North America Rigid Thermoform Plastic Packaging Market

Market Size in USD million

CAGR :

%

USD

207.80 million

USD

290.53 million

2022

2030

USD

207.80 million

USD

290.53 million

2022

2030

| 2023 –2030 | |

| USD 207.80 million | |

| USD 290.53 million | |

|

|

|

North America Rigid Thermoform Plastic Packaging Market Analysis and Size

One of the main trends in rigid plastic packaging is using fiber-based materials for packaging. in addition to agriculture, medicine, personal care, and pharmaceuticals. Rigid plastic packaging solutions are used in various industrial verticals. Extrusion, injection molding, blow molding, thermoforming, and other techniques are used to create these packing components. Plastic bottles, on the other hand, have become an appealing replacement for glass bottles due to their appealing qualities, affordability, lightness, ease of production, and impact resistance.

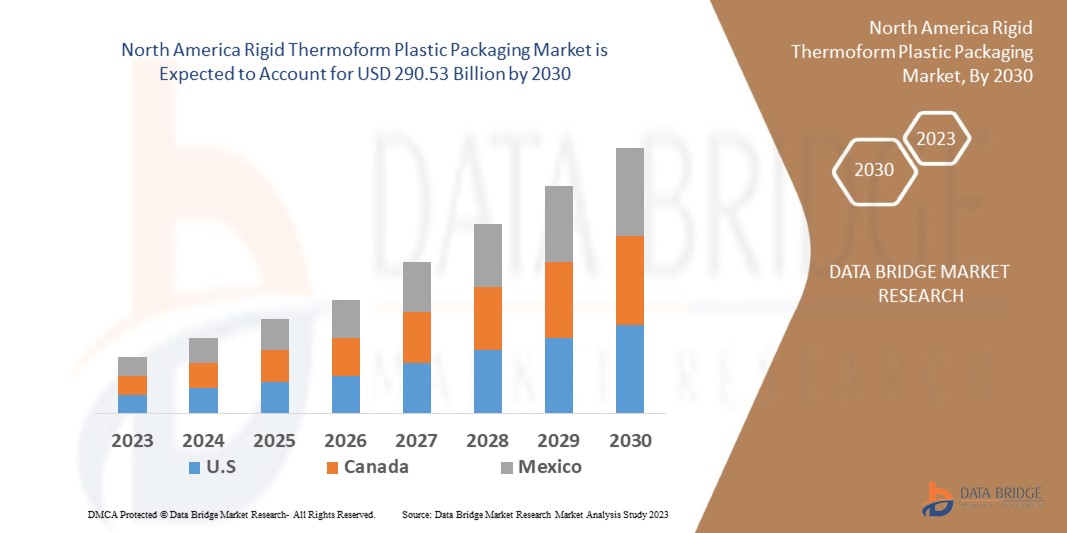

Data Bridge Market Research analyses that the rigid thermoform plastic packaging market is expected to reach USD 290.53 billion by 2030, which was USD 207.8 billion in 2022, registering a CAGR of 4.82% during the forecast period of 2023 to 2030. In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand

North America Rigid Thermoform Plastic Packaging Market Scope and Segmentation

|

Report Metric |

Details |

|

Forecast Period |

2023 to 2030 |

|

Base Year |

2022 |

|

Historic Years |

2021 (Customizable to 2015 - 2020) |

|

Quantitative Units |

Revenue in USD Billion, Volumes in Units, Pricing in USD |

|

Segments Covered |

Product (Polymethyl Methacrylate (PMMA), Bio-Degradable Polymers, Polyethylene, Acrylonitrile Butadiene Styrene (ABS), Polyvinyl Chloride (PVC), High Impact Polystyrene, Polystyrene, Polypropylene (PP)), Packaging Product (Bottles And Jars, Trays, Tubs, Cups, Others), Process (Plug Assist Forming, Thick Gauge Thermoforming, Thin Gauge Thermoforming, Vacuum Snapback), Manufacturing Process (Extrusion, Injection Molding, Others ), Application (Food And Beverage, Personal Care, Medical And Healthcare, Electrical And Electronics, Automotive, Construction, Consumer Goods And Appliances, Others), End-User (Food And Beverage, Personal Care, Household, Healthcare, Others) |

|

Countries Covered |

U.S., Canada, Mexico |

|

Market Players Covered |

ALPLA (Austria), Amcor plc (Australia), DS Smith (U.K.), Klöckner Pentaplast (Germany), Berry Global Inc.(U.S.), Pactiv Evergreen Inc.(U.S.), Sonoco Products Company (U.S.) |

|

Market Opportunities |

|

Market Definition

Thermoforming plastic is a manufacturing process that involves heating a plastic sheet until it becomes flexible, forming it into a specific shape, and trimming it to create a product for packaging purposes. Many types of packaging, including plastic clamshell trays, blisters, and lidding film, are made using thin-gauge thermoforming.

Plastic materials such as polypropylene (pp), high-density polyethylene (HDPE), and polyethylene (pet) are used in rigid plastic packaging for the packaging of new bottles and containers. These materials are strong and light. Polyethylene and polypropylene packaging solutions are used in various industries, including food and beverage, agriculture, aerospace, automotive, and medical.

North America Rigid Thermoform Plastic Packaging Market Dynamics

Drivers

• Recycling can help reduce waste and trash

There has been a lot of interest in the reuse and recycling of packaging materials worldwide. Recycling is converting trash into a product that can be used once more. Milk bottles made of HDPE and pet are frequently recycled. Recycling rigid plastic packaging reduces the need for raw materials, reducing air and water pollution and reducing greenhouse gas emissions. With recycled materials, co2 emissions can also be controlled. Rigid plastic packaging materials have shown significant recycling rates. Many governments and business stakeholders have developed plans to reduce plastic waste through recycling.

• Increasing healthcare sector demand

Its strength, cleanliness, clarity, and lightweight, rigid plastic packaging protects drugs from contamination. It is ideal for storing medical supplies such as needles, tablets, syrups, surgical equipment, and other items. According to projections, the demand for rigid plastic packaging will increase globally as the healthcare industry expands.

Opportunities

- Growing demand for rigid plastic packaging in the personal care and cosmetics sectors

For product packaging of sun care, skin care, oral care, body care, ornamental, and hair care products, rigid plastic packaging is used by the cosmetics and personal care industry. This gives the products frictionless storage and a longer shelf life. As the cosmetics and personal care market is emerging in nations quickly, so does the demand for rigid plastic packaging.

- Expanding polystyrene applications are expected to drive growth

Rigid and hard polystyrene is used in television and computer housings. Polystyrene is also used in other equipment because it provides the right type of finish and shape. Polystyrene is widely used in food product packaging. It promotes the cleanliness and freshness of food. Polystyrene is inexpensive to use, and because it is transparent, it is excellent in terms of appearance, which is critical in retail. Both general-purpose polystyrene (GPPS) and high-impact polystyrene (hips) are suitable for injection molding. Polystyrene's expanding applications are thus fuelling growth.

- The advantages of thermoforming are expected to increase demand for rigid plastic packaging

Thermoforming is a plastic forming technique used to create a wide range of consumer goods by softening a plastic sheet over a mold and allowing it to cool. With the right machinery, thermoforming can produce hundreds of plastic parts per hour, making it an ideal forming technique for producing plastic parts. The thin plastic sheet used to make thin-gauge plastic parts is known as thermoforming film. The advantages of thermoforming include lower costs, greater versatility, faster turnaround, and less waste. Plastic packaging for products in retail, medical, food and beverage, and other industries is created using thin-gauge thermoforming. These advantages of thermoforming are propelling market growth during the forecast period.

Restraints/ Challenges

- The environmental consequences of packaging are stifling growth.

High-density polyethylene (HDPE), expanded polystyrene (EPS), polyethylene terephthalate (PET), and polyvinyl chloride are the used polymers in the packaging industry (PVC). Many industries use rigid plastic packaging to preserve and store packaged goods such as industrial equipment, food, and medical supplies. The main issue that these polymers present is the difficulty in recycling, reusing, and sorting plastic waste. Plastic packaging materials can decompose in landfills for up to a thousand years, polluting the air, land, and water. Furthermore, at room temperature, thermoplastics soften and lose mechanical strength when exposed to direct sunlight. As a result, the negative environmental effects of rigid plastic packaging will constrain market growth.

This rigid thermoform plastic packaging market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the rigid thermoform plastic packaging market contact data bridge market research for an analyst brief, our team will help you take an informed market decision to achieve market growth.

Impact and Current Market Scenario of Raw Material Shortage and Shipping Delays

Data Bridge Market Research offers a high-level analysis of the market and delivers information by keeping in account the impact and current market environment of raw material shortage and shipping delays. This translates into assessing strategic possibilities, creating effective action plans, and assisting businesses in making important decisions.

Apart from the standard report, we also offer in-depth analysis of the procurement level from forecasted shipping delays, distributor mapping by region, commodity analysis, production analysis, price mapping trends, sourcing, category performance analysis, supply chain risk management solutions, advanced benchmarking, and other services for procurement and strategic support.

Expected Impact of Economic Slowdown on the Pricing and Availability of Products

When economic activity slows, industries begin to suffer. The forecasted effects of the economic downturn on the pricing and accessibility of the products are taken into account in the market insight reports and intelligence services provided by DBMR. With this, our clients can typically keep one step ahead of their competitors, project their sales and revenue, and estimate their profit and loss expenditures.

Recent Developments

- In 2021, Coexpan launched several packaging solutions utilizing its mono-material coexshield pet or pp trays for only produced food applications, claiming to extend shelf-life from 7 to 12 days. The innovation and technology center of coexpan, is intended to replace complex medium and high-barrier laminates with high-barrier mono-materials that include food-contact-appropriate additives. The goal of the book series is to reduce food waste by sustainable development goals.

North America Rigid Thermoform Plastic Packaging Market Scope

The rigid thermoform plastic packaging market is segmented on the basis of product, packaging, process, manufacturing process, application, and end-user. The growth amongst these segments will help you analyse meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Product

- Polymethyl methacrylate (PMMA)

- Bio-degradable polymers

- Polyethylene

- Acrylonitrile butadiene styrene (ABS)

- Polyvinyl chloride (PVC)

- High impact polystyrene

- Polystyrene

- Polypropylene (PP)

Packaging

- Bottles and Jars

- Trays

- Tubs

- Cups

- Others

Process

- Plug assist forming

- Thick gauge thermoforming

- Thin gauge thermoforming

- Vacuum snapback

Manufacturing Process

- Extrusion

- Injection molding

- Others

Application

- Food and beverage

- Personal care

- Medical and healthcare

- Electrical and electronics

- Automotive

- Construction

- Consumer goods and appliances

- Others

End-User

- Food and beverage

- Personal care

- Household

- Healthcare

- Others

North America Rigid Thermoform Plastic Packaging Market Regional Analysis/Insights

The North America rigid thermoform plastic packaging market is analysed and market size insights and trends are provided by country, by product, packaging, process, manufacturing process, application, and end-user.as referenced above.

The countries covered in the North America rigid thermoform plastic packaging market report are U.S., Canada, and Mexico.

U.S. country is dominating North America's rigid thermoform plastic packaging market due to the high innovations and development in the manufacturing of products, creating a large customer base for the rigid thermoform plastic packaging market.

The country section of the report also provides individual market impacting factors and changes in market regulation that impact the current and future trends of the market. Data points such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the data bridge market research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand.

Competitive Landscape and North America Rigid Thermoform Plastic Packaging Market Share Analysis

The rigid thermoform plastic packaging market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to rigid thermoform plastic packaging market.

Some of the major players operating in the rigid thermoform plastic packaging market are:

- ALPLA (Austria)

- Amcor plc (Australia)

- DS Smith (U.K.)

- Klöckner Pentaplast (Germany)

- Berry Global Inc.(U.S.)

- Pactiv Evergreen Inc.(U.S.)

- Sonoco Products Company (U.S.)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

- introduction

- OBJECTIVES OF THE STUDY

- MARKET DEFINITION

- OVERVIEW of NORTH AMERICA RIGID THERMOFORM PLASTIC PACKAGING MARKET

- LIMITATION

- MARKETS COVERED

- MARKET SEGMENTATION

- MARKETS COVERED

- geographicAL scope

- years considered for the study

- currency and pricing

- DBMR TRIPOD DATA VALIDATION MODEL

- material type LIFE LINE CURVE

- MULTIVARIATE MODELING

- primary interviews with key opinion leaders

- DBMR MARKET POSITION GRID

- MARKET APPLICATION COVERAGE GRID

- DBMR MARKET CHALLENGE MATRIX

- vendor share analysis

- IMPORT-EXPORT DATA

- secondary sourcEs

- assumptions

- EXECUTIVE SUMMARY

- premium insights

- market overview

- drivers

- Increasing use of thermoformed packaging for the transportation for medical supplies in global pandemiC

- increasing consumption rate for thermoform packaging in the growing e-commerce industry

- advanceD property of secure seals in the thermoform packaging

- Increasing demand FOR packaged food among the working population

- Restraints

- Issues in the sorting and recycling of thermoformed plastic waste

- Vulnerable nature of raw material and machinery pricing

- Opportunity

- Advancements in the thermoformed blister packaging in the pharmaceutical sector

- CHALLENGES

- high rates of complexity in shapes and designs of thermoformed packaging in the developing nations

- Stringent Rules and regulations on plastics ban

- IMPACT OF COVID-19 ON THE North America Rigid Thermoform Plastic Packaging Market

- ANALYSIS ON IMPACT OF COVID-19 ON RIGID THERMOFORM PLASTIC PACKAGING market

- AFTERMATH OF COVID-19 AND GOVERNMENT INITIATIVE TO BOOST THE RIGID THERMOFORM PLASTIC PACKAGING

- STRATEGIC DECISIONS FOR MANUFACTURERS AFTER COVID-19 TO GAIN COMPETITIVE MARKET SHARE

- IMPACT ON PRICE

- IMPACT ON DEMAND

- IMPACT ON SUPPLY CHAIN

- CONCLUSION

- North America rigid thermoform plastic packaging market, BY Material TYPE

- overview

- Polyethylene Terephthalate (PET)

- Polyethylene (PE)

- Polyvinyl Chloride (PVC)

- Polypropylene (PP)

- Polystyrene (PS)

- OTHERS

- North America rigid thermoform plastic packaging market, BY Distribution Channel

- overview

- online

- offline

- North America rigid thermoform plastic packaging market, BY Application

- overview

- Containers

- Food & Beverages

- Pharmaceuticals

- Personal Care & Cosmetics

- Electronics

- homecare

- Others

- Trays & Lids

- Food & Beverages

- Pharmaceuticals

- Personal Care & Cosmetics

- Electronics

- Homecare

- Others

- Blister Pack

- Food & Beverages

- Pharmaceuticals

- Personal Care & Cosmetics

- Electronics

- Homecare

- Others

- Clamshells

- Food & Beverages

- Pharmaceuticals

- Personal Care & Cosmetics

- Electronics

- Homecare

- Others

- OTHERS

- Food & Beverages

- Pharmaceuticals

- Personal Care & Cosmetics

- Electronics

- Homecare

- Others

- North AMERICA rigid thermoform plastic packaging market, BY COUNTRY

- North America

- U.S.

- Canada

- Mexico

- NORTH AMERICA rigid thermoform plastic packaging Market: COMPANY landscape

- company share analysis: NORTH AMERICA

- MergerS & AcquisitionS

- EXPANSIONS

- new product developmentS

- SWOT

- company profiles

- WestRock Company

- COMPANY SNAPSHOT

- REVENUE ANALYSIS

- PRODUCT PORTFOLIO

- RECENT UPDATE

- Amcor plc

- COMPANY SNAPSHOT

- REVENUE ANALYSIS

- PRODUCT PORTFOLIO

- RECENT UPDATE

- Sonoco Products Company

- COMPANY SNAPSHOT

- REVENUE ANALYSIS

- PRODUCT PORTFOLIO

- RECENT UPDATES

- WINPAK LTD.

- COMPANY SNAPSHOT

- REVENUE ANALYSIS

- PRODUCT PORTFOLIO

- RECENT UPDATE

- DS Smith

- COMPANY SNAPSHOT

- REVENUE ANALYSIS

- PRODUCT PORTFOLIO

- RECENT UPDATES

- COEXPAN

- COMPANY SNAPSHOT

- PRODUCT PORTFOLIO

- RECENT UPDATE

- Huhtamaki

- COMPANY SNAPSHOT

- REVENUE ANALYSIS

- PRODUCT PORTFOLIO

- RECENT UPDATE

- Fabri-Kal

- COMPANY SNAPSHOT

- PRODUCT PORTFOLIO

- RECENT UPDATES

- D&W Fine Pack

- COMPANY SNAPSHOT

- PRODUCT PORTFOLIO

- RECENT UPDATE

- EasyPak

- COMPANY SNAPSHOT

- PRODUCT PORTFOLIO

- RECENT UPDATES

- Constantia Flexibles

- COMPANY SNAPSHOT

- PRODUCT PORTFOLIO

- RECENT UPDATES

- Display Pack

- COMPANY SNAPSHOT

- PRODUCT PORTFOLIO

- RECENT UPDATES

- Genpak, LLC

- COMPANY SNAPSHOT

- PRODUCT PORTFOLIO

- RECENT UPDATE

- Pactiv LLC

- COMPANY SNAPSHOT

- PRODUCT PORTFOLIO

- RECENT UPDATE

- Placon

- COMPANY SNAPSHOT

- PRODUCT PORTFOLIO

- RECENT UPDATE

- Sabert Corporation

- COMPANY SNAPSHOT

- PRODUCT PORTFOLIO

- RECENT UPDATES

- questionnaire

- related reports

List of Table

TABLE 1 IMPORT DATA of Plates, sheets, film, foil and strip, of non-cellular plastics, not reinforced, laminated, supported or similarly combined with other materials, without backing, unworked or merely surface-worked or merely cut into squares or rectangles (excluding self-adhesive products, and floor, wall and ceiling coverings of heading (HS CODE- 3920) (USD Thousand)

TABLE 2 EXPORT data of Plates, sheets, film, foil and strip, of non-cellular plastics, not reinforced, laminated, supported or similarly combined with other materials, without backing, unworked or merely surface-worked or merely cut into squares or rectangles (excluding self-adhesive products, and floor, wall and ceiling coverings of heading (HS CODE- 3920) (USD Thousand)

TABLE 3 Thermoforming Machine Price (USD Dollar)

TABLE 4 Time taken for material to decompose in the environment (2015)

TABLE 5 demand brought on by Covid-19

TABLE 6 North America rigid thermoform plastic packaging market, BY material type, 2019-2028 (Million units)

TABLE 7 North America rigid thermoform plastic packaging market, BY material type, 2019-2028 (USD Million)

TABLE 8 North America rigid thermoform plastic packaging market, BY distribution Channel, 2019-2028 (USD Million)

TABLE 9 North America rigid thermoform plastic packaging market, BY application, 2019-2028 (USD Million)

TABLE 10 North America containers in rigid thermoform plastic packaging market, BY application, 2019-2028 (USD Million)

TABLE 11 North America Trays & lids in rigid thermoform plastic packaging market, BY application, 2019-2028 (USD Million)

TABLE 12 North America Blister pack in rigid thermoform plastic packaging market, BY application, 2019-2028 (USD Million)

TABLE 13 North America Clamshells in rigid thermoform plastic packaging market, BY application, 2019-2028 (USD Million)

TABLE 14 North America others in rigid thermoform plastic packaging market, BY application, 2019-2028 (USD Million)

TABLE 15 North America rigid thermoform plastic packaging Market, By Country, 2019-2028 (million Units)

TABLE 16 North America rigid thermoform plastic packaging Market, By Country, 2019-2028 (USD Million)

TABLE 17 North America rigid thermoform plastic packaging Market, By material Type, 2019-2028 (million Units)

TABLE 18 North America rigid thermoform plastic packaging Market, By Material Type, 2019-2028 (USD MILLION)

TABLE 19 North America rigid thermoform plastic packaging Market, By distribution channel, 2019-2028 (USD Million)

TABLE 20 North America rigid thermoform plastic packaging Market, By application, 2019-2028 (USD Million)

TABLE 21 North America containers in rigid thermoform plastic packaging Market, By Application, 2019-2028 (USD MILLION)

TABLE 22 North America Trays & Lids in rigid thermoform plastic packaging Market, By Application, 2019-2028 (USD MILLION)

TABLE 23 North America Blister Pack in rigid thermoform plastic packaging Market, By Application, 2019-2028 (USD MILLION)

TABLE 24 North America Clamshells in rigid thermoform plastic packaging Market, By Application, 2019-2028 (USD MILLION)

TABLE 25 North America Others in rigid thermoform plastic packaging Market, By Application, 2019-2028 (USD MILLION)

TABLE 26 U.S. rigid thermoform plastic packaging Market, By material Type, 2019-2028 (million Units)

TABLE 27 U.S. rigid thermoform plastic packaging Market, By Material Type, 2019-2028 (USD MILLION)

TABLE 28 U.S. rigid thermoform plastic packaging Market, By distribution channel, 2019-2028 (USD Million)

TABLE 29 U.S. rigid thermoform plastic packaging Market, By application, 2019-2028 (USD Million)

TABLE 30 U.S. containers in rigid thermoform plastic packaging Market, By Application, 2019-2028 (USD MILLION)

TABLE 31 U.S. Trays & Lids in rigid thermoform plastic packaging Market, By Application, 2019-2028 (USD MILLION)

TABLE 32 U.S. Blister Pack in rigid thermoform plastic packaging Market, By Application, 2019-2028 (USD MILLION)

TABLE 33 U.S. Clamshells in rigid thermoform plastic packaging Market, By Application, 2019-2028 (USD MILLION)

TABLE 34 U.S. Others in rigid thermoform plastic packaging Market, By Application, 2019-2028 (USD MILLION)

TABLE 35 CANADA rigid thermoform plastic packaging Market, By material Type, 2019-2028 (million Units)

TABLE 36 CANADA rigid thermoform plastic packaging Market, By Material Type, 2019-2028 (USD MILLION)

TABLE 37 CANADA rigid thermoform plastic packaging Market, By distribution channel, 2019-2028 (USD Million)

TABLE 38 CANADA rigid thermoform plastic packaging Market, By application, 2019-2028 (USD Million)

TABLE 39 CANADA containers in rigid thermoform plastic packaging Market, By Application, 2019-2028 (USD MILLION)

TABLE 40 CANADA Trays & Lids in rigid thermoform plastic packaging Market, By Application, 2019-2028 (USD MILLION)

TABLE 41 CANADA Blister Pack in rigid thermoform plastic packaging Market, By Application, 2019-2028 (USD MILLION)

TABLE 42 CANADA Clamshells in rigid thermoform plastic packaging Market, By Application, 2019-2028 (USD MILLION)

TABLE 43 CANADA Others in rigid thermoform plastic packaging Market, By Application, 2019-2028 (USD MILLION)

TABLE 44 MEXICO rigid thermoform plastic packaging Market, By material Type, 2019-2028 (million Units)

TABLE 45 MEXICO rigid thermoform plastic packaging Market, By Material Type, 2019-2028 (USD MILLION)

TABLE 46 MEXICO rigid thermoform plastic packaging Market, By distribution channel, 2019-2028 (USD Million)

TABLE 47 MEXICO rigid thermoform plastic packaging Market, By application, 2019-2028 (USD Million)

TABLE 48 MEXICO containers in rigid thermoform plastic packaging Market, By Application, 2019-2028 (USD MILLION)

TABLE 49 MEXICO Trays & Lids in rigid thermoform plastic packaging Market, By Application, 2019-2028 (USD MILLION)

TABLE 50 MEXICO Blister Pack in rigid thermoform plastic packaging Market, By Application, 2019-2028 (USD MILLION)

TABLE 51 MEXICO Clamshells in rigid thermoform plastic packaging Market, By Application, 2019-2028 (USD MILLION)

TABLE 52 MEXICO Others in rigid thermoform plastic packaging Market, By Application, 2019-2028 (USD MILLION)

List of Figure

FIGURE 1 NORTH AMERICA RIGID THERMOFORM PLASTIC PACKAGING MARKET: segmentation

FIGURE 2 NORTH AMERICA RIGID THERMOFORM PLASTIC PACKAGING MARKET: data triangulation

FIGURE 3 NORTH AMERICA RIGID THERMOFORM PLASTIC PACKAGING MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA RIGID THERMOFORM PLASTIC PACKAGING MARKET: regionaL VS COUNTRY MARKET analysis

FIGURE 5 NORTH AMERICA RIGID THERMOFORM PLASTIC PACKAGING MARKET: company research analysis

FIGURE 6 NORTH AMERICA RIGID THERMOFORM PLASTIC PACKAGING MARKET: THE material type LIFE LINE CURVE

FIGURE 7 NORTH AMERICA RIGID THERMOFORM PLASTIC PACKAGING MARKET: MULTIVARIATE MODELLING

FIGURE 8 NORTH AMERICA RIGID THERMOFORM PLASTIC PACKAGING MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 9 NORTH AMERICA RIGID THERMOFORM PLASTIC PACKAGING MARKET: DBMR MARKET POSITION GRID

FIGURE 10 NORTH AMERICA RIGID THERMOFORM PLASTIC PACKAGING MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 11 NORTH AMERICA RIGID THERMOFORM PLASTIC PACKAGING MARKET: THE MARKET CHALLENGE MATRIX

FIGURE 12 North America rigid thermoform plastic packaging Market: vendor share analysis

FIGURE 13 NORTH AMERICA RIGID THERMOFORM PLASTIC PACKAGING MARKET: SEGMENTATION

FIGURE 14 Increasing use of thermoformed packaging for the transportation for medical supplies in global pandemic IS DRIVING THE North America rigid thermoform plastic packaging market in the forecast period of 2021 to 2028

FIGURE 15 Polyethylene Terephthalate (PET) SEGMENT is expected to account for the largest share of the NORTH AMERICA RIGID THERMOFORM PLASTIC PACKAGING MARKET in 2021 & 2028

FIGURE 16 DRIVERS, RESTRAINTs, OPPORTUNITy AND CHALLENGEs OF North America rigid thermoform plastic packaging MARKET

FIGURE 17 the U.S. Retail Sales via E-commerce in 2019 (USD million)

FIGURE 18 Revenue Earned By Couriers and Express delivery service In the U.S. (2012-2018) (USD million)

FIGURE 19 the U.S. internet Users (2011-2016)

FIGURE 20 North America rigid thermoform plastic packaging market: BY Material Type, 2020

FIGURE 21 North America rigid thermoform plastic packaging market: BY distribution Channel, 2020

FIGURE 22 North America rigid thermoform plastic packaging market: BY application, 2020

FIGURE 23 North America rigid thermoform plastic packaging MARKET: SNAPSHOT (2020)

FIGURE 24 North America rigid thermoform plastic packaging MARKET: by COUNTRY (2020)

FIGURE 25 North America rigid thermoform plastic packaging MARKET: by COUNTRY (2021 & 2028)

FIGURE 26 North America rigid thermoform plastic packaging MARKET: by COUNTRY (2020 & 2028)

FIGURE 27 North America rigid thermoform plastic packaging MARKET: by Material TYPE (2021-2028)

FIGURE 28 North America rigid thermoform plastic packaging Market: company share 2020 (%)

North America Rigid Thermoform Plastic Packaging Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its North America Rigid Thermoform Plastic Packaging Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as North America Rigid Thermoform Plastic Packaging Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.