Растущая распространенность хронических заболеваний в АСЕАН является основным фактором, определяющим рынок скрининга здоровья. По мере изменения образа жизни и старения населения хронические заболевания, такие как сердечно-сосудистые заболевания, диабет и рак, становятся все более распространенными. Эта тенденция стимулировала спрос на регулярные скрининги здоровья, услуги раннего выявления и профилактические меры здравоохранения. Правительства и поставщики медицинских услуг расширяют программы скрининга и инвестируют в передовые диагностические технологии для эффективного решения этих проблем здравоохранения. Поскольку бремя хронических заболеваний продолжает расти, ожидается, что рынок скрининга здоровья в АСЕАН будет и дальше расширяться для удовлетворения растущих потребностей населения в здравоохранении. Например, в сентябре 2022 года был опубликован доклад ВОЗ «Регион ВОЗ Юго-Восточной Азии ускорит прогресс в профилактике и борьбе с неинфекционными заболеваниями», в котором показано, что прогресс в профилактике и борьбе с неинфекционными заболеваниями, включая уход за полостью рта и глазами, достигнут. Упомянутые неинфекционные заболевания, включая сердечно-сосудистые заболевания, рак, хронические респираторные заболевания и диабет, составляют почти две трети всех случаев смерти в регионе ВОЗ Юго-Восточной Азии. Почти половина этих смертей произошла преждевременно в возрасте от 30 до 69 лет в 2021 году.

Поскольку распространенность таких заболеваний, как диабет, сердечно-сосудистые заболевания и рак , продолжает расти, расширение доступа к комплексным медицинским обследованиям становится решающим фактором для эффективного управления этими проблемами здравоохранения. Инвестиции в передовые диагностические технологии, повышение осведомленности общественности в области здравоохранения и укрепление инфраструктуры здравоохранения будут иметь решающее значение для решения проблемы растущего бремени хронических заболеваний и улучшения общих показателей здоровья в регионе.

Доступ к полному отчету по адресу https://www.databridgemarketresearch.com/reports/asean-health-screening-market

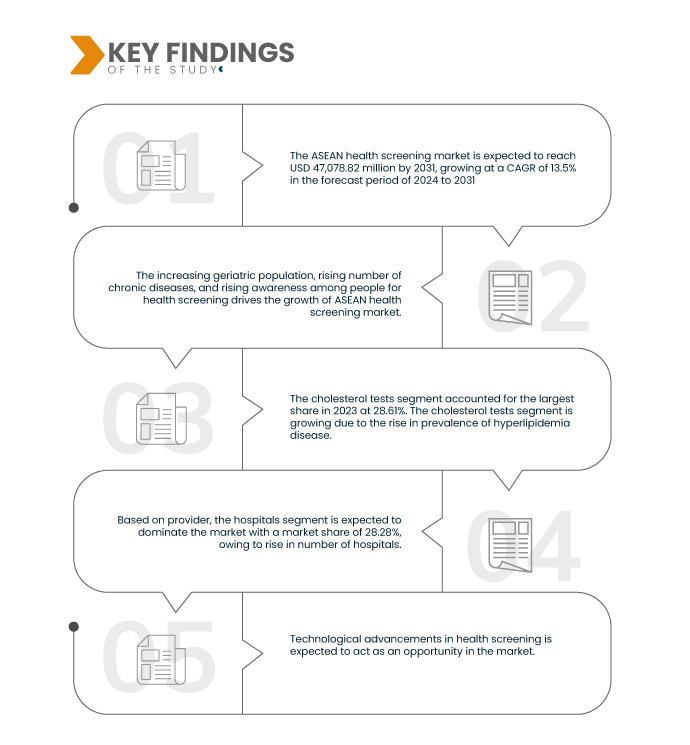

По данным исследования рынка Data Bridge, ожидается, что рынок медицинских скринингов в странах АСЕАН будет расти среднегодовыми темпами на 13,5% в прогнозируемый период с 2024 по 2031 год и достигнет 47 078,82 млн долларов США к 2031 году по сравнению с 17 697,22 млн долларов США в 2023 году. Ожидается, что сегмент тестов на холестерин будет способствовать росту рынка за счет растущего внедрения тестов на холестерин.

Основные выводы исследования

Рост числа хронических заболеваний для основных банковских решений

Область отчета и сегментация рынка

Отчет Метрика

|

Подробности

|

Прогнозируемый период

|

2024-2031

|

Базовый год

|

2023

|

Исторический год

|

2022 (можно изменить на 2016–2021)

|

Количественные единицы

|

Доход в млн. долл. США

|

Охваченные сегменты

|

Тип теста (тесты на холестерин, тест на диабет , тесты на рак, общий осмотр, ЗППП, тест на артериальное давление и другие), применение (сердечно-сосудистые заболевания, нарушения обмена веществ, онкология, воспалительные заболевания, заболевания опорно-двигательного аппарата, неврологические заболевания, осложнения гепатита С, состояния, связанные с иммунологией, и другие), тип панели (панели с несколькими тестами, панели с одним тестом), уход/учреждение (интегрированное, автономное), пользователь (домашний пользователь, медицинский турист), доход клиента (высший класс, средний класс и низший класс), поставщик (больницы, клиники, дома престарелых, реабилитационные центры, диагностические лаборатории и другие)

|

Страны, охваченные

|

Индия, Сингапур, Таиланд, Малайзия, Индонезия, Филиппины, Вьетнам, Камбоджа, Бруней, Бирма и Лаос

|

Охваченные участники рынка

|

Fullerton Health Corporation Limited (Сингапур), Mount Alvernia Hospital (Сингапур), PT Prodia Widyahusada Tbk (Индонезия), Raffles Medical Group (Сингапур), Icon Group (Австралия), The Farrer Park Company (Сингапур), Parkway Holdings Limited (Сингапур), PT Siloam International Hospitals Tbk (Индонезия), Mount Elizabeth Hospital (Сингапур) и SingHealth Group (Сингапур) и другие.

|

Данные, отраженные в отчете

|

Помимо информации о рыночных сценариях, таких как рыночная стоимость, темпы роста, сегментация, географический охват и основные игроки, рыночные отчеты, подготовленные Data Bridge Market Research, также включают в себя углубленный экспертный анализ, географически представленные данные о производстве и мощностях компаний, схемы сетей дистрибьюторов и партнеров, подробный и обновленный анализ ценовых тенденций и анализ дефицита цепочки поставок и спроса.

|

Анализ сегмента

Рынок медицинских скринингов в странах АСЕАН подразделяется на семь основных сегментов в зависимости от типа теста, области применения, типа панели, вида медицинской помощи/учреждения, пользователя, дохода клиента и поставщика.

- По типу теста рынок сегментирован на тесты на холестерин, диабет, рак, общие осмотры, ЗППП, анализы на артериальное давление и другие.

Ожидается, что в 2024 году сегмент тестов на холестерин будет доминировать на рынке.

Ожидается , что в 2024 году сегмент тестов на холестерин будет доминировать на рынке с долей рынка 28,61% из-за растущего спроса на тесты на холестерин.

- В зависимости от сферы применения рынок сегментирован на сердечно-сосудистые заболевания , нарушения обмена веществ, онкологию, воспалительные состояния, заболевания опорно-двигательного аппарата , неврологические состояния, осложнения гепатита С, состояния, связанные с иммунологией, и другие.

Ожидается, что в 2024 году сегмент сердечно-сосудистых заболеваний будет доминировать на рынке.

Ожидается, что в 2024 году сегмент сердечно-сосудистых заболеваний будет доминировать на рынке с долей рынка 33,50% из-за высокой распространенности сердечных заболеваний.

- В зависимости от типа панели рынок сегментируется на многотестовые панели и однотестовые панели. Ожидается, что в 2024 году сегмент многотестовых панелей будет доминировать на рынке с долей рынка 78,65%

- На основе ухода/учреждения рынок сегментируется на интегрированный и автономный. В 2024 году ожидается, что интегрированный сегмент будет доминировать на рынке с долей рынка 60,85%

- На основе пользователя рынок сегментирован на внутреннего пользователя и медицинского туриста. В 2024 году ожидается, что интегрированный сегмент будет доминировать на рынке с долей рынка 87,87%

- На основе доходов клиентов рынок сегментируется на высший класс, средний класс и низший класс. Ожидается, что в 2024 году сегмент высшего класса будет доминировать на рынке с долей рынка 59,11%

- По поставщику рынок сегментирован на больницы, клиники, дома престарелых, реабилитационные центры, диагностические лаборатории и т. д. Ожидается, что в 2024 году сегмент больниц будет доминировать на рынке с долей рынка 28,28%.

Основные игроки

Компания Data Bridge Market Research выделяет следующие компании в качестве основных игроков на рынке медицинских скринингов в странах АСЕАН, в том числе Fullerton Health Corporation Limited (Сингапур), Mount Alvernia Hospital (Сингапур), PT Prodia Widyahusada Tbk (Индонезия), Raffles Medical Group (Сингапур), Icon Group (Австралия), The Farrer Park Company (Сингапур), Parkway Holdings Limited (Сингапур), PT Siloam International Hospitals Tbk (Индонезия), Mount Elizabeth Hospital (Сингапур) и SingHealth Group (Сингапур) среди прочих.

Развитие рынка

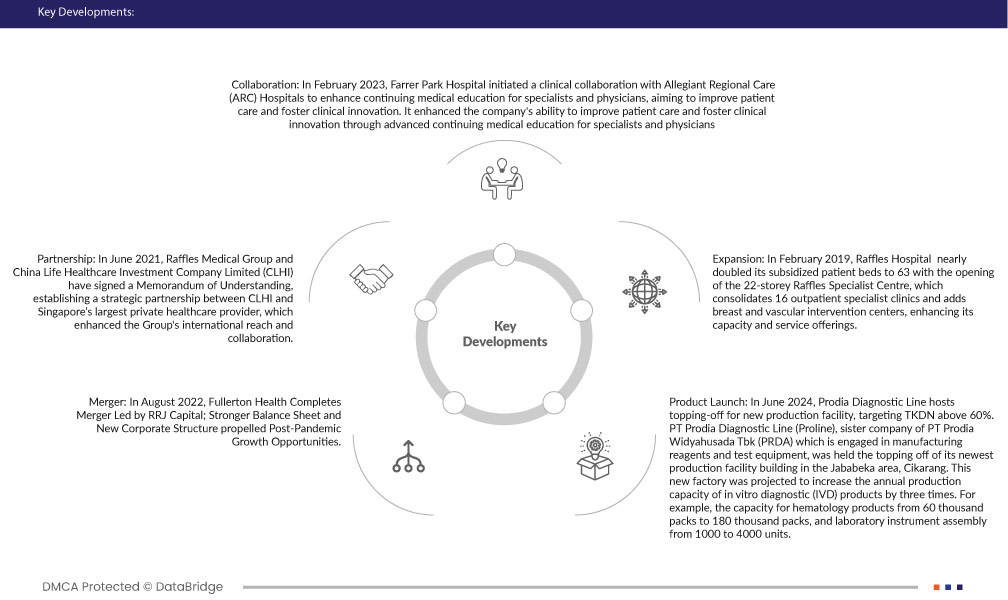

- В июне 2024 года компания Prodia Diagnostic Line провела дозаправку нового производственного объекта, нацеленного на TKDN выше 60%. PT Prodia Diagnostic Line (Proline), дочерняя компания PT Prodia Widyahusada Tbk (PRDA), которая занимается производством реагентов и испытательного оборудования, провела дозаправку своего новейшего производственного объекта в районе Джабабека, Чикаранг. Предполагается, что этот новый завод увеличит годовую производственную мощность продукции для диагностики in vitro (IVD) в три раза. Например, мощность по гематологической продукции с 60 тысяч упаковок до 180 тысяч упаковок, а сборка лабораторных приборов с 1000 до 4000 единиц

- В феврале 2023 года больница Farrer Park Hospital начала клиническое сотрудничество с больницами Allegiant Regional Care (ARC) Hospitals с целью улучшения непрерывного медицинского образования для специалистов и врачей с целью улучшения ухода за пациентами и содействия клиническим инновациям. Это расширило возможности компании по улучшению ухода за пациентами и содействию клиническим инновациям посредством продвинутого непрерывного медицинского образования для специалистов и врачей.

- В августе 2022 года Fullerton Health завершила слияние под руководством RRJ Capital; более сильный баланс и новая корпоративная структура стимулировали возможности роста после пандемии. Fullerton Health Corporation Limited («Fullerton Health» или «Компания») объявила о завершении слияния под руководством RRJ Capital («RRJ»), включающего вливание капитала частной инвестиционной компанией и старший кредит на общую сумму 390 миллионов долларов США. Слияние обеспечило более сильный баланс и новую структуру капитала, что стимулировало возможности роста после пандемии для паназиатского поставщика медицинских услуг

- В июне 2022 года больница Farrer Park запустила услугу колоректального скрининга с использованием искусственного интеллекта для улучшения обнаружения, классификации и наблюдения за колоректальными полипами и раком с целью улучшения ухода за пациентами и точности диагностики.

- В июне 2021 года Raffles Medical Group и China Life Healthcare Investment Company Limited (CLHI) подписали Меморандум о взаимопонимании, устанавливающий стратегическое партнерство между CLHI и крупнейшим частным поставщиком медицинских услуг в Сингапуре, что расширило международный охват и сотрудничество группы.

- В сентябре 2020 года Farrer Park Company Pte Ltd получила зеленый кредит в размере 120 миллионов долларов США от United Overseas Bank Limited (UOB), первый для медицинского учреждения в Сингапуре, подкрепляющий усилия по обеспечению устойчивости. Ожидалось, что средства пойдут на рефинансирование Connexion, новаторского интегрированного комплекса здравоохранения и гостеприимства в Сингапуре, что повысит операционную эффективность и инициативы по обеспечению устойчивости.

Региональный анализ

Географически в отчете о рынке медицинских скринингов стран АСЕАН представлены следующие страны: Индия, Сингапур, Таиланд, Малайзия, Индонезия, Филиппины, Вьетнам, Камбоджа, Бруней, Бирма и Лаос.

Согласно анализу Data Bridge Market Research:

Более подробную информацию об отчете о рынке медицинского скрининга в странах АСЕАН можно получить здесь – https://www.databridgemarketresearch.com/reports/asean-health-screening-market