North America Rowing Machines Market, By Type (Air, Water, Magnetic, and Hydraulic), Body Type (Metal and Solid Wood), Weight Capacity (300 to 499 Pounds, 200 to 249 Pounds, 100 to 199 Pounds, and Under 100 Pounds), Distribution Channel (Online and Offline), Resistant Level (Less Than 24 and More Than 24), Color (Black, Light Grey, and Others), End-User (Commercial and Residential) - Industry Trends and Forecast to 2030.

North America Rowing Machines Market Analysis and Size

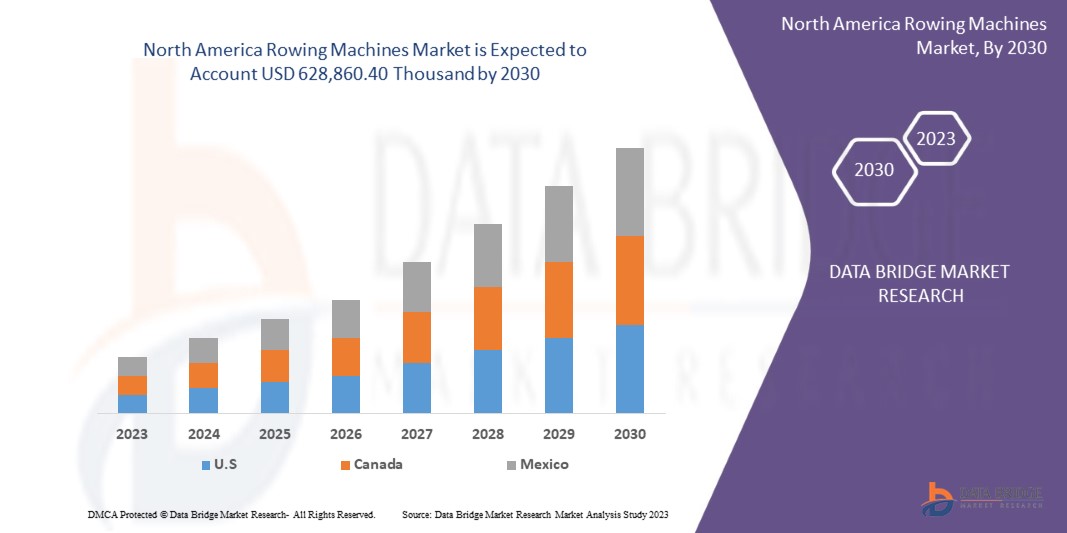

North America rowing machines market is expected to grow significantly in the forecast period of 2023 to 2030. Data Bridge Market Research analyzes that the market is growing with a CAGR of 4.5% in the forecast period of 2023 to 2030 and is expected to reach USD 628,860.40 thousand by 2030. The major factor driving the market growth is the rising popularity of rowing machine products among the millennials and growing awareness regarding the properties of the rowing machine products.

A rowing machine, sometimes known as a rower machine, simulates the motions of rowing and is excellent for a full-body workout. Aerobic fitness will increase with a low-impact cardiovascular workout on a rowing machine. Also, it tones and strengthens every muscle in the body. Many gyms have rowing machines that are easy to use. A rowing machine is a flexible exercise option because it is easier to transport than a treadmill or an elliptical.

North America rowing machines market report provides details of market share, new developments, and the impact of domestic and localized market players, analyzes opportunities in terms of emerging revenue pockets, changes in market regulations, products approvals, strategic decisions, product launches, geographic expansions, and technological innovations in the market. To understand the analysis and the market scenario, contact us for an analyst brief. Our team will help you create a revenue-impact solution to achieve your desired goal.

|

Report Metric

|

Details

|

|

Forecast Period

|

2023 to 2030

|

|

Base Year

|

2022

|

|

Historic Year

|

2021 (Customizable to 2020 - 2015)

|

|

Quantitative Units

|

Revenue in USD Thousand

|

|

Segments Covered

|

By Type (Air, Water, Magnetic, and Hydraulic), Body Type (Metal and Solid Wood), Weight Capacity (300 to 499 Pounds, 200 to 249 Pounds, 100 to 199 Pounds, and Under 100 Pounds), Distribution Channel (Online and Offline), Resistant Level (Less Than 24 and More Than 24), Color (Black, Light Grey, and Others), End-User (Commercial and Residential)

|

|

Countries Covered

|

U.S., Canada, and Mexico

|

|

Market Players Covered

|

BODYCRAFT, Johnson Health Tech, Nautilus, Inc., Mr Captain Brand, Stamina Products, Inc., Sunny Health and Fitness, iFIT Inc., York Fitness UK, Infiniti, Concept2 inc., WaterRower, RP3 Rowing, Peloton Interactive, Inc., ERGATTA, AVIRON INTERACTIVE INC., TECHNOGYM S.p.A, Hydrow, Oartec, Decathlon, Intense Enterprises, HAMMER Sport AG, Tunturi New Fitness, adidas AG., Cosco (India) Limited, Life Fitness, Pure Design Fitness, TOPIOM, Modcon Industries Private Limited, Shandong DHZ Fitness Equipment Co., Ltd, KAYA, SHUA, and SHANDONG BAODELONG FITNESS CO., LTD among others

|

Market Definition

Rowing machines, also known as ergometers or ergs, use the upper and lower body on every stroke. An indoor rower or rowing machine is a machine used to stimulate the action of watercraft rowing for the purpose of exercise or training for rowing. This helps in strengthening, toning the muscles, and improving endurance. Rowing is considered a total-body workout.

North America Rowing Machines Market Dynamics

DRIVERS

Rising Awareness of Weight Management Among Millennials

- In recent times, there has been an increasing shift among the current millennial generation toward obesity. According to an estimation of Cancer Research U.K., seven out of ten millennials who were born between 1981 and 1996 are on the path to becoming obese or overweight until they reach middle age. Several factors, such as consumption of highly processed foods, fast-paced lifestyle, stress eating, and sedentary lifestyle are factors attributed to obesity among millennials. However, because of different factors, there has been a rise in awareness of weight management among individuals. In this digital age, millennials are connected to a wide range of information available on social media and the internet. The population is exposed to various studies through news articles and other sources related to weight management and its importance for mental and physical well-being. In addition to it, the business involved in the fitness industry, corporates, health professionals, and the government is focused to spread awareness among the young population about the benefits of physical fitness to avoid diseases such as diabetes, cancer, and heart disease.

Increasing Spending on Professional Sports on a North America Level

- Most countries worldwide tend to spend money on sports for their citizens. The most important aspect of investment in professional sports is to improve public health so that the risk of chronic diseases such as heart disease and obesity decreases along with improvement in mental health. Moreover, the development of sports has the potential to contribute to the economic development of the nation by creating jobs and generating revenue through events and tourism. In addition to it, sports can improve intercultural communication and understanding. Countries can promote their cultures and create connections with other nations by holding international sporting events. Therefore, to promote the sports culture, the government, and various other organizations spend money on professional sports.

Growing Acceptance of Fitness Equipment in the Flourishing Hospitality Sector

- Over the past decades, the hospitality sector has seen a boom worldwide owing to factors such as an increase in disposable income, advancement in technology, ease of access to information, and globalization. In the hospitality industry, the requirements of hotel guests and those of gym customers increasingly coincide. Fitness enthusiasts who reside in hotels for various reasons, such as vacation or business trips prefer to book a room in a hotel, which has access to fitness centers or gyms. Millennials are becoming more aware of physical fitness. Thus, they look for different ways to be fit even when they are traveling and staying in hotels.

OPPORTUNITIES

Rising Spending on Foldable Variants

- North America rowing machines market has been growing in recent years owing to various factors such as a rise in awareness of physical activity and a growing dedicated gym setup. Moreover, the manufacturers of rowing machines have observed this trend and are focusing on developing new variants of rowing machines, which are foldable in nature. As the conventional rowing machines acquired more space, it was difficult to set up the machine along with other instruments in the gym. However, due to the foldable variants, the space issue in the gym gets resolved. When not in use, the machines could be folded and kept, which further saves space for other activities. In addition, vertical standing rowing machines are present in the market to which customers are attracted.

Increasing Incorporation of Other Features, Namely Entertainment and Virtual Rowing Experience

- The fitness industry is innovating constantly, which is fuelled by digital developments, and social media engagement. There has been increasing significance of technologies, including virtual and augmented reality, blockchain, artificial intelligence, the Internet of Things, robotics, cloud, data analytics, wearable technology, and many more. Manufacturers of rowing machines are incorporating a wide range of technological advancements in rowing machines to give a user-friendly experience to customers.

RESTRAINTS/CHALLENGES

High Prices Associated with Rowing Machines

- Rowing machines are well-known fitness equipment that is used for full-body workouts. Through performing workout on rowing machines, one can train a majority of muscles, keeps the heart strong, and aid in weight loss. However, the high price is one of the major drawbacks related to rowing machines. The majority of the price is related to the production cost of the equipment. Various raw materials such as steel, iron, rubbers, and leather are required to build fitness equipment such as rowing machines. Steel prices are volatile in nature that are affected by the supply-demand or geopolitical situations that are occurring across the globe. Moreover, the prices of coking coal, which is a key raw material to manufacture steel, are volatile in nature. The lack of raw materials due to increased demand has caused the cost of rowing machines to go up. Rowing machines are not popular when compared to other fitness equipment, such as cycling bikes and treadmills, which makes the cost of rowing machines scale up. Also, the cost of rowing machines increases due to the high logistics costs. The freight costs are high due to the volatile price of crude oil and the shortage of containers, which contributes to the high cost of logistics.

Availability of Other Fitness Equipment and Various Exercises

- Although rowing machines have various advantages associated with them, there are a few drawbacks associated with them. They require a large area due to the flywheel or tank, rails, and the necessity for enough space for a full extension of arms and legs. It can be challenging to fit the machine into a more compact home or apartment. Moreover, if proper form is not maintained, the rower can cause injury or back pain. The noise generated by rowing machines can be unbearable for some individuals, which proves to be one of the drawbacks of rowing machines.

Recent Development

- In September 2021, Nautilus, Inc. announced the signing of a formal deal to acquire VAY, a North America leader in motion technology. The purchase will enable Nautilus to grow its JRNY digital platform by offering core technologies that will power the company's vision and motion-tracking capabilities, which will allow for real-time data analysis during workouts. These features will be integrated into Nautilus' JRNY platform to develop and expedite highly tailored one-on-one exercise sessions

North America Rowing Machines Market Scope

North America rowing machines market is segmented into seven notable segments based on type, body type, weight capacity, distribution channel, resistant level, color, and end-user. The growth amongst these segments will help you analyze major growth segments in the industries and provide the users with a valuable market overview and market insights to make strategic decisions to identify core market applications.

Type

- Air

- Water

- Magnetic

- Hydraulic

On the basis of type, the market is segmented into air, water, magnetic, and hydraulic.

Body Type

- Metal

- Solid Wood

On the basis of body type, the market is segmented into metal and solid wood.

Weight Capacity

- 300 to 499 Pounds

- 200 to 249 Pounds

- 100 to 199 Pounds

- Under 100 Pounds

On the basis of weight capacity, the market is segmented into 300 to 499 Pounds, 200 to 249 Pounds, 100 to 199 Pounds, and Under 100 Pounds.

Distribution Channel

- Online

- Offline

On the basis of distribution channel, the market is segmented into online and offline.

Resistant Level

- Less Than 24

- More Than 24

On the basis of resistant level, the market is segmented into less than 24 and more than 24.

Color

- Black

- Light Grey

- Others

On the basis of color, the market is segmented into black, light grey, and others.

End-User

- Commercial

- Residential

On the basis of end-user, the market is segmented into commercial and residential.

North America Rowing Machines Market Regional Analysis/Insights

North America rowing machines market is segmented into seven notable segments based on type, body type, weight capacity, distribution channel, resistant level, color, and end-user.

The countries in North America rowing machines market are the U.S., Canada, and Mexico.

The U.S. is dominating North America rowing machines market in terms of market share and market revenue due to growing awareness regarding the properties of the rowing machines products in the region.

The country section of the report also provides individual market-impacting factors and changes in market regulation that impact the current and future trends of the market. Data point downstream and upstream value chain analysis, technical trends, porter's five forces analysis, and case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of North America brands and their challenges faced due to large or scarce competition from local and domestic brands, the impact of domestic tariffs, and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and North America Rowing Machines Market Share Analysis

North America rowing machines market competitive landscape provides details of competitors. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, production sites and facilities, company strengths and weaknesses, product launch, product trials pipelines, product approvals, patents, product width and breadth, application dominance, and technology lifeline curve. The above data points provided are only related to the companies’ focus related to the market.

Some of the prominent participants operating in North America rowing machines market are BODYCRAFT, Johnson Health Tech, Nautilus, Inc., Mr Captain Brand, Stamina Products, Inc., Sunny Health and Fitness, iFIT Inc., York Fitness UK, Infiniti, Concept2 inc., WaterRower, RP3 Rowing, Peloton Interactive, Inc., ERGATTA, AVIRON INTERACTIVE INC., TECHNOGYM S.p.A, Hydrow, Oartec, Decathlon, Intense Enterprises, HAMMER Sport AG, Tunturi New Fitness, adidas AG., Cosco (India) Limited, Life Fitness, Pure Design Fitness, TOPIOM, Modcon Industries Private Limited, Shandong DHZ Fitness Equipment Co., Ltd, KAYA, SHUA, and SHANDONG BAODELONG FITNESS CO., LTD among others.

SKU-