North America Medical Device Testing Market, By Service Type (Testing Services, Inspection Service and Certification Services), Testing Type (Physical Testing, Chemical/Biological Testing, Cybersecurity Testing, Microbiology and Sterility Testing, and Others), Phase (Preclinical and Clinical), Sourcing Type (In-House and Outsourced), Device Class (Class I, Class II and Class III), Product (Active Implant Medical Device, Active Medical Device, Non-active Medical Device, In vitro Diagnostics Medical Device, Opthalmic Medical Device, Orthopedic and Dental Medical Device, Vascular Medical Device, and Others) - Industry Trends and Forecast to 2030.

North America Medical Device Testing Market Analysis and Insights

Medical devices are crucial since they directly impact human lives. Medical device manufacturers follow testing, verification, and validation best practices to ensure the quality and reliability of medical equipment to provide safe and effective healthcare services to patients. There is a high-level overview of implementing medical device testing strategies. Multiple regulatory bodies and compliances govern medical devices. On the other hand, end users expect exceptional performance, effectiveness, and safety from the device that they use. This compels medical device manufacturers to create and deploy testing strategies that work across the development cycle - from concept and design to production.

The rising need for the verification and validation of medical devices globally has enhanced the growth of the market. Some of the major market players are highly focusing on various service launches and service approvals during this crucial period. In addition, the increasing demand for in-vitro tests is also contributing to the rising demand for medical device testing. The North America medical device testing market is growing in the forecast year due to a rise in market players and the availability of advanced services.

However, the barriers to the local development of medical devices and the high cost of medical devices might hamper the growth of the North America medical device testing market in the forecast period.

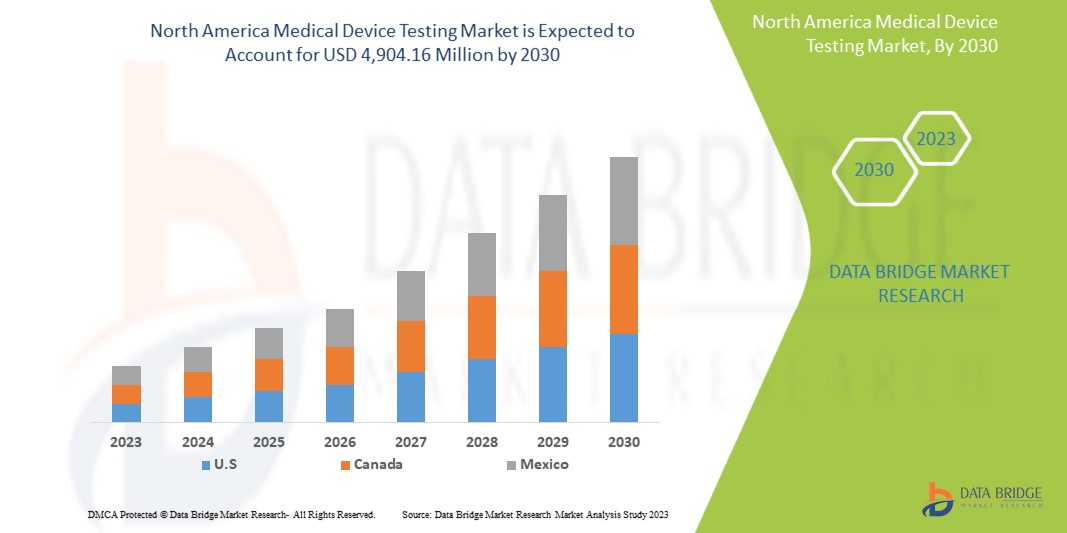

Data Bridge Market Research analyzes that the North America medical device testing market is expected to reach the value of USD 4,904.16 million by 2030, at a CAGR of 12.0% during the forecast period.

|

Report Metric

|

Details

|

|

Forecast Period

|

2023 to 2030

|

|

Base Year

|

2022

|

|

Historic Years

|

2021 (Customisable to 2015-2020)

|

|

Quantitative Units

|

Revenue in USD Million

|

|

Segments Covered

|

Service Type (Testing Services, Inspection Service and Certification Services), Testing Type (Physical Testing, Chemical/Biological Testing, Cybersecurity Testing, Microbiology Testing and Sterility Testing, and Others), Phase (Preclinical and Clinical), Sourcing Type (In-House and Outsourced), Device Class (Class I, Class II and Class III), Product (Active Implant Medical Device, Active Medical Device, Non-active Medical Device, In vitro Diagnostics Medical Device, Opthalmic Medical Device, Orthopedic and Dental Medical Device, Vascular Medical Device, and Others)

|

|

Countries Covered

|

U.S., Canada, and Mexico

|

|

Market Players Covered

|

Intertek Group plc, SGS SA, Bureau Veritas, TUV SUD, TUV Rheinland, Pace, Charles River Laboratories., Biomedical Device Labs, UL LLC, North American Science Associates, LLC, WuXi AppTec, NSF., Laboratory Corporation of America Holdings, Eurofins Scientific, NELSON LABORATORIES, LLC- A SOTERA HEALTH COMPANY, Gateway Analytical., Element Materials Technology, Hohenstein, Cigniti, Q Laboratories, and IMR Test Labs among others

|

Market Definition

Medical device testing is the process of demonstrating that the device is reliably and safely performed in use. In new product development, extensive design validation testing is applied. This includes performance testing, toxicity, chemical analysis, and sometimes human factors or even clinical testing. Ongoing quality assurance testing is generally more limited. This usually includes dimensional checks, some functional tests, and packaging verification. Various types of medical testing services are available there in the market, such as inspection services, certification services, and others.

North America Medical Device Testing Market Dynamics

This section deals with understanding the market drivers, advantages, opportunities, restraints, and challenges. All of this is discussed in detail below:

Drivers

- Rising Need for Verification Validation of Medical Devices

Medical device testing is the process of demonstrating that the device will reliably and safely perform diagnosis and treatment. The demand for medical devices is constantly rising as there is a high prevalence of various diseases seen among various regions across the globe.

The methods of verification and validation are widespread and extensively being used in the healthcare industry. In general, verification is the developmental phase of a product if it complies with the specified requirements, whereas validation checks if the intended use has been met and, thus, usability specifics are fulfilled. The most common types of verification and validation for medical devices are design, process, and software verification and validation.

Medical devices are also becoming smaller and more complex in design using advanced, engineered plastics. This makes the process of validation and verification (V&V) all the more important. The results in better repeatability, fewer mistakes, less rework and redesign, faster time to market, improved competitiveness, and lower production costs. Additionally, increasing standards and regulations about medical device validation and verification services are anticipated to drive the growth of the medical device testing market.

- Increasing Demand for In-Vitro Tests

In vitro diagnostics (IVD) are tests done on samples such as blood or tissue that have been taken from the human body. In vitro diagnostics can detect diseases or other conditions and can be used to monitor a person’s overall health to help cure, treat, or prevent diseases.

In-vitro tests are used in various disease detections, such as HIV infections, malaria, and hepatitis, among others. The prevalence of such diseases is rapidly increasing across the globe, which leads to the increasing demand for in-vitro tests and various medical devices. As medical devices have become widely available for various diseases due to the rapid manufacturing of medical testing companies, it is a major factor driving the growth of the market.

Opportunities

- Rise in Healthcare Expenditure

Healthcare expenditure has increased worldwide as disposable income in various countries is increasing. Moreover, to accomplish the population requirements, government bodies and healthcare organizations are taking the initiative to accelerate healthcare expenditure. The rise in healthcare expenditure simultaneously helps healthcare settings to improve their treatment facilities for various disorders in the countries.

Growing healthcare expenditure is also beneficial for further economic growth and healthcare sector growth, and it is primarily fruitful as it significantly affects the development of better and more advanced medical products. Therefore, the surge in healthcare expenditure is a greater opportunity for the North America medical device testing market growth.

- Development in Ai And Iot in Various Medical Devices

Artificial intelligence (AI) is a powerful and ever-emerging technology that has the potential to improve capabilities across a multitude of industries. Medical devices with artificial intelligence hold the promise of revolutionizing the healthcare industry, helping medical professionals more accurately and effectively diagnose and treat their patients and improve their overall care. Along with its benefits, medical device artificial intelligence also faces challenges, including the need for regulation to keep up with technological advancement.

Thus, the North America medical device testing market is witnessing a series of developments in drug-device combination, personalized medicine, and elevated adaption of various portable and wearable medical devices. Implementing technological advancements such as IoT and Artificial Intelligence in various devices is a key growth parameter for the global medical device testing service market, creating a huge opportunity.

Challenges/ Restraints

- High Competition in Medical Technology Industry

Many global companies face significant competition from many companies, from large medical device manufacturing companies with multiple product lines. Several players have wide financial and marketing resources than others. The common competition in healthcare involves various elements such as price, quality, convenience, and brand name. Competition can also be based on new technologies and innovation. In general, competition reduces inefficiencies that would otherwise yield high costs of output, which are eventually passed to consumers by high costs of health care and delivery. Products on the market are marketed based on product specifications, product consistency, supply, and price. Consumers, however, benefit from competition that offers rewards for continuing product upgrades and facilitates a higher degree of service efficiency among industry participants. The company’s ability to compete in the market is also impacted by changes in consumer preferences and requirements, such as the growing demand for more eco-friendly medical devices that can be easily dumped without harming the environment and the products incorporated with digital capabilities. This shows high competition in the market, which is a major challenge for the market.

- Barriers to the Local Development of Medical Devices

While promoting standards and control of medical devices is essential, excessive regulations, particularly in the domestic context, can also act as a barrier to local innovation of these devices.

It can potentially hinder domestic innovation by subjecting new technologies to a lengthy and expensive licensing procedure, subsequently increasing the cost and the time that local manufacturers have to spend in addition to the manufacturing cost of the medical equipment. A few products, which are of significant value to low-income countries, may be removed from the market due to the perceived risks associated with their use.

Various factors, such as licensing procedures, the cost of the medical equipment, and various other regulations for the production of medical devices faced by local development manufacturers, all these causes may hamper the growth of the medical device testing market.

Recent Developments

- In April 2021, TÜV SÜD announced that it had presented itself at Medtec LIVE to exhibit its ability to be a one-stop shop for medical device testing. The company’s services cover testing in electrical and functional safety, cyber security and software, EMC, and biocompatibility. The experts from TÜV SÜD featured in the program of the online trade show and congress with various talks, a live hack, and an elevator pitch.

- In June 2020, Intertek announced the expansion of its personal protective equipment services to include precertification testing of N95 respirators to requirements set by the National Institute for Occupational Safety and Health (NIOSH). The new services are the result of the successful accreditation to NIOSH Standard Test Protocols, in accordance with ISO 17025. With these new services, Intertek expands upon its solutions and resources to support customers and the global community during the COVID-19 pandemic.

North America medical device testing market Scope

North America medical device testing market is segmented into service type, testing type, phase, sourcing type, device class, and product. The growth among segments helps you analyze niche pockets of growth and strategies to approach the market and determine your core application areas and the difference in your target markets.

Service Type

- Testing Services

- Inspection Services

- Certification Services

On the basis of service type, the North America medical device testing market is segmented into testing services, inspection services, and certification services.

Testing Type

- Physical Testing

- Chemical/Biological Testing

- Cybersecurity Testing

- Microbiology And Sterility Testing

- Others

On the basis of testing type, the North America medical device testing market is segmented into physical testing, chemical/biological testing, cybersecurity testing, microbiology and sterility testing, and others.

Phase

- Preclinical

- Clinical

On the basis of phase, the North America medical device testing market is segmented into preclinical and clinical.

Sourcing Type

- In-House

- Outsourced

On the basis of sourcing type, the North America medical device testing market is segmented into in-house and outsourced

Device Class

- Class I

- Class II

- Class III

On the basis of device class, the North America medical device testing market is segmented into class I, class II, and class III.

Product

- Active Implant Medical Device

- Active Medical Device

- Non-Active Medical Device

- In Vitro Diagnostic Medical Device

- Ophthalmic Medical Device

- Orthopedic and Dental Medical Device

- Vascular Medical Device

- Others

On the basis of product, the North America medical device testing market is segmented into active implant medical device, active medical device, non-active medical device, in vitro diagnostics medical device, opthalmic medical device, orthopedic and dental medical device, vascular medical device, and others.

North America Medical Device Testing Market Regional Analysis/Insights

North America medical device testing market is segmented into service type, testing type, phase, sourcing type, device class, and product.

The countries covered in this market report are the U.S., Canada, and Mexico.

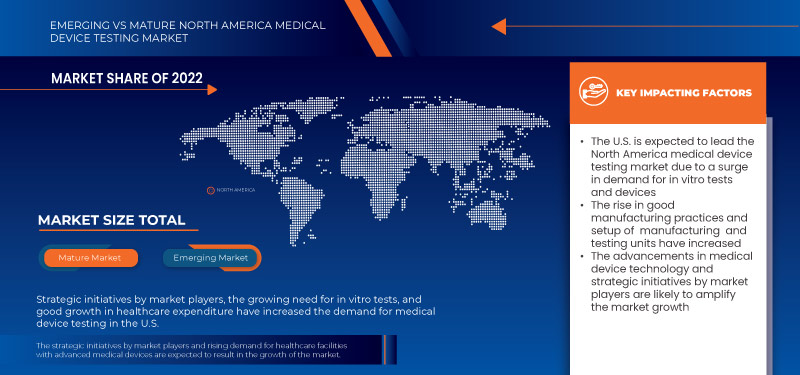

The U.S. is expected to dominate the market due to the high prevalence of medical device testing in the region and the rise in healthcare expenditure.

The country section of the report also provides individual market-impacting factors and changes in regulation in the market domestically that impact the current and future trends of the market. Data points such as new sales, replacement sales, country demographics, regulatory acts, and import-export tariffs are some of the major pointers used to forecast the market scenario for individual countries. Also, presence and availability of Europe brands and their challenges faced due to large or scarce competition from local and domestic brands, and impact of sales channels are considered while providing forecast analysis of the country data.

Competitive Landscape and North America Medical Device Testing Market Share Analysis

North America medical device testing market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in R&D, new market initiatives, production sites and facilities, company strengths and weaknesses, product launch, product trials pipelines, product approvals, patents, product width and breath, application dominance, technology lifeline curve. The above data points provided are only related to the company’s focus on the North America medical device testing market.

Some of the major players operating in the North America medical device testing market are Intertek Group plc, SGS SA, Bureau Veritas, TUV SUD, TUV Rheinland, Pace, Charles River Laboratories., Biomedical Device Labs, UL LLC, North American Science Associates, LLC, WuXi AppTec, NSF., Laboratory Corporation of America Holdings, Eurofins Scientific, NELSON LABORATORIES, LLC- A SOTERA HEALTH COMPANY, Gateway Analytical., Element Materials Technology, Hohenstein, Cigniti, Q Laboratories, and IMR Test Labs among others.

SKU-