North America Re Closable Zipper Market

Market Size in USD Million

CAGR :

%

USD

234.81 Million

USD

355.67 Million

2024

2032

USD

234.81 Million

USD

355.67 Million

2024

2032

| 2025 –2032 | |

| USD 234.81 Million | |

| USD 355.67 Million | |

|

|

|

Re-closable Zipper Market Analysis

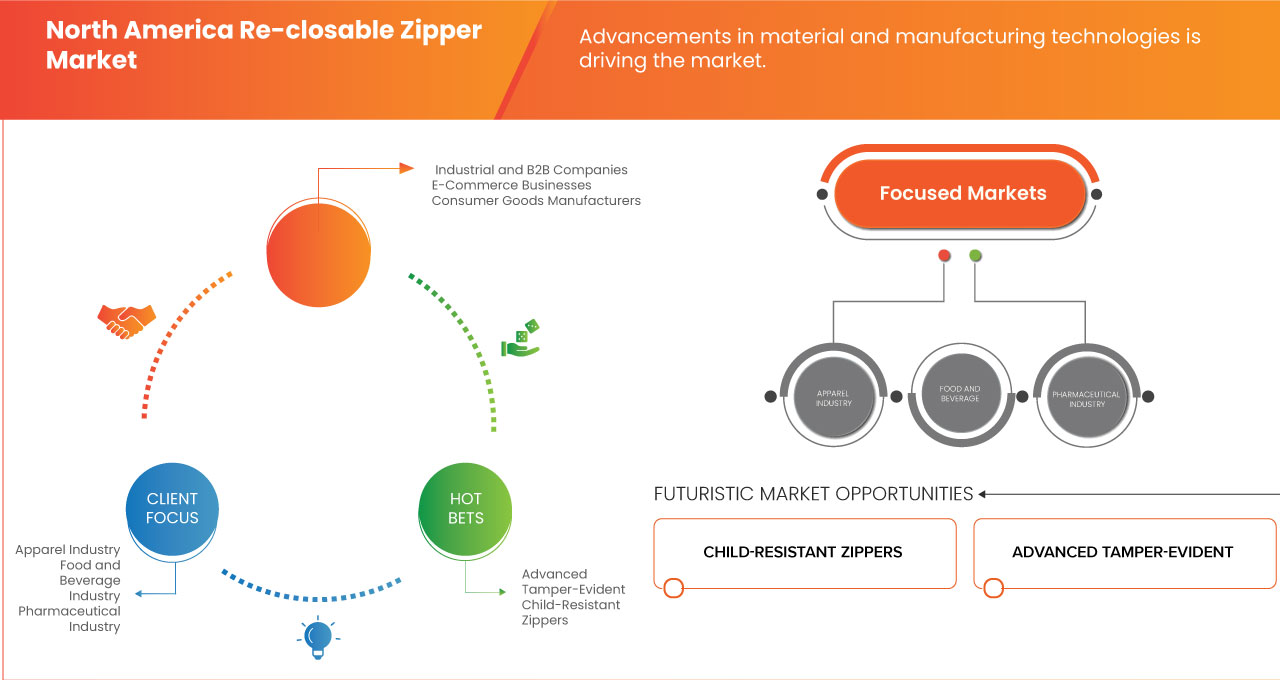

The North America re-closable zipper market is witnessing substantial growth, driven by rising consumer demand for convenient and sustainable packaging solutions. With industries such as food and beverages, pharmaceuticals, and personal care increasingly adopting resealable packaging, the market benefits from the growing focus on product freshness, hygiene, and ease of use. Eco-conscious consumers are favoring reusable packaging options, prompting manufacturers to innovate and offer advanced zipper designs that enhance sealing performance and durability while minimizing environmental impact.

Re-closable Zipper Market Size

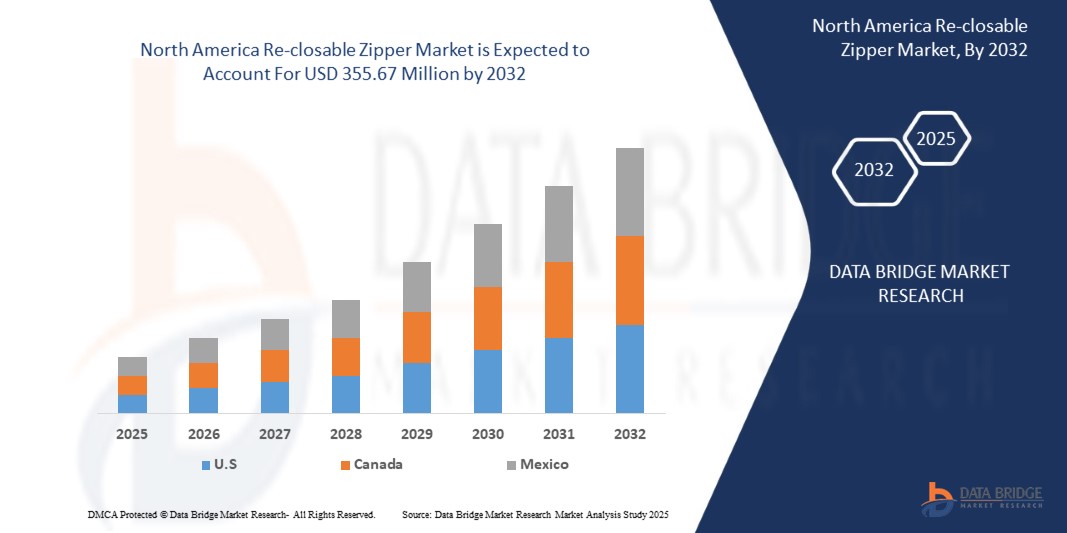

Data Bridge Market Research analyses that the North America re-closable zipper market is expected to reach USD 355.67 million by 2032 from USD 234.81 million in 2024, growing with a CAGR of 5.5% in the forecast period of 2025 to 2032. In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and PESTLE analysis.

Re-closable Zipper Market Trends

“Advancements in Manufacturing Technologies”

Advancements in material and manufacturing technologies, such as AI-driven systems and smart automation, will significantly enhance the efficiency, precision, and sustainability of the North American re-closable zipper market. By optimizing production processes, reducing defects, and improving product consistency, these innovations will enable manufacturers to meet the increasing demand for high-quality, eco-friendly zippers. Furthermore, the integration of advanced materials and automated systems will help streamline operations, lower production costs, and support the development of more durable and sustainable re-closable zippers, aligning with the evolving market trends toward sustainability and performance.

Report Scope and Re-closable Zipper Market segmentation

|

Report Metric |

Re-closable Zipper Market Insights |

|

Segments Covered |

|

|

Countries Covered |

U.S., Canada, and Mexico |

|

Key Market Players |

TOTANI CORPORATION (Japan), Mamata Machinery Limited (India), Karlville Development, LLC. (U.S.), C K ZIPPER PVT LTD (India), Reynolds Consumer Products (U.S.), Zip-Pak (U.S.), LPS Industries LLC, Glenroy, Inc (U.S.), ELPLAST EUROPE Limited (Poland), IMPAK CORPORATION (U.S.), Layfield Group, Smart Plastic Technologies (U.S.), TedPack Company Limited (China), Kleer Pak Mfg. Co., Inc. (U.S.), LD PACKAGING(FOSHAN) CO .,LTD (China), C.I. TAKIRON Corporation (Japan), NIFTY PLASTICS PVT. LTD. (India), Montage (India), Sealed Air Corporation (U.S.), and Novolex (U.S.) among others. |

|

Market Opportunities |

|

|

Value Added Data |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework |

North America Re-closable Zipper Market Definition

Re- closable zipper encompasses products designed to create secure, reusable closures for various types of packaging. These zippers are commonly used in packaging of food, beverages, and consumer goods to provide convenience and ensure freshness. They are typically made from flexible plastics such as Polyethylene (PE) or Polypropylene (PP), and sometimes polyester or nylon for added durability. They are made using extrusion and molding technologies to create interlocking profiles from materials like plastic or nylon.

North America Re-closable Zipper Market Dynamics

This section deals with understanding the market drivers, advantages, opportunities, restraints, and challenges. All of this is discussed in detail below:

Drivers

- Growing Consumer Demand for Convenience Packaging

The North America re-closable zipper market is experiencing significant growth driven by increasing consumer demand for convenience packaging. Busy lifestyles and the need for easy-to-use, resealable solutions in food, personal care, and household products are fueling this trend. Re-closable zippers enhance product freshness, reduce waste, and provide user-friendly functionality, making them a preferred choice among consumers. Additionally, the rising focus on sustainable packaging, with re-closable zippers enabling reusable and eco-friendly designs, is further boosting market adoption across the region.

For instance,

- In August 2023, American Packaging Corporation celebrated the opening of its USD 100 million, 275,000-square-foot manufacturing facility in Cedar City, Utah, marking its first plant in the western U.S. This expansion aligns with growing consumer demand for convenience packaging, including re-closable zippers, as the company caters to diverse markets such as healthcare, pet food, coffee, and food products. The facility is expected to create 135+ high-paying jobs initially, with potential growth to 300–400 employees in five years, reflecting increased demand for flexible, consumer-friendly packaging solutions driven by the rising U.S. consumer spending trend

Expansion in E-Commerce and Retail Packaging

The expansion of e-commerce and retail packaging is significantly driving growth in the re-closable zipper market. As online shopping continues to rise, consumers demand packaging solutions that ensure product freshness, convenience, and ease of use during transit and storage. Re-closable zippers provide an ideal solution for this, offering the ability to reseal packages after opening, which is especially important for products like food and personal care items. Retailers and manufacturers are increasingly adopting these packaging solutions to meet consumer preferences, improve product shelf life, and reduce waste, thereby boosting the demand for re-closable zipper packaging in the e-commerce and retail sectors.

For instance,

- In November 2024, U.S. e-commerce sales on Black Friday reached a record-breaking USD 10.8 billion, marking a significant 10.2% year-over-year increase. Mobile devices played a crucial role, facilitating 52.28% of these online transactions. This surge in e-commerce activity is driving the demand for packaging solutions that ensure product freshness, convenience, and ease of use, especially in sectors like food, personal care, and retail. The growing trend of online shopping directly correlates with the expansion of the North American re-closable zipper market, as consumers increasingly favor packaging that is both practical for transit and reusable, reflecting the broader shift toward consumer-centric and sustainable retail packaging

Opportunities

- Adoption of Re-Closable Zippers in Non-Food Sectors

The adoption of re-closable zippers in non-food sectors presents a significant growth opportunity for the market, driven by increasing demand for convenient, secure, and reusable packaging solutions. Industries such as personal care, pharmaceuticals, and household products are increasingly utilizing re-closable zippers for their ability to preserve product integrity, enhance user convenience, and support sustainability goals. This growing adoption across diverse applications highlights the potential for market expansion as businesses prioritize innovative packaging to meet evolving consumer preferences and regulatory demands.

For instance: -

- In September 2024, according to an article published by Flexible Packaging, ProAmpac launched QUADFLEX Recyclable LFQ, a large-format quad-seal pouch designed for applications in non-food sectors such as lawn and garden care, showcasing the rising demand for sustainable and durable packaging solutions. This innovation highlights the growing adoption of recyclable packaging in non-food industries, presenting an opportunity for the re-closable zipper market to expand into these sectors by integrating eco-friendly and high-performance features into their products

Growing Demand for Eco-Friendly and Biodegradable Zipper Solutions

The growing demand for sustainable packaging has created significant opportunities for eco-friendly and biodegradable zipper solutions in the North America re-closable zipper market. As consumers and businesses increasingly prioritize environmentally responsible practices, the adoption of biodegradable materials and compostable zippers is gaining traction across industries. These innovations not only address regulatory pressures to reduce plastic waste but also align with the rising preference for green alternatives. This shift is expected to drive market growth by enabling companies to offer sustainable, re-closable solutions that cater to environmentally conscious consumers.

For instance: -

- In March 2021, Saica Flex launched a new recyclable packaging range made from 100% polyethylene (PE), featuring over 50% post-consumer recycled (PCR) content for non-food applications. The mono-PE laminate adhered to CEFLEX and Plastics Recyclers Europe guidelines, offering a sustainable alternative to conventional multimaterial solutions. It supported easy-open features, resealable zippers, and compatibility with existing filling lines. This innovation aligned with circular economy goals and regulatory demands, providing opportunities for eco-friendly and biodegradable solutions in the North America re-closable zipper market

Restraints/Challenges

- Competition from Substitute Closure Solutions and Alternatives

Competition from substitutes presents a significant challenge for the North America re-closable zipper market, as alternative closure solutions such as adhesive seals, hook-and-loop fasteners, and buttons offer cost-effective and convenient options for various applications. These substitutes often cater to the same end-user industries, including food packaging and consumer goods, putting pressure on re-closable zipper manufacturers to innovate and maintain market relevance. Additionally, shifting consumer preferences toward sustainable and reusable options further intensifies competition, compelling zipper manufacturers to adopt eco-friendly materials and enhance product differentiation to retain their market share.

For instance: -

- In August 2024, Velcro Companies launched newly redesigned packaging for their iconic VELCRO Brand hook and loop fasteners to enhance the shopping experience and help consumers select the best products for their fastening needs. The bold, modern design, created in collaboration with brand experts Landor, featured a revamped logo, color-coded categorizations, and on-pack imagery to simplify product selection for DIYers and crafters. By addressing consumer challenges in navigating crowded retail shelves and offering versatile, easy-to-use fastening solutions, Velcro effectively highlighted its strength, durability, and innovation. This development intensified competition for the North America re-closable zipper market, as Velcro’s improvements further differentiated its products from traditional zipper alternatives

Re-closable Zipper Market Scope

The North America re-closable zipper market is segmented into six notable segments based on the product, material, and application. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Product

- Single Track Zippers

- Dual Track Zippers

- Press to Close Zippers

- Powder Zippers

- Liquid Zippers

- Child Resistant Zippers

- Others

Material

- Coil Zippers

- Molded Zippers

- Metal Zippers

- Others

Application

- Food and Beverages

- Application

- Fruits & Vegetables

- Oilseeds, Nuts And Grains

- Bakery & Confectionary

- Dairy Products

- Meat Products

- Snacks

- Frozen Food

- Ready-to-Eat Food

- Beverages

- Type

- Alcoholic

- Non-Alcoholic

- Others

- Clothing

- Pet Food

- Others

Re-closable Zipper Market Regional Analysis

North America re-closable zipper market is segmented into three notable segments on the basis of the product, material, and application.

The countries covered in the North America re-closable zipper market report as U.S., Canada, and Mexico.

U.S. is expected to be the dominant and fastest growing country in the North America re-closable zipper market due to advancements in material and manufacturing technologies.

The country section of the report also provides individual market impacting factors and changes in market regulation that impact the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of regional brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Re-closable Zipper Market Share

North America re-closable zipper market competitive landscape provides details of the competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to North America re-closable zipper market.

The North America Re-Closable Zipper Market Leaders Operating in the Market Are:

- TOTANI CORPORATION (Japan)

- Mamata Machinery Limited (India)

- Karlville Development, LLC. (U.S.)

- C K ZIPPER PVT LTD (India)

- Reynolds Consumer Products (U.S.)

- Zip-Pak (U.S.)

- LPS Industries LLC

- Glenroy, Inc (U.S.)

- ELPLAST EUROPE Limited (Poland)

- IMPAK CORPORATION (U.S.)

- Layfield Group, Smart Plastic Technologies (U.S.)

- TedPack Company Limited (China)

- Kleer Pak Mfg. Co., Inc. (U.S.)

- LD PACKAGING(FOSHAN) CO .,LTD (China)

- C.I. TAKIRON Corporation (Japan)

- NIFTY PLASTICS PVT. LTD. (India)

- Montage (India)

- Sealed Air Corporation (U.S.)

- Novolex (U.S.)

Latest Developments in North America Re-Closable Zipper Market

- In November 2024, Karlville to showcase sustainable packaging solutions at All4Pack Paris 2024. Karlville will feature innovative products like the REVO PRO 1 pouch filling machine and the Zero Plastic Paper Carry Handle at All4Pack Paris 2024, highlighting its commitment to sustainability and eco-friendly packaging solutions. Karlville benefits from increased brand visibility and recognition for its sustainable innovations, positioning itself as a leader in environmentally conscious packaging solutions, while engaging with potential customers and partners

- In June, LPS Industries has released an article encouraging pet-food manufacturers to consider flexible packaging, emphasizing the advantages of multi-layered laminates, puncture-resistant films, and enhanced reseal ability to improve shelf-life and attract consumers. This initiative benefits LPS Industries by solidifying its position as a leader in the pet food packaging industry, enhancing its reputation for offering customizable, resealable solutions such as zipper pouches, and further broadening its footprint in the flexible packaging market

- In February 2022, Mamata has earned the Best Plastics and Polymers Brands 2022 Award for the fourth consecutive time, highlighting its industry leadership. This accolade strengthens Mamata's standing as a top player in the plastics and polymers sector, boosting its credibility and market presence, particularly in the re-closable zipper packaging market

- In April 2023, Sealed Air Corporation and Koenig & Bauer AG are expanding their strategic partnership to create advanced digital printing technology, enabling faster, higher-quality, and more cost-effective packaging solutions. By integrating Sealed Air's prismiq technology into Koenig & Bauer's RotaJET-series presses, this collaboration enhances Sealed Air's re-closable zipper solutions, improving packaging designs, reducing time-to-market, and incorporating digital content into packaging, leading to increased operational efficiency and stronger consumer engagement

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF NORTH AMERICA RE-CLOSABLE ZIPPER MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 MULTIVARIATE MODELING

2.8 PRODUCT TIMELINE CURVE

2.9 MARKET APPLICATION COVERAGE GRID

2.1 SECONDARY SOURCES

2.11 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTER’S FIVE FORCES

4.2 PESTLE ANALYSIS

4.2.1 POLITICAL FACTORS

4.2.2 ECONOMIC FACTORS

4.2.3 SOCIAL FACTORS

4.2.4 TECHNOLOGICAL FACTORS

4.2.5 LEGAL FACTORS

4.2.6 ENVIRONMENTAL FACTORS

4.3 TECHNOLOGICAL ADVANCEMENT BY MANUFACTURERS

4.3.1 INNOVATIVE MATERIALS

4.3.2 SMART ZIPPER DESIGNS

4.3.3 AUTOMATION IN PRODUCTION

4.3.4 CUSTOMIZABLE FEATURES

4.3.5 DIGITAL PRINTING AND BRANDING

4.4 VENDOR SELECTION CRITERIA

4.4.1 SCOPE OF SERVICE:

4.4.2 STRONG PARTNERSHIPS:

4.4.3 CUSTOMER SUPPORT:

4.4.4 PRICE & DELIVERY:

4.4.5 QUALITY AND PERFORMANCE:

4.4.6 INNOVATION:

4.4.7 FLEXIBILITY:

4.5 RAW MATERIAL COVERAGE

5 REGULATION COVERAGE

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 GROWING CONSUMER DEMAND FOR CONVENIENCE PACKAGING

6.1.2 EXPANSION IN E-COMMERCE AND RETAIL PACKAGING

6.1.3 ADVANCEMENTS IN MATERIAL AND MANUFACTURING TECHNOLOGIES

6.1.4 RISE IN FLEXIBLE PACKAGING

6.2 RESTRAINTS

6.2.1 RECYCLABILITY CONCERNS OF PLASTIC ZIPPERS

6.2.2 STRINGENT REGULATIONS ON PLASTIC USAGE

6.3 OPPORTUNITIES

6.3.1 ADOPTION OF RE-CLOSABLE ZIPPERS IN NON-FOOD SECTORS

6.3.2 GROWING DEMAND FOR ECO-FRIENDLY AND BIODEGRADABLE ZIPPER SOLUTIONS

6.3.3 PARTNERSHIPS AND EXPANSION OF MANUFACTURING CAPABILITIES

6.4 CHALLENGES

6.4.1 RAW MATERIAL PRICE VOLATILITY

6.4.2 COMPETITION FROM SUBSTITUTE CLOSURE SOLUTIONS AND ALTERNATIVES

7 NORTH AMERICA RE-CLOSABLE ZIPPER MARKET, BY PRODUCT

7.1 OVERVIEW

7.2 SINGLE TRACK ZIPPERS

7.3 DUAL TRACK ZIPPERS

7.4 PRESS TO CLOSE ZIPPERS

7.5 POWDER ZIPPERS

7.6 LIQUID ZIPPERS

7.7 CHILD RESISTANT ZIPPERS

7.8 OTHERS

8 NORTH AMERICA RE-CLOSABLE ZIPPER MARKET, BY MATERIAL

8.1 OVERVIEW

8.2 COIL ZIPPERS

8.3 MOLDED ZIPPERS

8.4 METAL ZIPPERS

8.5 OTHERS

9 NORTH AMERICA RE-CLOSABLE ZIPPER MARKET, BY APPLICATION

9.1 OVERVIEW

9.2 FOOD AND BEVERAGES

9.2.1 FOOD AND BEVERAGES, BY TYPE

9.2.1.1 FRUITS AND VEGETABLES

9.2.1.2 OILSEEDS, NUTS AND GRAINS

9.2.1.3 BAKERY AND CONFECTIONARY

9.2.1.4 DAIRY PRODUCTS

9.2.1.5 MEAT PRODUCTS

9.2.1.6 SNACKS

9.2.1.7 FROZEN FOODS

9.2.1.8 READY-TO-EAT FOOD

9.2.1.8.1 BEVERAGES

9.2.1.8.1.1 BEVERAGES, BY TYPE

9.2.1.8.1.2 ALCOHOLIC

9.2.1.8.1.3 NON-ALCOHOLIC

9.2.1.9 OTHERS

9.3 CLOTHING

9.4 PET FOOD

9.5 OTHERS

10 NORTH AMERICA RE-CLOSABLE ZIPPER MARKET, BY COUNTRY

10.1 NORTH AMERICA

10.1.1 U.S.

10.1.2 CANADA

10.1.3 MEXICO

11 NORTH AMERICA RE-CLOSABLE ZIPPER MARKET, COMPANY LANDSCAPE

11.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

12 SWOT ANALYSIS

13 COMPANY PROFILES

13.1 REYNOLDS CONSUMER PRODUCTS

13.1.1 COMPANY SNAPSHOT

13.1.2 REVENUE ANALYSIS

13.1.3 PRODUCT PORTFOLIO

13.1.4 RECENT DEVELOPMENTS

13.2 C.I. TAKIRON CORPORATION

13.2.1 COMPANY SNAPSHOT

13.2.2 PRODUCT PORTFOLIO

13.2.3 RECENT DEVELOPMENT

13.3 ZIP-PAK

13.3.1 COMPANY SNAPSHOT

13.3.2 PRODUCT PORTFOLIO

13.3.3 RECENT DEVELOPMENT

13.4 ELPLAST EUROPE LIMITED

13.4.1 COMPANY SNAPSHOT

13.4.2 PRODUCT PORTFOLIO

13.4.3 RECENT DEVELOPMENTS

13.5 LD PACKAGING(FOSHAN) CO .,LTD

13.5.1 COMPANY SNAPSHOT

13.5.2 PRODUCT PORTFOLIO

13.5.3 RECENT DEVELOPMENT

13.6 C K ZIPPER PVT LTD.

13.6.1 COMPANY SNAPSHOT

13.6.2 PRODUCT PORTFOLIO

13.6.3 RECENT DEVELOPMENT

13.7 GLENROY, INC

13.7.1 COMPANY SNAPSHOT

13.7.2 PRODUCT PORTFOLIO

13.7.3 RECENT DEVELOPMENT

13.8 IMPAK CORPORATION

13.8.1 COMPANY SNAPSHOT

13.8.2 PRODUCT PORTFOLIO

13.8.3 RECENT DEVELOPMENT

13.9 KARLVILLE DEVELOPMENT, LLC.

13.9.1 COMPANY SNAPSHOT

13.9.2 PRODUCT PORTFOLIO

13.9.3 RECENT DEVELOPMENT

13.1 KLEER PAK MFG. CO., INC

13.10.1 COMPANY SNAPSHOT

13.10.2 PRODUCT PORTFOLIO

13.10.3 RECENT DEVELOPMENT

13.11 LPS INDUSTRIES

13.11.1 COMPANY SNAPSHOT

13.11.2 PRODUCT PORTFOLIO

13.11.3 RECENT DEVELOPMENTS

13.12 MAMATA MACHINERY LIMITED

13.12.1 COMPANY SNAPSHOT

13.12.2 PRODUCT PORTFOLIO

13.12.3 RECENT DEVELOPMENT

13.13 MONTAGE

13.13.1 COMPANY SNAPSHOT

13.13.2 PRODUCT PORTFOLIO

13.13.3 RECENT DEVELOPMENT

13.14 NIFTY PLASTICS PVT. LTD.

13.14.1 COMPANY SNAPSHOT

13.14.2 PRODUCT PORTFOLIO

13.14.3 RECENT DEVELOPMENT

13.15 NOVOLEX

13.15.1 COMPANY SNAPSHOT

13.15.2 PRODUCT PORTFOLIO

13.15.3 RECENT DEVELOPMENT

13.16 SEALED AIR

13.16.1 COMPANY SNAPSHOT

13.16.2 REVENUE ANALYSIS

13.16.3 PRODUCT PORTFOLIO

13.16.4 RECENT DEVELOPMENT

13.17 SMART PLASTIC TECHNOLOGIES

13.17.1 COMPANY SNAPSHOT

13.17.2 PRODUCT PORTFOLIO

13.17.3 RECENT DEVELOPMENTS

13.18 TEDPACK COMPANY LIMITED

13.18.1 COMPANY SNAPSHOT

13.18.2 PRODUCT PORTFOLIO

13.18.3 RECENT DEVELOPMENT

13.19 TOTANI CORPORATION

13.19.1 COMPANY SNAPSHOT

13.19.2 PRODUCT PORTFOLIO

13.19.3 RECENT DEVELOPMENTS

14 QUESTIONNAIRE

15 RELATED REPORTS

List of Table

TABLE 1 REGULATORY COVERAGE

TABLE 2 REGULATION/RULE RELATED TO PLASTIC USAGE IN NORTH AMERICA

TABLE 3 NORTH AMERICA RE-CLOSABLE ZIPPER MARKET, BY PRODUCT 2018-2032 (USD THOUSAND)

TABLE 4 NORTH AMERICA RE-CLOSABLE ZIPPER MARKET, BY PRODUCT 2018-2032 ( THOUSAND UNITS)

TABLE 5 NORTH AMERICA RE-CLOSABLE ZIPPER MARKET, BY MATERIAL, 2018-2032 (USD THOUSAND)

TABLE 6 NORTH AMERICA RE-CLOSABLE ZIPPER MARKET, BY MATERIAL, 2018-2032 ( THOUSAND UNITS)

TABLE 7 NORTH AMERICA RE-CLOSABLE ZIPPER MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 8 NORTH AMERICA RE-CLOSABLE ZIPPER MARKET, BY APPLICATION, 2018-2032 ( THOUSAND UNITS)

TABLE 9 NORTH AMERICA FOOD AND BEVERAGES IN RE-CLOSABLE ZIPPER MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 10 NORTH AMERICA BEVERAGES IN RE-CLOSABLE ZIPPER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 11 NORTH AMERICA RE-CLOSABLE ZIPPER MARKET, BY COUNTRY, 2018-2032 (USD THOUSAND)

TABLE 12 U.S. RE-CLOSABLE ZIPPER MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 13 U.S. RE-CLOSABLE ZIPPER MARKET, BY PRODUCT, 2018-2032 (THOUSAND UNITS)

TABLE 14 U.S. RE-CLOSABLE ZIPPER MARKET, BY MATERIAL, 2018-2032 (USD THOUSAND)

TABLE 15 U.S. RE-CLOSABLE ZIPPER MARKET, BY MATERIAL, 2018-2032 (THOUSAND UNITS)

TABLE 16 U.S. RE-CLOSABLE ZIPPER MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 17 U.S. RE-CLOSABLE ZIPPER MARKET, BY APPLICATION, 2018-2032 (THOUSAND UNITS)

TABLE 18 U.S. FOOD AND BEVERAGES IN RE-CLOSABLE ZIPPER MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 19 U.S. BEVERAGES IN RE-CLOSABLE ZIPPER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 20 CANADA RE-CLOSABLE ZIPPER MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 21 CANADA RE-CLOSABLE ZIPPER MARKET, BY PRODUCT, 2018-2032 (THOUSAND UNITS)

TABLE 22 CANADA RE-CLOSABLE ZIPPER MARKET, BY MATERIAL, 2018-2032 (USD THOUSAND)

TABLE 23 CANADA RE-CLOSABLE ZIPPER MARKET, BY MATERIAL, 2018-2032 (THOUSAND UNITS)

TABLE 24 CANADA RE-CLOSABLE ZIPPER MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 25 CANADA RE-CLOSABLE ZIPPER MARKET, BY APPLICATION, 2018-2032 (THOUSAND UNITS)

TABLE 26 CANADA FOOD AND BEVERAGES IN RE-CLOSABLE ZIPPER MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 27 CANADA BEVERAGES IN RE-CLOSABLE ZIPPER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 28 MEXICO RE-CLOSABLE ZIPPER MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 29 MEXICO RE-CLOSABLE ZIPPER MARKET, BY PRODUCT, 2018-2032 (THOUSAND UNITS)

TABLE 30 MEXICO RE-CLOSABLE ZIPPER MARKET, BY MATERIAL, 2018-2032 (USD THOUSAND)

TABLE 31 MEXICO RE-CLOSABLE ZIPPER MARKET, BY MATERIAL, 2018-2032 (THOUSAND UNITS)

TABLE 32 MEXICO RE-CLOSABLE ZIPPER MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 33 MEXICO RE-CLOSABLE ZIPPER MARKET, BY APPLICATION, 2018-2032 (THOUSAND UNITS)

TABLE 34 MEXICO FOOD AND BEVERAGES IN RE-CLOSABLE ZIPPER MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 35 MEXICO BEVERAGES IN RE-CLOSABLE ZIPPER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

List of Figure

FIGURE 1 NORTH AMERICA RE-CLOSABLE ZIPPER MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA RE-CLOSABLE ZIPPER MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA RE-CLOSABLE ZIPPER MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA RE-CLOSABLE ZIPPER MARKET: NORTH AMERICA VS REGIONS MARKET ANALYSIS

FIGURE 5 NORTH AMERICA RE-CLOSABLE ZIPPER MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA RE-CLOSABLE ZIPPER MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA RE-CLOSABLE ZIPPER MARKET: DBMR MARKET POSITION GRID

FIGURE 8 NORTH AMERICA RE-CLOSABLE ZIPPER MARKET: MARKET END USER COVERAGE GRID

FIGURE 9 NORTH AMERICA RE-CLOSABLE ZIPPER MARKET: SEGMENTATION

FIGURE 10 SEVEN SEGMENTS COMPRISE THE NORTH AMERICA RE-CLOSABLE ZIPPER MARKET, BY PRODUCT (2024)

FIGURE 11 EXECUTIVE SUMMARY

FIGURE 12 STRATEGIC DECISIONS

FIGURE 13 GROWING CONSUMER DEMAND FOR CONVENIENCE PACKAGING IS EXPECTED TO DRIVE THE NORTH AMERICA RE-CLOSABLE ZIPPER MARKET IN THE FORECAST PERIOD OF 2025 TO 2032

FIGURE 14 SINGLE TRACK ZIPPERS SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA RE-CLOSABLE ZIPPER MARKET IN 2025 & 2032

FIGURE 15 VENDOR SELECTION CRITERIA

FIGURE 16 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF NORTH AMERICA RE-CLOSABLE ZIPPER MARKET

FIGURE 17 U.S. CONSUMER SPENDING TRENDS AND FORECAST (IN USD BILLION)

FIGURE 18 POLYETHYLENE PRICES FLUCTUATION FROM 2021 TO 2025 (IN USD PER TON)

FIGURE 19 POLYPROPYLENE PRICES FLUCTUATION FROM 2021 TO 2025 (IN USD PER TON)

FIGURE 20 NORTH AMERICA RE-CLOSABLE ZIPPER MARKET: BY PRODUCT, 2024

FIGURE 21 NORTH AMERICA RE-CLOSABLE ZIPPER MARKET: BY MATERIAL, 2024

FIGURE 22 NORTH AMERICA RE-CLOSABLE ZIPPER MARKET: BY APPLICATION, 2024

FIGURE 23 NORTH AMERICA RE-CLOSABLE ZIPPER MARKET: SNAPSHOT (2024)

FIGURE 24 NORTH AMERICA RE-CLOSABLE ZIPPER MARKET, COMPANY SHARE 2024 (%)

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.