North America Network Test Lab Automation Market, By Component (Hardware, Software, Services), Network Type (Physical Network, Virtual Network, Hybrid Network), Testing Type (Functional Testing, Regression Testing, Performance Testing), Deployment Mode (Cloud, On-Premise, Hybrid), End-User (Enterprise Vertical, Service Provider), Organization Size (Large Enterprise, Small & Medium Enterprise), Automation Type (Modular Automation, Total Lab Automation) – Industry Trends and Forecast to 2029

Market Analysis and Size

As industries and enterprises accelerate their digital transformation initiatives, new product and technology cycles are getting shorter. To ensure success of new technology introduction in existing operational environments, it is critical to have the right resources to extensively test and validate the device, product or solution for real world reliability, performance and interoperability. Since testing on simulated environments introduces significant future risks, most enterprises make considerable investments in building lab infrastructure and expertise or get it tested by network test lab automation service providers. As these new technologies and products from industries and enterprises are more complex than before and enterprises face a skills gap in networking, testing, monitoring and automation; the service providers do the testing on behalf of enterprises. The services provider may use testing type such as functional, performance or regression for the proposed product and take help of various tools in test. The arrival of Artificial Intelligence and its integration with IOTs and 5G will rise the rate of digital products in all industries and has to be tested before launch. This will make the North America network test lab automation market bloom in the future.

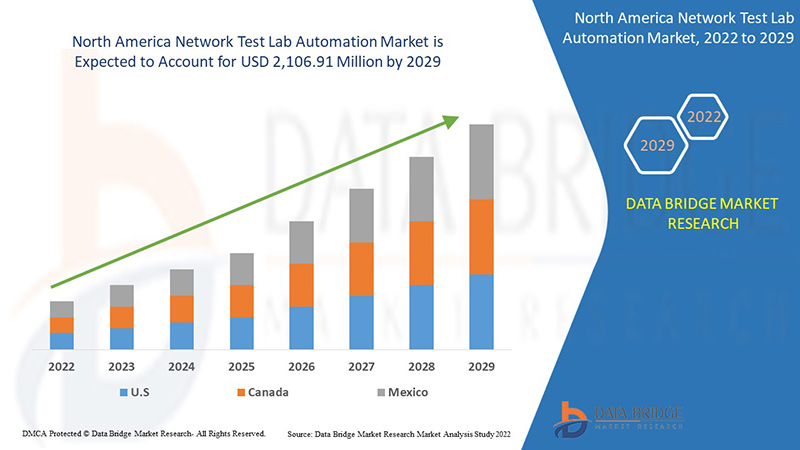

Data Bridge Market Research analyses that the North America network test lab automation market is expected to reach the value of USD 2,106.91 million by 2029. The network test lab automation market report also covers pricing analysis, patent analysis, and technological advancements in depth.

|

Report Metric

|

Details

|

|

Forecast Period

|

2022 to 2029

|

|

Base Year

|

2021

|

|

Historic Years

|

2020

|

|

Quantitative Units

|

Revenue in USD Million

|

|

Segments Covered

|

By Component (Hardware, Software, Services), Network Type (Physical Network, Virtual Network, Hybrid Network), Testing Type (Functional Testing, Regression Testing, Performance Testing), Deployment Mode (Cloud, On-Premise, Hybrid), End-User (Enterprise Vertical, Service Provider), Organization Size (Large Enterprise, Small & Medium Enterprise), Automation Type (Modular Automation, Total Lab Automation)

|

|

Countries Covered

|

U.S., Canada and Mexico in North America

|

|

Market Players Covered

|

Qualisystems Ltd., Spirent Communications, Lepton, Pluribus Networks, Polatis, Calient Technologies, Fiber Smart Networks, Fiber Mountain, Cisco, Sedona Systems, Anuta Networks, Versa Networks, Netbrain, Juniper Networks, Netscout, Keysight Technologies, ZPE Systems, Inc., Bell Integrator, Danaher, Great Software Laboratory, Accuver, Wipro, Appviewx, Kentik, HCL Technologies.

|

Market Definition

The process of automating the configuration, operation, deployment, testing, and management of virtual and physical devices in a network is referred to as network automation. The availability of the network service will increase as everyday functions and network testing, as well as repetitive procedures, are handled and controlled automatically. Any network can benefit from network automation. Enterprises, service providers, and data centres can use software and hardware-based solutions to automate their networks, lowering operational costs, reducing human error, and increasing productivity.

Network Test Lab Automation Market Dynamics

This section deals with understanding the market drivers, advantages, opportunities, restraints and challenges. All of this is discussed in detail as below:

Drivers

- Rise in demand for automation and solution for seamless customer experience

Nowadays, research and pathology laboratories have undergone significant evolution in the last two decades. In the labs, there is a growing demand for technologically advanced automated instruments and laboratory systems. Several innovations, including lab automation, are being driven by the desire to improve diagnoses, medication discovery, and research.

With lab automation, different lab scientists and professionals are able to achieve next-gen speed, consistency, and precision in research and report generation. Furthermore, lab automation advancements have resulted in the standardization of processes that help in reducing the number of errors. Therefore, the increasing evaluation of real-time results with the help of automated techniques and the growing cases of diagnosis has resulted in a significant demand for advanced software and cutting-edge automated systems.

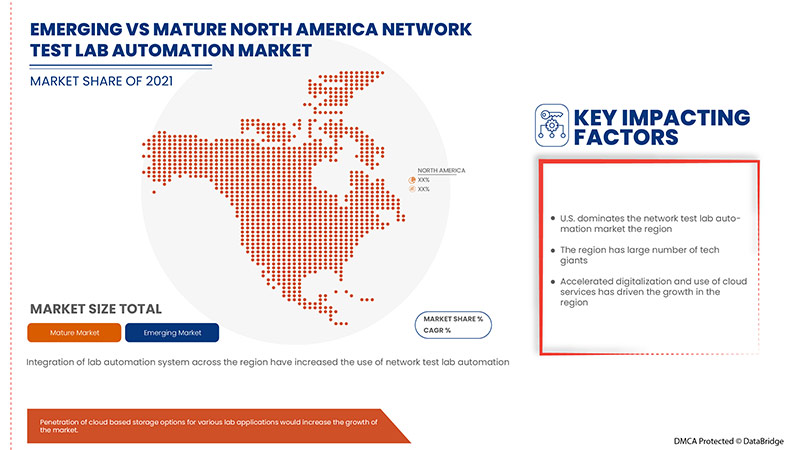

- Penetration of cloud based storage options for various lab applications

Over the last few decades, it is reported that 90% of businesses have chosen the cloud-based solutions over traditional computing and data storage methods for benefits like better insights, easier collaboration, and reduced costs for the organizations. However, increased cloud usage means that businesses also need to manage their cloud infrastructure more efficiently in order to manage operational efficiency and reduced complexity. Cloud automation refers to the use of software and processes to automate the provisioning and management of cloud computing workloads and services such as virtual network creation, virtual machine deployment, load balancing, and performance monitoring. Using cloud automation, IT administrators can reduce or eliminate manual processes to lower administrative overhead and speed up the delivery of resources.

Opportunities

- Growing need of network automation & testing for digital transformation

Digital transformation is the process of using digital technologies to transform existing traditional and non-digital business processes and services, or creating new ones, to meet the evolving market and customer expectations. Thus it is completely altering the way businesses are managed and operated, and how value is delivered to customers. Digital transformation is important as it allows organizations to adapt to ever-changing industries and continually improve its operations accordingly. Every digital transformation initiative will have its own specific goals. The main purpose of any digital transformation is to improve the current processes. But, the digital transformation of organizations, it requires extensive planning, proper resource management, testing & development of products and software with huge capital investment. If not done, it can take a long time to implement the software and business model which result leads in a loss of capital and time for an organisation. According to a Bain & Company study, only 8% of global companies have been able to achieve their targeted business outcomes from their investments in digital technology. This makes the integration of network automation and testing very essential for the successful digital transformation.

Restraints/Challenges

- Rise in complexity of lab automation systems and thereby increasing the risk of downtime

Network lab automation processes have been implemented across the globe to benefit from decreasing the necessity for human staff and to perform repetitive tasks by implementing automated machine processes instead. But the higher the complexity of the system, the greater the risk that a system failure would generate serious consequences on laboratory functioning. Many critical system failures, especially involving the assembly lines, would require restoring manual procedures for managing samples (i.e. manual sorting, centrifugation). Although in most labs, it is found that resources are a limiting factor for development and testing. A traditional way to manage the labs and coordinate schedules is to use patch panels and change connections manually. However, this approach is not scalable and is inefficient in many cases.

- Lack of skilled workforce and experienced expertise

Artificial Intelligence (AI), Machine Learning (ML), the Internet of Things (IoT), and Automation are new technologies which have the potential to transform the network testing industry over the next decade. These technological trends have become even more important with the COVID-19 pandemic changing the tech-driven landscape. With the global pandemic changing workforce dynamics, the reliance on cutting-edge software, web, and mobile applications has grown substantially. To support this ever-growing demand, businesses turned to technology to increase the need to release fully functional, feature-rich, and flawless products and software to their end-users. As a result, in came test automation brought the promise of extensive test coverage, scientific test accuracy, streamlined testing operations, lower cost, and increased resource efficiency. This resulted in the need for a large skilled workforce for the industry to meet the rising demand. A skilled worker is any worker who has special skills, training, or knowledge that they can then apply to their work. The skills required for the network testing industry may include proficiency in various programming languages, mastery of leading automation testing tools (codeless ones too), should have experience in manual testing and knowledge of test management tools with an understanding of business requirements. This requirement narrowed down the number of skilled labour for the industry additionally the demand for this role is increasing as less qualified labour is in the industry.

Post COVID-19 Impact on Network Test Lab Automation Market

COVID-19 created a positive impact on the network test lab automation market due to rapid adoption of remote working and cloud infrastructure.

The COVID-19 pandemic has impacted the network test lab automation market to an extent in positive manner. Increasing adoption and utilization of artificial intelligence and machine learning in enterprises has helped the market to grow during and after the pandemic. Also, the growth has been high after the market has opened after COVID-19, and it is expected that there would be considerable growth in the sector owing to higher demand of industry 4.0 and automation technology.

Solution providers are making various strategic decisions to bounce back post-COVID-19. The players are conducting multiple research and development activities to improve the technology involved in the network test lab automation. With this, the companies will bring advanced technologies to the market. In addition, government initiatives for use of automation technology has led to the market's growth

Recent Development

- In April 2022, Keysight Technologies, Inc. announced that its automated field-to-lab device test platform solutions have been selected by Xiaomi. Xiaomi chose Keysight's test tools to verify 5G device performance under a variety of network signaling and radio channel circumstances. To develop advanced 5G test solutions, Keysight effectively combined lab and field-based test capabilities. This collaboration will enhance the client portfolio and the presence of the company.

- In January 2022, Spirent acquires octoScope to expand WiFi testing capabilities. octoScope’s test solutions comprise automated Wi-Fi and 5G testing in emulated real-world-like environments, including the latest WiFi 6 and WiFi 6E technologies. This acquisition will help in wireless network test solutions company to expand WiFi testing capabilities also enhance the services and also brand reorganization across the globe.

North America Network Test Lab Automation Market Scope

The network test lab automation market is segmented on the basis component, network type, testing type, deployment mode, end-user, organization size, automation type. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Component

- Hardware

- Software

- Services

On the basis of component, the North America network test lab automation market is segmented into hardware, software, services.

Network Type

- Physical Network

- Virtual Network

- Hybrid Network

On the basis of network type, the North America network test lab automation market has been segmented into physical network, virtual network, hybrid network.

Testing Type

- Functional Testing

- Regression Testing

- Performance Testing

On the basis of testing type, the North America network test lab automation market has been segmented into functional testing, regression testing, performance testing.

Deployment Mode

- Cloud

- Hybrid

- On-Premise

On the basis of deployment mode, the North America network test lab automation market is segmented into cloud, hybrid, on-premise.

End-User

- Enterprise Vertical

- Service Provider

On the basis of end-user, the North America network test lab automation market has been segmented into enterprise vertical, service provider.

Organization Size

- Large Enterprise

- Small & Medium Enterprise

On the basis of organization size, the North America network test lab automation market is segmented into large enterprise, small & medium enterprise.

Automation Type

- Modular Automation

- Total Lab Automation

On the basis of automation type, the North America network test lab automation market is segmented into modular automation, total lab automation.

Network Test Lab Automation Market Regional Analysis/Insights

The network test lab automation market is analysed and market size insights and trends are provided by country, component, network type, testing type, deployment mode, end-user, organization size and automation type as referenced above.

The countries covered in the network test lab automation market report are U.S., Canada and Mexico in North America. U.S. dominates in the North America region as it is home to many tech giants of the world, which are in constant need for testing their systems, applications and updates.

The country section of the report also provides individual market impacting factors and changes in market regulation that impact the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Network Test Lab Automation Market Share Analysis

The network test lab automation market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to network test lab automation market.

Some of the major players operating in the network test lab automation market are: Qualisystems Ltd., Spirent Communications, Lepton, Pluribus Networks, Polatis, Calient Technologies, Fiber Smart Networks, Fiber Mountain, Cisco, Sedona Systems, Anuta Networks, Versa Networks, Netbrain, Juniper Networks, Netscout, Keysight Technologies, ZPE Systems, Inc., Bell Integrator, Danaher, Great Software Laboratory, Accuver, Wipro, Appviewx, Kentik, HCL Technologies.

SKU-