North America Smart Irrigation Market, By Offering (Hardware, Software, Services), System Type (Sensor-Based Controller Systems, Weather-Based Controller Systems), Application (Agriculture, Non-Agriculture), Country (U.S., Canada and Mexico) Industry Trends and Forecast to 2028

Market Analysis and Insights: North America Smart Irrigation Market

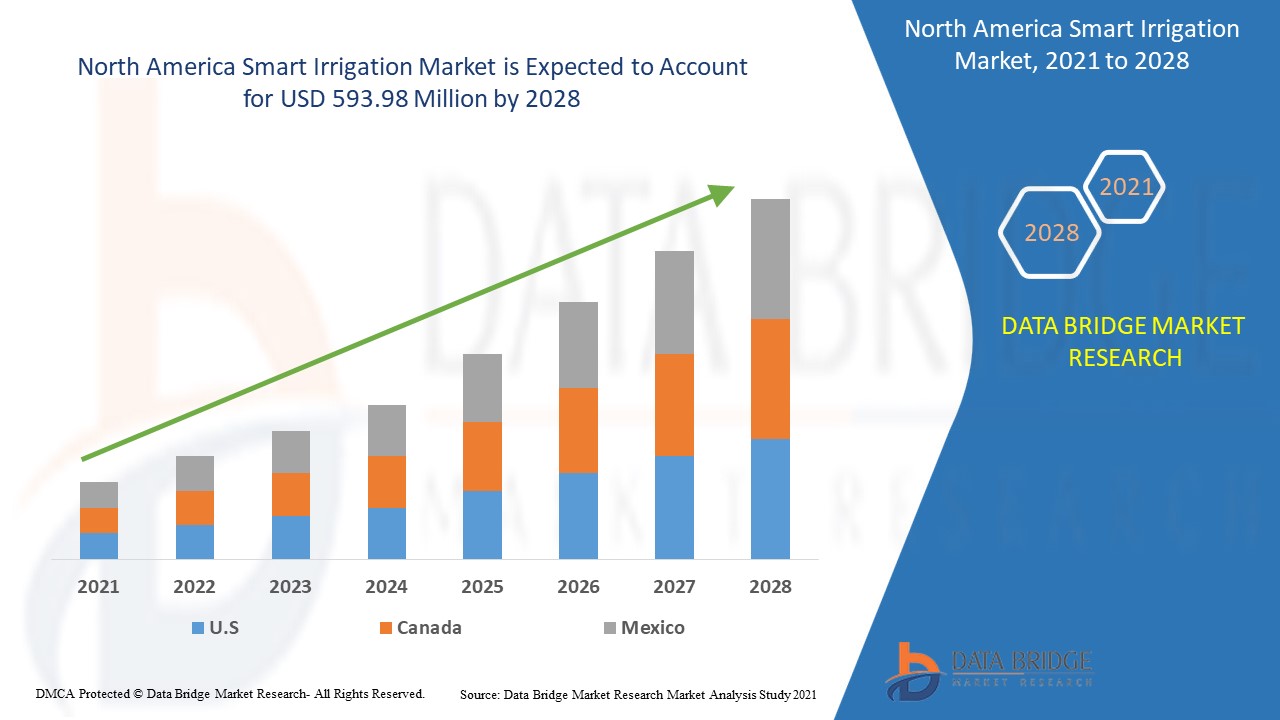

The smart irrigation market is expected to gain market growth in the forecast period of 2021 to 2028. Data Bridge Market Research analyses that the market is growing with the CAGR of 13.5% in the forecast period of 2021 to 2028 and expected to reach USD 593.98 million by 2028.

Smart irrigation technologies help people precisely to schedule/assign when plants and crops need to be watered and during the concentration of water when required by the plant. Using advanced technologies such as IoT/M2M sensors, growers can monitor the soil moisture levels around their plants, monitor weather conditions, so they can use water more efficiently and effectively. Moreover, the concentration of fertilizers required for optimum growth of the plants and crops can also be monitored using smart irrigation technologies. Smart irrigation technologies are quite different from traditional irrigation technologies as they operate on a present programmed schedule and timers. Smart irrigation technologies consist of controllers and sensors, controllers are of two types climate-based and soil moisture controllers. On the other hand, sensors consist of soil moisture, rain freeze, and wind sensors. Additionally, there are various other types of sensors such as temperature, fertigation, and others. One of the advantages of smart irrigation technology is that it helps with the elimination of water wastage and even provides a healthy and attractive landscape.

The possible growth of the market has been highly boosted due to an increase in government initiatives and policies to promote water conservation & farming and growth in wireless sensors integrated irrigation sprinklers and dripping systems American region. The high installation cost of smart Irrigation solutions can act as a major restraint factor for North America smart irrigation market.

This smart irrigation market report provides details of market share, new developments, and product pipeline analysis, impact of domestic and localised market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, product approvals, strategic decisions, product launches, geographical expansions, and technological innovations in the market. To understand the analysis and the market scenario contact us for an Analyst Brief, our team will help you create a revenue impact solution to achieve your desired goal.

North America Smart Irrigation Market Scope and Market Size

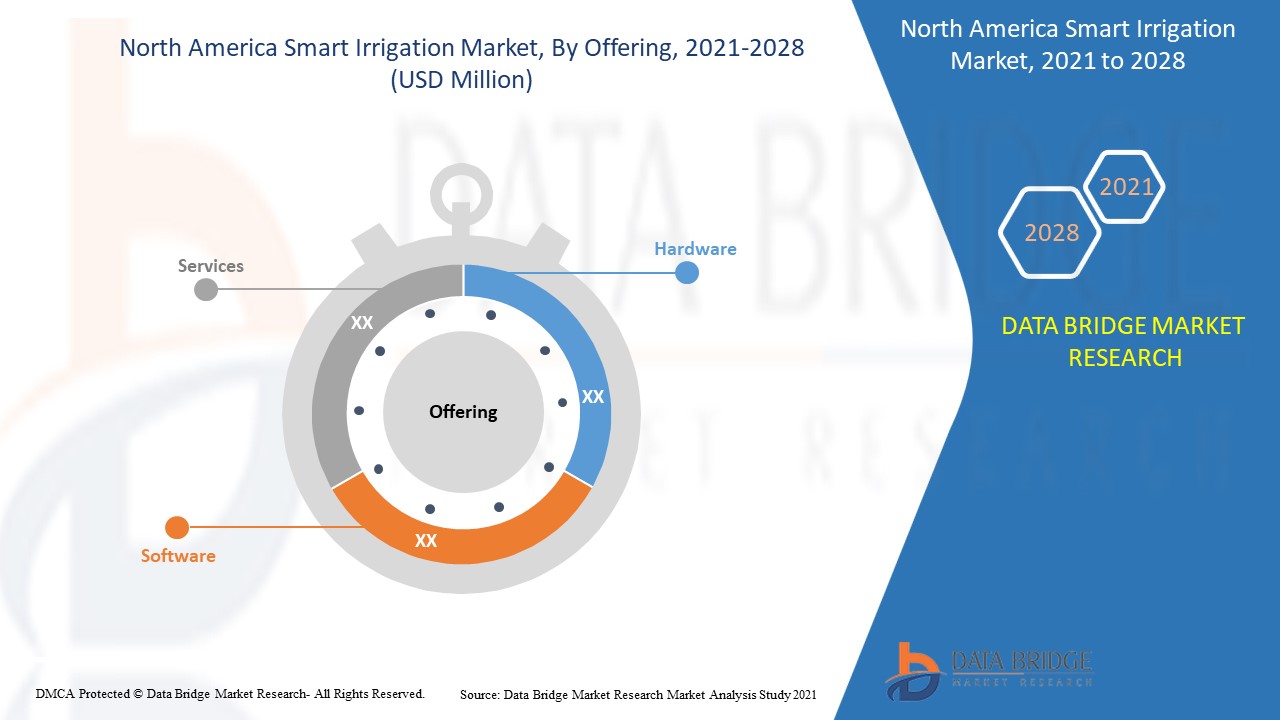

The smart irrigation market is segmented on the basis of offering, systems type and application. The growth among segments helps you analyse niche pockets of growth and strategies to approach the market and determine your core application areas and the difference in your target markets.

- On the basis of offering, North America smart irrigation market is segmented into hardware, software, and services. In 2021, the hardware held a major share in the market, increase in government initiatives and policies to promote water conservation & farming.

- On the basis of system type, North America smart irrigation market is segmented into weather-based controller systems and sensor-based controller systems. In 2021, the sensor-based controller systems segment hold the largest market share in North America smart irrigation market owing such as growth of smart cities and need for efficient irrigation systems to fuel smart irrigation controller adoption.

- On the basis of application, North America smart irrigation market is segmented into agriculture and non- agriculture. In 2021, the agriculture segment augments the market with largest share owing to factors such as rise in penetration of automated monitoring systems in the farming sector.

North America Smart Irrigation Market Country Level Analysis

The smart irrigation market is analysed and market size information is provided by the country, offering, system type and application.

The countries covered in North America smart irrigation market report are the U.S., Canada and Mexico.

The U.S. accounted for maximum share in the North America smart irrigation market owing to presence of large number of companies providing smart irrigation products and solutions. Canada is second dominating country in smart irrigation market due to increase in adoption of products and technical advancements in products. Mexico is the third dominating country in smart irrigation market as the smart irrigation is increasing in the country.

The country section of the smart irrigation market report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points such as new sales, replacement sales, country demographics, regulatory acts and import-export analysis are some of the major pointers used to forecast the market scenario for individual countries. Also, presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of sales channels are considered while providing forecast analysis of the country data.

Increasing adoption of Contract Manufacturing

The smart irrigation market also provides you with detailed market analysis for every country growth in installed base of different kind of products for smart irrigation market, impact of technology using life line curves and changes in requirement of abrasives products, regulatory scenarios and their impact on the smart irrigation market. The data is available for historic period 2011 to 2019.

Competitive Landscape and Smart irrigation Market Share Analysis

The smart irrigation market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, company strengths and weaknesses, product launch, clinical trials pipelines, brand analysis, product approvals, patents, product width and breadth, application dominance, technology lifeline curve. The above data points provided are only related to the companies’ focus related to North America smart irrigation market.

Some of the major players operating in North America smart irrigation market are Orbit Irrigation Products LLC., HydroPoint, The Toro Company, Rain Bird Corporation, Rachio inc., NETAFIM, Galcon, Weathermatic, HUNTER INDUSTRIES, Banyan Water, Inc., Stevens Water Monitoring Systems Inc., Valmont Industries, Inc., The Scotts Company LLC., AquaSpy, Soil Scout Oy, Jain Irrigation, Inc., CALSENSE, Acclima, Inc., Caipos GmbH, Delta-T Devices Ltd, WaterForce, RainMachine - Green Electronics LLC, Skydrop, LLC, Lindsay Corporation, Wiseconn Engineering, Nelson Irrigation, and Hortau among others.

For instance,

- In July 2020, NETAFIM entered into a partnership with Sentek’s Industry. The key feature of this partnership was to strengthen NETAFIM’s digital farming capabilities as Sentek’s Industry is known for its soil sensor technology. This partnership helps in developing products with end-to-end cloud-based automation capabilities and provides control solutions. Both the companies benefited mutually from this partnership which helped them to expand their markets.

Partnership, joint ventures and other strategies enhances the company market share with increased coverage and presence. It also provides the benefit for organisation to improve their offering for smart irrigation market through expanded product range.

SKU-