Рынок систем терморегулирования электромобилей в Азиатско-Тихоокеанском регионе по типу двигателя (BEV, PHEV, HEV и FCV), технологии (активная и пассивная), типу аккумулятора (обычный и твердотельный), емкости аккумулятора (30–60 кВт·ч, 60–90 кВт·ч, ниже 30 кВт·ч и выше 90 кВт·ч), типу транспортного средства (легковой и коммерческий), типу системы (терморегулирование аккумулятора HVAC, силовая установка и другие). Тенденции отрасли и прогноз до 2029 года.

Анализ и размер рынка систем терморегулирования электромобилей в Азиатско-Тихоокеанском регионе

Электромобили являются перспективной возобновляемой заменой бензиновым автомобилям для защиты окружающей среды. Многие правительства предпринимают инициативы по продвижению электромобилей и предоставляют налоговые льготы и выкупы. Рост рынка электромобилей обусловлен быстрым развитием технологий, что создает спрос на системы терморегулирования электромобилей на рынке. Азиатско-Тихоокеанский рынок систем терморегулирования электромобилей быстро растет из-за роста спроса на электромобили на рынке. Компании даже запускают новые продукты, чтобы получить большую долю рынка.

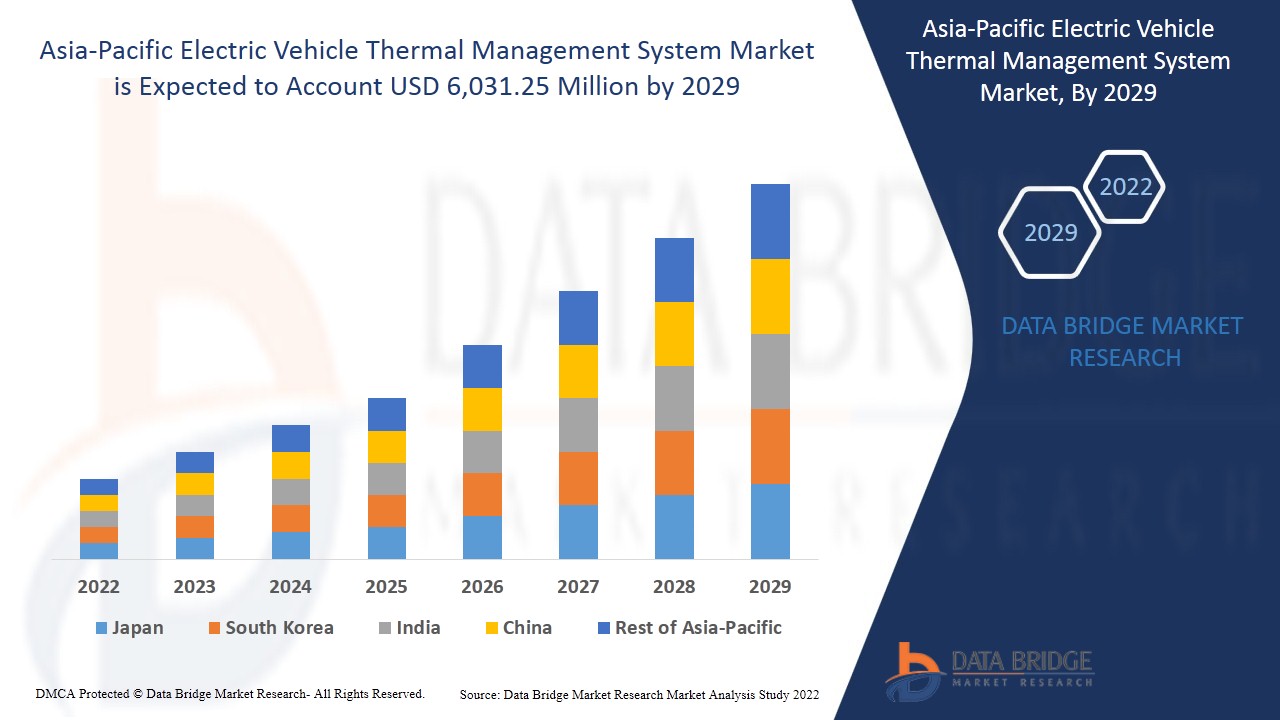

Data Bridge Market Research анализирует, что рынок систем терморегулирования электромобилей в Азиатско-Тихоокеанском регионе, как ожидается, достигнет значения 6 031,25 млн долларов США к 2029 году при среднегодовом темпе роста 24,3% в прогнозируемый период. «BEV» составляет самый заметный сегмент типа двигателя, поскольку они энергоэффективны, преобразуя 80% своей потребляемой энергии в движение автомобиля, и у них есть система рекуперативного торможения, которая собирает энергию и возвращает ее в аккумулятор, когда автомобиль останавливается. Отчет о рынке систем терморегулирования электромобилей в Азиатско-Тихоокеанском регионе также подробно охватывает анализ цен, патентный анализ и технологические достижения.

Определение рынка систем терморегулирования электромобилей в Азиатско-Тихоокеанском регионе

Система терморегулирования в электромобиле — это решение, которое помогает управлять теплом, выделяемым в ходе электрохимических процессов, происходящих в ячейках, что позволяет аккумулятору работать безопасно и эффективно. Эффективные системы терморегулирования необходимы в электромобилях для поддержания температуры аккумулятора в правильном диапазоне и предотвращения колебаний температуры внутри аккумуляторной батареи. Таким образом, системы терморегулирования играют важную роль в контроле теплового поведения аккумулятора.

Внедрение электромобилей растет во всем мире из-за их нулевого уровня выбросов и высокой эффективности от бака до колес. Это потребовало надлежащей системы управления аккумулятором для достижения максимальной производительности при работе в различных условиях. Кроме того, растущая тенденция к увеличению скорости зарядки, которая позволит заряжать быстрее и совершать более длительные поездки, повысила спрос на более эффективное терморегулирование в электромобилях.

|

Отчет Метрика |

Подробности |

|

Базовый год |

2021 |

|

Прогнозируемый период |

2022 - 2029 |

|

Исторический год |

2020 |

|

Количественные единицы |

Доход в млн. долл. США, цены в долл. США |

|

Охваченные сегменты |

По типу тяги (BEV, PHEV, HEV и FCV), технологии (активная и пассивная), типу аккумулятора (обычный и твердотельный), емкости аккумулятора (30–60 кВт·ч, 60–90 кВт·ч, ниже 30 кВт·ч и выше 90 кВт·ч), типу транспортного средства (легковой и коммерческий), типу системы (терморегулирование аккумулятора, HVAC, силовая установка и другие) |

|

Страны, охваченные |

Китай, Япония, Индия, Южная Корея, Сингапур, Малайзия, Австралия, Таиланд, Индонезия, Филиппины и остальные страны Азиатско-Тихоокеанского региона |

|

Охваченные участники рынка |

MAHLE GmbH, Valeo, Dana Limited, Hanon Systems, Marelli Holdings Co., Ltd., Robert Bosch GmbH, BorgWarner Inc., Continental AG, VOSS Automotive GmbH, Kendrion NV, LG Chem, DENSO Corporation, NORMA Group, MODINE MANUFACTURING COMPANY, GENTHERM, A. KAYSER AUTOMOTIVE SYSTEMS GmbH, Ymer Technology, Grayson и другие |

Динамика рынка систем терморегулирования электромобилей в Азиатско-Тихоокеанском регионе

В этом разделе рассматривается понимание рыночных драйверов, преимуществ, возможностей, ограничений и проблем. Все это подробно обсуждается ниже:

- Растущий спрос на электромобили

Автомобильная промышленность демонстрирует огромный рост из-за растущего спроса на роскошные электромобили. Некоторые из факторов, стимулирующих продажи электромобилей, включают строгие государственные правила в отношении выбросов транспортных средств, растущий спрос на экономичные, высокопроизводительные и малоэмиссионные автомобили.

- Стимулы и субсидии правительства для электромобилей

Рост загрязнения и дефицит ресурсов, особенно в автомобильном секторе, позволил правительству принять меры по защите окружающей среды, что привело к изменению тенденций в автомобильной промышленности с обычных моторизованных транспортных средств на электрические гибридные транспортные средства для защиты окружающей среды. Многие национальные правительства приняли меры по предоставлению стимулов для принятия электромобилей вместо обычных транспортных средств, такие как предоставление скидок при покупке, налоговых льгот, налоговых кредитов и некоторых других.

- Растущий спрос на решения по термическому охлаждению

Рост спроса на электромобили привел к прогрессу в производстве аккумуляторов, чтобы обеспечить большую мощность и требующих менее частых зарядок, но вместе с этим возникла также потребность в эффективной системе охлаждения, чтобы защитить аккумулятор от перегрева. Разряд аккумулятора генерирует тепло; чем быстрее аккумулятор разряжается, тем больше тепла выделяется. Это тепло может привести к выходу из строя устройств. Таким образом, чтобы сохранить аккумулятор и транспортное средство в безопасности, потребность в надлежащей системе терморегулирования стала необходимой для повышения спроса на нее на рынке.

- Высокие первоначальные затраты

Электромобили лучше всего подходят для транспортировки, а также они будут оказывать меньшее воздействие на окружающую среду, поскольку они помогут контролировать загрязнение воздуха. Однако первоначальная стоимость электромобилей выше, чем у автомобилей с бензиновым двигателем, поскольку они включают в себя технологически усовершенствованные компоненты, которые не наносят вреда окружающей среде. Напротив, эксплуатационные расходы электромобилей ниже, чем у автомобилей с бензиновым двигателем. Таким образом, первоначальная стоимость электромобилей может ограничить рост рынка.

- Производительность аккумулятора в различных условиях окружающей среды

Аккумулятор представляет собой электрохимическую систему, которая включает реакции и транспортировку ионов и электронов. Скорость зарядки/разрядки или механизм деградации аккумулятора зависит от изменения температуры. Например, высокая температура окружающей среды допускает относительно высокую скорость зарядки, но также увеличивает скорость роста SEI (твердоэлектролитный интерфейс), что сокращает срок службы аккумулятора. С другой стороны, низкая температура окружающей среды замедляет рост SEI, но это способствует литиевому покрытию. В результате аккумуляторы можно оптимизировать как для высоких, так и для низких температур, но поддержание одинаковой производительности при разных температурах может быть проблематичным. Таким образом, эти факторы могут стать серьезной проблемой для рынка систем терморегулирования электромобилей в Азиатско-Тихоокеанском регионе.

Влияние COVID-19 на рынок систем терморегулирования электромобилей в Азиатско-Тихоокеанском регионе

COVID-19 оказал серьезное влияние на рынок систем терморегулирования электромобилей, поскольку почти каждая страна решила закрыть все производственные мощности, за исключением тех, которые занимаются производством товаров первой необходимости. Правительство приняло ряд строгих мер, таких как закрытие производства и продажи неосновных товаров, блокировка международной торговли и многое другое, чтобы предотвратить распространение COVID-19. Единственным бизнесом, работающим в этой пандемической ситуации, являются основные службы, которым разрешено открыться и запустить процессы.

Рост рынка систем терморегулирования электромобилей растет из-за правительственной политики, направленной на поддержку роста электромобилей. Кроме того, возросшая обеспокоенность по поводу устойчивости и экологических проблем увеличивает спрос на электромобили на рынке. Таким образом, правительственные постановления и стимулы, вероятно, будут способствовать росту рынка. Однако такие факторы, как высокая начальная стоимость электромобиля и сложность проектирования решения по терморегулированию, сдерживают рост рынка. Остановка производственных предприятий во время пандемии оказала значительное влияние на рынок.

Производители принимают различные стратегические решения, чтобы оправиться после COVID-19. Игроки проводят многочисленные исследования и разработки для улучшения технологий, задействованных в системе терморегулирования электромобилей. С этим компании выведут на рынок передовые и точные контроллеры. Кроме того, правительственные инициативы по внедрению электромобилей привели к росту рынка

Последние события

- В декабре 2021 года компания Continental AG объявила о получении первого заказа на высокопроизводительный компьютер (HPC) для автомобиля от крупного китайского производителя автомобилей. HPC будет управлять передачей данных, обновлениями по беспроводной связи, а также управлением крутящим моментом и температурой. В рамках этого соглашения компания предоставит своему клиенту аппаратное обеспечение HPC, базовое программное обеспечение, услуги по интеграции и проектирование архитектуры. Таким образом, компания сделает шаг к центральным кросс-доменным вычислительным решениям для будущей мобильности

- В сентябре 2021 года компания MAHLE GmbH объявила о разработке совершенно новой системы охлаждения аккумуляторов. Эта новая система охлаждения Immersion сокращает время зарядки электромобилей. Кроме того, эта система делает аккумуляторы более компактными, делая электромобили более дешевыми и ресурсоэффективными. Таким образом, компания глубоко проникает на рынок электромобильности

Масштаб рынка систем терморегулирования электромобилей в Азиатско-Тихоокеанском регионе

Рынок систем терморегулирования электромобилей в Азиатско-Тихоокеанском регионе сегментирован по типу двигателя, технологии, типу батареи, емкости батареи, типу транспортного средства и типу системы. Рост среди этих сегментов поможет вам проанализировать сегменты с незначительным ростом в отраслях и предоставить пользователям ценный обзор рынка и рыночные идеи, которые помогут им принимать стратегические решения для определения основных рыночных приложений.

Тип движителя

- БЭВ

- PHEV

- HEV

- ФКВ

В зависимости от типа силовой установки рынок систем терморегулирования электромобилей в Азиатско-Тихоокеанском регионе сегментируется на BEV, PHEV, HEV и FCV.

Технологии

- Активный

- Пассивный

По технологическому признаку рынок систем терморегулирования электромобилей в Азиатско-Тихоокеанском регионе сегментирован на активные и пассивные.

Тип батареи

- Общепринятый

- Твердотельный

В зависимости от типа аккумулятора рынок систем терморегулирования электромобилей в Азиатско-Тихоокеанском регионе сегментирован на традиционные и твердотельные.

Емкость аккумулятора

- 30-60 кВтч

- 60-90 кВтч

- Менее 30 кВтч

- Более 90 кВтч

На основе емкости аккумулятора рынок систем терморегулирования электромобилей в Азиатско-Тихоокеанском регионе сегментирован на 30–60 кВт·ч, 60–90 кВт·ч, менее 30 кВт·ч и более 90 кВт·ч.

Тип транспортного средства

- Пассажир

- Коммерческий

В зависимости от типа транспортного средства рынок систем терморегулирования электромобилей в Азиатско-Тихоокеанском регионе сегментирован на легковые и коммерческие.

Тип системы

- Управление температурой аккумулятора

- ОВиК

- Силовая установка

- Другие

По типу системы рынок систем терморегулирования электромобилей в Азиатско-Тихоокеанском регионе сегментирован на системы терморегулирования аккумуляторных батарей, системы отопления, вентиляции и кондиционирования воздуха, силовые агрегаты и другие.

Региональный анализ/информация о рынке систем терморегулирования электромобилей в Азиатско-Тихоокеанском регионе

Проведен анализ рынка систем терморегулирования электромобилей в Азиатско-Тихоокеанском регионе, а также предоставлены сведения о размерах рынка и тенденциях по странам, типу двигателя, технологии, типу аккумулятора, емкости аккумулятора, типу транспортного средства и типу системы, как указано выше.

В отчете о рынке систем терморегулирования электромобилей в Азиатско-Тихоокеанском регионе рассматриваются такие страны, как Китай, Япония, Индия, Южная Корея, Сингапур, Малайзия, Австралия, Таиланд, Индонезия, Филиппины и остальные страны Азиатско-Тихоокеанского региона.

Китай, вероятно, станет самым быстрорастущим рынком систем терморегулирования электромобилей в Азиатско-Тихоокеанском регионе. Рост инфраструктуры, коммерческих и промышленных разработок в развивающихся странах, таких как Китай, Япония, Индия и Южная Корея, приписывают доминированию рынка. Китай доминирует в Азиатско-Тихоокеанском регионе благодаря высоким производственным и аутсорсинговым производственным мощностям аккумуляторных продуктов и высокому уровню внедрения электромобилей.

Раздел отчета по странам также содержит отдельные факторы, влияющие на рынок, и изменения в регулировании рынка, которые влияют на текущие и будущие тенденции рынка. Такие данные, как анализ цепочки создания стоимости сверху и снизу, технические тенденции и анализ пяти сил Портера, тематические исследования, являются некоторыми из указателей, используемых для прогнозирования рыночного сценария для отдельных стран. Кроме того, при предоставлении прогнозного анализа данных по странам учитываются наличие и доступность брендов Азиатско-Тихоокеанского региона и их проблемы, связанные с большой или малой конкуренцией со стороны местных и отечественных брендов, влияние внутренних тарифов и торговые пути.

Анализ конкурентной среды и доли рынка систем терморегулирования электромобилей в Азиатско-Тихоокеанском регионе

Конкурентная среда рынка систем терморегулирования электромобилей в Азиатско-Тихоокеанском регионе содержит подробную информацию по конкурентам. Включены следующие сведения: обзор компании, финансовые показатели компании, полученный доход, рыночный потенциал, инвестиции в исследования и разработки, новые рыночные инициативы, присутствие в Азиатско-Тихоокеанском регионе, производственные площадки и объекты, производственные мощности, сильные и слабые стороны компании, запуск продукта, широта и широта продукта, доминирование в применении. Вышеуказанные пункты данных связаны только с фокусом компаний на рынке систем терморегулирования электромобилей в Азиатско-Тихоокеанском регионе.

Некоторые из основных игроков, работающих на рынке систем терморегулирования электромобилей в Азиатско-Тихоокеанском регионе:

- МАХЛЕ ГмбХ

- Валео

- Дана Лимитед

- Системы Ханон

- Марелли Холдингс Ко., Лтд.

- Роберт Бош ГмбХ

- BorgWarner Inc.

- Континентальный АГ

- VOSS Automotive GmbH

- Кендрион, Невада

- LG Хим

- Корпорация ДЕНСО

- Группа компаний НОРМА

- ПРОИЗВОДСТВЕННАЯ КОМПАНИЯ МОДИН

- ГЕНТЕРМ

- А. КАЙЗЕР АУТОМОТИВ СИСТЕМС ГмбХ

- Технология Ymer

- Грейсон

Методология исследования: Азиатско-Тихоокеанский рынок систем терморегулирования электромобилей

Сбор данных и анализ базового года выполняется с использованием модулей сбора данных с большими размерами выборки. Этап включает получение рыночной информации или связанных данных из различных источников и стратегий. Он включает изучение и планирование всех данных, полученных из прошлого заранее. Он также охватывает изучение несоответствий информации, наблюдаемых в различных источниках информации. Рыночные данные анализируются и оцениваются с использованием статистических и последовательных моделей рынка. Кроме того, анализ доли рынка и анализ ключевых тенденций являются основными факторами успеха в рыночном отчете. Чтобы узнать больше, запросите звонок аналитика или оставьте свой запрос.

Ключевой методологией исследования, используемой исследовательской группой DBMR, является триангуляция данных, которая включает в себя интеллектуальный анализ данных, анализ влияния переменных данных на рынок и первичную (отраслевую экспертную) проверку. Помимо этого, модели данных включают сетку позиционирования поставщиков, анализ временной линии рынка, обзор рынка и руководство, сетку позиционирования компании, патентный анализ, анализ цен, анализ доли рынка компании, стандарты измерения, Азиатско-Тихоокеанский регион в сравнении с региональным и анализ доли поставщиков. Чтобы узнать больше о методологии исследования, отправьте запрос, чтобы поговорить с нашими отраслевыми экспертами.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Интерактивная панель анализа данных

- Панель анализа компании для возможностей с высоким потенциалом роста

- Доступ аналитика-исследователя для настройки и запросов

- Анализ конкурентов с помощью интерактивной панели

- Последние новости, обновления и анализ тенденций

- Используйте возможности сравнительного анализа для комплексного отслеживания конкурентов

Содержание

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF ASIA PACIFIC ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 THE CHALLENGE MATRIX MARKET

2.9 MULTIVARIATE MODELING

2.1 PROPULSION TYPE TIMELINE CURVE

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 BATTERY COOLING LINES FOR ELECTRIC AND HYBRID VEHICLES (MATERIAL)

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 INCREASING DEMAND FOR ELECTRIC VEHICLES

5.1.2 INCENTIVES AND SUBSIDIES BY THE GOVERNMENT FOR ELECTRIC VEHICLES

5.1.3 INCREASING ENVIRONMENTAL CONCERNS

5.1.4 RISING DEMAND FOR THERMAL COOLING SOLUTIONS

5.1.5 GOVERNMENT INITIATIVES TO REDUCE EMISSION LEVELS

5.2 RESTRAINTS

5.2.1 HIGH UPFRONT COST

5.2.2 DESIGN COMPLEXITIES OF THE COMPONENTS

5.3 OPPORTUNITIES

5.3.1 INCREASE IN VARIOUS STRATEGIC DECISIONS BY THE COMPANIES

5.3.2 ADOPTION OF NEW TECHNOLOGIES IN LITHIUM-ION BATTERIES

5.4 CHALLENGES

5.4.1 BATTERY PERFORMANCE IN DIFFERENT ENVIRONMENTAL CONDITIONS

5.4.2 LACK OF CHARGING INFRASTRUCTURE FOR ELECTRIC VEHICLES IN UNDERDEVELOPED COUNTRIES

6 ASIA PACIFIC ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY PROPULSION TYPE

6.1 OVERVIEW

6.2 BEV

6.3 PHEV

6.4 HEV

6.5 FCV

7 ASIA PACIFIC ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY TECHNOLOGY

7.1 OVERVIEW

7.2 ACTIVE

7.3 PASSIVE

8 ASIA PACIFIC ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY BATTERY TYPE

8.1 OVERVIEW

8.2 CONVENTIONAL

8.3 SOLID-STATE

9 ASIA PACIFIC ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY BATTERY CAPACITY

9.1 OVERVIEW

9.2 30-60 KWH

9.3 60-90 KWH

9.4 BELOW 30 KWH

9.5 ABOVE 90 KWH

10 ASIA PACIFIC ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY VEHICLE TYPE

10.1 OVERVIEW

10.2 PASSENGER

10.2.1 BEV

10.2.2 PHEV

10.2.3 HEV

10.2.4 FCV

10.3 COMMERCIAL

10.3.1 BEV

10.3.2 PHEV

10.3.3 HEV

10.3.4 FCV

11 ASIA PACIFIC ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY SYSTEM TYPE

11.1 OVERVIEW

11.2 BATTERY THERMAL MANAGEMENT SYSTEM

11.3 HVAC

11.4 POWERTRAIN

11.5 OTHERS

12 ASIA PACIFIC ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY REGION

12.1 ASIA-PACIFIC

12.1.1 CHINA

12.1.2 SOUTH KOREA

12.1.3 JAPAN

12.1.4 INDIA

12.1.5 AUSTRALIA

12.1.6 SINGAPORE

12.1.7 THAILAND

12.1.8 MALAYSIA

12.1.9 INDONESIA

12.1.10 PHILIPPINES

12.1.11 REST OF ASIA-PACIFIC

13 ASIA PACIFIC ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET: COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: ASIA PACIFIC

14 SWOT ANALYSIS

15 COMPANY PROFILE

15.1 MAHLE GMBH

15.1.1 COMPANY SNAPSHOT

15.1.2 REVENUE ANALYSIS

15.1.3 COMPANY SHARE ANALYSIS

15.1.4 PRODUCT PORTFOLIO

15.1.5 RECENT DEVELOPMENTS

15.2 VALEO

15.2.1 COMPANY SNAPSHOT

15.2.2 REVENUE ANALYSIS

15.2.3 COMPANY SHARE ANALYSIS

15.2.4 PRODUCT PORTFOLIO

15.2.5 RECENT DEVELOPMENT

15.3 DANA LIMITED

15.3.1 COMPANY SNAPSHOT

15.3.2 REVENUE ANALYSIS

15.3.3 COMPANY SHARE ANALYSIS

15.3.4 PRODUCT PORTFOLIO

15.3.5 RECENT DEVELOPMENTS

15.4 HANON SYSTEMS

15.4.1 COMPANY SNAPSHOT

15.4.2 REVENUE ANALYSIS

15.4.3 COMPANY SHARE ANALYSIS

15.4.4 PRODUCT PORTFOLIO

15.4.5 RECENT DEVELOPMENT

15.5 MARELLI HOLDINGS CO., LTD.

15.5.1 COMPANY SNAPSHOT

15.5.2 COMPANY SHARE ANALYSIS

15.5.3 PRODUCT PORTFOLIO

15.5.4 RECENT DEVELOPMENTS

15.6 A. KAYSER AUTOMOTIVE SYSTEMS GMBH

15.6.1 COMPANY SNAPSHOT

15.6.2 PRODUCT PORTFOLIO

15.6.3 RECENT DEVELOPMENT

15.7 BORGWARNER INC.

15.7.1 COMPANY SNAPSHOT

15.7.2 REVENUE ANALYSIS

15.7.3 PRODUCT PORTFOLIO

15.7.4 RECENT DEVELOPMENTS

15.8 CONTINENTAL AG

15.8.1 COMPANY SNAPSHOT

15.8.2 REVENUE ANALYSIS

15.8.3 PRODUCT PORTFOLIO

15.8.4 RECENT DEVELOPMENTS

15.9 DENSO CORPORATION

15.9.1 COMPANY SNAPSHOT

15.9.2 REVENUE ANALYSIS

15.9.3 PRODUCT PORTFOLIO

15.9.4 RECENT DEVELOPMENTS

15.1 GENTHERM

15.10.1 COMPANY SNAPSHOT

15.10.2 REVENUE ANALYSIS

15.10.3 PRODUCT PORTFOLIO

15.10.4 RECENT DEVELOPMENTS

15.11 GRAYSON

15.11.1 COMPANY SNAPSHOT

15.11.2 PRODUCT PORTFOLIO

15.11.3 RECENT DEVELOPMENT

15.12 KENDRION N.V.

15.12.1 COMPANY SNAPSHOT

15.12.2 REVENUE ANALYSIS

15.12.3 PRODUCT PORTFOLIO

15.12.4 RECENT DEVELOPMENT

15.13 LG CHEM

15.13.1 COMPANY SNAPSHOT

15.13.2 REVENUE ANALYSIS

15.13.3 PRODUCT PORTFOLIO

15.13.4 RECENT DEVELOPMENT

15.14 MODINE MANUFACTURING COMPANY

15.14.1 COMPANY SNAPSHOT

15.14.2 REVENUE ANALYSIS

15.14.3 PRODUCT PORTFOLIO

15.14.4 RECENT DEVELOPMENT

15.15 NORMA GROUP

15.15.1 COMPANY SNAPSHOT

15.15.2 REVENUE ANALYSIS

15.15.3 PRODUCT PORTFOLIO

15.15.4 RECENT DEVELOPMENTS

15.16 ROBERT BOSCH GMBH

15.16.1 COMPANY SNAPSHOT

15.16.2 REVENUE ANALYSIS

15.16.3 PRODUCT PORTFOLIO

15.16.4 RECENT DEVELOPMENT

15.17 VOSS AUTOMOTIVE GMBH

15.17.1 COMPANY SNAPSHOT

15.17.2 PRODUCT PORTFOLIO

15.17.3 RECENT DEVELOPMENT

15.18 YMER TECHNOLOGY

15.18.1 COMPANY SNAPSHOT

15.18.2 PRODUCT PORTFOLIO

15.18.3 RECENT DEVELOPMENT

16 QUESTIONNAIRE

17 RELATED REPORTS

Список таблиц

TABLE 1 LEVEL OF PRESENCE OF AIR POLLUTANTS IN MAJOR CITIES OF THE WORLD

TABLE 2 ASIA PACIFIC ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY PROPULSION TYPE, 2020-2029 (USD MILLION)

TABLE 3 ASIA PACIFIC BEV IN ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 4 ASIA PACIFIC PHEV IN ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 5 ASIA PACIFIC HEV IN ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 6 ASIA PACIFIC FCV IN ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 7 ASIA PACIFIC ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 8 ASIA PACIFIC ACTIVE IN ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 9 ASIA PACIFIC PASSIVE IN ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 10 ASIA PACIFIC ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY BATTERY TYPE, 2020-2029 (USD MILLION)

TABLE 11 ASIA PACIFIC CONVENTIONAL IN ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 12 ASIA PACIFIC SOLID-STATE IN ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 13 ASIA PACIFIC ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY BATTERY CAPACITY, 2020-2029 (USD MILLION)

TABLE 14 ASIA PACIFIC 30-60 KWH IN ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 15 ASIA PACIFIC 60-90 KWH IN ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 16 ASIA PACIFIC BELOW 30 KWH IN ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 17 ASIA PACIFIC ABOVE 90 KWH IN ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 18 ASIA PACIFIC ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 19 ASIA PACIFIC PASSENGER IN ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 20 ASIA PACIFIC PASSENGER IN ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY PROPULSION TYPE, 2020-2029 (USD MILLION)

TABLE 21 ASIA PACIFIC COMMERCIAL IN ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY REGION, 2020-2029 (USD MILLION

TABLE 22 ASIA PACIFIC COMMERCIAL IN ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY PROPULSION TYPE, 2020-2029 (USD MILLION)

TABLE 23 ASIA PACIFIC ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY SYSTEM TYPE, 2020-2029 (USD MILLION)

TABLE 24 ASIA PACIFIC BATTERY THERMAL MANAGEMENT SYSTEM IN ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 25 ASIA PACIFIC HVAC IN ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY REGION, 2020-2029 (USD MILLION

TABLE 26 ASIA PACIFIC POWERTRAIN IN ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY REGION, 2020-2029 (USD MILLION

TABLE 27 ASIA PACIFIC OTHERS IN ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY REGION, 2020-2029 (USD MILLION

TABLE 28 ASIA-PACIFIC ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 29 ASIA-PACIFIC ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY PROPULSION TYPE, 2020-2029 (USD MILLION)

TABLE 30 ASIA-PACIFIC ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 31 ASIA-PACIFIC ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY BATTERY TYPE, 2020-2029 (USD MILLION)

TABLE 32 ASIA-PACIFIC ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY BATTERY CAPACITY, 2020-2029 (USD MILLION)

TABLE 33 ASIA-PACIFIC ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 34 ASIA-PACIFIC PASSENGER IN ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY PROPULSION TYPE, 2020-2029 (USD MILLION)

TABLE 35 ASIA-PACIFIC COMMERCIAL IN ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY PROPULSION TYPE, 2020-2029 (USD MILLION)

TABLE 36 ASIA-PACIFIC ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY SYSTEM TYPE, 2020-2029 (USD MILLION)

TABLE 37 CHINA ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY PROPULSION TYPE, 2020-2029 (USD MILLION)

TABLE 38 CHINA ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 39 CHINA ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY BATTERY TYPE, 2020-2029 (USD MILLION)

TABLE 40 CHINA ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY BATTERY CAPACITY, 2020-2029 (USD MILLION)

TABLE 41 CHINA ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 42 CHINA PASSENGER IN ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY PROPULSION TYPE, 2020-2029 (USD MILLION)

TABLE 43 CHINA COMMERCIAL IN ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY PROPULSION TYPE, 2020-2029 (USD MILLION)

TABLE 44 CHINA ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY SYSTEM TYPE, 2020-2029 (USD MILLION)

TABLE 45 SOUTH KOREA ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY PROPULSION TYPE, 2020-2029 (USD MILLION)

TABLE 46 SOUTH KOREA ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 47 SOUTH KOREA ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY BATTERY TYPE, 2020-2029 (USD MILLION)

TABLE 48 SOUTH KOREA ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY BATTERY CAPACITY, 2020-2029 (USD MILLION)

TABLE 49 SOUTH KOREA ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 50 SOUTH KOREA PASSENGER IN ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY PROPULSION TYPE, 2020-2029 (USD MILLION)

TABLE 51 SOUTH KOREA COMMERCIAL IN ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY PROPULSION TYPE, 2020-2029 (USD MILLION)

TABLE 52 SOUTH KOREA ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY SYSTEM TYPE, 2020-2029 (USD MILLION)

TABLE 53 JAPAN ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY PROPULSION TYPE, 2020-2029 (USD MILLION)

TABLE 54 JAPAN ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 55 JAPAN ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY BATTERY TYPE, 2020-2029 (USD MILLION)

TABLE 56 JAPAN ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY BATTERY CAPACITY, 2020-2029 (USD MILLION)

TABLE 57 JAPAN ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 58 JAPAN PASSENGER IN ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY PROPULSION TYPE, 2020-2029 (USD MILLION)

TABLE 59 JAPAN COMMERCIAL IN ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY PROPULSION TYPE, 2020-2029 (USD MILLION)

TABLE 60 JAPAN ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY SYSTEM TYPE, 2020-2029 (USD MILLION)

TABLE 61 INDIA ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY PROPULSION TYPE, 2020-2029 (USD MILLION)

TABLE 62 INDIA ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 63 INDIA ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY BATTERY TYPE, 2020-2029 (USD MILLION)

TABLE 64 INDIA ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY BATTERY CAPACITY, 2020-2029 (USD MILLION)

TABLE 65 INDIA ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 66 INDIA PASSENGER IN ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY PROPULSION TYPE, 2020-2029 (USD MILLION)

TABLE 67 INDIA COMMERCIAL IN ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY PROPULSION TYPE, 2020-2029 (USD MILLION)

TABLE 68 INDIA ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY SYSTEM TYPE, 2020-2029 (USD MILLION)

TABLE 69 AUSTRALIA ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY PROPULSION TYPE, 2020-2029 (USD MILLION)

TABLE 70 AUSTRALIA ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 71 AUSTRALIA ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY BATTERY TYPE, 2020-2029 (USD MILLION)

TABLE 72 AUSTRALIA ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY BATTERY CAPACITY, 2020-2029 (USD MILLION)

TABLE 73 AUSTRALIA ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 74 AUSTRALIA PASSENGER IN ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY PROPULSION TYPE, 2020-2029 (USD MILLION)

TABLE 75 AUSTRALIA COMMERCIAL IN ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY PROPULSION TYPE, 2020-2029 (USD MILLION)

TABLE 76 AUSTRALIA ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY SYSTEM TYPE, 2020-2029 (USD MILLION)

TABLE 77 SINGAPORE ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY PROPULSION TYPE, 2020-2029 (USD MILLION)

TABLE 78 SINGAPORE ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 79 SINGAPORE ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY BATTERY TYPE, 2020-2029 (USD MILLION)

TABLE 80 SINGAPORE ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY BATTERY CAPACITY, 2020-2029 (USD MILLION)

TABLE 81 SINGAPORE ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 82 SINGAPORE PASSENGER IN ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY PROPULSION TYPE, 2020-2029 (USD MILLION)

TABLE 83 SINGAPORE COMMERCIAL IN ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY PROPULSION TYPE, 2020-2029 (USD MILLION)

TABLE 84 SINGAPORE ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY SYSTEM TYPE, 2020-2029 (USD MILLION)

TABLE 85 THAILAND ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY PROPULSION TYPE, 2020-2029 (USD MILLION)

TABLE 86 THAILAND ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 87 THAILAND ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY BATTERY TYPE, 2020-2029 (USD MILLION)

TABLE 88 THAILAND ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY BATTERY CAPACITY, 2020-2029 (USD MILLION)

TABLE 89 THAILAND ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 90 THAILAND PASSENGER IN ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY PROPULSION TYPE, 2020-2029 (USD MILLION)

TABLE 91 THAILAND COMMERCIAL IN ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY PROPULSION TYPE, 2020-2029 (USD MILLION)

TABLE 92 THAILAND ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY SYSTEM TYPE, 2020-2029 (USD MILLION)

TABLE 93 MALAYSIA ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY PROPULSION TYPE, 2020-2029 (USD MILLION)

TABLE 94 MALAYSIA ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 95 MALAYSIA ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY BATTERY TYPE, 2020-2029 (USD MILLION)

TABLE 96 MALAYSIA ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY BATTERY CAPACITY, 2020-2029 (USD MILLION)

TABLE 97 MALAYSIA ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 98 MALAYSIA PASSENGER IN ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY PROPULSION TYPE, 2020-2029 (USD MILLION)

TABLE 99 MALAYSIA COMMERCIAL IN ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY PROPULSION TYPE, 2020-2029 (USD MILLION)

TABLE 100 MALAYSIA ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY SYSTEM TYPE, 2020-2029 (USD MILLION)

TABLE 101 INDONESIA ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY PROPULSION TYPE, 2020-2029 (USD MILLION)

TABLE 102 INDONESIA ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 103 INDONESIA ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY BATTERY TYPE, 2020-2029 (USD MILLION)

TABLE 104 INDONESIA ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY BATTERY CAPACITY, 2020-2029 (USD MILLION)

TABLE 105 INDONESIA ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 106 INDONESIA PASSENGER IN ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY PROPULSION TYPE, 2020-2029 (USD MILLION)

TABLE 107 INDONESIA COMMERCIAL IN ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY PROPULSION TYPE, 2020-2029 (USD MILLION)

TABLE 108 INDONESIA ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY SYSTEM TYPE, 2020-2029 (USD MILLION)

TABLE 109 PHILIPPINES ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY PROPULSION TYPE, 2020-2029 (USD MILLION)

TABLE 110 PHILIPPINES ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 111 PHILIPPINES ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY BATTERY TYPE, 2020-2029 (USD MILLION)

TABLE 112 PHILIPPINES ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY BATTERY CAPACITY, 2020-2029 (USD MILLION)

TABLE 113 PHILIPPINES ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 114 PHILIPPINES PASSENGER IN ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY PROPULSION TYPE, 2020-2029 (USD MILLION)

TABLE 115 PHILIPPINES COMMERCIAL IN ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY PROPULSION TYPE, 2020-2029 (USD MILLION)

TABLE 116 PHILIPPINES ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY SYSTEM TYPE, 2020-2029 (USD MILLION)

TABLE 117 REST OF ASIA-PACIFIC ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY PROPULSION TYPE, 2020-2029 (USD MILLION)

Список рисунков

FIGURE 1 ASIA PACIFIC ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET: SEGMENTATION

FIGURE 2 ASIA PACIFIC ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET: DATA TRIANGULATION

FIGURE 3 ASIA PACIFIC ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET: DROC ANALYSIS

FIGURE 4 ASIA PACIFIC ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET: ASIA PACIFIC VS REGIONAL MARKET ANALYSIS

FIGURE 5 ASIA PACIFIC ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 ASIA PACIFIC ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 ASIA PACIFIC ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET: DBMR MARKET POSITION GRID

FIGURE 8 ASIA PACIFIC ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 ASIA PACIFIC ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET: SEGMENTATION

FIGURE 10 INCREASING DEMAND FOR ELECTRIC VEHICLES IS EXPECTED TO DRIVE THE ASIA PACIFIC ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 11 BEV PROPULSION TYPE SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE ASIA PACIFIC ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET IN 2022 & 2029

FIGURE 12 ASIA-PACIFIC IS EXPECTED TO DOMINATE AND IS THE FASTEST-GROWING REGION IN THE ASIA PACIFIC ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF ASIA PACIFIC ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET

FIGURE 14 ASIA PACIFIC ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET: BY PROPULSION TYPE 2021

FIGURE 15 ASIA PACIFIC ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET: BY TECHNOLOGY, 2021

FIGURE 16 ASIA PACIFIC ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET: BY BATTERY TYPE, 2021

FIGURE 17 ASIA PACIFIC ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET: BY BATTERY CAPACITY, 2021

FIGURE 18 ASIA PACIFIC ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET: BY VEHICLE TYPE, 2021

FIGURE 19 ASIA PACIFIC ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET: BY SYSTEM TYPE, 2021

FIGURE 20 ASIA-PACIFIC ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET: SNAPSHOT (2021)

FIGURE 21 ASIA-PACIFIC ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET: BY COUNTRY (2021)

FIGURE 22 ASIA-PACIFIC ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET: BY COUNTRY (2022 & 2029)

FIGURE 23 ASIA-PACIFIC ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET: BY COUNTRY (2021 & 2029)

FIGURE 24 ASIA-PACIFIC ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET: BY PROPULSION TYPE (2022-2029)

FIGURE 25 ASIA PACIFIC ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET: COMPANY SHARE 2021 (%)

Методология исследования

Сбор данных и анализ базового года выполняются с использованием модулей сбора данных с большими размерами выборки. Этап включает получение рыночной информации или связанных данных из различных источников и стратегий. Он включает изучение и планирование всех данных, полученных из прошлого заранее. Он также охватывает изучение несоответствий информации, наблюдаемых в различных источниках информации. Рыночные данные анализируются и оцениваются с использованием статистических и последовательных моделей рынка. Кроме того, анализ доли рынка и анализ ключевых тенденций являются основными факторами успеха в отчете о рынке. Чтобы узнать больше, пожалуйста, запросите звонок аналитика или оставьте свой запрос.

Ключевой методологией исследования, используемой исследовательской группой DBMR, является триангуляция данных, которая включает в себя интеллектуальный анализ данных, анализ влияния переменных данных на рынок и первичную (отраслевую экспертную) проверку. Модели данных включают сетку позиционирования поставщиков, анализ временной линии рынка, обзор рынка и руководство, сетку позиционирования компании, патентный анализ, анализ цен, анализ доли рынка компании, стандарты измерения, глобальный и региональный анализ и анализ доли поставщика. Чтобы узнать больше о методологии исследования, отправьте запрос, чтобы поговорить с нашими отраслевыми экспертами.

Доступна настройка

Data Bridge Market Research является лидером в области передовых формативных исследований. Мы гордимся тем, что предоставляем нашим существующим и новым клиентам данные и анализ, которые соответствуют и подходят их целям. Отчет можно настроить, включив в него анализ ценовых тенденций целевых брендов, понимание рынка для дополнительных стран (запросите список стран), данные о результатах клинических испытаний, обзор литературы, обновленный анализ рынка и продуктовой базы. Анализ рынка целевых конкурентов можно проанализировать от анализа на основе технологий до стратегий портфеля рынка. Мы можем добавить столько конкурентов, о которых вам нужны данные в нужном вам формате и стиле данных. Наша команда аналитиков также может предоставить вам данные в сырых файлах Excel, сводных таблицах (книга фактов) или помочь вам в создании презентаций из наборов данных, доступных в отчете.