Us And Mexico Cat Litter Market

Market Size in USD Million

CAGR :

%

USD

3,240.48 Million

USD

4,469.05 Million

2022

2030

USD

3,240.48 Million

USD

4,469.05 Million

2022

2030

| 2023 –2030 | |

| USD 3,240.48 Million | |

| USD 4,469.05 Million | |

|

|

|

U.S. and Mexico Cat Litter Market Analysis and Insights

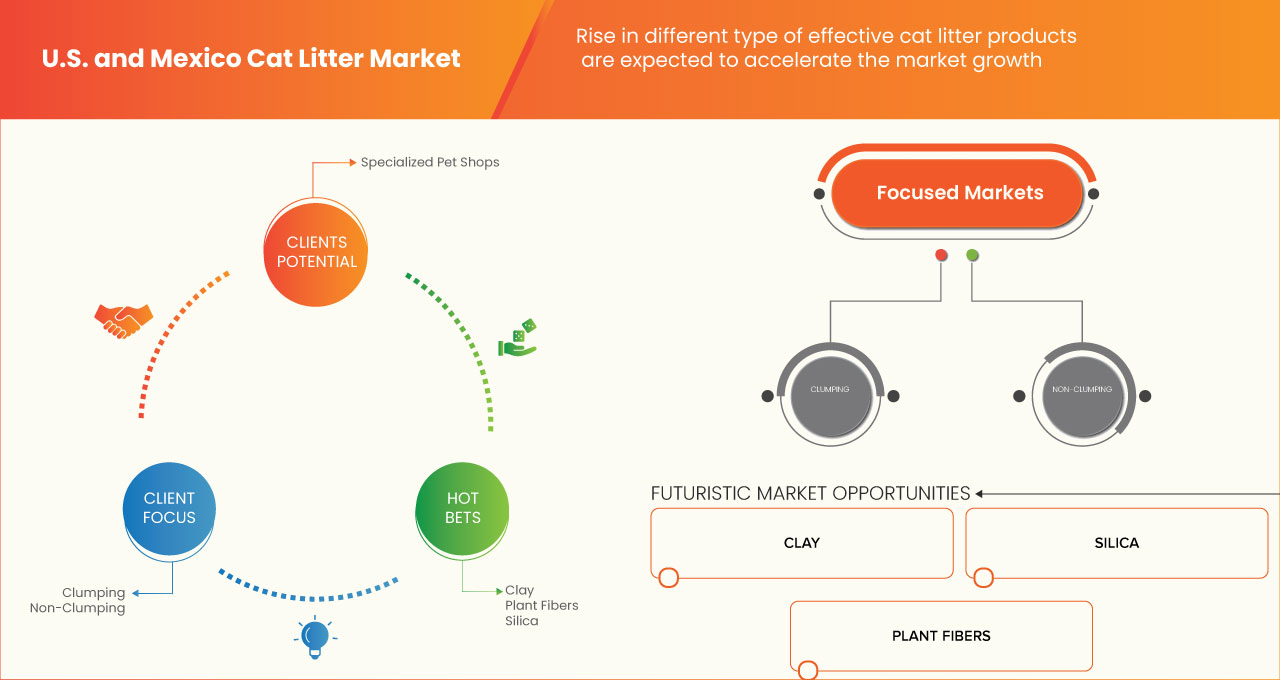

Rising awareness regarding the health of the pet and development of eco-friendly and biodegradable cat litter products in the U.S. provide market with a lucrative growth. Along with this, rise in different type of effective cat litter products are also boosting up the cat litter market.

The U.S. and Mexico cat litter market is expected to grow from 2023 to 2030. Data Bridge Market Research analyses that the market is growing with a CAGR of 4.1% in the forecast period of 2023 to 2030 and is expected to reach USD 4,469.05 million by 2030 from USD 3,240.48 million in 2022.

|

Report Metric |

Details |

|

Forecast Period |

2023 to 2030 |

|

Base Year |

2022 |

|

Historic Years |

2021 (Customizable to 2020-2016) |

|

Quantitative Units |

Revenue in USD Million |

|

Segments Covered |

By Product Type (Clumping, Non-Clumping, Crystals, Deodorant Litters, Conventional, Others), Raw Material (Clay, Silica, and Plant Fibers), Type (Scented and Non-Scented), Form (Coarse Litter and Fine Litter), Distribution Channel (Specialized Pet Shops, E-Commerce, Hypermarkets/Supermarkets, and Other), End User (Adult Cats and Kittens). |

|

Countries Covered |

U.S. and Mexico |

|

Market Players Covered |

The major companies which are dealing in the market are The Clorox Company, Nestlé Purina Petcare (Subsidiary of Nestle), Oil-Dri Corporation of America., Pettex Limited, Dr. Elsey's, Sinchem Silica Gel Co., Ltd., Weihai Pearl Silica Gel CO.,Ltd, Mars, Incorporated and its Affiliates, Healthy Pet, Pestell Pet Products, Church & Dwight Co., Inc., sWheat Scoop, and Bentaş, among others. |

Market Definition of U.S. and Mexico Cat Litter Market

A litter box, also known as a sandbox, cat box, litter tray, cat pan, pot, or litter pan, is an indoor feces and urine collection box for cats and other pets that instinctively or through training will use such a repository. They are provided for pets that are permitted free roaming of a home but who cannot or only sometimes go outside to excrete their metabolic waste.

Cat litter is an essential supply for all indoor cats. It is used instinctively by a cat to bury its urine and feces, but some owners prefer what type of litter they'd like their cats to use. The most common type of litter is clay-based, which is absorbent and has natural odor control, and the other two main types of clay cat litter are clumping and non-clumping. Clumping cat litter is often preferred by many cat owners who like to scoop the urine waste out of the litter box regularly. Still, others like the lower cost of non-clumping litter and will dump the entire litter box contents when necessary.

Rising awareness regarding the health of the pet has enhanced the market demand. The rising healthcare expenditure for better health services also contributes to the market's growth. Along with this, rising effective cat litter products are also boosting the cat litter market.

U.S. and Mexico Cat Litter Market Dynamics

This section deals with understanding the market drivers, advantages, opportunities, restraints, and challenges. All of this is discussed in detail below:

DRIVERS

Rise in different types of effective cat litter products

Cat litter is an essential supply for all indoor cats. It is used instinctively by a cat to bury its urine and feces, but some ownprefer for what type of litter they'd like their cats to use.

Price, odor control, the amount of dust, absorbency, how well it clumps, availability to purchase, scent or lack thereof, and other factors may play a role in the type of litter which would be suitable for the cats. There are several different types of cat litter which are available in market for different species of cats which includes bentonite cat litter, pine cat litter, crystal cat litter, tofu cat litter, and mixed cat litter (tofu litter mixed with bentonite litter).

Thus, the rise in different types of cat litter products is expected for the growth of the U.S. and Mexico cat litter market due to its great advantages such as safer for the environment and controlling of odor.

Growing pet ownership in both the U.S. and Mexico

In the United States, seven out of every 10 households own a pet. From unconditional love to emotional support, pets are a vital part of their owners’ lives. This growth is mainly fed by an increase in the number of millennials becoming pet owners and their commonly held view that their pets are family members. As a result of this viewpoint, these pet owners are willing to spend more money on their animals than past generations were.

Thus the various advantages of having pets such as they can increase possibility to exercise, get outside and can help manage loneliness and depression by giving companionship has increased the number of pet ownership in U.S. and Mexico which is expected to drive the growth of the market.

RESTRAINT

High cost of products

Plenty of one-time expenses pop up when anyone buys a new dog or cat. These can include spaying or neutering, vaccinations, rabies shots, microchipping, licensing, training and pet supplies such as a crate, food bowls, leash, toys, brushes, litter boxes, litter and puppy pads.

The cat litter products are of high cost due to several reasons, which includes the cost of producing and packaging, advertising and promotion expenses, competition among brands in the market, demand for different types of litter, and more.

Hence high cost associated with the cat litter products it is expected to restrict the growth of U.S. and Mexico cat litter market.

OPPORTUNITY

Rising awareness regarding the health of the pet

Rising number of people owning pets at home has significantly increased the awareness regarding the health of pet as they affect the overall surrounding they live in.

Children younger than 5 years old, people with weakened immune systems, and people 65 years of age and older are more likely to get diseases spread between animals and people (also known as zoonotic diseases). Pregnant women are also at a higher risk for certain animal-related diseases.

Thus, rising awareness regarding the pet health and various veteran organizations providing several healthcare facilities for pet acts as opportunities for the growth of the US and Mexico Cat Litter Market.

CHALLENGE

Fluctuations in raw material prices can impact the cost of manufacturing cat litter products

Cat litters are primarily made of clay and other minerals, natural ingredients such as pine, wheat or corn, or synthetic crystallized silica. Other ingredients that may be added to cat litter include baking soda is natural salt which is made from trona deposits and is added to clay and other types of cat litter to absorb and neutralize odors.

Mineral oil ingredient may be added to help control dust so kitty isn’t trying to toilet in a dust storm and you’re not enveloped in a cloud of dust every time your cat covers their waste or you pour more litter into the box. It can also help keep kitty litter from sticking to the bottom of the box for easy cleanup.

Hence huge fluctuations in the costs of raw materials needed for the manufacturing of cat litter products is expected to challenge the US and Mexico cat litter market.

Recent Developments

- In February 2023, Nestlé Purina PetCare announced plans to acquire Red Collar Pet Foods' Miami, Oklahoma pet treats factory from Arbor Investments, with an anticipated closing in March. The addition of the Miami factory to Purina's North American production footprint will mark the 22nd Purina owned and operated facility nationwide and expand in-house capabilities for dog and cat treats innovation and production. This has helped the company to expand globally.

- In April 2022, The Clorox Company announced the launch of a new initiative to advance environmental justice through investment in community parks to help provide better access to green spaces among underserved communities. The Healthy Parks Project aligns the company's purpose to champion people to be well and thrive every single day with its commitment to diversity, equity and inclusion. This has helped the company to expand their products.

- In September, 2022 Church & Dwight Co., Inc. has signed a definitive agreement to acquire the Hero Mighty Patch brand (Hero) and other acne treatment products for $630 million, consisting of cash and Church & Dwight restricted stock. Mighty Patch is the #2 brand in the acne category in the United States and the #1 patch brand in acne. The transaction, which is subject to customary closing conditions, is expected to close in the fourth quarter. This had helped the company to expand globally.

- In January Oil-Dri Corporation of America announced increasing prices for cat litter products effective April 1, 2022. These pricing actions will apply to branded and private-label cat litter items in the United States. This has helped the company to improve the economic conditions of the company.

U.S. and Mexico Cat Litter Market Scope

The U.S. and Mexico cat litter market is categorized into six notable segments such as product type, raw material, type, form, end user, and distribution channel. The growth amongst these segments will help you analyze meager growth segments in the industries and provide the users with a valuable market overview and market insights to make strategic decisions to identify core market applications.

Product Type

- CLUMPING

- NON-CLUMPING

- CRYSTALS

- DEODORANT LITTERS

- CONVENTIONAL

- OTHERS

On the basis of product type, the U.S. and Mexico cat litter market is segmented into clumping, non-clumping, crystals, deodorant litters, conventional, and others.

Raw Material

- CLAY

- SILICA

- PLANT FIBERS

On the basis of raw material, the U.S. and Mexico cat litter market is segmented into clay, silica, and plant fibers.

Type

- SCENTED

- NON-SCENTED

Based on type, the U.S. and Mexico cat litter market is segmented into scented and non-scented.

Form

- COARSE LITTER

- FINE LITTER

On the basis of form, the U.S. and Mexico cat litter market is segmented into coarse litter and fine litter.

End User

- ADULT CATS

- KITTENS

On the basis of end user, the U.S. and Mexico cat litter market is segmented into adult cats and kittens.

Distribution Channel

- SPECIALIZED PET SHOPS

- E-COMMERCE

- HYPERMARKETS/SUPERMARKETS

- OTHERS

On the basis of distribution channel the U.S. and Mexico cat litter market is segmented into specialized pet shops, e-commerce, hypermarkets/supermarkets, and others.

U.S. and Mexico Cat Litter Market Analysis/Insights

The U.S. and Mexico cat litter market is analyzed, and market size insights and trends are provided by country, product type, raw material, type, form, end user, and distribution channel. as referenced above.

The country covered in this market report are the U.S. and Mexico.

- In 2023, U.S. is dominating the U.S. and Mexico cat litter market in terms of market share and revenue and will continue to flourish its dominance during the forecast period.

The country section of the report also provides individual market impacting factors and changes in regulations in the market that impact the current and future trends of the market. Data points, such as new and replacement sales, country demographics, disease epidemiology, and import-export tariffs, are some of the major pointers used to forecast the market scenario for individual countries. In addition, the presence and availability of Global brands and their challenges faced due to competition from local and domestic brands and the impact of sales channels are considered while providing forecast analysis of the country data.

Competitive Landscape and Cat Litter Market Share Analysis

The cat litter market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, Global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to cat litter market.

The major companies which are dealing in the market are The Clorox Company, Nestlé Purina Petcare (Subsidiary of Nestle), Oil-Dri Corporation of America., Pettex Limited, Dr. Elsey's, Sinchem Silica Gel Co., Ltd., Weihai Pearl Silica Gel CO.,Ltd, Mars, Incorporated and its Affiliates, Healthy Pet, Pestell Pet Products, Church & Dwight Co., Inc., sWheat Scoop, and Bentaş, among others.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE U.S. AND MEXICO CAT LITTER MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 PRODUCT TYPE LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET END USER COVERAGE GRID

2.11 VENDOR SHARE ANALYSIS

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTEL ANALYSIS

4.2 PORTER’S

4.3 U.S. AND MEXICO CAT LITTER MARKET, LIST OF KEY BUYERS

4.4 PRICE TREND ANALYSIS

4.5 U.S. AND MEXICO CAT LITTER MARKET, PRODUCTION CONSUMPTION ANALYSIS

4.6 U.S. AND MEXICO CAT LITTER MARKET, VENDOR SELECTION CRITERIA

4.6.1 YEARS IN BUSINESS

4.6.2 ABILITY TO CONSTANTLY SUPPLY PRODUCTS OR SERVICES

4.6.3 ABILITY TO SUPPLY ALL THE PRODUCTS REQUIRED OR THE COMPLETE SOLUTION

4.6.4 FLEXIBILITY TO ALLOW CHANGES IN ORDERS OR PRODUCT LINES

4.6.5 SUBSTANTIAL CATALOG OF PRODUCTS OR RANGE OF SERVICES

4.6.6 TESTIMONIALS AND REFERENCES

4.6.7 SUSTAINABILITY AND FINANCIAL STABILITY

4.6.8 PRICES

4.6.9 DELIVERY TIMES

4.6.10 TERMS OF BUSINESS

4.6.11 CUSTOMER SERVICE

4.7 SUPPLY CHAIN ANALYSIS

4.7.1 OVERVIEW

4.7.2 LOGISTIC COST SCENARIO

4.7.3 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

5 REGULATORY FRAMEWORK

5.1 REGULATORY SCENARIO IN THE U.S

5.2 REGULATORY SCENARIO IN THE MEXICO

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 RISE IN DIFFERENT TYPES OF EFFECTIVE CAT LITTER PRODUCTS

6.1.2 GROWING PET OWNERSHIP IN BOTH THE U.S. AND MEXICO

6.1.3 URBANIZATION AND CHANGING LIFESTYLES HAVE LED TO A RISE IN DEMAND FOR CONVENIENT AND EASY-TO-USE CAT LITTER PRODUCTS

6.2 RESTRAINTS

6.2.1 HIGH COST OF PRODUCTS

6.2.2 ENVIRONMENTAL CONCERNS ASSOCIATED WITH THE DISPOSAL OF CAT LITTER

6.2.3 AVAILABILITY OF LOW-COST ALTERNATIVES, SUCH AS SAND AND SOIL

6.3 OPPORTUNITIES

6.3.1 RISING AWARENESS REGARDING THE HEALTH OF THE PET

6.3.2 DEVELOPMENT OF ECO-FRIENDLY AND BIODEGRADABLE CAT LITTER PRODUCTS

6.4 CHALLENGES

6.4.1 FLUCTUATIONS IN RAW MATERIAL PRICES CAN IMPACT THE COST OF MANUFACTURING CAT LITTER PRODUCTS.

6.4.2 THE REGULATORY ENVIRONMENT FOR PET PRODUCTS CAN CREATE CHALLENGES FOR MANUFACTURERS AND IMPORTERS

7 U.S. AND MEXICO CAT LITTER MARKET, BY PRODUCT TYPE

7.1 OVERVIEW

7.2 CLUMPING

7.3 NON-CLUMPING

7.4 CRYSTALS

7.5 DEODORANT LITTERS

7.6 CONVENTIONAL

7.7 OTHERS

8 U.S. AND MEXICO CAT LITTER MARKET, BY RAW MATERIAL

8.1 OVERVIEW

8.2 CLAY

8.3 PLANT FIBERS

8.3.1 PAPER/WOOD

8.3.2 CORN

8.3.3 WHEAT

8.3.4 PINE

8.3.5 WALNUT

8.3.6 OTHERS

8.4 SILICA

9 U.S. AND MEXICO CAT LITTER MARKET, BY TYPE

9.1 OVERVIEW

9.2 NON-SCENTED

9.3 SCENTED

10 U.S. AND MEXICO CAT LITTER MARKET, BY FORM

10.1 OVERVIEW

10.2 FINE LITTER

10.3 COARSE LITTER

11 U.S. AND MEXICO CAT LITTER MARKET, BY DISTRIBUTION CHANNEL

11.1 OVERVIEW

11.2 HYPERMARKETS/SUPERMARKETS

11.3 SPECIALIZED PET SHOPS

11.4 E-COMMERCE

11.5 OTHERS

12 U.S. AND MEXICO CAT LITTER MARKET, BY END USER

12.1 OVERVIEW

12.2 ADULT CATS

12.3 KITTENS

13 U.S. AND MEXICO CAT LITTER MARKET, COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: U.S. AND MEXICO

13.2 COMPANY SHARE ANALYSIS: U.S.

13.3 COMPANY SHARE ANALYSIS: MEXICO

14 COMPANY PROFILE

14.1 NESTLÉ PURINA PETCARE (SUBSIDIARY OF NESTLE)

14.1.1 COMPANY SNAPSHOT

14.1.2 SWOT ANALYSIS

14.1.3 PRODUCTION CAPACITY

14.1.4 PRODUCT PORTFOLIO

14.1.5 RECENT DEVELOPMENT

14.2 CHURCH & DWIGHT CO., INC.

14.2.1 COMPANY SNAPSHOT

14.2.2 REVENUE ANALYSIS

14.2.3 SWOT ANALYSIS

14.2.4 PRODUCTION CAPACITY

14.2.5 PRODUCT PORTFOLIO

14.2.6 RECENT DEVELOPMENT

14.3 THE CLOROX COMPANY

14.3.1 COMPANY SNAPSHOT

14.3.2 REVENUE ANALYSIS

14.3.3 SWOT ANALYSIS

14.3.4 PRODUCTION CAPACITY

14.3.5 PRODUCT PORTFOLIO

14.3.6 RECENT DEVELOPMENT

14.4 OIL-DRI CORPORATION OF AMERICA

14.4.1 COMPANY SNAPSHOT

14.4.2 REVENUE ANALYSIS

14.4.3 SWOT ANALYSIS

14.4.4 PRODUCTION CAPACITY

14.4.5 PRODUCT PORTFOLIO

14.4.6 RECENT DEVELOPMENT

14.5 MARS, INCORPORATED AND ITS AFFILIATES

14.5.1 COMPANY SNAPSHOT

14.5.2 SWOT ANALYSIS

14.5.3 PRODUCTION CAPACITY

14.5.4 PRODUCT PORTFOLIO

14.5.5 RECENT DEVELOPMENT

14.6 BENTAŞ

14.6.1 COMPANY SNAPSHOT

14.6.2 SWOT ANALYSIS

14.6.3 PRODUCTION CAPACITY

14.6.4 PRODUCT PORTFOLIO

14.6.5 RECENT DEVELOPMENT

14.7 DR. ELSEY'S.

14.7.1 COMPANY SNAPSHOT

14.7.2 SWOT ANALYSIS

14.7.3 PRODUCTION CAPACITY

14.7.4 PRODUCT PORTFOLIO

14.7.5 RECENT DEVELOPMENT

14.8 HEALTHY PET

14.8.1 COMPANY SNAPSHOT

14.8.2 SWOT ANALYSIS

14.8.3 PRODUCTION CAPACITY

14.8.4 PRODUCT PORTFOLIO

14.8.5 RECENT DEVELOPMENT

14.9 PESTELL PET PRODUCTS

14.9.1 COMPANY SNAPSHOT

14.9.2 SWOT ANALYSIS

14.9.3 PRODUCTION CAPACITY

14.9.4 PRODUCT PORTFOLIO

14.9.5 RECENT DEVELOPMENT

14.1 PETTEX LIMITED.

14.10.1 COMPANY SNAPSHOT

14.10.2 SWOT ANALYSIS

14.10.3 PRODUCTION CAPACITY

14.10.4 PRODUCT PORTFOLIO

14.10.5 RECENT DEVELOPMENT

14.11 SINCHEM SILICA GEL CO., LTD.

14.11.1 COMPANY SNAPSHOT

14.11.2 SWOT ANALYSIS

14.11.3 PRODUCTION CAPACITY

14.11.4 PRODUCT PORTFOLIO

14.11.5 RECENT DEVELOPMENTS

14.12 SWHEAT SCOOP

14.12.1 COMPANY SNAPSHOT

14.12.2 SWOT ANALYSIS

14.12.3 PRODUCTION CAPACITY

14.12.4 PRODUCT PORTFOLIO

14.12.5 RECENT DEVELOPMENT

14.13 WEIHAI PEARL SILICA GEL CO., LTD

14.13.1 COMPANY SNAPSHOT

14.13.2 SWOT ANALYSIS

14.13.3 PRODUCTION CAPACITY

14.13.4 PRODUCT PORTFOLIO

14.13.5 RECENT DEVELOPMENT

15 QUESTIONNAIRE

16 RELATED REPORTS

List of Table

TABLE 1 FOLLOWING IS THE LIST OF KEY BUYERS FOR THE U.S. AND MEXICO CAT LITTER MARKET:

TABLE 2 U.S. CAT LITTER MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 3 MEXICO CAT LITTER MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 4 U.S. CAT LITTER MARKET, BY RAW MATERIAL, 2021-2030 (USD MILLION)

TABLE 5 MEXICO CAT LITTER MARKET, BY RAW MATERIAL, 2021-2030 (USD MILLION)

TABLE 6 U.S. PLANT FIBERS IN CAT LITTER MARKET, BY RAW MATERIAL, 2021-2030 (USD MILLION)

TABLE 7 MEXICO PLANT FIBERS IN CAT LITTER MARKET, BY RAW MATERIAL, 2021-2030 (USD MILLION)

TABLE 8 U.S. CAT LITTER MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 9 MEXICO CAT LITTER MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 10 U.S. CAT LITTER MARKET, BY FORM, 2021-2030 (USD MILLION)

TABLE 11 MEXICO CAT LITTER MARKET, BY FORM, 2021-2030 (USD MILLION)

TABLE 12 U.S. CAT LITTER MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 13 MEXICO CAT LITTER MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 14 U.S. CAT LITTER MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 15 MEXICO CAT LITTER MARKET, BY END USER, 2021-2030 (USD MILLION)

List of Figure

FIGURE 1 U.S. AND MEXICO CAT LITTER MARKET: SEGMENTATION

FIGURE 2 U.S. AND MEXICO CAT LITTER MARKET: DATA TRIANGULATION

FIGURE 3 U.S. AND MEXICO CAT LITTER MARKET: DROC ANALYSIS

FIGURE 4 U.S. CAT LITTER MARKET: COUNTRY MARKET ANALYSIS

FIGURE 5 MEXICO CAT LITTER MARKET: COUNTRY MARKET ANALYSIS

FIGURE 6 U.S. AND MEXICO CAT LITTER MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 7 U.S. AND MEXICO CAT LITTER MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 8 U.S. AND MEXICO CAT LITTER MARKET: DBMR MARKET POSITION GRID

FIGURE 9 U.S. AND MEXICO CAT LITTER MARKET: MARKET END USER COVERAGE GRID

FIGURE 10 U.S. CAT LITTER MARKET: VENDOR SHARE ANALYSIS

FIGURE 11 U.S. AND MEXICO CAT LITTER MARKET: SEGMENTATION

FIGURE 12 RISE IN DIFFERENT TYPE OF EFFECTIVE CAT LITTER PRODUCTS IS EXPECTED TO DRIVE THE U.S. CAT LITTER MARKET IN THE FORECAST PERIOD

FIGURE 13 INCREASING DEMAND FOR CAT LITTER PRODUCTS IS EXPECTED TO DRIVE THE MEXICO CAT LITTER MARKET IN THE FORECAST PERIOD

FIGURE 14 THE PRODUCT TYPE SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE U.S. CAT LITTER MARKET IN 2023 & 2030

FIGURE 15 THE PRODUCT TYPE SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE MEXICO CAT LITTER MARKET IN 2023 & 2030

FIGURE 16 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE U.S. AND MEXICO CAT LITTER MARKET

FIGURE 17 U.S. CAT LITTER MARKET, BY PRODUCT TYPE, 2022

FIGURE 18 MEXICO CAT LITTER MARKET, BY PRODUCT TYPE, 2022

FIGURE 19 U.S. CAT LITTER MARKET, BY PRODUCT TYPE, 2023-2030 (USD MILLION)

FIGURE 20 MEXICO CAT LITTER MARKET, BY PRODUCT TYPE, 2023-2030 (USD MILLION)

FIGURE 21 U.S. CAT LITTER MARKET, BY PRODUCT TYPE, CAGR (2023-2030)

FIGURE 22 MEXICO CAT LITTER MARKET, BY PRODUCT TYPE, CAGR (2023-2030)

FIGURE 23 U.S. CAT LITTER MARKET, BY PRODUCT TYPE, LIFELINE CURVE

FIGURE 24 MEXICO CAT LITTER MARKET, BY PRODUCT TYPE, LIFELINE CURVE

FIGURE 25 U.S. CAT LITTER MARKET, BY RAW MATERIAL, 2022

FIGURE 26 MEXICO CAT LITTER MARKET, BY RAW MATERIAL, 2022

FIGURE 27 U.S. CAT LITTER MARKET, BY RAW MATERIAL, 2023-2030 (USD MILLION)

FIGURE 28 MEXICO CAT LITTER MARKET, BY RAW MATERIAL, 2023-2030 (USD MILLION)

FIGURE 29 U.S. CAT LITTER MARKET, BY RAW MATERIAL, CAGR (2023-2030)

FIGURE 30 MEXICO CAT LITTER MARKET, BY RAW MATERIAL, CAGR (2023-2030)

FIGURE 31 U.S. CAT LITTER MARKET, BY RAW MATERIAL, LIFELINE CURVE

FIGURE 32 MEXICO CAT LITTER MARKET, BY RAW MATERIAL, LIFELINE CURVE

FIGURE 33 U.S. CAT LITTER MARKET, BY TYPE, 2022

FIGURE 34 MEXICO CAT LITTER MARKET, BY TYPE, 2022

FIGURE 35 U.S. CAT LITTER MARKET, BY TYPE, 2023-2030 (USD MILLION)

FIGURE 36 MEXICO CAT LITTER MARKET, BY TYPE, 2023-2030 (USD MILLION)

FIGURE 37 U.S. CAT LITTER MARKET, BY TYPE, CAGR (2023-2030)

FIGURE 38 MEXICO CAT LITTER MARKET, BY TYPE, CAGR (2023-2030)

FIGURE 39 U.S. CAT LITTER MARKET, BY TYPE, LIFELINE CURVE

FIGURE 40 MEXICO CAT LITTER MARKET, BY TYPE, LIFELINE CURVE

FIGURE 41 U.S. CAT LITTER MARKET, BY FORM, 2022

FIGURE 42 MEXICO CAT LITTER MARKET, BY FORM, 2022

FIGURE 43 U.S. CAT LITTER MARKET BY FORM, 2023-2030 (USD MILLION)

FIGURE 44 MEXICO CAT LITTER MARKET BY FORM, 2023-2030 (USD MILLION)

FIGURE 45 U.S. CAT LITTER MARKET, BY FORM, CAGR (2023-2030)

FIGURE 46 MEXICO CAT LITTER MARKET, BY FORM, CAGR (2023-2030)

FIGURE 47 U.S. CAT LITTER MARKET, BY FORM, LIFELINE CURVE

FIGURE 48 MEXICO CAT LITTER MARKET, BY FORM, LIFELINE CURVE

FIGURE 49 U.S. CAT LITTER MARKET, BY DISTRIBUTION CHANNEL, 2022

FIGURE 50 MEXICO CAT LITTER MARKET, BY DISTRIBUTION CHANNEL, 2022

FIGURE 51 U.S. CAT LITTER MARKET, BY DISTRIBUTION CHANNEL, 2023-2030 (USD MILLION)

FIGURE 52 MEXICO CAT LITTER MARKET, BY DISTRIBUTION CHANNEL, 2023-2030 (USD MILLION)

FIGURE 53 U.S. CAT LITTER MARKET, BY DISTRIBUTION CHANNEL, CAGR (2023-2030)

FIGURE 54 MEXICO CAT LITTER MARKET, BY DISTRIBUTION CHANNEL, CAGR (2023-2030)

FIGURE 55 U.S. CAT LITTER MARKET, BY DISTRIBUTION CHANNEL, LIFELINE CURVE

FIGURE 56 MEXICO CAT LITTER MARKET, BY DISTRIBUTION CHANNEL, LIFELINE CURVE

FIGURE 57 U.S. CAT LITTER MARKET, BY END USER, 2022

FIGURE 58 MEXICO CAT LITTER MARKET, BY END USER, 2022

FIGURE 59 U.S. CAT LITTER MARKET, BY END USER, 2023-2030 (USD MILLION)

FIGURE 60 MEXICO CAT LITTER MARKET, BY END USER, 2023-2030 (USD MILLION)

FIGURE 61 U.S. CAT LITTER MARKET, BY END USER, CAGR (2023-2030)

FIGURE 62 MEXICO CAT LITTER MARKET, BY END USER, CAGR (2023-2030)

FIGURE 63 U.S. CAT LITTER MARKET, BY END USER, LIFELINE CURVE

FIGURE 64 MEXICO CAT LITTER MARKET, BY END USER, LIFELINE CURVE

FIGURE 65 U.S. AND MEXICO CAT LITTER MARKET: COMPANY SHARE 2022 (%)

FIGURE 66 U.S. CAT LITTER MARKET: COMPANY SHARE 2022 (%)

FIGURE 67 MEXICO CAT LITTER MARKET: COMPANY SHARE 2022 (%)

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.