Asia Pacific Food Acidulants Market

Размер рынка в млрд долларов США

CAGR :

%

USD

17,583.40 Million

USD

28,133.40 Million

2021

2029

USD

17,583.40 Million

USD

28,133.40 Million

2021

2029

| 2022 –2029 | |

| USD 17,583.40 Million | |

| USD 28,133.40 Million | |

|

|

|

Рынок пищевых ингредиентов (подкислителей) в Азиатско-Тихоокеанском регионе по типу ( лимонная кислота , молочная кислота, уксусная кислота, фумаровая кислота, винная кислота, яблочная кислота, глюконовая кислота, фосфорная кислота и соли, янтарная кислота, цитрат натрия, цитрат калия, дубильная кислота, муравьиная кислота и другие), форме (сухие и жидкие), функции (контроль pH, усилитель кислотного вкуса, консерванты и другие), каналу сбыта (B2B и B2C), конечному потребителю (сектор переработки пищевых продуктов, сектор общественного питания и бытовые услуги/розничная торговля). Тенденции и прогноз отрасли до 2029 года.

Анализ рынка и идеи

Рынок пищевых ингредиентов (подкислителей) Азиатско-Тихоокеанского региона набирает значительные темпы роста из-за роста пищевой промышленности и напитков , а также роста спроса на ароматизированные напитки и продукты питания. Рост спроса на подкислители в алкогольных напитках, таких как вино, также стимулирует рост рынка пищевых ингредиентов (подкислителей) Азиатско-Тихоокеанского региона. Однако ожидается, что строгие государственные правила, связанные с подкислителями, и риски для здоровья, связанные с некоторыми подкислителями, такими как фосфорная кислота, будут сдерживать рост рынка подкислителей в прогнозируемый период.

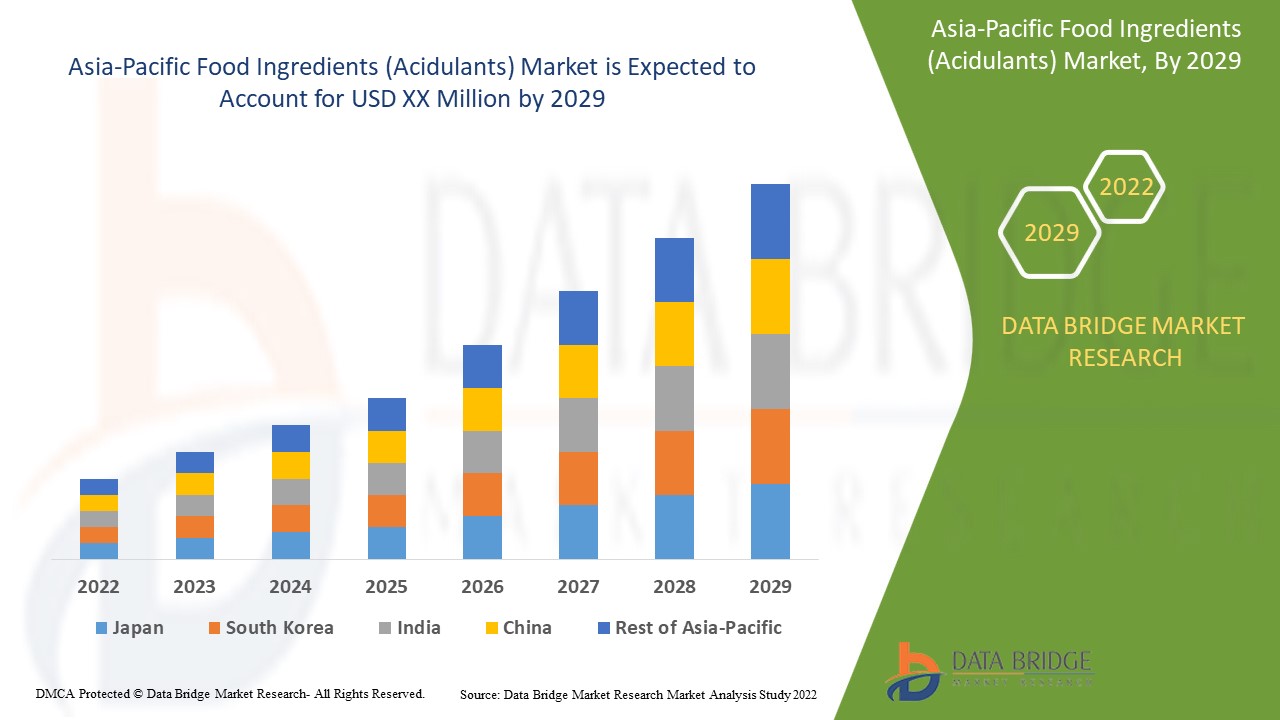

По данным Data Bridge Market Research, ожидается, что рынок пищевых ингредиентов (подкислителей) в Азиатско-Тихоокеанском регионе будет расти среднегодовыми темпами на 6,1% в течение прогнозируемого периода с 2022 по 2029 год.

|

Отчет Метрика |

Подробности |

|

Прогнозируемый период |

2022-2029 |

|

Базовый год |

2021 |

|

Исторические годы |

2020 (Можно настроить на 2019 - 2014) |

|

Количественные единицы |

Доход в млн. долл. США, цены в долл. США |

|

Охваченные сегменты |

По типу (лимонная кислота, молочная кислота, уксусная кислота, фумаровая кислота, винная кислота, яблочная кислота, глюконовая кислота, фосфорная кислота и соли, янтарная кислота, цитрат натрия, цитрат калия, дубильная кислота, муравьиная кислота и другие), форме (сухая и жидкая), функции (контроль pH, усилитель кислотного вкуса, консерванты и другие), каналу сбыта (B2B и B2C), конечный пользователь (сектор переработки пищевых продуктов, сектор общественного питания и бытовые/розничная торговля) |

|

Страны, охваченные |

Китай, Япония, Индия, Южная Корея, Таиланд, Филиппины, Индонезия, Сингапур, Вьетнам, Малайзия, Австралия, Новая Зеландия и остальные страны Азиатско-Тихоокеанского региона |

|

Охваченные участники рынка |

Cargill, Incorporated, Brenntag SE, Tate & Lyle, ADM, Foodchem International Corporation, Corbion, Bartek Ingredients Inc., Weifang Ensign Industry Co., Ltd, Chemvera Specialty Chemicals Pvt. Ltd., Hawkins Watts Limited, Richest Group, Suntran.cn, Arshine Pharmaceutical Co., INDUSTRIAL TECNICA PECUARIA, SA, Arihant Chemicals и другие |

Определение рынка

Подкислители — это химические соединения, которые придают пищевым продуктам терпкий, кислый или кислый вкус или усиливают воспринимаемую сладость пищевых продуктов. Подкислители также могут функционировать как разрыхлители и эмульгаторы в некоторых видах обработанных пищевых продуктов. Хотя подкислители могут снижать pH, они отличаются от регуляторов кислотности, которые являются пищевыми добавками, специально предназначенными для изменения стабильности пищевых продуктов или ферментов в них. Типичными подкислителями являются уксусная кислота (например, в соленьях) и лимонная кислота. Многие напитки, такие как кола, содержат фосфорную кислоту. Кислые конфеты часто изготавливаются с использованием яблочной кислоты. Другие подкислители, используемые в производстве пищевых продуктов, включают фумаровую кислоту, винную кислоту, молочную кислоту и глюконовую кислоту.

Динамика рынка пищевых ингредиентов (кислот) в Азиатско-Тихоокеанском регионе

Драйверы

- Растущий спрос на полуфабрикаты, вероятно, будет способствовать росту индустрии пищевых подкислителей

Подкислители являются ключевым ингредиентом, используемым в производстве полуфабрикатов для придания освежающего вкуса, улучшения текстуры и терпкости, а также улучшения вкуса продукта. С ростом спроса на улучшенные полуфабрикаты/готовые к употреблению продукты из-за напряженного образа жизни и меняющихся предпочтений потребителей производители пищевых продуктов требуют добавлять больше подкислителей в продукты питания для удовлетворения спроса.

- Широкое использование лимонной и яблочной кислоты в новых алкогольных и безалкогольных напитках

В большинстве напитков лимонная кислота является первым выбором для использования в качестве подкислителя. Это специфическая, относительно мягкая или слегка резкая кислинка и освежающий эффект на большинстве фруктовых вкусов. Кроме того, яблочная кислота используется, когда ожидается сильное усиление вкуса, в основном в сочетании с лимонной кислотой. Помимо этих подкислителей, в напитках также используются фосфорная и янтарная кислоты. Фосфорная кислота в основном используется в газированных напитках, таких как кола, для придания особого вкусового профиля и сильного воздействия на pH. Все эти факторы, как ожидается, будут стимулировать рост рынка пищевых ингредиентов (подкислителей) в Азиатско-Тихоокеанском регионе.

Возможности

- Растущий спрос на подкислители со стороны растущей пищевой промышленности в странах с развивающейся экономикой, таких как Индия и Китай

Пищевая промышленность постоянно растет в Индии и Китае из-за возросшего спроса на полуфабрикаты, готовую к употреблению еду, быстрорастворимые напитки, переработанные мясные продукты, кондитерские изделия и т. д. Занятой образ жизни потребителей увеличивает располагаемый доход, поэтому потребители тратят больше денег и стремятся пробовать новые и лучшие продукты питания с разными вкусами.

Подкислители помогают придать освежающую нотку спортивному напитку, сливочную тающую консистенцию сыру, желированную текстуру желе и другим продуктам питания, что увеличивает спрос на подкислители в пищевой промышленности и создает новые возможности для рынка подкислителей.

Например,

- По данным Investor Portal, в 2021 году валовая добавленная стоимость в индийской пищевой промышленности выросла с 17 583,40 млн долларов США до 28 133,40 млн долларов США за 5 лет 2016-2021 гг.

Ограничения/Проблемы

- Проблемы, возникающие из-за чрезмерного использования продуктов на основе фосфатов

Фосфор естественным образом содержится во многих продуктах питания, а фосфорная кислота используется в качестве подкислителя. Поэтому большинство людей получают достаточно фосфора с пищей. Рекомендуемое суточное количество (RDA) фосфора, необходимое для нормальной работы организма, составляет 700 мг. Его можно легко получить из натуральных источников пищи. Продукты с высоким содержанием белка (например, мясо, бобы, яйца, курица и рыба) обычно содержат много фосфора. Это означает, что дополнительная фосфорная кислота из обработанной пищи и газировки превышает потребности организма.

Однако из-за растущего потребления нездоровой и консервированной пищи среди людей наблюдается более высокое потребление фосфорной кислоты, чем обычно.

Например,

В одной газировке может содержаться до 500 мг фосфорной кислоты.

Люди, которые принимают 4000 мг фосфора в день, считаются подверженными высокому риску негативных последствий для здоровья, связанных с фосфором.

В этом отчете о рынке пищевых ингредиентов (подкислителей) в Азиатско-Тихоокеанском регионе содержатся сведения о последних новых разработках, правилах торговли, анализе импорта-экспорта, анализе производства, оптимизации цепочки создания стоимости, доле рынка, влиянии внутренних и локальных игроков рынка, анализируются возможности с точки зрения новых источников дохода, изменений в правилах рынка, стратегического анализа роста рынка, размера рынка, роста рынка категорий, ниш и доминирования приложений, одобрения продуктов, запусков продуктов, географических расширений, технологических инноваций на рынке. Чтобы получить больше информации о рынке пищевых ингредиентов (подкислителей) в Азиатско-Тихоокеанском регионе, свяжитесь с Data Bridge Market Research для получения аналитического обзора; наша команда поможет вам принять обоснованное рыночное решение для достижения роста рынка.

Влияние COVID-19 на рынок пищевых ингредиентов (кислот) в Азиатско-Тихоокеанском регионе

После пандемии спрос на подкислители увеличился, поскольку больше не будет ограничений на передвижение, и, следовательно, поставка продуктов будет легкой. Кроме того, растущая тенденция пробовать новые кухни и безалкогольные напитки, ферментированные напитки, такие как комбуча, кефир, водный кефир, тепаче и боза, особенно среди молодого населения, будет способствовать росту рынка.

Возросший спрос на ферментированные напитки позволяет производителям выпускать инновационные и ароматизированные ферментированные напитки, что в конечном итоге увеличивает спрос на подкислители, что способствует росту рынка.

Недавнее развитие

- В марте 2022 года Brenntag SE приобрела израильского дистрибьютора специализированной химии YS Ashkenazi Agencies Ltd вместе с его дочерней компанией Biochem Trading. Это приобретение представляет собой выход Brenntag на израильский рынок. Это приобретение увеличит репутацию компании

Масштаб рынка пищевых ингредиентов (кислот) в Азиатско-Тихоокеанском регионе

Рынок пищевых ингредиентов (подкислителей) Азиатско-Тихоокеанского региона сегментирован по типу, форме, функции, каналу сбыта и конечному пользователю. Рост среди этих сегментов поможет вам проанализировать сегменты с незначительным ростом в отраслях и предоставить пользователям ценный обзор рынка и рыночные идеи для принятия стратегических решений по определению основных рыночных приложений.

Тип

- Лимонная кислота

- Цитрат натрия

- Цитрат калия

- Уксусная кислота

- Муравьиная кислота

- Глюконовая кислота

- Фумаровая кислота

- Яблочная кислота

- Фосфорная кислота и соли

- Винная кислота

- Молочная кислота

- Дубильная кислота

- Янтарная кислота

- Другие

По типу рынок пищевых ингредиентов (подкислителей) Азиатско-Тихоокеанского региона сегментируется на лимонную кислоту, цитрат натрия, цитрат калия, уксусную кислоту, муравьиную кислоту, глюконовую кислоту, яблочную кислоту, фосфорную кислоту и ее соли, винную кислоту, молочную кислоту, дубильную кислоту, фумаровую кислоту, янтарную кислоту и другие.

Форма

- Сухой

- Жидкость

По форме рынок пищевых ингредиентов (подкислителей) Азиатско-Тихоокеанского региона сегментируется на сухие и жидкие.

Функция

- контроль pH

- Кислотный усилитель вкуса

- Консерванты

- Другие

По функциональному признаку рынок пищевых ингредиентов (подкислителей) Азиатско-Тихоокеанского региона сегментируется на регуляторы pH, усилители кислого вкуса, консерванты и другие.

Канал распространения

- В2В

- B2C

По каналам сбыта рынок пищевых ингредиентов (подкислителей) Азиатско-Тихоокеанского региона сегментируется на B2B и B2C.

Конечный пользователь

- Бытовая техника/Розничная торговля

- Сектор пищевой промышленности

- Сектор общественного питания

По признаку конечного потребителя рынок пищевых ингредиентов (подкислителей) в Азиатско-Тихоокеанском регионе сегментируется на сектор бытового потребления/розничной торговли, сектор переработки пищевых продуктов и сектор общественного питания.

Региональный анализ/информация о рынке пищевых ингредиентов (кислот) в Азиатско-Тихоокеанском регионе

Проведен анализ рынка пищевых ингредиентов (подкислителей) в Азиатско-Тихоокеанском регионе, а также предоставлены сведения о размерах рынка и тенденциях по странам, типу, форме, функции, конечному пользователю и каналу сбыта, как указано выше.

В отчете о рынке пищевых ингредиентов (подкислителей) Азиатско-Тихоокеанского региона рассматриваются следующие страны: Китай, Япония, Индия, Южная Корея, Таиланд, Филиппины, Индонезия, Сингапур, Вьетнам, Малайзия, Австралия, Новая Зеландия и остальные страны Азиатско-Тихоокеанского региона.

Ожидается, что Китай будет доминировать на рынке пищевых ингредиентов (подкислителей) Азиатско-Тихоокеанского региона с точки зрения доли рынка и доходов и продолжит процветать в течение прогнозируемого периода. Это связано с наличием растущего спроса на продукты питания и напитки, особенно на обработанные продукты, из-за изменения образа жизни и ограничений по времени.

The country section of the report also provides individual market impacting factors and changes in regulations in the market that impact the current and future trends of the market. Data points, such as new and replacement sales, country demographics, disease epidemiology, and import-export tariffs, are some of the major pointers used to forecast the market scenario for individual countries. In addition, the presence and availability of Asia-Pacific brands and their challenges faced due to high competition from local and domestic brands and the impact of sales channels are considered while providing forecast analysis of the country data.

Competitive Landscape and Asia-Pacific Food Ingredients (Aciduants) Market Share Analysis

The Asia-Pacific food ingredients (acidulants) market competitive landscape provides details by the competitors. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, Asia-Pacific presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width, and breadth, and application dominance. The above data points provided are only related to the companies' focus on the Asia-Pacific food ingredients (acidulants) market.

Some of the major players operating in the Asia-Pacific food ingredients (acidulants) market are Cargill, Incorporated, Brenntag SE, Tate & Lyle, ADM, Foodchem International Corporation, Corbion, Bartek Ingredients Inc., Weifang Ensign Industry Co., Ltd, Chemvera Specialty Chemicals Pvt. Ltd., Hawkins Watts Limited, Richest Group, Suntran.cn, Arshine Pharmaceutical Co., INDUSTRIAL TECNICA PECUARIA, S.A., Arihant Chemicals, among others.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The market data is analyzed and estimated using market statistical and coherent models. In addition, market share analysis and key trend analysis are the major success factors in the market report. The key research methodology used by the DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market, and primary (industry expert) validation. Apart from this, data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Company Market Share Analysis, Standards of Measurement, Asia-Pacific Vs Regional, and Vendor Share Analysis. Please request an analyst call in case of further inquiry.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Интерактивная панель анализа данных

- Панель анализа компании для возможностей с высоким потенциалом роста

- Доступ аналитика-исследователя для настройки и запросов

- Анализ конкурентов с помощью интерактивной панели

- Последние новости, обновления и анализ тенденций

- Используйте возможности сравнительного анализа для комплексного отслеживания конкурентов

Содержание

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE ASIA PACIFIC FOOD INGREDIENTS (ACIDULANTS) MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 TYPE LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET END-USER COVERAGE GRID

2.11 VENDOR SHARE ANALYSIS

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 BRAND ANALYSIS

4.2 FACTORS INFLUENCING PURCHASING DECISION

4.2.1 PRICING OF FOOD INGREDIENTS (ACIDULANTS)

4.2.2 QUALITY AND PURITY OF ACIDULANTS

4.2.3 CERTIFIED FOOD INGREDIENTS (ACIDULANTS)

4.3 REGULATORY OR LEGAL RISK COVERAGE

4.4 NEW PRODUCT LAUNCH STRATEGIES

4.5 PATENT ANALYSIS

4.6 RAW MATERIAL ANALYSIS – TOP 10 ACIDULANTS

4.6.1 CITRIC ACID

4.6.2 ACETIC ACID

4.6.3 SODIUM CITRATE

4.6.4 LACTIC ACID

4.6.5 FUMARIC ACID

4.6.6 TARTARIC ACID

4.6.7 MALIC ACID

4.6.8 GLUCONIC ACID

4.6.9 PHOSPHORIC ACID AND SALT

4.7 RISK ANALYSIS (LIQUIDITY) – MAJOR PLAYERS

4.8 RISK ANALYSIS OF ACIDULANTS

4.8.1 CITRIC ACID

4.8.2 SODIUM CITRATE

4.8.3 ACETIC ACID

4.8.4 SUCCINIC ACID

4.8.5 MALIC ACID

4.8.6 TARTARIC ACID

4.8.7 POTASSIUM CITRATE

4.8.8 GLUCONIC ACID

4.8.9 FUMARIC ACID

4.8.10 LACTIC ACID

4.8.11 TANNIC ACID

4.8.12 FORMIC ACID

4.8.13 PHOSPHORIC ACID AND SALTS

4.9 RUSSIA AND UKRAINE WAR IMPACT

4.9.1 COUNTRIES THAT ARE LIKELY TO BE IMPACTED THE MOST –

4.9.2 RISK OF CIVIL UNREST

4.1 SUPPLY CHAIN OF ASIA PACIFIC FOOD INGREDIENTS (ACIDULANTS) MARKET

4.10.1 RAW MATERIAL PROCUREMENT

4.10.2 FOOD INGREDIENT (ACIDULANTS) PRODUCTION/PROCESSING

4.10.3 DISTRIBUTION

4.10.4 END-USERS

4.11 SUPPLIER DEEP DIVE – PART 1

4.12 PORTER'S FIVE FORCES ANALYSIS FOR CITRIC ACID-

4.13 PORTER'S FIVE FORCES ANALYSIS FOR LACTIC ACID-

4.14 PORTER'S FIVE FORCES ANALYSIS FOR ACETIC ACID-

4.15 PORTER'S FIVE FORCES ANALYSIS FOR FUMARIC ACID-

4.16 PORTER'S FIVE FORCES ANALYSIS FOR TARTARIC ACID-

4.17 PORTER'S FIVE FORCES ANALYSIS FOR MALIC ACID-

4.18 PORTER'S FIVE FORCES ANALYSIS FOR GLUCONIC ACID-

4.19 PORTER'S FIVE FORCES ANALYSIS FOR PHOSPHORIC ACID AND SALT-

4.2 PORTER'S FIVE FORCES ANALYSIS FOR SUCCINIC ACID-

4.21 PORTER'S FIVE FORCES ANALYSIS FOR SODIUM CITRATE –

4.22 SUPPLIERS DEEP DIVE – PART 2

4.22.1 PRODUCTION LOCATIONS

4.22.2 SUPPLIER SPECIFIC RISKS/OPPORTUNITIES

4.22.3 MARKETS THEY SELL TO

4.22.4 SUPPLIER SPECIFIC RISKS/OPPORTUNITIES

4.22.5 MARKETS THEY SELL TO

4.22.6 PRODUCTION LOCATIONS

4.23 ADM

4.23.1 PRODUCTION LOCATIONS

4.23.2 SUPPLIER SPECIFIC RISKS/OPPORTUNITIES

4.23.3 MARKETS THEY SELL TO

4.24 CORBION N.V

4.24.1 PRODUCTION LOCATIONS

4.24.2 SUPPLIER SPECIFIC RISKS/OPPORTUNITIES

4.24.3 MARKETS THEY SELL TO

4.25 TATE & LYLE

4.25.1 PRODUCTION LOCATIONS

4.25.2 SUPPLIER SPECIFIC RISKS/OPPORTUNITIES

4.25.3 MARKETS THEY SELL TO

4.26 JUNGBUNZLAUER SUISSE AG

4.26.1 PRODUCTION LOCATIONS

4.26.2 SUPPLIER SPECIFIC RISKS/OPPORTUNITIES

4.26.3 MARKETS THEY SELL TO

4.27 BARTEK INGREDIENTS INC.

4.27.1 PRODUCTION LOCATIONS

4.27.2 SUPPLIER SPECIFIC RISKS/OPPORTUNITIES

4.27.3 MARKETS THEY SELL TO

4.28 DAIRYCHEM

4.28.1 PRODUCTION LOCATIONS

4.28.2 SUPPLIER SPECIFIC RISKS/OPPORTUNITIES

4.28.3 MARKETS THEY SELL TO

4.29 WEIANG ENSIGN INDUSTRY CO.,LTD.

4.29.1 PRODUCTION LOCATIONS

4.29.2 SUPPLIER SPECIFIC RISKS/OPPORTUNITIES

4.29.3 MARKETS THEY SELL TO

4.3 INDUSTRIAL TECNICA PECUARIA, S.A.

4.30.1 PRODUCTION LOCATIONS

4.30.2 SUPPLIER SPECIFIC RISKS/OPPORTUNITIES

4.30.3 MARKETS THEY SELL TO

4.31 PRODUCTION CAPACITY – TOP FIVE PLAYERS

4.32 PRICING ANALYSIS FOR FOOD INGREDIENTS (ACIDULANTS)

4.33 SWOT ANALYSIS – TOP 10 ACIDULANTS

4.33.1 CITRIC ACID –

4.33.2 ACETIC ACID –

4.33.3 SODIUM CITRATE –

4.33.4 SUCCINIC ACID –

4.33.5 LACTIC ACID –

4.33.6 FUMARIC ACID –

4.33.7 TARTARIC ACID –

4.33.8 MALIC ACID –

4.33.9 GLUCONIC ACID –

4.33.10 PHOSPHORIC ACID AND SALTS -

5 REGULATIONS:

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 GROWING DEMAND FOR CONVENIENCE FOOD PRODUCTS IS LIKELY TO FAVOR FOOD ACIDULANTS INDUSTRY GROWTH

6.1.2 WIDE USE OF CITRIC ACID AND MALIC ACID IN EMERGING ALCOHOLIC AS WELL AS NON-ALCOHOLIC BEVERAGE APPLICATIONS

6.1.3 RISE IN DEMAND FOR ACIDULANTS SUCH AS MALIC ACID, LACTIC ACID, AND SODIUM LACTATE IN THE CONFECTIONERY INDUSTRY

6.1.4 GROWING DEMAND FOR INSTANT BEVERAGES, CARBONATED DRINKS, AND FERMENTED DRINKS IS LIKELY TO FAVOR ACIDULANTS MARKET GROWTH

6.2 RESTRAINTS:

6.2.1 RULES AND REGULATION OF FOOD REGULATORY BODIES ON ACIDULANTS PRODUCTS

6.2.2 ISSUES ARISING DUE TO OVER USAGE OF PHOSPHATE-BASED PRODUCTS

6.3 OPPORTUNITIES

6.3.1 INCREASING DEMAND FOR ACIDULANTS FROM THE RISING FOOD PROCESSING INDUSTRY IN EMERGING ECONOMIES SUCH AS INDIA AND CHINA

6.3.2 BIOLOGICAL PRODUCTION OF CITRIC ACID AND ACETIC ACID

6.4 CHALLENGES

6.4.1 GROWING HEALTH CONCERNS REGARDING ACIDULANTS

6.4.2 HIGH PRICES OF ACIDULANTS

7 IMPACT OF COVID-19 ON THE ASIA PACIFIC FOOD INGREDIENTS (ACIDULANTS) MARKET

7.1 IMPACT ON DEMAND AND SUPPLY CHAIN

7.2 IMPACT ON PRICE

7.3 CONCLUSION

8 ASIA PACIFIC FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE

8.1 OVERVIEW

8.2 CITRIC ACID

8.3 LACTIC ACID

8.4 ACETIC ACID

8.5 FUMARIC ACID

8.6 TARTARIC ACID

8.7 MALLIC ACID

8.8 GLUCONIC ACID

8.9 PHOSPHORIC ACID

8.1 SUCCINIC ACID

8.11 SODIUM CITRATE AND SALT

8.12 POTASSIUM CITRATE AND SALT

8.13 TANNIC ACID AND SALT

8.14 FORMIC ACID AND SALT

8.15 OTHERS

9 ASIA PACIFIC FOOD INGREDIENTS (ACIDULANTS) MARKET, BY FORM

9.1 OVERVIEW

9.2 DRY

9.3 LIQUID

10 ASIA PACIFIC FOOD INGREDIENTS (ACIDULANTS) MARKET, BY FUNCTION

10.1 OVERVIEW

10.2 PH CONTROL

10.3 ACIDIC FLAVOR ENHANCER

10.4 PRESERVATIVES

10.5 OTHERS

11 ASIA PACIFIC FOOD INGREDIENTS (ACIDULANTS) MARKET, BY DISTRIBUTION CHANNEL

11.1 OVERVIEW

11.2 B2B

11.2.1 WHOLESALERS

11.2.2 ONLINE

11.3 B2C

11.3.1 SUPERMARKET

11.3.2 ONLINE

11.3.3 HYPERMARKET

11.3.4 DEPARTMENTAL STORES

11.3.5 SPECIALTY STORES

11.3.6 OTHERS

12 ASIA PACIFIC FOOD INGREDIENTS (ACIDULANTS) MARKET, BY END-USER

12.1 OVERVIEW

12.2 FOOD PROCESSING SECTOR

12.2.1 FOOD

12.2.1.1 PROCESSED MEAT PRODUCTS

12.2.1.1.1 POULTRY

12.2.1.1.2 PORK

12.2.1.1.3 BEEF

12.2.1.1.4 OTHERS

12.2.1.2 DAIRY PRODUCTS

12.2.1.2.1 CHEESE

12.2.1.2.2 MILK-POWDER

12.2.1.2.3 ICE CREAM

12.2.1.2.4 SPREADS

12.2.1.2.5 OTHERS

12.2.1.3 CONVENIENCE FOOD

12.2.1.3.1 READY TO EAT PRODUCTS

12.2.1.3.2 SOUPS & SAUCES

12.2.1.3.3 SEASONING & DRESSING

12.2.1.3.4 NOODLES & PASTA

12.2.1.3.5 OTHERS

12.2.1.4 BAKERY

12.2.1.4.1 CAKES & PASTRIES

12.2.1.4.2 BREAD

12.2.1.4.3 BISCUITS & COOKIES

12.2.1.4.4 MUFFINS

12.2.1.4.5 OTHERS

12.2.1.5 CONFECTIONERY

12.2.1.5.1 CHOCOLATE

12.2.1.5.2 GUMS & JELLY

12.2.1.5.3 HARD & SOFT CANDY

12.2.1.5.4 CREAM FILLINGS

12.2.1.5.5 OTHERS

12.2.1.5.6 SEAFOOD PRODUCTS

12.2.1.5.7 PROCESSED FOOD

12.2.1.5.8 SPORTS NUTRITION

12.2.1.5.9 DIETARY SUPPLEMENTS

12.2.1.5.10 INFANT FORMULA

12.2.1.6 BEVERAGES

12.2.1.6.1 NON-ALCOHOLIC BEVERAGES

12.2.1.6.1.1 RTD

12.2.1.6.1.2 FRUIT JUICES

12.2.1.6.1.3 SOFT DRINKS

12.2.1.6.1.4 DAIRY DRINKS

12.2.1.6.1.5 FLAVORED DRINKS

12.2.1.6.1.6 OTHERS

12.2.1.6.1.7 ALCOHOLIC BEVERAGES

12.3 FOOD SERVICE SECTOR

12.3.1 RESTAURANTS

12.3.2 CAFÉS

12.3.3 HOTELS

12.3.4 CANTEEN/CAFETERIA

12.3.5 CLOUD KITCHEN

12.4 HOUSEHOLD/RETAIL

13 ASIA PACIFIC FOOD INGREDIENTS (ACIDULANTS) MARKET, BY REGION

13.1 ASIA-PACIFIC

13.1.1 CHINA

13.1.2 INDIA

13.1.3 JAPAN

13.1.4 SOUTH KOREA

13.1.5 THAILAND

13.1.6 PHILIPPINES

13.1.7 INDONESIA

13.1.8 SINGAPORE

13.1.9 VIETNAM

13.1.10 MALAYSIA

13.1.11 NEW ZEALAND

13.1.12 AUSTRALIA

13.1.13 REST OF ASIA-PACIFIC

14 ASIA PACIFIC FOOD INGREDIENT (ACIDULANTS) MARKET, COMPANY LANDSCAPE

14.1 COMPANY SHARE ANALYSIS: ASIA PACIFIC

15 COMPANY PROFILE

15.1 CARGILL, INCORPORATED

15.1.1 COMPANY SNAPSHOT

15.1.2 REVENUE ANALYSIS

15.1.3 COMPANY SHARE ANALYSIS

15.1.4 PRODUCT PORTFOLIO

15.1.5 RECENT DEVELOPMENTS

15.2 TATE & LYLE

15.2.1 COMPANY SNAPSHOT

15.2.2 REVENUE ANALYSIS

15.2.3 COMPANY SHARE ANALYSIS

15.2.4 PRODUCT PORTFOLIO

15.2.5 RECENT DEVELOPMENTS

15.3 ADM

15.3.1 COMPANY SNAPSHOT

15.3.2 REVENUE ANALYSIS

15.3.3 COMPANY SHARE ANALYSIS

15.3.4 PRODUCT PORTFOLIO

15.3.5 RECENT DEVELOPMENTS

15.4 JUNGBUNZLAUER SUISSE AG

15.4.1 COMPANY SNAPSHOT

15.4.2 COMPANY SHARE ANALYSIS

15.4.3 PRODUCT PORTFOLIO

15.4.4 RECENT DEVELOPMENTS

15.5 BRENNTAG SE

15.5.1 COMPANY SNAPSHOT

15.5.2 REVENUE ANALYSIS

15.5.3 COMPANY SHARE ANALYSIS

15.5.4 PRODUCT PORTFOLIO

15.5.5 RECENT DEVELOPMENTS

15.6 ARIHANT CHEMICALS

15.6.1 COMPANY SNAPSHOT

15.6.2 PRODUCT PORTFOLIO

15.6.3 RECENT DEVELOPMENTS

15.7 ARSHINE PHARMACEUTICAL CO.

15.7.1 COMPANY SNAPSHOT

15.7.2 PRODUCT PORTFOLIO

15.7.3 RECENT DEVELOPMENT

15.8 BARTEK INGREDIENTS INC.

15.8.1 COMPANY SNAPSHOT

15.8.2 PRODUCT PORTFOLIO

15.8.3 RECENT DEVELOPMENTS

15.9 CHEMVERA SPECIALTY CHEMICALS PVT. LTD.

15.9.1 COMPANY SNAPSHOT

15.9.2 PRODUCT PORTFOLIO

15.9.3 RECENT DEVELOPMENT

15.1 CORBION

15.10.1 COMPANY SNAPSHOT

15.10.2 REVENUE ANALYSIS

15.10.3 PRODUCT PORTFOLIO

15.10.4 RECENT DEVELOPMENTS

15.11 DAIRYCHEM

15.11.1 COMPANY SNAPSHOT

15.11.2 PRODUCT PORTFOLIO

15.11.3 RECENT DEVELOPMENTS

15.12 DIRECT FOOD INGREDIENTS LTD

15.12.1 COMPANY SNAPSHOT

15.12.2 PRODUCT PORTFOLIO

15.12.3 RECENT DEVELOPMENT

15.13 FBC INDUSTRIES

15.13.1 COMPANY SNAPSHOT

15.13.2 PRODUCT PORTFOLIO

1.13.3 RECENT DEVELOPMENTS 343

15.14 FOODCHEM INTERNATIONAL CORPORATION

15.14.1 COMPANY SNAPSHOT

15.14.2 PRODUCT PORTFOLIO

15.14.3 RECENT DEVELOPMENT

15.15 HAWKINS WATTS LIMITED

15.15.1 COMPANY SNAPSHOT

15.15.2 PRODUCT PORTFOLIO

15.15.3 RECENT DEVELOPMENTS

15.16 INDUSTRIAL TECNICA PECUARIA, S.A.

15.16.1 COMPANY SNAPSHOT

15.16.2 PRODUCT PORTFOLIO

15.16.3 RECENT DEVELOPMENT

15.17 INNOVA CORPORATE

15.17.1 COMPANY SNAPSHOT

15.17.2 PRODUCT PORTFOLIO

15.17.3 RECENT DEVELOPMENTS

15.18 RICHEST GROUP

15.18.1 COMPANY SNAPSHOT

15.18.2 PRODUCT PORTFOLIO

15.18.3 RECENT DEVELOPMENT

15.19 SUNTRAN.CN

15.19.1 COMPANY SNAPSHOT

15.19.2 PRODUCT PORTFOLIO

15.19.3 RECENT DEVELOPMENTS

15.2 WEIFANG ENSIGN INDUSTRY CO.,LTD

15.20.1 COMPANY SNAPSHOT

15.20.2 PRODUCT PORTFOLIO

15.20.3 RECENT DEVELOPMENT

16 QUESTIONNAIRE

17 RELATED REPORTS

Список таблиц

TABLE 1 REGULATORY OR LEGAL RISK COVERAGE FRAMEWORK

TABLE 2 MICROORGANISMS USED FOR THE PRODUCTION OF CITRIC ACID

TABLE 3 COMPARISON OF CITRIC ACID PRODUCTION FROM THE VARIOUS SUBSTRATES USING Y. LIPOLYTICA STRAINS

TABLE 4 CITRIC ACID APPLICATION IN DIFFERENT FOOD AND BEVERAGES INDUSTRY

TABLE 5 MICROORGANISMS USED TO PRODUCE ACETIC ACID

TABLE 6 ACETIC ACID APPLICATION IN DIFFERENT FOOD AND BEVERAGES INDUSTRY

TABLE 7 MICROORGANISMS USED FOR PRODUCING SODIUM CITRATE

TABLE 8 SODIUM CITRATE APPLICATION IN DIFFERENT FOOD AND BEVERAGES INDUSTRY

TABLE 9 MICROORGANISMS USED FOR BIO-SUCCINIC ACID PRODUCTION

TABLE 10 SUCCINIC ACID APPLICATION IN THE FOOD AND BEVERAGES INDUSTRY

TABLE 11 MICROORGANISMS USED TO PRODUCE LACTIC ACID-

TABLE 12 COMPARISON OF DIFFERENT STRAINS AND SUBSTRATES FOR LACTIC ACID PRODUCTION

TABLE 13 LACTIC ACID APPLICATION IN DIFFERENT FOOD AND BEVERAGES INDUSTRY-

TABLE 14 MICROORGANISMS USED IN THE PRODUCTION OF FUMARIC ACID

TABLE 15 FUMARIC ACID APPLICATION IN DIFFERENT FOOD AND BEVERAGES INDUSTRY-

TABLE 16 TARTARIC ACID APPLICATION IN DIFFERENT FOOD AND BEVERAGES INDUSTRY

TABLE 17 MALIC ACID APPLICATION IN DIFFERENT FOOD AND BEVERAGES INDUSTRY

TABLE 18 APPLICATIONS OF GLUCONIC ACID IN DIFFERENT FOOD AND BEVERAGES INDUSTRY-

TABLE 19 PHOSPHORIC ACID AND SALTS APPLICATION IN DIFFERENT FOOD AND BEVERAGES INDUSTRY

TABLE 20 RAW MATERIAL FOR DIFFERENT FOOD INGREDIENTS (ACIDULANTS)-

TABLE 21 MARKET SHARE OF CITRIC ACID

TABLE 22 MARKET SHARE OF LACTIC ACID

TABLE 23 MARKET SHARE OF FUMARIC ACID

TABLE 24 MARKET SHARE OF TARTARIC ACID

TABLE 25 MARKET SHARE OF MALIC ACID

TABLE 26 CATEGORY AND THEIR FUNCTIONALITY

TABLE 27 ACIDULANTS IN VARIOUS FOOD FUNCTIONALITY

TABLE 28 ACIDULANTS PRODUCTS AND THEIR APPLICATIONS

TABLE 29 ASIA PACIFIC AVERAGE SELLING PRICES OF ACIDULANTS

TABLE 30 THE BELOW TABLE SHOWS THE ACIDULANTS AND THEIR APPLICATIONS IN BEVERAGES

TABLE 31 THE RECOMMENDED DIETARY ALLOWANCE (RDA) FOR PHOSPHORUS IS THE FOLLOWING:

TABLE 32 THE TABLE BELOW SHOWS CITRIC ACID-PRODUCING MICROORGANISMS AND THEIR SPECIES:

TABLE 33 BELOW TABLE SHOWS THE SIDE EFFECTS OF ACIDULANTS:

TABLE 34 ASIA PACIFIC FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 35 ASIA PACIFIC FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (MILLION TONS)

TABLE 36 ASIA PACIFIC CITRIC ACID IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 37 ASIA PACIFIC LACTIC ACID IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 38 ASIA PACIFIC ACETIC ACID IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 39 ASIA PACIFIC FUMARIC ACID IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 40 ASIA PACIFIC TARTARIC ACID IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 41 ASIA PACIFIC MALLIC ACID IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 42 ASIA PACIFIC GLUCONIC ACID IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 43 ASIA PACIFIC PHOSPHORIC ACID IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 44 ASIA PACIFIC SUCCINIC ACID IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 45 ASIA PACIFIC SODIUM CITRATE AND SALT IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 46 ASIA PACIFIC POTASSIUM CITRATE AND SALT IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 47 ASIA PACIFIC TANNIC ACID AND SALT IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 48 ASIA PACIFIC FORMIC ACID AND SALT IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 49 ASIA PACIFIC OTHERS IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 50 ASIA PACIFIC FOOD INGREDIENTS (ACIDULANTS) MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 51 THE TABLE BELOW SHOWS THE FUNCTIONS OF DIFFERENT ACIDULANTS IN SOLID FORM:

TABLE 52 ASIA PACIFIC DRY IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 53 THE BELOW TABLE SHOWS THE FUNCTIONS OF LIQUID ACIDULANTS IN THE FOOD PROCESSING INDUSTRY:

TABLE 54 ASIA PACIFIC LIQUID IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 55 ASIA PACIFIC FOOD INGREDIENTS (ACIDULANTS) MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 56 ASIA PACIFIC PH CONTROL IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 57 ASIA PACIFIC ACIDIC FLAVOR ENHANCER IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 58 ASIA PACIFIC PRESERVATIVES IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 59 ASIA PACIFIC OTHERS IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 60 ASIA PACIFIC FOOD INGREDIENTS (ACIDULANTS) MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 61 ASIA PACIFIC B2B IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 62 ASIA PACIFIC B2B IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 63 ASIA PACIFIC B2C IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 64 ASIA PACIFIC B2C IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 65 ASIA PACIFIC FOOD INGREDIENTS (ACIDULANTS) MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 66 ASIA PACIFIC FOOD PROCESSING SECTOR IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 67 ASIA PACIFIC FOOD PROCESSING SECTOR IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 68 ASIA PACIFIC FOOD IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 69 ASIA PACIFIC PROCESSED MEAT PRODUCTS IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 70 ASIA PACIFIC DAIRY PRODUCTS IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 71 ASIA PACIFIC CONVENIENCE FOOD IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 72 ASIA PACIFIC BAKERY IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 73 ASIA PACIFIC CONFECTIONERY IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 74 ASIA PACIFIC BEVERAGES IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 75 ASIA PACIFIC NON-ALCOHOLIC BEVERAGES IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 76 ASIA PACIFIC FOOD SERVICE SECTOR IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 77 ASIA PACIFIC FOOD SERVICE SECTOR IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 78 ASIA PACIFIC HOUSEHOLD/RETAIL IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 79 ASIA-PACIFIC FOOD INGREDIENTS (ACIDULANTS) MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 80 ASIA-PACIFIC FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 81 ASIA-PACIFIC FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (MILLION TONS)

TABLE 82 ASIA-PACIFIC FOOD INGREDIENTS (ACIDULANTS) MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 83 ASIA-PACIFIC FOOD INGREDIENTS (ACIDULANTS) MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 84 ASIA-PACIFIC FOOD INGREDIENTS (ACIDULANTS) MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 85 ASIA-PACIFIC B2B IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 86 ASIA-PACIFIC B2C IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 87 ASIA-PACIFIC FOOD INGREDIENTS (ACIDULANTS) MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 88 ASIA-PACIFIC FOOD SERVICE SECTOR IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 89 ASIA-PACIFIC FOOD PROCESSING SECTOR IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 90 ASIA-PACIFIC FOOD IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 91 ASIA-PACIFIC DAIRY PRODUCTS IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 92 ASIA-PACIFIC BAKERY IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 93 ASIA-PACIFIC CONVENIENCE FOOD IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 94 ASIA-PACIFIC PROCESSED MEAT PRODUCTS IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 95 ASIA-PACIFIC CONFECTIONERY IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 96 ASIA-PACIFIC BEVERAGES IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 97 ASIA-PACIFIC NON-ALCOHOLIC BEVERAGES IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 98 CHINA FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 99 CHINA FOOD INGREDIENTS (ACIDULANTS) MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 100 CHINA FOOD INGREDIENTS (ACIDULANTS) MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 101 CHINA FOOD INGREDIENTS (ACIDULANTS) MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 102 CHINA B2B IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 103 CHINA B2C IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 104 CHINA FOOD INGREDIENTS (ACIDULANTS) MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 105 CHINA FOOD SERVICE SECTOR IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 106 CHINA FOOD PROCESSING SECTOR IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 107 CHINA FOOD IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 108 CHINA DAIRY PRODUCTS IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 109 CHINA BAKERY IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 110 CHINA CONVENIENCE FOOD IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 111 CHINA PROCESSED MEAT PRODUCTS IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 112 CHINA CONFECTIONERY IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 113 CHINA BEVERAGES IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 114 CHINA NON-ALCOHOLIC BEVERAGES IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 115 INDIA FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 116 INDIA FOOD INGREDIENTS (ACIDULANTS) MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 117 INDIA FOOD INGREDIENTS (ACIDULANTS) MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 118 INDIA FOOD INGREDIENTS (ACIDULANTS) MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 119 INDIA B2B IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 120 INDIA B2C IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 121 INDIA FOOD INGREDIENTS (ACIDULANTS) MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 122 INDIA FOOD SERVICE SECTOR IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 123 INDIA FOOD PROCESSING SECTOR IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 124 INDIA FOOD IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 125 INDIA DAIRY PRODUCTS IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 126 INDIA BAKERY IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 127 INDIA CONVENIENCE FOOD IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 128 INDIA PROCESSED MEAT PRODUCTS IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 129 INDIA CONFECTIONERY IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 130 INDIA BEVERAGES IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 131 INDIA NON-ALCOHOLIC BEVERAGES IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 132 JAPAN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 133 JAPAN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 134 JAPAN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 135 JAPAN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 136 JAPAN B2B IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 137 JAPAN B2C IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 138 JAPAN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 139 JAPAN FOOD SERVICE SECTOR IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 140 JAPAN FOOD PROCESSING SECTOR IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 141 JAPAN FOOD IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 142 JAPAN DAIRY PRODUCTS IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 143 JAPAN BAKERY IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 144 JAPAN CONVENIENCE FOOD IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 145 JAPAN PROCESSED MEAT PRODUCTS IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 146 JAPAN CONFECTIONERY IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 147 JAPAN BEVERAGES IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 148 JAPAN NON-ALCOHOLIC BEVERAGES IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 149 SOUTH KOREA FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 150 SOUTH KOREA FOOD INGREDIENTS (ACIDULANTS) MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 151 SOUTH KOREA FOOD INGREDIENTS (ACIDULANTS) MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 152 SOUTH KOREA FOOD INGREDIENTS (ACIDULANTS) MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 153 SOUTH KOREA B2B IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 154 SOUTH KOREA B2C IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 155 SOUTH KOREA FOOD INGREDIENTS (ACIDULANTS) MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 156 SOUTH KOREA FOOD SERVICE SECTOR IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 157 SOUTH KOREA FOOD PROCESSING SECTOR IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 158 SOUTH KOREA FOOD IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 159 SOUTH KOREA DAIRY PRODUCTS IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 160 SOUTH KOREA BAKERY IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 161 SOUTH KOREA CONVENIENCE FOOD IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 162 SOUTH KOREA PROCESSED MEAT PRODUCTS IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 163 SOUTH KOREA CONFECTIONERY IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 164 SOUTH KOREA BEVERAGES IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 165 SOUTH KOREA NON-ALCOHOLIC BEVERAGES IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 166 THAILAND FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 167 THAILAND FOOD INGREDIENTS (ACIDULANTS) MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 168 THAILAND FOOD INGREDIENTS (ACIDULANTS) MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 169 THAILAND FOOD INGREDIENTS (ACIDULANTS) MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 170 THAILAND B2B IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 171 THAILAND B2C IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 172 THAILAND FOOD INGREDIENTS (ACIDULANTS) MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 173 THAILAND FOOD SERVICE SECTOR IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 174 THAILAND FOOD PROCESSING SECTOR IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 175 THAILAND FOOD IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 176 THAILAND DAIRY PRODUCTS IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 177 THAILAND BAKERY IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 178 THAILAND CONVENIENCE FOOD IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 179 THAILAND PROCESSED MEAT PRODUCTS IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 180 THAILAND CONFECTIONERY IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 181 THAILAND BEVERAGES IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 182 THAILAND NON-ALCOHOLIC BEVERAGES IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 183 PHILIPPINES FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 184 PHILIPPINES FOOD INGREDIENTS (ACIDULANTS) MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 185 PHILIPPINES FOOD INGREDIENTS (ACIDULANTS) MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 186 PHILIPPINES FOOD INGREDIENTS (ACIDULANTS) MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 187 PHILIPPINES B2B IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 188 PHILIPPINES B2C IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 189 PHILIPPINES FOOD INGREDIENTS (ACIDULANTS) MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 190 PHILIPPINES FOOD SERVICE SECTOR IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 191 PHILIPPINES FOOD PROCESSING SECTOR IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 192 PHILIPPINES FOOD IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 193 PHILIPPINES DAIRY PRODUCTS IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 194 PHILIPPINES BAKERY IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 195 PHILIPPINES CONVENIENCE FOOD IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 196 PHILIPPINES PROCESSED MEAT PRODUCTS IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 197 PHILIPPINES CONFECTIONERY IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 198 PHILIPPINES BEVERAGES IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 199 PHILIPPINES NON-ALCOHOLIC BEVERAGES IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 200 INDONESIA FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 201 INDONESIA FOOD INGREDIENTS (ACIDULANTS) MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 202 INDONESIA FOOD INGREDIENTS (ACIDULANTS) MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 203 INDONESIA FOOD INGREDIENTS (ACIDULANTS) MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 204 INDONESIA B2B IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 205 INDONESIA B2C IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 206 INDONESIA FOOD INGREDIENTS (ACIDULANTS) MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 207 INDONESIA FOOD SERVICE SECTOR IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 208 INDONESIA FOOD PROCESSING SECTOR IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 209 INDONESIA FOOD IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 210 INDONESIA DAIRY PRODUCTS IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 211 INDONESIA BAKERY IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 212 INDONESIA CONVENIENCE FOOD IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 213 INDONESIA PROCESSED MEAT PRODUCTS IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 214 INDONESIA CONFECTIONERY IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 215 INDONESIA BEVERAGES IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 216 INDONESIA NON-ALCOHOLIC BEVERAGES IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 217 SINGAPORE FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 218 SINGAPORE FOOD INGREDIENTS (ACIDULANTS) MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 219 SINGAPORE FOOD INGREDIENTS (ACIDULANTS) MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 220 SINGAPORE FOOD INGREDIENTS (ACIDULANTS) MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 221 SINGAPORE B2B IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 222 SINGAPORE B2C IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 223 SINGAPORE FOOD INGREDIENTS (ACIDULANTS) MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 224 SINGAPORE FOOD SERVICE SECTOR IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 225 SINGAPORE FOOD PROCESSING SECTOR IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 226 SINGAPORE FOOD IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 227 SINGAPORE DAIRY PRODUCTS IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 228 SINGAPORE BAKERY IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 229 SINGAPORE CONVENIENCE FOOD IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 230 SINGAPORE PROCESSED MEAT PRODUCTS IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 231 SINGAPORE CONFECTIONERY IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 232 SINGAPORE BEVERAGES IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 233 SINGAPORE NON-ALCOHOLIC BEVERAGES IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 234 VIETNAM FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 235 VIETNAM FOOD INGREDIENTS (ACIDULANTS) MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 236 VIETNAM FOOD INGREDIENTS (ACIDULANTS) MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 237 VIETNAM FOOD INGREDIENTS (ACIDULANTS) MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 238 VIETNAM B2B IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 239 VIETNAM B2C IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 240 VIETNAM FOOD INGREDIENTS (ACIDULANTS) MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 241 VIETNAM FOOD SERVICE SECTOR IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 242 VIETNAM FOOD PROCESSING SECTOR IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 243 VIETNAM FOOD IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 244 VIETNAM DAIRY PRODUCTS IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 245 VIETNAM BAKERY IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 246 VIETNAM CONVENIENCE FOOD IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 247 VIETNAM PROCESSED MEAT PRODUCTS IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 248 VIETNAM CONFECTIONERY IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 249 VIETNAM BEVERAGES IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 250 VIETNAM NON-ALCOHOLIC BEVERAGES IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 251 MALAYSIA FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 252 MALAYSIA FOOD INGREDIENTS (ACIDULANTS) MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 253 MALAYSIA FOOD INGREDIENTS (ACIDULANTS) MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 254 MALAYSIA FOOD INGREDIENTS (ACIDULANTS) MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 255 MALAYSIA B2B IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 256 MALAYSIA B2C IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 257 MALAYSIA FOOD INGREDIENTS (ACIDULANTS) MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 258 MALAYSIA FOOD SERVICE SECTOR IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 259 MALAYSIA FOOD PROCESSING SECTOR IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 260 MALAYSIA FOOD IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 261 MALAYSIA DAIRY PRODUCTS IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 262 MALAYSIA BAKERY IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 263 MALAYSIA CONVENIENCE FOOD IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 264 MALAYSIA PROCESSED MEAT PRODUCTS IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 265 MALAYSIA CONFECTIONERY IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 266 MALAYSIA BEVERAGES IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 267 MALAYSIA NON-ALCOHOLIC BEVERAGES IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 268 NEW ZEALAND FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 269 NEW ZEALAND FOOD INGREDIENTS (ACIDULANTS) MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 270 NEW ZEALAND FOOD INGREDIENTS (ACIDULANTS) MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 271 NEW ZEALAND FOOD INGREDIENTS (ACIDULANTS) MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 272 NEW ZEALAND B2B IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 273 NEW ZEALAND B2C IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 274 NEW ZEALAND FOOD INGREDIENTS (ACIDULANTS) MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 275 NEW ZEALAND FOOD SERVICE SECTOR IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 276 NEW ZEALAND FOOD PROCESSING SECTOR IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 277 NEW ZEALAND FOOD IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 278 NEW ZEALAND DAIRY PRODUCTS IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 279 NEW ZEALAND BAKERY IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 280 NEW ZEALAND CONVENIENCE FOOD IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 281 NEW ZEALAND PROCESSED MEAT PRODUCTS IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 282 NEW ZEALAND CONFECTIONERY IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 283 NEW ZEALAND BEVERAGES IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 284 NEW ZEALAND NON-ALCOHOLIC BEVERAGES IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 285 AUSTRALIA FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 286 AUSTRALIA FOOD INGREDIENTS (ACIDULANTS) MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 287 AUSTRALIA FOOD INGREDIENTS (ACIDULANTS) MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 288 AUSTRALIA FOOD INGREDIENTS (ACIDULANTS) MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 289 AUSTRALIA B2B IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 290 AUSTRALIA B2C IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 291 AUSTRALIA FOOD INGREDIENTS (ACIDULANTS) MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 292 AUSTRALIA FOOD SERVICE SECTOR IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 293 AUSTRALIA FOOD PROCESSING SECTOR IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 294 AUSTRALIA FOOD IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 295 AUSTRALIA DAIRY PRODUCTS IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 296 AUSTRALIA BAKERY IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 297 AUSTRALIA CONVENIENCE FOOD IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 298 AUSTRALIA PROCESSED MEAT PRODUCTS IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 299 AUSTRALIA CONFECTIONERY IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 300 AUSTRALIA BEVERAGES IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 301 AUSTRALIA NON-ALCOHOLIC BEVERAGES IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 302 REST OF ASIA-PACIFIC FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

Список рисунков

FIGURE 1 ASIA PACIFIC FOOD INGREDIENTS (ACIDULANTS) MARKET: SEGMENTATION

FIGURE 2 ASIA PACIFIC FOOD INGREDIENTS (ACIDULANTS) MARKET: DATA TRIANGULATION

FIGURE 3 ASIA PACIFIC FOOD INGREDIENTS (ACIDULANTS) MARKET: DROC ANALYSIS

FIGURE 4 ASIA PACIFIC FOOD INGREDIENTS (ACIDULANTS) MARKET: ASIA PACIFIC VS REGIONAL MARKET ANALYSIS

FIGURE 5 ASIA PACIFIC FOOD INGREDIENTS (ACIDULANTS) MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 ASIA PACIFIC FOOD INGREDIENTS (ACIDULANTS) MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 ASIA PACIFIC FOOD INGREDIENTS (ACIDULANTS) MARKET: DBMR MARKET POSITION GRID

FIGURE 8 ASIA PACIFIC FOOD INGREDIENTS (ACIDULANTS) MARKET: MARKET END-USER COVERAGE GRID

FIGURE 9 ASIA PACIFIC FOOD INGREDIENTS (ACIDULANTS) MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 ASIA PACIFIC FOOD INGREDIENTS (ACIDULANTS) MARKET: SEGMENTATION

FIGURE 11 NORTH AMERICA IS EXPECTED TO DOMINATE THE ASIA PACIFIC FOOD INGREDIENTS (ACIDULANTS) MARKET AND IS GROWING WITH THE HIGHEST CAGR IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 12 GROWING DEMAND FOR CONVENIENCE FOOD PRODUCTS IS LIKELY TO FAVOR FOOD ACIDULANTS INDUSTRY GROWTH WHICH IS DRIVING THE ASIA PACIFIC FOOD INGREDIENTS (ACIDULANTS) MARKET IN THE FORECAST PERIOD

FIGURE 13 CITRIC ACID SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE ASIA PACIFIC FOOD INGREDIENTS (ACIDULANTS) MARKET IN 2022 & 2029

FIGURE 14 UKRAINE AND RUSSIA’S SHARE OF ASIA PACIFIC TRADE (2018-2020)-

FIGURE 15 SUPPLY CHAIN OF ASIA PACIFIC FOOD INGREDIENTS (ACIDULANTS) MARKET

FIGURE 16 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE ASIA PACIFIC FOOD INGREDIENTS (ACIDULANTS) MARKET

FIGURE 17 THE BELOW GRAPH SHOWS THE ASIA PACIFIC MARKET SIZE FOR BEVERAGES

FIGURE 18 THE BELOW GRAPH SHOWS THE SALES OF ASIA PACIFIC NON-ALCOHOLIC BEVERAGES FROM 2018 TO 2022:

FIGURE 19 THE BELOW GRAPH SHOWS THE SALES OF NON-ALCOHOLIC BEVERAGES IN U.S. FROM 2019 TO 2021-

FIGURE 20 ASIA PACIFIC FOOD INGREDIENTS (ACIDULANTS) MARKET: BY TYPE, 2021

FIGURE 21 ASIA PACIFIC FOOD INGREDIENTS (ACIDULANTS) MARKET: BY FORM, 2021

FIGURE 22 ASIA PACIFIC FOOD INGREDIENTS (ACIDULANTS) MARKET: BY FUNCTION, 2021

FIGURE 23 ASIA PACIFIC FOOD INGREDIENTS (ACIDULANTS) MARKET, BY DISTRIBUTION CHANNEL, 2021

FIGURE 24 ASIA PACIFIC FOOD INGREDIENTS (ACIDULANTS) MARKET: BY END-USER, 2021

FIGURE 25 ASIA-PACIFIC FOOD INGREDIENTS (ACIDULANTS) MARKET: SNAPSHOT (2021)

FIGURE 26 ASIA-PACIFIC FOOD INGREDIENTS (ACIDULANTS) MARKET: BY COUNTRY (2021)

FIGURE 27 ASIA-PACIFIC FOOD INGREDIENTS (ACIDULANTS) MARKET: BY COUNTRY (2022 & 2029)

FIGURE 28 ASIA-PACIFIC FOOD INGREDIENTS (ACIDULANTS) MARKET: BY COUNTRY (2021 & 2029)

FIGURE 29 ASIA-PACIFIC FOOD INGREDIENTS (ACIDULANTS) MARKET: BY TYPE (2022 & 2029)

FIGURE 30 ASIA PACIFIC FOOD INGREDIENT (ACIDULANTS) MARKET: COMPANY SHARE 2021 (%)

Методология исследования

Сбор данных и анализ базового года выполняются с использованием модулей сбора данных с большими размерами выборки. Этап включает получение рыночной информации или связанных данных из различных источников и стратегий. Он включает изучение и планирование всех данных, полученных из прошлого заранее. Он также охватывает изучение несоответствий информации, наблюдаемых в различных источниках информации. Рыночные данные анализируются и оцениваются с использованием статистических и последовательных моделей рынка. Кроме того, анализ доли рынка и анализ ключевых тенденций являются основными факторами успеха в отчете о рынке. Чтобы узнать больше, пожалуйста, запросите звонок аналитика или оставьте свой запрос.

Ключевой методологией исследования, используемой исследовательской группой DBMR, является триангуляция данных, которая включает в себя интеллектуальный анализ данных, анализ влияния переменных данных на рынок и первичную (отраслевую экспертную) проверку. Модели данных включают сетку позиционирования поставщиков, анализ временной линии рынка, обзор рынка и руководство, сетку позиционирования компании, патентный анализ, анализ цен, анализ доли рынка компании, стандарты измерения, глобальный и региональный анализ и анализ доли поставщика. Чтобы узнать больше о методологии исследования, отправьте запрос, чтобы поговорить с нашими отраслевыми экспертами.

Доступна настройка

Data Bridge Market Research является лидером в области передовых формативных исследований. Мы гордимся тем, что предоставляем нашим существующим и новым клиентам данные и анализ, которые соответствуют и подходят их целям. Отчет можно настроить, включив в него анализ ценовых тенденций целевых брендов, понимание рынка для дополнительных стран (запросите список стран), данные о результатах клинических испытаний, обзор литературы, обновленный анализ рынка и продуктовой базы. Анализ рынка целевых конкурентов можно проанализировать от анализа на основе технологий до стратегий портфеля рынка. Мы можем добавить столько конкурентов, о которых вам нужны данные в нужном вам формате и стиле данных. Наша команда аналитиков также может предоставить вам данные в сырых файлах Excel, сводных таблицах (книга фактов) или помочь вам в создании презентаций из наборов данных, доступных в отчете.