North America Sports Betting Market Analysis and Insights

Sports betting is a financial bet on the result of one or numerous games, event/non-event of an occasion inside a game, or wagering on sports in seven days in length or season-long rivalry. Sports betting involves staking on the outcome of sporting events. Bettors attempt to predict the result of an event in order to win their bet - and potentially profit. NFL, NHL, NBA, MLB and other iconic American sports are all part of the package at sports betting. But besides that they also offer a range of European and other worldly sports, so the online sportsbooks is a good choice if person come from other territories across the globe.

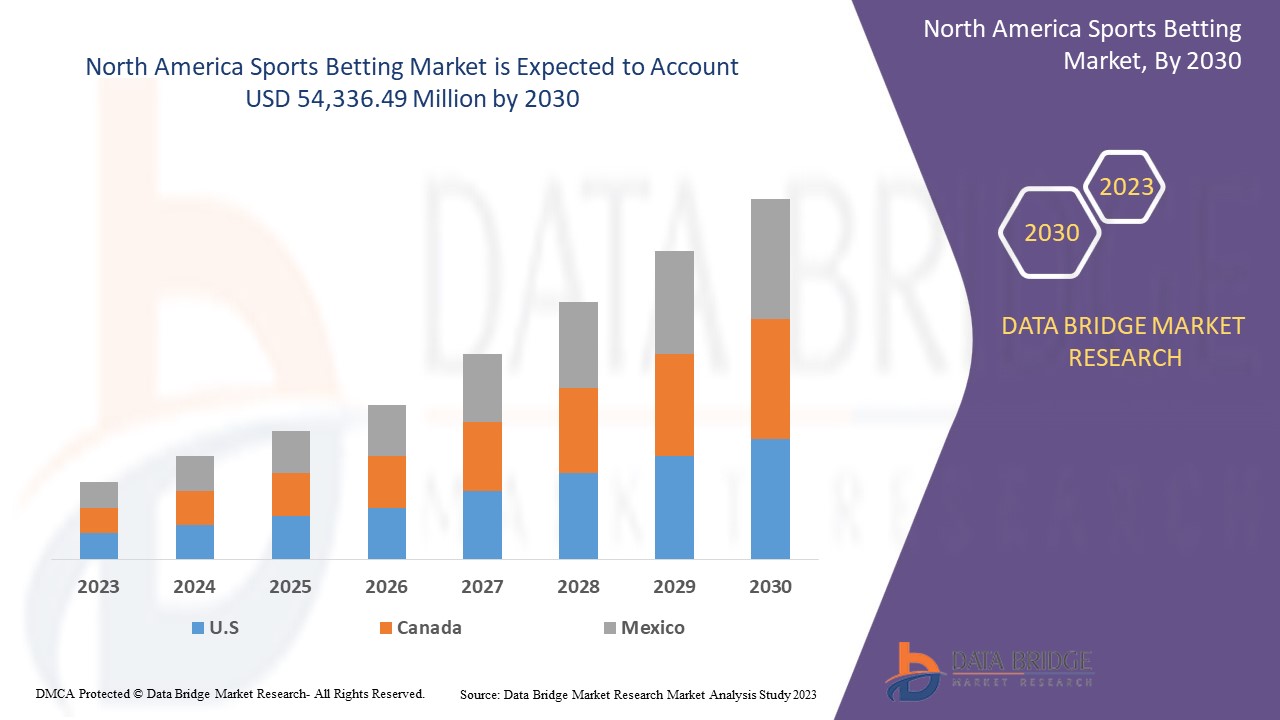

North America sports betting market is expected to gain market growth in the forecast period of 2023 to 2030. Data Bridge Market Research analyses that the market is growing with a CAGR of 8.9% in the forecast period of 2023 to 2030 and is expected to reach USD 54,336.49 million by 2030.

|

Report Metric |

Details |

|

Forecast Period |

2023 to 2030 |

|

Base Year |

2022 |

|

Historic Years |

2021 |

|

Quantitative Units |

Revenue in USD Million |

|

Segments Covered |

By Type (Line-In-Play, Fixed Old Betting, Exchange Betting, Daily Fantasy, Spread Betting, E-Sports, Pari Mutuel), Platform (Online and Offline), Sports (Racing and Non Racing Sports), Operator (Casinos, Bingo Halls, Card Rooms, Bookmakers, Coin-Operated Gambling Device, Concession Operators, Video Gaming Terminals, Lotteries Operator, Off-Track Sports Betting, and Others), Age Group (GEN Z, GEN Y/MILLENIALS, GEN X, Baby Boomers). |

|

Countries Covered |

U.S., Canada, Mexico |

|

Market Players Covered |

BETSSON AB, FORTUNA ENTERTAINMENT GROUP A.S., LAS VEGAS SANDS CORPORATION, bet365., Flutter Entertainment plc, 888 Holdings Plc, Entain, Kindred Group plc, MGM Resorts International, Kindred Group plc, Wynn Resorts Ltd, NOVIBET, Galaxy Entertainment Group Limited, Resorts World at Sentosa Pte. Ltd., Sun International, RTSmunity a.s., SKY INFOTECH, Peermont North America Proprietary Limited, SJM Holdings Limited, Sportradar AG, FanUp, Inc., Rivalry Ltd., EveryMatrix., Kairos Group, BETAMERICA, Scientific Game, ComeOn Group among others. |

Market Definition

Sports betting is a financial bet on the result of one or numerous games, events/non-events of an occasion inside a game, or wagering on sports in seven days in length or season-long rivalry. Sports betting involves staking on the outcome of sporting events. Bettors attempt to predict the result of an event to win their bet - and potentially profit.

NFL, NHL, NBA, MLB, and other iconic American sports are all part of the package for sports betting. But besides that, they also offer a range of European and otherworldly sports, so online sportsbooks are a good choice if people come from other territories across the globe.

Sports Betting Market Dynamics

Drivers

-

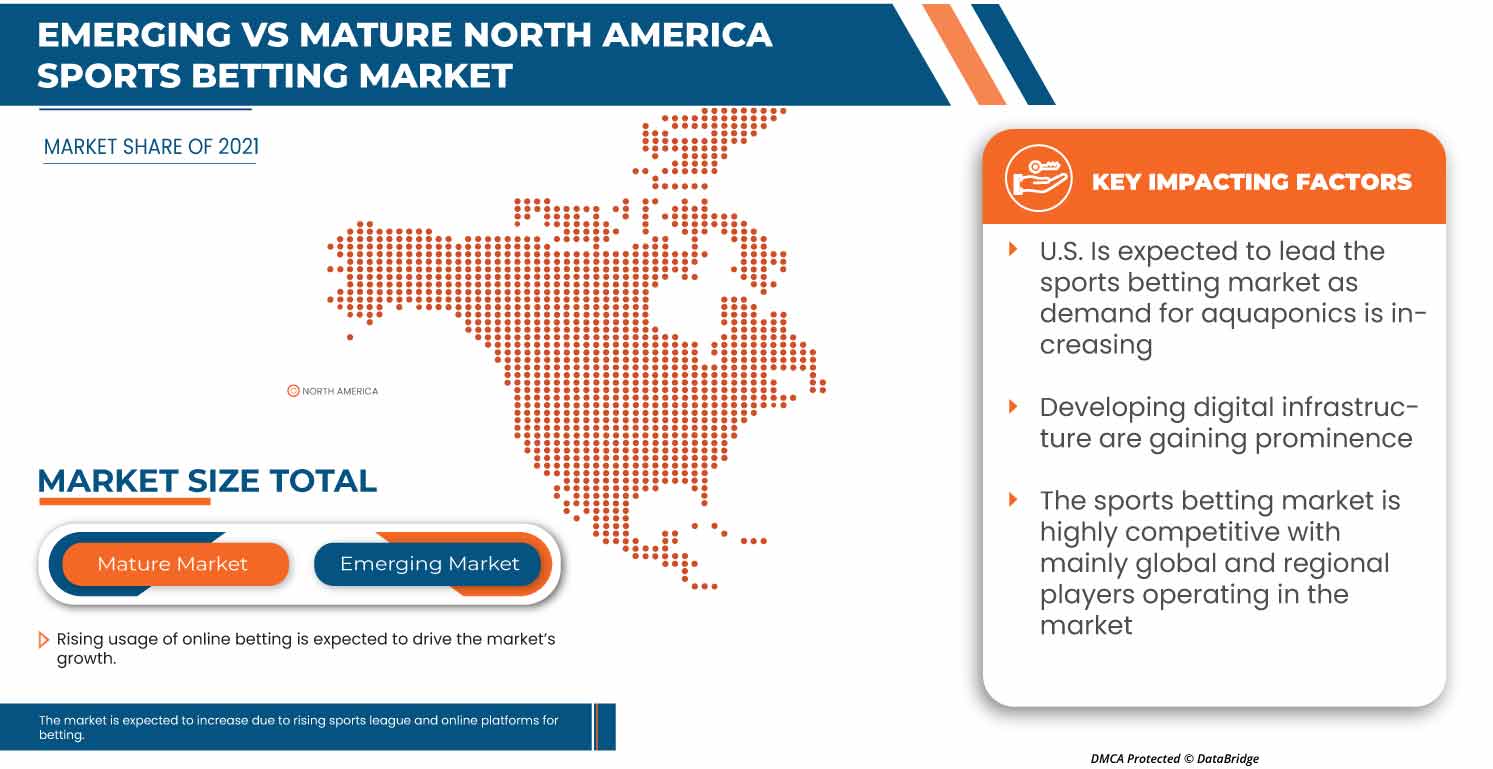

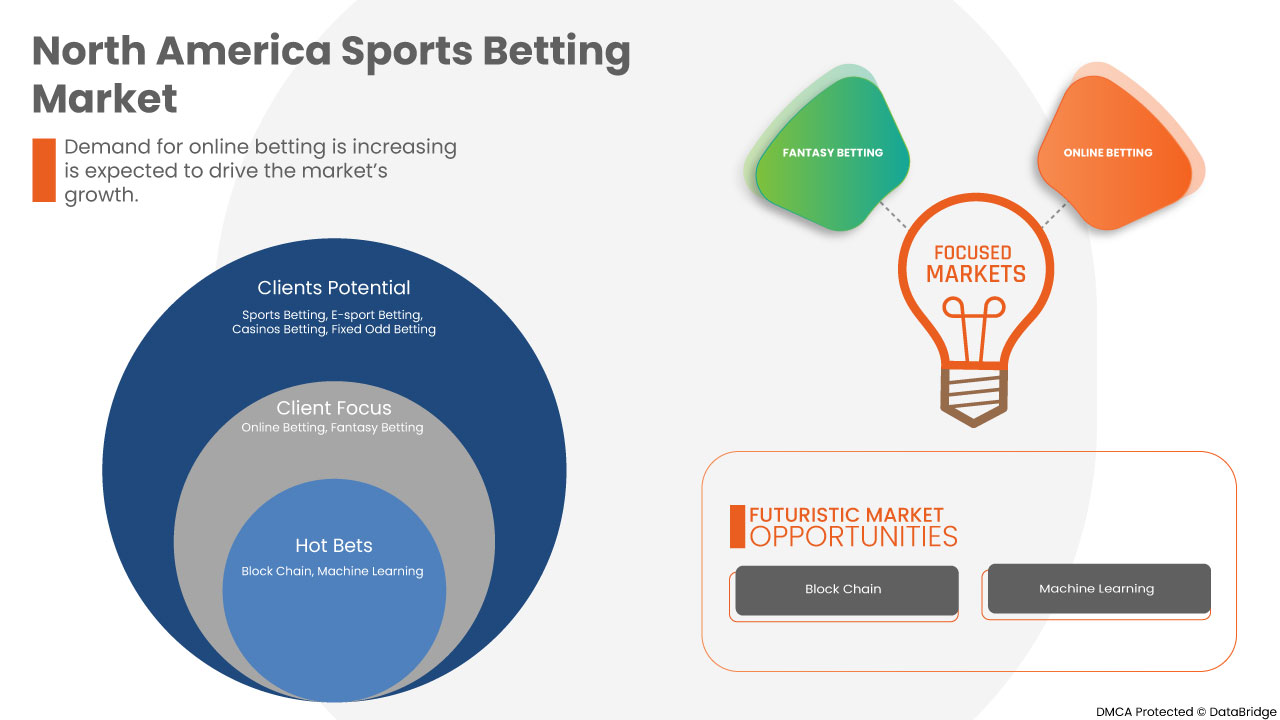

Rising usage of online betting

Sports betting is known as predicting sports results and making a bet on the outcome. The most popular sports for wagering at the amateur and professional levels include association football, American football, basketball, baseball, hockey, track cycling, car racing, mixed martial arts, and boxing. The frequency of sports wagering varies by culture. In addition to non-athletic events like reality TV competitions and elections, sports betting is legal in non-human competitions like cockfighting, greyhound racing, and horse racing.

-

Increasing e-sports competition

Every year, more and more people play video games, and more and more of them are entering virtual worlds. The popularity of e-sports games currently brings in more money than the music and film industries combined. For many people, gaming is no longer merely a pastime. The e-sports sector is expanding as a result of the pandemic. Millions of people turned to recreational gaming during the shutdown; some even turned to professional gaming. But the variety of games and genres available is just as impressive as the success of the top e-sports titles.

Opportunity

-

Rise in live e-sports coverage platform

The e-sports sector has grown significantly in terms of spectators and money. The growing audience was the key factor in the income growth, not just because those viewers were bringing in money. Brands are engaging in e-sports marketing, both directly and indirectly, as they recognise the potential of reaching a sizable and engaged audience. The surges in e-sports investment and revenue have been fuelled in part by the pop-culturization of the sector. The social aspect of live streaming and gameplay is a major reason why e-sports have reached such heights. Fans can interact directly with players and teams through video game-specific streaming services like Twitch and YouTube Gaming, while more widely used social networks have fostered these relationships. Some e-sports organizations, like FaZe Clan, are aggressively expanding into markets like merchandise, giving their brands more recognition than if they had only focused on e-sports.

Restraints/Challenges

Everyone in the world of sports betting is searching for an advantage. While most seasoned, sharp bettors know that growing a bankroll requires careful money management, in-depth analytical research, and much patience, many novice bettors are searching for quick wins.

In the modern world, sports betting has grown highly widespread. Sports betting is a type of gambling in which a wager is made on how a sporting event will turn out. Online betting is one of the many sports betting types available anywhere. Politicians' elections and reality show competitions are only examples of non-athletic activities that can be bet on. The gambling industry has changed how sports are watched and even played. The uncertainty of the outcome is an essential part of the sport's attraction. If the result is pre-determined, the integrity of sports is lost, and with this, a large part of its meaning and appeal for fans. Match fixing is, therefore, a major threat to sports, and the advent of online gambling has increased the risk of match-fixing for financial gain. The huge scale of the North America gambling industry is attractive to organized crime, and the range of the types of bets has increased inside misinformation.

Post COVID-19 Impact on Sports Betting Market

The COVID-19 has positively affected the market. As the use of online games has increased in those years such as betting and fantasy sports games among others. Hence the use of sports betting has widely increased in the world’s population. Hence, the pandemic has effected positively on this market.

Recent Development

- In September 2022, Entain Plc announced that it had collaborated with Bally’s Corporation, BetMGM, DraftKings FanDuel, and MGM Resorts International to Launch Principles for Responsible Gaming. This helps organisation brand image among others globally.

North America Sports betting Market Scope

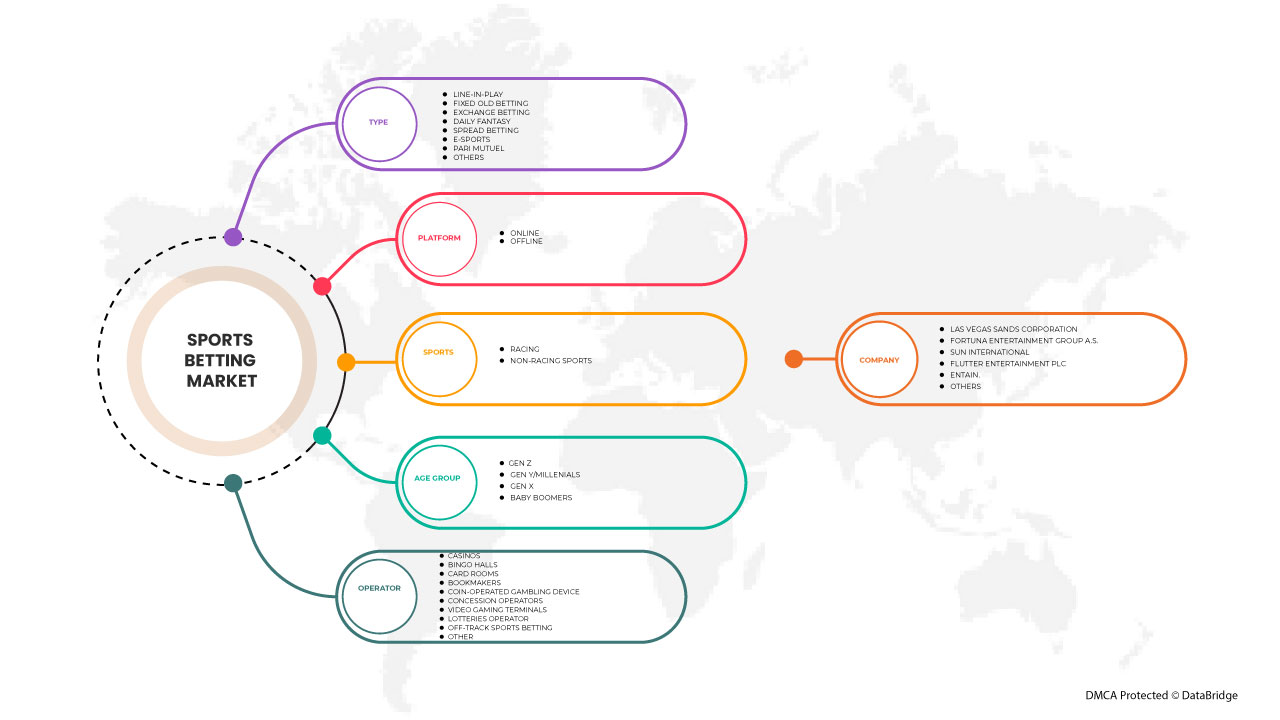

North America sports betting market is segmented into type, platform, operator, sports, and age group. The growth amongst these segments will help you analyse meagre growth segments in the industries and provide the users with a valuable market overview and market insights to make strategic decisions to identify core market applications.

Type

- Line-In-Play

- Fixed Old Betting

- Exchange Betting

- Daily Fantasy

- Spread Betting

- E-Sports

- Pari Mutuel

- Others

On the basis of type, the North America sports betting market is segmented into line-in-play, fixed old betting, exchange betting, daily fantasy, spread betting, e-sports, pari mutuel, others.

Platform

- Online

- Offline

On the basis of platform, the North America sports betting market is segmented into online and offline.

Sports

- Racing

- Non Racing Sports

On the basis of sports, the North America sports betting market is segmented into racing and non-racing sports.

Operator

- Food Grade

- Casinos

- Bingo Halls

- Card Rooms

- Bookmakers

- Coin-Operated Gambling Device

- Concession Operators

- Video Gaming Terminals

- Lotteries Operator

- Off-Track Sports Betting

- Others

On the basis of operator, the North America sports betting market is segmented into food grade, casinos, bingo halls, card rooms, bookmakers, coin-operated gambling device, concession operators, video gaming terminals, lotteries operator, off-track sports betting, others.

Age Group

- Gen Z

- Gen Y/Millennials

- Gen X

- Baby Boomers

On the basis of age group, the North America sports betting market is segmented into gen z, gen y, gen x and baby boomers.

Sports Betting Market Regional Analysis/Insights

The sports betting market is analysed and market size insights and trends are provided by country, type, platform, sports, operator, age group as referenced above.

North America market comprises of the countries U.S., Canada and Mexico.

U.S. dominates the sports betting market in terms of market share and market revenue and will continue to flourish its dominance during the forecast period. This is due to high demand for verification and validation of medical devices in the country.

The country section of the report also provides individual market impacting factors and changes in regulations in the market that impact the current and future trends of the market. Data points, such as new and replacement sales, country demographics, disease epidemiology, and import-export tariffs, are some of the major pointers used to forecast the market scenario for individual countries. In addition, the presence and availability of North America brands and their challenges faced due to high competition from local and domestic brands, and impact of sales channels are considered while providing forecast analysis of the country data.

Competitive Landscape and Sports Betting Market Share Analysis

The sports betting market competitive landscape provides details by the competitors. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, North America presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, and application dominance. The above data points provided are only related to the companies' focus on sports betting market.

Some of the major players operating in the sports betting market are BETSSON AB, FORTUNA ENTERTAINMENT GROUP A.S., LAS VEGAS SANDS CORPORATION, bet365., Flutter Entertainment plc, 888 Holdings Plc, Entain, Kindred Group plc, MGM Resorts International, Kindred Group plc, Wynn Resorts Ltd, NOVIBET, Galaxy Entertainment Group Limited, Resorts World at Sentosa Pte. Ltd., Sun International, RTSmunity a.s., SKY INFOTECH, Peermont North America Proprietary Limited, SJM Holdings Limited, Sportradar AG, FanUp, Inc., Rivalry Ltd., EveryMatrix., Kairos Group, BETAMERICA, Scientific Game, ComeOn Group among others.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF NORTH AMERICA SPORTS BETTING MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 MULTIVARIATE MODELING

2.6 TYPE LIFELINE CURVE

2.7 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.8 DBMR MARKET POSITION GRID

2.9 VENDOR SHARE ANALYSIS

2.1 SECONDARY SOURCES

2.11 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHT

4.1 CONSUMER BEHAVIOUR PATTERN

4.2 PESTEL ANALYSIS

4.2.1 POLITICAL

4.2.1.1 POLITICAL STABILITY OF ORGANIZATIONS:

4.2.1.2 FISCAL POLICY (TAXATION):

4.2.1.3 TRANSPARENCY IN GOVERNMENT STRUCTURE

4.2.2 ECONOMIC

4.2.2.1 INFLATION:

4.2.2.2 ECONOMIC GROWTH RATE

4.2.2.3 EXCHANGE AND INTEREST RATE

4.2.3 SOCIAL

4.2.3.1 DEMOGRAPHICS

4.2.3.2 GENDER

4.2.3.3 CULTURAL AND SOCIETAL NORMS

4.2.4 TECHNOLOGICAL

4.2.4.1 TECHNOLOGICAL INNOVATIONS

4.2.4.2 RESEARCH AND DEVELOPMENT

4.2.5 LEGAL

4.2.5.1 EMPLOYER REGULATIONS

4.2.5.2 LAW GOVERNING INTELLECTUAL PROPERTY

4.2.5.3 CONSUMER PROTECTION LEGISLATION

4.3 PORTER'S FIVE FORCES ANALYSIS FOR NORTH AMERICA SPORTS BETTING MARKET

5 REGULATION COVERAGE

5.1 REGULATIONS IN EUROPE

5.2 REGULATIONS IN NORTH AMERICA

5.3 REGULATIONS IN AUSTRALIA

5.4 REGULATIONS IN AFRICA

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 RISING USAGE OF ONLINE BETTING

6.1.2 INCREASING E-SPORTS COMPETITION

6.1.3 DEVELOPING DIGITAL INFRASTRUCTURE

6.1.4 INCREASE IN THE NUMBER OF SPORTS LEAGUES AND EVENTS

6.2 RESTRAINTS

6.2.1 STRINGENT REGULATORY FRAMEWORK

6.2.2 DECLINE IN OFFLINE BETTING PLATFORMS

6.3 OPPORTUNITIES

6.3.1 RISE IN LIVE ESPORTS COVERAGE PLATFORM

6.3.2 SURGE IN PURCHASING POWER OF MIDDLE-INCOME GROUPS

6.3.3 INCREASING MARKETING & ADVERTISEMENTS

6.4 CHALLENGES

6.4.1 HIGH RISK OF SCAMS AND FRAUDERY

6.4.2 HIGH TAXATION IN SPORTS BETTING

7 NORTH AMERICA SPORTS BETTING MARKET, BY TYPE

7.1 OVERVIEW

7.2 LINE-IN-PLAY

7.3 FIXED ODD BETTING

7.4 E-SPORTS

7.5 EXCHANGE BETTING

7.6 SPREAD BETTING

7.7 DAILY FANTASY

7.8 PARI MUTUEL

7.9 OTHERS

8 NORTH AMERICA SPORTS BETTING MARKET, BY PLATFORM

8.1 OVERVIEW

8.2 ONLINE

8.2.1 BLOCK CHAIN

8.2.2 ARTIFICIAL INTELLIGENCE

8.2.3 VIRTUAL REALITY

8.2.4 MACHINE LEARNING TOOLS

8.2.5 OTHERS

8.3 OFFLINE

9 NORTH AMERICA SPORTS BETTING MARKET, BY SPORTS

9.1 OVERVIEW

9.2 RACING

9.2.1 HORSE

9.2.2 AUTO

9.2.3 DOG

9.2.4 OTHERS

9.3 NON - RACING

9.3.1 FOOTBALL

9.3.2 CRICKET

9.3.3 BASKETBALL

9.3.4 TENNIS

9.3.5 BASEBALL

9.3.6 BOXING

9.3.7 HOCKEY

9.3.8 GOLF

9.3.9 OTHERS

10 NORTH AMERICA SPORTS BETTING MARKET, BY OPERATOR

10.1 OVERVIEW

10.2 CASINOS

10.3 CARD ROOMS

10.4 BINGO HALLS

10.5 BOOK MAKERS

10.6 COIN-OPERATED GAMBLING DEVICE

10.7 CONCESSION OPERATOR

10.8 VIDEO GAMING TERMINALS

10.9 LOTTERIES OPERATOR

10.1 OFF-TRACK SPORTS BETTING

10.11 OTHER

11 NORTH AMERICA SPORTS BETTING MARKET, BY AGE GROUP

11.1 OVERVIEW

11.2 GEN Y/MILLENNIALS

11.3 GEN X

11.4 GEN Z

11.5 BABY BOOMERS

12 NORTH AMERICA SPORTS BETTING MARKET, BY REGION

12.1 NORTH AMERICA

13 NORTH AMERICA SPORTS BETTING MARKET, COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

14 SWOT ANALYSIS

15 COMPANY PROFILES

15.1 FORTUNAEN TERTAINMENT GROUP A.S.

15.1.1 COMPANY SNAPSHOT

15.1.2 COMPANY SHARE ANALYSIS

15.1.3 PRODUCT PORTFOLIO

15.1.4 RECENT DEVELOPMENT

15.2 FLUTTER ENTERTAINMENT PLC

15.2.1 COMPANY SNAPSHOT

15.2.2 REVENUE ANALYSIS

15.2.3 COMPANY SHARE ANALYSIS

15.2.4 PRODUCT PORTFOLIO

15.2.5 RECENT DEVELOPMENTS

15.3 WYNN RESORTS LTD.

15.3.1 COMPANY SNAPSHOT

15.3.2 REVENUE ANALYSIS

15.3.3 PRODUCT PORTFOLIO

15.3.4 COMPANY SHARE ANALYSIS

15.3.5 RECENT DEVELOPMENTS

15.4 ENTAIN

15.4.1 COMPANY SNAPSHOT

15.4.2 REVENUE ANALYSIS

15.4.3 COMPANY SHARE ANALYSIS

15.4.4 PRODUCT PORTFOLIO

15.4.5 RECENT DEVELOPMENTS

15.5 BET365.

15.5.1 COMPANY SNAPSHOT

15.5.2 PRODUCT PORTFOLIO

15.5.3 COMPANY SHARE ANALYSIS

15.5.4 RECENT DEVELOPMENT

15.6 888 HOLDINGS PLC

15.6.1 COMPANY SNAPSHOT

15.6.2 REVENUE ANALYSIS

15.6.3 PRODUCT PORTFOLIO

15.6.4 RECENT DEVELOPMENTS

15.7 BETAMERICA

15.7.1 COMPANY SNAPSHOT

15.7.2 PRODUCT PORTFOLIO

15.7.3 RECENT DEVELOPMENTS

15.8 COMEON GROUP

15.8.1 COMPANY SNAPSHOT

15.8.2 PRODUCT PORTFOLIO

15.8.3 RECENT DEVELOPMENTS

15.9 BETSSON AB

15.9.1 COMPANY SNAPSHOT

15.9.2 REVENUE ANALYSIS

15.9.3 PRODUCT PORTFOLIO

15.9.4 RECENT DEVELOPMENTS

15.1 EVERYMATRIX.

15.10.1 COMPANY SNAPSHOT

15.10.2 PRODUCT PORTFOLIO

15.10.3 RECENT DEVELOPMENTS

15.11 FANUP, INC.

15.11.1 COMPANY SNAPSHOT

15.11.2 PRODUCT PORTFOLIO

15.11.3 RECENT DEVELOPMENTS

15.12 KAIROS GROUP

15.12.1 COMPANY SNAPSHOT

15.12.2 PRODUCT PORTFOLIO

15.12.3 RECENT DEVELOPMENTS

15.13 KINDRED GROUP PLC

15.13.1 COMPANY SNAPSHOT

15.13.2 REVENUS ANALYSIS

15.13.3 PRODUCT PORTFOLIO

15.13.4 RECENT DEVELOPMENTS

15.14 LAS VEGAS SANDS CORPORATION

15.14.1 COMPANY SNAPSHOT

15.14.2 REVENUE ANALYSIS

15.14.3 COMPANY SHARE ANALYSIS

15.14.4 PRODUCT PORTFOLIO

15.14.5 RECENT DEVELOPMENTS

15.15 NOVIBET

15.15.1 COMPANY SNAPSHOT

15.15.2 PRODUCT PORTFOLIO

15.15.3 RECENT DEVELOPMENTS

15.16 PEERMONT NORTH AMERICA PROPRIETARY LIMITED.

15.16.1 COMPANY SNAPSHOT

15.16.2 PRODUCT PORTFOLIO

15.16.3 RECENT DEVELOPMENTS

15.17 RESORTS WORLD SENTOSA

15.17.1 COMPANY SNAPSHOT

15.17.2 PRODUCT PORTFOLIO

15.17.3 RECENT DEVELOPMENTS

15.18 RTSMUNITY A.S.

15.18.1 COMPANY SNAPSHOT

15.18.2 PRODUCT PORTFOLIO

15.18.3 RECENT DEVELOPMENT

15.19 SCIENTIFIC GAMES

15.19.1 COMPANY SNAPSHOT

15.19.2 PRODUCT PORTFOLIO

15.19.3 RECENT DEVELOPMENTS

15.2 SKY INFOTECH

15.20.1 COMPANY SNAPSHOT

15.20.2 PRODUCT PORTFOLIO

15.20.3 RECENT DEVELOPMENT

15.21 SPORTRADAR AG

15.21.1 COMPANY SNAPSHOT

15.21.2 REVENUE ANALYSIS

15.21.3 PRODUCT PORTFOLIO

15.21.4 RECENT DEVELOPMENTS

15.22 SUN INTERNATIONAL

15.22.1 COMPANY SNAPXSHOT

15.22.2 REVENUE ANALYSIS

15.22.3 PRODUCT PORTFOLIO

15.22.4 RECENT DEVELOPMENTS

15.23 TONYBET

15.23.1 COMPANY SNAPSHOT

15.23.2 PRODUCT PORTFOLIO

15.23.3 RECENT DEVELOPMENTS

16 QUESTIONNAIRE

17 RELATED REPORTS

List of Table

TABLE 1 VARIOUS E-SPORTS TYPES AND THEIR GENRES

TABLE 2 BLOCKCHAIN IN ESPORTS

TABLE 3 TOP 10 BIGGEST SPORTS LEAGUES IN THE WORLD

TABLE 4 LIST OF ESPORTS COVERAGE PLATFORM

TABLE 5 IMPACT OF TAX ON ONLINE BETTING

TABLE 6 NORTH AMERICA SPORTS BETTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 7 NORTH AMERICA LINE-IN-PLAY IN SPORTS BETTING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 8 NORTH AMERICA FIXED ODD BETTING IN SPORTS BETTING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 9 NORTH AMERICA E-SPORTS IN SPORTS BETTING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 10 NORTH AMERICA EXCHANGE BETTING IN SPORTS BETTING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 11 NORTH AMERICA SPREAD BETTING IN SPORTS BETTING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 12 NORTH AMERICA DAILY FANTASY IN SPORTS BETTING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 13 NORTH AMERICA PARI MUTUEL IN SPORTS BETTING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 14 NORTH AMERICA OTHERS IN SPORTS BETTING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 15 NORTH AMERICA SPORTS BETTING MARKET, BY PLATFORM, 2021-2030 (USD MILLION)

TABLE 16 NORTH AMERICA ONLINE IN SPORTS BETTING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 17 NORTH AMERICA ONLINE IN SPORTS BETTING MARKET, BY TECHNOLOGY, 2021-2030 (USD MILLION)

TABLE 18 NORTH AMERICA OFFLINE IN SPORTS BETTING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 19 NORTH AMERICA SPORTS BETTING MARKET, BY SPORTS, 2021-2030 (USD MILLION)

TABLE 20 NORTH AMERICA RACING IN SPORTS BETTING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 21 NORTH AMERICA RACING IN SPORTS BETTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 22 NORTH AMERICA NON-RACING IN SPORTS BETTING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 23 NORTH AMERICA NON-RACING IN SPORTS BETTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 24 NORTH AMERICA SPORTS BETTING MARKET, BY OPERATOR, 2021-2030 (USD MILLION)

TABLE 25 NORTH AMERICA CASINOS IN SPORTS BETTING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 26 NORTH AMERICA CARD ROOMS IN SPORTS BETTING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 27 NORTH AMERICA BINGO HALLS IN SPORTS BETTING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 28 NORTH AMERICA BOOK MAKERS IN SPORTS BETTING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 29 NORTH AMERICA COIN-OPERATED GAMBLING DEVICE IN SPORTS BETTING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 30 NORTH AMERICA CONCESSION OPERATOR IN SPORTS BETTING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 31 NORTH AMERICA VIDEO GAMING TERMINALS IN SPORTS BETTING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 32 NORTH AMERICA LOTTERIES OPERATOR IN SPORTS BETTING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 33 NORTH AMERICA OFF-TRACK SPORTS BETTING IN SPORTS BETTING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 34 NORTH AMERICA OTHER IN SPORTS BETTING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 35 NORTH AMERICA SPORTS BETTING MARKET, BY AGE GROUP, 2021-2030 (USD MILLION)

TABLE 36 NORTH AMERICA GEN Y/MILLENNIALS IN SPORTS BETTING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 37 NORTH AMERICA GEN X IN SPORTS BETTING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 38 NORTH AMERICA GEN Z IN SPORTS BETTING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 39 NORTH AMERICA BABY BOOMERS IN SPORTS BETTING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 40 NORTH AMERICA SPORTS BETTING MARKET, BY COUNTRY, 2021-2030 (USD MILLION)

TABLE 41 NORTH AMERICA SPORTS BETTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 42 NORTH AMERICA SPORTS BETTING MARKET, BY PLATFORM, 2021-2030 (USD MILLION)

TABLE 43 NORTH AMERICA ONLINE IN SPORTS BETTING MARKET, BY PLATFORM, 2021-2030 (USD MILLION)

TABLE 44 NORTH AMERICA SPORTS BETTING MARKET, BY SPORTS, 2021-2030 (USD MILLION)

TABLE 45 NORTH AMERICA RACING IN SPORTS BETTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 46 NORTH AMERICA NON-RACING SPORTS IN SPORTS BETTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 47 NORTH AMERICA SPORTS BETTING MARKET, BY OPERATOR, 2021-2030 (USD MILLION)

TABLE 48 NORTH AMERICA SPORTS BETTING MARKET, BY AGE GROUP, 2021-2030 (USD MILLION)

TABLE 49 U.S. SPORTS BETTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 50 U.S. SPORTS BETTING MARKET, BY PLATFORM, 2021-2030 (USD MILLION)

TABLE 51 U.S. ONLINE IN SPORTS BETTING MARKET, BY PLATFORM, 2021-2030 (USD MILLION)

TABLE 52 U.S. SPORTS BETTING MARKET, BY SPORTS, 2021-2030 (USD MILLION)

TABLE 53 U.S. RACING IN SPORTS BETTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 54 U.S. NON-RACING SPORTS IN SPORTS BETTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 55 U.S. SPORTS BETTING MARKET, BY OPERATOR, 2021-2030 (USD MILLION)

TABLE 56 U.S. SPORTS BETTING MARKET, BY AGE GROUP, 2021-2030 (USD MILLION)

TABLE 57 CANADA SPORTS BETTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 58 CANADA SPORTS BETTING MARKET, BY PLATFORM, 2021-2030 (USD MILLION)

TABLE 59 CANADA ONLINE IN SPORTS BETTING MARKET, BY PLATFORM, 2021-2030 (USD MILLION)

TABLE 60 CANADA SPORTS BETTING MARKET, BY SPORTS, 2021-2030 (USD MILLION)

TABLE 61 CANADA RACING IN SPORTS BETTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 62 CANADA NON-RACING SPORTS IN SPORTS BETTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 63 CANADA SPORTS BETTING MARKET, BY OPERATOR, 2021-2030 (USD MILLION)

TABLE 64 CANADA SPORTS BETTING MARKET, BY AGE GROUP, 2021-2030 (USD MILLION)

TABLE 65 MEXICO SPORTS BETTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 66 MEXICO SPORTS BETTING MARKET, BY PLATFORM, 2021-2030 (USD MILLION)

TABLE 67 MEXICO ONLINE IN SPORTS BETTING MARKET, BY PLATFORM, 2021-2030 (USD MILLION)

TABLE 68 MEXICO SPORTS BETTING MARKET, BY SPORTS, 2021-2030 (USD MILLION)

TABLE 69 MEXICO RACING IN SPORTS BETTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 70 MEXICO NON-RACING SPORTS IN SPORTS BETTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 71 MEXICO SPORTS BETTING MARKET, BY OPERATOR, 2021-2030 (USD MILLION)

TABLE 72 MEXICO SPORTS BETTING MARKET, BY AGE GROUP, 2021-2030 (USD MILLION)

List of Figure

FIGURE 1 NORTH AMERICA SPORTS BETTING MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA SPORTS BETTING MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA SPORTS BETTING MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA SPORTS BETTING MARKET: NORTH AMERICA VS. REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA SPORTS BETTING MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA SPORTS BETTING MARKET: MULTIVARIATE MODELLING

FIGURE 7 NORTH AMERICA SPORTS BETTING MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 8 NORTH AMERICA SPORTS BETTING MARKET: DBMR MARKET POSITION GRID

FIGURE 9 NORTH AMERICA SPORTS BETTING MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 NORTH AMERICA SPORTS BETTING MARKET: SEGMENTATION

FIGURE 11 RISING THE USAGE OF ONLINE BETTING AND INCREASING ESPORTS COMPETITION IS DRIVING THE NORTH AMERICA SPORTS BETTING MARKET IN THE FORECAST PERIOD OF 2023 TO 2030

FIGURE 12 LINE-IN-PLAY SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA SPORTS BETTING MARKET FROM 2023 TO 2030

FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE NORTH AMERICA SPORTS BETTING MARKET

FIGURE 14 NORTH AMERICA DATA FOR ONLINE BETTING USAGE

FIGURE 15 AI IN ESPORTS

FIGURE 16 NORTH AMERICA SPORTS BETTING MARKET: BY TYPE, 2022

FIGURE 17 NORTH AMERICA SPORTS BETTING MARKET: BY TYPE, 2023-2030 (USD MILLION)

FIGURE 18 NORTH AMERICA SPORTS BETTING MARKET: BY TYPE, CAGR (2023-2030)

FIGURE 19 NORTH AMERICA SPORTS BETTING MARKET: BY TYPE, LIFELINE CURVE

FIGURE 20 NORTH AMERICA SPORTS BETTING MARKET: BY PLATFORM, 2022

FIGURE 21 NORTH AMERICA SPORTS BETTING MARKET: BY PLATFORM, 2023-2030 (USD MILLION)

FIGURE 22 NORTH AMERICA SPORTS BETTING MARKET: BY PLATFORM, CAGR (2023-2030)

FIGURE 23 NORTH AMERICA SPORTS BETTING MARKET: BY PLATFORM, LIFELINE CURVE

FIGURE 24 NORTH AMERICA SPORTS BETTING MARKET: BY DISTRIBUTION CHANNEL, 2022

FIGURE 25 NORTH AMERICA SPORTS BETTING MARKET: BY DISTRIBUTION CHANNEL, 2023-2030 (USD MILLION)

FIGURE 26 NORTH AMERICA SPORTS BETTING MARKET: BY DISTRIBUTION CHANNEL, CAGR (2023-2030)

FIGURE 27 NORTH AMERICA SPORTS BETTING MARKET : BY DISTRIBUTION CHANNEL, LIFELINE CURVE

FIGURE 28 NORTH AMERICA SPORTS BETTING MARKET: BY OPERATOR, 2022

FIGURE 29 NORTH AMERICA SPORTS BETTING MARKET: BY OPERATOR, 2023-2030 (USD MILLION)

FIGURE 30 NORTH AMERICA SPORTS BETTING MARKET: BY OPERATOR, CAGR (2023-2030)

FIGURE 31 NORTH AMERICA SPORTS BETTING MARKET: BY OPERATOR, LIFELINE CURVE

FIGURE 32 NORTH AMERICA SPORTS BETTING MARKET: BY AGE GROUP, 2022

FIGURE 33 NORTH AMERICA SPORTS BETTING MARKET: BY AGE GROUP, 2023-2030 (USD MILLION)

FIGURE 34 NORTH AMERICA SPORTS BETTING MARKET: BY AGE GROUP, CAGR (2023-2030)

FIGURE 35 NORTH AMERICA SPORTS BETTING MARKET: BY AGE GROUP, LIFELINE CURVE

FIGURE 36 NORTH AMERICA SPORTS BETTING MARKET: SNAPSHOT (2022)

FIGURE 37 NORTH AMERICA SPORTS BETTING MARKET: BY COUNTRY (2022)

FIGURE 38 NORTH AMERICA SPORTS BETTING MARKET: BY COUNTRY (2023 & 2030)

FIGURE 39 NORTH AMERICA SPORTS BETTING MARKET: BY COUNTRY (2023 & 2030)

FIGURE 40 NORTH AMERICA SPORTS BETTING MARKET: BY TYPE (2023 & 2030)

FIGURE 41 NORTH AMERICA SPORTS BETTING MARKET: COMPANY SHARE 2022 (%)

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.