North America Transplant Diagnostics Market Analysis and Insights

Transplant diagnosis is a diagnostic procedure usually divided into pre-transplant and post-transplant procedures. It helps to analyze the health status of the patient. If this is avoided, the immunocompromised person is at risk of developing HAI or worse, which can lead to death. The procedure is a harmonious collaboration between healthcare professionals and laboratory experts, ensuring better patient outcomes. In addition, close matching of donor and recipient HLA markers is important. This increases the likelihood of graft survival and minimizes serious complications of immunological transplantation. The increased prevalence of chronic illnesses among the worldwide population is likely to drive market expansion throughout the forecast years. Furthermore, the increasing use of stem cell therapy and personalized medications is gaining popularity. The use of new diagnostic techniques has improved the medical outcomes of organ transplants. The rate of organ rejection can be reduced by matching the compatibility of the donor and recipient before transplantation.

However, the high cost of procedures associated with PCR and NGS diagnostic instruments is one of the most significant. As a result, market growth may be hampered in the long run. The cost of medical equipment is one element that may challenge critical transplant diagnosis device vendors.

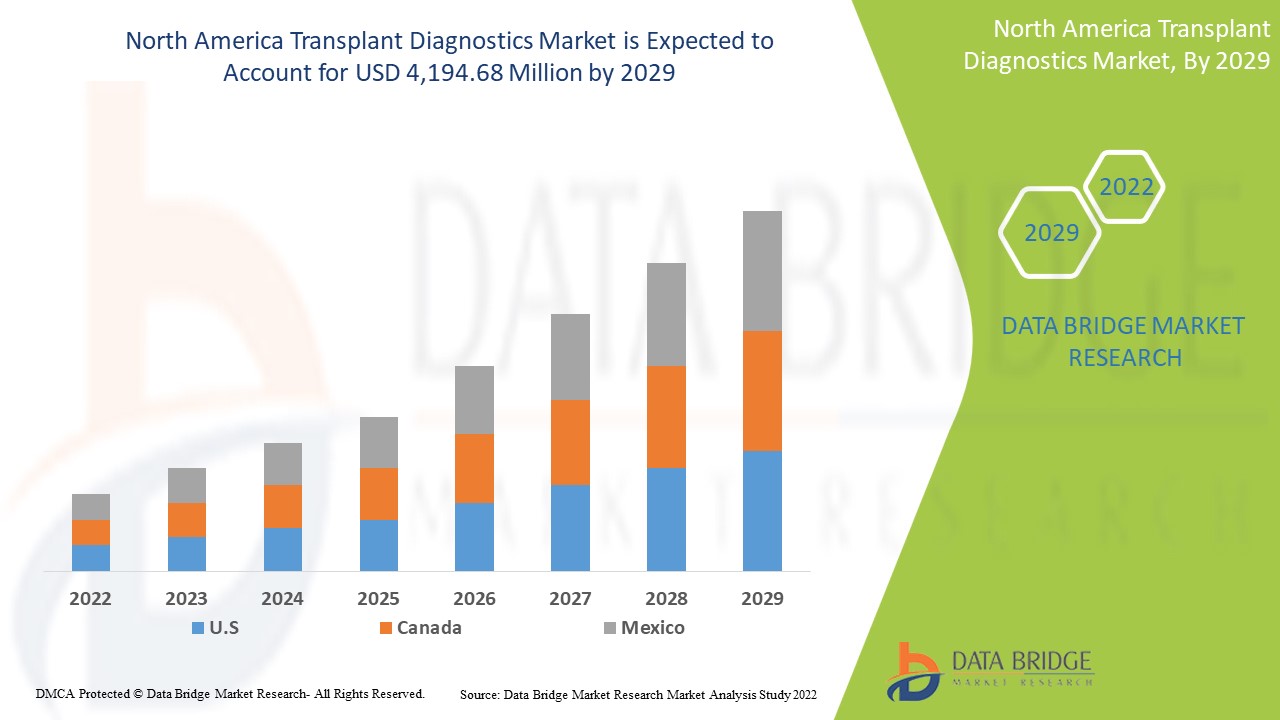

Data Bridge Market Research analyzes that the North America transplant diagnostics market is expected to reach a value of USD 4,194.68 million by 2029, at a CAGR of 6.9% during the forecast period. This market report also covers pricing analysis, patent analysis, and technological advancements in depth.

|

Report Metric |

Details |

|

Forecast Period |

2022 to 2029 |

|

Base Year |

2021 |

|

Historic Years |

2020 (Customizable to 2019-2014) |

|

Quantitative Units |

Revenue in USD Million, Pricing in USD |

|

Segments Covered |

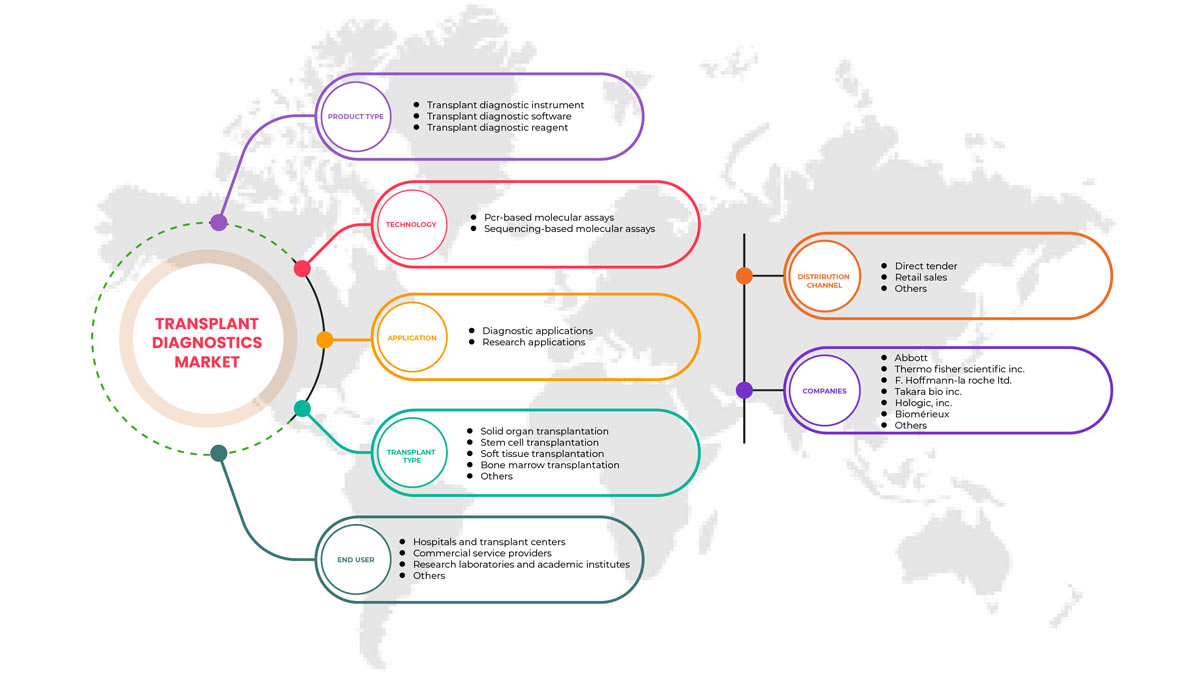

By Product Type (Transplant Diagnostic Instrument, Transplant Diagnostic Software, Transplant Diagnostic Reagent), Technology (PCR-Based Molecular Assays, Sequencing-Based Molecular Assays), Transplant Type (Solid Organ Transplantation, Stem Cell Transplantation, Soft Tissue Transplantation, Bone Marrow Transplantation, Other), Application (Diagnostic Applications, Research Applications), End User (Research Laboratories and Academic Institutes, Hospital and Transplant Centers, Commercial Service Providers, Others), Distribution Channel (Direct Tender, Retail Sales and Others) |

|

Countries Covered |

U.S., Canada, and Mexico |

|

Market Players Covered |

Hologic, Inc., Biofortuna Limited, Takara Bio Inc., Abbott, Diagnóstica Longwood SL, Adaptive Biotechnologies, NanoString, Arquer Diagnostics Ltd, altona Diagnostics GmbH, ELITechGroup, DiaSorin S.p.A., Horiba Ltd, EUROFINS VIRACOR, CareDx Inc., Laboratory Corporation of America Holdings., Randox Laboratories Ltd., Thermo Fisher Scientific Inc., Preservation Solutions, Inc., TransMedics, Transonic, Stryker, Bio-Rad Laboratories, Inc., Zimmer Biomet, QIAGEN, F. Hoffmann-La Roche Ltd, BIOMÉRIEUX, Illumina, Inc., Luminex Corporation (A subsidiary of DiaSorin Company), IMMUCOR, among others |

Market Definition

Transplant diagnostics are the immunogenetics and histocompatibility of organ and hematopoietic stem cell transplantations. These diagnostics help healthcare professionals determine compatibility between potential recipients and organ donors. These are used in various disciplines, such as immunogenetics, pathology, and infectious diseases, among others. Transplant diagnostics are used to determine whether the donor and the recipient of the organ are compatible before or after the transplant. With the introduction of transplant diagnostics, the prevalence of diseases that can cause organ failure, including both pre-and post-transplant screening, is expected to explode. The market has attracted the interest of healthcare professionals due to the many advantages these tests offer to verify suitability for a transplant procedure. Organ transplantation is one of the most popular treatment options for many end-stage renal disease patients on continuous dialysis.

In addition, it is possible to investigate organ transplantation for cases involving the heart, liver, or bone marrow. Although in many cases, there is a strong association between renal failure and liver transplantation, including end-stage renal disease. New transcriptomic, proteomic, and genomic indicators in molecular diagnostics can help to better tailor transplant therapy and early detection of rejection events. Also, strategic initiatives by market players, technological progressions in transplant diagnostics, high sterility assurance, and increasing investment in healthcare infrastructure increase the demand for transplant diagnostics.

North America Transplant Diagnostics Market Dynamics

This section deals with understanding the market drivers, advantages, opportunities, restraints, and challenges. All of this is discussed in detail below:

Drivers

- Rising number of transplant procedures

The demand for organ transplantation has rapidly increased worldwide during the past decade due to the increased incidence of vital organ failure and improved post-transplant outcomes. Demand for kidney, heart, liver and lungs transplant is very high. Alcohol consumption, lack of exercise and drug abuse are leading causes of organ failure. The number of living donor transplants has been affected by the COVID-19 pandemic. But living donor transplants have increased by 14.2 percent over 2020.

- In addition, organ transplantation improves patient survival and quality of life and has a major positive impact on public health and the socioeconomic burden of organ failure. The European Union (EU) has a relatively uniform and structured approach to organ transplantation, well-developed national programs, international systems to facilitate organ sharing and well-defined exchange policies, making Europe a leader in this field.

Thus, the increasing number of transplant procedures across the globe and the increase in successful transplantations is expected to boost the North America transplant diagnostics market.

- Increase in the technological advancements in the field of transplants

New technologies are rapidly changing traditional approaches to organ transplantation. The main challenges in organ transplantation are how best to identify and, if possible, eliminate the need for lifelong immunosuppression and how to expand the pool of donors suitable for human transplantation. Researchers have developed an advanced system where transport time can be extended by tricking donor organs into thinking they are still inside the body. This system keeps oxygenated blood flowing through the organs to delay tissue death. A normothermic perfusion machine mimics the human body, ensuring constant blood flow to the organ. The machine can also deliver drugs or other nutrients to keep the liver in optimal condition before the transplant.

In addition, bio-artificial organ production techniques are a range of enabling techniques that can be used to produce human organs based on bionic principles. Over the past ten years, significant progress has been made in developing various organ manufacturing technologies. The past decade has seen tremendous advances in new technologies such as single-cell RNA sequencing, Nano biotechnology and CRISPR-Cas9 gene editing. However, creative applications of such new and powerful technologies to improve clinical transplantation have only begun. With such tools, there are now good opportunities to make major breakthroughs in defining and providing optimized and individualized care for all organ transplants.

Restraint

- High cost of organ transplantation

Organ transplantation therapy employs highly technologically advanced products. The development of these products involves rigorous research and development by the developing players. Thus, the procedures and product cost remains high, which proportionally increases the cost of testing. Also, organ transplants are expensive because they are incredibly resource-intensive and involve high-paid doctors, transportation and expensive medications.

- In addition, desensitizing therapies have also been used to achieve transplantation from an incompatible donor. However, such procedures are very expensive and may be associated with complications and worse long-term outcomes.

Thus, the high cost of transplantation and treatment using advanced modalities and technology products will act as a major restraining factor for the growth of the North America transplant diagnostics market.

Opportunity

-

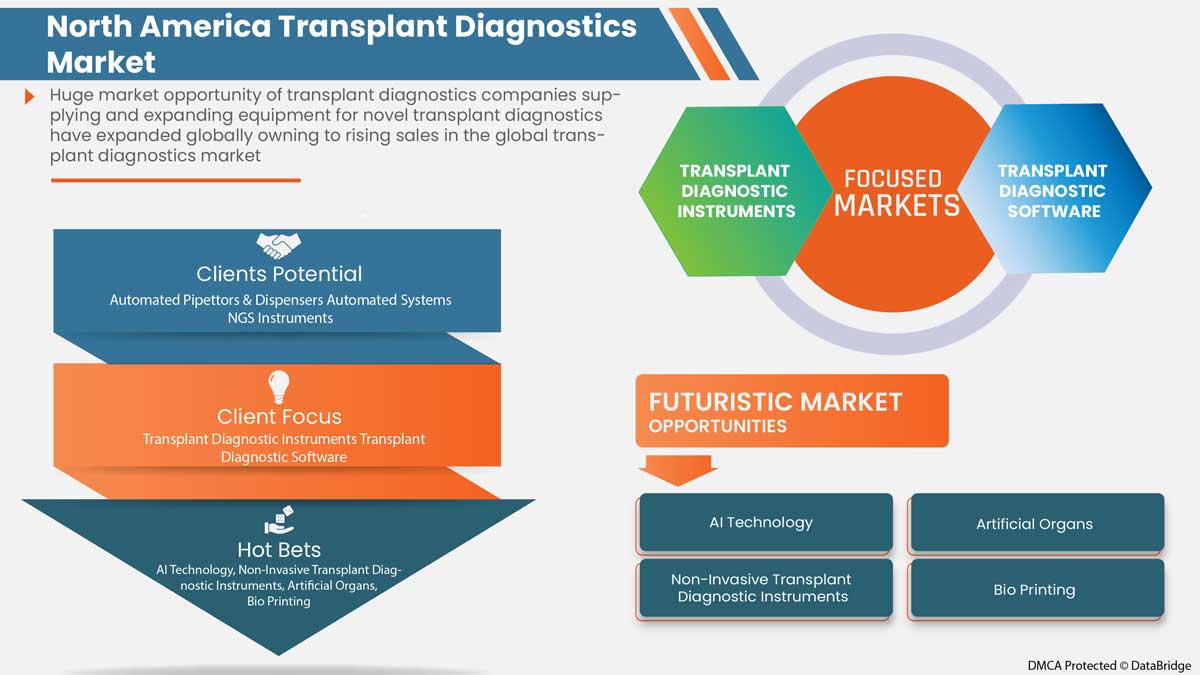

Strategic initiatives by market players

The rise in the North America transplant diagnostics market increases the need for strategic business ideas. It includes a partnership, business expansion and other development. The surge in demand for a donor organs is significantly increasing the demand for transplant diagnostic kits. The planned strategies allow the market players to align with the organization's functional activities to achieve set goals. It guides the company's discussions and decision-making in determining resource and budget requirements to accomplish objectives, thus increasing operational efficiency.

These strategic initiatives, such as product launches, agreements and business expansion by the major market players, will boost the market growth and are expected to act as an opportunity for the North America transplant diagnostics market. The strategic initiatives are expected to aid in growth and improve the company's product portfolio, ultimately leading to more revenue generation. Hence, these strategic initiatives by the market players may be expected to as an opportunity that helps them to drive the North America transplant diagnostics market.

Challenge

- Ethical challenges faced during organ transplantation

The surge in the incidence of failure of vital organs and inadequate supply of organs has created a wide gap between organ supply and organ demand. The issue has resulted in long approval times to receive an organ and a rise in deaths. The events, which occurred in the previous years and continue in the present, have raised many ethical, moral and societal issues regarding supply, the methods of organ allocation and the use of living donors as volunteers, including minors.

Lack of accuracy in reporting, the donated organs can't be supplied and procedures that neither relieve suffering nor prolong life are rapidly identified.

Issues such as lack of organ procurement, religious acceptance, brain death and misconceptions related to organ donation and transplantation are still present on many ethical personal and community levels, even within the medical community. The various aspects of ethical, cultural and religious nature should not be a barrier to the act of organ donation and transplantation all of these are issues to be solved. Therefore, ethical challenges faced during organ transplantation are expected to challenge market growth.

Post-COVID-19 Impact on North America Transplant Diagnostics Market

North America transplant diagnostics market has been badly affected by COVID-19. Hospital admissions were limited to non-essential treatment, and clinics were temporarily closed during the pandemic. The implementation of social distancing, blocking the population, and limited access to clinics has greatly affected the market. The slowdown in patient flows and referrals also affected the market growth. However, the market will continue to grow in the post-pandemic period due to the relaxation of previously imposed restrictions.

Manufacturers are making various strategic decisions to bounce back post-COVID-19. The players are conducting multiple R&D activities, product launches, and strategic partnerships to improve the technology and test results in the North America transplant diagnostics market.

Recent Developments

- In July 2022, Horiba Medical launched a brand new product in its Yumizen Hematology Category. The product has new and advanced characteristics to satisfy the needs of various clinical as well as laboratory requirements. This has helped the company to diversify its product offerings

- In January 2022, Hoffmann-La Roche Ltd introduced Cobas Infinity edge, a cloud-based point-of-care platform accessible. With its advanced technology, healthcare practitioners can handle patient data. This has helped the company to diversify their product line

North America Transplant Diagnostics Market Scope

North America transplant diagnostics market is segmented into product type, technology, transplant type, application, end user, and distribution channel. The growth among segments helps you analyze niche pockets of growth and strategies to approach the market and determine your core application areas and the difference in your target markets.

Product Type

- Transplant Diagnostic Instrument

- Transplant Diagnostic Software

- Transplant Diagnostic Reagent

On the basis of product type, the North America transplant diagnostics market is segmented into transplant diagnostic instrument, transplant diagnostic software, transplant diagnostic reagent.

Technology

- PCR-Based Molecular Assays

- Sequencing-Based Molecular Assays

On the basis of technology, the North America transplant diagnostics market is segmented into PCR-based molecular assays, and sequencing-based molecular assays.

Transplant Type

- Solid Organ Transplantation

- Stem Cell Transplantation

- Soft Tissue Transplantation

- Bone Marrow Transplantation

- Other Transplants

On the basis of transplant type, the North America transplant diagnostics market is segmented into solid organ transplantation, stem cell transplantation, soft tissue transplantation, bone marrow transplantation, and other transplants.

Application

- Diagnostic Applications

- Research Applications

On the basis of application, the North America transplant diagnostics market is segmented into diagnostic applications and research applications.

End User

- Research Laboratories and Academic Institutes

- Hospitals and Transplant Centers

- Commercial Service Providers

- Others

On the basis of end user, the North America transplant diagnostics market is segmented into research laboratories and academic institutes, hospitals and transplant centers, commercial service providers, and others.

Distribution Channel

- Direct Tender

- Retail Sales

- Others

On the basis of distribution channel, the North America transplant diagnostics market is segmented into direct tender, retail sales, and others.

North America Transplant Diagnostics Market Regional Analysis/Insights

North America transplant diagnostics market is analyzed, and market size information is provided by country, product type, technology, transplant type, application, end user, and distribution channel.

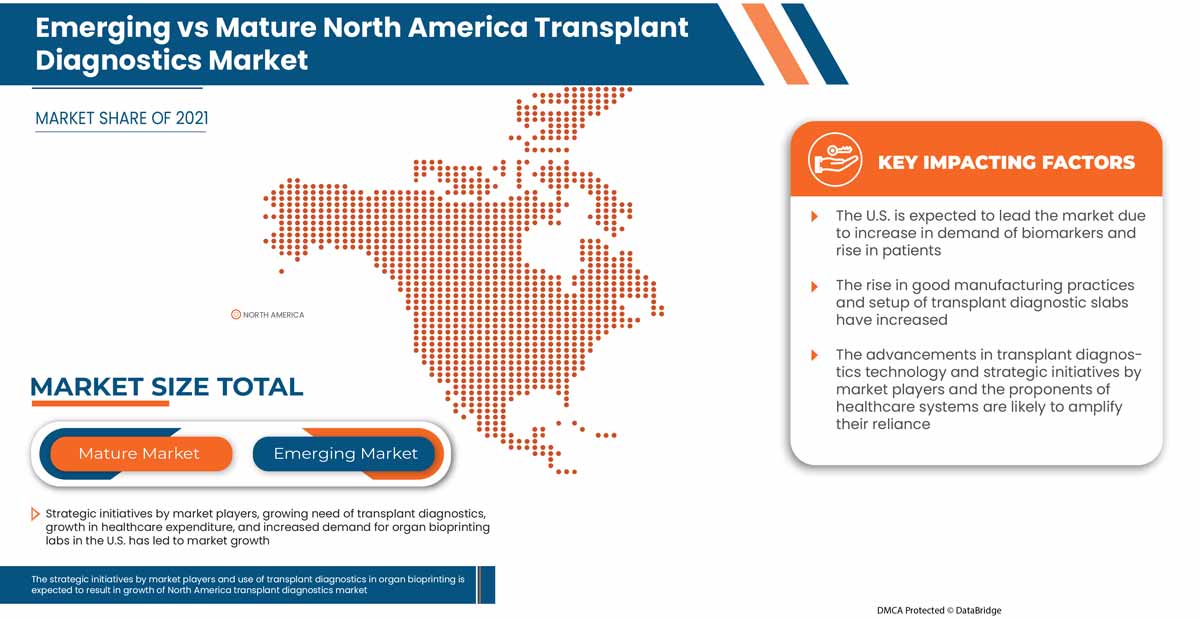

Some countries covered in the North America transplant diagnostics market are the U.S., Canada, and Mexico.

The U.S. is expected to dominate the North America transplant diagnostics market due to the presence of key market players in the largest consumer market with high GDP.

The country section of the report also provides individual market-impacting factors and domestic regulation changes that impact the market's current and future trends. Data points such as new sales, replacement sales, country demographics, regulatory acts, and import-export tariffs are some of the major pointers used to forecast the market scenario for individual countries. Also, the presence and availability of North American brands and their challenges faced due to large or scarce competition from local and domestic brands and the impact of sales channels are considered while providing forecast analysis of the country data.

Competitive Landscape and North America Transplant Diagnostics Market Share Analysis

North America transplant diagnostics market competitive landscape provides details by the competitor. Details included are company overview, company financials, revenue generated, market potential, investment in R&D, new market initiatives, production sites and facilities, company strengths and weaknesses, product launch, product trials pipelines, product approvals, patents, product width and breath, application dominance, technology lifeline curve. The above data points provided are only related to the company's focus on the North America transplant diagnostics market.

Some of the major players operating in the North America transplant diagnostics market are Hologic, Inc., Biofortuna Limited, Takara Bio Inc., Abbott, Diagnóstica Longwood SL, Adaptive Biotechnologies, NanoString, Arquer Diagnostics Ltd, altona Diagnostics GmbH, ELITechGroup, DiaSorin S.p.A., Horiba Ltd, EUROFINS VIRACOR, CareDx Inc., Laboratory Corporation of America Holdings., Randox Laboratories Ltd., Thermo Fisher Scientific Inc., Preservation Solutions, Inc., TransMedics, Transonic, Stryker, Bio-Rad Laboratories, Inc., Zimmer Biomet, QIAGEN, F. Hoffmann-La Roche Ltd, BIOMÉRIEUX, Illumina, Inc., Luminex Corporation (A subsidiary of DiaSorin Company), IMMUCOR, among others.

Research Methodology: North America Transplant Diagnostics Market

Data collection and base year analysis are done using data collection modules with large sample sizes. The market data is analyzed and estimated using market statistical and coherent models. In addition, market share analysis and key trend analysis are the major success factors in the market report. The key research methodology used by the DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market, and primary (industry expert) validation. Apart from this, data models include a Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Company Market Share Analysis, Standards of Measurement, North America vs Regional, and Vendor Share Analysis. Please request an analyst call in case of further inquiry.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE NORTH AMERICA TRANSPLANT DIAGNOSTICS MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 MULTIVARIATE MODELLING

2.7 MARKET APPLICATION COVERAGE GRID

2.8 SOURCE LIFELINE CURVE

2.9 DBMR MARKET POSITION GRID

2.1 VENDOR SHARE ANALYSIS

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

3.1 EPIDEMOLOGY

3.2 PESTEL_ANALYSIS

3.3 PORTER'S FIVE FORCE

3.4 TECHNOLOGICAL INNOVATIONS

4 NORTH AMERICA TRANSPLANT DIAGNOSTICS MARKET: REGULATIONS

5 KEY STRATEGIC INITIATIVES

6 INDUSTRIAL INSIGHTS:

7 MARKET OVERVIEW

7.1 DRIVERS

7.1.1 RISING NUMBER OF TRANSPLANT PROCEDURES

7.1.2 INCREASE IN THE TECHNOLOGICAL ADVANCEMENTS IN THE FIELD OF TRANSPLANTS

7.1.3 RISING HEALTHCARE SPENDING

7.1.4 ADOPTION OF CROSS-MATCHING AND CHIMERISM TESTING DURING PRE- AND POST-TRANSPLANTATION

7.2 RESTRAINTS

7.2.1 HIGH COST OF ORGAN TRANSPLANTATION

7.2.2 THE RISKS AND DIFFICULTIES OF ORGAN TRANSPLANTATION

7.3 OPPORTUNITIES

7.3.1 STRATEGIC INITIATIVES BY MARKET PLAYERS

7.3.2 RISE IN PUBLIC, PRIVATE, AND GOVERNMENT FUNDING FOR ORGAN TRANSPLANTATION

7.3.3 SURGE IN AWARENESS ABOUT THE IMPORTANCE OF ORGAN TRANSPLANTATION

7.4 CHALLENGES

7.4.1 ETHICAL CHALLENGES FACED DURING ORGAN TRANSPLANTATION

7.4.2 LACK OF ORGAN DONORS OR GAP BETWEEN ORGAN DONORS AND ORGANS NEEDED ANNUALLY

8 NORTH AMERICA TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE

8.1 OVERVIEW

8.2 TRANSPLANT DIAGNOSTIC INSTRUMENTS

8.2.1 AUTOMATED PIPETTORS & DISPENSERS

8.2.2 AUTOMATED SYSTEMS

8.2.2.1 NUCLEIC ACID EXTRACTION SYSTEM

8.2.2.2 PCR SETUP

8.2.2.3 OTHERS

8.2.3 NGS INSTRUMENTS

8.2.4 READERS & ANALYZERS

8.2.5 TRANSPLANT DIAGNOSTIC KITS

8.2.5.1 ASPERGILLUS SPP KITS

8.2.5.2 P. JIROVECII KITS

8.2.5.3 CMV KITS

8.2.5.4 EBV KITS

8.2.5.5 BKV KITS

8.2.5.6 VZV KITS

8.2.5.7 HSV1 KITS

8.2.5.8 HSV2 KITS

8.2.5.9 PARVOVIRUS B19 KITS

8.2.5.10 ADENOVIRUS KITS

8.2.5.11 ENTEROVIRUS KITS

8.2.5.12 JCV KITS

8.2.5.13 HHV6 KITS

8.2.5.14 HHV7 KITS

8.2.5.15 HHV8 KITS

8.2.5.16 TOXOPLASMA GONDII KITS

8.2.5.17 HEPATITIS E KITS

8.2.5.18 OTHER KITS

8.2.6 OTHER KITS

8.3 TRANSPLANT DIAGNOSTIC SOFTWARE’S

8.3.1 DNA SOFTWARE

8.3.2 NGS SOFTWARE

8.3.3 DATA MANAGEMENT SOFTWARE

8.3.4 OTHER SOFTWARE’S

8.4 TRANSPLANT DIAGNOSTIC REAGENTS

8.4.1 MONOCLONAL ANTIBODIES

8.4.2 CYTOTOXIC CONTROLS

8.4.3 HUMAN SERUM

8.4.4 OTHER REAGENTS

9 NORTH AMERICA TRANSPLANT DIAGNOSTICS MARKET, BY TECHNOLOGY

9.1 OVERVIEW

9.2 PCR-BASED MOLECULAR ASSAYS

9.2.1 REAL TIME PCR

9.2.2 SEQUENCE-SPECIFIC PRIMER-PCR

9.2.3 SEQUENCE-SPECIFIC OLIGONUCLEOTIDE-PCR

9.2.4 RESTRICTION FRAGMENT LENGTH POLYMORPHISM (RFLP)

9.2.5 OTHER-PCR BASED MOLECULAR ASSAYS

9.3 SEQUENCING-BASED MOLECULAR ASSAYS

9.3.1 SANGER SEQUENCING

9.3.2 NEXT GENERATION SEQUENCING

9.3.3 OTHER SEQUENCING-BASED MOLECULAR ASSAYS.

10 NORTH AMERICA TRANSPLANT DIAGNOSTICS MARKET, BY TRANSPLANT TYPE

10.1 OVERVIEW

10.2 SOLID ORGAN TRANSPLANTATION

10.2.1 KIDNEY TRANSPLANTATION

10.2.2 LIVER TRANSPLANTATION

10.2.3 HEART TRANSPLANTATION

10.2.4 LUNG TRANSPLANTATION

10.2.5 PANCREAS TRANSPLANTATION

10.2.6 OTHER ORGAN TRANSPLANTATIONS

10.3 STEM CELL TRANSPLANTATION

10.3.1 BONE MARROW TRANSPLANT (BMT)

10.3.2 PERIPHERAL BLOOD STEM CELL TRANSPLANT

10.3.3 CORD BLOOD TRANSPLANT

10.3.4 OTHER STEM CELL TRANSPLANTS

10.4 SOFT TISSUE TRANSPLANTATION

10.4.1 SKIN GRAFT

10.4.2 CARTILAGE TRANSPLANTATION

10.4.3 ADRENAL AUTOGRAFTING

10.4.4 OTHER SOFT TISSUE TRANSPLANTATION.

10.5 BONE MARROW TRANSPLANTATION

10.5.1 AUTOLOGOUS BONE MARROW TRANSPLANT

10.5.2 ALLOGENEIC BONE MARROW TRANSPLANT

10.5.3 UMBILICAL CORD BLOOD TRANSPLANT.

10.6 OTHERS

11 NORTH AMERICA TRANSPLANT DIAGNOSTICS MARKET, BY APPLICATION

11.1 OVERVIEW

11.2 DIAGNOSTIC APPLICATIONS

11.2.1 TRANSPLANT DIAGNOSTIC INSTRUMENT

11.2.1.1 AUTOMATED PIPETTORS & DISPENSERS

11.2.1.2 AUTOMATED SYSTEMS

11.2.1.3 NGS INSTRUMENTS

11.2.1.4 READERS & ANALYZERS

11.2.1.5 TRANSPLANT DIAGNOSTIC KITS

11.2.1.6 OTHERS

11.2.2 TRANSPLANT DIAGNOSTIC SOFTWARE

11.2.2.1 DNA SOFTWARE

11.2.2.2 NGS SOFTWARE

11.2.2.3 DATA MANAGEMENT SOFTWARE

11.2.2.4 OTHER SOFTWARES

11.2.3 TRANSPLANT DIAGNOSTIC REAGENT

11.2.3.1 MONOCLONAL ANTIBODIES

11.2.3.2 CYTOTOXIC CONTROLS

11.2.3.3 HUMAN SERUM

11.2.3.4 OTHER REAGENTS

11.3 RESEARCH APPLICATIONS

11.3.1 TRANSPLANT DIAGNOSTIC INSTRUMENT

11.3.1.1 AUTOMATED PIPETTORS & DISPENSERS

11.3.1.2 AUTOMATED SYSTEMS

11.3.1.3 NGS INSTRUMENTS

11.3.1.4 READERS & ANALYZERS

11.3.1.5 TRANSPLANT DIAGNOSTIC KITS

11.3.1.6 OTHERS

11.3.2 TRANSPLANT DIAGNOSTIC SOFTWARE

11.3.2.1 DNA SOFTWARE

11.3.2.2 NGS SOFTWARE

11.3.2.3 DATA MANAGEMENT SOFTWARE

11.3.2.4 OTHER SOFTWARES

11.3.3 TRANSPLANT DIAGNOSTIC REAGENT

11.3.3.1 MONOCLONAL ANTIBODIES

11.3.3.2 CYTOTOXIC CONTROLS

11.3.3.3 HUMAN SERUM

11.3.3.4 OTHER REAGENTS

12 NORTH AMERICA TRANSPLANT DIAGNOSTICS MARKET, BY END USER

12.1 OVERVIEW

12.2 HOSPITALS AND TRANSPLANT CENTERS

12.3 COMMERCIAL SERVICE PROVIDERS

12.4 RESEARCH LABORATORIES AND ACADEMIC INSTITUTES

12.5 OTHERS

13 NORTH AMERICA TRANSPLANT DIAGNOSTICS MARKET, BY DISTRIBUTION CHANNEL

13.1 OVERVIEW

13.2 DIRECT TENDER

13.3 RETAIL SALES

13.4 OTHERS

14 NORTH AMERICA TRANSPLANT DIAGNOSTICS MARKET, BY REGION

14.1 NORTH AMERICA

14.1.1 U.S.

14.1.2 CANADA

14.1.3 MEXICO

15 NORTH AMERICA TRANSPLANT DIAGNOSTICS MARKET: COMPANY LANDSCAPE

15.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

16 SWOT ANALYSIS

17 COMPANY PROFILE

17.1 ABBOTT

17.1.1 COMPANY SNAPSHOT

17.1.2 REVENUE ANALYSIS

17.1.3 COMPANY SHARE ANALYSIS

17.1.4 PRODUCT PORTFOLIO

17.1.5 RECENT DEVELOPMENTS

17.2 THERMO FISHER SCIENTIFIC INC.

17.2.1 COMPANY SNAPSHOT

17.2.2 REVENUE ANALYSIS

17.2.3 COMPANY SHARE ANALYSIS

17.2.4 PRODUCT PORTFOLIO

17.2.5 RECENT DEVELOPMENTS

17.3 F. HOFFMANN LA ROCHE LTD

17.3.1 COMPANY SNAPSHOT

17.3.2 REVENUE ANALYSIS

17.3.3 COMPANY SHARE ANALYSIS

17.3.4 PRODUCT PORTFOLIO

17.3.5 RECENT DEVELOPMENT

17.4 TAKARA BIO INC.

17.4.1 COMPANY SNAPSHOT

17.4.2 REVENUE ANALYSIS

17.4.3 COMPANY SHARE ANALYSIS

17.4.4 PRODUCT PORTFOLIO

17.4.5 RECENT DEVELOPMENTS

17.5 HOLOGIC, INC

17.5.1 COMPANY SNAPSHOT

17.5.2 REVENUE ANALYSIS

17.5.3 COMPANY SHARE ANALYSIS

17.5.4 PRODUCT PORTFOLIO

17.5.5 RECENT DEVELOPMENTS

17.6 ADAPTIVE BIOTECHNOLOGIES

17.6.1 COMPANY SNAPSHOT

17.6.2 REVENUE ANALYSIS

17.6.3 PRODUCT PORTFOLIO

17.6.4 RECENT DEVELOPMENT

17.7 ALTONA DIAGNOSTICS

17.7.1 COMPANY SNAPSHOT

17.7.2 PRODUCT PORTFOLIO

17.7.3 RECENT DEVELOPMENTS

17.8 ARQUER DIAGNOSTICS LTD

17.8.1 COMPANY SNAPSHOT

17.8.2 PRODUCT PORTFOLIO

17.8.3 RECENT DEVELOPMENTS

17.9 BAG DIAGNOSTICS GMBH

17.9.1 COMPANY SNAPSHOT

17.9.2 PRODUCT PORTFOLIO

17.9.3 RECENT DEVELOPMENTS

17.1 BIOFORTUNA LIMITED

17.10.1 COMPANY SNAPSHOT

17.10.2 PRODUCT PORTFOLIO

17.10.3 RECENT DEVELOPMENT

17.11 BIOMÉRIEUX

17.11.1 COMPANY SNAPSHOT

17.11.2 REVENUE ANALYSIS

17.11.3 PRODUCT PORTFOLIO

17.11.4 RECENT DEVELOPMENTS

17.12 BIO-RAD LABORATORIES, INC.

17.12.1 COMPANY SNAPSHOT

17.12.2 REVENUE ANALYSIS

17.12.3 PRODUCT PORTFOLIO

17.12.4 RECENT DEVELOPMENT

17.13 BIOTYPE GMBH

17.13.1 COMPANY SNAPSHOT

17.13.2 PRODUCT PORTFOLIO

17.13.3 RECENT DEVELOPMENTS

17.14 CAREDX INC.

17.14.1 COMPANY SNAPSHOT

17.14.2 REVENUE ANALYSIS

17.14.3 PRODUCT PORTFOLIO

17.14.4 RECENT DEVELOPMENTS

17.15 CLONIT SRL

17.15.1 COMPANY SNAPSHOT

17.15.2 PRODUCT PORTFOLIO

17.15.3 RECENT DEVELOPMENT

17.16 DIAGNOSTICA LONGWOOD SL

17.16.1 COMPANY SNAPSHOT

17.16.2 PRODUCT PORTFOLIO

17.16.3 RECENT DEVELOPMENTS

17.17 DIASORIN S.P.A.

17.17.1 COMPANY SNAPSHOT

17.17.2 REVENUE ANALYSIS

17.17.3 PRODUCT PORTFOLIO

17.17.4 RECENT DEVELOPMENT

17.18 ELITECHGROUP

17.18.1 COMPANY SNAPSHOT

17.18.2 PRODUCT PORTFOLIO

17.18.3 RECENT DEVELOPMENTS

17.19 EUROFINS VIRACOR

17.19.1 COMPANY SNAPSHOT

17.19.2 PRODUCT PORTFOLIO

17.19.3 RECENT DEVELOPMENTS

17.2 HORIBA LTD

17.20.1 COMPANY SNAPSHOT

17.20.2 REVENUE ANALYSIS

17.20.3 PRODUCT PORTFOLIO

17.20.4 RECENT DEVELOPMENT

17.21 ILLUMINA, INC.

17.21.1 COMPANY SNAPSHOT

17.21.2 REVENUE ANALYSIS

17.21.3 PRODUCT PORTFOLIO

17.21.4 RECENT DEVELOPMENTS

17.22 IMMUCOR

17.22.1 COMPANY SNAPSHOT

17.22.2 PRODUCT PORTFOLIO

17.22.3 RECENT DEVELOPMENTS

17.23 LABORATORY CORPORATION OF AMERICA HOLDINGS.

17.23.1 COMPANY SNAPSHOT

17.23.2 REVENUE ANALYSIS

17.23.3 PRODUCT PORTFOLIO

17.23.4 RECENT DEVELOPMENTS

17.24 LUMINEX CORPORATION. (A SUBSIDIARY OF DIASORIN)

17.24.1 COMPANY SNAPSHOT

17.24.2 REVENUE ANALYSIS

17.24.3 PRODUCT PORTFOLIO

17.24.4 RECENT DEVELOPMENT

17.25 NANOSTRING

17.25.1 COMPANY SNAPSHOT

17.25.2 REVENUE ANALYSIS

17.25.3 PRODUCT PORTFOLIO

17.25.4 RECENT DEVELOPMENT

17.26 PATHONOSTICS

17.26.1 COMPANY SNAPSHOT

17.26.2 PRODUCT PORTFOLIO

17.26.3 RECENT DEVELOPMENTS

17.27 PRESERVATION SOLUTIONS, INC.

17.27.1 COMPANY SNAPSHOT

17.27.2 PRODUCT PORTFOLIO

17.27.3 RECENT DEVELOPMENTS

17.28 QIAGEN

17.28.1 COMPANY SNAPSHOT

17.28.2 REVENUE ANALYSIS

17.28.3 PRODUCT PORTFOLIO

17.28.4 RECENT DEVELOPMENTS

17.29 RANDOX LABORATORIES LTD.

17.29.1 COMPANY SNAPSHOT

17.29.2 PRODUCT PORTFOLIO

17.29.3 RECENT DEVELOPMENTS

17.3 STRYKER

17.30.1 COMPANY SNAPSHOT

17.30.2 REVENUE ANALYSIS

17.30.3 PRODUCT PORTFOLIO

17.30.4 RECENT DEVELOPMENT

17.31 TRANSMEDICS

17.31.1 COMPANY SNAPSHOT

17.31.2 REVENUE ANALYSIS

17.31.3 PRODUCT PORTFOLIO

17.31.4 RECENT DEVELOPMENTS

17.32 TRANSONIC.

17.32.1 COMPANY SNAPSHOT

17.32.2 PRODUCT PORTFOLIO

17.32.3 RECENT DEVELOPMENT

17.33 ZIMMER BIOMET

17.33.1 COMPANY SNAPSHOT

17.33.2 REVENUE ANALYSIS

17.33.3 PRODUCT PORTFOLIO

17.33.4 RECENT DEVELOPMENTS

18 QUESTIONNAIRE

19 RELATED REPORTS

List of Table

TABLE 1 NORTH AMERICA TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 2 NORTH AMERICA TRANSPLANT DIAGNOSTIC INSTRUMENTS IN TRANSPLANT DIAGNOSTICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 3 NORTH AMERICA TRANSPLANT DIAGNOSTIC INSTRUMENTS IN TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 4 NORTH AMERICA AUTOMATED SYSTEMS IN TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 5 NORTH AMERICA TRANSPLANT DIAGNOSTIC KITS IN TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 6 NORTH AMERICA TRANSPLANT DIAGNOSTIC SOFTWARE’S IN TRANSPLANT DIAGNOSTICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 7 NORTH AMERICA TRANSPLANT DIAGNOSTIC SOFTWARE’S IN TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 8 NORTH AMERICA TRANSPLANT DIAGNOSTIC REAGENTS IN TRANSPLANT DIAGNOSTICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 9 NORTH AMERICA TRANSPLANT DIAGNOSTIC REAGENTS IN TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 10 NORTH AMERICA TRANSPLANT DIAGNOSTICS MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 11 NORTH AMERICA PCR-BASED MOLECULAR ASSAYS IN TRANSPLANT DIAGNOSTICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 12 NORTH AMERICA PCR-BASED MOLECULAR ASSAYS IN TRANSPLANT DIAGNOSTICS MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 13 NORTH AMERICA SEQUENCING-BASED MOLECULAR ASSAYS IN TRANSPLANT DIAGNOSTICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 14 NORTH AMERICA SEQUENCING-BASED MOLECULAR ASSAYS IN TRANSPLANT DIAGNOSTICS MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 15 NORTH AMERICA TRANSPLANT DIAGNOSTICS MARKET, BY TRANSPLANT TYPE, 2020-2029 (USD MILLION)

TABLE 16 NORTH AMERICA SOLID ORGAN TRANSPLANTATION IN TRANSPLANT DIAGNOSTICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 17 NORTH AMERICA SOLID ORGAN TRANSPLANTATION IN TRANSPLANT DIAGNOSTICS MARKET, BY TRANSPLANT TYPE, 2020-2029 (USD MILLION)

TABLE 18 NORTH AMERICA STEM CELL TRANSPLANTATION IN TRANSPLANT DIAGNOSTICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 19 NORTH AMERICA STEM CELL TRANSPLANTATION IN TRANSPLANT DIAGNOSTICS MARKET, BY TRANSPLANT TYPE, 2020-2029 (USD MILLION)

TABLE 20 NORTH AMERICA SOFT TISSUE TRANSPLANTATION IN TRANSPLANT DIAGNOSTICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 21 NORTH AMERICA SOFT TISSUE TRANSPLANTATION IN TRANSPLANT DIAGNOSTICS MARKET, BY TRANSPLANT TYPE, 2020-2029 (USD MILLION)

TABLE 22 NORTH AMERICA BONE MARROW TRANSPLANTATION IN TRANSPLANT DIAGNOSTICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 23 NORTH AMERICA BONE MARROW TRANSPLANTATION IN TRANSPLANT DIAGNOSTICS MARKET, BY TRANSPLANT TYPE, 2020-2029 (USD MILLION)

TABLE 24 NORTH AMERICA OTHERS IN TRANSPLANT DIAGNOSTICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 25 NORTH AMERICA TRANSPLANT DIAGNOSTICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 26 NORTH AMERICA DIAGNOSTIC APPLICATIONS IN TRANSPLANT DIAGNOSTICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 27 NORTH AMERICA DIAGNOSTIC APPLICATIONS IN NORTH AMERICA TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 28 NORTH AMERICA TRANSPLANT DIAGNOSTIC INSTRUMENTS IN NORTH AMERICA TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 29 NORTH AMERICA TRANSPLANT DIAGNOSTIC SOFTWARE IN NORTH AMERICA TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 30 NORTH AMERICA TRANSPLANT DIAGNOSTIC REAGENT IN NORTH AMERICA TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 31 NORTH AMERICA RESEARCH APPLICATIONS IN TRANSPLANT DIAGNOSTICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 32 NORTH AMERICA RESEARCH APPLICATIONS IN NORTH AMERICA TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 33 NORTH AMERICA TRANSPLANT DIAGNOSTIC INSTRUMENTS IN NORTH AMERICA TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 34 NORTH AMERICA TRANSPLANT DIAGNOSTIC SOFTWARE IN NORTH AMERICA TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 35 NORTH AMERICA TRANSPLANT DIAGNOSTIC REAGENT IN NORTH AMERICA TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 36 NORTH AMERICA TRANSPLANT DIAGNOSTICS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 37 NORTH AMERICA HOSPITALS AND TRANSPLANT CENTERS IN TRANSPLANT DIAGNOSTICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 38 NORTH AMERICA COMMERCIAL SERVICE PROVIDERS IN TRANSPLANT DIAGNOSTICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 39 NORTH AMERICA RESEARCH LABORATORIES AND ACADEMIC INSTITUTES IN TRANSPLANT DIAGNOSTICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 40 NORTH AMERICA OTHERS IN TRANSPLANT DIAGNOSTICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 41 NORTH AMERICA TRANSPLANT DIAGNOSTICS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 42 NORTH AMERICA DIRECT TENDER IN TRANSPLANT DIAGNOSTICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 43 NORTH AMERICA RETAIL SALES IN TRANSPLANT DIAGNOSTICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 44 NORTH AMERICA OTHERS IN TRANSPLANT DIAGNOSTICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 45 NORTH AMERICA TRANSPLANT DIAGNOSTICS MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 46 NORTH AMERICA TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 47 NORTH AMERICA TRANSPLANT DIAGNOSTICS INSTRUMENT IN TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 48 NORTH AMERICA AUTOMATED SYSTEMS IN TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 49 NORTH AMERICA TRANSPLANT DIAGNOSTIC KITS IN TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 50 NORTH AMERICA TRANSPLANT DIAGNOSTIC SOFTWARE IN TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 51 NORTH AMERICA TRANSPLANT DIAGNOSTIC REAGENT IN TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 52 NORTH AMERICA TRANSPLANT DIAGNOSTICS MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 53 NORTH AMERICA PCR-BASED MOLECULAR ASSAYS IN TRANSPLANT DIAGNOSTICS MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 54 NORTH AMERICA SEQUENCE-BASED MOLECULAR ASSAYS IN TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 55 NORTH AMERICA TRANSPLANT DIAGNOSTICS MARKET, BY TRANSPLANT TYPE, 2020-2029 (USD MILLION)

TABLE 56 NORTH AMERICA SOLID ORGAN TRANSPLANTATION IN TRANSPLANT DIAGNOSTICS MARKET, BY TRANSPLANT TYPE, 2020-2029 (USD MILLION)

TABLE 57 NORTH AMERICA STEM CELL TRANSPLANTATION IN TRANSPLANT DIAGNOSTICS MARKET, BY TRANSPLANT TYPE, 2020-2029 (USD MILLION)

TABLE 58 NORTH AMERICA SOFT TISSUE TRANSPLANTATION IN TRANSPLANT DIAGNOSTICS MARKET, BY TRANSPLANT TYPE, 2020-2029 (USD MILLION)

TABLE 59 NORTH AMERICA BONE-MARROW TRANSPLANTATION IN TRANSPLANT DIAGNOSTICS MARKET, BY TRANSPLANT TYPE, 2020-2029 (USD MILLION)

TABLE 60 NORTH AMERICA TRANSPLANT DIAGNOSTICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 61 NORTH AMERICA DIAGNOSTICS APPLICATIONS TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 62 NORTH AMERICA TRANSPLANT DIAGNOSTICS INSTRUMENT IN TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 63 NORTH AMERICA TRANSPLANT DIAGNOSTIC SOFTWARE IN TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 64 NORTH AMERICA TRANSPLANT DIAGNOSTIC REAGENT IN TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 65 NORTH AMERICA RESEARCH APPLICATIONS TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 66 NORTH AMERICA TRANSPLANT DIAGNOSTICS INSTRUMENT IN TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 67 NORTH AMERICA TRANSPLANT DIAGNOSTIC SOFTWARE IN TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 68 NORTH AMERICA TRANSPLANT DIAGNOSTIC REAGENT IN TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 69 NORTH AMERICA TRANSPLANT DIAGNOSTICS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 70 NORTH AMERICA TRANSPLANT DIAGNOSTICS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 71 U.S. TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 72 U.S. TRANSPLANT DIAGNOSTICS INSTRUMENT IN TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 73 U.S. AUTOMATED PIPETTORS & DISPENSERS, BY PRODUCT TYPE, 2020-2029 VOLUME (UNITS)

TABLE 74 U.S. AUTOMATED PIPETTORS & DISPENSERS, BY PRODUCT TYPE, 2020-2029 ASP (USD)

TABLE 75 U.S. AUTOMATED SYSTEMS IN TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 76 U.S. TRANSPLANT DIAGNOSTIC INSTUMENTS IN TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 VOLUMES (UNITS)

TABLE 77 U.S. TRANSPLANT DIAGNOSTIC KITS IN TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 ASP (USD)

TABLE 78 U.S. TRANSPLANT DIAGNOSTIC INSTUMENTS IN TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 VOLUMES (UNITS)

TABLE 79 U.S. TRANSPLANT DIAGNOSTIC KITS IN TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 ASP (USD)

TABLE 80 U.S. TRANSPLANT DIAGNOSTIC KITS IN TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 81 U.S. TRANSPLANT DIAGNOSTIC KITS IN TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 VOLUMES (UNITS)

TABLE 82 U.S. TRANSPLANT DIAGNOSTIC KITS IN TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 ASP (USD)

TABLE 83 U.S. TRANSPLANT DIAGNOSTIC SOFTWARE IN TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 84 U.S. TRANSPLANT DIAGNOSTIC REAGENT IN TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 85 U.S. TRANSPLANT DIAGNOSTIC REAGENTS IN TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 VOLUMES (UNITS)

TABLE 86 U.S. TRANSPLANT DIAGNOSTIC REAGENTS IN TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 ASP (USD)

TABLE 87 U.S. TRANSPLANT DIAGNOSTICS MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 88 U.S. PCR-BASED MOLECULAR ASSAYS IN TRANSPLANT DIAGNOSTICS MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 89 U.S. SEQUENCE-BASED MOLECULAR ASSAYS IN TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 90 U.S. TRANSPLANT DIAGNOSTICS MARKET, BY TRANSPLANT TYPE, 2020-2029 (USD MILLION)

TABLE 91 U.S. SOLID ORGAN TRANSPLANTATION IN TRANSPLANT DIAGNOSTICS MARKET, BY TRANSPLANT TYPE, 2020-2029 (USD MILLION)

TABLE 92 U.S. STEM CELL TRANSPLANTATION IN TRANSPLANT DIAGNOSTICS MARKET, BY TRANSPLANT TYPE, 2020-2029 (USD MILLION)

TABLE 93 U.S. SOFT TISSUE TRANSPLANTATION IN TRANSPLANT DIAGNOSTICS MARKET, BY TRANSPLANT TYPE, 2020-2029 (USD MILLION)

TABLE 94 U.S. BONE-MARROW TRANSPLANTATION IN TRANSPLANT DIAGNOSTICS MARKET, BY TRANSPLANT TYPE, 2020-2029 (USD MILLION)

TABLE 95 U.S. TRANSPLANT DIAGNOSTICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 96 U.S. DIAGNOSTICS APPLICATIONS TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 97 U.S. TRANSPLANT DIAGNOSTICS INSTRUMENT IN TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 98 U.S. TRANSPLANT DIAGNOSTIC SOFTWARE IN TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 99 U.S. TRANSPLANT DIAGNOSTIC REAGENT IN TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 100 U.S. RESEARCH APPLICATIONS TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 101 U.S. TRANSPLANT DIAGNOSTICS INSTRUMENT IN TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 102 U.S. TRANSPLANT DIAGNOSTIC SOFTWARE IN TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 103 U.S. TRANSPLANT DIAGNOSTIC REAGENT IN TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 104 U.S. TRANSPLANT DIAGNOSTICS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 105 U.S. TRANSPLANT DIAGNOSTICS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 106 CANADA TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 107 CANADA TRANSPLANT DIAGNOSTICS INSTRUMENT IN TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 108 CANADA AUTOMATED PIPETTORS & DISPENSERS, BY PRODUCT TYPE, 2020-2029 VOLUME (UNITS)

TABLE 109 CANADA AUTOMATED PIPETTORS & DISPENSERS, BY PRODUCT TYPE, 2020-2029 ASP (USD)

TABLE 110 CANADA AUTOMATED SYSTEMS IN TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 111 CANADA TRANSPLANT DIAGNOSTIC INSTUMENTS IN TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 VOLUMES (UNITS)

TABLE 112 CANADA TRANSPLANT DIAGNOSTIC KITS IN TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 ASP (USD)

TABLE 113 CANADA TRANSPLANT DIAGNOSTIC INSTUMENTS IN TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 VOLUMES (UNITS)

TABLE 114 CANADA TRANSPLANT DIAGNOSTIC KITS IN TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 ASP (USD)

TABLE 115 CANADA TRANSPLANT DIAGNOSTIC KITS IN TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 116 CANADA TRANSPLANT DIAGNOSTIC KITS IN TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 VOLUMES (UNITS)

TABLE 117 CANADA TRANSPLANT DIAGNOSTIC KITS IN TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 ASP (USD)

TABLE 118 CANADA TRANSPLANT DIAGNOSTIC SOFTWARE IN TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 119 CANADA TRANSPLANT DIAGNOSTIC REAGENT IN TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 120 CANADA TRANSPLANT DIAGNOSTIC REAGENTS IN TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 VOLUMES (UNITS)

TABLE 121 CANADA TRANSPLANT DIAGNOSTIC REAGENTS IN TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 ASP (USD)

TABLE 122 CANADA TRANSPLANT DIAGNOSTICS MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 123 CANADA PCR-BASED MOLECULAR ASSAYS IN TRANSPLANT DIAGNOSTICS MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 124 CANADA SEQUENCE-BASED MOLECULAR ASSAYS IN TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 125 CANADA TRANSPLANT DIAGNOSTICS MARKET, BY TRANSPLANT TYPE, 2020-2029 (USD MILLION)

TABLE 126 CANADA SOLID ORGAN TRANSPLANTATION IN TRANSPLANT DIAGNOSTICS MARKET, BY TRANSPLANT TYPE, 2020-2029 (USD MILLION)

TABLE 127 CANADA STEM CELL TRANSPLANTATION IN TRANSPLANT DIAGNOSTICS MARKET, BY TRANSPLANT TYPE, 2020-2029 (USD MILLION)

TABLE 128 CANADA SOFT TISSUE TRANSPLANTATION IN TRANSPLANT DIAGNOSTICS MARKET, BY TRANSPLANT TYPE, 2020-2029 (USD MILLION)

TABLE 129 CANADA BONE-MARROW TRANSPLANTATION IN TRANSPLANT DIAGNOSTICS MARKET, BY TRANSPLANT TYPE, 2020-2029 (USD MILLION)

TABLE 130 CANADA TRANSPLANT DIAGNOSTICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 131 CANADA DIAGNOSTICS APPLICATIONS TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 132 CANADA TRANSPLANT DIAGNOSTICS INSTRUMENT IN TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 133 CANADA TRANSPLANT DIAGNOSTIC SOFTWARE IN TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 134 CANADA TRANSPLANT DIAGNOSTIC REAGENT IN TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 135 CANADA RESEARCH APPLICATIONS TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 136 CANADA TRANSPLANT DIAGNOSTICS INSTRUMENT IN TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 137 CANADA TRANSPLANT DIAGNOSTIC SOFTWARE IN TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 138 CANADA TRANSPLANT DIAGNOSTIC REAGENT IN TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 139 CANADA TRANSPLANT DIAGNOSTICS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 140 CANADA TRANSPLANT DIAGNOSTICS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 141 MEXICO TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 142 MEXICO TRANSPLANT DIAGNOSTICS INSTRUMENT IN TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 143 MEXICO AUTOMATED PIPETTORS & DISPENSERS, BY PRODUCT TYPE, 2020-2029 VOLUME (UNITS)

TABLE 144 MEXICO AUTOMATED PIPETTORS & DISPENSERS, BY PRODUCT TYPE, 2020-2029 ASP (USD)

TABLE 145 MEXICO AUTOMATED SYSTEMS IN TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 146 MEXICO TRANSPLANT DIAGNOSTIC INSTUMENTS IN TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 VOLUMES (UNITS)

TABLE 147 MEXICO TRANSPLANT DIAGNOSTIC KITS IN TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 ASP (USD)

TABLE 148 MEXICO TRANSPLANT DIAGNOSTIC INSTUMENTS IN TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 VOLUMES (UNITS)

TABLE 149 MEXICO TRANSPLANT DIAGNOSTIC KITS IN TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 ASP (USD)

TABLE 150 MEXICO TRANSPLANT DIAGNOSTIC KITS IN TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 151 MEXICO TRANSPLANT DIAGNOSTIC KITS IN TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 VOLUMES (UNITS)

TABLE 152 MEXICO TRANSPLANT DIAGNOSTIC KITS IN TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 ASP (USD)

TABLE 153 MEXICO TRANSPLANT DIAGNOSTIC SOFTWARE IN TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 154 MEXICO TRANSPLANT DIAGNOSTIC REAGENT IN TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 155 MEXICO TRANSPLANT DIAGNOSTIC REAGENTS IN TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 VOLUMES (UNITS)

TABLE 156 MEXICO TRANSPLANT DIAGNOSTIC REAGENTS IN TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 ASP (USD)

TABLE 157 MEXICO TRANSPLANT DIAGNOSTICS MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 158 MEXICO PCR-BASED MOLECULAR ASSAYS IN TRANSPLANT DIAGNOSTICS MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 159 MEXICO SEQUENCE-BASED MOLECULAR ASSAYS IN TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 160 MEXICO TRANSPLANT DIAGNOSTICS MARKET, BY TRANSPLANT TYPE, 2020-2029 (USD MILLION)

TABLE 161 MEXICO SOLID ORGAN TRANSPLANTATION IN TRANSPLANT DIAGNOSTICS MARKET, BY TRANSPLANT TYPE, 2020-2029 (USD MILLION)

TABLE 162 MEXICO STEM CELL TRANSPLANTATION IN TRANSPLANT DIAGNOSTICS MARKET, BY TRANSPLANT TYPE, 2020-2029 (USD MILLION)

TABLE 163 MEXICO SOFT TISSUE TRANSPLANTATION IN TRANSPLANT DIAGNOSTICS MARKET, BY TRANSPLANT TYPE, 2020-2029 (USD MILLION)

TABLE 164 MEXICO BONE-MARROW TRANSPLANTATION IN TRANSPLANT DIAGNOSTICS MARKET, BY TRANSPLANT TYPE, 2020-2029 (USD MILLION)

TABLE 165 MEXICO TRANSPLANT DIAGNOSTICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 166 MEXICO DIAGNOSTICS APPLICATIONS TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 167 MEXICO TRANSPLANT DIAGNOSTICS INSTRUMENT IN TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 168 MEXICO TRANSPLANT DIAGNOSTIC SOFTWARE IN TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 169 MEXICO TRANSPLANT DIAGNOSTIC REAGENT IN TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 170 MEXICO RESEARCH APPLICATIONS TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 171 MEXICO TRANSPLANT DIAGNOSTICS INSTRUMENT IN TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 172 MEXICO TRANSPLANT DIAGNOSTIC SOFTWARE IN TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 173 MEXICO TRANSPLANT DIAGNOSTIC REAGENT IN TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 174 MEXICO TRANSPLANT DIAGNOSTICS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 175 MEXICO TRANSPLANT DIAGNOSTICS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

List of Figure

FIGURE 1 NORTH AMERICA TRANSPLANT DIAGNOSTICS MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA TRANSPLANT DIAGNOSTICS MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA TRANSPLANT DIAGNOSTICS MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA TRANSPLANT DIAGNOSTICS MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA TRANSPLANT DIAGNOSTICS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA TRANSPLANT DIAGNOSTICS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA TRANSPLANT DIAGNOSTICS MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 8 NORTH AMERICA TRANSPLANT DIAGNOSTICS MARKET: DBMR MARKET POSITION GRID

FIGURE 9 NORTH AMERICA TRANSPLANT DIAGNOSTICS MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 NORTH AMERICA TRANSPLANT DIAGNOSTICS MARKET: SEGMENTATION

FIGURE 11 INCREASING USE OF TRANSPLANT DIAGNOSTICS IS EXPECTED TO DRIVE THE NORTH AMERICA TRANSPLANT DIAGNOSTICS MARKET IN THE FORECAST PERIOD

FIGURE 12 TRANSPLANT DIAGNOSTIC INSTRUMENT SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA TRANSPLANT DIAGNOSTICS MARKET IN 2022 & 2029

FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE NORTH AMERICA TRANSPLANT DIAGNOSTICS MARKET

FIGURE 14 NORTH AMERICA TRANSPLANT DIAGNOSTICS MARKET: BY PRODUCT TYPE, 2021

FIGURE 15 NORTH AMERICA TRANSPLANT DIAGNOSTICS MARKET: BY PRODUCT TYPE, 2022-2029 (USD MILLION)

FIGURE 16 NORTH AMERICA TRANSPLANT DIAGNOSTICS MARKET: BY PRODUCT TYPE, CAGR (2022-2029)

FIGURE 17 NORTH AMERICA TRANSPLANT DIAGNOSTICS MARKET: BY PRODUCT TYPE, LIFELINE CURVE

FIGURE 18 NORTH AMERICA TRANSPLANT DIAGNOSTICS MARKET : BY TECHNOLOGY, 2021

FIGURE 19 NORTH AMERICA TRANSPLANT DIAGNOSTICS MARKET : BY TECHNOLOGY, 2022-2029 (USD MILLION)

FIGURE 20 NORTH AMERICA TRANSPLANT DIAGNOSTICS MARKET : BY TECHNOLOGY, CAGR (2022-2029)

FIGURE 21 NORTH AMERICA TRANSPLANT DIAGNOSTICS MARKET : BY TECHNOLOGY, LIFELINE CURVE

FIGURE 22 NORTH AMERICA TRANSPLANT DIAGNOSTICS MARKET : BY TRANSPLANT TYPE, 2021

FIGURE 23 NORTH AMERICA TRANSPLANT DIAGNOSTICS MARKET : BY TRANSPLANT TYPE, 2022-2029 (USD MILLION)

FIGURE 24 NORTH AMERICA TRANSPLANT DIAGNOSTICS MARKET : BY TRANSPLANT TYPE, CAGR (2022-2029)

FIGURE 25 NORTH AMERICA TRANSPLANT DIAGNOSTICS MARKET : BY TRANSPLANT TYPE, LIFELINE CURVE

FIGURE 26 NORTH AMERICA TRANSPLANT DIAGNOSTICS MARKET: BY APPLICATION, 2021

FIGURE 27 NORTH AMERICA TRANSPLANT DIAGNOSTICS MARKET: BY APPLICATION, 2022-2029 (USD MILLION)

FIGURE 28 NORTH AMERICA TRANSPLANT DIAGNOSTICS MARKET: BY APPLICATION, CAGR (2022-2029)

FIGURE 29 NORTH AMERICA TRANSPLANT DIAGNOSTICS MARKET: BY APPLICATION, LIFELINE CURVE

FIGURE 30 NORTH AMERICA TRANSPLANT DIAGNOSTICS MARKET : BY END USER, 2021

FIGURE 31 NORTH AMERICA TRANSPLANT DIAGNOSTICS MARKET : BY END USER, 2022-2029 (USD MILLION)

FIGURE 32 NORTH AMERICA TRANSPLANT DIAGNOSTICS MARKET : BY END USER, CAGR (2022-2029)

FIGURE 33 NORTH AMERICA TRANSPLANT DIAGNOSTICS MARKET : BY END USER, LIFELINE CURVE

FIGURE 34 NORTH AMERICA TRANSPLANT DIAGNOSTICS MARKET: BY DISTRIBUTION CHANNEL, 2021

FIGURE 35 NORTH AMERICA TRANSPLANT DIAGNOSTICS MARKET: BY DISTRIBUTION CHANNEL, 2022-2029 (USD MILLION)

FIGURE 36 NORTH AMERICA TRANSPLANT DIAGNOSTICS MARKET: BY DISTRIBUTION CHANNEL, CAGR (2022-2029)

FIGURE 37 NORTH AMERICA TRANSPLANT DIAGNOSTICS MARKET: BY DISTRIBUTION CHANNEL, LIFELINE CURVE

FIGURE 38 NORTH AMERICA TRANSPLANT DIAGNOSTICS MARKET: SNAPSHOT (2021)

FIGURE 39 NORTH AMERICA TRANSPLANT DIAGNOSTICS MARKET: BY COUNTRY (2021)

FIGURE 40 NORTH AMERICA TRANSPLANT DIAGNOSTICS MARKET: BY COUNTRY (2022 & 2029)

FIGURE 41 NORTH AMERICA TRANSPLANT DIAGNOSTICS MARKET: BY COUNTRY (2021 & 2029)

FIGURE 42 NORTH AMERICA TRANSPLANT DIAGNOSTICS MARKET: BY PRODUCT TYPE (2022-2029)

FIGURE 43 NORTH AMERICA TRANSPLANT DIAGNOSTICS MARKET: COMPANY SHARE 2021 (%)

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.