Market Analysis and Insights: North America Probe Card Market

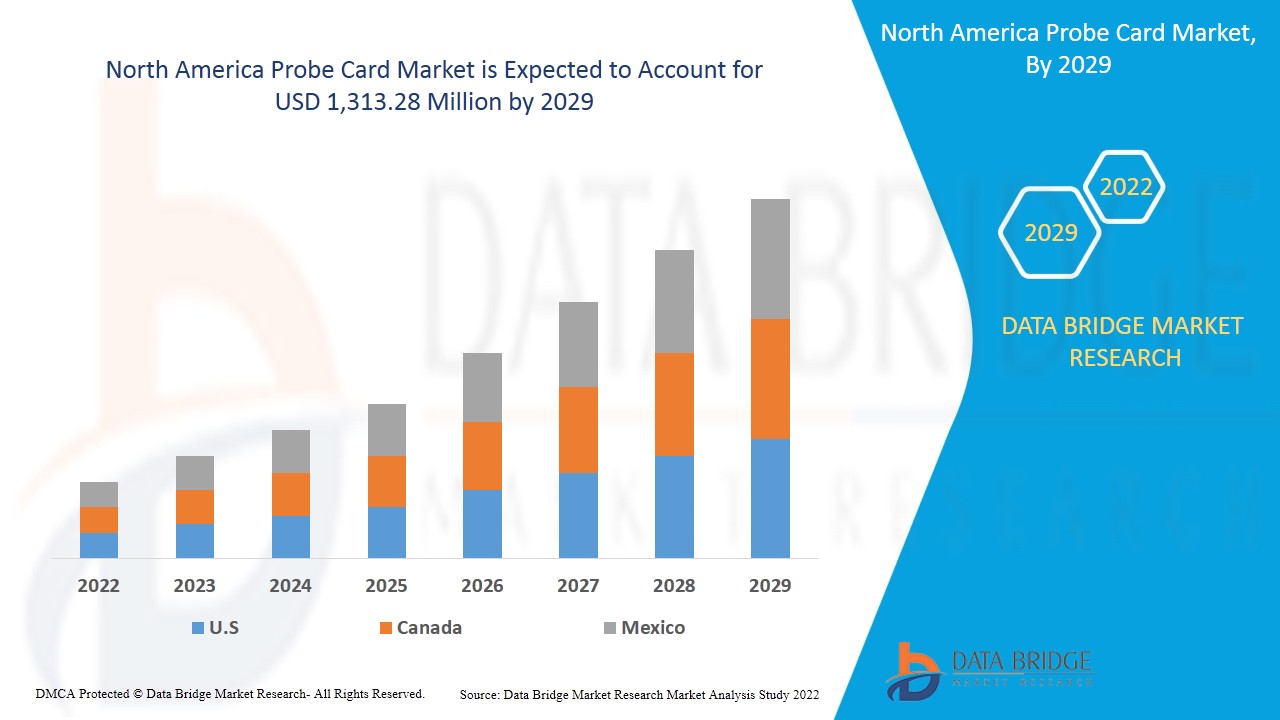

North America probe card market is expected to gain market growth in the forecast period of 2022 to 2029. Data Bridge Market Research analyses that the market is growing with a CAGR of 10.7% in the forecast period of 2022 to 2029 and is expected to reach USD 1,313.28 million by 2029. The increasing use of integrated circuits in electronic devices is expected to boost the North America probe card market.

A probe card is an interface used to perform a wafer test for a semiconductor wafer. This process is used to check the quality of integrated circuits or latent semantic indexing in the first process of semiconductor manufacturing. Generally, the probe card is electrically connected to a tester and mechanically docked to a prober. The main function of a probe card is to provide an electrical path between the test system and the circuits on the wafer, where the circuits can be tested. The main parts included in probe cards are called printed circuit boards (PCB) and some forms of contact elements. Many items are considered in a probe card, some being very common to use, and some having very special uses.

A surge in demand for electronic testing in the semiconductor industry may act as a driver in the North America probe card market. Lack of awareness among consumers regarding the benefits of the probe card solution is expected to challenge the market growth. However, a rise in strategic partnership and collaboration among the organization is expected to provide opportunities for the North America probe card market. The high cost associated with the probe card solution can restrain the market.

North America probe card market report provides details of market share, new developments, and product pipeline analysis, the impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, product approvals, strategic decisions, product launches, geographic expansions, and technological innovations in the market. To understand the analysis and the North America probe card market scenario, contact Data Bridge Market Research for an Analyst Brief; our team will help you create a revenue impact solution to achieve your desired goal.

North America Probe Card Market Scope and Market Size

North America probe card market is segmented based on probe type, manufacturing technology type, wafer size, head size, test, material, application, beam size and end-use. The growth among segments helps you analyze niche pockets of growth and strategies to approach the market and determine your core application areas and the difference in your target markets.

- On the basis of probe type, the North America probe card market is segmented into advanced probe card, standard probe card. In 2022, the advanced probe card segment is anticipated to dominate the market because it provides high efficiency in lower-size semiconductors.

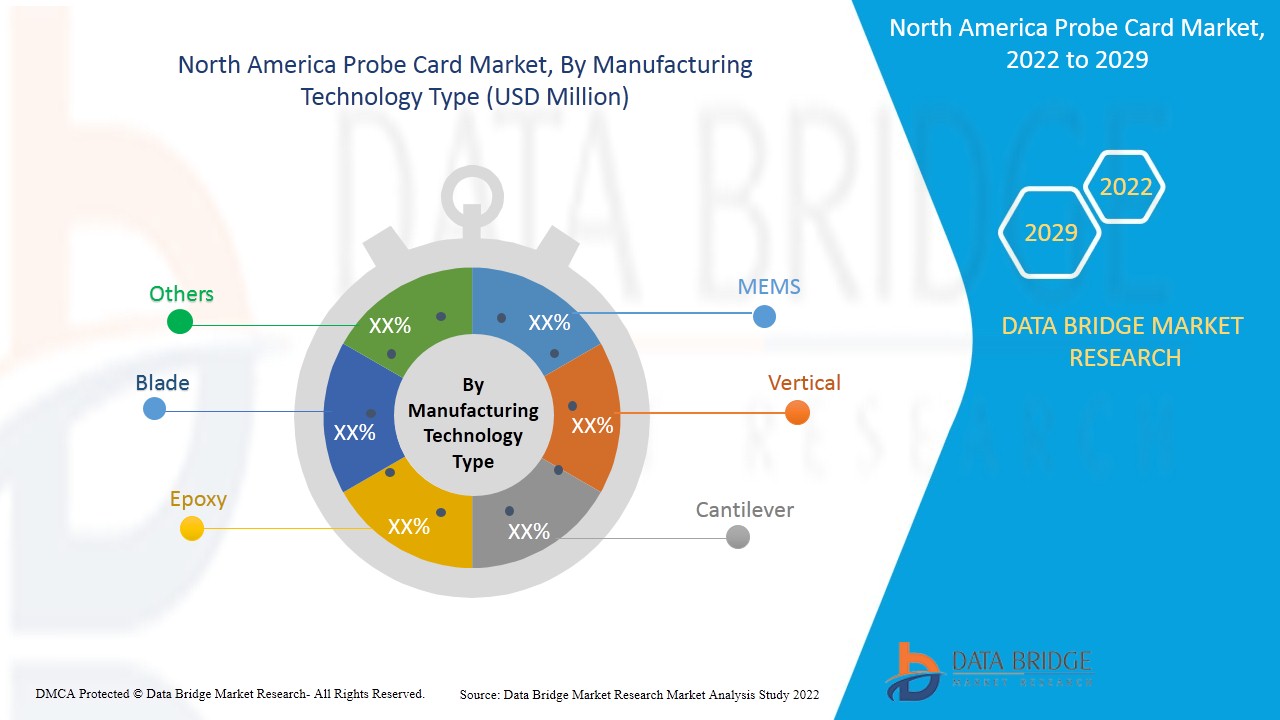

- On the basis of manufacturing technology type, the North America probe card market is segmented into MEMS, vertical, cantilever, epoxy, blade, others. In 2022, the MEMS segment is anticipated to dominate the market because it suits the high-density manufacturing processes of lower than 14nm.

- On the basis of wafer size, the North America probe card market is segmented into more than 12 inches and less than 12 inches. In 2022, more than 12 inches segment is anticipated to dominate the market because it gives good usage of the semiconductor wafer and high speed of production.

- On the basis of head size, the North America probe card market is segmented into more than 40mm x 40mm and less than 40mm x 40mm. In 2022, the more than 40mm x 40mm segment is anticipated to dominate the market because it contains different varieties of semiconductor/LCD industries.

- On the basis of test, the North America probe card market is segmented into DC test, functional test, and AC test. In 2022, the DC test segment is anticipated to dominate the market because the direct current test helps identify current breakage in the circuit and detect the quality in the early stage.

- On the basis of material, the North America probe card market is segmented into tungsten, Copper Clad Laminated (CCL), aluminum, and others. In 2022, the tungsten segment is anticipated to dominate the market because its high melting point and extremely high shape stability even under a super high-temperature environment make it suitable for probe needles.

- On the basis of application, the North America probe card market is segmented into WLCSP, SIP, mixed signal flip chip, and analog. In 2022, the WLCSP segment is anticipated to dominate the market because this application is useful in all kinds of ICs like DRAM, logic, CMOS sensor, and others.

- On the basis of beam size, the North America probe card market is segmented into more than 1.5 mil and less than 1.5 mil. In 2022, the more than 1.5 mil segment is anticipated to dominate the market because it contains a minimum feature size that is maintenance-friendly.

- On the basis of end-use, the North America probe card market is segmented into the foundry, parametric, logic and memory device, DRAM, CMOS image sensor (CIS), flash, others. In 2022, the foundry segment is anticipated to dominate the market with the rise in demand from the automotive and portable electronics sectors.

North America Probe Card Market Country Level Analysis

North America probe card market is segmented based on probe type, manufacturing technology type, wafer size, head size, test, material, application, beam size and end-use.

The countries covered in the North America probe card market report are the U.S., Canada, and Mexico. The U.S. is expected to dominate the North America probe card market due to the investment of semiconductor industries in the countries after COVID-19.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impact the current and future trends of the market. Data points such as new sales, replacement sales, country demographics, regulatory acts, and import-export tariffs are some of the major pointers used to forecast the market scenario for individual countries. Also, the presence and availability of North American brands and their challenges faced due to large or scarce competition from local and domestic brands, the impact of sales channels are considered while providing forecast analysis of the country data.

Surge in Demand for Electronic Testing in Semiconductor Industry is Boosting North America Probe Card Market Growth

The North America probe card market also provides you with a detailed market analysis for every country's growth in a particular market. Additionally, it provides detailed information regarding the market players’ strategy and their geographical presence. The data is available for the historical period 2011 to 2020.

Competitive Landscape and North America Probe Card Market Share Analysis

The North America probe card market competitive landscape provides details by the competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, production sites and facilities, company strengths and weaknesses, product launch, product trials pipelines, product approvals, patents, product width, and breadth, application dominance, technology lifeline curve. The above data points provided are only related to the company’s focus related to the North America probe card market.

Some of the major companies dealing in the North America probe card are FormFactor, FEINMETALL GmbH, RIKA DENSHI CO., LTD., TSE co,. Ltd., dynamic-test, STAr Technologies Inc., MICRONICS JAPAN CO., LTD., Translarity, SV Probe, MPI Corporation, Onto Innovation, JAPAN ELECTRONIC MATERIALS CORPORATION, WinWay Tech. Co., Ltd., Wentworth Labs, htt high tech grade GmbH, Technoprobe S.p.A., among others in domestic players. DBMR analysts understand competitive strengths and provide competitive analysis for each competitor separately.

Many contracts and agreements are also initiated by the companies worldwide, which accelerates the North America probe card market.

For instances,

- In December 2021, FormFactor started a new manufacturing facility for semiconductor wafer probe card for production in California. The initiative was taken to expand the production capacity of probe cards. The benefit of the production facility will help the company meet customer rising demand. The market will have more number of products with significant features

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF NORTH AMERICA PROBE CARD MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MULTIVARIATE MODELING

2.9 PROBE TYPE TIMELINE CURVE

2.1 MARKET APPLICATION COVERAGE GRID

2.11 THE MARKET CHALLENGE MATRIX

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 SUPPLY CHAIN

4.1.1 MANUFACTURERS

4.1.2 CONSUMPTION

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 INCREASING USE OF INTEGRATED CIRCUITS IN ELECTRONIC DEVICES

5.1.2 SURGE IN DEMAND FOR ELECTRONIC TESTING IN THE SEMICONDUCTOR INDUSTRY

5.1.3 GROWING INVESTMENT IN MINIATURIZATION OF ELECTRONIC COMPONENT

5.1.4 RISING DEMAND FOR SEMICONDUCTORS PROBE CARDS IN AUTOMOBILE INDUSTRY

5.2 RESTRAINTS

5.2.1 HIGH COST ASSOCIATED WITH PROBE CARD SOLUTION

5.2.2 IMPACT OF METAL PRICES ON OVERALL COMPONENT PRODUCTION COST

5.3 OPPORTUNITIES

5.3.1 RISE IN STRATEGIC PARTNERSHIP AND COLLABORATION

5.3.2 RISING ADOPTION OF PROBE CARDS SOLUTION IN AUTOMOTIVE INDUSTRY

5.3.3 INCREASING USE OF SEMICONDUCTORS IN MILITARY AND DEFENSE SECTOR

5.4 CHALLENGES

5.4.1 LACK OF AWARENESS AMONG CONSUMERS REGARDING BENEFITS OF PROBE CARD SOLUTION

5.4.2 DISRUPTION IN SUPPLY OF PROBE CARD

5.4.3 TECHNOLOGICAL ACCELERATION CREATES A CHALLENGING ENVIRONMENT FOR PROBE CARD SOLUTION

6 IMPACT ANALYSIS OF COVID-19 ON NORTH AMERICA PROBE CARD MARKET

6.1 ANALYSIS ON IMPACT OF COVID-19 ON THE MARKET

6.2 STRATEGIC DECISIONS BY MANUFACTURERS AFTER COVID-19

6.3 IMPACT ON PRICE

6.4 IMPACT ON DEMAND AND SUPPLY CHAIN

6.5 CONCLUSION

7 NORTH AMERICA PROBE CARD MARKET, BY PROBE TYPE

7.1 OVERVIEW

7.2 ADVANCED PROBE CARD

7.2.1 MEMS SP

7.2.2 VERTICAL PROBE

7.2.3 U-PROBE

7.2.4 SP-PROBE

7.2.5 OTHERS

7.3 STANDARD PROBE CARD

8 NORTH AMERICA PROBE CARD MARKET, BY MANUFACTURING TECHNOLOGY TYPE

8.1 OVERVIEW

8.2 MEMS

8.3 VERTICAL

8.4 CANTILEVER

8.5 EPOXY

8.6 BLADE

8.7 OTHERS

9 NORTH AMERICA PROBE CARD MARKET, BY WAFER SIZE

9.1 OVERVIEW

9.2 MORE THAN 12 INCHES

9.3 LESS THAN 12 INCHES

10 NORTH AMERICA PROBE CARD MARKET, BY HEAD SIZE

10.1 OVERVIEW

10.2 MORE THAN 40MM X 40MM

10.3 LESS THAN 40MM X 40MM

11 NORTH AMERICA PROBE CARD MARKET, BY TEST

11.1 OVERVIEW

11.2 DC TEST

11.3 FUNCTIONAL TEST

11.4 AC TEST

12 NORTH AMERICA PROBE CARD MARKET, BY MATERIAL

12.1 OVERVIEW

12.2 TUNGSTEN

12.3 COPPER CLAD LAMINATED (CCL)

12.4 ALUMINUM

12.5 OTHERS

13 NORTH AMERICA PROBE CARD MARKET, BY APPLICATION

13.1 OVERVIEW

13.2 WLCSP

13.3 SIP

13.4 MIXED SIGNAL FLIP CHIP

13.5 ANALOG

14 NORTH AMERICA PROBE CARD MARKET, BY BEAM SIZE

14.1 OVERVIEW

14.2 MORE THAN 1.5 MIL

14.3 LESS THAN 1.5 MIL

15 NORTH AMERICA PROBE CARD MARKET, BY END-USE

15.1 OVERVIEW

15.2 FOUNDRY

15.2.1 ADVANCED PROBE CARD

15.2.2 STANDARD PROBE CARD

15.3 PARAMETRIC

15.3.1 ADVANCED PROBE CARD

15.3.2 STANDARD PROBE CARD

15.4 LOGIC AND MEMORY DEVICE

15.4.1 ADVANCED PROBE CARD

15.4.2 STANDARD PROBE CARD

15.5 DRAM

15.5.1 ADVANCED PROBE CARD

15.5.2 STANDARD PROBE CARD

15.6 CMOS IMAGE SENSOR (CIS)

15.6.1 ADVANCED PROBE CARD

15.6.2 STANDARD PROBE CARD

15.7 FLASH

15.7.1 ADVANCED PROBE CARD

15.7.2 STANDARD PROBE CARD

15.8 OTHERS

16 NORTH AMERICA PROBE CARD MARKET, BY REGION

16.1 NORTH AMERICA

16.1.1 U.S.

16.1.2 CANADA

16.1.3 MEXICO

17 NORTH AMERICA PROBE CARD MARKET: COMPANY LANDSCAPE

17.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

18 SWOT ANALYSIS

19 COMPANY PROFILE

19.1 FORMFACTOR

19.1.1 COMPANY SNAPSHOT

19.1.2 REVENUE ANALYSIS

19.1.3 COMPANY SHARE ANALYSIS

19.1.4 PRODUCT PORTFOLIO

19.1.5 RECENT DEVELOPMENTS

19.2 TECHNOPROBE S.P.A.

19.2.1 COMPANY SNAPSHOT

19.2.2 COMPANY SHARE ANALYSIS

19.2.3 PRODUCT PORTFOLIO

19.2.4 RECENT DEVELOPMENT

19.3 MICRONICS JAPAN CO., LTD.

19.3.1 COMPANY SNAPSHOT

19.3.2 REVENUE ANALYSIS

19.3.3 COMPANY SHARE ANALYSIS

19.3.4 PRODUCT PORTFOLIO

19.3.5 RECENT DEVELOPMENT

19.4 MPI CORPORATION

19.4.1 COMPANY SNAPSHOT

19.4.2 REVENUE ANALYSIS

19.4.3 COMPANY SHARE ANALYSIUS

19.4.4 PRODUCT PORTFOLIO

19.4.5 RECENT DEVELOPMENTS

19.5 CHUNGHWA PRECISION TEST TECH.CO. LTD

19.5.1 COMPANY SNAPSHOT

19.5.2 REVENUE ANALYSIS

19.5.3 COMPANY SHARE ANALYSIS

19.5.4 PRODUCT PORTFOLIO

19.5.5 RECENT DEVELOPMENT

19.6 FEINMETALL GMBH

19.6.1 COMPANY SNAPSHOT

19.6.2 PRODUCT PORTFOLIO

19.6.3 RECENT DEVELOPMENTS

19.7 HTT HIGH TECH TRADE GMBH

19.7.1 COMPANY SNAPSHOT

19.7.2 PRODUCT PORTFOLIO

19.7.3 RECENT DEVELOPMENTS

19.8 KOREA INSTRUMENT CO., LTD

19.8.1 COMPANY SNAPSHOT

19.8.2 PRODUCT PORTFOLIO

19.8.3 RECENT DEVELOPMENT

19.9 JAPAN ELECTRONIC MATERIALS CORPORATION

19.9.1 COMPANY SNAPSHOT

19.9.2 REVENUE ANALYSIS

19.9.3 PRODUCT PORTFOLIO

19.9.4 RECENT DEVELOPMENT

19.1 MICROFRIEND

19.10.1 COMPANY SNAPSHOT

19.10.2 PRODUCT PORTFOLIO

19.10.3 RECENT DEVELOPMENT

19.11 ONTO INNOVATION

19.11.1 COMPANY SNAPSHOT

19.11.2 REVENUE ANALYSIS

19.11.3 PRODUCT PORTFOLIO

19.11.4 RECENT DEVELOPMENTS

19.12 SV PROBE

19.12.1 COMPANY SNAPSHOT

19.12.2 PRODUCT PORTFOLIO

19.12.3 RECENT DEVELOPMENT

19.13 STAR TECHNOLOGIES INC.

19.13.1 COMPANY SNAPSHOT

19.13.2 PRODUCT PORTFOLIO

19.13.3 RECENT DEVELOPMENTS

19.14 RIKA DENSHI CO., LTD.

19.14.1 COMPANY SNAPSHOT

19.14.2 PRODUCT PORTFOLIO

19.14.3 RECENT DEVELOPMENT

19.15 TSE CO,. LTD.

19.15.1 COMPANY SNAPSHOT

19.15.2 REVENUE ANALYSIS

19.15.3 PRODUCT PORTFOLIO

19.15.4 RECENT DEVELOPMENT

19.16 TRANSLARITY

19.16.1 COMPANY SNAPSHOT

19.16.2 PRODUCT PORTFOLIO

19.16.3 RECENT DEVELOPMENT

19.17 DYNAMIC-TEST

19.17.1 COMPANY SNAPSHOT

19.17.2 PRODUCT PORTFOLIO

19.17.3 RECENT DEVELOPMENTS

19.18 WILL TECHNOLOGY

19.18.1 COMPANY SNAPSHOT

19.18.2 PRODUCT PORTFOLIO

19.18.3 RECENT DEVELOPMENTS

19.19 WENTWORTH LABS

19.19.1 COMPANY SNAPSHOT

19.19.2 PRODUCT PORTFOLIO

19.19.3 RECENT DEVELOPMENTS

19.2 WINWAY TECH. CO., LTD.

19.20.1 COMPANY SNAPSHOT

19.20.2 PRODUCT PORTFOLIO

19.20.3 RECENT DEVELOPMENT

20 QUESTIONNAIRE

21 RELATED REPORTS

List of Table

TABLE 1 NORTH AMERICA PROBE CARD MARKET, BY PROBE TYPE, 2020-2029 (USD MILLION)

TABLE 2 NORTH AMERICA ADVANCED PROBE CARD IN PROBE CARD MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 3 NORTH AMERICA ADVANCED PROBE CARD IN PROBE CARD MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 4 NORTH AMERICA STANDARD PROBE CARD IN PROBE CARD MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 5 NORTH AMERICA PROBE CARD MARKET, BY MANUFACTURING TECHNOLOGY TYPE, 2020-2029 (USD MILLION)

TABLE 6 NORTH AMERICA MEMS IN PROBE CARD MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 7 NORTH AMERICA VERTICAL IN PROBE CARD MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 8 NORTH AMERICA CANTILEVER IN PROBE CARD MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 9 NORTH AMERICA EPOXY IN PROBE CARD MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 10 NORTH AMERICA BLADE IN PROBE CARD MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 11 NORTH AMERICA OTHERS IN PROBE CARD MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 12 NORTH AMERICA PROBE CARD MARKET, BY WAFER SIZE, 2020-2029 (USD MILLION)

TABLE 13 NORTH AMERICA MORE THAN 12 INCHES IN PROBE CARD MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 14 NORTH AMERICA LESS THAN 12 INCHES IN PROBE CARD MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 15 NORTH AMERICA PROBE CARD MARKET, BY HEAD SIZE, 2020-2029 (USD MILLION)

TABLE 16 NORTH AMERICA MORE THAN 40MM X 40MM IN PROBE CARD MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 17 NORTH AMERICA LESS THAN 40MM X 40MM IN PROBE CARD MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 18 NORTH AMERICA PROBE CARD MARKET, BY TEST, 2020-2029 (USD MILLION)

TABLE 19 NORTH AMERICA DC TEST IN PROBE CARD MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 20 NORTH AMERICA FUNCTIONAL TEST IN PROBE CARD MARKET, BY REGION, 2020-2029 (USD MILLION

TABLE 21 NORTH AMERICA AC TEST IN PROBE CARD MARKET, BY REGION, 2020-2029 (USD MILLION

TABLE 22 NORTH AMERICA PROBE CARD MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 23 NORTH AMERICA TUNGSTEN IN PROBE CARD MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 24 NORTH AMERICA COPPER CLAD LAMINATED (CCL) IN PROBE CARD MARKET, BY REGION, 2020-2029 (USD MILLION

TABLE 25 NORTH AMERICA ALUMINUM IN PROBE CARD MARKET, BY REGION, 2020-2029 (USD MILLION

TABLE 26 NORTH AMERICA OTHERS IN PROBE CARD MARKET, BY REGION, 2020-2029 (USD MILLION

TABLE 27 NORTH AMERICA PROBE CARD MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 28 NORTH AMERICA WLCSP IN PROBE CARD MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 29 NORTH AMERICA SIP IN PROBE CARD MARKET, BY REGION, 2020-2029 (USD MILLION

TABLE 30 NORTH AMERICA MIXED SIGNAL FLIP CHIP IN PROBE CARD MARKET, BY REGION, 2020-2029 (USD MILLION

TABLE 31 NORTH AMERICA ANALOG IN PROBE CARD MARKET, BY REGION, 2020-2029 (USD MILLION

TABLE 32 NORTH AMERICA PROBE CARD MARKET, BY BEAM SIZE, 2020-2029 (USD MILLION)

TABLE 33 NORTH AMERICA MORE THAN 1.5 MIL IN PROBE CARD MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 34 NORTH AMERICA LESS THAN 1.5 MIL IN PROBE CARD MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 35 NORTH AMERICA PROBE CARD MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 36 NORTH AMERICA FOUNDRY IN PROBE CARD MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 37 NORTH AMERICA FOUNDRY IN PROBE CARD MARKET, BY PROBE TYPE, 2020-2029 (USD MILLION)

TABLE 38 NORTH AMERICA PARAMETRIC IN PROBE CARD MARKET, BY REGION, 2020-2029 (USD MILLION

TABLE 39 NORTH AMERICA PARAMETRIC IN PROBE CARD MARKET, BY PROBE TYPE, 2020-2029 (USD MILLION)

TABLE 40 NORTH AMERICA LOGIC AND MEMORY DEVICE IN PROBE CARD MARKET, BY REGION, 2020-2029 (USD MILLION

TABLE 41 NORTH AMERICA LOGIC AND MEMORY DEVICE IN PROBE CARD MARKET, BY PROBE TYPE, 2020-2029 (USD MILLION)

TABLE 42 NORTH AMERICA DRAM IN PROBE CARD MARKET, BY REGION, 2020-2029 (USD MILLION

TABLE 43 NORTH AMERICA DRAM IN PROBE CARD MARKET, BY PROBE TYPE, 2020-2029 (USD MILLION)

TABLE 44 NORTH AMERICA CMOS IMAGE SENSOR (CIS) IN PROBE CARD MARKET, BY REGION, 2020-2029 (USD MILLION

TABLE 45 NORTH AMERICA CMOS IMAGE SENSOR (CIS) IN PROBE CARD MARKET, BY PROBE TYPE, 2020-2029 (USD MILLION)

TABLE 46 NORTH AMERICA FLASH IN PROBE CARD MARKET, BY REGION, 2020-2029 (USD MILLION

TABLE 47 NORTH AMERICA FLASH IN PROBE CARD MARKET, BY PROBE TYPE, 2020-2029 (USD MILLION)

TABLE 48 NORTH AMERICA OTHERS IN PROBE CARD MARKET, BY REGION, 2020-2029 (USD MILLION

TABLE 49 NORTH AMERICA PROBE CARD MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 50 NORTH AMERICA PROBE CARD MARKET, BY PROBE TYPE, 2020-2029 (USD MILLION)

TABLE 51 NORTH AMERICA ADVANCED PROBE CARD IN PROBE CARD MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 52 NORTH AMERICA PROBE CARD MARKET, BY MANUFACTURING TECHNOLOGY TYPE, 2020-2029 (USD MILLION)

TABLE 53 NORTH AMERICA PROBE CARD MARKET, BY WAFER SIZE, 2020-2029 (USD MILLION)

TABLE 54 NORTH AMERICA PROBE CARD MARKET, BY HEAD SIZE, 2020-2029 (USD MILLION)

TABLE 55 NORTH AMERICA PROBE CARD MARKET, BY TEST, 2020-2029 (USD MILLION)

TABLE 56 NORTH AMERICA PROBE CARD MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 57 NORTH AMERICA PROBE CARD MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 58 NORTH AMERICA PROBE CARD MARKET, BY BEAM SIZE, 2020-2029 (USD MILLION)

TABLE 59 NORTH AMERICA PROBE CARD MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 60 NORTH AMERICA FOUNDRY IN PROBE CARD MARKET, BY PROBE TYPE, 2020-2029 (USD MILLION)

TABLE 61 NORTH AMERICA PARAMETRIC IN PROBE CARD MARKET, BY PROBE TYPE, 2020-2029 (USD MILLION)

TABLE 62 NORTH AMERICA LOGIC AND MEMORY DEVICE IN PROBE CARD MARKET, BY PROBE TYPE, 2020-2029 (USD MILLION)

TABLE 63 NORTH AMERICA DRAM IN PROBE CARD MARKET, BY PROBE TYPE, 2020-2029 (USD MILLION)

TABLE 64 NORTH AMERICA CMOS IMAGE SENSOR (CIS) IN PROBE CARD MARKET, BY PROBE TYPE, 2020-2029 (USD MILLION)

TABLE 65 NORTH AMERICA FLASH IN PROBE CARD MARKET, BY PROBE TYPE, 2020-2029 (USD MILLION)

TABLE 66 U.S. PROBE CARD MARKET, BY PROBE TYPE, 2020-2029 (USD MILLION)

TABLE 67 U.S. ADVANCED PROBE CARD IN PROBE CARD MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 68 U.S. PROBE CARD MARKET, BY MANUFACTURING TECHNOLOGY TYPE, 2020-2029 (USD MILLION)

TABLE 69 U.S. PROBE CARD MARKET, BY WAFER SIZE, 2020-2029 (USD MILLION)

TABLE 70 U.S. PROBE CARD MARKET, BY HEAD SIZE, 2020-2029 (USD MILLION)

TABLE 71 U.S. PROBE CARD MARKET, BY TEST, 2020-2029 (USD MILLION)

TABLE 72 U.S. PROBE CARD MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 73 U.S. PROBE CARD MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 74 U.S. PROBE CARD MARKET, BY BEAM SIZE, 2020-2029 (USD MILLION)

TABLE 75 U.S. PROBE CARD MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 76 U.S. FOUNDRY IN PROBE CARD MARKET, BY PROBE TYPE, 2020-2029 (USD MILLION)

TABLE 77 U.S. PARAMETRIC IN PROBE CARD MARKET, BY PROBE TYPE, 2020-2029 (USD MILLION)

TABLE 78 U.S. LOGIC AND MEMORY DEVICE IN PROBE CARD MARKET, BY PROBE TYPE, 2020-2029 (USD MILLION)

TABLE 79 U.S. DRAM IN PROBE CARD MARKET, BY PROBE TYPE, 2020-2029 (USD MILLION)

TABLE 80 U.S. CMOS IMAGE SENSOR (CIS) IN PROBE CARD MARKET, BY PROBE TYPE, 2020-2029 (USD MILLION)

TABLE 81 U.S. FLASH IN PROBE CARD MARKET, BY PROBE TYPE, 2020-2029 (USD MILLION)

TABLE 82 TABLE 132 CANADA PROBE CARD MARKET, BY PROBE TYPE, 2020-2029 (USD MILLION)

TABLE 83 CANADA ADVANCED PROBE CARD IN PROBE CARD MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 84 CANADA PROBE CARD MARKET, BY MANUFACTURING TECHNOLOGY TYPE, 2020-2029 (USD MILLION)

TABLE 85 CANADA PROBE CARD MARKET, BY WAFER SIZE, 2020-2029 (USD MILLION)

TABLE 86 CANADA PROBE CARD MARKET, BY HEAD SIZE, 2020-2029 (USD MILLION)

TABLE 87 CANADA PROBE CARD MARKET, BY TEST, 2020-2029 (USD MILLION)

TABLE 88 CANADA PROBE CARD MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 89 CANADA PROBE CARD MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 90 CANADA PROBE CARD MARKET, BY BEAM SIZE, 2020-2029 (USD MILLION)

TABLE 91 CANADA PROBE CARD MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 92 CANADA FOUNDRY IN PROBE CARD MARKET, BY PROBE TYPE, 2020-2029 (USD MILLION)

TABLE 93 CANADA PARAMETRIC IN PROBE CARD MARKET, BY PROBE TYPE, 2020-2029 (USD MILLION)

TABLE 94 CANADA LOGIC AND MEMORY DEVICE IN PROBE CARD MARKET, BY PROBE TYPE, 2020-2029 (USD MILLION)

TABLE 95 CANADA DRAM IN PROBE CARD MARKET, BY PROBE TYPE, 2020-2029 (USD MILLION)

TABLE 96 CANADA CMOS IMAGE SENSOR (CIS) IN PROBE CARD MARKET, BY PROBE TYPE, 2020-2029 (USD MILLION)

TABLE 97 CANADA FLASH IN PROBE CARD MARKET, BY PROBE TYPE, 2020-2029 (USD MILLION)

TABLE 98 MEXICO PROBE CARD MARKET, BY PROBE TYPE, 2020-2029 (USD MILLION)

TABLE 99 MEXICO ADVANCED PROBE CARD IN PROBE CARD MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 100 MEXICO PROBE CARD MARKET, BY MANUFACTURING TECHNOLOGY TYPE, 2020-2029 (USD MILLION)

TABLE 101 MEXICO PROBE CARD MARKET, BY WAFER SIZE, 2020-2029 (USD MILLION)

TABLE 102 MEXICO PROBE CARD MARKET, BY HEAD SIZE, 2020-2029 (USD MILLION)

TABLE 103 MEXICO PROBE CARD MARKET, BY TEST, 2020-2029 (USD MILLION)

TABLE 104 MEXICO PROBE CARD MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 105 MEXICO PROBE CARD MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 106 MEXICO PROBE CARD MARKET, BY BEAM SIZE, 2020-2029 (USD MILLION)

TABLE 107 MEXICO PROBE CARD MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 108 MEXICO FOUNDRY IN PROBE CARD MARKET, BY PROBE TYPE, 2020-2029 (USD MILLION)

TABLE 109 MEXICO PARAMETRIC IN PROBE CARD MARKET, BY PROBE TYPE, 2020-2029 (USD MILLION)

TABLE 110 MEXICO LOGIC AND MEMORY DEVICE IN PROBE CARD MARKET, BY PROBE TYPE, 2020-2029 (USD MILLION)

TABLE 111 MEXICO DRAM IN PROBE CARD MARKET, BY PROBE TYPE, 2020-2029 (USD MILLION)

TABLE 112 MEXICO CMOS IMAGE SENSOR (CIS) IN PROBE CARD MARKET, BY PROBE TYPE, 2020-2029 (USD MILLION)

TABLE 113 MEXICO FLASH IN PROBE CARD MARKET, BY PROBE TYPE, 2020-2029 (USD MILLION)

List of Figure

FIGURE 1 NORTH AMERICA PROBE CARD MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA PROBE CARD MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA PROBE CARD MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA PROBE CARD MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA PROBE CARD MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA PROBE CARD MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA PROBE CARD MARKET: DBMR MARKET POSITION GRID

FIGURE 8 NORTH AMERICA PROBE CARD MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 NORTH AMERICA PROBE CARD MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 10 NORTH AMERICA PROBE CARD MARKET: MARKET CHALLENGE MATRIX

FIGURE 11 NORTH AMERICA PROBE CARD MARKET: SEGMENTATION

FIGURE 12 INCREASING USE OF INTEGRATED CIRCUITS IN ELECTRONIC DEVICES IS EXPECTED TO DRIVE THE NORTH AMERICA PROBE CARD MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 13 THE ADVANCED PROBE TYPE SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA PROBE CARD MARKET IN 2022 & 2029

FIGURE 14 ASIA-PACIFIC IS EXPECTED TO DOMINATE AND IS THE FASTEST-GROWING REGION IN THE NORTH AMERICA PROBE CARD MARKET IN THE FORECAST PERIOD

FIGURE 15 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES FOR NORTH AMERICA PROBE CARD MARKET

FIGURE 16 NORTH AMERICA PROBE CARD MARKET: BY PROBE TYPE, 2021

FIGURE 17 NORTH AMERICA PROBE CARD MARKET: BY MANUFACTURING TECHNOLOGY TYPE, 2021

FIGURE 18 NORTH AMERICA PROBE CARD MARKET: BY WAFER SIZE, 2021

FIGURE 19 NORTH AMERICA PROBE CARD MARKET: BY HEAD SIZE, 2021

FIGURE 20 NORTH AMERICA PROBE CARD MARKET: BY TEST, 2021

FIGURE 21 NORTH AMERICA PROBE CARD MARKET: BY MATERIAL, 2021

FIGURE 22 NORTH AMERICA PROBE CARD MARKET: BY APPLICATION, 2021

FIGURE 23 NORTH AMERICA PROBE CARD MARKET: BY BEAM SIZE, 2021

FIGURE 24 NORTH AMERICA PROBE CARD MARKET: BY END-USE, 2021

FIGURE 25 NORTH AMERICA PROBE CARD MARKET: SNAPSHOT (2021)

FIGURE 26 NORTH AMERICA PROBE CARD MARKET: BY COUNTRY (2021)

FIGURE 27 NORTH AMERICA PROBE CARD MARKET: BY COUNTRY (2022 & 2029)

FIGURE 28 NORTH AMERICA PROBE CARD MARKET: BY COUNTRY (2021 & 2029)

FIGURE 29 NORTH AMERICA PROBE CARD MARKET: BY PROBE TYPE (2022-2029)

FIGURE 30 NORTH AMERICA PROBE CARD MARKET: COMPANY SHARE 2021 (%)

North America Probe Card Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its North America Probe Card Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as North America Probe Card Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.