Saudi Arabia Body Care And Personal Hygiene Market

Market Size in USD Billion

CAGR :

%

USD

1.35 Billion

USD

1.84 Billion

2024

2032

USD

1.35 Billion

USD

1.84 Billion

2024

2032

| 2025 –2032 | |

| USD 1.35 Billion | |

| USD 1.84 Billion | |

|

|

|

Saudi Arabia Body Care and Personal Hygiene Market Analysis

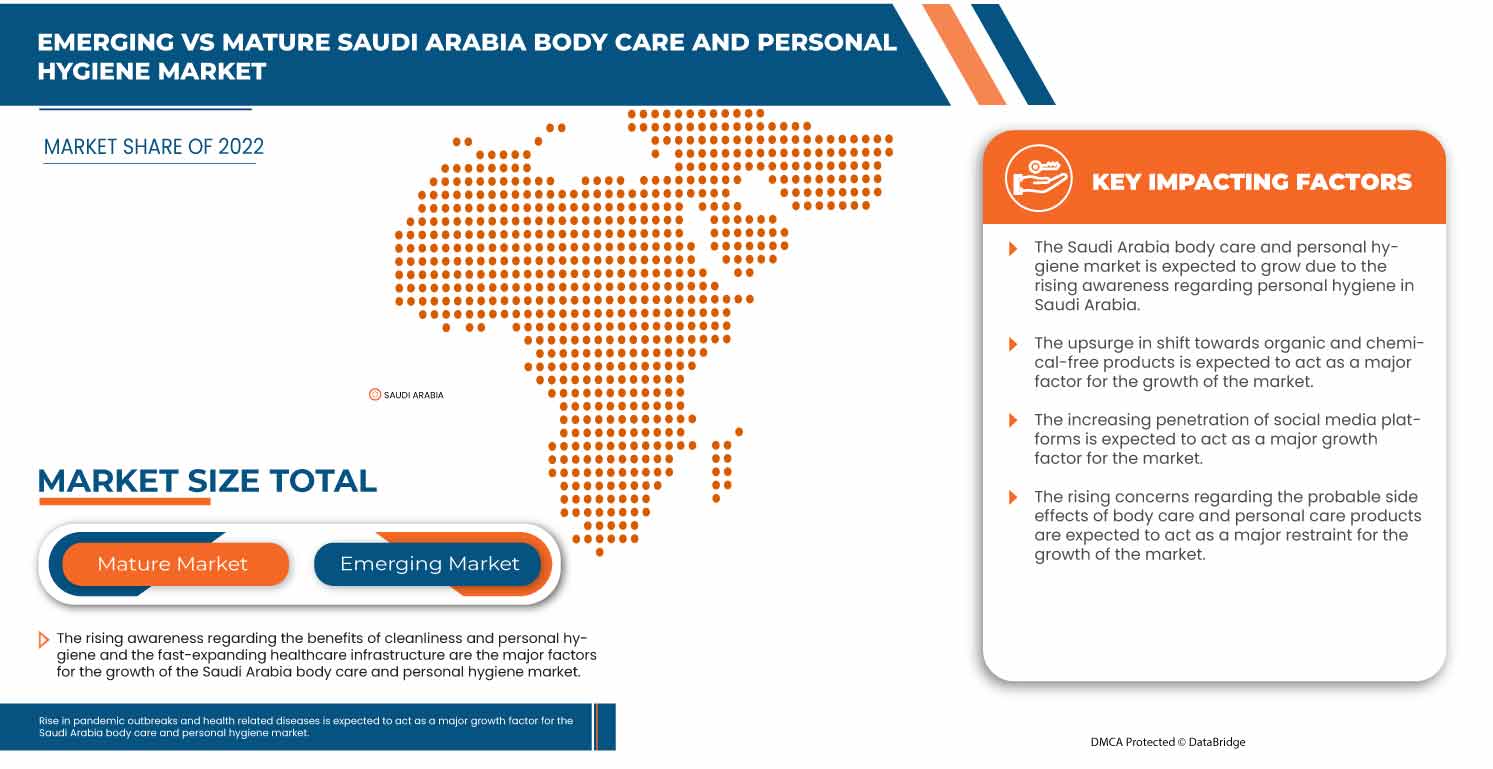

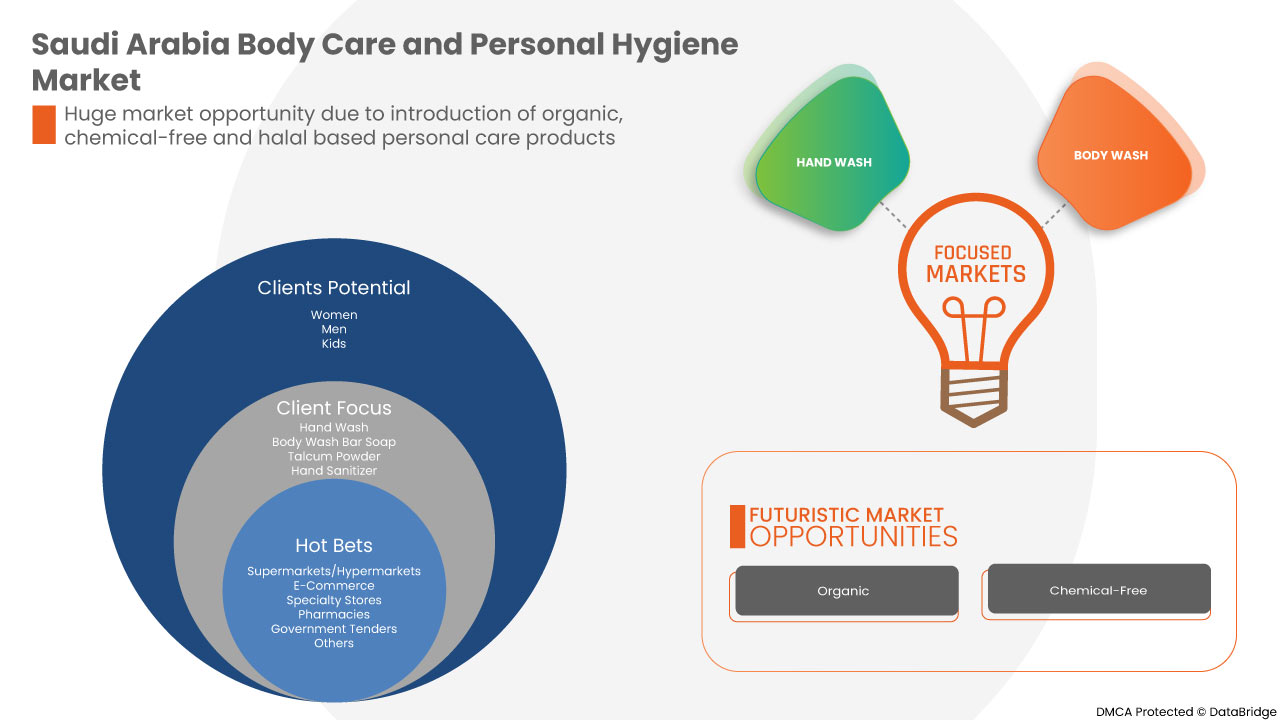

The Saudi Arabia body care and personal hygiene market is experiencing robust growth, driven by increasing awareness regarding benefits of maintaining cleanliness and personal hygiene. As the Saudi Arabia body care industry continues to expand, the surge in epidemic or pandemic outbreaks or diseases has increased. Introduction of organic, chemical-free and halal personal care products are creating opportunities for the market. Market dynamics are also influenced by government regulations against synthetic ingredients used in personal care products. Overall, the market is expected to continue expanding, with a focus on innovation and sustainability to meet evolving industrial demands.

Saudi Arabia Body Care and Personal Hygiene Market Size

Saudi Arabia body care and personal hygiene market size was valued at USD 1.35 billion in 2024 and is projected to reach USD 1.84 billion by 2032, with a CAGR of 3.9% during the forecast period of 2025 to 2032. In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework.

Saudi Arabia Body Care and Personal Hygiene Market Trends

“Fast Expanding Healthcare Infrastructure”

The fast-expanding healthcare infrastructure in Saudi Arabia has been a key factor in the growth of the body care and personal hygiene market. Over the past decade, the Kingdom has made significant investments in enhancing its healthcare system, including the construction of new hospitals, clinics, and healthcare centers, along with the modernization of existing facilities. This expansion is part of Saudi Arabia’s Vision 2030 initiative, which aims to diversify the economy and improve the quality of life for its citizens. As the healthcare infrastructure grows, there has been an increased focus on public health, disease prevention, and wellness, directly influencing the demand for personal hygiene and body care products.

With better healthcare facilities, more advanced medical technologies, and improved healthcare access, the Saudi population has become increasingly aware of the importance of personal hygiene in maintaining overall health and preventing illness. The expansion of healthcare services also includes the promotion of preventive health measures, such as regular check-ups, vaccinations, and wellness programs. These initiatives have helped create a stronger connection between health maintenance and personal hygiene, driving consumers to adopt better hygiene practices and invest in products that support their well-being.

Moreover, the improvement in healthcare infrastructure has led to a more robust distribution network for personal care products. As more healthcare facilities and pharmacies are established across the country, consumers now have greater access to a wide range of body care and hygiene products. This accessibility has facilitated the rise of premium and specialized hygiene products, catering to different skin types, age groups, and personal preferences.

The growing awareness of hygiene’s importance, combined with better access to healthcare resources, has resulted in a sustained demand for products like soaps, lotions, deodorants, oral care items, and sanitizers. As Saudi Arabia continues to expand its healthcare infrastructure, the body care and personal hygiene market is expected to thrive further, with increased consumer spending on hygiene-related products.

For instance,

- The Arab News article highlights the growth of Saudi Arabia's healthcare infrastructure, which drives demand for body care and hygiene products. As the government enhances healthcare facilities and services, there is a stronger emphasis on cleanliness and hygiene, leading to increased consumption of personal care items like sanitizers, soaps, and lotions

The rapid expansion of healthcare infrastructure in Saudi Arabia has contributed to the growth of the body care and personal hygiene market. With improved healthcare access, better public health awareness, and an increased focus on wellness, consumers are more inclined to prioritize hygiene practices. This, coupled with greater product accessibility, has led to higher demand for personal care items and is driving the market’s continued growth.

Report Scope and Market Segmentation

|

Attributes |

Saudi Arabia Body Care and Personal Hygiene Ingredients Key Market Insights |

|

Segments Covered |

|

|

Key Market Players |

Unilever (U.K.), Procter & Gamble (U.S.), L'ORÉAL (France), BEIERSDORF AG (U.A.E), Henkel Ag & Co. KGaA (Germany), Church & Dwight Co., Inc. (U.S.), Coty Inc. (U.S.), Kao Corporation (Tokyo), NAOS (U.S.), and Shiseido Company, Limited (Japan) |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Saudi Arabia Body Care and Personal Hygiene Market Definition

Body care and personal hygiene encompasses products and practices aimed at maintaining cleanliness, grooming, and overall health. This includes items like soaps, shampoos, deodorants, toothpaste, and skincare products, essential for personal cleanliness, odor control, and oral health. These routines promote physical well-being, prevent infections, and boost confidence, while contributing to public health by reducing disease transmission. The category caters to diverse consumer needs, ranging from everyday essentials to premium and eco-friendly options. Increasingly, consumers seek products that are sustainable, organic, and tailored to specific skin and hair needs, reflecting a shift toward wellness and environmentally conscious living.

Saudi Arabia Body Care and Personal Hygiene Market Dynamics

Drivers

- Increasing Awareness Regarding Benefits of Maintaining Cleanliness and Personal Hygiene

Increasing awareness regarding the benefits of maintaining cleanliness and personal hygiene has been a significant driver in the growth of the Saudi Arabian body care and personal hygiene market. Over the past decade, there has been a notable shift in consumer behavior, with individuals becoming more conscious of the importance of hygiene in maintaining overall health and well-being. This awareness has been fueled by various factors, including education campaigns, media exposure, and a growing emphasis on health and wellness in society.

In Saudi Arabia, personal hygiene is not only seen as a matter of cleanliness but also as a part of cultural and religious practices. The importance of hygiene is deeply rooted in Islamic teachings, which stress cleanliness as an essential component of daily life. This cultural context, combined with modern health initiatives, has led to greater acceptance of hygiene products and routines, especially among the younger population.

The rise in health consciousness has also been supported by the government’s efforts to promote wellness through various public health initiatives. Additionally, the growing availability of information through social media and other platforms has further encouraged consumers to adopt hygiene practices. With the increasing awareness of how cleanliness can prevent diseases, improve skin health, and enhance overall quality of life, more consumers are turning to body care and personal hygiene products such as soaps, lotions, deodorants, and oral care items.

In response to this demand, companies in the Saudi Arabian market are introducing innovative, high-quality products that cater to the needs of diverse consumer segments. There is also a rising preference for natural, organic, and sustainable personal care products, which are perceived as healthier and safer alternatives to conventional items. As a result, the Saudi body care and personal hygiene market is witnessing strong growth, driven by consumers’ heightened understanding of hygiene’s vital role in health maintenance.

For instance,

- The article highlights the critical role of hygiene in preventing infectious diseases. In Saudi Arabia, during the COVID-19 pandemic, this awareness led to a surge in demand for hygiene products like hand sanitizers, soaps, and disinfectants. Retailers such as Carrefour and Al-Dawaa saw significant sales increases, reflecting heightened hygiene consciousness

Increasing awareness of the health and wellness benefits of maintaining cleanliness has significantly boosted the demand for personal hygiene products in Saudi Arabia. This shift is driven by cultural, educational, and social factors, leading to a surge in consumer interest in body care products, with a growing preference for natural and innovative solutions.

- Surge in Epidemic or Pandemic Outbreaks or Diseases

The surge in epidemic or pandemic outbreaks, such as the COVID-19 pandemic, has significantly impacted the Saudi Arabian body care and personal hygiene market. In times of health crises, there is a marked increase in the public's awareness of hygiene practices and the need for proper sanitation to prevent the spread of infectious diseases. During the COVID-19 pandemic, for instance, personal hygiene became a top priority, with people focusing on maintaining cleanliness to protect themselves from the virus. This shift in behavior led to heightened demand for hygiene products like hand sanitizers, disinfectants, antibacterial soaps, face masks, and other personal care items.

The pandemic highlighted the critical role of hygiene in disease prevention and prompted consumers to adopt more rigorous personal care routines. As a result, there was a noticeable surge in the use of hand sanitizers and antibacterial products, with many individuals incorporating them into their daily habits. Moreover, the emphasis on personal cleanliness extended beyond just hand hygiene, with increased use of disinfectants for surfaces and other hygiene-related products.

In response to this growing demand, manufacturers and retailers in Saudi Arabia have expanded their product offerings, ensuring that consumers have access to a wide range of personal hygiene solutions. Additionally, with increased awareness of the connection between hygiene and health, there has been a shift toward products that provide added protection, such as antibacterial soaps, sanitizing wipes, and oral hygiene products.

This heightened awareness around hygiene, driven by the surge in epidemic outbreaks, has also led to long-term changes in consumer behavior. Even after the pandemic's peak, many consumers continue to prioritize hygiene and cleanliness, contributing to the sustained growth of the body care and personal hygiene market in Saudi Arabia.

For instance,

- The article from WHO emphasizes Saudi Arabia's strong health response to COVID-19, which included promoting hygiene practices like handwashing and mask-wearing. This national focus on hygiene led to a surge in demand for personal care products such as sanitizers, disinfectants, and soaps, driving growth in the body care market

The surge in epidemic or pandemic outbreaks, particularly covid-19, has significantly boosted the demand for body care and personal hygiene products in Saudi Arabia. the heightened focus on hygiene for disease prevention led to increased usage of products like sanitizers, disinfectants, and antibacterial items, resulting in a lasting shift in consumer behavior toward prioritizing cleanliness and hygiene. this trend continues to drive market growth.

Opportunities

- Penetration of Social Media Platforms

The introduction of organic, chemical-free, and halal personal care products has become a key opportunity in the Saudi Arabian body care and personal hygiene market. As consumers become more health-conscious and environmentally aware, there is an increasing demand for products that align with these values. Organic and chemical-free personal care items are gaining popularity due to growing concerns over the harmful effects of synthetic chemicals, such as parabens, sulfates, and artificial fragrances, which are commonly used in conventional beauty products. Many consumers are now prioritizing products that are gentler on the skin, especially those with sensitive skin or allergies, as well as those seeking a more natural, holistic approach to health.

Organic products, often derived from plant-based ingredients, are perceived as safer alternatives, providing not only better skin care but also contributing to overall well-being. Furthermore, the shift toward chemical-free formulations meets the increasing demand for sustainability and environmental responsibility. As a result, personal care brands in Saudi Arabia are investing in the development of products that are free from harmful chemicals and made from natural, sustainable ingredients.

In addition to the growing demand for organic and chemical-free options, there is also a rising interest in halal-certified personal care products. Saudi Arabia, being a predominantly Muslim country, sees strong consumer preference for halal products, which adhere to Islamic law by ensuring that ingredients are permissible and free from alcohol or animal-derived substances. The halal certification provides consumers with confidence that the products align with their religious beliefs and values.

This combination of organic, chemical-free, and halal products offers a lucrative opportunity for brands in Saudi Arabia to cater to an expanding market segment. Companies that can meet these consumer demands stand to gain a competitive edge and secure brand loyalty among consumers who are increasingly concerned with the safety, ethics, and religious compliance of the products they use.

For instance,

- The Kearney article highlights how the penetration of social media platforms in Saudi Arabia is transforming consumer behavior. Social media influencers and digital campaigns promote personal care products, increasing awareness and driving demand for body care and hygiene products. This offers significant opportunities for brands targeting younger, health-conscious audiences

The growing demand for organic, chemical-free, and halal personal care products presents a significant opportunity in Saudi Arabia’s body care and personal hygiene market. Consumers are increasingly seeking products that align with their health, environmental, and religious values, leading to a rise in demand for natural and halal-certified personal care items. Brands that cater to these needs can differentiate themselves and tap into a rapidly growing market segment.

- Introduction of Organic, Chemical-Free and Halal Personal Care Products

The introduction of organic, chemical-free, and halal personal care products presents a significant opportunity for the body care and personal hygiene market in Saudi Arabia. As consumer preferences shift towards safer, more natural options, there is a growing demand for products that align with health-conscious and ethical values. Saudi Arabia, with its increasing focus on wellness and healthy living, has seen a surge in consumers seeking organic and chemical-free personal care items, driven by concerns about the potential side effects of synthetic ingredients in conventional products.

Organic and chemical-free personal care products are perceived as safer alternatives, especially by consumers with sensitive skin, allergies, or those avoiding harmful chemicals such as parabens, sulfates, and synthetic fragrances. These products often contain plant-based ingredients, which are not only seen as gentler on the skin but also offer potential therapeutic benefits, appealing to a growing market segment focused on self-care and holistic health. In response, personal care brands in Saudi Arabia are increasingly formulating products with natural ingredients, ensuring that they are free from synthetic additives and harmful chemicals.

In addition to the demand for organic and chemical-free products, there is a rising interest in halal personal care products. As Saudi Arabia is a predominantly Muslim country, there is an increasing consumer preference for products that are certified halal. Halal certification ensures that the products meet the standards set by Islamic law, including the use of permissible ingredients and the avoidance of alcohol or animal-derived substances. This trend has opened up new market segments, with brands introducing halal-certified skincare, haircare, and personal hygiene products to cater to the local population's values and preferences.

The combination of organic, chemical-free, and halal products provides a unique opportunity for brands to differentiate themselves in a competitive market. Manufacturers that focus on these values can tap into a niche but rapidly growing consumer base that is willing to pay a premium for products that align with their ethical, health, and religious standards.

For instance,

- The article highlights how the growing demand for halal-certified products is boosting the cosmetics market in the U.A.E., a trend that extends to Saudi Arabia as well. Consumers in the region increasingly seek personal care items that comply with halal standards, creating opportunities for brands offering halal skincare and beauty products

The introduction of organic, chemical-free, and halal personal care products presents a major opportunity in Saudi Arabia’s body care and personal hygiene market. consumers are increasingly seeking safer, natural, and ethically produced products. The rising demand for organic and halal-certified personal care items, driven by health, religious, and ethical considerations, allows companies to differentiate themselves and cater to a rapidly expanding market segment focused on wellness and sustainability.

Restraints/Challenges

- Growing Consumer Awareness Regarding the Probable Side Effects of Body Care and Personal Care Products

As the body care and personal hygiene market in Saudi Arabia continues to expand, a growing concern among consumers about the probable side effects of body care and personal hygiene products has emerged as a significant restraint. Increased awareness of the potential adverse effects of certain ingredients in cosmetics, toiletries, and hygiene products is causing many consumers to seek safer, more natural alternatives. This concern has been driven by widespread information on the internet, social media campaigns, and advocacy from environmental and health organizations that highlight the risks of chemical additives, preservatives, parabens, sulfates, and artificial fragrances commonly found in personal care products.

Many consumers are becoming increasingly cautious about the long-term effects of synthetic chemicals on their skin, hair, and overall health. These concerns are particularly pronounced among those with sensitive skin or pre-existing health conditions, who may be more vulnerable to allergic reactions or irritation caused by certain products. As a result, there is a growing preference for products that are labeled as natural, organic, or free from harmful chemicals. This shift in consumer behavior is forcing manufacturers in Saudi Arabia to reformulate their products and focus on transparency by offering clear, detailed ingredient lists and certifications for safety and sustainability.

Furthermore, the demand for products with eco-friendly, cruelty-free, and sustainable credentials is increasing, further restricting the market for traditional personal care products. Companies that fail to address these consumer concerns risk losing market share to competitors who prioritize safety, quality, and environmental impact. As a result, the personal hygiene and body care market in Saudi Arabia is facing challenges in meeting consumer expectations for both effective products and minimal side effects.

For instances

- In February 2024, according to a study published by MDPI, the article discusses the increasing concern among consumers about the side effects of personal care products, particularly their ingredients. Consumers in Saudi ARABIA, like those in other regions, are becoming more aware of the potential harms caused by certain chemicals, such as parabens and phthalates, commonly used in body care products. This growing awareness is driving consumers toward natural and organic alternatives, which are perceived to be safer for both health and the environment. As a result, personal care brands face pressure to reformulate their products or risk losing market share to more sustainable, eco-friendly options

Growing consumer awareness regarding the potential side effects of chemicals in body care and personal hygiene products is acting as a restraint in the Saudi Arabian market. Concerns about allergies, irritation, and long-term health risks have led consumers to seek natural, organic, and safer alternatives. This shift is forcing manufacturers to reformulate products and prioritize transparency, sustainability, and eco-friendly practices to meet evolving consumer demands.

- Lack in Efficacy of Distribution Channels

A significant challenge in the Saudi Arabian body care and personal hygiene market is the lack of efficacy in distribution channels. Despite the growing demand for personal care products, the distribution system in the country faces several challenges that hinder market growth and product accessibility. One of the primary issues is the fragmented nature of the distribution network, with many rural areas and smaller cities lacking easy access to a wide range of products. While major urban centers like Riyadh and Jeddah have strong retail infrastructure, the reach in remote areas is limited, leading to uneven product availability across the country.

Furthermore, there is a reliance on traditional retail channels, such as physical stores and supermarkets, which may not be able to keep up with the increasing demand for online shopping. E-commerce in Saudi Arabia has grown rapidly in recent years, but many brands still rely heavily on brick-and-mortar sales. This underutilization of online platforms restricts potential sales growth, especially with the rising popularity of online shopping, where consumers can easily compare prices and access a broader range of products.

In addition, logistical inefficiencies also contribute to distribution challenges. Inadequate supply chain infrastructure, delays in shipments, and inconsistent stock levels can result in product shortages and missed sales opportunities. This issue becomes even more prominent for international brands trying to penetrate the Saudi market, as they face the complexities of navigating local regulations and customs processes.

The inefficiency of distribution channels not only limits product availability but also affects the marketing and promotional efforts of brands. Companies struggle to reach their target audience effectively, leading to potential loss of market share to competitors with more streamlined and efficient distribution networks. For the Saudi Arabian body care and personal hygiene market to continue its growth, addressing these distribution inefficiencies will be crucial.

For instances

- In January 2020, an article published by the International Trade Administration highlighted that the efficacy of distribution channels in Saudi Arabia faces challenges such as reliance on traditional methods, regional disparities in infrastructure, and a preference for cash payments over digital transactions. These issues hinder the smooth movement of products, especially in remote areas, and impact the efficiency of logistics, e-commerce, and retail operations

The lack of efficacy in distribution channels is a significant challenge for the Saudi Arabian body care and personal hygiene market. Fragmented networks, limited access in rural areas, and underutilized e-commerce platforms hinder product availability and sales growth. Inefficiencies in supply chain logistics further exacerbate the issue, affecting brands’ ability to reach their target consumers effectively. Streamlining distribution channels and enhancing online sales platforms will be essential for sustained market growth.

Impact and Current Market Scenario of Raw Material Shortage and Shipping Delays

Data Bridge Market Research offers a high-level analysis of the market and delivers information by keeping in account the impact and current market environment of raw material shortage and shipping delays. This translates into assessing strategic possibilities, creating effective action plans, and assisting businesses in making important decisions.

Apart from the standard report, we also offer in-depth analysis of the procurement level from forecasted shipping delays, distributor mapping by region, commodity analysis, production analysis, price mapping trends, sourcing, category performance analysis, supply chain risk management solutions, advanced benchmarking, and other services for procurement and strategic support.

Expected Impact of Economic Slowdown on the Pricing and Availability of Products

When economic activity slows, industries begin to suffer. The forecasted effects of the economic downturn on the pricing and accessibility of the products are taken into account in the market insight reports and intelligence services provided by DBMR. With this, our clients can typically keep one step ahead of their competitors, project their sales and revenue, and estimate their profit and loss expenditures.

Saudi Arabia Body Care and Personal Hygiene Market Scope

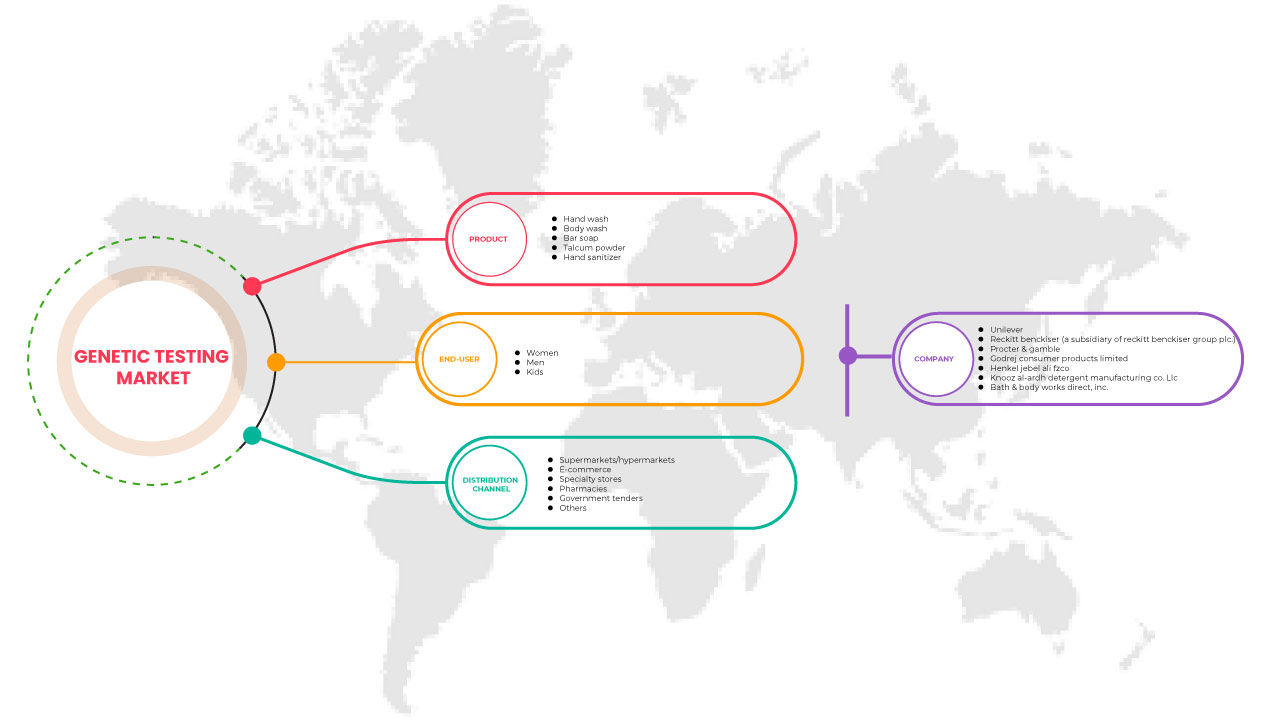

The market is segmented on the basis of product, price range, packaging, target customer, and distribution channel. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Product

- Body Shampoo / Wash / Shower Gel

- Hair Shampoo

- Body Scrub

- Shower Oil

- Petroleum Jelly

- Hand Liquid Wash

- Wet Wipes

- Hand Sanitizer

- Nail Polish Remover

- Baby Shampoo

- Alcohol Antiseptic Spray

- Others

Price Range

- Mass

- Premium

- Luxury

Packaging

- Bottles and Jars

- Containers

- Tubes

- Pouches

- Sachets

- Dispensers

Target Customer

- Women

- Men

- Kids

- Unisex

Distribution Channel

- Non-Store Based Retailer

- Store Based Retailer

- Distributors and Wholesalers

- Duty Free Shops

Saudi Arabia Body Care and Personal Hygiene Market Share

The market competitive landscape provides details by competitors. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

Saudi Arabia Body Care and Personal Hygiene Market Leaders Operating in the Market Are:

- Unilever (U.K.)

- Procter & Gamble (U.S.)

- L'ORÉAL (France)

- BEIERSDORF AG (U.A.E)

- Henkel Ag & Co. KGaA (Germany)

- Church & Dwight Co., Inc. (U.S.)

- Coty Inc. (U.S.)

- Kao Corporation (Tokyo)

- NAOS (U.S.)

- Shiseido Company, Limited (Japan)

Latest Developments in Saudi Arabia Body Care and Personal Hygiene Market

- In November 2024, Unilever has partnered with Nufarm to cultivate sustainable biomass oil from energy cane. This collaboration aims to reduce reliance on petrochemical ingredients, support Unilever's net-zero emissions target by 2039, and create a more resilient and waste-free supply chain

- In September 2024, L’Oréal has partnered with Abolis Biotechnologies and Evonik to develop sustainable, bio-based ingredients for beauty products. The collaboration, backed by significant investments, aims to scale up the production of innovative ingredients, supporting L’Oréal's sustainability goals and advancing biotechnology in various industries

- In August 2024, L’Oréal has acquired a 10% stake in Galderma Group and entered a strategic scientific partnership to combine their expertise in dermatology and skin biology. This collaboration focuses on enhancing performance in the fast-growing aesthetics market. The deal is expected to drive innovation in skincare and aesthetic treatments, further strengthening both companies' positions in the beauty and dermatology sectors

- In February 2024, Henkel has signed an agreement to acquire Vidal Sassoon's hair care business in Greater China from Procter & Gamble. This acquisition will expand Henkel’s presence in the premium retail segment of the Chinese hair care market, complementing its existing portfolio and providing a complete range of hair care products

- In January 2023, P&G Beauty announced its acquisition of Mielle Organics, a leading textured hair care brand. Co-founders Monique and Melvin Rodriguez will continue to lead Mielle as an independent subsidiary. The partnership expands access to high-quality products and supports Mielle's community-focused initiatives, including the Mielle Cares program

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELING

2.7 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.8 DBMR MARKET POSITION GRID

2.9 DBMR VENDOR SHARE ANALYSIS

2.1 SECONDARY SOURCES

2.11 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTER’S FIVE FORCES ANALYSIS

4.1.1 THREAT OF NEW ENTRANTS

4.1.2 BARGAINING POWER OF SUPPLIERS

4.1.3 BARGAINING POWER OF BUYERS

4.1.4 THREAT OF SUBSTITUTES

4.1.5 INTERNAL COMPETITION

4.2 IMPORT EXPORT SCENARIO

4.3 PRICING ANALYSIS

4.4 BRAND OUTLOOK

4.4.1 BRAND COMPARATIVE ANALYSIS

4.4.2 PRODUCT VS BRAND OVERVIEW

4.5 CONSUMER BUYING BEHAVIOUR

4.5.1 CULTURAL INFLUENCE AND SOCIAL NORMS

4.5.2 ECONOMIC FACTORS

4.5.3 PSYCHOLOGICAL FACTORS

4.5.4 THE IMPACT OF HEALTH AND WELLNESS TRENDS

4.5.5 CONCLUSION

4.6 FACTORS AFFECTING BUYING DECISIONS

4.6.1 CULTURAL AND RELIGIOUS INFLUENCES

4.6.2 ECONOMIC FACTORS

4.6.3 SOCIAL INFLUENCE AND PEER PRESSURE

4.6.4 BRAND REPUTATION AND TRUST

4.6.5 HEALTH AND WELLNESS TRENDS

4.6.6 CONVENIENCE AND AVAILABILITY

4.6.7 CONCLUSION

4.7 IMPACT OF ECONOMIC SLOWDOWN

4.7.1 IMPACT ON PRICES

4.7.2 IMPACT ON SUPPLY CHAIN

4.7.3 IMPACT ON SHIPMENT

4.7.4 IMPACT ON DEMAND

4.7.5 IMPACT ON STRATEGIC DECISION-MAKING

4.7.6 CONCLUSION

4.8 PRODUCT ADOPTION SCENARIO

4.8.1 AWARENESS AND INTRODUCTION OF NEW PRODUCTS

4.8.2 INTEREST AND EVALUATION

4.8.3 TRIAL

4.8.4 ADOPTION AND LOYALTY

4.8.5 IMPACT OF TECHNOLOGICAL ADVANCEMENTS

4.8.6 CONCLUSION

4.9 PRODUCTION CAPACITY OUTLOOK

4.9.1 MARKET DYNAMICS AND DEMAND TRENDS

4.9.2 GOVERNMENT POLICIES AND INDUSTRIAL INITIATIVES

4.9.3 CAPACITY EXPANSION AND INVESTMENTS

4.9.4 TECHNOLOGY AND SUSTAINABILITY

4.9.5 CHALLENGES AND OPPORTUNITIES

4.9.6 FUTURE OUTLOOK

4.1 SUPPLY CHAIN ANALYSIS

4.10.1 OVERVIEW

4.10.2 LOGISTIC COST SCENARIO

4.10.3 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

4.11 RAW MATERIAL SOURCING ANALYSIS

4.11.1 NATURAL INGREDIENTS

4.11.2 SYNTHETIC INGREDIENTS AND PETROCHEMICALS

4.11.3 FRAGRANCES AND ESSENTIAL OILS

4.11.4 4PACKAGING MATERIALS

4.11.5 CHALLENGES IN RAW MATERIAL SOURCING

4.11.6 CONCLUSION

5 REGULATION COVERAGE

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 INCREASING AWARENESS REGARDING BENEFITS OF MAINTAINING CLEANLINESS AND PERSONAL HYGIENE

6.1.2 SURGE IN EPIDEMIC OR PANDEMIC OUTBREAKS OR DISEASES

6.1.3 FAST EXPANDING HEALTHCARE INFRASTRUCTURE

6.2 RESTRAINTS

6.2.1 GROWING CONSUMER AWARENESS REGARDING THE PROBABLE SIDE EFFECTS OF BODY CARE AND PERSONAL CARE PRODUCTS

6.2.2 GOVERNMENT REGULATIONS AGAINST SYNTHETIC INGREDIENTS USED IN PERSONAL CARE PRODUCTS

6.3 OPPORTUNITIES

6.3.1 INTRODUCTION OF ORGANIC, CHEMICAL-FREE AND HALAL PERSONAL CARE PRODUCTS

6.3.2 PENETRATION OF SOCIAL MEDIA PLATFORMS

6.4 CHALLENGES

6.4.1 LACK IN EFFICACY OF DISTRIBUTION CHANNELS

6.4.2 MAINTAINING THE INTEGRITY AND AUTHENTICITY OF PARTICULAR BODY OR PERSONAL CARE PRODUCT

7 SAUDI ARABIA BODY CARE AND PERSONAL HYGIENE MARKET, BY PRODUCT

7.1 OVERVIEW

7.2 BODY SHAMPOO / WASH / SHOWER GEL

7.3 HAIR SHAMPOO

7.4 BODY SCRUB

7.5 SHOWER OIL

7.6 PETROLEUM JELLY

7.7 HAND LIQUID WASH

7.8 WET WIPES

7.9 HAND SANITIZER

7.1 NAIL POLISH REMOVER

7.11 BABY SHAMPOO

7.12 ALCOHOL ANTISEPTIC SPRAY

7.13 OTHERS

8 SAUDI ARABIA BODY CARE AND PERSONAL HYGIENE MARKET, BY PRICE RANGE

8.1 OVERVIEW

8.2 MASS

8.3 PREMIUM

8.4 LUXURY

9 SAUDI ARABIA BODY CARE AND PERSONAL HYGIENE MARKET, BY PACKAGING

9.1 OVERVIEW

9.2 BOTTLES AND JARS

9.3 CONTAINERS

9.4 TUBES

9.5 POUCHES

9.6 SACHETS

9.7 DISPENSERS

10 SAUDI ARABIA BODY CARE AND PERSONAL HYGIENE MARKET, BY TARGET CUSTOMER

10.1 OVERVIEW

10.2 WOMEN

10.3 MEN

10.4 KIDS

10.5 UNISEX

11 SAUDI ARABIA BODY CARE AND PERSONAL HYGIENE MARKET, BY DISTRIBUTION CHANNEL

11.1 OVERVIEW

11.2 NON-STORE BASED RETAILER

11.3 STORE BASED RETAILER

11.4 DISTRIBUTORS AND WHOLESALERS

11.5 DUTY FREE SHOPS

12 SAUDI ARABIA BODY CARE AND PERSONAL HYGIENE MARKET: COMPANY LANDSCAPE

12.1 COMPANY SHARE ANALYSIS: NORTH AMERICA AND EUROPE

13 SWOT ANALYSIS

14 COMPANY PROFILES

14.1 UNILEVER

14.1.1 COMPANY SNAPSHOT

14.1.2 REVENUE ANALYSIS

14.1.3 PRODUCT PORTFOLIO

14.1.4 RECENT DEVELOPMENT

14.2 PROCTER & GAMBLE

14.2.1 COMPANY SNAPSHOT

14.2.2 REVENUE ANALYSIS

14.2.3 PRODUCT PORTFOLIO

14.2.4 RECENT DEVELOPMENT

14.3 L'ORÉAL

14.3.1 COMPANY SNAPSHOT

14.3.2 REVENUE ANALYSIS

14.3.3 PRODUCT PORTFOLIO

14.3.4 RECENT DEVELOPMENT

14.4 BEIERSDORF AG

14.4.1 COMPANY SNAPSHOT

14.4.2 REVENUE ANALYSIS

14.4.3 PRODUCT PORTFOLIO

14.4.4 RECENT DEVELOPMENT

14.5 HENKEL AG & CO. KGAA

14.5.1 COMPANY SNAPSHOT

14.5.2 REVENUE ANALYSIS

14.5.3 PRODUCT PORTFOLIO

14.5.4 RECENT DEVELOPMENT

14.6 CHURCH & DWIGHT CO., INC.

14.6.1 COMPANY SNAPSHOT

14.6.2 REVENUE ANALYSIS

14.6.3 PRODUCT PORTFOLIO

14.6.4 RECENT DEVELOPMENT

14.7 COTY INC.

14.7.1 COMPANY SNAPSHOT

14.7.2 REVENUE ANALYSIS

14.7.3 PRODUCT PORTFOLIO

14.7.4 RECENT DEVELOPMENT

14.8 KAO CORPORATION

14.8.1 COMPANY SNAPSHOT

14.8.2 REVENUE ANALYSIS

14.8.3 PRODUCT PORTFOLIO

14.8.4 RECENT DEVELOPMENT

14.9 NAOS

14.9.1 COMPANY SNAPSHOT

14.9.2 PRODUCT PORTFOLIO

14.9.3 RECENT DEVELOPMENT

14.1 SHISEIDO COMPANY, LIMITED

14.10.1 COMPANY SNAPSHOT

14.10.2 REVENUE ANALYSIS

14.10.3 PRODUCT PORTFOLIO

14.10.4 RECENT DEVELOPMENT

15 QUESTIONNAIRE

16 RELATED REPORTS

List of Table

TABLE 1 BRAND COMPARATIVE ANALYSIS

TABLE 2 PRODUCT VS BRAND OVERVIEW

TABLE 3 REGULATORY COVERAGE

TABLE 4 SAUDI ARABIA BODY CARE AND PERSONAL HYGIENE MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 5 SAUDI ARABIA BODY CARE AND PERSONAL HYGIENE MARKET, BY PRODUCT, 2018-2032 (THOUSAND UNITS)

TABLE 6 SAUDI ARABIA BODY SHAMPOO / WASH / SHOWER GEL IN BODY CARE AND PERSONAL HYGIENE MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 7 SAUDI ARABIA BODY SHAMPOO / WASH / SHOWER GEL IN BODY CARE AND PERSONAL HYGIENE MARKET, BY SKIN TYPE, 2018-2032 (USD THOUSAND)

TABLE 8 SAUDI ARABIA BODY SHAMPOO / WASH / SHOWER GEL IN BODY CARE AND PERSONAL HYGIENE MARKET, BY FRAGRANCE, 2018-2032 (USD THOUSAND)

TABLE 9 SAUDI ARABIA HAIR SHAMPOO IN BODY CARE AND PERSONAL HYGIENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 10 SAUDI ARABIA HAIR SHAMPOO IN BODY CARE AND PERSONAL HYGIENE MARKET, BY NATURE, 2018-2032 (USD THOUSAND)

TABLE 11 SAUDI ARABIA HAIR SHAMPOO IN BODY CARE AND PERSONAL HYGIENE MARKET, BY HAIR TYPE, 2018-2032 (USD THOUSAND)

TABLE 12 SAUDI ARABIA HAIR SHAMPOO IN BODY CARE AND PERSONAL HYGIENE MARKET, BY FRAGRANCE, 2018-2032 (USD THOUSAND)

TABLE 13 SAUDI ARABIA BODY SCRUB IN BODY CARE AND PERSONAL HYGIENE MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 14 SAUDI ARABIA SHOWER OIL IN BODY CARE AND PERSONAL HYGIENE MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 15 SAUDI ARABIA SYNTHETIC SHOWER OILS IN BODY CARE AND PERSONAL HYGIENE MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 16 SAUDI ARABIA NATURAL/ORGANIC SHOWER OILS IN BODY CARE AND PERSONAL HYGIENE MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 17 SAUDI ARABIA PLANT-BASED OILS IN BODY CARE AND PERSONAL HYGIENE MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 18 SAUDI ARABIA SHOWER OIL IN BODY CARE AND PERSONAL HYGIENE MARKET, BY SKIN TYPE, 2018-2032 (USD THOUSAND)

TABLE 19 SAUDI ARABIA PETROLEUM JELLY IN BODY CARE AND PERSONAL HYGIENE MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 20 SAUDI ARABIA HAND LIQUID WASH IN BODY CARE AND PERSONAL HYGIENE MARKET, BY NATURE, 2018-2032 (USD THOUSAND)

TABLE 21 SAUDI ARABIA HAND LIQUID WASH IN BODY CARE AND PERSONAL HYGIENE MARKET, BY FRAGRANCE, 2018-2032 (USD THOUSAND)

TABLE 22 SAUDI ARABIA WET WIPES IN BODY CARE AND PERSONAL HYGIENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 23 SAUDI ARABIA SKIN CARE WET WIPES IN BODY CARE AND PERSONAL HYGIENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 24 SAUDI ARABIA WET WIPES IN BODY CARE AND PERSONAL HYGIENE MARKET, BY DISPOSABILITY, 2018-2032 (USD THOUSAND)

TABLE 25 SAUDI ARABIA WET WIPES IN BODY CARE AND PERSONAL HYGIENE MARKET, BY MATERIAL, 2018-2032 (USD THOUSAND)

TABLE 26 SAUDI ARABIA WET WIPES IN BODY CARE AND PERSONAL HYGIENE MARKET, BY PACKAGING SIZE, 2018-2032 (USD THOUSAND)

TABLE 27 SAUDI ARABIA WET WIPES IN BODY CARE AND PERSONAL HYGIENE MARKET, BY FRAGRANCE, 2018-2032 (USD THOUSAND)

TABLE 28 SAUDI ARABIA HAND SANITIZE IN BODY CARE AND PERSONAL HYGIENE MARKET, BY COMPOSITION TYPE, 2018-2032 (USD THOUSAND)

TABLE 29 SAUDI ARABIA HAND SANITIZE IN BODY CARE AND PERSONAL HYGIENE MARKET, BY FORM, 2018-2032 (USD THOUSAND)

TABLE 30 SAUDI ARABIA HAND SANITIZE IN BODY CARE AND PERSONAL HYGIENE MARKET, BY FRAGRANCE, 2018-2032 (USD THOUSAND)

TABLE 31 SAUDI ARABIA NAIL POLISH REMOVER IN BODY CARE AND PERSONAL HYGIENE MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 32 SAUDI ARABIA NAIL POLISH REMOVER IN BODY CARE AND PERSONAL HYGIENE MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 33 SAUDI ARABIA NAIL POLISH REMOVER IN BODY CARE AND PERSONAL HYGIENE MARKET, BY FORM, 2018-2032 (USD THOUSAND)

TABLE 34 SAUDI ARABIA BABY SHAMPOO IN BODY CARE AND PERSONAL HYGIENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 35 SAUDI ARABIA BABY SHAMPOO IN BODY CARE AND PERSONAL HYGIENE MARKET, BY AGE, 2018-2032 (USD THOUSAND)

TABLE 36 SAUDI ARABIA BABY SHAMPOO IN BODY CARE AND PERSONAL HYGIENE MARKET, BY NATURE, 2018-2032 (USD THOUSAND)

TABLE 37 SAUDI ARABIA BABY SHAMPOO IN BODY CARE AND PERSONAL HYGIENE MARKET, BY FRAGRANCE, 2018-2032 (USD THOUSAND)

TABLE 38 SAUDI ARABIA ALCOHOL ANTISEPTIC SPRAY IN BODY CARE AND PERSONAL HYGIENE MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 39 SAUDI ARABIA ALCOHOL ANTISEPTIC SPRAY IN BODY CARE AND PERSONAL HYGIENE MARKET, BY ALCOHOL CONCENTRATION, 2018-2032 (USD THOUSAND)

TABLE 40 SAUDI ARABIA ALCOHOL ANTISEPTIC SPRAY IN BODY CARE AND PERSONAL HYGIENE MARKET, BY SPRAY TYPE, 2018-2032 (USD THOUSAND)

TABLE 41 SAUDI ARABIA BODY CARE AND PERSONAL HYGIENE MARKET, BY PRICE RANGE, 2018-2032 (USD THOUSAND)

TABLE 42 SAUDI ARABIA BODY CARE AND PERSONAL HYGIENE MARKET, BY PACKAGING, 2018-2032 (USD THOUSAND)

TABLE 43 SAUDI ARABIA BODY CARE AND PERSONAL HYGIENE MARKET, BY TARGET CUSTOMER, 2018-2032 (USD THOUSAND)

TABLE 44 SAUDI ARABIA BODY CARE AND PERSONAL HYGIENE MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 45 SAUDI ARABIA NON-STORE BASED RETAILER IN BODY CARE AND PERSONAL HYGIENE MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 46 SAUDI ARABIA STORE BASED RETAILER IN BODY CARE AND PERSONAL HYGIENE MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 47 SAUDI ARABIA STORE BRAND STORES IN BODY CARE AND PERSONAL HYGIENE MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

List of Figure

FIGURE 1 SAUDI ARABIA BODY CARE AND PERSONAL HYGIENE MARKET

FIGURE 2 SAUDI ARABIA BODY CARE AND PERSONAL HYGIENE MARKET: DATA TRIANGULATION

FIGURE 3 SAUDI ARABIA BODY CARE AND PERSONAL HYGIENE MARKET: DROC ANALYSIS

FIGURE 4 SAUDI ARABIA BODY CARE AND PERSONAL HYGIENE MARKET: COUNTRY VS REGIONAL MARKET ANALYSIS

FIGURE 5 SAUDI ARABIA BODY CARE AND PERSONAL HYGIENE MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 SAUDI ARABIA BODY CARE AND PERSONAL HYGIENE MARKET: MULTIVARIATE MODELLING

FIGURE 7 SAUDI ARABIA BODY CARE AND PERSONAL HYGIENE MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 8 SAUDI ARABIA BODY CARE AND PERSONAL HYGIENE MARKET: DBMR MARKET POSITION GRID

FIGURE 9 SAUDI ARABIA BODY CARE AND PERSONAL HYGIENE MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 SAUDI ARABIA BODY CARE AND PERSONAL HYGIENE MARKET: SEGMENTATION

FIGURE 11 SAUDI ARABIA BODY CARE AND PERSONAL HYGIENE MARKET, EXECUTIVE SUMMARY

FIGURE 12 TWELVE SEGMENTS COMPRISE THE SAUDI ARABIA BODY CARE AND PERSONAL HYGIENE MARKET, BY PRODUCT

FIGURE 13 STRATEGIC DECISIONS

FIGURE 14 SURGE IN EPIDEMIC OR PANDEMIC OUTBREAKS OR DISEASES IS EXPECTED TO DRIVE THE SAUDI ARABIA BODY CARE AND PERSONAL HYGIENE MARKET IN THE FORECAST PERIOD

FIGURE 15 THE BODY SHAMPOO / WASH / SHOWER GEL SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE SAUDI ARABIA BODY CARE AND PERSONAL HYGIENE MARKET IN 2025 AND 2032

FIGURE 16 PORTER’S FIVE FORCES ANALYSIS

FIGURE 17 IMPORT EXPORT SCENARIO (USD THOUSAND)

FIGURE 18 SAUDI ARABIA BODY CARE AND PERSONAL HYGIENE MARKET, 2023-2032, AVERAGE SELLING PRICE (USD/UNIT)

FIGURE 19 SAUDI ARABIA BODY AND PERSONAL HYGIENE MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES

FIGURE 20 SAUDI ARABIA BODY CARE AND PERSONAL HYGIENE MARKET: BY PRODUCT, 2024

FIGURE 21 SAUDI ARABIA BODY CARE AND PERSONAL HYGIENE MARKET: BY PRICE RANGE, 2024

FIGURE 22 SAUDI ARABIA BODY CARE AND PERSONAL HYGIENE MARKET: BY PACKAGING, 2024

FIGURE 23 SAUDI ARABIA BODY CARE AND PERSONAL HYGIENE MARKET: BY TARGET CUSTOMER, 2024

FIGURE 24 SAUDI ARABIA BODY CARE AND PERSONAL HYGIENE MARKET: BY DISTRIBUTION CHANNEL, 2024

FIGURE 25 SAUDI ARABIA BODY CARE AND PERSONAL HYGIENE MARKET: COMPANY SHARE 2024 (%)

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.