Сектор малого и среднего бизнеса (SMB) в Японии стремительно расширяется, что приводит к увеличению спроса на эффективные и экономичные решения, особенно в сфере налогообложения и бухгалтерского учета. По мере роста компаний все более важной становится необходимость оптимизировать финансовые операции и гарантировать соответствие меняющемуся законодательству. В этом контексте облачное программное обеспечение для налогообложения и бухгалтерского учета предлагает идеальную альтернативу для SME, стремящихся улучшить финансовое управление, сохраняя при этом контроль над расходами.

Доступ к полному отчету по адресу https://www.databridgemarketresearch.com/reports/japan-tax-it-software-market

По данным исследования рынка Data Bridge, ожидается, что объем японского рынка программного обеспечения для налоговых ИТ-систем к 2032 году достигнет 4,66 млрд долларов США по сравнению с 2,58 млрд долларов США в 2024 году, а среднегодовой темп роста составит 7,7% в прогнозируемый период с 2025 по 2032 год.

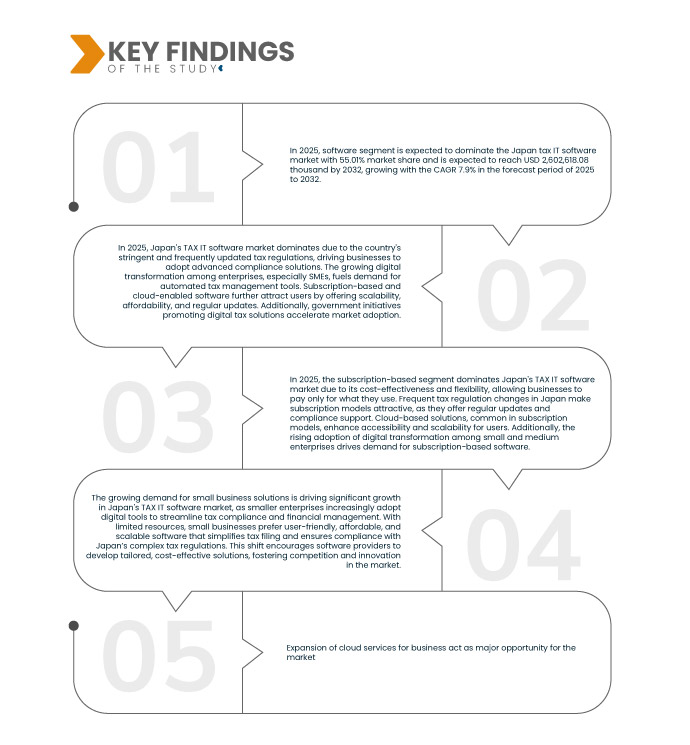

Основные выводы исследования

Растущее внедрение интеллектуальных зданий/систем VRF на базе Интернета вещей в регионе

Поскольку здания становятся все более связанными и интеллектуальными, интеграция систем VRF с IoT обеспечивает точный контроль, мониторинг и оптимизацию функций отопления и охлаждения в режиме реального времени. Эти системы позволяют осуществлять бесперебойное управление потреблением энергии, повышая эффективность и сокращая расходы, что особенно привлекательно в коммерческих и крупномасштабных жилых проектах. Возможность удаленной настройки параметров, прогнозирования потребностей в обслуживании и анализа данных о производительности повышает привлекательность систем VRF в среде интеллектуальных зданий.

Область отчета и сегментация рынка

Отчет Метрика

|

Подробности

|

Прогнозируемый период

|

2025-2032

|

Базовый год

|

2024

|

Исторический год

|

2023 (можно изменить на 2018-2022)

|

Количественные единицы

|

Доход в млрд долларов США

|

Охваченные сегменты

|

Предложение (программное обеспечение и услуги), Тип налога (подоходный налог, корпоративный налог, налог на имущество и другие), Режим развертывания (новое облако и локально), Размер организации (малые и средние предприятия и крупные предприятия), Модель дохода (единовременная покупка и на основе подписки), Отрасль (банковское дело, финансовые услуги и страхование (BFSI), ИТ и телекоммуникации, производство, розничная торговля и товары народного потребления, здравоохранение, энергетика и коммунальные услуги, СМИ и развлечения и другие)

|

Охваченные участники рынка

|

SAP (Германия), ADP, Inc. (США), freee KK (Япония), Money Forward, Inc. (Япония), PCA Corporation (США), QUICKBOOKS (INTUIT INC.) (США), SAGE GROUP PLC (Великобритания), TKC Corporation (Япония) и Wolters Kluwer NV (Нидерланды)

|

Данные, отраженные в отчете

|

Помимо таких рыночных данных, как рыночная стоимость, темпы роста, сегменты рынка, географический охват, участники рынка и рыночный сценарий, рыночный отчет, подготовленный командой Data Bridge Market Research, включает в себя углубленный экспертный анализ, анализ импорта/экспорта, анализ цен, анализ потребления продукции и анализ пестицидов.

|

Анализ сегмента

Рынок программного обеспечения для налоговой ИТ-системы Японии сегментирован на шесть основных сегментов в зависимости от предложения, типа налогообложения, режима развертывания, размера организации, модели получения дохода и отрасли.

- На основе предложения рынок сегментирован на программное обеспечение и услуги.

Ожидается, что в 2025 году сегмент программного обеспечения будет доминировать на рынке с долей рынка 55,01%.

Ожидается, что в 2025 году сегмент программного обеспечения будет доминировать на рынке с долей рынка 55,01% из-за возросшей сложности налогового регулирования и необходимости упрощенного цифрового соответствия. Компании внедряют специализированное налоговое программное обеспечение для повышения эффективности обработки сложных налоговых расчетов, отчетности и подачи документов, сокращая зависимость от ручных процессов.

- По типу налога рынок сегментирован на подоходный налог, корпоративный налог, налог на имущество и другие.

Ожидается, что в 2025 году на рынке будет доминировать подоходный налог с долей рынка 39,76%.

Ожидается, что в 2025 году подоходный налог будет доминировать на рынке с долей рынка 39,76% из-за растущей потребности в точных автоматизированных налоговых расчетах и соблюдении требований в ответ на сложные правила подоходного налога. По мере развития структур подоходного налога с физических и юридических лиц предприятия и частные лица ищут программное обеспечение, которое упрощает подачу деклараций и обеспечивает точность, чтобы избежать штрафов.

- На основе режима развертывания рынок был сегментирован на облачный и локальный. В 2025 году ожидается, что облако будет доминировать на рынке с долей рынка 71,39% в прогнозируемый период с 2025 по 2032 год.

- На основе размера организации рынок был сегментирован на малые и средние предприятия и крупные предприятия. В 2025 году сегмент крупных предприятий, как ожидается, будет доминировать на рынке с долей рынка 54,94% в прогнозируемый период с 2025 по 2032 год.

- На основе модели доходов рынок был сегментирован на одноразовую покупку и подписку. В 2025 году сегмент подписки, как ожидается, будет доминировать на рынке с долей рынка 65,66% в прогнозируемый период с 2025 по 2032 год.

- На основе отрасли рынок был сегментирован на банковское дело, финансовые услуги и страхование (BFSI), ИТ и телекоммуникации, производство, розничную торговлю и потребительские товары, здравоохранение, энергетику и коммунальные услуги, СМИ и развлечения и др. Ожидается, что в 2025 году сегмент банковских, финансовых услуг и страхования (BFSI) будет доминировать на рынке с долей рынка 28,06% в прогнозируемый период с 2025 по 2032 год.

Основные игроки

Data Bridge Market Research анализирует SAP (Германия), ADP, Inc. (США), freee KK (Япония), Money Forward, Inc. (Япония) и PCA Corporation (США) как основных игроков, работающих на рынке.

Развитие рынка

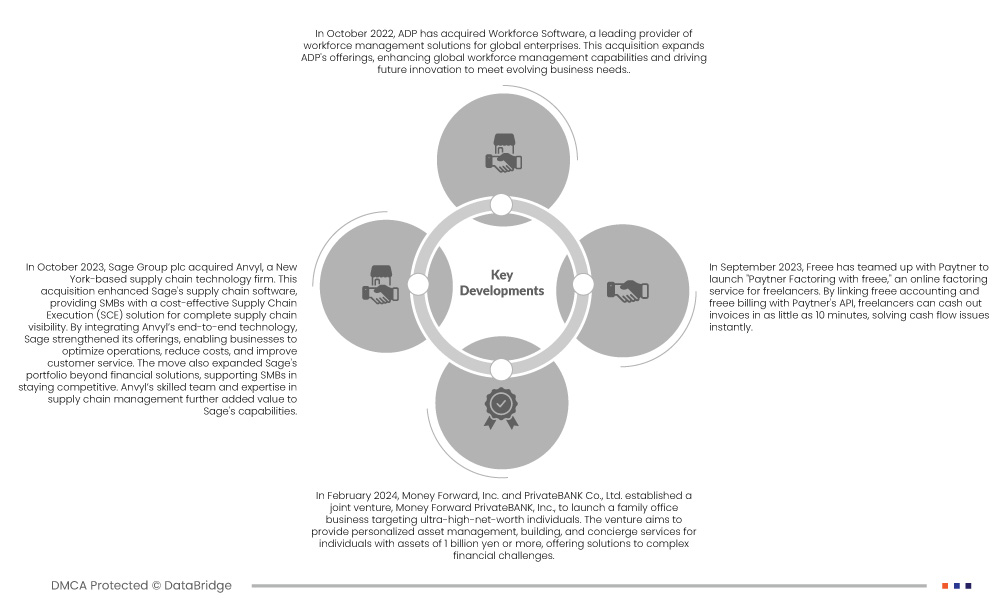

- В октябре 2024 года ADP приобрела WorkForce Software, ведущего поставщика решений по управлению рабочей силой для глобальных предприятий. Это приобретение расширяет предложения ADP, улучшая возможности глобального управления рабочей силой и стимулируя будущие инновации для удовлетворения меняющихся потребностей бизнеса.

- В октябре 2024 года компания TKC Co., Ltd. выпустила TKC-Phone SE3 — защищенный смартфон, предназначенный для офисов налоговых бухгалтеров. Это устройство помогает фирмам соблюдать требования Закона о налоговых бухгалтерах в отношении конфиденциальности и надзора. Оно включает ограничения приложений, защиту данных и управление устройствами, обеспечивая конфиденциальность для сотрудников и безопасную связь. Внедрение по всей стране запланировано на декабрь 2024 года.

- В августе Sage Group plc расширила свою AP Automation на основе ИИ по всему миру для Sage Intacct, что позволило компаниям оптимизировать процессы обработки счетов к оплате и улучшить финансовые операции. В США с помощью этого инструмента обрабатывалось более 10 000 счетов в месяц, что позволило организациям сэкономить 100 000 счетов в год. Автоматизация сократила усилия по вводу данных и выявила такие проблемы, как дубликаты. Это расширение, наряду с другими глобальными обновлениями, укрепило приверженность Sage безопасным, совместимым и эффективным финансовым решениям для компаний по всему миру, поддерживая рост и операционную эффективность.

- В феврале 2024 года Money Forward, Inc. и PrivateBANK Co., Ltd. создали совместное предприятие Money Forward PrivateBANK, Inc. для запуска бизнеса семейного офиса, ориентированного на лиц с очень высоким уровнем собственного капитала. Целью предприятия является предоставление персонализированных услуг по управлению активами, строительству и консьерж-услуг для лиц с активами в размере 1 млрд иен и более, предлагая решения для сложных финансовых проблем.

- В июле 2015 года Yayoi Co., Ltd. запустила "Yayoi Accounting Online", облачное бухгалтерское программное обеспечение, предназначенное для малого бизнеса. Платформа упрощает бухгалтерский учет с такими функциями, как автоматическая загрузка транзакций, сканирование OCR и двунаправленная синхронизация с настольными версиями. Нацеленная на повышение операционной эффективности, она позволяет компаниям управлять финансами в режиме реального времени, обеспечивая при этом соответствие меняющимся нормам

Более подробную информацию об отчете по рынку программного обеспечения для налоговых ИТ-систем Японии можно получить здесь – https://www.databridgemarketresearch.com/reports/japan-tax-it-software-market