Thailand Business Process Outsourcing (BPO) Market Analysis and Insights

Market players are expanding their service offerings in order to acquire a competitive advantage. The global market is rising steadily as a result of the expanding industrial sector, infrastructure development, and technical improvements in developing countries. The adoption of IoT, and AI technologies is considerably driving the global market. Increased government backing and investment in rebuilding the old power transmission and distribution system is one element driving the market's rapid rise.

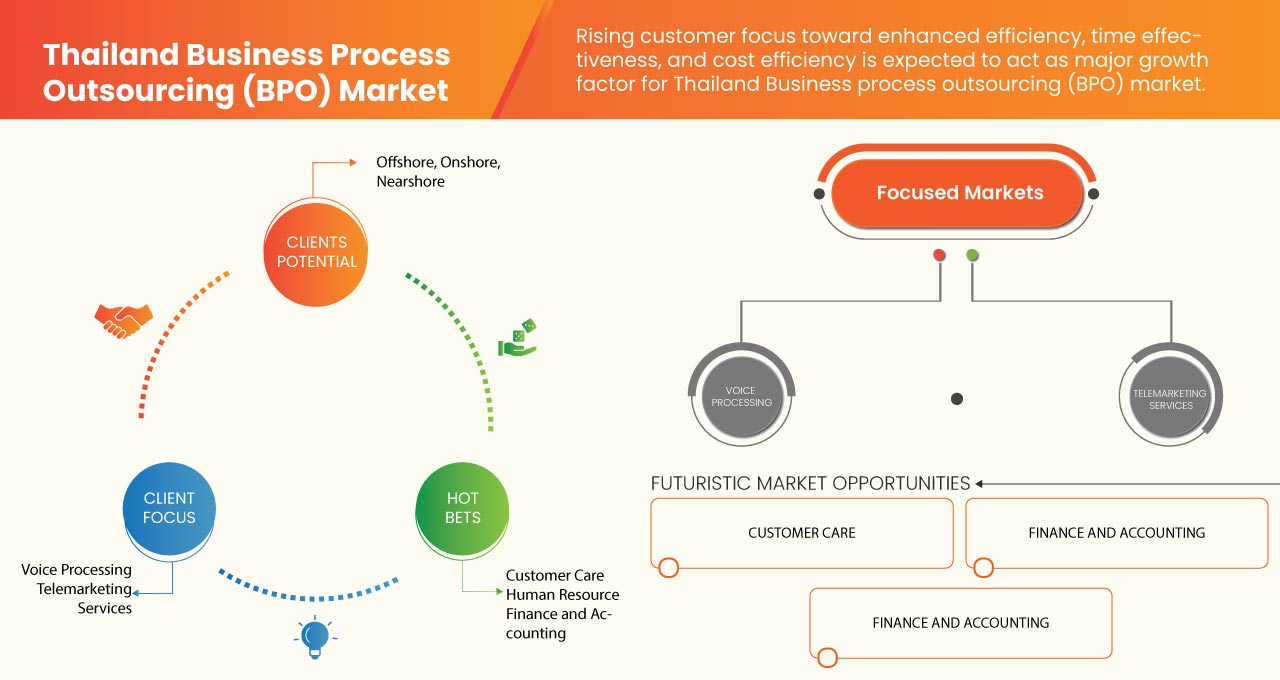

During the forecast period, manufacturers involved in the business process outsourcing (BPO) market likely benefit significantly from increased awareness of the advantages of business process outsourcing and investments in various organizations. Data Bridge Market Research analyses that the Thailand business process outsourcing market will grow at a CAGR of 7.1% during the forecast period of 2023 to 2030.

|

Report Metric |

Details |

|

Forecast Period |

2023 to 2030 |

|

Base Year |

2022 |

|

Historic Years |

2021 (Customizable to 2015-2020) |

|

Quantitative Units |

Revenue in Million, Volumes in Units, Pricing in USD |

|

Segments Covered |

Location (Offshore, Nearshore, and Onshore), Services (Voice Processing, Telemarketing Services, 3D Visualization Services, Image Editing Services, Virtual Staffing Services, and Others) Application (Customer Care, Finance and Accounting, Talent and HR Services, Sales and Marketing, Sourcing, Procurement and Supply Chain, Facilities and Administration, Product Engineering, Training, and Others), Deployment Mode (On Premise, and Cloud), Organization Size (Large Enterprises, Small & Medium Enterprises), Ownership (Captive, and Third Party), Outsourcing Approach (Best-Shore, Bundled Services, Contract Based, and Fee For Service), End-User (BFSI, IT and Telecommunication, Healthcare, Manufacturing, Retail & E-commerce, Government & Defense, Transportation and Logistics, Travel & Hospitality, Education, Energy and Utilities, and Others) |

|

Country Covered |

Thailand |

|

Market Players Covered |

Accenture, Infosys Limited, Capgemini, IBM Corporation, Cognizant , Wipro Limited, Genpact, HCL Technologies Limited, NCR Corporation, Amdocs, ExlService Holdings, Inc., CBRE, Tech Mahindra Limited, TTEC, Unity Communications, Octopus Tech, Concentrix Corporation, CGI Inc. among others |

Market Definition

Business process outsourcing (BPO) is the practice of contracting or outsourcing a specific work process or process to an external service provider for the required function. The services can include payroll, accounting, telemarketing, data recording, social media marketing, customer support, and more. BPO can be done for non-core business activities such as recruiting, managing finance and payroll, supervising procurement, and providing training among others. Business process outsourcing can be provided in various domains, including human resources, sales & marketing, supply chain, finance & accounting, education & training, and payment among others. Outsourcing necessary processes such as recruiting, accounts payable, managing procurement, or various utility bill processing help take care of important yet repetitive tasks that need to perform very frequently or on a daily basis and need to free your internal resources to focus on your core competency. As organizations streamline and improve their services or products, they can gain business and scale up their operations, which then helps them to increase their revenue.

Global Business Process Outsourcing (BPO) Market Dynamics

This section deals with understanding the market drivers, advantages, opportunities, restraints and challenges. All of this is discussed in detail as below:

Drivers

- Rising customer focus toward enhanced efficiency, time effectiveness, and cost efficiency

Business process outsourcing has become an easy and cost-effective practice used widely in today's digitization world. It further enables business owners to reduce the burden of work and concentrate on other core aspects of their operation. Developed countries such as Japan, U.K., U.S. among others, always prefer outsourcing for their business processes. The ongoing digital revolution has made companies switch from traditional Business Process Services (BPS) towards technological aspects such as Business Process as a Service (BPaaS) to succeed. There is a huge difference in the wage/pay patterns of the western developed and developing countries. The kind of work is done in the west for a very high price to obtain a considerably cheaper rate in developing countries such as the Philippines, India, and Japan, with a difference of up to 60%. BPO allows gain flexibility in the workforce and avoids the need to hire. In addition to the legal obligations relating to the employment contract, the company does not have to bear any expenses related to the recruitment of an employee.

- Growing preference for cloud technology and its significance on process automation

Digital technologies have created new opportunities for business leaders. Traditional operations and business process outsourcing models are reinventing into more intelligent workflows using automation, Artificial Intelligence (AI), the Internet of Things (IoT), cloud, and other new technologies. Businesses must constantly evolve to more intelligent, fully orchestrated processes that consider clients, employees, suppliers, and business partners to remain relevant and continue their growth.

- Increasing dependence on sales and marketing for customer service enhancement

Sales and marketing are one of the most crucial functions of any business. Every company needs to promote and sell its products to its customers or clients to generate revenue. Companies need to sell their products and services to remain in business, but before that, they company must also need to create awareness of their respective services to their customers on continuous terms. And for this, the companies utilize various techniques such as online marketing, telemarketing, assisting customers, and approaching prospects. Many small companies do not have enough resources, so they outsource marketing or telemarketing/telesales.

Opportunities

- Focus on multi-workflow scheduling of business

Earlier, automated workflows were reserved only for wealthy organizations willing to invest heavily in complex CRM and ERP systems. But, the advent of cloud technology has turned this concept on its head. As the technology transformed, people started leveraging its power to automate their complex workflow processes to achieve process integration. BPO has dramatically expanded in recent years as companies see the benefit in reducing costs, improving efficiency and customer service, and enabling high growth while working with limited resources.

- Emergence of digital technologies, namely AI, IoT, and cloud computing

Cloud computing has turned out to be a major driving force for digital transformation across industries. It provides unparalleled agility and reduces operational and management overheads. Several governments and businesses are starting to leverage this technology and are slowly gaining popularity across several verticals. The potential has become so open that the notion of the cloud is limited to only IT functions has completely changed. This is further integrated with other technologies such as Artificial Intelligence (AI), the Internet of Things (IoT), and edge computing, among others.

Restraints

- Growing concerns regarding data security and privacy concern

Nowadays, data security has become more important than ever, leaving many people curious about how BPO companies handle data security. While business process outsourcing is increasing in popularity, many organizations fear working with a third-party BPO company could put their data at risk.

- Stringent government regulations

If market forces drive outsourcing, businesses that outsource in the Thailand economy can increase productivity and wages, not by the need to execute costly laws and lawsuits. However, legal and regulatory considerations sometimes affect companies' sourcing patterns, including their contracts with offshore suppliers, not just a mission for cheap labor. Organizations resort to external contracting or outsourcing to cut labor costs. Outsourcing abroad or offshoring, however, is relatively complex, with major political overtones linked to the transfer of jobs. The interaction of diverse national business environments in such transnational relationships is a multi-layered process in which diverging legal, economic, and social concerns arise. Offshore outsourcing type now a popular corporate strategy that is used to a large extent by organizations in developed countries to upsurge profitability by investing overseas in relatively 'low-wage' developing countries such as India, Japan, Philippines, China, and Brazil.

Challenges

- Lack of skilled workforce and high attrition rate

Attrition and lack of skilled professionals are perhaps one of the biggest challenges faced by most business process outsourcing (BPO) companies. Attrition in the business process outsourcing (BPO) sector has terrible effects on the organization. The high attrition costs increase the costs to the organization considerably. The more people leave an organization or company, the more it drains on the company's resources, such as recruitment expenses, training, orientation expenses, and time. The high attrition rate adversely affects the productivity of the organization.

COVID-19 Impact on Thailand Business Process Outsourcing Market

COVID-19 has had a negative impact on practically every business and industry. The commercial circumstances that COVID-19 has created are unprecedented, and various organizations are scrambling to react.

Covid-19's influence on the BPO business is broad and multifaceted, and many BPO firms are still undertaking changes to suit its consequences. The BPO sector is extremely fortunate to be able to operate digitally, allowing BPO firms to continue to operate with minimal health and safety risks for employees.

However, this does not imply that the BPO industry adjustments have been simple to implement. Not every BPO organization was built to allow team members to work remotely. In truth, the majority of BPO firms operate from an office with dedicated equipment, software, and hardware.

BPO firms have implemented a number of technological and digital innovations in order to maintain excellent virtual performance. The influence of COVID-19 on the BPO business is far-reaching and important, and we'll go through some of the most significant changes in more detail below.

Recent Development

- In January 2021, Genpact announced the acquisition of data engineering and analytics firm Enquero. This helps the company provide services such as harnessing data, cloud technologies, and analytics to drive growth and be more resilient, agile, and connected. This increases its service portfolio.

Thailand Business Process Outsourcing (BPO) Market Scope

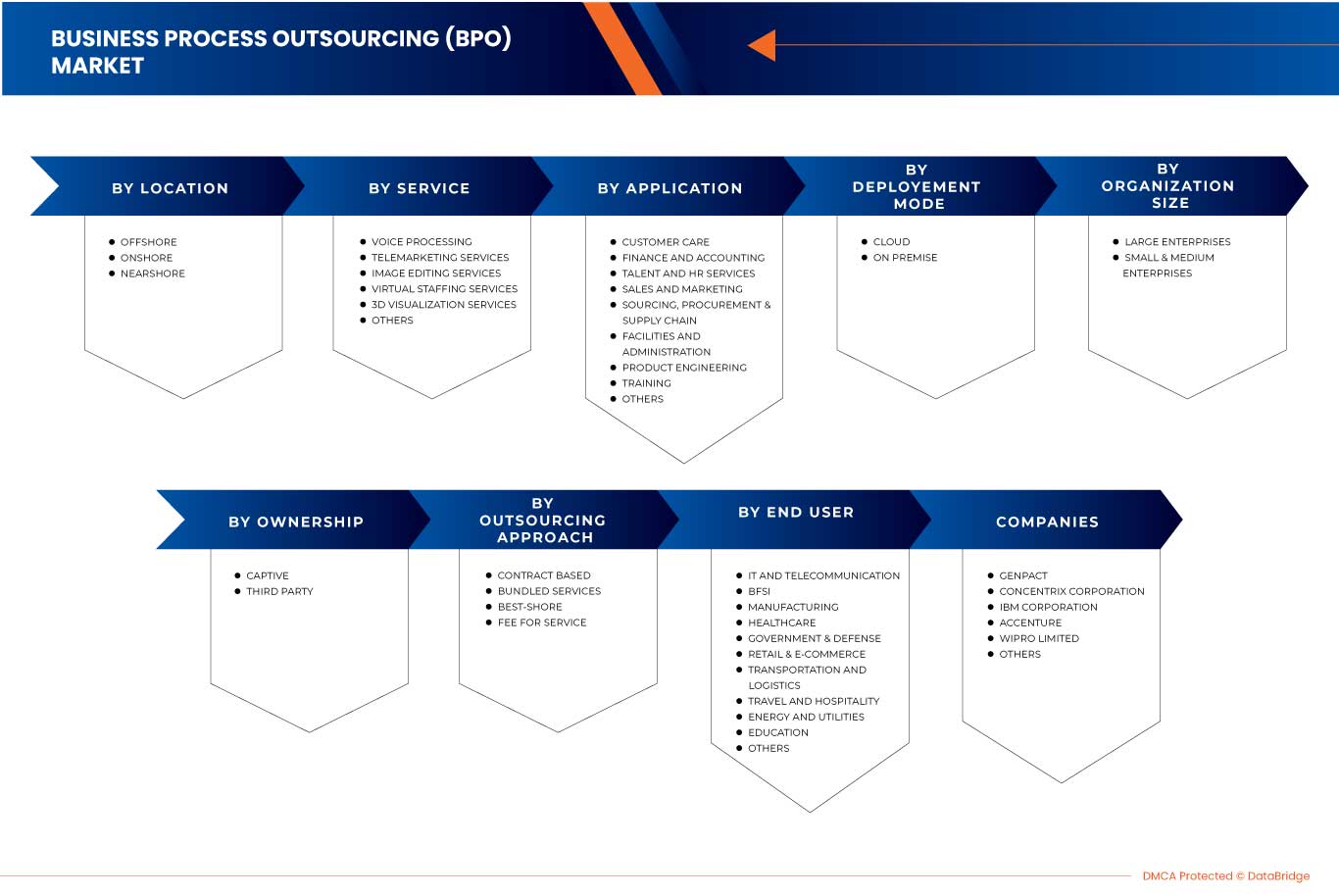

Thailand business process outsourcing (BPO) market is segmented on the basis of location, service, application, deployment mode, organization size, ownership, outsourcing approach, and end user. The growth amongst these segments will help you analyze meager growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Location

- Offshore

- Onshore

- Nearshore

On the basis of location, the market is segmented into offshore, onshore, and nearshore.

Service

- Voice processing

- Telemarketing services

- Image editing services

- Virtual staffing services

- 3d visualization services

- Others

On the basis of service, the market is segmented into voice processing, telemarketing services, image editing services, virtual staffing services, and 3D visualization services, and others.

Application

- Customer care

- Finance and accounting

- Talent and HR Services

- Sales and marketing

- Sourcing, Procurement & Supply Chain

- Facilities and administration

- Product engineering

- Training

- Others

On the basis of application, the market is segmented into customer care, finance and accounting, talent and HR services, sales and marketing, sourcing, procurement & supply chain, facilities and administration, product engineering, training, and others.

Deployment Mode

- Cloud

- On Premise

On the basis of deployment mode, the market is segmented into cloud and on premise.

Organization Size

- Large Enterprises

- Small & Medium Enterprises

On the basis of organization size, the market is segmented into large enterprises, and small & medium enterprises.

Ownership

- Captive

- Third Party

On the basis of ownership, the market is segmented into captive and third party.

Outsourcing Approach

- Contract based

- Bundled services

- Best-shore

- Fee for service

On the basis of outsourcing approach, the market is segmented into contract based, bundled services, best-shore, and fee for service.

End User

- IT and telecommunication

- BFSI

- Manufacturing

- Healthcare

- Government & Defense

- Retail & E-Commerce

- Transportation and logistics

- Travel and hospitality

- Energy and utilities

- Education

- Others

On the basis of end user, the market is segmented into IT and telecommunication, BFSI, manufacturing, healthcare, government & defense, retail & e-commerce, transportation and logistics, travel and hospitality, energy and utilities, education, and others.

Competitive Landscape and Thailand Business Process Outsourcing (BPO) Market Share Analysis

Thailand business process outsourcing (BPO) market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, solution launch, product width and breadth, and application dominance. The above data points provided are only related to the companies' focus related to the Thailand business process outsourcing (BPO) market.

Some of the major players operating in the Thailand business process outsourcing (BPO) market are Accenture, Infosys Limited, Capgemini, IBM Corporation, Cognizant, Wipro Limited, Genpact, HCL Technologies Limited, NCR Corporation, Amdocs, ExlService Holdings, Inc., CBRE, Tech Mahindra Limited, TTEC, Unity Communications, Octopus Tech, Concentrix Corporation, CGI Inc. among others.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE THAILAND BUSINESS PROCESS OUTSOURCING (BPO) MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 LOCATION LIFELINE CURVE

2.8 MARKET CHALLENGE MATRIX

2.9 MARKET END-USER COVERAGE GRID

2.1 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.11 DBMR MARKET POSITION GRID

2.12 VENDOR SHARE ANALYSIS

2.13 SECONDARY SOURCES

2.14 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTER’S FIVE FORCES

4.2 PATENT ANALYSIS

4.3 TECHNOLOGICAL MAP

4.4 BUSINESS MODEL AND PRICING ASSESSMENT OF KEY PLAYERS

4.4.1 GENPACT

4.4.2 CONCENTRIX CORPORATION

4.4.3 IBM

4.5 INSIGHT FOR IPO LISTING FOR KEY PLAYERS, IPO PRICING, KEY CONSIDERATION, AND CHALLENGES

4.5.1 GENPACT

4.5.2 CONCENTRIX CORPORATION

4.5.3 IBM

4.5.4 ACCENTURE

4.5.5 WIPRO LIMITED

4.6 VALUE CHAIN ANALYSIS

4.7 COMPANY COMPARATIVE ANALYSIS

4.7.1 WIPRO LIMITED

4.7.2 INFOSYS LIMITED

4.7.3 COGNIZANT

4.8 CASE STUDIES

4.9 REGULATORY SYTANDARDS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 INCREASING NEED FOR BUSINESS AGILITY

5.1.2 RISING CUSTOMER FOCUS TOWARD ENHANCED EFFICIENCY, TIME EFFECTIVENESS, AND COST EFFICIENCY

5.1.3 GROWING PREFERENCE FOR CLOUD TECHNOLOGY AND ITS SIGNIFICANCE ON PROCESS AUTOMATION

5.1.4 INCREASING DEPENDENCE ON SALES AND MARKETING FOR CUSTOMER SERVICE ENHANCEMENT

5.1.5 UPSURGE IN THE CAPACITY OF QUALITY ENTERPRISE DATA

5.2 RESTRAINTS

5.2.1 GROWING CONCERNS REGARDING DATA SECURITY AND PRIVACY CONCERN

5.2.2 STRINGENT GOVERNMENT REGULATIONS

5.3 OPPORTUNITIES

5.3.1 FOCUS ON MULTI-WORKFLOW SCHEDULING OF BUSINESS

5.3.2 EMERGENCE OF DIGITAL TECHNOLOGIES, NAMELY AI, IOT, AND CLOUD COMPUTING

5.3.3 INCREASE IN THE ESTABLISHMENT OF SERVICE CENTERS AND IT SECTOR SPENDING

5.3.4 GROWING NUMBER OF START-UPS PARTNERING WITH BUSINESS PROCESS OUTSOURCING (BPO)

5.4 CHALLENGES

5.4.1 LACK OF SKILLED WORKFORCE AND HIGH ATTRITION RATE

5.4.2 FREQUENT DISRUPTION AFFECTS THE OPERATIONAL EFFICIENCY OF BUSINESS PROCESS OUTSOURCING (BPO)

5.4.3 INCREASE IN THE PRESENCE OF NEW ENTRANTS

6 THAILAND BUSINESS PROCESS OUTSOURCING (BPO) MARKET, BY LOCATION

6.1 OVERVIEW

6.2 OFFSHORE

6.3 ONSHORE

6.4 NEARSHORE

7 THAILAND BUSINESS PROCESS OUTSOURCING (BPO) MARKET, BY SERVICE

7.1 OVERVIEW

7.2 VOICE PROCESSING

7.2.1 INBOUND

7.2.2 OUTBOUND

7.2.3 SURVEY AND MARKET RESEARCH

7.3 TELEMARKETING SERVICES

7.4 IMAGE EDITING SERVICES

7.5 VIRTUAL STAFFING SERVICES

7.6 3D VISUALIZATION SERVICES

7.6.1 3D ANIMATION

7.6.2 CAD MODELING

7.6.3 3D ILLUSTRATION

7.6.4 3D DEVELOPMENT

7.6.5 OTHERS

7.7 OTHERS

8 THAILAND BUSINESS PROCESS OUTSOURCING (BPO) MARKET, BY APPLICATION

8.1 OVERVIEW

8.2 CUSTOMER CARE

8.3 FINANCE AND ACCOUNTING

8.4 TALENT AND HR SERVICES

8.5 SALES AND MARKETING

8.6 SOURCING, PROCUREMENT AND SUPPLY CHAIN

8.7 FACILITIES AND ADMINISTRATION

8.8 PRODUCT ENGINEERING

8.9 TRAINING

8.1 OTHERS

9 THAILAND BUSINESS PROCESS OUTSOURCING (BPO) MARKET, BY DEPLOYMENT MODE

9.1 OVERVIEW

9.2 CLOUD

9.3 ON PREMISE

10 THAILAND BUSINESS PROCESS OUTSOURCING (BPO) MARKET, BY ORGANIZATION SIZE

10.1 OVERVIEW

10.2 LARGE ENTERPRISES

10.2.1 CLOUD

10.2.2 ON PREMISE

10.3 SMALL & MEDIUM ENTERPRISES

10.3.1 CLOUD

10.3.2 ON PREMISE

11 THAILAND BUSINESS PROCESS OUTSOURCING (BPO) MARKET, BY OWNERSHIP

11.1 OVERVIEW

11.2 CAPTIVE

11.3 THIRD PARTY

12 THAILAND BUSINESS PROCESS OUTSOURCING (BPO) MARKET, BY OUTSOURCING APPROACH

12.1 OVERVIEW

12.2 CONTRACT BASED

12.3 BUNDLED SERVICES

12.4 BEST-SHORE

12.5 FEE FOR SERVICE

13 THAILAND BUSINESS PROCESS OUTSOURCING (BPO) MARKET, BY END USER

13.1 OVERVIEW

13.2 IT AND TELECOMMUNICATION

13.2.1 CUSTOMER CARE

13.2.2 FINANCE AND ACCOUNTING

13.2.3 TALENT AND HR SERVICES

13.2.4 SALES AND MARKETING

13.2.5 SOURCING, PROCUREMENT & SUPPLY CHAIN

13.2.6 FACILITIES AND ADMINISTRATION

13.2.7 PRODUCT ENGINEERING

13.2.8 TRAINING

13.2.9 OTHERS

13.3 MANUFACTURING

13.3.1 CUSTOMER CARE

13.3.2 FINANCE AND ACCOUNTING

13.3.3 TALENT AND HR SERVICES

13.3.4 SALES AND MARKETING

13.3.5 SOURCING, PROCUREMENT & SUPPLY CHAIN

13.3.6 FACILITIES AND ADMINISTRATION

13.3.7 PRODUCT ENGINEERING

13.3.8 TRAINING

13.3.9 OTHERS

13.4 BFSI

13.4.1 CUSTOMER CARE

13.4.2 FINANCE AND ACCOUNTING

13.4.3 TALENT AND HR SERVICES

13.4.4 SALES AND MARKETING

13.4.5 SOURCING, PROCUREMENT & SUPPLY CHAIN

13.4.6 FACILITIES AND ADMINISTRATION

13.4.7 PRODUCT ENGINEERING

13.4.8 TRAINING

13.4.9 OTHERS

13.5 GOVERNMENT & DEFENSE

13.5.1 CUSTOMER CARE

13.5.2 FINANCE AND ACCOUNTING

13.5.3 TALENT AND HR SERVICES

13.5.4 SALES AND MARKETING

13.5.5 SOURCING, PROCUREMENT & SUPPLY CHAIN

13.5.6 FACILITIES AND ADMINISTRATION

13.5.7 PRODUCT ENGINEERING

13.5.8 TRAINING

13.5.9 OTHERS

13.6 TRANSPORTATION AND LOGISTICS

13.6.1 CUSTOMER CARE

13.6.2 FINANCE AND ACCOUNTING

13.6.3 TALENT AND HR SERVICES

13.6.4 SALES AND MARKETING

13.6.5 SOURCING, PROCUREMENT & SUPPLY CHAIN

13.6.6 FACILITIES AND ADMINISTRATION

13.6.7 PRODUCT ENGINEERING

13.6.8 TRAINING

13.6.9 OTHERS

13.7 RETAIL AND E-COMMERCE

13.7.1 CUSTOMER CARE

13.7.2 FINANCE AND ACCOUNTING

13.7.3 TALENT AND HR SERVICES

13.7.4 SALES AND MARKETING

13.7.5 SOURCING, PROCUREMENT & SUPPLY CHAIN

13.7.6 FACILITIES AND ADMINISTRATION

13.7.7 PRODUCT ENGINEERING

13.7.8 TRAINING

13.7.9 OTHERS

13.8 TRAVEL AND HOSPITALITY

13.8.1 CUSTOMER CARE

13.8.2 FINANCE AND ACCOUNTING

13.8.3 TALENT AND HR SERVICES

13.8.4 SALES AND MARKETING

13.8.5 SOURCING, PROCUREMENT & SUPPLY CHAIN

13.8.6 FACILITIES AND ADMINISTRATION

13.8.7 PRODUCT ENGINEERING

13.8.8 TRAINING

13.8.9 OTHERS

13.9 HEALTHCARE

13.9.1 CUSTOMER CARE

13.9.2 FINANCE AND ACCOUNTING

13.9.3 TALENT AND HR SERVICES

13.9.4 SALES AND MARKETING

13.9.5 SOURCING, PROCUREMENT & SUPPLY CHAIN

13.9.6 FACILITIES AND ADMINISTRATION

13.9.7 PRODUCT ENGINEERING

13.9.8 TRAINING

13.9.9 OTHERS

13.1 ENERGY AND UTILITIES

13.10.1 CUSTOMER CARE

13.10.2 FINANCE AND ACCOUNTING

13.10.3 TALENT AND HR SERVICES

13.10.4 SALES AND MARKETING

13.10.5 SOURCING, PROCUREMENT & SUPPLY CHAIN

13.10.6 FACILITIES AND ADMINISTRATION

13.10.7 PRODUCT ENGINEERING

13.10.8 TRAINING

13.10.9 OTHERS

13.11 EDUCATION

13.11.1 CUSTOMER CARE

13.11.2 FINANCE AND ACCOUNTING

13.11.3 TALENT AND HR SERVICES

13.11.4 SALES AND MARKETING

13.11.5 SOURCING, PROCUREMENT & SUPPLY CHAIN

13.11.6 FACILITIES AND ADMINISTRATION

13.11.7 PRODUCT ENGINEERING

13.11.8 TRAINING

13.11.9 OTHERS

13.12 OTHERS

14 THAILAND BUSINESS PROCESS OUTSOURCING (BPO) MARKET: COMPANY LANDSCAPE

14.1 COMPANY SHARE ANALYSIS: THAILAND

15 SWOT ANALYSIS

16 COMPANY PROFILE

16.1 GENPACT

16.1.1 COMPANY SNAPSHOT

16.1.2 REVENUE ANALYSIS

16.1.3 SOLUTION PORTFOLIO

16.1.4 RECENT DEVELOPMENTS

16.2 CONCENTRIX CORPORATION

16.2.1 COMPANY SNAPSHOT

16.2.2 REVENUE ANALYSIS

16.2.3 SERVICE PORTFOLIO

16.2.4 RECENT DEVELOPMENTS

16.3 IBM CORPORATION

16.3.1 COMPANY SNAPSHOT

16.3.2 REVENUE ANALYSIS

16.3.3 SERVICE PORTFOLIO

16.3.4 RECENT DEVELOPMENTS

16.4 ACCENTURE

16.4.1 COMPANY SNAPSHOT

16.4.2 REVENUE ANALYSIS

16.4.3 SERVICE PORTFOLIO

16.4.4 RECENT DEVELOPMENTS

16.5 WIPRO LIMITED

16.5.1 COMPANY SNAPSHOT

16.5.2 REVENUE ANALYSIS

16.5.3 SERVICE PORTFOLIO

16.5.4 RECENT DEVELOPMENTS

16.6 INFOSYS LIMITED

16.6.1 COMPANY SNAPSHOT

16.6.2 REVENUE ANALYSIS

16.6.3 SERVICE PORTFOLIO

16.6.4 RECENT DEVELOPMENTS

16.7 AMDOCS

16.7.1 COMPANY SNAPSHOT

16.7.2 REVENUE ANALYSIS

16.7.3 SERVICE PORTFOLIO

16.7.4 RECENT DEVELOPMENTS

16.8 CAPGEMINI

16.8.1 COMPANY SNAPSHOT

16.8.2 REVENUE ANALYSIS

16.8.3 SERVICE PORTFOLIO

16.8.4 RECENT DEVELOPMENTS

16.9 CBRE

16.9.1 COMPANY SNAPSHOT

16.9.2 REVENUE ANALYSIS

16.9.3 SERVICES PORTFOLIO

16.9.4 RECENT DEVELOPMENTS

16.1 CGI INC.

16.10.1 COMPANY SNAPSHOT

16.10.2 REVENUE ANALYSIS

16.10.3 SERVICE PORTFOLIO

16.10.4 RECENT DEVELOPMENTS

16.11 COGNIZANT

16.11.1 COMPANY SNAPSHOT

16.11.2 REVENUE ANALYSIS

16.11.3 SERVICE PORTFOLIO

16.11.4 RECENT DEVELOPMENTS

16.12 EXLSERVICE HOLDINGS, INC.

16.12.1 COMPANY SNAPSHOT

16.12.2 REVENUE ANALYSIS

16.12.3 SERVICE PORTFOLIO

16.12.4 RECENT DEVELOPMENTS

16.13 HCL TECHNOLOGIES LIMITED

16.13.1 COMPANY SNAPSHOT

16.13.2 REVENUE ANALYSIS

16.13.3 SERVICE PORTFOLIO

16.13.4 RECENT DEVELOPMENTS

16.14 NCR CORPORATION

16.14.1 COMPANY SNAPSHOT

16.14.2 REVENUE ANALYSIS

16.14.3 SERVICE PORTFOLIO

16.14.4 RECENT DEVELOPMENTS

16.15 OCTOPUS TECH

16.15.1 COMPANY SNAPSHOT

16.15.2 SERVICES PORTFOLIO

16.15.3 RECENT DEVELOPMENTS

16.16 TECH MAHINDRA LIMITED.

16.16.1 COMPANY SNAPSHOT

16.16.2 REVENUE ANALYSIS

16.16.3 SERVICE PORTFOLIO

16.16.4 RECENT DEVELOPMENTS

16.17 TTEC

16.17.1 COMPANY SNAPSHOT

16.17.2 REVENUE ANALYSIS

16.17.3 SERVICE PORTFOLIO

16.17.4 RECENT DEVELOPMENTS

16.18 UNITY COMMUNICATIONS

16.18.1 COMPANY SNAPSHOT

16.18.2 SERVICE PORTFOLIO

16.18.3 RECENT DEVELOPMENTS

17 QUESTIONNAIRE

18 RELATED REPORTS

List of Table

TABLE 1 REVENUE EARNED FROM TOP CLIENTS

TABLE 2 THAILAND BUSINESS PROCESS OUTSOURCING (BPO) MARKET, BY LOCATION, 2021-2030 (USD MILLION)

TABLE 3 THAILAND BUSINESS PROCESS OUTSOURCING (BPO) MARKET, BY SERVICE, 2021-2030 (USD MILLION)

TABLE 4 THAILAND VOICE PROCESSING IN BUSINESS PROCESS OUTSOURCING (BPO) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 5 THAILAND 3D VISUALIZATION SERVICES IN BUSINESS PROCESS OUTSOURCING (BPO) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 6 THAILAND BUSINESS PROCESS OUTSOURCING (BPO) MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 7 THAILAND BUSINESS PROCESS OUTSOURCING (BPO) MARKET, BY DEPLOYMENT MODE, 2021-2030 (USD MILLION)

TABLE 8 THAILAND BUSINESS PROCESS OUTSOURCING (BPO) MARKET, BY ORGANIZATION SIZE, 2021-2030 (USD MILLION)

TABLE 9 THAILAND LARGE ENTERPRISES IN BUSINESS PROCESS OUTSOURCING (BPO) MARKET, BY DEPLOYMENT MODE, 2021-2030 (USD MILLION)

TABLE 10 THAILAND SMALL & MEDIUM ENTERPRISES IN BUSINESS PROCESS OUTSOURCING (BPO) MARKET, BY DEPLOYMENT MODE, 2021-2030 (USD MILLION)

TABLE 11 THAILAND BUSINESS PROCESS OUTSOURCING (BPO) MARKET, BY OWNERSHIP, 2021-2030 (USD MILLION)

TABLE 12 THAILAND BUSINESS PROCESS OUTSOURCING (BPO) MARKET, BY OUTSOURCING APPROACH, 2021-2030 (USD MILLION)

TABLE 13 THAILAND BUSINESS PROCESS OUTSOURCING (BPO) MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 14 THAILAND IT AND TELECOMMUNICATION IN BUSINESS PROCESS OUTSOURCING (BPO) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 15 THAILAND MANUFACTURING IN BUSINESS PROCESS OUTSOURCING (BPO) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 16 THAILAND BFSI IN BUSINESS PROCESS OUTSOURCING (BPO) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 17 THAILAND GOVERNMENT & DEFENSE IN BUSINESS PROCESS OUTSOURCING (BPO) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 18 THAILAND TRANSPORTATION AND LOGISTICS IN BUSINESS PROCESS OUTSOURCING (BPO) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 19 THAILAND RETAIL AND E-COMMERCE IN BUSINESS PROCESS OUTSOURCING (BPO) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 20 THAILAND TRAVEL AND HOSPITALITY IN BUSINESS PROCESS OUTSOURCING (BPO) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 21 THAILAND HEALTHCARE IN BUSINESS PROCESS OUTSOURCING (BPO) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 22 THAILAND ENERGY AND UTILITIES IN BUSINESS PROCESS OUTSOURCING (BPO) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 23 THAILAND EDUCATION IN BUSINESS PROCESS OUTSOURCING (BPO) MARKET, BY TYPE, 2021-2030 (USD MILLION)

List of Figure

FIGURE 1 THAILAND BUSINESS PROCESS OUTSOURCING (BPO) MARKET: SEGMENTATION

FIGURE 2 THAILAND BUSINESS PROCESS OUTSOURCING (BPO) MARKET: DATA TRIANGULATION

FIGURE 3 THAILAND BUSINESS PROCESS OUTSOURCING (BPO) MARKET: DROC ANALYSIS

FIGURE 4 THAILAND BUSINESS PROCESS OUTSOURCING (BPO) MARKET: REGIONAL VS COUNTRY MARKET ANALYSIS

FIGURE 5 THAILAND BUSINESS PROCESS OUTSOURCING (BPO) MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 THAILAND BUSINESS PROCESS OUTSOURCING (BPO) MARKET: MULTIVARIATE MODELLING

FIGURE 7 THAILAND BUSINESS PROCESS OUTSOURCING (BPO) MARKET: LOCATION CURVE

FIGURE 8 THE MARKET CHALLENGE MATRIX BY SERVICE

FIGURE 9 THAILAND BUSINESS PROCESS OUTSOURCING (BPO) MARKET: MARKET END-USER COVERAGE GRID

FIGURE 10 THAILAND BUSINESS PROCESS OUTSOURCING (BPO) MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 11 THAILAND BUSINESS PROCESS OUTSOURCING (BPO) MARKET: DBMR MARKET POSITION GRID

FIGURE 12 THAILAND BUSINESS PROCESS OUTSOURCING (BPO) MARKET: VENDOR SHARE ANALYSIS

FIGURE 13 THAILAND BUSINESS PROCESS OUTSOURCING (BPO) MARKET: SEGMENTATION

FIGURE 14 INCREASING NEED FOR BUSINESS AGILITY IS EXPECTED TO DRIVE THE THAILAND BUSINESS PROCESS OUTSOURCING (BPO) MARKET GROWTH IN THE FORECAST PERIOD

FIGURE 15 THE OFFSHORE SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE THAILAND BUSINESS PROCESS OUTSOURCING (BPO) MARKET IN 2023 & 2030

FIGURE 16 BPO PROCESS FLOW PRE SHIPMENT

FIGURE 17 BPO PROCESS FLOW POST SHIPMENT

FIGURE 18 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THAILAND BUSINESS PROCESS OUTSOURCING (BPO) MARKET

FIGURE 19 CHANGES IN ORGANIZATION FOR AGILITY

FIGURE 20 PUBLIC CLOUD ADOPTION FOR BUSINESS OPERATIONS

FIGURE 21 AI ADOPTION RATES AROUND THE GLOBE

FIGURE 22 THAILAND BUSINESS PROCESS OUTSOURCING (BPO) MARKET: BY LOCATION, 2022

FIGURE 23 THAILAND BUSINESS PROCESS OUTSOURCING (BPO) MARKET: BY SERVICE, 2022

FIGURE 24 THAILAND BUSINESS PROCESS OUTSOURCING (BPO) MARKET: BY APPLICATION, 2022

FIGURE 25 THAILAND BUSINESS PROCESS OUTSOURCING (BPO) MARKET: BY DEPLOYMENT MODE, 2022

FIGURE 26 THAILAND BUSINESS PROCESS OUTSOURCING (BPO) MARKET: BY ORGANIZATION SIZE, 2022

FIGURE 27 THAILAND BUSINESS PROCESS OUTSOURCING (BPO) MARKET: BY OWNERSHIP, 2022

FIGURE 28 THAILAND BUSINESS PROCESS OUTSOURCING (BPO) MARKET: BY OUTSOURCING APPROACH, 2022

FIGURE 29 THAILAND BUSINESS PROCESS OUTSOURCING (BPO) MARKET: BY END USER, 2022

FIGURE 30 THAILAND BUSINESS PROCESS OUTSOURCING (BPO) MARKET: COMPANY SHARE 2022 (%)

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.