North America Ultrasound Imaging Devices Market, By Array Format (Phased Array, Linear Array, Curved Linear Array, Others), Device Display (Color Ultrasound Devices, Black and White (B/W) Ultrasound Devices), Device Portability (Trolley/Cart-Based Ultrasound Devices, Compact/Handheld Ultrasound Devices, Stationary Ultrasound Devices, Point-of-Care Ultrasound Devices), Technology (Diagnostic Ultrasound, Therapeutic Ultrasound), Application (Radiology/General Imaging, Obstetrics and Gynecology, Cardiovascular, Gastroenterology, Vascular, Urological, Orthopedic and Musculoskeletal, Pain Management, Emergency Department, Critical Care, Others), End-User (Hospitals, Surgical Centers, Research and Academia, Maternity Centers, Ambulatory Care Centers, Diagnostic Centers, Others), Distribution Channel (Direct Tender, Third Party Distributors, Retail Sales) – Industry Trends and Forecast to 2030.

North America Ultrasound Imaging Devices Market Analysis and Size

Urological treatment procedures are gaining popularity all over the world. The increasing number of medical procedures involving the kidneys, ureters, bladder, urethra, prostate gland, and reproductive health have broadened the scope of ultrasound imaging instruments. Increasing the adoption of new technology in these medical systems would improve their efficiency in healthcare processes even more.

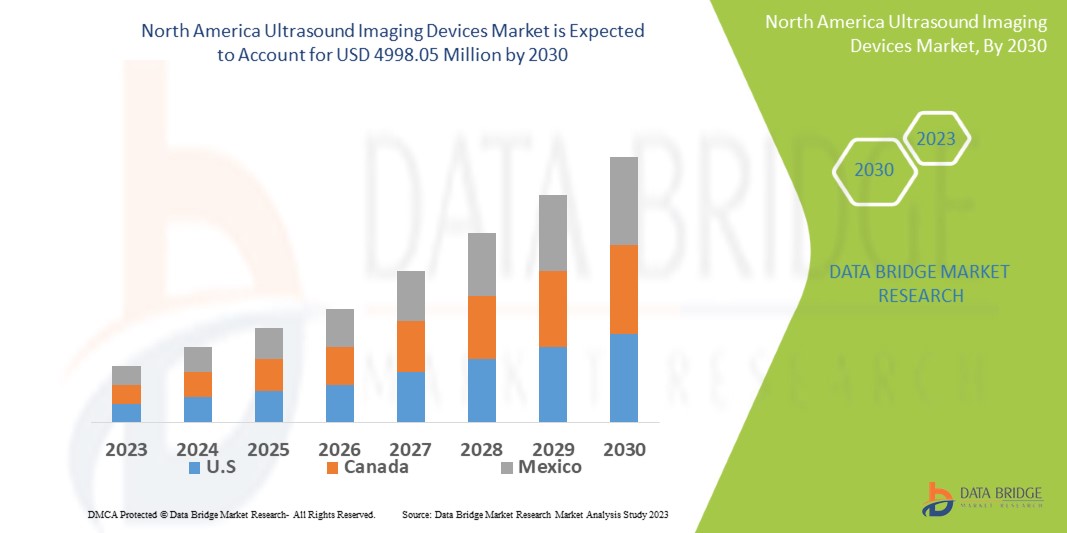

Data Bridge Market Research analyses that the ultrasound imaging devices market which was USD 3065.733 million in 2022, is expected to reach USD 4998.05 million by 2030, at a CAGR of 6.3% during the forecast period 2023 to 2030. In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework.

North America Ultrasound Imaging Devices Market Scope and Segmentation

|

Report Metric

|

Details

|

|

Forecast Period

|

2023 to 2030

|

|

Base Year

|

2022

|

|

Historic Years

|

2021 (Customizable to 2015 - 2020)

|

|

Quantitative Units

|

Revenue in USD Million, Volumes in Units, Pricing in USD

|

|

Segments Covered

|

Array Format (Phased Array, Linear Array, Curved Linear Array, Others), Device Display (Color Ultrasound Devices, Black and White (B/W) Ultrasound Devices), Device Portability (Trolley/Cart-Based Ultrasound Devices, Compact/Handheld Ultrasound Devices, Stationary Ultrasound Devices, Point-of-Care Ultrasound Devices), Technology (Diagnostic Ultrasound, Therapeutic Ultrasound), Application (Radiology/General Imaging, Obstetrics and Gynecology, Cardiovascular, Gastroenterology, Vascular, Urological, Orthopedic and Musculoskeletal, Pain Management, Emergency Department, Critical Care, Others), End User (Hospitals, Surgical Centers, Research and Academia, Maternity Centers, Ambulatory Care Centers, Diagnostic Centers, Others), Distribution Channel (Direct Tender, Third Party Distributors, Retail Sales)

|

|

Countries Covered

|

U.S., Canada and Mexico in North America

|

|

Market Players Covered

|

Koninklijke Philips N.V. (Netherlands), CANON MEDICAL SYSTEMS CORPORATION (Japan), Hitachi, Ltd. (Japan), Siemens (Germany), Shenzhen Mindray Bio-Medical Electronics Co., Ltd. (China), ALPINION MEDICAL SYSTEMS Co., Ltd (U.S.), CHISON Medical Technologies Co., Ltd. (U.S.), EDAN Instruments, Inc. (China), ESAOTE SPA (Italy), FUJIFILM Corporation (Japan), FUKUDA DENSHI (Japan), Hologic, Inc. (U.S.), SAMSUNG HEALTHCARE (U.S.), Analogic Corporation (U.S.), General Electric (U.S.), TOSHIBA CORPORATION (Japan), Trivitron Healthcare (India)

|

|

Market Opportunities

|

|

Market Definition

Ultrasound imaging devices generate images of the inside of the body by using high-frequency sound waves. The ultrasound system employs ultrasonic imaging technology. Ultrasound equipment can produce real-time images of biological components that show how the body moves. An ultrasound system consists of a transducer and an ultrasonic detector, or probe.

North America Ultrasound Imaging Devices Market Dynamics

Drivers

- Rising prevalence of chronic diseases

One of the key market drivers is the rising prevalence of chronic diseases. According to an American Cancer Society report published in January 2022, approximately 19,880 women are expected to be diagnosed with ovarian cancer in 2022. It also stated that ovarian cancer is the fifth leading cause of death in women, accounting for more deaths than any other cancer of the female reproductive system. Furthermore, it was reported that a woman's lifetime risk of developing ovarian cancer is about 1 in 78, and her lifetime risk of dying from ovarian cancer is about 1 in 108. According to the same source, cancer primarily affects older women. Approximately half of the women are diagnosed with ovarian cancer. Therefore, such instances are anticipated to propel the market's growth during the forecast period.

- Rising usage of ultrasound devices

The prevalence of chronic diseases is expected to rise, resulting in an increase in patients requiring improved diagnostic and therapeutic options. Emerging markets would be the most affected, as population growth in developing countries is expected to be rapid, resulting in increased healthcare spending. Advances in disease detection and diagnosis will also help to keep the cost of treating chronic illnesses under control. According to the World Health Organization, global chronic illness prevalence is expected to rise by 57% by 2020, with obesity rates and disease incidences such as diabetes on the rise, driving the need for ultrasound devices to identify patients. Using ultrasound technologies to diagnose patients earlier contributes to lower overall healthcare costs. The use of ultrasound devices is expected to increase as the number of patients with chronic conditions rise, fuelling the market's expansion.

- Demand for ultrasound imaging devices

With rising demand for ultrasound imaging devices for minimally invasive diagnostic and therapeutic applications, as well as the introduction of more technologically advanced ultrasound equipment, demand for ultrasound imaging devices has increased over the previous year. Furthermore, government initiatives to raise awareness about the importance of early detection have increased demand for ultrasonic imaging instruments.

Opportunities

- New product launches

Product launches and partnership agreements between major players are expected to drive the market. For instance, Butterfly Network, announced in May 2022 that it had signed a contract with the Medical University of South Carolina (MUSC) to supply its point-of-care ultrasound devices and software to the organization, which includes its medical school, research facilities, and 14 hospitals. As a result of the above-mentioned factors, the growth of the market in the United States is expected to rise.

Restraints/Challenges

- High cost associated with R&D activities

High research and development costs, insufficient infrastructure facilities, uneven distribution of medical services, and a lack of awareness in developing countries are all likely to hamper the market growth. Furthermore, during the forecast period of 2023-2030. A lack of favourable reimbursement scenarios and technology penetration in developing economies, a decline in healthcare expenses in advanced countries, rising patent expiry, government pricing pressure, high cost of ultrasound devices, and a lack of suitable infrastructure in low and middle-income countries are expected to pose challenges to the market.

This ultrasound imaging devices market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the ultrasound imaging devices market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

COVID-19 Impact on Ultrasound Imaging Devices Market

The market reaction to COVID-19 has been minimal. Revenue has suffered as the rate of medical device production has slowed. Demand for ultrasound equipment decreased as the use of imaging systems decreased due to a decrease in the need for emergency treatment. The post-pandemic period, on the other hand, is expected to get the market back on track. COVID-19 is a fluid disease that can harm a variety of tissues and organs as it progresses. Due to the disease's impact on all phases and organs, a practical and adaptable imaging system that can dynamically identify specifics or anomalies is required. Ultrasonography meets all of these criteria and has several advantages over other imaging modalities, including portability and affordability. Ultrasonography played a crucial role in the COVID-19 outbreak in terms of triage, monitoring, spotting organ damage, and enabling patients to choose their own personalised treatment plans. The main pathogenic effects of COVID-19-induced changes in the liver, heart, and lungs' ultrasonography are the subject of this review.

Recent Development

- In 2020, Hitachi, Ltd. began international sales of the ARIETTA 750, a new model in the ARIETTA diagnostic ultrasound platform series. With this new launch, Hitachi, Ltd. expanded its product portfolio and market demand, resulting in increased revenue in the future.

- In 2020, Samsung Madison announced its flagship RS 85 Prestige ultrasound diagnostic system at the Radiological Society of North America (RSNA), which will be used to increase the company's standing in the global marketplace.

North America Ultrasound Imaging Devices Market Scope

The ultrasound imaging devices market is segmented on the basis of array format, technology, device display, device portability, application, end-user and distribution channel. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Array Format

- Phased Array

- Linear Array

- Curved Linear Array

- Others

Technology

- Diagnostic Ultrasound Systems

- 2D Imaging Systems

- 3D and 4D Imaging Systems

- Doppler Imaging

- Therapeutic Ultrasound Systems

- High-Intensity Focused Ultrasound (HIFU)

- Extracorporeal Shockwave Lithotripsy (ESWL)

Device Display

- Colour Ultrasound Devices

- Black and White (B/W) Ultrasound Devices

Device Portability

- Trolley/Cart-Based Ultrasound Devices

- Compact/Handheld Ultrasound Devices

Application

- Radiology/General Imaging

- Cardiology

- Obstetrics/Gynecology

- Vascular

- Urology

- Others

End-user

- Hospitals

- Surgical Centers

- Research and Academia

- Maternity Centers

- Ambulatory Care Centers

- Diagnostic Centers

- Others

Distribution channel

- Direct Tender

- Third Party Distributors

- Retail Sales

Ultrasound Imaging Devices Market Regional Analysis/Insights

The ultrasound imaging devices market is analyzed and market size insights and trends are provided by country, array format, technology, device display, device portability, application, end-user and distribution channel as referenced above.

The countries covered in the ultrasound imaging devices market report are U.S., Canada and Mexico in North America.

U.S. is expected to dominate the market due to the high adoption of ultrasound imaging devices, high technology adoption and well-established healthcare infrastructure The country's well-equipped hospitals provide a variety of diagnostic and therapeutic ultrasound services to patients.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Healthcare Infrastructure Growth Installed base and New Technology Penetration

The ultrasound imaging devices market also provides you with detailed market analysis for every country growth in healthcare expenditure for capital equipment, installed base of different kind of products for ultrasound imaging devices market, impact of technology using life line curves and changes in healthcare regulatory scenarios and their impact on the ultrasound imaging devices market. The data is available for historic period 2011-2021.

Competitive Landscape and Ultrasound Imaging Devices Market Share Analysis

The ultrasound imaging devices market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to ultrasound imaging devices market.

Some of the major players operating in the ultrasound imaging devices market are:

- Koninklijke Philips N.V. (Netherlands)

- CANON MEDICAL SYSTEMS CORPORATION (Japan)

- Hitachi, Ltd. (Japan)

- Siemens (Germany)

- Shenzhen Mindray Bio-Medical Electronics Co., Ltd. (China)

- ALPINION MEDICAL SYSTEMS Co., Ltd (U.S.)

- CHISON Medical Technologies Co., Ltd. (U.S.)

- EDAN Instruments, Inc. (China)

- ESAOTE SPA (Italy)

- FUJIFILM Corporation (Japan)

- FUKUDA DENSHI (Japan)

- Hologic, Inc. (U.S.)

- SAMSUNG HEALTHCARE (U.S.)

- Analogic Corporation (U.S.)

- General Electric (U.S.)

- TOSHIBA CORPORATION (Japan)

- Trivitron Healthcare (India)

SKU-