сбор данных и анализ базового года выполняются с использованием модулей сбора данных с большими размерами выборки. Этап включает получение рыночной информации или связанных данных из различных источников и стратегий. Он включает изучение и планирование всех данных, полученных из прошлого заранее. Он также охватывает изучение несоответствий информации, наблюдаемых в различных источниках информации. Рыночные данные анализируются и оцениваются с использованием статистических и последовательных моделей рынка. Кроме того, анализ доли рынка и анализ ключевых тенденций являются основными факторами успеха в отчете о рынке. Чтобы узнать больше, пожалуйста, запросите звонок аналитика или оставьте свой запрос.

Ключевой методологией исследования, используемой исследовательской группой DBMR, является триангуляция данных, которая включает в себя интеллектуальный анализ данных, анализ влияния переменных данных на рынок и первичную (отраслевую экспертную) проверку. Модели данных включают сетку позиционирования поставщиков, анализ временной линии рынка, обзор рынка и руководство, сетку позиционирования компании, патентный анализ, анализ цен, анализ доли рынка компании, стандарты измерения, глобальный и региональный анализ и анализ доли поставщика. Чтобы узнать больше о методологии исследования, отправьте запрос, чтобы поговорить с нашими отраслевыми экспертами.

Доступна настройка

Data Bridge Market Research является лидером в области передовых формативных исследований. Мы гордимся тем, что предоставляем нашим существующим и новым клиентам данные и анализ, которые соответствуют и подходят их целям. Отчет можно настроить, включив в него анализ ценовых тенденций целевых брендов, понимание рынка для дополнительных стран (запросите список стран), данные о результатах клинических испытаний, обзор литературы, обновленный анализ рынка и продуктовой базы. Анализ рынка целевых конкурентов можно проанализировать от анализа на основе технологий до стратегий портфеля рынка. Мы можем добавить столько конкурентов, о которых вам нужны данные в нужном вам формате и стиле данных. Наша команда аналитиков также может предоставить вам данные в сырых файлах Excel, сводных таблицах (книга фактов) или помочь вам в создании презентаций из наборов данных, доступных в отчете.