Спрос на энергоэффективность стал существенной движущей силой роста европейского рынка источников бесперебойного питания (ИБП). Поскольку предприятия и отрасли все больше полагаются на технологии и цифровую инфраструктуру, потребность в надежных источниках питания для защиты критически важных операций становится первостепенной. В этом контексте энергоэффективность вышла на первый план, поскольку организации ищут решения ИБП, которые не только обеспечивают бесперебойное питание во время отключений, но и минимизируют потребление энергии и эксплуатационные расходы. По мере усиления экологических проблем компании осознают важность снижения своего углеродного следа и повышения потребления энергии. В результате производители ИБП внедряют инновации для разработки более энергоэффективных систем, которые соответствуют целям устойчивого развития, привлекая предприятия, ищущие как надежную защиту питания, так и снижение расходов на электроэнергию.

Доступ к полному отчету: https://www.databridgemarketresearch.com/reports/europe-uninterruptible-power-supply-ups-market

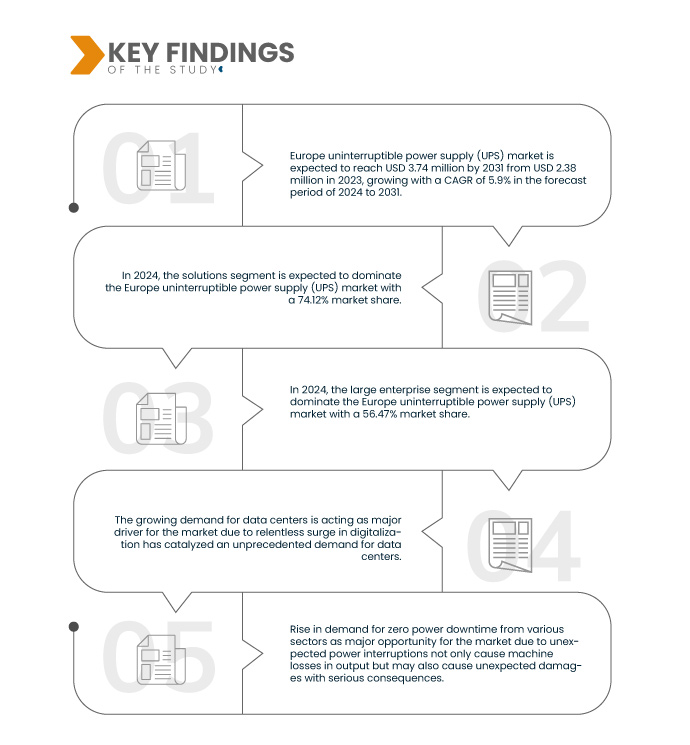

Data Bridge Market Research анализирует, что рынок источников бесперебойного питания (ИБП) в Европе, как ожидается, достигнет 3,74 млрд долларов США к 2031 году с 2,38 млрд долларов США в 2023 году, увеличившись с CAGR на 5,9% в прогнозируемый период с 2024 по 2031 год. Поскольку центры обработки данных продолжают расширяться и сталкиваются с растущим спросом на электроэнергию, становится важным требование минимизировать потребление энергии и повысить общую эффективность. Благодаря таким технологиям, как улучшенные блоки питания (БП), усовершенствованные регуляторы напряжения и эффективные блоки распределения питания (БРП), рынок ИБП позиционируется для удовлетворения критической потребности в энергоэффективных решениях в быстро меняющемся ландшафте центров обработки данных. Этот спрос не только соответствует целям экологической устойчивости, но и согласуется с экономией затрат и оптимизацией эксплуатации, что делает энергоэффективность определяющим фактором, который, как ожидается, сформирует будущую траекторию рынка источников бесперебойного питания (ИБП) в Европе.

Основные выводы исследования

Растущий спрос на центры обработки данных

Растущий спрос на центры обработки данных по всей Европе значительно подстегнул рост рынка источников бесперебойного питания (ИБП). Поскольку предприятия и организации стремятся внедрить цифровую трансформацию и использовать мощь больших данных, потребность в надежной и устойчивой инфраструктуре никогда не была столь выраженной. Системы ИБП играют ключевую роль в обеспечении непрерывности операций в центрах обработки данных, снижая риски, связанные с перебоями в подаче электроэнергии, и обеспечивая бесперебойный доступ к критически важным услугам. Поскольку цифровой ландшафт продолжает развиваться, инвестиции в решения ИБП остаются стратегическим императивом для операторов центров обработки данных, позволяя им удовлетворять растущие требования мира, управляемого данными, при этом сохраняя эксплуатационное совершенство и удовлетворенность клиентов.

Область отчета и сегментация рынка

Отчет Метрика

|

Подробности

|

Прогнозируемый период

|

2024-2031

|

Базовый год

|

2023

|

Исторические годы

|

2022 (Можно настроить на 2016-2021)

|

Количественные единицы

|

Доход в млн. долл. США

|

Охваченные сегменты

|

Компоненты (решения и услуги), Размер организации (крупное предприятие, среднее предприятие и малое предприятие), Тип (онлайн, офлайн и линейно-интерактивный), Выход (переменный ток в переменный, постоянный ток в постоянный и переменный ток в постоянный), Топология (линейно-интерактивная и напольная), Применение (промышленный транспорт, обработанные продукты питания, гидроэлектростанции, геотермальная энергия, теплицы, климат-контроль, миксеры, резка и другие), Диапазон мощности (500-1200 кВА, 200-500 кВА, 20-200 кВА, 1200-1500 кВА и менее 20 кВА), Центр обработки данных (облачный, совместное размещение, корпоративный, периферийный и другие), Вертикаль (государственный и общественный сектор, ИТ и центр обработки данных, жилой сектор, энергетика и коммунальные услуги, телекоммуникации, производство, здравоохранение, розничная торговля, BFSI, образование и другие), Канал продаж (прямой и косвенный)

|

Страны, охваченные

|

Германия, Франция, Великобритания, Италия, Испания, Россия, Турция, Бельгия, Нидерланды, Норвегия, Финляндия, Швейцария, Дания, Швеция, Польша и остальные страны Европы

|

Охваченные участники рынка

|

Schneider Electric (Франция), General Electric Company (США), Panduit Corp. (США), ABB (Швейцария), AEG (Нидерланды), Delta Electronics, Inc. (Тайвань), Eaton (Ирландия), Mitsubishi Electric Corporation (Япония), Siemens (Германия), Vertiv Group Corp. (США), Toshiba International Corporation (Германия), Norden (США), Langley Holdings plc (Великобритания), Shenzhen Kstar Science&Technology Co., Ltd (США), RPS Spa - Member of the Riello Elettronica Group (Япония), Legrand (Япония), SOCOMEC (США), Cyber Power Systems (США), Inc., Fortron Source GmbH (FSP GROUP) (Швейцария) и Huawei Digital Power Technologies Co., Ltd. (Япония) и другие

|

Данные, отраженные в отчете

|

Помимо таких рыночных данных, как рыночная стоимость, темпы роста, сегменты рынка, географический охват, участники рынка и рыночный сценарий, рыночный отчет, подготовленный командой Data Bridge Market Research, включает в себя углубленный экспертный анализ, анализ импорта/экспорта, анализ цен, анализ потребления продукции и анализ пестицидов.

|

Анализ сегмента

Европейский рынок источников бесперебойного питания (ИБП) разделен на десять основных сегментов, которые различаются по компонентам, размеру организации, типу, производительности, топологии, применению, диапазону мощности, центру обработки данных , вертикали и каналу продаж.

- На основе компонентов рынок сегментируется на решения и услуги. Сегмент решений далее подразделяется по типу на 50 кВА и ниже, 51-100 кВА, 101-250 кВА, 251-500 кВА и 501 кВА и выше. Сегмент услуг далее подразделяется по типу на поддержку и обслуживание, интеграцию и внедрение, а также обучение, образование и консалтинг

Ожидается, что в 2024 году сегмент решений будет доминировать на рынке.

Ожидается, что в 2024 году сегмент решений будет доминировать на рынке с долей рынка 74,12% благодаря спросу на комплексные пакеты, объединяющие программное обеспечение, услуги и оборудование, обеспечивающие надежные решения по резервному питанию, адаптированные к различным потребностям потребителей.

- В зависимости от размера организации рынок сегментируется на крупные предприятия, средние предприятия и малые предприятия.

Ожидается, что в 2024 году на рынке будет доминировать сегмент крупных предприятий.

Ожидается, что в 2024 году сегмент крупных предприятий будет доминировать на рынке с долей рынка 56,47%, поскольку доминирование обусловлено растущим акцентом на эффективность, масштабируемость и гибкость систем управления питанием в различных отраслях, что способствует предпочтению интегрированных решений ИБП.

- По типу рынок сегментируется на онлайн, офлайн и линейно-интерактивный. Ожидается, что в 2024 году онлайн-сегмент будет доминировать на рынке с долей рынка 41,07%

- На основе выходной мощности рынок сегментирован на AC-AC, DC-DC и AC-DC. AC-AC далее подразделяется по типу на трехфазные и однофазные. Трехфазные далее сегментируются на основе диапазона мощности на выше 480 В, 240-480 В и менее 240 В. Однофазные далее сегментируются на основе мощности на 5-10 кВА, ниже 5 кВА и более 10 кВА. Ожидается, что в 2024 году сегмент AC-AC будет доминировать на рынке с долей рынка 40,94%.

- На основе топологии рынок сегментирован на линейно-интерактивный и стационарный. Ожидается, что в 2024 году сегмент линейно-интерактивного сегмента будет доминировать на рынке с долей рынка 58,06%.

- На основе сферы применения рынок сегментируется на промышленный транспорт, переработанные пищевые продукты, гидроэлектростанции, геотермальные установки, теплицы, климат-контроль, смесители, резку и др. Ожидается, что в 2024 году сегмент промышленного транспорта будет доминировать на рынке с долей рынка 21,00%.

- На основе диапазона мощности рынок сегментирован на 500-1200 кВА, 200-500 кВА, 20-200 кВА, 1200-1500 кВА и менее 20 кВА. Ожидается, что в 2024 году сегмент 500-1200 кВА будет доминировать на рынке с долей рынка 31,53%

- На основе центра обработки данных рынок сегментируется на облако, размещение, корпоративный, периферийный и др. Ожидается, что в 2024 году облачный сегмент будет доминировать на рынке с долей рынка 37,06%.

- На основе вертикали рынок был сегментирован на государственный и общественный сектор, ИТ и центры обработки данных, жилой сектор, энергетику и коммунальные услуги, телекоммуникации, производство, здравоохранение, розничную торговлю, BFSI, образование и другие. Каждый сегмент, за исключением других, далее сегментируется на основе компонентов в решения и услуги. Ожидается, что в 2024 году сегмент государственного и общественного сектора будет доминировать на рынке с долей рынка 16,49%

- На основе канала продаж рынок был сегментирован на прямой и косвенный. Косвенный сегмент, если далее сегментировать на основе типа на дистрибьютора/оптовика, специализированный магазин и т. д. Ожидается, что в 2024 году прямой сегмент будет доминировать на рынке с долей рынка 65,87%

Основные игроки

Data Bridge Market Research анализирует Legrand (Япония), Fortron Source GmbH (FSP GROUP) (Швейцария), Siemens (Германия), Huawei Digital Power Technologies Co., Ltd. (Япония), General Electric Company (США) как основные компании, работающие на европейском рынке источников бесперебойного питания (ИБП).

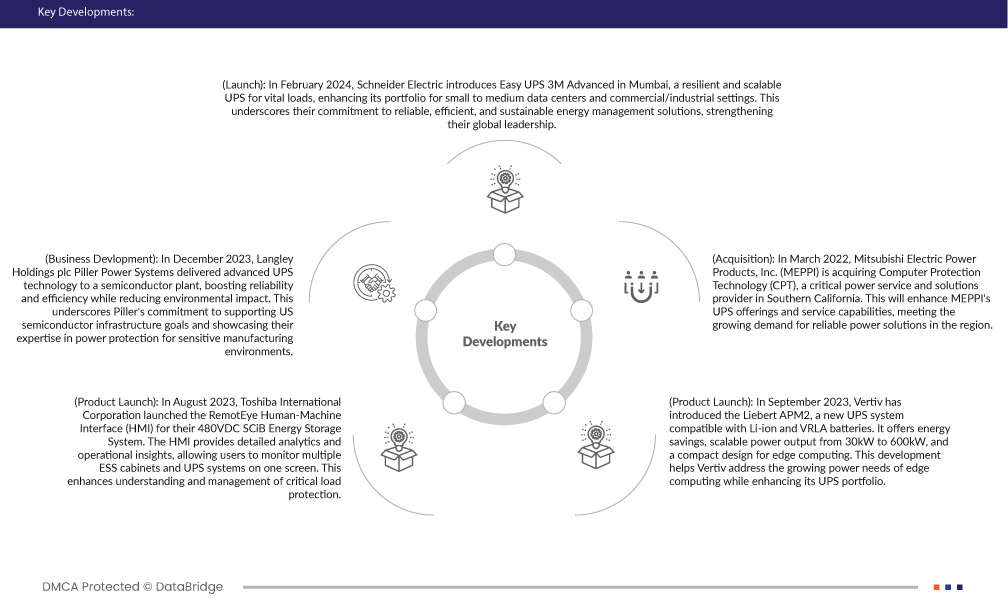

Развитие рынка

- В феврале 2024 года Schneider Electric представляет Easy UPS 3M Advanced в Мумбаи, надежный и масштабируемый ИБП для критически важных нагрузок, расширяя свой портфель для малых и средних центров обработки данных и коммерческих/промышленных установок. Это подчеркивает их приверженность надежным, эффективным и устойчивым решениям по управлению энергией, укрепляя их глобальное лидерство.

- В декабре 2023 года Langley Holdings plc Piller Power Systems поставила передовую технологию ИБП на завод по производству полупроводников, повысив надежность и эффективность, а также снизив воздействие на окружающую среду. Это подчеркивает приверженность Piller поддержке целей полупроводниковой инфраструктуры США и демонстрации их опыта в области защиты электропитания для чувствительных производственных сред.

- В августе 2023 года корпорация Toshiba International Corporation запустила интерфейс человек-машина (HMI) RemotEye для своей системы хранения энергии SCiB 480 В постоянного тока. HMI предоставляет подробную аналитику и операционную информацию, позволяя пользователям контролировать несколько шкафов ESS и систем ИБП на одном экране. Это улучшает понимание и управление защитой критической нагрузки.

- В сентябре 2023 года Vertiv представила Liebert APM2 — новую систему ИБП, совместимую с литий-ионными и VRLA-аккумуляторами. Она обеспечивает экономию энергии, масштабируемую выходную мощность от 30 кВт до 600 кВт и компактный дизайн для периферийных вычислений. Эта разработка помогает Vertiv удовлетворять растущие потребности периферийных вычислений в электроэнергии, одновременно расширяя свой портфель ИБП.

- В марте 2022 года Mitsubishi Electric Power Products, Inc. (MEPPI) приобретает Computer Protection Technology (CPT), поставщика критически важных услуг и решений в области электропитания в Южной Калифорнии. Это расширит возможности и возможности обслуживания ИБП MEPPI, удовлетворяя растущий спрос на надежные решения в области электропитания в регионе.

Региональный анализ

Географически в отчете о мировом рынке управления виртуальной инфраструктурой представлены следующие страны: Германия, Франция, Великобритания, Италия, Испания, Россия, Турция, Бельгия, Нидерланды, Норвегия, Финляндия, Швейцария, Дания, Швеция, Польша и остальные страны Европы.

Согласно анализу Data Bridge Market Research:

Ожидается, что Европа будет доминировать и станет самым быстрорастущим регионом на европейском рынке источников бесперебойного питания (ИБП).

Ожидается, что Германия будет доминировать на европейском рынке источников бесперебойного питания (ИБП) благодаря своему мощному инженерному мастерству и репутации надежности, что делает ее решения ИБП востребованными во всех отраслях. Кроме того, фокус Германии на инновациях и приверженность устойчивому развитию соответствуют меняющимся потребностям рынка, что еще больше укрепляет ее лидирующие позиции.

Для получения более подробной информации об отчете о рынке источников бесперебойного питания (ИБП) в Европе нажмите здесь – https://www.databridgemarketresearch.com/reports/europe-uninterruptible-power-supply-ups-market