Asia Pacific Distributed Antenna System Das Market

Размер рынка в млрд долларов США

CAGR :

%

USD

10.72 Billion

USD

30.69 Billion

2024

2032

USD

10.72 Billion

USD

30.69 Billion

2024

2032

| 2025 –2032 | |

| USD 10.72 Billion | |

| USD 30.69 Billion | |

|

|

|

|

Рынок распределенных антенных систем (DAS) в Азиатско-Тихоокеанском регионе по предложению (оборудование и услуги), покрытию (внутреннее и внешнее), владению (оператор, нейтральный хост и предприятие), технологии (операторский Wi-Fi и малые соты), пользовательскому оборудованию (500 тыс. FT2, 200–500 тыс. FT2 и

Размер рынка распределенных антенных систем (DAS) в Азиатско-Тихоокеанском регионе

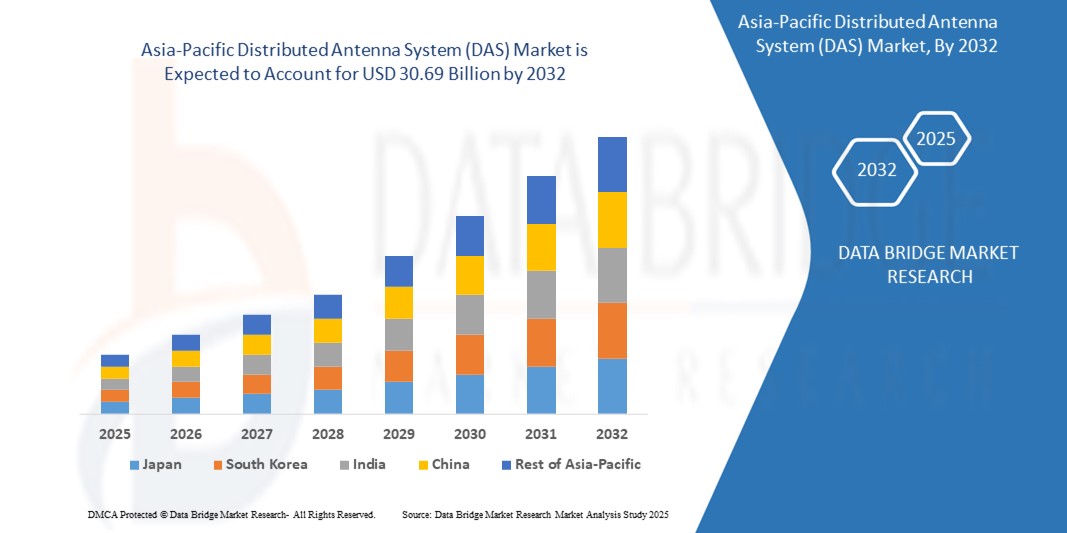

- Объем рынка распределенных антенных систем (DAS) в Азиатско-Тихоокеанском регионе оценивался в 10,72 млрд долларов США в 2024 году и, как ожидается , достигнет 30,69 млрд долларов США к 2032 году при среднегодовом темпе роста 16,2% в течение прогнозируемого периода.

- Рынок распределенных антенных систем (DAS) в Азиатско-Тихоокеанском регионе обусловлен быстрой урбанизацией, что приводит к появлению густонаселенных районов с высоким спросом на бесперебойную и высококачественную беспроводную связь.

Анализ рынка распределенных антенных систем (DAS) в Азиатско-Тихоокеанском регионе

- Крупные мегаполисы Азиатско-Тихоокеанского региона, такие как Шанхай, Токио, Мумбаи и Сингапур, переживают беспрецедентный рост населения и урбанизацию. Этот всплеск оказывает огромное давление на существующую беспроводную инфраструктуру, что приводит к перегрузке сети и пробелам в покрытии.

- Развертывание сетей 5G по всему региону еще больше усилило спрос на решения DAS. Технология 5G обещает более высокую скорость передачи данных, меньшую задержку и большую емкость сети, что требует развертывания DAS для улучшения внутреннего и наружного покрытия, особенно в густонаселенных городских районах.

- Ожидается, что Китай будет доминировать на рынке распределенных антенных систем (DAS) в Азиатско-Тихоокеанском регионе из-за своей прочной промышленной базы, растущего числа пользователей смартфонов и распространения устройств IoT, что обуславливает необходимость в надежном внутреннем и наружном беспроводном покрытии. Решения DAS имеют решающее значение для эффективного распределения сигналов в этих средах, решая проблемы, связанные с высотными зданиями и многолюдными пространствами.

- Ожидается, что Индия станет самым быстрорастущим регионом на рынке LNA в Азиатско-Тихоокеанском регионе в течение прогнозируемого периода. Этот рост поддерживается экспоненциальным ростом трафика мобильных данных, вызванным ростом использования смартфонов и приложений с интенсивным использованием данных, что требует повышения пропускной способности и покрытия сети.

- Ожидается, что сегмент оборудования будет доминировать на рынке распределенных антенных систем (DAS) в Азиатско-Тихоокеанском регионе с долей рынка 54,23% в прогнозируемый период. Азиатско-Тихоокеанский регион переживает быструю урбанизацию и значительное расширение своей телекоммуникационной инфраструктуры, включая агрессивное развертывание сетей 4G и 5G. Это требует существенных инвестиций в аппаратные компоненты, такие как антенны, радиоблоки, кабели и головные станции, для создания и улучшения покрытия и пропускной способности сети.

Область применения отчета и сегментация рынка распределенных антенных систем (DAS) в Азиатско-Тихоокеанском регионе

|

Атрибуты |

Обзор рынка распределенных антенных систем (DAS) в Азиатско-Тихоокеанском регионе |

|

Охваченные сегменты |

|

|

Страны, охваченные |

Азиатско-Тихоокеанский регион

|

|

Ключевые игроки рынка |

|

|

Возможности рынка |

|

|

Информационные наборы данных с добавленной стоимостью |

Помимо информации о рыночных сценариях, таких как рыночная стоимость, темпы роста, сегментация, географический охват и основные игроки, рыночные отчеты, подготовленные Data Bridge Market Research, также включают анализ импорта и экспорта, обзор производственных мощностей, анализ потребления продукции, анализ ценовых тенденций, сценарий изменения климата, анализ цепочки поставок, анализ цепочки создания стоимости, обзор сырья и расходных материалов, критерии выбора поставщиков, анализ PESTLE, анализ Портера и нормативную базу. |

Тенденции рынка распределенных антенных систем (DAS) в Азиатско-Тихоокеанском регионе

«Внедрение ИИ и машинного обучения для обнаружения аномалий в реальном времени»

- В связи с быстрой урбанизацией в Азиатско-Тихоокеанском регионе существует значительная потребность в улучшенном покрытии внутри помещений в коммерческих зданиях, торговых центрах, больницах, аэропортах и жилых комплексах. Решения DAS для помещений имеют решающее значение для обеспечения надежной связи в этих средах с высокой плотностью.

- Современные строительные материалы часто препятствуют прохождению беспроводных сигналов на открытом воздухе, поэтому внутренние системы DAS необходимы для обеспечения бесперебойной работы мобильной связи внутри зданий.

- Например, в январе 2024 года Nokia и China Mobile совместно разработали недорогую гибридную распределенную внутреннюю систему 5G. Эта система использует систему удаленной радиосвязи 5G Pico Remote Radio Head от Nokia, пассивные антенны DAS и технологию Bluetooth Low Energy (BLE) для решения проблем покрытия 5G в помещениях. (Источник: Mordor Intelligence, вероятная дата до января 2024 года, поскольку в статье упоминаются данные за декабрь 2022 года).

- Растущий спрос на упреждающий надзор, более строгие нормативные рамки и расширение цифровой торговли в различных классах активов способствуют формированию более прозрачной и соответствующей требованиям финансовой экосистемы.

Динамика рынка распределенных антенных систем (DAS) в Азиатско-Тихоокеанском регионе

Водитель

«Расширение сетей 5G и высокоскоростной беспроводной связи»

- Развертывание сетей 5G в Азиатско-Тихоокеанском регионе значительно увеличивает спрос на высокопроизводительные LNA. Эти усилители необходимы для повышения качества сигнала и снижения шума в высокочастотных приложениях, включая базовые станции 5G и пользовательские устройства.

- Ожидается, что к 2035 году инвестиции Азиатско-Тихоокеанского союза в инфраструктуру 5G во всех отраслях достигнут 10,6 трлн евро, что подчеркивает значительный потенциал роста местных сетевых операторов в регионе.

Например:

- В декабре 2024 года индийская компания Bharti Airtel подписала многомиллиардное соглашение с Ericsson об расширении покрытия 4G и 5G, что свидетельствует о значительных инвестициях в сетевую инфраструктуру.

- По мере ускорения развертывания 5G в регионе растет потребность в DAS, которые могут поддерживать более высокие частоты, улучшенное качество сигнала и большую эффективность сети. Эти системы играют важнейшую роль в улучшении покрытия и производительности беспроводных сетей связи, что делает их незаменимыми в развивающемся телекоммуникационном ландшафте. Следовательно, ожидается, что распространение инфраструктуры 5G значительно ускорит принятие DAS, усилив их стратегическое значение в передовой экосистеме связи Азиатско-Тихоокеанского региона.

Возможность

«Интеграция DAS в автомобильные усовершенствованные системы помощи водителю (ADAS)»

- Переход автомобильной промышленности к передовым системам помощи водителю и технологиям автономного вождения создает возможности для интеграции DAS. DAS играют решающую роль в автомобильных системах связи, улучшая прием и обработку сигналов.

- Растущий спрос на функции безопасности и информационно-развлекательные системы в транспортных средствах стимулирует внедрение систем DAS в автомобильном секторе.

Например,

- В 2025 году компания Huawei продемонстрировала свою передовую систему помощи водителю (ADAS) под названием Qiankun, установленную по меньшей мере на семи китайских автопроизводителях, включая производимую в Китае Audi Q6L e-tron компании Volkswagen, что подчеркивает интеграцию передовых систем связи в транспортные средства.

- Интеграция распределенных антенных систем (DAS) в усовершенствованные системы помощи водителю (ADAS) представляет собой значительную возможность роста для рынка DAS в Азиатско-Тихоокеанском регионе. Поскольку производители автомобилей в Азиатско-Тихоокеанском регионе все больше внимания уделяют безопасности, возможностям автономного вождения и системам с большим количеством датчиков, DAS играет решающую роль в улучшении качества приема сигнала и связи между модулями связи.

Сдержанность/Вызов

«Проблемы конфиденциальности данных и фрагментация регулирования в Азиатско-Тихоокеанском регионе»

- Внедрение решений DAS в Азиатско-Тихоокеанском регионе осложняется строгими законами о конфиденциальности данных и различиями в нормативных актах в разных странах, которые накладывают ограничения на то, где и как обрабатываются и хранятся данные.

- Разрозненность нормативно-правовой базы в странах Азиатско-Тихоокеанского региона создает препятствия для внедрения единых инструментов DAS, что приводит к более высоким затратам на настройку.

Например,

- В феврале 2024 года обсуждения во Всемирной торговой организации подчеркнули сложность правил цифровой торговли, поскольку такие страны, как Индия и Индонезия, рассматривают возможность изменения тарифов на цифровые услуги, что отражает неопределенность регулирования в регионе.

- Проблемы конфиденциальности данных и нормативная фрагментация в Азиатско-Тихоокеанском регионе создают значительные проблемы для развертывания унифицированных систем DAS. Строгие правила защиты данных и различные национальные законы увеличивают затраты на настройку и затрудняют интеграцию, замедляя внедрение современных решений DAS в регионе.

Объем

Рынок сегментирован по компонентному составу, модели развертывания, размеру организации и вертикали.

|

Сегментация |

Субсегментация |

|

Предлагая: |

|

|

По охвату: |

|

|

По форме собственности: |

|

|

По технологии |

|

|

По возможностям пользователя |

|

|

По вертикали |

|

Ожидается, что в 2025 году на рынке будет доминировать сегмент оборудования с наибольшей долей в сегменте компонентов.

Ожидается, что сегмент оборудования будет доминировать на рынке распределенных антенных систем (DAS) в Азиатско-Тихоокеанском регионе с долей рынка 52,23% в прогнозируемый период. Растущий спрос на сложные инструменты мониторинга в реальном времени. Передовые системы наблюдения позволяют соблюдать нормативные требования, выявляя рыночные манипуляции, мошенничество и нерегулярное торговое поведение в различных классах активов.

Ожидается, что в прогнозируемый период наибольшая доля рынка распределенных антенных систем (DAS) в Азиатско-Тихоокеанском регионе будет приходиться на сегмент Indoor .

В 2025 году сегмент Indoor на рынке распределенных антенных систем (DAS) в Азиатско-Тихоокеанском регионе, как ожидается, будет занимать наибольшую долю, приблизительно 61,3%. Облачные решения для наблюдения набирают обороты в Азиатско-Тихоокеанском регионе благодаря своей масштабируемости, экономической эффективности и способности обрабатывать огромные объемы торговых данных. Эти платформы расширяют возможности мониторинга в реальном времени и поддерживают межрыночное и межактивное наблюдение, необходимое для сложных финансовых операций.

Региональный анализ рынка распределенных антенных систем (DAS) в Азиатско-Тихоокеанском регионе

«Китай занимает самую большую долю на рынке распределенных антенных систем (DAS) в Азиатско-Тихоокеанском регионе»

- Китай является доминирующим игроком на рынке распределенных антенных систем (DAS) в Азиатско-Тихоокеанском регионе, движимый своей развитой финансовой инфраструктурой, жестко регулируемыми рынками и сильным акцентом на технологическое внедрение в системах наблюдения. Роль страны как финансового центра еще больше укрепляет ее рыночные позиции.

- Финансовые учреждения Китая отдают приоритет передовым инструментам надзора, чтобы гарантировать соблюдение строгих нормативных требований.

- Особое внимание к интеграции аналитики на основе искусственного интеллекта и мониторинга в реальном времени усиливает лидирующую роль Китая на рынке.

- Правительственные инициативы, поддерживающие цифровую трансформацию и обновления нормативной базы, усиливают доминирование Китая в сфере финансовых технологий.

«Ожидается, что Индия зарегистрирует самый высокий среднегодовой темп роста на рынке распределенных антенных систем (DAS) в Азиатско-Тихоокеанском регионе»

- Ожидается, что Индия станет свидетелем самых высоких совокупных годовых темпов роста (CAGR) на рынке распределенных антенных систем (DAS) в Азиатско-Тихоокеанском регионе, чему будет способствовать растущее внедрение в стране передовых систем наблюдения и технологий регулирования.

- Рост объемов цифровой торговли и трансграничных финансовых операций обусловливает спрос на системы наблюдения в режиме реального времени.

- Нормативно-правовая база Индии развивается в сторону поддержки использования искусственного интеллекта и машинного обучения, расширяя возможности инструментов надзора за торговлей.

- Рост сложности финансового рынка и спроса на решения по обеспечению глобального соответствия еще больше ускоряют рост рынка в Индии.

Доля рынка распределенных антенных систем (DAS) в Азиатско-Тихоокеанском регионе

Конкурентная среда рынка содержит сведения о конкурентах. Включены сведения о компании, ее финансах, полученном доходе, рыночном потенциале, инвестициях в исследования и разработки, новых рыночных инициативах, глобальном присутствии, производственных площадках и объектах, производственных мощностях, сильных и слабых сторонах компании, запуске продукта, широте и широте продукта, доминировании приложений. Приведенные выше данные касаются только фокуса компаний на рынке.

Основными лидерами рынка, работающими на рынке, являются:

- АТ&Т.

- ООО «АТС ИП»

- Корнинг Инкорпорейтед

- CommScope, Inc

- Хьюз Сетевые Системы

- Anixter Inc.

- Птица.

- BTI Беспроводной

- Кобхэм Беспроводной

- Comba Telecom Systems Holdings Ltd.

- Беспроводной ДАЛИ

- ГАЛТРОНИКС

- ХУБЕР+ЗУНЕР

- Решения RFI-технологий

- Вестелл Текнолоджиз, Инк.,

- CenRF Communications Limited

Последние разработки на рынке распределенных антенных систем (DAS) в Азиатско-Тихоокеанском регионе

- В октябре 2024 года компания Frog Cellsat представила решение 5G active DAS, интеллектуальные мини-усилители и ретранслятор VHF на Индийском мобильном конгрессе. Эти технологии направлены на улучшение связи в крупных местах, таких как аэропорты и метрополитены, удовлетворяя растущий спрос на сети с высокой пропускной способностью.

- В июне 2024 года корпорация NEC объявила о прорыве в технологии радиосвязи по оптоволокну, представив метод передачи данных по 1-битному волокну. Это нововведение обеспечивает экономически эффективные сети связи в миллиметровом диапазоне, необходимые для приложений Beyond 5G/6G в помещениях с высокой плотностью, таких как высотные здания и фабрики.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Интерактивная панель анализа данных

- Панель анализа компании для возможностей с высоким потенциалом роста

- Доступ аналитика-исследователя для настройки и запросов

- Анализ конкурентов с помощью интерактивной панели

- Последние новости, обновления и анализ тенденций

- Используйте возможности сравнительного анализа для комплексного отслеживания конкурентов

Методология исследования

Сбор данных и анализ базового года выполняются с использованием модулей сбора данных с большими размерами выборки. Этап включает получение рыночной информации или связанных данных из различных источников и стратегий. Он включает изучение и планирование всех данных, полученных из прошлого заранее. Он также охватывает изучение несоответствий информации, наблюдаемых в различных источниках информации. Рыночные данные анализируются и оцениваются с использованием статистических и последовательных моделей рынка. Кроме того, анализ доли рынка и анализ ключевых тенденций являются основными факторами успеха в отчете о рынке. Чтобы узнать больше, пожалуйста, запросите звонок аналитика или оставьте свой запрос.

Ключевой методологией исследования, используемой исследовательской группой DBMR, является триангуляция данных, которая включает в себя интеллектуальный анализ данных, анализ влияния переменных данных на рынок и первичную (отраслевую экспертную) проверку. Модели данных включают сетку позиционирования поставщиков, анализ временной линии рынка, обзор рынка и руководство, сетку позиционирования компании, патентный анализ, анализ цен, анализ доли рынка компании, стандарты измерения, глобальный и региональный анализ и анализ доли поставщика. Чтобы узнать больше о методологии исследования, отправьте запрос, чтобы поговорить с нашими отраслевыми экспертами.

Доступна настройка

Data Bridge Market Research является лидером в области передовых формативных исследований. Мы гордимся тем, что предоставляем нашим существующим и новым клиентам данные и анализ, которые соответствуют и подходят их целям. Отчет можно настроить, включив в него анализ ценовых тенденций целевых брендов, понимание рынка для дополнительных стран (запросите список стран), данные о результатах клинических испытаний, обзор литературы, обновленный анализ рынка и продуктовой базы. Анализ рынка целевых конкурентов можно проанализировать от анализа на основе технологий до стратегий портфеля рынка. Мы можем добавить столько конкурентов, о которых вам нужны данные в нужном вам формате и стиле данных. Наша команда аналитиков также может предоставить вам данные в сырых файлах Excel, сводных таблицах (книга фактов) или помочь вам в создании презентаций из наборов данных, доступных в отчете.