В последние годы Саудовская Аравия переживает значительный рост и развитие в секторах строительства и инфраструктуры. Правительство активно инвестирует в различные проекты по диверсификации экономики и поддержке долгосрочного видения развития страны, известного как Vision 2030. Саудовская Аравия принимает инициативы умных городов для повышения удобства проживания, устойчивости и эффективности. Например, King Salman Energy Park (SPARK) нацелен на создание интегрированного города, ориентированного на отрасли, связанные с энергетикой. Он будет предоставлять различные услуги и инфраструктуру для поддержки нефтяного, газового и нефтехимического секторов.

Доступ к полному отчету по адресу https://www.databridgemarketresearch.com/reports/middle-east-glass-market

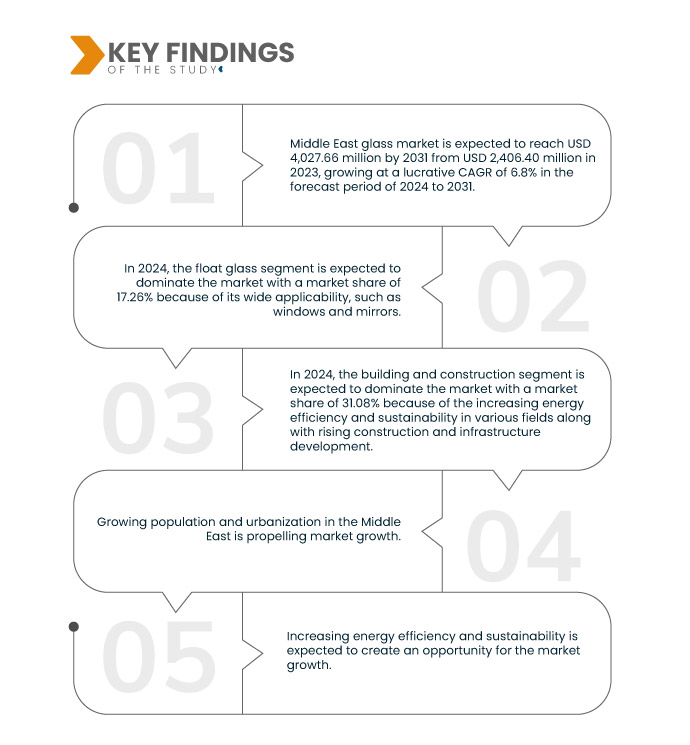

По данным исследования Data Bridge Market Research, ожидается, что объем рынка стекла на Ближнем Востоке к 2031 году достигнет 4 027,66 млн долларов США по сравнению с 2 406,40 млн долларов США в 2023 году, а среднегодовой темп роста составит 6,8% в прогнозируемый период с 2024 по 2031 год.

Основные выводы исследования

Рост населения и урбанизация на Ближнем Востоке

Ближний Восток пережил значительный рост населения и урбанизацию в последние десятилетия. Население региона Ближнего Востока растет в среднем на 1,56%. Это значительно превышает общемировой темп роста населения в 1,1%. Высокие темпы миграции, высокий уровень рождаемости, более высокая продолжительность жизни и более низкие показатели детской смертности способствуют росту населения, а также улучшения в здравоохранении и условиях жизни, таких как благосостояние, занятость, образование и другие, способствовали расширению населения. Кроме того, экономическое развитие и возможности привлекли людей из сельских районов в странах Ближнего Востока.

Область отчета и сегментация рынка

Отчет Метрика

|

Подробности

|

Прогнозируемый период

|

2024-2031

|

Базовый год

|

2023

|

Исторические годы

|

2022 (можно изменить на 2016–2021)

|

Количественные единицы

|

Доход в млн. долл. США Объем в тыс. кв. м. и цены в долл. США

|

Охваченные сегменты

|

Тип (флоат-стекло, архитектурное стекло, литое стекло, выдувное стекло, прозрачное стекло, тонированное стекло, узорчатое стекло или текстурированное стекло, армированное стекло, сверхпрозрачное стекло, специальное стекло, защитное стекло, стеклянная тара и другие), продукт (с покрытием и без покрытия), функция (стекло с УФ-фильтром, теплоизоляционное стекло, безопасное остекление , звукоизолированное остекление, самоочищающееся стекло, ионообменное стекло и другие), толщина (4 мм, 5 мм, 6 мм, 8 мм, 2 мм, 3 мм, 10 мм, 12 мм и более 12 мм), применение (строительство, автомобилестроение, аэрокосмическая промышленность, электроприборы, солнечная энергетика, упаковка, мебель и другие)

|

Страны, охваченные

|

Саудовская Аравия, ОАЭ, Катар, Оман, Кувейт, Турция и остальной Ближний Восток

|

Охваченные участники рынка

|

Şişecam (Турция), Guardian Industries Holdings Site (США), IKKGlass (Саудовская Аравия), AGC Inc. (Япония), Dubai Investments (ОАЭ), Alma (Саудовская Аравия), ARABIAN PROCESSING GLASS CO (Саудовская Аравия), Glas Trösch Holding Ag (Швейцария), Obeikan Glass Company (Саудовская Аравия), QGI (Катар), REGIONGLASS (Саудовская Аравия), Saint-Gobain (Франция) и Zoujaj (Саудовская Аравия) и другие

|

Данные, отраженные в отчете

|

Помимо информации о рыночных сценариях, таких как рыночная стоимость, темпы роста, сегментация, географический охват и основные игроки, рыночные отчеты, подготовленные Data Bridge Market Research, также включают в себя углубленный экспертный анализ, географически представленные данные о производстве и мощностях компаний, схемы сетей дистрибьюторов и партнеров, подробный и обновленный анализ ценовых тенденций и анализ дефицита цепочки поставок и спроса.

|

Анализ сегмента

Рынок стекла на Ближнем Востоке делится на пять основных сегментов в зависимости от типа, продукта, функции, толщины и области применения.

- По типу рынок стекла на Ближнем Востоке сегментируется на флоат-стекло, архитектурное стекло, литое стекло, выдувное стекло, прозрачное стекло, тонированное стекло, узорчатое стекло или текстурированное стекло, армированное стекло, сверхпрозрачное стекло, специальное стекло, безопасное стекло, стеклянную тару и другие.

Ожидается, что в 2024 году сегмент флоат-стекла будет доминировать на рынке стекла на Ближнем Востоке.

Ожидается, что в 2024 году сегмент флоат-стекла будет доминировать на рынке с долей рынка 17,26% ввиду его широкой применимости, например, для изготовления окон и зеркал.

- По видам продукции рынок стекла на Ближнем Востоке сегментируется на стеклянную продукцию с покрытием и без покрытия.

Ожидается, что в 2024 году сегмент стекла с покрытием будет доминировать на рынке стекла на Ближнем Востоке.

Ожидается, что в 2024 году сегмент покрытий будет доминировать на рынке с долей рынка 69,57% ввиду его широкого применения в различных отраслях промышленности.

- На основе функциональности рынок стекла на Ближнем Востоке сегментируется на УФ-фильтрующее стекло, теплоизоляционное стекло, безопасное остекление, звукоизоляционное остекление, самоочищающееся стекло, ионообменное стекло и др. Ожидается, что в 2024 году сегмент УФ-фильтрующего стекла будет доминировать на рынке с долей рынка 30,54%.

- По толщине рынок сегментирован на 4 мм, 5 мм, 6 мм, 8 мм, 2 мм, 3 мм, 10 мм, 12 мм и более 12 мм. Ожидается, что в 2024 году сегмент 4 мм будет доминировать на рынке с долей рынка 21,41%

- По сфере применения рынок сегментируется на строительство, автомобилестроение, аэрокосмическую промышленность, электроприборы, солнечную энергетику, упаковку, мебель и др. Ожидается, что в 2024 году сегмент строительства будет доминировать на рынке с долей рынка 31,08%.

Основные игроки

Data Bridge Market Research анализирует Şişecam (Турция), Guardian Industries Holdings Site (США), IKKGlass (Саудовская Аравия), AGC Inc. (Япония) и Dubai Investments (ОАЭ) как основных игроков на рынке стекла Ближнего Востока.

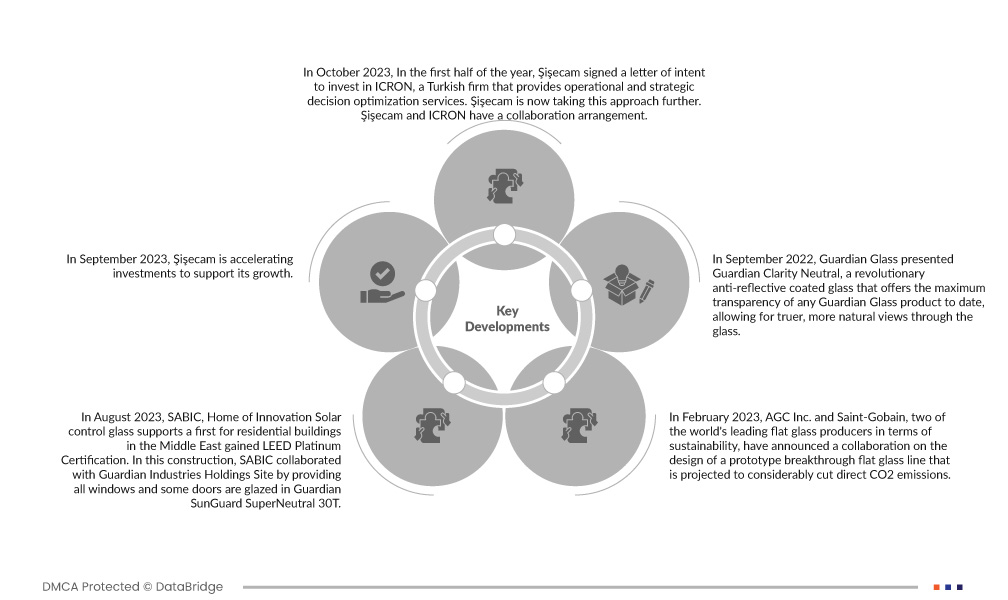

Развитие рынка

- В октябре 2023 года, в первой половине года, Şişecam подписала письмо о намерении инвестировать в ICRON, турецкую фирму, которая предоставляет услуги по оптимизации операционных и стратегических решений. Теперь Şişecam развивает этот подход дальше. Şişecam и ICRON имеют соглашение о сотрудничестве. В рамках сделки первоначальное участие Şişecam в ICRON составит 15,7%, с возможной ставкой партнерства в 33,1% за счет прогрессивных инвестиций. С этим соглашением Şişecam надеется расшириться с ICRON и вывести свой подход к операционному совершенству и оптимизации на новый уровень, что станет его первой инвестицией в сектор инноваций в области программного обеспечения.

- В сентябре 2023 года Şişecam ускоряет инвестиции для поддержки своего роста. В ответ на возросшую мировую конкурентоспособность и растущий спрос на автомобильное стекло Sisecam запустила новую линию по производству автомобильного стекла стоимостью около 4 млрд турецких лир (190 млн долларов США) с дополнительными капитальными затратами на своем производственном объекте в Люлебургазе. Новая линия будет иметь годовую мощность 200 000 тонн и создаст 114 дополнительных рабочих мест. Она будет посвящена исключительно архитектурному стеклу, увеличивая производительность и эффективность

- В августе 2023 года SABIC, Home of Innovation Solar control glass поддерживает первое в истории жилое здание на Ближнем Востоке, получившее платиновый сертификат LEED. В этой конструкции все окна и некоторые двери застеклены Guardian SunGuard SuperNeutral 30T, двойным серебряным солнцезащитным стеклом, которое избирательно пропускает естественный свет, ограничивая при этом накопление солнечного тепла и потребность в энергоемком кондиционировании воздуха. Это помогает фирме получить большее признание за ее усилия в области охраны окружающей среды

- В феврале 2023 года компании AGC Inc. и Saint-Gobain, два ведущих мировых производителя листового стекла с точки зрения устойчивого развития, объявили о сотрудничестве по разработке прототипа революционной линии по производству листового стекла, которая, как ожидается, значительно сократит прямые выбросы CO2.

- В сентябре 2022 года Guardian Glass представила Guardian Clarity Neutral — революционное антибликовое стекло, которое обеспечивает максимальную прозрачность среди всех продуктов Guardian Glass на сегодняшний день, позволяя получить более реалистичные и естественные виды через стекло. Guardian Clarity Neutral снижает отражения и блики в специальных приложениях, таких как витрины магазинов, музейные экспонаты, рамы для картин и дверцы коммерческих холодильников, делая стекло почти невидимым и обеспечивая более четкие, непрерывные и естественные виды через стекло. Это помогает организации повысить производительность и доход

Региональный анализ

Географически в отчете по рынку стекла на Ближнем Востоке рассматриваются следующие страны: Саудовская Аравия, ОАЭ, Катар, Оман, Кувейт, Турция и остальные страны Ближнего Востока.

Согласно анализу Data Bridge Market Research:

Ожидается, что Саудовская Аравия станет доминирующей и наиболее быстрорастущей страной на рынке стекла на Ближнем Востоке.

Ожидается, что Саудовская Аравия станет доминирующей и наиболее быстрорастущей страной благодаря росту строительства и развитию инфраструктуры в стране.

Более подробную информацию об отчете о рынке стекла на Ближнем Востоке можно получить здесь – https://www.databridgemarketresearch.com/reports/middle-east-glass-market