North America Respiratory Masks Market, By Type (FFP, Common Grade Surgical Masks, Non-Medical Grade Respiratory Masks and Other), Usability (Reusable and Disposable), Age (Pediatric and Adult), Material (Polypropylene (PP), Polyurethane, Polyester, Cotton and Others), Application (Military, Industrial, Public, Medical and Others), End User (Hospitals and Clinics, Homecare Setting, Public Safety Service Organization, Oil & Gas Companies, Manufacturing Companies, Construction Companies and Others), Distribution Channels (Direct Tenders, Retail, Online Pharmacies and Others), Country (U.S., Canada, Mexico) Industry Trends and Forecast to 2028

Market Analysis and Insights: North America Respiratory Masks Market

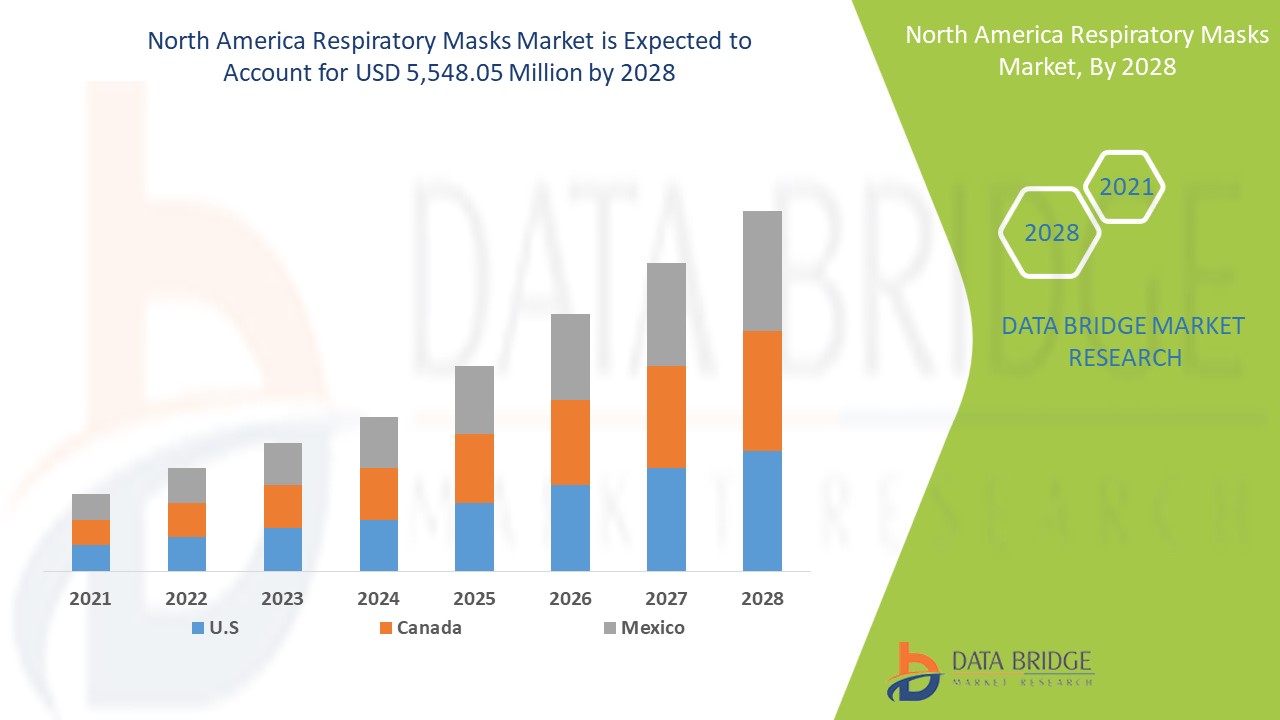

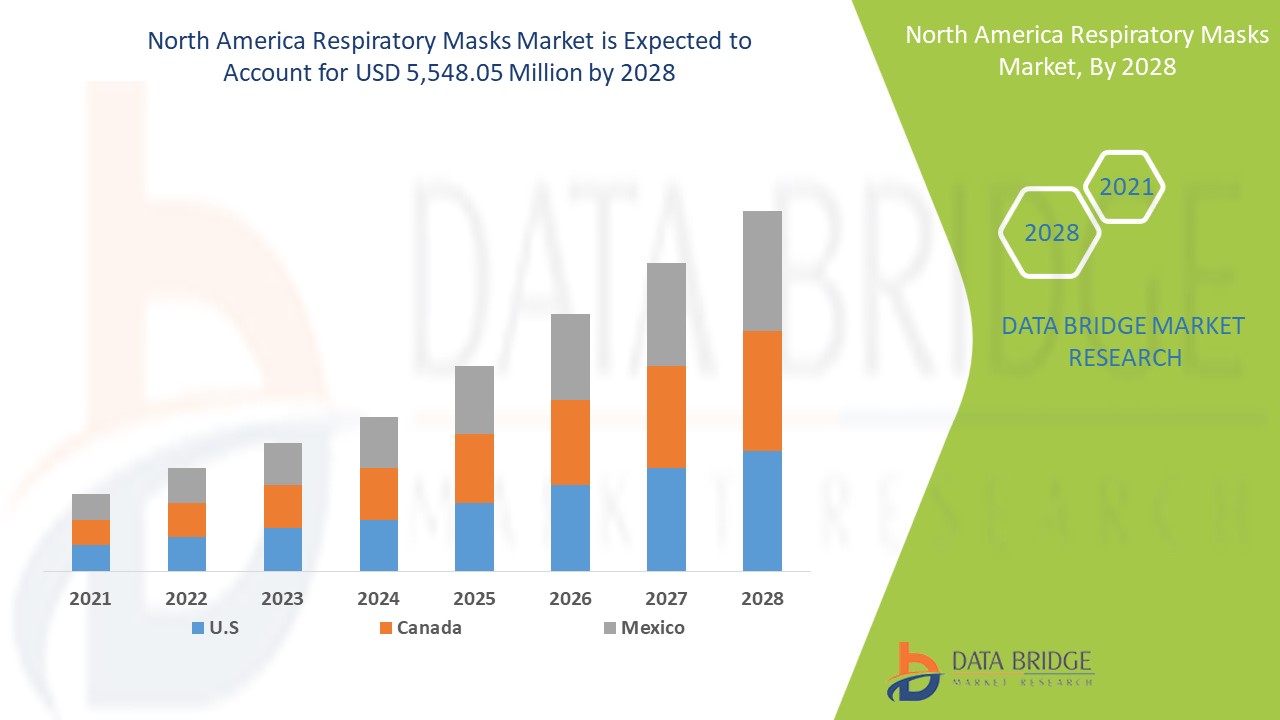

Respiratory masks mortars market is expected to gain market growth in the forecast period of 2021 to 2028. Data Bridge Market Research analyses that the market is growing at a CAGR of 8.5% in the forecast period of 2021 to 2028 and expected to reach USD 5,548.05 Million by 2028. Increasing health awareness and safety concerns against the infectious diseases drives the demand for the respiratory masks market growth in the forecast period.

Respiratory masks are masks designed to protect the human respiratory system by reducing the number of filter particles from the air to contaminate the respiratory track and reducing the number of particles or germs breathed inside. The use of respiratory masks increases with the rise in occupational safety regulations for workers' safety in various industries. A respiratory mask is available to the individuals by usability such as reusable and disposable.

Growth of online pharmaceutical marketing will act as a driver for the respiratory masks market growth in the forecast period. Environmental concerns associated with the disposal of masks are restraining the growth of the respiratory masks market in the forecast period. Growing investment in healthcare particularly in the emerging economies brings opportunities for the growth of the respiratory masks market. Unpredictability in the price of raw material is challenging the growth of the respiratory masks market.

This respiratory masks market report provides details of market share, new developments, and product pipeline analysis, impact of domestic and localised market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, product approvals, strategic decisions, product launches, geographic expansions, and technological innovations in the market. To understand the analysis and the market scenario contact us for an Analyst Brief, our team will help you create a revenue impact solution to achieve your desired goal.

North America Respiratory Masks Mortars Market Scope and Market Size

The respiratory masks market is segmented on the basis of the type, usability, age, material, application, end user and distribution channels. The growth among segments helps you analyse niche pockets of growth and strategies to approach the market and determine your core application areas and the difference in your target markets.

- On the basis of type, the respiratory masks market is segmented into FFP, common grade surgical masks, non-medical grade respiratory masks and other. In 2021, FFP segment is dominating due to a large population number, especially in India and China.

- On the basis of usability, the respiratory masks market is segmented into reusable and disposable. In 2021, the disposable segment is dominating due to the rise in demand in medical products with a price range of products, affordable by mass.

- On the basis of age, the respiratory masks market is segmented into pediatric and adult. In 2021, pediatric segment is dominating due to the increase in demand especially from rural areas.

- On the basis of material, the respiratory masks market is segmented into polypropylene (PP), polyurethane, polyester, cotton and others. In 2021, polypropylene (PP) segment is dominating due to a rise in demand from cosmetics and personal care products such as skin lotion, shampoos and others.

- On the basis of application, the respiratory masks market is segmented into military, industrial, public, medical and others. In 2021, medical segment is dominating due to the increase in demand for medical products in the region especially from the construction industry.

- On the basis of end user, the respiratory masks market is segmented into hospitals and clinics, homecare setting, public safety service organization, oil & gas companies, manufacturing companies, construction companies and others. In 2021, hospitals and clinics segment is dominating due to an increase in the number of old-aged population in countries such as India and China.

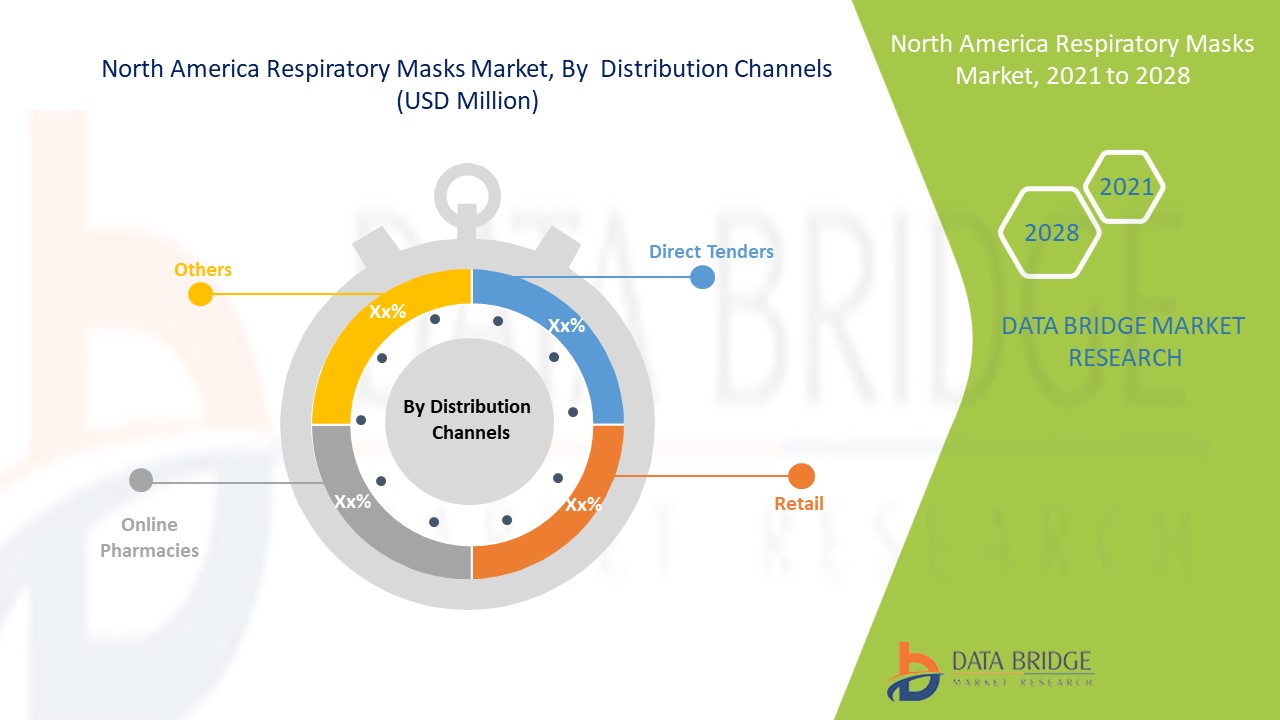

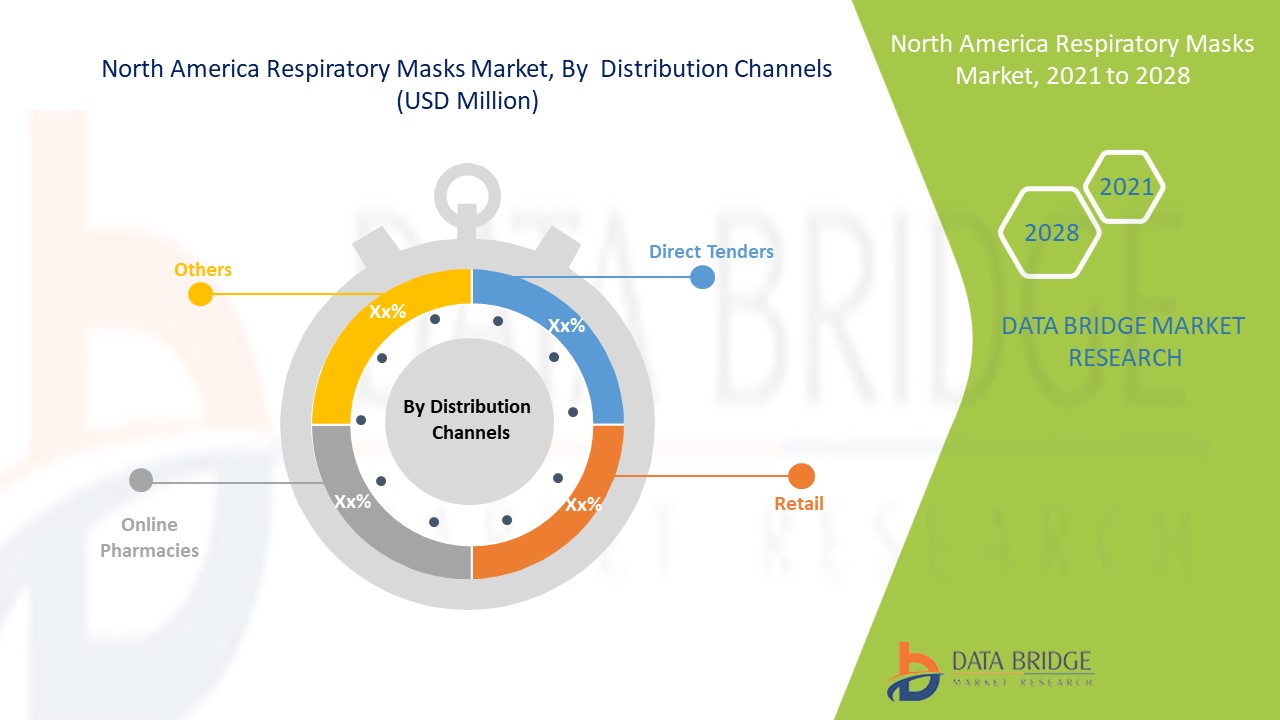

- On the basis of distribution channels, the respiratory masks market is segmented into direct tenders, retail, online pharmacies and others. In 2021, direct tenders segment is dominating due to increased numbers as direct tender ensures a low and effective cost range.

Respiratory Masks Market Country Level Analysis

Respiratory masks market is analysed and market size information is provided by the country, type, usability, age, material, application, end user and distribution channels as referenced above.

The countries covered in the North America respiratory masks mortars market report are U.S., Canada and Mexico in North America.

The U.S. is dominating the North American market due to more regulations for the lower the spread of COVID-19.

Respiratory Masks Market, By Distribution Channel

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points such as new sales, replacement sales, country demographics, regulatory acts and import-export tariffs are some of the major pointers used to forecast the market scenario for individual countries. Also, presence and availability of North America brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of sales channels are considered while providing forecast analysis of the country data.

Increasing Demand of Headphone/Earphone in Respiratory Masks

The respiratory masks market also provides you with detailed market analysis for every country growth in installed base of different kind of products for respiratory masks market, impact of technology using life line curves and changes in infant formula regulatory scenarios and their impact on the respiratory masks market. The data is available for historic period 2010 to 2019.

Competitive Landscape and Respiratory Masks Market Share Analysis

Respiratory masks market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, company strengths and weaknesses, product launch, clinical trials pipelines, brand analysis, product approvals, patents, product width and breath, application dominance, technology lifeline curve. The above data points provided are only related to the company’s focus related to North America respiratory masks market.

The major players covered in the report are Honeywell International Inc., Dukal Corporation, Medline Industries, Inc., Johnson & Johnson Services, Inc., ANSELL LTD., Owens & Minor, Cardinal Health, The Gerson Companies, 3M, DuPont, TORAY INDUSTRIES, INC, Moldex-Metric, Reckitt Benckiser Group plc, Mölnlycke Health Care AB, AlphaProTech, McKesson Corporation, CAMBRIDGE MASK CO, PAUL BOYÉ TECHNOLOGIES, Macopharma, MSA and Aerem among other domestic and global players. DBMR analysts understand competitive strengths and provide competitive analysis for each competitor separately.

Many product developments are also initiated by the companies worldwide which are also accelerating the growth of respiratory masks market.

For instance,

- In May 2020, 3M have decided to expand N95 mask production to 95M per month. With the increasing demand of the face mask, the company has decided to increase the production of the high quality respiratory mask. This development helps the company to increase production and revenue.

Partnership, joint ventures and other strategies enhances the company market share with increased coverage and presence. It also provides the benefit for organisation to improve their offering for respiratory masks through expanded range of size.

SKU-