Market Analysis and Size

Obesity, diabetes, and metabolic syndrome have all become major public health issues as a result of their links to an imbalanced calorie intake. Sugar substitutes play an important role in reducing calories as part of an overall healthy diet and physical activity regimen to combat the conditions mentioned above.

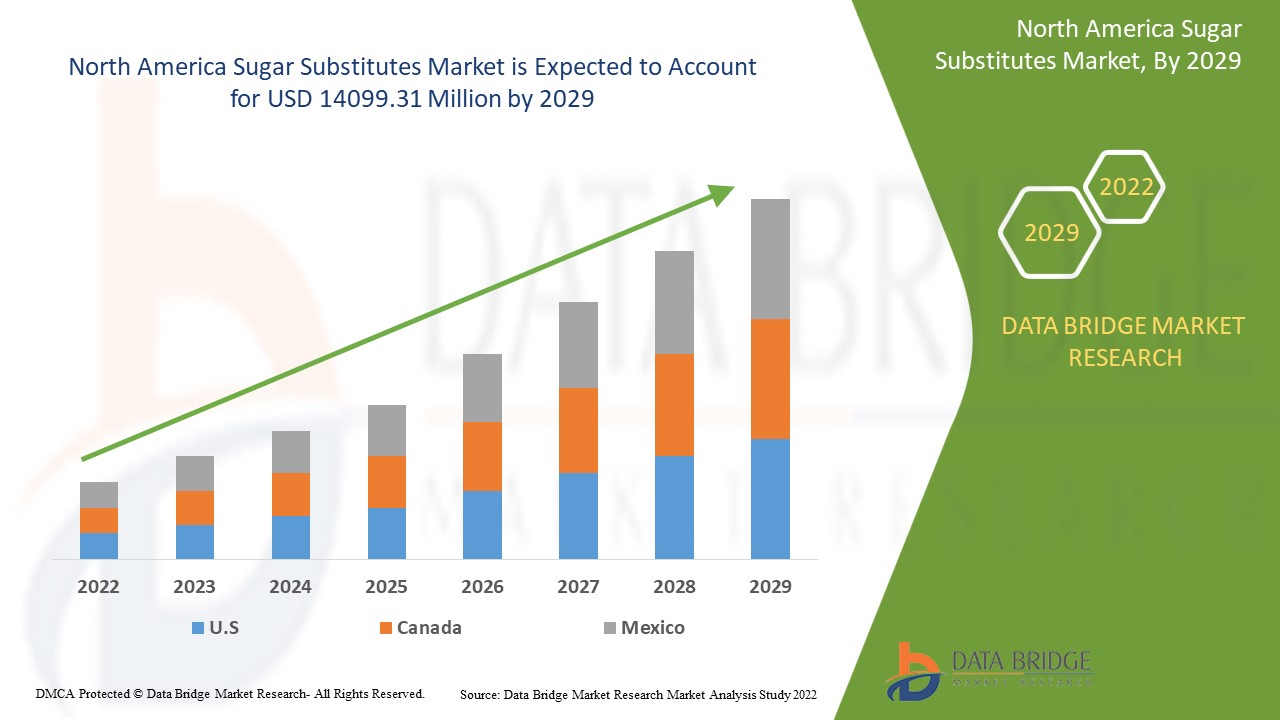

Data Bridge Market Research analyses that the sugar substitutes market which was growing at a value of 7617.42 million in 2021 and is expected to reach the value of USD 14099.31 million by 2029, at a CAGR of 8.0% during the forecast period of 2022 to 2029.

Market Definition

A sugar substitute is a food additive that tastes like sugar but contains far less calories than sugar-based sweeteners, making it a zero-calorie or low-calorie sweetener. They are derived from natural substances or artificially created using chemicals and preservatives.

Report Scope and Market Segmentation

|

Report Metric |

Details |

|

Forecast Period |

2022 to 2029 |

|

Base Year |

2021 |

|

Historic Years |

2020 (Customizable to 2019 - 2014) |

|

Quantitative Units |

Revenue in USD million, Volumes in Units, Pricing in USD |

|

Segments Covered |

Type (High-Fructose Syrups, High-Intensity Sweeteners, Low-Intensity Sweeteners), Form (Crystallized, Liquid, Powder), Category (Natural, Synthetic), Application (Beverages, Food Products, Oral Care, Pharmaceuticals, Others) |

|

Countries Covered |

U.S., Canada and Mexico |

|

Market Players Covered |

DuPont (US), ADM (US), Tate & Lyle (UK), Ingredion (US), Cargill Incorporated (US), Roquette Frères (France), PureCircle Ltd (US), MacAndrews & Forbes Incorporated (US), JK Sucralose Inc. (China), Ajinomoto Co. Inc. (Japan), JK Sucralose Inc. (China), Ajinomoto Co. Inc. (Japan), NutraSweetM Co. (U.S.), Südzucker AG (Germany), Layn Corp. (China), Zhucheng Haotian Pharm Co., Ltd. (China), HSWT (France) |

|

Opportunities |

|

Sugar substitutes Market Dynamics

Drivers

- Rising preferences for natural sugar

Sugar substitutes are commonly used as sugar substitutes in beverages such as soft drinks or carbonated beverages, flavouring juices, and other food products. Natural sugar substitutes are gaining popularity in the United States as consumer preferences shift toward organic-based foods and beverages. Natural sugar is a low caloric sweetener extracted from plants like stevia, monk fruits, and others that is 200 times sweeter than sugar. These advantages of sugar substitutes, as well as their organic advantages, have aided market growth.

Growing demand in various end user industries

The increased use of sugar substitute in various end-use applications such as pharmaceutical, cosmetics, food, ethanol production, feed, and others is also driving the market. It can be utilized as a water-retention agent in personal care and cosmetics serums, as well as a nutritional supplement in pharmaceutical products like syrups and injections. Strong R&D paired with technical expertise has propelled the company to the forefront, and as a result, crystalline sugar demand has expanded over time.

Opportunity

Growing technical innovation in the food processing sector and rising demand for nutritional snack bars will augment market growth. Sugar substitute manufacturers are expected to benefit from price fluctuations in sugar. As a result of these factors, the market is expanding in tandem with the number of diabetic patients and consumer health consciousness.

Restraints

However, many scientists believe that excessive sugar substitute consumption can lead to serious health problems such as type II diabetes, heart disease, obesity, and in some cases can led to cancer. The decreased availability of sugar substitutes, combined with the development of artificial sweeteners, has shifted consumer preferences toward artificial sweeteners, limiting market growth.

This sugar substitutes market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the sugar substitutes market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

COVID-19 Impact on Sugar Substitutes Market

The North America pandemic of COVID-19 disease is becoming a major impediment to the North America economy and has an impact on the growth of the food and beverage industry. Food manufacturers have reduced production of major food products. Furthermore, as people seek solutions to improve their overall health and well-being, there is a rapid increase in demand for less sugary and immunity-boosting products because of the COVID-19 pandemic, most health-conscious customers have turned to low-calorie or sugar-free foods. As a result of rising health consciousness and high demand for sugar-reduced solutions among the North America population, manufacturers and product formulators have been forced to use sugar substitutes.

Recent development

- Tate & Lyle will release the VANTAGE sweetener solution design tools in July 2020. It is a collection of new and innovative sweetener solution design tools, as well as an education programme, for creating sugar-reduced food and drinks with low-calorie sweeteners.

North America Sugar Substitutes Market Scope

The sugar substitutes market is segmented on the basis of type, form, category and application. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Type

- High-intensity sweeteners

- Low-intensity sweeteners

- High-fructose syrups

On the basis of type, the market is segmented into high-intensity sweeteners, low-intensity sweeteners and high-fructose syrups.

Form

- Powder

- Crystallized

- Liquid.

On the basis of form, the market is segmented into powder, crystallized and liquid.

Category

- Natural

- Synthetic

On the basis of category, the market is segmented into natural and synthetic.

Application

- Food products

- Oral care

- Pharmaceuticals

- Beverages

On the basis of application, the market is segmented into beverages, food products, oral care, pharmaceuticals and others.

Sugar Substitutes Market Regional Analysis/Insights

The sugar substitutes market is analysed and market size insights and trends are provided by country, type, form, category and application.as referenced above.

The countries covered in the sugar substitutes market report are U.S., Canada and Mexico.

In the North America sugar substitutes market, North America and Europe accounted for the vast majority of market share because of the presence of key market players, significant investment in R&D, technologically advanced methods of production, and the availability of raw materials in the region. The advancement of pharmaceuticals through the use of natural sugar has proven to be the most promising for market growth.

The country section of the report also provides individual market impacting factors and changes in market regulation that impact the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of North America brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Sugar Substitutes Market Share Analysis

The sugar substitutes market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, North America presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to sugar substitutes market.

Some of the major players operating in the sugar substitutes market are:

- DuPont (US)

- ADM (US)

- Tate & Lyle (UK)

- Ingredion (US)

- Cargill Incorporated (US)

- Roquette Frères (France)

- PureCircle Ltd (US)

- MacAndrews & Forbes Incorporated (US)

- JK Sucralose Inc. (China)

- Ajinomoto Co. Inc. (Japan)

- JK Sucralose Inc. (China)

- Ajinomoto Co. Inc. (Japan)

- NutraSweetM Co. (U.S.)

- Südzucker AG (Germany)

- Layn Corp. (China)

- Zhucheng Haotian Pharm Co., Ltd. (China)

- HSWT (France)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF NORTH AMERICA SUGAR SUBSTITUTES MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MULTIVARIATE MODELING

2.9 PRODUCT TIMELINE CURVE

2.1 MARKET APPLICATION COVERAGE GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 MARKET OVERVIEW

3.1 DRIVERS

3.1.1 GROWING NUMBER OF OBESITY & DIABETIC POPULATION

3.1.2 RISING TREND OF HEALTHY LIFESTYLE AND HEALTHY PRODUCTS

3.1.3 INCREASED USAGE OF SUGAR SUBSTITUTES IN FOOD & BAKERY PRODUCTS

3.1.4 INCREASING DEMAND FOR NATURAL SWEETENERS/PLANT SOURCED SWEETENERS

3.1.5 FLUCTUATING PRICES OF SUGAR AND INCREASED TAXATION ON SUGAR PRODUCTS

3.2 RESTRAINTS

3.2.1 STRINGENT REGULATIONS AND POLICIES FOR SUGAR SUBSTITUTE

3.2.2 SIDE EFFECTS OF THE SUGAR SUBSTITUTE

3.3 OPPORTUNITIES

3.3.1 GROWING CONSUMPRION OF HEALTHY AND NUTRITIONAL DRINKS HAVING SUGAR SUBSTITUTES

3.3.2 INCREASING AWARENESS OF SUGAR SUBSTITUTE IN DEVELOPING NATIONS

3.3.3 STRONG INITIATIVES AND STUDIES FOR THE PRODUCT DEVELOPMENT

3.3.4 NEW SUGAR LABELING RULES

3.4 CHALLENGES

3.4.1 MORE EFFORTS TOWARDS TASTE IMPROVEMENT

3.4.2 VAGUENESS ABOUT SUGAR SUBSTITUTE BENEFITS

4 EXECUTIVE SUMMARY

5 PREMIUM INSIGHTS

5.1 PARENT MARKET ANALYSIS

5.2 EXPECTED GROWTH OF SWEETENERS USAGE FOR NEXT 3 YEARS

6 NORTH AMERICA SUGAR SUBSTITUTES MARKET, BY TYPE

6.1 OVERVIEW

6.2 HIGH-FRUCTOSE SYRUPS

6.3 HIGH-INTENSITY SWEETENERS

6.3.1 ASPARTAME

6.3.2 CYCLAMATE

6.3.3 ACE-K

6.3.4 SACCHARINE

6.3.5 STEVIA

6.3.6 SUCROLOSE

6.3.7 HONEY

6.3.8 GLYCYRRHIZIN

6.3.9 ALITAME

6.3.10 NEOTAME

6.3.11 OTHERS

6.4 LOW-INTENSITY SWEETENERS

6.4.1 ERYTHRITOL

6.4.2 MALTITOL

6.4.3 SORBITOL

6.4.4 XYLITOL

6.4.5 ISOMALT

6.4.6 HYDROGENATED STARCH HYDROYSATES

6.4.7 MANNITOL

6.4.8 LACITOL

6.4.9 D-TAGATOSE

6.4.10 TREHALOSE

6.4.11 OTHERS

7 NORTH AMERICA SUGAR SUBSTITUTES MARKET, BY FORM

7.1 OVERVIEW

7.2 CRYSTALLIZED

7.3 LIQUID

7.4 POWDER

8 NORTH AMERICA SUGAR SUBSTITUTES MARKET, BY APPLICATION

8.1 OVERVIEW

8.2 BEVERAGES

8.2.1 CARBONATED SOFT DRINKS

8.2.2 FLAVORED DRINKS

8.2.3 POWDERED BEVERAGES

8.2.3.1 RTD COFFEE

8.2.3.2 RTD TEA

8.2.3.3 SMOOTHIES

8.2.3.4 OTHERS

8.2.4 JUICES

8.2.5 DAIRY ALTERNATIVE DRINKS

8.2.6 FUNCTIONAL DRINKS

8.2.7 OTHERS

8.3 FOOD PRODUCTS

8.3.1 DAIRY PRODUCTS

8.3.1.1 ICE CREAM

8.3.1.2 TOPPINGS

8.3.1.3 YOGURTS

8.3.1.4 PUDDING

8.3.1.5 OTHERS

8.3.2 BAKERY PRODUCTS

8.3.2.1 COOKIES & BISCUITS

8.3.2.2 CAKE & PASTRIES

8.3.2.3 MUFFINS & DONUTS

8.3.2.4 BREADS & ROLLS

8.3.2.5 OTHERS

8.3.3 CONFECTIONERY

8.3.3.1 CHOCOLATE

8.3.3.2 GUMMIES & MARSHMALLOWS

8.3.3.3 HARD CANDIES

8.3.3.4 OTHERS

8.3.4 TABLE-TOP SWEETENER

8.3.5 NUTRITIONAL BARS

8.3.6 BREAKFAST CEREALS

8.3.7 OTHERS

8.4 ORAL CARE

8.4.1.1 TOOTHPASTE

8.4.1.2 ORAL RINSES

8.4.1.3 OTHERS

8.5 PHARMACEUTICALS

8.5.1.1 SYRUPS

8.5.1.2 GRANULATED POWDERS

8.5.1.3 TABLETS

8.5.1.4 OTHERS

8.6 OTHERS

9 NORTH AMERICA SUGAR SUBSTITUTES MARKET, BY CATEGORY

9.1 OVERVIEW

9.2 NATURAL

9.3 SYNTHETIC

10 NORTH AMERICA SUGAR SUBSTITUTES MARKET, BY GEOGRAPHY

10.1 NORTH AMERICA

10.1.1 U.S.

10.1.2 CANADA

10.1.3 MEXICO

11 NORTH AMERICA SUGAR SUBSTITUTES MARKET, COMPANY LANDSCAPE

11.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

12 SWOT & DBMR ANALYSIS

12.1 DATA BRIDGE MARKET RESEARCH ANALYSIS

13 COMPANY PROFILES

13.1 ADM

13.1.1 COMPANY SNAPSHOT

13.1.2 REVENUE ANALYSIS

13.1.3 COMPANY SHARE ANALYSIS

13.1.4 PRODUCT PORTFOLIO

13.1.5 RECENT DEVELOPMENTS

13.2 CARGILL, INCORPORATED.

13.2.1 COMPANY SNAPSHOT

13.2.2 REVENUE ANALYSIS

13.2.3 COMPANY SHARE ANALYSIS

13.2.4 PRODUCT PORTFOLIO

13.2.5 RECENT DEVELOPMENTS

13.3 INGREDION INCORPORATED

13.3.1 COMPANY SNAPSHOT

13.3.2 REVENUE ANALYSIS

13.3.3 COMPANY SHARE ANALYSIS

13.3.4 PRODUCT PORTFOLIO

13.3.5 RECENT DEVELOPMENTS

13.4 TATE & LYLE

13.4.1 COMPANY SNAPSHOT

13.4.2 REVENUE ANALYSIS

13.4.3 COMPANY SHARE ANALYSIS

13.4.4 PRODUCT PORTFOLIO

13.4.5 RECENT DEVELOPMENTS

13.5 AJINOMOTO HEALTH & NUTRITION NORTH AMERICA, INC.

13.5.1 COMPANY SNAPSHOT

13.5.2 REVENUE ANALYSIS

13.5.3 PRODUCT PORTFOLIO

13.5.4 RECENT DEVELOPMENTS

13.6 ALSIANO

13.6.1 COMPANY SNAPSHOT

13.6.2 PRODUCT PORTFOLIO

13.6.3 RECENT DEVELOPMENTS

13.7 BENEO (A SUBSIDIARY OF SÜDZUCKER AG)

13.7.1 COMPANY SNAPSHOT

13.7.2 REVENUE ANALYSIS

13.7.3 PRODUCT PORTFOLIO

13.7.4 RECENT DEVELOPMENTS

13.8 DUPONT.

13.8.1 COMPANY SNAPSHOT

13.8.2 REVENUE ANALYSIS

13.8.3 PRODUCT PORTFOLIO

13.8.4 RECENT DEVELOPMENTS

13.9 FOODCHEM INTERNATIONAL CORPORATION

13.9.1 COMPANY SNAPSHOT

13.9.2 PRODUCT PORTFOLIO

13.9.3 RECENT DEVELOPMENTS

13.1 HYET SWEET

13.10.1 COMPANY SNAPSHOT

13.10.2 PRODUCT PORTFOLIO

13.10.3 RECENT DEVELOPMENTS

13.11 JK SUCRALOSE INC.

13.11.1 COMPANY SNAPSHOT

13.11.2 PRODUCT PORTFOLIO

13.11.3 RECENT DEVELOPMENT

13.12 MAFCO WORLDWIDE LLC

13.12.1 COMPANY SNAPSHOT

13.12.2 PRODUCT PORTFOLIO

13.12.3 RECENT DEVELOPMENT

13.13 MATSUTANI CHEMICAL INDUSTRY CO., LTD.

13.13.1 COMPANY SNAPSHOT

13.13.2 PRODUCT PORTFOLIO

13.13.3 RECENT DEVELOPMENT

13.14 MITSUI SUGAR CO.,LTD.

13.14.1 COMPANY SNAPSHOT

13.14.2 REVENUE ANALYSIS

13.14.3 PRODUCT PORTFOLIO

13.14.4 RECENT DEVELOPMENT

13.15 NUTRASWEET CO.

13.15.1 COMPANY SNAPSHOT

13.15.2 PRODUCT PORTFOLIO

13.15.3 RECENT DEVELOPMENT

13.16 PURECIRCLE

13.16.1 COMPANY SNAPSHOT

13.16.2 REVENEUE ANALYSIS

13.16.3 PRODUCT PORTFOLIO

13.16.4 RECENT DEVELOPMENTS

13.17 PYURE BRANDS LLC

13.17.1 COMPANY SNAPSHOT

13.17.2 PRODUCT PORTFOLIO

13.17.3 RECENT DEVELOPMENTS

13.18 ROQUETTE FRÈRES

13.18.1 COMPANY SNAPSHOT

13.18.2 PRODUCT PORTFOLIO

13.18.3 RECENT DEVELOPMENTS

13.19 STARTINGLINE S.P.A.

13.19.1 COMPANY SNAPSHOT

13.19.2 PRODUCT PORTFOLIO

13.19.3 RECENT DEVELOPMENT

13.2 ZUCHEM INC.

13.20.1 COMPANY SNAPSHOT

13.20.2 PRODUCT PORTFOLIO

13.20.3 RECENT DEVELOPMENT

14 CONCLUSION

15 QUESTIONNAIRE

16 RELATED REPORTS

List of Table

TABLE 1 NORTH AMERICA SUGAR SUBSTITUTES MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 2 NORTH AMERICA HIGH-FRUCTOSE SYRUPS IN SUGAR SUBSTITUTES MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 3 NORTH AMERICA HIGH-INTENSITY SWEETENERS IN SUGAR SUBSTITUTES MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 4 NORTH AMERICA HIGH-INTENSITY SWEETENERS IN SUGAR SUBSTITUTES MARKET, BY COMPOSITION, 2018-2027 (USD MILLION)

TABLE 5 NORTH AMERICA LOW-INTENSITY SWEETENERS IN SUGAR SUBSTITUTES MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 6 NORTH AMERICA LOW-INTENSITY SWEETENERS IN SUGAR SUBSTITUTES MARKET, BY COMPOSITION, 2018-2027 (USD MILLION)

TABLE 7 NORTH AMERICA SUGAR SUBSTITUTES MARKET, BY FORM, 2018-2027 (USD MILLION)

TABLE 8 NORTH AMERICA CRYSTALLIZED FORM IN SUGAR SUBSTITUTES MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 9 NORTH AMERICA LIQUID FORM IN SUGAR SUBSTITUTES MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 10 NORTH AMERICA POWDER FORM IN SUGAR SUBSTITUTES MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 11 NORTH AMERICA SUGAR SUBSTITUTES MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 12 NORTH AMERICA BEVERAGES APPLICATION IN SUGAR SUBSTITUTES MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 13 NORTH AMERICA BEVERAGES IN SUGAR SUBSTITUTES MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 14 NORTH AMERICA POWDERED BEVERAGES IN SUGAR SUBSTITUTES MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 15 NORTH AMERICA FOOD PRODUCTS APPLICATION IN SUGAR SUBSTITUTES MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 16 NORTH AMERICA FOOD PRODUCTS IN SUGAR SUBSTITUTES MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 17 NORTH AMERICA DAIRY PRODUCTS IN SUGAR SUBSTITUTES MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 18 NORTH AMERICA BAKERY PRODUCTS IN SUGAR SUBSTITUTES MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 19 NORTH AMERICA CONFECTIONERY IN SUGAR SUBSTITUTES MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 20 NORTH AMERICA ORAL CARE APPLICATION IN SUGAR SUBSTITUTES MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 21 NORTH AMERICA ORAL CARE IN SUGAR SUBSTITUTES MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 22 NORTH AMERICA PHARMACEUTICALS APPLICATION IN SUGAR SUBSTITUTES MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 23 NORTH AMERICA PHARMACEUTICALS IN SUGAR SUBSTITUTES MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 24 NORTH AMERICA OTHERS APPLICATION IN SUGAR SUBSTITUTES MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 25 NORTH AMERICA SUGAR SUBSTITUTES MARKET, BY CATEGORY, 2018-2027 (USD MILLION)

TABLE 26 NORTH AMERICA NATURAL CATGORY IN SUGAR SUBSTITUTES MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 27 NORTH AMERICA SYNTHETIC CATEGORY IN SUGAR SUBSTITUTES MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 28 NORTH AMERICA SUGAR SUBSTITUTES MARKET, BY COUNTRY, 2018-2027 (USD MILLION)

TABLE 29 NORTH AMERICA SUGAR SUBSTITUTES MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 30 NORTH AMERICA HIGH-INTENSITY SWEETENERS IN SUGAR SUBSTITUTES MARKET, BY COMPOSITION, 2018-2027 (USD MILLION)

TABLE 31 NORTH AMERICA LOW-INTENSITY SWEETENERS IN SUGAR SUBSTITUTES MARKET, BY COMPOSITION, 2018-2027 (USD MILLION)

TABLE 32 NORTH AMERICA SUGAR SUBSTITUTES MARKET, BY FORM, 2018-2027 (USD MILLION)

TABLE 33 NORTH AMERICA SUGAR SUBSTITUTES MARKET, BY CATEGORY, 2018-2027 (USD MILLION)

TABLE 34 NORTH AMERICA SUGAR SUBSTITUTES MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 35 NORTH AMERICA BEVERAGES IN SUGAR SUBSTITUTES MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 36 NORTH AMERICA POWDERED BEVERAGES IN SUGAR SUBSTITUTES MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 37 NORTH AMERICA FOOD PRODUCTS IN SUGAR SUBSTITUTES MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 38 NORTH AMERICA BAKERY PRODUCTS IN SUGAR SUBSTITUTES MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 39 NORTH AMERICA CONFECTIONERY IN SUGAR SUBSTITUTES MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 40 NORTH AMERICA DAIRY PRODUCTS IN SUGAR SUBSTITUTES MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 41 NORTH AMERICA ORAL CARE IN SUGAR SUBSTITUTES MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 42 NORTH AMERICA PHARMACEUTICALS IN SUGAR SUBSTITUTES MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 43 U.S. SUGAR SUBSTITUTES MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 44 U.S. HIGH-INTENSITY SWEETENERS IN SUGAR SUBSTITUTES MARKET, BY COMPOSITION, 2018-2027 (USD MILLION)

TABLE 45 U.S. LOW-INTENSITY SWEETENERS IN SUGAR SUBSTITUTES MARKET, BY COMPOSITION, 2018-2027 (USD MILLION)

TABLE 46 U.S. SUGAR SUBSTITUTES MARKET, BY FORM, 2018-2027 (USD MILLION)

TABLE 47 U.S. SUGAR SUBSTITUTES MARKET, BY CATEGORY, 2018-2027 (USD MILLION)

TABLE 48 U.S. SUGAR SUBSTITUTES MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 49 U.S. BEVERAGES IN SUGAR SUBSTITUTES MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 50 U.S. POWDERED BEVERAGES IN SUGAR SUBSTITUTES MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 51 U.S. FOOD PRODUCTS IN SUGAR SUBSTITUTES MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 52 U.S. BAKERY PRODUCTS IN SUGAR SUBSTITUTES MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 53 U.S. CONFECTIONERY IN SUGAR SUBSTITUTES MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 54 U.S. DAIRY PRODUCTS IN SUGAR SUBSTITUTES MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 55 U.S. ORAL CARE IN SUGAR SUBSTITUTES MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 56 U.S. PHARMACEUTICALS IN SUGAR SUBSTITUTES MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 57 CANADA SUGAR SUBSTITUTES MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 58 CANADA HIGH-INTENSITY SWEETENERS IN SUGAR SUBSTITUTES MARKET, BY COMPOSITION, 2018-2027 (USD MILLION)

TABLE 59 CANADA LOW-INTENSITY SWEETENERS IN SUGAR SUBSTITUTES MARKET, BY COMPOSITION, 2018-2027 (USD MILLION)

TABLE 60 CANADA SUGAR SUBSTITUTES MARKET, BY FORM, 2018-2027 (USD MILLION)

TABLE 61 CANADA SUGAR SUBSTITUTES MARKET, BY CATEGORY, 2018-2027 (USD MILLION)

TABLE 62 CANADA SUGAR SUBSTITUTES MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 63 CANADA BEVERAGES IN SUGAR SUBSTITUTES MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 64 CANADA POWDERED BEVERAGES IN SUGAR SUBSTITUTES MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 65 CANADA FOOD PRODUCTS IN SUGAR SUBSTITUTES MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 66 CANADA BAKERY PRODUCTS IN SUGAR SUBSTITUTES MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 67 CANADA CONFECTIONERY IN SUGAR SUBSTITUTES MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 68 CANADA DAIRY PRODUCTS IN SUGAR SUBSTITUTES MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 69 CANADA ORAL CARE IN SUGAR SUBSTITUTES MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 70 CANADA PHARMACEUTICALS IN SUGAR SUBSTITUTES MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 71 MEXICO SUGAR SUBSTITUTES MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 72 MEXICO HIGH-INTENSITY SWEETENERS IN SUGAR SUBSTITUTES MARKET, BY COMPOSITION, 2018-2027 (USD MILLION)

TABLE 73 MEXICO LOW-INTENSITY SWEETENERS IN SUGAR SUBSTITUTES MARKET, BY COMPOSITION, 2018-2027 (USD MILLION)

TABLE 74 MEXICO SUGAR SUBSTITUTES MARKET, BY FORM, 2018-2027 (USD MILLION)

TABLE 75 MEXICO SUGAR SUBSTITUTES MARKET, BY CATEGORY, 2018-2027 (USD MILLION)

TABLE 76 MEXICO SUGAR SUBSTITUTES MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 77 MEXICO BEVERAGES IN SUGAR SUBSTITUTES MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 78 MEXICO POWDERED BEVERAGES IN SUGAR SUBSTITUTES MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 79 MEXICO FOOD PRODUCTS IN SUGAR SUBSTITUTES MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 80 MEXICO BAKERY PRODUCTS IN SUGAR SUBSTITUTES MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 81 MEXICO CONFECTIONERY IN SUGAR SUBSTITUTES MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 82 MEXICO DAIRY PRODUCTS IN SUGAR SUBSTITUTES MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 83 MEXICO ORAL CARE IN SUGAR SUBSTITUTES MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 84 MEXICO PHARMACEUTICALS IN SUGAR SUBSTITUTES MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

List of Figure

FIGURE 1 NORTH AMERICA SUGAR SUBSTITUTES MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA SUGAR SUBSTITUTES MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA SUGAR SUBSTITUTES MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA SUGAR SUBSTITUTES MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA SUGAR SUBSTITUTES MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA SUGAR SUBSTITUTES MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA SUGAR SUBSTITUTES MARKET: DBMR MARKET POSITION GRID

FIGURE 8 NORTH AMERICA SUGAR SUBSTITUTES MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 NORTH AMERICA SUGAR SUBSTITUTES MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 10 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES OF NORTH AMERICA SUGAR SUBSTITUTES MARKET

FIGURE 11 NORTH AMERICA SUGAR SUBSTITUTES MARKET: SEGMENTATION

FIGURE 12 GROWING NUMBER OF OBESITY & DIABETIC POPULATION AND RISING TREND OF HEALTHY LIFESTYLE AND HEALTHY PRODUCTS ARE EXPECTED TO DRIVE THE NORTH AMERICA SUGAR SUBSTITUTES MARKET IN THE FORECAST PERIOD OF 2020 TO 2027

FIGURE 13 HIGH-FRUCTOSE SYRUPS IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF NORTH AMERICA SUGAR SUBSTITUTES MARKET IN 2020 & 2027

FIGURE 14 NORTH AMERICA SUGAR SUBSTITUTES MARKET: BY TYPE, 2019

FIGURE 15 NORTH AMERICA SUGAR SUBSTITUTES MARKET: BY FORM, 2019

FIGURE 16 NORTH AMERICA SUGAR SUBSTITUTES MARKET: BY APPLICATION, 2019

FIGURE 17 NORTH AMERICA SUGAR SUBSTITUTES MARKET: BY CATEGORY, 2019

FIGURE 18 NORTH AMERICA SUGAR SUBSTITUTES MARKET: SNAPSHOT (2019)

FIGURE 19 NORTH AMERICA SUGAR SUBSTITUTES MARKET: BY COUNTRY (2019)

FIGURE 20 NORTH AMERICA SUGAR SUBSTITUTES MARKET: BY COUNTRY (2020 & 2027)

FIGURE 21 NORTH AMERICA SUGAR SUBSTITUTES MARKET: BY COUNTRY (2019 & 2027)

FIGURE 22 NORTH AMERICA SUGAR SUBSTITUTES MARKET: BY TYPE (2020-2027)

FIGURE 23 NORTH AMERICA SUGAR SUBSTITUTES MARKET: COMPANY SHARE 2019 (%)

North America Sugar Substitutes Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its North America Sugar Substitutes Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as North America Sugar Substitutes Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.