U.S. Polymerase Chain Reaction Market Analysis and Size

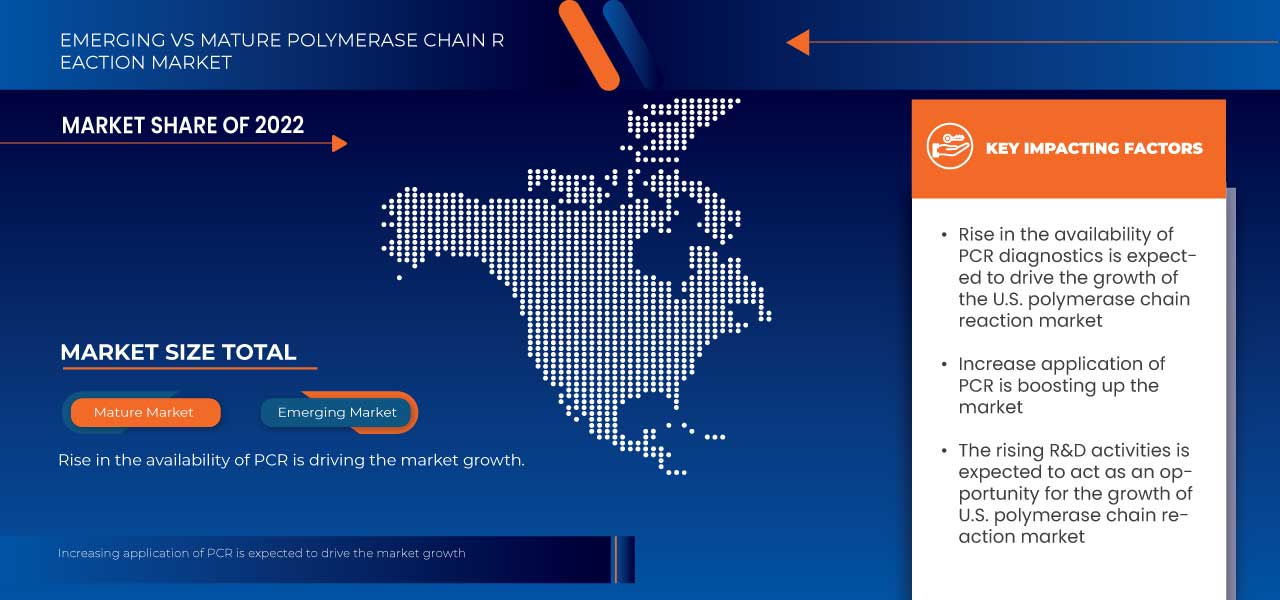

The U.S. polymerase chain reaction market is expected to grow in the forecast year due to the rise in the number of market players and the availability of advanced technological diagnostic devices. The increasing development in the field of advanced techniques is further expected to boost market growth. However, difficulties such as the stringent regulations for the production and commercialization of treatment drugs and medical devices for diagnosis and surgery are expected to restrain market growth in the forecast period.

Data Bridge Market Research analyzes that, U.S. polymerase chain reaction market is expected to reach the value of USD 11,168.47 million by 2030, at a CAGR of 12.2% during the forecast period. This market report also covers pricing analysis and technological advancements in depth.

|

Report Metric |

Details |

|

Forecast Period |

2023 to 2030 |

|

Base Year |

2022 |

|

Historic Years |

2021 (Customizable to 2015 - 2020) |

|

Quantitative Units |

Revenue in USD Million, Volumes in Units, Pricing in USD |

|

Segments Covered |

Product Type (Reagents, Instruments, Consumables, and Software and Services), Method (Real-Time PCR, Reverse-Transcriptase (RT) PCR, Conventional PCR, Multiplex PCR, Nested PCR, Hot Start PCR, Long-Range PCR, Assembly PCR, Inverse PCR, and Others), Application (Clinical, Life Science and Related Researches, Forensic Science, Environmental Microbiology, and Other), End User (Pharmaceutical and Biotechnology Companies, Hospitals and Clinics, Diagnostic Laboratories, Academic and Research Organizations, Forensic Laboratories, Reference Laboratories, and Others), Distribution Channel (Direct Tender, Retail Sales, and Others) |

|

Country Covered |

U.S. |

|

Market Players Covered |

Beckman Coulter, Inc, F. Hoffmann-La Roche Ltd, Promega Corporation, Illumina, Inc, Bio-Rad Laboratories, Inc, QIAGEN, Merck KGaA, GenScript, Thermo Fisher Scientific Inc, PerkinElmer Inc, Enzo Life Sciences, Inc., bioMérieux Inc, Takara Bio Inc., LGC biosearch technologies, Meridian bioscience, Inc., luminex corporation, and Agilent Technologies, Inc among others |

Market Definition

Polymerase Chain Reaction (PCR) is a method widely used to make millions to billions of copies of a specific DNA sample rapidly, allowing scientists to amplify a very small sample of DNA or a part of it sufficiently to enable detailed study. It is a technique used to make numerous copies of a specific segment of DNA quickly and accurately. PCR is based on using the ability of DNA polymerase to synthesize new strands of DNA complementary to the offered template strand. The majority of PCR methods rely on thermal cycling. Thermal cycling exposes reactants to repeated cycles of heating and cooling to permit different temperature-dependent reactions—specifically, DNA melting and enzyme-driven DNA replication.

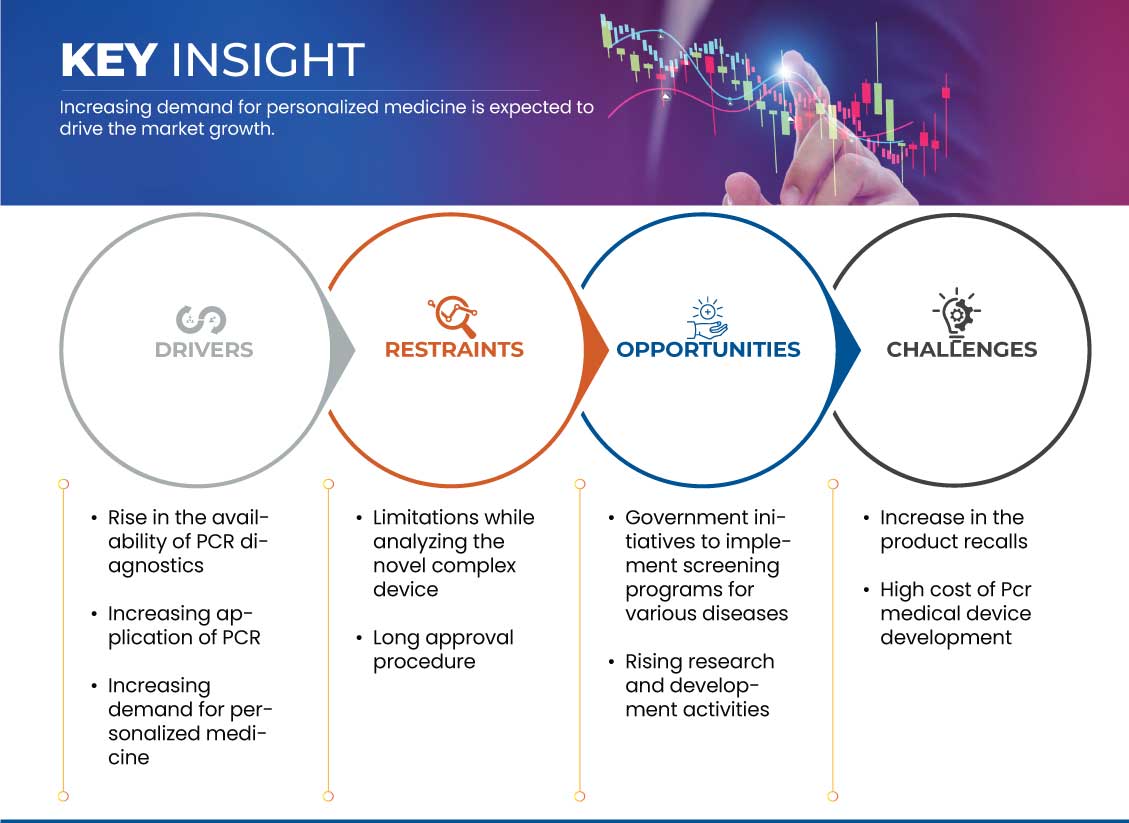

U.S. Polymerase Chain Reaction Market Dynamics

This section deals with understanding the market drivers, advantages, opportunities, restraints, and challenges. All of this is discussed in detail below:

DRIVERS

- Rise in the Availability of PCR Diagnostics

The polymerase chain reaction is one of the most widely used techniques in modern biology. PCR is based on a molecular technique for in-vitro amplification which generate millions number of copies of a specific region in a DNA strand. The rise in availability and the adoption of PCR devices is due to the diagnosis of various diseases and rapid results. PCR is a simple and widely used process in which minute amounts of DNA can be amplified into multiple copies. In addition to the rapidity with which this assay works, it can quantitatively demonstrate how much of a particular sequence is present.

For instance,

- In August 2020, as per the national human genome research institute, the rise in the availability of PCR is due to a fast and inexpensive technique used to amplify small segments of DNA. The technology availability is rising as it is rapid, accurate, and scalable making it ideal for large-scale viral testing

Thus, increasing the production of PCR instruments and reagents also enhances the efficiency of product availability, for this reason, a rise in the availability of PCR diagnostics is expected to drive the growth of the market.

- Increasing Application of PCR

PCR has many research and practical applications. PCR has been routinely used in DNA cloning, medical diagnostics, and forensic analysis of DNA. The PCR technique has become a standard diagnostic and research tool in the field of dentistry. PCR and other molecular biology techniques enable the diagnosis of infectious microbes that cause maxillofacial infections. This helps in the effective management of conditions such as periodontal disease, caries, oral cancer, and endodontic infections.

For instance,

- In May 2023, as per NCBI Article, PCR is the most well-developed molecular technique up to now, and has a wide range of already fulfilled, and potential, clinical applications, including specific or broad-spectrum pathogen detection, evaluation of emerging novel infections, surveillance, early detection of biothreat agents

Thus, on concluding, the increasing applications of PCR is expected to drive the growth of the market.

OPPORTUNITY

- Government Initiatives to Implement Screening Programs for Various Diseases

The burden of diseases continues to increase globally and has great financial, emotional, and physical stress on health systems, families, and individuals. In countries where the healthcare system is strong, the survival rate in many types of diseases, such as cancer is improved due to quality care, increased awareness, and accessible early detection. According to Centers for Disease Control and Prevention, the U.S.-Pacific islands and territories through the National Comprehensive Cancer Control Program (NCCCP) adapted to form or support alliances to combat cancer in their communities which led to increase the awareness of lung cancer screening programs and use of PCR diagnosis for early detection as PCR allows pieces of DNA to be amplified find and diagnose a genetic condition or a disease related to cancer.

For instance,

- In March 2021, as per NCBI Article, the government directed that covid-19 screening program should be performed in healthcare workers as they are at a high risk of infection and they potentially experience more significant risks for emerging infectious diseases owing to occupational exposure to sick patients and virus-contaminated surfaces

The growing government initiatives to implement screening programs for various diseases is expected to act as opportunity for the growth of the market.

RESTRAINT / CHALLENGE

- Limitations while Analyzing the Novel Complex Device

Analyzing a complex medical device involves understanding the device’s context of use, workload, and the environment in which it will be used. There are various factors that contributes to the complexity of novel product used in laboratories. The continued engagement between staff and device manufacturers early in the development process is much needed and becomes mandatory to understand in order to operate the part or overall setup. The technological challenges for the PCR diagnosis in getting complex due to advances that consist of a heterogeneous set of novel and widely disparate technologies.

In recent years, there has been an increased use of AI/ML in medical devices, especially for tasks that require the analysis of large volumes of data or the interpretation of complex information.The limitations in the detection and analysis of novel complex products such as machines, tools and equipment’s are hampering the growth of the U.S. polymerase chain reaction market.

Recent Developments

- In February 2022, Thermo Fisher Scientific Inc. announced the launch of a new rapid environmental test to help in the fight against COVID-19. The Thermo Scientific Renvo Rapid PCR Test is the latest solution in the company’s in-air pathogen surveillance product portfolio. The Renvo Rapid PCR Test is performed on air samples collected using the company’s Thermo Scientific AerosolSense Sampler. This helped the organization in developing more revenue

- In March 2020, Bio-Rad Laboratories, Inc. announced that its Real-Time qPCR products are being used by testing laboratories globally to screen for COVID-19. This helped the organization in developing overall revenue

U.S. Polymerase Chain Reaction Market Scope

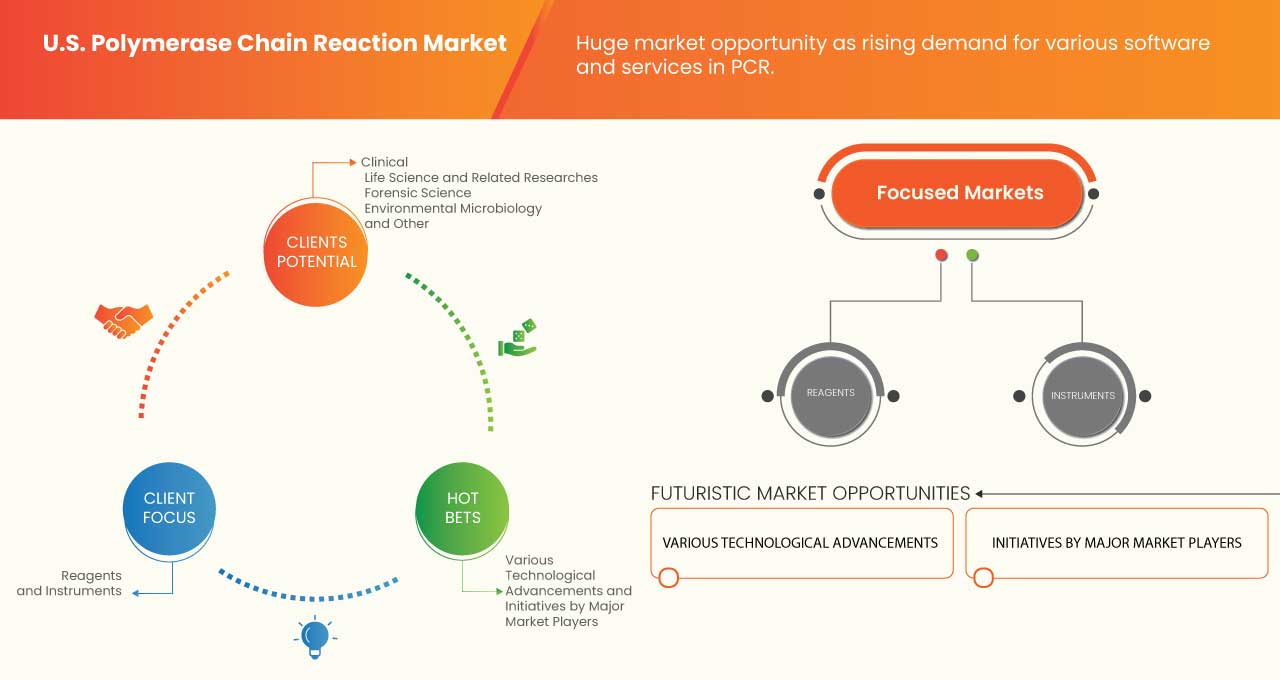

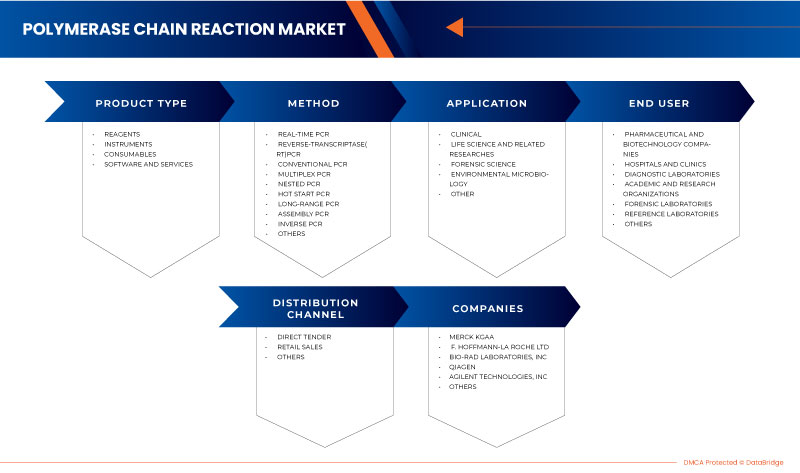

The U.S. polymerase chain reaction market is segmented into five notable segments based on product type, method, application, end-user, and distribution channel. The growth amongst these segments will help you analyze meager growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Product Type

- Reagents

- Instruments

- Consumables

- Software And Services

On the basis of product type, the market is segmented into reagents, instruments, consumables, software, and services.

Method

- Real-Time PCR

- Reverse-Transcriptase (RT) PCR

- Conventional PCR

- Multiplex PCR

- Nested PCR

- Hot Start PCR

- Long-Range PCR

- Assembly PCR

- Inverse PCR

- Others

On the basis of method, the market is segmented into real-time PCR, reverse-transcriptase (RT) PCR, conventional PCR, multiplex PCR, nested PCR, hot start PCR, long-range PCR, assembly PCR, inverse PCR, and others.

By Application

- Clinical

- Life Science and Related Researches

- Forensic Science

- Environmental Microbiology

- Other

On the basis of application, the market is segmented into clinical, life science and related researches, forensic science, environmental microbiology, and other.

By End Users

- Pharmaceutical and Biotechnology Companies

- Hospitals and Clinics

- Diagnostic Laboratories

- Academic and Research Organizations

- Forensic Laboratories

- Reference Laboratories

- Others

On the basis of end-user, the market is segmented into pharmaceutical and biotechnology companies, hospitals and clinics, diagnostic laboratories, academic and research organizations, forensic laboratories, reference laboratories, and others.

By Distribution Channel

- Direct Tender

- Retail Sales

- Others

On the basis of distribution channel, the market is segmented into direct tender, retail sales, and others.

Competitive Landscape and U.S. Polymerase Chain Reaction Market Share Analysis

The U.S. polymerase chain reaction market competitive landscape provides details of the competitor. Details included are company overview, company financials, revenue generated, market potential, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, and application dominance. The above data points provided are only related to the companies' focus related to the market.

Some of the major market players operating in the U.S. polymerase chain reaction market are Beckman Coulter, Inc, F. Hoffmann-La Roche Ltd, Promega Corporation, Illumina, Inc, Bio-Rad Laboratories, Inc, QIAGEN, Merck KGaA, GenScript, Thermo Fisher Scientific Inc, PerkinElmer Inc, Enzo Life Sciences, Inc., bioMérieux Inc, Takara Bio Inc., LGC biosearch technologies, Meridian bioscience, Inc., luminex corporation, and Agilent Technologies, Inc among others

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE U.S. POLYMERASE CHAIN REACTION MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 PRODUCT TYPE LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET END USER COVERAGE GRID

2.11 VENDOR SHARE ANALYSIS

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTLE ANALYSIS

4.2 PORTER'S FIVE FORCES MODEL

4.3 INSTALLATION BASE

4.4 COST ANALYSIS

4.5 VALUE CHAIN ANALYSIS

4.6 HEALTHCARE ECONOMY

4.6.1 HEALTHCARE EXPENDITURE

4.6.2 CAPITAL EXPENDITURE

4.6.3 CAPEX TRENDS

4.6.4 CAPEX ALLOCATIONS

4.6.5 FUNDING SOURCES

4.6.6 INDUSTRY BENCHMARKS

4.6.7 GDP RATIO IN OVERALL GDP

4.6.8 HEALTHCARE SYSTEM STRUCTURE

4.6.9 GOVERNMENT POLICIES

4.6.10 ECONOMIC DEVELOPMENT

4.7 INDUSTRY INSIGHTS

4.7.1 MICRO AND MACROECONOMIC FACTORS

4.7.2 PENETRATION AND GROWTH PROSPECT MAPPING

4.7.3 KEY PRICING STRATEGIES

4.8 TECHNOLOGY ROADMAP

5 REGULATORY COMPLIANCE

5.1 REGULATORY AUTHORITIES

5.2 REGULATORY CLASSIFICATIONS

5.3 REGULATORY SUBMISSIONS

5.4 INTERNATIONAL HARMONIZATION

5.5 COMPLIANCE AND QUALITY MANAGEMENT SCENARIO

5.6 REGULATORY CHALLENGES AND STRATEGY

6 MARKET OVERVIEW, U.S. POLYMERASE CHAIN REACTION MARKET

6.1 DRIVERS

6.1.1 RISE IN THE AVAILABILITY OF PCR DIAGNOSTICS

6.1.2 INCREASING APPLICATION OF PCR

6.1.3 INCREASING DEMAND FOR PERSONALIZED MEDICINE

6.2 RESTRAINTS

6.2.1 LIMITATIONS WHILE ANALYZING THE NOVEL COMPLEX DEVICE

6.2.2 LONG APPROVAL PROCEDURE

6.3 OPPORTUNITIES

6.3.1 GOVERNMENT INITIATIVES TO IMPLEMENT SCREENING PROGRAMS FOR VARIOUS DISEASES

6.3.2 RISING RESEARCH AND DEVELOPMENT ACTIVITIES

6.4 CHALLENGES

6.4.1 INCREASE IN THE PRODUCT RECALLS

6.4.2 HIGH COST OF PCR MEDICAL DEVICE DEVELOPMENT

7 U.S. POLYMERASE CHAIN REACTION MARKET, BY PRODUCT TYPE

7.1 OVERVIEW

7.2 REAGENTS

7.2.1 DNA OR PCR TEMPLATES

7.2.2 DNA POLYMERASE I ENZYME

7.2.2.1 TAQ DNA POLYMERASE

7.2.2.2 HIGH-FIDELITY DNA POLYMERASE

7.2.2.3 GREEN TAQ DNA POLYMERASE

7.2.2.4 HOT START TAQ DNA POLYMERASE

7.2.2.5 PROOFREADING DNA POLYMERASE

7.2.2.6 OTHERS

7.2.3 PRIMERS

7.2.4 DEOXYNUCLEOTIDE TRIPHOSPHATES (DNTPS)

7.2.5 PCR BUFFERS

7.2.5.1 TRIS-HCL

7.2.5.2 POTASSIUM CHLORIDE (KCL)

7.2.5.3 MAGNESIUM CHLORIDE

7.2.6 MASTER MIX OR PCR KIT

7.2.7 PROBES

7.2.8 ANTI-TAQ DNA POLYMERASE ANTIBODY

7.2.9 DIGITAL PCR SUPERMIXES

7.2.10 OTHERS

7.3 INSTRUMENTS

7.3.1 BY TYPE

7.3.1.1 DIGITAL PCR

7.3.1.1.1 DIGITAL PCR(DDPCR)

7.3.1.1.2 CHIP BASED DIGITAL PCR

7.3.1.1.3 BEAMING DIGITAL PCR

7.3.1.2 REAL TIME PCR

7.3.1.3 CONVENTIONAL PCR

7.3.1.4 OTHERS

7.3.2 BY MODALITY

7.3.2.1 STANDLONE

7.3.2.2 HANDHELD

7.3.2.3 PORTABLE

7.4 CONSUMABLES

7.4.1 PCR TUBES AND CAPS

7.4.2 PCR STRIPS

7.4.3 PCR WELL PLATES

7.4.4 STRIP TUBES

7.4.5 PLATE SEALS

7.4.6 CARTRIDGES AND GASKETS

7.4.7 OTHERS

7.5 SOFTWARE AND SERVICES

8 U.S. POLYMERASE CHAIN REACTION MARKET, BY METHOD

8.1 OVERVIEW

8.2 REAL-TIME PCR

8.3 REVERSE-TRANSCRIPTASE(RT) PCR

8.4 CONVENTIONAL PCR

8.5 MULTIPLEX PCR

8.6 NESTED PCR

8.7 HOT START PCR

8.8 LONG-RANGE PCR

8.9 ASSEMBLY PCR

8.1 INVERSE PCR

8.11 OTHERS

9 U.S. POLYMERASE CHAIN REACTION MARKET, BY APPLICATION

9.1 OVERVIEW

9.2 CLINICAL

9.2.1 ONCOLOGY TESTING

9.2.2 INFECTIOUS DISEASE TESTING

9.2.2.1 HUMAN PAPILLOMAVIRUS

9.2.2.2 HIV

9.2.2.3 HCV

9.2.2.4 HEPATITIS B VIRUS

9.2.2.5 OTHERS

9.2.3 TRANSPLANT DIAGNOSTICS

9.2.4 PATERNITY TESTING

9.2.5 OTHERS

9.3 LIFE SCIENCE AND RELATED RESEARCHES

9.3.1 MICROBIOLOGY

9.3.2 MOLECULAR AND CELL BIOLOGY

9.3.3 OTHERS

9.4 FORENSIC SCIENCE

9.4.1 DNA TYPING

9.4.2 DNA TESTING

9.4.3 GENETIC FINGERPRINTING

9.5 ENVIRONMENTAL MICROBIOLOGY

9.5.1 DETECTION OF TARGETED MICROORGANISMS

9.5.2 QUANTIFICATION OF MICROBIAL POPULATION

9.5.3 MICROBIAL COMMUNITY ANALYSIS

9.5.4 DETECTION OF MICROBIAL PATHOGEN

9.5.5 DETECTION OF GENE EXPRESSION IN THE ENVIRONMENT

9.5.6 DETECTION OF INDICTOR MICROORGANISMS IN WATER

9.5.7 ENVIRONMENTAL DNA ANALYSIS

9.5.8 OTHERS

9.6 OTHERS

10 U.S. POLYMERASE CHAIN REACTION MARKET, BY END USER

10.1 OVERVIEW

10.2 PHARMACEUTICAL AND BIOTECHNOLOGY COMPANIES

10.3 HOSPITALS AND CLINICS

10.3.1 PRIVATE

10.3.1.1 TIER 1

10.3.1.2 TIER 2

10.3.1.3 TIER 3

10.3.2 PUBLIC

10.3.2.1 TIER 1

10.3.2.2 TIER 2

10.3.2.3 TIER 3

10.4 DIAGNOSTIC LABORATORIES

10.5 ACADEMIC AND RESEARCH ORGANIZATIONS

10.6 FORENSIC LABORATORIES

10.7 REFERENCE LABORATORIES

10.8 OTHERS

11 U.S. POLYMERASE CHAIN REACTION MARKET, BY DISTRIBUTION CHANNEL

11.1 OVERVIEW

11.2 DIRECT TENDER

11.3 RETAIL SALES

11.4 OTHERS

12 U.S. POLYMERASE CHAIN REACTION MARKET: COMPANY LANDSCAPE

12.1 COMPANY SHARE ANALYSIS: U.S.

13 SWOT ANALYSIS

14 U.S. POLYMERASE CHAIN REACTION MARKET, COMPANY PROFILE

14.1 MERCK KGAA

14.1.1 COMPANY SNAPSHOT

14.1.2 REVENUE ANALYSIS

14.1.3 PRODUCT PORTFOLIO

14.1.4 RECENT DEVELOPMENTS

14.2 F. HOFFMANN- LA ROCHE LTD

14.2.1 COMPANY SNAPSHOT

14.2.2 REVENUE ANALYSIS

14.2.3 PRODUCT PORTFOLIO

14.2.4 RECENT DEVELOPMENT

14.3 BIO-RAD LABORATORIES, INC

14.3.1 COMPANY SNAPSHOT

14.3.2 REVENUE ANALYSIS

14.3.3 PRODUCT PORTFOLIO

14.3.4 RECENT DEVELOPMENTS

14.4 QIAGEN

14.4.1 COMPANY SNAPSHOT

14.4.2 REVENUE ANALYSIS

14.4.3 PRODUCT PORTFOLIO

14.4.4 RECENT DEVELOPMENTS

14.5 AGILENT TECHNOLOGIES, INC.

14.5.1 COMPANY PROFILE

14.5.2 REVENUE ANALYSIS

14.5.3 PRODUCT PORTFOLIO

14.5.4 RECENT DEVELOPMENT

14.6 ABBOTT

14.6.1 COMPANY SNAPSHOT

14.6.2 REVENUE ANALYSIS

14.6.3 PRODUCT PORTFOLIO

14.6.4 RECENT DEVELOPMENT

14.7 BECKMAN COULTER, INC.

14.7.1 COMPANY SNAPSHOT

14.7.2 PRODUCT PORTFOLIO

14.7.3 RECENT DEVELOPMENTS

14.8 BIOMERIUX

14.8.1 COMPANY PROFILE

14.8.2 REVENUE ANALYSIS

14.8.4 RECENT DEVELOPMENT

14.9 ENZO LIFE SCIENCES, INC.

14.9.1 COMPANY SNAPSHOT

14.9.2 PRODUCT PORTFOLIO

14.9.3 RECENT DEVELOPMENT

14.1 GENSCRIPT

14.10.1 COMPANY SNAPSHOT

14.10.2 REVENUE ANALYSIS

14.10.3 PRODUCT PORTFOLIO

14.10.4 RECENT DEVELOPMENTS

14.11 ILLUMINA INC

14.11.1 COMPANY SNAPSHOT

14.11.2 REVENUE ANALYSIS

14.11.3 PRODUCT PORTFOLIO

14.11.4 RECENT DEVELOPMENT

14.12 LGC BIOSEARCH TECHNOLOGIES

14.12.1 COMPANY SNAPSHOT

14.12.2 PRODUCT PORTFOLIO

14.12.3 RECENT DEVELOPMENT

14.13 LUMINEX CORPORATION

14.13.1 COMPANY SNAPSHOT

14.13.2 PRODUCT PORTFOLIO

14.13.3 RECENT DEVELOPMENT

14.14 MERIDIAN BIOSCIENCE INC

14.14.1 COMPANY PROFILE

14.14.2 REVENUE ANALYSIS

14.14.4 RECENT DEVELOPMENT

14.15 PERKINELMER INC

14.15.1 COMPANY PROFILE

14.15.2 REVENUE ANALYSIS

14.15.4 RECENT DEVELOPMENT

14.16 PROMEGA CORPORATION

14.16.1 COMPANY SNAPSHOT

14.16.2 PRODUCT PORTFOLIO

14.16.3 RECENT DEVELOPMENT

14.17 TAKARA BIO INC

14.17.1 COMPANY PROFILE

14.17.2 REVENUE ANALYSIS

14.17.4 RECENT DEVELOPMENT

14.18 THERMO FISHER SCIENTIFIC

14.18.1 COMPANY SNAPSHOT

14.18.2 REVENUE ANALYSIS

14.18.3 PRODUCT PORTFOLIO

14.18.4 RECENT DEVELOPMENTS

15 QUESTIONNAIRE

16 RELATED REPORTS

List of Table

TABLE 1 U.S. POLYMERASE CHAIN REACTION MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 2 U.S. REAGENTS IN POLYMERASE CHAIN REACTION MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 3 U.S. DNA POLYMERASE I ENZYME IN POLYMERASE CHAIN REACTION MARKET, BY REAGENTS, 2021-2030 (USD MILLION)

TABLE 4 U.S. PCR BUFFERS IN POLYMERASE CHAIN REACTION MARKET, BY REAGENTS, 2021-2030 (USD MILLION)

TABLE 5 U.S. INSTRUMENTS IN POLYMERASE CHAIN REACTION MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 6 U.S. DIGITAL PCR IN POLYMERASE CHAIN REACTION MARKET, BY TECHNOLOGY, 2021-2030 (USD MILLION)

TABLE 7 U.S. INSTRUMENTS IN POLYMERASE CHAIN REACTION MARKET, BY MODALITY, 2021-2030 (USD MILLION)

TABLE 8 U.S. CONSUMABLES IN POLYMERASE CHAIN REACTION MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 9 U.S. POLYMERASE CHAIN REACTION MARKET, BY METHOD, 2021-2030 (USD MILLION)

TABLE 10 U.S. POLYMERASE CHAIN REACTION MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 11 U.S. CLINICAL IN POLYMERASE CHAIN REACTION MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 12 U.S. INFECTIOUS DISEASE TESTING IN POLYMERASE CHAIN REACTION MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 13 U.S. LIFE SCIENCE AND RELATED RESEARCHES IN POLYMERASE CHAIN REACTION MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 14 U.S. FORENSIC SCIENCE IN POLYMERASE CHAIN REACTION MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 15 U.S. ENVIRONMENTAL MICROBIOLOGY IN POLYMERASE CHAIN REACTION MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 16 U.S. POLYMERASE CHAIN REACTION MARKET, BY END USER, 2018-2030 (USD MILLION)

TABLE 17 U.S. HOSPITALS AND CLINICS IN POLYMERASE CHAIN REACTION MARKET, BY END USERS, 2021-2030 (USD MILLION)

TABLE 18 U.S. PRIVATE IN POLYMERASE CHAIN REACTION MARKET, BY END USERS, 2021-2030 (USD MILLION)

TABLE 19 U.S. PUBLIC IN POLYMERASE CHAIN REACTION MARKET, BY END USERS, 2021-2030 (USD MILLION)

TABLE 20 U.S. POLYMERASE CHAIN REACTION MARKET, BY DISTRIBUTION CHANNEL, 2018-2030 (USD MILLION)

List of Figure

FIGURE 1 U.S. POLYMERASE CHAIN REACTION MARKET: SEGMENTATION

FIGURE 2 U.S. POLYMERASE CHAIN REACTION MARKET: DATA TRIANGULATION

FIGURE 3 U.S. POLYMERASE CHAIN REACTION MARKET: DROC ANALYSIS

FIGURE 4 U.S. POLYMERASE CHAIN REACTION MARKET: GLOBAL VS REGIONAL MARKET ANALYSIS

FIGURE 5 U.S. POLYMERASE CHAIN REACTION MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 U.S. POLYMERASE CHAIN REACTION MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 U.S. POLYMERASE CHAIN REACTION MARKET: DBMR MARKET POSITION GRID

FIGURE 8 U.S. POLYMERASE CHAIN REACTION MARKET: MARKET END USER COVERAGE GRID

FIGURE 9 U.S. POLYMERASE CHAIN REACTION MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 U.S. POLYMERASE CHAIN REACTION MARKET: SEGMENTATION

FIGURE 11 INCREASING APPLICATION OF PCR IS EXPECTED TO DRIVE THE GROWTH OF THE U.S. POLYMERASE CHAIN REACTION MARKET IN THE FORECAST PERIOD

FIGURE 12 THE REAGENTS SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE U.S. POLYMERASE CHAIN REACTION MARKET IN 2023 AND 2030

FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES OF THE U.S. POLYMERASE CHAIN REACTION MARKET

FIGURE 14 U.S. POLYMERASE CHAIN REACTION MARKET: BY PRODUCT TYPE, 2022

FIGURE 15 U.S. POLYMERASE CHAIN REACTION MARKET: BY PRODUCT TYPE, 2023-2030 (USD MILLION)

FIGURE 16 U.S. POLYMERASE CHAIN REACTION MARKET: BY PRODUCT TYPE, CAGR (2023-2030)

FIGURE 17 U.S. POLYMERASE CHAIN REACTION MARKET: BY PRODUCT TYPE, LIFELINE CURVE

FIGURE 18 U.S. POLYMERASE CHAIN REACTION MARKET: BY METHOD, 2022

FIGURE 19 U.S. POLYMERASE CHAIN REACTION MARKET: BY METHOD, 2023-2030 (USD MILLION)

FIGURE 20 U.S. POLYMERASE CHAIN REACTION MARKET: BY METHOD, CAGR (2023-2030)

FIGURE 21 U.S. POLYMERASE CHAIN REACTION MARKET: BY METHOD, LIFELINE CURVE

FIGURE 22 U.S. POLYMERASE CHAIN REACTION MARKET: BY APPLICATION, 2022

FIGURE 23 U.S. POLYMERASE CHAIN REACTION MARKET: BY APPLICATION, 2023-2030 (USD MILLION)

FIGURE 24 U.S. POLYMERASE CHAIN REACTION MARKET: BY APPLICATION, CAGR (2023-2030)

FIGURE 25 U.S. POLYMERASE CHAIN REACTION MARKET: BY APPLICATION, LIFELINE CURVE

FIGURE 26 U.S. POLYMERASE CHAIN REACTION MARKET: BY END USER, 2022

FIGURE 27 U.S. POLYMERASE CHAIN REACTION MARKET: BY END USER, 2023-2030 (USD MILLION)

FIGURE 28 U.S. POLYMERASE CHAIN REACTION MARKET: BY END USER, CAGR (2023-2030)

FIGURE 29 U.S. POLYMERASE CHAIN REACTION MARKET: BY END USER, LIFELINE CURVE

FIGURE 30 U.S. POLYMERASE CHAIN REACTION MARKET: BY DISTRIBUTION CHANNEL, 2022

FIGURE 31 U.S. POLYMERASE CHAIN REACTION MARKET: BY DISTRIBUTION CHANNEL, 2023-2030 (USD MILLION)

FIGURE 32 U.S. POLYMERASE CHAIN REACTION MARKET: BY DISTRIBUTION CHANNEL, CAGR (2023-2030)

FIGURE 33 U.S. POLYMERASE CHAIN REACTION MARKET: BY DISTRIBUTION CHANNEL, LIFELINE CURVE

FIGURE 34 U.S. POLYMERASE CHAIN REACTION MARKET: COMPANY SHARE 2022 (%)

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.