Asia Pacific Antibody Drug Conjugates Market

Размер рынка в млрд долларов США

CAGR :

%

USD

2.06 Billion

USD

7.10 Billion

2024

2032

USD

2.06 Billion

USD

7.10 Billion

2024

2032

| 2025 –2032 | |

| USD 2.06 Billion | |

| USD 7.10 Billion | |

|

|

|

|

Сегментация рынка конъюгатов антител с лекарственными средствами (ADC) в Азиатско-Тихоокеанском регионе по продуктам (Enhertu, Kadcyla, Trodelvy, Polivy, Adcetris, Padcev, Besponsa, Elahere, Zylonta, Mylotarg, Tivdak и другие), компонент антигена (рецептор HER2, Trop-2, CD79B, CD30, Nectin 4, CD22, CD19, CD33, тканевые факторы и другие), компонент антитела (ADC третьего поколения, ADC второго поколения, ADC четвертого поколения и ADC первого поколения), компонент линкеров (расщепляемые линкеры и нерасщепляемые линкеры), компонент цитотоксических полезных нагрузок или боеголовок (агенты, повреждающие ДНК, и агенты, разрушающие микротрубочки), технология линкеров (пептидные линкеры, тиоэфирные линкеры, гидразоновые линкеры и Дисульфидные линкеры), Технология конъюгации (сайт-специфическая конъюгация и химическая конъюгация), Показания (рак молочной железы, рак крови (лейкемия, лимфома), рак легких, гинекологический рак, рак желудочно-кишечного тракта, рак мочеполовой системы и другие), Конечный пользователь (больницы, специализированные центры, клиники, амбулаторные центры, домашняя медицинская помощь и другие), Канал сбыта (прямые тендеры, розничные продажи и другие) - Тенденции отрасли и прогноз до 2032 г.

Размер рынка конъюгатов антител с лекарственными средствами (ADC) в Азиатско-Тихоокеанском регионе

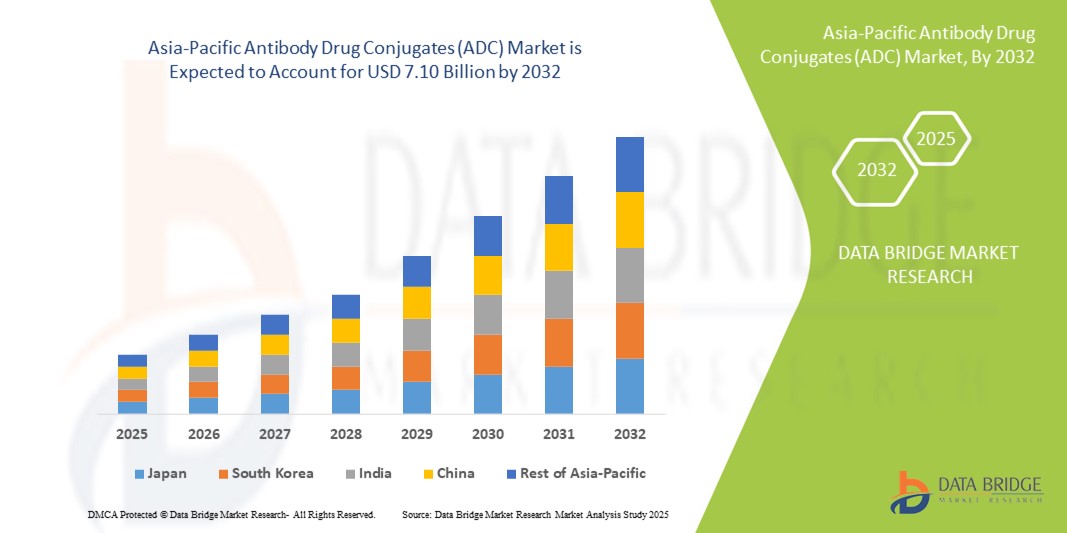

- Объем рынка конъюгатов антител с лекарственными препаратами (ADC) в Азиатско-Тихоокеанском регионе оценивался в 2,06 млрд долларов США в 2024 году и, как ожидается , достигнет 7,10 млрд долларов США к 2032 году при среднегодовом темпе роста 16,70% в течение прогнозируемого периода.

- Рост рынка во многом обусловлен ростом заболеваемости раком, увеличением инвестиций в исследования в области онкологии и большей доступностью целевых терапевтических средств в таких странах, как Китай, Япония и Южная Корея.

- Кроме того, растущее принятие точной медицины, наряду с благоприятными правительственными инициативами по улучшению биофармацевтических инноваций, позиционирует ADC как предпочтительный метод лечения рака. Эти сходящиеся факторы стимулируют устойчивый спрос на терапии ADC, тем самым значительно стимулируя расширение рынка в регионе

Анализ рынка конъюгатов антител и лекарственных препаратов (ADC) в Азиатско-Тихоокеанском регионе

- Конъюгаты антител с лекарственными средствами (ADC), которые сочетают в себе возможности нацеливания моноклональных антител с мощным эффектом цитотоксических препаратов по уничтожению клеток, становятся критически важным классом терапевтических средств в онкологии в Азиатско-Тихоокеанском регионе благодаря своей повышенной эффективности, целенаправленной доставке и сниженной системной токсичности.

- Растущий спрос на ADC обусловлен в первую очередь ростом распространенности рака, улучшением инфраструктуры здравоохранения и расширением доступа к передовым биофармацевтическим препаратам в странах с развивающейся экономикой, таких как Китай и Индия.

- Китай доминировал на рынке конъюгатов антител с лекарственными препаратами (ADC) в Азиатско-Тихоокеанском регионе с наибольшей долей выручки в 48,1% в 2024 году, чему способствовали ускоренные процедуры получения разрешений регулирующих органов, обширные клинические исследования и стратегические партнерства между отечественными фирмами и глобальными игроками в области биотехнологий, сосредоточенные на новых разработках ADC.

- Ожидается, что в Японии будет наблюдаться самый быстрый рост рынка конъюгатов антител с лекарственными средствами (ADC), чему будут способствовать высокие расходы на здравоохранение, устоявшаяся фармацевтическая промышленность и растущая осведомленность пациентов о таргетной терапии рака.

- Сегмент рака молочной железы доминировал на рынке конъюгатов антител с лекарственными препаратами (ADC) в Азиатско-Тихоокеанском регионе, с долей рынка 40,2% на рынке конъюгатов антител с лекарственными препаратами (ADC) в Азиатско-Тихоокеанском регионе в 2024 году, что обусловлено высоким уровнем заболеваемости, ростом показателей диагностики и наличием нескольких одобренных методов лечения ADC, нацеленных на HER2-положительный рак молочной железы.

Область применения отчета и сегментация рынка конъюгатов антител и лекарственных препаратов (ADC) в Азиатско-Тихоокеанском регионе

|

Атрибуты |

Основные сведения о рынке конъюгатов антител и лекарственных препаратов (ADC) в Азиатско-Тихоокеанском регионе |

|

Охваченные сегменты |

|

|

Страны, охваченные |

Азиатско-Тихоокеанский регион

|

|

Ключевые игроки рынка |

|

|

Возможности рынка |

|

|

Информационные наборы данных с добавленной стоимостью |

Помимо аналитических данных о рыночных сценариях, таких как рыночная стоимость, темпы роста, сегментация, географический охват и основные игроки, рыночные отчеты, подготовленные Data Bridge Market Research, также включают в себя углубленный экспертный анализ, анализ цен, анализ доли бренда, опрос потребителей, демографический анализ, анализ цепочки поставок, анализ цепочки создания стоимости, обзор сырья/расходных материалов, критерии выбора поставщиков, анализ PESTLE, анализ Портера и нормативную базу. |

Тенденции рынка конъюгатов антител и лекарственных препаратов (ADC) в Азиатско-Тихоокеанском регионе

«Рост числа клинических испытаний и местного биотехнологического сотрудничества»

- Значительной и набирающей силу тенденцией на рынке ADC в Азиатско-Тихоокеанском регионе является всплеск региональных клинических испытаний и стратегического сотрудничества между местными биотехнологическими фирмами и глобальными фармацевтическими компаниями, направленного на ускорение разработки и коммерциализации новых методов лечения ADC.

- Например, в 2024 году китайская компания Biokin Pharmaceuticals заключила соглашение о совместной разработке с американской биотехнологической фирмой с целью продвижения линейки ADC, нацеленных на HER2, что отражает растущую тенденцию к международному партнерству, обусловленную растущим потенциалом региона в области НИОКР и реформами в сфере регулирования.

- Увеличение инвестиций в онкологические разработки и улучшение нормативно-правовой базы, особенно в Китае и Южной Корее, позволяют ускорить процесс одобрения и оптимизировать пути для инновационных терапевтических средств, таких как ADC. Эти достижения побуждают как местные, так и многонациональные компании расширять свои клинические испытания и создавать локализованные производственные мощности

- Более того, правительства по всему региону, особенно в Китае и Японии, активно финансируют программы исследований рака и точной медицины, способствуя созданию благоприятной среды для инноваций ADC. Известные инициативы включают расширенное финансирование в рамках китайского плана «Здоровый Китай 2030» и японского «Закона о содействии контролю рака», оба направлены на улучшение результатов лечения онкологии с помощью передовых терапевтических средств.

- Интеграция передовых технологий линкеров и методов сайт-специфической конъюгации также набирает обороты в региональных усилиях по развитию, позволяя ADC достигать более высоких терапевтических индексов с улучшенными профилями безопасности. Это меняет стандарт ухода и позиционирует ADC как передовые варианты в таргетной терапии рака

- В результате Азиатско-Тихоокеанский регион становится привлекательным центром исследований ADC, чему способствуют сильные научные знания, увеличивающиеся пулы пациентов для онкологических исследований и благоприятная нормативно-правовая среда, которая поддерживает быстрые инновации и одобрения.

Динамика рынка конъюгатов антител и лекарственных препаратов (ADC) в Азиатско-Тихоокеанском регионе

Водитель

«Растущее бремя рака и растущий спрос на таргетную терапию»

- Рост заболеваемости различными видами рака в Азиатско-Тихоокеанском регионе в сочетании с растущей осведомленностью о прецизионной онкологии является основным фактором, стимулирующим спрос на ADC в регионе.

- Например, в 2024 году Всемирная организация здравоохранения оценила более 9 миллионов новых случаев рака в Азии, среди которых наиболее распространены рак груди, легких и желудка. Этот тревожный рост приводит к увеличению спроса на инновационные варианты лечения, такие как ADC, которые предлагают улучшенную специфичность и сниженную токсичность по сравнению с традиционной химиотерапией.

- Кроме того, растущая доступность биопрепаратов и растущее страховое покрытие на ключевых рынках, таких как Китай и Япония, поддерживают более широкий доступ к терапии ADC. Благоприятная политика возмещения и национальные программы здравоохранения также поощряют принятие дорогостоящих методов лечения за счет снижения финансового бремени для пациентов

- Инвестиции в биофармацевтику также растут в регионе, такие компании, как Seagen и Daiichi Sankyo, расширяют свое присутствие в ADC посредством местных партнерств и расширенных клинических программ. Эти стратегические шаги позволяют ускорить циклы разработки и улучшить доступность ADC по всему региону

- Кроме того, растущие возможности региональных CRO и CDMO поддерживают комплексную разработку ADC, от ранних стадий исследований до производства в коммерческих масштабах, что еще больше повышает готовность к местному рынку.

Сдержанность/Вызов

«Высокая сложность производства и изменчивость регулирования»

- Несмотря на потенциал роста, рынок АЦП в Азиатско-Тихоокеанском регионе сталкивается с существенными проблемами, включая высокую сложность производства и стоимость, связанную с производством АЦП, что ограничивает доступность и масштабируемость в некоторых частях региона.

- ADC требуют точности в химии конъюгации, производства с высокой степенью локализации и строгого контроля качества, все это повышает производственные затраты. Эти технические препятствия могут ограничить выход на рынок для небольших биотехнологических компаний, у которых нет инфраструктуры или капитала для инвестиций в разработку и производство ADC

- Кроме того, несогласованность регулирования в странах Азиатско-Тихоокеанского региона создает препятствия для бесперебойной региональной коммерциализации. В то время как Китай и Япония упростили пути для биопрепаратов, другие страны по-прежнему сталкиваются с длительными процессами одобрения или не имеют четких инструкций, специфичных для ADC

- Эти препятствия могут задержать выход на рынок и ограничить трансграничное сотрудничество, особенно для новых игроков. Более того, отсутствие опытной рабочей силы и технических знаний на некоторых развивающихся рынках может еще больше замедлить принятие и инновации ADC

- Преодоление этих барьеров посредством гармонизированных нормативных рамок, увеличения государственно-частных инвестиций в возможности биопроизводства и программ обучения для производства ADC будет иметь решающее значение для обеспечения устойчивого роста и равноправного доступа во всем Азиатско-Тихоокеанском регионе.

Масштаб рынка конъюгатов антител и лекарственных препаратов (ADC) в Азиатско-Тихоокеанском регионе

Рынок сегментирован по продукту, антигенному компоненту, антителу, линкерному компоненту, цитотоксическим нагрузкам, линкерной технологии, технологии конъюгации, показаниям, конечному пользователю и каналу сбыта.

- По продукту

На основе продукта рынок конъюгатов антител и лекарственных препаратов (ADC) в Азиатско-Тихоокеанском регионе сегментирован на Enhertu, Kadcyla, Trodelvy, Polivy, Adcetris, Padcev, Besponsa, Elahere, Zylonta, Mylotarg, Tivdak и другие. Сегмент Enhertu доминировал на рынке с самой большой долей выручки на рынке в 2024 году, что обусловлено его широким клиническим применением при HER2-положительных видах рака и сильным внедрением в ключевых странах Азиатско-Тихоокеанского региона, таких как Япония, Китай и Южная Корея. Надежные данные об эффективности Enhertu и одобрения регулирующих органов по нескольким показаниям для солидных опухолей укрепили его лидерство в региональном ландшафте ADC.

Ожидается, что сегмент Polivy будет демонстрировать самые быстрые темпы роста с 2025 по 2032 год, что обусловлено его растущим применением в лечении диффузной крупноклеточной В-клеточной лимфомы (DLBCL) и включением в региональные руководства по лечению. Стратегическое расширение Roche и растущее покрытие возмещения в онкологических центрах дополнительно поддерживают его быстрый рост на этом рынке.

- По антигенному компоненту

На основе антигенного компонента рынок конъюгатов антител и лекарственных препаратов (ADC) в Азиатско-Тихоокеанском регионе сегментируется на рецепторы HER2, Trop-2, CD79B, CD30, нектин 4, CD22, CD19, CD33, тканевые факторы и другие. Сегмент рецепторов HER2 занимал наибольшую долю выручки в 2024 году, что объясняется высокой распространенностью HER2-положительных видов рака и доступностью современных ADC, нацеленных на этот антиген, включая Kadcyla и Enhertu.

Ожидается, что сегмент Trop-2 продемонстрирует самые высокие темпы роста в течение прогнозируемого периода, чему будет способствовать рост использования Trodelvy и растущий клинический интерес к препаратам, воздействующим на Trop-2, для лечения агрессивного рака молочной железы и уротелиального рака в регионе.

- По компоненту антитела

На основе генерации антител рынок конъюгатов антител и лекарственных препаратов (ADC) Азиатско-Тихоокеанского региона сегментирован на ADC первого поколения, ADC второго поколения, ADC третьего поколения и ADC четвертого поколения. Сегмент ADC второго поколения доминировал на рынке с наибольшей долей в 2024 году благодаря клиническому успеху и коммерческой доступности ADC, таких как Kadcyla и Adcetris, которые обеспечивают повышенную стабильность и эффективность.

Ожидается, что сегмент АЦП третьего поколения будет расти самыми быстрыми темпами в период с 2025 по 2032 год, что обусловлено технологическими достижениями в области сайт-специфической конъюгации и улучшенными профилями безопасности, которые внедряются региональными разработчиками и глобальными фармацевтическими партнерами, такими как:

- По компоненту линкера

На основе линкерного компонента рынок конъюгатов антител с лекарственными средствами (ADC) в Азиатско-Тихоокеанском регионе сегментируется на расщепляемые линкеры и нерасщепляемые линкеры. Сегмент расщепляемых линкеров занимал большую часть рыночной выручки в 2024 году, что обусловлено их способностью избирательно высвобождать цитотоксические агенты в опухолевой среде, тем самым снижая системную токсичность и улучшая терапевтические результаты.

Ожидается, что сегмент нерасщепляемых линкеров будет расти самыми быстрыми темпами в течение прогнозируемого периода, особенно в области гематологических злокачественных новообразований, где механизмы внутриклеточной деградации способствуют эффективному высвобождению лекарственных средств даже без расщепления линкера.

- По цитотоксическим боевым нагрузкам или компонентам боеголовок

На основе цитотоксических нагрузок рынок конъюгатов антител и лекарственных препаратов (ADC) в Азиатско-Тихоокеанском регионе сегментируется на агенты, повреждающие ДНК, и агенты, разрушающие микротрубочки. Сегмент агентов, разрушающих микротрубочки, доминировал на рынке в 2024 году, что обусловлено их успешным использованием в известных ADC, таких как Kadcyla и Adcetris. Эти агенты проявляют мощную противоопухолевую активность и продемонстрировали благоприятные результаты как при солидном раке, так и при раке крови.

Ожидается, что сегмент агентов, повреждающих ДНК, будет расти самыми быстрыми темпами в период с 2025 по 2032 год благодаря их уникальным механизмам и растущему внедрению в ADC следующего поколения, включая те, которые разрабатываются для лечения солидных опухолей с высокой мутационной нагрузкой.

- По технологии Linker

На основе технологии линкеров рынок конъюгатов антител с лекарственными средствами (ADC) в Азиатско-Тихоокеанском регионе сегментируется на пептидные линкеры, тиоэфирные линкеры, гидразоновые линкеры и дисульфидные линкеры. Сегмент пептидных линкеров обеспечил наибольшую долю выручки в 2024 году, что обусловлено их селективным расщеплением в опухолевых тканях и совместимостью с современными конструкциями ADC.

Ожидается, что сегмент тиоэфирных линкеров будет расти самыми быстрыми темпами в течение прогнозируемого периода, поскольку они обеспечивают химическую стабильность и широко используются в одобренных ADC, таких как Kadcyla, обеспечивая безопасную и эффективную доставку лекарственных средств в системный кровоток.

- По технологии конъюгации

На основе метода конъюгации рынок конъюгатов антител и лекарственных препаратов (ADC) в Азиатско-Тихоокеанском регионе сегментируется на сайт-специфическую конъюгацию и химическую конъюгацию. Сегмент химической конъюгации занимал самую высокую долю рынка в 2024 году, поскольку это был обычный метод, используемый в большинстве ADC первого и второго поколения.

Ожидается, что сегмент сайт-специфической конъюгации будет расти самыми быстрыми темпами в течение прогнозируемого периода благодаря его способности повышать точность доставки полезной нагрузки, улучшать терапевтический индекс и поддерживать разработку АЦП нового поколения для различных показаний.

- По показаниям

На основе показаний рынок конъюгатов антител и лекарственных препаратов (ADC) в Азиатско-Тихоокеанском регионе сегментируется на рак молочной железы, рак крови (лейкемия, лимфома), рак легких, гинекологический рак, рак желудочно-кишечного тракта, рак мочеполовой системы и другие. Сегмент рака молочной железы доминировал на рынке с наибольшей долей рынка в 40,2% в 2024 году, что обусловлено высоким бременем HER2-положительных случаев и широким использованием одобренных ADC, таких как Enhertu и Kadcyla.

Ожидается, что сегмент рака легких будет демонстрировать самые быстрые темпы роста в период с 2025 по 2032 год в связи с ростом заболеваемости, появлением клинических испытаний ADC для немелкоклеточного рака легкого и растущим внедрением стратегий прецизионной медицины в Китае и Японии.

- Конечным пользователем

На основе конечного пользователя рынок конъюгатов антител и лекарственных препаратов (ADC) в Азиатско-Тихоокеанском регионе сегментируется на больницы, специализированные центры, клиники, амбулаторные центры, домашнюю медицинскую помощь и другие. Сегмент больниц составил наибольшую долю рынка в 2024 году, поскольку они являются основными местами лечения рака и введения ADC, требующими контролируемых сред.

Ожидается, что сегмент специализированных центров будет расти самыми высокими среднегодовыми темпами в течение прогнозируемого периода, что будет обусловлено ростом инвестиций в онкологические учреждения и спросом пациентов на специализированную высококачественную помощь в специализированных центрах лечения онкологии.

- По каналу распространения

На основе канала сбыта рынок конъюгатов антител и лекарственных препаратов (ADC) в Азиатско-Тихоокеанском регионе сегментируется на прямые торги, розничные продажи и другие. Сегмент прямых торгов доминировал на рынке в 2024 году, что было обусловлено централизованными закупками государственными и частными больничными сетями, особенно для дорогостоящих онкологических методов лечения, требующих соглашений об оптовых закупках.

Ожидается, что сегмент розничных продаж будет расти самыми быстрыми темпами в течение прогнозируемого периода в связи с постепенным переходом к моделям амбулаторного лечения онкологических заболеваний, расширением аптечных сетей и повышением доступа пациентов к целевой терапии через частные системы здравоохранения в таких странах, как Япония и Южная Корея.

Анализ рынка конъюгатов антител и лекарственных препаратов (ADC) в Азиатско-Тихоокеанском регионе

- Китай доминировал на рынке конъюгатов антител с лекарственными препаратами (ADC) в Азиатско-Тихоокеанском регионе с наибольшей долей выручки в 48,1% в 2024 году, чему способствовали ускоренные процедуры получения разрешений регулирующих органов, обширные клинические исследования и стратегические партнерства между отечественными фирмами и глобальными игроками в области биотехнологий, сосредоточенные на новых разработках ADC.

- Рост региона дополнительно стимулируется увеличением инвестиций в онкологические НИОКР, активной деятельностью в области клинических испытаний и расширением внутренних производственных возможностей. Биофармацевтический сектор Китая быстро развивается, что делает его ключевым центром для разработки и коммерциализации ADC

- Благоприятная политика возмещения расходов, увеличение расходов на здравоохранение и растущая осведомленность о прецизионной онкологии в таких странах, как Япония, Южная Корея и Австралия, также способствуют региональному расширению, позиционируя Азиатско-Тихоокеанский регион как основного участника мирового рынка ADC в ближайшие годы.

Обзор рынка конъюгатов антител и лекарственных препаратов (ADC) в Китае

Китайский рынок конъюгатов антител с лекарственными препаратами (ADC) занял самую большую долю выручки в Азиатско-Тихоокеанском регионе в 2024 году, чему способствовала поддерживающая государственная политика, быстрорастущий онкологический конвейер и сильная отечественная фармацевтическая производственная база. Реформы регулирования, такие как система «MAH» (держатель разрешения на маркетинг) и ускоренное одобрение лекарств, сделали Китай центром разработки ADC. Повышение осведомленности о таргетных методах лечения и стратегические альянсы между китайскими фирмами и мировыми лидерами в области биотехнологий еще больше стимулируют расширение рынка, особенно в области лечения HER2-положительных и гематологических видов рака.

Обзор рынка конъюгатов антител и лекарственных препаратов (ADC) в Японии

Рынок конъюгатов антител и лекарственных препаратов (ADC) в Японии набирает обороты благодаря развитой инфраструктуре здравоохранения, значительным инвестициям в НИОКР в области онкологии и раннему внедрению инновационных терапевтических средств. Зрелая фармацевтическая промышленность Японии и устоявшиеся системы возмещения расходов поддерживают внедрение дорогостоящих биологических препаратов, таких как ADC. Рост заболеваемости раком груди и легких в сочетании с доверием населения Японии к целевым методам лечения способствуют сильному росту, особенно для ADC второго и третьего поколения с доказанными профилями безопасности и эффективности.

Обзор рынка конъюгатов антител и лекарственных препаратов (ADC) в Индии

Рынок конъюгатов антител и лекарственных препаратов (ADC) в Индии готов к быстрому росту, обусловленному ростом распространенности рака, улучшением доступа к специализированной помощи и растущим участием в глобальных клинических испытаниях. Растущий средний класс Индии и фокус на развитии инфраструктуры здравоохранения сделали передовые методы лечения более доступными. Появление местных биотехнологических компаний, инвестирующих в исследования ADC, в сочетании с поддерживающей политикой в рамках таких инициатив, как «Make in India» и «Pharma Vision 2020», как ожидается, значительно улучшит возможности внутреннего производства и разработки, укрепив позиции страны на рынке ADC в Азиатско-Тихоокеанском регионе.

Обзор рынка конъюгатов антител и лекарственных препаратов (ADC) в Южной Корее

Южнокорейский рынок антитело-лекарственных конъюгатов (ADC) неуклонно расширяется из-за сильного акцента страны на биотехнологических инновациях, государственного финансирования онкологических исследований и растущей распространенности рака, связанного с образом жизни. Ведущие фармацевтические фирмы Южной Кореи активно сотрудничают с международными биотехнологическими компаниями для совместной разработки и коммерциализации новых терапий ADC. Оптимизированная нормативная база страны и высокие расходы на здравоохранение дополнительно поддерживают интеграцию ADC в протоколы лечения онкологии в крупных больницах и специализированных онкологических центрах.

Доля рынка конъюгатов антител и лекарственных препаратов (ADC) в Азиатско-Тихоокеанском регионе

Индустрия конъюгатов антител с лекарственными препаратами (ADC) в Азиатско-Тихоокеанском регионе в основном представлена хорошо зарекомендовавшими себя компаниями, в том числе:

- Daiichi Sankyo Co., Ltd. (Япония)

- Seagen Inc. (США)

- АстраЗенека (Великобритания)

- RemeGen Co., Ltd. (Китай)

- Mycenax Biotech Inc. (Тайвань)

- Mabwell (Шанхай) Bioscience Co., Ltd. (Китай)

- Mersana Therapeutics, Inc. (США)

- Biocon Biologics Ltd. (Индия)

- WuXi Biologics (Cayman) Inc. (Китай)

- Samsung Biologics Co., Ltd. (Южная Корея)

- Bio-Thera Solutions, Ltd. (Китай)

- Zymeworks Inc. (Канада)

- Prestige Biopharma Ltd. (Сингапур)

- SinoMab BioScience Limited (Гонконг)

- Kyowa Kirin Co., Ltd. (Япония)

- AbbVie Inc. (США)

- Innovent Biologics, Inc. (Китай)

- Nanjing Leads Biolabs Co., Ltd. (Китай)

- Тот Биофарм Ко., Лтд. (Китай)

- Amgen Inc. (США)

Каковы последние события на мировом рынке конъюгатов антител с лекарственными препаратами (ADC) в Азиатско-Тихоокеанском регионе?

- В апреле 2024 года китайская биофармацевтическая компания RemeGen Co., Ltd. объявила о расширении своих глобальных клинических испытаний диситамаба ведотина, HER2-таргетного ADC, на Юго-Восточную Азию и Австралию. Этот шаг направлен на ускорение получения разрешений регулирующих органов по всему Азиатско-Тихоокеанскому региону и отражает стратегическую направленность компании на расширение доступа к противораковым препаратам нового поколения. Инициатива RemeGen подчеркивает растущую вовлеченность региона в мировое развитие онкологии и его растущую значимость в экосистеме инноваций ADC

- В марте 2024 года японская компания Daiichi Sankyo заключила исследовательское и лицензионное соглашение с сингапурским институтом генома A*STAR для изучения новых полезных нагрузок ADC и технологий линкеров. Сотрудничество направлено на расширение терапевтического окна существующих ADC и создание более таргетированных методов лечения солидных опухолей. Это развитие подчеркивает растущую тенденцию к трансграничному сотрудничеству в Азиатско-Тихоокеанском регионе, направленному на продвижение исследований в области онкологии и разработки лекарств.

- В феврале 2024 года южнокорейская Samsung Biologics объявила о расширении контрактной разработки и производства ADC, позиционируя себя как ключевого регионального игрока в производстве ADC. С ростом спроса на аутсорсинговое биофармацевтическое производство в Азиатско-Тихоокеанском регионе это расширение повышает масштабируемость цепочек поставок ADC и помогает региональным биотехнологическим фирмам быстрее и экономически эффективнее выводить на рынок новые методы лечения

- В феврале 2024 года индийская компания Biocon Biologics подписала эксклюзивное партнерское соглашение с американской биотехнологической фирмой о совместной разработке и коммерциализации линейки ADC, нацеленных на гинекологические и желудочно-кишечные раковые заболевания. Партнерство соответствует стратегической цели Biocon по расширению своего онкологического портфеля и использованию растущей клинической и производственной инфраструктуры Индии для передовых биопрепаратов

- В январе 2024 года австралийский Институт медицинских исследований Гарвана начал клиническое исследование фазы I, оценивающее новый направленный на Trop-2 ADC, разработанный в партнерстве с местным биотехнологическим стартапом. Исследование представляет собой одно из первых ранних исследований ADC, запущенных в Австралии, и отражает растущую роль местных научно-исследовательских институтов в продвижении таргетной терапии рака, адаптированной к региональным группам пациентов.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Интерактивная панель анализа данных

- Панель анализа компании для возможностей с высоким потенциалом роста

- Доступ аналитика-исследователя для настройки и запросов

- Анализ конкурентов с помощью интерактивной панели

- Последние новости, обновления и анализ тенденций

- Используйте возможности сравнительного анализа для комплексного отслеживания конкурентов

Содержание

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF ASIA-PACIFIC ANTIBODY DRUG CONJUGATES (ADC) MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 MULTIVARIATE MODELLING

2.7 MARKET APPLICATION COVERAGE GRID

2.8 PRODUCT LIFELINE CURVE

2.9 DBMR MARKET POSITION GRID

2.1 VENDOR SHARE ANALYSIS

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTAL ANALYSIS

4.2 PORTER’S FIVE FORCES

4.3 PESTEL ANALYSIS

5 COST STRUCTURE ANALYSIS OF ANTIBODY-DRUG CONJUGATE (ADC) MANUFACTURING

5.1 ANTIBODIES

5.1.1 OVERVIEW OF ANTIBODY PRODUCTION

5.1.1.1 In-house vs. Outsourced:

5.1.2 ANTIBODY PRICING FACTORS

5.2 LINKERS

5.2.1 ROLE AND TYPES OF LINKERS

5.2.1.1 Cost Impact by Linker Type:

5.3 CYTOTOXIC AGENTS

5.3.1 COST CONSIDERATIONS:

5.3.2 BUFFERS AND SOLVENTS

5.4 COST BREAKDOWN BY MANUFACTURING STAGE

5.4.1 PRE-PRODUCTION COSTS

5.4.2 CONJUGATION PROCESS

5.4.3 PURIFICATION AND FILTRATION

5.4.4 QUALITY CONTROL

5.5 COST PROJECTIONS AND PRICING TRENDS (2024–2030)

5.5.1 PROJECTED COST FLUCTUATIONS

5.5.2 COST IMPACT OF SCALABILITY

5.6 SUPPLIER AND GEOGRAPHIC PRICING TRENDS

5.6.1 GEOGRAPHIC COST VARIATIONS

5.6.2 SUPPLIER ANALYSIS

5.6.3 CONCLUSION

6 ASIA-PACIFIC ANTIBODY DRUG CONJUGATES (ADC) MARKET: REGULATIONS

7 MARKET OVERVIEW

7.1 DRIVERS

7.1.1 INCREASING PREVALENCE OF CANCER

7.1.2 ADVANCES IN ANTIBODY-DRUG CONJUGATE (ADC) TECHNOLOGY

7.1.3 INCREASING DEMAND FOR TARGETED THERAPIES

7.1.4 ADVANCEMENTS IN PROTEOMICS AND GENOMICS RESEARCH

7.2 RESTRAINTS

7.2.1 HIGH DEVELOPMENT COST & MANUFACTURING COMPLEXITIES

7.2.2 SAFETY AND TOXICITY ISSUES OF ANTIBODY DRUG CONJUGATES

7.3 OPPORTUNITIES

7.3.1 GROWING ONCOLOGY PIPELINE FOR ANTIBODY DRUG CONJUGATES (ADCS)

7.3.2 INCREASING INVESTMENT IN CANCER RESEARCH

7.3.3 INCREASING COLLABORATION WITH RESEARCH INSTITUTIONS FOR ANTIBODY DRUG CONJUGATES

7.4 CHALLENGES

7.4.1 CLINICAL TRIAL FAILURES FOR ANTIBODY DRUG CONJUGATES DEVELOPMENT

7.4.2 LENGTHY CLINICAL TRIALS AND DEVELOPMENT PHASES

8 ASIA-PACIFIC ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY PRODUCT

8.1 OVERVIEW

8.2 ENHERTU

8.3 KADCYLA

8.4 TRODELVY

8.5 POLIVY

8.6 ADCETRIS

8.7 PADCEV

8.8 BESPONSA

8.9 ELAHERE

8.1 ZYLONTA

8.11 MYLOTARG

8.12 TIVDAK

8.13 OTHERS

9 ASIA-PACIFIC ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY ANTIGEN COMPONENT

9.1 OVERVIEW

9.2 HER2 RECEPTOR

9.3 TROP-2

9.4 CD79B

9.5 CD30

9.6 NECTIN 4

9.7 CD22

9.8 CD19

9.9 CD33

9.1 TISSUE FACTORS

9.11 OTHERS

10 ASIA-PACIFIC ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY ANTIBODY COMPONENT

10.1 OVERVIEW

10.2 THIRD GENERATION ADCS

10.3 SECOND GENERATION ADCS

10.4 FOURTH GENERATION ADCS

10.5 FIRST GENERATION ADCS

11 ASIA-PACIFIC ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY LINKERS COMPONENT

11.1 OVERVIEW

11.2 CLEAVABLE LINKERS

11.2.1 PEPTIDE BASED

11.2.2 ACID SENSITIVE OR ACID LABILE

11.2.3 GLUTATHIONE SENSITIVE DISULFIDE

11.3 NON CLEAVABLE LINKERS

12 ASIA-PACIFIC ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY CYTOTOXIC PAYLOADS OR WARHEADS COMPONENT

12.1 OVERVIEW

12.2 DNA DAMAGING AGENTS

12.2.1 CAMPTOTHECIN

12.2.2 CALICHEAMICIN

12.2.3 PYRROLOBENZODIAZEPINES

12.3 MICROTUBULE DISRUPTING AGENTS

12.3.1 AURISTATIN

12.3.2 MAYTANSINOIDS

13 ASIA-PACIFIC ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY LINKER TECHNOLOGY

13.1 OVERVIEW

13.2 PEPTIDE LINKERS

13.3 THIOETHER LINKERS

13.4 HYDRAZONE LINKERS

13.5 DISULFIDE LINKERS

14 ASIA-PACIFIC ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY CONJUGATION TECHNOLOGY

14.1 OVERVIEW

14.2 SITE-SPECIFIC CONJUGATION

14.3 CHEMICAL CONJUGATION

15 ASIA-PACIFIC ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY INDICATION

15.1 OVERVIEW

15.2 BREAST CANCER

15.3 BLOOD CANCER (LEUKEMIA, LYMPHOMA)

15.4 LUNG CANCER

15.5 GYNECOLOGICAL CANCER

15.6 GASTROINTESTINAL CANCER

15.7 GENITOURINARY CANCER

15.8 OTHERS

16 ASIA-PACIFIC ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY END USER

16.1 OVERVIEW

16.2 HOSPITALS

16.3 SPECIALTY CENTER

16.4 CLINICS

16.5 AMBULATORY CENTERS

16.6 HOME HEALTHCARE

16.7 OTHERS

17 ASIA-PACIFIC ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY DISTRIBUTION CHANNEL

17.1 OVERVIEW

17.2 DIRECT TENDERS

17.3 RETAIL SALES

17.3.1 HOSPITAL PHARMACY

17.3.2 RETAIL PHARMACY

17.3.3 ONLINE PHARMACY

17.4 OTHERS

18 ASIA-PACIFIC ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY REGION

18.1 ASIA-PACIFIC

18.1.1 JAPAN

18.1.2 CHINA

18.1.3 INDIA

18.1.4 AUSTRALIA

18.1.5 SINGAPORE

18.1.6 REST OF ASIA-PACIFIC

19 ASIA-PACIFIC ANTIBODY DRUG CONJUGATES (ADC): COMPANY LANDSCAPE

19.1 COMPANY SHARE ANALYSIS: GLOBAL

20 SWOT ANALYSIS

21 COMPANY PROFILES

21.1 DAIICHI SANKYO, INC.

21.1.1 COMPANY SNAPSHOT

21.1.2 REVENUE ANALYSIS

21.1.3 PRODUCT PORTFOLIO

21.1.4 RECENT DEVELOPMENT

21.2 F. HOFFMANN-LA ROCHE LTD

21.2.1 COMPANY SNAPSHOT

21.2.2 REVENUE ANALYSIS

21.2.3 PRODUCT PORTFOLIO

21.2.4 RECENT DEVELOPMENT

21.3 GILEAD SCIENCES, INC.

21.3.1 COMPANY SNAPSHOT

21.3.2 REVENUE

21.3.3 PRODUCT PORTFOLIO

21.3.4 RECENT DEVELOPMENT

21.4 ASTELLAS PHARMA INC.

21.4.1 COMPANY SNAPSHOT

21.4.2 REVENUE ANALYSIS

21.4.3 PRODUCT PORTFOLIO

21.4.4 RECENT DEVELOPMENT

21.5 TAKEDA PHARMACEUTICAL COMPANY LIMITED

21.5.1 COMPANY SNAPSHOT

21.5.2 REVENUE ANALYSIS

21.5.3 PRODUCT PORTFOLIO

21.5.4 RECENT DEVELOPMENT

21.6 ABBVIE INC.

21.6.1 COMPANY SNAPSHOT

21.6.2 REVENUE

21.6.3 PRODUCT PORTFOLIO

21.6.4 RECENT DEVELOPMENT

21.7 ADC THERAPEUTICS SA

21.7.1 6.1 COMPANY SNAPSHOT

21.7.2 REVENUE ANALYSIS

21.7.3 PRODUCT PORTFOLIO

21.7.4 RECENT DEVELOPMENT

21.8 AMGEN, INC.

21.8.1 COMPANY SNAPSHOT

21.8.2 REVENUE ANALYSIS

21.8.3 PRODUCT PORTFOLIO

21.8.4 RECENT DEVELOPMENT

21.9 ASTRAZENECA

21.9.1 COMPANY SNAPSHOT

21.9.2 REVENUE ANALYSIS

21.9.3 PRODUCT PORTFOLIO

21.9.4 RECENT DEVELOPMENT

21.1 BAYER

21.10.1 COMPANY SNAPSHOT

21.10.2 REVENUE ANALYSIS

21.10.3 PRODUCT PORTFOLIO

21.10.4 RECENT DEVELOPMENT

21.11 BYONDIS

21.11.1 COMPANY SNAPSHOT

21.11.2 PRODUCT PORTFOLIO

21.11.3 RECENT DEVELOPMENT

21.12 EISAI INC

21.12.1 COMPANY SNAPSHOT

21.12.2 REVENUE ANALYSIS

21.12.3 PRODUCT PORTFOLIO

21.12.4 RECENT DEVELOPMENT

21.13 GSK PLC

21.13.1 COMPANY SNAPSHOT

21.13.2 REVENUE ANALYSIS

21.13.3 PRODUCT PORTFOLIO

21.13.4 RECENT DEVELOPMENT

21.14 JOHNSON & JOHNSON SERVICES, INC.

21.14.1 COMPANY SNAPSHOT

21.14.2 REVENUE ANALYSIS

21.14.3 PRODUCT PORTFOLIO

21.14.4 RECENT DEVELOPMENT

21.15 OXFORD BIOTHERAPEUTICS

21.15.1 COMPANY SNAPSHOT

21.15.2 PRODUCT PORTFOLIO

21.15.3 RECENT DEVELOPMENT

21.16 PFIZER INC.

21.16.1 COMPANY SNAPSHOT

21.16.2 REVENUE ANALYSIS

21.16.3 PRODUCT PORTFOLIO

21.16.4 RECENT UPDATES

21.17 REMEGEN

21.17.1 COMPANY SNAPSHOT

21.17.2 PRODUCT PORTFOLIO

21.17.3 RECENT DEVELOPMENTS

21.18 SANOFI

21.18.1 COMPANY SNAPSHOT

21.18.2 REVENUE ANALYSIS

21.18.3 PRODUCT PORTFOLIO

21.18.4 RECENT DEVELOPMENT

21.19 SUTRO BIOPHARMA, INC.

21.19.1 COMPANY SNAPSHOT

21.19.2 REVENUE ANALYSIS

21.19.3 PRODUCT PORTFOLIO

21.19.4 RECENT UPDATES

22 QUESTIONNAIRE

23 RELATED REPORTS

Список таблиц

TABLE 1 PROJECTED PRICE CHANGE (2024–2030)

TABLE 2 ASIA-PACIFIC ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY PRODUCT, 2022-2031 (USD MILLION)

TABLE 3 ASIA-PACIFIC ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY PRODUCT, 2022-2031 (VOLUME IN UNITS)

TABLE 4 ASIA-PACIFIC ENHERTU IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 5 ASIA-PACIFIC KADCYLA IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 6 ASIA-PACIFIC TRODELVY IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 7 ASIA-PACIFIC POLIVY IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 8 ASIA-PACIFIC ADCETRIS IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 9 ASIA-PACIFIC PADCEV IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 10 ASIA-PACIFIC BESPONSA IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 11 ASIA-PACIFIC ELAHERE IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 12 ASIA-PACIFIC ZYLONTA IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 13 ASIA-PACIFIC MYLOTARG IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 14 ASIA-PACIFIC TIVDAK IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 15 ASIA-PACIFIC OTHERS IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 16 ASIA-PACIFIC ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY ANTIGEN COMPONENT, 2022-2031 (USD MILLION)

TABLE 17 ASIA-PACIFIC HER2 RECEPTOR IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 18 ASIA-PACIFIC TROP-2 IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 19 ASIA-PACIFIC CD79B IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 20 ASIA-PACIFIC CD30 IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 21 ASIA-PACIFIC NECTIN 4 IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 22 ASIA-PACIFIC CD22 IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 23 ASIA-PACIFIC CD19 IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 24 ASIA-PACIFIC CD33 IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 25 ASIA-PACIFIC TISSUE FACTORS IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 26 ASIA-PACIFIC OTHERS IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 27 ASIA-PACIFIC ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY ANTIBODY COMPONENT, 2022-2031 (USD MILLION)

TABLE 28 ASIA-PACIFIC THIRD GENERATION ADCS IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 29 ASIA-PACIFIC SECOND GENERATION ADCS IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 30 ASIA-PACIFIC FOURTH GENERATION ADCS IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 31 ASIA-PACIFIC FIRST GENERATION ADCS IN OPHTHALMOLOGY MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 32 ASIA-PACIFIC ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY LINKERS COMPONENT, 2022-2031 (USD MILLION)

TABLE 33 ASIA-PACIFIC CLEAVABLE LINKERS IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 34 ASIA-PACIFIC CLEAVABLE LINKERS IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY COMPONENT, 2022-2031 (USD MILLION)

TABLE 35 ASIA-PACIFIC NON CLEAVABLE LINKERS IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 36 ASIA-PACIFIC ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY CYTOTOXIC PAYLOADS OR WARHEADS COMPONENT, 2022-2031 (USD MILLION)

TABLE 37 ASIA-PACIFIC DNA DAMAGING AGENTS IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 38 ASIA-PACIFIC DNA DAMAGING AGENTS IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY COMPONENT, 2022-2031 (USD MILLION)

TABLE 39 ASIA-PACIFIC MICROTUBULE DISRUPTING AGENTS IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 40 ASIA-PACIFIC MICROTUBULE DISRUPTING AGENTS IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY COMPONENT, 2022-2031 (USD MILLION)

TABLE 41 ASIA-PACIFIC ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY LINKER TECHNOLOGY, 2022-2031 (USD MILLION)

TABLE 42 ASIA-PACIFIC PEPTIDE LINKERS IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 43 ASIA-PACIFIC THIOETHER LINKERS IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 44 ASIA-PACIFIC HYDRAZONE LINKERS IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 45 ASIA-PACIFIC DISULFIDE LINKERS IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 46 ASIA-PACIFIC ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY CONJUGATION TECHNOLOGY, 2022-2031 (USD MILLION)

TABLE 47 ASIA-PACIFIC SITE-SPECIFIC CONJUGATION IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 48 ASIA-PACIFIC CHEMICAL CONJUGATION IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 49 ASIA-PACIFIC ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY INDICATION, 2022-2031 (USD MILLION)

TABLE 50 ASIA-PACIFIC BREAST CANCER IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 51 ASIA-PACIFIC BLOOD CANCER (LEUKEMIA, LYMPHOMA) IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 52 ASIA-PACIFIC LUNG CANCER IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 53 ASIA-PACIFIC GYNECOLOGICAL CANCER IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 54 ASIA-PACIFIC GASTROINTESTINAL CANCER IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 55 ASIA-PACIFIC GENITOURINARY CANCER IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 56 ASIA-PACIFIC OTHERS IN OPHTHALMOLOGY MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 57 ASIA-PACIFIC ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY END USER, 2022-2031 (USD MILLION)

TABLE 58 ASIA-PACIFIC HOSPITALS IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 59 ASIA-PACIFIC SPECIALTY CENTERS IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 60 ASIA-PACIFIC CLINICS IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 61 ASIA-PACIFIC AMBULATORY CENTERS IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 62 ASIA-PACIFIC HOME HEALTHCARE IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 63 ASIA-PACIFIC OTHERS IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 64 ASIA-PACIFIC ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 65 ASIA-PACIFIC DIRECT TENDERS IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 66 ASIA-PACIFIC RETAIL SALES IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 67 ASIA-PACIFIC RETAIL SALES IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 68 ASIA-PACIFIC OTHERS IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 69 ASIA-PACIFIC ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY COUNTRY, 2022-2031 (USD MILLION)

TABLE 70 ASIA-PACIFIC ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY PRODUCT, 2022-2031 (USD MILLION)

TABLE 71 ASIA-PACIFIC ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY PRODUCT, 2022-2031 (VOLUME IN UNITS)

TABLE 72 ASIA-PACIFIC ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY PRODUCT, 2022-2031 (ASP)

TABLE 73 ASIA-PACIFIC ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY ANTIGEN COMPONENT, 2022-2031 (USD MILLION)

TABLE 74 ASIA-PACIFIC ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY ANTIBODY COMPONENT, 2022-2031 (USD MILLION)

TABLE 75 ASIA-PACIFIC ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY LINKERS COMPONENT, 2022-2031 (USD MILLION)

TABLE 76 ASIA-PACIFIC CLEAVABLE LINKERS IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY COMPONENT, 2022-2031 (USD MILLION)

TABLE 77 ASIA-PACIFIC ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY CYTOTOXIC PAYLOADS OR WARHEADS COMPONENT, 2022-2031 (USD MILLION)

TABLE 78 ASIA-PACIFIC DNA DAMAGING AGENTS IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY COMPONENT, 2022-2031 (USD MILLION)

TABLE 79 ASIA-PACIFIC MICROTUBULE DISRUPTING AGENTS IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY COMPONENT, 2022-2031 (USD MILLION)

TABLE 80 ASIA-PACIFIC ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY LINKER TECHNOLOGY, 2022-2031 (USD MILLION)

TABLE 81 ASIA-PACIFIC ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY CONJUGATION TECHNOLOGY, 2022-2031 (USD MILLION)

TABLE 82 ASIA-PACIFIC ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY INDICATION, 2022-2031 (USD MILLION)

TABLE 83 ASIA-PACIFIC ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY END USER, 2022-2031 (USD MILLION)

TABLE 84 ASIA-PACIFIC ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 85 ASIA-PACIFIC RETAIL SALES IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 86 JAPAN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY PRODUCT, 2022-2031 (USD MILLION)

TABLE 87 JAPAN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY PRODUCT, 2022-2031 (VOLUME IN UNITS)

TABLE 88 JAPAN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY PRODUCT, 2022-2031 (ASP)

TABLE 89 JAPAN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY ANTIGEN COMPONENT, 2022-2031 (USD MILLION)

TABLE 90 JAPAN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY ANTIBODY COMPONENT, 2022-2031 (USD MILLION)

TABLE 91 JAPAN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY LINKERS COMPONENT, 2022-2031 (USD MILLION)

TABLE 92 JAPAN CLEAVABLE LINKERS IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY COMPONENT, 2022-2031 (USD MILLION)

TABLE 93 JAPAN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY CYTOTOXIC PAYLOADS OR WARHEADS COMPONENT, 2022-2031 (USD MILLION)

TABLE 94 JAPAN DNA DAMAGING AGENTS IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY COMPONENT, 2022-2031 (USD MILLION)

TABLE 95 JAPAN MICROTUBULE DISRUPTING AGENTS IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY COMPONENT, 2022-2031 (USD MILLION)

TABLE 96 JAPAN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY LINKER TECHNOLOGY, 2022-2031 (USD MILLION)

TABLE 97 JAPAN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY CONJUGATION TECHNOLOGY, 2022-2031 (USD MILLION)

TABLE 98 JAPAN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY INDICATION, 2022-2031 (USD MILLION)

TABLE 99 JAPAN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY END USER, 2022-2031 (USD MILLION)

TABLE 100 JAPAN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 101 JAPAN RETAIL SALES IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 102 CHINA ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY PRODUCT, 2022-2031 (USD MILLION)

TABLE 103 CHINA ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY PRODUCT, 2022-2031 (VOLUME IN UNITS)

TABLE 104 CHINA ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY PRODUCT, 2022-2031 (ASP)

TABLE 105 CHINA ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY ANTIGEN COMPONENT, 2022-2031 (USD MILLION)

TABLE 106 CHINA ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY ANTIBODY COMPONENT, 2022-2031 (USD MILLION)

TABLE 107 CHINA ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY LINKERS COMPONENT, 2022-2031 (USD MILLION)

TABLE 108 CHINA CLEAVABLE LINKERS IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY COMPONENT, 2022-2031 (USD MILLION)

TABLE 109 CHINA ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY CYTOTOXIC PAYLOADS OR WARHEADS COMPONENT, 2022-2031 (USD MILLION)

TABLE 110 CHINA DNA DAMAGING AGENTS IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY COMPONENT, 2022-2031 (USD MILLION)

TABLE 111 CHINA MICROTUBULE DISRUPTING AGENTS IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY COMPONENT, 2022-2031 (USD MILLION)

TABLE 112 CHINA ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY LINKER TECHNOLOGY, 2022-2031 (USD MILLION)

TABLE 113 CHINA ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY CONJUGATION TECHNOLOGY, 2022-2031 (USD MILLION)

TABLE 114 CHINA ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY INDICATION, 2022-2031 (USD MILLION)

TABLE 115 CHINA ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY END USER, 2022-2031 (USD MILLION)

TABLE 116 CHINA ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 117 CHINA RETAIL SALES IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 118 INDIA ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY PRODUCT, 2022-2031 (USD MILLION)

TABLE 119 INDIA ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY PRODUCT, 2022-2031 (VOLUME IN UNITS)

TABLE 120 INDIA ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY PRODUCT, 2022-2031 (ASP)

TABLE 121 INDIA ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY ANTIGEN COMPONENT, 2022-2031 (USD MILLION)

TABLE 122 INDIA ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY ANTIBODY COMPONENT, 2022-2031 (USD MILLION)

TABLE 123 INDIA ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY LINKERS COMPONENT, 2022-2031 (USD MILLION)

TABLE 124 INDIA CLEAVABLE LINKERS IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY COMPONENT, 2022-2031 (USD MILLION)

TABLE 125 INDIA ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY CYTOTOXIC PAYLOADS OR WARHEADS COMPONENT, 2022-2031 (USD MILLION)

TABLE 126 INDIA DNA DAMAGING AGENTS IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY COMPONENT, 2022-2031 (USD MILLION)

TABLE 127 INDIA MICROTUBULE DISRUPTING AGENTS IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY COMPONENT, 2022-2031 (USD MILLION)

TABLE 128 INDIA ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY LINKER TECHNOLOGY, 2022-2031 (USD MILLION)

TABLE 129 INDIA ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY CONJUGATION TECHNOLOGY, 2022-2031 (USD MILLION)

TABLE 130 INDIA ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY INDICATION, 2022-2031 (USD MILLION)

TABLE 131 INDIA ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY END USER, 2022-2031 (USD MILLION)

TABLE 132 INDIA ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 133 INDIA RETAIL SALES IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 134 AUSTRALIA ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY PRODUCT, 2022-2031 (USD MILLION)

TABLE 135 AUSTRALIA ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY PRODUCT, 2022-2031 (VOLUME IN UNITS)

TABLE 136 AUSTRALIA ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY PRODUCT, 2022-2031 (ASP)

TABLE 137 AUSTRALIA ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY ANTIGEN COMPONENT, 2022-2031 (USD MILLION)

TABLE 138 AUSTRALIA ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY ANTIBODY COMPONENT, 2022-2031 (USD MILLION)

TABLE 139 AUSTRALIA ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY LINKERS COMPONENT, 2022-2031 (USD MILLION)

TABLE 140 AUSTRALIA CLEAVABLE LINKERS IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY COMPONENT, 2022-2031 (USD MILLION)

TABLE 141 AUSTRALIA ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY CYTOTOXIC PAYLOADS OR WARHEADS COMPONENT, 2022-2031 (USD MILLION)

TABLE 142 AUSTRALIA DNA DAMAGING AGENTS IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY COMPONENT, 2022-2031 (USD MILLION)

TABLE 143 AUSTRALIA MICROTUBULE DISRUPTING AGENTS IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY COMPONENT, 2022-2031 (USD MILLION)

TABLE 144 AUSTRALIA ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY LINKER TECHNOLOGY, 2022-2031 (USD MILLION)

TABLE 145 AUSTRALIA ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY CONJUGATION TECHNOLOGY, 2022-2031 (USD MILLION)

TABLE 146 AUSTRALIA ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY INDICATION, 2022-2031 (USD MILLION)

TABLE 147 AUSTRALIA ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY END USER, 2022-2031 (USD MILLION)

TABLE 148 AUSTRALIA ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 149 AUSTRALIA RETAIL SALES IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 150 SINGAPORE ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY PRODUCT, 2022-2031 (USD MILLION)

TABLE 151 SINGAPORE ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY PRODUCT, 2022-2031 (VOLUME IN UNITS)

TABLE 152 SINGAPORE ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY PRODUCT, 2022-2031 (ASP)

TABLE 153 SINGAPORE ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY ANTIGEN COMPONENT, 2022-2031 (USD MILLION)

TABLE 154 SINGAPORE ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY ANTIBODY COMPONENT, 2022-2031 (USD MILLION)

TABLE 155 SINGAPORE ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY LINKERS COMPONENT, 2022-2031 (USD MILLION)

TABLE 156 SINGAPORE CLEAVABLE LINKERS IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY COMPONENT, 2022-2031 (USD MILLION)

TABLE 157 SINGAPORE ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY CYTOTOXIC PAYLOADS OR WARHEADS COMPONENT, 2022-2031 (USD MILLION)

TABLE 158 SINGAPORE DNA DAMAGING AGENTS IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY COMPONENT, 2022-2031 (USD MILLION)

TABLE 159 SINGAPORE MICROTUBULE DISRUPTING AGENTS IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY COMPONENT, 2022-2031 (USD MILLION)

TABLE 160 SINGAPORE ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY LINKER TECHNOLOGY, 2022-2031 (USD MILLION)

TABLE 161 SINGAPORE ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY CONJUGATION TECHNOLOGY, 2022-2031 (USD MILLION)

TABLE 162 SINGAPORE ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY INDICATION, 2022-2031 (USD MILLION)

TABLE 163 SINGAPORE ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY END USER, 2022-2031 (USD MILLION)

TABLE 164 SINGAPORE ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 165 SINGAPORE RETAIL SALES IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 166 REST OF ASIA-PACIFIC ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY PRODUCT, 2022-2031 (USD MILLION)

TABLE 167 REST OF ASIA-PACIFIC ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY PRODUCT, 2022-2031 (VOLUME IN UNITS)

TABLE 168 REST OF ASIA-PACIFIC ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY PRODUCT, 2022-2031 (ASP)

Список рисунков

FIGURE 1 ASIA-PACIFIC ANTIBODY DRUG CONJUGATES (ADC) MARKET: SEGMENTATION

FIGURE 2 ASIA-PACIFIC ANTIBODY DRUG CONJUGATES (ADC) MARKET: DATA TRIANGULATION

FIGURE 3 ASIA-PACIFIC ANTIBODY DRUG CONJUGATES (ADC) MARKET: DROC ANALYSIS

FIGURE 4 ASIA-PACIFIC ANTIBODY DRUG CONJUGATES (ADC) MARKET: ASIA-PACIFIC VS REGIONAL MARKET ANALYSIS

FIGURE 5 ASIA-PACIFIC ANTIBODY DRUG CONJUGATES (ADC) MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 ASIA-PACIFIC ANTIBODY DRUG CONJUGATES (ADC) MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 ASIA-PACIFIC ANTIBODY DRUG CONJUGATES (ADC) MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 8 ASIA-PACIFIC ANTIBODY DRUG CONJUGATES (ADC) MARKET: DBMR MARKET POSITION GRID

FIGURE 9 ASIA-PACIFIC ANTIBODY DRUG CONJUGATES (ADC) MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 ASIA-PACIFIC ANTIBODY DRUG CONJUGATES (ADC) MARKET: SEGMENTATION

FIGURE 11 EXECUTIVE SUMMARY

FIGURE 12 STRATEGIC DECISIONS

FIGURE 13 RISING INCIDENCE OF CANCER IS DRIVING THE GROWTH OF THE ASIA-PACIFIC ANTIBODY DRUG CONJUGATES (ADC) MARKET FROM 2024 TO 2031

FIGURE 14 THE PRODUCT SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE ASIA-PACIFIC ANTIBODY DRUG CONJUGATES (ADC) MARKET IN 2024 AND 2031

FIGURE 15 DROC

FIGURE 16 ASIA-PACIFIC ANTIBODY DRUG CONJUGATES (ADC) MARKET: BY PRODUCT, 2023

FIGURE 17 ASIA-PACIFIC ANTIBODY DRUG CONJUGATES (ADC) MARKET: BY PRODUCT, 2024-2031 (USD MILLION)

FIGURE 18 ASIA-PACIFIC ANTIBODY DRUG CONJUGATES (ADC) MARKET: BY PRODUCT, CAGR (2024-2031)

FIGURE 19 ASIA-PACIFIC ANTIBODY DRUG CONJUGATES (ADC) MARKET: BY PRODUCT, LIFELINE CURVE

FIGURE 20 ASIA-PACIFIC ANTIBODY DRUG CONJUGATES (ADC) MARKET: BY ANTIGEN COMPONENT, 2023

FIGURE 21 ASIA-PACIFIC ANTIBODY DRUG CONJUGATES (ADC) MARKET: BY ANTIGEN COMPONENT, 2024-2031 (USD MILLION)

FIGURE 22 ASIA-PACIFIC ANTIBODY DRUG CONJUGATES (ADC) MARKET: BY ANTIGEN COMPONENT, CAGR (2024-2031)

FIGURE 23 ASIA-PACIFIC ANTIBODY DRUG CONJUGATES (ADC) MARKET: BY ANTIGEN COMPONENT, LIFELINE CURVE

FIGURE 24 ASIA-PACIFIC ANTIBODY DRUG CONJUGATES (ADC) MARKET: BY ANTIBODY COMPONENT, 2023

FIGURE 25 ASIA-PACIFIC ANTIBODY DRUG CONJUGATES (ADC) MARKET: BY ANTIBODY COMPONENT, 2024-2031 (USD MILLION)

FIGURE 26 ASIA-PACIFIC ANTIBODY DRUG CONJUGATES (ADC) MARKET: BY ANTIBODY COMPONENT, CAGR (2024-2031)

FIGURE 27 ASIA-PACIFIC ANTIBODY DRUG CONJUGATES (ADC) MARKET: BY ANTIBODY COMPONENT, LIFELINE CURVE

FIGURE 28 ASIA-PACIFIC ANTIBODY DRUG CONJUGATES (ADC) MARKET: BY LINKERS COMPONENT, 2023

FIGURE 29 ASIA-PACIFIC ANTIBODY DRUG CONJUGATES (ADC) MARKET: BY LINKERS COMPONENT, 2024-2031 (USD MILLION)

FIGURE 30 ASIA-PACIFIC ANTIBODY DRUG CONJUGATES (ADC) MARKET: BY LINKERS COMPONENT, CAGR (2024-2031)

FIGURE 31 ASIA-PACIFIC ANTIBODY DRUG CONJUGATES (ADC) MARKET: BY LINKERS COMPONENT, LIFELINE CURVE

FIGURE 32 ASIA-PACIFIC ANTIBODY DRUG CONJUGATES (ADC) MARKET: BY CYTOTOXIC PAYLOADS OR WARHEADS COMPONENT, 2023

FIGURE 33 ASIA-PACIFIC ANTIBODY DRUG CONJUGATES (ADC) MARKET: BY CYTOTOXIC PAYLOADS OR WARHEADS COMPONENT, 2024-2031 (USD MILLION)

FIGURE 34 ASIA-PACIFIC ANTIBODY DRUG CONJUGATES (ADC) MARKET: BY CYTOTOXIC PAYLOADS OR WARHEADS COMPONENT, CAGR (2024-2031)

FIGURE 35 ASIA-PACIFIC ANTIBODY DRUG CONJUGATES (ADC) MARKET: BY CYTOTOXIC PAYLOADS OR WARHEADS COMPONENT, LIFELINE CURVE

FIGURE 36 ASIA-PACIFIC ANTIBODY DRUG CONJUGATES (ADC) MARKET: BY LINKER TECHNOLOGY, 2023

FIGURE 37 ASIA-PACIFIC ANTIBODY DRUG CONJUGATES (ADC) MARKET: BY LINKER TECHNOLOGY, 2024-2031 (USD MILLION)

FIGURE 38 ASIA-PACIFIC ANTIBODY DRUG CONJUGATES (ADC) MARKET: BY LINKER TECHNOLOGY, CAGR (2024-2031)

FIGURE 39 ASIA-PACIFIC ANTIBODY DRUG CONJUGATES (ADC) MARKET: BY LINKER TECHNOLOGY, LIFELINE CURVE

FIGURE 40 ASIA-PACIFIC ANTIBODY DRUG CONJUGATES (ADC) MARKET: BY CONJUGATION TECHNOLOGY, 2023

FIGURE 41 ASIA-PACIFIC ANTIBODY DRUG CONJUGATES (ADC) MARKET: BY CONJUGATION TECHNOLOGY, 2024-2031 (USD MILLION)

FIGURE 42 ASIA-PACIFIC ANTIBODY DRUG CONJUGATES (ADC) MARKET: BY CONJUGATION TECHNOLOGY, CAGR (2024-2031)

FIGURE 43 ASIA-PACIFIC ANTIBODY DRUG CONJUGATES (ADC) MARKET: BY CONJUGATION TECHNOLOGY, LIFELINE CURVE

FIGURE 44 ASIA-PACIFIC ANTIBODY DRUG CONJUGATES (ADC) MARKET: BY INDICATION, 2023

FIGURE 45 ASIA-PACIFIC ANTIBODY DRUG CONJUGATES (ADC) MARKET: BY INDICATION, 2024-2031 (USD MILLION)

FIGURE 46 ASIA-PACIFIC ANTIBODY DRUG CONJUGATES (ADC) MARKET: BY INDICATION, CAGR (2024-2031)

FIGURE 47 ASIA-PACIFIC ANTIBODY DRUG CONJUGATES (ADC) MARKET: BY INDICATION, LIFELINE CURVE

FIGURE 48 ASIA-PACIFIC ANTIBODY DRUG CONJUGATES (ADC) MARKET: BY END USER, 2023

FIGURE 49 ASIA-PACIFIC ANTIBODY DRUG CONJUGATES (ADC) MARKET: BY END USER, 2024-2031 (USD MILLION)

FIGURE 50 ASIA-PACIFIC ANTIBODY DRUG CONJUGATES (ADC) MARKET: BY END USER, CAGR (2024-2031)

FIGURE 51 ASIA-PACIFIC ANTIBODY DRUG CONJUGATES (ADC) MARKET: BY END USER, LIFELINE CURVE

FIGURE 52 ASIA-PACIFIC ANTIBODY DRUG CONJUGATES (ADC) MARKET: BY DISTRIBUTION CHANNEL, 2023

FIGURE 53 ASIA-PACIFIC ANTIBODY DRUG CONJUGATES (ADC) MARKET: BY DISTRIBUTION CHANNEL, 2024-2031 (USD MILLION)

FIGURE 54 ASIA-PACIFIC ANTIBODY DRUG CONJUGATES (ADC) MARKET: BY DISTRIBUTION CHANNEL, CAGR (2024-2031)

FIGURE 55 ASIA-PACIFIC ANTIBODY DRUG CONJUGATES (ADC) MARKET: BY DISTRIBUTION CHANNEL, LIFELINE CURVE

FIGURE 56 ASIA-PACIFIC ANTIBODY DRUG CONJUGATES (ADC) MARKET: SNAPSHOT (2023)

FIGURE 57 ASIA-PACIFIC ANTIBODY DRUG CONJUGATES (ADC): COMPANY SHARE 2023 (%)

Методология исследования

Сбор данных и анализ базового года выполняются с использованием модулей сбора данных с большими размерами выборки. Этап включает получение рыночной информации или связанных данных из различных источников и стратегий. Он включает изучение и планирование всех данных, полученных из прошлого заранее. Он также охватывает изучение несоответствий информации, наблюдаемых в различных источниках информации. Рыночные данные анализируются и оцениваются с использованием статистических и последовательных моделей рынка. Кроме того, анализ доли рынка и анализ ключевых тенденций являются основными факторами успеха в отчете о рынке. Чтобы узнать больше, пожалуйста, запросите звонок аналитика или оставьте свой запрос.

Ключевой методологией исследования, используемой исследовательской группой DBMR, является триангуляция данных, которая включает в себя интеллектуальный анализ данных, анализ влияния переменных данных на рынок и первичную (отраслевую экспертную) проверку. Модели данных включают сетку позиционирования поставщиков, анализ временной линии рынка, обзор рынка и руководство, сетку позиционирования компании, патентный анализ, анализ цен, анализ доли рынка компании, стандарты измерения, глобальный и региональный анализ и анализ доли поставщика. Чтобы узнать больше о методологии исследования, отправьте запрос, чтобы поговорить с нашими отраслевыми экспертами.

Доступна настройка

Data Bridge Market Research является лидером в области передовых формативных исследований. Мы гордимся тем, что предоставляем нашим существующим и новым клиентам данные и анализ, которые соответствуют и подходят их целям. Отчет можно настроить, включив в него анализ ценовых тенденций целевых брендов, понимание рынка для дополнительных стран (запросите список стран), данные о результатах клинических испытаний, обзор литературы, обновленный анализ рынка и продуктовой базы. Анализ рынка целевых конкурентов можно проанализировать от анализа на основе технологий до стратегий портфеля рынка. Мы можем добавить столько конкурентов, о которых вам нужны данные в нужном вам формате и стиле данных. Наша команда аналитиков также может предоставить вам данные в сырых файлах Excel, сводных таблицах (книга фактов) или помочь вам в создании презентаций из наборов данных, доступных в отчете.