Рынок стоматологических лабораторий Азиатско-Тихоокеанского региона, по видам продукции (общие и диагностические приборы, лечебные приборы и другие), тенденции отрасли и прогноз до 2029 г.

Анализ рынка и идеи

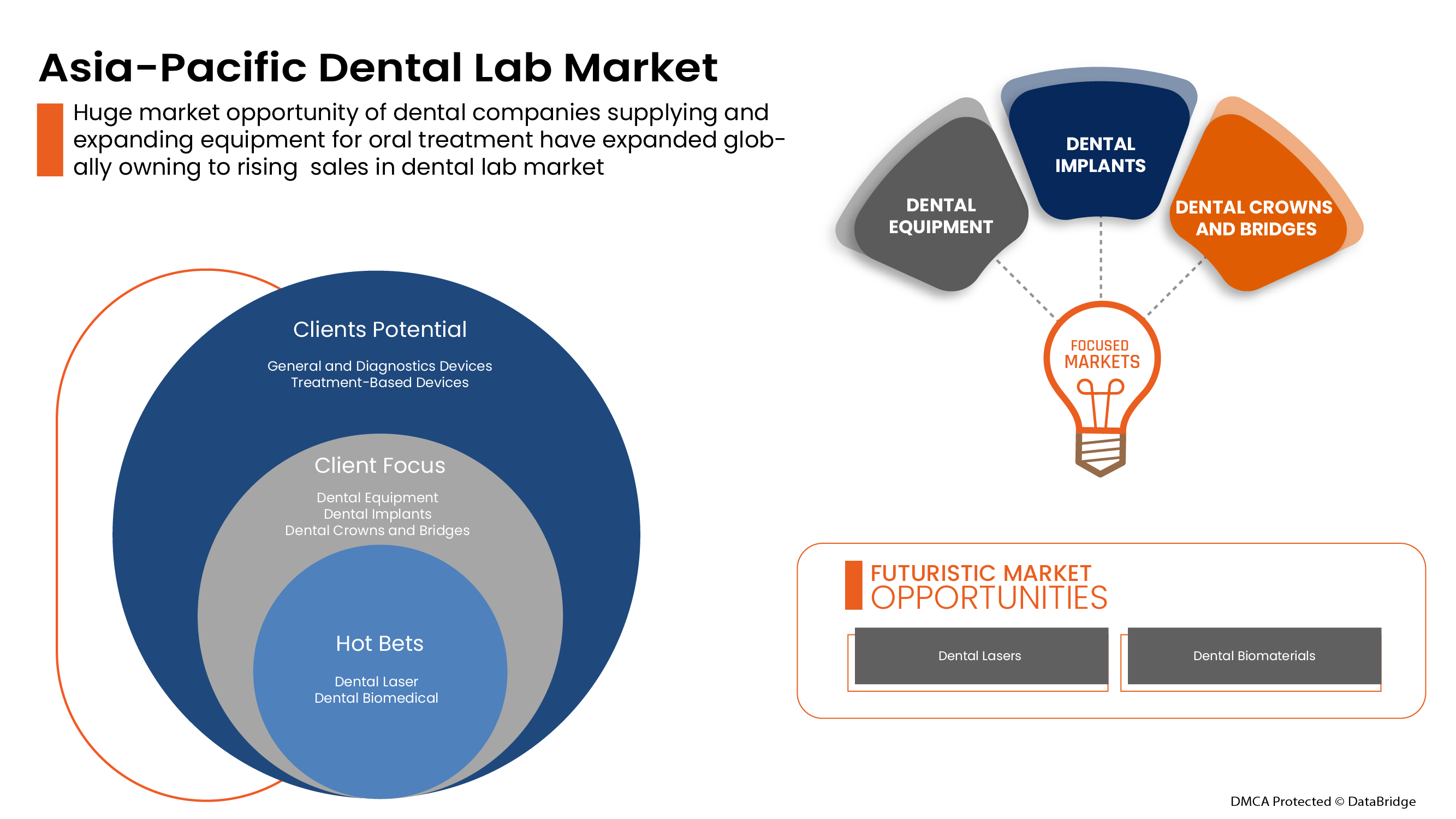

Оборудование в зуботехнической лаборатории включает в себя полный спектр систем, используемых для изготовления несъемных или съемных зубных протезов. Задача зубного техника — изготавливать коронки, мосты, зубные протезы и ортодонтические приспособления на основе предписаний стоматолога. Многие из этих задач требуют высокой точности, и мастерство техника в значительной степени определяет конечный успех лечения. Лаборант проходит обучение на рабочем месте или в рамках официальных образовательных программ.

Технологический прогресс в стоматологической отрасли заключается в использовании процессов автоматизированного проектирования и автоматизированного производства (CAD/CAM); процессов, посредством разработки устройств 3D-сканирования высокой четкости, более точного, быстрого и простого программного обеспечения для проектирования, а также точного субтрактивного или аддитивного производства инновационных материалов.

Определение рынка

Основная роль зуботехнической лаборатории заключается в предоставлении реставрационной стоматологии, чтобы идеально скопировать все функциональные и эстетические параметры, которые были определены стоматологом в реставрационном решении. На протяжении всего реставрационного процесса, от первоначальной консультации пациента, диагностики и планирования лечения до окончательного размещения реставрации, пути коммуникации между стоматологом и лабораторным техником теперь могут обеспечить полную передачу информации. Функциональные компоненты, окклюзионные параметры, фонетика и эстетические требования — это лишь некоторые из основных типов информации, которые необходимы техникам для завершения изготовления успешных, функциональных и эстетических реставраций. Сегодня, как и в прошлом, инструменты коммуникации между стоматологом и техником включают фотографию, письменную документацию и слепки существующих зубов пациента.

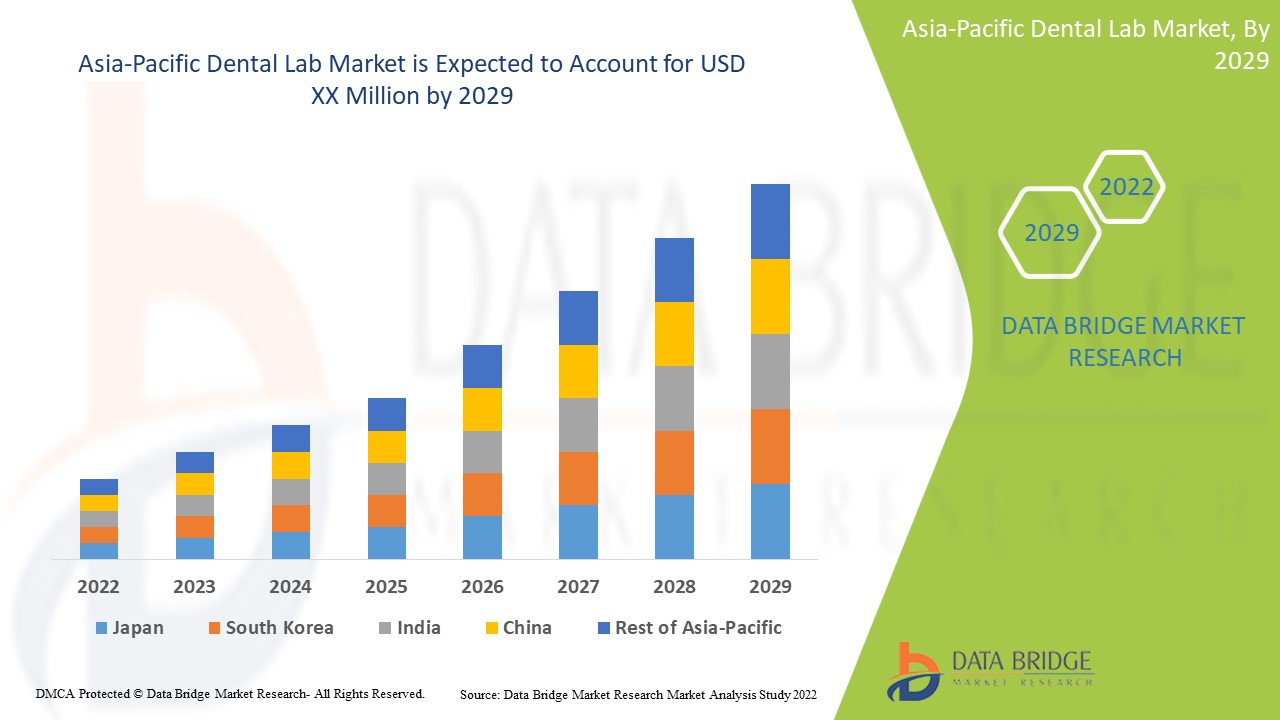

Стоматологическая лаборатория Азиатско-Тихоокеанского региона поддерживает и стремится снизить тяжесть симптомов. Data Bridge Market Research анализирует, что рынок стоматологических лабораторий будет расти со среднегодовым темпом роста 13,4% в течение прогнозируемого периода с 2022 по 2029 год.

|

Отчет Метрика |

Подробности |

|

Прогнозируемый период |

2022-2029 |

|

Базовый год |

2021 |

|

Исторические годы |

2020 (Можно настроить на 2019 - 2014) |

|

Количественные единицы |

Доход в млн. долл. США, цены в долл. США |

|

Охваченные сегменты |

Побочные продукты (общие и диагностические приборы, лечебные приборы и другие) |

|

Страны, охваченные |

Япония, Индия, Китай, Южная Корея, Австралия, Сингапур, Таиланд, Малайзия, Индонезия, Филиппины и остальные страны Азиатско-Тихоокеанского региона |

|

Охваченные участники рынка |

Ultradent Products Inc., A-dec Inc., BioHorizons IPH Inc., Carestream Health, Dentatus, Roland DGA Corporation, 3Shape A/S, Formlabs, PLANMECA OY, Septodont, 3M, BEGO GmbH & Co. KG, VOCO Gmbh, Henry Schein, Inc., GC Corporation, BIOLASE, Inc., Bicon, LLC, Dentsply Sirona, Envista (дочерняя компания Danaher Corporation)., Kulzer GmbH. (дочерняя компания Mitsui Chemicals, Inc), CAMLOG Biotechnologies GmbH, Zimvie Inc. (дочерняя компания Zimmer Biomet), Institut Straumann AG и OSSTEM UK |

Динамика рынка стоматологических лабораторий в Азиатско-Тихоокеанском регионе

Драйверы

- Высокая распространенность стоматологических заболеваний

Здоровье полости рта является одним из важнейших аспектов поддержания здоровья десен, зубов и орально-лицевой системы, которая позволяет говорить, жевать и улыбаться. Согласно отчету Всемирной организации здравоохранения за март 2022 года, около 2,0 миллиардов человек во всем мире страдают от кариеса постоянных зубов, среди которых около 520 миллионов детей страдают от кариеса молочных зубов.

Наиболее распространенными стоматологическими заболеваниями являются кариес, заболевания пародонта и рак полости рта.

Например,

- В 2021 году в США, по данным Центра по контролю и профилактике заболеваний (CDC), более 1 из 4 (26%) взрослых в США имеют нелеченный кариес зубов. 70,1% взрослых в возрасте 65 лет и старше страдают заболеваниями пародонта, а 47,2% взрослых в возрасте 30 лет и старше имеют какую-либо форму заболеваний пародонта.

Поскольку компании постоянно занимаются исследованиями и разработками, знания о распространенности заболеваний полости рта помогут в поиске новых решений, а это поможет в большем сотрудничестве и партнерстве с участниками рынка в таких странах, как Азиатско-Тихоокеанский регион. Таким образом, ожидается, что рост числа случаев заболеваний полости рта, таких как кариес, разрушение зубов и рак полости рта, будет способствовать росту мирового рынка стоматологических лабораторий.

- Рост активности исследований и разработок в стоматологической отрасли

Ценовое давление привело к изменениям в основной динамике отрасли дентальных имплантатов. Инновации привели к существенному увеличению числа местных и региональных игроков, занимающихся созданием аналогичных продуктов и предлагающих их по более низкой цене.

Например,

- В 2018 году Young Innovations (США) объявила о приобретении Johnson-Promidet (США). Компания специализируется на высококачественных решениях для стоматологических наконечников. Это приобретение приведет к предоставлению инновационной, высококачественной продукции и решений для врачей и их пациентов, а также к расширению портфеля брендов и продуктов за счет органического роста и приобретений.

Рост научно-исследовательской и опытно-конструкторской деятельности заставил компании активнее расширять свои услуги на рынке, ориентируясь на большее количество клиентов, что привело к росту мирового рынка стоматологических лабораторий.

Возможности

- Выпуск новых продуктов

Основные игроки также пытаются разработать конкретные стратегии, такие как запуск продуктов, приобретения, одобрения, расширения и партнерства, чтобы обеспечить бесперебойную работу бизнеса, избежать рисков и увеличить долгосрочный рост продаж на рынке.

Компании, работающие на рынке стоматологических лабораторий, предлагают различные новые продукты, основанные на новых технологиях. Наиболее заметные новинки в сфере стоматологических лабораторий появились в области дентальной визуализации и цифровой стоматологии.

Например,

- В 2019 году компания Zimmer Biomet (Индиана, США) объявила о запуске новой линейки нерассасывающихся мембран и шовных материалов, специально разработанных для устранения бактериальной инфильтрации в операционное поле.

Эти стратегические инициативы, такие как со стороны участников рынка, включая приобретение, конференции и запуски целевых сегментных продуктов, помогают компаниям расти и улучшать портфель продуктов компании, в конечном итоге приводя к большему получению доходов. Таким образом, эти стратегические инициативы со стороны участников рынка предоставляют возможность, которая помогает им стимулировать рост рынка.

Ограничения/Проблемы

- Сценарий отсутствия надлежащего возмещения

Происходят быстрые изменения в стоматологических процедурах, стоматологическом страховании, ставках возмещения, а также правилах и положениях. Стоматологические службы выставления счетов стремятся подавать точные претензии плательщикам страховки и получают максимальное возмещение; эти претензии отклоняются из-за многих факторов, которые могут включать недействительную документацию среди прочего. Опрос, проведенный Bankers Healthcare Group (BHG), показал, что снижение ставок возмещения является очень серьезной проблемой среди стоматологов.

Текущая процедура оценки покрытия непрозрачна, а также отличается у разных плательщиков, что в конечном итоге приводит к непоследовательным решениям о покрытии и, следовательно, ограничивает доступ медицинских работников и пациентов к лучшему лечению. Эта проблема страхования сдерживает рынок и создает различные проблемы для отрасли, делая ее ответственным сдерживающим фактором для рынка.

- Нехватка квалифицированных специалистов

В развивающихся странах и странах с переходной экономикой наблюдается нехватка квалифицированной рабочей силы в сфере здравоохранения из-за миграции и ряда других факторов.

В Африке была самая неадекватная система здравоохранения, особенно в регионах Африки к югу от Сахары, которые серьезно пострадали из-за миграции медицинских работников. В среднем в 57 странах отмечалась критическая нехватка медицинских работников, дефицит составлял около 2,4 млн врачей и медсестер.

Влияние COVID-19 на рынок стоматологических лабораторий

Во время пандемии стоматологическая лаборатория оказывает заметное влияние на снижение смертности и заболеваемости пациентов с COVID-19. Для подтверждения этих результатов необходимы дальнейшие масштабные исследования. Необходимо определить протокол для стоматологической лаборатории при инфекции COVID-19 для достижения наилучших возможных клинических результатов. Стоматологические лаборатории и техники выходят из состояния вымирания. По данным Национального центра биотехнологической информации, исследования показали, что существует высокий уровень загрязнения зубных слепков, поступающих в стоматологическую лабораторию.

Недавнее развитие

- В сентябре Envista заключила соглашение с Planmeca OY. В соглашении говорилось, что Envista продаст свой бизнес KaVo Treatment Unit and Instrument компании Planmeca OY за 455 миллионов долларов США с потенциальной выплатой вознаграждения в размере до 30 миллионов долларов США. Это увеличит количество клиентов и повысит доступность KaVo Treatment Unit в стоматологических клиниках.

Масштаб рынка стоматологических лабораторий в Азиатско-Тихоокеанском регионе

Рынок стоматологических лабораторий сегментирован на основе одного сегмента: продукты. Рост среди этих сегментов поможет вам проанализировать сегменты с незначительным ростом в отраслях и предоставить пользователям ценный обзор рынка и рыночные идеи, которые помогут им принимать стратегические решения для определения основных рыночных приложений.

Продукция

- Общие и диагностические приборы

- Устройства для лечения

- Другие

По видам продукции рынок стоматологического оборудования Азиатско-Тихоокеанского региона сегментируется на общие и диагностические приборы, лечебные приборы и другие.

Анализ трубопровода

Региональный анализ/анализ рынка стоматологических лабораторий

Проанализирован рынок стоматологических лабораторий в Азиатско-Тихоокеанском регионе, а также предоставлены сведения о размерах рынка и тенденциях по регионам и продуктам, указанным выше.

В отчете о рынке стоматологических лабораторий рассматриваются следующие страны: Япония, Индия, Китай, Южная Корея, Австралия, Сингапур, Таиланд, Малайзия, Индонезия, Филиппины и остальные страны Азиатско-Тихоокеанского региона.

Ожидается, что Китай будет доминировать на рынке из-за роста случаев заболеваний пародонта, развития медицинского туризма и увеличения числа пациентов стоматологических лабораторий в Азиатско-Тихоокеанском регионе.

Раздел отчета по странам также содержит отдельные факторы, влияющие на рынок, и изменения в регулировании рынка внутри страны, которые влияют на текущие и будущие тенденции рынка. Такие данные, как новые продажи, замещающие продажи, демография страны, эпидемиология заболеваний и импортно-экспортные тарифы, являются одними из основных указателей, используемых для прогнозирования рыночного сценария для отдельных стран. Кроме того, при предоставлении прогнозного анализа данных по стране учитываются наличие и доступность глобальных брендов и их проблемы из-за большой или малой конкуренции со стороны местных и отечественных брендов, влияние каналов продаж.

Анализ конкурентной среды и доли рынка стоматологических лабораторий

Конкурентная среда рынка стоматологических лабораторий в Азиатско-Тихоокеанском регионе содержит подробную информацию по конкурентам. Включены следующие сведения: обзор компании, финансовые показатели компании, полученный доход, рыночный потенциал, инвестиции в исследования и разработки, новые рыночные инициативы, присутствие в Азиатско-Тихоокеанском регионе, производственные площадки и объекты, производственные мощности, сильные и слабые стороны компании, запуск продукта, широта и широта продукта, доминирование в применении. Приведенные выше данные касаются только фокуса компаний на рынке стоматологических лабораторий.

Некоторые из основных игроков, работающих на рынке стоматологических лабораторий, включают Ultradent Products Inc., A-dec Inc., BioHorizons IPH Inc., Carestream Health, Dentatus, Roland DGA Corporation, 3Shape A/S, Formlabs, PLANMECA OY, Septodont, 3M, BEGO GmbH & Co. KG, VOCO Gmbh, Henry Schein, Inc., GC Corporation, BIOLASE, Inc., Bicon, LLC, Dentsply Sirona, Envista (дочерняя компания Danaher Corporation), Kulzer GmbH. (дочерняя компания Mitsui Chemicals, Inc), CAMLOG Biotechnologies GmbH, Zimvie Inc. (дочерняя компания Zimmer Biomet), Institut Straumann AG и OSSTEM UK и другие.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Интерактивная панель анализа данных

- Панель анализа компании для возможностей с высоким потенциалом роста

- Доступ аналитика-исследователя для настройки и запросов

- Анализ конкурентов с помощью интерактивной панели

- Последние новости, обновления и анализ тенденций

- Используйте возможности сравнительного анализа для комплексного отслеживания конкурентов

Содержание

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE ASIA PACIFIC DENTAL LAB MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 ASIA PACIFIC DENTAL LABMARKET: SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 MULTIVARIATE MODELLING

2.7 PRODUCT SEGMENT LIFELINE CURVE

2.8 DBMR MARKET POSITION GRID

2.9 VENDOR SHARE ANALYSIS

2.1 SECONDARY SOURCES

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTEL ANALYSIS

4.2 PORTER'S FIVE FORCES MODEL

5 ASIA PACIFIC DENTAL LAB MARKET: REGULATIONS

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 RAPID GROWTH IN THE GERIATRIC POPULATION

6.1.2 HIGH PREVALENCE OF DENTAL DISORDERS

6.1.3 RISE IN RESEARCH AND DEVELOPMENT ACTIVITY IN DENTAL INDUSTRIES

6.1.4 INCREASING AWARENESS OF PERIODONTAL DISEASE

6.1.5 GROWING MEDICAL TOURISM FOR DENTAL PROCEDURES

6.2 RESTRAINTS

6.2.1 HIGH COST OF DENTAL EQUIPMENT AND MATERIALS

6.2.2 LACK OF PROPER REIMBURSEMENT SCENARIO

6.2.3 LACK OF DENTAL KNOWLEDGE IN EMERGING COUNTRIES

6.3 OPPORTUNITIES

6.3.1 NEW PRODUCT RELEASES

6.3.2 INCREASED AESTHETIC DENTISTRY IN DENTAL LABS

6.4 CHALLENGES

6.4.1 LACK OF SKILLED TECHNICIANS

6.4.2 DELAYED ADOPTION OF ADVANCED TECHNOLOGIES IN EMERGING ECONOMIES

7 ASIA PACIFIC DENTAL LAB MARKET, BY PRODUCTS

7.1 OVERVIEW

7.2 GENERAL AND DIAGNOSTICS DEVICES

7.2.1 DENTAL EQUIPMENT

7.2.1.1 DENTAL CHAIRS

7.2.1.2 HAND PIECES

7.2.1.3 LIGHT CURE EQUIPMENT

7.2.1.4 SCALING UNITS

7.2.2 DENTAL IMPLANTS

7.2.2.1 TITANIUM DENTAL IMPLANTS

7.2.2.2 ZIRCONIA DENTAL IMPLANTS

7.2.3 DENTAL CROWNS & BRIDGES

7.2.3.1 METAL-FUSED CERAMIC CROWNS

7.2.3.2 CERAMIC CAD/CAM

7.2.3.3 CERAMIC CONVENTIONAL CROWNS & BRIDGES

7.2.4 DENTAL SYSTEMS AND PARTS

7.2.4.1 INSTRUMENT DELIVERY SYSTEMS

7.2.4.2 CONE BEAM CT SCANNING

7.2.4.3 CAD/CAM SYSTEMS

7.2.4.4 3D PRINTERS

7.2.4.5 DENTAL MILLING MACHINE

7.2.5 DENTAL RADIOLOGY EQUIPMENT

7.2.5.1 EXTRA-ORAL RADIOLOGY

7.2.5.1.1 FILM-BASED DEVICES

7.2.5.1.2 DIGITAL DEVICES

7.2.5.2 INTRA-ORAL RADIOLOGY

7.2.5.2.1 BITEWINGS

7.2.5.2.2 PERIAPICALS

7.2.5.2.3 OCCUSAL

7.2.6 DENTAL BIOMATERIALS

7.2.7 DENTAL LASERS

7.2.7.1 DIODE LASERS

7.2.7.2 YTTRIUM LASERS

7.2.7.3 CO2 LASERS

7.3 TREATMENT-BASED DEVICES

7.3.1 ORTHODONTICS

7.3.1.1 REMOVABLE

7.3.1.2 FIXED

7.3.1.2.1 BRACKETS

7.3.1.2.2 ARCHWIRES

7.3.1.2.3 ANCHORAGE APPLIANCES

7.3.1.2.4 LIGATURES

7.3.2 ENDOTONICS

7.3.2.1 PERMANENT ENDODONTIC SEALERS

7.3.2.2 OBTURATORS

7.3.3 PERIODONTICS

7.3.3.1 DENTAL ANESTHETICS

7.3.3.1.1 INJECTABLE ANESTHETICS

7.3.3.1.2 TOPICAL ANESTHETICS

7.3.3.2 DENTAL SUTURES

7.3.3.3 DENTAL HEMOSTATS

7.3.3.3.1 COLLAGEN-BASED HEMOSTATS

7.3.3.3.2 OXIDIZED REGENERATED CELLULOSE-BASED HEMOSTATS

7.3.3.3.3 GELATIN-BASED HEMOSTATS

7.4 OTHERS

7.4.1 OTHER DENTAL LABORATORY MACHINES

7.4.2 HYGIENE MAINTENANCE DEVICES

7.4.3 RETAIL DENTAL CARE ESSENTIALS

7.4.4 OTHER CONSUMABLES

8 ASIA PACIFIC DENTAL LAB MARKET, BY REGION

8.1 ASIA-PACIFIC

8.1.1 CHINA

8.1.2 JAPAN

8.1.3 INDIA

8.1.4 SOUTH KOREA

8.1.5 AUSTRALIA

8.1.6 SINGAPORE

8.1.7 THAILAND

8.1.8 MALAYSIA

8.1.9 INDONESIA

8.1.10 PHILIPPINES

8.1.11 REST OF ASIA-PACIFIC

9 ASIA PACIFIC DENTAL LAB MARKET, COMPANY LANDSCAPE

9.1 COMPANY SHARE ANALYSIS: ASIA PACIFIC

10 SWOT ANALYSIS

11 COMPANY PROFILE

11.1 HENRY SCHEIN, INC.(2021)

11.1.1 COMPANY SNAPSHOT

11.1.2 REVENUE ANALYSIS

11.1.3 COMPANY SHARE ANALYSIS

11.1.4 PRODUCT PORTFOLIO

11.1.5 RECENT DEVELOPMENTS

11.2 DENTSPLY SIRONA (2021)

11.2.1 COMPANY SNAPSHOT

11.2.2 REVENUE ANALYSIS

11.2.3 COMPANY SHARE ANALYSIS

11.2.4 PRODUCT PORTFOLIO

11.2.5 RECENT DEVELOPMENTS

11.3 ENVISTA (A SUBSIDIARY OF DANAHER CORPORATION) (2021)

11.3.1 COMPANY SNAPSHOT

11.3.2 REVENUE ANALYSIS

11.3.3 COMPANY SHARE ANALYSIS

11.3.4 PRODUCT PORTFOLIO

11.3.5 RECENT DEVELOPMENTS

11.4 INSTITUT STRAUMANN AG (2021)

11.4.1 COMPANY SNAPSHOT

11.4.2 REVENUE ANALYSIS

11.4.3 COMPANY SHARE ANALTSIS

11.4.4 PRODUCT PORTFOLIO

11.4.5 RECENT DEVELOPMENTS

11.5 PLANMECA OY. (2021)

11.5.1 COMPANY SNAPSHOT

11.5.2 COMPANY SHARE ANALYSIS

11.5.3 PRODUCT PORTFOLIO

11.5.4 RECENT DEVELOPMENTS

11.6 3M (2021)

11.6.1 COMPANY SNAPSHOT

11.6.2 REVENUE ANALYSIS

11.6.3 PRODUCT PORTFOLIO

11.6.4 RECENT DEVELOPMENTS

11.7 A-DEC-IN (2021)

11.7.1 COMPANY SNAPSHOT

11.7.2 PRODUCT PORTFOLIO

11.7.3 RECENT DEVELOPMENTS

11.8 BIOHORIZONS IPH, INC. (2021)

11.8.1 COMPANY SNAPSHOT

11.8.2 PRODUCT PORTFOLIO

11.8.3 RECENT DEVELOPMENTS

11.9 BIOLASE, INC.(2021)

11.9.1 COMPANY SNAPSHOT

11.9.2 REVENUE ANALYSIS

11.9.3 PRODUCT PORTFOLIO

11.9.4 RECENT DEVELOPMENTS

11.1 BEGO GMBH & CO. KG

11.10.1 COMPANY SNAPSHOT

11.10.2 PRODUCT PORTFOLIO

11.10.3 RECENT DEVELOPMENTS

11.11 BICON, LLC

11.11.1 COMPANY SNAPSHOT

11.11.2 PRODUCT PORTFOLIO

11.11.3 RECENT DEVELOPMENTS

11.12 CAMLOG BIOTECHNOLOGIES GMBH

11.12.1 COMPANY SNAPSHOT

11.12.2 PRODUCT PORTFOLIO

11.12.3 RECENT DEVELOPMENTS

11.13 CARESTREAM HEALTH (2021)

11.13.1 COMPANY SNAPSHOT

11.13.2 PRODUCT PORTFOLIO

11.13.3 RECENT DEVELOPMENTS

11.14 DENTATUS (2021)

11.14.1 COMPANY SNAPSHOT

11.14.2 PRODUCT PORTFOLIO

11.14.3 RECENT DEVELOPMENTS

11.15 FORMLABS (2021)

11.15.1 COMPANY SNAPSHOT

11.15.2 PRODUCT PORTFOLIO

11.15.3 RECENT DEVELOPMENTS

11.16 GC CORPORATION

11.16.1 COMPANY SNAPSHOT

11.16.2 PRODUCT PORTFOLIO

11.16.3 RECENT DEVELOPMENTS

11.17 KULZER GMBH (A SUBSIDIARY OF MITSUI CHEMICALS, INC) (2021)

11.17.1 COMPANY SNAPSHOT

11.17.2 REVENUE ANALYSIS

11.17.3 PRODUCT PORTFOLIO

11.17.4 RECENT DEVELOPMENTS

11.18 OSSTEM U.K.(2021)

11.18.1 COMPANY SNAPSHOT

11.18.2 PRODUCT PORTFOLIO

11.18.3 RECENT DEVELOPMENTS

11.19 PINDAN DENTAL LABORATORY

11.19.1 COMPANY SNAPSHOT

11.19.2 PRODUCT PORTFOLIO

11.19.3 RECENT DEVELOPMENTS

11.2 ROLAND DG CORPORATION (2021)

11.20.1 COMPANY SNAPSHOT

11.20.2 REVENUE ANALYSIS

11.20.3 PRODUCT PORTFOLIO

11.20.4 RECENT DEVELOPMENTS

11.21 SEPTODONT (2021)

11.21.1 COMPANY SNAPSHOT

11.21.2 PRODUCT PORTFOLIO

11.21.3 RECENT DEVELOPMENTS

11.22 3 SHAPE A/S (2021)

11.22.1 COMPANY SNAPSHOT

11.22.2 PRODUCT PORTFOLIO

11.22.3 RECENT DEVELOPMENTS

11.23 ULTRADENT PRODUCTS INC (2021)

11.23.1 COMPANY SNAPSHOT

11.23.2 PRODUCT PORTFOLIO

11.23.3 RECENT DEVELOPMENTS

11.24 VOCO GMBH (2021)

11.24.1 COMPANY SNAPSHOT

11.24.2 PRODUCT PORTFOLIO

11.24.3 RECENT DEVELOPMENTS

11.25 YOUNG INNOVATIONS, INC (2021)

11.25.1 COMPANY SNAPSHOT

11.25.2 PRODUCT PORTFOLIO

11.25.3 RECENT DEVELOPMENTS

11.26 ZIMVIE INC. (A SUBSIDIARY OF ZIMMET BIOMET HOLDINGS)(2021)

11.26.1 COMPANY SNAPSHOT

11.26.2 REVENUE ANALYSIS

11.26.3 PRODUCT PORTFOLIO

11.26.4 RECENT DEVELOPMENTS

12 QUESTIONNAIRE

13 RELATED REPORTS

Список таблиц

TABLE 1 DENTAL TREATMENT COSTS IN THE U.K.

TABLE 2 AESTHETIC PROCEDURES AND COST RANGES IN THE U.S. (2018)

TABLE 3 ASIA PACIFIC DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 4 ASIA PACIFIC GENERAL & DIAGNOSTICS DEVICES IN DENTAL LAB MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 5 ASIA PACIFIC GENERAL & DIAGNOSTICS DEVICES IN DENTAL LAB MARKET, BY PRODUCTS ,2020-2029 (USD MILLION)

TABLE 6 ASIA PACIFIC DENTAL EQUIPMENT IN DENTAL LAB MARKET, BY PRODUCTS , 2020-2029 (USD MILLION)

TABLE 7 ASIA PACIFIC DENTAL IMPLANTS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 8 ASIA PACIFIC DENTAL CROWNS & BRIDGES IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 9 ASIA PACIFIC DENTAL SYSTEMS AND PARTS IN DENTAL LAB MARKET, BY PRODUCTS , 2020-2029 (USD MILLION)

TABLE 10 ASIA PACIFIC DENTAL RADIOLOGY EQUIPMENT IN DENTAL LAB MARKET, BY PRODUCTS , 2020-2029 (USD MILLION)

TABLE 11 ASIA PACIFIC EXTRA-ORAL RADIOLOGY IN DENTAL LAB MARKET, BY PRODUCTS , 2020-2029 (USD MILLION)

TABLE 12 ASIA PACIFIC INTRA-ORAL RADIOLOGY IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 13 ASIA PACIFIC DENTAL LASERS IN DENTAL LAB MARKET, BY PRODUCTS , 2020-2029 (USD MILLION)

TABLE 14 ASIA PACIFIC TREATMENT-BASED DEVICES IN DENTAL LAB MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 15 ASIA PACIFIC TREATMENT-BASED DEVICES IN DENTAL LAB MARKET, BY PRODUCTS , 2020-2029 (USD MILLION)

TABLE 16 ASIA PACIFIC ORTHODONTICS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 17 ASIA PACIFIC FIXED IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 18 ASIA PACIFIC ENDODONTICS IN DENTAL LAB MARKET, BY PRODUCTS , 2020-2029 (USD MILLION)

TABLE 19 ASIA PACIFIC PERIODONTICS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 20 ASIA PACIFIC DENTAL ANESTHETICS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 21 ASIA PACIFIC DENTAL HEMOSTATS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 22 ASIA PACIFIC OTHERS IN DENTAL LAB MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 23 ASIA PACIFIC OTHERS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 24 ASIA-PACIFIC DENTAL LAB MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 25 ASIA-PACIFIC DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 26 ASIA-PACIFIC GENERAL AND DIAGNOSTIC DEVICES IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 27 ASIA-PACIFIC DENTAL EQUIPMENT IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 28 ASIA-PACIFIC DENTAL IMPLANTS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 29 ASIA-PACIFIC DENTAL CROWNS AND BRIDGES IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 30 ASIA-PACIFIC DENTAL SYSTEMS AND PARTS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 31 ASIA-PACIFIC DENTAL RADIOLOGY EQUIOMENT IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 32 ASIA-PACIFIC EXTRA-ORAL RADIOLOGY IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 33 ASIA-PACIFIC INTRA-ORAL RADIOLOGY IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 34 ASIA-PACIFIC DENTAL LASERS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 35 ASIA-PACIFIC TREATMENT-BASED DEVICES IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 36 ASIA-PACIFIC ORTHODONTICS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 37 ASIA-PACIFIC FIXED IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 38 ASIA-PACIFIC ENDODONTIC IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 39 ASIA-PACIFIC PERIODONTICS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 40 ASIA-PACIFIC DENTAL ANESTHETICS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 41 ASIA-PACIFIC DENTAL HEMOSTATS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 42 ASIA-PACIFIC OTHERS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 43 CHINA DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 44 CHINA GENERAL AND DIAGNOSTIC DEVICES IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 45 CHINA DENTAL EQUIPMENT IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 46 CHINA DENTAL IMPLANTS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 47 CHINA DENTAL CROWNS AND BRIDGES IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 48 CHINA DENTAL SYSTEMS AND PARTS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 49 CHINA DENTAL RADIOLOGY EQUIOMENT IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 50 CHINA EXTRA-ORAL RADIOLOGY IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 51 CHINA INTRA-ORAL RADIOLOGY IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 52 CHINA DENTAL LASERS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 53 CHINA TREATMENT-BASED DEVICES IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 54 CHINA ORTHODONTICS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 55 CHINA FIXED IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 56 CHINA ENDODONTIC IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 57 CHINA PERIODONTICS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 58 CHINA DENTAL ANESTHETICS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 59 CHINA DENTAL HEMOSTATS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 60 CHINA OTHERS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 61 JAPAN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 62 JAPAN GENERAL AND DIAGNOSTIC DEVICES IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 63 JAPAN DENTAL EQUIPMENT IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 64 JAPAN DENTAL IMPLANTS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 65 JAPAN DENTAL CROWNS AND BRIDGES IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 66 JAPAN DENTAL SYSTEMS AND PARTS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 67 JAPAN DENTAL RADIOLOGY EQUIOMENT IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 68 JAPAN EXTRA-ORAL RADIOLOGY IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 69 JAPAN INTRA-ORAL RADIOLOGY IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 70 JAPAN DENTAL LASERS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 71 JAPAN TREATMENT-BASED DEVICES IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 72 JAPAN ORTHODONTICS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 73 JAPAN FIXED IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 74 JAPAN ENDODONTIC IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 75 JAPAN PERIODONTICS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 76 JAPAN DENTAL ANESTHETICS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 77 JAPAN DENTAL HEMOSTATS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 78 JAPAN OTHERS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 79 INDIA DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 80 INDIA GENERAL AND DIAGNOSTIC DEVICES IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 81 INDIA DENTAL EQUIPMENT IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 82 INDIA DENTAL IMPLANTS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 83 INDIA DENTAL CROWNS AND BRIDGES IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 84 INDIA DENTAL SYSTEMS AND PARTS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 85 INDIA DENTAL RADIOLOGY EQUIOMENT IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 86 INDIA EXTRA-ORAL RADIOLOGY IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 87 INDIA INTRA-ORAL RADIOLOGY IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 88 INDIA DENTAL LASERS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 89 INDIA TREATMENT-BASED DEVICES IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 90 INDIA ORTHODONTICS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 91 INDIA FIXED IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 92 INDIA ENDODONTIC IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 93 INDIA PERIODONTICS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 94 INDIA DENTAL ANESTHETICS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 95 INDIA DENTAL HEMOSTATS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 96 INDIA OTHERS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 97 SOUTH KOREA DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 98 SOUTH KOREA GENERAL AND DIAGNOSTIC DEVICES IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 99 SOUTH KOREA DENTAL EQUIPMENT IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 100 SOUTH KOREA DENTAL IMPLANTS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 101 SOUTH KOREA DENTAL CROWNS AND BRIDGES IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 102 SOUTH KOREA DENTAL SYSTEMS AND PARTS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 103 SOUTH KOREA DENTAL RADIOLOGY EQUIOMENT IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 104 SOUTH KOREA EXTRA-ORAL RADIOLOGY IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 105 SOUTH KOREA INTRA-ORAL RADIOLOGY IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 106 SOUTH KOREA DENTAL LASERS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 107 SOUTH KOREA TREATMENT-BASED DEVICES IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 108 SOUTH KOREA ORTHODONTICS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 109 SOUTH KOREA FIXED IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 110 SOUTH KOREA ENDODONTIC IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 111 SOUTH KOREA PERIODONTICS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 112 SOUTH KOREA DENTAL ANESTHETICS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 113 SOUTH KOREA DENTAL HEMOSTATS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 114 SOUTH KOREA OTHERS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 115 AUSTRALIA DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 116 AUSTRALIA GENERAL AND DIAGNOSTIC DEVICES IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 117 AUSTRALIA DENTAL EQUIPMENT IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 118 AUSTRALIA DENTAL IMPLANTS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 119 AUSTRALIA DENTAL CROWNS AND BRIDGES IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 120 AUSTRALIA DENTAL SYSTEMS AND PARTS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 121 AUSTRALIA DENTAL RADIOLOGY EQUIOMENT IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 122 AUSTRALIA EXTRA-ORAL RADIOLOGY IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 123 AUSTRALIA INTRA-ORAL RADIOLOGY IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 124 AUSTRALIA DENTAL LASERS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 125 AUSTRALIA TREATMENT-BASED DEVICES IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 126 AUSTRALIA ORTHODONTICS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 127 AUSTRALIA FIXED IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 128 AUSTRALIA ENDODONTIC IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 129 AUSTRALIA PERIODONTICS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 130 AUSTRALIA DENTAL ANESTHETICS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 131 AUSTRALIA DENTAL HEMOSTATS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 132 AUSTRALIA OTHERS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 133 SINGAPORE DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 134 SINGAPORE GENERAL AND DIAGNOSTIC DEVICES IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 135 SINGAPORE DENTAL EQUIPMENT IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 136 SINGAPORE DENTAL IMPLANTS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 137 SINGAPORE DENTAL CROWNS AND BRIDGES IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 138 SINGAPORE DENTAL SYSTEMS AND PARTS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 139 SINGAPORE DENTAL RADIOLOGY EQUIOMENT IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 140 SINGAPORE EXTRA-ORAL RADIOLOGY IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 141 SINGAPORE INTRA-ORAL RADIOLOGY IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 142 SINGAPORE DENTAL LASERS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 143 SINGAPORE TREATMENT-BASED DEVICES IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 144 SINGAPORE ORTHODONTICS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 145 SINGAPORE FIXED IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 146 SINGAPORE ENDODONTIC IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 147 SINGAPORE PERIODONTICS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 148 SINGAPORE DENTAL ANESTHETICS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 149 SINGAPORE DENTAL HEMOSTATS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 150 SINGAPORE OTHERS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 151 THAILAND DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 152 THAILAND GENERAL AND DIAGNOSTIC DEVICES IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 153 THAILAND DENTAL EQUIPMENT IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 154 THAILAND DENTAL IMPLANTS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 155 THAILAND DENTAL CROWNS AND BRIDGES IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 156 THAILAND DENTAL SYSTEMS AND PARTS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 157 THAILAND DENTAL RADIOLOGY EQUIOMENT IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 158 THAILAND EXTRA-ORAL RADIOLOGY IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 159 THAILAND INTRA-ORAL RADIOLOGY IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 160 THAILAND DENTAL LASERS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 161 THAILAND TREATMENT-BASED DEVICES IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 162 THAILAND ORTHODONTICS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 163 THAILAND FIXED IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 164 THAILAND ENDODONTIC IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 165 THAILAND PERIODONTICS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 166 THAILAND DENTAL ANESTHETICS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 167 THAILAND DENTAL HEMOSTATS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 168 THAILAND OTHERS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 169 MALAYSIA DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 170 MALAYSIA GENERAL AND DIAGNOSTIC DEVICES IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 171 MALAYSIA DENTAL EQUIPMENT IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 172 MALAYSIA DENTAL IMPLANTS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 173 MALAYSIA DENTAL CROWNS AND BRIDGES IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 174 MALAYSIA DENTAL SYSTEMS AND PARTS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 175 MALAYSIA DENTAL RADIOLOGY EQUIOMENT IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 176 MALAYSIA EXTRA-ORAL RADIOLOGY IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 177 MALAYSIA INTRA-ORAL RADIOLOGY IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 178 MALAYSIA DENTAL LASERS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 179 MALAYSIA TREATMENT-BASED DEVICES IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 180 MALAYSIA ORTHODONTICS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 181 MALAYSIA FIXED IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 182 MALAYSIA ENDODONTIC IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 183 MALAYSIA PERIODONTICS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 184 MALAYSIA DENTAL ANESTHETICS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 185 MALAYSIA DENTAL HEMOSTATS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 186 MALAYSIA OTHERS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 187 INDONESIA DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 188 INDONESIA GENERAL AND DIAGNOSTIC DEVICES IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 189 INDONESIA DENTAL EQUIPMENT IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 190 INDONESIA DENTAL IMPLANTS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 191 INDONESIA DENTAL CROWNS AND BRIDGES IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 192 INDONESIA DENTAL SYSTEMS AND PARTS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 193 INDONESIA DENTAL RADIOLOGY EQUIOMENT IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 194 INDONESIA EXTRA-ORAL RADIOLOGY IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 195 INDONESIA INTRA-ORAL RADIOLOGY IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 196 INDONESIA DENTAL LASERS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 197 INDONESIA TREATMENT-BASED DEVICES IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 198 INDONESIA ORTHODONTICS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 199 INDONESIA FIXED IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 200 INDONESIA ENDODONTIC IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 201 INDONESIA PERIODONTICS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 202 INDONESIA DENTAL ANESTHETICS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 203 INDONESIA DENTAL HEMOSTATS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 204 INDONESIA OTHERS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 205 PHILIPPINES DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 206 PHILIPPINES GENERAL AND DIAGNOSTIC DEVICES IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 207 PHILIPPINES DENTAL EQUIPMENT IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 208 PHILIPPINES DENTAL IMPLANTS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 209 PHILIPPINES DENTAL CROWNS AND BRIDGES IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 210 PHILIPPINES DENTAL SYSTEMS AND PARTS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 211 PHILIPPINES DENTAL RADIOLOGY EQUIOMENT IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 212 PHILIPPINES EXTRA-ORAL RADIOLOGY IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 213 PHILIPPINES INTRA-ORAL RADIOLOGY IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 214 PHILIPPINES DENTAL LASERS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 215 PHILIPPINES TREATMENT-BASED DEVICES IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 216 PHILIPPINES ORTHODONTICS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 217 PHILIPPINES FIXED IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 218 PHILIPPINES ENDODONTIC IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 219 PHILIPPINES PERIODONTICS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 220 PHILIPPINES DENTAL ANESTHETICS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 221 PHILIPPINES DENTAL HEMOSTATS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 222 PHILIPPINES OTHERS IN DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 223 REST OF ASIA-PACIFIC DENTAL LAB MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

Список рисунков

FIGURE 1 ASIA PACIFIC DENTAL LAB MARKET : SEGMENTATION

FIGURE 2 ASIA PACIFIC DENTAL LABMARKET: DATA TRIANGULATION

FIGURE 3 ASIA PACIFIC DENTAL LABMARKET: DROC ANALYSIS

FIGURE 4 ASIA PACIFIC DENTAL LABMARKET: ASIA PACIFIC VS REGIONAL MARKET ANALYSIS

FIGURE 5 ASIA PACIFIC DENTAL LABMARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 ASIA PACIFIC DENTAL LABMARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 ASIA PACIFIC DENTAL LABMARKET: DBMR POSITION GRID

FIGURE 8 ASIA PACIFIC DENTAL LABMARKET: VENDOR SHARE ANALYSIS

FIGURE 9 ASIA PACIFIC DENTAL LAB MARKET: SEGMENTATION

FIGURE 10 NORTH AMERICA IS ANTICIPATED TO DOMINATE THE ASIA PACIFIC DENTAL LAB MARKET AND ASIA-PACIFIC IS ESTIMATED TO BE GROWING WITH THE HIGHEST CAGR IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 11 INCREASED INCIDENCE OF DENTAL DISEASES, RISE IN PRODUCT LAUNCHES AND MEDICAL TOURISM FOR DENTAL TREATMENT ACROSS THE WORLD IS EXPECTED TO DRIVE THE ASIA PACIFIC DENTAL LAB MARKET FROM 2022 TO 2029

FIGURE 12 PRODUCT TYPE SEGMENT IS EXPECTED TO HAVE THE LARGEST SHARE OF THE ASIA PACIFIC DENTAL LAB MARKET FROM 2022 & 2029

FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE ASIA PACIFIC DENTAL LAB MARKET

FIGURE 14 FORECAST GERIATRIC POPULATION 2010-2050 TIME PERIOD (IN MILLIONS)

FIGURE 15 INCREASED INCIDENCE OF PERIODONTAL DISEASE IN THE U.S., 2020

FIGURE 16 ASIA PACIFIC DENTAL LAB MARKET: BY PRODUCTS, 2021

FIGURE 17 ASIA PACIFIC DENTAL LAB MARKET: BY PRODUCTS, 2022-2029 (USD MILLION)

FIGURE 18 ASIA PACIFIC DENTAL LAB MARKET: BY PRODUCTS, CAGR (2022-2029)

FIGURE 19 ASIA PACIFIC DENTAL LAB MARKET: BY PRODUCTS, LIFELINE CURVE

FIGURE 20 ASIA-PACIFIC DENTAL LAB MARKET: SNAPSHOT (2021)

FIGURE 21 ASIA-PACIFIC DENTAL LAB MARKET: BY COUNTRY (2021)

FIGURE 22 ASIA-PACIFIC DENTAL LAB MARKET: BY COUNTRY (2022 & 2029)

FIGURE 23 ASIA-PACIFIC DENTAL LAB MARKET: BY COUNTRY (2021 & 2029)

FIGURE 24 ASIA-PACIFIC DENTAL LAB MARKET: BY PRODUCTS (2022-2029)

FIGURE 25 ASIA PACIFIC DENTAL LAB MARKET: COMPANY SHARE 2021 (%)

Методология исследования

Сбор данных и анализ базового года выполняются с использованием модулей сбора данных с большими размерами выборки. Этап включает получение рыночной информации или связанных данных из различных источников и стратегий. Он включает изучение и планирование всех данных, полученных из прошлого заранее. Он также охватывает изучение несоответствий информации, наблюдаемых в различных источниках информации. Рыночные данные анализируются и оцениваются с использованием статистических и последовательных моделей рынка. Кроме того, анализ доли рынка и анализ ключевых тенденций являются основными факторами успеха в отчете о рынке. Чтобы узнать больше, пожалуйста, запросите звонок аналитика или оставьте свой запрос.

Ключевой методологией исследования, используемой исследовательской группой DBMR, является триангуляция данных, которая включает в себя интеллектуальный анализ данных, анализ влияния переменных данных на рынок и первичную (отраслевую экспертную) проверку. Модели данных включают сетку позиционирования поставщиков, анализ временной линии рынка, обзор рынка и руководство, сетку позиционирования компании, патентный анализ, анализ цен, анализ доли рынка компании, стандарты измерения, глобальный и региональный анализ и анализ доли поставщика. Чтобы узнать больше о методологии исследования, отправьте запрос, чтобы поговорить с нашими отраслевыми экспертами.

Доступна настройка

Data Bridge Market Research является лидером в области передовых формативных исследований. Мы гордимся тем, что предоставляем нашим существующим и новым клиентам данные и анализ, которые соответствуют и подходят их целям. Отчет можно настроить, включив в него анализ ценовых тенденций целевых брендов, понимание рынка для дополнительных стран (запросите список стран), данные о результатах клинических испытаний, обзор литературы, обновленный анализ рынка и продуктовой базы. Анализ рынка целевых конкурентов можно проанализировать от анализа на основе технологий до стратегий портфеля рынка. Мы можем добавить столько конкурентов, о которых вам нужны данные в нужном вам формате и стиле данных. Наша команда аналитиков также может предоставить вам данные в сырых файлах Excel, сводных таблицах (книга фактов) или помочь вам в создании презентаций из наборов данных, доступных в отчете.